#avoiding federal tax

Explore tagged Tumblr posts

Text

.

#me stuff#venting#okay i love how various powers that be at state and local levels are reacting to this hurricane of terrible - keep it up#but please. for once. can i see a government acknowledge the impact that cancelling grants has?#i'm a bit sore because i keep seeing all of *are you a former federal worker or contractor?* stuff#but over in the nonprofit sector you have people who are just as vital to the implementation of various stuff#who don't even have contract status#that does not make us any less unemployed#we're basically your contractors with the added bonus of being cheaper because we aren't allowed to make a profit on our gov't work#alas. this is such a minor bone to pick but the remains of my industry are floating like ash on the wind#we're gone#but we're don't seem to be part of the national conversation#i keep hearing kind intelligent people saying stuff like *alas. the executive branch powers have operated on fuzzy norms...#and now we're paying for it* NO. Stuff is happening that IS NOT within the realm of executive branch vagueness#(saying that irl btw. not online)#it is just flat out not legal. sometimes not even constitutional.#CONGRESS CONTROLS THE PURSE#you can't withhold and redirect congressionally appropriated tax dollars. you can't raid and vandalize NGOs for funsies#....there's worse terrible stuff going on. obviously. but this is the niche i get to see on linkedin#a friend lovingly had the audacity to ask me if I've thought about taking a break from news and social media#I HAVE. I literally cannot avoid it because anywhere i want to work is doing activism because every day stuff i care about is trashed#linked in. the boringest of social sites. linked in is the bane of my existence#but when you don't fit under a neat little branch in the US department of labor occupations handbook#job boards are not so helpful. oh well. let's go apply to another entry-level position that 100+ people have already applied to#(i am okay btw. just arrrrrrrrrghhhhhh)

1 note

·

View note

Link

War Room Breaking! Hunter Biden Pleads Guilty in Federal Tax Case to Avoid Witness Testimony into the Biden Crime Family

#avoid#biden#breaking!#case#crime#family#federal#guilty#hunter#infowars#news#pleads#radio#renegade#room#talk#tax#testimony#war#witness

0 notes

Text

The one weird monopoly trick that gave us Walmart and Amazon and killed Main Street

I'm coming to BURNING MAN! On TUESDAY (Aug 27) at 1PM, I'm giving a talk called "DISENSHITTIFY OR DIE!" at PALENQUE NORTE (7&E). On WEDNESDAY (Aug 28) at NOON, I'm doing a "Talking Caterpillar" Q&A at LIMINAL LABS (830&C).

Walmart didn't just happen. The rise of Walmart – and Amazon, its online successor – was the result of a specific policy choice, the decision by the Reagan administration not to enforce a key antitrust law. Walmart may have been founded by Sam Walton, but its success (and the demise of the American Main Street) are down to Reaganomics.

The law that Reagan neutered? The Robinson-Patman Act, a very boring-sounding law that makes it illegal for powerful companies (like Walmart) to demand preferential pricing from their suppliers (farmers, packaged goods makers, meat producers, etc). The idea here is straightforward. A company like Walmart is a powerful buyer (a "monopsonist" – compare with "monopolist," a powerful seller). That means that they can demand deep discounts from suppliers. Smaller stores – the mom and pop store on your Main Street – don't have the clout to demand those discounts. Worse, because those buyers are weak, the sellers – packaged goods companies, agribusiness cartels, Big Meat – can actually charge them more to make up for the losses they're taking in selling below cost to Walmart.

Reagan ordered his antitrust cops to stop enforcing Robinson-Patman, which was a huge giveaway to big business. Of course, that's not how Reagan framed it: He called Robinson-Patman a declaration of "war on low prices," because it prevented big companies from using their buying power to squeeze huge discounts. Reagan's court sorcerers/economists asserted that if Walmart could get goods at lower prices, they would sell goods at lower prices.

Which was true…up to a point. Because preferential discounting (offering better discounts to bigger customers) creates a structural advantage over smaller businesses, it meant that big box stores would eventually eliminate virtually all of their smaller competitors. That's exactly what happened: downtowns withered, suburban big boxes grew. Spending that would have formerly stayed in the community was whisked away to corporate headquarters. These corporate HQs were inevitably located in "onshore-offshore" tax haven states, meaning they were barely taxed at the state level. That left plenty of money in these big companies' coffers to spend on funny accountants who'd help them avoid federal taxes, too. That's another structural advantage the big box stores had over the mom-and-pops: not only did they get their inventory at below-cost discounts, they didn't have to pay tax on the profits, either.

MBA programs actually teach this as a strategy to pursue: they usually refer to Amazon's "flywheel" where lower prices bring in more customers which allows them to demand even lower prices:

https://www.youtube.com/watch?v=BaSwWYemLek

You might have heard about rural and inner-city "food deserts," where all the independent grocery stores have shuttered, leaving behind nothing but dollar stores? These are the direct product of the decision not to enforce Robinson-Patman. Dollar stores target working class neighborhoods with functional, beloved local grocers. They open multiple dollar stores nearby (nearly all the dollar stores you see are owned by one of two conglomerates, no matter what the sign over the door says). They price goods below cost and pay for high levels of staffing, draining business off the community grocery store until it collapses. Then, all the dollar stores except one close and the remaining store fires most of its staff (working at a dollar store is incredibly dangerous, thanks to low staffing levels that make them easy targets for armed robbers). Then, they jack up prices, selling goods in "cheater" sizes that are smaller than the normal retail packaging, and which are only made available to large dollar store conglomerates:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

Writing in The American Prospect, Max M Miller and Bryce Tuttle1 – a current and a former staffer for FTC Commissioner Alvaro Bedoya – write about the long shadow cast by Reagan's decision to put Robinson-Patman in mothballs:

https://prospect.org/economy/2024-08-13-stopping-excessive-market-power-monopoly/

They tell the story of Robinson-Patman's origins in 1936, when A&P was using preferential discounts to destroy the independent grocery sector and endanger the American food system. A&P didn't just demand preferential discounts from its suppliers; it also charged them a fortune to be displayed on its shelves, an early version of Amazon's $38b/year payola system:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

They point out that Robinson-Patman didn't really need to be enacted; America already had an antitrust law that banned this conduct: section 2 of the the Clayton Act, which was passed in 1914. But for decades, the US courts refused to interpret the Clayton Act according to its plain meaning, with judges tying themselves in knots to insist that the law couldn't possibly mean what it said. Robinson-Patman was one of a series of antitrust laws that Congress passed in a bid to explain in words so small even federal judges could understand them that the purpose of American antitrust law was to keep corporations weak:

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

Both the Clayton Act and Robinson-Patman reject the argument that it's OK to let monopolies form and come to dominate critical sectors of the American economy based on the theoretical possibility that this will lead to lower prices. They reject this idea first as a legal matter. We don't let giant corporations victimize small businesses and their suppliers just because that might help someone else.

Beyond this, there's the realpolitik of monopoly. Yes, companies could pass lower costs on to customers, but will they? Look at Amazon: the company takes $0.45-$0.51 out of every dollar that its sellers earn, and requires them to offer their lowest price on Amazon. No one has a 45-51% margin, so every seller jacks up their prices on Amazon, but you don't notice it, because Amazon forces them to jack up prices everywhere else:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

The Robinson-Patman Act did important work, and its absence led to many of the horribles we're living through today. This week on his Peoples & Things podcast, Lee Vinsel talked with Benjamin Waterhouse about his new book, One Day I’ll Work for Myself: The Dream and Delusion That Conquered America:

https://athenaeum.vt.domains/peoplesandthings/2024/08/12/78-benjamin-c-waterhouse-on-one-day-ill-work-for-myself-the-dream-and-delusion-that-conquered-america/

Towards the end of the discussion, Vinsel and Waterhouse turn to Robinson-Patman, its author, Wright Patman, and the politics of small business in America. They point out – correctly – that Wright Patman was something of a creep, a "Dixiecrat" (southern Democrat) who was either an ideological segregationist or someone who didn't mind supporting segregation irrespective of his beliefs.

That's a valid critique of Wright Patman, but it's got little bearing on the substance and history of the law that bears his name, the Robinson-Patman Act. Vinsel and Waterhouse get into that as well, and while they made some good points that I wholeheartedly agreed with, I fiercely disagree with the conclusion they drew from these points.

Vinsel and Waterhouse point out (again, correctly) that small businesses have a long history of supporting reactionary causes and attacking workers' rights – associations of small businesses, small women-owned business, and small minority-owned businesses were all in on opposition to minimum wages and other key labor causes.

But while this is all true, that doesn't make Robinson-Patman a reactionary law, or bad for workers. The point of protecting small businesses from the predatory practices of large firms is to maintain an American economy where business can't trump workers or government. Large companies are literally ungovernable: they have gigantic war-chests they can spend lobbying governments and corrupting the political process, and concentrated sectors find it comparatively easy to come together to decide on a single lobbying position and then make it reality.

As Vinsel and Waterhouse discuss, US big business has traditionally hated small business. They recount a notorious and telling anaecdote about the editor of the Chamber of Commerce magazine asking his boss if he could include coverage of small businesses, given the many small business owners who belonged to the Chamber, only to be told, "Over my dead body." Why did – why does – big business hate small business so much? Because small businesses wreck the game. If they are included in hearings, notices of inquiry, or just given a vote on what the Chamber of Commerce will lobby for with their membership dollars, they will ask for things that break with the big business lobbying consensus.

That's why we should like small business. Not because small business owners are incapable of being petty tyrants, but because whatever else, they will be petty. They won't be able to hire million-dollar-a-month union-busting law-firms, they won't be able to bribe Congress to pass favorable laws, they can't capture their regulators with juicy offers of sweet jobs after their government service ends.

Vinsel and Waterhouse point out that many large firms emerged during the era in which Robinson-Patman was in force, but that misunderstands the purpose of Robinson-Patman: it wasn't designed to prevent any large businesses from emerging. There are some capital-intensive sectors (say, chip fabrication) where the minimum size for doing anything is pretty damned big.

As Miller and Tuttle write:

The goal of RPA was not to create a permanent Jeffersonian agrarian republic of exclusively small businesses. It was to preserve a diverse economy of big and small businesses. Congress recognized that the needs of communities and people—whether in their role as consumers, business owners, or workers—are varied and diverse. A handful of large chains would never be able to meet all those needs in every community, especially if they are granted pricing power.

The fight against monopoly is only secondarily a fight between small businesses and giant ones. It's foundationally a fight about whether corporations should have so much power that they are too big to fail, too big to jail, and too big to care.

Community voting for SXSW is live! If you wanna hear RIDA QADRI and me talk about how GIG WORKERS can DISENSHITTIFY their jobs with INTEROPERABILITY, VOTE FOR THIS ONE!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/14/the-price-is-wright/#enforcement-priorities

#pluralistic#Robinson-Patman Act#ftc#alvaro bedoya#monopoly#monopsony#main street#too big to jail#too big to care#impunity#regulatory capture#prices#the american prospect#Max M Miller#Bryce Tuttle#a and p#wright patman

2K notes

·

View notes

Text

To all the "Hands Off" Protesters (Democrats):

We are currently at a critical juncture with a national debt of $36.5 trillion, increasing by $2 trillion each year. This is a critical issue, and most experts are warning us that we have relatively few years left to take decisive action before America faces a financial crisis that would have catastrophic consequences for this country and the world.

Amid all your protests, the burning of Teslas, and your petulant vitriol, one crucial element is glaringly missing: any plan to cut government spending. Instead, your goal appears to be to spend even more.

We finally have leaders in President Trump and Elon Musk who are courageous enough to finally focus on sustainable spending practices that are critical to avoid risking our economic future. Time is of the essence—instead of being in the way, let’s act together before it’s too late.

If not...

HANDS OFF - my tax dollars, which were not intended for your pet projects and the corrupt, virtue-signaling Socialists who spew the garbage you all take as gospel. It’s not a slush fund and a money laundering operation through left-wing NGO's to make politicians rich.

HANDS OFF - my child at school. Teach them the basics of reading, writing, and arithmetic. They are not there to be indoctrinated into your Marxist ideologies.

HANDS OFF - trying to force American women and girls to compete against biological men, and then adding insult to injury, forcing them to change and shower in front of them. Stop forcing your fu@ked up theories on the rest of us.

HANDS OFF - all the property you destroy in the name of whatever cause you’re supporting that given week. Other people’s vehicles are not yours to destroy. Neither are statues or all the other s#it you light on fire.

HANDS OFF - our college campuses. Decent kids are there to learn. Free speech is protected. Violence, intimidation, and taking over buildings are not. By the way, if your cause is so just, take off the masks and show yourself. Cowards one and all.

HANDS OFF - our president, who was duly elected to clean up the mess y’all created. We sat by and watched as you supported a puppet who was practically dead. It damn near destroyed the nation. Financially, from a security standpoint, and morally.

HANDS OFF - to all the federal district judges. Your power does not supersede the executive branch. And, stop using Lawfare by going after your political opponents.

HANDS OFF - our ICE Agents, who are taking violent gang bangers out of our country and forcing people who want to come here to do so legally. It should be the only way. Period. End of story.

HANDS OFF - our Free Speech rights. For years, you have used the process of cancelling people who simply wanted to express their own ideas. In your world, you think free speech can only be allowed if it agrees with your screwed up ideologies.

HANDS OFF - the American family. You have done everything possible to destabilize the concept of families because you believe that our ultimate allegiance should be to the government.

HANDS OFF - from imposing your Marxist views of Critical Race Theory (CRT) and the methods you’ve used to implement them through Diversity, Equity, and Inclusion (DEI). Most Americans are compassionate individuals who believe in judging people based on their character rather than the color of their skin.

These principles are what the vast majority of Americans voted for.

You don’t like it, be like that slob Rosie O'Donnell and move to Europe, which is being taken over by radical Islam.

So, to borrow your stupid little slogan…. Hands Off...

Love,

MAGA Country...

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#make america great again

355 notes

·

View notes

Text

History tells us that all freedoms are conditional. In 1920, the Soviet Union became the first country in the world to legalize abortion, as part of a socialist commitment to women’s health and well-being. Sixteen years later, that decision was reversed once Stalin was in power and realized that birth rates were falling.

The pressure on all nations to keep up their population levels has never gone away. But in 2025, that demographic crunch is going to get even crunchier—and the casualty will be gender rights. In both the United States and the United Kingdom, the rate at which babies are being born has been plummeting for 15 years. In Japan, Poland, and Canada, the fertility rate is already down to 1.3. In China and Italy, it is 1.2. South Korea has the lowest in the world, at 0.72. Research published by The Lancet medical journal predicts that by 2100, almost every country on the planet won’t be producing enough children to sustain its population size.

A good deal of this is because women have more access to contraception, are better educated than ever, and are pursuing careers that mean they are more likely to avoid or delay having children. Parents are investing more in each child that they do have. The patriarchal expectation that women should be little more than babymakers is thankfully crumbling.

But the original dilemma remains: How do countries make more kids? Governments have responded with pleas and incentives to encourage families to procreate. Hungary has abolished income tax for mothers under the age of 30. In 2023, North Korean leader Kim Jong-Un was seen weeping on television as he urged the National Conference of Mothers to do their part to stop declining birth rates. In Italy, Premier Giorgia Meloni has backed a campaign to reach at least half a million births a year by 2033.

As these measures fail to have their intended effect, though, the pressure on women is taking a more sinister turn. Conservative pro-natalist movements are promoting old-fashioned nuclear families with lots of children, achievable only if women give birth earlier. This ideology at least partly informs the devastating clampdown on abortion access in some US states. Anyone who thinks that abortion rights have nothing to do with population concerns should note that in the summer of 2024, US Senate Republicans also voted against making contraception a federal right. This same worldview feeds into the growing backlash against sexual and gender minorities, whose existence for some poses a threat to the traditional family. The most extreme pro-natalists also include white supremacists and eugenicists.

The more concerned that nations become about birth rates, the greater the risk to gender rights. In China, for instance, the government has taken a sharply anti-feminist stance in recent years. President Xi Jinping told a meeting of the All-China Women’s Federation in 2023 that women should “actively cultivate a new culture of marriage and child-bearing.”

For now, most women are at least able to exercise some choice over if and when they have children, and how many they have. But as fertility rates dip below replacement levels, there is no telling how far some nations may go to buoy their population levels. 2025 looks to be a year in which their choice could well be taken away.

225 notes

·

View notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

434 notes

·

View notes

Text

Trump's Press Secretary Accidentally Blurts Out Real Goal of His Tariff Scam, then Later, Lies to Americans about How Tariffs Work

"In his speech to Congress, President Trump kept lying about his tariffs, falsely claiming that Canada is letting huge amounts of fentanyl into our country and suggesting the trade wars will only get worse. Then press secretary Karoline Leavitt told reporters directly that if Canada wants to avoid tariffs in the future, it should become the fifty-first U.S. state.

She revealed it: Trump’s tariffs are not about fentanyl or any supposed unfair treatment of the U.S. They’re about forcing Canada, with no justification whatsoever, to submit to his will. Newsflash: It’s not OK for the American president to lie relentlessly about our allies and threaten them with economic Armageddon to bend them to his deranged, passing whims." (source)

The Trump administration is still trying to gaslight Americans into believing that tariffs will be good for the economy, even as the stock market hemorrhages cash. White House press secretary Leavitt got into a heated back-and-forth with an Associated Press reporter on Tuesday, in which she revealed that she really doesn’t understand how tariffs affect consumers—or at least is totally willing to lie about it. (source)

When asked why Trump isn't trying to lower prices like he promised, but instead, is raising prices with higher taxes in the form of tariffs, Leavitt said “He’s actually not implementing tax hikes. Tariffs are a tax hike on foreign countries, ...Tariffs are a tax cut for the American people.”

She blatantly lied. Tariffs are not paid by the foreign countries selling the goods. They are a type of sales tax paid by the American businesses buying the goods. That increase in cost is generally passed on to you, the consumer. Simply put, tariffs are hidden taxes that siphon money out of your wallet, and into the federal government.

Even Donald Trump has admitted that his tariffs will destabilize the economy, but has repeatedly dodged questions about whether his tariffs would dive the U.S. headlong into a recession. Trump's own lack of confidence in his handling of the economy sent the stock market into a tail spin.

It seems Trump is using tariffs to kill two birds with one stone. He's willing to risk economic hardship on the American people, taking money out of our wallets, in order to make up for the huge tax cuts he promised his billionaire buddies, and to coerce other countries to submit to his will.

As usual, when Trump gets his way — WE all have to pay.

#news#economy#economics#karoline leavitt#trump#politics#government#us politics#America#USA#donald trump#democracy#republicans#democrats#American politics#election#aesthetic#beauty-funny-trippy#Washington DC#conservatives#vote#voting#presidential election#current events#capitalism#tariffs#foreign policy#important#business#finance

94 notes

·

View notes

Text

While billionaires stash fortunes in offshore havens, the IRS is targeting gig workers who make a few bucks answering questions on a platform where people earn side income by sharing expertise.

A federal court in California has authorized the IRS to demand records from JustAnswer. While ProPublica revealed that America's wealthiest often pay lower tax rates than schoolteachers, the IRS is focusing its investigative muscle on gig workers trying to earn extra income.

"The world is getting smaller for tax cheats," crowed IRS Commissioner Danny Werfel, in a Department of Justice press release – though apparently not small enough to catch the billionaire class exploiting sophisticated tax avoidance schemes. While JustAnswer users face scrutiny, the wealthiest Americans continue employing armies of accountants to legally dodge billions in taxes through complex trusts and partnerships that the IRS fails to audit.

121 notes

·

View notes

Text

If Elon Musk’s week were a Tesla, it would be the one parked outside a dealership in Oregon — the one with bullet holes in the windshield, a Molotov cocktail smoldering underneath, and the word "NAZI" scrawled across its hood. That’s not an exaggeration; that’s just Musk’s ego finally colliding with reality at high speed.

The man who once promised to colonize Mars now seems content burning down Earth. As Musk prances around Washington in his new role as Trump’s favorite government hatchet man, his so-called Department of Government Efficiency (DOGE) has turned out to be less about saving tax dollars and more about gutting everything that remotely resembles structure or accountability. Federal employees? Fired. Foreign aid programs? Slashed. Amtrak? Musk’s been eyeballing that one like a cat stalking a goldfish bowl.

Naturally, people aren’t happy. And when Elon Musk pisses off the public, they respond with a fury that makes Mad Max look like a yoga retreat.

TESLA GOES UP IN FLAMES — LITERALLY

This week alone, a Tesla dealership in Oregon was riddled with bullets like someone mistook it for a Wild West saloon. In Boston, a Tesla charging station was torched in what police believe was deliberate arson. In Colorado, someone planted a Molotov cocktail near a Tesla dealership. Over in France, a dozen Teslas were reduced to smoking husks outside a dealership near Toulouse. If Musk’s vision for the future was electric cars in every driveway, he probably didn’t imagine half of them looking like props from a Michael Bay movie.

In Manhattan’s West Village, protesters flooded a Tesla showroom chanting, "Nobody voted for Elon Musk!" — a fair point, since the only ballot Musk ever seemed interested in was whatever half-baked Twitter poll he was running to justify his latest tantrum. Six people were arrested after demonstrators stormed the showroom, with one unlucky soul charged with resisting arrest and obstructing government administration.

Meanwhile, in Massachusetts, one protester decided to skip the firebombs and go the arts-and-crafts route: he plastered stickers of Musk’s face on several Teslas — an act Musk angrily declared was "vandalism." Which is rich, coming from a man whose entire career is essentially high-speed vandalism of logic, decency, and common sense.

MUSK’S “MARTYR” ACT FALLS FLAT

Naturally, Musk reacted to all this chaos with the grace of a raccoon cornered in a dumpster. He claimed on X that ActBlue-funded leftist groups were behind the violence. Never mind that Forbes found zero evidence to support that claim — Elon’s approach to facts is about as precise as his driving instructions for Tesla Autopilot.

The man’s spent so much time in right-wing echo chambers that he now sees George Soros lurking behind every broken window and paint can. According to Musk’s logic, protesters torching cars across multiple continents are all part of some vast conspiracy to... make him look bad? No need, Elon — you’re doing that just fine on your own.

WHEN EVEN TESLA OWNERS ARE EMBARRASSED

The backlash isn’t just limited to Molotov cocktails and spray paint. Tesla owners — the very people who once bragged about their sleek, zero-emission status symbols — are now dumping their cars just to distance themselves from Musk’s political dumpster fire.

“I’m sort of embarrassed to be seen in that car now,” one former Tesla owner told The New York Times before trading in his Model S.

Imagine spending fifty grand on a car only to feel like you’re cruising down the street in a MAGA parade float. For years, Tesla owners took pride in driving the car of the future — now they’re just trying to avoid being seen in public like they’re piloting a clown car through town.

THE KING OF COLLAPSE

Musk’s descent into unhinged paranoia has turned his once-vaunted empire into a bonfire. His crusade against “woke culture” has driven his businesses into chaos. His obsession with control has gutted Twitter, slashed Tesla’s reputation, and made DOGE a bureaucratic joke.

The man’s ego is writing checks reality can’t cash. His cars are getting torched, his employees are fleeing DOGE like rats from a sinking ship, and his credibility is burning faster than a Tesla Supercharger station in Boston.

Elon Musk wanted to be humanity’s savior — the genius billionaire who would drag us into a brighter tomorrow. Instead, he's become the guy with too much money, too little sense, and a talent for turning everything he touches into scorched wreckage.

(Fear and Loathing Closer to the Edge)

56 notes

·

View notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

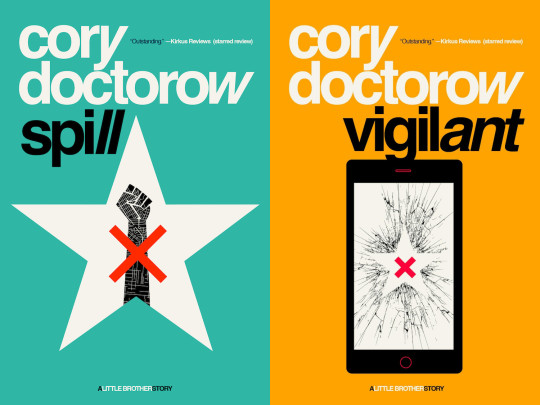

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

Washington state Democrats accidentally leaked a document entitled “2025 Revenue Options” describing how they plan to hunt down citizens for additional taxes. An email containing the document and an accompanying PowerPoint presentation was sent to everyone in the Senate and entail exactly how they will wordsmith their way into extorting the people. “Do say: ‘Pay what they owe’ — but Don’t say: “Tax the rich” or “pay their fair share” because “taxes aren’t a punishment,” the graph read.

The proposal includes an 11% tax on firearms and ammunition. Storage units would be reclassified as RENTALS and seen as retail transactions. Amid the cost of living crisis exacerbated by shelter costs, these politicians believe that citizens should pay more in property taxes.

“Avoid centering the tax or talking in vague terms about ��the economy’ or ‘education,’” the document states, instead opting to use positive connotations such as “providing,” “ensuring,” and “funding.” These lawmakers note that they must “identify the villain” who is preventing “progress.” That villain is the government, but the government needs to pin your woes on another source to create division. “We can ensure that extremely wealthy Washingtonians are taxed on their assets just like middle-class families are already taxed on theirs,” the slide reads.

The leaked document assures that this common rhetoric is intended to blind the masses into believing that tax hikes will not affect them but the dreaded “rich” who do not pay their “fair share.” In truth, no amount of taxation could ever be enough for the government as it spends perpetually with no plan to “pay their fair share” of debt.

Smart money has been fleeing blue states for this precise reason. Amazon’s Jeff Bezos notably fled Washington state for Florida, reportedly saving $1 billion on taxes alone. He moved his parents out of the state as well to avoid the death tax, which is among the highest in the nation at 20%. Governor Jay Inslee is wrapping up his term by insisting on a “wealth tax.”

The state is expected to face a $16 billion revenue deficit over the next four years and believes a 1% levy on the wealthiest residents could generate $3.4 billion over that time period. Businesses generating over $1 million annually would be in a new tax category called “service and other activities” and would be required to pay a 20% surcharge from October 2025 to December 2026. Come January 2027, successful businesses would be punished with a 10% tax. Why would anyone choose to conduct business in a state that punishes success? Innovators are not going to begin their businesses under these conditions and established companies will simply leave.

“Let’s be clear: there is a deficit ahead, but it’s caused by overspending, not by a recession or a drop in revenue,” Gildon said in a statement. “When the cost of doing business goes up, consumers feel it too. His budget would make living in Washington even less affordable.”

The state failed to manage its finances properly, and that burden now falls on the people. We see the same problem emerge at the local and federal levels. Governments feel entitled to YOUR money. Rather than correcting the root issue of spending and misallocated funds, governments believe the people they govern will foot the bill. The rhetoric is always the same as they insist they are “progressing” society by punishing the greedy and vilified rich. In truth, everyone suffers as a result of government mismanagement.

58 notes

·

View notes

Text

We still don’t know quite why the assassin of Brian Thompson targeted the CEO of UnitedHealthcare. But it’s hardly a secret that UnitedHealthcare has the worst record among all large insurers in denying necessary medical care to its subscribers.

The data confirm what far too many patients experience. In 2023, UnitedHealth’s denial rate of claims was 32 percent, compared to an industry average of 16 percent. Nonprofits had a far better record than for-profits.

I had assumed that UnitedHealth’s business model was to lowball premiums and then more than make up the profit by denying claims. But it’s even worse than that.

In Massachusetts, where I live, a supplemental Medicare policy from UnitedHealth costs $251 a month. An identical policy from Blue Cross, which has the state’s best record in not denying care, costs $212.

Why on earth would consumers buy such a flawed insurance product? It helps if they are captive customers, steered to UnitedHealth by a trusted source. That would be AARP.

AARP has just under 38 million members. But AARP is basically an insurance marketing scheme masquerading as an advocacy group for the elderly.

For 27 years, UnitedHealth has been the co-branded choice of AARP. If you are looking for a supplemental policy to conventional Medicare, or a Medicare Advantage product, or a Medicare drug insurance policy, AARP will steer you to UnitedHealth. And only to UnitedHealth.

The reason is shameful. UnitedHealth kicks back 4.95 percent of premium income from AARP subscribers to AARP. And the numbers are staggering. According to AARP’s audited financial report, AARP made $289.3 million from member dues, but $1.134 billion from kickbacks from insurers, of which the lion’s share, $905 million, was from health insurers. AARP delicately refers to these as royalties.

And somehow, because it is a nonprofit, AARP manages to avoid income taxes on this kickback income. Despite Congress’s efforts over the years to make nonprofits pay taxes on commercial income, AARP paid only about $3 million in federal income taxes on “royalties” of well over a billion. Read here the full article by The American Prospect

91 notes

·

View notes

Text

Help Stop Trump's "Big Beautiful Bill"

House Committees have been working on completing their individual portions of the budget reconciliation bill that Republicans are pushing through to enact hefty tax cuts for the wealthy and corporations. To pay for these tax cuts—and take advantage of the filibuster-proof reconciliation procedure—Republicans are including many spending cuts and policy changes from their partisan wish list.

In addition to gutting Medicaid, boosting ICE funding and green lighting the sale of public lands for fossil fuel production, these harmful provisions include:

$351 billion in cuts to student aid. This includes new limits on Pell Grant eligibility, new caps on how much a student can borrow, roll backs of protections from predatory lenders, and a repeal of President Biden’s student debt forgiveness program.

$50 billion in cuts to the Federal Employee Retirement System, including significant reductions in take-home pay, retirement benefits, and protections against unjust treatment for federal workers.

Slashes to funding for the Consumer Financial Protection Bureau (CFPB) by nearly 70% and a complete dissolution of the Public Company Accounting Oversight Board, the government’s top watchdog of public company audits.

A widespread roll back of climate-focused programs and clean energy tax incentives authorized by the 2022 Inflation Reduction Act, including the elimination of EV tax credits, the Greenhouse Gas Reduction Fund, and countless other grants that have led to $630 billion in new business investments and jobs.

A $300 billion funding cut and stringent new work requirements for SNAP, the food assistance program that helps over 42 million low-income people nationwide.

Language pulled from the REINS Act, a long-time Republican goal, that would give Congress new control over federal rule making. This would make it easier for Republicans to roll back any regulation they don’t like, including those that have already been finalized and implemented.

A limit to federal judges’ authority to hold government officials in contempt of court. A move clearly designed to defend the Trump administration from accountability for defying the courts.

Once all committee work is complete, the House and Senate will both need to approve and vote on the full reconciliation bill. House Republicans are aiming for a floor vote by Memorial Day weekend.

What is worse is that the GOP is planning to advance the bill even further at 1 a.m. to avoid attention.

Call your Reps and demand they oppose this destructive bill.

These are scripts to various aspects of the bill:

This one below is a more general version:

The rest are more specific to certain provisions of the bill, call them as well under the Big Bueatiful Bill Act: https://5calls.org/all/

Fax Tool:

Find your legislator:

#aclu#us politics#fuck project 2025#stop internet censorship#lgbtq+#american politics#fuck donald trump#stop project 2025#stop bad bills#fight for the future#save medicaid#save our national parks#save the environment#enviromentalism#queer rights#queer community#civil rights#authoritarianism#Stop Trump#anti ai

40 notes

·

View notes

Text

Runaway

Part II - Sacrificial Lamb

Previous I Next

Summary: Hold onto the good times, for they never last. A glimpse into the first half of your life and how you came to live at the Tillman ranch. You thought Roy Tillman was your savior, until the dreaded truth comes to light, leaning heavily on Gator as you both try to navigate young adulthood.

CW: This has elements of canon storyline. Heavy content and mature themes. Minimal use of Y/N. Reader is referred to as "Sunshine" and other pet names. Mentions of drug and alcohol use. Reader has a bad home life. Roy Tillman (a cw on his own). Depictions of domestic abuse. Reader is slapped - mentions of bruises. Fighting. Young love. Allusions to underage consensual sex (not explicit). Angst. Trauma bonding. Hurt no comfort. Let me know if I missed anything!

18+ Only! Minors DNI! Heed the warnings!

WC: 12.4K

Lehigh, North Dakota Early Spring 2007

For most kids, sixteen can be a tumultuous time in their lives to begin with but it seemed life had dealt you the losing hand at every turn.

From the moment you drew your first breath, you were doomed by the narrative. Born to drug addict parents moving from place to place or town to town, the only viable options for two people trying to avoid jail time or bad debts, simply dragging you around with them. It was a wonder the two halfwits managed to keep you alive those first few years.

They were smart enough to know they had to settle down before you started Kindergarten and ended up in the middle of Nowhere, North Dakota. They inherited a place from your grandmother who had passed away a few months prior, a single wide trailer that you got to call home for the better part of your childhood. It was a two-bedroom shack barely suitable for one person, let alone three. They grew pot out of the back bedroom, leaving you to sleep on a cot shoved into the corner of the living room.

School became your happy place, a solace from the reality of home. You flourished, despite your odds and loved to read. Books were an escape from reality. Late at night, you hid under the covers with a flashlight reading about princes and faraway kingdoms or of magic beyond your understanding. All manner of fantasy that you wished in some way could be true. You dreamt of your own adventures that would someday lead you miles away from here.

Both your parents had garnered the attention of the local authorities a month after your birthday. The county seized the property due to back taxes and your father took the fall for all the weed landing him a one-way ticket to federal prison. Somehow, they still let your mom keep custody despite her obvious involvement, coupled with the fact that the two of you had nowhere to live.

The two of you lived in and out of dumpy motels in the seedier parts of Lehigh until the day you were caught stealing from the local market where they detained you and called the Sheriff's department.

“Where’s your mom?” Roy Tillman asked with a sigh, looking down at you sitting there in the manager's office of the Piggly Wiggly. He sighed, taking the wide brimmed cowboy hat from his head, laying it on the desk beside him. The local sheriff had more than his fair share of run-ins with your family. He knew your past and your parents all too well.

You shrug instead of answering, pulling at a loose thread at the bottom of your very worn and dirty shirt. One of five you kept on rotation, the rest packed into the backpack on the floor beside you.

You hadn’t seen her in three days after she pawned off the only thing of value that you had left, a gold ring that she had given you a few years prior. It was the last straw, you knew right then and there she didn’t and would never care about you the way a mother should. She was nothing more than a junkie looking for her next fix.

He bent down to your level, fixing you with a sympathetic yet authoritative gaze that made you swallow the lump in your throat when your eyes met his as he asked you again. His presence made you feel uneasy at first, but he was taking his time to talk with you instead of speaking down to you like everyone else had.

“I d– don’t know. Haven’t seen her for a few days.” Your voice came out meek, suddenly feeling small under his domineering gaze, looking away from him.

His eyes narrowed, regarding you for a moment. “How old are you?”

“Si– Sixteen.” Your hangnail was suddenly more interesting, averting your attention as you began to pick at it as you answered.

“A pretty girl your age shouldn’t be out on her own.” He muttered more to himself than to you as he stood back up. “Well, come on now. Get up.”

You reluctantly stood, wary footsteps taking you to your resigned fate as the Sheriff walked you out. Your face was on fire from all the knowing gazes around the store. He tipped his hat to the store manager and led you to his blazer, helping you into the passenger side.

Instead of taking you to jail, to your surprise he took pity on you. For a runaway teen with nowhere else to go, he gave you an offer, an opportunity to live with a normal family and to better yourself. It seemed like a dream come true.

The Tillman's had a nice home on a large ranch with plenty of space to thrive and grow. The spare room was set up for you right next to Roy's teenage sons.

You'd seen Gator at school but coming from different sides of town, the two of you had never spoken. He was popular, played football and was far too pretty for his own good, the epitome of an all-American teenage boy. The kind of young man that parents would love to see their daughter date. Yes sir and yes ma'am were ingrained in his vocabulary. He was perfect and you absolutely hated him.

When you arrived, Roy's wife, Nadine immediately made you feel welcome, soon learning she was his second wife and not Gator's mother. She was younger than you imagined but seemed to be an old soul with her soft spoken and kind nature, advice of all manner at the ready if you asked.

It was church every Sunday and family dinners at night. It didn’t go without rules, but it was the structure and routine you so badly needed.

They gave you some new clothes, a warm, soft bed to sleep in and a roof over your head. You had your own room, a private sanctuary all to yourself. When you laid your head down on the feather pillow that night, you hoped that you wouldn't have to leave anytime soon. It was the first time in a long time you felt safe.

Gator completely ignored your presence for the first couple of days, until he couldn't. Roy had told him it was his duty to show you around the ranch and teach you various chores you would be doing, in his words, to “earn your keep.”

“You're still doing it wrong.” He sighed, pinching the bridge of his nose as he crossed the stall, bootsteps heavy, grabbing the shovel roughly out of your hands. You'd grown accustomed to the frown gracing his handsome features that he most often wore around you, as if it caused him physical pain to be in your presence.

Your hands were beginning to blister, it was hot, and the barn smelled well, like a barn. It was a strong mixture of manure, hay and earth.

“You need to use more force. Here.” He demonstrates again, working across the old barnwood floor. He wore a crisp white shirt that showed off the lean muscle of his arms and shoulders as he moved, tucked into his tight-fitting Wranglers. His green cap was situated backwards, per usual, unless the sun was directly in his face. If you weren’t so annoyed you might have appreciated how good he looked, but in your current state it just infuriated you further.

He stops midway, an exhausted look replacing the frown when he hears your huff, turning his head in time to see your eyes roll, crossing your arms over your chest.

“Aren't you just a ray of fuckin' sunshine.” He scoffs, moving the shovel upright resting his hands on the end.

“Think you're too good for shovelin’ horse shit? Hmm? That it?” He spat.

Your brows furrowed at his attempt at an insult, insinuating that he knew anything about your life. Rich, coming from a boy that grew up in a house where he never had to want for anything.

“No asshole, it's your bullshit I can't stand. You think you know anything about me? You don't know shit!” There was a fiery defiance in your eyes as you spoke but there was something else there. Something raw and vulnerable he couldn't quite put his finger on.

His brows furrowed at the sudden outburst; another venomous laced comment was on the tip of his tongue, but he thought better of it at the last second. He knew the heavy hand that ruled the ranch would tan his hide if he didn't show you how to do the rest of the chores, so he sighed and tried a different approach.

“Look, I'm tryin’ to help ya’ out. Roy he… he expects things to be done proper ‘round here. So just… can ya’ at least try?” He finally asks, with an almost pleading look. If only you'd known then, in his own way, he was already trying to warn you.

For the first time, his words seemed genuine, without the usual disdain. Warily, you narrowed your gaze but finally dropped your arms to your sides in a more relaxed, less defensive position.

“Yeah.” You nod, already reaching for the shovel to start again, this time doing it exactly as he had instructed instead of half-assing it just to spite him.

“There ya’ go, Sunshine. Gettin' the hang of it now.” He grins, crossing his arms and leaning against the wall. You couldn't help the small smile that lifted the edges of your lips at the little nickname that suddenly didn't seem so condescending.

The rest of the day went much smoother. It seemed you finally had a small understanding while he showed you around the property demonstrating how to complete the other various chores that you and he would be sharing.

His thorny shell melted just a little more, as you began to warm up to him. He even cracked a couple of jokes and tried to make you laugh as the day waned. He could be crude and rough around the edges but there was something else there, a glimpse of his boyish charm in the gentle way he spoke to you.

It was quiet out as the day began to wind down. The sun was setting over the horizon while you finished brushing the horses. You had been chatting about nothing and everything as the last rays fanned out across the barn bathing you both with its warmth. When he looked at you, his hazel eyes caught the light just right, making the usual brown tones burst with greens and golds.

When you stared at him a beat too long, his lips curled with that cocky, crooked grin that made a faint blush warm your cheeks before you quickly looked away and cleared your throat. He huffed a small chuckle but didn’t say anything, keeping that genuine smile, a true rarity you would come to find out in the coming weeks around the Tillman ranch.

Each evening you all sat down to have supper together. Prayers were said before each meal while you all held hands, a family tradition you weren’t accustomed to. Roy was at the head of the table with Nadine to his left and Gator to his right, and you seated next to the aloof boy.

It was the same every time, he begrudgingly took your hand and dropped it as if your touch was searing to his skin. You weren't sure what you had done to offend him so vehemently, especially since the two of you had finally been getting along so well.

The dinner table was where the ugly truth began to seep into this painted reality a mere two weeks after you had come to live with them.

Report cards were just released and Roy asked Gator why his grades were slipping while serving himself another helping of mashed potatoes.

“I don't know, school’s hard sometimes. I—” he began but Roy quickly cut him off.

“Schools hard? That's all you have to say for yourself?” Raising his voice before his hands came down against the table making everyone jump.

“Roy,” Nadine's mild-mannered voice cut in, but he held up his hand to silence her, making her mouth snap shut.

“Dad it's—”

“Gator, school is going to be the easiest thing you ever have to do. Get your grades up. Or. Else.” He pointed a finger at him. “You have the Tillman name to uphold, and you will not make a fool of me. Understood?”

He nodded, forking at the food on his plate but that wasn't enough for the elder man.

“Is that understood?” Leaning slightly into his space with a stone-cold look to his eye.

“Yes, sir.” The younger boy replied a little more sheepishly.

You watched the entire interaction unfold while keeping your own head down, trying to stay calm, watching as Nadine's eyes bounced between the two like she was waiting for something to happen. You immediately lost your appetite, asking to be dismissed from the table a few minutes later, thankful Roy obliged without any objections.

Late that same night, you were startled awake by the sound of glass breaking followed by muffled shouting and cries. You clung to the sheets and pulled them up, covering your head. It became the startling realization you had traded one abusive home only to be stuck in another. The perfect facade that was the Tillman home began to crack, showing all the festering secrets and lies in one fell swoop.

As you lay there, a soft knock came at the door, but you didn't move, too afraid to open your eyes until his hushed voice cut through the dark as he poked his head in.

“Hey, Y/N, are you awake?” Gator whispered out soft and timid, as the shouting and cries were slowly fading out. When you say nothing, he sighs, slowly pulling it closed on creaking hinges.

“Wait!” You whisper, making him stop. “Wh—what do you want?”

He pauses, watching as you carefully lower the covers, your sleep mussed hair popping into view before your wide, frightened eyes catch his.

“Can I come in?” He asks, hand still poised on the handle. He seemed small standing there in his grey joggers and tight-fitting tee, shifting slightly on bare feet waiting for you to answer.

You nod, not seeing him as a threat but kept your guard up, giving him a puzzled sort of look as you sit up.

He takes another look back out into the hall before quietly tiptoeing in and softly shutting the door behind him, crossing the room to the edge of the bed taking a seat at the end of it. He stays silent a moment longer, as if trying to figure out what to say.

“Why'd you come here?” He finally asks, with a hint of frustration, trying to keep it no louder than a whisper.

“I didn't have a choice.” You shrug, eyes flitting down to the worn comforter. “Dads in jail, mom didn't want me. Your dad said I could stay here that I— I'd be safe.”

Recounting the small conversation Roy had with you, it was either come here or spend the rest of your teenage years in juvie or foster care. It had seemed like a no-brainer.

“Yeah… Safe.” He scoffs. “Not everythin’ is sunshine and rainbows.”

You stared at him in disbelief for a moment, tears threatening to spill over your lash line.

“You don’t think I know that?” It came out a little breathless and high pitched, a little louder than you intended, unable to hide your emotion. “I should be used to bullshit by now.”

He gulped, not expecting the sudden reaction from you, firmly holding your gaze as his lips part but nothing comes out.

You think he's about to leave, head swiveling to the door as he sighs, then looking back to you through the dim light.

“Just try to stay out o’ trouble. Keep your head down and try not to piss off the old man.” He settles on.

There was a hint of something you couldn’t quite discern in his actions and words. Was he worried about you? He oozed a sort of macho bravado but here in this room, he slowly began to show a little more of himself. A teenager, just like you, trying to find his way in the world.

“Yeah,” you agree, unsure of what else to say.

“I better go. Ya’ gonna be okay?” He mumbled quietly, with a sweet sincerity to his question, rising from the bed to take his leave.

You nod, even though you didn’t feel okay, prompting him to nod back before he shuffled back out into the hall, leaving you alone once more. All the shouting had finally stopped, leaving the faint murmuring of the TV drifting from the room down the hall. The safety you had felt was gone, leaving you to question if there was truly any good left in the world. A question a sixteen-year-old shouldn’t have to worry about.

Something else happened that night. It was the first time Gator Tillman ever let someone see him in a different light. This compassionate, caring side he kept hidden away was vastly overshadowed by this continuous need for acceptance and love from his father, bringing out the worst side of him.

He had taken note of how strong willed you were, with a fiery, no bullshit nature that immediately drew him in. These attributes were also what worried him. The ranch had never been kind to those unwilling to fall in line and do as they were told.