#automotive industry companies

Explore tagged Tumblr posts

Text

The Automotive Market: Trends, Key Players, and Future Outlook

The global automotive market is undergoing a profound transformation, driven by rapid advancements in technology, shifting consumer preferences, and a global push toward sustainability. This market, which has long been a pillar of the global economy, is now at the forefront of innovation, embracing new paradigms in mobility, connectivity, and energy efficiency. This blog delves into the current trends shaping the automotive industry, profiles the key players driving these changes, and offers a forward-looking conclusion on what the future holds.

Market Trends

The automotive industry is currently being shaped by several major trends that are redefining the very nature of mobility and transportation.

1. Electrification and the Rise of Electric Vehicles (EVs)

One of the most significant trends in the automotive market is the shift from traditional internal combustion engine (ICE) vehicles to electric vehicles (EVs). Governments around the world are implementing stringent emissions regulations and offering incentives to promote the adoption of EVs. This has led to a surge in demand for electric vehicles, with global EV sales reaching over 10 million units in 2023, representing a 50% increase from the previous year.

The electrification trend is not limited to passenger vehicles; commercial vehicles, including trucks and buses, are also transitioning to electric power. This shift is being driven by advances in battery technology, which have led to increased range, reduced charging times, and lower costs. As a result, major automakers are investing heavily in EV research and development, with many planning to phase out ICE vehicles entirely in the coming decades.

2. Autonomous Driving and Advanced Driver Assistance Systems (ADAS)

The development of autonomous vehicles (AVs) is another transformative trend in the automotive industry. Companies like Waymo, Tesla, and General Motors are leading the charge in developing self-driving technology. While fully autonomous vehicles are not yet a common sight on roads, significant progress has been made in advanced driver assistance systems (ADAS), which include features like lane-keeping assistance, adaptive cruise control, and automatic emergency braking.

These technologies are improving vehicle safety and enhancing the driving experience, and they are becoming standard in new vehicles. The trend towards autonomy is also being supported by advancements in artificial intelligence (AI), machine learning, and sensor technologies, which are critical for enabling vehicles to navigate complex environments.

3. Connectivity and the Internet of Vehicles (IoV)

The automotive market is increasingly interconnected, with vehicles becoming part of a broader digital ecosystem known as the Internet of Vehicles (IoV). Connected vehicles can communicate with each other, as well as with infrastructure and other devices, enabling a range of new services and applications. For example, connected vehicles can receive real-time traffic updates, access remote diagnostics, and even enable over-the-air software updates.

This trend is driving innovation in areas such as infotainment, telematics, and vehicle-to-everything (V2X) communication. Automakers are partnering with tech companies to develop new services that enhance the driving experience and improve vehicle safety. As connectivity becomes more prevalent, it is expected to lead to the development of new business models and revenue streams in the automotive industry.

4. Shared Mobility and the Changing Concept of Vehicle Ownership

The traditional concept of vehicle ownership is evolving, with a growing trend toward shared mobility solutions. Ride-hailing services like Uber and Lyft, as well as car-sharing platforms like Zipcar, are gaining popularity, particularly in urban areas. These services offer consumers greater flexibility and convenience, reducing the need for personal vehicle ownership.

The shared mobility trend is also being driven by the rise of electric and autonomous vehicles, which are well-suited to shared use. In addition, younger generations, particularly millennials and Gen Z, are showing a preference for access over ownership, further fueling the growth of shared mobility. As this trend continues to gain momentum, it is expected to have a significant impact on vehicle sales and the overall structure of the automotive market.

5. Sustainability and the Circular Economy

Sustainability is becoming a key focus for the automotive industry as concerns about climate change and environmental impact grow. Automakers are adopting circular economy practices, which involve designing products with end-of-life in mind, recycling materials, and reducing waste. This approach is not only good for the environment but also makes good business sense, as it can lead to cost savings and new revenue opportunities.

In addition to electrification, other green technologies are being explored, such as hydrogen fuel cells and sustainable materials. The automotive industry is also investing in renewable energy sources for manufacturing and aiming to achieve carbon neutrality across the value chain. These efforts are being driven by both regulatory pressures and consumer demand for more sustainable products.

Key Market Players

Several major players dominate the global automotive market, each contributing to the industry's evolution and shaping its future trajectory. These companies are not only the largest automakers by volume but also leaders in innovation, sustainability, and new mobility solutions.

1. Toyota Motor Corporation

Toyota has long been a leader in the global automotive market, known for its pioneering work in hybrid technology and its commitment to sustainability. The company's hybrid models, such as the Prius, have been highly successful, and Toyota is now making significant investments in electric vehicles. Toyota's market share remains strong, particularly in Asia, where it is the dominant player. In 2023, Toyota sold over 9.5 million vehicles worldwide, maintaining its position as the world's largest automaker.

Toyota's strategy includes a balanced approach to electrification, with a focus on both battery-electric vehicles (BEVs) and hydrogen fuel cell vehicles (FCEVs). The company is also investing in autonomous driving technology through its subsidiary, Toyota Research Institute (TRI), and is exploring new business models in shared mobility.

2. Volkswagen Group

Volkswagen is another global automotive giant, with a strong presence in Europe and China. The company is aggressively pursuing electrification, with plans to invest over €70 billion in electric mobility, hybridization, and digitalization by 2030. Volkswagen's electric vehicle lineup, which includes models like the ID.3 and ID.4, is gaining traction in key markets, and the company aims to become the world's leading electric car manufacturer.

In addition to its focus on EVs, Volkswagen is also investing in autonomous driving and digital services. The company is developing its own software platform, Volkswagen Automotive Cloud, which will enable connected services and over-the-air updates. Volkswagen's long-term strategy is to transform into a software-driven mobility provider, offering a range of services beyond traditional vehicle sales.

3. Tesla, Inc.

Tesla has revolutionized the automotive industry with its focus on electric vehicles and sustainable energy. The company is the leader in the electric vehicle market, with a market share of approximately 20% of global EV sales. Tesla's Model 3 and Model Y are among the best-selling electric vehicles worldwide, and the company continues to innovate with new models like the Cybertruck and the Tesla Semi.

Tesla's success is driven by its vertically integrated business model, which includes its own battery production, software development, and a global network of charging stations. The company's focus on autonomy is also a key differentiator, with its Autopilot and Full Self-Driving (FSD) systems being among the most advanced on the market. Tesla's vision of a sustainable future extends beyond vehicles, as it also produces solar energy products and energy storage solutions.

4. General Motors (GM)

General Motors is one of the oldest and largest automakers in the world, with a strong presence in North America and China. The company is undergoing a major transformation, with a focus on electric and autonomous vehicles. GM has committed to an all-electric future, with plans to phase out internal combustion engines by 2035. The company's electric vehicle lineup includes models like the Chevrolet Bolt EV and the upcoming Hummer EV.

GM is also investing heavily in autonomous driving technology through its subsidiary, Cruise. The company plans to launch a fully autonomous ride-hailing service in the near future, positioning itself as a leader in the new mobility landscape. GM's strategy also includes partnerships with tech companies to develop connected services and digital platforms.

5. Hyundai Motor Group

Hyundai Motor Group, which includes both Hyundai and Kia, is rapidly expanding its presence in the global automotive market. The company is investing heavily in electric vehicles, with plans to launch 23 new EV models by 2025. Hyundai's Ioniq and Kia's EV6 are among the company's flagship electric vehicles, and both have received strong reviews for their performance and design.

In addition to electric vehicles, Hyundai is also exploring hydrogen fuel cell technology. The company is one of the few automakers that is actively developing FCEVs, with models like the Hyundai Nexo leading the way. Hyundai's long-term strategy includes a focus on sustainable mobility and smart cities, with investments in autonomous driving, connectivity, and shared mobility solutions.

Conclusion

The automotive market is in the midst of a profound transformation, driven by trends such as electrification, autonomy, connectivity, shared mobility, and sustainability. These trends are reshaping the industry, leading to the development of new business models, the emergence of new competitors, and the evolution of consumer preferences. Key players like Toyota, Volkswagen, Tesla, General Motors, and Hyundai are at the forefront of these changes, investing heavily in research and development to stay ahead of the curve. These companies are not only leaders in vehicle production but also pioneers in the development of new technologies and mobility solutions.

#automotive Market#automotive industry#automotive industry companies#automotive industry trends#future of automotive industry#automotive industry growth

0 notes

Text

Revving Up Success - Insights Into India's Automotive Companies Market

The audio file covers India's automotive industry companies' significant role in the nation's economy, highlighting its diversity, manufacturing prowess, and economic contributions. It discusses top automotive companies like Tata Motors and Maruti Suzuki, manufacturing capabilities, technological advancements, market dynamics, and shifts towards electric vehicles and sustainability. Challenges, financial performance, global competitiveness, and future growth prospects with Indian automobile companies are also examined, emphasizing innovation and strategic initiatives for sustained success in the evolving automotive landscape.

#automobile#automotive industry#automotive industry companies#Indian automobile companies#top automobile companies#auto companies#automobile manufacturing companies#automotive company

0 notes

Text

🇺🇸 As we approach Chrysler's 100th anniversary, Frank B. Rhodes Jr., great-grandson of company founder Walter P. Chrysler, is raising concerns about the brand’s future and wants to take action to rescue it. In a recent open letter to “investors and workers,” Rhodes announced his plan to revitalize Chrysler and its related brands—Dodge, Ram, and Jeep—under new “American” ownership.

🚗 Stellantis, the current parent company of Chrysler, has come under criticism from Rhodes for its management of the brand, which he claims has been severely neglected. The Chrysler brand currently offers only one vehicle, the Pacifica minivan, while several promising concept cars, such as the Chrysler Airflow, were shelved before reaching production. Rhodes highlighted Stellantis’ focus on European brands like Citroën and Peugeot, arguing that Chrysler has been left behind.

💼 Rhodes, who has been a Chrysler ambassador for over 40 years, points to his family’s legacy and his own ownership of the final Chrysler 300C as reasons for his dedication to the brand. He submitted a 17-page proposal to Stellantis executives, inviting them to a confidential discussion on reviving Chrysler. His plan includes giving equity stakes to employees, echoing the worker-centered vision of his great-grandfather, who founded the company on principles of American ingenuity and innovation.

📉 Rhodes also expresses concern about the future of Dodge, which has focused heavily on electric vehicles (EVs) despite its core customer base being more interested in American muscle and performance cars. He argues that Stellantis’ push toward an all-electric lineup by 2028 for Chrysler is out of step with market trends, where hybrids are gaining popularity. The all-electric path, Rhodes warns, could be disastrous for the brand’s future.

🔧 Despite these challenges, Rhodes remains optimistic about the potential to rebuild Chrysler as a symbol of blue-collar luxury and innovation. He is calling for a return to American-designed and built products, and greater autonomy for Chrysler and Dodge within Stellantis. Rhodes’ ultimate goal is to rescue the brand from what he sees as poor management and ensure that Chrysler survives to celebrate its next century.

🚨 As Chrysler fans prepare for the 100th anniversary celebrations next summer, including a large event in Pennsylvania, Rhodes is urging action to prevent the brand from fading into obscurity. Without intervention, he warns, Chrysler’s future looks bleak.

#transatlantic torque#brits and yanks on wheels#companies#technology#brands#engineering#cars#tech#old cars#innovation#business and industry sectors#history#chrysler#dodge#Plymouth#walter chrysler#detroit#michigan#big three#Chrysler Motors#automotive#american auto#automobile#classic cars#car#made in usa#stellantis#fiat chrysler automobiles#american company#american car

13 notes

·

View notes

Text

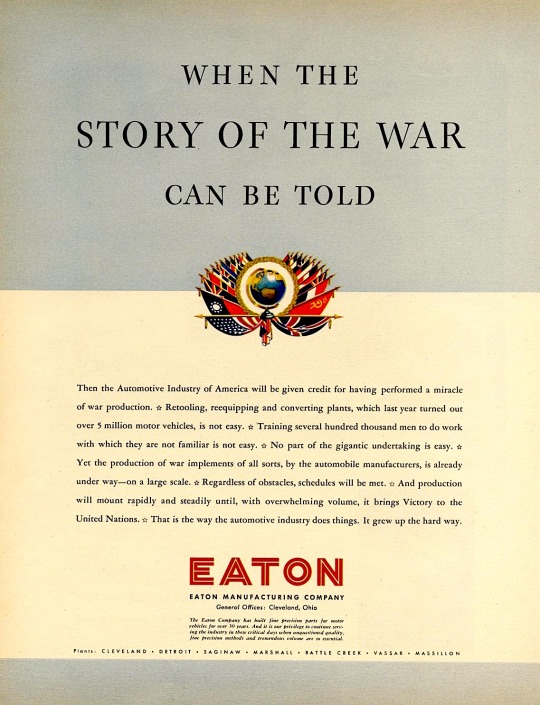

When the story of the war can be told. Eaton Manufacturing Company ad - 1942.

#vintage illustration#vintage advertising#american industry#life during wartime#ww2#wwii#wwii era#ww2 era#the 40s#the 1940s#war production#military industrial complex#war supplies#world war ii#world war two#world war 2#u.s. military#eaton manufacturing company#management companies#automotive industry#retooling#eaton#automobile manufacturers

3 notes

·

View notes

Text

🚘 Many of you know me as a project manager in the field of transportation and logistics. Today, I’m excited to share that I’ve expanded my expertise to include Automotive Engineering.

🎓 I’m thrilled to announce that I’ve completed my studies and earned a certificate in “Automotive Industrial Engineering” from Starweaver on Coursera! Huge thanks to Lluís Foreman his invaluable guidance and support throughout this journey.

#companies#technology#brands#engineering#cars#tech#innovation#old cars#business and industry sectors#history#automotive#british automotive#learning#continuous improvement#continious learning#certification#certified#industry#automobile#plants#production#supply chain management#management#logistics#innovation car#innovative#design#car#automotive history#coursera

5 notes

·

View notes

Text

there’s a lot of scummy shit going around in the car industry right now, but i think some of the most nauseating shit is car features requiring subscriptions.

cars are not fucking video games or streaming services. they are transportation devices. if the car has a self-tracking feature, or heated seats, or a HUD, then it is built into the car. there is NO REASON to put it behind a paywall lther than companies trying to suck their customer’s wallets dry.

it is becoming more and more clear that automotive companies are caring more about profit margins than they care about providing their customers with safe, comfortable vehicles. and their concerns about a “pleasant driving experience” died out long ago

#rosie speaks#i love cars but the automotive industry makes me wanna froth at the mouth#esp BMW & tesla#they’re the most guilty of this type of shit#cars#tag: automotive enthusiasm#automotive#car enthusiast#transportation#automotive industry#car industry#anyways repeat after me:#EVs are more harmful than ICEs and companies selling your cars features through subscriptions is predatory

4 notes

·

View notes

Text

Digital Marketing Companies in Mysore

One of the Best Digital Marketing Service Provider in the entire Mysore City.

Visit Our Website Today and Get in Touch with Us!!!

Contact Us for more info - [email protected] | +91 963 272 4344

#ipopi ads#digitalmarketing#digital marketing#top digital marketing agencies#top digital marketing services#digitalization#leading digital marketing company in mysore#leading digital marketing agency in mysore#leading social media marketing company in mysore#top social media marketing strategy#top digital marketing company in mysore#top digital marketing agency in mysore#top ad agency in mysore#top advertising agency in mysore#top digital marketers in india#digital marketing for automotive industry#digital media#best digital marketing company in mysore#best social media marketing company in mysore#best digital marketing agency in mysore#best digital marketing services#google ads#online marketing#digital marketing in mysore#automotive industry#internet marketing#facebook ads#social media marketing#social media management#social media

6 notes

·

View notes

Text

Challenges Faced By Automotive Component Manufacturing Companies In 2022

Noteworthy availability and technology implanted inside today's cars has heightened interest in related technologies and cross-channel collaboration for everything from safety to smart cars to service provided by automotive component manufacturing companies.

However, as cars become more unpredictable, so do their operating guidelines. Even if it's in a digital system, Millennials don't want to deal with a long, confusing manual. They prefer to use trials to learn about their vehicle's capabilities, but when they do require assistance, they must use a conversational interface to receive customized, context-specific assistance.

Global brands have become more aware of the impact customer experience has on steadfastness and income, yet few have been able to give clients the experience that matters most—not the experience that surprises or delights them, but the one that lives up to their expectations. Customers anticipate that car brands will mirror the same availability and reconciliation that they currently find in their vehicles throughout the remainder of the customer journey.

They expect consistency and continuity in brand understanding, whether they're visiting a dealership, driving one of your cars, exploring your website, or collaborating with you on social media. They anticipate that it will be simple to find answers and personalized help, regardless of where, when, or on what device.

The automotive components manufacturing industry is experiencing massive disruption and transformation. Convergence between technology companies and automakers is blurring industry lines and expanding the traditional automotive company's boundaries. Consumers are shifting from an ownership-centric to a service-centric mindset. The supply chain will be central to this transformation because service has surpassed item as the most important purchaser need, the customer experience will determine the ultimate fate of car brands—far more than the cars you deliver.

Here are five of the biggest challenges and disruptions in the automotive component manufacturing companies

Attracting talent

As the automotive components manufacturing industry continues to transform, manufacturers will need to continue attracting the best and brightest talent in order to keep up with customer’s demands.

Overloading

Automotive component manufacturing companies, like all businesses, experience ups and downs. Overcapacity occurs when a producer has already invested resources such as payroll and materials into building a specific quantity, only to discover later that they do not require producing as much as they had planned. As a result, there is an overspending that can disrupt cash flow and result in waste. Increased manufacturing floor responsiveness and improved master production scheduling are excellent ways to avoid overcapacity.

Globalization

Increased global competition implies lower market prices for a variety of vehicles: once again, most solutions call for increased efficiency to compensate for a minor margin of income. Consumers are becoming increasingly concerned about sustainability. As a result, auto component manufacturers must work harder to produce more environmentally friendly vehicles and to improve their manufacturing skills.

Urbanization

At the moment, consumers have a diverse set of criteria for their vehicles, many of which are relevant to urbanization. They include smaller vehicles, improved maneuverability, and increased fuel efficiency.

The automotive components manufacturing industry serves as a single source of customer legitimacy, providing a complete history of customer interactions across channels, one interface for agents to use regardless of communication platform and a dependable, comprehensive source of customer voice insights. A combined hub also enables OEMs to collect best practices from dealerships and share them across the organization.

#automotive component manufacturers#Automotive components companies#electric vehicle component manufacturers in india#automotive sustainability#sustainability in automotive industry#auto parts manufacturers in india

2 notes

·

View notes

Text

even if this was going into production to be sold, when's the last time you saw a Ferrari FXX on the road? An Aston Martin Valkyrie? How about a Lambourghini Essenza? A Bugatti Bolide?

Trick question: the answer is never. They're all commerically available sports cars, and none of them are road-legal.

The most expensive designer cars these days mostly aren't. (and BMW, who made the concept car we're talking about, were one of the first companies to start this trend, so we know they follow it). The majority of them are track only (meaning you can drive them on properly inspected and liscenced racetracks, but not the road), but in the case of the Ferarri XX cars, you can't even take them on racetracks, you can drive them on your own property or on Ferrarri's property only.

we might, in 30 years time, be seeing cars based on this design on the roads, but if BMW do start selling something using this, we'll almost certainly see two or three generations of eye-wateringly expensive track-only cars before they ever consider trying to make something that's certificed road-legal. and once it is, it'll be a limited run bought by people with seven zeroes on their monthly pay check. and then a marginally less limited run purched by people with six zeroes. And only after that will we reach a point were there's any chance that you will actually see something based on this on the road. that's how it goes with cool interesting new car tech - especially when it's cool interesting new tech designed to make your car lighter (and therefore faster) or weirder looking (and therefor cooler).

worrying about BMW's cutting edge sportscar concepts backing into you on the street makes about as much sense as worrying that everyone who owns a light aircraft is going to start taxing it down the road to take their kids to school. that's not the environment that vehical is designed for, and its not going to be where anyone uses it.

BMW's concept car: give it a carussy and a gear shift that looks like a clit. men aren't gonna know how to drive this thing

#i do get why people would be worried about this#because most people's biggest exposure to 'automotive company does something experimental and ultimately dangerous'#is the cybertruck#but that happened because elon is a silacone valley tech grifter and a professional con man not an engineer#(also the cybertruck is not actually experimental it's just shit)#(everything quote unquote new about it is shit the industry tried and rejected decades ago)#(this is legit experimental and new)#BMW have plenty of faults#but they are an an actual engineering firm#who know they loose all their sales if people don't trust them to make good and safe vehicals

13K notes

·

View notes

Text

How Vertical AI Agents Are Transforming Industry Intelligence in 2025

New Post has been published on https://thedigitalinsider.com/how-vertical-ai-agents-are-transforming-industry-intelligence-in-2025/

How Vertical AI Agents Are Transforming Industry Intelligence in 2025

If 2024 was the year of significant advancements in general AI, 2025 is shaping up to be the year of specialized AI systems. Known as vertical AI agents, these purpose-built solutions combine advanced AI capabilities with deep domain expertise to tackle industry-specific challenges. McKinsey estimates that over 70% of AI’s total value potential will come from these vertical AI applications. Gartner predicts that more than 80% of enterprises will have used vertical AI by 2026. This article explores how vertical AI agents are reshaping industry intelligence and paving the way for a new era of business innovation.

From General-Purpose to Specialized AI

If you take a step back and look at the bigger picture of technological evolution, the shift from general-purpose AI to industry-specific AI is nothing new. It reflects a similar trend we have seen before. For instance, in the early days of enterprise software, platforms like SAP and Oracle offered broad capabilities that required extensive customization to meet unique business needs. Over time, vendors introduced tailored solutions like Salesforce Health Cloud for healthcare or Microsoft Dynamics 365 for retail, offering pre-built functionalities designed for specific industries.

Similarly, AI initially focused on general-purpose capabilities like pre-trained models and development platforms, which provided a foundation for building advanced solutions but required significant customization to develop industry-specific applications.

Vertical AI agents are bridging this gap. Solutions like PathAI in healthcare, Vue.ai in retail, and Feedzai in finance empower businesses with highly accurate and efficient tools specifically designed to meet their requirements. Gartner predicts that organizations using vertical AI see a 25% return on investment (ROI) compared to those relying on general-purpose AI. This figure highlights the effectiveness of vertical AI in addressing unique industry challenges.

Vertical AI: Next Level in AI Democratization

The rise of vertical AI agents is essentially the next big step in making AI more accessible to industry. In the early days, developing AI was expensive and limited to large corporations and research institutions due to the high costs and expertise required. Cloud platforms like AWS, Microsoft Azure, and Google Cloud have since made scalable infrastructure more affordable. Pre-trained models like OpenAI’s GPT and Google’s Gemini have allowed businesses to fine-tune AI for specific needs without requiring deep technical expertise or massive datasets. Low-code and no-code tools like Google AutoML and Microsoft Power Platform have taken it a step further, making AI accessible even to non-technical users. Vertical AI takes this accessibility to the next level by providing tools that are pre-configured for specific industry needs, reducing customization efforts and delivering better, more efficient results.

Why Vertical AI is a Billion Dollar Market

Vertical AI has the potential to redefine industries much like software-as-a-service (SaaS) did in the past. While SaaS made software scalable and accessible, vertical AI can take this one step further by automating entire workflows. For instance, while SaaS platforms like Salesforce improved customer relationship management, vertical AI agents can go a step further to autonomously identify sales opportunities and recommend personalized interactions.

By taking over repetitive tasks, vertical AI allows businesses to use their resources more effectively. In manufacturing, for example, vertical AI agents can predict equipment failures, optimize production schedules, and enhance supply chain management. These solutions not only improve efficiency but also reduce labor costs. Additionally, vertical AI agents integrate seamlessly with proprietary tools and workflows, significantly reducing the effort needed for integration. For example, in retail, vertical AI like Vue.ai integrates directly with e-commerce platforms and CRMs to analyze customer behavior and recommend personalized products, minimizing integration effort while improving efficiency. Moreover, vertical AI agents are designed to work within specific regulatory frameworks, such as Basel III in finance or HIPAA in healthcare, ensuring businesses can utilize AI without compromising on industry standards or ethical AI requirements.

Hence, it’s no surprise that the vertical AI market, valued at $5.1 billion in 2024, is projected to reach $47.1 billion by 2030 and could surpass $100 billion by 2032.

Vertical AI Agents in Action: Automotive AI Agents

Google Cloud has recently launched its vertical AI agents specifically designed for the automotive industry. Known as automotive AI agents, these tools are designed to help automakers create intelligent, customizable in-car assistants. Automakers can customize the agents by defining unique wake words, integrating third-party applications, and adding proprietary features. Integrated with vehicle systems and Android Automotive OS, these agents offer features like voice-controlled navigation, hands-free media playback, and predictive insights.

Mercedes-Benz has adopted Google Cloud’s Automotive AI Agent for its MBUX Virtual Assistant, debuting in the new CLA model. This enhanced assistant offers conversational interaction, personalized recommendations, proactive assistance, and precise navigation. By enabling hands-free operations, these agents enhance safety and cater to diverse user needs, showcasing the potential of vertical AI to revolutionize industries.

The Road Ahead: Challenges and Opportunities

While vertical AI agents have immense potential, they are not without challenges. Integrating these systems into businesses can be a challenging task due to legacy systems, data silos, and resistance to change. Also, building and deploying vertical AI agents isn’t easy as it requires a rare combination of AI expertise and industry-specific skills. Companies need teams that understand both the technology side and the specific needs of their industry.

As these systems play a bigger role in critical processes, ethical use and human oversight become crucial. Industries will need to develop ethical guidelines and governance frameworks to keep up with the technology.

That said, vertical AI offers enormous opportunities. With their combination of advanced AI and specialized expertise, these agents are set to become the cornerstone of business innovation in 2025 and beyond.

The Road Ahead

The rise of vertical AI agents is a vital moment in the evolution of industry intelligence. By addressing industry-specific challenges with ease and perfection, these systems have potential to redefine how businesses operate. However, their successful adoption will depend on overcoming integration challenges, building cross-disciplinary expertise, and ensuring ethical deployment.

As vertical AI continues to gain traction in 2025, it will likely reshape industries and redefine business operations. Companies that adopt these solutions early will position themselves to lead in an increasingly competitive market.

#2024#2025#Accessibility#adoption#agent#agents#ai#ai agent#AI AGENTS#AI systems#android#applications#Article#Artificial Intelligence#autoML#automotive#Automotive AI Agent#automotive industry#AWS#azure#Behavior#billion#Building#Business#change#Cloud#code#Commerce#Companies#customer relationship management

0 notes

Text

#Gravity Die Casting parts manufacturing Company in India#Gravity Die Casting Manufacturing facility#Gravity Die Casting Company india#Custom GDC Solution#Automotive GDC Components#Industrial GDC Suppliers#Expert GDC Solution#precision GDC Parts Manufacturers#High Quality GDC Parts Manufacturers

0 notes

Text

The Automotive Market: Trends, Market Players

The automotive industry has undergone significant transformations in recent years, driven by technological advancements, shifting consumer preferences, and increasing environmental concerns. As a leading market research company, we have analyzed the current state of the automotive market, highlighting key trends, market players, and challenges that shape its future.

Market Size and Share

The global automotive market size is projected to reach $7.4 trillion by 2025, growing at a compound annual growth rate (CAGR) of 4.4% from 2020 to 2025. The market is dominated by the top five players: Toyota, Volkswagen, General Motors, Ford, and Honda, which collectively hold a market share of over 50%.

Market Trends

Several trends are shaping the automotive market:

Electrification: Electric vehicles (EVs) are gaining popularity, driven by government incentives, declining battery costs, and increasing environmental awareness. EVs are expected to account for 30% of global sales by 2030.

Autonomous Vehicles: Autonomous driving technology is advancing rapidly, with companies like Waymo, Tesla, and Cruise leading the charge. Autonomous vehicles are expected to revolutionize the industry, improving safety and efficiency.

Connected Cars: The rise of connected cars has enabled advanced safety features, improved infotainment systems, and enhanced customer experiences. This trend is expected to continue, with 75% of new vehicles featuring connectivity by 2025.

Sustainable Manufacturing: The industry is shifting towards sustainable manufacturing practices, focusing on reducing waste, energy consumption, and environmental impact. This trend is driven by consumer demand for eco-friendly products and government regulations.

Market Players

The top five players in the global automotive market are:

Toyota Motor Corporation: With a market share of 14.1%, Toyota is the largest player in the market, known for its reliable and fuel-efficient vehicles.

Volkswagen AG: Volkswagen holds a market share of 11.4%, with a strong presence in Europe and a growing presence in Asia.

General Motors Company: General Motors has a market share of 10.4%, with a diverse portfolio of brands including Chevrolet, Cadillac, and GMC.

Ford Motor Company: Ford has a market share of 8.5%, with a focus on electric and autonomous vehicles.

Honda Motor Co., Ltd.: Honda has a market share of 7.4%, with a strong presence in Asia and a growing presence in North America.

Market Challenges

The automotive market faces several challenges:

Regulatory Pressures: Stricter emissions regulations and increasing environmental concerns are driving the adoption of electric and hybrid vehicles, posing a significant challenge for traditional internal combustion engine manufacturers.

Technological Disruption: The rapid advancement of autonomous and connected car technologies is forcing companies to invest heavily in research and development to stay competitive.

Global Economic Uncertainty: Economic downturns and trade tensions can impact consumer spending and demand for vehicles, affecting the market's growth.

Supply Chain Disruptions: Global supply chain disruptions, such as those caused by the COVID-19 pandemic, can impact production and delivery of vehicles, leading to losses and revenue declines.

Conclusion The automotive market is undergoing significant transformations driven by technological advancements, shifting consumer preferences, and increasing environmental concerns. The top five players in the market are Toyota, Volkswagen, General Motors, Ford, and Honda, which collectively hold a market share of over 50%. The market is expected to grow at a CAGR of 4.4% from 2020 to 2025, driven by trends such as electrification, autonomous vehicles, connected cars, and sustainable manufacturing. However, the market faces challenges such as regulatory pressures, technological disruption, global economic uncertainty, and supply chain disruptions. To stay competitive, companies must invest in research and development, adopt sustainable manufacturing practices, and adapt to changing consumer preferences.

#automotive industry companies#automotive industry trends#future of automotive industry#automotive industry growth#global automotive industry

0 notes

Text

vimeo

Revving Up Success - Insights into India's Automotive Companies Market

The video explores the dynamic landscape of Indian automobile manufacturers. It emphasizes the automotive industry's pivotal role in India's economic growth, innovation, and global positioning by covering manufacturing capabilities, market trends, challenges, sustainability, financial performance, global competitiveness, future opportunities, and top automobile companies. The video delves into the current state of automotive industry companies, technological advancements, financial prowess, and strategies for sustained success and international prominence. It highlights the Indian auto industry's resilience, adaptability, and potential for sustained growth in the evolving automotive market. For more info on Indian automobile companies, visit the India Brand Equity Foundation.

#automobile#automobile industry#automotive industry companies#Indian automobile manufacturers#top automobile companies#Indian automobile companies#auto companies#automotive company#Vimeo

0 notes

Text

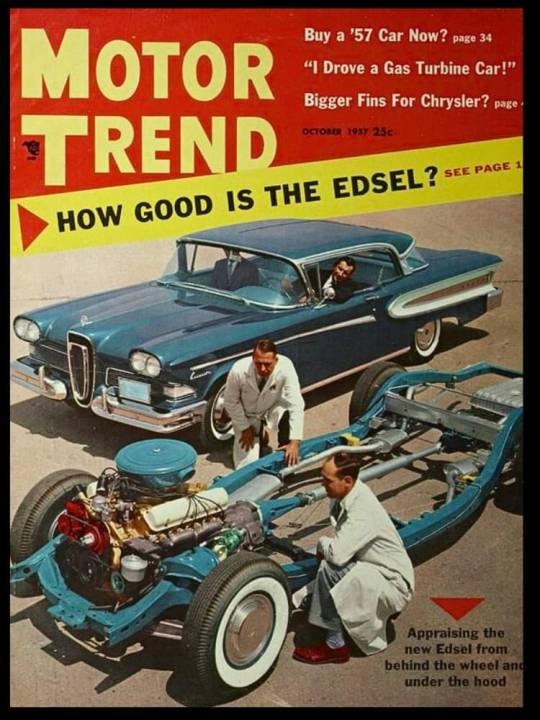

🇺🇲 On September 4, 1957, Ford Motor Company introduced the Edsel, a new division aimed at revolutionizing the market. Unlike Ford, Lincoln, or Mercury, the Edsel had its own identity with four models: the smaller Pacers and Rangers, and the larger Citations and Corsairs.

🚘 The Edsel became notorious for its failure. Launched during a booming economy, it was designed as a large, flashy car. But by the time it hit showrooms, the economy had shifted, and consumers wanted smaller, more efficient cars.

🤔 The Edsel’s unique design, including push-button gear shifting on the steering wheel, wasn’t well-received. Issues like a hood ornament that could fly off didn’t help its reputation. In its first year, Edsel sold just 64,000 cars, losing $250 million ($2.5 billion today).

💔 The Edsel brand was discontinued after the 1960 model year, marking one of the biggest flops in automotive history.

#brits and yanks on wheels#transatlantic torque#retro cars#brands#vehicle#cars#companies#old cars#american cars#automobile#ford edsel#edsel#ford motor co#ford#detroit#michigan#american auto#made in america#muscle car#old car#classic cars#car#classic car#luxury cars#business and industry sectors#lincoln#automotive#1950s cars#edsel ford#v8 engine

15 notes

·

View notes

Text

Ship to the automotive industry. Celanese Chemicals ad - 1950.

#vintage illustration#vintage advertising#the 50s#the 1950s#celanese#celanese chemical company#celanese chemicals#acids#glycols#solvents#alcohols#ketones#formaldehyde#acetone#propylene glycol#industry#manufacturing#automotive industry#chemical industry#chemical companies

4 notes

·

View notes

Text

Factory Automation in pune | India

The total automation of the production process is what we mean when we talk about factory automation. Using technologies like robotic arms, hydraulic systems, and pneumatic systems to automate the construction of increasingly complicated systems is standard procedure in the manufacturing industry.

#Factory Automation Pune#Industrial Automation Control India#Process Automation Robotics India#Industrial Automation Siemens#Industrial Automation Industry Pune#Robotics Company India#Automotive for Assembly Lines Pune#Automation Solution India

0 notes