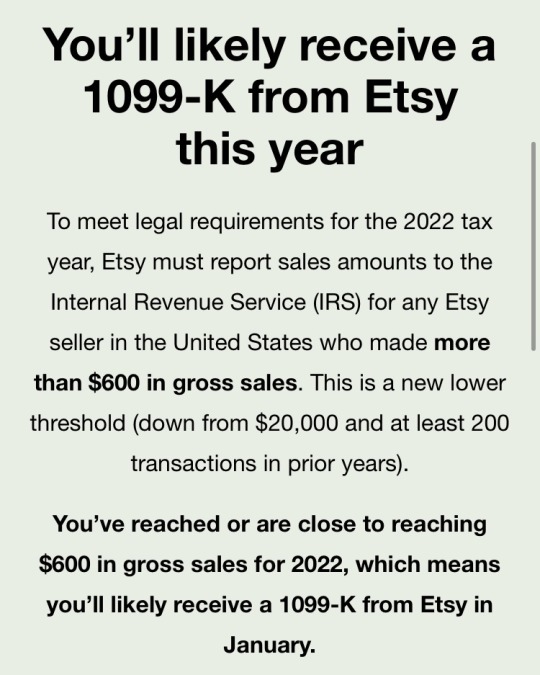

#any amount over 600 is getting taxed this year

Explore tagged Tumblr posts

Text

I fucking hate the government

#she speaks#fuck the irs#they’re making PayPal Venmo and cash app send out 1099s too#any amount over 600 is getting taxed this year#unless it’s a gift and even then over a certain dollar amount still gets taxed

7 notes

·

View notes

Text

What is the personal savings allowance?

New Post has been published on https://interestrate.co.uk/what-is-the-personal-savings-allowance/

What is the personal savings allowance?

Maximising your income by minimising your tax liability is being financially tax efficient. And, if you use all of your allowances, you’ll be doing so legitimately.

One such allowance is your personal savings allowance, which can be an effective way to shield your income from paying more tax than necessary.

What exactly is the personal savings allowance (PSA)?

The personal savings allowance is a tax-free allowance introduced in the UK in 2016. It works by giving individuals a certain amount of interest they can earn on their savings without paying any tax on it.

The amount of the PSA you receive depends on your income tax band or thresholds. You’ll need to know your tax band before calculating your tax-free savings. Significantly, savings interest is classed as income. You need to add it to your total earnings before determining what tax bracket you sit in. If your interest takes you into a higher bracket, you need to be aware of the impact on your PSA.

For basic rate taxpayers (those who earn up to £50,270 per year), the PSA is £1,000. For higher-rate taxpayers (those who earn between £50,271 and £125,140 per year), the PSA is £500. Additional rate taxpayers (those who make over £125,140 per year) do not receive a PSA.

The PSA applies to interest earned on savings accounts, bank accounts, building society accounts, and certain types of bonds. However, it does not apply to interest earned on ISA accounts, as the interest on these accounts is already tax-free.

If an individual earns more interest than their PSA, they must pay tax on the excess interest. Basic rate taxpayers will pay tax at 20% on the excess interest, while higher rate taxpayers will pay 40%.

It’s worth noting that the PSA is a personal allowance, which means couples who hold joint accounts can each claim their own PSA, effectively doubling the tax-free amount of interest they can earn on their savings.

Personal savings allowances vs Personal allowance

One of the reasons tax can be so difficult to understand is the jargon behind it. Specific to the personal savings allowance, one reason that it can be hard to understand at first is that it sounds so similar to ‘personal allowance’. Yet, they are two different concepts.

The personal allowance is the amount you can earn every tax year before paying taxes. For HMRC reporting purposes, your personal allowance refers to income earned as wages or salary. However, if you are a business owner, you’ll need to pay income tax on your business’s profits or tax on dividends over your dividend allowance.

For 2023/24, the personal allowance for most people is £12,570. However, you may have a slightly higher personal allowance if you can claim marriage or blind person’s allowance. Conversely, it may be lower if you’re a higher-rate taxpayer or still owe HMRC tax from previous years.

Calculating tax owed on savings interest

Any savings interest, or savings income, you earn from your savings accounts is included towards your personal savings allowance (PSA) until you go over your allocated amount.

As a result, when calculating what tax you must pay, you must remember all your accounts and the interest earned on them, as they will affect your PSA. If you have multiple savings accounts, the interest earned on every single one is added to determine if you have exceeded your PSA. For example, if you have two savings accounts with interest earnings of £600 each, your total interest earnings would be £1,200, which exceeds the £1,000 PSA for basic rate taxpayers. You can get an annual interest summary from your bank.

In addition, some types of savings income, such as income from fixed-term bonds or savings accounts with bonus interest rates, may be subject to tax at source, meaning that tax is deducted before the interest is paid to you. So, for example, if you earn £1,200 in interest on a savings account, but £200 tax is deducted at source, your PSA will only apply to the remaining £1,000 interest.

The starting rate for savings income

The starting rate for savings and the personal savings allowance are two different ideas that are closely related. But, again, it’s essential to understand both so you know what is taxable for your self-assessment.

The starting rate for savings is a special savings rate available to people who have a low income. If you are eligible, you can earn some savings income tax-free in addition to your Personal Savings Allowance (PSA). Currently, the starting savings rate is £5,000.

To be eligible, you must meet the following criteria:

You must be a UK resident for tax purposes.

You must have taxable non-savings income, such as employment or rental income, below the personal allowance for the tax year. Remember, for the tax year 2023/24, the personal allowance is £12,570.

You must be a basic rate taxpayer, which means your taxable income is between £12,571 and £50,270 for the tax year 2023/24.

Your savings income (such as interest from savings accounts, bonds, or other savings products) must not exceed the starting rate for the savings limit for the tax year.

Remember, eligibility criteria and the amount of tax-free savings income available may change each tax year, so it’s essential to check the HM Revenue & Customs (HMRC) website or consult a financial advisor for the latest information.

ISAs and your personal savings allowance

ISAs (Individual Savings Accounts) are a type of savings account in the UK that offer tax-free interest and gains on investments. Unlike non-ISA investments, ISAs have separate tax-free allowances and are not included in your personal savings allowance (PSA).

The annual ISA allowance is £20,000 as of the 2023/24 tax year, which means you can invest up to £20,000 in an ISA each year without paying tax on the interest earned or the gains made. You can split this allowance between different types of ISAs, such as cash ISAs, stocks and shares ISAs, innovative finance ISAs, and Lifetime ISAs.

ISAs do not affect your personal allowance for income tax purposes. For savers, then, using up your ISA allowance can be an effective way of shielding your interest earnings, particularly if you are going to go above your PSA.

Cash ISAs

Cash ISAs are most similar to regular savings accounts and offer a headline interest rate when you open an account. While that reliability coupled with tax efficiency is attractive to some, many are put off by the low rates that these products often have.

Stocks and shares ISAs

Due to the relatively low interest rates available with cash ISAs, many look to open Stocks and Shares ISAs, which are riskier products but offer uncapped return potential. In addition, investing in a Stocks and Shares ISA can be a particularly effective way to retain funds if you are trying to minimize the amount of tax owed because you will use up your PSA. Notably, the compound interest you earn can add up to significantly more than if it had been taxed.

Innovative finance ISAs

A less well-known product, an innovative finance ISA offers access to more types of investable assets. Generally speaking, that will mean investments in peer-to-peer lending or crowdfunding, which will be protected from tax. This product type may be attractive if you want to invest in more asset classes to diversify your portfolio. However, the trade-off is increased risk.

Lifetime ISAs

Available to those between 18 and 39, if you open this type of account, you can get a 25% top-up bonus payment from the Government on savings up to £4,000. However, how you spend the money has strict criteria. For example, you must keep it in an account until you are 60 or use it to buy your first home.

You can get all these different types of ISAs from many providers. However, ensure they are overseen by the Financial Conduct Authority and the Prudential Regulation Authority to protect you from scams or negligent behaviour.

Investment types and your personal savings allowance

The PSA applies to interest earned and interest distributions on savings and cash investments such as:

Bank and building society accounts – including current accounts, instant access savings accounts, and notice accounts.

Life annuity payments and some life insurance contracts

Open-ended investment companies, investment trusts and unit trusts.

Peer-to-peer lending – interest earned from peer-to-peer lending platforms.

Government bonds – including premium bonds and national savings and investment (NS&I) products.

Corporate bonds – including bonds issued by companies.

Certificates of Deposit – short-term fixed-rate savings products offered by banks and building societies.

Money market funds – mutual funds that invest in short-term debt securities.

The PSA does not apply to income from other investments, such as dividend income from stocks and shares, property income, or income from rental properties. These types of income are subject to their own tax rules and regulations.

Do I need to declare savings interest to HMRC?

Yes, in most cases, you must declare savings interest to HMRC. This is because savings interest is seen as income and is subject to income tax.

If the total interest earned on your savings accounts exceeds your personal savings allowance (PSA), you must declare the excess interest to HMRC and pay tax on it. Most people will need to declare savings interest on their self-assessment tax return if they complete one. If you find yourself in this position, you could also ask HMRC or a tax advisor or accountant for other declaration options.

It’s essential to keep records of your savings interest earned, such as statements from your savings accounts or a summary of your interest earned for the tax year. This will help you accurately report your income to HMRC and avoid penalties for incorrect reporting.

What to do if you have already paid tax on your savings

If you have paid tax on your savings income but believe you should not have, you may be able to claim a refund from HMRC.

The circumstances in which you may be able to claim a refund include:

You have not exceeded your Personal Savings Allowance (PSA) or Starting Rate for Savings allowance but paid tax on savings interest.

You have overpaid tax on your savings income due to an error, such as your bank or building society not correctly applying your tax code or not deducting tax at the correct rate.

To claim a refund, you can contact HMRC directly or use their online services to submit a claim. To support your claim, you must provide evidence of the tax paid on your savings income, such as bank statements or savings account statements.

There may be time limits for claiming a refund, so it’s best to do so as soon as possible. You should also be aware that HMRC may conduct an investigation to verify your claim and could request additional information or documentation. It’s always a good idea to consult a financial advisor or tax professional for assistance with making a claim or dealing with HMRC.

The personal savings allowance

As with anything tax related, the personal savings allowance can seem a little complicated when you first read about it. However, it will become clearer the more self-assessments you do or the more work you complete with a tax advisor or accountant. The critical thing to remember is to keep informed about how much the allowance currently is – especially if you complete your own self-assessment – and keep tabs on your investments that attract interest.

0 notes

Text

What To Find Out About Short-term Business Debt Financing

However, there are a number of common steps to follow should you choose a short-term funding choice. If cash is tight and also you need a short-term loan to fund operating expenses, take a deeper dive into the business’ funds and budget before borrowing. Likewise, evaluate whether the loan funds will enhance the business’ income or otherwise enhance its funds and ability to make payments. Then, determine how a lot you can realistically afford in payments every month—or week—and find a loan that fits your budget.

One benefit of traces of credit score over business bank cards is that the former typically charge a decrease Annual Percentage Rate . Small Business Administration loans are similar to standard term loans provided by private lenders. Most traditional business loans offered by personal lenders won't course of a loan utility except it’s accompanied by a detailed marketing short term business loan strategy. A stable business plan is your company’s highway map for the future. Without one, it’s very exhausting for a prospective lender to gauge whether your concept is commercially viable. Short-term small business loans can help business house owners survive a troublesome time or seasonal slump in income, but there are some cons to consider as well.

The Small Business Administration has excessive requirements for his or her loans. You will must have a good credit score history and powerful profits to qualify for an SBA loan. You will likely want to indicate that you’ve been in business a minimum of a 12 months to qualify for most SBA loans.

In fact, a brief term loan might actually help you elevate your credit score whereas avoiding extra interest funds. That mentioned, many lenders that don't require a proper business plan as a part of the application process offer short-term loans with greater annual percentage rates . Higher APRs imply a greater share of a loan’s repayments goes towards curiosity rather than the principal. Short-term business loans have numerous repayment terms, including daily, weekly or monthly, with different costs of borrowing.

Unpaid invoices are sold to a factoring company at a discount in exchange for a money advance. The company then assumes accountability for amassing cost out of your prospects. OnDeck’s business line of credit score provides fast and flexible entry to working capital. No prepayment penalties, account upkeep charges or inactivity charges.

The lender’s APRs range from 9.77% to 35.98%, relying in your creditworthiness and the loan terms, and that rate contains the LendingClub’s origination fee of 1.99% to eight.99%. To get a loan, you’ll must have a credit score of no less than 600 and no bankruptcies or tax liens on your credit report. Our platform brings banking and non-banking financial corporations so that you can select from. You can go through the rates of interest offered by them and make your choice. There’s no need to look elsewhere when we convey you a one-stop destination to care for your small business loan requirements. Many lenders additionally require a personal guarantee, which is a binding legal doc during which you pledge to personally pay again the loan if your business can’t.

While invoice financing includes borrowing cash with an bill as collateral, invoice factoring doesn’t contain a credit score relationship in any respect. The quantity of interest you’ll pay with bill financing depends short term financing on the lender, the bill and your creditworthiness. But you can usually anticipate to pay an interest rate between 13% and 60%.

Term lengths for business loans range with the kind of loan secured, the precise amount borrowed, the financial historical past of the borrower, and the chosen lender. Like expenses, borrowed funds could short term loan be divided into short- and long-term loans. A short-term loan comes due inside one 12 months; a long-term loan has a maturity larger than one year.

Instead of receiving a lump sum quantity that businesses should pay again in installments, a credit line operates as a credit card for companies. Therefore, you are not assuming the chance of borrowing too much. On the Yubi Loans platform, it is potential to get personalized business loans in accordance with your particular business necessities.

0 notes

Text

How Long Does It Take To Get a Tax Refund on The Cash App?

The Cash App offers various services like transferring money, paying bills, buying stocks, and receiving tax refunds. Many users wonder how long it takes to get a +1(909) 610-3890 Cash App Tax Refund. The answer can vary depending on multiple factors.

Firstly, the timing of the tax refund depends on how you filed your taxes. If you filed your taxes online, the Internal Revenue Service (IRS) sends a confirmation stating the acceptance of the tax return. If you filed with an online tax filing service, the confirmation message is usually within 24 hours of submitting the return. However, if you filed by mail, it takes around four to six weeks to receive the confirmation message.

Once the IRS accepts your refund, it processes the refund and sends it to your bank account or Cash App. The time taken to get a cash app tax refund depends on the payment mode you select. If you choose to have it deposited directly into your bank account, it takes around 2 to 5 business days for the refund to show up in your account. However, Cash App Direct Deposit option takes about 1-5 business days, and it can take less than a day if you opt for a standard instant deposit.

However, it is essential to remember that Cash App does not have any control over when the IRS sends the tax refund. The refund timeline is entirely dependent on how the IRS processes the refund. Sometimes, if the tax return has a mistake, it can take longer to process. In such cases, the refund is sent only after resolving the issue that caused the delay.

The time it takes to get a cash app tax refund entirely depends on how quickly the IRS processes your return, any possible issues with the tax returns, and which payment mode you choose. If you filed your taxes online and selected a direct deposit to your bank account or Cash App, it typically takes about 2-5 business days to show up in your Cash App account. However, the refund can take a week or two or sometimes longer periods based on the processing time taken by the IRS. It is always best to be patient and wait for the refund to arrive since it is a significant amount of money and requires a lot of processing.

How Long Does it Take For Cash App Taxes?

Cash App has become a popular option for people who want a simple and convenient way to pay their bills, rent, or make purchases online. However, some users of Cash App may be confused about how the app handles taxes. In this essay, we will explore +1(909) 610-3890 How long does it take for cash app taxes?

First and foremost, it is important to understand that Cash App is not responsible for cash app taxes or tax filings. As an individual using the app, it is your responsibility to report your earnings and pay taxes on them. Cash App does not withhold any taxes from payments made through the app. It is up to each user to keep accurate records of their transactions and report them appropriately.

If you use Cash App for business purposes, you may need to report your earnings to the IRS. Business owners are required to report and pay taxes on any income they receive, regardless of the form of payment. You should keep accurate records of your transactions and consult with a tax professional if you have any questions or concerns about filing your taxes.

Individuals who use Cash App for personal transactions may not need to report their earnings to the IRS, depending on the amount of money they receive. If you receive more than $600 in payments through Cash App in a calendar year, you will receive a Form 1099-K from the app. This form reports the amount of cash app taxes you have received through the app and is sent to the IRS. You can expect to receive your Form 1099-K by January 31st of the following year.

Cash App does not handle taxes directly but relies on individual users to report their earnings appropriately. If you receive payments through Cash App for business purposes, you will need to report them to the IRS. If you receive more than $600 through Cash App in a calendar year, you will receive a Form 1099-K from the app, which will be sent to the IRS. It is important to keep accurate records of your transactions and consult with a tax professional if you have any questions or concerns about your cash app taxes status.

#how long does it take to get tax refund on cash app#how long does it take for cash app taxes#how long does it take for your cash app tax#cash app tax refund#cash app tax refund hit#cash app tax refund time#cash app tax refund deposit

0 notes

Note

Hi, Dutch person here, DO NOT GO TO THE NETHERLANDS!

We're currently in a massive housing crisis the likes we have never seen since before war times. It's so bad that a basic two room apartment will have rent that's over the 1K a month when it should be 600 or less and don't get me started on the absolute mess that comes with buying a house. Even the cringe real estate TV shows are quitting one by one because there's no available houses to show off anymore that are within budget for the people who sign up. On top of that, our current prime minister is absolute dogshit, has lied about many many financial affairs, the biggest of which falsly labeled mostly single moms of color as suspicious, accusing them of tax fraud. Many of said women have lost their kids to child protective services and some have even taken their own lives. They're still waiting for the compensation they're owed.

Finally, it's well known within the LGBTQ+ community that this country absolutely sucks at protecting us. Sure, a lot of countries have room for improvement there you're right, but many transmasc folks had to deal with being treated less than human by health care officials here. We only have a very few amount of clinics that have the capability to provide care for trans people and there are many horror stories of folks being denied treatment if they, for instance, don't want bottom surgery because if they don't 'they're not trans' according to some outdated definition some doctors still use. Not to mention the 2 year long waiting to even be contacted for a first time appointment. I'd say if you're already on hormones you'd stand a better chance, but A. chances are the paperwork will be insane for you and B. A lot of meds are straight up forbidden here and if you're on any of those, you're basically screwed. I actually want to leave my country for these reasons and many, many more, there are countless things I could name. Our country USED to be perfectly fine and a better alternative to live in for a lot of folks, but the last ten years a lot got shrunk or cut entirely from our healthcare system, educational system and even the police (and yes, that is a problem here because ACAB isn't really a big thing here and instead they don't have enough people to accurately do their jobs, the police station in my town had to leave due to underfunding and it's only gone downhill since, recently someone got shot a few feet from my house which has never happened in all the 25 years I've lived here.) Reconsider Spain, don't come here, save yourself.

i understand where you're coming from but I need you to know that shot for shot all of this is happening in america & worse.

like we live in a 3 bedroom home for 2.4k where there's water damage sinking our roommates bedroom into the kitchen ceiling and the landlord KNOWS that and in response tried to raise our rent further. the idea of living ANYWHERE w two bedrooms for only 1k?? insane. id jump ship to live there right now if i could. that's inflated for you but for us people are paying 2k+ for studios that don't even have one bedroom.

& being treated subhuman by doctor's is the regular for dfab and trans people here. being denied treatment for not being trans enough is also normalized (i had to pay hundreds and hundreds of dollars for therapy and mental exams before i got on t), but my fiance and i have both been on testosterone and we're going to have our names and gender markers changed before we move anyway so it just doesn't fuss me tbh. like that's all bad shit but america does all of that on steroids while actively shooting guns at children w abandon. trust me, it's a step up.

#the netherlands is our choice landing spot bc its specifically very easy for americans to immigrate there by design#but i dont think were planning on living there forever. we just need a foothold in europe and out of this nightmare country

27 notes

·

View notes

Text

So how the heck do the Avengers pay for stuff, and how rich are they?

So, in the wake of “Falcon and the Winter Soldier” There’s a lot of debate about why Sam didn’t seem to get paid well for his work in the Avengers (at least in the MCU continuity), and this has got me thinking: we’ve got no evidence that the Avengers are, financially, anything but a hot mess. So lets break it down, Avenger by Avenger, using real-world pay scales for the ones who have jobs.

Tony: a billionaire, so clearly he’s a financial genius, right? Well….. his actions say otherwise. He’s shown to be wildly irresponsible with his money. He inherited a lot of wealth form his parents which was managed by the first Jarvis, Obadiah, and Pepper for him, he buys and then gives away not just woks of art, but entire collections by major 20th century artists on a whim, destroyed his own cars and home without concern, he tanks the value of his own company in the first Iron Man with a bad press interview, gets kicked of his own bord of directors, and ultimately, in Iron Man 2, gives control of his company to Pepper. He’s insanely rich, and insanely smart, but man, he’s not smart with his money. So all the cool stuff, his suits, the Avengers tower, the facility up-state: that’s all paid for by him, but Pepper is holding the purse-stings. So, does he pay the others? We have no evidence for most of them… but we do with Spidey. Peter Parker is in the Stark Internship Program a euphemism to hide the fact he’s training and mentoring him as a super-hero, but I find the wording interesting: he refers to Spidey, his surrogate son and chosen heir, as an intern. I.E., Unpaid. I’m guessing this is Howard’s influence over him, some sort of ‘make you own way in the world, son’ attitude, but if he’s not paying Spidey, is he paying anyone else? He certainly pays for stuff super heroes suits and things, equipment, fuel, the base, but does he pay anyone a wage? No one ever mentions it. You think it would come up.

So, if he’s not paying them a wage, where do Avengers (and thier allies) get their day-to-day money from, and are they rich? Using google and https://www.federalpay.org, lets find out.

Cap: Well, before Civil war, he’s a shield operative, and he presumably still holds his military rank: he’s a US Army captain, with (well) over 40 years service, so USD$88,142.40 per year, with $237.71 drill pay (pay per drill you have to do on weekends, on leave or outside of normal service) and $175.00 per month hazard pay (which I bet is interesting) on top of that. As a WW2 veteran, he’d be eligible for a war pension if he:

Was not discharged for dishonorable reasons; and,

Served 90 days of active military duty; and,

Served at least one day during wartime ("wartime" as determined by the VA); and,

Had countable family income below a certain yearly limit; and,

Is age 65 years or older; or

Regardless of age is permanently disabled, not due to wilful misconduct.

As he’s still receiving 90k per year, he’s ineligible for a pension as his countable yearly income is above the limit. So if shield pays him in accordance with his rank and years of service, about $90, 600 per year incuding hazard pay.

After civil war, he’s a fugitive on the run, so presumably flat broke. I’d asume he gets his pension returened to him after the snap.

He’s also just gone from the 40’s to the present day, so 70 years of inflation probably makes buying things very confusing for him: everything would seem insanely expensive at first. He’d also not know what the correct prices are for anything invented after 45. You might get used to how much more expensive food and coffee is, but how much is a smart-phone worth? $200? $2000 $20000? Who knows? I bet the others have to facepalm a lot when he either refuses to pay for what he sees as clear price-gouging, and at the same time regularly pays insane amounts of money for goods and services because he doesn’t know better. He also has no known assets other than his pay: he rents an apartment making him one of the few American males in his age-group who isn’t a home-owner

Thor: Does Asgard even have currency? It’s depicted like a “Crystal spires and toga” type utopia with no poverty: even working class Asgardian’s like Scourge seem to be pretty well-off and want for nothing, so he’s from a post-scarcity society where actual magic is a thing. His “Another” coffee cup smashing and the fact he doesn’t have a computer of phone in Ragnarök might indicate that, no, he just doesn’t have, need or understand money. Splitting a bar tab with him must be a nightmare. His breakdown post snap indicates he’s got some cash, but not a huge amount, and is probably skiving of Valkyrie and the other Asgardians.

Banner: Okay, so a PhD could make you a lot of money from patents… in pharmacology or engineering. Theoretical physics? Not so good. And if Banner did have any patents, they’ve probably been seized under eminent domain by the US military. At the start of The Hulk film, he’s working a entry-level factory job at a botteling plant in Brazil. The minimum wage in Brazil is 1069.62 Real per month, that’s 12,835.44 Real per year, or around $2437.79 US per year, before everything goes wrong for him! He then runs off to India, works for Tony for a bit and then gets shot into space. Spidey may actually make more in allowance than Banner does, and Banner is a gown ass man with bills to pay: I’d imagine he loses a lot in ripped clothing.

Natasha and Barton: Pre Civil-war, both are government spooks, so how well does that pay? The salaries of CIA Intelligence Analysts based in the US range from $25,838 to $685,701 , with a median salary of $125,340, so let’s assume that Shield pays in a similar range: $685,701 per year for Director Fury, around 125,000 for Natasha and Cliff, which explains Cliff’s nice, middle-class mid-western home. Post civil war, presumably not great: we know that Natasha spends a lot of her savings running and hiding all across the world, and Cliff takes a deal and presumably lives of his savings, pension and his wife’s income.

Rhodes: Full USAF colonel with over 10 years service? $105,562.80 per year, plus $293.23 drill pay per drill and $175 per month hazard pay, and because he’s team Stark and not Team Cap in Civil War, he’d not lose any of that. He presumably also gets an injury pay-out after his accident. After T’challa and Stark, he might be the best paid avenger.

Dr Strange: spends all his money he made as a surgeon on trying to cure his hands: spends literally his last dollars heading to Nepal to train. Wong even jokes with him about their lack of worldly money when asking for a tuna-melt. But, can use illusion to make people think he has money, and his home and clothes etc. come with the job, so in the same boat as Thor in that he has no money, but needs none AKA, he’s a bastard to try and split a restaurant bill with.

Wanda and Vision: No know source of income, just sort of live in Tony’s hose and eat his food, and on top of that Wanda goes on the run after civil war… yet they can stay in fancy hotels in Edinburgh, a relatively expensive city, and Vison apparently bought them a house to retire in, so one of them has some source of money. Maybe Tony gave Vision years of back-pay form when he was still Jarvis, or maybe the vison has a day job, which is, frankly, hilarious. Could you imagine him as a barista? I can, and it makes me very happy.

Scott Lang: I’d assumed he’d be super, super broke, but apparently the average pay for a private security consultant in the Bay area is $85,430 per year. Not bad. Pity he gets sucked into the quantum realm just as his business is taking off, so presumably, flat broke again.

Bucky: no known income, and I doubt Hydra paid him for being the Winter Soldier so he probably has no savings, but he should, technically, qualify for a military pension. As a single veteran, he’d be eligible for federal tax-free pension of up to $1732 per month, or $20,784 tax free per year. Not much for someone who lives in NYC. He may also be eligible for medical benefits over the loss of his arm. Whether or not he got to see any of that money given how confused his life has been over the past 10 years is unclear, but on paper he’s eligible.

T’challa: He is, quite possibly, richer than Stark, and as an absolute monarch pays no tax and has access to his Nation’s vast wealth in vibanium. It’s good to be the king!

Captain Marvel: USAF captain, and a test pilot; the test pilot school only accepts applicants with a service length of less than 9 years 6 months (10 years six moths of helicopters) as they don’t want older applicants. With 8 years service, $79,538.40, plus drill pay and hazard. However, no know (human) pay since 1990. Flat broke.

Guardians of the Galaxy: no data, but I’m assuming “Cowboy Bebop” levels of perpetual never-ending poverty given the way they choose to live. I’d also assume Rocket has taken all their cash into some sort of Ponzi scheme of his own creation, because just look at him, of course he has.

Spidey: he’s got about $10 of his aunts’ money at any given time, so he can buy lunch… which may in fact be more than Banner or Lang, and we know it’s more that Strange or Thor.

So, here the big one: how rich or how broke is Sam?

Sam Wilson: annoyingly, we’re not directly told what rank Sam held in any MCU film. USAF pararescue “Maroon berets” are generally NCO’s (but there’ are officer-ranked pararescue) , and he’s seen working on his wings at one point, where as officers don’t generally work on or maintain airframes. He’s shown wearing a Nation Air guard grey while jogging at one point to confuse the matter further. The general consensus on redit is he’s a former USAF tech sergeant (E-6). But how long was he in the air force? With six years service (the minimum sensible time he could have served to work in pararescue based on his age), that would be $41,464.80 per year, plus drill pay and hazard. As Anthony Mackie, the actor that plays him, was 36 as of Civil War, and assuming the character is the same age, and assuming he retired from the air force that year, and he joined the USAF at 17, the youngest you can join, he’d have served 19 years, giving him a pay of $51,566.40, the maximum pay you can get at this rank before promotion to Master Sergent, but meaning he left just before he’d qualify for the 50% final salary pension you’d qualify for after 20 years. Which seems weird. So let’s assume the character is one year older than the actor that plays him and served 20 years (ages 17-37), that means Sam has a military pension of $25,783.20 per year (20,784 of it tax-free), plus any injury benefits. He councils other veterans, but doesn’t get paid for that. He also chooses Team Cap in Civil War, so would become a wanted criminal, and so lose his income between 2016 and 2018, and then gets snapped and has no income for 5 years, which would destroy his credit rating. Like the rest of Team Cap, he presumably gets his post snap pardon, and goes to work for the US government at his former pay and rank. However, given how Captain John Walker treats him as an equal, it’s possible he’s been promoted to a captain when the hired back, giving him a pay of between $54,176.40 to $88,142.40 (with 20 years experience, depending on if they take into account his prior service or not, and how much prior service he has), but either way, he’s just starting this as a new job after being legally dead for 5 years: no savings, and no credit.

Commercial fishing vessels cost about 10% of their total value per year in maintenance alone. I can’t identify what sort of boat the Wilson’s have, but some quick googling indicates that the cheapest 15m long wooden in-shore shrimp trawler costs around $140,000, so that’s $14,000 per year in maintenance costs alone, minimum. And that’s a lower estimate, assuming the rest of the business is sound, which we know it isn’t.

So, in concussion, yes, Sam is in some serious financial trouble until he can re-build his savings and credit, but the scary bit is he’s not alone in that: he’s probably better off than Lang, Banner, Danvers, Strange, Thor, Bucky, Wanda and Parker. Only Clint (if he gets a full pardon and gets his full pension), Rhodes, Stark and T’challa aren’t in some sort of potential financial problems. That asshole bank teller was right: despite the fact it seems to pay well on paper, with a few exceptions, the Avengers financials are probibaly a mess. EDIT: Rocket is running the Ponzi scheme, if that’s not clear from context. The others know they have money somewhere, but not where it’s gone. And It’s been pointed out to me that as he’s technically a POW while he’s the Winter Soldier, Bucky is owed over 70 years back-pay, equal to over 3 million dollars, details in the notes.

#MCU#sam wilson#falcon#captin marvel#captin america#tony stark#iron man#war machine#winter solider#bucky barnes#guardians of the galaxy#rocket raccoon#dr strange#hulk#wanda#vison#wandavision#the avengers#fan theory#working out how rich or poor mcu people are#what the heck do Tony Starks tax returns look like?#black panther#black widow#hawkeye#ant man#thor#rich list#peter parker#spiderman#federal pay scales

176 notes

·

View notes

Text

I know most people don’t really care about homophobic horse game nonsense anymore but here’s the current diet drama:

The game has two currencies: a normal main currency, “gold dust”, and premium “mobia” only obtainable through microtransactions or by buying from another player.

In any game where the currencies can be exchanged between each other, there needs to be currency sinks to keep too much normal currency from circulating. HI3 does this in the form of buying ranch parcels, buying slots for ranch buildings and decorations which let you have more horses, buying slots for custom art, etc, etc. More horse slots means more horses to sell which means more gold for you, but each barn only gives you 3-5 slots. Horses usually sell to an NPC for 4k gold at most. There’s also a system that automatically “taxes” a percentage of your gold to the game itself to forcefully remove it from circulation.

The problem? The gold sinks are fecking capped. They rise exponentially to the point that i.e. parcel one goes from 1,000 gold, to parcel eleven being 89,000,000 gold. No one has ever reached it. Multiplying expense and the taxing system literally ensure no one will ever reach it. And this goes for every sink!

When every sink gets too expensive for a player to use, players end up accumulating more and more GD, and since they know the next upgrade will always be exponentially more expensive, all they're motivated to spend it on is mobia. The exchange rates went nuts, from around 1:600 to 1:1200, and people still struggle to make their ranches more than bare bones or rows and rows of ugly barns.

A forum thread has existed for over a year now asking for a reexamination of exponential sinks, but after 264 responses still hasn’t even been acknowledged by the devs.

Instead, the devs added a system a while ago where players pay 50,000 gold whenever they want and get a new horse slot plus some other perks. So far, exchange rates have gone down, but... Big players who bought upwards of 500+ horse slots have started breeding and selling their massive amounts of horses, effectively putting MORE gold back into the game.

How much? Oh, you know, around 4k per horse. Over Eight Million a month for a person at 500, combined with the previous profits they were getting from their existing slots, with only a 2.5 mil investment needed each month to keep them at the top. When the devs were informed a week in that the system needed a limit (when players were already over 590+), the horse slots you could buy were capped. To 500.

And no, those profits still aren’t enough to afford the gold sinks. Meaning most of that money will go towards mobia.

People have been buying lots of mobia while it’s cheap(now 1:880), and we’re all waiting for those big players to break even and start flooding the economy, all while begging the devs to do something about exponential sinks so the game isn’t 90% grinding. Fun :)

21 notes

·

View notes

Note

Hate to ask you literally anything at this point, but do you know if patron earnings will be taxed at a $600 threshold?

Not sure but that doesn't matter for me as my patreon is already set up as work income bc it's part of my business. I already pay taxes on anything that comes in through patreon and paypal. However I would assume so since the law is seemingly affecting everything *on the grounds that* receiving money over $600 from *any source* is now seen as income.

Again the previous law was basically that any source of income 20k or over would be reported to th IRS as income on which you would be expected to file. This primarily affected small businesses then, like if you had an etsy, you didn't have to really worry about that unless you were making enough for it to matter to the IRS but if you ended up breaking 20k a year the IRS would come 'knocking at your door' expecting a cut and if you weren't filing you can nd up getting audited and indebted. Nuance being that this mattered more bc moneysharing apps are not like...work, which is what Patreon is. Patreon is set up as a platform that enables creators to be paid for their creations, aka work. But paypal, venmo cashapp etc are supposed to be places where you can send/receive money for *nothing* so it's heinous to consider that income especially at amounts under even one measly grand a year.

p.s. Found this on Patreon's site

so in certain states it is taxed at the $600 threshold whil the $20k is still holding elsewhere however I wouldn't trust this to stay where it's at bc I do not trust this system's endless hunger for the money of those who barely have any and it's distaste for taxing those who have exorbitant amounts.

ps. ilu don't feel bad asking me stuff

8 notes

·

View notes

Text

Annotated Timeline of Period 9

Drew Gaither

2nd APUSH

11-27-18

Mr Johnson

A. Ronald Reagan’s victory in the presidential election of 1980 represented an important milestone, allowing conservatives to enact significant tax cuts and continue the deregulation of many industries.

As Reagan began his first term in office, the country was suffering through several years of stagflation, in which high inflation was accompanied by high unemployment. To fight high inflation, the Federal Reserve Board was increasing the short-term interest rate, which was near its peak in 1981. Reagan proposed a four-pronged economic policy (Reaganomics ~ supply side) that was intended to reduce inflation and stimulate economic and job growth: 1) reduce government spending on domestic programs; 2) reduce taxes for individuals, businesses and investments; 3) reduce the burden of regulations on business, and 4) support slower money growth in the economy.

In Congress, Representative Jack Kemp, Republican of New York, and Senator Bill Roth, Republican of Delaware, had long supported the supply-side principles behind the Economic Recovery Tax Act (ERTA) (1981), which would also be known as the Kemp-Roth act. The bill, which received broad bipartisan support in Congress, represented a significant change in the course of federal income tax policy, which until then was believed by most people to work best when used to affect the demand during times of recession. The ERTA included a 25 per cent reduction in marginal tax rates for individuals, phased in over three years, and indexed for inflation from that point on. The marginal tax rate, or the tax rate on the last dollar earned, was considered more important to economic activity than the average tax rate (total tax paid as a percentage of income earned), as it affected income earned through “extra” activities such as education, entrepreneurship or investment. Reducing marginal tax rates, the theory went, would help the economy grow faster through such extra efforts by individuals and businesses. The 1981 Act, combined with another major tax reform act in 1986, cut marginal tax rates on high-income taxpayers from 70 per cent to around 30 per cent. Reagan's 1981 cut in the top regular tax rate on unearned income reduced the maximum capital gains rate to only 20% – its lowest level since the Hoover administration.

In April 1980, the federal government enacted the crude oil windfall profit tax on the U.S. oil industry. The main purpose of the tax was to recoup the federal government's revenue that would have otherwise gone to the oil industry as a result of the decontrol of oil prices. Supporters of the tax viewed this revenue as an unearned and unanticipated windfall caused by high oil prices, which were determined by the OPEC (Organisation of Petroleum Exporting Countries) cartel. Despite its name, the windfall profit tax (WPT) was actually an excise tax, not a profits tax, imposed on the difference between the market price of oil and an adjusted base price. The tax was repealed in 1988 because (1) it was an administrative burden to the Internal Revenue Service (IRS), (2) it was a compliance burden to the oil industry, (3) due to low oil prices, the tax was generating little or no revenues in 1987 and 1988, and (4) it made the United States more dependent on foreign oil. The depressed state of the U.S. oil industry after 1986 also contributed to the repeal decision.

Part of Reagan’s deregulation overall was massive deregulation of the FDR New Deal Bank Regulations. Federal requirements that set maximum interest rates on savings accounts were phased out. This eliminated the advantage previously held by savings banks. Checking accounts could now be offered by any type of bank. All depository institutions could now borrow from the Fed in a time of need, a privilege that had been reserved for commercial banks. In return, ALL banks had to place a certain percentage of their deposits in the Fed. This gave the FED more control and stabilized state banks. Garn - St. Germain Act of 1982 allowed savings banks to now issue credit cards to make non-residential real estate loans and commercial loans and facilitated actions previously only allowed to commercial banks. Deregulation practically eliminated the distinction between commercial and savings banks. Deregulation caused a rapid growth of savings banks and saving and loans (S&L’s) that now made all types of non-homeowner related loans. Now that S&L's could tap into the huge profit centres of commercial real estate investments, many credit-card issuing entrepreneurs looked to the loosely regulated S&Ls like a profit-making centre. As the '80s wore on the economy appeared to grow. Interest rates continued to go up as well as real estate speculation. The real estate market was in what was known as a "boom" mode. Many S&L's took advantage of the lack of supervision and regulations to make highly speculative investments, in many cases loaning more money than they really should. When the real estate market crashed, and it did so in a dramatic fashion, the S&L's were crushed. They now owned properties that they had paid enormous amounts of money for but weren't worth a fraction of what they paid. Many went bankrupt, losing their depositor's money. This was known as the S&L Crisis. In 1980 the US had 4,600 thrifts, by 1988 mergers and bankruptcies left 3,000. By the mid-1990's less than 2,000 survived. The S&L Crisis cost about $600 Billion USD in "bailouts." This is $1,500 USD dollars for every man, woman, and child in the United States. In summary, the S&L crisis was caused by deregulation which led to high-interest rates that then collapsed. Other causes included inadequate capital and defrauding shorthanded government regulatory agencies (fewer regulators and inspectors).

On August 3rd, 1981 almost 13,000 air-traffic controllers went on strike after negotiations with the federal government to raise their pay and shorten their workweek, but their efforts were fruitless. The controllers complained of difficult working conditions and a lack of recognition of the pressures they faced. Across the country, some 7,000 flights were cancelled. The same day, President Reagan called the strike illegal and threatened to fire any controller who had not returned to work within 48 hours. Robert Poli, president of the Professional Air-Traffic Controllers Association (PATCO), was found in contempt by a federal judge and ordered to pay $1,000 USD a day in fines. This is comparable to Teddy Roosevelt’s interference in the Anthracite Coal Strike, banking on it being a “national emergency” if Americans did not get coal in the middle of the winter. He used a “bully pulpit” as he had no real power. Unlike Roosevelt, Reagan did have power and on August 5, 1981, President Ronald Wilson Reagan begins firing 11,359 air-traffic controllers striking in violation of his order for them to return to work. The executive action, regarded as extreme by many, significantly slowed air travel for months. In addition, he declared a lifetime ban on the rehiring of the strikers by the Federal Aviation Administration (FAA). On August 17th (ironically a day after my sister Angel's birthday), the FAA began accepting applications for new air traffic controllers, and on October 22nd the Federal Labour Relations Authority decertified PATCO. This for many conservatives was a major milestone as it dealt harsh blows to the already much-depleted labour union system that had been so prevalent during the Progressive Era and the Gilded Age.

In 1994, under the Clinton administration, the Contract with America was signed on the Capitol steps in Washington, D.C., by members of the Republican minority before the Republican Party gained control of Congress in 1994. The “Contract with America” outlined legislation to be enacted by the House of Representatives within the first 100 days of the 104th Congressional Convention (1995–96). Among the proposals were tax cuts, a permanent line-item veto, measures to reduce crime and provide middle-class tax relief, and constitutional amendments requiring term limits and a balanced budget. With the exception of the constitutional amendment for term limits, all parts of the “Contract with America” were passed by the House, under the leadership of the speaker of the House, Newt Gingrich.

Under George W. Bush and continued under Barack Obama two major changes to the tax code were made: (1) the EGTRRA and the JGTRRA. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) is an income tax cut enacted on June 7th, 2001. The Bush administration designed the tax cuts to stimulate the economy and end the 2001 Recession. Families would spend the extra money, increasing the demand. It, out of many things, increased the tax-deductible contributions people could make to their IRA accounts, doubled the child tax credit from $500 to $1,000, expanded the Earned Income Tax Credit, provided greater tax deductions for education expenses and savings, reduced the gift tax, and provided relief from the Alternative Minimum Tax.

The EITC phased out the estate and generation-skipping transfer taxes so that they were eliminated in 2010. The Jobs and Growth Tax Relief Reconciliation Act (JGTRRA) is an investment tax-cut that was enacted by the Bush Administration on May 28th, 2003. Its goal was to end the 2001 Recession. It reduced the long-term capital gains tax rate from 20 percent to 15 percent. For taxpayers who were already in the 10-15th per cent income tax bracket, it reduced the rate to 5 per cent and then to zero in 2008. It changed the dividend tax rate to the same as the long-term capital gains rate. Prior to that, dividends were taxed as regular income. Increased tax deductions for small businesses, accelerated many of the provisions in the EGTRRA, which were supposed to be phased in more gradually, raising the exemption for the Alternative Minimum Tax.

B. Conservatives argued that liberal programs were counterproductive in fighting poverty and stimulating economic growth. Some of their efforts to reduce the size and scope of government met with inertia and liberal opposition, as many programs remained popular with voters.

Reagan stated in his 1987 State of the Union Address that he would “finally break the poverty trap” and in 1988 he signed the Family Support Act in October. The Family Support Act was the culmination of a major 1987 congressional debate on welfare. The act provided for an extensive state-managed education and training program with transitional medical assistance, child-care benefits, and stronger child support enforcement. Under the act, educators are provided opportunities to form linkages with other agencies to strengthen families and help them move toward self-sufficiency. Education is the pivotal goal of the FSA, to help families avoid long-term dependence on public assistance, and the act requires states to make educational services available to participants under the Job Opportunities and Basic Skills (JOBS) training program. Training and employment personnel and vocational and adult educators may join human services staff in providing education and training programs to JOBS clients. Heralded as an “end of welfare,” critics viewed the FSA as a failure. However, the act generated the expectation among voters that welfare recipients would and should be required to work. Despite the goals of the Family Support Act, the nationwide Aid to Families with Dependent Children (AFDC) caseload remained constant in the late 1980s, and then grew by more than a third between 1990 and 1994. Reagan also helped save Social Security by passing the Social Security Reform Act of 1983. It provided extra revenue dedicated to securing the solvent future of Social Security.

President Reagan signed legislation expanding Medicaid on several occasions. From 1982 to 1988, Reagan signed legislation mandating coverage for children and pregnant women receiving cash assistance, mandating emergency treatment of illegal immigrants who would otherwise be ineligible for Medicaid and expanding the low-income populations that states could choose to cover, among other expansions. Reagan also signed into law the Medicare Catastrophic Coverage Act of 1988 (MCCA), a health care bill to expand Medicare and increase taxes to pay for it which passed in both the House of Representatives and the U.S. Senate by wide margins. Most people thought for good or ill, this expansion of government would be permanent. It provided full coverage for hospital stays after deductibles of $560 USD (for hospitals) and $1,370 USD (doctor bills, 80% of drug costs covered after a $600 deductible, 150 days of coverage for skilled nursing care, and 38 days of coverage for home health care). To pay for this coverage, the bill included a $400 USD a year surcharge (tax) for seniors making $40,000 USD per year and an $800 USD surcharge for those in the top tax brackets. It was political backlash against those surcharges that caused the bill to be repealed during the George H. W. Bush administration.

Reagan believed that widespread freeloading plagued welfare and social programs. As Reagan slashed spending in his first term on programs, the poverty rate climbed from 12% to 15% and unemployment rose from 7% to 11%. Within seven months of Reagan's inauguration, Congress had enacted the largest spending and tax cuts in its history, slashing fiscal 1982 spending $35 billion USD below projected levels and reducing personal and corporate income taxes by $37.7 billion USD. The biggest change was to reduce benefits for the working poor and focus federal welfare assistance primarily on the non-working poor. Congress, for example, amended the major cash benefit program -- Aid to Families with Dependent Children (AFDC) -- to eliminate most payments to working parents. According to the Congressional Budget Office (CBO), “Of the 450,000 to 500,000 families with earnings estimated to be receiving AFDC at the time of the [1981 program] changes, about one-half are estimated to have lost eligibility because of [those changes]. Another 40 per cent are estimated to have had their AFDC benefits reduced, and the remaining 10 per cent to have received unchanged or higher benefits. The other changes, which affect primarily non-income earners, are estimated to have made at least another 100,000 families ineligible and reduced benefits significantly for another 100,000.” Congress in 1981 and 1982 made changes in the Food Stamp program that, according to the CBO, eliminated about 4 per cent -- or one million people -- from the rolls. Deferrals in adjustments for inflation affected most people still receiving benefits. Although Congress refused Reagan's request to put a cap on the federal contribution on Medicaid (the state-run health care program for the poor) it did reduce federal Medicaid grants to the states and allowed the states to require Medicaid recipients to pay for part of the cost of their care. In addition, since AFDC recipients are automatically eligible for Medicaid, many of those eliminated from the AFDC rolls lost their medical benefits as well.

Congress abolished altogether the Public Service Employment (PSE) program, which provided jobs for the unemployed in state and local governments and in non-profit agencies. PSE was one of the most controversial of the low-income-targeted programs. Its advocates said PSE provided many poor individuals with work experience that eventually helped them move completely into the unsubsidised job market. However, opponents said the program provided dead-end, make-work jobs; news reports on mismanagement and provision of jobs to non-needy individuals further tarnished the program's image. The administration also targeted the Work Incentive Program (WIN) for cutbacks. The program, which provides job search and training assistance, has been mandatory for AFDC recipients without children under the age of 6 since its inception in 1967. However, Reagan's budgeters claimed the program was neither successful nor cost-effective in reducing welfare dependency. Although Congress rejected requests to eliminate the program, the number of registrants dropped from 1.6 million in 1981 to 1 million in 1982. Other major spending cuts affecting the poor were made in federal housing assistance programs, social services, and community services; school lunch programs, compensatory education and emergency energy assistance.

Counteractive measures during time include the Family and Medical Leave Act that was drafted by Donna Lenhoff of the Women’s Legal Defence Fund and a staffer for California’s Congressman Howard Berman in 1984. In 1985, the first version of the law introduced in the House of Representatives allowed for 18 weeks over a two-year period for unpaid parental leave for the birth, adoption, or serious illness of a child, and 26 weeks of unpaid medical leave for the employee’s own serious health condition. The law applies to employers with 50 or more employees. Nine years transpired between the initial draft of the bill and the actual passage of the FMLA in 1993 due to heavy political resistance. Over time, a coalition was formed from organisations representing diverse groups, including workers and unions, women, children and parents, the elderly, health professionals, and religious organizations. Many compromises were made to increase the bill’s political viability, including reducing the length of allowed leave and increasing the minimum employer size for employers covered by the law. The FMLA was signed into law by President Bill Clinton. The final version of the bill allowed for 12 weeks of unpaid parental and medical leave and applied to employers with at least 50 employees. It allowed employees to take leave to care for family members, but only if the family members are spouses, children or parents.

C. Policy debates continued over free-trade agreements, the scope of the government social safety net, and calls to reform the U.S. financial system.

Ronald Reagan’s 1984 Caribbean Basin Initiative prompted a major increase in US food aid to Haiti. In 1984, Haiti received $11 million USD in food aid; from 1985-1988, Haiti received $54 million USD in food aid. The Caribbean Basin Initiative called for integrating Haiti into the global market by redirecting 30% of Haiti’s domestic food production towards export crops, a plan that USAID experts systematically carried out. The United States fully recognised that this would lead to widespread hunger in rural Haiti, as peasant land was converted to grow food for foreigners. At the time, Jean-Claude Duvalier, the son of Haiti’s infamous dictator, Francois Duvalier, ruled Haiti. Like his father, the younger Duvalier held onto power by controlling Haiti’s repressive security forces. He received millions in US aid intended to maintain US influence in the Caribbean as a bulwark against Cuba. The Reagan administration conditioned US aid on Duvalier’s support for the plan to restructure Haiti’s economy. Thus began the most massive foreign intervention in Haiti since the 1915-1934 American occupation.

By 1990, the year Fr. Jean Bertrand Aristide was elected President in Haiti’s first democratic election, US rice imports outpaced domestic production. Aristide was the candidate of Haiti’s popular movement Lavalas. He won with 67% of the vote. His February 1991 inauguration marked a victory for Haiti’s poor majority after decades of Duvalier family dictatorships and military rule, signalling the participation of the poor in a new social order. The Aristide government met with a large coalition of farmers’ associations and unions and proposed buying all Haitian-grown rice in order to stabilize the price, limiting rice imports during periods between harvests. Just seven months after his inauguration, President Aristide and the democratic government were overthrown in a bloody military coup led by General Raoul Cedras. Trained in the United States and funded by the CIA, Cedras commanded the Haitian Army. His regime unleashed the collective violence of Haiti’s repressive forces against its own people. From 1991-1994, nearly 5,000 Lavalas activists and supporters of the constitutional government were massacred; many others were savagely tortured and imprisoned. Rape as a political weapon was widespread. Three hundred thousand Haitians were driven into hiding, while tens of thousands fled the country.

In 1985, the US imposed import quotas on Japanese cars. Japan flooded the U.S. market with high-quality cars that sold far below the price at which the Big Three could afford to build, sell, and survive. In 1985, the dollar, at 220 to the yen, was still too high to arrest the rising U.S. trade deficit. The Big Three were at death's door. Refusing to let any of them go under, Reagan intervened to save the industry by imposing import quotas on Japanese cars. Free traders denounced Reagan as a heretic. The death of Ford and Chrysler were of far less concern to them than fidelity to the free-trade gospel of David Ricardo and Adam Smith. It was Reagan, after all, who first articulated a goal of free trade in the Western Hemisphere. America's first free trade agreement with Israel, implemented in 1985, was a Reagan achievement. A US-Canada agreement followed. In 1986, Reagan launched the Uruguay Round, a series of talks aimed at the reduction of trade barriers among more than 60 nations.

Back in 1984, President Ronald Reagan passed the Trade and Tariff Act, which allowed the president special authority to negotiate free trade agreements more quickly. Going off of Reagan's initiative, Canadian Prime Minister Mulroney supported the president and the Canada-U.S. Free Trade Agreement was eventually signed in 1988; it went into effect one year after. When George H. W. Bush became president, he began to negotiate with Mexican President Salinas to generate a trade agreement between Mexico and the United States. The trade agreement was part of President Bush's three-part plan called the Enterprise for the Americas Initiative, which also included debt relief programs. After Mexico lobbied for a trilateral trade (Triangular Trade - Concept Originating from Mercantilist Slave Trades in the 1500-the 1800s) agreement in 1991, NAFTA was created as a way to open up free trade between the three, not just two, superpowers in North America. President H.W. Bush signed the NAFTA agreement in 1992, which was also signed by Canadian Prime Minister Brian Mulroney and Mexican President Salinas. The agreement went into effect under Bush's successor President Bill Clinton, who signed the agreement himself on December 8th, 1993. By January of 1994, the trade agreement was in effect.

The Central America Free Trade Agreement (CAFTA) is an expansion of NAFTA to five Central American nations (Guatemala, El Salvador, Honduras, Costa Rica and Nicaragua), and the Dominican Republic. It was signed May 28th, 2004, and passed through the U.S. House of Representatives by one vote in the middle of the night on July 27th, 2005. After more than a decade of CAFTA, countries in the region have faced hardships for workers and farmers, corporate attacks on health and environmental laws, political instability, and deplorable human rights conditions. CAFTA is based on the failed neoliberal NAFTA model, which has displaced family farmers in trade partner countries, exacerbated the "race to the bottom" in labour and environmental standards, and promoted privatization and deregulation of key public services.

Now a look at the domestic side. Under Governor Mitt Romney’s administration, with his support and advocacy, the Commonwealth of Massachusetts passed a health care reform law in 2006 with the aim of providing health insurance to nearly all of its residents. The law mandated that nearly every resident of Massachusetts obtain a minimum level of insurance coverage, provided free health care insurance for residents earning less than 150% of the federal poverty level (FPL) and mandated employers with more than 10 "full-time" employees to provide healthcare insurance. The law was adopted by senators Barrack Obama and Ted Kennedy into the Patient Protection and Affordable Care Act (ACA). Obama campaigned on it and after winning the 2008 election, set to work on passing it. The ACA was signed into law by President Obama in March 2010. Its major provisions go into effect on January 1st, 2014, although significant changes went into effect before that date and will continue in years to come. The Act extended insurance to more than 30 million uninsured people, primarily by expanding Medicaid and providing federal subsidies to help lower-and middle-income Americans buy private coverage. Twenty-six states and the National Federation of Independent Business had brought suit in federal court challenging the mandate that individuals carry insurance or pay penalties, as well as the expansion of Medicaid. The Supreme Court ruled that states could not be forced into cooperating with the Medicaid expansion, but left most of the other provisions intact. Much of the Obamacare political action came in 2009, the first year of the presidency. On July 14th, House Democrats introduced a 1,000-page plan for overhauling the US health care system. The debate raged throughout the summer and beyond.

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a massive piece of financial reform legislation passed by the Obama administration in 2010 as a response to the Geroge Bush's financial crisis of 2008. Named after sponsors U.S. Senator Christopher J. Dodd and U.S. Representative Barney Frank, the act's numerous provisions -- spelt out over roughly 2,300 pages -- are being implemented over a period of several years and intended to decrease various risks in the U.S. financial system. The act established a number of new government agencies tasked with overseeing various components of the act and by extension various aspects of the banking system. Dodd-Frank put regulations on the financial industry and created programs to stop mortgage companies and lenders from taking advantage of consumers. This dense, complex law continues to be a hot topic in American politics. Supporters of it say it places much-needed restrictions on Wall Street, but critics charge that Dodd-Frank burdens investors with "too many rules" that "slow economic growth." An additional provision of the Dodd-Frank Act is known as the Volcker Rule, named after Paul Volcker. Volcker was chairman of the Federal Reserve under presidents Jimmy Carter and Ronald Reagan, and chairman of the Economic Recovery Advisory Board under President Obama (AKA, dude forgot to retire). The Volcker Rule forbids banks from making certain investments with their own accounts. For example, banks can’t invest, own or sponsor any proprietary trading operations or hedge funds for their own profit, with some exceptions. Banks like Wells Fargo, Wachovia, Goldman Sachs, Citigroup, and Chase ALL broke this rule. Dodd-Frank is viewed as one of the most stringent regulations on banks since the FDR era, which was prompted after the Great Depression of 1929.

Citizens United v. Federal Election Commission is a United States Supreme Court case involving Citizens United, a 501(c)(4) non-profit organisation, and whether the group's film critical of a political candidate could be defined as an electioneering communication under the 2002 Bipartisan Campaign Reform Act, also known as the McCain-Feingold Act. Decided in 2010, in a 5-to-4 decision, the Supreme Court held that corporate funding of independent political broadcasts in candidate elections cannot be limited because doing so would "violate" the First Amendment. The Court's decision struck down a provision of the McCain-Feingold Act that banned for-profit and not-for-profit corporations and unions from broadcasting electioneering communications in the 30 days before a presidential primary and in the 60 days before the general elections. The decision overruled Austin v. Michigan Chamber of Commerce (1990) and partially overruled McConnell v. Federal Election Commission (2003). The decision upheld, however, the requirements for disclaimer and disclosure by sponsors of advertisements, and the ban on direct contributions from corporations or unions to candidates. The overall precedent set, however, was that “money is speech,” and thus any limitation on money transactions would be considered "suppression of free speech" (I call bullshit). However, this ruling was flawed, as you cannot argue that prostitution or the payment of drugs is “speech.” Nevertheless, the Reagan and Bush stacked Supreme Court upheld such a ruling under the guise of the first amendment.

POL-1.0: Explain how and why political ideas, beliefs, institutions, party systems, and alignments have developed and changed.

Imagine a pendulum oscillating back and forth. Due to the laws of physics, the amount of energy applied to one end of the pendulum will match the other side equally. However, there is energy lost due to friction which inevitably stops the pendulum altogether, dead centre, and in line with the force due to gravity. Politics in any given society act in a pendulum manner. Key events, such as a war, a depression, a recession, or among other things act as the energy supplied to that pendulum. When the economy is bad and social issues are at a major crossroads, energy is applied to the right of the pendulum swaying it to the left. When the economy is good, energy is applied in the other direction, i.e. social welfare programs in the former like under FDR following the Great Depression of 1929, or during the Progressive Era and the Republican Normalcy preceding the crash in the latter, or the Conservative resurgence. The election of 1980 represents a shift in the ideology of the nation. After suffering from the Vietnam War, and the Carter administration bearing the brunt of military debt and major crises inherited from the Ford and Nixon presidencies, the United States citizens felt that they could "no longer trust a Democratic," welfare-friendly administration. In 1980, actor, republican and California governor Ronald Reagan won the U.S. presidency by all but three US states (because EVERYONE LIKED HIS MOVIES, and were BLINDED by his DONOR'S POLICY OBJECTIVES). With Reagan came a return to conservative values, that, although two “Democratic” presidents followed him, the United States still operates with. In other words, we swung so far back to the right, that it TRUMPED Herbert Hoover's or even Andrew Johnson's failed legacies). The “Neo-Liberal” philosophy that Presidents Ronald Reagan, George H. W. Bush, Bill Clinton, George W. Bush AND Barack Obama ALL HAVE championed keeps that pendulum ever to the right, with an ANGRY populace BEGGING for a HARD-LEFT TURN AGAIN, something that goes EVEN FURTHER than President Franklin Delano Roosevelt or President John F. Kennedy!

The Republican and Democratic parties have amalgamated into one, corporate elite business party, where one must be subservient to corporate donors (Bill Moyers talks about this in his dissection of the Deep State). Tax cuts under the Reagan and Bush administrations, as well bank deregulations, the repeal of Glass-Steagall under Clinton, and the major increase in defence spending have contributed to a massive debt-deficit driven economy. And lest we forget the major increases in illegal wars under the second Bush administration. Artificial inflation, stagflation, and depreciating wages have led to a rise in homelessness, deaths, health care loss, starvation and overall poverty in America. Major slashes to public funding have only added to this loss. And the grossly misguided theory that cutting taxes for the TOP moneymakers, while potentially raising lower-income taxers will someone “trickle-down” wealth for those at the bottom has led to decades of congressional tax cuts that have only lead to corporations buying back their own stocks, artificially boosting the Gross Domestic Product while leaving workers without a dollar more to their name. All of this resulted in the election of a demagogue in 2016; a living embodiment of the SYSTEM of neoliberalism sparked by Reagan. Donald Jay Trump was a mere product of the years of wreckage to the American economy and political institutions paved by his predecessors. In this way, Washington D.C. has become a mere artifice, or "political theatre," that OLIGARCHS in Wall Street and Capitol Hill have successfully orchestrated, as individuals like Jeff Bezos, the Walton Family, Rothchild, the Koch Brothers, and Warren Buffet get filthy rich off the work that THEIR EMPLOYEES put in. And all they do is sit on their fat, rich, lazy white asses and SIT ALL day scheming their next corporate takeover for VALUELESS US Dollars AT THE EXPENSE OF THEIR WORKERS HEALTHS & FAMILIES because OUR COUNTRY is 28 TRILLION DOLLARS in DEBT to THEM and THEIR SWISS BANK ACCOUNTS. That, combined with the bought corporate media that spews economic propaganda about “how well the economy is doing,” which seeps into the minds of Americans as we educate the future generation on what is right and wrong, is a recipe for a disaster. And the failure to properly address these issues has only further cemented their legacies in the inevitable, irreversible, and fast-approaching demise of the American Empire. Through this demise, may we FINALLY become A TRUE DEMOCRATIC NATION that works TOGETHER with ALL COUNTRIES, rather than LORD OVER THEM like PUPPETS on our DEMONIC STRINGS.

C. Employment increased in service sectors and decreased in manufacturing, and union membership declined.

Between 1970 and 2000, manufacturing employment was relatively stable, ranging from 16.8 to 19.6 million workers, and generally remaining between 17 and 18 million. However, this relationship broke down in the early 2000s, a period of rapidly growing trade deficits. At that time, manufacturing employment began a prolonged collapse, falling to a low of 11.5 million workers in February 2010, and recovering by December 2014 to 12.3 million workers, where it has remained. Overall, manufacturing lost 5 million jobs between January 2000 and December 2014. Between 2000 and 2007, growing trade deficits in manufactured goods led to the loss of 3.6 million manufacturing jobs in that period. Between 2007 and 2009, the massive collapse in overall U.S. output hit manufacturing particularly hard (real manufacturing output fell 10.3 per cent between 2007 and 2009). This collapse was followed by the slowest recovery in domestic manufacturing output in more than 60 years. Reasonably strong GDP growth over the past five years has not been sufficient to counter these trends; only about 900,000 of the 2.3 million manufacturing jobs lost during the Great Recession have been recovered.

In addition, the resurgence of the U.S. trade deficit in manufactured goods since 2009 has hurt the recovery of manufacturing output and employment. As more free-trade policies like NAFTA, CAFTA, and the TPP (Trans-Pacific Pact) have taken root and have gotten more aggressively laissez-faire, more and more jobs have been outsourced to lower-wages and less regulated countries such as Mexico with the automobile industry; China has virtually every industry, and India practically owns the customer support industry. Without regulations, US manufacturer labourers have no way to compete with countries that have non-union, slave-labour like, and in some cases actual slave labour conditions. This all has lead to the continuance of manufacturing jobs being outsourced. The emphasis on labour cuts, especially unions, was fuelled by Reagan’s bold policy of strike-breaking by firing 11,359 striking air traffic controllers who had ignored his order to return to work, causing a significant impact on labour-management relations in the private sector.