#annual payout

Explore tagged Tumblr posts

Text

#India#women farmers#cash handouts#Modi government#budget announcement#February 1#government expenditure#Pradhan Mantri Kisan Samman Nidhi#annual payout#general election#female voters#election strategy#financial support#agriculture ministry#finance ministry#BJP#Bharatiya Janata Party#opinion polls#Madhya Pradesh#cash transfer program#voting bloc#Narendra Modi#third term#political strategy#government finances#rural economy#landowning women#voting demographics#financial assistance#female empowerment

0 notes

Text

Waking in the middle of the night thinking about those two ASIC things that were lodged a day late and how shitty my boss will be and how the superfunds need to be uploaded to BGL and that those two new guys keep asking dumb questions and one's quite nice, the other is really sour, almost grumpy, he's not really a bully, just really "wait I have to do that?" Like yes, you have to data entry into our software and I think I'm adopting his mannerisms especially talking to Sophia but maybe I always had that in me, maybe I've always been grumpy "no I don't know how long I worked on it, I kept getting interrupted" but also those stupid ASIC things I should've taken more notice of the date and I'm so dumb and there were two of them and

#i just want to go back to sleep!!!!!!#but no i have to stress out about how angry Sophia will be#plus the invoices total was only $4500 like kill me?????? she'll be shitty all week#why am i going on Monday oh right because she'll need a coffee and water#i just#plus the super funds like it's her fault that we've waited this long to do it she should've organised it all months ago#but she puts it on me and gets mad at me for it not getting done????#As if it's my fault#maybe i should just work Tuesday and I'll be alone and be able to get it all done#no interruptions on Tuesday#once it's all done and then i quit and move to Mexico and change my name#come back every weekend for the football#Just fly in fly out for Collingwood games#do that until the annual leave payout is all gone#this is fine#i could work Tuesday at my parents house because the work laptop is still there like I'm still set up to work from home#but going into the office would be fine too just lock the doors no one is coming in anyway#unplug the phone#forever#listen to Taylor Swift

2 notes

·

View notes

Text

The WGA has two main stipulations. First, the guild wants to make sure that “literary material” — the MBA term for screenplays, teleplays, outlines, treatments, and other things that people write — can’t be generated by an AI. In other words, ChatGPT and its cousins can’t be credited with writing a screenplay. If a movie made by a studio that has an agreement with the WGA has a writing credit — and that’s over 350 of America’s major studios and production companies — then the writer needs to be a person.

“Based on what we’re aiming for in this contract, there couldn’t be a movie that was released by a company that we work with that had no writer,” says August.

Second, the WGA says it’s imperative that “source material” can’t be something generated by an AI, either. This is especially important because studios frequently hire writers to adapt source material (like a novel, an article, or other IP) into new work to be produced as TV or films. However, the payment terms, particularly residual payouts, are different for an adaptation than for “literary material.” It’s very easy to imagine a situation in which a studio uses AI to generate ideas or drafts, claims those ideas are “source material,” and hires a writer to polish it up for a lower rate. “We believe that is not source material, any more than a Wikipedia article is source material,” says August. “That’s the crux of what we’re negotiating.”

In negotiations prior to the strike, the AMPTP refused the WGA’s demands around AI, instead countering with “annual meetings to discuss advancements in technology.”

The looming threat of AI to Hollywood, and why it should matter to you by Alissa Wilkinson

#wga strike#writer's guild of america strike#wga#writers' strike#writers' rights#important#support the strike#This is just one of the many reasons for striking but it needs careful consideration#AI NEEDS to be regulated#power in a union

17K notes

·

View notes

Text

Carrie Hair - Adult

Elevate your Sims' style with this long, flowing hair with edgy short bangs—perfect for a gothic or spooky Halloween look! ☠️

Get $6 off The Ultimate Simmer Annual Plan with my code ➡️SHOP_MSQSIMS12 . (even during sales!) ⏩Shop HERE

I receive payouts from your purchases. Thank you for your support! 💗 Download (Free)

#the sims 4#thesims4#simmer#sims 4 simblr#sims4#the sims#ts4 maxis match#maxis match cc#sims 4 maxis match#ts4 maxis cc#ts4 hair#ts4 cc#sims 4#sims 4 cc#sims community#the sims 4 hair#long hair#ts4 goth#ts4 halloween

579 notes

·

View notes

Text

Academic economists get big payouts when they help monopolists beat antitrust

After 40 years of rampant corporate crime, there's a new sheriff in town: Jonathan Kanter was appointed by Biden to run the DOJ Antitrust Divisoon, and he's overseen 170 "significant antitrust actions" in the past 2.5 years, culminating in a court case where Google was ruled to be an illegal monopolist:

https://pluralistic.net/2024/08/07/revealed-preferences/#extinguish-v-improve

Kanter's work is both extraordinary and par for the course. As Kanter said in a recent keynote for the Fordham Law Competition Law Institute’s 51st Annual Conference on International Antitrust Law and Policy, we're witnessing an epochal, global resurgence of antitrust:

https://www.justice.gov/opa/speech/assistant-attorney-general-jonathan-kanter-delivers-remarks-fordham-competition-law-0

Kanter's incredible enforcement track record isn't just part of a national trend – his colleagues in the FTC, CFPB and other agencies have also been pursuing an antitrust agenda not seen in generations – but also a worldwide trend. Antitrust enforcers in Canada, the UK, the EU, South Korea, Australia, Japan and even China are all taking aim at smashing corporate monopolies. Not only are they racking up impressive victories against these giant corporations, they're stealing the companies' swagger. After all, the point of enforcement isn't just to punish wrongdoing, but also to deter wrongdoing by others.

Until recently, companies hurled themselves into illegal schemes (mergers, predatory pricing, tying, refusals to deal, etc) without fear or hesitation. Now, many of these habitual offenders are breaking the habit, giving up before they've even tried. Take Wiz, a startup that turned down Google's record-shattering $23b buyout offer, understanding that the attempt would draw more antitrust scrutiny than it was worth:

https://finance.yahoo.com/news/wiz-turns-down-23-billion-022926296.html

As welcome as this antitrust renaissance is, it prompts an important question: why didn't we enforce antitrust law for the 40 years between Reagan and Biden?

That's what Kanter addresses the majority of his remarks to. The short answer is: crooked academic economists took bribes from monopolists and would-be monopolists to falsify their research on the impacts of monopolists, and made millions (literally – one guy made over $100m at this) testifying that monopolies were good and efficient.

After all, governments aren't just there to enforce rules – they have to make the rules first, and do to that, they need to understand how the world works, so they can understand how to fix the places where it's broken. That's where experts come in, filling regulators' dockets and juries' ears with truthful, factual testimony about their research. Experts can still be wrong, of course, but when the system works well, they're only wrong by accident.

The system doesn't work well. Back in the 1950s, the tobacco industry was threatened by the growing scientific consensus that smoking caused cancer. Industry scientists confirmed this finding. In response, the industry paid statisticians, doctors and scientists to produce deceptive research reports and testimony about the tobacco/cancer link.

The point of this work wasn't necessarily to convince people that tobacco was safe – rather, it was to create the sense that the safety of tobacco was a fundamentally unanswerable question. "Experts disagree," and you're not qualified to figure out who's right and who's wrong, so just stop trying to figure it out and light up.

In other words, Big Tobacco's cancer denial playbook wasn't so much an attack on "the truth" as it was an attack on epistemology – the system by which we figure out what is true and what isn't. The tactic was devastatingly effective. Not only did it allow the tobacco giants to kill millions of people with impunity, it allowed them to reap billions of dollars by doing so.

Since then, epistemology has been under sustained assault. By the 1970s, Big Oil knew that its products would render the Earth unfit for human habitation, and they hired the same companies that had abetted Big Tobacco's mass murder to provide cover for their own slow-motion, planetary scale killing spree.

Time and again, big business has used assaults on epistemology to provide cover for unthinkable crimes. This has given rise to today's epistemological crisis, in which we don't merely disagree about what is true, but (far more importantly) disagree about how the truth can be known:

https://pluralistic.net/2024/03/25/black-boxes/#when-you-know-you-know

Ask a conspiratorialist why they believe in Qanon or Hatians in Springfield eating pets, and you'll get an extremely vibes-based answer – fundamentally, they believe it because it feels true. As the old saying goes, you can't reason someone out of a belief they didn't reason their way into.

This assault on reason itself is at the core of Kanter's critique. He starts off by listing three cases in which academic economists allowed themselves to be corrupted by the monopolies they studied:

George Mason University tricked an international antitrust enforcer into attending a training seminar that they believed to be affiliated with the US government. It was actually sponsored by the very companies that enforcer was scrutnizing, and featured a parade of "experts" who asserted that these companies were great, actually.

An academic from GMU – which receives substantial tech industry funding – signed an amicus brief opposing an enforcement action against their funders. The academic also presented a defense of these funders to the OECD, all while posing as a neutral academic and not disclosing their funding sources.

An ex-GMU economist, Joshua Wright, submitted a study defending Qualcomm against the FTC, without disclosing that he'd been paid to do so. Wright has elevated undisclosed conflicts of interest to an art form:

https://www.wsj.com/us-news/law/google-lawyer-secret-weapon-joshua-wright-c98d5a31

Kanter is at pains to point out that these three examples aren't exceptional. The economics profession – whose core tenet is "incentive matter" – has made it standard practice for individual researchers and their academic institutions to take massive sums from giant corporations. Incredibly, they insist that this has nothing to do with their support of monopolies as "efficient."

Academic centers often serve as money-laundries for monopolist funders; researchers can evade disclosure requirements when they publish in journals or testify in court, saying only that they work for some esteemed university, without noting that the university is utterly dependent on money from the companies they're defending.

Now, Kanter is a lawyer, not an academic, and that means that his job is to advocate for positions, and he's at pains to say that he's got nothing but respect for ideological advocacy. What he's objecting to is partisan advocacy dressed up as impartial expertise.

For Kanter, mixing advocacy with expertise doesn't create expert advocacy – it obliterates expertise, as least when it comes to making good policy. This mixing has created a "crisis of expertise…a pervasive breakdown in the distinction between expertise and advocacy in competition policy."

The point of an independent academia, enshrined in the American Association of University Professors' charter, is to "advance knowledge by the unrestricted research and unfettered discussion of impartial investigators." We need an independent academy, because "to be of use to the legislator or the administrator, [an academic] must enjoy their complete confidence in the disinterestedness of [his or her] conclusions."

It's hard to overstate just how much money economists can make by defending monopolies. Writing for The American Prospect, Robert Kuttner gives the rate at $1,000/hour. Monopoly's top defenders make unimaginable sums, like U Chicago's Dennis Carlton, who's brought in over $100m in consulting fees:

https://prospect.org/economy/2024-09-24-economists-as-apologists/

The hidden cost of all of this is epistemological consensus. As Tim Harford writes in his 2021 book The Data Detective, the truth can be known through research and peer-review:

https://pluralistic.net/2021/01/04/how-to-truth/#harford

But when experts deliberately seek to undermine the idea of expertise, they cast laypeople into an epistemological void. We know these questions are important, but we can't trust our corrupted expert institutions. That leaves us with urgent questions – and no answers. That's a terrifying state to be in, and it makes you easy pickings for authoritarian grifters and conspiratorial swindlers.

Seen in this light, Kanter's antitrust work is even more important. In attacking corporate power itself, he is going after the machine that funds this nihilism-inducing corruption machine.

This week, Tor Books published SPILL, a new, free LITTLE BROTHER novella about oil pipelines and indigenous landback!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/25/epistemological-chaos/#incentives-matter

Image: Ron Cogswell (modified) https://en.wikipedia.org/wiki/File:George.Mason.University.Arlington.Campus.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

322 notes

·

View notes

Video

youtube

Biden vs. Trump: Whose Economic Plan Is Better for You?

Trump failed to deliver on his number one campaign promise:

President Trump presided over a historic net loss of nearly 3 million American jobs, the worst jobs numbers ever recorded under an American president.

This is no fluke. America’s economy has almost always done worse under Republican presidents. A New York Times analysis found that since 1933, the U.S. economy has grown nearly twice as fast on average under Democrats.

Now Trump’s defenders claim it’s not his fault that the economy collapsed under his watch. It was the pandemic. But there are two big things wrong with this.

First, the pandemic recession was as bad as it was because of Trump. His failure to lead with any national strategy left America in chaos throughout 2020, long after other nations had developed coordinated testing, tracing, and social distancing plans that allowed them to reopen their economies.

But secondly, even before the pandemic, Trump failed to deliver on his economic promises. Job growth slowed under Trump.

America added more jobs in President Obama’s last three years than in Trump’s first three.

Even before the pandemic most middle-class American households saw their incomes go down under Trump.

Trump’s major economic policy was cutting taxes on the rich and big corporations. He promised it would result in $4,000 annual raises for workers. How did that work out? Did you get a $4,000 raise?

Republicans keep claiming that if we just cut enough taxes on the rich, the wealth will “trickle down.” But it never works. Wage growth slowed after Reagan’s tax cuts for the rich and big corporations. And the Bush and Trump tax cuts didn’t trickle down either.

These giveaways to the wealthy came at the expense of investments in infrastructure, education, and health care, making life more expensive and difficult for everyone who isn’t rich.

They also exploded the debt and deficit. Reagan oversaw a 186% increase in the national debt — the biggest percentage increase in over 70 years. The Bush and Trump tax cuts, that mostly benefited corporations and the rich, are the main reasons why America’s debt is growing faster than the economy.

Republican presidents have led us into the three worst economic crises of the last century, and Democrats led us out of them.

Republicans talk about running the country like a business, but they want to run it the way Trump ran his businesses: with massive debts, a string of failures, and payouts for the folks at the top, while workers get shafted again and again. Given Republicans’ track record, why would any hard-working American put their financial security in the hands of a Republican president ever again?

403 notes

·

View notes

Text

Qasim Rashid at Let's Address This:

In an arguably unprecedented case on the meaning of free speech, a 42-year-old Florida woman named Briana Boston has been arrested and charged on terrorism charges against Blue Cross and Blue Shield health insurance corporation. According to the arrest affidavit, after BCBS denied her health insurance claim, Boston responded, "Delay, deny, depose. You people are next." Apparently, though Boston does not own a firearm, has no violent criminal history, and indicated no acts of violence whatsoever—this statement amounts to a threat of terrorism and mass shooting. Let’s Address This. Briana Boston has little engagement in political activism, with a single $1 donation made to a New York political race years ago. But like millions of Americans, she received the hurtful news that her health insurance claim had been denied.

When Lakeland Police contacted Boston at her home, she admitted to using the “Delay, Deny, Depose” phrase and added, “healthcare companies played games and deserved karma from the world because they are evil.” She went on to say that she used the phrase, “because it’s what is in the news right now.” Lakeland Police Chief Sam Taylor responded that, “[Boston has] been in this world long enough that she certainly should know better that you can’t make threats like that in the current environment that we live in and think that we’re not going to follow up and put you in jail.” But what actual threat did Boston make, especially when compared to the violence corporations actually and knowingly impose upon the American people? As an attorney who represents women who are survivors of domestic violence, I cannot count how many times a survivor sought a restraining order against an abusive partner, and could not attain it because despite past abuse, and despite the new threat to “bash your face in” was too vague and unclear. What makes Blue Cross and Blue Shield so special that they deny a woman’s healthcare claim and then get her arrested for terrorism because she peacefully and verbally expressed frustration?

Likewise, as a human rights lawyer who has also literally survived violent death threats made against me and even testified in federal court against the man who threatened to kill me, I have to ask—what about her statement is a threat? The phrase “Delay, Deny, Depose” is a common insurance statement, used for decades as official policy to actively prevent having to make payouts. And the results of this policy are not hypothetical, they have been punitive, deadly, and are ongoing.

[...] Class warfare against working people is when billion dollar insurance corporations can live by “Delay, Deny, Depose” for decades—even as their policies actually and knowingly enable tens of thousands of annual deaths—but when a working person denied healthcare merely says that exact phrase—it’s terrorism. The logical conclusion then, if we are to understand this, is that corporations ARE people when enacting policies that kill people, but NOT people when we demand arrest of the corporate executives who enact the policies that kill people, but ARE people again when a person repeats back to them the exact policies they use to kill people. Again, the hypocrisy is beyond glaring.

[...] Understand that the point of arresting Briana Boston goes well beyond her. The BCBS CEO knows full well she alone is incapable of causing any violence or harm to their corporation. The decision to charge and arrest her with terrorism for an innocuous statement of frustration is an intimidation tactic meant to suppress dissent and force compliance. I do not advocate for violence, but I do study history. And the history of every violent economic revolution is such that when the billionaire or elite class pushed working people to the brink of human desecration and berated them until they had nothing left to lose, the only people that actually lost everything, were the elites.

Throwing Briana Boston in jail for using the words “Delay, deny, depose. You people are next” while on a call made to BCBS over being denied health insurance coverage is overkill. Thankfully, she was freed from jail.

See Also:

Ken Klippenstein: Mom Charged With Terrorism for Health Insurance "Threat"

97 notes

·

View notes

Text

okay

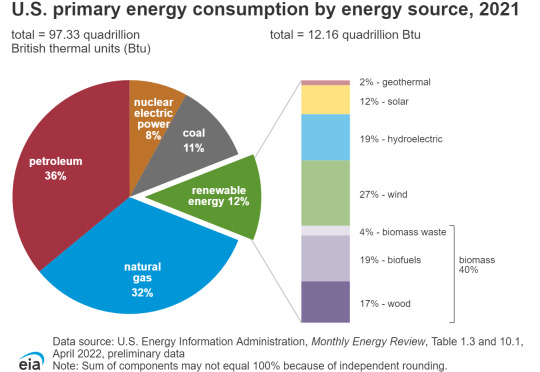

For decades, nuclear power has been the largest source of clean energy in the United States, accounting for 19% of total energy produced last year

false. first sentence. off to a great start. you may notice this is a 2022 chart but i can tell you the only new reactors started since then are vogtle 3 and 4 (you may notice that's not a new power plant but new reactors at an existing plant), years late and $17b over budget, vogtle as a whole produces 1.1gwh, we use about 29 million annually. point being: it has not risen to 19%, the last reactor since vogtle was watts bar in 2016 and since then we've decommissioned 14 of them

The industry directly employs nearly 60,000 workers in good paying jobs

weirdly low estimate, almost by half

maintains these jobs for decades

"maintains" is doing a lot of work here, does that include toxic exposure payouts? because they are still fighting pretty hard to get those in the world's first nuclear contamination site, hanford

and supports hundreds of thousands of other workers

✅ true! 475,000 according to the NEI link above

In the midst of transformational changes taking place throughout the U.S. energy system

sure

the Biden-Harris Administration is continuing to build on President Biden’s unprecedented goal of a carbon free electricity sector by 2035

have they developed carbon free cement yet? (yes.) at scale? (no.) are we just not counting construction emissions because they're one-time emissions investments or how does this work exactly, i would love to know because i think we're also not counting emissions from waste transport to longterm storage because we haven't started doing that. anyway they've built a train for it even though we don't have a storage site so that's umm. that's uhh. fine i'm sure

while also ensuring that consumers across the country have access to affordable, reliable electric power

i guess you can still say "across the country" if you exclude texas as an outlier

and creating good-paying clean energy jobs.

i guess you can still call them good paying clean energy jobs if everybody who mines and refines the uranium dies of cancer because you just pulled out of the largest disarmament program in history due to it being geopolitically inadmissible (for russia... to continue... selling us the uranium from decommissioning...? i'm still trying to figure out the optics of that one but anyway as i have previously stated we didn't actually stop buying it in cases where it's "liable to cause supply chain issues")

Alongside renewable power sources like wind and solar, a new generation of nuclear reactors is now capturing the attention of a wide range of stakeholders

weird way to say that

for nuclear energy’s ability to produce clean, reliable energy and meet the needs of a fast-growing economy, driven by President Biden’s Investing in America agenda and manufacturing boom.

this is a carrier sentence to inject the president's name, but i would like to question which sectors of the growing economy are driving the most energy demand because i'm sure there are no nasty truths being elided there (it's computing)

The Administration recognizes that decarbonizing our power system, which accounts for a quarter of all the nation’s greenhouse gas emissions, represents a pivotal challenge requiring all the expertise and ingenuity our nation can deliver.

it's time once again for... the energy flow sankey chart! the reason the power system accounts for a quarter of greenhouse gas emissions is in no small part because 67% of it is lost to waste heat. has the nation's expertise and ingenuity started working on that yet

The Biden-Harris Administration is today hosting a White House Summit on Domestic Nuclear Deployment, highlighting the collective progress being made from across the public and private sectors

oh boy! a summit! talking about it is the same as doing it

Under President Biden’s leadership, the Administration has taken a number of actions to strengthen our nation’s energy and economic security by reducing – and putting us on the path to eliminating – our reliance on Russian uranium for civil nuclear power and building a new supply chain for nuclear fuel

gosh, i got ahead of myself and already criticized both of those things

including: signing on to last year’s multi-country declaration at COP28 to triple nuclear energy capacity globally by 2050

everybody criticized that

developing new reactor designs

which ones, the bill gates project that just got cancelled because utilities pulled out (edit: that's nuscale, the bill gates project is terrapower), the rolls royce submarine, or the one that just got regulatory approval (edit: this is also nuscale)

extending the service lives of existing nuclear reactors

yep! you sure showed the embrittlement at diablo canyon by doing nothing about it

and growing the momentum behind new deployments

nonsense clause, but it has this really ominous undercurrent due to its vagueness

Recognizing the importance of both the existing U.S. nuclear fleet and continued build out of large nuclear power plants, the U.S. is also taking steps to mitigate project risks associated with large nuclear builds and position U.S. industry to support an aggressive deployment target.

this one is not nonsense but they can't just out and out say "we are deregulating the industry because opening the process for public comment is most often the thing that slows it down" because then somebody might realize they're bulldozing ahead no matter what any constituent says, does, or actually wants

To help drive reactor deployment while ensuring ratepayers and project stakeholders are better protected, theAdministration is announcing today the creation of a Nuclear Power Project Management and Delivery working group that will draw on leading experts from across the nuclear and megaproject construction industry to help identify opportunities to proactively mitigate sources of cost and schedule overrun risk

i'm sure a revolving door working group packed with industry insiders can solve this without compromising their commitment to the profit motive, not that it particularly matters since the cost is passed on to the consumer in the form of fees on the electric bill

The United States Army is also announcing that it will soon release a Request for Information to inform a deployment program for advanced reactors to power multiple Army sites in the United States

good god... that is a fresh nightmare i did not see coming

Additionally, the Department of Energy released today a new primer highlighting the expected enhanced safety of advanced nuclear reactors

"expected" really serves to demonstrate several points i've made

i'm going to stop going line by line here because i know this is already too boring and long for anyone to read this far, unless anybody wants to know what i think about parts 50, 52, and 53 of the NRC licensing guidance -- which many of you have very clearly stated over the years that you don't -- and while i do want to acknowledge that it does go into more detail and even answer some of the questions i raised (vogtle comes up, diablo canyon comes up, a list of which SMR designs is given, or at least a list of the companies responsible for them),

what i would like to focus on is one conspicuous absence:

the reason we need a new fleet of reactors is because they are an essential part of the bomb production chain. they are the beginning of the refinement process, and we cannot carry out the plan (already underway) to replace the minutemen missiles currently in silos with sentinel missiles without significant new construction. we cannot start the president's desired wars with russia and china without the new sentinels. he's not going to be the one to carry this out, he's ensuring whoever is his successor in about 2030 or more likely 2040 will be armed to do so. limited amount of time left to prevent that

93 notes

·

View notes

Text

The concept of insurance, of any kind of insurance, is a scam.

It relies on the fact that they pay out less than they receive. For example, with car insurance, in most cases, if you were to hit a car, you could pay out the other the same amount as your insurance without even getting close to what you pay annually. There is no way to make profit fairly as an insurance company. A savings account, if it werent for insurance often being mandatory, would literally be a better deal.

When this is applied to life saving care, it becomes a for-profit-human-slaughterhouse. The monthly payments have no relation to the payouts. The only difference is that they are leveraging healthy people’s contribution to pay for those people who somehow do get more care than theyve paid for approved, but the bottom line is that SOMEONE is paying for it, a ceo is getting paid to do it, and the money is getting all shuffled around to make it work.

In a tax based healthcare system, the only thing that leaves the model is the ceo. People pay in, now through taxes instead of standard prices set by one man or a group of them, money is moved around to support the sick while the healthy still pay in, just like normal healthcare now, only there’s not a leach at the top sucking all the money out of the system.

When people who oppose universal healthcare say “well someone’s gotta pay for it!” They dont realize that they are already paying for someone’s healthcare if they are paying in more than they use their insurance(likely) and if they use their insurance more than they pay in THEN SOMEONE ELSE IS ALREADY FUNDING THEIR HEALTHCARE.

Literally the system is already ready. We just need to remove one stumbling block from the set-up and we’ll be good to go, from all forms of insurance but health insurance first and foremost! Now that the public can see theyre unified in this goal, hopefully we can remove these leaches for good, and not in a hydra-like fashion where another one instantly pops up.

20 notes

·

View notes

Text

In July 2020, a 72-year-old attorney posing as a delivery person rang the doorbell at US district judge Esther Salas’ house in North Brunswick, New Jersey. When the door opened, the attorney fired a gun, wounding the judge’s husband—and killing her only child, 20-year-old Daniel Mark Anderl.

The murderer, Salas said, had found her address online and was outraged because she hadn’t handled a case of his client fast enough. In her despair, Salas publicly pleaded, “We can make it hard for those who target us to track us down … We can't just sit back and wait for another tragedy to strike.”

She wanted judges to be able to keep their home addresses private. New Jersey lawmakers delivered. Months after the murder, they unanimously enacted Daniel’s Law. Today, current and former judges, cops, prosecutors, and others working in criminal justice can have their household’s address and phone numbers withheld from government records in the state. They also can demand that the data be removed from any website, including popular tools for researching people such as Whitepages, Spokeo, Equifax, and RocketReach.

Companies that don’t comply within 10 business days have to pay a penalty of at least $1,000. This makes New Jersey’s law the only privacy statute in the US that guarantees people a court payout when requests to keep information private are ignored.

That provision is being put to a consequential test.

In a pile of lawsuits in New Jersey—drummed up by a 41-year-old serial entrepreneur named Matt Adkisson and five law firms, including two of the nation’s most prominent—about 20,000 workers, retirees, and their relatives are suing 150 companies and counting for allegedly failing to honor requests to have their personal information removed under Daniel’s Law.

These companies, which Adkisson estimates generate $150 billion annually in sales, may now be on the hook for $8 billion in penalties. But what’s more important to him is the hope that this narrow New Jersey law could act as a wedge to force data brokers to stop publishing sensitive data about people of all professions nationwide. He’s hoping that this multibillion-dollar pursuit, with its army of union cop households, may be a catalyst for better personal privacy for us all.

If he doesn’t win, the oft-derided data broker industry would have proved that it has a right under the First Amendment to publish people’s contact information. Websites could avoid further regulation, and no one in the US may ever be guaranteed by law to become less googleable. “I never thought we would have such a hard time, that it would turn into such a battle,” Adkisson says. “Just home address, phone number, remove it. One state. Twenty-thousand people.”

This is the first definitive account of how the fate of one of the country’s most intriguing privacy laws came to rest on the shoulders of Adkisson’s latest tech startup, Atlas.

Matt Adkisson is almost your prototypical lifelong entrepreneur. He quit high school at 16 to code video games and small-business websites. His parents insisted, though, that he audit classes across the street from their home, at the US Naval War College in Rhode Island. So he began learning about national security. One lesson he picked up: When judges live in fear and can’t rule impartially, democracies can wither.

But saving democracy wasn't his passion. Making money was. He headed off to the Massachusetts Institute of Technology with designs on becoming a consultant or investment banker, but dropped out before senior year. Like so many other young people in the midst of the Web 2.0 frenzy, he had an entrepreneurial itch. Without telling them, Adkisson cashed out his parents’ tuition payment, and in 2006, he and a friend slept under office desks for a month before founding a company called FreeCause with Adkisson’s brother to develop marketing tools for Facebook games. Adkisson later bought shares of the nascent social media startup. Both bets paid millions. In 2009, FreeCause sold for about $30 million.

Adkisson upgraded to nights on a friend’s couch in San Francisco, where he used his wealth to invest in or start dozens of other software companies. As they sold, he became a comfortable multimillionaire. It was his last big deal, in 2018, that set him down the path of privacy crusader. He had sold Safer, which developed a Google Chrome competitor called Secure Browser, to antivirus maker Avast for about $10 million.

Adkisson and a cofounder recall that during a meeting over lakeside beers near offices in Friedrichshafen, Germany, after the deal closed, an Avast executive demanded they feed search activity from Secure Browser’s millions of users to Jumpshot, a sibling unit that was selling antivirus users’ browsing history to companies wanting to study consumer trends.

Adkisson stood to make millions of dollars in bonuses from the proposed integration. He refused. It was too intrusive to share that intimate data, he says, and a violation of trust. (Avast declined to comment on the episode. It shuttered Jumpshot, and this year agreed to pay $16.5 million to settle US government charges over the service’s allegedly deceptive data usage.)

Adkisson left Avast in December 2020 thinking he would keep adding to his portfolio of over 300 startup investments or pursue something in AI, like automating brushstrokes to create on-demand oil paintings. But he couldn’t shake the Friedrichshafen incident. For his web browsing, he started to use VPNs and the privacy-focused search engine DuckDuckGo. He tried to get websites to remove his new East Coast home address. Those efforts mostly failed; companies had no obligation to comply.

These websites that sell addresses or phone numbers typically get that data by buying voter or property records from governments, and user account details from companies willing to deal. The easy access to data enabled by the aggregators can be vital to services like identity verification or targeted advertising. But the customers also can include people who are looking for an old friend. Or investigating a crime. Or someone with a grudge against, say, a judge.

As Adkisson dug into the data broker industry in 2021, he read about how a law that went into effect the year before had given Californians a right to demand companies delete their personal information. So Adkisson and two cofounders launched a service they called RoundRobin, to help Californians do just that for a fee. Services like DeleteMe and Optery were already selling deletion assistance, but Adkisson felt they were more marketing spin than serious tech.

RoundRobin joined the well-known startup accelerator Y Combinator in April 2021 and began developing software to simplify making requests. But the startup had no way to enforce the takedowns it wanted to charge customers for; only California’s attorney general could sue for violations of the nascent law. Data websites ignored RoundRobin.

Given Adkisson’s pedigree, investors held out hope. California privacy activist Tom Kemp, Lightspeed Venture Partners, and others invested about $2 million in RoundRobin that August. But the struggle continued. The cofounders renamed the company to the more serious-sounding Atlas Data Privacy in January 2022. It didn’t help. But then, a break. Just as Adkisson was considering giving up and his initial cofounders were pulling out, a relative of his in California who had worked in law enforcement mentioned Daniel Anderl’s murder—and the law it inspired in New Jersey. “Fate delivered the Garden State,” Adkisson says.

He soon reached out to law enforcement experts, including a former Boston police commissioner and a retired Navy rear admiral. The two told Adkisson stories about cops who were attacked in their homes. They urged him to press on.

The first organization to return Adkisson’s cold calls was the New Jersey State Policemen's Benevolent Association, the state’s largest police union. They said a few of the organization’s 31,000 members needed help containing some inadvertently leaked contact information. Adkisson and a cofounder, J.P. Carlucci, took a stab. Despite limited success, union members were excited by Adkisson’s moxy. In July 2022, a union leadership group voted unanimously to offer Atlas’ service as a benefit to members with the intention of using Daniel’s Law to demand websites remove phone numbers and addresses. The cost, spread across all members paying for the union’s legal protection plan, was hundreds of thousands of dollars annually, Adkisson says.

In August 2022, with the deal signed and thousands of members soon enrolled, Atlas established headquarters in Jersey City, New Jersey, and set out to prove it could deliver better results than back in California. For that, it needed litigation power.

The first six law firms Adkisson called refused to take up the New Jersey cases. They worried about their financial return and the likelihood of success. Judges had discretion over the $1,000 payouts, plaintiffs had to prove physical harm, and to even bring a case, attorneys had to mobilize each plaintiff individually. It wasn’t a good equation.

Over seafood in San Francisco on the waterfront, one attorney sketched out for Adkisson revisions to Daniel’s Law that could make Atlas’ job easier. Adkisson took those suggestions back to the police union, which in turn used its weight in Trenton to push lawmakers to enact the changes. By December 2022, legislators introduced amendments requiring judges to impose financial penalties on websites that failed to honor removal requests, allowing those covered by the law to sue more liberally, and enabling attorneys to more easily bring big cases. In July 2023, just after the third anniversary of Daniel’s murder, the governor signed these amendments into law.

Atlas stayed focused on recruiting more users, from the police union and beyond. Newly hired staff—the company grew to a total of eight people—learned the lingo, like don’t refer to state troopers as “officers.” Adkisson let clients call him directly 24/7 for technical support. He drove his Jeep Cherokee more than 50,000 miles to every corner of the state. The Atlas team spent 18 hours on back-to-back days at a correctional facility to catch every shift, plying union guards with Crumbl Cookies and Shake Shack. “Word started to spread, like, ‘Who the hell are these people?’” Adkisson says. “That brought us credibility.”

Days before last Christmas, Atlas finished the software for users to select the companies to which they wanted to send emailed data removal requests. The tired team gathered over Zoom watching a tally rise as the emails landed in data brokers’ inboxes. Altogether, Atlas would deliver 40 million emails to 1,000 websites on behalf of roughly 20,000 people over the next five months.

Helping users with only the easy targets—the ad-supported websites that tend to pop up when googling someone’s name—“would have been a band-aid on a wound that needed much deeper treatment,” Adkisson says. To provide what it viewed as comprehensive support and more than what competitors offer, Atlas also was facilitating takedown requests to mainstream services such as Zillow and Twilio. They tend to supply data through fee-supported advanced tools that don't pop up on a standard Google query.

Twilio denies that it provides data subject to Daniel’s Law. Zillow didn’t respond to WIRED’s requests for comment. Atlas, Adkisson says, spent about $1.3 million in labor and fees to verify websites it targeted were actually providing home addresses and phone numbers.

The startup got its first response on December 26. Red Violet, whose Forewarn data dossiers help real estate agents vet potential clients, was demanding Atlas cease and desist, erroneously claiming that Daniel’s Law applied only to government agencies and not private companies. Adkisson had expected the legal teeth of the updated Daniel's Law to inspire widespread compliance. This was a rough start. “Demoralizing,” Adkisson says.

Other companies responded with demands to see ID cards of Atlas clients, apparently suspicious that the startup was making up its customers or people demanding takedowns were pretending to work in law enforcement just to be covered by the law. Adkisson told one company they could call requestors to authenticate demands. After all, it had their numbers. Another company suggested that if Atlas clients wanted anonymity, they should have used an LLC to buy property instead of their own names.

Akisson says the most retaliatory response came from LexisNexis, which lets police and businesses search for people's contact information and life history, typically for investigations and background checks. He alleges that instead of removing Atlas clients’ phone numbers and addresses from view, LexisNexis needlessly froze their entire files in its system, impeding credit checks some were undergoing for loan applications.

LexisNexis spokesperson Paul Eckloff disputes that freezing was an overreach. The company deemed that step as necessary to honor the requests submitted by Atlas users to not disclose their data. “This company couldn’t be more dedicated to supporting law enforcement,” he says. “We would support common sense protections.” But he described Daniel’s Law as overly punitive.

To Adkisson, the people being punished were the cops, judges, and other government workers he had met on his Jeep excursions through New Jersey. Among them were police officers Justyna Maloney, 38, and her husband, Sergeant Scott Maloney, 46, who work in Rahway, a tiny city along the border with New York City.

In April 2023, Justyna was filmed by a YouTuber who runs the channel Long Island Audit, which has over 842,000 subscribers. He often films himself trying to goad police into misbehavior, and Justyna asking him to leave a government office became his newest viral hit. Followers inundated the Rahway Police’s Facebook page with about 6,500 comments, including death threats, slurs, and links to the Maloneys’ address and phone numbers on SearchPeopleFREE.com and Whitepages. Scott says Facebook wouldn’t remove the comments linking to the contact information. Neither would the police department, citing First Amendment concerns. Tensions boiled.

In August 2023, Scott received texts demanding $3,000 or “your family will be responsible for paying me in blood.” The texts listed his sister’s name and address. An hour later, the same number sent a video of two ski-masked individuals bearing guns inside an unknown location. Atlas wasn’t up and running yet, so Scott, determined to delete all his family’s contact data online, sat on his lagoonside deck every evening for weeks, crushing Michelob Ultras to stay calm as he navigated takedown forms. He put in so many requests to Whitepages for his family that it barred him from making more.

The Facebook comments linking to the Maloneys’ address only came down after they sued their bosses last November for violating Daniel’s Law. This past January, a state judge ruled that the risk to the couple “far outweighs” potential harm to the police department from censorship complaints.

As Adkisson looked to sue noncompliant data websites, he had no trouble signing up the Maloneys as plaintiffs. And because Daniel’s law now made it possible, thanks to Atlas and the police union’s lobbying, to collect guaranteed penalties from data websites, Adkisson had been able to secure five law firms, including prominent national firms Boies Schiller Flexner and Morgan & Morgan, and some attorneys who personally knew the Daniel of “Daniel’s Law.”

On February 6, Atlas and the legal team began filing lawsuits, naming the Maloneys and about 20,000 other clients as plaintiffs. In state court, 110 cases remain unresolved across five different counties. Thirty-six lawsuits are being contested in federal court before Judge Harvey Bartle III, who is based in Philadelphia but commutes across the Delaware River to Camden, New Jersey, because judges based in the state were conflicted out by virtue of being eligible for Daniel’s Law protections.

Eight defendants quickly filed motions to dismiss in state court, but they were all denied. At the federal level, most companies are arguing together that the New Jersey statute violates their First Amendment right to freedom of speech. It’s an argument that’s allowed personal information to stay online before. Federal courts have given leeway to publication of lawmakers’ contact information and actors’ birthdates, leaving doubts over whether cops and judges and their homes and phones would fare any better.

Defendants have told Bartle to consider a US Supreme Court decision in 2011 that found a law in Vermont that protected doctors’ privacy unreasonably singled out data use by drugmakers. Atlas’ foes view Daniel’s Law as similarly arbitrary because it holds New Jersey agencies to different standards than their companies when it comes to keeping data private. They also say it’s unfair that they must remove numbers that cops still list on personal websites.

Some companies fighting the lawsuits note that the $1,000 penalty that the law guarantees may lead to companies acting out of fear and removing more data than needed, or honoring requests that are actually invalid. What’s more, these defendants say that Atlas’ true motivation is money. They claim that instead of trying to quickly protect those already signed up when last year’s amendments passed, Atlas sought out more users to run up the potential monetary judgment and duped them into paying for protections they could exercise for free themselves.

Adkisson disputes the accusations. He says Atlas needed time to finish its platform and ensure it was able to properly log usage, so that judges wouldn’t dismiss cases based on technicalities like takedown requests ending up in spam folders. The startup also won’t be profiting from the lawsuit, he says. Two-thirds of any proceeds will go to the users represented; anything he and Atlas are left with after covering the costs of bringing the lawsuits would be donated to law enforcement charities and privacy advocacy groups through Atlas’ nonprofit arm, Coalition for Data Privacy and Security. Privacy is “a very real, tactical, and visceral need,” Adkisson says.

He was reminded of that this past May when he took WIRED in his Jeep to meet with Peter Andreyev, a cop in Point Pleasant Beach, New Jersey, and president of the statewide Policemen's Benevolent Association. Around dusk that day, Adkisson handed Andreyev a search result for his name on DataTree.com, a website that sells property records. Andreyev slipped on his black-rimmed glasses and brought his linebacker figure toward a conference table to review the page. It took him just two seconds to tense up. “Oh shit,” he said.

He stared at a street-view image of his home, and a birds-eye shot with his address overlaid. The square footage was in there too, for good measure. His head visibly rattling and legs restless, Andreyev pounded the table. “I—I’m pretty infuriated by this.”

Like many law enforcement officers, the 51-year-old rarely goes a day without nightmares about some known thug or detractor attacking him and his family. The DataTree printout reinforced for him that it would take just a few clicks for anyone to target him in the vulnerability of his own home. WIRED pulled up Andreyev’s report from DataTree with just a free trial.

As Andreyev continued to study the page, Adkisson pointed out something he viewed as particularly galling. In February, Atlas had sued First American, the $6 billion title insurance company that operates DataTree, for allegedly not complying with removal requests. Andreyev had been listed as one of the lead plaintiffs, alongside the Maloneys. In the following weeks, DataTree removed Andreyev’s address from one section of the search result for his name but left it up on the map that Andreyev was now staring at. “That’s no way compliant,” Andreyev said. “Fuck, it pisses me off.” First American declined to comment. As the legal battle plays out, Andreyev says he's left to continue looking over his shoulder—even at home.

The antidote of making officers more difficult to find could require greater creativity from those investigating or advertising to them, says Neil Richards, a Washington University School of Law professor and author of Why Privacy Matters. But it doesn’t make the work impossible. Richards, who isn’t involved in the Atlas litigation, says courts need to recognize that “privacy protections are a fundamental First Amendment concern, and one that's even more important than a company's ability to make money trafficking in phone numbers and home addresses.”

In the coming months, Judge Bartle will decide whether cops and judges living in fear imperils public safety. If so, he’ll have to settle whether Daniel’s Law is the least onerous solution. A loss for Atlas and its clients would effectively be treating “anything done with information” as free expression, Richards says, and stymie further attempts to regulate the digital world.

On the other hand, a victory for Atlas could be a boon for its business. Adkisson says tens of thousands of people across the country have joined the company’s waiting list: prison nurses, paramedics, teachers. All of them, he adds, anticipating someday gaining the same removal power as New Jerseyans. Since the beginning of 2023, at least seven states have passed similar measures to Daniel’s Law. None of those, however, include the monetary penalty that gets lawyers interested in pursuing enforcement. “Step one is, win here,” Adkisson says, referring to New Jersey.

After the dispiriting start, he thinks momentum is swinging in Atlas’ favor. In August, the startup raised its first funding since 2021, about $8.5 million in litigation financing and equity investment.

Adkisson says compliance with more recent removal requests is increasing, and a few defendants are settling. In September, a state judge approved the first deal, in which NJParcels.com owner Areaplot admitted to 28,230 violations of Daniel’s Law and accepted five years of oversight. PogoData, a revenue-less website that had made property owners’ names searchable, settled this month. Bill Wetzel, its 79-year-old hobbyist owner, would owe $20 million for breaching the deal but he says he supports removing names of officers in harm’s way.

Then again, against the better-funded defendants with more at stake and unpredictable courts, Adkisson recognizes that a broader victory for privacy and Atlas is uncertain. In telling his story, he wants to ensure there’s opportunity for people to learn from any missteps if Atlas fails. But his advisers, including former boss Steve Avalone, don’t expect Adkisson to give up easy. They describe him as the ultimate gadfly—unorthodox, tenacious, and wealthy. “There’s few people with that horsepower and that charisma,” Avalone says.

For his part, Adkisson says he’s driven by a sad truth. The tragedies, fueled in part by contact information online, that judge Salas wanted to bring an end to after her son’s murder haven’t stopped. Last October, a man allegedly shot to death Andrew Wilkinson, a Maryland state judge, who hours earlier had denied the man custody of his child. The National Center for State Courts said it was the third targeted shooting of a state judge in as many years.

Maryland investigators say they believe the now-deceased assailant found Wilkinson’s address online, though they never recovered definitive evidence beyond a search query for the judge’s name. When he heard about the murder the day it happened, Adkisson immediately googled Wilkinson. His address was right there.

25 notes

·

View notes

Note

Hello! I've been looking at setting up an Inprnt shop myself, but I'm unfamiliar with the platform from an artist's perspective. I was wondering if you'd be willing to let me know what you think about it? Any pros or cons you've found while using it?

Totally, here's a quick pros-cons rundown from my experience:

Pros:

Unbelievably easy to use for uploads

All the printing and shipping work is done very smoothly on their end

Firmly anti-AI and anti-plagiarism, with fast responses to reporting and also backstops against false-positive AI detection

Higher default percentage payout (30%) than many competitors

Very reasonably priced for higher quality prints. I've used the site for a canvas print of one of my own photos as well as for some posters of other artists' work, and everything has been really professional

Artist's prices for your own work (again, I got a really nice canvas print of one of my bears that's hanging in the living room of my dad's house)

Easily allows you to place orders for other shops on the site using your balance from your sales

Cons:

Custom crops are not supported

Payout percentage is still very low relatively speaking (obviously worth it to me for the amount of time/work, but it wouldn't be where I'd sell digital art, for example)

Setting up withdrawals is very annoying and you can only do it at over $100 without filling out a special request, which is limited annually. Given the relatively low price of most sales, this may take a long time for a small shop and sucks when $80 is sitting there and would make a huge difference in your life.

No ability to batch upload work

Relatively difficult to internally promote your work on (again, I don't put that much time into the site, but if I were a full-time artist, I would want more from it)

20 notes

·

View notes

Text

google search is it normal to constantly talk back to your boss

#i'm sorry#i'm such a bitch#but sophia freaks out about things where it's actually perfectly fine????#i don't know#she could easily get rid of me#well i say easily and then i remember her annoyed today that she didn't have enough for the wages#soooo does she have enough for the annual leave payout#if she gets her loan over christmas AND sells one or two houses then i'm gone for sure#if she gets an interest free loan from my nana then i'm dead for sure

1 note

·

View note

Note

do we have any idea what his payout was? mclaren gave 18m for 2023. his salary was like 7m at vcarb. so the remaining is his payout?? or does that incl enchante, wines, just annual increase etc?

I don't think we've ever got a clear idea what Daniel's salary was at Red Bull - I know It increased from his third driver contract salary when he was promoted. I don't think his payout for this year would be particularly high though, as he wasn't re-signed for 2025 and the option was on Red Bull's side, so his payout would most likely have just been the remainder of his salary for 2024, unless there were penalties for breaking his contract/taking him out of the seat (personally I doubt it given when Daniel's negotiating power when he signed for RBR in 2022).

It would include his income from personal sponsors (gopro, optus, beats, thorne), I guess it would probably include enchante and dr3wines but I'm honestly not sure.

12 notes

·

View notes

Text

"people just don't seek out music anymore and that's why spotify is such a vital service in helping artists get discovered and paid"

hey. buddy. listen 2 me. my fixation on the band sElf is because twenty seconds of a song of theirs was backing a monster hunter world gameplay clip someome posted to a now-dead twitter account. A hand-curated music playlist for a VRChat world I accidentally typo'd my way into introduced me to Superorganism's "It's All Good" a few years ago. Crumb's two albums Jinx and Ice Melt are among the highest number of full-album playthroughs in my library because i caught a shitty recording of Locket playing in-car over a snippet of someone's dash cam footage audio that was lifted for a youtube clip compilation channel someone else runs. back in 2011 my high school forced my entire grade to watch an anti-bullying PSA that ran on for 40 minutes but the credits had Dabrye's "Making It Pay" playing over it and that set me on the path to exploring all of Ghostly International's available music releases i could get my paws on at the time.

like. i've discovered music in the most obtuse places, often via the most unlicensed conduits those tunes could've possibly accompanied, and i can say with one hundred percent sincerity that the $9 i've spent just once on a digital album or two so i could listen to it again and again has probably put more food on the table of these musicians than spotify's "minimum one thousand streams annually per-song before payouts" discovery playback ever could achieve across a decade for many of these folks. i promise this isn't a brag, I just don't know how else to explain that spotify really isn't the only viable path forward when music permeates every facet of this world and all you have to do is take note when something catches your ear. the only thing truly making it harder to discover new music is licensing restrictions, automated Content-ID matching, and the universal/sony/warner music trio regularly leveraging both of the former to ensure your favorite song has an expiration date by tamping down on all of this, and unless you can hunt down a copy to save locally, a time will come when you'll never be able to hear that favorite song again. this isn't a threat; you and me both are going to outlive this service, as we've outlived many other online-only services before it.

(and i say this with complete sincerity to those not in a financially viable place to buy albums on the reg: just slurp the .wav off youtube homie. compared to spotify, the net gain to the individual artist is exactly the same. who knows, maybe you'll be able to inadvertently pass it along to someone else who's able to go and make that purchase, as others have unknowingly done to me. word of mouth alone is a /very/ powerful discovery tool)

#txt#this is not aimed at anyone here#it is however aimed at one specific user of an obscure gaming forum i frequent who had some really confusing takes on the topic a year ago#i still think about it sometimes#i don't understand how you can place so much faith in a single app in this day and age. like. you've seen how disasterous that can be right

11 notes

·

View notes

Text

Probably not a hot take

I currently have on my desk three notices of data breaches which may affect me, and expect two more in the next week.

Now, clearly there are "hackers". However, I also know that if these companies followed established data protection standards these breaches would be meaningless.

These are issues because of corporate negligence and greed. The causes are twofold:

First, companies collect way too much data. They track our browsing habits. Our spending habits. Our sleeping habits. Why? in the hope that maybe later they can sell that data. There's an entire economy built around buying and selling information which shouldn't even exist. There's no reason, as a consumer, for my Roomba to upload a map of the inside of my house to the iRobot servers. It provides zero value to me, it's not necessary for the robot to operate. The company can't even articulate a business need for it. They just want to collect the data in order to sell it later.

Second, companies are incredibly lax about IT security. They're understaffed, underfunded, and they often don't bother training people on the technology they have, nor do they install and configure it (hint: a firewall doesn't count if it's still sitting in a box on the datacenter floor).

And I think the only way for companies to sit up and take notice is to make them bleed. You can issue guidelines as much as you want, they won't care because making changes and performing due diligence is expensive. They'd much rather just snoop on their customers and sell it all.

So what we need to do, is set a regulatory environment in which:

We recognize that customers, not companies are the victims of data breaches. The companies which are breached are not victims, they are accomplices.

Create a legal definition of private data. This should definitely include medical data, SSNs, &c, but should be broad enough to include information we'd not think about collecting normally (someday in the future, someone will create a toilet which is able to track how often you flush your toilet. They WILL want to sell that data. Fuck 'em.) [I would also want to sneak in there some restrictions clarifying that disclosing this data is covered under the 5th amendment - that no one else can provide your medical data in a court of law, and that you cannot be compelled to do so.]

Create a legal set of guidelines for data security. This needs to be a continuing commitment - a government organization which issues guidance annually. this guidance should establish the minimum standards (e.g., AES128 is required, AES256 certainly qualifies, it's not "the FITSA guidelines only allow AES128, we can't legally use AES512").

Legislate that failure to follow these guidelines to protect private data is negligence, and that responsibility for corporate negligence goes all the way up to the corporate officers. This should be considered a criminal, not civil, matter.

Restrict insurance payouts to companies when the cause is their own negligence.

Set minimum standards for restitution to victims, but clearly state that the restitution should be either the minimum, or 200% the cost to make the victim "whole" - whichever is higher. This must be exempted from arbitration and contractual restrictions - fuck DIsney's bullshit; no one signs their rights away.

Make the punishments for data negligence so severe that most companies - or at least their officers - are terrified of the risks. I'm talking putting CISOs and CEOs in jail and confiscating all their property for restitution.

The goal here is to make it so that the business model of "spy on people, sell their information" is too damned risky and companies don't do it. Yes, it will obsolete entire business models. That's the idea.

10 notes

·

View notes

Note

Every day I come refresh your Tumblr and hold my breath for that Onlyfans link to appear 😞

Here are some things I did not know going into this:

OF performs ID verication requiring official documentation and photo submission, which can be rejected multiple times if the submissions don't perfectly match their specifications.

They require W9 tax forms to be submitted in order to appropriately link bank accounts for payouts.

Having a W9 means it would be best practices to have a sole proprietorship or LLC created to provide an EIN instead of a SSN, while also affording content creators some legal protections.

An LLC is better suited for this as it has the most legal protections, particularly in case of a lawsuit where prosecution would go after the business instead of the individual.

Operating an LLC would reasonably mean you should have a bank account opened for your registered business to simplify annual fiscal reporting and taxes.

LLC creation as well as sole proprietorship creation have their own specific fees within the state of operation.

OF Customer Support has to authorize connection to a business account, which is a manual process.

I'm currently working on this, but will let you all know once things are ready. Also need to develop a content upload timeline and marketing plan as I work within the limited confines of separating this from my wider public life.

Have patience my dear 🙌🏼

In the meantime, I am still accepting requests for paid content 🤷🏽♂️😄

38 notes

·

View notes