#also some folks are gonna consider this analysis very obvious which

Explore tagged Tumblr posts

Text

If you haven't seen my first Parrot post (which is fair its. in a weird spot and was a pain to post) here you go New season! New bullshit! Parrot I know what you are. (S2 spoilers below)

So Evbo finally decided to pay Parrot a visit, and it reveals a decent amount of information. Lets analyze.

[Transcript Start]

Evbo (Narrating): So instead, I think its time we bury the hatchet- or bury the axe in PVP Civilization terms- with Parrot. Because I think its about time I forgave him. Evbo (to Parrot): It doesn't look like you're too shocked to see I have a diamond sword. Parrot: If you've got a diamond sword that must mean you've came here from the outside. So that means Tabi won...but she let you live. Evbo: (Sighs) You are..right about that. She did win. Just like you predicted in your message. I just wished I could've realized what was happening sooner. If I did, then maybe the Eternal Sword would still be here and we wouldn't all be in danger.

Parrot: You're not the one to blame. No one in your position would've expected you to stop Tabi. Honestly, its a miracle you're still alive. I should be the one to apologize. I should've warned you sooner. And because of that, my civilization will pay for the consequences of my actions. You see, the Bows, Axes and Tridents never attacked each other. But each one of them knew that whoever obtained the Eternal Sword first would seek to wipe out every civilization. (Sighs) I can't say for certain how long we have, but the Axes are the most ruthless civilization of them all. So its safe to assume they won't hesitate to attack. Evbo: Wait- I don't get it. I thought all of the civilizations were against the Swords. So why would Tabi and the Axes attack the other civilizations?

Parrot: Each civilization holds their own Eternal Weapon. If one civilization were to collect all five, there would be no stopping them.

Evbo: (Sighs) This is just great. I didn't just cause the downfall of the Swords, but I guess I caused the downfall of the whole world. That is unless I stop her, right? If I can go to the other civilizations and stop Tabi from getting all 5 Eternal Weapons I mean- there's still a chance! Unfortunately me being a Diamond Sword kinda makes that complicated. Parrot: The only way you'll have a chance of surviving in another civilization is by getting another weapon, but I can help you with that. Evbo: Lets go! I'm gonna be able to get another weapon!? Okay! Sounds like a plan. Wait- Hold on- I actually need your help with something. And before you say no, you owe me.

[Transcript End]

Alright so a few things to unpack there. Parrot is acting as a supportive friend here, which is fair. He's also blaming himself for not warning Evbo sooner. He also seems somewhat aware that he just put the Bow Civilization in critical danger. Not great. Something interesting though. That I'm unsure was mentioned beforehand.

So in case we've forgotten. Here's what we're working with in terms of confirmed weapons (minus shields which. don't seem to be classified as a weapon)

Parrot mentions there being Five eternal weapons. We see Four civilizations on the map from the diamond sword layer and Four actual weapons. Assuming the Axes already have their own Eternal Weapon already, that would mean the Axes would only have to collect Three weapons. They already collected the Eternal Sword so..that means they would need two more right? But that doesn't add up to five. Assuming that they're implying Shields have their own Eternal "Weapon" (Probably a shield) that leaves us at...four. Huh?

I saw somewhere that Evbo forgot about the mace's entire existence (but who knows maybe he'll surprise me) so thats probably not the 5th weapon. So that leaves us with...

...Horrifying. Imagining Evbo running around with that loaded with firework rockets. Dear god. Anyway that's not what this post is about. I just thought it was funny. Back to Parrot's shenanigans. Evbo apparently has to be the one to forgive Parrot. And also Parrot "Owes him" for...something. So its safe to assume that. Something happened there when they went to go do murder on the whole iron sword layer. So that leaves me to assume: Parrot suggested the murder of the iron sword layer. And Evbo is covering for him. And Evbo was the actual assistant in this. Probably a crackshot theory, but I'm going off of memory and the stuff I have already written. Its either that or Evbo specifically wasn't forgiving Parrot for..not revealing his weapon type immediately? Which nobody else did either until Zam decided to commit "A Throwaway Joke" and run away so...hm. Idk about that. Feels weird to have to forgive the guy that literally gave you the heads up about a betrayal over that, right? That's why I think its something more than that.

Speaking of weird things Parrot is up to. The yellow elephant in the room.

You knew I was absolutely going to talk about this. Hoo boy. Some implications.

First off: Parrot could easily kill Zam right here. Zam quite literally just made himself unarmed. But he doesn't. Pretty sure these two were actually on the same side, and thats why Parrot wasn't trying to help Evbo out of the prison. Second: Zam's phrasing "I want to know why you're the only one still alive." Someone might say "Oh he's talking about how Parrot is the only bow left from his civilization because Tabi killed them!" WRONG. Zam does NOT know that right now. He's been stuck in Sword Civilization and the Diamond Swords would absolutely kick his ass considering it would be a 4v1. He does NOT have outsider info. There's no implication that he has actually seen whats happening outside. You know what this is about though? The fucking massacre on the iron sword layer. Its Empty. And Evbo confirms this in his narration! Quote: "Its not like there's anyone there to fight him.(Parrot)" WE HAVE A CONFESSION. IN VIDEO. IT WAS NOT JUST A FEW PEOPLE. THE ENTIRE LAYER IS GONE. oh i love this series so much

But yeah. I fully support the idea of Parrot being yet another antagonist. The quiet type that hides this shit in the background and manages to scare another antagonist. One that literally has immortality. Or at least implied to still have it because why wouldn't he go back and hit the armor stand after retrieving his trident? But yeah I need. I need more of whatever their dynamic is. Zam and Parrot are fascinating together rn. What did they get up to assuming they were infact, on the same side during the prison arc. And I honestly think Evbo in some sense, knows these two worked together. That's probably the most likely contender for what Evbo "forgave" Parrot of. Ahhhh layers !!

#pvp civilization#pvp civ spoilers#pvpciv#sympathytea overthinks#i'm still a supporter of cult leader parrot stuff#like honestly this dude definitely could#also zam being implied to be intimidated by parrot murdering this whole layer#and trying to resolve this peacefully#AUGH#he was already established to be a coward when he was fighting evbo#but goddamn#hes a suck up too??#excellent honestly#this series is peak fiction#also some folks are gonna consider this analysis very obvious which#yeah it is#im mainly just making this as a sequel to my prior analysis and also because i havent seen anyone else talk about this yet in detail#also im prob getting the weapons thing wrong im gonna be real SOB#my brain is hurting from that one in particular

7 notes

·

View notes

Note

um thoughts on hamlet?

i’m sobbing thank you and i’m sorry in advance because this is going to be LONG

so my hottest take on hamlet (i have many, many hot takes on this play) is that ophelia’s suicide was a hoax, and that gertrude, the queen, straight up murdered ophelia instead. why do i believe this? many reasons:

1. throughout the play, gertrude and ophelia have almost no relationship in terms of interaction between them. many, if not most, stagings of the play place ophelia and gertrude on opposite sides of the stage when a scene has both of them in it, and gertrude’s dialogue toward and about ophelia heavily suggests that she doesn’t really care for ophelia at all. at best, she tolerates ophelia, and at worst, she treats ophelia like an interloper in her court, a flighty girl who drives her son to distraction and has as much to offer to gertrude as her father. (gertrude’s famous line, “more matter with less art,” is an annoyed outburst directed at ophelia’s father polonius, whom gertrude outwardly loathes.) in ophelia’s last scene before her death, she appears to have lost her mind to grief in the wake of her father’s murder, and wanders through a royal meeting handing out flowers and singing. however, she gives gertrude fennel and columbines, which represent adultery in flower language, and TELLS GERTRUDE AS MUCH, TO HER FACE. in case you’re unfamiliar with hamlet, one of the big conflicts in the play is that gertrude, hamlet’s mother the queen, married claudius, the king’s brother, approximately thirty seconds after the king died and there’s a rumor floating around court that they were hooking up LONG before hamlet senior fell victim to the classic poison-in-the-ear trick. (later it’s confirmed that claudius himself was the one who murdered the king. whoops!) so ophelia accusing the queen of adultery is of course a HUGE slap in the face, and ophelia only gets away with it because ~~~she’s mad with grieeeeef sob cry~~~ which is GENIUS and i have more theories about that particular action on ophelia’s but that’s another post for another day.

2. ophelia dies offstage. she is never seen or heard from again until her funeral in act V. the only reason we find out about ophelia’s death - and in fact, the only way we know how she died - is because gertrude tells us about it. yes, gertrude, weirdly enough! gertrude gives a monologue which describes in excruciating detail exactly how ophelia died, right down to the kind of plants that were getting caught in her dress as she drowned and what songs she sang as she slipped into her watery grave. the sort of details you would only expect a person who was there to witness the death could provide. sketchy, right? what’s even sketchier is that gertrude makes no mention of having heard this from someone else. she’s not like, “oh, this is the hot village goss, take a sip babes,” she doesn’t offer any explanation at all as to how this information got to her. she just dives straight into her ultra explicit account of the drowning. SUPER weird! and furthermore, why is gertrude of all people the one giving us this information when there is clearly no love lost in their relationship? couldn’t this have come from one of those rando shakespeare characters who show up for one scene, deliver a message, and then vanish again? well, sure, but it didn’t. it came from gertrude. and that was intentional on shakespeare’s part - he wants you to be suspicious of this information, beCAUSE...

3. the play itself tells us that the conditions of ophelia’s death are VERY SUS. the very next scene after gertrude’s macabre monologue is act V scene I, wherein two gravediggers are preparing ophelia’s grave for her burial and discussing between themselves why they’re preparing for a christian burial if she killed herself. (in shakespeare’s time, suicide was a sin, and people who committed suicide weren’t given proper burials because of it.) the dialogue goes like this:

GRAVEDIGGER 1: Is she to be buried in Christian burial when she willfully seeks her own salvation? (translation: Why is she getting a proper burial if she killed herself?) GRAVEDIGGER 2: I tell thee she is. Therefore make her grave straight. The crowner hath sat on her and finds it Christian burial. (After examining her, the coroner said she should get a proper burial.) GRAVEDIGGER 1: How can that be, unless she drowned herself in her own defense? (So what, she drowned in self-defense?) GRAVEDIGGER 2: Why, ‘tis found so. (That’s what they said she did.)

the text here indicates loud and clear that something about ophelia’s death is complicated, enough that there’s DOUBT about it being a suicide. and what’s more, there’s so much doubt that her death was a suicide, she gets to be buried for real in the eyes of God. but the text does not explicitly state what, exactly, is so weird about ophelia’s death. it just wants you to know that the whens and wherefores about it are strange, and that characters who are not emotionally involved believe it’s strange, too. it doesn’t stop there, either! the priest who’s going to perform the funeral ceremony says, in as many words, to the royal family, “Her death was doubtful.” interesting!

4. gertrude has this TOTAL crocodile tears thing going on at ophelia’s funeral. after spending the entire play openly disdaining ophelia as a silly little airhead, here’s what she has to say at her grave:

GERTRUDE: Sweets to the sweet. Farewell! I hoped thou shouldst have been my Hamlet’s wife. I thought thy bride-bed to have decked, sweet maid, and not have strewed thy grave. (I thought I’d be covering your wedding bed in flowers, not your grave.)

kind of a weird, sudden change of heart for her to have about ophelia, right? you could argue that it’s grief-driven, that people gain new perspective after someone dies and maybe she’s just now realizing that ophelia was really a great person all along. but given just how few fucks she gave about ophelia when she was alive, it doesn’t make sense for her to be sad after ophelia’s death, unless she’s being performative about her grief. and yeah, she’s the queen, people are paying attention to how she reacts to shit and therefore on some level everything she does is performative, but it’s in particular how she relates her grief back to ophelia being her son’s girlfriend that gives me pause, beCAUSE...

5. there is, of course, that whole Oedipal reading of hamlet, where the reason hamlet and gertrude’s relationship is fifty shades of fucked up is because they’re sexually attracted to one another. while this reading of hamlet is mostly a freudian analysis that is treated as a sort of embarrassing joke nowadays by scholars and theatre folks alike, when you read the scenes between hamlet and gertrude - in particular the famous closet scene, from which the bulk of this analysis derives - you DEFINITELY get the sense that this relationship is weird and toxic for reasons that have nothing to do with the fact that gertrude married hamlet’s uncle. gertrude is really, really, really wrapped up in her son. but not in a loving, maternal sort of way - instead, it comes across as a narcissistic parent desperate to understand why their child has not turned out exactly the way the parent wanted them to be. gertrude continually accuses hamlet of acting out of pocket specifically to hurt her, and does not consider any other motivation for his actions. when he acts out of turn in court, it embarrasses her. his strange behavior reflects poorly on her as a mother and as the queen, and she doesn’t like it. she has a nervous breakdown over it in the closet scene, where she basically begs hamlet to be normal for her sake.

now with all of this in mind...

i believe gertrude, having gotten fed up with her son acting Weird and making her look bad all the time, decides that in order to exert SOME means of control over the situation, is going to take it upon herself to eliminate anything that could be the cause of his bad behavior. and the most obvious cause, at least to her, is ophelia. why would gertrude believe this? well, in act one, polonius encourages ophelia to break up with hamlet, because he’s worried hamlet’s gonna steal his daughter’s virginity (which, gross, but whatever, we’re not here to talk about that today). because ophelia’s an obedient daughter, she does so. then, in act two, ophelia runs to tell her father polonius about an encounter she had with hamlet in her bedroom, where he did a bunch of weird creepy shit and then left her a letter that expressed how desperately in love with her he was. polonius decides that hamlet’s gone nuts because ophelia dumped him, and the two of them tell the king and queen about their theory. claudius asks gertrude if she thinks the theory holds water, and gertrude responds that it might. later on, in act three scene one (i.e. “to be or not to be”), this theory is apparently confirmed - at least to polonius and gertrude - by the way hamlet treats ophelia.

so, the very first theory posited to gertrude about why her son’s acting weird is that it’s because of ophelia. and we’ve already established that a) gertrude doesn’t like ophelia, and b) gertrude is a narcissist. she’s desperate to make hamlet stop his bad behavior and therefore stop making her look bad. the worse hamlet’s behavior gets, the worse gertrude’s desperation gets to stop it. and everyone else in this play solves their problems with murder, so it tracks that gertrude would solve her problem with murder, too!

gertrude killed ophelia hoping that it would make her son would go back to normal. (and, if for some reason you like the Oedipal reading of hamlet, it could be argued that she was also jealous of ophelia. but i don’t really love the Oedipal reading, so i’m choosing to ignore this argument.) the fact that ophelia was apparently insane at the time just made it easier for her to make up the suicide alibi. that’s why she knows so much about the circumstances surrounding ophelia’s death - because she was THERE and she CAUSED IT. that’s why shakespeare has gertrude delivering the news of her death. that’s why the play tells us, repeatedly, that the circumstances of ophelia’s death are suspicious. because ophelia didn’t drown herself. gertrude totally straight up drowned her!

thanks for coming to my TED talk everyone

14 notes

·

View notes

Text

finally. i decided to do this. anyways hello there, i am jake and today i want to talk about something; you see, if you are in the tf2 fandom, you probably know about heavymedic. Wherther you are a hardcore gamer who resents f2p’s or a person that never played the game but has trillions of notes on their art- you know heavymedic exists and most of all you probably ship it.

And I find that weird. In the few fandoms in my life I have been in I had never seen a single ship be so widely if not shipped, then accepted. Sure, maybe everyone in the GF fandom knows what Billdip is - for better or for worse. Sure, maybe the HS fandom is 70% shipping.

But I have never ever seen such a phenomenon in a prominent multiplayer game fandom. A fandom, sadly, oftentimes filled with toxicity. Overwatch is very similar here - yet ships are either a hot topic of discussion or straight up ignored. But TF2? In here for whatever reason we ship these two mercenaries. And in this essay I will try and find a reason or two why is that.

Apologies for any mistakes or incoherency. English is not my first language, I need to ramble, and my vocabulary is all over the place.

Content warning: mentions of homophobia, blood, death, mentions of WLW fetishization, nsfw mention. Also MASSIVE SPOILERS FOR THE TF2 COMICS.

Part 1: Canonical Evidence and Interactions

Let’s be honest: I could ramble about this one for days on end. But I’ll try and keep it short.

First and foremost we have the official videos. And of course the first thing that comes to mind is Meet the Medic.

At the very start of the part where Medic himself appears, we see him telling a joke about a particularly gruesome situation to Heavy.

He laughs along with him, visibly enjoying his company. He even smiles as he waits for another joke. Heavy only shows genuine fear a lot later.

And of course this damn scene always cracks me up. Medic slightly pinches Heavy’s cheek and strokes his lip gently (the other part is almost not noticeable unless you play the video at slow speed).

Of course we all know about the Hand Hold that happens somewhere halfway in the vid. I don’t think I have to explain the gayness in that. The fact their hands stay interlocked even after Medic helps Heavy up. The deep breath Medic takes because even he cannot handle the emotions. That few seconds is unresolved sexual tension manifest.

Overall the short shows a strong feeling of trust between these two. Medic confides in Heavy and reverse. Yeah he puts a baboon heart into his friend’s chest cavity but the fact (as proven at the end of the video) that Heavy was the first one to have an Ubercharge implanted into him shows that Medic at the very least considers him a lab rat.

I treat End of the Line as non-canonical, as do many others, and as such won’t discuss it here. But it will forever crack me up that Valve endorsed such levels of homoerotic subtext.

These two have some short moments in other videos, like for example in Invasion Heavy helps Medic up (CINEMATIC PARALLELS) but it’s nothing major so I guess I’ll skip forward.

Second is their interactions ingame. You might call me a weirdo for trying to find stuff in there but holy shit I have things to say and I’m going to say them.

You thought I was going to fanboy over the “i love this doktor” voiceline huh? Well not really. I wish these two had unique lines if they assist one another.

Heavy is literally listed on the official wiki as the “ideal medic buddy” and multiple pages on that exact wiki say some pretty interesting things.

I have to say something about the Gentleman’s Ushanka and/or Pocket Medic. They are both community cosmetics - but the fact they both got accepted by Valve says a lot. Above is text snipped from the actual wiki.

Last but not least: The Comics. Darned comics. The pair of mercenaries has basically no interaction - unless you count issue 6.

Heavy getting absolutely PISSED when Medic is killed by Ch*avy. Their reunion. Medic referring to Heavy by “my friend” in a totally straight way. Kind of sad Valve wasted an opportunity for them to hug. Maybe they knew their comic artist ships them and wanted to avoid having to answer the Question™.

Part 2: Dynamics

This part’s a bit trickier, mostly due to the reason that I’m new to this whole dynamic analysis thing. Yeah I’m good at spotting canonical evidence but very specific shipping dynamics often escape my gaze.

The most obvious one is Big Guy, Little Guy. Quoting the TVTROPES page:

[…] This trope describes a pair of guys who always fight together, are best friends forever, and quite often have a very obvious hierarchy: The little guy is often in charge […] The little guy is usually listed first, since he’s the leader, and they are always listed together, as if they are one entity. In fact, some episodes may center on the fact that they can’t live without each other. […] If this is a case of Brains and Brawn, the Big Guy is usually the Brawn, and the Little Guy the Brains. It’s almost never the other way around, but in some cases the Big Guy can be rather smart too. […]

A sub-type of this, a common favorite here on Tumblr is known as “small chaotic big calm” and hoo boy if that isn’t these two. I don’t really have much to say here - again I am not an expert.

Part 3: Fandom Impact

So you don’t think Red Oktoberfest (as Heavymedic is sometimes called) is super popular on anywhere else than Tumblr? Wrong.

It’s hard to find TF2 fics on Archive of Our Own not tagged with Heavy/Medic. Of course most of them only contain hints to their relationship but go in the main tf2 tag and I can guarantee you, you’ll gonna see “implied heavy/medic” all the time.

But these two go further than AO3 or Tumblr or Instagram or whatever. They are recognized even within the wider circle of the fanbase. Take this SFM, for example. (I am using the Saxxy Awards version of Secret Lives here mostly due to the fact that the Heavymedic moment is much gayer. In the normal version, the dialogue isn’t changed, but they simply hold hands.)

youtube

But it gets deeper. (WARNING: THE GAY MOMENT IN THIS ONE IS NSFW. NOT EXPLICITLY SO BUT JUST A HEADS UP TUMBLR PLEASE DO NOT FLAG ME)

youtube

And the best part? The comments are extremely positive. You’d expect hoards upon hoards of homophobes screeching but no, the comments are supportive. Even on places such as Reddit or Youtube, comments like “yeah they’re gay and in love” do not get downvoted/disliked to hell; in fact the opposite.

Part 4: Canon Status

Let’s be real. Most ships are shipped because people want to explore the dynamics in fanfic, fanart or something else. But Heavymedic is shipped because… well, I have no idea.

Actually, I kind of do - but only theories. You see, while the canonical evidence is here, the creators have never said anything about them. No confirmation, no disproval, no hinting, nothing.

But the ship is so prominent! There has to be something causing this!- you say. And to that I present you 2 theories on why Heavy/Medic is so popular.

Theory number 1 states that we simply all choose to interpret their interactions as homoerotic. And this is very easy to disprove - there’s simply no way we just collectively agreed on these matters out of nothing. There has to be something bigger.

And theory 2 states that, well, our interpretation is the desired interpretation. But this is even more ridiculous than theory 1 for a number of reasons. If they are in fact gay, why hasn’t Valve made them canon yet?

A Theoretical Scenario

I am going to ramble big time on this one, so buckle up lads. I’ll discuss a theoretical scenario in which, well, if that was not obvious, Valve confirms Heavymedic as canon. Maybe then we will see why they will probably never do so.

TF2 is considered by typical capital G, alt-right Gamers as a “non-political” game. This means no women (in the game itself, at least, and if even, sexy women only), no queer folk and no minorities (for some reason they accept Demoman but throw a fit if someone draws any other merc as not being pearl white). Team Fortress 2 was around before Gamergate and other things like Gamers Rise Up. It’s a classic and Valve is regarded as the good guy to Epic Game’s bad guy. If Valve did anything to confirm doubts, wherther it be clearing up popular fanon or confirming ships, these people would throw hands. (Although they seemed to ignore when one of the writers confirmed Miss Pauling is a lesbian. Huh.) Even those that don’t play TF2 would come to the aid of their bros.

Let me illustrate with two very similar examples. In both cases these confirmations were the first made by the company as a whole, both are fairly recent and both confirm a character as gay.

First we have the confirmation of Tracer from Overwatch as a lesbian. It was done in one of OVW’s comics. Tracer is the FACE of Overwatch as a whole and while most of the fanbase accepted it (thankfully the Gamers are reluctant to infest ow), some people threw what I can only describe as a hissy fit. At least her girlfriend’s a background character.

Second is Neeko from League of Legends. Unlike Tracer she was added a while before it was confirmed she was gay. LOL is much more toxic and filled with Gamers than OW and holy shit people smeared LOL so much.

Of course these are not accurate to Heavy/Medic. In both of the cases I listed it was girls being wlw and we all know how much cisgender heterosexual gamers LOVE yuri porn. Apparently only girls can be gay because they can jack off to it - if it’s two guys then it’s disgusting. Nevertheless I think these are good approximations - in every case the company gets “shat on” on social media and other sites. With the community that Valve has, I think even if they wanted them to be gay, they would never ever confirm it.

Conclusion

I’m sorry for that ending. I had to theorize a bit. Regardless I’d love if you shared this on other sites, reblogged or whatever - I wasted at least 1 and a half hours of my life on it. Feel free to cite this as a source if someone asks you why you ship the big heavy weapons expert and the feral battle medic.

66 notes

·

View notes

Text

Video Analysis #5- CRISIS CORE (The Truth/’You Will Rot’)

Alright folks, the wait is over. As promised, I finally have written up my analysis of this very pivotal point in Sephiroth’s tragic timeline. After all of the posts I have made leading up to this, we have learnt of his compassion, his friendship, his loyalty and his martial prowess. Tonight, we’re going to delve into the start of his madness. Buckle your seatbelts peeps and grab some popcorn, this is gonna be a long one. The clip is 3 minutes long, hopefully the analysis I write doesn’t ramble on for too long. Sit back, relax and enjoy the read! (Also testing out a new format for these types of posts with more structured topics and headings <3)

Context

Before we talk about the scene linked below, we must first talk about the events leading up to Genesis’ being an utter douchebag to his little brother and pulling him further into the madness that would lead to his downfall. Sephiroth and Zack arrive at the Nibelheim reactor and quickly discover that not all is as it seems. The pods containing experiments from past JENOVA projects are revealed to the two SOLDIERS and it begins to make Sephiroth question his entire existence. He had been deprived of the truth his whole life, and even now at the cusp of it all his mind is breaking because he can’t tell what is right and what is wrong anymore. Even with Zack trying to help him, the information thrusted at him is all too much for him to bare.

ShinRa had no idea how fragile Sephiroth’s mental state actually was, nor did they consider the fact that maybe sending Sephiroth to Nibelheim may not be such a good idea considering what was hidden there. But that’s a story for another time, let’s get this started!

‘Am I... A human being?’

Here we begin to see the slow breaking of the once proud hero. The way he says those words, the tone of which he conveys his shock and utter sadness at the fact that the life given to him is most likely nothing more than a fruitless lie. This is such a stark contrast to the Sephiroth we all knew and loved when speaking to his friends in past analysis videos. It hurts a lot more for me since I absolutely adore this character and just hearing him slowly lose his mind really hits me in the gut. After this we see Genesis confirm albeit in the most cruel, heartless and condescending way possible that Sephiroth was an experiment and while Sephiroth really didn’t need to believe a word Genesis said, his psyche had already been broken. All this information being thrown at him is such a huge tidal wave of emotion, it’s no wonder Sephiroth felt overwhelmed.

(“No such luck. You are a monster.” Okay small tangent for a second: Genesis in this scene is doing himself no favours at all. He wants Sephiroth’s help so that he can live right? Why tell him that he’s a monster and droll on and on about how his life was a lie and that his mother wasn’t actually a real human being but an otherworldly cosmic entity AKA a Monster? AND THEN PROCEED TO ASK HIM FOR HELP THINKING THAT HE’LL JUST WILLINGLY ACCEPT? As I told a good friend of mine: Genesis is such an idiot. I AM SORRY GENESIS RPERS OKAY, I LOVE HIS CHARACTER BUT THE WAY HE ACTS IN THIS SCENE IS SO FUCKING DUMB)

Genesis calls Sephiroth the ‘Greatest Monster Created by the Jenova Project’. And this is 100% truth, we’ve all seen just how strong he is, how special Sephiroth is. This is Genesis trying to turn him onto his side by appealing to the monster and detaching him from his human self. But this was a completely wrong way to do it, especially with a fragile mind like Sephiroth’s. He wanted to be human but he knew he somehow wasn’t in a way, he was always detached. And while he always opened up to people in a manner of which was incredibly kind hearted, he always felt like his brith wasn’t normal. Now finding out the truth, he DOES NOT want to be a monster, he DOES NOT want to be considered compartively to the beasts that were in the pods and with Genesis’ continual insistence that Sephiroth is nothing more than a monster, the small rope that was keeping his mind in check was slowly breaking under the large weight of the truth.

‘Poor little Sephiroth. You’ve never actually met your mother.”

Here is where things get super bad for our soon to be psychopath. Genesis throws out all of his cards onto the field, revealing the truth about Sephiroth’s existence and also revealing the truth about his mother: JENOVA. Genesis was right, Sephiroth had no idea who his mother was other than the supposed truths that ShinRa told him. I like to believe that when Sephiroth was growing up, they gave him a forged picture of what his mother looked like AKA JENOVA and from that day onwards, Sephiroth has always conjured that image in his head, that same picture is on his desk back at Shinra HQ and he cherishes it. It makes it hurt so much more watching the scene with this in mind as Genesis further digs into Sephiroth’s heart by mentioning that she was nothing more than a monster and whatever he clung onto was a giant fat lie.

Notice how Sephiroth turns away from Genesis, the natural smile is gone. His stance, his posture has gone. He’s almost lurching forward, his confident strides naught but small steps forward. His eyes are wide and close at times, he is trying so hard to process everything but it’s all coming too fast for him to handle This form of coercion employed by Genesis may have worked on Angeal but Sephiroth? Hell no. It’s also quite amusing that Genesis knocks Sephiroth out of his confused state by calling him by his full title. SOLDIER: 1ST CLASS, SEPHIROTH. He says it similarly to how a general would do a roll call of his cadets before training, and this is literally conveying Genesis’ belief that he is in full control of Sephiroth, he holds the cards, he holds the power over his little brother this time. He believes that Sephiroth will give him what he wants. Little did he know how wrong he would be however.

‘What do you want of me?’

Genesis’ motivations are finally made clear and we learn what makes Sephiroth so special when it comes to the JENOVA Project. We finally learn of the project where Angeal and Genesis originated from as well as the the one where Sephiroth was from. I’ll let Genesis say why in the video becaue he’ll explain it better than I can, I’ll end up butchering it if I tried. Basically what he wants is Sephiroth to share his cells so that he can stop his degradation. He’s slowly dying a painful death and Sephiroth can stop that because his cells have been perfected. Sephiroth has remained quiet this entire time, pondering the truth while Genesis flaps his gums about being saved, he has already made the decision in his head of what he wants to do.

‘The Truth I have sought all my life. You will R O T.’

And here we finally reach the end. Sephiroth with no remorde left in his heart, his mind deadset on now learning the truth of his birth, denies and what I believe he also does is disown Genesis as a friend and brother. All the memories they shared, all the times they recited and enacted ‘Loveless’ together with Angeal, all of that is now dust in the wind. His expression, the deadpan stare that he gives Genesis is a lot more similar to the evil Sephiroth scowl we all know and love. The way in which he speaks, gone is the relatively light hearted, dry humoured tone of the hero that everyone looked up too when trying to become a soldier. No, he speaks with rage and grief in his tongue. He is legitimately torn asunder after the revalation. Whether it be lie or truth that came from Genesis, he’s done with his brother. Their friendhip is over. And at last, he delivers probably the most scathing, delicious and satisfying burns in Final Fantasy. Not only does he reject Genesis, he literally tells him to ROT. To DECAY! He tells Genesis in the most fitting way to just ‘GO DIE’. ‘THEN PERISH’. It’s one of my favourite insults in Final Fantasy ever. It’s nice to see the sarcastic wit hadn’t died with Sephiroth’s kind hearted nature.

The scene ends with Sephiroth heading to ShinRa Manor to find further information of his existence while Genesis is left at the reactor. The closing words being: ‘ I see, perfect monter indeed...’. Genesis was actually surprised when Sephiroth denied him, it was quite a priceless reaction if I do say so myself.

I guess this is a fitting way to conclude with a very salty Genesis and a very angy Sephiroth. I want to thank you all for sticking with it this far I know this was a lot longer than normal but there was so much information to digest. I hope I didn’t waffle or state anything that was super obvious from the clip. This’ll probably be the last one for a while as this definitely took a lot of steam out of me. But yes, I’m glad so many of you enjoy this, if you have any scene requests that you'd want to see me have a shot at IM me <3

7 notes

·

View notes

Text

Thoughts on “Destiel is Real.”

So, I’ve been relatively scarce of late (except for when I went bonkers with reblogging deadly Cockles content...which I think I blacked out from b/c it was like being waaayyyy too high and it’s all their fault) because, if y’all don’t know, I have stage 4 breast cancer and am in chemo. I’m tolerating it really well but it takes a surprising amount of time, actually, especially since I’m still working 80% time and also living alone so doing house stuff etc.

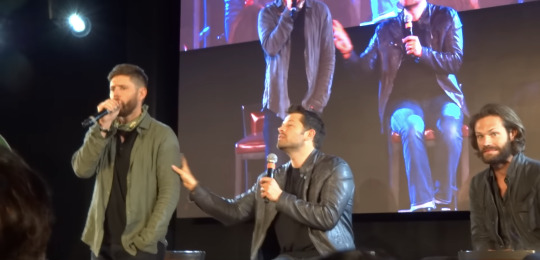

This is all to say that I’m weighing in on things belatedly a lot. Like, I do still want to analyze the Cockles JIB panel as a whole b/c, oh my, was there a lot there. But today I will settle for this piece of it. I apologize if this is reduplicating what smart folks said elsewhere right when it happened. I was also off Twitter to avoid having it bring me down so I might just be really unaware. But as soon as this moment happened I was like, “oh man we’re gonna argue about this for like 84 years.” So here’s my small contribution on what this reminded me of.

To me, listening to Jensen and watching him engage the crowd, inspired a lot of anxiety b/c it did definitely seem like he was pissed off. I just couldn’t tell with what or who, especially given firsthand context from some folks in the room like @bluestar86 who wrote this account: https://twitter.com/bluestar861/status/1130255687290937344?s=21 about the general positivity Jensen and Misha had shown earlier (which is why Misha mentioned the shirt) and how the energy in the room was almost entirely positive. I totally believe that. But it didn’t reconcile easily with what I felt I saw from Jensen.

Until I remembered SDCC 2011. The one where Misha had been fired and all of them knew but none of the fans do. I wrote a long meta on that panel that I’m actually super happy with so maybe check it out? Anyway, this is how I described some of the dynamics:

The way everyone is sitting at this table isolates Sera and the body language from Jared and Jensen is openly hostile. Jensen especially pushes himself as far away as possible, defensively crosses his arms, leans away, doesn’t make any eye contact. Jared is also pissed and is functionally shielding Misha with his body while he does the first Cas question. Both of them are very protective and Jensen is more than a little hostile. They also both keep egging the audience on in their love for Cas/Misha, as when Jensen shouts “YEAH!” in affirmation of audience shrieks about the character. They want to show Sera what a piss poor decision it was to take Misha away from the fans…and from them. Whatever else you see happening these are some amazing friends.

So, we had a remarkably angry Jensen at this panel and he was angry specifically because the network had made what he considered--both professionally and personally--to be a fucking terrible decision. But he couldn’t say that. He’s got NDAs and stuff to worry about. So instead he settled, among other things, from egging the audience on to show how much they loved and wanted more Castiel.

Now I’m not saying the correlation is 1-1 with Destiel. But I am suggesting a thought experiment where something similar could be going on. And by “something similar” I mean “Jensen has inside knowledge about a thing the network has decided that he thinks is fucking stupid and that will hurt the fandom.” Like, oh for example, they’re not moving Destiel out of the subtext.

Additional fuel for this fire. Many have speculated that it’s network president Mark Pedowitz who’s the blocker. Jensen, earlier in the panel, asks the audience to applaud Pedowitz. That’s weird and he’s never done it before. True, Jared was talking about how Pedowitz says that they set examples for other shows and that Pedowitz is complimenting them on it so it was at least that in part. But Jensen is MASTERFUL at throwing shade while appearing to be doing the correct, professional thing. Witness his comments about Bob Singer and last year’s S13 finale. He’s done it with Eugenie and Sera too and probably others I don’t know about. Having the audience applaud Pedowitz if he knows something negative about Pedowitz--something the audience won’t like and that will actively hurt many of them--has a major bite of irony that I feel Jensen is perfectly capable of trying to engineer. (Or maybe there hasn’t been a final decision but he knows it doesn’t look good and why. Don’t lose hope! This is just speculation and a thought experiment.)

I’m going to put the JIB analysis under a cut, since it’s long and has lots of images. It ends with “The most similar behavior I saw was Jensen angrily getting the audience to cheer for something, even doing the same hand-raising gesture. In 2011 it was Castiel (”Go on! Show Sera how much you love the character she killled!”) and this time it was Destiel (”Go on! Show the network how much you love the ship they won’t textualize!”). That’s what made me think, initially, that he may know something about plans for Destiel that a) makes him mad, b) that he considers a bad decision by the network, c) that he thinks that audience will be hurt by.”

Anyway,

If you watch the JIB panel (starting about 12 mins in) you see, first, that Jensen wants Misha not to bring it up. He raises his hand at Misha which I first thought was him being like “shhhhhh don’t bring that up!” but which on repeat viewing I think was him actually just trying to get Misha to shut up so he could literally try to understand what she was saying. Once the audience reacts to Misha’s comment these are their faces:

Jared is absolutely looking at Misha like, “dude, why did you have to go and do that? You just threw a live grenade onstage.” Jensen is hamming it up gesturing at the audience to scream louder.

Jared changes his face to “well, when you’re right, you’re right! What are you gonna do.”

Here’s Jensen. He’s looking grumpy. Now, is it fake grumpy, a recognized and favored persona that he has. Or is it actually grumpy? Or is it both”

I think it’s both. But I also think he looks sad. And concerned. Like, on behalf of the audience not for him. Now you can say I’m projecting if you want--this is all total rampant speculation--but look at his eyes. I think he’s upset that he has to talk about this at all (since he knows a little about the fandom conflict it sets off) but there’s something else.

He pauses for a good, long time looking at the audience responding. And according to Saz and others the response was HUGELY POSITIVE! So why does he then announce into the mic with a grumpy fake laugh and what I honestly have to call sarcasm, “Destiel is real!”

Note that Misha is not worried by this. If Jensen were actually legitimately furious I think Misha would look a little worried. But instead he looks amused and curious about where this is going.

This is Jensen asking “Is it?” for the first time. He looks intentionally confused - that’s the bit he’s doing.

Here’s Jensen after the audience starts to audibly yell “Nooooo!!” His face says “WHAAAAAAT!?”

People then yell “yes” to drown them out and he asks, “Where?”

Second “where?”. Maybe he’s trying to get them to say “subtext” - a word the cast has great familiarity with and which was used in “Fan Fiction” and which they can joke around a lot about. That’s my guess. Maybe he has a subtext joke set up he wants to do with Misha. (Remember his tweet to Misha during “Fan Fiction: “you keep your subtext to yourself. I’m not that kind of girl. Wait...”)

They don’t - at least not clearly. Someone in the front row says, “Nowhere.” Misha says, “Help” (after mouthing something at someone in the audience that is probably “I’m sorry about this.” Jensen checks on Misha BUT disregards the fact that he’s looking over at the question-asker (who didn’t even ASK a Destiel question, just wear a shirt she liked) and asks “Where?” AGAIN.

Misha then takes things in hand and reaches out to tell Jensen, “don’t get into a fight with these people.” Jared is making a “Yikes!” face at the person in the first row who is continually yelling “Nowhere!”.

Jensen does sit down, but he’s mad. He’s really tense and it takes him a while to shake it off.

Who’s he tense with? The most obvious answer is the audience but let’s consider a couple things. 1) The audience was giving a mixed answer, including and sometimes more loudly the “Nowhere!” that you would think Jensen would want to hear IF he were angry/tense about the “Destiel is real” shirt or the audience’s support of it. 2) He was demanding consensus and an answer to where it was real EITHER to have them say “nowhere”--which they did so why not just stop?--OR to get them to say something like “subtext” to lead them into either a question or a bit about it.

So why keep pushing? Hoping to change the answer? Hoping to find consensus? Or maybe just hoping to get them to make a lot of noise about it for a long time (at which he succeeded). Now, Jensen is famously inconsistent about Destiel and also famously different onstage, especially for J2 audiences...though this, the most Holy Gay panel of all the panels, isn’t a place he’d shy away from, e.g. “What would Dean and Cas do on a trip to Rome? Everything I think of right now is inappropriate.”

Which brings us back to “who’s he tense with”? Could it be only part of the audience? Which part? The part yelling “nowhere” or the part yelling whatever positive things they were yelling? I’m going to hypothesize, based on a LOT of other stuff that I’ve written about, that he’s annoyed with the negative folks spoiling it for everyone with their “nowheres” and is trying to get the positive folks to drown them out and give him a good answer he can run with.

The fact that nothing coherent emerges is actually what gets him annoyed. And, by extension, the volume and persistence of that small part of the audience, which lets people like Pedowitz shoot down the idea of textual Destiel as something the viewers “don’t want,” annoys the living shit out of him because he sees the viewers all the time and knows that a majority of them either are ok with or actively want textual Destiel. I imagine him thinking something along the lines of, “Why can’t these nice people just have what they want? It’s b/c of assholes like you.”

He definitely lets his emotions get the better of him. He was already not in the best place, thanks to circumstances I hope to write about later but which boil down to having his special panel with Misha (that he was visibly psyched for from the moment he got onstage, “I always have so much fun with you!”) taken away because he got some awkward wood from being choked and straddled. So with that grumpiness he was primed not to make the best decisions. He gets aggressive and confrontational when he’s pissed, which is a thing I don’t love about him, even though it’s very easy to see why, and maybe this was just his battleground of choice.

To get back to the thought experiment about whether this is like SDCC 2011, though, I think it could be. I think it’s far more complex, given all the discourse surrounding Destiel and Jensen’s own sexuality. (Here’s a post I wrote in response to a question about Jensen and Destiel and bi!Dean that asked whether I thought he experienced them as about himself and Misha.) It’s tough, b/c each piece of evidence could go both ways (ha). Either mentioning Pedowitz for applause is excellent shade or total sincerity. Either Jensen is mad at the pro-Destiel audience and trying to get them to admit that they’re wrong, or he’s mad at the antis and trying to get them drowned out.

The most similar behavior I saw was Jensen angrily getting the audience to cheer for something, even doing the same hand-raising gesture. In 2011 it was Castiel (”Go on! Show Sera how much you love the character she killled!”) and this time it was Destiel (”Go on! Show the network how much you love the ship they won’t textualize!”). That’s what made me think, initially, that he may know something about plans for Destiel that a) makes him mad, b) that he considers a bad decision by the network, c) that he thinks that audience will be hurt by.

Given his shift in attitude overall and the mood of the room as described by attendees, it seems plausible to me that his engagement was a performance, using the audience, of what it is the viewers ACTUALLY want. But it could also just have been a grouchy Jensen taking it out on an old, familiar punching bag - the topic he never wants to discuss onstage - Destiel.

#jensen about destiel#jensen feels#jensen meta#panel meta#jibcon 2019#jib 10#wank adjacent#negativity for ts#wank for ts#just in case#sdcc 2011#text vs subtext#network things#mark pedowitz#actor opinions#sexuality speculation#only in a link though#I honestly hope you know the question wasn't about the ship#misha brought it up#then regretted it#j2m#lots of face journeys here#my meta#and actually there is no cockles here which seems crazy#except of course it's everywhere#in misha's gentle little touch to stop jensen#the way jensen will sit down when he does that#what a complex guy he is#it's why I'm never over him#anyway

305 notes

·

View notes

Note

Since I first issued my dire predictions of civil violence in the not-so-distant future, I’ve been looking, exhaustively, for evidence I’m wrong. III Have you considered this angle: The traditional media's hyping that up? I mean, we know in the early/mid 60's the newspapers and cameras focused on the small number of violent protestors during anti-war protests and made them out to be the majority. If the media has no shred of integrity left, why are you looking at them for evidence of integrity?

That’s just the thing - I’m not. I’m looking at people. at the “man on the street” and in both my personal life (as in actual meatspace, not online) and in actual journalism (some people still do it, outside and inside the mainstream establishment,) I’m seeing a decidedly worrisome tone.

We all remember “literally shaking” on Twitter the night of the election, but there were other words going around quite a bit - sick, disgusted, afraid, scared, etc. Twitter - as it’s used by the majority - gives a quick insight into the personal emotions of the people using it. (This is why PR uses that bank on the presumed intimacy - like Trump’s twitter - tend to be more successful, and more careful, sterile treatments, like the Clinton campaign that took 12 staffers and 10 drafts to compose a single tweet, typically lack traction.) Sure, us seal-clubbin neocons and tree-hugging liberals had a good giggle at the triggered snowflakes breathlessly predicting the Right Wing Gestapo emerging from the woodwork to bash the gays - but then a friend of mine told me it’d actually happened, post-election, to a friend of his, and that’s when my laughter stopped.

As was explained to me, the LGBTQ folks feared that Trump’s election would be seen as “permission” by all the knuckledraggers, and it seems it was. So it’s time to ask yourself the question - how did the knuckledraggers get that impression to begin with? Maybe - just maybe - it had something to do with the media screaming, 24/7, for months, that Trump was literally Hitler and that he was going to oppress all the gays and Jews and Muslims and fluffy bunnies. “Of course he’s Our Guy,” the Illinois Nazis said with glee, “the entire news media keeps screaming about it!”

Also consider that the media’s reinforcing the left wing’s narrative, which makes people on the left wing much more likely to believe it since it’s validating their own beliefs. Vox.com has an excellent article on the Russian conspiracy blitz and why it’s playing so well with Democrats, and the author is neither a Trump fan or apologist (as is abundantly clear from the article itself.) It’s worth reading entire, but this quote stands out:

“Misinformation is much more likely to stick when it conforms with people’s preexisting beliefs, especially those connected to social groups that they’re a part of,” says Arceneaux. “In politics, that plays out (usually) through partisanship: Republicans are much more likely to believe false information that confirms their worldview, and Democrats are likely to do the opposite.”

The article accurately compares the current phenomena to the entire “birther” movement on the right - it’s the exact same psychological phenomena, so unsurprisingly you see it manifesting with human beings on both sides of the spectrum. A lot of politics falls into that category, and it’s where most of that “political common ground” I keep talking about can be found. The difference is that the Left controls the lion’s share of the communication media and in turn, our culture. Hollywood - a cultural engine if there ever was one - is extremely left wing and has been since before McCarthy’s day. The modern telecommunications and internet media, which lives and breathes in Sillicon Valley, is likewise invested in the left wing; Erich Schmidt, chairman of Alphabet (Google’s parent company,) founded a PAC to give Hillary’s campaign IT support during the election, and we all remember how the CEO of Mozilla was hurled out of office because he dared to cast a private, anti-revolutionary vote. The next time you hear leftists talking about how “de-platforming” is legitimate, remember that the leftists literally own the fucking platforms. Nobody’s gonna find your conservative site if Google de-lists it. This is the problem - both sides have their lunatics willing to swallow any shit they’re being shoveled, but only one side has a massive megaphone that’s actively colluding - complete with sticky-handed twitter high-fives - to push the same narrative across the board, and cross-validate it.

Hilariously, the Vox author (Kevin Drum) doesn’t see it, making the article a self-demonstrating one:

Luckily for the Democratic Party, there isn’t really a pre-built media ecosystem for amplifying this like there was for Republicans. In the absence of left-wing Limbaughs and Breitbarts, media outlets totally unconcerned with factual rigor, it’s much harder for this stuff to become mainstream.

… except he does see it, because he goes on to name some examples (and some tweets) of people chugging the kool-aid… but all of them Democratic politicians or DNC staffers who should know better, not the media itself. He’s clearly intelligent and well-balanced, he’s standing in the middle of a bullshit cyclone he knows is bullshit, but he’s only just now starting to smell the rot and he hasn’t even noticed objective journalism’s decaying corpse yet, despite standing in its ribcage. If someone like him can be so stymied, how do you think That Guy - you know, [the bitter old man |the aging hippie creep] who always [ sits on his porch yelling at birds | shuffles around Trader Joe’s in grungy sandals comparing kale prices] and blames everything on [ dat gal-dern Mooslim Obongo | the military-industrial-jew-lizardman-complex] is going to react?

Some people do actually believe this shit and they are mostly Democrats - hell, here’s a Gallup poll with the numbers if you doubt my analysis. And to re-iterate, they’re inflaming extremists on both sides of the spectrum, because the more violence antifa commits, the more the Illinois Nazis will croon “see, we were right all along!”

The traditional mass media engaging in this shit is much, much worse than the right-wing “alternative news ecosystem,” the blogs, the talk radio hosts, infogiggles, etc. They’re all personality-based and those personalities differ and disagree (if they didn’t, how would they offer content distinct from what the others offer?) This is natural, because conservatives argue. They argue a lot. It might surprise some of you given how often the media portrays the NRA as triple Satan, but there’s gun rights groups that exist specifically because some conservatives think the NRA is too wussy. You’ve got social conservatives, business/free market conservatives, REEE TAXES conservatives, etc., and they rarely see eye to eye. Ann Coulter - the Screeching Enchantress herself - once wrote that “Republicans can’t put together a two-car funeral without writing six books denouncing each other.”

You don’t see this on the left - not in the media, at any rate. There’s more to this than just the obvious mainstream media collusion; the back-slapping and twitterwank, although their deliberate and conscious effort plays a huge part. There’s also how the left wing thinks.

If you’re old enough to remember the Bush years, you’ll remember how often the left would attack Rush Limbaugh - even though an entire ecosystem of conservative, national talk-radio had sprung up by then, so he was no longer The One And Only Conservative Voice In Mass Media. Liberals treated - and attacked - him as the de facto leader of the right wing, and this puzzled conservatives no end, because a pundit, however clever, is not a goddamn politician or leader.

The left wing, however, thinks differently. Unlike classical liberalism, which is mostly concerned with balancing the inherent rights of individuals with the rights of every other individual in a social contract, the leftists (communism/socialism/etc.) focus on the collective as the central, essential point, and move from there. This is why “virtue signalling” exists; leftists care very much about what others think of them. Emmet Rensin’s essay on smugness in liberalism, which I’ve mentioned many times, showcases it well; while describing his subject, he also illustrated the mechanisms by which it manifests - left-wing culture. Everything he described - the virtue-signalling to others that you know the correct facts, the knowing, even the “Eye roll, crying emoji, forward to John Oliver for sick burns,“ exemplifies it. This Mother Jones writer’s reaction to his piece has a telling line:

“I’ve long since gotten tired of the endless reposting of John Oliver’s "amazing,” “perfect,” “mic drop” destruction of whatever topic he takes on this week.”

They key here is John Oliver. When leftists look at Rush Limbaugh, they see a conservative John Oliver - in short, a demagogue. Demagogues and cults of personality have always been of prime importance with the left wing - remember how Obama was lionized by the left during his first campaign? To say nothing of the Kennedy’s being immortalized as “Camelot.” Yes, conservatives liked Reagan a whole lot, but we don’t vote in entire fucking royal dynasties, which is why Low-Energy Jeb is cooling his heels right now. And these demagogues, you’ll note, are all on the same page when it comes to ripping into conservatives… and their epic, wicked put-downs then become The Big Joke that the left wing retweets and reblogs and parrots to each other ad nauseum. Remember Tina Fey’s mockery of the only working mother leftists have ever despised? I’ve seen people on facebook quote “I can see Russia from my house” fully believing that Sarah Palin herself said it - the Tina Fey skit is the reality, for them. Truth is lost around the twentieth re-tweet, or so.

And these “comedians” - in truth, pundits and opinion columnists - base their jokes on whatever quote-unquote “revelations” aired in the mainstream media’s news broadcasts that morning.

If you’ve ever noticed how quickly a new catchphrase or word gets onto every leftist’s lips - like “fake news” - this is how it’s done. It’s not just the mass media moving in lockstep co-ordination to get the message out; it’s how the phrases become the newest “in-thing” with the entire leftist culture, that then get bandied about in the social sphere, on and off-line. After the cruise missile strike on Syria, I watched, on /pol/ alone, about thirty different varying interpretations, everything from “Assad and Putin are unironically heroes shove omfg I love facism Trump why u blow them up” to “I HOPE HE DROPS A MOAB ON RUSSIA NEXT FUCK THE REDS NUCLEAR WAR NOW” to a bunch of “he’s really playing 64 dimensional chess check this shit just you wait” that covered everything in-between. And that’s just on /pol/, which is so full of bullshit and jokes they literally made a fucking containment board for the containment board - called /bantz/. You don’t see this in the leftist blogosphere - the opinions all align the same way and vary only in magnitude of gibbering lunacy. And the John Oliver quotes don’t just define the conversation, they define the fucking language - for instance, “Drumpf.”

Do not, for one second, think that the media doesn’t know how all this shit works. They may be delusional, but they don’t control and run vast media empires because they’re stupid. And a lot of them have been at this for a long, long time.

13 notes

·

View notes

Text

Round two of the “Hold My Beer” Great Meta Scavenger Hunt

For this, our honorary Misha Collins figure and Scavenger Hunt queen @elizabethrobertajones has asked us to rank all 12 season openers OR all 11 (12 if you are feeling super ambitious) season finales by a theme, character, concept etc of your choice.

I figured I might as well make this super difficult for myself and go with three D’s for my theme. Being Doom, Death and Destiel. I’m also picking finales over openers because, well finales usually have more of the three D’s in general. Doom is based on how bad the situation is for the world at the end of the episode, Death is based on the deaths in the episode and the emotional punch of those deaths, and destiel is based on how much destiel (or the ground work for destiel) there actually is in the episode. I’ll give each episode a ranking out of 10 for each ‘D’ and then average it out for my final scale… and try not to be intimidated at adding maths into a meta post. Ha.

I should apologise for submitting this so late, but Lizzy did stress there was no real deadline and I have always been terrible at deadlines anyway.

Under the cut as this is loooonnngggg. Enjoy. :)

Season 1, episode 22.

DOOM – John is possessed by Azazel, but he gets over it, Azazel gets away, and the Winchester’s get pretty upset about this. Meg gets exorcised though so actually doom wise there is less of a threat by episode end than there has been all season. Azazel is on the loose but the Winchesters still have the colt. Very little doom. 1/10.

DEATH – Ah to remember the days when the Winchesters actually cared about the meat suits the demons possessed… Oh how things change. Meg is exorcised and the actual human Meg dies of her injuries (did the demon just keep using the name of the girl it possessed? That one always confused me) John almost kills Dean but doesn’t and marks the first in a long line of people in this season who overcome possession to save Dean thanks to their undying love for him (and yet the boy still thinks he is worthless). Big car crash at the end leaves us with a cliff hanger wondering if the Winchester’s are dead but its such a normal way to try to kill them that we all know it aint gonna stick. 3/10 for attempting to scare the audience into thinking the Winchesters can be killed by a TRUCK. Pfft.

DESTIEL - I miss Cas. Did I mention I’m a Cas girl and think his presence makes this series infinitely better?! Still, what we do get in this episode is a Dean who admits that he lies and Azazel mocking Dean’s personality as always hiding the truth, the pain… etc… So we start to get some good insight into Dean’s character, we know by this episode that Dean hides A LOT and puts on a performance all the time. We know that the tough guy macho image he tries to portray is in no way near the real him. But I’m scraping the barrel so it still only gets 1/10 for the barest glimpses into Dean’s true self and the hint that he is hiding a lot more.

Season 2, episode 22.

DOOM – One dead yellowed eyed demon, one demon deal for Dean and a whole lot of evil unleashed upon the world. We got some good levels of doom here, even if Azazel is gone. At least John Winchester managed to crawl out of hell and disappear off… somewhere… do we ever find out what happened to John Winchester’s soul? Maybe he decided to hang around on earth haunting some poor unsuspecting bystander. For that reason and all other reasons above, I’m ranking this a 4/10. They were still just ordinary demons that were unleashed after all… and that was a weird sentence to write.

DEATH – Well, that was emotional. We get some pretty stirring speeches from Dean over poor Sam’s corpse, but he comes back. Of course. So it doesn’t really count unless we are counting deaths for emotional impact rather than if they STAY dead. Dean shoots Azazel in a very therapeutic moment for him, and also threw his own life away to save his brother. Also this made me chuckle: “Dad brought me back, Bobby. I'm not even supposed to be here.” Oh Dean. You’ll get used to it. Happens all the time. I’m also adding a point for the death of Ash last episode because damn. I liked Ash. Besides, technically this was a two parter. 6/10 for emotional impact and because they finally killed the bad guy.

DESTIEL – Well, there isn’t much I can really say as one half of this love pairing isn’t even here yet. But, on Dean’s side we are getting more and more hints into his now glaringly obvious bisexuality. I’m using 2x21 here because as said above, this is a two parter. Dean identifies Ash by his watch which tells an interesting story (I’m not gonna get into the Dean x Ash stuff here and instead direct you here for that glorious analysis) and also we got Lily who was a Dean mirror who lost everything thanks to Azazels influence (like Dean at episode end) and lost her life because of her inability to accept the situation she was in (like Dean at the end of this episode). So, for that reason I’m rating this a 2/10.

Season 3, episode 16

DOOM – Not so much in terms of doom this episode, Lilith was already out and doing her thing, We all still think Ruby is a good guy, the world is no more broken than it has been all season. 3/10

DEATH – Oh Dean. As Dickens would say he is as dead as a door-nail, and then go on about why a door-nail was considered a good simile for death. Perhaps the Horseman Death could answer that question, but I digress. Dean is dead, and Sam is very sad, and there is seemingly no hope now that Dean is strung up in hell. Sad times. This was probably my favourite death of the entire series, simply because it was still early enough for us to actually believe it. How on earth was Dean supposed to come back from this? His soul is literally strung up in hell. Therefore, 9/10 for an epic death scene.

DESTIEL – Still no Cas, and very little in terms of bi-dean analysis unfortunately. I’m giving it half a point for the eager anticipation of Dean’s hell rescue though and the wealth of fanfiction that came from that… 0.5/10.

Season 4, episode 22

DOOM – So much doom! (for the time – nowadays Lucifer just leaves us feeling kinda meh) The release of Lucifer! The breaking of the 66 Seals! The angels are up to no good! It’s the apocalypse! AHHHHHH DOOM ALL THE DOOM! END OF THE WORLD DOOM!!! For that reason I am marking it 10/10 doom wise.

DEATH – Bye bye Ruby. You were a manipulative bitch and I loved you. Hated the way you died though. Never like the idea of having a woman held back by a man whilst another man stabs her… it just leaves a bad taste in my mouth regardless of whether she was demonic or not. Also bye bye Lilith. Your death was actually pretty cool. You went out laughing. BUT NO! Not CAS! Cue Castiel’s first death scene and let me tell you it was explosive. Heh. Sorry. Basically 4 seasons in and this was my FAVOURITE season finale so far. Yeah so no Winchester brother died, but Castiel stole her hearts from his very first scene and having to watch him die after getting our hopes up like that was just cruel. It was emotional, especially the way he died for DEAN. Because of DEAN and… well I’ll get on to that. 8/10 on the Death rating.

DESTIEL – HERE WE GO FINALLY. So who started shipping destiel at THIS point? I was a late bloomer (a 6x20 shipper) but I was picking up on things here and on my many many re--watches of this episode I find it impossible not to see the whole scene in the green room as overly romantic. We had major heart eyes from our star crossed lovers, we had epic speeches about choice and freedom and humanity, we had one fallen angel statue and one soon to be fallen very real hunky angel man, we had Dean getting bodily pressed into a wall by said hunky angel man in a very erotic display of power and disobedience. Basically every DeanCas scene in this entire episode had me drooling. It ended with Cas giving everything for the man he lo- liked a lot, I mean pfft… its not like giving up everything you’ve ever believed in and fought for and known your entire long existence for one guy is a big deal or anything… right? Totally platonic right? I’m rating this one as an 9/10 on the destiel scale… I’m not quite sure another season finale can come close… top marks are reserves for an actual canon love confession.

Season 5, episode 22

DOOM – Well. What can I say about Swan Song? The apocalypse was stopped, Lucifer defeated, the horseman put in their place, Death off eating pizza in another galaxy… it all turned out okay doom-wise. The episode packs a big punch, but its an emotional punch rather than a “WE ARE ALL GOING TO DIE” punch, so actually, this finale is quite understated when you rank it against the rest. Low doom score. 5/10 doom.

DEATH – Death is rampant in this episode, but he’s getting sloppy because it doesn’t stick. Sam sacrifices himself for the world. It’s emotional. Bobby dies, Castiel dies, Dean nearly dies, Adam dies, Michael and Lucifer get thrown in the cage, lots of death but none of it stays dead! Come episode end all the folks that matter are alive and walking around topside like it’s no big deal. But it still gets points for ending on a mystery and for Dean still believing his brother is dead and being all sad about it and for the audience being all worried because WHAT IS WRONG WITH SAM? But he still isn’t dead. 7/10 for Death.

DESTIEL – I’ll be honest with you all. I think Swan Song is totally overrated. I prefer Lucifer Rising. Like waaaay prefer it. I’m biased of course because of Destiel. In this episode there were a few moments. Dean saying “Aww, Ain’t he a little angel” when Cas is asleep in the back seat is one of them, The car ride at the end. Dean’s pain is evident at everything he has lost but his need for Cas right then, to me at least, is obvious. He just couldn’t bring him to ask Cas to stay, so Cas left. It is a sad ending that leaves a bitter taste in my mouth. 5/10 for destiel.

Season 6, episode 22

DOOM – Well, this is what happens when you bottle up your feelings rather than confessing your undying love for someone. Oh Cas. Why couldn’t you just TELL HIM THE TRUTH! The absorbed purgatory souls turn Castiel into a crazy power hungry God and it is very very bad. Well, if you are homophobic, or republican, or a member of the KKK… or basically Donald Trump and therefore all of the above…otherwise honestly, Godstiel really wasn’t all that bad. We could probably do with a Godstiel in our world about now… *Oh gosh shhh now that’s a terrible thought I totally don’t wish that on anyone…ahem.* So I’m giving it a low doom score. Bring Godstiel to our universe 2k17. He will sort shit out. 5/10

DEATH – I am still mourning Balthazar. This one hurts hard because he doesn’t ever come back. L Also Raphael but really I didn’t care. He needed to remove the stick from up his ass anyway. 8/10 because Balthazar won’t be forgotten.

DESTIEL – In the afterglow of 6x20, we suddenly have our destiel goggles glued to our faces and it only makes this episode so much worse. They are actually in post break up hell here and Castiel has completely lost his way. Dean’s heart break is clear to see, and his line “I know there's a lot of bad water under the bridge, but we were family once. I'd have died for you. I almost did a few times. So if that means anything to you... Please. I've lost Lisa, I've lost Ben, and now I've lost Sam. Don't make me lose you too.” Makes me shed a tear. For all the break up trauma 7/10.

Season 7, episode 23

DOOM – Season 7, the world went to hell, Leviathans wanted to eat us (well mostly America but I assume some of them travelled overseas to annoy the Europeans…) But in the end Cas stepped up and helped save the day. Dick was vanquished and although leviathans still roamed the earth they are apparently useless without their leader. So doom levels are fairly standard. Kevin was abducted by Crowley and his minions though and Dean and Cas zapped to purgatory where they will have to face all kinds of DOOM. So on a worldwide scale not a lot of doom, on a personal level for our characters? Lots of doom. 7/10 to average it out.

DEATH – We say goodbye to the Leviathan King and with him goes all the dick jokes of season 7. It’s probably a good thing to be honest. That many dick jokes should not be allowed in one season. We also say goodbye to Bobby’s ghost. It was emotional. I still wish Bobby had never died. L Technically not a death so much as a ‘moving into the light’ moment, it still struck a chord. Other than that we also have a sort of death for Dean and Cas getting sent to purgatory though since they are still together we shouldn’t really be counting it. Death rating is 6/10 and that’s all mainly for Bobby.

DESTIEL – Ah 7x23 was good on the destiel front. ‘Tis the episode where Castiel turned up naked, covered in bees… kinky. It’s the episode where Cas was Dean’s “Boyfriend first” and of course, the episode of “I’d rather have you, cursed or not.” We got longing looks and confessions of forgiveness and basically it was great. 8/10

Season 8, episode 23

DOOM – The Angels are falling! Hell is still open for business! Metatron is a massive dick and I am in tears by the end of the episode every. Single. Time. I’m not even getting into it more than that. This is my favourite season finale. I love every second of it. Doom wise it’s pretty epic 8/10 doom score

DEATH – OH NO SAM DON’T YOU SPEAK LIKE THAT! L Poor Sammy. Seriously though this was HEARTBREAKING and even though Sam doesn’t die he is in a pretty awful state by episode end and it was so fucking emotional I can’t even deal with it. Hence a death score of 6/10 because SAaaaaaaaammmmmmmmm.

DESTIEL – “This is it? E.T. goes home?” The cupids bow, the two gruff men falling in love right in front of a confused and amazed Dean, the cupids bow on the TV shooting at both Dean and Cas? The arrows in the back of the Impala. The climax of the angel fall spell and the one of these is not the same as the others ingredients theory. Us meta writers screaming at our TV screens because it ALL adds up to destiel. It ALL points to Cas being in love with Dean. I love this episode. 8/10 for all the symbolism and Dean’s utterly romantic and longing looks at Cas in the bar.

Season 9, episode 23

DOOM – Does Dean being a demon count as death or doom here? Both? Both is good. Dean Winchester unleashed as a freshly born knight of hell. That doesn’t sound good for the fate of the world in all honesty. However, heaven is basically sorted and Metatron has been put behind bars so this episode doesn’t leave us in such an apocalyptic state as previous season finales have. Therefore it gets a doom score of 5/10.

DEATH – Oh Dean. Why did you follow Crowley. Why did you take that mark? Why did you think you could face Metatron when he was all powered up on tablet? Simply put “I’m proud of us” and Cas’ face when Metatron shows him the angel blade covered in Dean’s blood. Those two moments alone give this a high score in the emotional stakes that mean a Winchester has once again dramatically died in a season finale. It loses two marks for the black eyes since once again right out of the Princess Bride Dean was only mostly dead. 8/10

DESTIEL – I have one thing and one thing only to say right here “He’s in love… with humanity”. Cue a million fangirls all over the world screaming at their TV/Computer screens at that very dramatic pause. Thanks Metatron. I didn’t know Dean had a new nickname. 7/10.

Season 10, episode 23

DOOM – Thanks to Winchester toxic co-dependency we have a primordial chaos goddess on the loose, intent on nothing but absolute universal destruction according to Death. So yeah, pretty much the ultimate DOOM. Since this episode was just a whole barrel of WTF I’m marking it down 2 points. Because I’m bitter. So sue me. Otherwise 8/10.

DEATH – Again with the whatthefuckery. YOU CAN’T KILL DEATH DEAN THAT IS TOTALLY UNACCEPTABLE. This was NOT a Death I was willing to accept and I still am not willing to accept it a season and a half later. Death is fucking with you Winchesters so he can jump out at you both and give you a fucking heart attack later on. You would probably both deserve it. 5/10. Not happy.

DESTIEL – So after the horrifying end to 10x22 with the brutal reverse crypt scene, Dean is haunted with guilt over what he did to Cas, but it is no homo’d to the max thanks to Rudy or whatever the fuck his name was I didn’t even bother to look it up or re-watch (did I mention I really didn’t like this episode – except for Death) I suppose I’ll give it a point for Dean’s dream in the deleted scene and a point for the flash of Dean in the mirror (fuck you Rudy I’ll pretend you weren’t there) and a point for Cas’ “Everyone loves something” about Rowena because yes Cas we know you are in love with Dean that was practically established canon in 9x23. It gets a 3/10. I hated this episode.

Season 11, episode 23