#agri-financing

Explore tagged Tumblr posts

Text

Field validation: Agri-financing and insurance market assessment

The mission team conducted a ground check regarding the agri-finance baseline with agricultural cooperatives, the private sector, including cashew nut processors, the Cashew Nut Association of Cambodia, as well as MFIs and banks. The purpose of the mission was to verify and validate the agri-financing and insurance baseline assessments by gathering additional data on the ground. Based on the…

View On WordPress

#agri-financing#Agricultural cooperative#Cashew#FAO#insurance market#Kampong Thom#PEARL#Preah Vihear

0 notes

Text

Agri Gold Loan: Affordable Financing Solutions for Farmers

Agriculture has always been the backbone of the Indian economy, with millions of farmers working tirelessly to feed the nation. However, farming comes with its own set of challenges, such as fluctuating crop yields, unpredictable weather conditions, and the need for timely financial support to maintain day-to-day operations. To address these challenges, City Union Bank offers Agri Gold Loans, providing an affordable and efficient financing solution for farmers across India.

In this blog, we’ll dive deep into the benefits of Agri Gold Loans, how they can help farmers access the capital they need, and the easy process of applying for this loan through City Union Bank.

What is an Agri Gold Loan?

An Agri Gold Loan is a loan facility offered to farmers and individuals engaged in agricultural activities to meet their financial needs. This loan is secured against the gold that borrowers pledge as collateral. The gold can include ornaments, coins, or bars, and the loan amount is determined based on the weight and purity of the gold. It provides farmers with quick access to funds, enabling them to fulfill agricultural requirements such as buying seeds, fertilizers, equipment, or covering other operational expenses.

City Union Bank offers Agri Gold Loans with attractive features, making it a reliable and affordable choice for farmers looking for financial support.

Why Choose Agri Gold Loan by City Union Bank?

City Union Bank’s Agri Gold Loan is designed to offer flexible and accessible financial solutions to farmers. Here’s why it stands out as a great option for farmers seeking financial help:

1. Quick Access to Funds

One of the primary benefits of an Agri Gold Loan is the fast approval and disbursement process. Farmers don’t need to wait for days to access their funds. The loan is processed quickly, and the loan amount is disbursed to the borrower’s account almost immediately after the gold is evaluated. This makes it ideal for addressing urgent financial needs, especially when farmers face unexpected expenses.

2. Flexible Loan Amount

City Union Bank offers flexible loan amounts based on the value of the gold pledged. The loan amount typically ranges from a percentage of the market value of the gold, ensuring that farmers can access enough capital to meet their agricultural needs. The loan amount is designed to be sufficient to cover a variety of farming-related expenses, including purchasing seeds, fertilizers, pesticides, and equipment.

3. Low-Interest Rates

Agri Gold Loans by City Union Bank come with some of the most competitive interest rates in the market. The bank understands the financial pressures farmers face and offers lower interest rates to make the loan more affordable. This allows farmers to borrow the necessary funds without incurring high interest costs, ensuring that they can repay the loan comfortably.

4. Flexible Repayment Options

City Union Bank offers flexible repayment tenures for Agri Gold Loans, allowing borrowers to choose a repayment plan that fits their financial situation. Farmers can opt for a short-term loan with quick repayment or a longer repayment period based on their income cycle and ability to repay. The bank offers both EMI (Equated Monthly Installment) options as well as bullet repayment options to suit different needs.

5. Minimal Documentation

City Union Bank simplifies the application process for Agri Gold Loans by requiring minimal documentation. Farmers need to submit basic documents such as identity proof, address proof, and a few details about their farming activities. The gold pledged as collateral serves as the primary security for the loan, which further reduces the complexity of the documentation process.

6. Security and Safety of Gold

City Union Bank ensures the safety and security of the gold pledged for the loan. The gold is kept in secure vaults, and the bank provides a receipt as proof of the gold’s safe custody. This guarantees that farmers’ valuable assets are protected throughout the loan tenure.

7. No End-Use Restrictions

Unlike some traditional loans, the Agri Gold Loan by City Union Bank does not impose restrictions on how the loan amount can be used. Farmers are free to use the loan for any agricultural purpose, whether it’s purchasing agricultural inputs, paying labor costs, improving farm infrastructure, or any other operational requirement.

How to Apply for an Agri Gold Loan?

Applying for an Agri Gold Loan with City Union Bank is a simple and straightforward process. Here’s a step-by-step guide to help farmers apply for this loan:

Step 1: Visit the Nearest City Union Bank Branch

To apply for an Agri Gold Loan, you will need to visit the nearest City Union Bank branch. The bank has a strong presence across India, so there should be a branch in your locality. You can also check the bank's website (https://cityunionbank.com/) for the nearest branch location.

Step 2: Submit the Necessary Documents

Once at the bank, you will need to submit basic documents for verification. These may include:

Proof of identity (Aadhaar card, voter ID, or passport)

Proof of address (electricity bill, ration card, etc.)

Agricultural land documents (if applicable)

Passport-sized photographs

The documentation process is simple and quick, allowing for faster processing of your loan.

Step 3: Pledge Your Gold

For an Agri Gold Loan, you will need to pledge your gold as collateral. The loan amount will be determined based on the weight and purity of the gold you submit. The bank will evaluate the gold and provide you with a loan offer based on the value of the pledged gold.

Step 4: Loan Approval and Disbursement

After your gold is evaluated, the loan will be approved, and the funds will be disbursed to your account. The entire process is quick, and you will receive the loan amount within a short period. In some cases, the loan amount can be disbursed in cash or transferred directly to your bank account, depending on the bank’s policies.

Step 5: Repay the Loan

Once the loan is disbursed, you will need to repay the loan according to the agreed-upon terms. City Union Bank offers flexible repayment options, and you can choose the tenure that suits your financial situation.

Eligibility Criteria for Agri Gold Loan

To be eligible for an Agri Gold Loan with City Union Bank, you need to meet the following requirements:

Age: You must be at least 18 years old and a maximum of 70 years of age at the time of loan maturity.

Agricultural Background: The loan is available to individuals engaged in agricultural activities, including farmers, agricultural laborers, and people with agricultural land.

Gold: You must have gold (gold coins, bars, or jewelry) that meets the bank's quality and purity standards to pledge as collateral.

Repayment Capacity: The bank will assess your ability to repay the loan based on your farming income, assets, and financial situation.

Benefits of Agri Gold Loan for Farmers

Agri Gold Loans offer several benefits to farmers, helping them navigate the challenges they face in their agricultural ventures. Here are some of the key advantages:

1. Timely Financial Support

Agri Gold Loans provide farmers with quick access to funds, ensuring they can meet pressing financial needs, especially during planting seasons, harvest time, or unexpected emergencies.

2. No Need for Other Collateral

Since the loan is secured against gold, farmers don’t need to pledge their land or other assets. This reduces the risk to their primary livelihood and ensures that only their gold is at stake in case of non-repayment.

3. Easy Access to Credit

Agri Gold Loans are accessible to a large number of farmers, even those who might not have access to traditional banking services or credit scores. Gold, which is readily available to many, serves as an easy collateral for securing the loan.

4. Boost Agricultural Productivity

With the help of Agri Gold Loans, farmers can invest in better quality seeds, fertilizers, irrigation systems, and other inputs that can boost crop yield and improve overall farm productivity.

Conclusion

For farmers, securing timely funding can make all the difference between success and failure in their agricultural endeavors. City Union Bank’s Agri Gold Loan offers a straightforward, affordable, and accessible solution to meet these financial needs. With competitive interest rates, flexible repayment options, and minimal documentation, it’s the perfect financing tool for farmers looking to boost their operations and secure a better future.If you are a farmer looking for a quick and affordable way to access funds, consider applying for an Agri Gold Loan with City Union Bank today. With easy access to credit and the support you need, this loan can help you achieve your agricultural goals and make the most of every season.

0 notes

Text

#gold loan#sahibandhu#sahibandhu gold loan#loan against gold#instant gold loan#best gold loan#best gold loan service#gold loan near me#gold loan for farmers#Agricultural financing#Farming loans#Low interest gold loans for farmers#agriculture gold loan#Agri gold loan#gold loan for agriculture

0 notes

Text

How Kenya’s Investment in Macadamia Nuts is Driving Regional Export Growth

Discover how Kenya’s investment in macadamia farming and digital innovation has propelled the country to become a leading exporter, overcoming regulatory challenges and boosting agricultural growth. Explore the role of MSMEs and digital platforms in transforming Kenya’s macadamia sector, driving productivity, and enhancing market access for sustainable economic growth. Learn how Kenya’s macadamia…

#Africa agri-food systems#African food economy#AGRA 2024 report#agricultural financing Kenya#agricultural infrastructure investment#agricultural value chains#cash crops in kenya#digital agriculture Kenya#digital farming innovations#digital platforms for farmers#farm input distribution#food systems transformation#Hello Tractor Kenya#Kenya export diversification#Kenya macadamia farming#Kenya macadamia success#Kenyan agricultural exports#Kenyan farm management#M-Kulima platform#M-Pesa agriculture#macadamia exports#macadamia industry growth#macadamia market challenges#macadamia productivity#macadamia regulatory challenges#mechanization in farming#MSMEs economic growth#MSMEs in agriculture#private sector in agriculture#sustainable agriculture

1 note

·

View note

Text

Improving Access to Inclusive Financing for Smallholder Farmers through Crop Farming and Agri-Finance Innovations

Improving Access to Inclusive Financing for Smallholder Farmers through Crop Farming and Agri-Finance Innovations Background: Smallholder farmers in developing countries often lack access to affordable and appropriate financial services that could help them improve agricultural productivity, increase incomes, and build resilience. Traditional financial institutions have struggled to serve this…

#CROP FARMING AND AGRI-FINANCE#Financing for Smallholder Farmers#Improving Access to Inclusive Financing for Smallholder Farmers through Crop Farming and Agri-Finance Innovations

0 notes

Text

Agri business management colleges in india

India's agricultural sector is a vital part of its economy, and with the growing importance of agri-business, the International Institute of Business Studies (IIBS) offers specialized Agri-Business Management courses. These programs are thoughtfully designed to equip students with the knowledge and skills needed to excel in the complex world of agriculture and agri-business management.

Key Features of Agri-Business Management Courses at IIBS:

1. Comprehensive Curriculum: The courses cover a wide spectrum of agri-business topics, including agricultural economics, farm management, supply chain management, agricultural marketing, and sustainability in agriculture.

2. Practical Learning: Practical application is a central focus, with students engaging in farm visits, agri-business projects, and real-world case studies, gaining hands-on experience in agri-business operations.

3. Experienced Faculty: The courses are guided by experienced instructors with industry knowledge, offering insights and guidance based on their practical experience in agri-business.

4. Industry Integration: IIBS often collaborates with agricultural organizations and companies, providing students with opportunities for internships, research projects, and industry exposure.

5. Certifications: The program may include opportunities to earn relevant certifications, enhancing the employability and credibility of students in the agri-business field.

6. Career Support IIBS offers career placement services, connecting students with potential employers in the agri-business sector and providing guidance on job searches, resume building, and interview preparation.

7. Networking Opportunities: Students can often network with industry professionals, peers, and alumni, building valuable connections within the agri-business community.

8. State-of-the-Art Facilities: IIBS typically provides modern facilities, including agricultural labs, research centers, and resources necessary for students to gain practical experience in agri-business management.

9. Flexible Learning Options: The institution may offer flexibility in terms of course duration and scheduling, accommodating the diverse needs of students.

In conclusion, Agri-Business Management Courses at IIBS provide a solid foundation for a successful career in the agri-business sector. Whether you are looking to enter the field or enhance your existing agri-business skills, these courses offer a platform for growth and career advancement in the dynamic and evolving world of agri-business.

#mba#iibs#pgdm#business#data science#management#environment#education#educational#Agri-Business Management#finance management

0 notes

Text

Powering Dutch Fields: Massey Fergusons Impact on Agri-Equipment

Buy Now

Massey Ferguson is a globally recognized high-quality label that provides a diverse range of tractors and agricultural equipment. This advanced and premium brand of tractors caters to all farmers and addresses every emerging mechanization requirement.

STORY OUTLINE

Massey Ferguson's eco-tech reduces fuel by 10%, cuts pesticides 20%, and conserves 40% energy, embodying sustainable farming leadership.

Fuel efficiency aids climate goals, precision tech safeguards soil, and collaborations empower farmers, advancing eco-friendly practices.

Operating in 140+ countries, Massey Ferguson's 300+ machinery models drive productivity and sustainability, transcending borders with innovation.

Massey Ferguson's fusion of excellence and eco-consciousness drives Dutch green goals, leaving a lasting agricultural mark globally.

In the thriving Agricultural landscape of the Netherlands, one name has stood the test of time and innovation—Massey Ferguson. With a legacy rooted in mechanization and a commitment to pushing the boundaries of farming technology, Massey Ferguson has played a pivotal role in shaping the nation's Agri-equipment market.

1.Greening the Future: Massey Ferguson's Vision

In an era when sustainable agriculture has become a global imperative, Massey Ferguson stands as a steadfast advocate for a greener tomorrow. As the Netherlands and the world navigate the intricate complexities of ecological responsibility, Massey Ferguson's vision emerges as a beacon of hope and progress.

Massey Ferguson's machinery has been reported to reduce fuel consumption by up to 10%, contributing to lower carbon emissions and decreased environmental footprint.

The precision technology embedded in Massey Ferguson's tractors has led to a potential reduction of up to 20% in fertilizer and pesticide usage, supporting healthier ecosystems and soil quality.

The integration of eco-friendly features in Massey Ferguson's equipment has led to energy savings of approximately 40% compared to conventional models, aligning with the broader global goal of reducing energy consumption.

2.Sustainability and Excellence: Massey Ferguson's Impact

Know More about this Report:- Request for a sample report

Massey Ferguson's influence extends beyond machinery—it fosters sustainability and excellence. Committed to ecological responsibility, it aligns with the Netherlands' sustainable agriculture drive. Advanced, eco-friendly technology equips farmers for a greener, more productive future.

Fuel-efficient equipment reduces emissions up to 10%, aiding climate goals. Precision technology cuts fertilizer and pesticide use by 20%, safeguarding soil and water. Energy-efficient components yield 40% energy savings, conserving resources. Collaborations with experts refine eco-friendly practices.

Educational initiatives empower farmers for seamless sustainability transition. Massey Ferguson's role in Dutch agriculture contributes to national green goals and biodiversity preservation. By intertwining excellence with eco-consciousness, it shapes an agricultural legacy of enduring positive impact.

3.Growth Beyond Borders: A Global Footprint

Massey Ferguson's influence isn't confined to Dutch fields. The brand's reach extends across the globe, making it a trusted name in Agri-equipment. Its innovations have traversed continents, supporting farmers worldwide in their quest for enhanced productivity and sustainable practices.

Massey Ferguson's market presence extends to over 140 countries, demonstrating its truly global footprint. With a diverse range of over 300 tractor models and farm machinery.

In conclusion, Massey Ferguson's legacy in the Netherlands' agricultural landscape is a testament to its pioneering spirit and commitment to sustainable excellence. Through its vision for greener farming, impactful technology, and global outreach, Massey Ferguson shapes a resilient agricultural future that transcends borders, benefiting both farmers and the planet.

#Netherlands Agriculture Equipment sector#Netherlands Agriculture Equipment Market trends#Netherlands Agriculture Equipment Market Growth Rate#Netherlands Agriculture Equipment Market demand#Agriculture Equipment Services Market#Agriculture Equipment Market Aggregators#Netherlands Agricultural Equipment Financing Companies#fendt agricultural equipment market revenue#Major Brands in Agriculture Equipment in Netherlands#Netherlands Crop Planting Equipment Market#Dutch Agri Machinery Market Insights#CLAAS Agriculture Equipment Market

0 notes

Text

Challis Capital Empowering Agri-Businesses with Tailored Financial Solutions

Introduction:

The agricultural industry plays a crucial role in feeding the world's growing population and sustaining economies. However, agri-businesses often face unique financial challenges that require specialized support. Challis Capital, a reputable Australian financial institution, recognizes the importance of agriculture and offers tailored financial solutions to empower agri-businesses. In this article, we will explore Challis Capital's agri-business solutions and how they assist agricultural enterprises in achieving their growth and expansion goals.

Challis Capital's Agri-Business Solutions Overview:

Challis Capital understands the specific financial needs of the agricultural sector and provides a comprehensive range of solutions designed to address the challenges faced by agri-businesses. Let's delve into some of the key features of their agri-business offerings:

Agricultural Property Finance:

Challis Capital offers agricultural property finance, providing funding solutions for the acquisition, expansion, and development of rural properties. This type of financing enables agri-businesses to purchase farmland, invest in infrastructure, or expand their operations.

Livestock Financing:

Livestock financing is a specialized solution provided by Challis Capital to assist agri-businesses in the purchase, breeding, or trading of livestock. This financing option helps farmers manage their livestock inventory, maximize productivity, and capitalize on market opportunities.

Machinery and Equipment Financing:

Challis Capital recognizes the importance of modern machinery and equipment in agricultural operations. They offer tailored financing solutions for the purchase or upgrade of machinery and equipment, enabling agri-businesses to enhance productivity and efficiency.

Working Capital Loans:

To support day-to-day operations and manage cash flow fluctuations, Challis Capital provides working capital loans for agri-businesses. These loans assist farmers in meeting operational expenses, purchasing inputs, managing labor costs, and ensuring the smooth running of their businesses.

Advantages of Challis Capital's Agri-Business Solutions:

Challis Capital's agri-business solutions offer several advantages to farmers and agri-business owners:

Expertise in the Agricultural Sector:

With a deep understanding of the agricultural industry, Challis Capital's team of experts possesses the knowledge and experience required to address the unique financial challenges faced by agri-businesses. They provide specialized guidance and support tailored to the specific needs of farmers and agri-business owners.

Flexible Financing Options:

Challis Capital recognizes that each agri-business is unique, with varying financial requirements. Their solutions are flexible and customizable, ensuring that farmers can access the funds they need to fuel growth and expansion. Whether it's property finance, livestock financing, machinery and equipment loans, or working capital, Challis Capital offers tailored options.

Streamlined Application Process:

Challis Capital understands the time-sensitive nature of agri-business operations. Their streamlined application process ensures quick approval and efficient disbursement of funds, allowing farmers to seize market opportunities without unnecessary delays.

Long-Term Partnerships:

Challis Capital aims to build enduring relationships with agri-businesses, providing ongoing support beyond the initial financing. They strive to be trusted partners, offering strategic advice and financial solutions that align with the long-term goals of their clients.

Conclusion:

Challis Capital's agri-business solutions stand as a testament to their commitment to supporting the growth and success of the agricultural sector. By providing tailored financial solutions, specialized expertise, and a streamlined application process, Challis Capital empowers agri-businesses to overcome financial obstacles and seize opportunities for growth. If you are an agri-business owner seeking financial support for property acquisition, livestock trading, machinery upgrades, or working capital needs, exploring Challis Capital's range of agri-business solutions could be a strategic move toward realizing your agricultural ambitions.

For more information about Venture Capital visit Challis Capital

0 notes

Text

AGET Business School - Best PGDM MBA College in Delhi NCR

AGET Business School is an AICTE affiliated PGDM College in Delhi NCR. It was established in the year 2015 with an aim to provide quality management education to the students.

The PGDM programs (equivalent to MBA degree) offered by AGET are PGDM in Project Management (Advance Construction Management), PGDM in Financial Management & Control and PGDM in Agri Business Management.

AGET has an excellent record of 100% placement since its inception. On an average, around 10-15% of the student’s secure overseas placements. More Than 100 Companies Visit AGET Every Year for Recruitment.

Students seeking PGDM admission can also avail 'AGET Top Rankers Scholarship', 'AGET Excalibur Award Scholarship' and 'AGET Business School Merit Scholarship'.

#PGDM Colleges#MBA Colleges#PGDM Colleges in Delhi NCR#MBA Colleges in Delhi NCR#PGDM in Project Management#MBA in Project Management#PGDM in Construction Management#MBA in Construction Management#PGDM in Agri Business Management#MBA in Agri Business Management#PGDM in Financial Management & Control#MBA in Financial Management & Control#MBA in Finance#PGDM in Finance

1 note

·

View note

Text

Metalman Auto files draft papers with SEBI to raise funds via IPO

The IPO consists of a fresh issue of Rs 350 crore and an offer for sale of upto 12.64 million shares by its existing shareholders and promoters.

Metalman Auto Ltd has submitted a Draft Red Herring Prospectus (DRHP) to the Securities and Exchange Board of India (SEBI) to raise capital through an Initial Public Offering (IPO). The IPO includes a fresh issuance of shares worth Rs 350 crore and an offer for sale of up to 12.64 million shares by the company’s current shareholders and promoters.

The proceeds from the fresh issue will be allocated as follows: Rs 25 crore will be used to partially finance the capital expenditure for the procurement of plant and machinery at the Pithampur manufacturing unit 2. The company also plans to utilize Rs 240 crore to repay a portion of its existing debt. As of June 2024, Metalman Auto Ltd has a total debt of Rs 314.43 crore.

The firm operates nine manufacturing units across five states in India, strategically located near OEM customers to ensure efficient production and supply. Axis Capital, ICICI Securities, and Motilal Oswal Investment Advisors are the lead managers for this issue.

Metalman Auto Ltd is a leader in the metal fabrication, finishing, and assembly sector in India, specializing in the production of metal components for two-wheelers (including both electric and internal combustion engines), three-wheelers, passenger vehicles, commercial vehicles, agri-vehicles, and off-highway vehicles. Additionally, the company manufactures aesthetic components for white goods, such as panels for washing machines, and offers contract manufacturing services for two-wheeler electric vehicle (2W EV) OEMs.

#metalman auto#oem manufacturing#oemparts#electric vehicles#metal fabrication#fabricationservices#steel fabrication#supplier#manufacturer#stainless steel#transport technology#transport service#transport for london#vehicle transport#transportation#ipo news#ipo alert#markets#stocks#business standard#business magazines#High-Volume Automotive Parts Manufacturing#manufacturing#automotive parts#parts Manufacturin#automotive industry#automotive#car accessories

2 notes

·

View notes

Text

#gold loan#Gold loan for farmers#Agricultural financing#Farming loans#Low interest gold loans for farmers#agriculture gold loan#Agri gold loan#gold loan for agriculture

0 notes

Text

Guide to agricultural financing options for Kenyan farmers

The agricultural industry in Kenya is a highly dynamic and complex sector that involves a wide range of activities, from small-scale subsistence farming to large-scale commercial agriculture. Agriculture is an important contributor to the country’s economy and provides livelihoods to millions of Kenyans. However, access to timely and affordable financing remains a major challenge for many farmers…

View On WordPress

#5 importance of agricultural finance#agricultural finance notes#agricultural finance pdf#agricultural financing#importance of agricultural finance pdf#problems of agricultural financing#role of financial institutions in agriculture sector#ten sources of agricultural finance#types of agricultural finance#What agricultural commodity makes the most money?#What are 4 factors a lending institution might use when determining?#What are the best crops to invest in Kenya?#What are the critical sources of agricultural financing in Nigeria?#What are the determinants of agri lending in Kenya?#What are the determinants of financing?#What are the factors of lending?#What are the five sources of agricultural credit?#What are the major sources type of financing?#What are the sources of agricultural finance in Kenya?#What are the sources of finance for SMEs in Kenya?#What are the two main sources of agricultural finance in India?#What are the two sources of agricultural finance in Nepal?#What is the most expensive fruit in Kenya?#Which agricultural business is most profitable?#Which agriculture business is most profitable in Kenya?

0 notes

Text

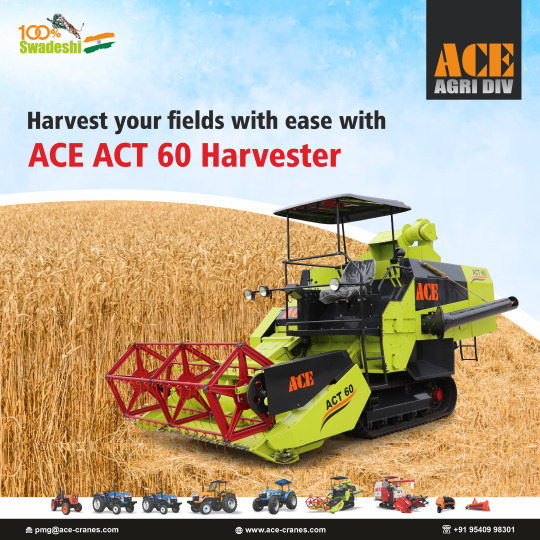

Harvest your fields with ease with ACE ACT 60 Harvester With modern features - ✅ Rubber Tracks ✅ Maximum Ground Clearance ✅ No crop loss ✅ Low 🛠 Maintenance Cost ✅ Warranty - 1000 Hours or 1 Year

☑️ Recognized by Ministry of Agriculture ☑️ Available on subsidy by Agriculture Department ☑️ Finance facility available

Contact your nearest ACE Agri-Equipment dealer today and bring home the ACE ACT 60 Harvester 🈷️

#harvester combine#harvester machine price india#combine harvester in india#combine harvester price in india#harvester in india#harvester combine manufacturers#combine machine in india#harvester combine price#chain harvester in india#paddy harvester in india#best combine harvester in india#Multi Crop Harvester#ACT 60

2 notes

·

View notes

Text

US confronts Brazil over ethanol tariff

The U.S. Trade Representative's chief agriculture negotiator, Doug McKalip, is preparing to head to Brazil as the Biden administration tries to get the South American nation to end its tariff on U.S. ethanol.

USTR Katherine Tai told the Senate Finance Committee last week she put McKalip in charge of working with Brazil on the issue and that she confronted the administration of newly elected Brazilian President Luiz Inácio Lula da Silva about the country’s ethanol tariff when she was in the capital city of Brasilia earlier this month.

“Tai went there first to open the door — establishing new relationships with this new (Lula) administration, but McKalip’s coming in (for a) market access mission,” Mackenzie Boubin, director of global ethanol exports for the U.S. Grains Council, told Agri-Pulse.

“He’s going down next week. We’ve been collaborating with his team. We’ve been giving him our talking points associated with this, and I think he’s actually a very good advocate for us. … He knows ethanol.”

Continue reading.

#brazil#politics#united states#us politics#brazilian politics#economy#international politics#mod nise da silveira#image description in alt

3 notes

·

View notes

Text

Editor's Note: Below is a viewpoint from the Foresight Africa 2023 report, which explores top priorities for the region in the coming year. Read the full chapter on food security.

In Liberia, we hold one truth to be self-evident: If one has not eaten rice on any given day, then one has not eaten. Well, at least that is the conventional theory that has driven food policy and planning for the last 60 years.

Rice is Liberia’s staple food, and our contemporary history has been completely shaped by rice: Its availability on the local market, price, and, to a lesser extent, quality. Since 1979, when government plans to raise tariffs on imported rice caused deadly riots, and eventually a coup d’état, public policy has favored imports over locally produced rice.

Fast forward to 2022, and it’s 4Cs: COVID-19, Climate, Conflict, and Commodity price escalations. Four simultaneous and intensifying shocks, at a time when we have not fully recovered from the previous shock of Ebola.

And here is another incontrovertible truth: Liberians’ dogged reliance on imported food is not sustainable. The looming food security crisis is an opportunity to finally tackle rice availability on three main fronts: Boosting smallholder production; taking agribusiness micro, small, and medium-sized enterprises (MSMEs) to scale; and attracting commercial agri-food enterprises.

Since we have ostensibly been doing just these things for years, now is the time to innovate the “how” of agri-food production. The “innovation” is simple: Enhance what is working, what is familiar and help farmers and businesses to produce more, faster, cheaper—and get surpluses to market. The technologies exist to do this.

Take rice. President Weah has set up a National Rice Stabilization Task Force to ensure constant availability of rice in our markets. We have set a national goal to grow 75 percent of what we consume in four cropping seasons: A 150 percent increase in production over what we are doing now.

In setting these targets, we considered the production realities of our smallholders. Realizing the adoption of yield improving technologies has been poor, and rarely sustained past project-end, we are resolving some of the challenges brought on by limited capital and labor for any given piece of land: Improving weed and pest management on farms; post-harvest processing capacities at village level (to optimize use); and access to markets and digital buying platforms. Couple these with solutions that enhance food and nutrition security, water, and energy at community level.

We work with MSMEs along the value chain to grow or build and service and maintain the seeds, tools, and equipment needed to produce, package, transport, and market rice to urban consumers. The Liberia Agricultural Commercialization Fund is providing critical financing to innovations that service food markets and helping rice processors to scale up operations.

We are building our knowledge base and creating business profiles to attract private investments.

The global food security crisis compels Liberia to draw on its legendary resilience and creativity. We are intentional about getting rice right. And we will.

2 notes

·

View notes

Text

A united Europe to protect our standards!

Europe is the world’s largest market. It’s the market that offers the greatest safety for its citizens. There are standards for testing food, medicines, products, vehicles and so on.

Deregulation is on Trump’s agenda at the request of billionaires like Elon Musk, the Sackler family and Peter Thiel. They are calling for a return to the “gilded age” (1870-1890), during which companies were not burdened by social, environmental or hygienic standards. But food was produced on site, which is no longer the case today. The consequences would be worse. It’s the age of the “Robber Barons”. Incommensurable fortunes were made. They made the laws and paid no taxes, to the detriment of consumer safety, workers and the environment.

There are products that aren’t sold because they don’t meet these standards. These people consider it a business opportunity gone.

If there’s no need to test or buy quality products, it drives prices down and wins markets. This drags everyone down and transfers the costs to society: the cost of the sick, environmental pollution, accident compensation, etc.

The USA will promise either sanctions or benefits to certain European countries in order to divide Europe and force it to lower its standards. For example, Perrier would not be troubled by health standards, and could sell water unfit for human consumption. For example, toys could be sold even if they contain toxic products. For example, GMOs would be on the European market.

In addition, the agri-business sector is exerting pressure within Europe to abandon environmental and social standards. For example, they would like to reuse dangerous plant protection products, or bleach chickens raised in appalling conditions.

Some European standards have been hijacked for individual interests, and with excessive administration. For example, the format of vegetables is designed to favor manufacturers. As a result, some would like to undo the standards. But that’s forgetting that the majority of these standards protect us against poisoning, fires, accidents and so on. Not all standards are bad. People should be able to exert pressure to improve standards and remove those that only serve individual interests. They are not guaranteed.

« Les bénéfices de l’Union européenne sont systématiquement sous-estimés, parce qu’ils sont considérés comme acquis » – Le Monde: https://www.lemonde.fr/idees/article/2024/12/26/les-benefices-de-l-union-europeenne-sont-systematiquement-sous-estimes-parce-qu-ils-sont-consideres-comme-acquis_6468688_3232.html

With the EU-Mercosur agreement, products from Brazil or Argentina can enter the European market without being subject to standards. Europe is already under internal pressure to lower these standards.

If standards disappear, there’ll be a lot of sickness and accidents. Today’s societies are complex. Only a few ultra-rich people are going to make huge short-term profits, to the detriment of society as a whole. We need to be able to trust medicines, food and means of transport. For example, meningitis has resurfaced because some people had doubts about the vaccine. Another example: the Boeing 737 max was grounded because it was unreliable. What would happen if it was allowed to fly again? Chinese, Russian and Indian products, among others, of low quality or potentially dangerous, would arrive on the European market.

Wasteful use of public money is another issue. If those who receive public money are not held to the same standards, many things go wrong. For example, Space X was not subject to the same standards as NASA. Many rockets exploded because the materials used were not suitable, not up to standard but cheaper. NASA couldn’t have afforded so many failures. It’s a monstrous waste of public money (these tests were financed by the U.S. government), an enormous source of pollution and unfair competition with NASA.

If one European political leader has a political interest in lowering standards, this weakens the whole of Europe, which is less able to impose its conditions. Selfishly following the Americans does not make for a strong Europe.

Gatsby le Magnifique – F. Scott Fitzgerald – Wikipedia: https://fr.wikipedia.org/wiki/Gatsby_le_Magnifique

The Current War (2017) – https://www.imdb.com/title/tt2140507/?ref_=ext_shr_em

John Le Carré’s Gardener’s Constancy , a well-researched novel about pharmaceutical trials in Africa: https://en.wikipedia.org/wiki/The_Constant_Gardener

--------------------------------------------

Pour une Europe unie pour protéger nos normes!: https://www.aurianneor.org/pour-une-europe-unie-pour-proteger-nos-normes/

EU-Mercosur: https://www.aurianneor.org/eu-mercosur/

The pill umbrella: https://www.aurianneor.org/the-pill-umbrella-drug-research-went-from-the/

Price ceilings and price floors: https://www.aurianneor.org/price-ceilings-and-price-floors/

We’re all in it together: https://www.aurianneor.org/were-all-in-it-together/

Ayn Rand is popular today; but her ideas lead to destruction, what are the solutions?: https://www.aurianneor.org/ayn-rand-is-popular-today-but-that-leads-to-destruction-what-are-the-solutions/

En pro de una defensa europea: https://www.aurianneor.org/en-pro-de-una-defensa-europea/

Conditional military assistance: https://www.aurianneor.org/conditional-support/

The moral compass: https://www.aurianneor.org/the-moral-compass/

Who backs the US military?: https://www.aurianneor.org/who-backs-the-us-military/

The richest 1% are at war with the rest of the world: https://www.aurianneor.org/the-richest-1-are-at-war-with-the-rest-of-the-world/

Solidarité Hélvétique: https://www.aurianneor.org/solidarite-helvetique-democratie-semi-directe/

#accident#aurianneor#cost#defense#deregulation#drugs#environment#europe#food#food safety#gilded age#hygiene#import#market#mercosur#phytosanitary#price#public money#quality#Robber barons#safety#sick#social#solidarity#standards#transport#workers

1 note

·

View note