#accounts receivable software

Explore tagged Tumblr posts

Text

Streamlining Receivables: Maximizing Efficiency with Accounts Receivable Software

In the realm of financial management, efficient management of accounts receivable (AR) is vital for maintaining healthy cash flow and sustaining business operations. At Micro Com Systems LTD, we recognize the significance of seamless AR processes and the pivotal role of Accounts Receivable software in optimizing receivables management. In this blog, we delve into the benefits of Accounts Receivable software and how Micro Com Systems LTD leverages this technology to maximize efficiency and profitability.

Automated Invoicing and Billing: Accounts Receivable software automates the invoicing and billing process, reducing manual errors and streamlining payment collections. Micro Com Systems LTD can generate professional invoices, send them to clients electronically, and track payment statuses in real time. Automated reminders for overdue payments help expedite collections and improve cash flow management.

Efficient Payment Processing: With Accounts Receivable software, Micro Com Systems LTD can offer multiple payment options to clients, including credit card payments, ACH transfers, and online payment portals. This flexibility enhances customer satisfaction and accelerates payment processing. Integration with payment gateways ensures secure and seamless transactions, reducing processing times and minimizing payment delays.

Customizable Payment Terms: Accounts Receivable software allows Micro Com Systems LTD to define and customize payment terms for different clients and contracts. Flexible payment schedules, discounts for early payments, and penalty provisions for late payments can be easily configured within the software. This level of customization improves client relationships, encourages prompt payments, and optimizes cash flow forecasting.

Real-time Receivables Tracking: Monitoring and tracking receivables in real time is essential for proactive decision-making and risk management. Accounts Receivable software provides Micro Com Systems LTD with comprehensive dashboards and reports that offer insights into receivables aging, outstanding balances, collection trends, and client payment behaviors. This real-time visibility enables informed strategic planning and effective follow-up actions.

Integration with Accounting Systems: Accounts Receivable software seamlessly integrates with Micro Com Systems LTD's existing accounting systems, ERP solutions, and financial platforms. This integration ensures data consistency, eliminates manual data entry errors, and enhances overall financial visibility. By synchronizing AR data with general ledger accounts, the software facilitates accurate financial reporting and reconciliation.

Automated Collections and Dunning: Accounts Receivable software automates collections processes through dunning letters, reminder emails, and follow-up notifications. Micro Com Systems LTD can set up automated workflows for escalating overdue accounts, initiating collection calls, and negotiating payment arrangements. This automation reduces administrative burden, improves collections efficiency, and minimizes bad debt risks.

Credit Management and Risk Assessment: Effective credit management is essential for mitigating credit risks and optimizing credit decisions. Accounts Receivable software enables Micro Com Systems LTD to assess client creditworthiness, establish credit limits, and monitor credit exposures. Automated credit checks, credit scoring models, and credit risk reports provide valuable insights for informed credit decisions and proactive risk mitigation.

Scalability and Growth Support: As Micro Com Systems LTD expands its client base and business operations, Accounts Receivable software offers scalability and flexibility to accommodate growth. The software's modular architecture allows for seamless upgrades, customization of workflows, and integration of additional functionalities as needed. This scalability supports Micro Com Systems LTD's strategic objectives and ensures scalability in receivables management.

In conclusion, Accounts Receivable software plays a crucial role in optimizing receivables management, improving cash flow, and enhancing client relationships for Micro Com Systems LTD. By leveraging advanced automation, real-time visibility, and customization capabilities, the software empowers Micro Com Systems LTD to streamline AR processes, mitigate risks, and drive sustainable growth and profitability.

0 notes

Text

Transforming Accounts Receivable: A Deep Dive into Modern Solutions with Kapittx

In the dynamic world of modern business, effective accounts receivable (AR) management has become a linchpin for sustained growth and financial stability. The increasing demand for streamlined financial processes necessitates the adoption of innovative solutions.

Every company invests substantial resources to grow the business and revenue. However, that revenue must be converted into cash.

The team and the processes responsible for converting revenue to cash by effectively managing receivables are –

Also managing 100% of company’s revenue

Either can save or lose millions in the form of bad debt and interest cost

As a customer touch point, can influence customer service and satisfaction, directly affecting revenue.

Why current AR process is not effective?

Traditional accounting ERPs with spreadsheets, once considered revolutionary, have become outdated in the face of rapid advancements in Automation, Machine Learning, and Artificial Intelligence (AI). The historical approach of relying on spreadsheets, emails, phone calls, and personal visits to manage receivables has persisted through generations. However, the limitations of these traditional processes, marked by manual tasks and delays, are evident in the current fast-paced business landscape.

The Challenge of Traditional AR Processes:

Traditional AR processes are notorious for their inefficiencies, resulting in delayed payments and increased Days Sales Outstanding (DSO). Their lack of agility poses a significant challenge for businesses striving to navigate fluctuating payment behaviors, complex customer interactions, and the growing demand for real-time data insights.

The Emergence of Innovative Solutions:

Acknowledging the critical need for a modern approach to AR management, innovative platforms like Kapittx have come to the forefront. These solutions leverage automation, analytics, and AI to effectively address the complexities of the modern business environment, empowering CFOs and finance organizations to take control of their receivables and cash flow.

Benefits of AI-Powered AR Tools and Processes:

Increased Cash Flow and Reduced DSO: AI-powered tools streamline processes, resulting in quicker payments and a notable reduction in Days Sales Outstanding.

Boost in Credit Sales and Margins: Improved efficiency enhances credit sales and profit margins, contributing to overall revenue growth.

Enhanced Productivity of Collection and Sales Teams: AI-driven automation increases the productivity of collection and sales teams, saving valuable time for managers and CFOs.

Reduced Bad Debt and Interest Costs: Advanced analytics minimize the risk of bad debt, leading to substantial savings in interest costs.

Lower Administrative Costs: Automation across the revenue cycle reduces administrative costs, optimizing overall financial operations.

Decrease in Deductions and Concessions Losses: AI-powered tools help identify and mitigate deductions and concessions losses, preserving revenue.

Enhanced Customer Service: Improved efficiency and responsiveness contribute to enhanced customer service, fostering stronger client relationships.

Decreased Administrative Burden on Sales Force and Management: Automation reduces the administrative burden on the sales force and management, allowing them to focus on core revenue-generating activities.

Drivers of Receivable Management

What are the drivers of receivable management? Which are within the control and outside the of control of the receivable management team? When is a good time to change your AR process :

Receivables management is an art that requires finesse in human interactions and creative problem-solving. Simultaneously, it is a science that leverages data, analytics, and technology to optimize processes, manage risks, and drive strategic decision-making. The most successful CFOs, Finance Controllers, Credit Managers or Receivables Managers are those who seamlessly integrate both the artistic and scientific aspects, adapting to the dynamic nature of the field. It encompasses business processes, technological tools, workforce skills and motivation, corporate culture, evolving behaviors of customers and colleagues, an optimal organizational structure, performance metrics, incentives, and adaptability to navigate shifting external factors.

The quality of the revenue cycle operation is reflected in the receivables asset. Any mistake in the order, fulfillment, invoicing, payment, or customer satisfaction process will result in a delayed or incomplete payment in the receivables ledger.

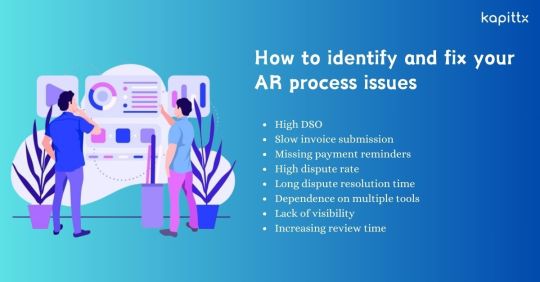

How to identify and fix your AR process issues

Accounts receivable is a critical function that affects your cash flow, customer satisfaction, and profitability. However, many businesses struggle with inefficient and outdated AR processes that lead to poor performance and customer dissatisfaction. Here are some common indicators that your AR process needs a rehaul:

High DSO: If invoice collection period is 50% more than the credit period, it means you are taking too long to collect payments from your customers. This can affect your working capital and cash flow. High DSO can also indicate that you are not managing your customer credit risk effectively, or that you are not enforcing your payment terms consistently.

Slow invoice submission: If you are not sending your invoices to your customers within 2 to 5 days of invoice generation, you are missing out on the opportunity to get paid faster. Delayed invoice submission can also cause confusion and disputes with your customers, especially if they receive multiple invoices at once or if the invoice details are inaccurate or incomplete.

Missing payment reminders: If you are not sending timely and friendly payment reminders to your customers, you are letting them forget or ignore their payment obligations. Payment reminders are an essential part of your AR process, as they help you maintain a positive relationship with your customers and encourage them to pay on time.

High dispute rate: If you are receiving a lot of invoice disputes from your customers, it means that there is something wrong with your invoicing process or your product or service delivery. Invoice disputes can cause delays in payment, damage your customer trust, and increase your administrative costs.

Long dispute resolution time: If you are not resolving invoice disputes quickly and efficiently, you are prolonging the payment cycle and creating frustration for your customers. Dispute resolution time is a key metric that reflects your customer service quality and your AR process effectiveness.

Dependence on multiple tools: If you are using different tools to manage your receivables, such as accounting ERP, spreadsheets, and report generating tools, you are creating unnecessary complexity and inefficiency in your AR process. Using multiple tools can cause data inconsistency, duplication, and errors, as well as increase your operational costs and time.

Lack of visibility: If you are not able to track and analyze the reasons for payment delays, you are missing out on valuable insights that can help you improve your AR process and customer experience. Understanding the root causes of payment delays can help you identify and address the internal and external factors that affect your AR performance.

Increasing review time: If you are spending more time reviewing your receivables than acting on them, you are wasting your resources and losing your competitive edge. Reviewing your receivables is important, but it should not take away from your core activities, such as collecting payments, resolving disputes, and building customer relationships.

According to a study, 70% of the invoice payments are delayed not because customers want to delay, but due to internal challenges and broken AR processes. Therefore, it is crucial to optimize your AR process and eliminate the inefficiencies and errors that cause payment delays.

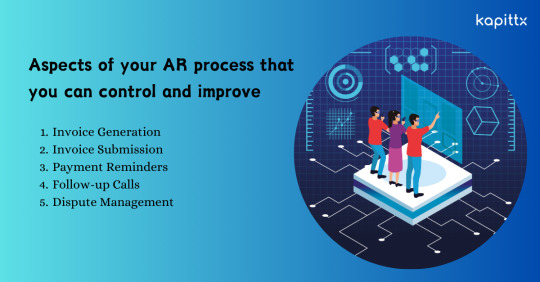

Aspects of your AR process that you can control and improve:

Invoice generation: You can automate your invoice generation process and ensure that your invoices are accurate, complete, and compliant with your customer’s requirements. You can also use electronic invoicing to reduce paper usage, printing costs, and delivery time.

Invoice submission: You can automate your invoice submission process and send your invoices to your customers via their preferred channel, such as email, web portal, or EDI. You can also use invoice tracking to confirm that your invoices are received and opened by your customers.

Payment reminders: You can automate your payment reminder process and send personalized and friendly reminders to your customers via their preferred channel, such as email, SMS, or phone. You can also use payment reminder templates to ensure consistency and professionalism in your communication.

Follow-up calls: You can automate your follow-up call process and schedule and execute calls to your customers based on their payment behavior and risk profile. You can also use call scripts to ensure that your calls are polite, respectful, and effective.

Dispute management: You can automate your dispute management process and capture, categorize, and assign disputes to the right person or team. You can also use dispute resolution workflows to ensure that disputes are resolved in a timely and satisfactory manner.

Aspects of your AR process that you cannot control:

Customer errors: If your customer makes a mistake in placing an order, receiving a product or service, making a payment, or updating their information, it can result in a past due or short payment in your receivables ledger. You can try to prevent customer errors by providing clear and accurate information, instructions, and support to your customers.

Customer dissatisfaction: If your customer is unhappy with your product or service, or with your customer service, they may withhold or delay their payment as a form of protest or retaliation. You can try to prevent customer dissatisfaction by delivering high-quality products and services, and by providing excellent customer service.

Automation is revolutionizing receivables management. Credit and collection software offers work flow, data management, and analysis tools that surpass even the best ERP systems. By enabling access to all the information related to the invoice-to-cash process and providing the tools to act on that data from a single user interface, companies that have adopted receivables management software have achieved dramatic improvements in performance, as seen by reduced DSO and delinquencies. But efficiency is not the only benefit. The data collected from credit and collection activities also provides valuable customer and process insights that can be used to enhance customer profitability, invoice accuracy, and customer satisfaction. When used properly, receivables management automation becomes the missing link between back office operations and front line customer relationship management.

What to look for to modernise your AR Process?

In the ever-evolving landscape of finance, the adoption of automation is crucial for staying competitive and optimizing operational efficiency. Modernizing your Accounts Receivable (AR) process through automation is not just a trend but a strategic move to enhance productivity, minimize errors, and foster a more agile business environment.

Key Considerations for Modernizing Accounts Receivable process with Automation:

Integration Capabilities:

Ensure that the automation solution seamlessly integrates with existing systems, ERPs, and other relevant tools to avoid disruptions and enhance overall efficiency.

Scalability:

Choose an automation solution that can scale alongside your business growth. This ensures that the system remains effective and adaptable as your AR needs evolve.

User-Friendly Interface:

Opt for an automation platform with an intuitive and user-friendly interface. This reduces the learning curve for your team and promotes swift adoption across different departments.

Data Security and Compliance:

Prioritize platforms that adhere to stringent data security standards and compliance regulations. Protecting sensitive financial information is paramount in the modern business landscape.

Customization and Flexibility:

Look for automation tools that offer customization options to tailor the solution to your specific AR processes. Flexibility is key to accommodating diverse business requirements.

Workflow Automation:

Identify a solution that automates routine and time-consuming tasks, such as invoice processing, payment reminders, and data entry. This not only saves time but also reduces the risk of human errors.

Analytics and Reporting:

Choose a platform that provides robust analytics and reporting features. Real-time insights into AR performance empower decision-makers to identify trends, make informed decisions, and strategize for the future.

Collaboration Features:

Opt for automation tools that facilitate collaboration among team members and stakeholders. Effective communication and seamless collaboration are crucial for a streamlined AR process.

Customer Experience Enhancement:

Prioritize solutions that enhance the customer experience. Automation can improve the speed and accuracy of invoicing, payment processing, and dispute resolution, leading to increased customer satisfaction.

Cost-Benefit Analysis:

Conduct a thorough cost-benefit analysis to assess the potential return on investment. While automation involves an upfront investment, the long-term benefits in terms of efficiency and cost savings often outweigh the initial costs.

Modernizing your Accounts Receivable process through automation is not just a technological upgrade; it’s a strategic decision to future-proof your finance operations. By considering these key factors, you can select the right automation solution that aligns with your business goals, enhances efficiency, and propels your organization toward sustained success in the dynamic financial landscape.

#ar management#Accounts Receivable Software#Accounts Receivable Automation Process#AR Collection#AR Software#Accounts Receivable Management Tools#AR Automation Solution

1 note

·

View note

Text

#Accounts Receivable Software#Payment Reminder Software#Payment Followup Software#debt collection Software#Online Payment Collection Software

1 note

·

View note

Text

I haven’t really seen any of the more recent U.S. election news hitting tumblr yet so here’s some updates (now edited with sources added):

There’s evidence of Trump cheating and interfering with the election.

Possible Russian interference.

Mail-in ballots are not being counted or “recognized” in multiple (notably swing) states.

30+ bomb threats were called in and shut down polling stations on Election Day.

20+ million votes are still unaccounted for, and that’s just to have the same voter turnout as 2020.

There was record voter turnout and new/first-time voter registration this year. We definitely should be well over the turnout in 2020.

U.S. citizens are using this site to demand, not only a recount, but a complete investigation into election fraud and interference for the reasons stated above:

Here is what I submitted as an example:

An investigation for election interference and fraud is required. We desperately need a recount or even a revote. The American people deserve the right to a free and fair election. There has been evidence unveiled of Trump cheating and committing election fraud which is illegal. There is some evidence of possible Russian interference. At least 30+ bomb threats were called in to polling places. Multiple, notably swing states, have ballots unaccounted for and voting machines not registering votes. Ballots and ballot boxes were tampered with and burned. Over 20 million votes that we know of are unaccounted for. With record turnout and new voter registration this year, there should be no possibility that there are less votes than even in the 2020 election.

Sources (working on finding more links but if anyone wants to add info, it’s appreciated):

FBI addressing Russian interference and bomb threats:

Emails released by Rachael Bellis (private account, can’t share original tweet) confirming Trump committing election fraud:

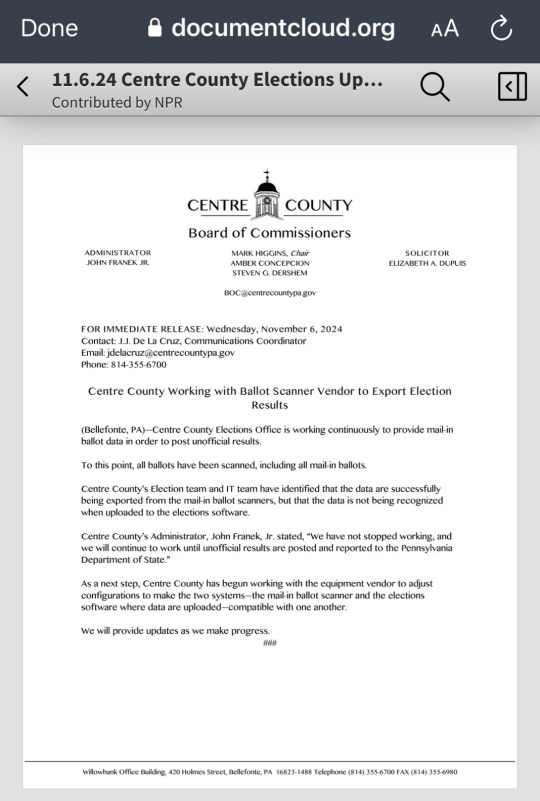

Pennsylvania's Centre County officials say they are working with their ballot scanner vendor to figure out why the county's mail-in ballot data is "not being recognized when uploaded to the elections software:”

Wisconsin recount:

[ID:

Multiple screenshots and images.

The first is a screenshot with a link and information for contacting the White House directly regarding election fraud. The instructions include choosing to leave a comment to President Joe Biden directly and to select election security as the reason.

The screenshot then instructs people to include any or all of the following information in a paragraph as a comment to the president:

32 fake bomb threats were called into Democratic leaning poll places, rendering polling places closed for at least an hour.

A lot of people reporting their ballots were not counted for various reasons.

This all occurred in swing states.

This is too coincidental that these things happen and swing in his favor after months of hinting at foul play.

Directly state that an investigation for tampering, interference, fraud is required, not just a recount.

The second image is from the FBI Twitter account that reads:

The FBI is aware of bomb threats to polling locations in several states, many of which appear to originate from Russian email domains. None of the threats have been determined to be credible thus far. https://t.co/j3YfajVK1m — FBI (@FBI) November 5, 2024

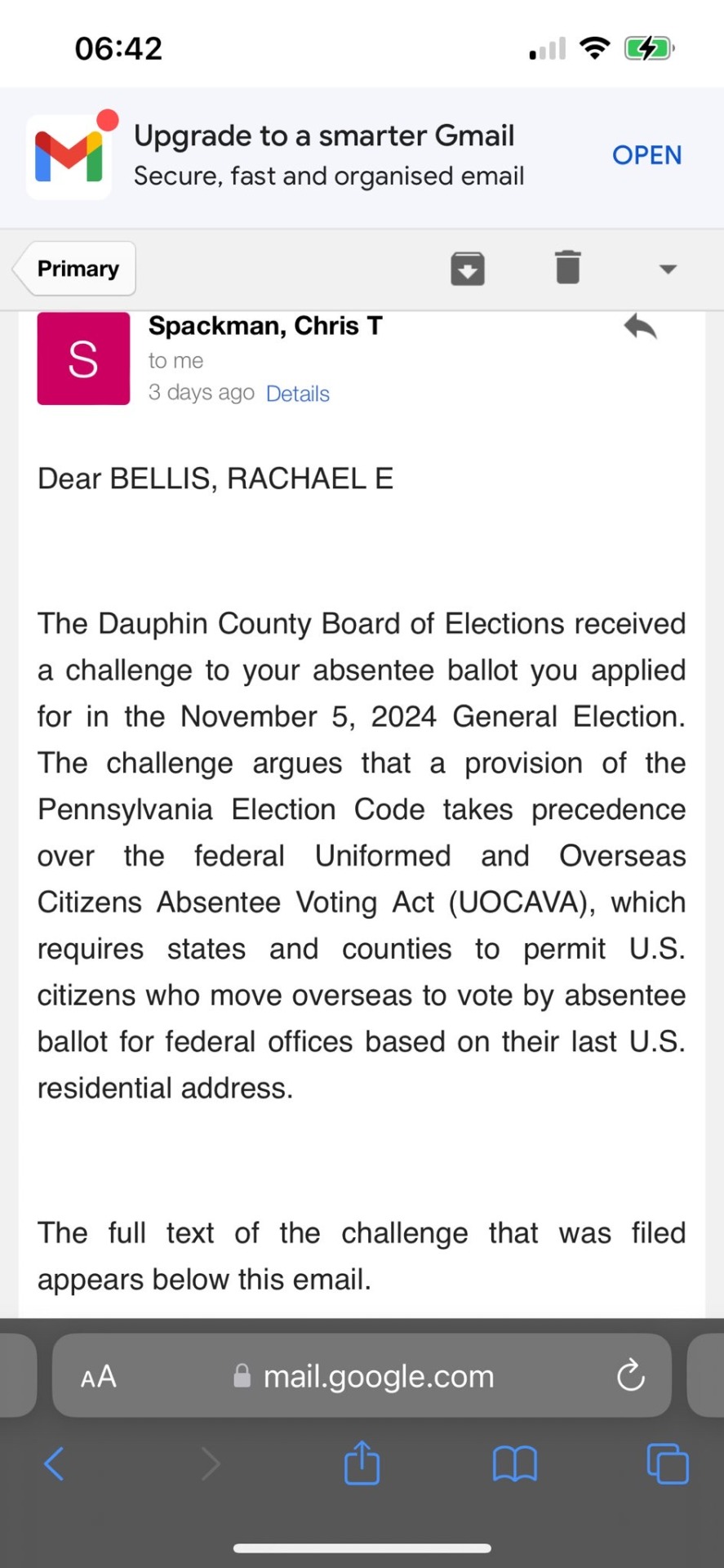

The next four Gmail screenshots of an email sent to Rachael Bellis from Chris T. Spackman that read together as follows:

Dear BELLIS, RACHAEL E., The Dauphin County Board of Elections received a challenge to your absentee ballot you applied for in the November 5, 2024 General Election. The challenge argues that a provision of the Pennsylvania Election Code takes precedence over the federal Uniformed and Overseas Citizens Absentee Voting Act (UOCAVA), which requires states and counties to permit U.S. citizens who move overseas to vote by absentee ballot for federal offices based on their last U.S. residential address.

The full text of the challenge that was filed appears below this email.

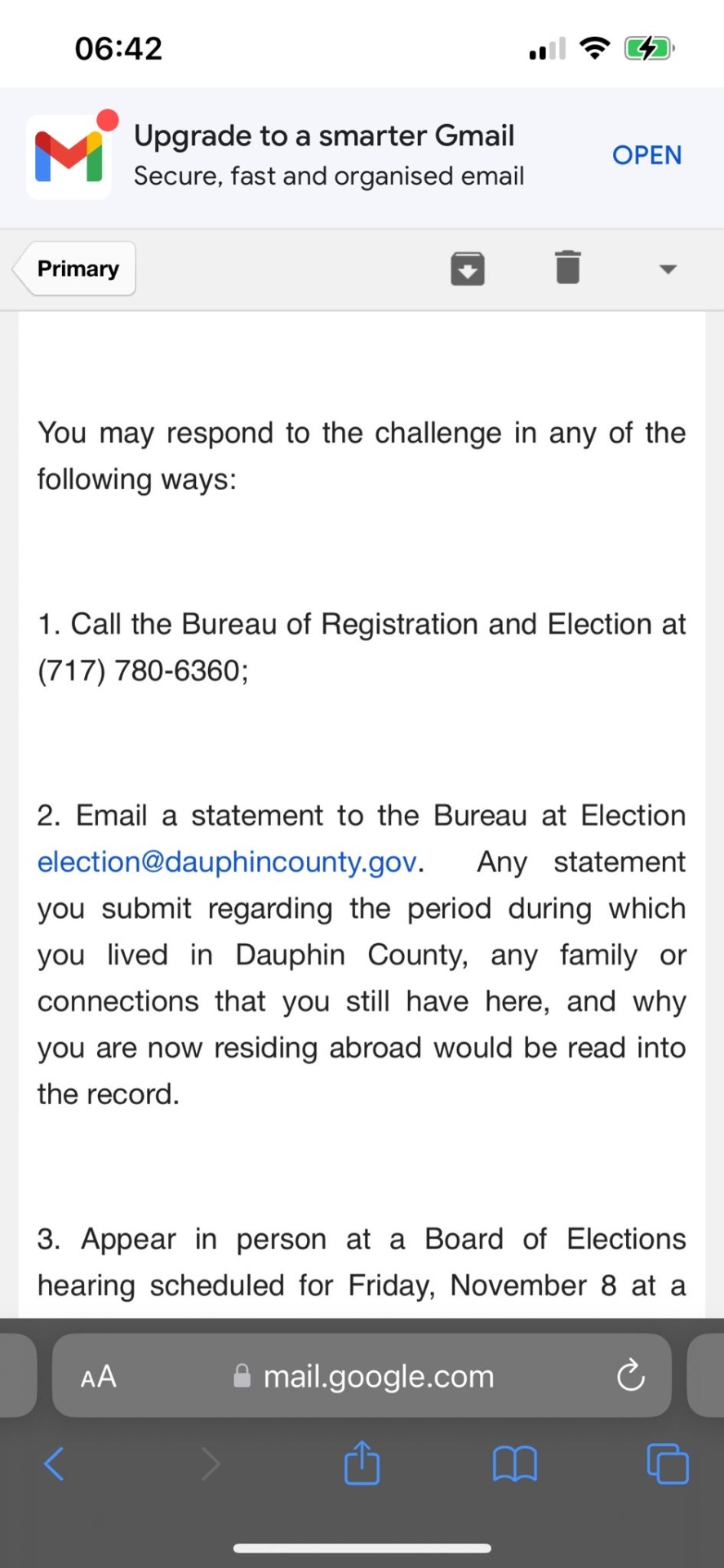

You may respond to the challenge in any of the following ways:

1. Call the Bureau of Registration and Election at (717) 780-6360;

2. Email a statement to the Bureau at Election [email protected]. Any statement you submit regarding the period during which you lived in Dauphin County, any family or connections that you still have here, and why you are now residing abroad would be read into the record.

3. Appear in person at a Board of Elections hearing scheduled for Friday, November 8 at a time to be determined in the Commissioners Public Hearing Room, 4th floor of Dauphin County Administration Building, 2 S 20d St, Harrisburg, PA 17111. The meeting is also likely to be livestreamed on Facebook on the Dauphin County channel.

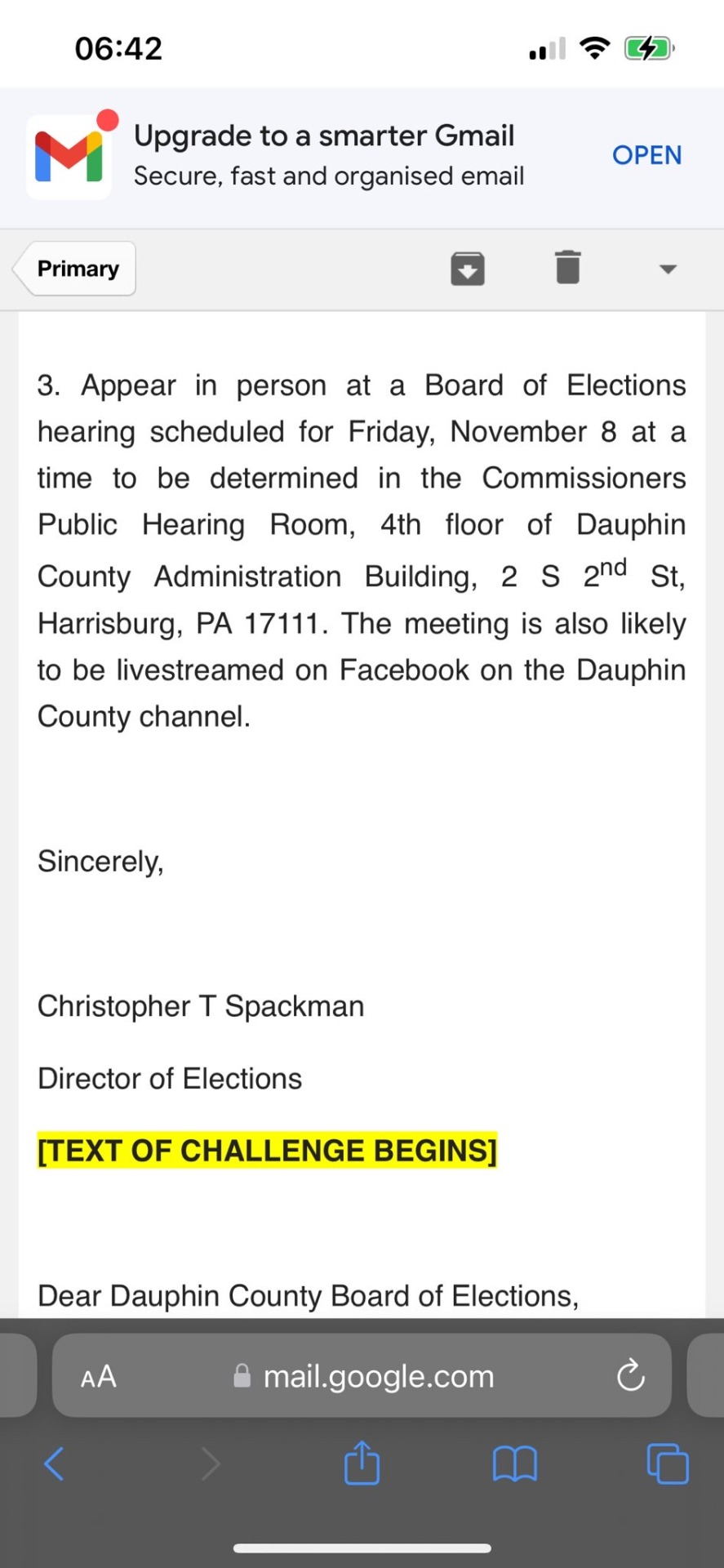

Sincerely,

Christopher T Spackman

TEXT OF CHALLENGE BEGINS

Dear Dauphin County Board of Elections,

I am submitting this challenge to an absentee ballot application pursuant to 25 Pa. Stat.

3146.8(f).

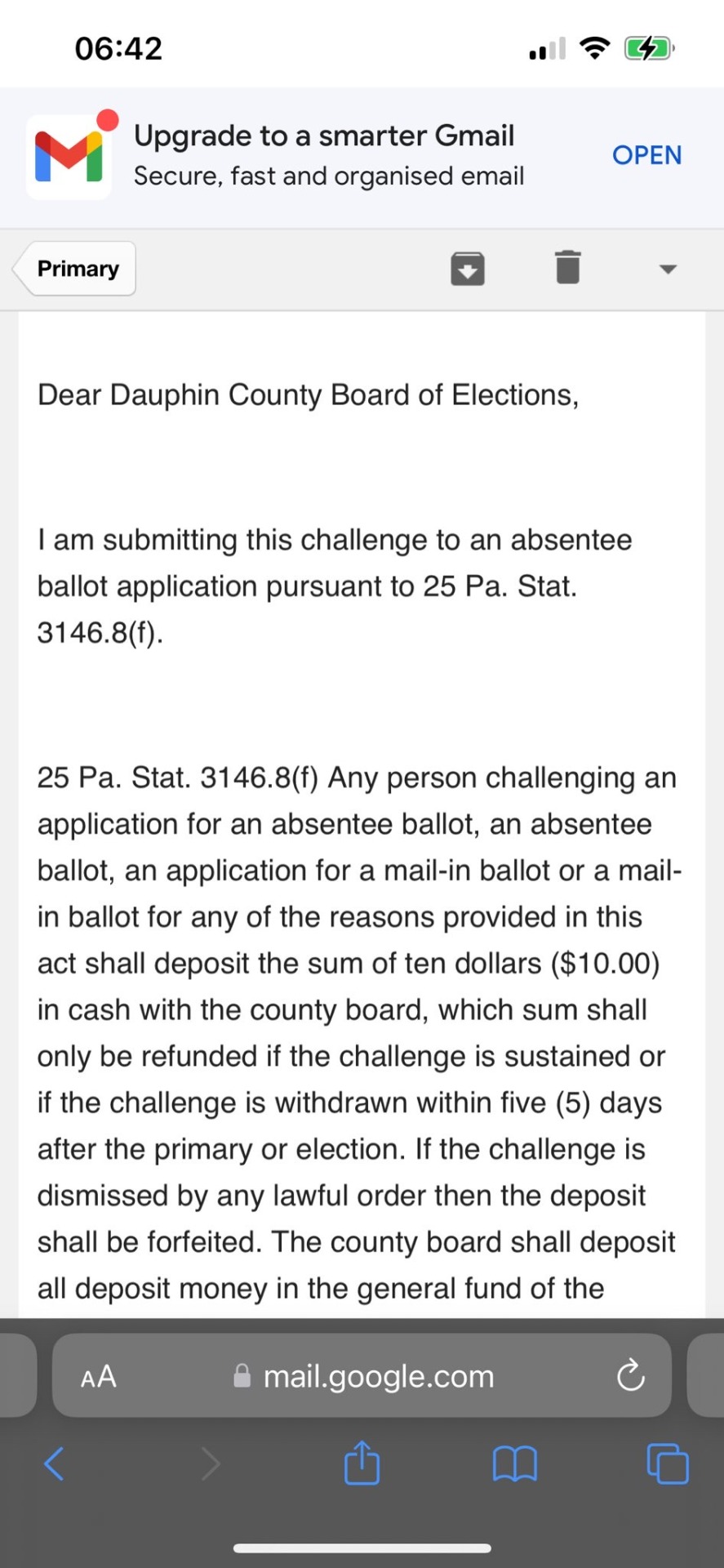

25 Pa. Stat. 3146.8(f) Any person challenging an application for an absentee ballot, an absentee ballot, an application for a mail-in ballot or a mail-in ballot for any of the reasons provided in this act shall deposit the sum of ten dollars ($10.00) in cash with the county board, which sum shall only be refunded if the challenge is sustained or if the challenge is withdrawn within five (5) days after the primary or election. If the challenge is dismissed by any lawful order then the deposit shall be forfeited. The county board shall deposit all deposit money in the general fund of the…

The rest of the forwarded email is cut off.

The last image is a screenshot of the official statement from the Centre County, Pennsylvania Board of Commissioners released on November 6, 2024 that states:

Centre County Working with Ballot Scanner Vendor to Export Election Results.

(Bellefonte, PA) -Centre County Elections Office is working continuously to provide mail-in ballot data in order to post unofficial results.

To this point, all ballots have been scanned, including all mail-in ballots.

Centre County's Election team and IT team have identified that the data are successfully being exported from the mail-in ballot scanners, but that the data is not being recognized when uploaded to the elections software.

Centre County's Administrator, John Franek, Jr. stated, "We have not stopped working, and we will continue to work until unofficial results are posted and reported to the Pennsylvania Department of State."

As a next step, Centre County has begun working with the equipment vendor to adjust configurations to make the two systems-the mail-in ballot scanner and the elections software where data are uploaded -compatible with one another.

We will provide updates as we make progress.

/end ID]

#sources added#us politics#us election#presidential election#2024 presidential election#election interference#election integrity#election security#image described#image description in alt#image description included#image description added#described#kamala harris#kamala 2024#us news#us presidents#updated id

36K notes

·

View notes

Text

Accounts Receivable Automation

Revolutionize Your Financial Operations with AR Automation

Discover how Accounts Receivable Automation is changing the landscape of financial management. By automating AR processes, businesses can significantly reduce manual errors, improve cash flow, and increase efficiency. Learn more about the latest AR tools that integrate seamlessly with your existing financial systems.

For more details click : Accounts Receivable Automation

0 notes

Text

Simplifying Your Financial Management

Streamline your financial management with our expert account and bookkeeping services. We provide accurate, timely, and reliable financial solutions to help your business stay organized and compliant. Partner with us to focus on growth while we handle your books with precision.

#Accounting#Bookkeeping#Financial Management#Accounts Receivable#Accounts Payable#Financial Reporting#Tax Preparation#Payroll Services#Audit#Budgeting#Financial Analysis#Invoice Processing#Bank Reconciliation#Expense Tracking#Cash Flow Management#Ledger Maintenance#General Ledger#Balance Sheet#Income Statement#Profit and Loss#VAT Filing#Compliance#Accounting Software#QuickBooks

1 note

·

View note

Text

Tawfik needs to buy tent covers and other necessities.

My other promos

Updated: Nov 29

Member(s): @dev-tawfik (current), @devtawfik (shadowbanned), @tawfikblog, @90-tawfik (shadowbanned)

Verification: @/90-ghost

Payment methods:

Gfm for education: PayPal, Venmo, Google Pay, credit/debit (donation match $10 USD). Focus on Kofi instead until at least mid-December

Kofi for survival (mentioned here): PayPal, credit/debit. Focus on this until at least mid-December

Tawfik is a Palestinian currently taking online classes at an Egyptian university. His Kofi campaign needs to reach $3,000 to buy tent covers and other necessities for his family (see here). Any additional funds in the gfm and Kofi will go towards the next semester's payments and family care respectively.

More info:

Now he is focusing on getting his Kofi to $3,000 (fees included) to get his family tent covers and other survival needs. See here.

Nov 27: Tawfik has reached the Kofi goal to buy flu medication and a vaccine, so we are now focusing entirely on the gfm. His goal of $10,050 by Nov 28 (hard deadline) for his international student fees were also reached on the same day.

He plans to fundraise for this year's remaining academic fees (which will be significantly less than what we already raised), and hopes that the war will end by the next year so he can get a job and pay himself.

Update Nov 20: More details here. Tawfik has fallen ill with the flu and won't be online much. He needs USD $228 (fees included) for medications and a vaccine. This requires him to reach 71% of his goal on Kofi (which is specifically for non-education related needs). At the same time, he needs $10,050 in his gfm by Nov 28 to pay off his international student fees.

Update Nov 15: We reached the halfway goal for the international student fee of USD $9,050 by Nov 15. Now going for the full fee of $10,050 by Nov 28.

Update Nov 6:

Tawfik got an extension to Nov 30 to pay the international fee. New goals of USD $9,050 by Nov 15 and $10,050 by Nov 28 (to account for transfer time) were set. The final goal was reduced with some backup money. Grades will be withheld until payment is made.

Update Nov 5:

Currently, it seems impossible to raise the required funds ($10,050 - $10,150) by Nov 13. Tawfik has emailed his school to negotiate for more time.

Update Oct 29:

Now @dev-tawfik.

The next goal was $9,250 to pay off international student fees (due Nov 13, see math section below) that Tawfik just found out about.

The family urgently needed $1,000 for healthy food (Tawfik's father has health problems and needs vegetables).

Tawfik initially wanted to use the gfm money for education only as promised, but had to add the sum to the campaign goal (a total of $10,250) because the Kofi he made solely for his family wasn't receiving many donations early on.

There were some issues with the Kofi taking a few weeks to transfer funds, but that's been resolved. It is now for support of Tawfik's family and transfers money relatively quickly.

From Oct 17-27, we fundraised to $7,200 to buy some food for the family. This food money will last roughly 2 weeks.

We are focusing back on international student fees and set a short-term goal of $8,862 in the campaign by Nov 3. There will be another small goal set after this date.

We need roughly $10,050 (an estimate) in the campaign by Nov 13 (hard deadline). Again, this isn't a concrete number and involves some usage of Tawfik's backup money.

Campaign details:

Tawfik is a software engineering student in Palestine trying to continue his education by enrolling in online classes at an Egyptian university.

He already raised roughly USD $2,500 in late July through a now closed Paypal campaign and paid the school as an application and reservation fee. This is nonrefundable.

We fundraised $4,113 (5200 - 1087) and paid off his tuition for the year on Oct 7

The gfm is meant for education only. To support the family, donate to the Kofi. It no longer faces issues with long transfer times.

Tawfik has some extra leftover funds from paying off the tuition, but it isn't much and is to be used for emergencies.

Oct 17: Tawfik bought his textbooks ($800 incl fees → $6,000 in campaign) and got a small discount for being Palestinian. This money saved went into his emergency funds.

Math:

Please let me know if I screwed up the calculation somewhere.

The transfer fee is assumed to be ~$50 per $600 earned. My bad in earlier calculations where I set it after the bank fee rather than before.

Textbooks: base $600

Funds left after:

Gfm for 40 donations: 570.6

~$50 transfer fee: 520.13

12% Bank fee: 458.13

To cover the funds lost to fees, we need an extra $200 (assumed 15 donations). After fees on that, it's only $166 (enough to cover the short-term goal)

So we need 600 + 200 = $800 for the textbooks.

This is $6,000 in the campaign.

Slightly outdated: International student fees: base $2,423

900£ = USD $1,180.93

60k EGP = USD $1,241.29

Funds left after:

Gfm fees for 160 donations: 2304.74

Transfer fee, ~$200: 2,104.74

12% Bank fee: 1852.17

To cover the funds lost to fees, we need an extra $800 (assumed 55 donations). After fees on that, it's only $625 (enough to cover the short-term goal)

So we need 2423 + 800 = $3,223 for the international student fee.

This is $9,223 10,223 in the campaign, rounded up to $ 9,250 10,250

The rate of ~$100 daily is sufficient to get us to this goal before the deadline of Nov 13 (this accounts for the 2 days needed for transfers)

5K notes

·

View notes

Text

Someone accessed my Gmail 2 days ago, compromising my linked accounts like Twitter and YouTube. Here's how it happened, why I fell for it, and what you can learn to avoid making the same mistake:

The scam I fell victim to was a cookie hijack. The hacker used malicious software to steal my browser cookies (stuff like autofill, auto sign in, etc), allowing them to sign in to my Gmail and other accounts, completely bypassing my 2FA and other security protocols.

A few days ago, I received a DM from @Rachael_Borrows, who claimed to be a manager at @Duolingo. The account seemed legitimate. It was verified, created in 2019, and had over 1k followers, consistent with other managers I’d seen at the time n I even did a Google search of this person and didnt find anything suspicious.

She claimed that @Duolingo wanted me to create a promo video, which got me excited and managed to get my guard down. After discussing I was asked to sign a contract and at app(.)fastsigndocu(.)com. If you see this link, ITS A SCAM! Do NOT download ANY files from this site.

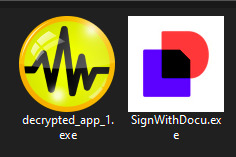

Unfortunately, I downloaded a file from the website, and it downloaded without triggering any firewall or antivirus warnings. Thinking it was just a PDF, I opened it. The moment I did, my console and Google Chrome flashed. That’s when I knew I was in trouble. I immediately did an antivirus scan and these were some of the programs it found that were added to my PC without me knowing:

The thing about cookie hijacking is that it completely bypasses 2FA which should have been my strongest line of defense. I was immediately signed out of all my accounts and within a minute, they changed everything: passwords, 2FA, phone, recovery emails, backup codes, etc.

I tried all methods but hit dead ends trying to recover them. Thankfully, my Discord wasn’t connected, so I alerted everyone I knew there. I also had an alternate account, @JLCmapping, managed by a friend, which I used to immediately inform @/TeamYouTube about the situation

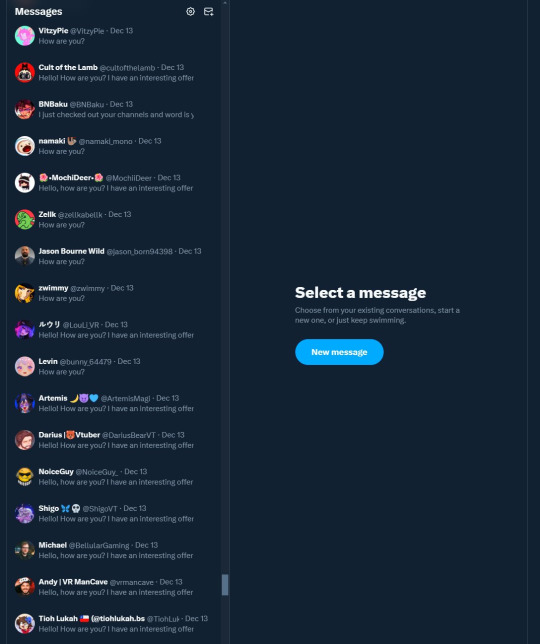

Meanwhile, the hackers turned my YouTube channel into a crypto channel and used my Twitter account to spam hundreds of messages, trying to use my image and reputation to scam more victims

Thankfully, YouTube responded quickly and terminated the channel. Within 48 hours, they locked the hacker out of my Gmail and restored my access. They also helped me recover my channel, which has been renamed to JoetasticOfficial since Joetastic_ was no longer available.

Since then, I’ve taken several steps to secure my accounts and prevent this from happening again. This has been a wake-up call to me, and now I am more cautious around people online. I hope sharing it helps others avoid falling victim to similar attacks. (End)

(side note) Around this time, people also started to impersonate me on TikTok and YouTube. With my accounts terminated, anyone searching for "Joetastic" would only find the imposter's profiles. I’m unsure whether they are connected or if it’s just an unfortunate coincidence, but it made the situation even more stressful.

3K notes

·

View notes

Text

What are Accounts Receivable Management Services?

In the vast domain of finance and accounting, the term ‘accounts receivable’ often surfaces. Essentially, it refers to the money owed to a company by its clients or customers. But what many might not be fully acquainted with are the services designed to manage these receivables. In this article, we will explore accounts receivable management services, emphasizing the growing landscape of accounts receivable services in India.

#Accounts Receivable#accounts receivable management#accounts receivable management software#Myndsolution

0 notes

Text

1 note

·

View note

Text

Retirement Village Software: Streamline Your Operations and Improve Resident Care

Retirement village software is a comprehensive software solution that can help you streamline your operations and improve resident care. It can automate many of the tasks involved in running a retirement village software, such as:

Managing resident records

Tracking occupancy and waitlists

Scheduling staff and activities

Managing finances and billing

Generating reports

Communicating with residents and families

This can free up your staff to focus on providing the best possible care to your residents.

In addition, retirement village software can help you improve resident care by providing you with the tools you need to:

Track resident health and care needs

Develop personalized care plans

Coordinate care with other providers

Monitor resident satisfaction

This can help you ensure that your residents are receiving the care they need and that they are happy with the quality of life in your retirement village.

If you are looking for a way to streamline your operations and improve resident care, consider investing in retirement village software.

#accounts payable software australia#aged care accounting#accounts receivable brisbane#asset management software australia#accounts payable brisbane

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

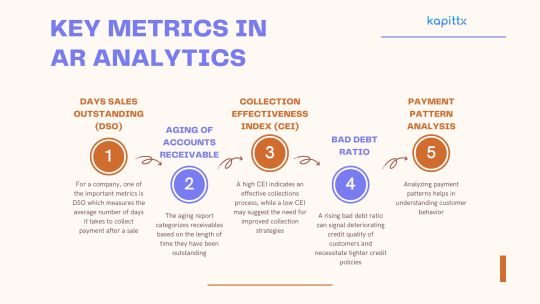

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

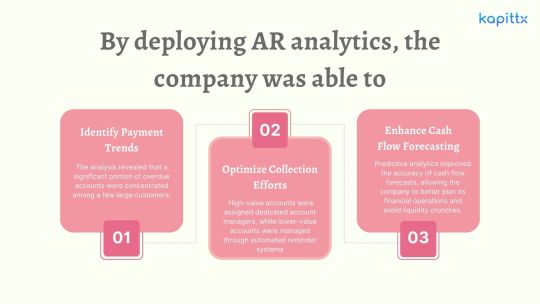

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Accounts payable (AP) and Accounts Receivable (AR) are two crucial accounting functions that are required by any process manufacturer doing business in today’s world economy. Where AR activities signifies ‘Order to Cash’ process, AP activities signifies ‘Procure to Pay’ process.

0 notes

Text

So, let me try and put everything together here, because I really do think it needs to be talked about.

Today, Unity announced that it intends to apply a fee to use its software. Then it got worse.

For those not in the know, Unity is the most popular free to use video game development tool, offering a basic version for individuals who want to learn how to create games or create independently alongside paid versions for corporations or people who want more features. It's decent enough at this job, has issues but for the price point I can't complain, and is the idea entry point into creating in this medium, it's a very important piece of software.

But speaking of tools, the CEO is a massive one. When he was the COO of EA, he advocated for using, what out and out sounds like emotional manipulation to coerce players into microtransactions.

"A consumer gets engaged in a property, they might spend 10, 20, 30, 50 hours on the game and then when they're deep into the game they're well invested in it. We're not gouging, but we're charging and at that point in time the commitment can be pretty high."

He also called game developers who don't discuss monetization early in the planning stages of development, quote, "fucking idiots".

So that sets the stage for what might be one of the most bald-faced greediest moves I've seen from a corporation in a minute. Most at least have the sense of self-preservation to hide it.

A few hours ago, Unity posted this announcement on the official blog.

Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs. We will also add cloud-based asset storage, Unity DevOps tools, and AI at runtime at no extra cost to Unity subscription plans this November. We are introducing a Unity Runtime Fee that is based upon each time a qualifying game is downloaded by an end user. We chose this because each time a game is downloaded, the Unity Runtime is also installed. Also we believe that an initial install-based fee allows creators to keep the ongoing financial gains from player engagement, unlike a revenue share.

Now there are a few red flags to note in this pitch immediately.

Unity is planning on charging a fee on all games which use its engine.

This is a flat fee per number of installs.

They are using an always online runtime function to determine whether a game is downloaded.

There is just so many things wrong with this that it's hard to know where to start, not helped by this FAQ which doubled down on a lot of the major issues people had.

I guess let's start with what people noticed first. Because it's using a system baked into the software itself, Unity would not be differentiating between a "purchase" and a "download". If someone uninstalls and reinstalls a game, that's two downloads. If someone gets a new computer or a new console and downloads a game already purchased from their account, that's two download. If someone pirates the game, the studio will be asked to pay for that download.

Q: How are you going to collect installs? A: We leverage our own proprietary data model. We believe it gives an accurate determination of the number of times the runtime is distributed for a given project. Q: Is software made in unity going to be calling home to unity whenever it's ran, even for enterprice licenses? A: We use a composite model for counting runtime installs that collects data from numerous sources. The Unity Runtime Fee will use data in compliance with GDPR and CCPA. The data being requested is aggregated and is being used for billing purposes. Q: If a user reinstalls/redownloads a game / changes their hardware, will that count as multiple installs? A: Yes. The creator will need to pay for all future installs. The reason is that Unity doesn’t receive end-player information, just aggregate data. Q: What's going to stop us being charged for pirated copies of our games? A: We do already have fraud detection practices in our Ads technology which is solving a similar problem, so we will leverage that know-how as a starting point. We recognize that users will have concerns about this and we will make available a process for them to submit their concerns to our fraud compliance team.

This is potentially related to a new system that will require Unity Personal developers to go online at least once every three days.

Starting in November, Unity Personal users will get a new sign-in and online user experience. Users will need to be signed into the Hub with their Unity ID and connect to the internet to use Unity. If the internet connection is lost, users can continue using Unity for up to 3 days while offline. More details to come, when this change takes effect.

It's unclear whether this requirement will be attached to any and all Unity games, though it would explain how they're theoretically able to track "the number of installs", and why the methodology for tracking these installs is so shit, as we'll discuss later.

Unity claims that it will only leverage this fee to games which surpass a certain threshold of downloads and yearly revenue.

Only games that meet the following thresholds qualify for the Unity Runtime Fee: Unity Personal and Unity Plus: Those that have made $200,000 USD or more in the last 12 months AND have at least 200,000 lifetime game installs. Unity Pro and Unity Enterprise: Those that have made $1,000,000 USD or more in the last 12 months AND have at least 1,000,000 lifetime game installs.

They don't say how they're going to collect information on a game's revenue, likely this is just to say that they're only interested in squeezing larger products (games like Genshin Impact and Honkai: Star Rail, Fate Grand Order, Among Us, and Fall Guys) and not every 2 dollar puzzle platformer that drops on Steam. But also, these larger products have the easiest time porting off of Unity and the most incentives to, meaning realistically those heaviest impacted are going to be the ones who just barely meet this threshold, most of them indie developers.

Aggro Crab Games, one of the first to properly break this story, points out that systems like the Xbox Game Pass, which is already pretty predatory towards smaller developers, will quickly inflate their "lifetime game installs" meaning even skimming the threshold of that 200k revenue, will be asked to pay a fee per install, not a percentage on said revenue.

[IMAGE DESCRIPTION: Hey Gamers!

Today, Unity (the engine we use to make our games) announced that they'll soon be taking a fee from developers for every copy of the game installed over a certain threshold - regardless of how that copy was obtained.

Guess who has a somewhat highly anticipated game coming to Xbox Game Pass in 2024? That's right, it's us and a lot of other developers.

That means Another Crab's Treasure will be free to install for the 25 million Game Pass subscribers. If a fraction of those users download our game, Unity could take a fee that puts an enormous dent in our income and threatens the sustainability of our business.

And that's before we even think about sales on other platforms, or pirated installs of our game, or even multiple installs by the same user!!!

This decision puts us and countless other studios in a position where we might not be able to justify using Unity for our future titles. If these changes aren't rolled back, we'll be heavily considering abandoning our wealth of Unity expertise we've accumulated over the years and starting from scratch in a new engine. Which is really something we'd rather not do.

On behalf of the dev community, we're calling on Unity to reverse the latest in a string of shortsighted decisions that seem to prioritize shareholders over their product's actual users.

I fucking hate it here.

-Aggro Crab - END DESCRIPTION]

That fee, by the way, is a flat fee. Not a percentage, not a royalty. This means that any games made in Unity expecting any kind of success are heavily incentivized to cost as much as possible.

[IMAGE DESCRIPTION: A table listing the various fees by number of Installs over the Install Threshold vs. version of Unity used, ranging from $0.01 to $0.20 per install. END DESCRIPTION]

Basic elementary school math tells us that if a game comes out for $1.99, they will be paying, at maximum, 10% of their revenue to Unity, whereas jacking the price up to $59.99 lowers that percentage to something closer to 0.3%. Obviously any company, especially any company in financial desperation, which a sudden anchor on all your revenue is going to create, is going to choose the latter.

Furthermore, and following the trend of "fuck anyone who doesn't ask for money", Unity helpfully defines what an install is on their main site.

While I'm looking at this page as it exists now, it currently says

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

However, I saw a screenshot saying something different, and utilizing the Wayback Machine we can see that this phrasing was changed at some point in the few hours since this announcement went up. Instead, it reads:

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming or web browser is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

Screenshot for posterity:

That would mean web browser games made in Unity would count towards this install threshold. You could legitimately drive the count up simply by continuously refreshing the page. The FAQ, again, doubles down.

Q: Does this affect WebGL and streamed games? A: Games on all platforms are eligible for the fee but will only incur costs if both the install and revenue thresholds are crossed. Installs - which involves initialization of the runtime on a client device - are counted on all platforms the same way (WebGL and streaming included).

And, what I personally consider to be the most suspect claim in this entire debacle, they claim that "lifetime installs" includes installs prior to this change going into effect.

Will this fee apply to games using Unity Runtime that are already on the market on January 1, 2024? Yes, the fee applies to eligible games currently in market that continue to distribute the runtime. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

Again, again, doubled down in the FAQ.

Q: Are these fees going to apply to games which have been out for years already? If you met the threshold 2 years ago, you'll start owing for any installs monthly from January, no? (in theory). It says they'll use previous installs to determine threshold eligibility & then you'll start owing them for the new ones. A: Yes, assuming the game is eligible and distributing the Unity Runtime then runtime fees will apply. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

That would involve billing companies for using their software before telling them of the existence of a bill. Holding their actions to a contract that they performed before the contract existed!

Okay. I think that's everything. So far.

There is one thing that I want to mention before ending this post, unfortunately it's a little conspiratorial, but it's so hard to believe that anyone genuinely thought this was a good idea that it's stuck in my brain as a significant possibility.

A few days ago it was reported that Unity's CEO sold 2,000 shares of his own company.

On September 6, 2023, John Riccitiello, President and CEO of Unity Software Inc (NYSE:U), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 50,610 shares and purchased none.

I would not be surprised if this decision gets reversed tomorrow, that it was literally only made for the CEO to short his own goddamn company, because I would sooner believe that this whole thing is some idiotic attempt at committing fraud than a real monetization strategy, even knowing how unfathomably greedy these people can be.

So, with all that said, what do we do now?

Well, in all likelihood you won't need to do anything. As I said, some of the biggest names in the industry would be directly affected by this change, and you can bet your bottom dollar that they're not just going to take it lying down. After all, the only way to stop a greedy CEO is with a greedier CEO, right?

(I fucking hate it here.)

And that's not mentioning the indie devs who are already talking about abandoning the engine.

[Links display tweets from the lead developer of Among Us saying it'd be less costly to hire people to move the game off of Unity and Cult of the Lamb's official twitter saying the game won't be available after January 1st in response to the news.]

That being said, I'm still shaken by all this. The fact that Unity is openly willing to go back and punish its developers for ever having used the engine in the past makes me question my relationship to it.

The news has given rise to the visibility of free, open source alternative Godot, which, if you're interested, is likely a better option than Unity at this point. Mostly, though, I just hope we can get out of this whole, fucking, environment where creatives are treated as an endless mill of free profits that's going to be continuously ratcheted up and up to drive unsustainable infinite corporate growth that our entire economy is based on for some fuckin reason.

Anyways, that's that, I find having these big posts that break everything down to be helpful.

#Unity#Unity3D#Video Games#Game Development#Game Developers#fuckshit#I don't know what to tag news like this

6K notes

·

View notes

Text

iNymbus DeductionsXchange resolves and disputes deductions and chargebacks automatically while increasing speed and efficiency by 30X. DeductionsXchange introduces cloud robotic automation for uploading denied claim packets to retail vendor portals and submitting disputes on the customer’s behalf. Not only are processing costs reduced dramatically via the elimination of manual labor, but companies can also take back revenue from previously invalid and undisputed chargebacks and deductions.

0 notes