#accounting and taxation course

Explore tagged Tumblr posts

Text

Business Accounting and Taxation Course Curriculum: What You'll Learn

In the present powerful business world, the interest for experts with top to bottom information on Business Accounting and Taxation Course is at an untouched high. Organizations depend on gifted people to deal with their monetary cycles and guarantee consistency with always advancing assessment regulations. One program that has acquired critical fame among trade graduates and working experts is the Business Bookkeeping and Tax collection Course.

This article investigates the subtleties of this course, its advantages, vocation possibilities, and why it is a brilliant decision for anybody hoping to construct a lifelong in Business Accounting and Taxation Course.

What is a Business Accounting and Taxation Course?

The Business Accounting and Taxation Course (BAT) is a specific program intended to give understudies a pragmatic comprehension of key monetary ideas, bookkeeping programming, and expense guidelines. Dissimilar to customary degree programs, this course centers around genuine applications, making it ideal for people who wish to acquire work prepared abilities in a brief period.

Key Highlights of the Course:

Covers fundamental points like GST, direct duties, finance the board, and monetary revealing.

Offers involved preparing with bookkeeping programming like Count, SAP, and QuickBooks.

Plans understudies for jobs in bookkeeping, reviewing, and tax assessment.

Why Pick a Business Accounting and Taxation Course?

Signing up for a Business Accounting and Taxation Course offers various benefits:

1. Industry-Significant Abilities

The course is custom fitted to address the issues of the business world. It gives viable information on bookkeeping cycles and assessment regulations that are straightforwardly pertinent in the working environment.

2. Brief Length

Not at all like extended degree programs, the BAT course is commonly finished in a couple of months, permitting understudies to rapidly enter the work market.

3. Popularity for Talented Experts

With organizations continually exploring complex expense frameworks and monetary guidelines, there is a developing interest for prepared experts in bookkeeping and tax collection.

4. Professional success

For people previously working in the money area, this course can assist with upgrading their abilities and increment their possibilities of advancements or better open doors.

5. Pioneering Advantages

Business people and entrepreneurs can likewise profit from this course, as it furnishes them with the information expected to deal with their business funds actually.

Educational program of the Business Accounting and Tax assessment Course

The Business Accounting and Taxation Course covers a great many points to guarantee a balanced comprehension of the subject. Here are a portion of the center parts:

1. Bookkeeping Basics

Standards of bookkeeping

Diary sections and record support

Arrangement of fiscal summaries

2. Tax assessment

Direct assessments (Personal Expense)

Roundabout expenses (GST)

Charge documenting and consistence

3. Finance The board

Estimation of compensations

Opportune Asset (PF) and Representative State Protection (ESI)

TDS on compensations

4. Monetary Revealing

Planning of asset reports

Benefit and misfortune explanations

Income examination

5. Bookkeeping Programming Preparing

Active involvement in Count, SAP, and QuickBooks.

6. Progressed Succeed

Information investigation and monetary displaying utilizing Succeed.

Who Can Sign up for a Business Bookkeeping and Tax collection Course?

This course is reasonable for a great many people, including:

1. Business Graduates

B.Com graduates hoping to spend significant time in bookkeeping and tax assessment will view this as course exceptionally advantageous.

2. Working Experts

Money and bookkeeping experts looking to overhaul their abilities and advance their professions can sign up for this course.

3. Business visionaries and Entrepreneurs

Entrepreneurs can acquire important bits of knowledge into dealing with their business funds effectively.

4. Work Searchers

People hoping to begin their vocations in bookkeeping or tax collection can involve this course as a venturing stone.

Profession Open doors In the wake of Following through with the Tasks

Finishing a Business Bookkeeping and Tax collection Course opens up different profession choices in the money and bookkeeping area. A portion of the jobs you can seek after include:

1. Charge Specialist

Give charge arranging and consistence administrations to people and organizations.

2. Bookkeeper

Oversee monetary records, plan reports, and guarantee consistence with bookkeeping norms.

3. GST Expert

Help organizations in recording GST returns and overseeing consistence with GST guidelines.

4. Monetary Investigator

Investigate monetary information to give experiences and proposals to business choices.

5. Finance Supervisor

Handle finance processes, including pay computations and legal allowances.

6. Reviewer

Direct monetary reviews to guarantee precision and consistence with administrative principles.

7. Business Consultant

Offer consultancy administrations to organizations on monetary administration and assessment improvement.

Advantages of a Business Bookkeeping and Tax collection Course

1. Viable Information

The course underlines active preparation, guaranteeing understudies are work prepared upon finish.

2. Better Work Possibilities

The abilities gained through this course are exceptionally pursued by bosses, prompting better open positions and more significant compensations.

3. Time and Cost Proficiency

Contrasted with degree programs, this course is more limited in term and more reasonable.

4. Flexibility Across Enterprises

Each business, no matter what its size or industry, requires bookkeeping and duty the executives, making these abilities generally appropriate.

5. Upgraded Certainty

The complete information and abilities acquired through this course impart trust in dealing with certifiable monetary situations.

How to Pick the Right Establishment for the Course?

While choosing an establishment for the Business Bookkeeping and Tax collection Course, think about the accompanying elements:

1. Certification

Guarantee the foundation is perceived and offers affirmation upon consummation of the course.

2. Educational program

Check whether the schedule is cutting-edge and covers generally fundamental points.

3. Reasonable Preparation

Search for establishments that give involved preparing genuine applications.

4. Arrangement Help

Establishments offering position backing can help you launch your profession.

5. Surveys and Tributes

Research online surveys or address graduated class to measure the nature of instruction and preparation.

End:

A Business Accounting and Taxation Course is a brilliant decision for anybody hoping to construct a compensating profession in the field of money and tax collection. The down to earth abilities and industry information acquired through this course upgrade employability as well as entryways to different worthwhile profession amazing open doors.

Whether you’re a trade graduate, a functioning proficient, or a business visionary, this course gives the devices and information expected to succeed in the unique universe of business and money. Venture out towards an effective vocation by signing up for a Business Accounting and Taxation Course today!

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course ,Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

How Can You Find The Right Accounting And Taxation Course For Your Career Goals?

Discover tips for finding the ideal accounting and taxation course to match your career goals. Learn about accounting course from account classes near me and explore top programs that offer career-focused training.

#account institute#account training centre#account training institute#account classes near me#accounting and taxation course#accounting course#cpa institute in kolkata#accountant course in kolkata#accounting classes online#best online accounting courses#accounting course online#cpa online courses#cpa classes online#cpa course#cpa classes

0 notes

Text

How Accounting And Tally Courses Can Help Students In Their Productive Future?

Accounting and tally classes are becoming increasingly important for students who want to pursue a career in finance or accounting. These classes provide students with the skills and knowledge they need to succeed in the field.

Learn More: https://www.edunuts.in/how-accounting-and-tally-courses-can-help-students-in-their-productive-future/

#account tally course#best account classes near me#accountant course duration#accounting and taxation course#accounting course#accounting certificate programs near me

0 notes

Text

NIFM Institute in Mumbai — Best Stock Market Training Courses in Mumbai

NIFM Institute in Mumbai is the best share market classes in Mumbai for stock market trading & training. At NIFM, we’ve always been partial to independent thinkers. Where we’ll teach you not only how to trade in the share or financial market but also how to make a living out of it in our stock market courses in Mumbai. NIFM share market training programs are simple to understand and easy to follow with practical case studies in an organized manner with a systematic flow. In our stock market courses, we will teach you to learn every factor that can affect stock market industry ups and downs, when to enter or exit, money-making strategies, discipline in the stock market, and control risk and loss.

Overview of Stock Market Courses in Mumbai

Trading in the stock market is a process that requires constant thinking, analysis, and discipline. What you think and what you choose determines your success in the business.

NIFM is the pioneer institute of stock market trading courses in Mumbai. Our institution has been focusing on providing qualitative stock market trading knowledge for over a decade in India. NIFM believes in classroom & practical sessions where the interaction of experienced trainers and other participants brings out the best results and clears all doubts about the toughest topics and makes them crystal clear. NIFM has helped thousands of investors learn the skills necessary to have the ability and confidence of the pros. We are the only stock market institution having 20+ branches all over India, where 50,000+ students have done certification of stock market courses, Job oriented courses, investor & trader courses under the supervision of industry experts. We have exclusively developed job oriented courses with 100% placement assistance for those who want to make a career in the stock market. NIFM has 6+ branches or institutes for stock market courses in Maharashtra.

Services offered by NIFM — Share Market Courses in Mumbai

Here in Mumbai, NIFM is offering 20+ stock market courses with certification and 100% placement assistance in top companies. They focus on more practical (75%) training than theoretical (25%) training. Students work on practicalities with the budget in hand to get more enhanced knowledge of trades, when to buy or sell stocks, market ups, and downs. This builds more confidence in students to find out when is the best time to enter the market or the right time to invest in stocks.

NIFM has courses for all 12th pass out students, graduated students, businessmen, investors, traders, housewives, retired persons. The availability of every generation of students makes our atmosphere more interesting, where all students can learn with the life experiences of others.

Stock Market Beginners Courses: If you are a fresher or beginner in the stock market then this certification course is for you. We helped you to learn all the basics of the share market with experts and be a market expert within 3 months.

Beginners to Advance level courses: NIFM offers Diploma & Advance Diploma courses in the stock market. Learn fundamental, technical analysis, industry up and down, the best time to buy and sell stocks. These courses offer 100% job assistance.

Job Oriented Courses: NIFM has exclusively developed job oriented courses for those who want to make their careers in the financial market or the stock market. They trained students according to the best industry requirements.

Trading and Investment Courses: This is one of the best courses to become a trader or investor in the stock market.

Technical Analysis Courses: Technical Analysis not only helps you understand the profit target but also aware of the risk involved in the trade. We teach the secrets of successful traders, We teach unique ideas to trade in Intraday, Swing trade, Short term delivery, Futures & Options.

NCFM NSE certification courses: Courses for NCFM Certification exam, and exclusively developed mock test papers which covers all syllabus for the examination.

NISM SEBI certification courses: NISM Certification courses to help students to crack the examination.

Diploma in Equity Sales Certification: This course is divided into 6 modules: Capital Market Module, Derivative Market Module, Currency derivatives module, Mutual Fund Distributors module, Investment Advisor (Level 1) and Equity Sales module.

Fundamental Analysis Crash Course: This course will help to understand all these aspects analysis of data, news, events, correlation, the impact of these while trading in the stock market or investing in other market segments.

Online Stock Market Courses: NIFM also offers online courses for those who want to learn online about day trading, trading basic terminology, how online trading systems work, Forex trading, swing trading, stock prices, live trading, and the stock exchange.

Why Choose NIFM, Best Stock Market Courses in Mumbai

Depth knowledge with practical exposure

75% practical exposure, 25% theoretical exposure

Certification after completion of course

Faculties over 30+ years of experience.

We work for all-round development for the student.

Students visits in NSE, BSE, SEBI offices

100% job assistance in topmost companies

100% support given to pass out students if any updating took place in course.

Conducting regular seminars for students by experts & industry.

Some unique courses are available only with NIFM.

Advance lab equipment/software for practical training.

Stock Market Courses Free Videos

NIFM made stock market trading learning easy for you with these free videos, you can watch and learn fast and earn fast with NIFM.

Click to enjoy your free videos today!

NIFM Preferred Employers

Our clients- Axis Securities, HDFC Securities, Kotak Securities, ICICI Direct, Motilal Oswal, Standard Securities, NIIT, Tradebulls, Bajaj Capital, SMC, Angel Broking, Advisory Mandi, Indiabulls Ventures, Nirmal Bang, Safe Express, IDBI Capital, Elite Wealth, Bonanza, Karvy Stock Broking, SAS Online, Mansukh, Silver skills, Parasram, Trustline, Zerodha, Jana Bank, LKP, BLB, etc

Seminars & Workshops at NIFM MUMBAI

NIFM organized seminars, events, and workshops to get engaged with our students and keep them up-to-date according to industry requirements. Click the link to watch some glimpse of our NIFM Capital Market Conclave 2019.

Any Doubts or Enquiries?

If you have any doubts and inquiries regarding the stock market industry or want brief counseling for your course, please reach us by filling this form — Contact Us for stock market courses enquiries. Our Counselor will reach and help you to suggest the best courses for your career, investment or trading purposes.

Reach NIFM MUMBAI

We are established in a prominent location in Parel, Mumbai. It is an effortless task in commuting to our establishment as there are various modes of transport readily available. It is at Shop №6, Kingston Tower, GD Ambekar, Road, Parel East, Mumbai, Maharashtra 400033

Source of Content: https://www.nifm.in/blog-details/387/stock-market-courses-in-mumbai.php

#stock broking courses in mumbai#share market training in mumbai#share trading courses in mumbai#stock market classes in mumbai#accounting taxation course in mumbai#stock market institute in mumbai#stock trading courses in mumbai#market investment courses in mumbai#stock market courses in mumbai#share market courses in mumbai#share market classes in mumbai#trading institute in mumbai#share market coaching in mumbai#trading classes in mumbai#share market institute in mumbai#best stock market institute in mumbai#accounting & taxation courses in mumbai#gst certification course in mumbai#gst course online in mumbai#gst online classes in mumbai#gst filing course in mumbai#gst online course with certificate in mumbai#gst certification course online in mumbai#gst course in mumbai#stock market trading in mumbai#share market trading in mumbai#trading course in mumbai#stock market for beginners in mumbai#financial accounting in mumbai#online accounting courses in mumbai

2 notes

·

View notes

Text

GST Consultant Eligibility Skill & certification Guide

How to Become a GST Practitioner in India

GST (Goods and Services Tax) ne India ke tax system ko simple banaya hai. Lekin businesses aur individuals ke liye GST filing aur compliance samajhna mushkil ho sakta hai. Isi wajah se GST Practitioner (GSTP) ki demand badh rahi hai. Agar aap GST expert banna chahte hain, to ye guide aapke liye hai.

GST Practitioner banna ek accha career option hai jo flexibility aur growth opportunities deta hai. Agar aapko taxation aur compliance me interest hai, to aap ye field choose kar sakte hain. GST laws aur filing ka knowledge rakhkar aap ek successful GSTP ban sakte hain. Let us discuss how to become GST practitioner in India.

GST Practitioner Kya Hota Hai?

GST Practitioner ek certified professional hota hai jo businesses ko GST-related compliance me madad karta hai. Ye professionals GST returns file karne, registrations karwane aur tax-related queries solve karne ka kaam karte hain.

GST Practitioner Banne ke Faayde

1. High Demand – Har business ko GST filing ki zaroorat hoti hai.

2. Self-Employment Opportunity – Freelance ya apna firm shuru kar sakte hain.

3. Government Certification – GSTN se registered hone par credibility badhti hai.

4. Good Earning Potential – Ek professional GST Practitioner acchi income kama sakta hai.

5. Work Flexibility – Part-time ya full-time kaam kar sakte hain.

GST Practitioner Banne Ke Liye Eligibility Criteria

GSTP banne ke liye aapko kuch basic eligibility criteria fulfill karne honge:

1. Nationality – Aap India ke citizen hone chahiye.

2. Age Limit – Minimum 18 saal ki umar honi chahiye.

3. Educational Qualification – Graduation ya usse upar ki degree honi chahiye:

o Commerce, Law, Banking ya Business Management stream se ho to better hoga.

o Chartered Accountant (CA), Cost Accountant, Company Secretary (CS) bhi apply kar sakte hain.

4. Character Certificate – Applicant ka good moral character hona chahiye.

5. Competency Test – GSTP exam clear karna zaroori hai.

GST Practitioner Banne Ka Process

Agar aap eligibility criteria fulfill karte hain, to aapko ye steps follow karne honge:

Step 1: GST Portal Par Registration Karein

1. GST Portal (www.gst.gov.in) par visit karein.

2. “Services” tab me “Registration” section par jayein.

3. “New Registration” select karein.

4. “GST Practitioner” option choose karein.

5. Apni details fill karein:

o Naam

o PAN Number

o Email ID

o Mobile Number

6. OTP verification ke baad password set karein.

7. Form submit karein aur Application Reference Number (ARN) save karein.

Step 2: Documents Upload Karein

Documents ki zaroorat padti hai:

· Aadhaar Card

· PAN Card

· Educational Certificates

· Address Proof

· Photograph aur Signature

Step 3: GSTP Exam Ke Liye Apply Karein

GSTP banne ke liye NACIN (National Academy of Customs, Indirect Taxes & Narcotics) dwara exam conduct hota hai.

1. Exam ke liye GST Portal par login karein.

2. NACIN ki website par jaakar registration karein.

3. Exam ka syllabus aur date check karein.

4. Exam fees pay karein.

Step 4: GSTP Exam Clear Karein

Exam me minimum 50% marks laane hote hain. Exam ke topics:

· GST Laws aur Rules

· GST Registration

· GST Returns

· Input Tax Credit

· E-way Bills

· Tax Payments

Step 5: GST Practitioner Certificate Receive Karein

Agar aap exam clear kar lete hain, to aapko GSTN se GSTP certificate milega. Is certificate ke baad aap officially GST filing aur consultancy services shuru kar sakte hain.

GST Practitioner Ke Rights & Responsibilities

Rights

1. GST Returns file karna.

2. Tax challans prepare karna.

3. GST Registration ke liye application file karna.

4. GST Refunds aur Audits me madad karna.

Responsibilities

1. Clients ke liye sahi aur timely GST filing ensure karna.

2. GST laws aur rules ka proper implementation karna.

3. Tax authorities ke saath compliance maintain karna.

GST Practitioner Ki Salary & Earning Potential

Ek GST Practitioner ki earning uski expertise aur clients ke number par depend karti hai. Ek beginner practitioner monthly ₹25,000 – ₹50,000 kama sakta hai. Experience badhne ke saath income bhi badh sakti hai.

GST Practitioner Banne Ke Liye Important Tips

1. GST Laws Ka Knowledge Rakhein – Regularly GST updates padhte rahein.

2. Practice Karein – Dummy GST filing aur real-world case studies par kaam karein.

3. Professional Certification Le Sakta Hai – CA, CS ya MBA hone se credibility badhti hai.

4. Networking Karein – Business professionals aur accountants ke saath connect karein.

5. Technology Aur Software Seekhein – GST filing ke liye software tools ka use karein. IPA offers GST Practitioner Course

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#diploma in taxation#payroll management course#sap fico course#accounting course#gst course#finance#business accounting and taxation (bat) course

0 notes

Text

The Role of Tax Consultants: A comprehensive guide

Taxation plays a crucial function within the monetary control of people and corporations. With ever-converting tax laws and rules, handling tax compliance may be a complex task. this is where tax experts come into the picture. They assist businesses and people navigate problematic international taxation, ensuring compliance while optimizing tax liabilities. this newsletter delves into "The role of Tax consultants:" and their importance within the economic region.

Who are Tax consultants?

Tax consultants, additionally called tax advisors, are professionals with in-depth information on tax criminal suggestions, pointers, and regulations. They help human beings, organizations, and corporations in making equipped tax returns, making plans for tax strategies, and making sure compliance with authorities' rules. Many tax consultants go through specialized schooling, inclusive of Taxation course in Kolkata, to build information in this area.

Key responsibilities of Tax Consultants

Tax-making plans and approach Tax experts expand techniques to reduce tax liabilities whilst ensuring compliance with felony requirements. They examine a customer’s monetary situation and recommend tax-saving investments, deductions, and exemptions that align with cutting-edge tax legal guidelines.

Tax Compliance and return filing Ensuring tax compliance is an essential position of tax experts. They prepare and report tax returns for people and agencies, assisting them keep away from penalties and criminal issues. Their know-how ensures that each one relevant deductions and credits are nicely applied.

Dealing with GST and other oblique Taxes With the introduction of products and offerings Tax (GST), companies require specialized help in GST compliance. Many tax specialists specialize in GST and help corporations with GST registration, return filing, and audits. individuals seeking to build understanding in this discipline can pursue a GST course in Kolkata to benefit from realistic knowledge of GST guidelines.

Representation in Tax Audits and Disputes Tax specialists constitute customers in case of tax audits, disputes, or litigation with tax authorities. They offer important documentation, reply to tax notices, and assist clear up troubles associated with tax tests.

Advisory on business Taxation Businesses frequently require professional advice on company taxation, worldwide taxation, and switch pricing. Tax experts manual organizations on structuring their financial transactions to acquire tax efficiency and compliance with nearby and global tax rules.

Taxation for people and Small groups Other than big corporations, tax experts also assist people and small commercial enterprise owners in dealing with personal and commercial enterprise taxes. They provide insights on earnings tax deductions, capital profits tax, and tax advantages for marketers.

Importance of Tax consultants within the financial sector

Ensuring Compliance with Tax legal guidelines Tax laws are complex and frequently changing. Non-compliance can bring about hefty consequences and prison consequences. Tax experts assist people and agencies stay compliant by means of retaining them up to date with modern tax regulations.

Saving Time and assets Taxation methods, consisting of documentation and return submission, may be time-consuming. Hiring a tax consultant lets companies and people to consciousness of middle sports whilst leaving tax-related matters to professionals.

Lowering Tax Liabilities Tax specialists examine financial facts to discover opportunities for tax financial savings. They help in structuring profits, investments, and prices in a tax-efficient manner.

Imparting expert financial recommendation Tax specialists paintings carefully with accountants, auditors, and monetary advisors to provide holistic economic making plan services. Many professionals decorate their expertise through an Accounting Course to serve their clients.

Supporting Startups and marketers Startups and small corporations often face tax-associated demanding situations due to restrained assets. Tax specialists help them in information tax incentives, deductions, and compliance requirements, ensuring smooth monetary operations.

How to end up a Tax consultant?

If you are inquisitive about becoming a tax representative, you can follow these steps:

Educational Qualification – A degree in accounting, finance, or commercial enterprise is beneficial.

Specialized Training – guides like the Taxation or a GST route in Kolkata offer sensible know-how and competencies required for tax consultancy.

Certifications and Licensing – obtaining certifications which include Chartered Accountant (CA), Certified Public Accountant (CPA), or a tax practitioner license can decorate professional prospects.

Gaining realistic revel in – operating with a tax consulting company or interning under a skilled tax consultant allows in building information.

Continuous learning – on the grounds that tax legal guidelines are dynamic, continuous getting to know and staying updated with tax guidelines are important.

Conclusion

The role of tax consultants is critical in today’s financial panorama. From tax planning and compliance to dispute decisions and advisory, tax specialists help individuals and companies control their tax affairs efficiently.

#accounting course in kolkata#taxation course#gst course#gst course in kolkata#accounting course#tally course#taxation course in kolkata

0 notes

Text

Why Should You Take the Google Analytics Course for Digital Marketing?

Understanding your audience and the ability to measure your efforts are crucial when diving into digital marketing. A Google Analytics Course in Ahmedabad equips you with the skills to track website traffic, analyse user behaviour, and make data-driven decisions that will boost your marketing strategies and enhance your online presence.

Master Website Traffic Analysis

Google Analytics Course in Ahmedabad can help you track which page visitors are coming from, land on, and hang around to see, and for how long. You will be shown how to interpret the data, which marketing channels provide the highest return, and how one should adjust the strategy at any given moment. To make sure that you place your time and resources accordingly, invest in those sites that give you the biggest desirable results.

Understand Audience Demographics

Knowing who the audience is, including basic information such as age, location, and interests, will enable them to produce content that helps fulfil their needs. It is for this reason that a Google Analytics Course in Ahmedabad will enable you to show how you can access information about the demographics of these individuals in order to know how best to create appropriate campaigns targeting them and how to better engage them with your message.

Enhance Conversion Tracking

Conversions, such as signing up for newsletters or buying a product, are important gauges of your marketing performance. With a Google Analytics course, you will be taught how to set up and track goals, showing you how your website effectively converts visitors into customers. It helps you understand and further improve your site for better conversion rates.

Improve Content Performance

Not all content is created equal. Certain pages and information draw in visitors, motivating them to spend much more time than others do. Knowing the ins and outs of how to use Google Analytics assesses which content best stimulates interest and why. Having that insight into the strengths will help you develop materials later on that really resonate with your audience and meet your marketing goals.

Enhance Your Career Prospects

In the modern job scenario, Google Analytics is one of the skills in high demand in the digital marketing professional workforce today. Completing the course will not only upgrade your capability but also add a crucial certification to your resume and make you more competitive.

Time to take your digital marketing one step ahead? Then why not enroll in Perfect Computer Education's Google Analytics course in Ahmedabad and see the magic of transforming your data into actionable insights? Visit our website to enrol in this course.

Read More:- https://perfecteducation.net/why-should-you-take-the-google-analytics-course-for-digital-marketing.php

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#myob training#quickbook training ahmedabad#foreign accounting and taxation training#xero training in ahmedabad#tally certification in ahmedabad#learn foreign accounting ahmedabad#Google Analytics Course

1 note

·

View note

Text

🚀 Why Choose CMA? Let's Break It Down! Want higher salary, global opportunities, and a career boost? 📈 The CMA course is your golden ticket! 🎫 💰 Higher Salary – More money, more happiness! 🌍 International Career – Work anywhere, live your dream! 🎯 1-Year Completion – Quick, easy, and worth it! 📜 ACCA Exemptions – Skip the extra hassle! 👉 Stop thinking, start your journey with the best CMA coaching in Delhi – FINAIM! Want to know more about: 🔎 CMA course details? 🔎 CMA course fees? 🔎 CMA course duration? Contact us to know more and start your success story today! 🚀 VISIT: https://finaim.in/cma-course-in-delhi/ FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#cma#cma course#cma usa#us cma certification#accounting#investment#management#taxation#law#cma fees#cma exam

0 notes

Text

Diploma in Taxation

#Title : What is computer accounting course#1. Introduction to Computer Accounting Course#What is Computer Accounting?#In today’s fast-paced world#businesses rely heavily on technology for their financial operations. A computer accounting course teaches individuals how to use computer#prepare reports#and ensure compliance with financial regulations. The shift from traditional manual accounting to computerized accounting has revolutionize#bookkeepers#and financial analysts.#The Importance of Computer Accounting in Modern Business#Computerized accounting has simplified tasks that once took hours or even days to complete. Instead of using paper ledgers and manual entri#businesses can now perform tasks like invoicing#payroll management#financial reporting#and budgeting with the help of accounting software. This digital transformation ensures more accuracy#efficiency#and speed in business operations.#2. Key Features of Computer Accounting Courses#Course Structure and Duration#A computer accounting course typically covers a wide range of topics#from basic accounting principles to advanced financial software applications. The course duration can vary based on the level of depth and#while diploma and degree programs may take months or even years to complete.#Basic Level: Introduction to Accounting Software#Intermediate Level: Managing Accounts#Transactions#and Reports#Advanced Level: Auditing#Taxation#and Financial Planning#Software Covered in the Course

1 note

·

View note

Text

Master GST with the Best Course in Chandigarh, Sector 34

Looking for a comprehensive GST course near me in Chandigarh, Sector 34? Join our expert-led training program to gain in-depth knowledge of Goods and Services Tax (GST), including filing, compliance, invoicing, and tax management. Our course is designed for professionals, students, accountants, and business owners seeking to enhance their skills and streamline their financial processes.

#accountant institute near me chandigarh#gst course near me chandigarh sector 34#gst course near sector 34 chandigarh#gst course in chandigarh sector 34#Accounting and Taxation Course in chandigarh sector 34

0 notes

Text

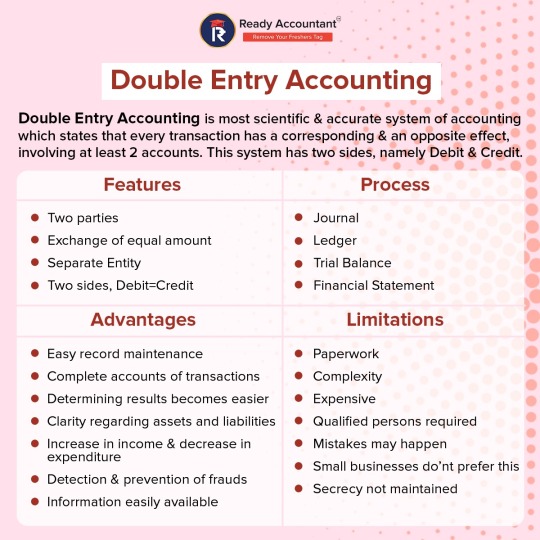

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Top Accounting & Finance Course | CA & Accounting Training

Join George Telegraph Institute of Accounts for the best accounting and finance course. Get expert CA training, accounting courses and career-ready skills at our institute.

#financial accounting course#accounting and finance course#financial accounting#cpa course#course accounting and finance#chartered accountant courses#ca course#ca course details#chartered accountant course details#accounting course#chartered accountant institute in kolkata#chartered accountant course in kolkata#account institute#account training centre#account training institute#account classes near me#accounting and taxation course

0 notes

Text

Top Leading professional Accounting Course Institute in Kolkata

Are you looking for professional online accounting course near you in Kolkata. George Telegraph Institute of Accounts provide you chartered accountant course, business accounting and taxation, computer accountant. Visit there website now.

Sealdah (Main Campus)

136, BB Ganguly Street, near Sealdah, Baithakkhana, Lebutala, Railway Station, Kolkata, West Bengal 700012

Kasba

1357, Rajdanga Main Road, Rajdanga Chakraborty Para, Sector A, East Kolkata Twp, Kolkata, West Bengal 700107

Call us on: +917604014541 /+917604014542

#accounting and taxation course#accounting course#computer accountant course#professional accounting courses#professional accounting course#chartered accountant institute in kolkata#chartered accountant course in kolkata#cpa institute in kolkata#accountant course in kolkata#business training institute#business accounting and taxation course near me#online accounting courses for cpa

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Certified Accountant Course – Enroll & Upgrade Your Skills

Best Accountant Course for Job | बेस्ट अकाउंटेंट कोर्स फॉर जॉब

1. Introduction | परिचय

अकाउंटिंग (Accounting) आज के समय में सबसे ज्यादा डिमांड वाले करियर ऑप्शन में से एक है। हर छोटे और बड़े बिज़नेस को अकाउंटेंट की जरूरत होती है। अगर आप बेस्ट अकाउंटेंट कोर्स करके अच्छी जॉब पाना चाहते हैं, तो यह गाइड आपके लिए है।

2. Why Choose an Accounting Career? | अकाउंटिंग करियर क्यों चुनें?

Advantages of Becoming an Accountant | अकाउंटेंट बनने के फायदे

· High Demand | अधिक मांग – हर सेक्टर में अकाउंटेंट की जरूरत होती है।

· Good Salary | अच्छी सैलरी – अनुभव बढ़ने के साथ सैलरी भी बढ़ती है।

· Job Security | जॉब सिक्योरिटी – यह एक स्थिर करियर विकल्प है।

· Freelancing Opportunities | फ्रीलांसिंग के अवसर – आप खुद का अकाउंटिंग बिजनेस भी शुरू कर सकते हैं।

3. Key Skills Required for an Accountant | अकाउंटेंट के लिए आवश्यक कौशल

Important Skills | महत्वपूर्ण कौशल

· Mathematical Skills | गणितीय कौशल

· Analytical Thinking | विश्लेषणात्मक सोच

· Attention to Detail | बारीकियों पर ध्यान

· Knowledge of Accounting Software | अकाउंटिंग सॉफ्टवेयर की जानकारी

· Communication Skills | संचार कौशल

4. Types of Accountant Courses | अकाउंटेंट कोर्स के प्रकार

Basic Accounting Courses | बेसिक अकाउंटिंग कोर्स

· Tally ERP 9

· QuickBooks

· MS Excel for Accounting

Advanced Accounting Courses | एडवांस अकाउंटिंग कोर्स

· Cost Accounting

· Financial Accounting & Auditing

· Taxation (GST & Income Tax)

Diploma & Certification Courses | डिप्लोमा और सर्टिफिकेट कोर्स

· Diploma in Financial Accounting

· Chartered Accountancy (CA)

· Certified Management Accountant (CMA)

5. Best Online Accountant Courses | बेस्ट ऑनलाइन अकाउंटेंट कोर्स

Top Online Platforms | टॉप ऑनलाइन प्लेटफार्म

· Coursera – Financial Accounting Fundamentals

· Udemy – Accounting & Bookkeeping Masterclass

· ICAI e-Learning Portal – CA Foundation Course

· LinkedIn Learning – Accounting Essentials

6. Best Offline Accountant Courses | बेस्ट ऑफलाइन अकाउंटेंट कोर्स

· ICAI (Institute of Chartered Accountants of India) – CA Course

· ICWA (Institute of Cost and Works Accountants) – CMA Course

· IGNOU (Indira Gandhi National Open University) – Diploma in Financial Accounting

7. Eligibility Criteria for Accountant Courses | अकाउंटिंग कोर्स के लिए पात्रता

· Basic Courses – 10+2 या ग्रेजुएशन

· Advanced Courses – ग्रेजुएशन के बाद

· Certification Courses – किसी मान्यता प्राप्त संस्थान से कोर्स करना अनिवार्य है।

8. Course Duration & Fees | कोर्स की अवधि और फीस

Course Name

Duration

Fees (INR)

Tally ERP 9

3-6 Months

₹5,000 - ₹15,000

Diploma in Accounting

6-12 Months

₹20,000 - ₹50,000

CA (Chartered Accountant)

3-5 Years

₹1,50,000+

CMA (Certified Management Accountant)

2-3 Years

₹1,00,000+

9. Job Opportunities After Completing Accountant Course | जॉब के अवसर

Best Job Roles for Accountants | अकाउंटेंट के लिए बेस्ट जॉब रोल्स

· Junior Accountant

· Financial Analyst

· Tax Consultant

· Auditor

· Cost Accountant

· Chartered Accountant (CA)

· Chief Financial Officer (CFO)

Top Companies Hiring Accountants | अकाउंटेंट्स को हायर करने वाली टॉप कंपनियां

· Deloitte

· KPMG

· EY (Ernst & Young)

· PwC (PricewaterhouseCoopers)

· Infosys

· TCS

10. Top Accounting Certifications | टॉप अकाउंटिंग सर्टिफिकेशन

· CA (Chartered Accountant) – Best for high-paying jobs.

· CMA (Certified Management Accountant) – Global recognition.

· CPA (Certified Public Accountant) – International career scope.

· ACCA (Association of Chartered Certified Accountants) – UK-based certification.

· CFA (Chartered Financial Analyst) – Ideal for investment banking & finance roles.

11. Conclusion | निष्कर्ष

अगर आप बेस्ट अकाउंटेंट कोर्स की तलाश में हैं, तो अपने करियर लक्ष्य को ध्यान में रखते हुए कोर्स चुनें। ऑनलाइन और ऑफलाइन दोनों ऑप्शंस मौजूद हैं, बस आपको सही कोर्स से शुरुआत करनी है। अकाउंटिंग में करियर न केवल स्टेबल है बल्कि इसमें शानदार ग्रोथ और कमाई की संभावनाएं भी हैं।

FAQs | अक्सर पूछे जाने वाले सवाल

1. कौन सा अकाउंटेंट कोर्स सबसे अच्छा है? अगर आप फुल-टाइम करियर चाहते हैं तो CA और CMA बेस्ट ऑप्शन हैं।

2. क्या बिना डिग्री के अकाउंटेंट बना जा सकता है? हाँ, कई डिप्लोमा और सर्टिफिकेट कोर्स बिना डिग्री के भी कर सकते हैं।

3. अकाउंटिंग में जॉब पाने के लिए कौन सा सर्टिफिकेट जरूरी है? Tally, CA, CMA, CPA, ACCA जैसी सर्टिफिकेशन से अच्छी जॉब मिल सकती है।

अब देर मत कीजिए! सही अकाउंटिंग कोर्स चुनें और अपने करियर को नई ऊँचाइयों तक ले जाएं। 🚀

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#Diploma in Computer Application#Business Accounting and Taxation (BAT) Course#Basic Computer Course#GST Course#SAP FICO Course#Payroll Management Course#Diploma in Financial Accounting#Diploma In Taxation#Tally Course

0 notes