#gst course

Explore tagged Tumblr posts

Text

Learn the Benefits of Using Tally Shortcut Keys

Tally Prime Accounting Software में Shortcut Keys की अहमियत

Tally software is one of the most widely used tools for managing financial data. But, what makes Tally even more efficient? It's the Tally shortcut keys. If you haven’t yet explored their power, you are missing out on saving a lot of time and effort.

Time-Saving Benefits of Tally Shortcut Keys

When you use Tally shortcut keys, tasks become more streamlined and quicker. Shortcut keys are the fastest way to navigate through the software without constantly searching through menus.

For example, pressing “Ctrl + O” allows you to open a voucher, and “Alt + F1” opens the company details. These little shortcuts reduce the time spent on tasks by half.

For Example If you’re adding an entry in a sales voucher, rather than manually selecting the fields, you can quickly press “Alt + S” and enter the necessary details. This makes it extremely easy to focus on accuracy rather than wasting time on clicks.

Accuracy in Accounting with Tally Shortcut Keys

Tally shortcuts also help you to double-check your entries without much effort. For instance, "Ctrl + Enter" is used to view more details of a voucher. This gives you a quick review before finalizing entries, ensuring accuracy in your accounting.

For Example:

When posting journal entries, instead of manually typing every field, you can use “Ctrl + J” for journal entries. This saves you both time and energy while ensuring there are fewer chances of errors.

Enhancing Workflow and Productivity with Tally Short Cut keys

Tally की shortcut keys का उपयोग करने से productivity बढ़ती है। The more quickly you can enter data, the more time you have for analysis and decision-making. Whether you are reconciling accounts, generating invoices, or preparing balance sheets, these shortcut keys make the process smoother and faster.

Tally Shortcut Keys for Advanced Users

Tally के अनुभवियों के लिए shortcut keys और भी अधिक महत्वपूर्ण हो जाते हैं। As an advanced user, knowing and using these shortcuts makes you a master at Tally. For example, “Alt + C” creates a new voucher, and “Alt + I” opens the inventory. With these shortcuts, professionals can manage complex tasks in seconds.

Example:

If you’re creating a balance sheet report, rather than manually selecting each option, using shortcuts such as “Ctrl + D” (to delete) and “Ctrl + F” (to find) allows you to work much faster.

The Power of Tally Shortcuts in Taxation

Taxation in accounting can be overwhelming due to the numerous calculations and forms. Tally shortcut keys play a huge role in simplifying tax-related tasks. For instance, “Alt + 2” opens the Sales Tax report, which helps users quickly get a detailed report without manual entries.

Why You Should Learn Tally Shortcut Keys

Learning Tally shortcut keys might seem time-consuming initially, but the benefits are long-lasting. It’s similar to learning to ride a bike. At first, it may feel challenging, but once you get the hang of it, you’ll wonder why you didn’t learn it sooner.

Personal Insight: My Experience with Tally Shortcuts

When I first started using Tally, I was overwhelmed by the sheer amount of data and features. But after learning a few essential Tally shortcut keys, everything became easier. Tasks that used to take minutes now take only seconds.

Complete List of 91 Tally Short Cut Keys given below:-

Short Cut Keys in Tally related to "Masters"

1. Create a master, on the fly

Alt+C

2. Open the calculator panel

Alt+N

3. Insert the base currency symbol in an input field.

Alt+4

4. Copy text from an input field

Ctrl+C

5. To paste input copied from a text field.

Ctrl+V

Short Cut Keys in Tally related to "Vouchers"

6. Payment Accounting Vouchers

F5

7. Receipt Accounting Vouchers

F6

8. Journal Accounting Vouchers

F7

9. Sales Accounting Vouchers

F8

10. To open Purchase Accounting Vouchers

F9

11. To open Credit Note Accounting Vouchers

Alt+F6

12. To open Debit Note Accounting Vouchers

Alt+F5

13. Stock Journal Inventory Vouchers

Alt+F7

14. To open Payroll voucher Payroll Vouchers

Ctrl+F4

15. Delivery Note Inventory Vouchers

Alt+F8

16. Physical Stock Inventory Vouchers

Ctrl+F7

17. Sales Order Inventory Vouchers

Ctrl+F8

18. Purchase Order Inventory Vouchers

Ctrl+F9

19. Receipt Note Inventory Vouchers

Alt+F9

20. Rejection In voucher Inventory Vouchers

Ctrl+F6

21. Rejection Out voucher Inventory Vouchers

Ctrl+F5

22. View list of all vouchers

F10

23. Mark a voucher as Optional

Ctrl+L Right button

24. Mark a voucher as Post-Dated

Ctrl+T Right button

25. Autofill details

Ctrl+F Right button

26. Retrieve Narration from the previous ledger

Alt+R

27. Open the calculator panel from Amount field

Alt+C

28. Delete a voucher/transaction

Alt+D

29. Cancel a voucher

Alt+X

30. Open a manufacturing journal voucher

Alt+V

31. Remove item/ledger line in a voucher

Ctrl+D

32. Retrieve the Narration from the previous voucher

, Ctrl+R

33. Open Contra Accounting Vouchers

F4

Short cut keys in Tally Prime related to "Reports"

34. Insert a voucher in a report

Alt+I

35. Create an entry in the report, by duplicating a voucher

Alt+2

36. Drill down from a line in a report

Enter

37. Delete an entry from a report

Alt+D

38. Add a voucher in a report

Alt+A

39. Cancel a voucher from a report

Alt+X

40. Remove an entry from a report

Ctrl+R

41. Hide or show the details in a table

Alt+T

42. Display all hidden line entries, if they were removed

Alt+U

43. Display the last hidden line

Ctrl+U

44. Expand or collapse information in a report

Shift+Enter

45. Alter a master during voucher entry

Ctrl+Enter

46. Select or deselect a line in a report

Shift+Space bar

47. Perform linear selection/deselection multiple lines in the report

Shift+Up/Down

48. Select or deselect all lines in a report

Ctrl+Space bar

49. Select or deselect lines till the end

Ctrl+Shift+End

50. Select or deselect lines till the top

Ctrl+Shift+Home

51. Invert selection of line items in a report

Ctrl+Alt+I

52. View values in different ways in a report

Ctrl+B Right button

53. Change view – display report details

Ctrl+H Right button

54. View the exceptions related to a report

Ctrl+J Right button

55. Export the current voucher or report

Ctrl+E Top menu

56. E-mail the current voucher or report

Ctrl+M Top menu

57. Print the current voucher or report

Ctrl+P Top menu

58. Synchronise data

Alt+Z Top menu

59. View the report in detailed or condensed format

Alt+F1 Right button

60. Open the GST Portal

Alt+V Right button

61. Add a new column

Alt+C Right button

62. To alter a column

Alt+A Right button

63. Filter data in a report

Alt+F12 Right button

64. Calculate balances using vouchers

Ctrl+F12 Right button

65. E-mail menu for sending transactions or reports

Alt+M Top menu

66. Print menu for printing transactions or reports.

Alt+P Top menu

Other Important Shortcut Keys in Tally Accounting Software

67. Go go back to the previous screen

Esc

68. Move to the first/last menu in a section

Ctrl+Up/Down

69. Move to the left-most/right-most drop-down top menu

Ctrl+Left/Right

70. Move from any line to the first line in a list

Home & PgUp

71. Rewrite data

Ctrl+Alt+R

72. Quit the application

Alt+F4

73. View the build information

Ctrl+Alt+B

74. Accept or save a screen

Ctrl+A

75. Expand or collapse a group in a table

Alt+Enter

76. Move to the last field or last line

Ctrl+End

77. Move to the first field or first line

Ctrl+Home

78. Open or hide calculator panel

Ctrl+N

79. Exit a screen or the application

Ctrl+Q

80. Open Company top menu

Alt+K Top menu

81. Switch to another company

F3 Right button

82. Shut the currently loaded companies

Ctrl+F3 ight button

83. Tally Help

Ctrl+F1

84. Open the list of configurations

F12 Right button

85. Open the company menu

Alt+K Top menu

86. Open the list of actions to company data

Alt+Y Top menu

87. Open the list of actions applicable to sharing

Alt+Z Top menu

88. Open the import masters, transaction,

Alt+O Top menu

89. Open the export menu for exporting masters, transactions,

Alt+E Top menu

90. Select the display language that is applicable across all screens

Ctrl+K Top menu

91. Select the data entry language that is applicable to all screens

Ctrl+W Top menu

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Income Tax

Accounting

Tally

Career

#tally course#business accounting and taxation (bat) course#finance#gst course#payroll management course#diploma in taxation

0 notes

Text

Choose the Best GST Coaching Centre Near You

IPAT Institute is the leading GST Coaching Centre Near me, offering expert training in GST laws, registration, returns, and compliance. Our industry-focused curriculum, practical sessions, and experienced faculty ensure you gain in-depth knowledge and hands-on experience. Join IPAT Institute to master GST concepts and enhance your career in taxation and finance.

0 notes

Text

What is the Difference Between Manual Accounting and e-Accounting?

Introduction

Accounting has been the backbone of businesses for centuries, evolving from traditional bookkeeping methods to modern digital solutions. In today’s fast-paced world, e-Accounting is revolutionizing how financial records are managed, making processes more efficient and error-free. But how does it compare to manual accounting? Let’s explore the key differences between the two and understand why e-Accounting is becoming the preferred choice for businesses and professionals.

Understanding Manual Accounting

Manual accounting is the conventional practice of recording transactions on paper with the help of physical registers, ledgers, and journals. It involves accountants doing arithmetic calculations, keeping records, and making financial statements manually. Manual accounting has been practiced for centuries and is popular among small businesses that have a small scale of operations.

Characteristics of Manual Accounting:

Transactions are recorded manually in books and ledgers.

Requires human labor for calculations and financial statements.

Time-consuming and susceptible to human mistakes.

No automation, making data retrieval challenging.

No access to real-time data; updates need manual inputs.

Understanding e-Accounting

With advancements in technology, e-Accounting has emerged as a modern approach to financial management. It involves using accounting software and cloud-based platforms to maintain financial records digitally. This method is widely used in corporate businesses, small enterprises, and even startups due to its efficiency, accuracy, and automation.

Key Features of e-Accounting:

Transactions are recorded digitally using accounting software.

Automated calculations minimize human errors.

Provides real-time access to financial data.

Cloud storage allows remote access to data.

Quicker processing and report creation.

Key Differences Between Manual Accounting and e-Accounting

Factors

Manual Accounting

e-Accounting

Recording Transactions

Handmade using ledgers and journals.

Electronic through software such as Tally, QuickBooks, and SAP.

Possibility of Errors

High likelihood of errors in calculations and human mistakes.

Less possibility of errors through automated calculations.

Data Security

Susceptible to damage, loss, or theft.

Safe through cloud storage and password protection.

Time Consumption

Takes a lot of time in calculations and report generation.

Quicker processing with automation and real-time report generation.

Cost Effectiveness

Lower in cost initially but involves extra expenditure on storage and maintenance.

Economical in the long term, saving paper and labor charges.

Data Accessibility

Restricted accessibility; physical presence is needed.

Accessible at all times, any place with an internet connection.

Why Businesses Are Moving to e-Accounting

The change in financial management through digital technology has prompted enterprises to move toward e-Accounting because it is efficient and reliable. Listed below are a few important reasons why e-Accounting has become the preference:

1. Real-Time Data Access

Unlike manual accounting, where accounts are updated periodically, e-Accounting offers instant access to data. Companies can monitor their financial position in real time, resulting in improved decision-making.

2. Accuracy and Error Minimization

Manual calculations tend to result in errors, which may lead to financial inconsistencies. With e-Accounting, automated processes guarantee accuracy, minimizing the chances of errors in financial reporting.

3. Time and Cost Savings

Traditional accounting takes hours of work to prepare financial statements. e-Accounting automates most processes, conserving precious time and minimizing costs related to paper records, storage, and manpower.

4. Safe Data Storage and Backup

Paper records are susceptible to loss, destruction, or theft. e-Accounting systems provide cloud-based storage, which secures data, provides automatic backup, and has limited access for authorized personnel.

5. Compliance with Tax Regulations

Most e-Accounting systems have in-built tax compliance functions, allowing for easy, error-free filing of GST, TDS management, and financial reporting. This keeps a company legally compliant without extra efforts.

Should You Learn e-Accounting?

For students and working professionals who want to pursue a career in accounting, learning e-Accounting is necessary. Since more and more businesses are depending on computerized accounting software, knowing e-Accounting tools such as Tally, QuickBooks, SAP, and Excel can provide job opportunities that can earn you a good income. If you are looking to become an accountant, tax advisor, or financial analyst, possessing e-Accounting skills can make you stand out in the employment market.

Conclusion

Though manual accounting has been a reliable practice for years, e-Accounting is the way forward for financial management. Its capacity to provide speed, accuracy, security, and accessibility makes it the first choice for companies and professionals. By embracing digital accounting tools, students and future accountants can improve their skills and remain competitive in the finance sector.

If you are in search of an institute to study e-Accounting with hands-on training, register yourself with a well-known accounting institution that provides practical learning on Tally, GST, and financial reporting. A well-structured course can lay a solid foundation and equip you with expertise in contemporary accounting practices. Visit us:

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#e accounting#gst course#tally course#tally prime#finance#tally course in yamuna vihar#tally software#tally course in uttam nagar#tally course academy#tally institute#GST course in yamuna nagar#GST course in uttam nagar

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Tally and GST Course: Your Path to Financial Expertise

Managing accounts and GST compliance is a critical skill for businesses and professionals. A Tally and GST Course is designed to equip you with the knowledge and tools required to handle accounting and taxation with ease using TallyPrime.

What is the Tally and GST Course?

The TallyPrime with GST course combines accounting fundamentals with GST concepts, providing a comprehensive learning experience. This course is ideal for accountants, business owners, and finance enthusiasts looking to enhance their skills.

Key Features of the Course

GST Compliance: Learn GST setup, invoicing, returns, and reconciliation.

Accounting Mastery: Understand financial transactions, inventory management, and reporting.

Practical Training: Hands-on exercises to apply concepts in real-world scenarios.

Industry-Recognized Certification: Boost your professional credibility with a Tally certification.

Why Enroll in a Tally and GST Course?

Stay updated with the latest GST regulations.

Simplify financial processes for businesses of all sizes.

Open up career opportunities in accounting and taxation.

Get Started Today!

Join the TallyPrime with GST course to gain expertise in accounting and GST compliance. Whether you’re a student, professional, or entrepreneur, this course will help you stand out in the competitive world of finance.

Take control of your financial management journey now!

0 notes

Text

https://iimskills.com/gst-certification-course-by-the-government/

1 note

·

View note

Text

Top Institutes Offering GST Practitioner Courses in India

The Labor and products Duty (GST) has changed the Indian tax collection framework, spurring an interest for talented experts who can oversee GST-related errands. A GST Expert Course is a particular program intended to outfit people with the information and abilities expected to fill in as guaranteed GST specialists.

If you’re thinking about a profession in tax collection or need to grow your skill in monetary consistence, signing up for a GST Expert Course can be a distinct advantage. This article investigates all that you want to be familiar with the course, including its advantages, structure, vocation possibilities, and how to get everything rolling.

What is a GST Specialist Course?

A GST Expert Course is an expert preparation program pointed toward instructing people about GST regulations, guidelines, consistence techniques, and documenting necessities. It plans contender to become confirmed GST experts, empowering them to help organizations and people in gathering their GST commitments.

Why Pick a GST Professional Course?

Here are a few justifications for why this course merits considering:

1. Appeal for GST Specialists

The execution of GST has provoked a consistent interest for gifted experts who can explore its intricacies.

2. Rewarding Profession Open doors

GST experts can acquire well by offering types of assistance, for example, charge documenting, consistence the board, and warning to organizations.

3. Enterprising Possibilities

Subsequent to following through with the tasks, you can begin your training and fabricate a client base, offering GST-related benefits freely.

4. Esteem Expansion for Experts

For bookkeepers, charge experts, and money experts, this course increases the value of their range of abilities.

Qualification to Turn into a GST Expert

Prior to signing up for a GST Professional Course, guarantee you meet the accompanying qualification models to enroll as a GST Expert with the GST Organization (GSTN):

Indian citizenship.

An advanced education in business, regulation, banking, or related fields, or comparable capabilities.

Working information on bookkeeping or tax collection.

What Does the GST Professional Course Cover?

The course educational plan is intended to give inside and out information on GST regulations, consistence methods, and down to earth applications. Here is a breakdown of the center points covered:

1. Prologue to GST

History and advancement of roundabout charges in India.

Goals and advantages of GST.

2. GST Enlistment

Sorts of GST enrollments.

Qualification standards and enrollment process.

Figuring out GSTIN (GST Recognizable proof Number).

3. GST Brings Documenting back

Kinds of GST returns (GSTR-1, GSTR-3B, and so forth.).

Cutoff times and recording methodology.

Normal mistakes and their goal.

4. Input Tax break (ITC)

Idea and advantages of ITC.

Conditions for guaranteeing ITC.

Compromise of ITC with GSTR-2A.

5. GST Consistence and Punishments

Consistence prerequisites for organizations.

Outcomes of resistance.

Question goal components.

6. GST Review and Evaluation

GST review methodology.

Evaluation types and rules.

Dealing with reviews by charge specialists.

7. Pragmatic Preparation

Active preparation in GST recording programming.

Contextual analyses and recreations.

Client association and true situations.

Advantages of a GST Specialist Course

1. Thorough Information

The course gives a careful comprehension of GST, making you capable in all parts of the tax collection framework.

2. Pragmatic Abilities

Through involved preparing and contextual investigations, you gain pragmatic experience that sets you up for certifiable difficulties.

3. Confirmation and Acknowledgment

After finishing the tasks, you get a certificate that adds believability to your profile and improves your expert standing.

4. Organizing Amazing open doors

The course permits you to interface with industry experts, tutors, and companions, extending your expert organization.

The most effective method to Sign up for a GST Expert Course

Stage 1: Pick the Right Establishment

Select a rumored establishment that offers a very much organized GST Specialist Course. Search for the accompanying:

Authorization and acknowledgment.

Experienced staff.

Situation help and industry associations.

Stage 2: Comprehend the Course Charge and Length

The course charge commonly goes somewhere in the range of ₹10,000 and ₹25,000, contingent upon the organization. The span is by and large somewhere in the range of 1 and 90 days.

Stage 3: Register for the Course

Complete the enrollment cycle by giving the necessary records and paying the expense.

Vocation Valuable open doors In the wake of Finishing a GST Expert Course

In the wake of finishing the tasks and enlisting with GSTN, you can seek after the accompanying jobs:

1. Autonomous GST Specialist

Offer GST-related administrations to people and organizations, like documenting returns, enlistments, and consistence the board.

2. Charge Advisor

Function as a specialist for firms, prompting on GST consistence, charge arranging, and question goal.

3. Bookkeeper or Money Leader

Join an organization’s money or bookkeeping office to oversee GST filings, ITC compromise, and consistence.

4. Coach or Teacher

Share your insight by turning into a GST coach, helping other people find out about GST guidelines and techniques.

Compensation Possibilities for GST Experts

The acquiring potential for GST experts relies upon variables like insight, area, and customer base. Overall:

Fledglings can acquire ₹20,000 to ₹30,000 each month.

Experienced professionals can procure ₹50,000 to ₹1,00,000 each month or more, particularly with a different client base.

Ways to succeed as a GST Expert

1. Remain Refreshed

GST regulations are dynamic, so it’s fundamental for stay up to date with the most recent revisions and notices.

2. Construct Solid Relational abilities

Clear correspondence is crucial for making sense of assessment ideas and consistence necessities for clients.

3. Influence Innovation

Dive more deeply into GST recording programming and apparatuses to further develop effectiveness and precision.

4. Grow Your Insight Base

Consider signing up for extra courses, for example, a Fundamental PC Course, to improve your specialized abilities.

End:

A GST Specialist Course is a superb decision for people looking for a remunerating profession in tax collection and consistence. With the rising reception of GST in India, organizations are effectively searching for gifted experts who can assist them with exploring this perplexing tax assessment framework.

By signing up for this course, you gain complete information, down to earth abilities, and a confirmation that can open ways to various vocation open doors. Whether you seek to work freely or inside an association, a GST Specialist Course can prepare for an effective and satisfying vocation.

Venture out today and position yourself as a confided in master in the field of GST.

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

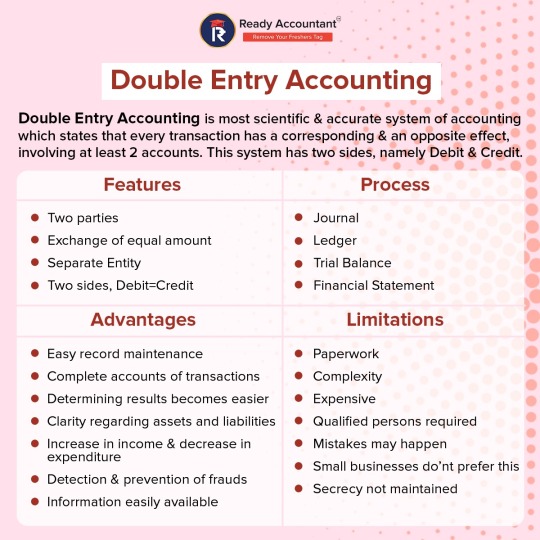

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Mastering double-entry accounting is essential to optimum financial management and record-keeping. Check out these tips to help you master and excel in double-entry accounting. Ready Accountant Your one-stop shop for on-the-job experience in Live Projects related to Accounting, GST, Taxation and ROC.

For more details visit: https://readyaccountant.com/

#accounting course#taxation course#gst course#tally course in kolkata#tally course#gst course in kolkata

0 notes

Text

Transform Your Accounting Knowledge with Tally Prime Course

Tally Prime Course: A Complete Guide for Beginners and Experts

Introduction

Tally Prime course एक ऐसा महत्वपूर्ण कदम है जो हर व्यापारिक व्यक्तियों और accountants के लिए जरूरी है। चाहे आप नए हो या अनुभवी, यह कोर्स आपको Tally Prime software के बारे में गहरी समझ प्रदान करता है।

Tally Prime एक बहुमुखी accounting software है, जो business owners को अपने वित्तीय डेटा को सटीक रूप से manage करने में मदद करता है। इस course के जरिए आप इसका सही तरीके से उपयोग करना सीख सकते हैं, जिससे आप अपने कार्यों को ज्यादा प्रभावी और समय-बचत तरीके से कर सकते हैं।

Tally Prime: Key Features और Benefits

Tally Prime course आपको इसके key features और benefits के बारे में विस्तार से सिखाएगा। Tally Prime में कई ऐसे powerful tools हैं जो accounting process को सरल और efficient बनाते हैं।

1. Efficient Account Management

Tally Prime में account management की प्रक्रिया बहुत आसान हो जाती है। इसके माध्यम से आप सारे transactions को एक ही जगह पर manage कर सकते हैं। Tally Prime course में आपको इस feature को पूरी तरह से समझाया जाता है।

2. GST Compliance

Tally Prime GST के हिसाब से पूरी तरह से compliant है। Tally Prime course में आप इसे सही तरीके से कैसे इस्तेमाल कर सकते हैं, यह जानेंगे। आपको GST reports, returns, और tax calculations पर भी सही मार्गदर्शन मिलेगा।

3. Real-time Data Access

Tally Prime की एक और खासियत है कि आपको real-time data access मिलता है। यानी, आप कभी भी अपने data को देख सकते हैं और analyze कर सकते हैं। इससे decision-making में काफी मदद मिलती है।

Tally Prime Course में क्या सिखेंगे?

Tally Prime course में कई ऐसे essential topics शामिल हैं, जो आपको accounting और finance के क्षेत्र में expert बना सकते हैं।

1. Basic Concepts of Accounting (लेखन के मूल सिद्धांत)

इस भाग में, आपको accounting के basic concepts, जैसे debit, credit, ledger, और journal entries के बारे में बताया जाएगा। Tally Prime में इनका कैसे सही तरीके से इस्तेमाल करना है, यह भी समझाया जाएगा।

2. Company Creation and Configuration (कंपनी बनाना और सेट करना)

जब आप Tally Prime में नया business शुरू करते हैं, तो सबसे पहले आपको अपनी कंपनी को configure करना होता है। इस कोर्स में, आप यह सिखेंगे कि कैसे एक नई कंपनी create करें और इसके साथ संबंधित सभी settings configure करें।

3. Creating and Managing Vouchers (वाउचर्स बनाना और प्रबंधित करना)

Tally Prime में vouchers create करना बहुत आसान है। इस course में आप vouchers के विभिन्न types के बारे में सीखेंगे जैसे payment, receipt, sales, और purchase vouchers।

4. Inventory Management (इन्वेंट्री प्रबंधन)

Tally Prime का inventory management feature एक business को अपनी inventory को सही तरीके से track करने की क्षमता देता है। इस course में आपको inventory tracking और stock management के tools के बारे में समझाया जाएगा।

Tally Prime Course क्यों जरूरी है?

कई लोग सोचते हैं कि Tally Prime सिर्फ small businesses के लिए है। लेकिन यह बात गलत है। Tally Prime बड़े corporate sectors में भी काम करता है।

1. Financial Accuracy:

Tally Prime का use करके आप financial statements की accuracy को बेहतर बना सकते हैं। इसमें data entry errors की संभावना कम होती है। Tally Prime course में आप सीखेंगे कि कैसे सटीक accounting reports generate करें।

2. Time-Saving:

Tally Prime आपको काम क���ने में बहुत time save करने का मौका देता है। इसके automated features आपको manual calculation से बचाते हैं, जिससे आपका समय बचता है। Tally Prime course में यह सीखना आसान होता है कि आप इसे कितनी जल्दी और प्रभावी तरीके से इस्तेमाल कर सकते हैं।

3. Easy Data Integration:

Tally Prime का सबसे बड़ा advantage यह है कि यह दूसरे tools के साथ integrate हो सकता है। इससे आपको सारे data को एक जगह manage करने में मदद मिलती है। Tally Prime course में आप यह जान सकते हैं कि इस integration को सही तरीके से कैसे सेट करें।

Tally Prime Course किसके लिए है?

Tally Prime course किसी भी व्यक्ति के लिए उपयुक्त हो सकता है जो accounting और finance के क्षेत्र में काम करना चाहता है।

1. Business Owners (व्यवसायी)

यदि आप business owner हैं, तो Tally Prime course आपके लिए महत्वपूर्ण हो सकता है। इससे आप अपनी कंपनी की finances को बेहतर तरीके से manage कर सकते हैं।

2. Accountants (लेखाकार)

Tally Prime course उन accountants के लिए भी है, जिन्हें Tally software का उपयोग करना आता है, लेकिन वे इसके advanced features को सही तरीके से इस्तेमाल करना चाहते हैं।

3. Students (छात्र)

यदि आप accounting और finance के student हैं, तो Tally Prime course आपके लिए एक बेहतरीन तरीका हो सकता है अपने career को start करने के लिए।

Tally Prime Course के फायदे

Tally Prime course लेने के कई फायदे हैं। यह course आपको accounting के practical aspects को सिखाता है, जिससे आप जल्द से जल्द अपना career बना सकते हैं।

1. Improved Career Opportunities (बेहतर करियर अवसर)

Tally Prime course करने के बाद आपकी employability बढ़ जाती है। आपने Tally Prime को अच्छे से समझा है, तो कई reputed companies में आपको job मिल सकती है।

2. Enhanced Knowledge (बेहतर ज्ञान)

Tally Prime course आपको न केवल software के technical aspects, बल्कि इसके business applications के बारे में भी सिखाता है। इससे आपके overall knowledge में वृद्धि होती है।

3. Cost-Effective (किफायती)

Tally Prime course एक बहुत ही cost-effective तरीका है सीखने का। अगर आप professional accountant बनना चाहते हैं तो यह course आपके लिए एक बहुत अच्छा investment हो सकता है।

How to Choose the Best Tally Prime Course?

Tally Prime course चुनने से पहले कुछ चीज़ें ध्यान में रखना जरूरी हैं:

1. Experienced Trainer:

कोर्स को अच्छे से सीखने के लिए एक अनुभवी trainer जरूरी है। इसलिए, उस संस्थान को चुनें, जहां experienced trainers हों।

2. Updated Curriculum:

Tally Prime के latest features और updates के बारे में सीखने के लिए updated curriculum होना चाहिए।

3. Hands-on Practice:

Theoretical knowledge के साथ-साथ hands-on practice भी जरूरी है। इसलिए, कोई ऐसा course चुनें जो practical sessions भी प्रदान करता हो।

4. Certification:

कोर्स के बाद आपको certificate भी मिलना चाहिए, जो आपके skills और knowledge को प्रमाणित करे।

Conclusion

Tally Prime course एक बेहतरीन तरीका है accounting और finance में expertise प्राप्त करने का। यह course आपको not only technical skills बल्कि practical business knowledge भी देता है, जिससे आप किसी भी business के financial management में सफलता पा सकते हैं।

चाहे आप एक student हो, business owner हो या accountant, Tally Prime course आपके लिए एक valuable investment हो सकता है। अगर आप इस course को अच्छे से समझते हैं, तो आप आसानी से finance और accounting field में अपनी career को एक नई दिशा दे सकते हैं।

Tally Prime की मदद से अपने व्यवसाय को सही तरीके से संभालें और अपने career को नई ऊँचाइयों तक पहुँचाएं।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Income Tax

Accounting

Tally

Career

#Tally Prime#diploma in taxation#payroll management course#business accounting and taxation (bat) course#gst course#sap fico course

0 notes

Text

Discover the Best GST Training in Chandigarh

IPAT Institute offers a comprehensive GST Course in Chandigarh, covering GST laws, registration, filing, and compliance. With expert faculty, practical training, and an industry-focused curriculum, we equip students with essential taxation skills. Join us to master GST concepts and boost your career in accounting, taxation, and finance.

0 notes

Text

Mastering Accounting and Bookkeeping in 2024:

Accounting and bookkeeping are must-haves for organizations in this very volatile financial environment. The year 2024 provides a bundle of technological advantages and regulatory changes. In this context, businesses and professionals must update with modern Accounting and Bookkeeping Rules. This book covers new trends and emphasizes the need for professional training under courses such as Tally Course, Taxation Course, Accounting Course in Kolkata, and GST Course in order to outshine them.

Accounting and Bookkeeping :

The Bedrock of Financial Management Accounting and bookkeeping constitute the bedrock of accounting for recording and interpreting financial performance. While bookkeeping deals with the precise calculation of transactions through a daily ledger, accounting further translates data into action.

Important factors to watch out for in 2024 are:

Automation: Software like Tally Prime streamlines processes and cuts down on errors. Regulatory Changes: Relating to GST, income tax, and international standards requires vigilance. Globalization: Companies having an international vision must implement IFRS for themselves.

To face such problems, professionals can take up specific courses like accounting courses or Tally course to build hands-on experience.

TOOLS TO BE EMPLOYED

Basic Accounting and Bookkeeping Practices in 2024

A. Accuracy True records are the root of proper book keeping. Training platforms like Tally Prime under a Tally Course in Kolkata assist one in developing a method of minimal error handling and maximizes efficiency for one .

B. Tax Compliance Knowing and keeping up to date with the changes in tax laws, such as GST, is crucial. Training through a GST Course or Taxation Course makes it abreast of knowledge and ensures continued compliance on an err-free basis.

C. Entity Separation Separation of personal and business finances is one characteristic that makes all transactions transparent and legally clear. It is one of the most basic accounting rules that a business should follow.

D. Comply with International Standards If your business is international, then compliance with IFRS will increase credibility and attract easy entry into global markets. Specialized accounting courses offer extensive knowledge of these worldwide standards.

E. Reconcile Periodically Audits and reconciliations are done frequently, which prove useful for them to detect discrepancies in time and prevent fraud. Training on tools like Tally Prime allows one to work proficiently in conducting such tasks.

3. Technological Innovation that Transforms Accounting

A. Automation and AI AI-driven tools change the face of predictive analytics and the detection of fraud. Courses like this Tally Course introduce trainees to integrating AI in accounting workflow.

B. Cloud-Based Solutions Cloud accounting provides access to financial information from anywhere while being secure. Most modern accountants have to learn how to use these tools.

C. Blockchain Blockchain technology enables tamper-proof records, which increases the level of transparency and trust in financial reporting.

D. Digital Tax Filing Digitized tax-filing platforms for taxes assist in making compliance easy. A GST Course equips one with hands-on experience on how to prepare GST returns effectively.

Overcoming Compliance Issues A. Coping with Change

Tax laws are changing all the time, and the process may sometimes be overwhelming. Courses, such as the Taxation Course in Kolkata or GST Course, help one keep in the times.

B. Securing Digital Accounting

Digital accounting requires strong cybersecurity. Secure practices training is needed in order to secure sensitive data.

C. Skills Gap Modern skills require modern techniques. The Tally Course or Accounting Course equips one to fulfill the industrial needs.

Benefits of Updated Rules

Proper Planning: The correct set of data helps in appropriate budgeting and forecasting. Strict Control: Laws should be followed without punitive measures and to gain authenticity Professional Training: Professional training leads towards high-value career prospects. Improved Transparency: Transparent financials are a source of stakeholder confidence. This is all about the steps to implement modern accounting rules.

6. Steps to Implement Modern Accounting Rules

Adoption of Advanced Tools The adoption of Tally Prime helps the firm operate efficiently and become more accountable.

Upskilling Teams Instruct the employees to take courses related to Tally Course and GST Course.

Periodical Audits It is essential to check for compliance and at the same time pick any kind of anomaly through regular review.

Be Updated: You have to sign up for an Accounting Course such that you are updated with the new and recent trends.

Use Expert Support: You can seek support from those experts who are professionalized in this domain or undergo advanced training courses for guarantee. Different Methods by which You will Follow the New Accounting and Bookkeeping Standard for 2024

How to be in Compliance With New Accounting and Bookkeeping Regulations of 2024

The new accounting and bookkeeping rules of 2024 overwhelm businesses, but there is a proper way to ensure that compliance with them becomes seamless. Here's how you can adapt to changes well:

Track the Regulatory Changes Stay updated on the latest changes in rules for accounting and book-keeping. You could read credible newsletters, participate in webinars, and follow some reliable financial blogs for this purpose. Education means that you will be equipped with the latest requirements on compliance at all times. End

Use Accounting Software Modern accounting software makes the difference. Automation helps save time and reduces human error. Update frequency should be a choice-criterion of the software as it shall help follow the changes made in regulations. Accuracy would also be enhanced through automation, and so will be the possibility of compliance.

Consultant Expertise While managing compliance proves relatively challenging in the absence of particularized skills, the employment of a professional accountant ensures that books are quite accurate and up to date. An experienced accountant can provide insights into the financial health of a business while ensuring one is in compliance with the latest rules.

Regular audit of financial records Provide frequent checks of your financial statements so you can detect any errors or mismatches before such inconsistencies become serious issues. Regular audits also ensure that your operations are within the new regulatory regime, thus not facing penalized consequences for non-compliance.

Capitalize on Improved Information and Communication Technology Facilities Cloud application and document management technologies make it more efficient to store and retrieve your records. These systems ensure secure storage and recording, efficient tracking, and fulfillment of newly promulgated regulations on data management.

Steps can thus be taken by the various businesses to not only keep up with new rules but also make accounting stream line and easier for better financial management 2024.

Conclusion

Accuracy, adherence, and utilization of technology in playing accounting and bookkeeping games will be at the center of learning in 2024. Any business or professional who specializes in these most important disciplines can thrive in competitive markets. Expanding knowledge by taking a Tally Course, Accounting Course, and GST Course in kolkata can help one keep better abreast of industry requirements and guaranteed financial success. Follow these strategies confidently as you negotiate this rapidly changing world of accounting.

0 notes

Text

The Role of Tax Consultants: A comprehensive guide

Taxation plays a crucial function within the monetary control of people and corporations. With ever-converting tax laws and rules, handling tax compliance may be a complex task. this is where tax experts come into the picture. They assist businesses and people navigate problematic international taxation, ensuring compliance while optimizing tax liabilities. this newsletter delves into "The role of Tax consultants:" and their importance within the economic region.

Who are Tax consultants?

Tax consultants, additionally called tax advisors, are professionals with in-depth information on tax criminal suggestions, pointers, and regulations. They help human beings, organizations, and corporations in making equipped tax returns, making plans for tax strategies, and making sure compliance with authorities' rules. Many tax consultants go through specialized schooling, inclusive of Taxation course in Kolkata, to build information in this area.

Key responsibilities of Tax Consultants

Tax-making plans and approach Tax experts expand techniques to reduce tax liabilities whilst ensuring compliance with felony requirements. They examine a customer’s monetary situation and recommend tax-saving investments, deductions, and exemptions that align with cutting-edge tax legal guidelines.

Tax Compliance and return filing Ensuring tax compliance is an essential position of tax experts. They prepare and report tax returns for people and agencies, assisting them keep away from penalties and criminal issues. Their know-how ensures that each one relevant deductions and credits are nicely applied.

Dealing with GST and other oblique Taxes With the introduction of products and offerings Tax (GST), companies require specialized help in GST compliance. Many tax specialists specialize in GST and help corporations with GST registration, return filing, and audits. individuals seeking to build understanding in this discipline can pursue a GST course in Kolkata to benefit from realistic knowledge of GST guidelines.

Representation in Tax Audits and Disputes Tax specialists constitute customers in case of tax audits, disputes, or litigation with tax authorities. They offer important documentation, reply to tax notices, and assist clear up troubles associated with tax tests.

Advisory on business Taxation Businesses frequently require professional advice on company taxation, worldwide taxation, and switch pricing. Tax experts manual organizations on structuring their financial transactions to acquire tax efficiency and compliance with nearby and global tax rules.

Taxation for people and Small groups Other than big corporations, tax experts also assist people and small commercial enterprise owners in dealing with personal and commercial enterprise taxes. They provide insights on earnings tax deductions, capital profits tax, and tax advantages for marketers.

Importance of Tax consultants within the financial sector

Ensuring Compliance with Tax legal guidelines Tax laws are complex and frequently changing. Non-compliance can bring about hefty consequences and prison consequences. Tax experts assist people and agencies stay compliant by means of retaining them up to date with modern tax regulations.

Saving Time and assets Taxation methods, consisting of documentation and return submission, may be time-consuming. Hiring a tax consultant lets companies and people to consciousness of middle sports whilst leaving tax-related matters to professionals.

Lowering Tax Liabilities Tax specialists examine financial facts to discover opportunities for tax financial savings. They help in structuring profits, investments, and prices in a tax-efficient manner.

Imparting expert financial recommendation Tax specialists paintings carefully with accountants, auditors, and monetary advisors to provide holistic economic making plan services. Many professionals decorate their expertise through an Accounting Course to serve their clients.

Supporting Startups and marketers Startups and small corporations often face tax-associated demanding situations due to restrained assets. Tax specialists help them in information tax incentives, deductions, and compliance requirements, ensuring smooth monetary operations.

How to end up a Tax consultant?

If you are inquisitive about becoming a tax representative, you can follow these steps:

Educational Qualification – A degree in accounting, finance, or commercial enterprise is beneficial.

Specialized Training – guides like the Taxation or a GST route in Kolkata offer sensible know-how and competencies required for tax consultancy.

Certifications and Licensing – obtaining certifications which include Chartered Accountant (CA), Certified Public Accountant (CPA), or a tax practitioner license can decorate professional prospects.

Gaining realistic revel in – operating with a tax consulting company or interning under a skilled tax consultant allows in building information.

Continuous learning – on the grounds that tax legal guidelines are dynamic, continuous getting to know and staying updated with tax guidelines are important.

Conclusion

The role of tax consultants is critical in today’s financial panorama. From tax planning and compliance to dispute decisions and advisory, tax specialists help individuals and companies control their tax affairs efficiently.

#accounting course in kolkata#taxation course#gst course#gst course in kolkata#accounting course#tally course#taxation course in kolkata

0 notes