#Tally course

Explore tagged Tumblr posts

Text

बी.कॉम के बाद Career Paths - जानें

Career Options After B.Com - बी.कॉम के बाद करियर विकल्प

Have you finished your B.Com

aur सोच रहे हो "ab kya?" You’re not alone. Many

graduates feel confused about their next step. This article will explore career

options after B.Com, mixing English और

Hindi, to guide you.

Job Opportunities After B.Com - बी.कॉम के बाद नौकरी के अवसर

Career options After B.Com, you can jump into many jobs. Let’s dive into some

popular ones.

Accounting aur Finance Jobs

You can become an accountant

ya financial analyst. Yeh jobs need number-crunching skills aur attention to

detail. Managing records और

analyzing data are key tasks here.

For example, mera friend

Rohan chose accounting after B.Com. He now works in a big firm aur enjoys it.

Starting salary can be around ₹3-5 lakhs per year (source: Payscale).

Banking mein Opportunities

Banks love hiring B.Com

graduates for clerk ya PO roles. Exams jaise IBPS can get you government jobs.

Yeh offer stability aur decent pay.

Marketing aur Sales Roles

Agar communication strong

hai, try marketing ya sales. You could start as a marketing executive. Yeh

field needs creativity aur confidence.

HR ke Liye Jobs

Human Resources mein, you

manage people aur hiring. B.Com graduates with people skills can shine here.

It’s rewarding if you like teamwork.

Government Jobs ka Option

Competitive exams jaise SSC

CGL ya UPSC bhi try kar sakte ho. These jobs offer security aur benefits.

Preparation is tough, but worth it.

Further Studies After B.Com - बी.कॉम के बाद आगे की पढ़ाई

Not ready for a job? Further studies

bhi ek great option hai.

M.Com - Master of Commerce

M.Com deepens your commerce

knowledge. It’s perfect agar teaching ya research pasand hai. Course duration

is 2 years.

MBA - Management ka Rasta

An MBA opens doors to

managerial roles. Specializations jaise finance ya marketing are popular. Many

B.Com students choose yeh path for growth.

For instance, meri cousin

Priya did MBA after B.Com. She’s now a marketing manager aur loves her job. Top

institutes jaise IIMs are highly valued.

Chartered Accountancy (CA)

CA is tough but prestigious.

Yeh accounting aur finance mein expert banata hai. Average salary post-CA can

hit ₹7-10 lakhs (source: ICAI).

Company Secretary (CS)

CS focuses on corporate law

aur compliance. It’s ideal agar legal aspects interest you. Yeh course bhi

well-respected hai.

Other Professional Courses

Courses jaise CFA ya data

analytics bhi consider karo. They boost your skills aur job prospects. Pick one

jo matches your interest.

Skills to Boost Your Career - करियर को बेहतर करने के लिए कौशल

Skills matter a lot after

B.Com. Let’s see some must-haves.

Communication Skills

Good communication helps in

every job. Yeh clear ideas share karne mein madad karti hai. Practice speaking

aur writing daily.

Computer Proficiency

Aaj kal, computer skills

zaroori hain. Learn MS Office ya accounting software jaise Tally. Yeh jobs mein

edge deta hai.

Analytical Thinking

Analyzing data aur decisions

lena important hai. Yeh skill finance aur marketing mein kaam aati hai.

Practice problem-solving to improve.

Time Management

Deadlines meet karna seekho.

Yeh efficiency badhata hai aur stress kam karta hai. I learned this during my

college projects.

Teamwork ka Magic

Most jobs need collaboration.

Team mein kaam karna success ke liye key hai. Be a good team player.

Tips to Pick the Right Path - सही राह चुनने के टिप्स

Choosing a career can be

confusing. Here’s some practical advice.

Apne Interests Check Karo

Think about what you enjoy.

Agar numbers pasand hain, finance try karo. Passion drives success.

Strengths ko Pehchano

Know your strong points.

Communication strong hai to marketing fits you. Play to your strengths.

Market Demand Dekho

Research which fields are

growing. Banking aur IT currently have high demand. Yeh practical decisions

mein help karta hai.

Guidance Lelo

Talk to teachers ya

professionals. Unke insights clarity dete hain. I once spoke to a counselor jo

really helped.

Experience Gain Karo

Internships ya part-time jobs

try karo. Yeh real-world exposure dete hain. Experience ne mujhe direction

diya.

Conclusion - अंतिम विचार

So, B.Com ke baad many career

options hain. You can work ya study further, depending on your goals. Main tip?

Apne interests aur skills pe focus karo.

For example, jab main

confused tha after B.Com, I researched a lot. Finally, finance mein career

banaya aur satisfied hoon. You too can find your path!

Start exploring aaj hi aur

apne dream career ki taraf badho. The key is action lena aur patience rakhna.

Best of luck!

Accounting Courses ,

Income Tax course ,

courses after 12th Commerce ,

Best Courses after b com ,

Diploma in accounting ,

SAP fico course

accounting and Taxation Course ,

GST Practitioner Course ,

Computer Course in delhi ,

Payroll Course in Delhi,

Tally Course in Delhi ,

diploma course after b com ,

Advanced Excel Course in Delhi ,

Computer ADCA Course

Data Entry Operator Course,

diploma in banking finance ,

stock market Course in Delhi,

six months course in accounting

Income Tax

Accounting

Tally

Career

#business accounting and taxation (bat) course#diploma in taxation#payroll management course#sap fico course#tally course#gst course#stock market

0 notes

Text

Roadmap to become Tally Master

Our comprehensive Financial E-Accounting Course offers you a step-by-step roadmap to master Tally and transform your skills in digital accounting. Learn how to use Tally ERP 9, one of the most popular accounting software solutions, to manage finances, record transactions, and generate detailed reports with ease. This course takes you through the essentials of Tally accounting, digital accounting, and financial management, ensuring you gain the skills needed to excel in the modern financial landscape. From basic concepts to advanced functionalities, you’ll learn to use Tally for effective business management, taxation, inventory tracking, and more.

📚 Learn financial e-accounting Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: Yamuna Vihar +91 9654382235 |

Uttam Nagar +91 9205122267

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

#tally course#Financial e-accounting#Tally course#Master Tally#Accounting software#Accounting career#Accounting skills#Tally Master#E-accounting course#Learn Tally#Financial accounting skills

0 notes

Text

Complete Guide to Tally Course: Learn Accounting & GST Management

A Tally course provides in-depth knowledge of accounting, GST, inventory management, and payroll processing using Tally ERP and Tally Prime. Designed for students, business owners, and professionals, this course covers financial transactions, tax compliance, and business reporting. Gain hands-on experience and enhance your career prospects in the accounting and finance industry. Start learning Tally today!

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Best Tally Training institute in Mohali

Bright Careers Solutions offers the best Tally Prime course, providing students with comprehensive training that is both practical and industry-relevant. Their course is ISO certified, ensuring a high standard of education and a recognized qualification. The Tally Prime course covers all essential aspects of accounting and business management, including GST, inventory management, payroll, and financial reporting, among others. With expert instructors and a hands-on approach, students gain real-world skills that prepare them for successful careers in accounting and finance. This certification boosts employability and provides a solid foundation for future growth in the field.

0 notes

Text

Scope Computers

Master Tally with Our Prime Tally Course! 🎓

Learn Tally from basics to advanced, including GST, payroll, and financial reporting. Perfect for students, professionals, and business owners.

✅ Hands-on Training ✅ Expert Guidance ✅ Certification Included

📅 Enroll Today and Elevate Your Accounting Skills

#tally#tallyprime#tallyeducation#tally course#tally training#financialaccounting#tally expert#tally certification#payroll management#skill development#boost your career#gst training

0 notes

Text

Accounting Classes Near Me

If you're looking to take accounting classes near you, various options may be available depending on your location. Local community colleges, universities, or adult education centers often offer introductory and advanced accounting courses, either in-person or online. These classes cover essential topics such as bookkeeping, financial statements, tax preparation, and auditing.

0 notes

Text

Role of Tally in Every Business Field.

In today's dynamic business environment, effective financial management is critical for success. Tally, a leading accounting software, has become a cornerstone for businesses across various sectors. This blog explores why Tally is vital for every business field, the career opportunities it offers, and how joining DICS Innovatives can help you carve out a successful career in this domain.

Why Tally is Important for Every Business Field

1. Streamlined Accounting Processes

Tally simplifies complex accounting tasks, making it accessible for businesses of all sizes. From small startups to large enterprises, Tally allows users to manage bookkeeping, invoicing, and payroll efficiently, ensuring that financial records are accurate and up-to-date.

2. Real-Time Financial Insights

Access to real-time data is essential for making informed business decisions. Tally provides instant financial reports and analytics, enabling businesses to monitor cash flow, track expenses, and identify trends—crucial for strategic planning.

3. Improved Accuracy and Compliance

Manual accounting is prone to errors, which can lead to financial discrepancies. Tally reduces this risk by automating calculations and checks, ensuring accuracy in financial reporting. Additionally, it helps businesses stay compliant with tax laws and regulations.

4. Versatility Across Industries

Regardless of the sector—be it retail, manufacturing, healthcare, or services—Tally is adaptable to various business needs. Its features cater to different industry requirements, making it a versatile tool for financial management.

5. Cost-Effective Solution

Tally is a cost-effective solution for businesses, especially small and medium-sized enterprises (SMEs). Its affordability combined with robust features makes it an ideal choice for managing finances without incurring high operational costs.

Career Opportunities with Tally

1. Accountant

Accountants play a crucial role in maintaining financial records and preparing financial statements. Proficiency in Tally is often a requirement for this position, making it an essential skill for aspiring accountants.

2. Finance Manager

Finance managers utilize Tally to oversee financial operations, manage budgets, and analyze financial performance. This role is vital for guiding a company's financial strategy and ensuring sustainable growth.

3. Tax Consultant

Tax consultants leverage Tally to manage tax compliance and planning for businesses. A deep understanding of Tally is essential for efficiently handling tax returns and ensuring adherence to regulations.

4. Business Analyst

Business analysts use Tally to analyze financial data and provide insights that drive strategic decisions. This role bridges the gap between finance and business, making it essential in various sectors.

Join DICS Innovatives for a Better Career

If you're looking to enhance your Tally skills and embark on a rewarding career, consider joining DICS Innovatives. Here’s why it’s the right choice for aspiring professionals:

1. Comprehensive Training Programs

DICS Innovatives offers extensive courses that cover all aspects of Tally, from basic functionalities to advanced features. You’ll gain practical knowledge that is directly applicable in the workplace.

2. Experienced Instructors

Learn from industry professionals with real-world experience. Their insights and guidance can help you navigate your career path and prepare for the challenges of the financial sector.

3. Job Placement Assistance

DICS Innovatives not only trains you but also provides job placement support after course completion. Their strong industry connections can help you secure a position in your desired field.

4. Flexible Learning Options

With both online and offline training available, you can choose a format that fits your schedule, making it easier to balance your education with other commitments.

Conclusion

In a world where financial management is crucial for business success, Tally stands out as a vital tool for companies across all sectors. Mastering Tally Institute in Pitampura not only enhances your employability but also opens doors to numerous career opportunities in accounting and finance. By joining DICS Innovatives, you can equip yourself with the knowledge and skills needed to thrive in this competitive landscape.

0 notes

Text

Best Diploma Course After B Com: Unlock Your Career Potential

Graduating with a Lone ranger of Business (B.Com) degree opens ways to different vocation ways. In any case, in the present serious market, having extra abilities can fundamentally upgrade your employability. A recognition course after B.Com is a superb method for acquiring particular information and useful mastery in a particular space. A considerable lot of these projects, like one-year Tally Course in money, bookkeeping, or the board, are intended to give work prepared abilities that can speed up your expert development.

In this article, we will investigate probably the most famous confirmation choices after B.Com, including the Count Course, and how these momentary courses can shape your profession.

Why Seek after a Certificate Course After B.Com?

Seeking after a certificate Tally Course after B.Com can be an essential choice in light of multiple factors:

1. Particular Information

While a B.Com degree gives major areas of strength for an in business and money, a recognition centers around particular abilities, making you a specialist in a particular region.

2. Brief Term

Most confirmation programs, including one-year courses, are present moment yet complete, permitting you to enter the work market rapidly.

3. Down to earth Preparing

Recognition courses underline involved preparing, furnishing understudies with industry-pertinent abilities.

4. Better Profession Amazing open doors

Extra capabilities can make your resume stick out, expanding your possibilities arrival more lucrative jobs.

Top Recognition Courses After B.Com

1. Confirmation in Monetary Bookkeeping (DFA)

A Confirmation in Monetary Bookkeeping is an ideal decision for the people who need to have practical experience in bookkeeping, tax collection, and money. This course centers around reasonable abilities and gives preparing in well known bookkeeping programming like Count.

Key Highlights:

Learning monetary revealing and investigation

Preparing on Count and other bookkeeping programming

Information on tax assessment, including GST consistence

Vocation Potential open doors:

Monetary Bookkeeper

Charge Advisor

Accounts Administrator

2. Count Course

One of the most well known one-year courses, the Count Course is ideal for people looking for aptitude in overseeing accounts utilizing Count programming. Count is generally utilized in organizations for errands, for example, accounting, GST recording, and finance the executives.

Key Highlights:

Dominating Count ERP 9 and Count Prime

GST bookkeeping and consistence

Finance the board and stock dealing with

Vocation Valuable open doors:

Count Administrator

Accounts Leader

GST Specialist

3. Recognition in Banking and Money

This course centers around banking activities, monetary administrations, and venture the executives. A Recognition in Banking and Money is great for those seeking to work in the financial area.

Key Elements:

Figuring out monetary business sectors and instruments

Preparing using a loan investigation and hazard the executives

Functional openness to banking activities

Profession Open doors:

Banking Official

Monetary Examiner

Speculation Investor

4. Confirmation in Tax collection

Tax collection is a basic part of monetary administration, and organizations require talented experts to deal with their expense commitments. This recognition course gives mastery in immediate and circuitous tax collection, including GST.

Key Highlights:

Understanding personal assessment and corporate expense

GST consistence and recording

Charge arranging methodologies

Profession Valuable open doors:

Charge Expert

GST Specialist

Charge Expert

5. Certificate in Human Asset The board (HRM)

For those keen on the administration side of business, a Certificate in HRM offers experiences into enlistment, finance the board, and representative relations.

Key Highlights:

Preparing on HR devices and programming

Grasping work regulations and finance frameworks

Learning enrollment and representative commitment techniques

Vocation Valuable open doors:

HR Leader

Finance Trained professional

Ability Obtaining Director

6. Recognition in Computerized Advertising

With the ascent of online organizations, advanced showcasing has turned into a fundamental ability. This course is great for business graduates who need to investigate showcasing and publicizing in the computerized space.

Key Elements:

Learning Website optimization, SEM, and online entertainment advertising

Preparing on instruments like Google Examination and AdWords

Creating content advertising and email promoting systems

Vocation Open doors:

Advanced Advertising Chief

Website design enhancement Trained professional

Virtual Entertainment Administrator

Advantages of One-Year Courses After B.Com

Picking a one-year course enjoys unmistakable benefits, particularly for late alumni:

Fast Vocation Movement

Momentary courses permit you to acquire work prepared abilities without going through years in advanced education.

Reasonable Choice

Confirmation programs are much of the time more reasonable than degree courses, making them open to a more extensive crowd.

Upgraded Employability

Bosses esteem up-and-comers with specific abilities, expanding your possibilities getting a helpful job.

Adaptable Learning Choices

Numerous confirmation courses are accessible on the web or parttime, permitting you to learn at your own speed.

How to Pick the Right Certificate Course?

While choosing a certificate course after B.Com, think about the accompanying elements:

1. Profession Objectives

Pick a course that lines up with your vocation yearnings. For example, decide on a Count course to have some expertise in bookkeeping programming or a recognition in HRM in the event that you're leaned toward individuals the executives.

2. Industry Interest

Research the work market to distinguish abilities and capabilities that are sought after.

3. Course Happy

Guarantee the educational program covers commonsense preparation and incorporates pertinent instruments and programming.

4. Authorization

Sign up for an organization with a decent standing and perceived certificates.

Best Organizations Offering Certificate Courses

1. Organization of Expert Bookkeepers (IPA)

Known for its bookkeeping and money programs, including Count and tax assessment courses.

2. NIIT

Offers an extensive variety of industry-pertinent certificate courses, including monetary bookkeeping and computerized showcasing.

3. Henry Harvin Bookkeeping Foundation

Spends significant time in bookkeeping and GST preparing, with reasonable openness to Count.

4. APTECH

Gives IT and money related recognition programs with adaptable learning choices.

Vocation Possibilities After Certificate Courses

Finishing a Diploma course after B.Com can prompt various profession open doors, for example,

Bookkeeping Jobs: Positions like Count administrator, accountant, or expense advisor are profoundly pursued.

Banking Area: Jobs in retail banking, credit examination, and venture the executives.

The board Positions: HR leader or finance expert jobs in huge associations.

Pioneering Adventures: Abilities from these courses can likewise assist you with dealing with your business funds actually.

End :

A diploma course after B.Com is a great method for acquiring particular abilities and upgrade your profession possibilities. Programs like the Count Course or a one-year course in bookkeeping, money, or showcasing are intended to satisfy the needs of the cutting edge work market.

By picking the right course and organization, you can make ready for a compensating profession. Whether you expect to turn into a bookkeeping master or a computerized showcasing subject matter expert, putting resources into a recognition course is a stage toward accomplishing your expert objectives.

0 notes

Text

Master Tally with the Best Tally Course at DICS Institute in laxmi nagar.

the Best Tally Course in Laxmi Nagar – Start Your Career in Accounting Today

In today’s world, accounting and finance professionals must be adept with the latest tools and technologies to stay competitive. Tally is one of the most popular accounting software used by businesses worldwide to manage financial transactions. If you’re looking to enhance your accounting skills or start a career in finance, the Tally Course in Laxmi Nagar is the perfect choice for you.

At our Tally Institute in Laxmi Nagar, we offer a comprehensive Tally Course designed to help you master the software and gain practical knowledge in accounting. Our course is structured to provide you with everything you need to know, from basic accounting principles to advanced financial management techniques.

Why Choose Our Tally Course in Laxmi Nagar?

Our Tally Course in Laxmi Nagar is designed for individuals who wish to build a strong foundation in accounting and financial management. With 100% placement assistance, we ensure that our students not only learn but also get the support they need to secure jobs in top companies. Our course is affordable, and we offer flexible payment options to make learning accessible to everyone.

The course duration is 3 months, providing you with enough time to master the various features of Tally. Whether you're a beginner or someone looking to upgrade your skills, our expert trainers will guide you through each module with practical examples and hands-on training.

What Will You Learn in the Tally Course?

Our Tally course covers all the key modules that will help you become proficient in managing accounting tasks with ease:

Chart of Accounts In this module, you will learn how to set up and manage a Chart of Accounts in Tally. This is the foundation of every accounting system, where you will organize and categorize different financial transactions for better record-keeping and reporting.

Billing and Invoicing You will be taught how to generate and manage bills and invoices efficiently using Tally. This module includes creating sales and purchase invoices, maintaining transaction records, and managing GST-compliant invoices.

Financial Reports One of the key aspects of accounting is generating financial reports. In this module, you will learn how to use Tally to generate important financial reports like the Balance Sheet, Profit & Loss Account, and Trial Balance. You’ll also learn how to analyze these reports to evaluate the financial health of a business.

Cash Flow Management Effective cash flow management is essential for the survival of any business. This module covers how to track and manage cash flows, including receipts and payments. You’ll learn how to monitor a business's liquidity and make informed financial decisions based on the cash flow report.

Banking and Reconciliation In this module, you will learn how to manage banking transactions using Tally, such as recording payments, deposits, and withdrawals. You will also be trained in bank reconciliation, a critical process for matching the business’s bank statement with its books, ensuring accuracy and avoiding discrepancies.

GST (Goods and Services Tax) Understanding GST is crucial for accountants in India. Our course provides in-depth knowledge of how to apply GST in Tally for sales and purchases. You will also learn how to generate GST-compliant invoices and file GST returns, which is a key requirement for businesses in India.

Inventory Management Tally also provides powerful tools for managing inventory. You will learn how to track stock, manage purchase and sales orders, and generate inventory reports. This module will help you keep track of stock levels and streamline the inventory management process.

Payroll Management In this module, you will learn how to process payroll using Tally. You will get hands-on experience in generating salary slips, managing deductions, and maintaining employee records.

100% Placement Assistance

We are committed to your career success. Our Tally Institute in Laxmi Nagar provides 100% placement assistance to ensure you get the job you deserve. From helping you build an effective resume to preparing you for interviews, we guide you every step of the way to ensure a smooth transition into the workforce.

Affordable Fees for Quality Education

We believe in offering quality education at affordable prices. Our Tally Course in Laxmi Nagar is competitively priced, ensuring that you get the best value for your investment. Additionally, we offer flexible payment options so you can start your course without any financial burden.

Join the Best Tally Course in Laxmi Nagar Today!

Our Tally Course in Laxmi Nagar is designed to provide practical knowledge that you can apply immediately in your career. With expert instructors, hands-on training, and 100% placement support, we ensure that you are job-ready by the end of the course.

Enroll today to start your journey towards becoming a proficient Tally user and securing a promising career in accounting and finance. Join the best Tally institute in Laxmi Nagar and unlock a world of opportunities!

https://www.dicslaxminagar.com/tally-institute-in-laxmi-nagar.php

0 notes

Text

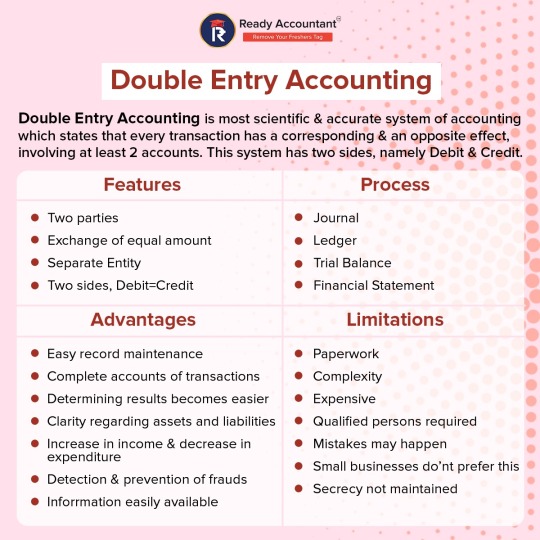

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

What is the Difference Between Manual Accounting and e-Accounting?

Introduction

Accounting has been the backbone of businesses for centuries, evolving from traditional bookkeeping methods to modern digital solutions. In today’s fast-paced world, e-Accounting is revolutionizing how financial records are managed, making processes more efficient and error-free. But how does it compare to manual accounting? Let’s explore the key differences between the two and understand why e-Accounting is becoming the preferred choice for businesses and professionals.

Understanding Manual Accounting

Manual accounting is the conventional practice of recording transactions on paper with the help of physical registers, ledgers, and journals. It involves accountants doing arithmetic calculations, keeping records, and making financial statements manually. Manual accounting has been practiced for centuries and is popular among small businesses that have a small scale of operations.

Characteristics of Manual Accounting:

Transactions are recorded manually in books and ledgers.

Requires human labor for calculations and financial statements.

Time-consuming and susceptible to human mistakes.

No automation, making data retrieval challenging.

No access to real-time data; updates need manual inputs.

Understanding e-Accounting

With advancements in technology, e-Accounting has emerged as a modern approach to financial management. It involves using accounting software and cloud-based platforms to maintain financial records digitally. This method is widely used in corporate businesses, small enterprises, and even startups due to its efficiency, accuracy, and automation.

Key Features of e-Accounting:

Transactions are recorded digitally using accounting software.

Automated calculations minimize human errors.

Provides real-time access to financial data.

Cloud storage allows remote access to data.

Quicker processing and report creation.

Key Differences Between Manual Accounting and e-Accounting

Factors

Manual Accounting

e-Accounting

Recording Transactions

Handmade using ledgers and journals.

Electronic through software such as Tally, QuickBooks, and SAP.

Possibility of Errors

High likelihood of errors in calculations and human mistakes.

Less possibility of errors through automated calculations.

Data Security

Susceptible to damage, loss, or theft.

Safe through cloud storage and password protection.

Time Consumption

Takes a lot of time in calculations and report generation.

Quicker processing with automation and real-time report generation.

Cost Effectiveness

Lower in cost initially but involves extra expenditure on storage and maintenance.

Economical in the long term, saving paper and labor charges.

Data Accessibility

Restricted accessibility; physical presence is needed.

Accessible at all times, any place with an internet connection.

Why Businesses Are Moving to e-Accounting

The change in financial management through digital technology has prompted enterprises to move toward e-Accounting because it is efficient and reliable. Listed below are a few important reasons why e-Accounting has become the preference:

1. Real-Time Data Access

Unlike manual accounting, where accounts are updated periodically, e-Accounting offers instant access to data. Companies can monitor their financial position in real time, resulting in improved decision-making.

2. Accuracy and Error Minimization

Manual calculations tend to result in errors, which may lead to financial inconsistencies. With e-Accounting, automated processes guarantee accuracy, minimizing the chances of errors in financial reporting.

3. Time and Cost Savings

Traditional accounting takes hours of work to prepare financial statements. e-Accounting automates most processes, conserving precious time and minimizing costs related to paper records, storage, and manpower.

4. Safe Data Storage and Backup

Paper records are susceptible to loss, destruction, or theft. e-Accounting systems provide cloud-based storage, which secures data, provides automatic backup, and has limited access for authorized personnel.

5. Compliance with Tax Regulations

Most e-Accounting systems have in-built tax compliance functions, allowing for easy, error-free filing of GST, TDS management, and financial reporting. This keeps a company legally compliant without extra efforts.

Should You Learn e-Accounting?

For students and working professionals who want to pursue a career in accounting, learning e-Accounting is necessary. Since more and more businesses are depending on computerized accounting software, knowing e-Accounting tools such as Tally, QuickBooks, SAP, and Excel can provide job opportunities that can earn you a good income. If you are looking to become an accountant, tax advisor, or financial analyst, possessing e-Accounting skills can make you stand out in the employment market.

Conclusion

Though manual accounting has been a reliable practice for years, e-Accounting is the way forward for financial management. Its capacity to provide speed, accuracy, security, and accessibility makes it the first choice for companies and professionals. By embracing digital accounting tools, students and future accountants can improve their skills and remain competitive in the finance sector.

If you are in search of an institute to study e-Accounting with hands-on training, register yourself with a well-known accounting institution that provides practical learning on Tally, GST, and financial reporting. A well-structured course can lay a solid foundation and equip you with expertise in contemporary accounting practices. Visit us:

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#e accounting#gst course#tally course#tally prime#finance#tally course in yamuna vihar#tally software#tally course in uttam nagar#tally course academy#tally institute#GST course in yamuna nagar#GST course in uttam nagar

0 notes

Text

Tally Pro: Advance Your Accounting Skills

Looking to enhance your accounting and financial management expertise? Tally Pro is the perfect course to take your skills to the next level. Designed for professionals and aspiring accountants, this course offers advanced training on TallyPrime to handle complex business scenarios effectively.

Why Choose Tally Pro?

Advanced Features: Master TallyPrime tools for financial management, inventory tracking, and tax compliance.

Comprehensive Curriculum: Learn advanced accounting, GST filing, payroll management, and more.

Practical Knowledge: Get hands-on experience with real-world case studies.

Certification Advantage: Enhance your career prospects with an industry-recognized certification.

Who Should Enroll?

Whether you’re a student, working professional, or business owner, Tally Pro is designed to suit your needs and provide the skills necessary to excel in accounting and finance.

Benefits of Tally Pro

Boost your efficiency in managing financial data.

Stay compliant with statutory requirements.

Gain expertise in creating detailed financial reports and insights.

Start Your Journey Today!

Unlock your potential with the Tally Pro course. Build your confidence and capability in managing business finances with ease.

Don’t miss the opportunity to become a certified Tally professional. Enroll now!

0 notes

Text

The Role of Tax Consultants: A comprehensive guide

Taxation plays a crucial function within the monetary control of people and corporations. With ever-converting tax laws and rules, handling tax compliance may be a complex task. this is where tax experts come into the picture. They assist businesses and people navigate problematic international taxation, ensuring compliance while optimizing tax liabilities. this newsletter delves into "The role of Tax consultants:" and their importance within the economic region.

Who are Tax consultants?

Tax consultants, additionally called tax advisors, are professionals with in-depth information on tax criminal suggestions, pointers, and regulations. They help human beings, organizations, and corporations in making equipped tax returns, making plans for tax strategies, and making sure compliance with authorities' rules. Many tax consultants go through specialized schooling, inclusive of Taxation course in Kolkata, to build information in this area.

Key responsibilities of Tax Consultants

Tax-making plans and approach Tax experts expand techniques to reduce tax liabilities whilst ensuring compliance with felony requirements. They examine a customer’s monetary situation and recommend tax-saving investments, deductions, and exemptions that align with cutting-edge tax legal guidelines.

Tax Compliance and return filing Ensuring tax compliance is an essential position of tax experts. They prepare and report tax returns for people and agencies, assisting them keep away from penalties and criminal issues. Their know-how ensures that each one relevant deductions and credits are nicely applied.

Dealing with GST and other oblique Taxes With the introduction of products and offerings Tax (GST), companies require specialized help in GST compliance. Many tax specialists specialize in GST and help corporations with GST registration, return filing, and audits. individuals seeking to build understanding in this discipline can pursue a GST course in Kolkata to benefit from realistic knowledge of GST guidelines.

Representation in Tax Audits and Disputes Tax specialists constitute customers in case of tax audits, disputes, or litigation with tax authorities. They offer important documentation, reply to tax notices, and assist clear up troubles associated with tax tests.

Advisory on business Taxation Businesses frequently require professional advice on company taxation, worldwide taxation, and switch pricing. Tax experts manual organizations on structuring their financial transactions to acquire tax efficiency and compliance with nearby and global tax rules.

Taxation for people and Small groups Other than big corporations, tax experts also assist people and small commercial enterprise owners in dealing with personal and commercial enterprise taxes. They provide insights on earnings tax deductions, capital profits tax, and tax advantages for marketers.

Importance of Tax consultants within the financial sector

Ensuring Compliance with Tax legal guidelines Tax laws are complex and frequently changing. Non-compliance can bring about hefty consequences and prison consequences. Tax experts assist people and agencies stay compliant by means of retaining them up to date with modern tax regulations.

Saving Time and assets Taxation methods, consisting of documentation and return submission, may be time-consuming. Hiring a tax consultant lets companies and people to consciousness of middle sports whilst leaving tax-related matters to professionals.

Lowering Tax Liabilities Tax specialists examine financial facts to discover opportunities for tax financial savings. They help in structuring profits, investments, and prices in a tax-efficient manner.

Imparting expert financial recommendation Tax specialists paintings carefully with accountants, auditors, and monetary advisors to provide holistic economic making plan services. Many professionals decorate their expertise through an Accounting Course to serve their clients.

Supporting Startups and marketers Startups and small corporations often face tax-associated demanding situations due to restrained assets. Tax specialists help them in information tax incentives, deductions, and compliance requirements, ensuring smooth monetary operations.

How to end up a Tax consultant?

If you are inquisitive about becoming a tax representative, you can follow these steps:

Educational Qualification – A degree in accounting, finance, or commercial enterprise is beneficial.

Specialized Training – guides like the Taxation or a GST route in Kolkata offer sensible know-how and competencies required for tax consultancy.

Certifications and Licensing – obtaining certifications which include Chartered Accountant (CA), Certified Public Accountant (CPA), or a tax practitioner license can decorate professional prospects.

Gaining realistic revel in – operating with a tax consulting company or interning under a skilled tax consultant allows in building information.

Continuous learning – on the grounds that tax legal guidelines are dynamic, continuous getting to know and staying updated with tax guidelines are important.

Conclusion

The role of tax consultants is critical in today’s financial panorama. From tax planning and compliance to dispute decisions and advisory, tax specialists help individuals and companies control their tax affairs efficiently.

#accounting course in kolkata#taxation course#gst course#gst course in kolkata#accounting course#tally course#taxation course in kolkata

0 notes

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes