#accounting course

Explore tagged Tumblr posts

Text

Boost Your Career with the Ready Accountant’s Certificate Program!

Be part of Ready Accountant ultimate Corporate Accounting & Finance course! We provide Tally Prime, GST Course, TDS, Taxation Course, Excel & extra with 100% process assistance. Best for freshers & upskillers. ✅ join now & remove your “fresher” tag!

1 note

·

View note

Text

Accounting and Taxation Fundamentals: Begin Your Learning

Accounting and Taxation Course: Ek Comprehensive Guide

Accounting and taxation course एक ऐसा program है जो students को financial management और tax laws सिखाता है। Yeh course perfect है for those जो finance field में career बनाना चाहते हैं। Moreover, it teaches you how to manage accounts, prepare statements, and understand tax rules easily.

Mujhe personally लगता है that such courses are game-changers for aspiring professionals. Without proper accounting, businesses apna financial health track नहीं कर सकते। Similarly, taxation knowledge ensures compliance aur tax savings, making this course super valuable.

What is an Accounting and Taxation Course?

An accounting and taxation course एक educational program है focused on accounting principles aur taxation complexities। Yeh typically covers bookkeeping, financial reporting, tax planning, aur compliance laws. Students jo yeh pursue करते हैं, they learn business finance management effectively.

In addition, courses practical training dete हैं using software jaise Tally ya QuickBooks. Yeh hands-on experience real-world scenarios ke liye students ko taiyaar karta hai। I’ve seen friends use these skills to solve actual financial problems confidently.

Benefits of Taking an Accounting aur Taxation Course

There are many benefits jab aap accounting and taxation course join करते हैं। Pehla, yeh essential skills deta hai jo har business mein zaruri hoti हैं। For example, managing accounts ya tax rules samajhna becomes second nature.

Second, employability badh jati hai after completing yeh course successfully. Companies talented accountants aur tax experts ki talash mein hamesha rehti हैं। Plus, mujhe lagta hai, yeh knowledge personal finances manage karne mein bhi helpful hai.

Key Subjects in Accounting aur Taxation Education

Accounting and taxation course mein aap variety of topics padhte हैं। Here’s a quick look at some key areas:

Financial Accounting

Yeh section transactions record karna, balance sheets banan, aur income statements prepare karna sikhata hai। You’ll master accurate financial record-keeping fast.

Management Accounting

Management accounting focuses on budgeting, forecasting, aur cost analysis for decision-making. Yeh business strategy banane mein help karta hai efficiently.

Taxation Laws

Taxation laws income tax, GST, aur corporate tax ke baare mein cover karte हैं। Filing returns aur tax calculations aapko aasani se samajh aayenge.

Practical training bhi hoti hai on software jaise Tally, jo kaam ko simpler banata hai। From my observation, these subjects practical life mein kaafi kaam aate हैं।

Who Should Join Yeh Accounting aur Taxation Course?

Yeh course perfect hai for students jo 12th complete karke finance mein interest rakhte हैं। Graduates bhi isse join kar sakte हैं apne career ko enhance karne ke liye। Even professionals already working in finance can upskill with this.

Entrepreneurs ko bhi yeh course business finances manage karne mein help karta hai। Agar aap personally money management seekhna chahte ho, toh yeh beneficial hai। Basically, anyone with finance curiosity should try it out!

Job Opportunities After Accounting aur Taxation Course

After this course, kaafi career paths khul jate हैं your future ke liye। Here are some options:

Accountant

Aap firms ya corporate departments mein accounts manage kar sakte ho। Financial statements banane ka kaam aapka daily routine ban jayega.

Tax Consultant

Tax consultant ban kar, aap tax planning aur compliance mein logon ki madad karoge। Yeh role flexibility aur good income deta hai.

Auditor

Auditors financial statements check karte हैं to ensure accuracy aur law compliance। Yeh job precision aur responsibility mangta hai.

Meri cousin ne yeh course kiya and now she’s a successful tax consultant. Demand for such professionals hamesha high rehti hai, so opportunities are endless.

How to Pick the Best Course for You

Choosing the right course important hai apne goals achieve karne ke liye। Pehle, curriculum check karo to see if it covers essential topics thoroughly. Faculty ka experience bhi dekho, kyunki unka guidance career shape karta hai.

Next, ensure course accredited hai aur practical training offer karta hai। Latest tax laws aur accounting standards updated hone chahiye. Reviews padhna ya alumni se baat karna bhi smart move hai.

Conclusion

Overall, accounting and taxation course ek valuable investment hai finance lovers ke liye। Yeh skills aur knowledge deta hai jo career ko boost kar sakta hai। So, agar aap interested ho, toh enroll karne mein hesitate mat karo!

#diploma in taxation#business accounting and taxation (bat) course#payroll management course#accounting course#sap fico course#gst course#stock market

0 notes

Text

The Importance of Financial Planning for Small Businesses

Financial planning is crucial for small businesses to ensure long-term stability and growth. It helps manage cash flow, reduce risks, and make informed investment decisions. Proper budgeting, tax planning, and forecasting prevent financial crises and support business expansion. Small business owners can enhance their financial skills by enrolling in an online course on accounting, gaining essential knowledge to manage finances effectively and drive their business toward success.

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Join our Accounting Course in Chandigarh

IPAT Institute offers a professional Accounting Course in Chandigarh. With expert training and an industry-focused curriculum, we prepare students for successful careers in accounting and finance. Join us to gain essential skills for opportunities in the financial sector.

0 notes

Text

Business Accounting and Taxation Course Curriculum: What You'll Learn

In the present powerful business world, the interest for experts with top to bottom information on Business Accounting and Taxation Course is at an untouched high. Organizations depend on gifted people to deal with their monetary cycles and guarantee consistency with always advancing assessment regulations. One program that has acquired critical fame among trade graduates and working experts is the Business Bookkeeping and Tax collection Course.

This article investigates the subtleties of this course, its advantages, vocation possibilities, and why it is a brilliant decision for anybody hoping to construct a lifelong in Business Accounting and Taxation Course.

What is a Business Accounting and Taxation Course?

The Business Accounting and Taxation Course (BAT) is a specific program intended to give understudies a pragmatic comprehension of key monetary ideas, bookkeeping programming, and expense guidelines. Dissimilar to customary degree programs, this course centers around genuine applications, making it ideal for people who wish to acquire work prepared abilities in a brief period.

Key Highlights of the Course:

Covers fundamental points like GST, direct duties, finance the board, and monetary revealing.

Offers involved preparing with bookkeeping programming like Count, SAP, and QuickBooks.

Plans understudies for jobs in bookkeeping, reviewing, and tax assessment.

Why Pick a Business Accounting and Taxation Course?

Signing up for a Business Accounting and Taxation Course offers various benefits:

1. Industry-Significant Abilities

The course is custom fitted to address the issues of the business world. It gives viable information on bookkeeping cycles and assessment regulations that are straightforwardly pertinent in the working environment.

2. Brief Length

Not at all like extended degree programs, the BAT course is commonly finished in a couple of months, permitting understudies to rapidly enter the work market.

3. Popularity for Talented Experts

With organizations continually exploring complex expense frameworks and monetary guidelines, there is a developing interest for prepared experts in bookkeeping and tax collection.

4. Professional success

For people previously working in the money area, this course can assist with upgrading their abilities and increment their possibilities of advancements or better open doors.

5. Pioneering Advantages

Business people and entrepreneurs can likewise profit from this course, as it furnishes them with the information expected to deal with their business funds actually.

Educational program of the Business Accounting and Tax assessment Course

The Business Accounting and Taxation Course covers a great many points to guarantee a balanced comprehension of the subject. Here are a portion of the center parts:

1. Bookkeeping Basics

Standards of bookkeeping

Diary sections and record support

Arrangement of fiscal summaries

2. Tax assessment

Direct assessments (Personal Expense)

Roundabout expenses (GST)

Charge documenting and consistence

3. Finance The board

Estimation of compensations

Opportune Asset (PF) and Representative State Protection (ESI)

TDS on compensations

4. Monetary Revealing

Planning of asset reports

Benefit and misfortune explanations

Income examination

5. Bookkeeping Programming Preparing

Active involvement in Count, SAP, and QuickBooks.

6. Progressed Succeed

Information investigation and monetary displaying utilizing Succeed.

Who Can Sign up for a Business Bookkeeping and Tax collection Course?

This course is reasonable for a great many people, including:

1. Business Graduates

B.Com graduates hoping to spend significant time in bookkeeping and tax assessment will view this as course exceptionally advantageous.

2. Working Experts

Money and bookkeeping experts looking to overhaul their abilities and advance their professions can sign up for this course.

3. Business visionaries and Entrepreneurs

Entrepreneurs can acquire important bits of knowledge into dealing with their business funds effectively.

4. Work Searchers

People hoping to begin their vocations in bookkeeping or tax collection can involve this course as a venturing stone.

Profession Open doors In the wake of Following through with the Tasks

Finishing a Business Bookkeeping and Tax collection Course opens up different profession choices in the money and bookkeeping area. A portion of the jobs you can seek after include:

1. Charge Specialist

Give charge arranging and consistence administrations to people and organizations.

2. Bookkeeper

Oversee monetary records, plan reports, and guarantee consistence with bookkeeping norms.

3. GST Expert

Help organizations in recording GST returns and overseeing consistence with GST guidelines.

4. Monetary Investigator

Investigate monetary information to give experiences and proposals to business choices.

5. Finance Supervisor

Handle finance processes, including pay computations and legal allowances.

6. Reviewer

Direct monetary reviews to guarantee precision and consistence with administrative principles.

7. Business Consultant

Offer consultancy administrations to organizations on monetary administration and assessment improvement.

Advantages of a Business Bookkeeping and Tax collection Course

1. Viable Information

The course underlines active preparation, guaranteeing understudies are work prepared upon finish.

2. Better Work Possibilities

The abilities gained through this course are exceptionally pursued by bosses, prompting better open positions and more significant compensations.

3. Time and Cost Proficiency

Contrasted with degree programs, this course is more limited in term and more reasonable.

4. Flexibility Across Enterprises

Each business, no matter what its size or industry, requires bookkeeping and duty the executives, making these abilities generally appropriate.

5. Upgraded Certainty

The complete information and abilities acquired through this course impart trust in dealing with certifiable monetary situations.

How to Pick the Right Establishment for the Course?

While choosing an establishment for the Business Bookkeeping and Tax collection Course, think about the accompanying elements:

1. Certification

Guarantee the foundation is perceived and offers affirmation upon consummation of the course.

2. Educational program

Check whether the schedule is cutting-edge and covers generally fundamental points.

3. Reasonable Preparation

Search for establishments that give involved preparing genuine applications.

4. Arrangement Help

Establishments offering position backing can help you launch your profession.

5. Surveys and Tributes

Research online surveys or address graduated class to measure the nature of instruction and preparation.

End:

A Business Accounting and Taxation Course is a brilliant decision for anybody hoping to construct a compensating profession in the field of money and tax collection. The down to earth abilities and industry information acquired through this course upgrade employability as well as entryways to different worthwhile profession amazing open doors.

Whether you’re a trade graduate, a functioning proficient, or a business visionary, this course gives the devices and information expected to succeed in the unique universe of business and money. Venture out towards an effective vocation by signing up for a Business Accounting and Taxation Course today!

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course ,Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

Boost Your Financial Efficiency With Accounting Course Singapore

Build your skills in an accounting course on essential accounting knowledge. Perfect for anyone starting or advancing in accounting, this course helps you thoroughly understand accounting principles and concepts needed to manage accounting tasks effectively. With practical exercises using cloud-based accounting software, you’ll become proficient in using key accounting software tools to maintain accurate records and transactions, perform swift bank reconciliations, and generate detailed financial reports.

0 notes

Text

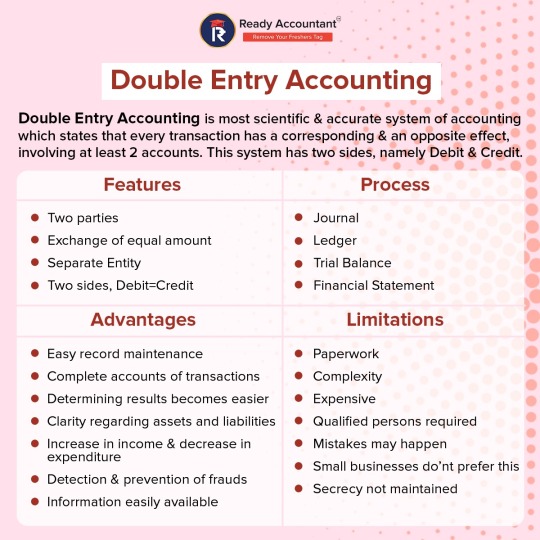

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Accounting Profit vs. Economic Profit – Key Differences

Know-how Accounting profit vs. Economic Profit is key for financial choices. Accounting profit is net income from explicit charges, while economic profit includes both explicit and implicit expenses, assisting resource efficiency. For anyone who wants to gain knowledge in the Accounting field then an Accounting Course from Ready Accountant is beneficial.

0 notes

Text

Top Challenges and Rewards of an Accounting Career

Accounting Career: The Path to Financial Success

What is an Accounting Career? | एक अकाउंटिंग करियर क्या है?

An accounting career involves managing financial records, budgeting, and ensuring a company’s financial health. Accounting professionals work with numbers, analyzing and preparing financial statements. एक अकाउंटिंग करियर का मतलब होता है वित्तीय रिकॉर्ड्स का प्रबंधन करना, बजट बनाना, और कंपनी की वित्तीय स्थिति की देखभाल करना। This field is perfect for those who love working with numbers and analyzing data.

Why Choose a Career in Accounting? | अकाउंटिंग करियर क्यों चुनें?

Choosing an accounting career can lead to long-term job security. The demand for accountants is high in various industries. अकाउंटिंग में करियर बनाने से आपको नौकरी में सुरक्षा मिलती है, क्योंकि यह क्षेत्र हमेशा बढ़ रहा है। Every business, from small startups to large corporations, needs accounting experts.

Job Stability and Growth | नौकरी की स्थिरता और वृद्धि

The accounting profession offers stability and consistent demand. Businesses, governments, and non-profits all require accountants. अकाउंटेंट्स की मांग कभी कम नहीं होती। Whether it's tax season or year-end reporting, accountants are always in demand.

Example: During financial crises or economic downturns, accountants are still needed to help companies manage their finances wisely.

Lucrative Pay Scale | अच्छा वेतनमान

Accounting is one of the most financially rewarding careers. As you gain experience, your salary increases significantly. अकाउंटिंग में करियर बनाने से अच्छा वेतन प्राप्त होता है, खासकर अगर आप अच्छे अनुभव के साथ आगे बढ़ते हैं। High-level positions such as Chief Financial Officer (CFO) or Tax Manager can offer six-figure salaries.

Example: Starting as a junior accountant might not pay much, but after gaining experience, you could be earning more than most jobs in the industry.

What Skills Are Required for an Accounting Career? | एक अकाउंटिंग करियर के लिए कौन सी क्षमताएं जरूरी हैं?

To succeed in an accounting career, there are certain skills you need to develop. These include technical and soft skills that will help you stand out in the competitive job market. एक अकाउंटिंग करियर में सफलता पाने के लिए आपको कुछ महत्वपूर्ण क्षमताओं की आवश्यकता होती है।

1. Analytical Skills | विश्लेषणात्मक क्षमताएं

Accountants must be able to analyze financial data and identify trends. They need to evaluate complex information to make sound decisions. अकाउंटेंट्स को वित्तीय डेटा का विश्लेषण करना आता है और उन्हें ट्रेंड्स पहचानने की क्षमता होनी चाहिए। This skill ensures that financial reports are accurate and useful.

Example: An accountant reviewing financial statements might notice discrepancies and investigate them further to maintain accuracy.

2. Attention to Detail | विवरण पर ध्यान

In accounting, small mistakes can lead to significant issues. A sharp eye for detail is essential in this career. अकाउंटिंग में छोटी गलती भी बड़े परिणाम दे सकती है, इसलिए विवरण पर ध्यान रखना बहुत महत्वपूर्ण होता है। Whether it's checking invoices or reviewing tax returns, precision is key.

Example: A minor error in tax reporting could lead to fines, which is why attention to detail is crucial for accountants.

3. Strong Communication Skills | प्रभावी संचार कौशल

Accountants often interact with different departments or clients. Being able to communicate financial data in an easy-to-understand way is important. अकाउंटेंट्स को वित्तीय जानकारी को समझाने की क्षमता होनी चाहिए, ताकि सभी संबंधित पक्ष सही निर्णय ले सकें। Clear communication helps build trust and makes the financial process smoother.

Example: An accountant may need to explain complex financial concepts to a non-financial team or client.

4. Organizational Skills | संगठनात्मक क्षमताएं

An accounting career requires excellent organizational skills. You’ll be handling multiple tasks, such as tax filings, audits, and financial reports. अकाउंटिंग में समय पर काम करना और सब कुछ सही से व्यवस्थित करना बहुत जरूरी है। This helps you stay on top of deadlines and manage multiple projects effectively.

Example: Keeping financial records organized allows accountants to quickly find the necessary information during audits or tax preparation.

Career Opportunities in Accounting | अकाउंटिंग में करियर के अवसर

The accounting profession offers a variety of career paths. You can work in different industries, from public accounting firms to government agencies. अकाउंटिंग में बहुत सारे करियर विकल्प हैं, जो आपको विभिन्न क्षेत्रों में काम करने का मौका देते हैं।

1. Public Accounting | सार्वजनिक अकाउंटिंग

In public accounting, professionals work for accounting firms. They provide services like auditing, tax preparation, and consulting for businesses. सार्वजनिक अकाउंटिंग में, आप अकाउंटिंग फर्मों के लिए काम करते हैं और अन्य व्यवसायों के लिए सेवाएं प्रदान करते हैं। It’s a great way to gain experience in a wide range of financial services.

Example: Public accountants often work with multiple clients, providing diverse services, which helps them gain valuable experience.

2. Corporate Accounting | कॉर्पोरेट अकाउंटिंग

Corporate accountants work within a company. They focus on internal financial management, budgeting, and reporting. कॉर्पोरेट अकाउंटिंग में आप कंपनी के अंदर काम करते हैं, जहां आपको वित्तीय प्रबंधन और रिपोर्टिंग से संबंधित कार्य करना होता है। It’s a more stable role compared to public accounting but can be just as rewarding.

Example: A corporate accountant might work for a manufacturing company, ensuring that the company’s budget aligns with its financial goals.

3. Government Accounting | सरकारी अकाउंटिंग

In government accounting, accountants work for local, state, or federal agencies. They manage public funds, ensuring that they are spent appropriately. सरकारी अकाउंटिंग में आप सरकारी एजेंसियों के लिए काम करते हैं, जहां आपको सरकारी फंड्स का सही उपयोग करना होता है। It’s a stable job with benefits and a strong sense of job security.

Example: Government accountants track how taxpayer money is spent, ensuring that it is used for public services like education or healthcare.

4. Forensic Accounting | फॉरेन्सिक अकाउंटिंग

Forensic accountants investigate financial discrepancies and fraud. They analyze records to find signs of illegal activities. फॉरेन्सिक अकाउंटिंग में, आप धोखाधड़ी और वित्तीय अनियमितताओं की जांच करते हैं। This role often involves working with law enforcement to uncover financial crimes.

Example: A forensic accountant might be hired to investigate a company suspected of financial fraud or embezzlement.

Educational Requirements for an Accounting Career | एक अकाउंटिंग करियर के लिए शैक्षिक आवश्यकताएँ

To start an accounting career, you need a solid educational foundation. Most accountants have at least a bachelor’s degree in accounting or finance. एक अकाउंटिंग करियर शुरू करने के लिए आपको अच्छा शैक्षिक आधार चाहिए।

1. Bachelor’s Degree in Accounting | अकाउंटिंग में स्नातक डिग्री

A bachelor’s degree in accounting is the first step to becoming an accountant. It teaches you the basics of accounting principles, taxation, and auditing. अकाउंटिंग में स्नातक डिग्री प्राप्त करना अकाउंटिंग करियर का पहला कदम है। It’s necessary to understand financial statements and accounting software.

2. Master’s Degree or CPA | मास्टर डिग्री या सीपीए

Many accountants pursue a Master’s degree or Certified Public Accountant (CPA) certification. This can open doors to higher-level positions and specialization. सीपीए या मास्टर डिग्री के साथ आप अधिक उन्नत पदों तक पहुँच सकते हैं। It also enhances your credibility and expertise in the field.

Example: Many accountants go on to earn a CPA, which allows them to file tax returns for clients and represent them before the IRS.

Challenges in an Accounting Career | अकाउंटिंग करियर में चुनौतियाँ

Though accounting can be a rewarding career, there are challenges too. Deadlines can be tight, and workloads heavy during tax season. अकाउंटिंग एक पुरस्कृत करियर हो सकता है, लेकिन इसमें चुनौतियां भी हैं।

1. Stressful Deadlines | तनावपूर्ण समयसीमा

Accountants often work under tight deadlines, especially during tax season or at year-end. This can lead to stress, but time management helps. अकाउंटेंट्स को अक्सर कड़े समयसीमा के तहत काम करना पड़ता है, जो तनावपूर्ण हो सकता है। Learning to manage time well is crucial to handle these pressures.

Example: During tax season, accountants might have to work late into the night to meet deadlines, but this pressure teaches them to manage their time more efficiently.

2. Long Working Hours | लंबी कार्य घंटियाँ

Accountants may need to work long hours, especially during busy times like audit season or when preparing year-end financial reports. लंबे समय तक काम करने की जरूरत पड़ सकती है, खासकर जब आपके पास बहुत सारे प्रोजेक्ट हों। Balancing work and life becomes important to avoid burnout.

Example: An auditor working on multiple client accounts might need to stay at the office longer to finish their work on time.

Conclusion | निष्कर्ष

An accounting career is a great choice for those interested in finance and numbers. With strong growth prospects, job security, and lucrative salaries, accounting offers a bright future. अकाउंटिंग में करियर एक बेहतरीन विकल्प हो सकता है, खासकर अगर आप वित्त और गणना में रुचि रखते हैं। Whether you pursue public accounting, corporate roles, or forensic accounting, the possibilities are endless.

Accountant course ,

Diploma in Taxation Course

courses after 12th Commerce ,

after b com which course is best ,

Diploma in finance ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Basic Computer Course fee ,

Payroll Management Course,

Tally training institute,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Delhi,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

#accounting course#diploma in taxation#payroll management course#business accounting and taxation (bat) course#sap fico course#finance

0 notes

Text

How to Create a Budget That Works for Your Business

Creating a budget that works for your business is essential for financial stability and growth. A well-structured budget helps track income, control expenses, and ensure profitability. By setting realistic financial goals and monitoring cash flow, businesses can make informed decisions. Enrolling in accounting professional courses can enhance budgeting skills, teaching strategies like forecasting and cost management. Master budgeting to improve financial efficiency and drive business success!

0 notes

Text

The Role of Tax Consultants: A comprehensive guide

Taxation plays a crucial function within the monetary control of people and corporations. With ever-converting tax laws and rules, handling tax compliance may be a complex task. this is where tax experts come into the picture. They assist businesses and people navigate problematic international taxation, ensuring compliance while optimizing tax liabilities. this newsletter delves into "The role of Tax consultants:" and their importance within the economic region.

Who are Tax consultants?

Tax consultants, additionally called tax advisors, are professionals with in-depth information on tax criminal suggestions, pointers, and regulations. They help human beings, organizations, and corporations in making equipped tax returns, making plans for tax strategies, and making sure compliance with authorities' rules. Many tax consultants go through specialized schooling, inclusive of Taxation course in Kolkata, to build information in this area.

Key responsibilities of Tax Consultants

Tax-making plans and approach Tax experts expand techniques to reduce tax liabilities whilst ensuring compliance with felony requirements. They examine a customer’s monetary situation and recommend tax-saving investments, deductions, and exemptions that align with cutting-edge tax legal guidelines.

Tax Compliance and return filing Ensuring tax compliance is an essential position of tax experts. They prepare and report tax returns for people and agencies, assisting them keep away from penalties and criminal issues. Their know-how ensures that each one relevant deductions and credits are nicely applied.

Dealing with GST and other oblique Taxes With the introduction of products and offerings Tax (GST), companies require specialized help in GST compliance. Many tax specialists specialize in GST and help corporations with GST registration, return filing, and audits. individuals seeking to build understanding in this discipline can pursue a GST course in Kolkata to benefit from realistic knowledge of GST guidelines.

Representation in Tax Audits and Disputes Tax specialists constitute customers in case of tax audits, disputes, or litigation with tax authorities. They offer important documentation, reply to tax notices, and assist clear up troubles associated with tax tests.

Advisory on business Taxation Businesses frequently require professional advice on company taxation, worldwide taxation, and switch pricing. Tax experts manual organizations on structuring their financial transactions to acquire tax efficiency and compliance with nearby and global tax rules.

Taxation for people and Small groups Other than big corporations, tax experts also assist people and small commercial enterprise owners in dealing with personal and commercial enterprise taxes. They provide insights on earnings tax deductions, capital profits tax, and tax advantages for marketers.

Importance of Tax consultants within the financial sector

Ensuring Compliance with Tax legal guidelines Tax laws are complex and frequently changing. Non-compliance can bring about hefty consequences and prison consequences. Tax experts assist people and agencies stay compliant by means of retaining them up to date with modern tax regulations.

Saving Time and assets Taxation methods, consisting of documentation and return submission, may be time-consuming. Hiring a tax consultant lets companies and people to consciousness of middle sports whilst leaving tax-related matters to professionals.

Lowering Tax Liabilities Tax specialists examine financial facts to discover opportunities for tax financial savings. They help in structuring profits, investments, and prices in a tax-efficient manner.

Imparting expert financial recommendation Tax specialists paintings carefully with accountants, auditors, and monetary advisors to provide holistic economic making plan services. Many professionals decorate their expertise through an Accounting Course to serve their clients.

Supporting Startups and marketers Startups and small corporations often face tax-associated demanding situations due to restrained assets. Tax specialists help them in information tax incentives, deductions, and compliance requirements, ensuring smooth monetary operations.

How to end up a Tax consultant?

If you are inquisitive about becoming a tax representative, you can follow these steps:

Educational Qualification – A degree in accounting, finance, or commercial enterprise is beneficial.

Specialized Training – guides like the Taxation or a GST route in Kolkata offer sensible know-how and competencies required for tax consultancy.

Certifications and Licensing – obtaining certifications which include Chartered Accountant (CA), Certified Public Accountant (CPA), or a tax practitioner license can decorate professional prospects.

Gaining realistic revel in – operating with a tax consulting company or interning under a skilled tax consultant allows in building information.

Continuous learning – on the grounds that tax legal guidelines are dynamic, continuous getting to know and staying updated with tax guidelines are important.

Conclusion

The role of tax consultants is critical in today’s financial panorama. From tax planning and compliance to dispute decisions and advisory, tax specialists help individuals and companies control their tax affairs efficiently.

#accounting course in kolkata#taxation course#gst course#gst course in kolkata#accounting course#tally course#taxation course in kolkata

0 notes

Text

Mastering double-entry accounting is essential to optimum financial management and record-keeping. Check out these tips to help you master and excel in double-entry accounting. Ready Accountant Your one-stop shop for on-the-job experience in Live Projects related to Accounting, GST, Taxation and ROC.

For more details visit: https://readyaccountant.com/

#accounting course#taxation course#gst course#tally course in kolkata#tally course#gst course in kolkata

0 notes