#Xero Integrations

Explore tagged Tumblr posts

Text

Streamline Operations with All-in-One Software - Matricle Solutions

Simplify and optimize your business with Matricle Solutions’ all in one business management software. Our tools are designed to enhance operational efficiency and drive growth.

#all in one business software#all in one business management software#inventory management software#automated invoicing#purchase order software#currency converter nz#small business management software#ordering management system#xero integrations#xero inventory management system#shopify inventory management#digital marketing nz#seo company auckland#seo services#digital marketing services

0 notes

Text

Discover enhanced efficiency in financial workflows with Xero Integrations through rootfi.dev. This powerful integration solution facilitates seamless connectivity between Xero and other applications, ensuring real-time data synchronization. Simplify accounting tasks, streamline processes, and elevate productivity with a user-friendly interface. Experience the benefits of unified financial management, making Xero Integrations via rootfi.dev a valuable asset for businesses aiming for precision and operational excellence.

0 notes

Text

#MYOB Integration#MYOB CRM#MYOB CRM Integration#MYOB Ecommerce#MYOB Ecommerce Integration#Woocommerce MYOB#MYOB Shopify#Shopify MYOB Integration#Joomla MYOB#MYOB EXO Integration#MYOB EXO CRM#Magento myob Integration#Xero myob#myob Integration with Zoho

2 notes

·

View notes

Text

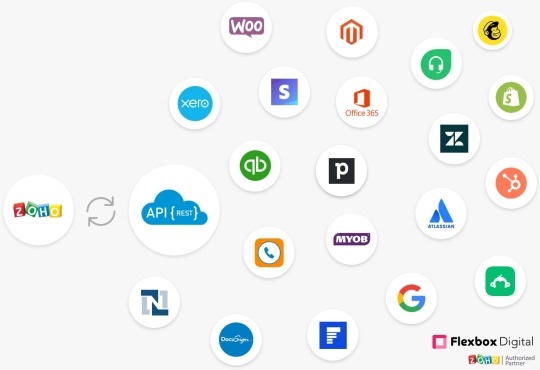

Zoho Integration & Its Work – Get Complete Details From Start

Constantly when you talk about programming applications there will come a point that you will discuss mix- interfacing one application to another. This is an essential prologue to Custom Zoho Apps Integration- it's anything but a top to bottom nerd manage, attempting to keep it basic. There are various purposes behind incorporating two programming bundles, yet the two key reasons are:

Data consistency- enter information once and have it recreated. This likewise lessens the potential for blunder in manual replication of information. An exceptionally basic model here is between the CRM framework and Accounts bundle.

The subsequent key explanation is efficient. Utilizing the model above you win a bit of business on the CRM framework; you presently need to add them to the administration work area, accounts bundle, update their email advertising subtleties, and so forth.

Local Zoho Integration

One of the benefits of utilizing applications from a solitary provider or a pack like ZohoCRMPlus or Zoho One is that Zoho has constructed various Custom Zoho Integration inside these applications. In the event that you are utilizing ZohoCRMPlus, it is exceptionally clear and quick to interface it to Zoho Analytics, Zoho Survey, Zoho Campaigns, Zoho Desk, ZohoSalesIQ, and so forth The Zoho.

Webhooks

Webhooks are a basic method of sending information starting with one application then onto the next. You may have a situation where when a Deal is set apart as Close Won on Zoho CRM API Integration you need Zoho Books to make a receipt. Each application develops their Webhooks somewhat contrastingly yet in a genuinely standard arrangement so it is an instance of perusing the documentation and understanding the designing.

Outsiders

Before we had Zoho Marketplace, a few organizations created ZOHO API Integration Melbourne and made them accessible "off the rack" - easy to enact, easy to start. For instance, on the off chance that you are utilizing Xero for your records, there are three applications accessible in the Zoho Marketplace which permit you to interface with Zoho CRM Xero Integration.

Joining Platform

A mixing stage is a place where designers have attempted to rearrange the multifaceted nature of building a custom mix by building various associations with programming applications that you would then be able to utilize an intuitive interface to construct a custom combination. Thus, for instance, on the off chance that you needed to make a Google Calendar Event from a Gmail Email, there is a template accessible.

Uniquely Built Zoho Xero Integration

There are times when nothing from what was just mentioned alternatives work for you this is the point at which you would assemble a custom Zoho Integration. Combinations like this utilization a Zoho API Integration - this is in basic terms is an approach to pass information starting with one programming application then onto the next programming application.

So what is the right choice for my Zoho Integration?

The appropriate response is it depends. The above is planned just to give you a short review of how you can coordinate Zoho applications with Custom Zoho Apps Integration.

#Custom Zoho Apps Integration#Custom Zoho Integration#Zoho API Integration#Zoho CRM API Integration#Zoho CRM Xero Integration#Zoho Xero Integration#Zoho Apps Integration Melbourne#ZOHO API Integration Melbourne#ZOHO API Integration Sydney

1 note

·

View note

Text

How to Choose the Best Accounting Software for Your Business

Introduction In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

PathQuest AP Seamlessly Integrates with Leading Accounting Systems

Experience seamless two-way integration with PathQuest AP and your accounting software. Automate invoice coding, sync payments, and optimize your workflow effortlessly. Whether it's QuickBooks, Xero, or Sage Intacct, streamline your vendor bill processing for higher efficiency and focus on value-added tasks. For more information visit us at https://pathquest.com/ap-integration/

#accounts payable integration#ap automation for quickbooks#sage intacct ap integration#xero ap automation

0 notes

Text

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Linkin Park - From Zero (with @jakeh2987)

Few bands have frustrated me more than nu-metal and rap-rock band Linkin Park. I’ve had such a complicated relationship with them for a multitude of reasons, whether for never listening to them during their initial popularity, their sound never being consistent for more than two albums, or hardly any of those sounds ever resonating with me. I’ve been listening to their discography as of late, as I’ve wanted to re-examine and re-contextualize their body of work. They’re a band that so many people love, but I’ve just never been able to “get it.” Maybe I’ve been too harsh on them over the years, so my thoughts might improve. There’s an elephant in the room that we need to address, though: on July 20th, 2017, vocalist Chester Bennington passed away by taking his own life.

I don’t know of a celebrity death that shook people to their core harder, especially for how unexpected it was. The band had just released One More Light, their foray into pop music that unfortunately didn’t sit well with longtime fans. Bennington’s death caused the band to lie dormant, and fans had no hope of the band getting back together, especially when Bennington was a once in a lifetime talent that no one could dare to replicate. They’ve stayed quiet for the past seven years, but they properly announced their return a few months ago, complete with a new singer in tow.

Emily Armstrong, of rock band Dead Sara, was touted at their new frontwoman, and boy, were fans angry. A lot of fans were welcoming and accepting, but even now, there are still a bunch of fans that can’t even fathom the idea of someone replacing Bennington, let alone a woman. Along with single “The Emptiness Machine,” the band also announced a new album, From Zero. Based on the idea of the band coming back “from zero,” as well as the band’s name being Xero, this record had a lot riding on it. I don’t want to talk about this album alone, though, so let’s welcome my buddy Jake back into the fold for this review! As a longtime fan of Linkin Park, how do you feel about them, and what was going through your mind when From Zero was announced?

When I look back on my musical journey and the development of my tastes, Linkin Park was my first favorite band, going back to around the time Minutes To Midnight came out. I just remember being excited by this form of more aggressive and heavier musc than I was used to at the time, and let's be honest, in 2006 going into 2007, I was just about to enter high school, so I was really prime for the angsty lyrics that were their signature. So, I've had love for this band for damn near 20 years now, which is kind of wild to think about, but you can imagine how shook I was personally by Chester Bennington's death. I think I actually remember you and I discussing it when the news first broke, and we were both totally shocked, because you're right, it came out of nowhere. I really had no idea what was going to happen next, but after they played their benefit show later in 2017, I was at peace with that being the end, because yeah, how could you replace someone like Bennington? Plenty of bands, absolutely iconic ones, even, have navigated tragedies and managed to come out the other side, sometimes bigger and better than ever (AC/DC immediately comes to mind), but Bennington's voice, both in the literal sense and in the sense of his lyrics and what he was saying about his mental health, was so integral to the band's identity, that I don't think you could blame anyone for wondering if they were done.

Well, seven years later, it turns out Linkin Park had more to say and share with the world, and that's in the form of this album, From Zero. A few weeks before the initial announcement and comeback show, buzz had started to build about a potential Linkin Park reunion, and I remember feeling a little apprehensive, but ultimately willing to trust Mike Shinoda that he wouldn't do any of this if there wasn't genuinely something there. The comeback show happens, Emily Armstrong gets introduced to the world as the new vocalist, and we're getting new music from one of my very favorite bands for the first time in close to a decade, something I wasn't sure was ever gonna happen again! I had no idea who Emily was, so I liked the idea of it being someone lesser known, and I also immediately loved the bold choice of choosing a woman to front one of the biggest rock bands on the planet, in a genre that has so few non-men performers at the forefront. I also really liked "The Emptiness Machine" upon first listen; it felt like a cool blend of old and new, and having Mike carry the first bit of the song before passing the reigns to Emily was a very cool symbolic way to introduce her to the fans. So, I was riding pretty high on all of this initially, honestly!

That all being said, I'd be remiss if I didn't at least briefly touch on some stuff regarding Emily's past and why some people started to question the choice to bring her on, mainly her alleged ties to the Church of Scientology and her support of now-convicted rapist Danny Masterson, of That 70's Show fane. From everything I've been able to gather from researching this, it appears that Emily was born into Scientology and hasn't been actively participating in anything relating to it for a very long time, and her support for Masterson only extended to the very first court date, and she immediately backed away once more and more evidence came to light over the course of the trial. So, after all of that was bubbling up and then was later put into a more clear perspective, I think unless you're just stubborn, or misogynstic, or both, there's a lot to be happy about regarding this comeback. So, let's talk about this album!

First, I wanna ask you, given your past history with the band, what was it about From Zero that finally made Linkin Park click for you?

When “The Emptiness Machine” first dropped, I hadn’t gone through the band’s discography yet, but it’s not only a good first single, it was a good debut single to showcase Armstrong’s vocals and how well of a fit she is for the band. I surprisingly really enjoyed it, especially for how it revived the band’s harder edged sounds, but still maintained a really catchy core. The week before From Zero came out, I got the idea to go through the band’s first couple of albums, ultimately revisiting those to see if I could enjoy those more now. Spoiler alert: Hybrid Theory and Meteora are fantastic. Despite being rather dated in spots, they still hold up quite well and they’re impeccably written, but that got me wanting to listen to their rest of their discography as I was also listening to From Zero.

I wanted to be able to compare their newest album to the rest of their discography, especially when part of From Zero’s appeal for me, personally, is that it takes a lot of elements of their other records and packages it into a tight set of 32 minutes. After going through the rest of their albums, as well as Shinoda’s last solo album, you can hear a lot of that here. Whether it’s the nu-metal of their first two albums, the alt-metal / hard-rock of 2007’s Minutes To Midnight, the moody and atmospheric sound of 2010’s A Thousand Suns, the rap-rock-meets-pop sound of 2012’s Living Things (there’s a lot of Living Things influence here, surprisingly), the post-hardcore stylings of 2014’s The Hunting Party, or the streamlined pop of 2017’s One More Light. Even on Shinoda’s 2018 solo album, Post-Traumatic, there’s some influence there.

From Zero isn’t only their first album in seven years, their first with a new singer, as well as their shortest album to date, but it’s their first album to celebrate their legacy and their body of work. Instead of going too much in one direction, because they could have easily made a nu-metal album and it would have been fine, but they took bits and pieces from their discography. Their albums are still rather hit or miss for me, but I don’t outright hate any of their albums anymore. My thoughts have improved on most of them, but their inconsistency is still kind of an issue for me, but From Zero is the first album of theirs since the first two that I’ve been able to really enjoy front to back. What about you, Jake? How do you feel about this record?

I think you hit the nail on the head there, and why I really like this album a lot; it's a celebration of the band's legacy and everything they've done before, but at the same time, and really importantly, it's also pushing them forward in a new direction that doesn't ever feel like a cheap retread or a ploy for nostalgia. That feeling of nostalgia comes naturally, just from the band playing to their strengths and having a blast doing it. "Two Faced" is probably my favorite song on the album; it's very much a called back to the Hybrid Theory/Meteora era, but I just really love the energy on that song, and there's an undeniable swagger in the back and forth between Emily and Mike. You're totally right, though, it would have been very easy to just do an album of all that, but they didn't, and that's a testament to how Linkin Park was never a band to stay stagnant, even when it didn't always work. Another highlight for me is "Over Each Other," a more ballad-y song where Emily fully gets the spotlight. It wouldn't feel out of place on Living Things or even One More Light, but whereas I thought One More Light in particular didn't do a lot with the sound they were going for, a song like this takes that idea and infuses it with a renewed Linkin Park essence that makes it work a lot better.

What were some of your highlights on the album?

From Zero certainly feels like a new direction, too, even with a lot of their previous albums infused within its DNA. That’s another reason why this record works so well, because it has its own identity. As for highlights, “Two Faced” is my favorite as well, because it has that nu-metal sound of the first two albums, but with something new and interesting about it. Emily and Mike sound great, too, but speaking of risks, “Casualty” is another huge highlight. I didn’t have Linkin Park making a hardcore song on my bingo card for this year, but here we are. Emily’s screams are fantastic, and while Mike is kind of just shouting, he still is pushing his voice in a way he hasn’t before. I also really like “Over Each Other,” because it’s a solo cut from Emily, and it’s a good choice to put a song with just her here. Songs like that, as well as some of the more pop-focused cuts, like “Stained,” “Overflow,” and the closing track, “Good Things Go” have the same kind of sound that One More Light did, like you said, but with something more. The latter track is another highlight, too, because of its very emotional and weighty sound that closes the album out on a real good note.

"Good Things Go" is actually a really great album closer, and I love how the last few seconds loop back around to the intro track, making for a really cool full circle loop that makes it even easier to immediately replay the album. I also gotta show some love to "Heavy Is The Crown;" that song was chosen as the theme to this year's League Of Legends world champinships, and I believe there's even a version of it featured in the newest season of Arcane (a show I really need to watch), and it's very easy to hear why. It's another quintinsensially Linkin Park song, and that long scream Emily does during the bridge?? I feel like that was the moment that was like "Okay, she's got this" for me.

I love that it loops around to the intro, because it shows that it’s a full circle experience, almost like the band itself is circling back to when they first started. They’re starting again, essentially, so I love a lot of the symbolism here. Oh, man, I forgot about “Heavy Is The Crown”! That’s definitely within my top three songs, and it’s a song that I’ve been coming back to quite a bit, whether it’s for that hook, or Emily’s wicked screams. That’s a song that shows the past and the present for the band at the same time, because you can hear their earlier material there, but also something new. I was pretty sold on her when the first single came out, but both “Heavy Is The Crown” and “Two Faced” really sold me, and actually had me more excited for the album. Mike is surprisingly a solid rapper, so I’m happy he gets to shine a lot throughout this thing. Even as a singer, he’s improved quite a bit, and it’s awesome to see their chemistry.

I also quite enjoy the lyrics on this thing, too, because they feel very quintessential Linkin Park, whether they’re interestingly vague and specific at the same time, and there’s a ton of emotional catharsis throughout. They aren’t anything too deep or poetic, but they never needed to be. Their lyrics have always been vague but specIn certain points, when Emily screams a certain line, I’m eerily reminded of Chester doing the same thing on the first two albums, and it sounds so good.

Speaking of which, there is another elephant in the room that I think we need to discuss, and that can be a good way to start to close this out — there are plenty of people that are going to write this off simply for the fact this isn’t with Chester. Even if Emily was another guy, I guarantee that people would still refuse to even give this a chance. What do you think about that minority of fans that refuse to give anything else a listen by them if it doesn’t have Chester?

You know, on some level, I do kind of get it. Chester Bennington really was one of a kind, and the rest of the band had an utterly impossible task when they were looking for someone to carry on this role. Honestly, the only scenario I could see that maybe most people wouldn't be too upset with was Mike taking on all the vocal duties himself, but as solid as I think he's grown as a vocalist, having those dual vocals is another thing that's always put Linkin Park apart from other bands in the genre. So, when such a key piece of something that meant so much to you isn't there anymore, I can understand the hesitation. But, I listen to Mike talk in any interview he's done since the comeback and how much he didn't want this to happen just for the sake of it happening, and how it only really felt like Linkin Park again after Emily starting singing on the songs, I don't know how you don't at the very least give it a solid chance. If it's not for you still, that's totally valid, but what I don't love is when people (and to be fair, this is only a very small but loud minority) invoke Chester and try to say some nonense about how this totally shits on his and the band's legacy or how they should have changed the name, or even say some downright sexist shit like "Lol it's just Paramore now!" It's like, you could just quietly move on if it's not for you, and it's not as if the rest of their discography just goes away all of a sudden. I just don't see a world where you see how happy the band is to be performing again, and how Emily's really coming into her own as she gets more comfortable, and at the very least be happy that this band gets to continue in some form, even if their new album isn't for you.

I think that’s part of the cloud that hangs over this album, albeit from a small (but vocal) minority of people with that opinion, but the elephant in the room of this album not featuring Chester looms over this thing. For a long time, it seemed impossible that they could fill his shoes, and they could have easily had Mike take on lead vocal duties, but you’re right, LP’s appeal were those dual vocals, especially the rapped vocals and the sung/screamed ones. The hesitation is understandable, and I think most people would be, but that’s the other thing: Mike and the other members would not want to bring someone aboard that they weren’t comfortable and confident in, and they brought back Linkin Park as a labor of love, not because they need a paycheck.

I could understand if you give this album a chance, and it just doesn’t do anything for you, but there are people that will refuse to listen to it out, purely out of principle. I suppose I’m just baffled, because how wouldn’t this hit with longtime fans that love the first few albums? It has a lot of the same stuff that fans have loved, and just because Chester isn’t on it, it doesn’t mean it isn’t as good. I think that’s the thing about it, too, where people can’t just be quiet if they don’t like something. People always feel the need to express their vitriol for something, no matter how small, and they’ll always find something to dislike. It’s good that it’s a small minority, because a lot of the reaction I’ve seen has been positive.

I think what will be really telling for all this when it's said and done is how they follow up From Zero. This was the foot in the door, and Linkin Park has never been one to rest on their laurels and make the same album twice, so I'm so curious to see where they go from here. I'm also hopeful that after the intial feelings of having the band back at all and having Emily there wear off, if the people who aren't gonna give it a shor or maybe aren't as into this won't be willing to give what they do next a shot. I'm probably being a tad optimistic, but I'd like to imagine that now that people know what they have, Linkin Park can really blow the doors off the place.

Regardless of all of that, I think From Zero is basically everything I could have asked for in a Linkin Park comeback. It's a lean and mean collection of songs that shows the band back doing what they do best while also pushing forward, and I'm just happy this happened at all, considering how hard I imagine it must have been for them to even think about doing it.

From Zero is an album that doesn’t need to be anything experimental or revolutionary, because it’s exactly their foot in the door. They got back together, and they need to show that they still got it, so to speak, and this is them doing what they do best, all the while adding some new and exciting ideas. It’s cool that we’re in a new era for the band, because there were many years we never thought we’d get that, so I’m anticipating what we get next. I never have been crazy about Linkin Park, but this is the album that made me “get” them, so to speak. I’m happy I get to share this joy, even if it’s from someone that hasn’t always been their biggest fan, or grew up with them, but I absolutely love this album, and it’s one of my favorites of the year.

#linkin park#from zero#heavy is the crown#good things go#the emptiness machine#rock#a thousand suns#living things#hybrid theory#meteora#the hunting party#minutes to midnight#one more light#chester bennington#mike shinoda#emily armstrong#hard rock#nu metal

7 notes

·

View notes

Text

Expert Power Platform Services | Navignite LLP

Looking to streamline your business processes with custom applications? With over 10 years of extensive experience, our agency specializes in delivering top-notch Power Apps services that transform the way you operate. We harness the full potential of the Microsoft Power Platform to create solutions that are tailored to your unique needs.

Our Services Include:

Custom Power Apps Development: Building bespoke applications to address your specific business challenges.

Workflow Automation with Power Automate: Enhancing efficiency through automated workflows and processes.

Integration with Microsoft Suite: Seamless connectivity with SharePoint, Dynamics 365, Power BI, and other Microsoft tools.

Third-Party Integrations: Expertise in integrating Xero, QuickBooks, MYOB, and other external systems.

Data Migration & Management: Secure and efficient data handling using tools like XRM Toolbox.

Maintenance & Support: Ongoing support to ensure your applications run smoothly and effectively.

Our decade-long experience includes working with technologies like Azure Functions, Custom Web Services, and SQL Server, ensuring that we deliver robust and scalable solutions.

Why Choose Us?

Proven Expertise: Over 10 years of experience in Microsoft Dynamics CRM and Power Platform.

Tailored Solutions: Customized services that align with your business goals.

Comprehensive Skill Set: Proficient in plugin development, workflow management, and client-side scripting.

Client-Centric Approach: Dedicated to improving your productivity and simplifying tasks.

Boost your productivity and drive innovation with our expert Power Apps solutions.

Contact us today to elevate your business to the next level!

#artificial intelligence#power platform#microsoft power apps#microsoft power platform#powerplatform#power platform developers#microsoft power platform developer#msft power platform#dynamics 365 platform

2 notes

·

View notes

Text

At SpryBit, we offer seamless myob integration service; Integrate MYOB with Ecommerce, CRM, Xero, zoho & boost productivity, and unlock even more value from your business applications! To know more visit: http://sprybit.com/myob-integration.html

#MYOB Integration#MYOB CRM#MYOB EXO Integration#MYOB Ecommerce#MYOB CRM Integration#Woocommerce MYOB#Shopify MYOB Integration#MYOB EXO CRM#Joomla MYOB#MYOB Ecommerce Integration#Magento MYOB Integration#Xero MYOB#MYOB Integration with Zoho

0 notes

Text

So after my previous post about me liking the idea that Xero is a wasp and I have thought about it and I thought about how that would work in the works I have.

In his backstory, I mentioned that his parents were semi-religious and grew up adoring moth culture, so with that it would make sense why both of them would be moths as interspecies marriage isn't accepted in most parts of Hallownest[can make a whole post about it and ].

Something that I didn't mention but I imagine that Xero takes after his mom(who ends up dying during childbirth whoopsy). Part of the reason why he was upset about his lynching was cause he felt like he degraded his mother as he was almost a perfect image of her. However, I never thought about what traits would take from his father.

So it would be perfect if his father was a wasp. Xero would have square eyes, thinner fur, and bent antennas. His body would be segmented though it would be hard to see under clothes and fur and he would be able to inject some venom(though it would be hard as his mouth can barely penetrate anything and would just pool in his mouth).

This was good that he looked mostly like a moth as hybrid bugs aren't well accepted, especially in a monoethnic society like the moth tribe. Xero's father wanted him to fit in as if anyone knew he was part wasp, then they would immediately think he was aggressive. To make sure he fit in he made sure that Xero would be integrated into moth society(he would have done this anyway to honor his late wife as she would have wanted this).

He integrated so well that most bugs just assume he is fully a moth, and those in the village who do know don't care enough as Xero contributes a lot. Though his wasp heritage isn't talked about until bugs start questioning him on how he is such a good fighter. He responds cause he trains with Markoth(and despite his wasp heritage, he rarely defeats his friend in a match). But this is a secret he wants to keep as long as he possibly can.

(Edit: I forgot to add, I haven't decided what type of wasp Xero's dad would be. I am thinking between a red paper wasp or a bald faced hornet)

6 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

ok xero has got to be a reference to zero from mega man right??? i mean obv the name is pronounced the same but also the fact that the Z is an X now is a nod to Mega Man X right? i mean X (the character) is integral to Zero’s story in moth mmx and the zero series. and i mean the dash and wall jump in hk are just like the dash and wall jump in mmx and zero and mmx especially is a classic essential 2d platformer so it would make sense that they reference it right? Plus Xero’s thing of trying to overthrow the king is kinda reminiscent of Zero in the zero series trying to overthrow Copy X as well. I cant tell if i’m stretching or not

#i’ve been on the mega man brainrot for basically this whole year and now that i’m getting some hk brainrot as well…..#bud says stuff#mega man#hollow knight

3 notes

·

View notes