#Uber Technologies Inc

Explore tagged Tumblr posts

Text

Uber? Lyft? What the hell is going on?

Ever had to contact customer support and heard over an automated voice instead of a human? How about contacting them and once you explain to them your issues only for them to give you ready-made responses as they haven't clue of what you're talking about? Well, that's been my excrcuiating experience as a driver for both companies at the same time. So, let's dive into how ludicrous it's been.

Let's start with Uber since it's rich with crazy stories. Uber has kind of a fair hourly wage going $25-30. You can receive payments on weekly basis like most jobs and contracts. Or you can have instant access to your money and even cash out once you've finished your shift with the Pro Card. Of course, I would choose the latter because why not? Normally I cash out directly to my debit card and needed I new one some time ago. I went in to change the details for the new card and had to undergo a security code verification via text message. I never received it so I had to contact support. I explained the issue I had and was told to whilelist my phone number from a text message. That's strange. How come I can receive text messages from Pro Card just fine when logging in, but not for this? Because this didn't work. I thought that this had to be a problem in their end. Now, a good tech support agent would troubleshoot such an issue should a solution like that not work. Not here; they "took it to further support" (Bear with here. I couldn't remember exactly what they said.) in order to resolve my issue. Their response: logout and in, reinstall the app and restart my phone. None of that worked because it's the most half-assed set of solutions of all time. Imagine if EA told you do that with their games you try to boot up. It'll just add the notoriety they're known for having.

It didn't feel like I was chatting with a human, so I decided to call support for a better chance. I had to wait (Get ready for this) ONE MOTHERFUCKING HOUR just to talk with someone. I can't believe I had the patience for that. I finally get to talk with an agent, only for them to tell me the same. Damn. Thing. Dude, what the fuck? Is Uber run by Skynet or something?! I kept contacting until I remembered why I had to whitelist the phone number I've been using with my account: it's because it's believed that it was being blocked by the provider. The number here is one I had setup for business reasons via TextFree, so I contacted them about it and they told me there was no issue on their end. Is Uber screwing with at this point? But, I went and switched the number on my account to my personal one, thinking that the business number is being assumed to be a VoIP, which is not allowed with some services. I finally get the code needed to finalize debit card changes to my Pro Card account.

Now this next story really interfered with my job significantly. I've been doing rideshare look normal, steady with a consistent schedule I setup for myself. The one thing that annoys me is that I have to verify my facial identity every once in a while. I mean, you know what I look like. Nothing too drastic has changed about me. So, why do I gotta go through this as I begin the job at a desired time? One day, I randomly go into the trip preferences menu to see it go from this:

To this:

Note: the Uber Eats food delivery preference is suppose to be there, but I didn't take a screenshot before it disappeared.

Of course, I had to talk to an agent. But this was more aggravating. I tried my damnedest to explain this issue. The agent, however, couldn't seem to figure out what I mean. Did they not have any job training? Once that was sorted, the agent said things like "This should be the type of experience for you to have" or "We understand your concern". Do ya, really? Because you should've went deeper into it by now. Continuing with this chat, guess what they told me then: the same solution from the Pro Card "troubleshoot", but that didn't work because THE APP IS NOT THE FUCKING PROBLEM! I disconnected and got in contact with a different agent. This bullshit repeated, but I got a whole new response. I got confirmation of my eligibility to have these preferences, including UberXL, and it was still approved. They also actually spent the time to look into it for a few minutes, although it was longer than. The problem involved the inspection of the vehicle I have registered. They wanted me to show an image of a newly documented inspection, but I don't have to worry about it for another 6 months. In my state at least, (I'm from the USA) I have to perform an annual inspection for legal validity of driving the vehicle, and it's $100. Doing this every 6 months makes no sense and it feels like it'll lead to an endless money pit, as a certain mechanic would say.

After that was sorted, I went back to doing the job like normal, only for it to happen again the next week. Starting to feel like Uber has a grudge against me. I go back to dealing with the same ol' crap more frustrated than ever, even angry, and get an unexpected response: I'm not eligible to perform UberXL rides. Well, isn't this the most inept thing to happen here? I drive a minivan, goddammit. What do you mean I'm not eligible? I just disconnected and almost didn't bother to reach another agent. But, I'm managed to collect myself and get it sorted out like last time. I'm certain this will happen again however.

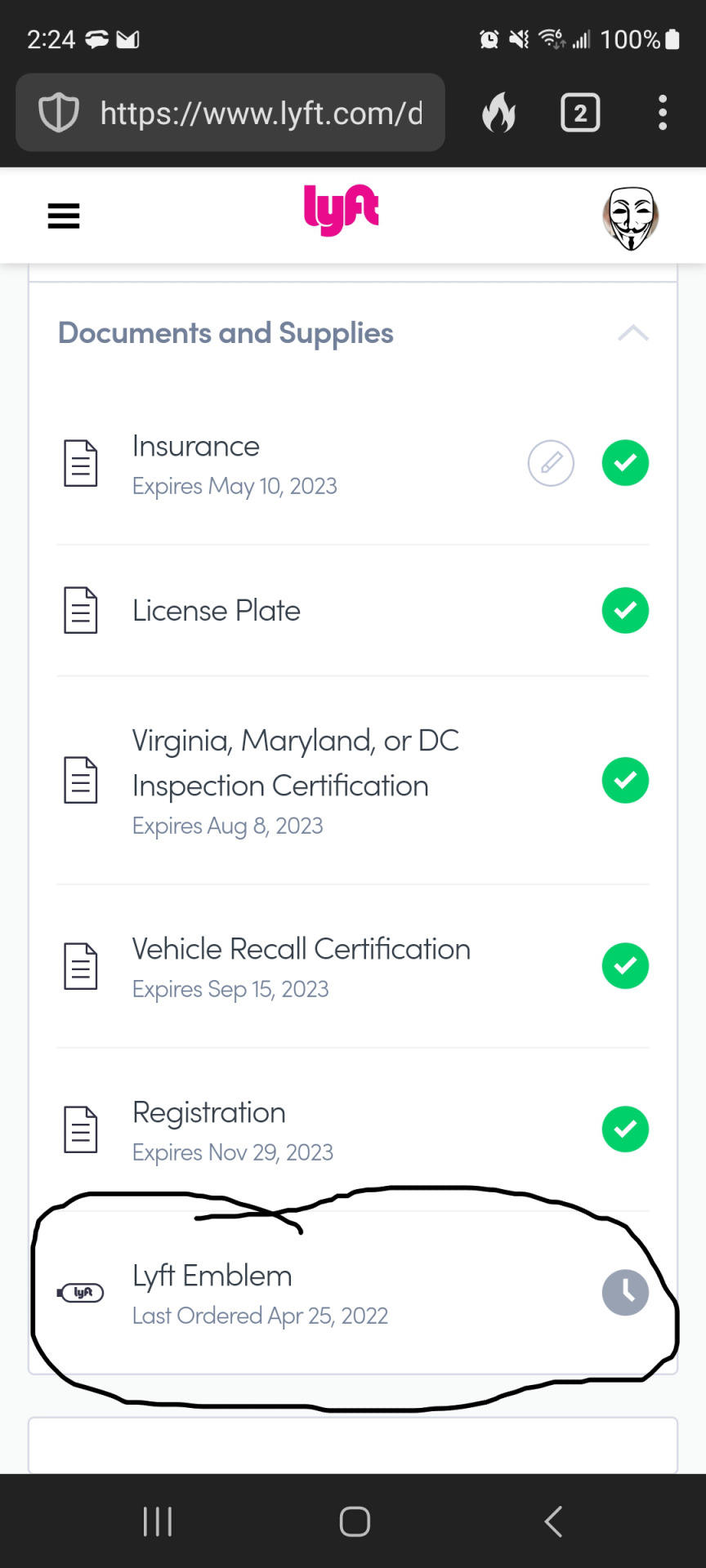

On the Lyft side of things, the same issue with support, except this is about emblems. Speaking of those emblems, the adhesive is weak sauce. So, I needed new ones. You can order new ones from the site or app with the push of a button. It's suppose to arrive within week, but didn't as that time range passed. I had to contact an agent, but it was hard to do it on the app because for some reason, they have too high of expectations that problems are solved with FAQs. But this is a troubleshooting issue; there's no way they can believe things can work fine that easily all the time. I had to go to the site to get help, and they responded by arranging a new order, which did arrive. Thing is, I've had this problem since I first signed up. I didn't even get my training kit with the cool pink mustache. After those emblems wear out too soon, I had to order another pair. Here's me thinking "Maybe they sorted out that issue with the delivery". But something even worse happened:

And as of the date of this blog post, it's still like this. Why? I even contacted them with this screenshot and they just gave me an automated message saying they'll just reship the emblems. This shouldn't have to be the only way to obtain new emblems beside the Express Hubs, which is too far from where I live. And they didn't arrive this time. If I contact them about any other problem, it'll just be the same type of response instead of troubleshooting.

Now, I don't know too much about the experience with support for riders since I've not used rideshare often. But I'm sure there's similar issues. The fact that this is the type of support we receive is unacceptable. It's as if they only measure their success financially based on the quantity of users. With the money they make, you'd think they could hire more competent employees for tech support, but they just found some random people with barely any tech skills to speak of and brought them in. There's got to be some kind of union strike or something because we can't keep letting them get away with this.

#uber#uber technologies inc#lyft#lyftblr#lyft inc#ride share#ridesharingapp#customer service#tech support#job#independent contractor#driver#driving#car#minivan#rider#passenger

14 notes

·

View notes

Text

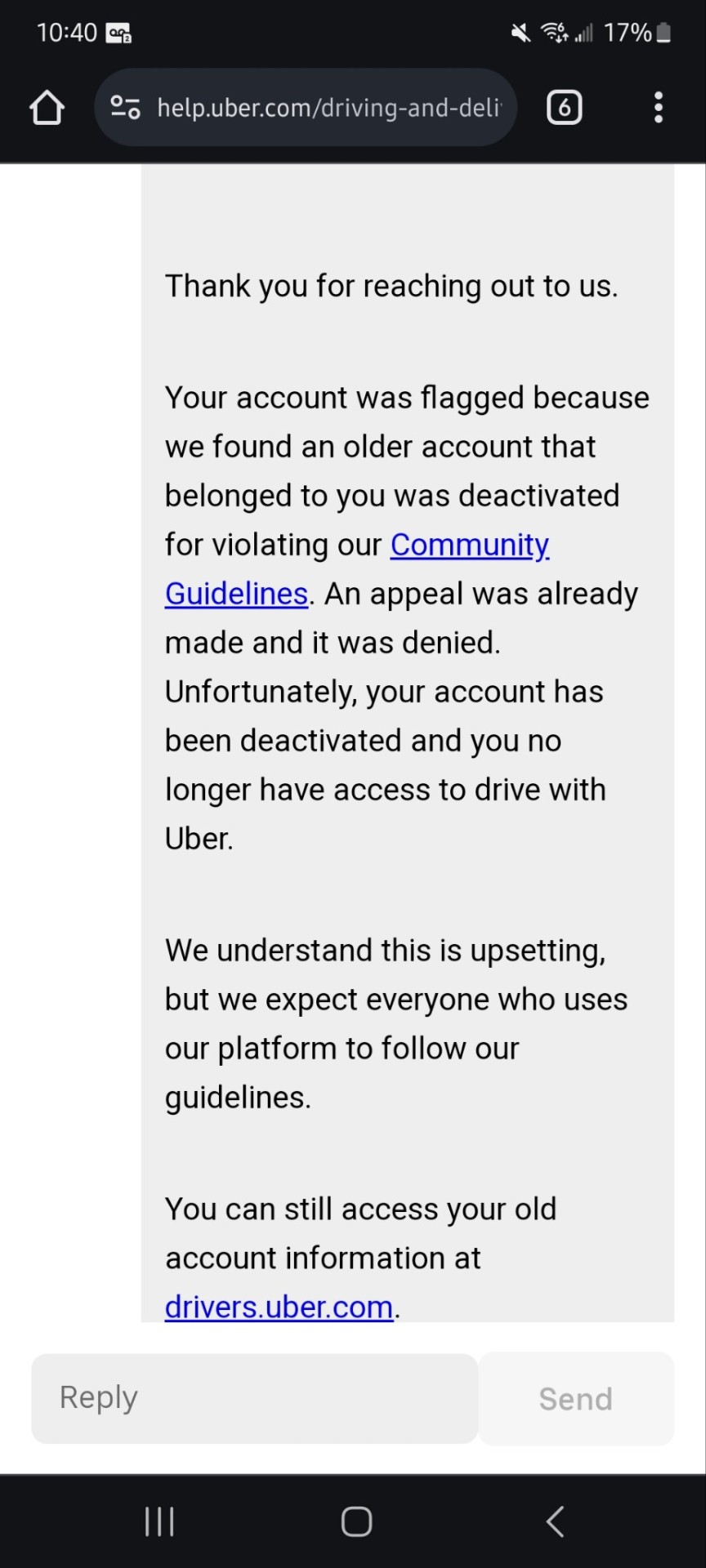

UBER told me to create another account. If I want to be work and I did everything as Uber told me to do

And then the results it's this

It's not fair 😡

#uber#uber technologies inc#uber driver#Uber wrongful deactivated#Uber Liar#Uber fraud#Uber fake#ride share#Gig#Uber unfair#Uber scam

2 notes

·

View notes

Text

Uber Received nearly 600,000 U.S. Sexual Assault Claims In Past 2 Years. Uber received a total of 5,981 allegations of serious sexual assault in the U.S. in 2017 and 2018, according to a new report. The claims range from unwanted touching and kissing to rape. Dec 5, 2019

#photos#ssd#files#documents#news#search#uber#Uber eats#postmates#text#sd#restore#.text#crime#illegal#legal#USA#worldwide#Travis Kalanick#Garrett camp#Dara Khosrowshahi#uber technologies inc#ca#eu

0 notes

Text

Uber reports third-quarter results that beat Wall Street's revenue expectations

Uber reported third-quarter results on Thursday that beat Wall Street’s expectations for revenue but missed on analysts’ projections for gross bookings. Shares of the company closed down more than 9% on Thursday. Here’s how the company did: Earnings per share: $1.20 vs. 41 cents expected by LSEG. Revenue: $11.19 billion vs. $10.98 billion expected by LSEG Uber’s revenue grew 20% in its third…

#Breaking News: Business#Breaking News: Technology#business news#Enterprise#Expedia Group Inc#Internet#Media#Technology#Uber Technologies Inc

0 notes

Text

How Mexico is winning the trade war between the U.S. and China

A freight train carries cargo shipping containers in the El Paso Sector along the US-Mexico border between New Mexico and Chihuahua state on December 9, 2021 in Sunland Park, New Mexico. Patrick T. Fallon | AFP | Getty Images New data shows a surge in trade between China and Mexico at a time of tough tariff talk during the presidential campaign. Customs data shows a significant increase in raw…

#Andrea Electronics Corp#Bayerische Motoren Werke AG#Breaking News: Business#Breaking News: Politics#business news#Canadian Pacific Kansas City Ltd#Canadian Pacific Railway Ltd#China#Donald Trump#Economic events#Ford Motor Co#Foreign policy#General Motors Co#Gesher I Acquisition Corp#India#International Trade#Kia Corp#Mexico#Mexico City#Pirelli & C SpA#politics#San Diego#Tesla Inc#Trade#Transportation#U.S. Economy#Uber Technologies Inc#United States

0 notes

Text

Uber for X" software

Uber for X" software is a versatile digital solution designed to replicate the success of the Uber business model across various industries and services. It empowers entrepreneurs and businesses to create on-demand service marketplaces, connecting users with specific needs to service providers seamlessly. This adaptable software offers a platform for efficient service booking, real-time tracking, and secure payments, making it a game-changer for businesses seeking to revolutionize the way services are delivered and accessed in the modern digital age.

0 notes

Text

Tired of guessing the best routes for your transportation services? Our scraped routes from Uber, Ola, and Rental cars give you the most accurate and reliable data to optimize your routes and increase your efficiency.

For more information, https://hirinfotech.com/website-scraping/ or contact us at [email protected]

#optimize#routes#transportationservices#ecommerce#privacy#customer experience#customerservice#customerfeedback#ola s1 pro#uber technologies inc#transport#taxi cab

0 notes

Text

(Reuters) - The administration of U.S. President Joe Biden will release a final rule as soon as this week that will make it more difficult for companies to treat workers as independent contractors rather than employees that typically cost a company more, an administration official said.

The U.S. Department of Labor rule, which was first proposed in 2022 and is likely to face legal challenges, will require that workers be considered employees entitled to more benefits and legal protections than contractors when they are "economically dependent" on a company.

A range of industries will likely be affected by the rule, which will take effect later this year, but its potential impact on app-based services that rely heavily on contract workers has garnered the most attention. Shares of Uber Technologies Inc, Lyft Inc and DoorDash all tumbled at least 10% when the draft rule was proposed in October 2022.

The rule is among the most impactful regulations ever issued by the Labor Department office that enforces U.S. wage laws, according to Marc Freedman, vice president at the U.S. Chamber of Commerce, the largest U.S. business lobby. But he said the draft version of the rule provides little guidance to companies on where to draw the line between employees and contractors.

"Economic dependence is an elusive concept that in some cases may end up being defined by the eyes of the beholder," Freedman said.

The Labor Department in the proposed rule said it would consider factors such as a worker's "opportunity for profit or loss, investment, permanency, the degree of control by the employer over the worker, (and) whether the work is an integral part of the employer’s business."

The rule replaces a Trump administration regulation that said workers who own their own businesses or have the ability to work for competing companies, such as a driver who works for Uber and Lyft, can be treated as contractors.

The department's sharp break from the Trump-era regulation will likely be the focus of lawsuits challenging the new rule, legal experts have said. Federal law requires agencies to adequately explain their decision to withdraw and replace existing rules.

The Biden administration has said the Trump-era rule violated U.S. wage laws and was out of step with decades of federal court decisions, and worker advocates have said a more strict standard was necessary to combat the rampant misclassification of workers in some industries.

The left-leaning Economic Policy Institute in a report last year estimated that a truck driver treated as a contractor earns up to $18,000 less per year than one who is deemed an employee, while construction workers' earnings drop by nearly $17,000 and home health aides lose out on up to $9,500 in pay and benefits.

Business groups sharply criticized the draft rule after it was proposed. Any change in policy is expected to increase labor costs for many sectors including trucking, retail and manufacturing.

Most federal and state labor laws, such as those requiring a minimum wage and overtime pay, only apply to a company's employees, who studies suggest can cost companies up to 30% more than independent contractors.

Nearly 40% of U.S. workers, or more than 64 million people, did some freelance work in the past 12 months, according to a December survey by freelancing marketplace Upwork.

10 notes

·

View notes

Text

Uber Eats Pledges to Slash Takeout Emissions and Plastic Waste

Edward Norton, actor, speaks during a Uber Technologies Inc. presentation in London, UK, on Thursday, June 8, 2023. Uber Technologies Inc. pledged to eliminate carbon emissions and "unnecessary" plastic waste from its growing delivery business by 2040, bringing it in line with goals at its ride-hailing arm.

#edward norton#fight club#primal fear#birdman#the grand budapest hotel#the french dispatch#knives out#motherless brooklyn#american history x#gettyimages#photos#jpgs

17 notes

·

View notes

Text

Mobility as a Service Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Mobility as a Service Market 2025 Size and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Mobility as a Service Market scenario, and feasibility study are the important aspects analyzed in this report.

The Mobility as a Service Market is experiencing robust growth driven by the expanding globally. The Mobility as a Service Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Mobility as a Service Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. The global mobility as a service (MaaS) market was $182.12 billion in 2018 and is expected to reach $210.44 billion by 2026, with a CAGR of 1.9% during the year. forecast period from 2019 to 2026.

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/102066

Key Strategies

Key strategies in the Mobility as a Service Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Mobility as a Service Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Mobility as a Service Market.

Major Mobility as a Service Market Manufacturers covered in the market report include:

Uber

Lyft, Inc

Didi Chuxing

Grab

Ola

Gett

Micro-mobility is expected to be the future of shared transportation, especially in developing countries. Micro-mobility is the use of light vehicles such as bikes and scooters on a shorter distance. For example, in the United States, motorbike and bicycle account for a significant share in the short distance traveling (under 5 miles). The growing inclination of consumers towards micro-mobility has drawn the attention of big players such as Daimler and BMW in micro-mobility transportation. This mobility as a service company has scooters on rent in 6 cities in Europe. Uber is also making plans to include rented bikes and scooters in their app by establishing partnerships with Getaround and Lime. Uber has also acquired JUMP that offers electric scooters and bikes on rent for the short-term. Increasing the use of micro-mobility is, in turn, saving time and money for consumers compared to the regular taxi rides.

Trends Analysis

The Mobility as a Service Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Mobility as a Service Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Mobility as a Service Market Solutions.

Regions Included in this Mobility as a Service Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Mobility as a Service Market.

- Changing the Mobility as a Service Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Mobility as a Service Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Mobility as a Service Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Mobility as a Service Market?

► Who are the prominent players in the Global Mobility as a Service Market?

► What is the consumer perspective in the Global Mobility as a Service Market?

► What are the key demand-side and supply-side trends in the Global Mobility as a Service Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Mobility as a Service Market?

Table Of Contents:

1 Market Overview

1.1 Mobility as a Service Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

#Mobility as a Service Market#Mobility as a Service Market Share#Mobility as a Service Market Size#Mobility as a Service Market trends#Mobility as a Service Market Growth#Mobility as a Service Market Insights#Mobility as a Services

0 notes

Text

Insiders At Uber Technologies Sold US$14m In Stock, Alluding To Potential Weakness

Many Uber Technologies, Inc. (NYSE:UBER) insiders ditched their stock over the past year, which may be of interest to the company’s shareholders. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, shareholders should take a deeper look if several insiders are…

0 notes

Text

How to Make Money in 2025

Top Strategies for Success

As we move into 2025, new opportunities to earn money continue to arise thanks to technological advances, shifting economic trends, and innovative business models. Whether you're interested in starting a side hustle or building a full-time business, here are some key strategies to make money in 2025.

1. Start an Online Business

The digital space offers endless possibilities for entrepreneurs. Some popular options include:

E-commerce: Sell products online via platforms like Shopify or Etsy, or try dropshipping.

Subscription Models: Offer subscription boxes or digital content, like exclusive newsletters.

Courses and Coaching: Share your expertise through online courses or coaching sessions.

2. Freelance Your Skills

The gig economy remains strong, and platforms like Upwork and Fiverr make it easy to offer services such as:

Web Design/Development

Writing/Content Creation

Graphic Design/Social Media Management

Freelancers enjoy flexibility and the potential for multiple income streams.

3. Invest in Emerging Technologies

Technology is where the big money is in 2025. Consider these investment opportunities:

Cryptocurrency & Blockchain: Bitcoin, Ethereum, and decentralized finance (DeFi) platforms are growing.

AI & Machine Learning: Startups focused on AI continue to see impressive growth.

Green Tech: Clean energy and electric vehicles are booming as sustainability becomes a priority.

Investing in these technologies can offer long-term financial rewards.

4. Real Estate: Passive Income

Real estate remains a classic way to build wealth. You can:

Buy Rental Properties (traditional or short-term rentals like Airbnb).

Invest in Crowdfunding: Platforms like Fundrise let you invest in real estate projects with lower capital.

Virtual Real Estate: Digital properties in virtual worlds are gaining popularity and can be bought and sold.

5. Stock Market & ETFs

Investing in stocks and exchange-traded funds (ETFs) remains a reliable way to make money:

Index Funds: These provide low-cost, diversified exposure to the stock market.

Dividend Stocks: Companies that pay dividends offer regular passive income.

Options Trading: For those with more experience, trading options can lead to higher returns (but with higher risks).

6. Content Creation & Influencer Marketing

Content creation continues to offer significant income potential. Build a following on platforms like:

YouTube, Instagram, TikTok, Twitch: Monetize through ads, sponsorships, and product promotions.

Affiliate Marketing: Promote products and earn commissions.

Merchandising: Many creators sell their own merchandise.

Consistency and value-driven content can turn a passion into a lucrative career.

7. Remote Work & Side Hustles

Remote jobs are more common than ever. Positions in software development, digital marketing, and customer support offer high-paying opportunities without commuting. Additionally, side hustles like:

Ride-sharing (Uber)

Pet-sitting or dog walking

Selling handmade items on Etsy

These are great ways to earn extra income in your spare time.

Conclusion

Making money in 2025 is all about adapting to the digital age and finding innovative ways to leverage your skills, interests, and investments. Whether you choose to start an online business, invest in emerging technologies, or create content, there are ample opportunities for success. Stay proactive, informed, and adaptable, and you can build financial wealth in this exciting new era.

0 notes

Text

youtube

Tesla's recent Cybercab launch has sent ripples through the market, but it looks like Uber emerged as a significant winner.

Today's Stocks & Topics: UNP - Union Pacific Corp., DJT - Trump Media & Technology Group Corp., Market Wrap, SWKS - Skyworks Solutions Inc., Did Uber Just Win Big from Tesla's Robotaxi Reveal?, POWL - Powell Industries Inc., The American Economy, If Trump Wins and The Stock Market, NTR - Nutrien Ltd., LAKE - Lakeland Industries Inc., Gold.

Video Content Details

00:00 Intro 00:21 Did Uber Just Win Big from Tesla's Robotaxi Reveal? 05:40 MARKET WRAP 07:58 UNP 10:50 DJT 12:24 SWKS 14:22 POWL 16:59 The American Economy 23:03 If Trump Win and The Market 25:36 NTR 27:42 LAKE 30:23 Gold

Call 888-99-CHART to hear your questions answered live.

0 notes

Text

Shared Mobility Market

Shared Mobility Market Size, Share, Trends: Uber Technologies Inc. Leads

Rapid Technological Advancements Fueling Market Growth

Market Overview:

The global Shared Mobility Market is expected to develop at a 16.3% CAGR from 2024 to 2031. The market value is predicted to rise from USD XX billion in 2024 to USD YY billion in 2031. Asia-Pacific is expected to lead the market, driven by rapid urbanization, increased traffic congestion, and rising environmental concerns. Rising smartphone penetration, a burgeoning urban population, and more investment in smart city programs are among the key metrics.

The market is expanding rapidly due to shifting customer preferences for cost-effective and convenient travel options, an increased emphasis on decreasing carbon emissions, and supporting government legislation promoting shared mobility solutions. Technological improvements in mobile applications, GPS tracking, and digital payment systems are accelerating industry growth.

DOWNLOAD FREE SAMPLE

Market Trends:

The Shared Mobility Market is undergoing a significant change towards the integration of artificial intelligence (AI) and machine learning (ML) technologies, which will transform the user experience and operational efficiency. This trend is especially visible in the ride-hailing and car-sharing industries, where AI-powered algorithms are being used to optimize route planning, predict demand trends, and improve rider-driver matching. Leading shared mobility platforms, for example, are using machine learning models to analyze historical data and real-time traffic information, resulting in more accurate estimated time of arrival (ETAs) and dynamic pricing strategies. The use of AI chatbots and virtual assistants in mobile applications improves customer assistance and engagement. This trend not only enhances user satisfaction but also helps service providers optimize fleet utilization and lower operational expenses.

Market Segmentation:

The Ride-hailing segment dominates the Shared Mobility Market, driven by convenience, cost-effectiveness, and widespread availability. The ride-hailing category has emerged as the dominating force in the Shared Mobility Market, accounting for over 60% of total market share by 2023. This domination is due mostly to the convenience, cost-effectiveness, and ubiquitous availability of ride-hailing services in both urban and suburban locations. The segment has seen major technological developments, with the addition of AI-driven matching algorithms, dynamic pricing models, and in-app safety measures that improve the entire user experience.

In recent news, top ride-hailing services have prioritized expanding their service offerings to incorporate multi-modal transportation alternatives. For example, a big global player recently added public transportation information and micro-mobility alternatives to its app, allowing users to plan end-to-end journeys with ease. This move has positioned ride-hailing firms as comprehensive mobility solutions, strengthening their market domination.

The corporate sector has also played a significant role in the growth of the ride-hailing business. Many businesses are cooperating with ride-hailing firms to give mobility perks to their employees, thereby eliminating traditional corporate fleet management systems. According to a recent industry survey, 72% of businesses in large metropolitan centers already include ride-hailing services as part of their employee perks package, indicating substantial B2B demand in this sub-segment.

Market Key Players:

Uber Technologies Inc.

Lyft, Inc.

DiDi Global Inc.

Grab Holdings Inc.

Bolt Technology OÜ

Zipcar, Inc.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Bike And Scooter Rental Market: Key Players and Competitive Landscape

The global bike and scooter rental market size was estimated at USD 5.54 billion in 2023 and is anticipated to grow at a CAGR of 16.8% from 2024 to 2030. The increasing awareness of environmental sustainability and the urgent need to reduce carbon emissions are major drivers for the growth of the market. With rising pollution and traffic congestion, e-bikes and scooters offer a green alternative to traditional vehicles, helping cities lower their carbon footprint. This shift towards eco-friendly transportation is being supported by both governmental policies and consumer preferences, creating a robust market for e-bike and scooter rentals.

Technological advancements are another significant factor propelling the market growth. Innovations in battery technology, such as longer battery life and faster charging times, have made e-bikes and scooters more reliable and convenient for users. Additionally, the integration of GPS and IoT (Internet of Things) technologies has enhanced the user experience by providing real-time tracking, seamless payments, and improved safety features. These technological improvements have made it easier for rental companies to manage their fleets and for customers to access and use these services efficiently.

Growing investment and interest from key automakers and startups in the mobility sector are propelling the growth of the market. Bike and scooter rental companies are investing heavily in expanding their fleets, improving infrastructure, and enhancing user experience. This influx of capital is accelerating the growth and adoption of these services, with many companies partnering with cities to create dedicated lanes and parking zones, further integrating e-bikes and scooters into urban transportation networks.

Gather more insights about the market drivers, restrains and growth of the Bike And Scooter Rental Market

Key Bike And Scooter Rental Company Insights

Some of the participants operating in the market include Lime, Nextbike, Cityscoot, Mobike, Spin, Scoot, Lyft, Skip, Tier Mobility, Bolt. The companies are focusing on various strategic initiatives, including investments, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

• In April 2024, Lime a rental electric scooter and bike operator backed by Uber Technologies Inc., announced a plan to invest $55 million to increase its existing fleet size.

• In January 2024, e-scooter rental companies Tier Mobility and Dott announced their merger, which will create the largest operator in Europe. Their investors are contributing an extra 60 million euros ($66 million) to support the newly combined entity.

• In March 2022, TIER Mobility (TIER) acquired Spin, a micromobility operator previously owned by Ford, expanding its reach to an additional 106 communities across North America.

Global Bike and Scooter Rental Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bike and scooter rental market report based on propulsion, vehicle, service, and region.

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

• Bike

• Scooter

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

• Pedal

• Electric

• Gasoline

Service Outlook (Revenue, USD Million, 2018 - 2030)

• Pay-as-you go

• Subscription Based

Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

• MEA

o KSA

o UAE

o South Africa

Order a free sample PDF of the Bike And Scooter Rental Market Intelligence Study, published by Grand View Research.

#Bike And Scooter Rental Market#Bike And Scooter Rental Market Analysis#Bike And Scooter Rental Market Report#Bike And Scooter Rental Market Size#Bike And Scooter Rental Market Share

0 notes

Text

Unlocking the Power of Location in the Digital Era

The global location of things market size is expected to reach USD 216.68 billion by 2030, registering a CAGR of 23.0% from 2023 to 2030, according to a new report by Grand View Research, Inc. The increasing penetration of smartphones and enhanced network connectivity coupled with the increasing demand for personalized services are propelling the market growth.

Location of things is an emerging sub-category of the IoT concept that enables connected devices to monitor and communicate their geographic location. Enabled by IoT sensors and location technologies embedded into various connected devices allows organizations and service providers to collect a variety of data over the network. Over the years, a variety of location-based services has been introduced, such as Google Maps, Uber, Waze, and many others, which have been enabled by the ability of a smartphone to locate itself. Location being the most vital dimension of the data collected allows service providers to provide contextual content for each user.

Advancements in connected wearable devices, connected vehicles, connected homes, smart cities, and Industrial IoT (IIoT) are bound to open extensive market avenues for the location of things market in the coming years. However, issues related to privacy and safety along with universally accepted standards are expected to challenge the industry.

Location Of Things Market Segment Highlights

North America dominated the global market and accounted for the largest revenue share of 30.3% in 2022. Technology proliferation, increased penetration of smartphones, and enhanced network connectivity have led to a faster adoption rate in North America than in other regions.

The mapping and navigation segment accounted for the highest revenue share of around 33.3% in 2022 and is estimated to register the fastest CAGR of 24.2% over the forecast period. The mapping and navigation technology enables users to track and monitor the movement of various physical devices.

The transportation and logistics segment accounted for the largest revenue share of around 24.8% in 2022 and is estimated to register the fastest CAGR of 24.4% over the forecast period, which is followed by the manufacturing and industrial segment. The development of connected car technologies and a variety of logistics solutions have enhanced the operational efficiencies and reduced the time-to-delivery for the transportation sector.

Asia Pacific is expected to register the highest CAGR of 24.7% over the forecast period owing to the increased spending on connected devices, investments in various IoT technologies, and increasing demand for personalized services.

Browse through Grand View Research's Communications Infrastructure Industry Research Reports.

The global e-commerce fulfillment services market size was valued at USD 123.69 billion in 2024 and is expected to grow at a CAGR of 14.2% from 2025 to 2030.

The global millimeter wave sensors & modules market was valued at USD 103.0 million in 2024 and is projected to grow at a CAGR of 30.6% from 2025 to 2030.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global location of things market report on the basis of application, vertical, and region:

Location Of Things Application Outlook (Revenue, USD Million, 2017 - 2030)

Mapping And Navigation

Asset Management

Location Intelligence

Media And Marketing Engagement

Location Of Things Vertical Outlook (Revenue, USD Million, 2017 - 2030)

Government, Defence And Public Utilities

Transportation And Logistics

Retail And Consumer Goods

Manufacturing And Industrial

Healthcare

Others

Location Of Things Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East And Africa

United Arab Emirataes (UAE)

Saudi Arabia

South Africa

Order a free sample PDF of the Location Of Things Market Intelligence Study, published by Grand View Research.

0 notes