#The United States Treasury

Explore tagged Tumblr posts

Text

Elon Musk who is an unelected billionaire who does not have have Congressional authority to halt payments and access millions of personal information and SSN numbers from Americans has forced himself and his 6 college student workers into the US Treasury while duly elected members of Congress who have access to federal buildings are denied entry.

The Oligarchy has taken over the federal government under the guidance of Donald Trump

#donald trump#potus#president trump#us politics#breaking news#politics#news#president of the united states#tumblr#united states politics#us treasury#usa news#us news#usa#united states news#United States#current events#us congress#congress#elon musk

870 notes

·

View notes

Text

This is a good article that gets into, in a clear way, what is being done and also helps clarify what cannot be done. For instance, politicians can't get physical, and probably shouldn't, with musk and his merry band of chucklenuts:

"Some political responses may help lead to other types of responses, but that is not their primary end. The primary goal of a political response is to make the political case. And that’s it."

"So it will help us and our cause to stop rolling our eyes when, say, a politician writes a stern letter to a Trump official demanding that the administration cease its illegal activity. That is actually what our senators and representatives are supposed to do. That is how they set the record and inform the press and through them the larger public. As discussed above, politicians don’t bring lawsuits. They usually don’t lead street protests. And the more experienced among them don’t waste political capital on performative stunts that don’t actually fix anything."

"That said, those letters and statements, which help establish the public record, are a vital resource. They are cited in lawsuits, often as evidence that the administration was on notice of its illegal actions. They point investigative journalists toward more reporting. And they are an important expenditure of political capital, signaling the priorities of our representatives."

#USpol#us politics#american politics#politics#political#coup#autogolpe#elongated muskrat#elon musk#elon#musk#donald trump#trump#trump administration#treasury#gsa#usaid#opm#congress#united states

66 notes

·

View notes

Text

Make it ma......nevermind

#elon musk#elongated muskrat#criminal behavior#united states#united states treasury department#donald trump#politics#republicans#gop#gop hypocrisy#republican hypocrisy#republican lies#2024 presidential election#trump administration#china#chinese#black lives matter

21 notes

·

View notes

Text

David Badash at NCRM:

Legal and political experts are raising alarms over what they describe as a deepening constitutional crisis after associates and close allies of Elon Musk—whom President Donald Trump appointed to lead the newly created temporary Department of Government Efficiency (DOGE)—reportedly gained access to or locked employees out of at least four federal agencies: the U.S. Treasury, the Office of Personnel Management (OPM), the United States Agency for International Development (USAID), and the General Services Administration (GSA). “USAID being unlawfully dismantled. DOGE member has closed HQ. New tranche of workers cut off email,” wrote the former Assistant USAID Administrator for Global Health, Atul Gawande. “Staff tell me, ‘It is frightening being inside USAID right now. Our checks and balances failed. Congress has abdicated its responsibilities.’ And Sec. [of State Marco] Rubio has abdicated his.” The Atlantic’s Norman Ornstein is a political scientist and co-author of the book, “It’s Even Worse Than It Looks: How the American Constitutional System Collided With the New Politics of Extremism.” Dr. Ornstein writes, “All of this is completely illegal; we have people who are not a part of government staging a coup right in front of our eyes. Not a single Republican in Congress objecting, Democrats floundering, the press treating it as a misdemeanor. Beyond frightening.” “This is how democracy dies,” responded economist Tony Annett, a 16-year veteran of the International Monetary Fund (IMF). “The opposition does nothing. The media play it down. The bureaucrats comply.” Longtime congressional reporter Jamie Dupree writes, “Congress approved money to run USAID. Trump is evidently ready to shut it down. The Constitutional crisis may already be here.”

Unelected coup leader Elon Musk’s unlawfully destroying several agencies under the shield of the scam agency known as Department of Government Efficiency has brought us towards a constitutional crisis. #MuskCoup

See Also:

Steady (Dan Rather): Doing Trump’s Dirty Work

Dispatches From A Collapsing State (Jared Yates Sexton): A Coup in Plain Sight: An Explainer as the Crisis Solidifies

#Elon Musk#Donald Trump#USAID#Musk Coup#DOGE#Office of Personnel Management#Treasury Department#United States Agency for International Development#General Services Administration#Department of Government Efficiency#Constitutional Crisis

20 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

The Treasury warns Congress that the debt ceiling could be reached in January. The FDA says that the decongestant in many cold medicines is ineffective

WASHINGTON-Treasury Secretary Janet Yellen said her agency would need to start taking "extraordinary measures," or special accounting maneuvers intended to prevent the nation from hitting the debt ceiling, as early as January 14, in a letter sent to congressional leaders Friday afternoon.

Kids do not click this link

"Treasury expects to hit the statutory debt ceiling between January 14 and January 23," Yellen wrote in the letter addressed to House and Senate leadership, at which point extraordinary measures would be used to prevent the government from breaching the nation's debt ceiling — which has been suspended until January 1.

The department has deployed the "extraordinary measures" before to keep the government operating. But once those measures run out, the government risks defaulting on its debt unless lawmakers and the president agree to lift the limit on the U.S. government's ability to borrow.

"I respectfully urge Congress to act to protect the full faith and credit of the United States," she said.

The news comes after President Joe Biden signed a bill into law last week that averted a government shutdown but did not include President-elect Donald Trump's core debt demand to raise or suspend the nation's debt limit. Congress approved the bill only after fierce internal debate among Republicans over how to handle Trump's demand. "Anything else is a betrayal of our country," Trump said in a statement.

After a protracted debate in summer 2023 over how to fund the government, policymakers crafted the Fiscal Responsibility Act, which included suspending the nation's $31.4 trillion borrowing authority until January 1, 2025.

Notably however, Yellen said, the debt is projected to temporarily decrease on January 2 because of a scheduled redemption of nonmarketable securities held by a federal trust fund associated with Medicare payments. As a result, "Treasury does not expect that it will be necessary to start taking extraordinary measures on January 2 to prevent the United States from defaulting on its obligations," she said.

The federal debt, which ballooned across both Republican and Democratic administrations, is now roughly $36 trillion. The spike in inflation after the coronavirus pandemic increased government borrowing costs; as a result, debt service next year will exceed spending on national security.

Republicans, who will have full control of the White House, House and Senate in the new year, have plans to extend Trump's 2017 tax cuts and other priorities but debate over how to pay for them.

Kids do not click this link

#janet yellen#fda#us fda#united states#usa#news#new york#Treasury warns#washingtonfarm#donald trump#trump#Washington#government shutdown#verbal shutdown#joe biden#usa politics#election 2024#politics

14 notes

·

View notes

Text

Warm your hands by the fires of the burning deep state. 😌

#it’s been christmas every week#get the irs next#department of government efficiency#doge#department of the treasury#treasury department#elon musk#scott bessent#president trump#donald trump#vice president vance#jd vance#united states agency for international development#usaid#trump administration#trump 47#project 2025#united states#usa#🇺🇸

5 notes

·

View notes

Text

#elon musk#tucson#arizona#coup#united states#treasury#high crimes and misdemeanors#social security#federal government#us treasury#tech#technology#theft#breach#impeach trump

5 notes

·

View notes

Text

President Donald Trump has signed an Executive Order that forces federal departments to collaborate with DOGE. This will likely be challenged in court.

Elon Musk and a gang of college grads has spent the past few weeks under the guise of The Department of Government Efficiency a made up department not approved by Congress basically accessing and acquiring people’s personal information including SSN numbers, accessing payment distribution systems, cancelling contracts and more.

This is ILLEGAL as only Congress can authorize and unauthorize payments. Congress only can approve federal spending.

A federal judge has asked Elon to halt his actions at the US Treasury and another federal judge has mandated that Trump end the federal funds freeze.

The Trump administration alongside Elon Musk have been defying judge court orders and proceeding anyways slamming the nation into a constitutional crisis.

#donald trump#potus#president trump#us politics#breaking news#politics#news#president of the united states#tumblr#united states politics#elon musk#department of government efficiency#us treasury#fema#usa news#usaid#usa#united states news#us news#current events

66 notes

·

View notes

Text

🇨🇳⚔️🇺🇲 💵 🚨

CHINA DUMPING US DOLLARS AS TRADE WAR BREWS

China has sold nearly $100 billion in US Treasury holdings since 2023, and nearly $49 billion in US Treasury bonds in just the last quarter.

The findings were published by the US Treasury Department and reported in the Business media, detailing a pattern of the People's Republic of China dumping US Treasury bonds as a trade war begins brewing between the two economic powers.

#source

@WorkerSolidarityNews

#china#china news#united states#us news#us foreign policy#US Treasury#trade war#politics#news#geopolitics#world news#global news#international news#breaking news#current events

18 notes

·

View notes

Text

“…preparatory to the coup that is going on now. The federal government has immense capacity and control over trillions of dollars. That power was a cocreation of the American people. It belongs to them. The oligarchs around Trump are working now to take it for themselves.”

https://snyder.substack.com/p/the-logic-of-destruction

#corruption#destruction#us politics#american politics#us treasury#treasury#elongated muskrat#elon musk#musk#elon#coup#united states#USpol

4 notes

·

View notes

Text

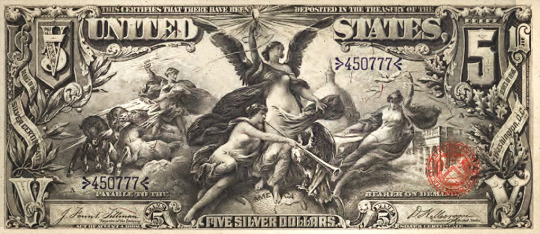

United States Five Dollar Silver Certificate - series 1896.

#united states currency#u.s. currency#5 dollar bill#five dollar bill#silver certificate#vintage currency#U.S. treasury#bureau of engraving & printing#money#paper currency#1896#series 1896#educational series#allegorical motifs#engraving#vintage illustration#neoclassical design#neoclassical#$5 notes#$5#currency#paper money#allegory#bank notes#currency design

16 notes

·

View notes

Text

Elon Musk is special government employee

2 notes

·

View notes

Text

TAX DAY tomorrow!

Posted here are a couple recent drawings I created reflecting on TAX DAY -the annual (and usually depressing) payment to a host of various taxes… Chin up!

#taxes#tax day#tariffis#IRS#United States Treasury#Taxes Due#Tax Payements#Tax Returns#illustration#Steven Salerno#stevensalerno.com

3 notes

·

View notes

Text

Improv comedians: Marriage is a bit. Ready to commit? Criminals: Marriage is a crime. Join me in doing some time? Financiers: Marriage is a bond. Make ours out for the treasury?

#this is a joke about the maturity rates for treasure bills/notes/bonds#finance#united states#united states treasury#wordplay#bad jokes#phoenix talks

173 notes

·

View notes

Text

Ukraine natural resources

youtube

US-Ukraine draft agreement for Ukraine's natural resources explained

#Ukraine's natural resources#how Zelensky destroyed Ukraine#Volodymyr Zelensky#Volodymyr Zelenskyy#Zelensky#Zelenskyy#Ukraine war#Russia#Russian Federation#US Treasury#Youtube#United States Secretary of the Treasury#US Secretary of the Treasury#Scott Bessent#Zelensky destroyed Ukraine#POTUS#United States of America#United States#USA#US#America

0 notes