#Tax-Efficient Portfolio Management

Explore tagged Tumblr posts

Text

#Tax-Efficient Investment Strategies#Mastering Tax-Efficient Investing#Best Tax-Efficient Investments 2024#How to Invest Tax-Efficiently#Tax-Efficient Investment Options#Investment Tax Planning Guide#Maximizing Tax Efficiency in Investments#Tax Benefits of Investments#Tax-Efficient Portfolio Management#Understanding Tax-Efficient Investment Vehicles

0 notes

Text

Effective portfolio management helps optimize wealth by tailoring investment strategies to individual goals, risk tolerance, and market conditions. It involves diversifying assets, regular portfolio reviews, and tax-efficient strategies to ensure growth and minimize risk. Professional services can help maximize returns and meet long-term financial objectives.

#wealth management#portfolio strategy#investment services#risk management#financial goals#asset allocation#portfolio review#diversified investments#wealth growth#tax-efficient#financial planning#investment return#risk tolerance#asset diversification#portfolio balance#financial advisors#long-term wealth#investment management#retirement planning#wealth protection#expert advice

0 notes

Text

Paper Release: A Discussion on the Release of the New "Uber Eats Index", and including its Rationale (Chicago), and Efficiencies (Los Angeles)

The creator of this paper, after attempting to find the most cost efficient take out order, and order substitution delivery service. And after discovering the ability with the Chase Sapphire Preferred Credit Card. To be able to order, with little to no ad

Uber Eats Index – Courtesy of Kevin Michael Miller Uber Eats Index As A Percentage – Courtesy of Kevin Michael Miller The creator of this paper, after attempting to find the most cost efficient take out order, and order substitution delivery service. And after discovering the ability with the Chase Sapphire Preferred Credit Card. To be able to order, with little to no additional delivery…

View On WordPress

#Caviar Meal Delivery#Chase Sapphire Bank Credit Card#Chase Sapphire Preferred#Chase Sapphire Reserve#Chicago Sales Taxes#Competitive Advantage#Delivery and Meal Delivery Services Industry#DoorDash Meal Delivery Service#DSGE#Grubhub#J.P. Morgan Chase Bank#Los Angeles County Sales Tax Proposal#Lyft#Market Efficiencies#Market Inefficiencies#Meal Delivery Services#Uber Eats#Uber Eats Index#Vector Auto Regression VAR#Vice President of Portfolio Management

0 notes

Text

OneNorthStar: Navigating Financial Success

OneNorthStar, a reputable financial advisory firm, is dedicated to guiding individuals and businesses toward financial prosperity. With a commitment to personalized service and a team of seasoned financial advisors, OneNorthStar strives to meet the diverse needs of its clients.

Comprehensive Financial Planning: At the core of OneNorthStar's offerings is comprehensive financial planning. The firm works closely with clients to understand their unique financial goals, risk tolerance, and time horizon. This collaborative approach allows for the creation of tailored strategies that encompass investment planning, retirement planning, risk management, tax optimization, and wealth preservation.

Investment Planning Expertise: OneNorthStar's team of experienced financial advisors excels in crafting investment portfolios that align with clients' objectives. By assessing risk tolerance and financial circumstances, the firm constructs diversified portfolios incorporating stocks, bonds, mutual funds, and other instruments. The goal is to optimize returns while managing risk, ensuring a solid foundation for long-term financial growth.

Wealth Management Beyond Investments: The firm goes beyond traditional investment planning, offering comprehensive wealth management services. This encompasses a holistic approach to financial well-being, including estate planning, tax strategies, and ongoing portfolio monitoring. OneNorthStar understands that financial success extends beyond investment returns, incorporating a broader perspective to safeguard and enhance clients' wealth.

Client-Centric Approach: OneNorthStar prides itself on its client-centric philosophy. The firm values open communication, transparency, and building long-lasting relationships. Client testimonials underscore the positive impact of the firm's guidance on financial outcomes, reinforcing OneNorthStar's reputation for reliability and excellence.

Educational Resources: Recognizing the importance of financial literacy, OneNorthStar provides educational resources to empower clients in making informed decisions. Whether through articles, webinars, or one-on-one consultations, the firm aims to enhance clients' financial knowledge and confidence.

Fascinated by the power of money

Vikram is fascinated by the power of money and deeply believes that everyone should have lots of it. That’s why he started onenorthstar to transform people’s financial future. Supported by his amazing family, today Vikram shoulders the challenges in people’s journeys to financial freedom through ONS. So that every person experiences financial well-being, and has the opportunity to create more of their life.

Contact US

Need financial advice from Vikram?

Connect today!!

Advice Session available in: 1 on 1 in person. Online video meetings.

T: +1 203-343-0880 E: [email protected] A: 80 Fourth St, Stamford, CT 06905

#Portfolio Manager#Financial Planning#Retirement Planning#Roth 401K#401K#IRA#403B#Investment Management#529 plan#brokerage account#Tax efficiency#Legacy Creation#Financial Planning Services#Financial Advisors#Financial Planning Firm#Finance Blogs#Post Retirement Plans

1 note

·

View note

Text

Portfolio Management Services (PMS) and Why Should You Care?

Introduction

Managing wealth effectively is an essential part of financial success, and one of the best ways to do this is through Portfolio Management Services (PMS). Whether you are a seasoned investor or just starting out, understanding PMS can help you make smarter financial decisions.

In this article, we’ll break down what PMS is, how it works, its benefits, and why you should consider it for wealth growth. Let’s dive in!

What is Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) is a professional investment service offered by financial experts or firms to manage your investments in stocks, bonds, mutual funds, and other assets. Unlike traditional mutual funds, PMS provides a more personalized and hands-on approach to investing, catering specifically to high-net-worth individuals (HNIs) and investors who want tailored strategies.

Types of PMS

There are three main types of Portfolio Management Services:

Discretionary PMS: The portfolio manager takes full control of investment decisions based on the investor's risk profile and financial goals.

Non-Discretionary PMS: The investor has full control over investment decisions, while the portfolio manager provides research and recommendations.

Advisory PMS: The portfolio manager only provides guidance, and the investor executes transactions independently.

How Does PMS Work?

Once you enroll in a Portfolio Management Service, the process generally follows these steps:

Assessment of Financial Goals: The PMS provider assesses your financial objectives, risk appetite, and investment horizon.

Investment Strategy Development: A customized strategy is developed based on your profile.

Execution: The portfolio manager makes investment decisions on your behalf (in discretionary PMS) or provides recommendations (in non-discretionary and advisory PMS).

Performance Monitoring: Regular monitoring and adjustments are made to optimize returns and minimize risks.

Reporting: You receive periodic reports to track portfolio performance.

Why Should You Care About PMS?

Now that you understand the basics, let's explore why Portfolio Management Services matter and how they can benefit you.

1. Personalized Investment Approach

Unlike mutual funds that follow a standard investment pattern, PMS provides customized investment strategies tailored to your financial goals and risk tolerance.

2. Professional Expertise

PMS ensures that your investments are managed by experienced professionals with in-depth market knowledge. This reduces emotional decision-making and improves the chances of wealth growth.

3. Higher Returns Potential

PMS investments are actively managed, meaning they can generate higher returns compared to passive investments like index funds or mutual funds.

4. Diversification

Portfolio managers allocate assets across different investment options, minimizing risk and ensuring a well-diversified portfolio.

5. Transparency and Control

With PMS, you get regular performance reports and updates. In non-discretionary PMS, you even have complete control over where your money is invested.

6. Tax Efficiency

Since PMS investments are individually managed, portfolio managers can implement tax-efficient strategies, such as harvesting capital losses to offset gains.

Who Should Consider PMS?

PMS is ideal for:

High-net-worth individuals (HNIs) who want a customized investment approach.

Investors looking for professional wealth management without handling investments themselves.

People with a long-term investment horizon seeking higher returns.

Busy professionals who don’t have time to track the stock market regularly.

Factors to Consider Before Choosing PMS

Before enrolling in PMS, consider the following:

1. Minimum Investment Requirement

PMS usually requires a minimum investment of ₹50 lakh in India. Ensure you meet the eligibility criteria.

2. Fee Structure

PMS providers charge fees in two ways:

Fixed Fee: A percentage of the total investment, regardless of portfolio performance.

Profit Sharing: A percentage of the returns generated beyond a certain benchmark.

3. Performance Track Record

Check the PMS provider’s historical performance and investment philosophy before making a decision.

4. Risk Management Approach

Understand how the portfolio manager mitigates risk during market downturns.

5. Investment Philosophy

Different PMS providers follow various strategies—growth investing, value investing, or sector-based investing. Choose one that aligns with your goals.

Common Myths About PMS

1. PMS is Only for the Ultra-Rich

While PMS does cater to high-net-worth individuals, some firms now offer customized solutions for investors with lower capital.

2. PMS Guarantees High Returns

Like any investment, PMS is subject to market risks. However, professional management can enhance returns over time.

3. Mutual Funds and PMS are the Same

Mutual funds are pooled investments, while PMS offers a personalized and actively managed portfolio.

Conclusion

If you are looking for a customized, professionally managed investment strategy with the potential for higher returns, Portfolio Management Services (PMS) might be the right choice for you.

It offers a tailored approach, expert management, and diversified investments, making it an excellent option for serious investors. However, always assess your risk appetite, research providers, and understand the fee structure before opting for PMS.

2 notes

·

View notes

Text

Experience Excellence in Business Services with Benchmark Professional Solutions Pvt. Ltd.

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, is a leading provider of a wide range of business and financial services. Their expertise lies in offering tailored solutions to businesses, ensuring smooth operations across various sectors. As a reliable partner, Benchmark Professional Solutions offers an extensive array of services that cater to diverse business needs.

One of the standout services provided by Benchmark is their Digital Signature Certificate (DSC) and token services. As a trusted partner for EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN, they ensure the highest standards in digital security, enabling businesses to operate with confidence in an increasingly digital world.

In the field of accounting and finance, Benchmark delivers professional services in accounts management, audits, and consultancy. Whether you're a small business or a large enterprise, their team ensures that your financial operations are compliant with the latest regulations, streamlining your accounting processes to boost efficiency.

Their legal expertise spans across trademark registrations, ROC compliance, and license and registration services. They provide comprehensive solutions to protect intellectual property and ensure businesses meet all statutory requirements without hassle.

Benchmark Professional Solutions also excels in handling income tax and GST compliance. Their team offers guidance on tax strategies to minimize liabilities while ensuring complete adherence to tax laws. Their consultancy services cover a wide spectrum of financial and operational matters, empowering businesses to grow sustainably.

Additionally, they offer outsourcing solutions, allowing businesses to delegate essential tasks to experts while focusing on core functions. Legal services, including civil and criminal representation, add another layer of support, ensuring clients receive comprehensive assistance in all legal matters.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Benchmark Professional Solutions Pvt. Ltd. stands out for its holistic approach to business and financial solutions. Their status as a certified Tally Solutions partner, combined with their extensive service portfolio, makes them a reliable and trustworthy partner. By choosing Benchmark, businesses benefit from expert guidance, streamlined operations, and the peace of mind that comes with knowing that every financial and legal detail is handled with precision.

2 notes

·

View notes

Text

Anisha Sharma & Associates: Comprehensive Business & Finance Solutions for Every Need

Comprehensive finance and legal solutions with Anisha Sharma & Associates

Anisha Sharma & Associates is a business and finance company that delivers a wide range of core and specialized services. With a team of seasoned professionals, the firm ensures that businesses, individuals, and entrepreneurs have access to reliable and expert financial solutions. Their commitment to providing tailored guidance in various domains makes them a trusted partner for numerous clients. Below is an overview of their core and specialized services.

Core Services:

1.Accounts: Maintaining accurate and timely financial records is crucial for every business. Anisha Sharma & Associates ensures that their clients’ accounting needs are managed with precision, enabling seamless financial operations.

2.Audit: Through detailed audits, the firm provides clients with insights into their financial health. Their audit services help identify areas of improvement and ensure compliance with regulatory requirements.

3.Trademark: Protecting intellectual property is vital for brand success. The firm helps clients register and safeguard their trademarks, ensuring that their brand identity is secure and recognized.

4.ROC (Registrar of Companies): Navigating company registration and ROC compliance can be complex. Anisha Sharma & Associates simplifies this process, ensuring all filings and compliances are met, avoiding legal complications.

5.License & Registration: Securing the appropriate licenses and registrations is essential for any business. The firm assists in obtaining licenses that enable businesses to operate legally and efficiently.

6.Loans: Access to finance is a key driver for business growth. Anisha Sharma & Associates assists clients in securing loans, offering guidance on the most suitable options to meet their needs.

7.Income Tax: Their income tax services ensure that clients remain compliant with tax laws while minimizing their tax liabilities through expert planning and timely filings.

8.GST: Goods and Services Tax (GST) compliance can be challenging for businesses. The firm ensures that all GST filings are accurate and up-to-date, allowing businesses to avoid penalties and manage taxes efficiently.

9.Consultancy: The company provides tailored consultancy services, offering expert advice to help businesses grow, streamline operations, and optimize financial strategies.

10.Outsourcing: For businesses looking to delegate their accounting and finance processes, the firm offers comprehensive outsourcing services that help reduce costs and improve efficiency.

11.DSC & Token: Digital signatures (DSC) are essential for secure electronic transactions. The firm assists clients in obtaining DSCs and tokens, ensuring the safe and authorized use of digital platforms.

12.Software: Anisha Sharma & Associates offers customized software solutions to streamline business processes, enhance productivity, and ensure smooth financial operations.

Specialized Services:

1.Stock Broking & Advisory: Offering guidance on investments and stock market trading, the firm helps clients make informed decisions and maximize returns on their portfolios.

2.Website & Digital: The digital landscape is evolving rapidly. The firm provides website development and digital solutions that help businesses establish a strong online presence and reach their target audience.

3.Real Estate Placement Consulting: Whether for buying, selling, or leasing, the firm’s real estate consulting services ensure that clients make profitable and well-informed decisions.

4.PF & ESI: Managing Provident Fund (PF) and Employee State Insurance (ESI) is crucial for employee welfare. Anisha Sharma & Associates ensures that clients remain compliant with these regulations while optimizing benefits for their workforce.

5.Civil & Criminal Lawyer: In addition to financial services, the firm provides legal support for both civil and criminal matters, ensuring comprehensive legal representation for their clients.

Why Choose Anisha Sharma & Associates?

Anisha Sharma & Associates stands out for its comprehensive range of services, combining financial expertise with legal acumen. Their client-centric approach ensures that each business or individual receives personalized solutions tailored to their specific needs. Whether managing day-to-day financial operations, navigating the complexities of compliance, or seeking legal representation, Anisha Sharma & Associates is a reliable partner for long-term success.

2 notes

·

View notes

Text

Maximize Efficiency with Expert Cash Management Solutions

In today’s fast-paced business environment, effective cash management is crucial for maintaining financial stability and supporting growth. Expert cash management solutions can help businesses streamline their operations, optimize liquidity, and enhance overall financial efficiency. This article explores how leveraging advanced cash management solutions can maximize efficiency and drive business success.

What is Cash Management?

Cash management involves the collection, handling, and use of cash in a business. The goal is to ensure that a company has enough cash on hand to meet its short-term obligations while optimizing the use of its funds. Effective cash management helps businesses avoid liquidity problems, reduce financing costs, and invest surplus cash wisely.

Key Benefits of Expert Cash Management Solutions

Improved Cash Flow Visibility

Expert cash management solutions provide real-time insights into cash flow. By integrating these solutions with your financial systems, you can gain a comprehensive view of your cash position, including incoming and outgoing funds. This visibility allows for better forecasting and planning, helping you anticipate cash needs and avoid potential shortfalls.

Enhanced Liquidity Management

Managing liquidity effectively is essential for ensuring that your business can meet its obligations without holding excessive cash. Advanced cash management tools help optimize liquidity by analyzing cash flow patterns and recommending strategies to manage working capital more efficiently. This includes managing accounts receivable and payable, optimizing cash reserves, and reducing idle cash.

Streamlined Cash Collection and Disbursement

Automated cash management solutions streamline the collection and disbursement processes. For example, electronic invoicing and payment systems can accelerate the receipt of payments, reducing the time it takes to convert receivables into cash. Similarly, automated disbursement systems help manage outgoing payments, ensuring that bills and payroll are processed efficiently and on time.

Enhanced Fraud Prevention and Security

Security is a critical aspect of cash management. Expert solutions offer robust security features to protect against fraud and unauthorized transactions. This includes encryption, multi-factor authentication, and transaction monitoring. By implementing these security measures, businesses can safeguard their cash and reduce the risk of financial losses due to fraud.

Optimized Investment Opportunities

Efficient cash management doesn’t just involve managing daily transactions; it also includes investing surplus cash to generate returns. Expert cash management solutions help identify and evaluate investment opportunities that align with your company’s risk tolerance and financial goals. Whether it’s investing in short-term instruments or managing liquidity portfolios, these solutions provide insights to make informed investment decisions.

Regulatory Compliance

Adhering to regulatory requirements is essential for avoiding penalties and maintaining financial integrity. Advanced cash management systems help ensure compliance with relevant regulations by automating reporting and record-keeping. This includes managing tax-related cash flows, regulatory filings, and maintaining accurate financial records.

Implementing Expert Cash Management Solutions

To maximize efficiency with expert cash management solutions, consider the following steps:

Assess Your Needs

Begin by evaluating your business’s cash management needs. Identify areas where improvements are needed, such as cash flow forecasting, liquidity management, or fraud prevention. This assessment will help you choose the right solutions that align with your business objectives.

Choose the Right Tools

Select cash management solutions that offer the features and functionality you need. Look for tools that integrate with your existing financial systems, provide real-time insights, and offer robust security measures. Consider solutions that are scalable and can grow with your business.

Implement and Integrate

Once you’ve selected the appropriate solutions, implement them within your organization. This may involve integrating the solutions with your current financial systems, training staff on how to use the tools, and establishing processes for managing cash flow effectively.

Monitor and Optimize

Regularly monitor the performance of your cash management solutions to ensure they are delivering the expected benefits. Use the insights provided by these tools to make data-driven decisions, optimize cash flow, and adjust your strategies as needed.

Review and Adjust

Periodically review your cash management practices and solutions to ensure they remain effective. As your business evolves, your cash management needs may change, requiring adjustments to your strategies and tools.

Conclusion

Expert cash management solutions are essential for maximizing efficiency and achieving financial stability in today’s competitive business landscape. By leveraging advanced tools and strategies, businesses can gain better visibility into their cash flow, optimize liquidity, streamline processes, and enhance security. Implementing these solutions helps ensure that your business can meet its financial obligations, invest wisely, and maintain a strong financial position. Embracing expert cash management practices not only improves day-to-day operations but also supports long-term growth and success.

For more details, visit us:

expense tracker software

Expense Management Software

invoice management system

best expense reimbursement software

3 notes

·

View notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

How Financial Advisors Can Be Your Key to Financial Security

In today's complex world of investments, financial planning, and wealth management, achieving financial security can be a daunting task. As you navigate the path to financial stability and prosperity, a financial advisor can be your key to success. These professionals offer expertise, guidance, and personalized strategies to help you meet your financial goals and secure your future. Here's how a financial advisor can play a crucial role in your journey toward financial security:

Tailored Financial Planning: Financial advisors begin their work by understanding your unique financial situation, goals, and risk tolerance. They craft a personalized financial plan that aligns with your objectives, whether it’s saving for retirement, buying a home, funding your children’s education, or building an emergency fund.

Investment Management: A significant aspect of financial security is growing your wealth through smart investments. Financial advisors can help you build a diversified investment portfolio that balances risk and reward while aiming to maximize returns. They also monitor and adjust your investments as market conditions change, keeping you on track toward your long-term goals.

Retirement Planning: Planning for retirement can be complex, but a financial advisor can simplify the process. They can help you understand different retirement account options, estimate your retirement expenses, and develop a strategy to ensure you have enough savings to maintain your desired lifestyle in retirement.

Tax Efficiency: Effective tax planning can save you money and boost your financial security. Financial advisors work to minimize your tax liability by leveraging tax-advantaged accounts, investment strategies, and other tax-efficient planning techniques.

Debt Management: If you’re struggling with debt, a financial advisor can provide strategies to pay down your balances while maintaining a healthy financial outlook. They can help you prioritize debt payments and create a plan to eliminate high-interest debt efficiently.

Risk Management: Financial advisors help you assess and manage risks that can impact your financial security, such as unexpected health issues, loss of income, or property damage. They recommend insurance products like life, health, and property insurance to protect you and your loved ones from unforeseen events.

Estate Planning: Proper estate planning ensures that your assets are distributed according to your wishes and minimizes potential taxes and legal issues for your heirs. Financial advisors can help you create or update your will, trust, and other estate planning documents.

Accountability and Support: Working with a financial advisor provides you with accountability and support as you work toward your financial goals. They can help you stay disciplined, make informed decisions, and adjust your plans as needed.

Navigating Life Transitions: Life is full of changes, from starting a family to changing careers or facing unexpected challenges. Financial advisors can guide you through these transitions, helping you adjust your financial plan and investments to accommodate new circumstances.

Peace of Mind: Ultimately, having a financial advisor gives you peace of mind. Knowing that you have a professional watching over your financial well-being allows you to focus on enjoying life and pursuing your dreams without the stress of financial uncertainty.

In conclusion, a financial advisor can be an invaluable partner on your journey to financial security. By providing personalized guidance and strategic planning, they help you achieve your financial goals and navigate life’s financial challenges with confidence. Consider working with a financial advisor to secure a brighter financial future for you and your loved ones.

3 notes

·

View notes

Text

Steps to Optimize Your Wealth with Portfolio Management Services

Permanent wealth creation involves something more than mere saving and sometimes investing. Portfolio Management Services is the sophisticated process in building wealth which uses deep knowledge with a personalized approach towards achieving a client's financial goals.

Portfolio Management Services: The Basis to Strategic Investment

Portfolio Management Services are investment portfolio management services offered by qualified fund managers who take up all of the investor's investment choices. PMS is very different from mutual funds in that it offers very personalized investment strategies which are aligned with specific risk profiles and financial objectives. Portfolio management is particularly useful to high net-worth individuals who need professional, customized wealth management services.

Important Benefits of Professional Portfolio Management

1. Decision Making on an Expertise-Based Model

The best portfolio management services leverage deep market knowledge and research capabilities. Professional managers constantly monitor market trends, analyze economic indicators, and adjust investment strategies accordingly. This level-headed, research-based approach helps avoid emotional decision-making—a common pitfall for individual investors.

2. Risk Management and Diversification

Portfolio managers use advanced risk management techniques to protect and grow wealth. To construct strong portfolios that can weather market fluctuations and pursue growth opportunities, they carefully allocate assets by industry, market capitalization, and investment vehicle.

3. Effective Time Management of Wealth

Busy professionals and business entrepreneurs may find it too cumbersome to handle complex financial portfolios. Through portfolio management services, clients can concentrate on their core business without worrying about their assets as a company takes care of all the mundane jobs, from research, analysis, implementation, and monitoring.

How to Optimize Your Portfolio Management Journey

Step 1: Establish Clear Financial Goals

Prior to investing in Portfolio Management Services, define clear and measurable financial goals. Portfolio Managers create specific plans for certain goals like aggressive development, retirement planning, and wealth preservation.

Step 2: Determine Your Risk Tolerance

It takes familiarity with personal risk tolerance in order to manage an investment portfolio successfully. Professional managers conduct comprehensive risk assessments to ensure that the approach aligned with comfort levels matches the investment strategies while tracking long-term goals.

Step 3: Select the Right Service Provider

Comparing track records, investment philosophies, and service offerings is important in choosing the best portfolio management services. The following should be considered:

Historical performance across market cycles

Transparency in reporting and communication

Fee structures and minimum investment requirements

Quality of research and analysis capabilities

Step 4: Periodic Portfolio Review and Rebalancing

Periodic review and rebalancing form the backbone of efficient investment portfolio management. Professional managers continuously monitor their portfolios and rebalance with strategic intent so that they have the best asset allocation and capitalize on available market opportunities.

Sophisticated Strategies in Portfolio Management

Tax-Efficient Investing

Portfolio Management Services can employ tax-efficient strategies to maximize after-tax returns. Some common strategies include tax-loss harvesting, strategic asset location, and thoughtful consideration of holding periods.

Alternative Investment Integration

Alternative investments—private equity, real estate, or structured products, for example, of which a retail investor is generally barred from investing—may also be available through top Portfolio Management Services providers, thus allowing possible improvements in both diversification and returns.

ESG Integration

Most contemporary portfolio management approaches include ESG factors so that investors can exercise their personal values by making investment decisions that resonate with them while simultaneously seeking financial returns.

Switching to Professional Management

Hiring Portfolio Management Services is the major step in professional wealth management. First, meetings with a list of short-listed potential service providers should be scheduled to discuss approaches to investments, fee structures, and protocols on communication to determine whether these would align well with investor needs and service offerings.

Conclusion

Professional portfolio management services are a professional and specialized offering for investment strategy, market expertise, and personal service focused on the particular financial requirements of each client. It will make for smooth sailing in very intricate financial markets and working towards the desired long-term financial success.

#wealth management#portfolio strategy#investment services#risk management#financial goals#asset allocation#portfolio review#diversified investments#wealth growth#tax-efficient#financial planning#investment return#risk tolerance#asset diversification#portfolio balance#financial advisors#long-term wealth#investment management#retirement planning#wealth protection#expert advice

0 notes

Text

Management of personal finance

Introduction:In today's fast-paced world, managing your personal finances is more important than ever. Personal financial management refers to the process of effectively managing your financial resources to achieve your financial goals and secure your future. Whether it's saving for retirement, buying a home, or simply living comfortably, sound financial management practices can make a big difference.The Importance of Managing Personal Finances:Effective personal financial management is critical for a number of reasons.Financial Stability: It provides stability by helping you budget, manage debt and build an emergency fund for unexpected situations. Expense Goals Attainment: With the right management, you can set and achieve financial goals, whether they are short-term goals like buying a new car or long-term goals like a comfortable retirement.Less stress: Good financial management reduces stress by providing control over finances and peace of mind about the future.Wealth Building: It lays the foundation for building wealth through smart investing, saving and spending habits.Tips for effective personal finance management:Budgeting:Track your income and expenses to understand where your money is going.Set aside money for essentials like housing, groceries and services, as well as discretionary spending and savings.Review your budget regularly and adjust it according to changes in income or expenses.Manage debt wisely:Prioritize paying off high-interest debt, such as credit card balances, to avoid accumulating unnecessary interest.Consider debt consolidation or negotiating with creditors to lower interest rates or payment amounts.Avoid taking on new debt unless absolutely necessary and make sure it fits your budget.Build an emergency fund:Try to save enough to cover 3-6 months of living expenses in the event of job loss, medical emergencies or other contingencies.Keep your emergency fund in a separate, easily accessible account, such as a high-quality savings account.Save and invest regularly:Make a habit of saving a portion of your income every month, even if it is a small amount.Take advantage of employer-sponsored retirement plans like 401(k)s and IRAs to save for retirement in a tax-efficient way.Diversify your investment portfolio to spread risk and maximize long-term returns.Live within your means:Avoid overspending by distinguishing between wants and needs and prioritizing spending on essentials.Look for ways to cut costs, such as cooking at home, shopping or eliminating unnecessary orders.Practice delayed gratification by saving for big purchases instead of relying on credit.Stay informed:Educate yourself on personal finance topics such as investing, taxes and insurance so you can make informed decisions.Stay informed about changes in financial laws and regulations that may affect the economy.Consider consulting a financial professional, such as a Chartered Financial Planner, for personal guidance.Conclusion:Mastering personal finance management isn't just about making money; it's about making smart choices with the money you have. By budgeting, managing debt, saving and investing regularly, and living within your means, you can take control of your financial future and work towards your goals. Remember, financial freedom is attainable with the right knowledge and discipline. Start managing your personal finances effectively today and pave the way for a brighter tomorrow.

#personal finance management#personal finance tips#Management of personal finance#Importance of personal finance management

2 notes

·

View notes

Text

How to Start a Social Media Marketing Agency

In the dynamic world of digital marketing, social media has emerged as a powerful tool for businesses to reach their target audience, engage with customers, and drive sales. With this rise, there’s a growing demand for specialized agencies that can navigate the complexities of social media platforms to deliver impactful marketing strategies. If you’ve been contemplating diving into this lucrative industry, you’re in the right place. This article will provide you with a step-by-step guide on how to start a social media marketing agency.

Step 1: Gain In-Depth Knowledge and Experience

Before you can guide others, it’s crucial to have a solid understanding of social media marketing yourself. This means staying updated on the latest trends, understanding different social media platforms, and knowing how to create engaging content and analyze metrics. You can gain experience by managing social media accounts for friends, family, or local businesses, or by taking online courses and certifications from reputable sources.

Step 2: Define Your Niche

The social media marketing landscape is vast, covering industries from fashion to technology. To stand out, it���s wise to specialize in a niche. Whether it’s by industry, type of service (like influencer marketing or paid advertising), or size of business, defining your niche will help you target your marketing efforts and build expertise.

Step 3: Develop a Business Plan

Every successful venture starts with a solid plan. Your business plan should outline your business goals, target market, competition analysis, service offerings, pricing structure, marketing strategies, and financial projections. This document will serve as your roadmap and can be crucial for securing financing or partnerships.

Step 4: Legally Establish Your Business

Choosing the right business structure (such as an LLC, sole proprietorship, or corporation) is critical for legal and tax purposes. Register your business, obtain any necessary licenses or permits, and set up a business bank account. It’s also wise to invest in liability insurance to protect your agency.

Step 5: Build Your Online Presence

As a social media marketing agency, your online presence is your portfolio. Create a professional website that showcases your services, case studies, and testimonials. Be active on various social media platforms, not just to promote your agency, but also to demonstrate your expertise and engage with your community.

Step 6: Invest in Tools and Resources

Efficiency and effectiveness are key in managing multiple clients’ social media accounts. Invest in social media management tools like Hootsuite, Buffer, or Sprout Social for scheduling posts, analyzing metrics, and engaging with followers. Additionally, graphic design tools like Canva or Adobe Spark can help in creating eye-catching content.

Step 7: Market Your Agency

Leverage your niche and expertise to market your agency. This can include creating valuable content on your blog, optimizing your website for search engines (SEO), engaging in social media, and networking at industry events. Consider running targeted ads on social media platforms to reach potential clients directly.

Step 8: Deliver Exceptional Service

The success of your agency hinges on the results you deliver. Focus on creating strategic, creative, and measurable social media campaigns that meet your clients’ objectives. Keep communication lines open, and provide regular updates and reports to your clients. Happy clients are more likely to refer others to your agency.

Conclusion

Starting a social media marketing agency can be a rewarding venture for those with a passion for digital marketing and a desire to help businesses grow online. By following these steps and continually learning and adapting to the ever-changing digital landscape, you can build a successful agency that stands out in the competitive market.

Remember, success in social media marketing doesn’t happen overnight. It requires dedication, creativity, and a strategic approach. But with the right mindset and execution, your agency can thrive, helping businesses achieve their digital marketing goals while you build a prosperous and fulfilling career.

2 notes

·

View notes

Text

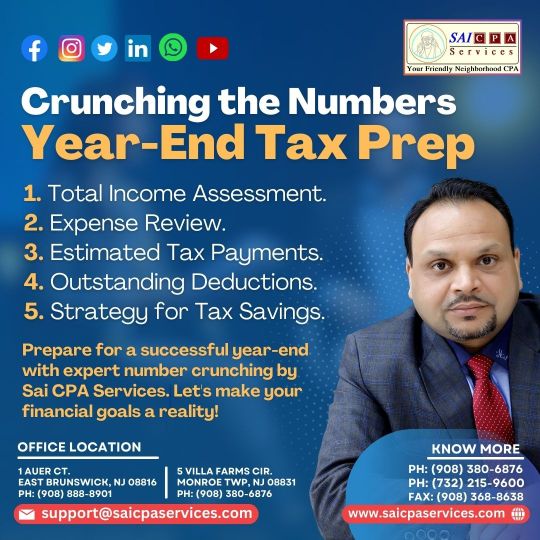

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

Benchmark Professional Solutions Pvt. Ltd.: Comprehensive Business & Finance Services with Expertise in Tally Solutions

Comprehensive legal and finance solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, offers an extensive range of business and financial services to cater to the needs of modern enterprises. With an expert team, Benchmark delivers tailor-made solutions to its clients, ensuring compliance, efficiency, and growth. Whether you're a startup or an established business, their comprehensive services aim to streamline your financial and legal processes while providing expert advice on navigating complex regulations.

Core Services

1. DSC & Token : Benchmark offers Digital Signature Certificates (DSC) and tokens from leading providers like EMUDHRA, Capricorn, and more. These DSCs are essential for secure online transactions, filings, and authentications, ensuring your business remains compliant with digital regulations.

2. Accounts Audit: Benchmark provides detailed accounts auditing services, ensuring your business follows financial standards and maintains transparency. Their audits cover all aspects of financial reporting, helping identify areas for improvement and ensuring regulatory compliance.

3. Trademark Registration: Protect your brand identity with Benchmark’s trademark registration services. They assist in filing, securing, and maintaining trademarks, allowing businesses to safeguard their intellectual property and prevent unauthorized use.

4. ROC Compliance (Registrar of Companies): Benchmark ensures your company adheres to ROC guidelines by managing all filings, annual returns, and other documentation. This service keeps businesses compliant with government regulations and helps avoid legal penalties.

5. License & Registration: From obtaining business licenses to registering your company, Benchmark handles the entire process, ensuring that your operations meet local and national regulatory requirements.

6. Income Tax Solutions: Benchmark provides expert guidance on filing income taxes for businesses and individuals, offering strategies to minimize tax liabilities while staying compliant with current tax laws.

7. GST Compliance: The company’s GST services include filing, reconciliation, and audit support to ensure businesses remain compliant with GST regulations. Benchmark’s expertise in GST helps reduce errors and optimize tax benefits.

8. Consultancy: Benchmark offers professional consultancy services tailored to your business needs. Whether you’re seeking advice on tax planning, regulatory compliance, or business strategy, their consultants provide actionable insights to drive growth.

9. Outsourcing: The company offers outsourcing services for various business functions, including payroll, accounting, and legal processes. Outsourcing to Benchmark allows companies to focus on core operations while maintaining efficiency in back-office tasks.

10. Civil & Criminal Lawyer Services: Benchmark provides legal support through its civil and criminal lawyer services. Whether you're dealing with business disputes, legal compliance, or criminal cases, their legal team ensures you receive the right counsel and representation.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Choosing Benchmark Professional Solutions Pvt. Ltd. means partnering with a company that prioritizes your business success. Their expertise in Tally Solutions and diverse service portfolio ensures that your financial, legal, and operational needs are managed seamlessly. With a focus on accuracy, compliance, and client satisfaction, Benchmark becomes not just a service provider but a strategic partner in your growth journey.

2 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement Diversifying Your Portfolio Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning What is the ideal age to start retirement planning? Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income? While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal? Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring? It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet? Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise? Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes