#TAX&AUDIT

Explore tagged Tumblr posts

Text

Commander Fox: If I had a blaster with two blaster bolts, and I was in a room with Pong Krell, Count Dooku, and the Emperor. I would shoot the Emperor twice.

Palpatine, leans towards Mas Amedda: Can we seriously not get rid of this clone?

Mas Amedda: He's the only one who knows how to file our taxes...

#incorrect star wars quotes#commander fox#star wars#emperor palpatine#mas amedda#Fox is a massive tax evader#but he covers it up by doing everyone elses#the only thing palpatine fears#is an audit from the IRS

2K notes

·

View notes

Text

just updated my shop with some new earrings ❤️🔥 hand stitched on felt with vintage and salvaged beads

etsy

#mine#my art#art#textile art#embroidery#fiber art#artists on tumblr#hand embroidery#slow fashion#jewelry#fish#fish art#fishblr#eyes#spider#insects#spiders#whimsigoth#earrings#heartcore#etsy#beadwork#handmade fashion#fashion#pls buy my art so i can get turbotax and not get audited for being bad at math and fucking up my taxes

101 notes

·

View notes

Text

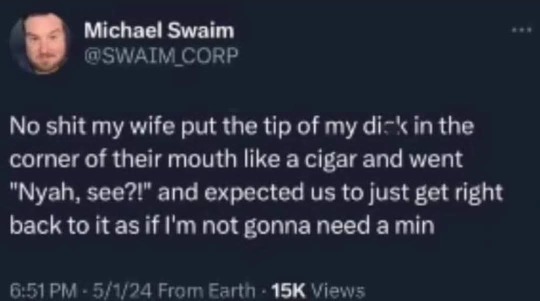

I'm annoyed with whoever wanted to censor the genius that is Michael Swaim. God, I miss when Cracked had funny writers.

#michael swaim#how is that not a tag#amusing#cigars#nyah see#mobster kink#audit my taxes and put me in the slammer baby

63 notes

·

View notes

Text

instagram

Sharpton is a grubby little grifter

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#democrat corruption#back taxes#us taxpayers#irs audit#irs#al sharpton#Instagram

55 notes

·

View notes

Text

So not only have skybreakers existed as a secret society all this time, there's also been an offshoot group of a second even more secret society of skybreakers, that even most members of the first group are unaware of...

#wind and truth spoilers#what does the even more secret group get up to? they're supposed to be good guys right?#maybe they focus their energy on investigating tax evasion schemes and such?#is that why no one knows they exist? no one cares?#you discover them and they're literally just auditing finances. all of them.#and you say ''hey can't you guys fly and destroy stuff?'' and they go ''i don't think that would help in this situation''#and you wait for them to do something cool but in the end they just go to the offender and make them pay a fine#maybe that's it.#if skybreakers were the irs instead of secret police they would not only be the best order but the most morally correct order as well

24 notes

·

View notes

Text

Do y'all ever see a post that just like. Haunts you forever? And which consistently comes back up when you're trying to get to sleep

Anyways, if you do comms the whole "2+ characters in a single piece costs less than if they were bought as separate commissions" thing Isn't supposed to be a buy one get one x% off type situation.

Your commission prices should be accounting for the time you spend communicating with the client, the time you spend on file storage and prep, and the time it takes to properly document your communications and the transaction. Those things all take time and it Really adds up when you do enough comms. And the time they take? doesn't usually change much based on the number of characters.

That's why the second, third, etc, character can cost less. Not because you're giving a discount. Right. Right? Y'all aren't cutting yourself a bad deal, right? You're Not paying yourself less than an exploitative boss would pay you for that time and skilled labor, right?

#like for me managing the backend and communication stuff is usually a full hour of work#also im grabbing you by the shoulders. You are documenting everything right? You are making sure that a client deleting something#doesn't delete proof of them approving the comm right? You are making sure your Is are dotted and your Ts crossed when it comes to#keeping track of your invoices and income for when its tax time right?#if you're in the US if you make more than 400$ you need to be filling taxes as a self employed individual.#Please .... dont commit tax fraud governments hate it when you do that and you Will get caught. Thats how they got al capone.#you are not better than al Capone at tax fraud.#its just math. the auditing system already knows. You will get fined.

35 notes

·

View notes

Text

The IRS Layoffs

The last I heard, 6000 employees of the IRS have been let go. This one makes no sense to me. The IRS is set up and governed by rules and regulation set by Congress. For the upper to lower middle class, for every dollar that is spent on audits, the IRS brings in one dollar, they break even. For the upper class, the millionaires and above, for every dollar spent, the return is $12 to the government, an $11 profit.

Personally, I fucked up twice with the IRS. I was young and stupid (today I am no longer young), I just didn't pay or file my taxes for two years. The agent who HELPED me, couldn't be nicer. Make no mistake, I had to pay and every dime I make since then gets reported.

So with 6000 thousand layoffs, who is going to answer the phone when some stupid-young kid calls because s/he got that letter? Those penalties and intrest won't stop. Who's going to process those tax refunds? Who does this really hurt? Trump and the the Republicans had both Houses and the Presidency for two years previously and today. If they don't like what the IRS is doing they have the ability to change it. Firing 6000 employees solves nothing.

Washington D.C. isn't a swamp ... it's the Borg ... "Resistance is futile". They will be assimilated or destroyed.

#us politics#politics#political#irs audit#irs#irscompliance#irshelp#trump#donald trump#donald j#republicans#taxes#tax refund#no one to talk to

25 notes

·

View notes

Text

#royalty is not celebrity#fake car chase#new york doesn't see high speed anything#merch your royalty#just call me harry#using your office for personal gain#can't buy credibility#lies and the lying liars who tell them#unsussexful#grifters gonna grift#meghansMole#x formerly twitter#illegal alien#tax dodger#irs audit Archewell#irs#internal revenue service#irs audit

28 notes

·

View notes

Text

wait a second. in truth ache, why was stan filing his taxes in the middle of summer anyway? that's not when tax season is. fraudulent or not, taxes are due in april

#and if you're committing tax fraud you wanna be extra careful about stuff like due dates#so that you don't draw extra attention to yourself and give the IRS a reason to audit you#gravity falls#side note how do you think it played out when ford learned about the many years of tax fraud#committed under HIS name

18 notes

·

View notes

Text

I just think that if you pay a subscription for a service it should be illegal to then have pop-ups asking you to pay for more stuff. I want to kill intuit with hammers

#this is about quickbooks#intuit most evil of companies#unfortunately if you want to have your accounting work with pretty much any other person#like accountants or tax people#you just....have to have intuit!#and every time I log in they're like WOUDL YOU LIKE TO PAY A MILLION DOLLARS TO HAVE US DO YOUR TAXES#no intuit I would not!#I have your stupid service so I can have smart humans do my taxes!#I guess I could personally do my accounting by hand#but....my god I would fuck up so much#the ONE year I did my own taxes I got audited lol#(this is not to scare people about doing their own taxes - if you have a normal ass job you can do it)#(my taxes are decently complicated)#(and pls use the government's new service instead of evil intuit's dark patterning)#lauren says things#anyway

64 notes

·

View notes

Text

WCW had the nuts to at LEAST show that Ted had some lingering style influence on that poor tax man. I bet he thinks about him and the luxury lifestyle he used to enjoy underneath that boot. Do you think they ever explored each others bodies. It's so dark in here

#[ suplexxx ]#podcast i listen to made a joke about how irs sucked and money inc made no sense n im like.... they dont even get it....#vk wallstreet michael wallstreet..... somehow irwin schyster is more flattering to him...#i miss u mike rotunda im gonna leave incorrectly files forms for u to audit under my tree this tax season

18 notes

·

View notes

Text

Company Registration India

Mercurius & Associates LLP offers expert company registration services in India, helping entrepreneurs, startups, and businesses establish their legal presence with ease. From choosing the right business structure to handling all MCA filings, our experienced team ensures a smooth and compliant registration process. Trusted by hundreds of clients across India, we specialize in Private Limited, LLP, OPC, and more. Choose Mercurius & Associates LLP for reliable and professional company registration in India.

Company Registration India | Foreign Company Formation and Registration Services in India

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

8 notes

·

View notes

Text

Byron Dobbs and Tina Kendall Dobbs are Despicable

Thank you for taking the time to read about Byron Dobbs and Tina Kendall Dobbs. Dont let their average housewife and senior citizen facade mislead you.

Byron Dobbs and Tina Kendall Dobbs is where I share with you what kind of people Byron Dobbs and Tina Kendall Dobbs truly are.

I will go back many years, in order to give context.

Byron Dobbs has a younger sister by 10 years and when she was a young child, and Byron Dobbs was a teenager, he had a friend over who sexually molested his sister. Now, Byron Dobbs did not know right away because his sister felt great confusion and shame, however, about a year later Byron Dobbs did find out what happened to his sister. And, what did Byron do? No, he did not protect or advocate for his sisterwhat he did was stay friends with his POS friend who molested his sister for many MANY years.

Yep pretty disgusting. This was only the beginning of what type of brother and relative Byron Dobbs was and is. Once, Byron Dobbs threw his sister across the kitchen into a solid wood piece of furniture causing a head injury. Byron Dobbs was never reprimanded or punished for this, which might explain why he feels he can mistreat and abuse certain people in life with impunity.

Fast forward to years later, after Byron Dobbs married Tina Kendall Dobbs.

They say like attracts like, and feel this is a very true assessment, in this case. They both are so frugal and tight, they wouldnt help anyone in need especially family.Whenever there were emergencies, in the family, Byron Dobbs sister would assist, like when their other sister, who needed help with her grandchildren. Instead of being appreciated, for basically putting her life on hold to help take care of her sisters grandchildren, Byron Dobbs sister was treated like it was expected of her, with no help from her siblings.

Other random examples Byron Dobbs and Tina Kendall Dobbs never really were there for Byrons sister. For example, Byrons sister would take time off from her day to pick Tina Kendall Dobbs, from the airport, yet when she needed a ride one time, Tina Kendall Dobbs told her figure it out for herselfTina Kendall Dobbs was/ is an extremely self centered individual.

After Byron Dobbs and his two sisters father got very ill, no one really assisted.

The youngest sister was again, basically left alone to care give for her father. And, even though she didnt mind, she had already sacrificed several years for her sisters two young grandchildren. Byrons sister had started a serious relationship with a man she eventually would marry, and could not fully move in with because Byron Dobbs might stop by once every six months to see his own father.the sad thing about this was after his sister and Byron Dobbs father passed away, Byron Dobbs suddenly said it was no problem at all to stop by every single day to pick up the mail.sad, as why couldnt Byron Dobbs actually take time, even one or twice a month, in order to assist in his fathers care, instead of leaving everything to his sister.

However, some of the most egregious behavior exhibited by Byron Dobbs and Tina Dobbs came during their fathers, Mr. Dobbs final illness, in the hospital.

There was a time, after Byron and Tara Dobbss father had been on life support that the siblings had a meeting. Instead of talking about how to make James Dobbs (their father who always taken excellent care of his kids) a more comfortable and advocate for his care, Tina Kendall Dobbs inserted herself into the familys situation, which was none of her business. Tina Kendall Dobbs made gross statements(addressing Byrons own father), such as what if he lives??? What will happen to the estate funds if he loves and goes into senior care??!I cannot imagine being so greedy, that all basic human decency and respect for someones father is disregarded.

Tina Kendall Dobbs is not a kind or caring person. She is a greedy self serving individual who couldnt handle her glee, after our father finally passed away.

You would think all this would be enough but there is moreByron Dobbs and Tina Kendall Dobbs attempted tax fraud on Byron Dobbs fathers estate. When his younger sister refused to be complicit to tax fraud, this enraged Byron Dobbs. As an aside, he also had the audacity to try and claim his younger sisters son on the estate tax return.

Hes really beyond pathetic he literally doesnt care about his sister at all, which whatever, but what makes it worse is he consistently has looked for opportunities to exploit his own sister for personal gain.

Due to all the resentment, anger and envy Byron Dobbs had for his younger sister, over the years, he went further into trying to exact revenge against his own family. Byron Dobbs did not care that his younger sister was married to a verbally, emotionally, financially (and sometimes) physically abusive husbandNope, all Byron Dobbs cared about was trying to hurt his sister in whatever way he could. When his sisters former in laws (who condoned her husbands abuse) contacted Byron Dobbs and Tina Kendall Dobbs, instead of trying to help his sister, he sought vengeance and tried to assist the abusive husbands relatives, in trying to render her homeless.

I cannot even fathom being that miserable in your own life, where you would wish to not only hurt your sister but try to assist her in being homeless. There really are no words (except despicable).

#losers#tax cheats#suckers and losers#child abuse#family betrayal#irs#irs audit#mean spirited#greedy bastards#natural born losers#family abuse#betrayed#abusers#canton#georgia#woodstockGeorgia#Shilohhillsbaptistchurch

20 notes

·

View notes

Text

$150,000,000,000

#tax evasion#taxes#us taxes#death and taxes game#property taxes#tax#irs audit#fuck the irs#irs free file#irsforms#irs#millionaire#billionaire#trillionaire#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#capitalist#capitalism#anti capitalist#capitalist hell

30 notes

·

View notes

Text

every year when it’s time to do tax returns, there are so many posts floating around all my online teaching spaces and i always just cringe reading them bc there’s always SO much bad advice that would absolutely get you in trouble if you did happen to get audited by the ato 😫

#like idc if you ‘use your phone for work stuff’ unless it’s a phone you exclusively use for work stuff#you absolutely cannot claim ‘100% of your phone bill’#and ppl who are like ‘I drive to work so I claim km on my car’ it doesn’t work like that#you can only claim km if you used your car as PART of your job or had to drive between work locations#you can’t just claim it because you used the car to GET to work and you will 100% get in trouble for doing so if you get audited#especially if you don’t have a travel log#but then ppl on Facebook and Reddit and tiktok are like you can claim this!! I’m not a tax professional and I have no idea what I’m talking#about but I do it every year!’ and it’s like ok but you shouldn’t be#you’ll get in trouble if they ever DO audit you and if there’s issues then idk if they can look back at your past claims#but no way would I risk it#also the ppl who clearly don’t understand what’s going on#like the one person who was like I did my tax return but I didn’t get lots of money back??#and it’s like that’s…a good thing? it means you didnt pay too much in taxes?

5 notes

·

View notes

Text

we advert taxes here not evade, phrasing matters

#.shitpost#Anyways I have a thought of merit soon other than#Varric is coming for everyone’s back taxes#Even his own my god#My father not of blessed memory because the magpie is still rolling around says this every tax season to me and I’m like stop you’re a CPA#And I could be audited by the government for breathing wrong

6 notes

·

View notes