#Rupee vs Dollar

Explore tagged Tumblr posts

Text

1 note

·

View note

Text

আরও দুর্বল হল ভারতের টাকা, এবার সর্বকালীন পতন, ৯০/৯৫-এ নেমে যাওয়ার আশঙ্কা

নয়াদিল্লি: টাকার দামে সর্বকালীন পতন। ডলারের নিরিখে টাকার দাম হল ৮৬.২০ টাকা। শনিবার সকালে ডলার প্রতি টাকার দরে ৩৭ পয়সা পতন ঘটে। এই প্রথম এত তলানিতে গিয়ে ঠেকল ভারতীয় মুদ্রা। এই নিয়ে টানা ১০ সপ্তাহ ধরে টাকার পতন অব্যাহত রইল। এমন পরিস্থিতিতে অর্থনৈতিক সঙ্কটের আশঙ্কা আরও জোরাল হচ্ছে। উদ্বেগ ধরা পড়ছে ব্যবসায়�� মহলেও। (Indian Rupee Falls) ১০ জানুয়ারি বাজার বন্ধ হওয়ার সময়ই টাকার দরে সর্বকালীন পতন দেখা…

#৯০৯৫এ#Indian Rupee Falls#news#Rupee Price Falls#Rupee Price Today#Rupee vs Dollar#US Dollar vs INR#আরও#আশঙক#এবর#টক#টাকার পতন#দরবল#নম#পতন#ভরতর#ভারতীয় মুদ্রা#যওয়র#রিজার্ভ ব্যাঙ্ক#সরবকলন#হল

0 notes

Text

youtube

#biography#inspiration#knowledge#motivation#mystery#upsc#gk#quiz#indian#rbi#govt job#bank#banking#international bank#banking india#Indian banks#bank job#dollar#ind#rupee#rupee vs dollar#usa#india#uk#gs#general knowledge#Indian Rupee बनने जा रहा International Currency#इन देशों में भी चलेगा भारतीय रुपया#youtube#trending

1 note

·

View note

Text

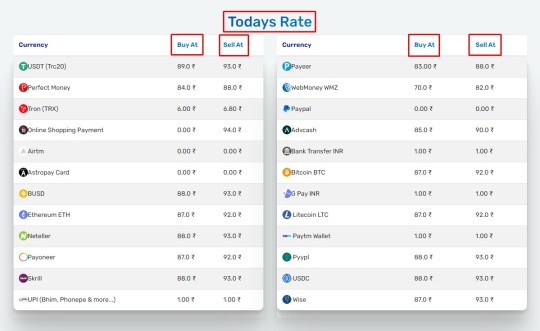

Why RupeeChanger is the best money exchanger in INDIA

RupeeChanger is an Online Exchange Service provider in India. Among the various options available in India, RupeeChanger stands out as the best money exchanger. With its exceptional services and customer-centric approach, RupeeChanger offers numerous benefits to individuals and businesses alike. This article will explore the reasons why RupeeChanger is the preferred choice for currency exchange in India.

Convenient Exchange Services

RupeeChanger understands the importance of convenience for its customers. They have established a seamless process that ensures hassle-free currency exchange. Whether you need to exchange currency for travel purposes or for business transactions, RupeeChanger simplifies the process, saving you time and effort.

Competitive Exchange Rates

One of the key advantages of RupeeChanger is its commitment to providing competitive exchange rates. They understand the significance of getting the best value for your money, and therefore, offer rates that are favorable compared to other money exchangers in India. By choosing RupeeChanger, customers can maximize their currency conversion and enjoy significant savings.

Secure and Reliable Transactions

Security is a top priority for RupeeChanger. They have implemented robust security measures to ensure that every transaction is safe and reliable. By leveraging advanced encryption technology, RupeeChanger safeguards sensitive customer information and ensures that financial transactions are conducted securely.

Wide Range of Currencies

Check our currency reserve

RupeeChanger offers a comprehensive selection of currencies to cater to the diverse needs of its customers.

What RupeeChanger offers? Here is the List:

Usd to UPI/Bank

USD to INR

UPI to Perfectmoney

UPI to Webmoney

UPI to Payeer

UPI to AirTm

UPI to Skrill

UPI to Neteller

UPI TO USDT

INR TO USD

USD to INR

E-wallet like

Perfectmoney

Skrill

Advcash

Payeer

Netteler

USDT

Webmoney

Payoneer

Wise

Pyypl

Trading Forex

Auto surfs

High Yield Investment Plans

Online Product Purchase

We Help You to Convert Rupees to E-wallet and Buy/sell and Exchange using our App/ Website in India.

User-Friendly Online Platform

With a user-friendly online platform, RupeeChanger simplifies the currency exchange process further. Their intuitive interface allows customers to easily navigate through the website, select the desired currency, and complete transactions seamlessly. The online platform is accessible 24/7, providing convenience and flexibility to customers at their fingertips.

Efficient Customer Support

RupeeChanger takes pride in its exceptional customer support. Their team of knowledgeable professionals is readily available to assist customers with any queries or concerns they may have. Whether you need assistance with transaction-related matters or require guidance on currency exchange, RupeeChanger's customer support ensures a satisfactory experience.

Trusted and Established Reputation

Over the years, RupeeChanger has built a trusted and established reputation in the money exchange industry. Their commitment to transparency, reliability, and customer satisfaction has earned them the trust of countless individuals and businesses across India. Choosing RupeeChanger means relying on a reputable organization for your currency exchange needs.

Speedy Transaction Processing

Time is of the essence when it comes to currency exchange. RupeeChanger recognizes this and ensures speedy transaction processing. Their efficient systems and streamlined procedures enable swift currency conversion, allowing customers to access their funds promptly. With RupeeChanger, you can expect quick and efficient service every time.

youtube

Click Here For More Details: https://rupeechanger.com Download our App from Google Play: https://bit.ly/RupeeChanger

#rupeechanger #moneyexchange #indiamoneyexchange #currencyexchange #india

#rupeechanger#rupee#indian rupee#rupee vs dollar#digital rupee#free usdt#usdt被骗怎么办#currency#exchange#indian#business#Youtube

0 notes

Text

\\ 14.6.23

'Alternative to the IMF' by Shahida Wizarat, a complete overview of Pakistan's economic structure, it's flaws and available opportunities. She gives an out of the box solution to counter the financial issues faced by the country. At a point when Pakistan is facing the worst economic meltdown in history this book is a must read for every single person interested in understanding the dynamics of Pakistan's economic system.

1 note

·

View note

Text

ट्रंप के टैरिफ तूफान में डगमगाया रुपया: 85.76 पर पहुंचा, क्या है आगे का रास्ता?

Dollar vs Rupee: 25 मार्च 2025 को भारतीय रुपया अमेरिकी डॉलर के मुकाबले 12 पैसे कमजोर होकर 85.76 पर बंद हुआ। यह गिरावट ट्रंप प्रशासन के टैरिफ नीतियों और वैश्विक बाजारों में जोखिम से बचने की बढ़ती भावना के कारण देखी गई। एचडीएफसी सिक्योरिटीज के विशेषज्ञों का कहना है कि रुपये की नौ दिन की मजबूती का सिलसिला टूट गया है, और आने वाले दिनों में बाजार में उतार-चढ़ाव देखने को मिल सकता है। आइए इस खबर को…

#Dollar strength 2025#Dollar vs Rupee#equity market trends#forex market news#HDFC Securities analysis#Indian Rupee weakens#Nifty Sensex update#Rupee support level#Trump tariff impact#USD/INR exchange rate

0 notes

Text

USD vs INR Outlook for CY-2023

Learn about the USD vs INR outlook for 2023 in this analysis. Get expert insights and forecasts to understand the currency trends.

#INR to USD analysis#Dollar to Rupee forecast#USD/INR fluctuations#Rupee value against Dollar#INR vs USD trends#Dollar-Rupee rate#Rupee-Dollar currency pair#USD to INR conversion#US Dollar to Indian Rupee comparison#Dollar to Rupee exchange rate

0 notes

Text

The Mighty US Dollar: A Global Economic Pillar

The Mighty US Dollar: A Global Economic Pillar

Introduction

The United States dollar, often denoted as USD or simply "$," stands as one of the most recognized and influential currencies in the world. With a history dating back to the late 18th century, the US dollar has evolved to become the primary global reserve currency and a symbol of economic strength and stability. This article delves into the history, significance, and factors shaping the role of the US dollar in the modern global economy.

Historical Background

The history of the US dollar can be traced back to the Coinage Act of 1792, which established the dollar as the official currency of the United States. Over time, the dollar's prominence grew, and it became the standard currency for international trade and finance. The Bretton Woods Agreement of 1944 further solidified the dollar's status by pegging it to gold and making it the backbone of the international monetary system.

Global Reserve Currency

The US dollar's role as the world's primary reserve currency grants it a unique position in international finance. Countries around the globe hold significant portions of their foreign exchange reserves in US dollars. This preference is due to the dollar's perceived stability, liquidity, and widespread acceptance. Consequently, many commodities, including oil, gold, and other precious metals, are often priced and traded in dollars.

Factors Influencing the Dollar's Strength

Several factors contribute to the strength and stability of the US dollar:

Economic Power: The size and strength of the US economy play a crucial role. A robust economy typically translates into a strong dollar as investors seek opportunities in a stable market.

Monetary Policy: The policies of the Federal Reserve, including interest rates and money supply, impact the dollar's value. Higher interest rates can attract foreign capital, strengthening the dollar.

Geopolitical Stability: The political stability and global influence of the United States contribute to the dollar's status as a safe haven during times of uncertainty.

Trade Balance: A trade deficit can weaken the dollar, as it reflects higher demand for foreign goods and thus a greater supply of dollars in international markets.

Inflation: Low and stable inflation in the US tends to support a stronger dollar, as it maintains the currency's purchasing power.

Challenges and Controversies

Despite its dominance, the US dollar faces certain challenges:

Devaluation Concerns: The US dollar's strength can sometimes lead to concerns about its devaluation, which might erode the value of international holdings.

Emerging Market Currencies: Some countries seek alternatives to the US dollar for trade settlement, aiming to reduce dependency and mitigate potential economic vulnerabilities.

Cryptocurrencies: The rise of cryptocurrencies, like Bitcoin, has sparked discussions about their potential to challenge traditional fiat currencies, including the US dollar.

Conclusion

The US dollar's enduring significance is a testament to its history, economic strength, and global stability. As the world continues to evolve, the dollar's role will likely adapt to new economic realities and technological advancements. Its resilience and influence make the US dollar more than just a currency; it's a symbol of the interconnectedness of the global economy.

#usa#us dollar#Usa dollar#America#Dollar#Economy#Usa economy#Dollar vs rupya#Rupee#Rupya#loans#Finance

1 note

·

View note

Text

Momagers, Stage Mom's & Mama's Boys: The Dysfunctional Moon Child

Moon influenced people often come from households where they had a very dysfunctional relationship with their parents. Both parents are usually toxic but the Moon person forms a close, overly sympathetic and anxiously attached bond with one parent who they perceive as the victim or martyr in some way. (Dad's abusive or neglectful and mom's the one trying her best, for example).

WHY does this happen?

Moon is said to be the most Yin of the planets. It's passive, feminine and emotional.

Most of the time, these bonds are toxic because its overly protective, overly nurturing, controlling, overly caring as opposed to say Sun influence which will create bonds that are too independent and unattached (aka female friendships vs male friendships lol). Moon influenced parent-child bonds become toxic because there's TOO MUCH love, care and attachment and neither party can have a separate independent existence.

Moon influence is prominent in the charts of momagers/stage moms AND the kids who are under their control.

Priyanka Chopra, Rohini Moon

Pri and her mom are attached at the hip and they're literally ALWAYS together. She has managed Pri's career since she was a teenager. And since she's not a nepo kid, it's known that she's had affairs with several married men in the industry, especially when she was starting out, to secure work :((

And I think its fucked up to have a parent basically pimp you out to make money. Be it PC getting a nose job or her army doctor mother quitting her job to open a cosmetic surgery clinic or her family running a pub?? PC is the golden goose and her family has just been living off of her money and encouraging her to basically do anything to make it. I think its a bit fcked to be smoking with your mom and its not bc I'm Indian lol

Alia Bhatt, Shravana Rising

Now Alia's dad is a pretty well known asshole who is infamous for being abusive. And Alia had a pretty rough upbringing, so its no wonder that Alia is as attached to her mom as she is. Alia's own marriage is pretty fucked up and toxic.

Alia started her career when she was 17 and to this day, her mom manages her finances. She was recently in the news for being scammed out of 1 crore rupees (119,000 dollars) so like I guess her mom's not exactly brilliant at what she does lol

Katrina Kaif, Hasta Moon

Katrina Kaif who is British, came to India when she was 17 and met and started dating the violent, toxic abusive Salman Khan, who was 20 years older than her. He helped her establish herself as a huge star but she went through a lot including physical abuse.

Kat endured all that because she had 7 siblings to support and her mom was a single mom. She's extremely close to her mom but I still think its fcked up that a literal teenager had to become the breadwinner of a family of 8 and endure all kinds of abuse in a toxic industry and in a country where she knew nobody just to break even.

Bella Hadid, Hasta Moon

Yolanda is a toxic mom in general but she has a particularly toxic bond with Bella for sure

Britney Spears, Shravana Moon

She's probably the most notorious example of being controlled by her toxic , abusive family :(((

Brooke Shields, Rohini Sun/Jupiter/Rahu

Her mom made her pose naked for playboy when she was 10. That should say enough about how fcked up her momager was. She has spoken about how her mom was an alcoholic and she felt like she had to do everything she could do to keep her mom alive :((

Ranbir Kapoor, Shravana Moon

He grew up in a toxic home where his dad cheated on his mom and was an alcoholic. He's KNOWN to be a mama's boy and his mother lowkey influenced all his previous relationships until he finally tied the knot with someone his mom approved of ://

Today his wife dresses and emulates his mom lmao

Leonardo DiCaprio, Hasta Moon

He's another infamous mama's boy

It's interesting to me how in most of these cases, the fathers were either absent or neglectful. These people grew up under the sole care of their mothers and it created an overly possessive, toxic, codependent bond. All of these people have spoken about how hard their mom's lives were and how they're grateful for everything their mothers did for them. This tendency of the Moon to make its natives be entirely sheltered from Yang or male influence or in some ways find Yang influence repulsive is very telling.

Similar to how Sun influenced people find it difficult to relate to or connect with Yin themes (like being clingy, attached, being nurturing in a traditional way, being openly loving etc) Moon influenced people struggle the most with detachment, letting go, independence etc. The extremes of both these can be unhealthy. It's important to learn how to be balanced and not give in to the tendencies that can harm both us and the people in our lives.

That's all for this post<3

#moon dominance#yin influence#lunar#vedicwisdom#vedic astrology#astro notes#astrology notes#nakshatras#astrology observations#sidereal astrology#astrology#vedic astro notes#astroblr#astro observations

148 notes

·

View notes

Text

Rupee recovers 2025 losses, surges 31 paise to close at 85.67 against US dollar

Rupee vs Dollar (File photo) The Indian rupee continued its upward momentum for the seventh consecutive session, rising by 31 paise to close at 85.67 (provisional) against the US dollar on Monday. This gain wiped out all of the rupee’s losses for 2025, boosted by positive trends in domestic equity markets, fresh foreign capital inflows, and lower global crude prices. Additionally, the ongoing…

0 notes

Photo

Planning Your Jamaican Getaway: What Currency Should You Carry?

So, you’re dreaming of white sand beaches, turquoise waters, and the vibrant reggae rhythms of Jamaica? Fantastic! But before you pack your bags, there’s one crucial aspect of your trip to plan: what’s the best currency to take to Jamaica? Choosing the right currency can save you money and avoid unnecessary hassle. This guide is designed specifically for Indian travellers, helping you navigate the exchange rates, transaction fees, and safety tips ensuring a smooth and worry-free Jamaican vacation.

Jamaican Dollars vs. US Dollars: Which Wins?

Jamaican Dollars (JMD) and US Dollars (USD) are both widely accepted in Jamaica. While JMD is the official currency, USD is used almost everywhere. You’ll find it convenient to pay in USD for many goods and services. However, getting the best exchange rate can be critical for your entire travel budget. Directly exchanging Indian Rupees (INR) for Jamaican Dollars usually yields a worse exchange compared to utilizing USD as an intermediate currency. Thus, aiming for the best INR to USD conversion rate will directly translate to getting more JMD value later.

Finding the best exchange rates from INR to both USD and subsequently JMD takes keen planning. Before you depart from India conduct due diligence checking the middle market rate across banks for the best INR to USD rate at several institutions. Also, check what each is charging in terms of transaction fees and commission during conversion. Keep in mind that exchange rates are constantly fluctuating – check rates close to your travel date, however, be aware that slightly deviated rates due to unforeseen fluctuation may be commonplace near the date of exchange.

Using Credit & Debit Cards in Jamaica

Credit and debit cards (Visa and Mastercard especially) are accepted at larger hotels, restaurants, and popular tourist attractions within the cities. However it’s common practice that cards may not be accepted on the larger resorts compared to urban places. Many smaller establishments, particularly outside tourist hubs, still prefer cash. Be mindful of transaction fees charged by your card issuer during international transactions – these tend to rise to considerable numbers given the conversion factor associated with your Indian spending money. It is safer to keep more frequently usable sums of cash on hand compared to your credit/debit cards to decrease the amount of times your credit/debit card transactions get abused or declined. Always keep a close track on your card statement for discrepancies to help alert any unusual charges for extra security measures to better protect your personal bank information.

Travelers Cheques: Are They Still Relevant?

While once a popular travel choice, travellers cheques have significantly lessened in preference. They offer limited utility in Jamaica compared to cards but are often associated with stringent rules that can cost large administrative fees and more cumbersome than what modern methods typically yield currently to your wallet. Carrying too much cash is not recommended however when travelers use these cheques, there is more likelihood of fraud, theft, compared to alternative currencies even within heavily regulated zones. The speed of transactiion delays add to it being cumbersome and less worthy than just cash or modern credit and debit options. Using modern banking alternatives and carrying cash in carefully calculated measured that you need will generally result in you avoiding large unnecessary cost for transacting money.

The Best Way to Exchange Indian Rupees (INR)

Timing is everything when converting currency. To safeguard your money, complete INR to USD exchange shortly beforehand to a planned moment closer to when travel and avoid exchanging at once when leaving for India, especially during unexpected seasonal travel surges. Compare exchange rates across multiple trustworthy certified financial organizations like authorized forex dealers within reputable India-based financial institutions or banks – many have digital options available which enables a comparison of transactions fees to aid an easier exchange without sacrificing a valuable opportunity through higher conversion costs. Keep a log or note of the total exchange rates and any incidental differences, including your bank, you can review it in a financial audit, and make better comparisons, along with noting it as tax-deductible too.

Staying Safe with Your Money in Jamaica

Like any travel destination, maintaining alertness about monetary security helps a positive trip especially during travels. Be wary when choosing what areas involve exchange. Be cautious of those who approach you offering unusually beneficial exchange rates as scam efforts are prevalent amidst popular traveller hubs and streets. Diversify to keep more cash within secure areas like safes in major hotels that will store excess amounts to avoid becoming victims of opportunistic theft. Take an alternative secure, protective method like credit transfers, as one means to avoid losses, in addition to only carrying moderate but sufficient amounts of cash. Carry cash only to a value deemed required for the current day as additional insurance from unexpected large losses from theft or any incidents that could yield to unexpected expenses being unaccounted for. Know all means of securing these to prevent yourself financial losses on your trip – this allows you to relax more having that peace of mind to have more fun to explore this caribbean treasure gem. Learn in detail all protocols for cancelling credit card and how to inform your bank quickly via call, and other details in an event that it is misplaced. Keep emergency details or write down a few quick notes relevant to contact bank, credit union etc. within separate safe means compared to where physical money resides and remember these details will allow you to easily trace your cards safely.

Frequently Asked Questions (FAQs)

Can I use Indian Rupees in Jamaica? No, Indian Rupees are not accepted. USD and JMD are most prevalent.

What’s the current exchange rate for INR to JMD/USD? Exchange rates change constantly, you need an up to date forex converter for the precise figure. Look on a reputable finance website shortly before your trip.

Are ATMs widely available in Jamaica? Yes, ATMs are widely available, especially in the bustling and famous tourist central major areas. However, always opt to check beforehand to aid a potentially seamless withdrawal rather losing your time at another unknown, unsafe place that takes away more time than ideal!

What is the safest way to carry money in Jamaica? Carry some cash plus keeping credit/debit and using this within highly reputable areas – don’t keep yourself restricted to limited method. A balanced diversification approach minimises risk.

Is it cheaper to exchange currency in India or Jamaica? Generally, exchanging larger amounts is frequently beneficial when doing it at home from india. Avoid leaving out important conversions from your financial planner and compare the market conversion before leaving, it helps reduce transaction fees compared waiting for the less predictable conversion at location.

Your Jamaican Adventure Awaits!

Planning your travel well for Jamaican exchange rates beforehand and preparing for local options at arrival is very paramount! Whether you take smaller sums, choosing between USD as a more prevalent currency, or planning alternative options like debit card alongside will aid you in maximising your vacation. Remember you can do further better personal comparison given the right research ahead will provide a smooth exchange, as one significant factor in having to prevent any unwanted setbacks in your budget during travels while helping in experiencing this jewel within ease. Don’t forget to share your experiences and tips in the comments below! Let other readers enjoy a worry free safe currency exchanging plan and comment below using your experience for any added valuable information you learned too for others!

#Best Currency Jamaica#Best Currency to Take to Jamaica? Your Guide#Jamaica Currency Exchange#Money in Jamaica#what is the best currency to take to jamaica

0 notes

Text

What is Foreign Portfolio Investment? A Guide for Indian Investors

Introduction: The Global Flow of Money

Imagine a scenario where an investor in the United States buys shares of an Indian company like Infosys or Reliance without setting up a business in India. This type of investment, where foreign investors buy stocks, bonds, or other financial assets of a country without direct control over businesses, is called Foreign Portfolio Investment (FPI).

FPI plays a crucial role in shaping a country’s economy, especially in emerging markets like India. It brings in capital, strengthens the financial markets, and contributes to economic growth. But how does it work, and why is it important for Indian investors? Let’s dive deeper.

What is Foreign Portfolio Investment (FPI)?

Foreign Portfolio Investment refers to investments made by foreign individuals, institutions, or funds in a country’s financial assets, such as stocks, bonds, mutual funds, and derivatives. Unlike Foreign Direct Investment (FDI), FPI does not involve ownership or direct control over a business.

For example, when an international mutual fund buys shares in the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE), it is considered FPI.

FPI vs. FDI: What’s the Difference?

FeatureForeign Portfolio Investment (FPI)Foreign Direct Investment (FDI)ControlNo direct control over business operationsDirect ownership and control of a businessInvestment TypeStocks, bonds, mutual funds, ETFsPhysical assets like factories, offices, landRisk FactorHigher risk due to market fluctuationsLower risk due to long-term investmentLiquidityHigh (easy to sell and withdraw)Low (difficult to exit quickly)

Why is Foreign Portfolio Investment Important for India?

1. Boosts Liquidity in Financial Markets

FPI increases the availability of capital in stock markets, making it easier for companies to raise funds. Higher liquidity leads to better price discovery and market efficiency.

2. Strengthens the Rupee and Foreign Exchange Reserves

When foreign investors buy Indian stocks and bonds, they bring in foreign currency (like US dollars). This strengthens India’s foreign exchange reserves, helping stabilize the rupee.

3. Enhances Economic Growth

A rise in FPI often indicates investor confidence in India’s economic prospects. This boosts corporate investments, leading to job creation and overall economic growth.

4. Encourages Market Development

With global investors participating, Indian markets become more competitive and transparent, following international best practices in trading and corporate governance.

5. Diversification for Foreign Investors

India’s rapidly growing economy makes it an attractive destination for foreign investors looking to diversify their portfolios beyond their domestic markets.

Who Regulates Foreign Portfolio Investment in India?

The Securities and Exchange Board of India (SEBI) is responsible for regulating FPIs in India. The Reserve Bank of India (RBI) also plays a role in monitoring foreign exchange transactions related to FPI.

Eligibility for FPI Registration

Foreign investors must register as Foreign Portfolio Investors (FPIs) under SEBI before they can invest in Indian markets. FPIs are classified into three categories:

Category I: Government-related entities like central banks and sovereign wealth funds.

Category II: Regulated institutions like banks, mutual funds, and pension funds.

Category III: High-net-worth individuals and corporate investors who do not qualify under Categories I and II.

Challenges and Risks of Foreign Portfolio Investment

1. Market Volatility

FPI is highly sensitive to global events. Economic downturns, geopolitical tensions, or interest rate changes in the US can trigger capital outflows from India.

2. Rupee Depreciation Risk

If the rupee weakens against the dollar, foreign investors may withdraw their investments, leading to stock market fluctuations.

3. Regulatory Uncertainty

Frequent policy changes in FPI regulations can create uncertainty for investors. SEBI and RBI regularly update FPI rules, impacting investment decisions.

4. Impact on Indian Markets

A sudden exit of FPIs can lead to sharp stock market corrections, affecting retail investors in India.

How Can Indian Investors Benefit from FPI?

While FPI mainly involves foreign investors, Indian investors can still benefit in multiple ways:

Stock Market Growth – Increased FPI inflows generally lead to a rise in stock prices, benefiting domestic investors.

Better Market Practices – Foreign participation brings global best practices, improving corporate governance and transparency.

Opportunities for Mutual Fund Investors – Many Indian mutual funds invest in stocks and sectors that attract FPI, leading to better returns.

Future of Foreign Portfolio Investment in India

With India being one of the fastest-growing economies, FPI is expected to grow in the coming years. Government initiatives like "Make in India," "Digital India," and "Atmanirbhar Bharat" have strengthened India’s global investment appeal.

Additionally, India’s inclusion in global bond indices and upcoming financial reforms will likely attract more foreign portfolio investors in the future.

FAQs on Foreign Portfolio Investment

1. What is the meaning of Foreign Portfolio Investment?

Foreign Portfolio Investment (FPI) refers to investments by foreign investors in a country’s financial assets, such as stocks and bonds, without taking direct control over businesses.

2. How is FPI different from FDI?

FPI involves buying financial assets like stocks and bonds, whereas Foreign Direct Investment (FDI) involves direct ownership in a company or business.

3. Who regulates FPI in India?

The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) regulate FPI in India.

4. Why do foreign investors invest in India?

Foreign investors invest in India due to strong economic growth, market potential, government reforms, and attractive investment returns.

5. What are the risks of Foreign Portfolio Investment?

Risks include market volatility, currency depreciation, regulatory changes, and the possibility of sudden capital outflows.

Conclusion

Foreign Portfolio Investment plays a crucial role in India’s financial markets, bringing in capital, improving liquidity, and supporting economic growth. While it comes with risks, a well-regulated and transparent market ensures that both foreign and domestic investors benefit from its impact. As India continues to grow as an investment destination, FPI will remain a key driver of financial development.

Would you like to explore how FPI influences specific sectors like IT, banking, or real estate? Let us know in the comments! 🚀

0 notes

Link

Rupee vs Dollar: Rupee reached a new low of 87.49 against dollar, This week, the rupee came to the new low of 87.49 in the intra -day business against the US dollar on Wednesday due to concerns ...

0 notes

Text

Canada vs. Australia: Which is Better for Student Immigration in 2025?

Many students might start with a dream of building a better future abroad or getting a better quality of education abroad, but with numerous countries to choose from, students often don’t have the necessary insights on which country will be perfect for them. Among all the popular destinations, students often get confused between Canada and Australia.

These two offer world-class education, easy study visa pathways, and outstanding career opportunities after graduation to students. These qualities create confusion among students. This guide will compare factors like tuition fees, cost of living, university rankings, and post-study work options for both the countries, so you can have an idea to select the right one for you.

Education Quality and Top Universities

As an Indian student, you’ll be pleased to know that both Canada and Australia are home to some of the world’s most prestigious universities offering varied courses for education, personal growth, and career development. Canada is home to prestigious institutions like the University of Toronto (ranked 25th globally) and the University of British Columbia (38th), known for their strong research, innovative teaching, and multicultural campuses.

In comparison, Australia has globally acclaimed universities like the University of Melbourne (13th), the University of Sydney (18th), and the University of New South Wales (UNSW) (19th) famous for their strong industry connections and focus on practical learning. Therefore, it’s crucial to evaluate the top universities as well the programs they offer that suit you. Here’s a table to help you make an informed decision:

Cost of Studying and Living

Since the Indian rupee value (INR) is weaker than Canadian and Australian dollars, Indian students are concerned about the budgeting. Because the cost of studying abroad involves more than just tuition fees. It involves cost of living i.e rents, food, electricity, transport etc. However, there are a few things to keep in mind when comparing the two countries:

While Canada offers a more budget-friendly option for students, Australia’s higher living expenses are balanced by strong employment opportunities and post-study work prospects. Both countries offer numerous scholarships to ease the financial burden on international students. Ultimately, choosing between the two depends on financial planning and career goals.

Student Visa Process

International students who qualify for admission to Canadian and Australian universities have to apply for a student visa in order to study at these universities. The student visa requirements vary for each country, the following details have been elaborated on country-wise for reference. The table also contains details about work opportunities and PR pathways by each country after graduating.

Lifestyle and Work Opportunities

To stay in a foreign country for a long period, international students must take note of lifestyle aspects, such as cultural diversity, safety, and climate. Canada and Australia offer vibrant student lifestyles but differ in climate and cultural experiences. Canada is known for its multicultural cities, safety, and cold winters, while Australia offers a sunny climate, outdoor activities, and a relaxed lifestyle. So it’s clear that Australia has a suitable climate and weather

conditions compared to Canada.

Another more important reason why Australia is a great choice for immigration, is job security. In Australia, you can be sure that you will have a stable job and a good income with its employment rate standing at 66.7%. The Canadian economy is also currently doing very well, with low unemployment and strong growth. This means that there are plenty of jobs available, and companies are often willing to invest in their employees by offering training and development opportunities.

How La Forêt Education Can Help You?

Navigating international education can be overwhelming, but La Forêt Education is here to guide you. Our expert counsellors help students choose the right country, prepare for IELTS, PTE, CELPIP, and TOEFL, and streamline visa applications. With personalized guidance, we ensure students achieve their study-abroad dreams hassle-free.

Conclusion

Canada and Australia both offer excellent education, career opportunities, and student-friendly policies. While Canada is more affordable and offers strong PR pathways, Australia provides a dynamic lifestyle and industry-focused learning. Ultimately, the best choice depends on your priorities—whether it's tuition fees, lifestyle, or career prospects. No matter your choice, take the leap with confidence and work towards a bright future!

1 note

·

View note

Text

Apparently Rupee fall vs Dollar was a "Calibrated" move. This is very complex economics for me.

0 notes

Text

डॉलर बनाम रुपये: एक डॉलर की कीमत ₹86 के पार क्यों पहुंची? मुद्रा की कीमतें कैसे बढ़ती-घटती हैं? जानें पूरी जानकारी

Dollar vs Rupee: Why did the price of one dollar cross ₹86? How do currency prices rise and fall? Know full details मुंबई: आज के समय में भारतीय रुपये की तुलना में अमेरिकी डॉलर की बढ़ती कीमत न केवल आम लोगों के लिए चिंता का विषय है, बल्कि यह भारतीय अर्थव्यवस्था को भी सीधे प्रभावित करता है। डॉलर बनाम रुपये की कीमतों में उतार-चढ़ाव क्यों होता है, यह समझना जरूरी है। इस लेख में, हम जानेंगे कि डॉलर की…

0 notes