#QR Code Payment Market

Explore tagged Tumblr posts

Text

QR Code Payment Market Report: Mapping the Industry Landscape in 2023

According to a recent FMI report, the QR code payment market size is predicted to reach US$ 11.67 billion in 2023. The adoption of QR code payments is predicted to surpass US$ 55.60 billion by 2033, exhibiting a CAGR of 16.9% between 2023 and 2033.

The market is a fast-expanding area of the digital payments sector, driven by the rising use of smartphones, e-commerce, and the simplicity and security that QR code payments provide. In today’s world, QR codes are a common sight, showing up on everything from product packaging to billboards to restaurant menus. The convenience of accepting payments through a quick code scan is luring more customers and business owners alike.

QR codes are simple to incorporate into current point-of-sale systems. This enables businesses to take QR code payments without having to spend money on pricey new equipment. The ability to increase security and efficiency in digital transactions is a significant opportunity in the QR code payment industry. The payment process can be streamlined and errors can be reduced by using QR.

Get a holistic overview of the market from industry experts to evaluate and develop growth strategies. Download a Sample Copy of the Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-16904

QR codes can also be readily encrypted to prevent fraud and unauthorized access. Moreover, QR code payments can be quickly connected with other electronic payment methods, including mobile wallets, to produce a smooth and secure payment experience. In response to the increased need for quick and secure digital payment methods brought on by e-commerce and online shopping, QR codes have developed as a vital technology.

Trends in the QR code payment market are largely focused on simplifying and streamlining the payment process for consumers and merchants alike. This includes initiatives to increase the acceptance, usability, and security of QR code payments. For instance, there has been a push to standardize QR code formats to clear up imprecision and improve compatibility across various payment systems.

Key Takeaways

Given the widespread use of mobile payments in nations like China, Japan, and India, the Asia Pacific region dominates the QR code payment market.

The expansion of e-commerce and mobile payment options has made North America a profitable QR code payment market after Asia Pacific.

In China, QR code payments are accepted widely and have taken over an increasingly popular form of payment, whilst, in the United States, the retail sector is seeing a rise in QR code payments.

The QR code payment market in India is growing rapidly given the government’s push for digital payments and the increased smartphone penetration.

Several companies, notably small street sellers, have been using QR code payments in Japan, where the technology has a high acceptance rate.

Competitive Landscape

Market players are heavily spending on research and development to advance their technology and gain market dominance in the QR code payment industry. To satisfy the rising demand for contactless payment choices, they are actively creating and introducing new solutions. Although certain key companies, including Square and PayPal, are adding QR code payment features to their current payment platforms, others, such as Alipay and WeChat Payare increasing their worldwide reach. Additionally, they are focusing on offering personalized and user-friendly services to attract and retain customers.

Recent Developments

Alipay unveiled a new “Smart Plan” function in February 2022 that enables customers to make installment payments for products using QR codes. By lowering the cost for consumers, this feature aims to increase expenditure.

WeChat Pay introduced a new function in December 2021 that enables users to divide costs and invoices with friends and family using QR codes. WeChat Pay BuddyPay is a tool that promises to make it simpler for users to manage their shared spending.

Know more about this market’s geographical distribution along with a detailed Analysis: https://www.futuremarketinsights.com/reports/qr-code-payment-market

Key Players

PaymentCloud

Paytm

LINE Pay Corporation

PayPal, Inc.

Clover Network, LLC

Revolut Technologies Inc.

Nearex Pte Ltd.

ACI Worldwide

Key Segments in the QR Code Payment Market

QR Code Payment Industry By Offering:

QR Code Payment as Solution

QR Code Payment as Services

QR Code Payment Industry By Payment Type:

QR Code Payment as Push Payment

QR Code Payment as Pull Payment

QR Code Payment Industry By Transaction Chanel:

QR Code Payment for Face-to-face

QR Code Payment for Remote

QR Code Payment Industry By End User:

QR Code Payment for Restaurant

QR Code Payment for Retail & E-commerce

QR Code Payment for E-ticket Booking

QR Code Payment for Others

QR Code Payment Industry By Region:

QR Code Payment in North America Market

QR Code Payment in Europe Market

QR Code Payment in Asia Pacific Market

QR Code Payment in Latin America Market

QR Code Payment in the Middle East & Africa Market

0 notes

Text

Check out the new product 🔥🔥 QR Code Scan and Smile

A unique t-shirt design featuring a black-and-white QR code cleverly embedded with the hidden message, “Scan for a Smile.” Surrounding the code, playful and colorful doodles of hearts, stars, and swirls add a vibrant and cheerful touch, making the design interactive and fun. This artwork blends modern tech with a lighthearted vibe, creating a conversation starter and a trendy, quirky addition to casual wear.

#scan for a smile#qr#qr code#meme#code#funny#scan#QR code#QR scanner#QR generator#QR technology#QR payment#QR marketing#QR stickers#QR menu#QR reader#QR business card#QR tracking#QR design#ScanForASmile#InteractiveDesign#QuirkyArt#TechAndFun#QRCodeTee#PlayfulDoodles#CreativeTShirt#FunFashion#HiddenMessage#CasualTrendyWear#SmileThroughArt

0 notes

Text

Innovative Transactions: Exploring the Dynamics of QR Codes in the Payment Market

Rapid increase in need of secured & hassle-free transaction services and adoption of QR code payments among merchants drive the growth of the global QR codes payment market. With increased usage in the automotive industry for production, tracking, and shipping, QR codes expanded beyond the automotive industry and are gaining momentum in the payment sectors. As it allows transactions to be touchless, the demand for QR codes payment has emerged as a permanent tech fixture from the beginning of coronavirus pandemic. Restaurants, retailers, and merchants are the largest end user segments that adopted QR code payments method in their existing businesses.

According to the report published by Allied Market Research, the global QR codes payment market generated $8.07 billion in 2020, and is anticipated to reach $35.07 billion by 2030, manifesting a CAGR of 16.1% from 2021 to 2030. The report focuses on an in-depth analysis of the key drivers, restraints, and opportunities of the market with thorough impact.

A massive acceptance and use of QR code payment among merchants and buyers and increase in the use of smartphones along with faster internet connectivity have propelled the growth of the global QR codes payment market. However, rise in data breaches and security issues in QR codes payments affect the growth of the market. Contrarily, developing economies offer opportunities for QR code payment companies to extend their offerings on the ground of rise in middle-class population, rapid urbanization, increase in literacy level, and growth in presence of tech-savvy youth generation. These factors would open up new doors of opportunities.

Request Sample Report@ https://www.alliedmarketresearch.com/request-sample/13440

Covid-19 Scenario:

With the rapid spread of the Covid-19 across the world, the usage and adoption of a QR code payment system has been increased among consumers worldwide. Sectors across the economy, including government and healthcare organizations, are relying on QR payment as it caters to the contactless-service norms. The use of digital payment systems such as QR can be seen significantly growing among the population below 30 years old. Banks and fintech industries are offering options of QR code payments to speed up their transaction processes and boost digitalized payments. Restaurants and diners are one of the biggest adopters of the QR code payment. The report offers detailed segmentation of the global QR codes payment market based on offering, payment type, transaction channel, end-user, and region.

Based on offering, the solution segment accounted for the largest market share in 2020, contributing to more than two-thirds of the total share, and is expected to maintain its leading position during the forecast period. On the other hand, the service segment is anticipated to witness the highest CAGR of 18.0% from 2021 to 2030.

Interested to Procure the Data? Inquire here @ https://www.alliedmarketresearch.com/purchase-enquiry/13440

Based on payment type, the push payment segment contributed to the largest share in 2020, accounting for more than three-fourths of the global QR codes payment market, and is expected to maintain the dominant position during the forecast period. However, the pull payment segment is estimated to manifest the highest CAGR of 18.4% throughout the forecast period.

Based on region, Asia Pacific contributed to the highest share in 2020, holding more than one-third of the total share, and is expected to portray the highest CAGR of 18.7% during the forecast period. The research also analyzes regions including North America, Europe, and LAMEA.

Get Detailed COVID-19 Impact Analysis on the QR Codes Payment Market @ https://www.alliedmarketresearch.com/request-for-customization/13440?reqfor=covid

Leading players of the global QR codes payment market that are analysed in the research include UnionPay International Co. Ltd., Barclays, LINE Pay Corporation, PayPal, Google, Revolut Ltd, Square, Inc., Alibaba.com, One97 Communications Limited (Paytm), and Tencent.

Key Market Segments

By Offering

Solution Static QR Code Merchant-Presented Mode (MPM) Customer-Presented Mode (CPM) Dynamic QR Code Services Professional Services Managed Services

By Payment Type

Push Payment Pull Payment

By Transaction Channel

Face-to-Face Remote

By End User

Restaurant Retail & E-Commerce E-Ticket Booking Others

Top Trending Reports: Commercial Insurance Market https://www.alliedmarketresearch.com/commercial-insurance-market-A11665 Trade Finance Market https://www.alliedmarketresearch.com/trade-finance-market Wealth Management Market https://www.alliedmarketresearch.com/wealth-management-market-A13068 Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528 Auto Extended Warranty Market https://www.alliedmarketresearch.com/auto-extended-warranty-market-A12526

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1–503–894–6022 Toll Free: +1–800–792–5285

UK: +44–845–528–1300

India (Pune): +91–20–66346060 Fax: +1–800–792–5285 [email protected]

0 notes

Text

QR Code Payment Market: Leveraging Data Analytics and AI for Success

The global QR code payment market size is expected to reach USD 33.13 billion by 2030. QR code payment offers a simple interface for quick money transactions anywhere and at any time. QR code payment methods are considered fast, versatile, and secure in comparison to traditional payment methods.

An increasing number of smartphone and internet users and rising demand for smart alternatives to traditional payment methods such as bank cards or cash is boosting the QR code payments industry’s growth. For instance, as per the Groupe Speciale Mobile Association’s (GSMA) The State of Mobile Internet Connectivity Report 2021, by the end of 2020, 51% of the population across the world, or more than 4 billion individuals, were using mobile internet, a rise of 225 million since the end of 2019. In addition, worldwide, smartphones held 68% of entire mobile connections in 2020, compared to 64% in 2019 and 47% in 2016.

Gain deeper insights on the market and receive your free copy with TOC now @: QR Code Payment Market Report

The volumes of digital payment transactions were already witnessing a rise owing to the growth of e-commerce. Furthermore, the increasing government initiatives to digitize payments are further expected to create market growth opportunities. For instance, in August 2020, the government of Andhra Pradesh, India, launched an initiative to drive financial inclusion and promote digital payments in rural areas to encourage and allow citizens to make and receive cashless payments using QR codes.

#QR Code Payment Market Size & Share#Global QR Code Payment Market#QR Code Payment Market Latest Trends#QR Code Payment Market Growth Forecast#COVID-19 Impacts On QR Code Payment Market#QR Code Payment Market Revenue Value

0 notes

Text

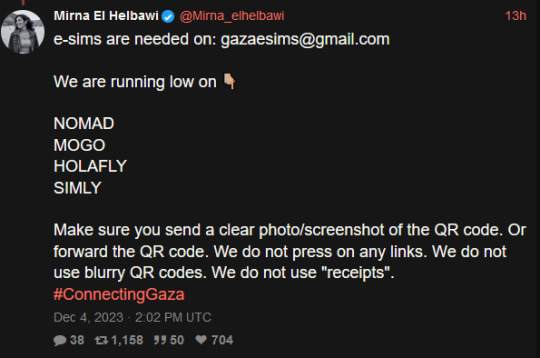

a rundown on the listed e-sim platforms from this tweet from mirna el helbawi. visit esimsforgaza to learn about this effort. (they also have a tutorial on how to purchase an esim and send it to them)

update v12 (5/21/24) holafly (israel and egypt), nomad (regional middle east), simly (palestine and middle east), mogo (israel), and airalo (discover) are currently in the highest in demand. if it has been more than 3 weeks since you initially sent your esim and your esim has not been activated, you can reforward your original email with the expiration date in the subject line. you can see gothhabiba’s guide for how to tell if your esims have been activated. if your esim has expired without use, you can contact customer service to renew or replace it.

troubleshooting hint 1: if you are trying to pay through paypal, make sure you have pop-ups enabled! otherwise the payment window won't be able to appear. (this issue most frequently seems to occur with nomad)

troubleshooting hint 2: if you are trying to purchase an esim using the provider's app, it may block you from purchasing if your phone does not fit the requirements to install and use their esims. use their website in your browser instead and this problem should go away.

nomad

for the month of may, first time referrals give 25% off for a person's first purchase and 25% off the referrer's next purchase! it's a great time to use someone's referral code from the notes if you are a first time buyer.

you can use a referral code to get $3 off your first purchase and also make it so the person whose code you used can buy more esims for gaza. many people have been leaving their referral codes in the replies of this post and supposedly a referral code may eventually reach capacity so just keep trying until you find one that works! BACKPACKNOMAD is another code to get $3 off your first purchase, it's been working for some people but not others so try out a referral code instead if you can't get it to work. NOMADCNG is a code for 5% off any middle east region nomad esims posted by connecting gaza. it can be used on any purchase, not just your first but is generally going to give less off than the first-purchase only codes, so use those first. it can be used in combination with nomad points. AWESOME NEW CODE: nomad esim discount code for 75% off any plan, NOMADCS25 do not know how long it lasts but this is an amazing deal esp. since they are really low on esims right now! (nomad promo codes do not work on plans that are already on sale, unlimited plans, and plans under $5)

weekly tuesdays only code on nomad web, PST timezone! it gives 10% off plans 10gb and above. NOMADTUE

nomad also seems to be kind of sluggish sometimes when it comes to sending out emails with the codes. you can look for them manually by going to manage -> manage plans -> the plan you purchased -> installation instruction and scroll down to install esim via QR code or manual input then select QR code to find the QR code which you can screenshot and email to them. often just the act of logging back into your nomad account after purchase seems to cause the email with the code to come through though.

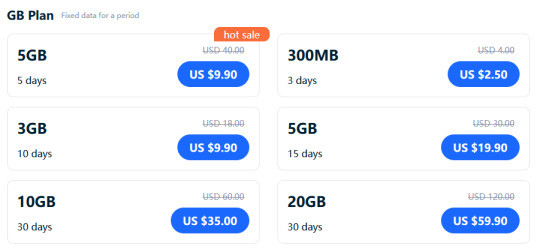

mogo

mogo's website is fucking annoying to navigate and i couldn't find any promo codes, but their prices are massively on sale anyway. you have to pick if you want your esim to be for iphone, ipad, or android for some reason. according to statcounter, android makes up approx. 75% of mobile markets in palestine while iphone represents approx. 25%. so i would probably recommend prioritizing donations of android esims but if you can afford multiple, try buying an iphone one too? if i can find any official direction from the connecting gaza crew on this i will update with it.

a good referral code to use for mogo is 8R29F9. the way things are worded are confusing but as far as i can tell, if you use it we both get a 10% discount on your first purchase. (the referrer gets a 10% voucher that allows them to top up in use esims, they are someone who i know has bought a lot of esims and will be able to make good use of the top-up discount vouchers!) also upon signing up it automatically generates a password for you which you can change by downloading the app. (check your email to find your account's current password)

holafly (also looking for holafly esims for egypt now)

holafly is pricier than the others and the only promo code i could find was ESIMNOW for 7% off. someone in the tags mentioned GETESIM7 as another 7% off code they had received, so if you have already used ESIMNOW or can't seem to get it to work, try GETESIM7. another 7% off code is HOLAXSUMMER7 which is valid until june 2nd. referral codes only seem to give 5% off and they don't stack. (i don't remember the source, it was on some sketchy coupon site i don't want to link to and only can recommend because i tried it myself) you can also use my referral link for 5% off if you can afford the 2% worse deal on your end, it will give me $5 credit which i can put towards buying more esims. connecting gaza has also posted the promo code HOLACNG for 5% off but since it is less than the 7% off codes and as far as i can tell does not give credit towards others to buy esims like the referral links, i would consider it lower priority for use.

simly (note: simly must be downloaded as an app to be used, the website link is to help people confirm they are downloading the right app)

i have not personally used simly so i am going to be going off of the sixth slide of mirna el helbawi's instagram guide, with some corrections from someone who has successfully purchased an esim from simly. after downloading the app and making an account, search for palestine or middle east and purchase your preferred package. the page the app takes you to after your purchase should have the QR code to send to the esimsforgaza email, it won't show up in your email receipt. someone kindly left her referral code in the tags of this post, it gives $3 off your first purchase and will give her $3 credit to put towards purchasing more esims for gaza. the code is CIWA2. (if this referral code doesn't work, try one from the notes of this post!) according to someone in the notes, ARB is a simly promo code for 25% off esims that is still working as of march 3rd.

airalo

some people have noted issues trying to sign up for airalo using the browser version of the website, it worked for me but if you are struggling you can give the mobile app a try and that should work. you can use a referral code to get $3 off your first purchase and give the code suppler a $3 credit for buying more esims. KARINA9661 is a code sourced from this post which is also a wonderful example of how using people's referral codes can really make a difference. if for some reason that referral code isn't working, you can find more in the notes of the original esim post i made here.

@/fairuzfan also has a tag of esim referral codes for various platforms!

(note: mogo and holafly both link to israel esims as there are no general regional packages for the middle east like on nomad and the esims for gaza website specifically linked to the israel package on mogo, so i linked to the equivalent on holafly.)

#esims for gaza#esims#gaza#palestine#free palestine#connecting gaza#despite not having used simly myself i'm fairly experienced with esim services at this point so i will likely be able to answer some#questions and i also have someone familiar with simly i can ask if i am not sure of the answer myself. so please go ahead and ask questions#if you're struggling with donating an esim from any of these sources!

6K notes

·

View notes

Text

the first drops of rain | k.mg

summary — mingyu's your first love. your first date with him could be described as fairytale like, at least until it begins raining. even then, maybe the rain is a paid actor, teaching you to slow down in your fast-paced student life.

featuring: mingyu x gn!reader, highschool au

word count: 2729 words

a/n: first seventeen work! kinda thought my first svt work would be seokmin or minghao but HAHA we’re here instead with a mingyu work. it’s based off a very precious memory of mine, and i felt like mingyu’s personality was the most similar to the guy i went out with <3

mingyu: we’re meeting at the start of the trail at 9, right?

You react to his message with a thumbs up, pulling up your shoes and glancing outside. The start of the trail is only a few hundred metres away from your house, so you’re not in a rush.

Mingyu asked you out on this date a few months ago, but you were overseas during the winter break, and weren’t able to go out with him. After a few months of discussing where to go, you finally settled on going cycling with him.

The sun rose quite a while ago, and the temperature is rather warm, but you figure that it’ll all be fine.

You check the time again and head downstairs, cycling over to the subway station to meet Mingyu.

You’re a few minutes late, so you expect to see Mingyu waiting there when you arrive, an apology already on the tip of your tongue, but you’re surprised when he’s not.

In fact, you have to wait another ten minutes before he finally arrives, a little out of breath and completely lost, without a bicycle. He smiles sheepishly at you, tucking his hands into his pockets.

He mumbles a “sorry”, curly hair falling in his eyes as he looks earnestly at you, shoulders raised in his nervousness.

Your annoyance at his tardiness dissipates once you see him in this state, genuinely apologetic and well-meaning. You let a soft sigh escape your lips. It’s okay.

Mingyu raises his phone and hesitantly says he needs to pick up his bike.

You’re about to reply when an old lady comes up to you, one hand clutching her grocery stroller. She politely asks if you know where the Flower Market is?

You nod. It’s right next to your apartment block, and you often go there to buy groceries yourself. You point the lady in the direction of the market, turning back to Mingyu.

Once again, before you can speak, Mingyu jerks his head at the stairs that the old lady has to climb up to get out of the subway station and onto the pavement. She lifts up the grocery stroller, and you rush to help her with it.

She smiles at you. Thank you.

You smile back. No problem.

Tilting your head towards the stairs, you beckon Mingyu to follow. The bicycles are located at the lowest level of the apartment block directly opposite yours, so you’re heading in the same direction as the lady anyway.

Once you’ve helped the old lady get her stroller up to the top of the stairs, you wave goodbye to her, prepared to head back down the flight of stairs to get your bicycle.

Fortunately for you, you don’t have to. Mingyu holds your bicycle in his hands, setting it down at the top of the stairs, and your heart warms, just a little.

It takes a longer time to figure out how the bike sharing system works than you thought it would. Mingyu scans the QR code on the back of the bicycle, frowning as he navigates the app, trying to figure out how the payment works. You stand to the side, holding on to your bicycle’s handlebars, watching his eyebrows knit themselves into a knot, before the wrinkles in his forehead slowly iron out when he finally gets the app to work.

All set? you ask.

Mingyu nods. All set.

You climb onto your bicycle, eager to head off, and Mingyu follows behind.

With the sun beating down on your backs, the two of you start off on the trail, figuring out a pace that works for both of you. You haven’t cycled in a long time, and you can’t go too slow, or you’ll be too unsteady for both of you to ride side-by-side on the narrow path.

The greenery on both sides of the trail helps to keep the temperature down, and you’re grateful for the shade it provides in the heat of summer. Next to you, Mingyu asks how school has been. You reply with one of those blasé “school is good” type of answers, but he doesn’t accept that.

Mingyu keeps prodding.

And, with your feet pedalling hard underneath you and the glare of the blue sky overhead, you find yourself opening up.

It’s started drizzling slightly when you reach the bicycle racks, so you chain your bicycles up and head to the nearby subway station to seek shelter. While you’re standing there, you ask Mingyu where he wants to go.

Originally, you wanted to go to watch a movie, but since the date was so impromptu, you didn’t check the movie timings out beforehand, so now you realise that none of the timings are convenient for you.

It’s fine, Mingyu insists. He’ll figure something out.

It doesn’t take long before he’s dragging you down another path you didn’t notice earlier, one that leads to a train station that’s no longer in use. Two carriages of the trains are left on the tracks as a memorial to the old train station, and despite the red tape covering the doors, Mingyu climbs up into the carriage.

You’re standing on the edges of the train tracks, watching him grin at you from inside. He leaps from the seat with a yelp, almost knocking his head, and he quickly exits the carriage.

What’s wrong? you ask.

He lifts his hand to show you that the seat was wet.

You laugh whole-heartedly and he pouts, but the joy in his eyes betrays him. His poorly-concealed excitement only grows when he looks ahead to see a bridge, breaking out into a run towards it.

You attempt to follow him, still balancing on the edges of the train tracks, quickly giving up when he doesn’t show any signs of waiting for you.

He turns around at the start of the bridge, and you grin at him as you step up onto the train tracks. He steps onto the edge next to yours, your feet moving in sync along those parallel metal lines drawn across the wooden tiles, his arms waving wildly as he fails to keep his balance.

Mingyu shakes his head out when he’s fallen three times, running his hand through his hair, glancing at you with the widest smile you’ve ever seen.

Your sunshine. That’s what he is, walking alongside you as you tread across the train tracks, hands carefully tucked into his pockets, watching your every step.

He speeds up when you hop off the tracks, and you follow him into a neighbourhood with two-story houses. Plants line the sidewalks, with overgrown creepers crawling up the walls and trees overhead shading you from the sun.

He points at the sign and tells you he came here once before, after his mother scolded him. It’s dangerously close to his home, a place that contains memories you can’t be a part of, a place you’re not sure you’re ready to intrude into.

You do anyway.

Mingyu leads you to the playground he’s only been to once before, when he was running away from his mother, and you pass by the empty basketball court.

You love basketball, you tell him, your steps slowing down. He whirls on his heel, looking up at the hoops, shading his eyes from the sun with his hand. Really?

Really, you say. You tell him how you used to play basketball during your half-hour long recess in elementary school instead of eating. Even though you were really bad and only played with a group of 5-6 other friends, it was still fun.

He understands.

You teach him how to climb onto the roof of the playground, your hands and feet making holds out of the railings and slides. You show him a view of the world that you loved as a kid, a view that makes you feel like you’re on top of the world. Like you’re unbeatable, invincible, and that the moment will last forever.

Slithering off the roof, you discreetly pull out your phone, but Mingyu spots you quickly enough. Don't film me, he pouts, eyebrows in a knot as his foot staggers around for a foothold.

You laugh and keep your camera pointed at him.

He hops down—ungracefully, you’d like to add; you think you were pretty graceful when jumping down yourself—and beckons you over with his hand.

Mingyu leads you to a sheltered area where the playground floor and gravel gives way to grass and soil, the trees overhead casting so much shade you get the impression that you’re in a rainforest. You can barely see past the crowns of the trees to the sky, which you’re sure is a shade of blue-grey. You can tell that it’s not raining, or the playground would be getting wet, but it isn’t quite sunny yet either.

The creak of a red swing brings your attention back to Mingyu. He smiles at you in warm invitation, and you take it, stepping up onto the swing. Your legs are on the left of his, your knees a fist’s width away from his. Opposite you, Mingyu lifts his eyes to yours and begins to speak.

How’s school, how’s life, how’s that toxic friend group in your dance club? he asks.

Stressful, interesting, shitty as ever, you reply.

He asks things like why, tell me more, is that leadership position working out for you?

You reply with much longer answers than you thought you would. The words flow from you like air leaking from a balloon with a hole. There’s so much pent-up frustration, bottled-up confusion, anxiety, envy, and even sadness you didn’t notice you were suppressing. They find their way out of your mouth in words you're surprised are coherent enough for him to understand, but somehow he manages it.

You’re not the only one telling stories, though. You ask Mingyu questions too, stuff like how’s being drama club president, do you like your juniors, what do you want to do at university?

And he, too, replies with amazing, I love them, I don't know but I’d like to be a counsellor someday.

And you learn.

From his smiles and nervous fidgeting and “um”s, you learn that he’s nervous. From the way he leans forward to talk to you and nods when you speak, you learn that his interest in you is genuine. From the tone of his voice and the smile in his eyes, you learn about his habits of joy and excitement. You pick apart his every move to learn something from it, absorbing a little more knowledge about him each time.

An hour or two passes. As it starts to drizzle again and lunch hour approaches, Mingyu gets up from the swing, not forgetting to hold it while you step off, and goes to the bench to get his tote bag before his things are drenched in the rain.

With a hand above your heads shielding you from the drizzle, the two of you half run-half walk to the mall nearby for lunch, raucous laughter echoing in your ears.

Mingyu offers to pay for your lunch thrice, and you refuse each time, reluctant to let him take money out of his allowance to pay for your meal. He insists you should let him pay for it, telling you that his father will give him more money. Still, you decline.

When he goes to visit the restroom, you quickly take your chance to buy your food before he gets back.

You take a seat successfully and wait for him to return, and he does—not without him trying to slide the bill into your bag first. After a while, he finally gives in, and the two of you settle down for lunch.

Lunch ends at around the same time the sky clears, and the two of you are rushing to climb onto your bicycles and leave before the rain starts up again. The weather has been unpredictable that morning, and you’re unwilling to take your chances. Instead of lingering around the mall, you’re unlocking your bicycle, fiddling with the stubborn lock, and Mingyu waits patiently beside you.

All set? he asks for the second time that day.

You reply the same way, All set.

Then you’re off, legs pedalling furiously, your balance miles better when you’re moving fast. In the morning, you had to keep swerving to avoid knocking into Mingyu at the slow pace you were going, but now you’re just trying to get home before it rains again. Your curfew is pretty early, and if you dally any longer, you’re definitely going to get an earful when you’re home.

Mingyu easily keeps pace with you, following your lead. From time to time, he’ll catch up and ride beside you for a stretch, and then you’ll pedal faster and he’ll fall behind again.

You feel the drizzle beginning when you ring your bell, bypassing yet another jogger on the trail. Cursing, you pick up speed, and Mingyu doesn’t question you as he follows behind.

The rain grows heavier more quickly than you’d expected, and soon there’s a steady stream of water raining down. You wipe futilely at your forehead from time to time, glasses sprayed with raindrops, and Mingyu calls out after you, laughing.

I’m not supposed to cycle in the rain, you tell him. My mum is going to kill me!

He seems to get it, but when you seek shelter under an overhead bridge to wipe your face with the remaining dry part of your T-shirt, he’s laughing at you.

You roll your eyes and point out the bits of water on his face, but he shrugs. You’re going to be cycling through the rain again anyway, so he doesn’t see the need to dry his face.

You clench your jaw, resolved to get home as soon as possible. The two of you climb back onto the bicycle, and start cycling home.

As if trying to deliberately annoy you, the downpour only gets heavier on your way home. It keeps coming down, and you fight to keep your balance and not skid on the watery path. You’re forced to slow down a little, your legs no longer pedalling as fast.

Your anxious heart begins to slow, and Mingyu's calm, sure voice carries over to you, despite the rain falling steadily around you. The sun is still high in the sky, and you wonder if there'll be a rainbow. That would be befitting for Mingyu, you think.

The whole way back, your mind is occupied by Mingyu's questions, his curiosity warming your heart. He genuinely cares about you, and this care distracts you from your fear of reaching home late. All thoughts of what your mother will say go out the window, until he's returned his bicycle and you've parked yours near the subway station, heading to the toilet to change into a new, dry shirt.

Mingyu didn't think to bring change, so he waits for you outside. He offers to help carry your bag, but you insist you can do it yourself. Just the thought that he's there, waiting outside, comforts you.

The two of you walk alongside each other on the way back to your home. You won't stop him from walking you home, especially not when you enjoy his company so much. He mentions something about his future family and you stiffen, afraid that he's jumping the gun. Your commitment issues start to resurface, your mind whirring as your heart jumps into panic mode, but you force yourself to take a few deep breaths and laugh.

He seems too happy to notice how forced your laugh is. Instead, he's asking for your mother's name, repeating it the whole way to make sure he's got it right.

Mrs? he asks.

Aunty, you correct.

Aunty, he repeats, and you nod your head. He asks for your father's, too, and he's still mumbling their names when you come up to the door. You ring the doorbell, and your mother comes to open the door, greeting Mingyu with a warm smile and a hearty welcome.

Come on in, she says. Mingyu shakes his head bashfully.

I've got to be going, he says. See you, Aunty.

You step into the house and wave at him until he's out of sight, your mother watching his retreating figure with you.

He seems like a nice boy, she says.

Oh, he is.

#k-labels#🪁 — my works#seventeen#mingyu#highschool au#mingyu x gn!reader#mingyu highschool au#mingyu x reader#mingyu x yn#mingyu x y/n

142 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

When avoiding scams and being hacked on discord specifically:

Don't click suspicious links. If you are not expecting it, do not open it.

Use 2FA when possible. It is the strongest way to protect yourself, but you still need to be vigilant and make sure you don't give away your accounts in other ways [ie token grabbers, QR codes, or other instant-login services].

Don't share passwords across accounts, especially with sensitive ones such as banking or legal documentation. The fewer shared passwords you have, the less likely a large data breach is going to affect a large number of your accounts and information.

Those "exposed" servers are phishing scams via verification bots. Someone sending you a DM saying that you may have sent someone pornography or nudes, and to join a server to see what it's about, is trying to lead you on to scan a login QR code, which bypasses 2FA and password usage.

If someone "accidentally reported you" it's a scam, they are playing off of a sense of fear and will ask you for your passwords by sending you to fake support accounts. You do not give passwords to official support, they do not need your password in order to access your account on their platform.

Continuing the above, websites will never make you prove your innocence in such a situation.

Anything to do with "crypto market" is a scam.

Do not download any files from people asking you to playtest a game, those "games" are token grabbers. Token grabbers are capable of bypassing 2FA, and can allow attackers to enter your account without a password.

Remove permissions from all bots that can "join servers for you". These bots can rejoin servers that you leave, or send you to different servers without your consent to artificially inflate user numbers.

Be vigilant when using the internet and especially social media or discord. Hackers and scammers rely almost 100% on you blundering into their schemes via panic, anger, or lack of knowledge. These same types of scams have been circulating the internet for over a decade in some cases, and victims fall for it when they aren't aware of the scam in the first place.

More general internet advice per @oldmanyaoi-jpeg:

If a message or group is trying to quickly induce a strong emotion, such as fear or anger, be aware that they may be trying to trick you into making an emotional decision (ex. "exposed" groups and accidental reporting scams)

additionally, any message with a deadline should be regarded with heavy suspicion, as they are likely trying to trick you into making a decision driven by panic (paypal and amazon payment scams)

Never click on a link that you find even remotely suspect, or call a number provided in a suspect message. Always get contact information directly from that entity (ex. go to paypal or amazon directly to check for suspicious activity or contact CS instead of clicking a provided "dispute" link)

If you aren't expecting a link, email, text, attachment, etc. it should always be judged suspiciously. (ex. "we have your package" scams, playtester scams, "you have a virus" scams)

If you are being asked to reveal any personal information, stop and examine everything critically, as you are likely getting scammed. Specifically and especially passwords- I work in IT. If people who have business with your account want in your account, we're getting into your account, and we don't need your password for it.

Be critical of the permissions asked for by an app you're linking to an account. "Joining servers" is one to be suspicious of, but there's plenty more (making posts for you, having access to documents in gdrive, seeing any personal information, etc) that you should always think about before giving to an app.

Delete accounts and remove access for apps that you aren't using. Reducing your digital footprint will reduce your vulnerability- no need to worry about an email regarding an old Venmo account if you've deleted it, for example. Compromised apps can't affect your account if you take away their permissions either.

2FA is the easiest way to protect yourself from any scam or malicious action, as even if you willingly give up your password, nobody can get in without your verification. So my final advice of the day:

Set up 2FA, and never give any verification code you receive to anyone who may be asking for it, no matter how much you trust them. The only time you should confirm a login with 2FA is when YOU are logging in.

#mine#remake of my old post to add better info#this is mostly in lieu of a wave of hacks on discord- but it's good to keep all of these things in mind and stay safe

6 notes

·

View notes

Text

Quishing: The Lurking Danger of QR Code Phishing

Nowadays, QR codes are everywhere, linking us to everything from restaurant menus to quick payment options. This widespread use has a downside, though. There's been a spike in QR phishing attacks, also known as "quishing". Recent figures show a frightening 51% increase in attacks over the last year. In a quishing attack, hackers play on our trust in QR codes. They design malicious QR codes to lead people to fraudulent websites. These fake sites aim to steal important info like login credentials and financial data. This type of crime can seriously harm both individuals and companies. Stopping quishing means taking cybersecurity measures. It's key to protect personal and financial information from those who abuse QR codes. Quishing is a big problem because these codes are so often trusted. Key Takeaways - QR phishing, or "quishing," has seen a 51% increase in attacks in the past year. - Quishing exploits the trust and convenience of QR codes to steal sensitive information like login credentials and financial data. - Quishing poses a significant threat to businesses, potentially leading to identity theft, reputation damage, and financial losses. - Robust cybersecurity measures are crucial to mitigate the risks of quishing effectively. - Safeguarding personal and financial information from QR code-based attacks is essential.

What is Quishing?

Quishing, or QR phishing, is a cyberattack that tricks users into using QR codes. Hackers make fake QR codes. When scanned, they take you to fake websites that try to steal your info or money. QR Phishing or 'Quishing' Defined Quishing fools people into sharing their personal or financial details. They do this by using the trust people have in QR codes. It can be hard for people to tell the difference and avoid these traps. Exploiting the Convenience and Trustworthiness of QR Codes QR codes are everywhere now, from menus to payment options. We use them a lot, which makes us feel safe. But, this also means they are perfect for cybercriminals to exploit with their tricks. How Quishing Attacks Work Hackers make QR codes that lead to fake sites when scanned. These codes can show up anywhere - in emails, ads, or on things we touch. This makes them very sneaky. It's harder to spot quishing attacks because we think QR codes are safe. They also use many devices, making it tough for companies to protect us. If you scan a bad QR code, you could be in danger. Finding these scams is tough because QR codes keep their secrets until you scan them. Scammers use our nosiness and feelings to get us to scan codes. This can lead to losing money or facing other online dangers.

The Rise of QR Codes and the Quishing Threat

Before the COVID-19 outbreak, QR codes were mostly in ads and marketing. But, with the pandemic, they're everywhere now. They're used in places like restaurants and for paying. They're even key in health campaigns. However, this increase means more 'quishing' attacks. These attacks imitate trusted sources and fool people into giving up info. The Pandemic-Driven Surge in QR Code Usage The pandemic pushed QR codes into more industries. By 2025, nearly 100 million in the US will be scanning QR codes with their phones. Almost 60% believe this trend will continue. This shows QR codes are now a big part of our future.

The Risks of Quishing for Individuals and Businesses

The use of QR codes has led to a new cybercrime: quishing, or QR phishing. It's a big risk for people and companies, as seen in the first source. A harmful QR code can steal your login details. This gives hackers access to your important accounts and info. Quishing attacks can swipe login credentials. This lets cybercriminals get into someone's crucial accounts. It might be email, bank, or other major services. It can bring on financial problems and threats to your identity too. Financial App Hijacking Bad QR codes might hijack financial apps on your phone. This allows crooks to see your financial info and maybe make fake transactions. They often use quick scare tactics through QR codes. This tricks people who trust the tech's ease and quickness. Exposure of Business Data Bigger businesses are also at risk. Their sensitive corporate data, like customer info, money records, and ideas, might get out. A successful attack can hit the company badly. They might lose money, and their good name, and even face legal issues. The ease and popularity of QR codes make them perfect for crooks. They use the tech's trust and easy-to-use nature to mess with people and companies.

Protecting Yourself from Quishing Attacks

The use of QR codes has increased a lot because of the COVID-19 pandemic. This rise has also brought more quishing attacks by cybercriminals. They create fake QR codes to lead people to sites that steal important info like login details and money. To stay safe, be careful with QR codes and always use good practices. Think Before You Scan Never quickly scan any QR code, even if it seems safe and from a known place. Scammers might put fake covers on real QR codes to fool users into dangerous websites. Always check the code and its environment before scanning it. Manually Type URLs Instead of scanning QR codes, type the URL of the website into your browser by hand. This way, you can check if the site is real and not a phishing site that wants to steal your info. Use Secure QR Code Scanner Apps When you have to scan a QR code, use a secure app on your phone. These apps can spot and alert you about risky QR codes, adding more safety for you. Remain Skeptical of Free Offers Be careful of QR codes that offer free stuff, big discounts, or anything that sounds too good to be true. Scammers often use these to make people act quickly out of fear or wanting the deal. This can lead to giving away important info. Educate Yourself and Others Keep learning about the newest quishing strategies and share what you know with others. Being informed and alert is crucial in fighting these threats. Take steps to protect your online safety and lower the chances of a quishing attack.

The Impact of Quishing on Businesses

QR codes are getting more popular, but so is the danger. Quishing, or QR phishing, attacks are on the rise. They can seriously harm businesses. They cause identity theft, money loss, and damage to a company's good name. By tricking a QR code, a hacker can steal important info. This includes login details and money data. This puts a business's important stuff in danger. Businesses may face big money losses and other expensive problems, like fixing the issue and dealing with the law. Reputation Damage Getting hit by a quishing attack can ruin a company's image. It makes customers distrust them. This bad name can lead to losing market share and make it hard to get new customers.

QR Code Security Best Practices for Businesses

The use of QR codes is growing fast. Businesses need to be one step ahead to keep themselves and their customers safe from quishing and QR phishing attacks. These attacks come from stealing login credentials. Over 80% of cyber attacks use phishing as their tool. By 2025, nearly 100 million U.S. smartphone users will be scanning QR codes. To fight quishing attacks, companies can follow certain steps: - Educate Employees: It's vital to teach your staff about the dangers of quishing. Make sure they know to check if the QR codes are real before they scan them. Warn them to be careful with QR codes from places you wouldn’t expect or people you don't trust. - Implement Secure QR Code Policies: Make solid rules for how QR codes are used in your company. These rules should cover making, sharing, and using QR codes safely. - Utilize Secure QR Code Generators: Choose trustworthy tools to make your QR codes. Look for ones that let you make dynamic QR codes. These change or expire, which helps prevent misuse. - Integrate QR Code Scanning Solutions: Use apps that look at the content behind QR codes first. This extra step checks if they are safe before opening them up for your team or customers. - Monitor and Respond to Threats: Keep an eye out for any quishing attacks. Always have a plan ready to stop and fix any problems that might come up fast. Following these QR code safety steps will help companies stay safe from quishing attacks. Such attacks have gone up 51% in 2023 in many fields. Staying alert and always working to improve QR code safety is key in today's world.

Emerging Quishing Trends and Future Threats

As QR codes get more popular, cybercriminals are finding new ways to trick people. They're now using QR codes in sophisticated phishing emails. These emails look like they're from someone you know or a trusted business. They make you think it's safe to scan the QR code. The bad guys exploit the trust people have in QR codes to get them to click on harmful links. This can lead to serious trouble, like losing your login details or money information. The number of quishing attacks on mobile phones is also going up. Cybercriminals know mobile devices are often less protected. They're making fake QR codes that take you to dangerous websites. There, they try to steal your personal or money info. Now, crooks have started using dynamic QR codes. They're tricky because hackers can easily change the link they go to. So, telling if a QR code is real or part of a scam is getting harder. In the future, experts worry quishing attacks will keep getting worse. They think crooks will find more ways to take advantage of how much we trust QR codes. As we keep using QR codes more, everyone needs to be careful. We need to use strong security to fight these new dangers. Emerging Quishing Trends Potential Future Threats - Sophisticated phishing emails with QR codes - Targeting mobile devices for quishing attacks - Exploiting dynamic QR codes that can be easily modified - Continued evolution of quishing tactics to exploit QR code convenience and trust - Increased prevalence of fake QR codes leading to malicious websites - Potential for large-scale data breaches and financial losses due to quishing attacks

Industry Perspectives on Quishing

The threat of quishing, also known as QR phishing, is getting bigger. Cybersecurity experts and leaders in various industries are sharing important insights. They are showing us how these attacks are changing and what we can do to protect our businesses and customers. Case Studies and Real-World Examples Cybercriminals are hitting various sectors with quishing attacks. ING Bank saw their customers lose money in 2022 to scammers using fake QR codes. In the U.S., drivers in Texas and Atlanta fell for fake QR codes on parking kiosks, losing their credit card info to hackers. In China, scammers posed as the Ministry of Finance, tricking people into sharing secrets with a fake QR code. These cases highlight the importance of strong security for businesses. Staying alert and putting in place solid defense strategies are crucial. This protects not only the business but also its customers from falling victim to quishing attacks.

Final Thoughts

QR codes have changed how we live daily, making things like paying and finding info easy. But, their use has also led to new dangers. Cybercriminals now trick people through QR codes in quishing, or QR phishing, scams. Quishing attacks have gone up by 51% just last year. Hackers use wicked QR codes to send people to fake sites. These sites aim to steal personal and financial info. With businesses and brands using more QR codes, the risk grows. To fight this, everyone needs to be sharp. Learn about the dangers and use strong security. Be careful with QR codes and always use safe scanning apps. This will help keep your data safe from tricky attacks. The spread of quishing shows we must stay updated on cyber threats. Technology is always moving forward. We all need to team up, follow the best security steps, and protect our digital lives. Let's make sure the ease of QR codes doesn't risk our online safety. Read the full article

2 notes

·

View notes

Text

Usage areas of QR codes:

1. Website Links 2. Social Media Promotion 3. Business Cards 4. Marketing Materials 5. Product Packaging 6. Menus 7. Phone Call 8. Sending SMS 9. Sending Email 10. App Download 11. Business Location Viewing 12. E-Sales 13. Event Tickets 14. Digital Payments 15. Educational Materials 16. Conference Badges 17. Wi-Fi Network Access 18. Resume or CV 19. Interactive Art and Exhibits 20. Survey and Feedback Forms 21. Emergency Information

I will QR code art for your needs.

Send me a message.

————————————————————————————

#business#marketingdigital#marketing#design#marketingagency#businessgrowth#vacation#poster#entrepreneur#aiart#qrcode#qr#qrart#artqrcode#stablediffusion#branding#fiverr#fiverrgig#fiverrgigs#fiverrseller

2 notes

·

View notes

Text

Unveiling Appz Review: Create Unlimited Apps

Appz Review: In this segment, you can present the Appz Reviews and make sense of why you are auditing it. You can likewise give some foundation data on the application business, like its size, development, and potential. You can likewise specify that the Appz Reviews is a cloud-based application that changes any watchword, URL, site, online business store, blog, or page into an iOS and Android PWA application in 60 seconds. You can end the presentation with a postulation explanation that sums up your central matters and assessment on the stage.

APPZ Review: Features

No-Code AI Mobile App Creator

Push Notifications

SMS Sender

Built-In Marketplace

Drag-N-Drop Templates

In-Depth Analytics

Interactive Elements

Instant Monetization

AR Integration

Payment Gateway Integration

AI App Contents Generator

eCom Integration

Access 4.9 Million Stock Library

QR Generator

SSL Encryption

Commercial License

30 Days Money Back Guarantee

Appz Works For:

Affiliate Marketers

CPA Marketers

Blog Owners

Product Creators

eCom Store Owners

Local Business Owners

Agency Owners

How Start Generating Profitable Mobile Apps?

Step 1: Login - Login to Appz Cloud-Based App (Nothing to Install)

Step 2: Select Templates - Select From Our Dozens of Templates or Start from Scratch.

Enter a “Keyword, Website, eCom Store, Blog or Even a Page”… And Appz Will Turn It Into iOS & Android PWA App.

Step 3: Publish - Publish Your New iOS/Android PWA Mobile Apps (No App Store Approval Needed).

You Can Also Start Your Mobile App Agency & Sell To Tons of Businesses On Our Built-In Marketplace

Step 4: Profits - Yup, that is it. On Average, Each App We Make Generates Money Like This

GET INSTANT ACCESS

3 notes

·

View notes

Text

Digital Marketing

The Covid-19 pandemic has revolutionized the way we connect and establish relationships, leading to a surge in digitalization. According to a survey by Statista, 63% of business owners believe that online visibility improves brand image. The best digital business cards provide significant value to individuals and businesses at affordable rates. Digital business cards offer numerous advantages, such as lower cost, ease of design and modification, multiple customization options, and environmental friendliness. However, it is important to consider potential challenges related to technical issues and data security. Creating a digital business card is simple. By selecting the appropriate platform and following a few steps, including choosing a design template, adding contact information and branding elements, and saving the card as a PDF or image, you can quickly create a professional digital business card. Sharing can be done through email, messaging apps, QR codes, and dedicated mobile apps. When going digital, you have the freedom to include various fields on your smart digital business card without space constraints. Besides basic contact details, consider adding social media links, payment apps, chatting apps, streaming platforms, creative platforms, Skype, Github, Calendly, and notes to enhance its functionality. Compared to paper business cards, digital business cards are more cost-effective and environmentally friendly. They require a one-time setup cost or a low monthly subscription, offering free or affordable plans with the option for advanced features. The sustainable nature of digital business cards contributes to a greener future. While determining the best digital business card solution can be challenging due to the numerous options available, Cardddle stands out as a great choice for its reasonable pricing, multiple design templates, customization options, and easy sharing capabilities.The Covid-19 pandemic has indeed transformed how we connect and build relationships, leading to a surge in digitalization. Statista's survey indicates that 63% of business owners believe online visibility improves brand image. Digital business cards offer several advantages, such as cost-effectiveness, easy design and modification, multiple customization options, and environmental friendliness. However, it's crucial to consider potential challenges related to technical issues and data security.Creating a digital business card is simple: select an appropriate platform, choose a design template, add contact information and branding elements, and save it as a PDF or image. Sharing can be done through email, messaging apps, QR codes, and dedicated mobile apps.Digital business cards offer more flexibility, allowing you to include various fields without space constraints, like social media links, payment apps, chatting apps, streaming platforms, Skype, Github, Calendly, and notes to enhance functionality. Compared to paper business cards, they are cost-effective and eco-friendly, with affordable plans and advanced features available.Among the many options, Cardddle stands out as a great choice due to its reasonable pricing, multiple design templates, customization options, and easy sharing capabilities. Embracing digital business cards can contribute to a greener future while maintaining professionalism and convenience in networking.

For more information open https://blogbymahimna.blogspot.com/2023/07/types-of-digital-marketing.html

3 notes

·

View notes

Text

Brazil counts success with Pix payments tool

At a stall selling fresh coconut water in a bustling São Paulo street market, customers have three payment options: cash, card or Pix.

The latter is an instant money transfer tool that has transformed day-to-day transactions in Brazil following its introduction almost three years ago.

“It’s much better — it’s faster, easier and fails far less,” says cashier Kleber de Jesus, as a colleague hacks a hole into one of the fruits.

He enters the amount on a card machine, producing a QR code on its screen. The customer opens a mobile banking app, scans the image and taps “confirm”. The money lands in seconds.

Amid a boom in financial technology launches across Latin America, that have brought basic banking services to millions for the first time, Pix has a strong claim to rank among the most impactful innovations.

To use it, an account with a bank, a fintech or a digital wallet provider is required. The service is mainly accessed using smartphones.

It is free for individuals and about two-thirds of the Brazilian population — some 140mn people — have used the app since it was launched by the country’s central bank in November 2020.

Pix is now the most common form of payment in the region’s largest economy by number of transactions, accounting for 29 per cent of transfers in 2022, according to central bank data on non-cash methods.

Continue reading.

#brazil#politics#brazilian politics#economy#monetary policy#central bank#mod nise da silveira#image description in alt

5 notes

·

View notes

Text

We are specialized in Generating More Footfalls for Food & Beverages (F&B) Businesses. A dedicated Marketing & IT Solutions Provider for Restopreneurs. You've got the taste, we've got the tools & strategies. Call us now and let's take your F&B business to new heights!

We are a team of experts who help restaurants like yours grow and succeed. We are specialized in Generating More Footfalls for Food & Beverages (F&B) Businesses with Engaging Marketing and Scalable IT Set up, backed by influencer endorsements, footfalls promotion strategies, brand communication & customer retention strategies.

We help you leverage the power of social media to expand your business reach. We will help you create content that engages your followers and boost your credibility and bring more traffic to your store. We will help you spark conversations and conversions, and generate more buzz and referrals for your business.

Contact us today and let's make your restaurant the talk of the town!

Bringing Technology to Your Table! Because Technology is helping restaurants provide faster, easier, and more personalized service to their customers. We help you elevate your menu, QR codes, Ordering systems, Table management, Real-time order tracking, Payment tracking, Listening your customers feedback, Streamline payments, and Optimize operations.

We believe in bridging the gap between timeless dining traditions and modern convenience, making your business more inviting and approachable. Our goal isn't to replace the human aspect of dining but to complement it with seamless, innovative solutions that will make your restaurant a place where technology and hospitality meet to thrive your business. Let's Thrive Together!

2 notes

·

View notes

Text

BALITANG NEGOSYO: Digital Banking Firm 'CIMB Bank Philippines' launches 'CIMB Pay' for Fee-Free QR and Bank Transfers [#OneNETnewsEXCLUSIVE]

TAGUIG, NATIONAL CAPITAL REGION -- 'CIMB Bank Philippines' unveil to introduce "CIMB Pay", a new feature for making QR code payments and transferring money to the Philippine banks or electronic wallets without any fees. This newly-launched digital payment system recently rolling out in the mobile app on February 8th, 2025 (Manila local time).

For those unfamiliar with CIMB, here is what you need to know from scratch. CIMB Group Holdings Berhad situated in 'Kuala Lumpur, Malaysia', is a leading universal bank operating in the high-growth economies of the ASEAN region. The full acronym of CIMB is Commerce International Merchant Bankers.

'Bian Chiang Bank' was founded in 1924 in 'Kuching', this said country of Malaysia. It rebranded as CIMB in September 2006, becoming a traditional and digital-only bank. CIMB has since become a significant player in various sectors, including consumer banking, corporate banking, investment banking, Islamic banking, asset management and insurance service, which later including loan services above the mid-2000s. Twelve (12) years later in December 2018, CIMB has also launched the expanded digital banking services in 'Bonifacio Global City, Metro Manila, National Capital Region', aiming to provide innovative financial solutions for the local market.

Today, "CIMB Pay" uses the QRPh system, the national EMV (Europay-Mastercard-VISA) standard for Quick Response (QR) payments in the Philippines, where users can pay to over 1 million merchants across the country, including those in Negros Oriental such as Dumaguete City. This allows customers to pay for goods and services by simply scanning the QR codes displayed by the merchants, making the payment process and overall convenience.

Apart from supporting merchant payments, "CIMB Pay" also has a peer-to-peer fund transfer feature. Users can immediately transfer funds to other banks or e-wallets like Bank of the Philippine Islands (BPI) or Maya wallet by generating and scanning QR codes directly, with transactions to be settled through 'InstaPay' network. Interestingly, 'CIMB Bank Philippines' has 5 free transfers a day through this transferring bank network platform, where customers can manage their finances without additional fees.

The launch of "CIMB Pay" proves 'CIMB Bank Philippines' commitment to improving the digital banking experience of its customers. With fee-free QR payments and transfers, the digital-only bank aims to promote financial inclusion and support the country's move towards a cashless economy.

With the rise of digital payments in the financial tech bank industry, "CIMB Pay" places 'CIMB Bank Philippines' at the leading edge of the financial industry, delivering customers convenient and swiss army-like banking services. 'CIMB Pay' and 'QRPh' system are both supervised and regulated by the 'Bangko Sentral ng Pilipinas' (BSP).

BANNER PHOTO COURTESY: CIMB Bank PH via PR BACKGROUND PROVIDED BY: Tegna

SOURCE: *https://www.cimbbank.com.ph/en/our-app/cimb-pay.html *https://www.cimbbank.com.ph/en/help-and-support/faqs/app-transactions/cimb-pay/about-cimb-pay/what-is-cimb-pay.html *https://www.cimb.com/en/who-we-are/our-presence/philippines.html *https://www.cimbbank.com.ph/en/our-dna/about-us.html and *https://en.wikipedia.org/wiki/CIMB

-- OneNETnews Online Publication Team

#business news#taguig#NCR#national capital region#CIMB#CIMB Pay#Philippines#launched#digital banking#exclusive#first and exclusive#OneNETnews

0 notes

Text

Customizable Invoices with Resmic

In today’s digital finance landscape, cryptocurrency is rapidly gaining popularity as a preferred payment method. However, many businesses hesitate to adopt it due to the complexities of accepting and managing crypto payments. This is where Resmic comes in—a cutting-edge, customizable invoicing platform that removes these obstacles and makes cryptocurrency payments effortless.

Whether you’re a small business owner or a freelancer, Resmic empowers you with the tools to accept crypto payments seamlessly. With its ability to generate fully customizable invoices and provide secure, shareable URLs, Resmic ensures that every transaction is smooth, efficient, and hassle-free

What is Resmic?

Resmic is an innovative platform that lets you create and manage cryptocurrency payment invoices with ease. Designed to remove the common barriers to accepting crypto payments, it simplifies the entire process. Whether you’re invoicing for a service, product, or subscription, Resmic gives you the flexibility to generate and share invoices tailored to your business needs.

With Resmic, you don’t need to deal with complex integrations, custodial services, or middlemen. Simply create an invoice, share the secure payment link, and receive crypto payments directly which is fast, seamless, and hassle-free!

How Resmic Simplifies Crypto Payments with Customizable Invoices?

1. Create Customizable Invoices with ease

Resmic lets you generate fully customizable invoices that match your brand and business needs. You can easily personalize them by adding your logo, business details, and tailored payment information. This way, every invoice looks professional and aligns with your brand identity, making transactions smoother and more trustworthy.

2. Offer Multiple Crypto Payment Options

With Resmic, you can give your customers the freedom to choose their preferred cryptocurrency. Whether they want to pay with Bitcoin, Ethereum, or other supported tokens, Resmic ensures a hassle-free experience. You can quickly configure your invoice to display the available crypto options, allowing clients to select the one that suits them best.

3. Share Secure Payment URLs Instantly

Forget the hassle of long wallet addresses and QR codes. Resmic automatically generates secure, shareable payment URLs for every invoice. You can send these links via email, social media, or messaging platforms, making it incredibly convenient for clients to access their payment page and complete transactions in just a few clicks.

4. Enjoy True Financial Freedom – No Middlemen, No KYC

Resmic puts you in complete control of your payments. Operating on a non-custodial model, it eliminates the need for third-party intermediaries. Plus, with no KYC (Know Your Customer) requirements, you can start accepting crypto payments instantly—no lengthy verifications, no delays, just seamless transactions.

How Resmic Benefits Your Business?

1. Faster Payments

With the instant and decentralized nature of cryptocurrencies, you no longer have to wait for slow banking processes. Resmic lets you receive payments quickly, ensuring you get paid without unnecessary delays. By leveraging the speed and efficiency of crypto transactions, you can improve cash flow and keep your business running smoothly.

2. Expand Your Business with Global Reach

Cryptocurrencies know no borders, and with Resmic, neither does your business. You can accept payments from clients worldwide, opening doors to new opportunities in international markets. Whether your customers prefer crypto over fiat currencies or need a frictionless payment method, Resmic makes cross-border transactions seamless and hassle-free.

3. Enjoy Unmatched Security and Transparency

With blockchain technology securing every transaction, Resmic ensures the highest levels of safety and transparency. Both you and your customers can track payments directly on the blockchain, eliminating doubts and adding an extra layer of trust. By using Resmic, you guarantee secure, verifiable, and tamper-proof transactions—giving you and your clients complete peace of mind.

Create Customizable Invoices in Minutes

Create Your Invoice: Visit Resmic Invoice, enter the details of your product or service, and customize your invoice.

Share the Payment Link: Once the invoice is ready, Resmic generates a unique, shareable URL. Share it with your customer via email, social media, or messaging apps.

Accept Payment: The customer clicks on the URL, chooses their preferred cryptocurrency, and completes the payment. You get notified instantly once the transaction is confirmed.

Why Choose Resmic?

Resmic is more than just a crypto invoicing tool—it’s a complete solution for businesses looking to integrate cryptocurrency payments effortlessly. Whether you’re a freelancer accepting payments for a service, a business selling products, or a subscription-based platform, Resmic gives you the tools to manage your crypto payments with ease.

Embrace the future of payments with Resmic and empower your business to accept cryptocurrency seamlessly.

Ready to get started? Visit Resmic Invoice today and unlock the potential of crypto payments!

1 note

·

View note