#Profitable Real Estate Tips

Text

Property investment in the UK is a dynamic field, necessitating a keen understanding of the market and strategic planning. Whether you are a seasoned investor or a novice, the tips mentioned in this article will guide you through the complexities of the UK property market, helping you to make informed decisions.

#Property Investment Advice#Real Estate Investment Strategies#UK Property Market#Profitable Real Estate Tips#Property Investment Essentials#Real Estate Investment Guide#Successful Property Investment#Property Market Insights#Real Estate Investment Opportunities#Property Investment Best Practices

0 notes

Text

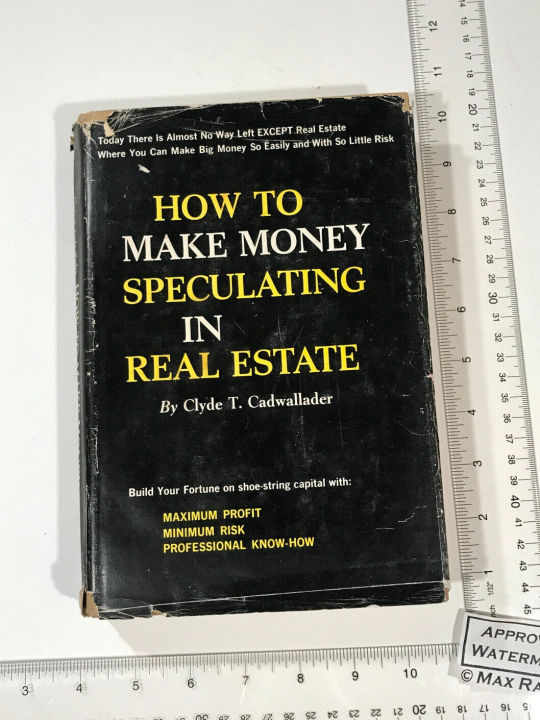

Book for Sale ~ Clyde Cadwallader 1960 How to Make Money Speculating in Real Estate * Big Profit | eBay https://www.ebay.com/itm/265988277610 #money #realestate #tips #deals #profits #speculating #flipping #nothingdown #buylow #sellhigh #1960s #selfhelp #personalwealth #books #rarebooks #DIY

#Book for Sale ~ Clyde Cadwallader 1960 How to Make Money Speculating in Real Estate * Big Profit | eBay https://www.ebay.com/itm/26598827761#money#realestate#tips#deals#profits#speculating#flipping#nothingdown#buylow#sellhigh#1960s#selfhelp#personalwealth#books#rarebooks#DIY#read#book shop#rare books#book buyers#bookseller#reading#vintage#real estate#markets#buy low#sell high#nothing down#personal wealth

2 notes

·

View notes

Photo

#The Millionaire Real Estate Investor: Strategies for Success in Property Investing#The Millionaire Real Estate Investor by Gary Keller is a comprehensive guide to achieving financial success through real estate investment.#providing practical advice#strategies#and case studies to empower readers to become successful investors.

Keller begins the book by emphasizing the importance of mindset and at#focusing on the key principles of wealthy investors. By cultivating a mindset of abundance#opportunity#and continuous learning#readers can pave the way for financial success in real estate.

The book then delves into the three main strategies for building wealth in#flipping#and renting. Keller explains each strategy in detail#outlining the benefits#risks#and key considerations for each approach. He provides practical tips on how to identify profitable investment opportunities#conduct market research#and navigate the complexities of real estate transactions.

One of the key takeaways from The Millionaire Real Estate Investor is the conce#money#and expertise to maximize returns and scale investments. By building a network of professionals#partners#and advisors#readers can leverage resources to accelerate their real estate investment portfolio.

Throughout the book#Keller shares real-life success stories and case studies of millionaire investors who have achieved financial freedom through real estate.#giving them a roadmap to follow and demonstrating that anyone can achieve success in real estate with the right mindset and strategies.

In#The Millionaire Real Estate Investor also addresses the importance of financial planning and goal setting. Keller emphasizes the value of s#creating a financial plan#and tracking progress to achieve long-term success in real estate investment.

Overall#The Millionaire Real Estate Investor is a must-read for anyone looking to build wealth through real estate. Whether you are a novice invest#the book offers valuable insights#practical advice#and actionable strategies to help you achieve financial success in real estate.

I highly recommend The Millionaire Real Estate Investor to

0 notes

Text

youtube

Join us on the Rent to Retirement Podcast as hosts Adam Schroeder and Zach Lemaster chat with David Richter, founder of Simple CFO. Discover the secrets to financial freedom through effective real estate investment strategies. David shares his journey from reading "Rich Dad, Poor Dad" to revolutionizing real estate finance with his unique system, inspiring investors to prioritize profitability and financial discipline. 🔑 Key Moments: 00:00:30: David's introduction and background in real estate 00:01:09: Transitioning from small-scale investments to major deals 00:02:08: The importance of understanding the financial backend in real estate 00:03:05: Introduction to the "Profit First" methodology 00:05:14: David discusses his lack of formal financial training and its impact 00:10:17: Practical tips for managing finances and maximizing profit 00:15:22: Strategies for effective cash flow management 00:20:30: Discussion on reinvesting and financial planning for growth 00:25:04: David's vision for future projects and continued impact in the financial world

#real estate investing#financial freedom#profit first#entrepreneurship#investment tips#business strategy#cash flow management#personal finance#Youtube

0 notes

Text

A Floridian Landlord's Playbook for Overcoming Common Rental Hurdles

Florida Eviction Lawyers

Hey there, fellow Landlord,

Diving into the world of Florida real estate can be as thrilling as a rocket launch at Cape Canaveral. Here’s my personal guide, honed from years in the trenches, to help you navigate the common ups and downs of renting out property.

Ensuring Rent Arrives on Time We’ve all felt the sting of late rent payments. Clear communication about…

View On WordPress

#commercial eviction attorney Florida#effective property management#eviction court representation Florida#eviction legal services Florida#eviction notice filing Florida#Florida Eviction Attorney#florida eviction process#Florida landlord guide#Florida real estate laws#Florida rental market analysis#handling tenant disputes#landlord financial planning#landlord legal compliance Florida#landlord tenant lawyer Florida#landlord-tenant relationships#lease agreement essentials#lease termination lawyer Florida#legal advice for landlords#property condition inspections#property damage management#property eviction legal advice.#property maintenance Florida#property management services#real estate attorney Florida#real estate investment Florida#real estate investment tips#real estate market trends Florida#rent payment policies#rental business profitability#rental insurance Florida

0 notes

Text

0 notes

Text

Location, Strategy, and ROI: The Ultimate Guide to Investing in Buy-to-Let Properties

If you're thinking about investing in a buy-to-let property, this post offers essential advice to help you succeed

You’re not alone if you want to invest in buy-to-let properties. This can be a profitable investment possibility if you do your research, examine the figures, and follow some key success guidelines. However, investing in buy-to-let comes with its own set of risks, so being prepared and making informed decisions is critical. In this post, we’ll go over some important pointers for property…

View On WordPress

#buy to let#Buy-to-let properties#Comprehensive Guide#investing#investment property#investors buying homes#mortgage#profitable investment#real estate#Real Estate Investing#The Ultimate Guide#tips

0 notes

Text

Evangeline Kingdom has 16 major territories (also called cities or holds). This article contains some information about each of them.

Realistically, I imagine there are a lot of little small towns and villages between these cities, but they are just too insignificant to map.

EVANGELITE TERRITORIES

Glasstide - Located at the northwestern tip of Noalen in the Frozenwind Pass region. Glasstide is one of the coldest cities on Looming Gaia, and also Evangeline Kingdom’s least populated territory. Its main industries are fishing and whaling. It’s an open secret that this city has the highest concentration of lycanthropes on Looming Gaia. This is because of its remote location, the fact that lycanthropes are hardy to cold weather, and the mass migration of lycanthropes to this location during the Full Moon Genocides. Living in such a cold, harsh region is difficult for most peoples, but those with lycanthropy seem to thrive here.

Wintermoore - Located in the mountains of the Frozenwind Pass region. This city was supposedly the birthplace of the first Stoneshaker minotaur clans. For much of its history it was populated by minotaurs, centaurs, and elves, but this changed in the 4th Age when it was violently conquered by Evangeline Kingdom. Its original population was enslaved and replaced with Evangelite commoners. It is now a mining town that provides much of the kingdom’s iron.

Weypine - Located in the cold, forested Winterwood region. It’s believed that this was the birthplace of the Namarie elves, and for most of history it was populated by their clans. It was later conquered by Evangeline Kingdom in the 4th age, its original population was enslaved, and now it is an Evangelite city best known for its logging industry.

Eastwalk - Located on the northern edge of the Timberland Forest region. Eastwalk is a prosperous industrial hub that exports many types of raw resources to the rest of the kingdom, most notably lumber, seafood, and mushrooms. It is one of the few Evangelite territories that has an electrical grid, which is powered by primitive wind turbines along the coast. However, most of the electricity generated is used to power its industrial operations, meaning the average Eastwalk citizen is still living in the dark ages of wood and coal.

Queenswater - Located along the Crown River in the Timberland Forest region. Queenswater is populated by many of Evangeline Kingdom’s wealthiest citizens. With its temperate weather, scenic location, and dam-powered electrical grid, it boasts the highest land values in the kingdom, so its no surprise that its biggest industry is real estate.

Waterview - Located around Crown Lake in the Timberland Forest region. Satyrs and nymphs used to hold large, rowdy revels here until the 4th Age, when Evangeline Kingdom enslaved all the region’s satyrs. Today its famous revels have been replaced by stuffy Evangelite galas, which are attended by the kingdom’s upper classes. Waterview is now a resort town mainly populated by tourists and the wealthy.

Newell - Located in the Timberland Forest region. This city is integral to Evangeline Kingdom’s fur and leather industry, with its extensive fur trapping, tanning, and textile processing operations. Local faunae advise business owners about animal populations in the forest, controlling what, when, and where they hunt from season to season. Such practices keep these industries sustainable under the Nymph Pact. However, some business owners feel the nymphs are harming their profits, and hire mercenaries to poach prohibited animals anyway. When caught, these poachers are dealt with swiftly and mercilessly by the faunae.

Aldfog - Located in the south Timberland Forest region. In ancient times, Aldfog was exclusively populated by satyrs and nymphs, who spent their days frolicking freely in the forest. Today, the satyrs’ descendents are enslaved to the Evangelites and forced to work for the city’s booming lumber industry. Local nymphs now oversee operations and replant trees that the Evangelites chop down. Its deep forested location has made Aldfog attractive to vampires, most of which are Evangelite slaves who got kidnapped into existing clans. These vampires often dabble in dark magics like necromancy, creating ghosts and zombies that escape into the woods. Many citizens and slaves seem to mysteriously disappear into the forest every year, never to be seen again. All of these things contribute to Aldfog’s “creepy” and “strange” reputation.

Rockreach - Located near Ironmaid Mountain. Rockreach was the birthplace of the first golden dworf clans, who quickly discovered and utilized its rich ore deposits. Their advanced metallurgy operations began polluting the river that provided water for many of the region’s other peoples, and this led to a long series of wars. Some time around the 4th Age, Rockreach couldn’t defend itself from its many enemies anymore, so it assimilated with Evangeline Kingdom for protection. Under Evangelite reign, it was forced to relocate its dirty industrial operations to Zareen Empire to satisfy the Nymph Pact. Today the river is clean, but Rockreach’s ore deposits are depleted, its impressive processing factories are abandoned, and most of its original dworfen populace has immigrated away to Zareen Empire. Now its economy is supported by a great quarry, which provides most of the kingdom’s stone. This stone-harvesting operation is overseen by local oreads. This was once the most technologically-advanced city in Evangeline Kingdom, but now it is but a giant pit where slaves toil away with primitive tools.

Silverspring - Located in western Blue Valley, Noalen. Ranching is this city’s bread and butter, as its vast, fertile grasslands are prime grazing grounds for livestock. Cattle, sheep, turkeys, and horses are the most common animals ranched here. Silverspring is Evangeline Kingdom’s largest meat producer. Many livestock-themed festivals and contests are held here every year, attracting visitors from all over the kingdom.

Evangeline Capital - Located around Bluerock Lake. The capital is the largest city in Evangeline Kingdom. It is a grand and heavily-fortified metropolis that acts as the kingdom’s main commercial, culture, and entertainment hub. Producers from all over the kingdom come here to sell their goods, especially during festivals, which attract many tourists. It is also home of the largest Lindist temple in the kingdom.

Merrowville - Located in the eastern Blue Valley region. Merrowville has had a troubled history since the rise of Folkvar Kingdom, as it has been captured, lost, and recaptured more than any other Evangelite territory. Its exposed location makes it rather hard to defend, so this isn’t likely to change until the war ends. Currently it’s home to a large Evangelite military presence, and all these soldiers gives it an infamous reputation for crime.

Greenhearst - Located in the Blue Valley region. The majority of the kingdom’s crops are grown in Greenhearst, but this city exports a lot of food to foreign kingdoms as well. Life here is quiet and simple, with slaves vastly outnumbering citizens. There isn’t much to do except work the fields and drink, and alcohol stays cheap thanks to the city’s local distilleries. In addition to food, Greenhearst provides Evangeline Kingdom with much of its beer too. Greenhearstians are stereotyped by other Evangelites as inbred, uneducated, drunks, but Greenhearstians themselves take pride in their rural, outdoorsy culture.

Rivermere - Located north of the Bluerock River. Rivermere sits right on Evangeline Kingdom’s southern border. It is primarily a military city, home to the largest barracks and training academies in the kingdom. Rivermere spares no expense on defenses to keep itself safe from foreign powers, but despite its efforts, its citizens are plagued by the rampant crime within its own walls. It is shamefully known as a hub for drug and sex trafficking.

Kelvingyard Town - Located between the Bluerock River and Refuge River. Kelvingyard Town is Evangeline Kingdom’s most infamous city, as its home to a massive slaving operation called Kelvingyard. The city’s entire economy was built around this slaveyard, which is also the source of all its electricity. Slaves are forced to turn heavy wheels which produce electricity for the city’s upper classes. The town itself is described as a drab, depressing place. Most of its citizens are employed by the Kelvingyard Slaving Company. The city’s strategic location allows slavers to snatch refugees attempting to travel from Yerim-Mor to Folkvar, providing a constant stream of new stock for its champion industry.

Oaken - Located on Oaken Island. Evangeline Kingdom has three domestic siege dragons in its possession, which they threaten to release upon their enemies as weapons of mass destruction. These dangerous beasts are contained in a facility here on Oaken Island, and the town’s whole existence centers around training and caring for them. This isolated location ensures minimal damage to the rest of the kingdom should the dragons escape, though the possibility is still taken very seriously, as the loss of the dragons alone would devastate the kingdom’s economy and military might. All of the kingdom’s aspiring dragoneers must spend at least one year caring for the siege dragons at Oaken before they can graduate. The city is home to many soldiers as a result, but also farmers, ranchers, fishermen, and hunters that feed them. Not to mention all the auxiliary business to support those industries, such as tool makers, shopkeepers, and even sex workers. The siege dragon containment facility is the keystone holding all of these livelihoods together, and should it collapse, all of Oaken collapses with it.

*

Questions/Comments?

Lore Masterpost

Read the Series

12 notes

·

View notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

"As Competition Policy International (CPI) reported earlier this month, "RealPage's system, which provides rental price recommendations based on real-time data from landlords, is alleged to be a key tool in manipulating the rental market. The firm's influence covers 70% of multifamily apartment buildings."

"The scheme purportedly operated by encouraging landlords to adopt RealPage's pricing recommendations, a practice they follow 80-90% of the time," reported CPI. "This coordinated approach reduces the availability of rental units, driving up prices. One of the architects of RealPage's system reportedly stated that the aim is to prevent landlords from undervaluing their properties, ensuring consistently higher rents across the board."

Zelnick said it was "unsurprising that some of the same companies that needlessly inflated housing costs have worked closely with a software company accused of helping landlords coordinate a massive price fixing scheme. Through-the-roof rent hikes based on greed—not need—have kept many Americans from getting ahead, which is why Congress must do more to support the Biden administration's affordable housing actions.""

I only learned recently about RealPage (Thanks, American Fever Dream podcast!) but it seems ripe for hacktivism to me... Oh, and what's this?

"In April 2023, author James M. Nelson posted an article, The Harlan Crow—Clarence Thomas connection no one saw coming—RealPage, based on research for his forthcoming book, The New Landlord, Powered by Big Data, and Artificial Intelligence. Nelson revealed that RealPage was created in 1998 by real estate heir, and owner of at least one US Supreme Court Justice (Clarence Thomas) , Harlan Crow. Yeah, that Harlan Crow."

Yes, that's right, folks. Your high rent is because of price fixing, and and the company making it happen is owned by one of the billionaires most responsible for corrupting our Supreme Court.

#eat the rich#the rent is too damn high#price fixing#fuck harlan crow#fuck landlords#corporate greed

3 notes

·

View notes

Text

The Homeless for profit Industry

There's several programs in the US. That attempt to get homeless people off the streets into homes, and they routinely claim they find stable *permanent* Housing. But that "permanent" housing lasts about a year. And those who can't recover in that time to a *more permanent* solution are Shit Outta Luck.

I could go into all the predatory lending behavior and identity theft that happens to people who don't have a secure place to keep their necessary "Three forms of ID" required to register vote in this country. (You need the fourth form of id post registration to vote every year as well.)

But that's just the tip of the iceberg. The visible shit.

Here's the thing; how long do you think it will take you find a permanent job, near a place to live and vehicle to drive if it isn't near public transit?

Don't say Uber; $40 to be driven to and from work is far to costly.

By permanent, I mean indefinite.

How many people keep their first jobs for more than a year? How many rental agreements last for more than a year?

And how many landlords are *so worried* about being taken advantage of by "squatters" and "renters" rights laws that they refuse to lease a property for longer than a year to somebody?

And, finally; How many landlords prey on the homeless because it means a guaranteed paycheck?

The fact that guaranteed payment plans by the government to pay landlords for a limited period of times means that homeless people wind up homeless and without the ability to save anything they've purchased over that year.

And the proposed solution is "Well, you're supposed to lease with another rental property every year until you die."

That's not permanent housing, especially if renters want you to leave at least bi-yearly. And before you say "why don't you save up your money for a down payment on a home?"

It's not just the down payment, is it? You need house inspections, a real estate agent who will take a % because otherwise you're likely to get screwed in the process.

You could wind up in a predatory home owner association. You could wind up signing a sales agreement with somebody who didn't actually own the property.

There's so many ways to wind up back on the street *even* when everything goes right.

And that's the issue facing people today; but if you've never been worried about losing a stable place to live, it's not something you think about.

Obviously; the main problem with renting, isn't renting. There's plenty of situations in which renting would be preferable. But because of the giant chunk of $$ it takes from your paycheck; it makes it hard to save up any money.

And thus the reason for a loan, which, if I remind you about the housing crisis; doesn't guarantee you can't lose your home when shit hits the fan.

This is why there's economic disparity. Because despite its unethical nature; it's not illegal.

And all of *that* doesn't even cover the increase demand, and thus the increased price of rental properties *caused* by homeless programs themselves. Which feeds into itself.

Because if you don't have permanent housing, and you don't have the ability to achieve permanent rent free housing; you're stuck feeding the system or camping in a van in Public Park or Nature Reserve, and paying for a YMCA membership in order to take showers.

And don't get me started on how expensive laundromats are getting. ($20 for a single load!? Gonna have to throw in an entire month's worth of laundry to break even...)

Right now; the most cost effective method is to get every homeless person a van, with a bed and a closet, a place to park that has a fire pit, a place to do laundry, and a bunch of outhouses.

Then they can all have a roof over their heads, transportation, and Covid Safe Distancing and mask free self-isolation.

Plus; instead of paying money to shitty landlords begging for free guaranteed handouts at others expense; you can create an entire class of mechanics that actually get paid to maintain something.

4 notes

·

View notes

Text

Understanding Home Loan Options in UAE

The UAE's real estate market is diverse, offering a variety of home loan options to suit different needs. Understanding these options is crucial for making an informed decision. This guide provides an overview of the different home loan options available in the UAE.

Types of Home Loans

Home loans, or mortgages, come in various forms, each with its benefits and considerations.

Fixed-Rate Mortgages: These loans have a fixed interest rate for a specified period, providing stability in monthly payments.

Variable-Rate Mortgages: The interest rate fluctuates based on market conditions, which can lead to lower initial rates but potential increases over time.

Islamic Mortgages: Compliant with Sharia law, these mortgages involve profit-sharing rather than interest payments.

For detailed information on home loans, visit home loan dubai.

Key Features of Different Home Loans

Fixed-Rate Mortgages:

Stability: Monthly payments remain the same throughout the fixed period.

Predictability: Easier to budget as payments do not change.

Higher Initial Rates: Typically, fixed rates are higher than variable rates.

Variable-Rate Mortgages:

Lower Initial Rates: Often start with lower rates than fixed-rate mortgages.

Potential Increases: Rates can increase over time based on market conditions.

Flexibility: Can benefit from falling interest rates.

Islamic Mortgages:

Sharia Compliance: No interest payments; instead, profit-sharing.

Ethical Financing: Aligns with Islamic principles.

Varied Structures: Different structures such as Ijara, Murabaha, and Musharaka.

For property purchases, explore Buy Villas in Dubai.

Choosing the Right Home Loan

Assess Your Financial Situation: Begin by evaluating your financial health. Calculate your income, expenses, and savings to determine how much you can afford.

Consider Your Goals: Determine your homeownership goals, whether it's stability, flexibility, or compliance with Islamic principles.

Compare Loan Options: Different lenders offer various products. Compare rates, terms, and conditions.

Consult with a Mortgage Advisor: Professional advice can help you navigate the complexities of securing a home loan. For expert advice, consider Best Mortgage Services.

Steps to Securing a Home Loan

Get Pre-Approved: Pre-approval provides an estimate of how much you can borrow, making the home search more focused and efficient.

Choose the Right Mortgage: Select a mortgage that aligns with your financial goals.

Submit Your Application: Complete the mortgage application, providing necessary documents such as proof of income, credit history, and property details.

Loan Approval and Offer: Once approved, the lender will present an offer detailing the loan amount, interest rate, and repayment terms.

Finalizing the Purchase: After accepting the offer, work with your lender to finalize the purchase. Ensure all legal and financial aspects are in order.

For rental options, visit Apartments For Rent in Dubai.

Tips for a Smooth Home Loan Process

Maintain a Good Credit Score: A high credit score improves your chances of loan approval and favorable terms.

Save for a Down Payment: Aim for at least 20% of the property's value to reduce mortgage insurance costs and improve loan terms.

Avoid New Debt: Refrain from taking on new debt during the loan process to maintain your financial profile.

Understand Fees and Charges: Be aware of all fees and charges associated with the loan, including processing fees, valuation fees, and early repayment penalties.

For selling your property, explore Sell Your Property in Dubai.

Legal and Regulatory Considerations

The UAE has specific regulations governing mortgages. Ensure compliance with all legal requirements, including property registration and transfer fees.

Dubai Land Department (DLD): The DLD oversees property transactions. Ensure all documents are registered with the DLD.

No Objection Certificate (NOC): If buying from a developer, obtain an NOC confirming no outstanding payments or disputes.

Conclusion

Understanding home loan options in the UAE involves careful planning and knowledge of the mortgage market. By following the steps outlined in this guide, you can navigate the process efficiently and achieve your homeownership goals. For more resources and expert advice, visit home loan dubai.

2 notes

·

View notes

Text

To Manifest more money, get more specific.

Here are a FEW( there’s nearly infinite ways, don’t close yourself off!) ways one can receive money

Treat it like Pokémon and collect them all lol

1. Salary/wages: Regular income earned from employment self/employment.

2. Investment returns: Profits gained from investments such as stocks, bonds, or real estate.

3. Inheritance: Money or assets received from a relative or benefactor.

4. Grants: Funds awarded by organizations or institutions for specific purposes, such as research or education.

5. Loan repayment: Money received when someone pays back a loan that was previously provided.

6. Dividends: Payments made to shareholders from the profits of a corporation.

7. Royalties: Payments received by creators for the use of their intellectual property, such as books, music, or inventions.

8. Tips: Additional money given as appreciation for services rendered, typically in industries like hospitality or personal services.

9. Rebates: Refunds or discounts given after a purchase, often as an incentive or promotion.

10. Alimony/child support: Regular payments made to a former spouse or partner for financial support.

11. Found money: Money discovered unexpectedly, such as in lost or forgotten accounts, or on the ground.

12. Lottery winnings: Prizes won through games of chance like lotteries or scratch-off tickets.

13. Refunds: Money returned to a consumer after returning a product or canceling a service.

14. Sponsorship: Funds provided by companies or individuals to support a person or organization in exchange for advertising or promotion.

15. Crowdfunding: Money raised from a large number of people, typically through online platforms, to support a project, cause, or individual.

16. Cashback rewards: Money returned to a consumer as a percentage of their purchases, often offered by credit card companies or retailers.

17. Scholarships: Funds awarded to students to help cover the costs of education, typically based on academic achievement, financial need, or other criteria.

18. Patronage: Financial support given by individuals or organizations to artists, writers, or other creatives to fund their work or projects.

19. Rental income: Money earned from leasing or renting out property or assets, such as real estate, vehicles, or equipment.

20. Contest winnings: Prizes awarded for winning competitions or contests, which may include cash or other rewards.

21. Side hustle earnings: Additional income earned from part-time or freelance work outside of one's primary job.

22. Government benefits: Financial assistance provided by the government to eligible individuals or families, such as unemployment benefits, social security, or welfare.

23. Referral bonuses: Money received for referring new customers or clients to a business or service.

24. Stock options: Compensation provided to employees in the form of company stock, often as part of their overall compensation package.

25. Affiliate marketing commissions: Money earned through promoting and selling products or services for companies as an affiliate marketer.

26. Consulting fees: Payments received for providing expert advice or services to clients or businesses.

27. Trust distributions: Money distributed to beneficiaries from a trust fund, typically according to the terms outlined in the trust agreement.

28. Liquidation proceeds: Money received from selling off assets, such as stocks, bonds, or property.

29. Cash gifts: Money given by friends, family, or acquaintances as a gesture of goodwill, celebration, or support.

30. Insurance payouts: Money received from insurance companies to cover losses, damages, or expenses incurred due to accidents, disasters, or other covered events.

Focus on the ones that fits your self concept the best, for the best results.

5 notes

·

View notes

Text

youtube

Join us on the Rent to Retirement Podcast as hosts Adam Schroeder and Zach Lemaster chat with David Richter, founder of Simple CFO. Discover the secrets to financial freedom through effective real estate investment strategies. David shares his journey from reading "Rich Dad, Poor Dad" to revolutionizing real estate finance with his unique system, inspiring investors to prioritize profitability and financial discipline. 🔑 Key Moments: 00:00:30: David's introduction and background in real estate 00:01:09: Transitioning from small-scale investments to major deals 00:02:08: The importance of understanding the financial backend in real estate 00:03:05: Introduction to the "Profit First" methodology 00:05:14: David discusses his lack of formal financial training and its impact 00:10:17: Practical tips for managing finances and maximizing profit 00:15:22: Strategies for effective cash flow management 00:20:30: Discussion on reinvesting and financial planning for growth 00:25:04: David's vision for future projects and continued impact in the financial world

#real estate investing#financial freedom#profit first#entrepreneurship#investment tips#business strategy#cash flow management#personal finance#real estate podcast#real estate finance#wealth management#passive income#property investment#financia#Youtube

0 notes

Text

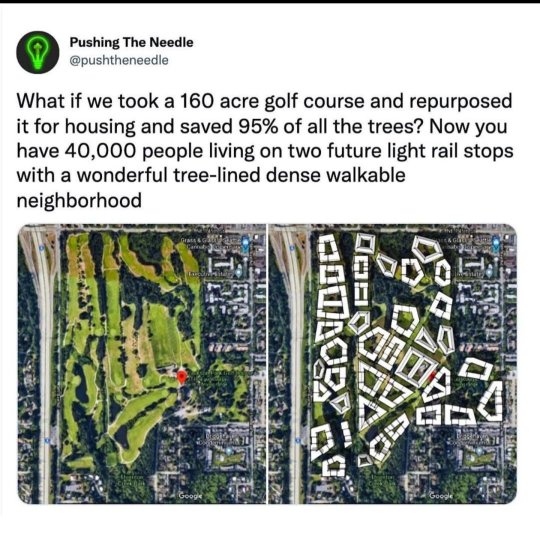

I don't want to be negative on an utopia post so I started my own.

For reasons, I have lots of golf lore. And transforming golf courses is a good idea in teory, but I'm afraid these kind of posts paint this trasformation as a miracle that will solve the housing crisis and become the solution to climate change. It's not.

There is a lot, and I mean a LOT of nuance.

For example, there's a difference between a links golf course in Scotland (a kind of course more integrated in the native nature in an already humid country), and a regular golf course in a desertic area in Florida. Or a par-3 course? (the one least eco-damaging and the friendliest to kids, old people and people in general)

More nuance: is the golf course in the middle of the city or is it a 60 minute ride from anywhere livable? (Because transforming a green area in the middle if a cramped city into more housing will increase the summer heat in the area. And transforming an isolated area is a waste of resources.)

Even more nuance: is it a golf course in use or one of the 200 golf courses closed in the U.S. in 2017?

And a big big nuance: is it a PUBLIC golf course or a PRIVATE golf course? Those are incredibly different problems with incredibly different approaches.

Most golf courses in the USA are a privately owned business that rely on the kind of clients that make business on the club house. And like to bee seen spending 8 hours staight walking around It is lucrative! Look at all that water, and the land they can aford with the tiny number of people perusing it at a time. Because they are not selling in bulk, they are selling exclusivity snd selling an image of power and richness.

One way to close them down is to ruin golf's public image. But this year they survived being shamed for betraying an association of terroist victim's families. I'm not kidding. I wish I was, but the golf lovers are willing to shove a LOT under the rug.

The tipping point for golf gourse private owners is not going to be shame. It's going to be: "is more profitable to exploit people through rent indefinitely than to sell the image of richness?"

You may love direct action, but a few weeks ago a main event for senior players was trashed. Destroyed, the ground was unplayable, and all the golf superintendants of the region pitched in and in the morning it was perfect and they played.

However you choose to dismantle it you have to take into account that this is still owned by people who live off the image of affluence, it is their business model. So whatever they build instead of a golf course is not going to be affordable for you and me.

It is not going to solve the housing crisis. The neighborhoods surounding a golf course are of high value, so you are going to find a strong opposition of a small army of semi rich Karens and Kens of the area unless you find something that will keep the value of their property up.

And this is not a crazy "what if" story. I come with receips because this has already happened.

Successful story of repurposed golf course into a park. The land had to be clawed out of private hands.

“It always had been identified,” Moskos said. “It just took 100 years to secure the land.”

Metro Parks bought the property, which had been a golf course for more than 50 years, for $4 million in October 2016. The 200-acre property connects three parks — Cascade Valley, Gorge and Sand Run — and creates the district’s second-largest contiguous area, at just under 1,700 acres.

Another repurposed golf course in Kent, this time apartments. Public space in debt sold to private hands to build "luxury rental housing". You decide if that's a success.

Auburn-based Landmark Development Group and HAL Real Estate will construct the project on the former Riverbend par 3 golf course property along the Green River they bought from the city of Kent for $10.5 million. The City Council voted to sell the property to eliminate the Riverbend Golf Complex fund’s debt of about $4 million and spend about $6 million to improve the 18-hole course across the street from the former par 3 course.

[...]

Marquee on Meeker will provide Kent first-of-its-kind, luxury rental housing and retail via two new six-story, 120-unit buildings featuring 6,000 square feet of retail each, and 21, 12-unit, three-story walk-up residential buildings. Residential units will feature high-quality finishes.

The apartment complex will include lounges, decks, fitness centers and a large clubhouse including a modern kitchen, pool, spa, outdoor fireplace and barbecue areas.

Yet another story, this time in Palm Springs. Dead golf course turned into "exclusive neighborhoods".

Overseen by Freehold Communities, a national real estate developer, Miralon represents one of the country’s biggest bets on agriculture-oriented real estate. [...] Residents in these exclusive neighborhoods can tend community gardens, fill up baskets of fruits in orchards, and, in Kukui’ula in Hawaii, even harvest guava, papaya, and pineapple.Selling a more experiential and exclusive lifestyle—“whether it’s tranquil, artsy, eclectic or organic, more or less everything is right where you want it,” says Miralon’s website. [...]

Of course, maybe the most sustainable use of land may actually be dense high-rises, which support resource conservation, public transit, and more efficient land use. But that may be a bit too radical, not to mention expensive, for Palm Springs.[...]

Miralon actually had its start as a failed golf course development named Avalon that, like it’s partial owner, Lehman Brothers, was stopped short by the recession.

There have been other successful stories, like Japan turning a defunct golf course into a solar farm. And there have been faillure stories about HOAs refusing to let affordable housing be built.

What can you do?

I don't know, do you live near a defunct golf course? Is there a public golf course in your town that you could encourage to plant local flora? Are you involved in a HOA that's blocking the repurposing of a golf course? Can you educate someone making seed bombs into a more productive course of action? I don't know! Here is where you have to think for yourself, learn about your area of influence and influence it.

Just make sure when you rage against the machine that you are aimed at the right direction, make sure there is at least one possibility of realizing what you set yo do, and know what will happen later to save yourself the pikachu face.

4 notes

·

View notes

Text

youtube

A face on a lover with a fire in his heart

A man under cover but you tore him apart

Oh, oh now I've found a real love

You'll never fool me again

George Michael (1963-2016) of Wham! passed away six years ago on this day at the age of 53. During the 1986 Christmas season, the duo's seasonal staple "Last Christmas" was blocked from hitting number one on the UK charts by another holiday song Michael contributed to, Band-Aid's charity single "Do They Know it's Christmas?" While the latter was explicitly made to raise funds for the Ethiopian famine, Wham! also donated all royalties from "Last Christmas" to the cause in additional support.

This is not surprising. In the wake of Michael's passing, a massive array of charitable contributions over his life came to light. This included a free Christmas concert for NHS nurses, a secret donation of 15,000 pounds for a Deal or No Deal contestant seeking IVF treatment, and a five thousand pound tip for a barmaid in debt.

Michael was a proud gay man who lost his partner Anselmo Feleppa (1956-1993) to AIDS-related causes, and as such devoted many of these financial gifts to supporting people in the community who were often left behind by institutions that sought to let them suffer and die.

As of 2021, Michael's estate continues to donate royalties from the song (one of the most profitable holiday tracks) to causes he cared for.

Merry Christmas, George.

19 notes

·

View notes