#Power-To-Gas Market Growth

Explore tagged Tumblr posts

Text

Global Power-To-Gas Market Is Estimated To Witness High Growth Owing To Increasing Demand For Renewable Energy Solutions

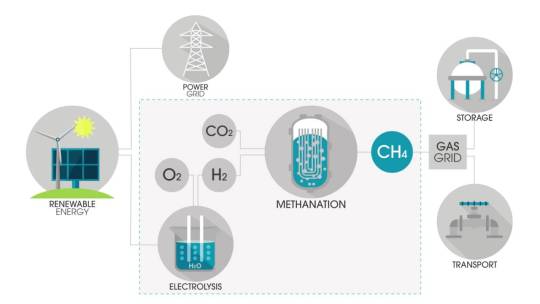

The global Power-To-Gas market is estimated to be valued at US$ 30.27 billion in 2022 and is expected to exhibit a CAGR of 12.2% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights. Market Overview: Power-To-Gas is a technology that converts electrical energy into chemical energy by using surplus renewable electricity to produce hydrogen or synthetic natural gas. This helps in storing excess renewable energy and enables its usage during periods of high demand. The process involves electrolysis, where water is split into hydrogen and oxygen, with the hydrogen further converted into methane. Power-To-Gas technology provides an efficient solution for energy storage and grid balancing, and reduces greenhouse gas emissions. Market Key Trends: One key trend in the Power-To-Gas market is the increasing demand for renewable energy solutions. As countries worldwide focus on reducing carbon emissions and transitioning towards cleaner energy sources, the demand for renewable energy solutions such as Power-To-Gas is expected to surge. This trend is driven by various factors, including government initiatives and policies promoting the use of renewable energy, growing concerns about climate change, and the need for energy security. For example, countries like Germany and Denmark have been at the forefront of adopting Power-To-Gas technology to store excess renewable energy generated from wind and solar power. In Germany, Power-To-Gas systems are being used to convert surplus wind power into hydrogen, which can then be injected into the natural gas grid or used as fuel for transportation. Similarly, in Denmark, Power-To-Gas facilities are being utilized to produce synthetic natural gas from surplus wind power. PEST Analysis: - Political: Governments worldwide are implementing favorable policies and regulations to promote the adoption of renewable energy solutions. This includes providing subsidies, tax incentives, and feed-in tariffs for renewable energy projects. - Economic: The decreasing cost of renewable energy technologies, such as solar panels and wind turbines, is making Power-To-Gas solutions more economically viable. Additionally, the potential for revenue generation from the sale of hydrogen or synthetic natural gas is attracting investments in Power-To-Gas projects. - Social: Growing awareness about the need for sustainable energy solutions and the harmful effects of fossil fuels on the environment is driving the demand for renewable energy solutions like Power-To-Gas. - Technological: Advancements in electrolysis technology and hydrogen fuel cells are improving the efficiency and cost-effectiveness of Power-To-Gas systems. The development of renewable energy storage technologies, such as hydrogen storage and underground caverns for synthetic natural gas, is further driving the adoption of Power-To-Gas. Key Takeaways: - The Global Power-To-Gas Market Size is expected to witness high growth, exhibiting a CAGR of 12.2% over the forecast period. This growth is driven by increasing demand for renewable energy solutions and the need for efficient energy storage and grid balancing. - Regionally, Europe is expected to dominate the Power-To-Gas market, owing to supportive government policies, well-established renewable energy infrastructure, and high investments in Power-To-Gas projects. Asia Pacific is projected to be the fastest-growing region, driven by rapid industrialization, urbanization, and a shift towards renewable energy sources.

#Power-To-Gas Market#Power-To-Gas Market Demand#Power-To-Gas Market Growth#Power-To-Gas Market Analysis#Power-To-Gas Market Values#Coherent Market Insights#Power-To-Gas

0 notes

Text

Global Gas Powered Water Pump Market Analysis and Expansion Forecast 2024 - 2031

The global gas-powered water pump market has seen notable growth in recent years, driven by increasing demand for efficient water management solutions across various sectors. This article provides a comprehensive analysis of the gas-powered water pump market, including key drivers, challenges, regional insights, and future trends.

Overview of the Gas Powered Water Pump Market

Gas-powered water pumps are mechanical devices that use gasoline or propane engines to pump water for various applications, including irrigation, construction, and emergency response. Known for their portability and efficiency, these pumps are widely used in both residential and commercial settings.

The global gas-powered water pump market is positioned for growth, driven by rising agricultural demands, urbanization, and the need for efficient emergency response solutions. While challenges such as environmental concerns and competition from alternative technologies persist

Market Definition and Segmentation

The gas-powered water pump market can be segmented based on:

Type: Centrifugal pumps, diaphragm pumps, submersible pumps, and others.

Application: Agricultural irrigation, construction, industrial use, and emergency services.

Region: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Key Market Drivers

1. Increasing Agricultural Demand

The growing need for efficient irrigation systems to support food production is a major driver for the gas-powered water pump market. Farmers are increasingly adopting these pumps to enhance crop yields and manage water resources effectively.

2. Urbanization and Infrastructure Development

Rapid urbanization and ongoing infrastructure projects, especially in developing countries, have led to increased demand for reliable water pumping solutions. Gas-powered water pumps are favored in construction sites due to their portability and power.

3. Natural Disasters and Emergency Response

The frequency of natural disasters has prompted governments and organizations to invest in emergency preparedness equipment, including gas-powered water pumps. These pumps are vital for flood control and water removal in disaster-stricken areas.

Challenges Facing the Market

1. Environmental Concerns

Gas-powered water pumps contribute to emissions and noise pollution, raising environmental concerns. As regulations around emissions tighten, there may be a shift towards more eco-friendly alternatives, such as electric pumps.

2. Competition from Electric and Solar Pumps

The rise of electric and solar-powered water pumps presents a challenge to gas-powered models. These alternatives offer lower operating costs and reduced environmental impact, making them increasingly attractive to consumers.

3. Fuel Availability and Costs

Fluctuating fuel prices can impact the operational costs of gas-powered water pumps. Additionally, in some regions, limited access to fuel can hinder the effectiveness and reliability of these pumps.

Regional Analysis

North America

North America is a prominent market for gas-powered water pumps, driven by a robust agricultural sector and significant infrastructure projects. The United States is the largest market, with a strong demand for portable pumps in various applications.

Europe

In Europe, the market for gas-powered water pumps is growing, although environmental regulations are pushing manufacturers to innovate. Countries with extensive agricultural practices, such as Germany and France, continue to be key markets.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the gas-powered water pump market due to increasing agricultural activities, urbanization, and infrastructure development. Countries like China and India are significant contributors to this growth.

Future Outlook

The global gas-powered water pump market is expected to see steady growth in the coming years. Key trends to watch include:

Technological Innovations: Manufacturers are likely to focus on developing more efficient engines and noise reduction technologies to meet regulatory standards and consumer demands.

Hybrid Solutions: The emergence of hybrid water pumps that combine gas and electric power may provide a balanced solution for various applications, appealing to a broader range of users.

Sustainability Initiatives: As environmental concerns grow, there will be an increasing emphasis on producing eco-friendly gas-powered pumps that minimize emissions and fuel consumption.

Conclusion

The global gas-powered water pump market is positioned for growth, driven by rising agricultural demands, urbanization, and the need for efficient emergency response solutions. While challenges such as environmental concerns and competition from alternative technologies persist, the market outlook remains positive. As manufacturers innovate and adapt to changing consumer preferences, gas-powered water pumps will continue to play a crucial role in water management across multiple sectors.

#Global Gas Powered Water Pump Market Size#Global Gas Powered Water Pump Market Trend#Global Gas Powered Water Pump Market Growth

0 notes

Text

Europe Gas Generator Market Growth, Trends, Demand, Industry Share, Challenges, Future Opportunities and Competitive Analysis 2033: SPER Market Research

The Europe Gas Generator Market encompasses the production, distribution, and utilization of gas-powered generators across European countries. With increasing concerns about energy security, environmental sustainability, and power reliability, the demand for gas generators is rising. Key drivers include the transition to cleaner energy sources, infrastructure development, and backup power requirements. Additionally, advancements in gas generator technology, such as improved efficiency and reduced emissions, contribute to market growth. Key players focus on innovation, product differentiation, and service quality to meet the diverse needs of customers and capitalize on market opportunities in Europe.

#Europe Gas Generator Market#Europe Gas Generator Market Challenges#Europe Gas Generator Market Competition#Europe Gas Generator Market Demand#Europe Gas Generator Market Future Outlook#Europe Gas Generator Market Growth#Europe Gas Generator Market Report#Europe Gas Generator Market Revenue#Europe Gas Generator Market Segmentation#Europe Gas Generator Market Share#Europe Gas Generator Market Size#Europe Gas Generator Market Trends#Europe Hydrogen Gas Generator Market#Europe Industrial Gas Generator Market#Europe Laboratory Gas Generators Market#Europe Large Generator Market#Europe Natural Gas Generator Market#Europe Natural Gas Generator Market Forecast#Europe Natural Gas Generator Market Opportunities#Europe Power Generator Market#Europe Residential Gas Generator Market#Gas Generator Market

0 notes

Text

#Global NiCd Batteries Market Size#Share#Trends#Growth#Industry Analysis By Type( Pocket Type#Sintered Type#Fibre Type)#By Application(Power#Transportation#Emergency Lighting#Oil and Gas#Telecommunications#Aviation#Others)#Key Players#Revenue#Future Development & Forecast 2023-2032

0 notes

Text

Power-to-Gas Market: Driving the Transition to a Hydrogen Economy

Power-to-Gas (P2G) is a rapidly emerging technology that aims to integrate renewable energy sources, such as wind and solar power, into existing gas infrastructure. P2G converts surplus electricity generated from renewables into hydrogen or synthetic natural gas (methane) through electrolysis. This process enables the storage and utilization of renewable energy in various sectors, including transportation, heating, and industrial applications.

Market Overview:

The global Power-to-Gas market has experienced significant growth in recent years and is expected to continue expanding at a substantial rate. The increasing focus on decarbonization, the integration of renewable energy sources, and the need for energy storage solutions are key factors driving the market's growth. Additionally, favorable government policies and incentives promoting clean energy technologies have further stimulated the adoption of Power-to-Gas systems.

Technologies:

Power-to-Gas systems primarily consist of three main components: electrolyzers, hydrogen storage, and methanation units.

Electrolyzers: Electrolysis is the core process in P2G systems. It involves the splitting of water molecules (H2O) into hydrogen (H2) and oxygen (O2) using electricity. Proton Exchange Membrane (PEM) electrolyzers and Alkaline Electrolyzers are the two main types used in P2G applications. PEM electrolyzers are known for their high efficiency, compact size, and fast response time, while alkaline electrolyzers offer lower costs and higher production capacities.

Hydrogen Storage: The produced hydrogen from electrolysis is stored for later use. Hydrogen can be stored in gaseous form in high-pressure tanks or as a liquid by cryogenic compression. Alternatively, it can be chemically combined with other elements to form more easily transportable compounds like ammonia or converted to synthetic natural gas.

Methanation Units: Methanation is the process of converting hydrogen with carbon dioxide (CO2) to produce synthetic natural gas (SNG). This step enhances the energy density and provides better storage options since the existing natural gas infrastructure can be utilized.

Applications:

The Power-to-Gas technology offers several applications across various sectors:

Energy Storage: P2G systems play a crucial role in storing surplus renewable energy and balancing supply-demand fluctuations in the electricity grid. Hydrogen or synthetic natural gas can be stored for extended periods and converted back to electricity or heat when needed.

Grid Balancing: P2G helps stabilize the electricity grid by providing grid operators with the flexibility to store excess energy during low demand and release it during peak demand periods. This improves the overall grid stability and reliability.

Sector Coupling: Power-to-Gas facilitates the integration of different sectors, such as transportation and heating, with the renewable energy sector. Hydrogen produced from P2G can be used as a fuel for fuel cell vehicles, while synthetic natural gas can be utilized for heating purposes in residential, commercial, and industrial settings.

Renewable Gas Injection: P2G enables the direct injection of renewable hydrogen or synthetic natural gas into existing natural gas pipelines, reducing the reliance on fossil fuels and decarbonizing the gas grid.

Market Outlook:

The Power-to-Gas market is expected to witness substantial growth in the coming years. The increasing deployment of renewable energy sources and the growing demand for energy storage solutions are the primary drivers for market expansion. The transportation sector, in particular, is anticipated to witness significant adoption of P2G technology, with the rise of fuel cell vehicles and the need for decarbonization. Furthermore, advancements in electrolyzer technologies, declining costs, and supportive government policies are likely to further accelerate market growth.

However, challenges such as the high cost of electrolyzers, limited infrastructure, and the need for effective carbon capture and utilization technologies remain key obstacles for wider market penetration. Continued research and development efforts, along with collaboration between industry stakeholders, are crucial to overcoming these challenges and unlocking the full potential of Power-to-Gas technology in the global energy transition.

0 notes

Text

by Tyler Durden

In a significant regulatory shift that took place quietly the day after Christmas, the Biden administration finalized new climate rules targeting natural gas-powered instantaneous water heaters. The Department of Energy (DOE), which traditionally issues a press release for such regulations, chose not to announce these changes publicly, raising eyebrows across various sectors.

According to the Free Beacon, the new regulations aim to reduce carbon dioxide emissions, a move aligned with broader climate change mitigation efforts. However, the regulations are set to remove approximately 40% of the current tankless water heater models from the market by 2029 (between gas and electric). This shift is expected to force consumers to opt for either more expensive or less efficient alternatives.

An industry analysis forecasts that the average cost increase for new water heaters due to the regulations will be around $450. This price hike is poised to disproportionately affect low-income and senior households, who are among the most reliant on the more affordable models currently targeted for phase-out.

Meanwhile, the timing of these regulations is noteworthy - coming in the wake of President-elect Donald Trump's electoral victory over Vice President Kamala Harris. Trump has expressed intentions to roll back many of Biden's climate initiatives to bolster energy production and stimulate economic growth. This regulatory push on water heaters is part of a series of actions targeting household appliances, including gas stoves and refriger

17 notes

·

View notes

Text

Throughout the 2024 U.S. presidential election campaign, observers spent much time puzzling over why voters seemed to be so unhappy with the economy, even when macroeconomic data—and most economists—suggested that the economy was historically strong.

The United States was growing at nearly 3 percent (faster than it had for decades); unemployment (at under 4 percent) was at historic lows; the stock market was at a record high after the best two consecutive years this century; manufacturing jobs were coming back, and inflation—which had surged during the COVID-19 pandemic—was back down to near target levels. The U.S. economy was in many ways the envy of the world, and yet 77 percent of the public believed it was “poor” or “only fair,” which now-President Donald Trump both encouraged and took advantage of.

While there were many reasons for this striking perception gap, the best explanation seems to be the unique role of inflation: Unlike broad macroeconomic trends that show up mainly in headlines, people experience inflation directly and several times every day, when filling up the gas tank or buying a sandwich causes sticker shock and anger for which political leaders must be to blame.

Whatever the reason, what got less attention during the campaign was the fact that a similarly striking gap existed between the United States’ actual strength and standing in the world and the perception that voters had of it.

Trump told voters a story of U.S. weakness and global decline, and Americans seemed to buy it, with just 33 percent of those polled in a February 2024 Gallup survey saying they were “satisfied” with the position of the United States in the world today—a level 20 points below what it had been four years previously..

What they apparently failed to see was that notwithstanding the wars in Ukraine and Gaza—and indeed, in some ways because of them—the United States was in a stronger geopolitical position than it had been for many years or even decades, in stark contrast with the perception of weakness and decline.

Compared with both its allies and its adversaries, the U.S. economy is in anything but decline. U.S. economic growth over the past 20 years has dwarfed that of other wealthy countries, a gap that has grown over the past few years to the point that the U.S. economy is now nearly twice the size of the eurozone and almost seven times that of Japan. Meanwhile, China’s 30-year run of meteoric growth seems to be ending with its economy bogged down by low consumption and a bloated property market, while Russia’s economy has been devasted by sanctions, export controls, and war.

The United States has real economic problems—including debt, stubborn inflation, and inequality—but its share of the global GDP, at around 26 percent, is higher than it has been for nearly two decades and similar to where it was at the end of the Reagan administration. That economic power remains the basis for exercising unparalleled global influence.

Virtually every other measure of relative power underscores U.S. global strength. Far from artificially constrained in the name of climate change, as alleged by critics, U.S. energy production is at an all-time high, with the country leading the world in production of both oil (20 percent of global production) and natural gas (25 percent). U.S. technology companies—such as Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla—dominate global markets, and the country remains well ahead of its allies and competitors in the field of artificial intelligence. The U.S. dollar remains the currency of choice for nearly 60 percent of international transactions and currency reserves—giving Washington unique power to leverage sanctions, freeze assets, and take advantage of deficit spending. Demographically, the United States is also better positioned than competitors, with a higher birthrate than any other advanced industrialized economy or adversaries such as China or Russia.

American voters in 2024 may not have been feeling good about the country’s standing in the world, but people elsewhere were: Even in summer 2024, amid rising global criticism of U.S. policy in the Middle East, a Pew poll of 34 countries from all over the world showed that international views of the United States were still strongly favorable (54 percent favorable vs. 31 percent unfavorable) and that twice as many people surveyed had confidence in President Joe Biden to do the right thing than they did in Chinese President Xi Jinping or Russian President Vladimir Putin—or Trump.

In other words, Americans had the impression that a strong majority of people around the world (57 percent vs. 42 percent, according to a February 2024 Gallup survey) viewed the United States unfavorably, when the reality was the other way around.

The U.S. geopolitical position in key regions of the world also belies the notion of decline. In Europe, the war in Ukraine has certainly been costly and has no doubt contributed to the American perception of foreign-policy failure. In fact, the response to Putin’s invasion was a remarkable demonstration of U.S. power. In February 2022, virtually all observers thought Russia would take Kyiv in weeks. Instead, finances and weapons from the United States and other allies helped Ukraine thwart the invasion, and the country remains free and independent, while Russia has lost some 700,000 dead and wounded on the battlefield and is forced to rely on North Korea for reinforcements.

With the addition of Finland and Sweden—and European defense spending rising considerably since the Russian invasion—a U.S.-led NATO is now bigger and more unified than ever. If Trump ends U.S. military support for Ukraine, alienates NATO allies (with initiatives such as unilateral tariffs or his threatened attempt to acquire Greenland), or pulls out of the NATO alliance altogether, U.S. influence there will obviously diminish; but he inherited a position of strength.

The United States’ strength and standing in Asia is also enviable. When the Biden administration took office, it seemed to be a matter of “when,” not “if,” China’s economy would surpass that of the United States, and fears about Beijing’s domination of the South China Sea or a military takeover of Taiwan were high.

Instead, China’s post-COVID-19 recovery has been anemic—leading Beijing to seek more stability in relations with the United States—and Washington has bolstered its extensive network of alliances around the region. Targeted U.S. export controls, tariffs, and investment restrictions have constrained China’s military rise while Washington has bolstered political and security ties with Japan, South Korea, Vietnam, Singapore, Australia, Taiwan, and others.

Trump could, of course, squander Washington’s leverage and influence if he repeats calls to pull U.S. troops out of South Korea or questions the country’s willingness to defend Taiwan, but those would be self-inflicted wounds.

Finally, for all the chaos in the Middle East—no doubt itself responsible for the impression of U.S. weakness—Washington’s geopolitical position in the region is now stronger than it has been for decades. The war between Israel and Hamas, which has caused mass civilian casualties and destruction, has been painfully tragic, and strong U.S. support for Israel has alienated Arab populations across the region.

At the same time—and in part thanks to that support—the strategic situation in the neighborhood has been positively transformed. The United States’ main regional adversary, Iran, is now believed by many to be weaker than it has been since its 1979 revolution, and its proxies—including Hamas and Hezbollah—have been decimated. Iran’s ballistic missile program, once a core element of its deterrent, has proved to be ineffective and its air defenses have been revealed as weak. Tehran also lost its main regional partner with the fall of the Assad regime in Syria.

The U.S. military’s demonstration in April 2024 and October 2024 that it—along with a coalition of regional partners—could shoot down hundreds of ballistic missiles and drones launched from Iran toward Israel was a powerful reminder to the entire region and beyond of the benefits of having the United States on your side. Trump is certainly inheriting a complicated regional picture in the Middle East, but he is also inheriting a historic opportunity.

None of this is to say that the United States does not face enormous challenges or rivalries on the world stage, including China, Russia, North Korea, and Iran. But the notion that the past four years revealed the United States to be a paper tiger—or that it is now in a weakened global position compared with any of its rivals—is absurd.

If Trump reverses the bipartisan policies that led to this position of strength—the creation and maintenance of alliances; an open U.S. economy; an investment in soft power (including through development assistance); upholding defense commitments; and a willingness to confront international aggressors and stand up for global rules and norms—then he could end up producing the very decline and insecurity that he falsely claims to have inherited.

13 notes

·

View notes

Text

President Trump's Achievements

Hey!! What has Donald Trump done while he was in office (as at July, 2017)!!!

1.Supreme Court Judge Gorsuch

2.59 missiles dropped in Syria.

3.He took us out of TPP

4.Illegal immigration is now down 70%( the lowest in 17 years)

5.Consumer confidence highest since 2000 at index125.6

6.Mortgage applications for new homes rise to a 7 year high.

7.Arranged 20% Tariff on soft lumber from Canada.

8.Bids for border wall are well underway.

9.Pulled out of the lopsided Paris accord.

10.Keystone pipeline approved.

11.NATO allies boost spending by 4.3%

12.Allowing VA to terminate bad employees.

13.Allowing private healthcare choices for veterans.

14.More than 600,000. Jobs created

15. Median household income at a 7 year high.

16. The Stock Market is at the highest ever In its history.

17. China agreed to American import of beef.

18. $89 Billion saved in regulation rollbacks.

19. Rollback of A Regulation to boost coal mining.

20. MOAB for ISIS

21. Travel ban reinstated.

22. Executive order for religious freedom.

23. Jump started NASA

24. $600 million cut from UN peacekeeping budget.

25. Targeting of MS13 gangs

26. Deporting violent illegal immigrants.

27. Signed 41 bills to date

28. Created a commission on child trafficking

29. Created a commission on voter fraud

30. Created a commission for opioids addiction.

31. Giving power to states to drug test unemployment recipients.

32. Unemployment lowest since may 2007.

33. Historic Black College University initiative

34. Women In Entrepreneurship Act

35. Created an office or illegal immigrant crime victims.

36. Reversed Dodd-Frank

37. Repealed DOT ruling which would have taken power away from local governments for infrastructure planning

38. Order to stop crime against law enforcement.

39. End of DAPA program.

40. Stopped companies from moving out of America.

41. Promoted businesses to create American Jobs.

42. Encouraged country to once again

43. 'Buy American and hire American

44. Cutting regulations 2 for every one created.

45. Review of all trade agreements to make sure they are America first.

46. Apprentice program

47. Highest manufacturing surge in 3 years.

48 $78 Billion promised reinvestment from major businesses like Exxon, Bayer, Apple, SoftBank, Toyota...

49. Denied FBI a new building.

50. $700 million saved with F-35 renegotiation.

51. Saves $22 million by reducing white house payroll.

52. Dept of treasury reports a $182 billion surplus for April 2017

(2nd largest in history.

53. Negotiated the release of 6 US humanitarian workers held captive in egypt.

54. Gas prices lowest in more than 12 years.

55. Signed An Executive Order To Promote Energy Independence And Economic Growth

56. Has already accomplished more to stop government interference into people's lives than any President in the history of America.

57. President Trump has worked with Congress to pass more legislation in his first 100 days than any President since Truman.

58. Has given head executive of each branches 6 month time Frame dated march 15 2017, to trim the fat. restructure and improve efficacy of their branch.

Observe the pushback the leaks the lies as entrenched POWER refuses to go silently into that good night!

I hope each and every one of you copy and paste this everywhere, every time you hear some dim wit say Trump hadn't done a thing!

THANK YOU!!!

Oh, yeah, and there's this..........

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#societal collapse#the communist manifesto#commandant kamala#kamala harris#the great awakening#truth justice and the american way#president trump#i'm more maga than ever!#maga 2024

27 notes

·

View notes

Text

Excerpt from this story from Canary Media:

Texas has become an all-around clean energy juggernaut, thanks to its lax permitting regime, fast grid-interconnection process, competitive energy market, and ample amount of solar- and wind-friendly land.

Its plans for the next year and a half underscore that status. As of July, the state intended to build 35 gigawatts of clean energy over 18 months, more than the next nine states combined, according to a Cleanview analysis of U.S. Energy Information Agency data.

Texas has long been the biggest player in U.S. wind energy. But in recent years, energy developers have raced to build solar in Texas too. Five years ago, the state had connected just 2.4 gigawatts of utility-scale solar to its grid; as of this past June, it had installed almost 22 GW of solar, per an American Clean Power report released this week. That’s nearly 10 times as much as back in 2019, and enough to propel Texas past California for large-scale solar installations.

Now Texas is writing its next chapter on clean energy: The state has become the nation’s hottest market for grid batteries as energy developers chase after its cheap solar and wind energy.

Given its staggering construction plans, Texas is set to only further solidify its place at the top of the clean energy leaderboard. But the rapid rise of the state’s clean energy sector has not yet yielded an outright energy transition, as the writer Ketan Joshi points out.

Though Texas has built more large-scale clean energy than any other state in absolute terms, it lags behind California — and plenty others — in terms of how clean its grid actually is. The Golden State met over half its electricity needs with renewables in 2023, per Ember data, while clean sources generated just 28 percent of Texas’ power. Electricity produced in the Lone Star State remains slightly more carbon intensive compared with the U.S. average.

Part of the story here is that, largely thanks to data centers and bitcoin mines, Texas is seeing some of the fastest growth in electricity demand of any state. That means much of the new solar, wind, and battery storage it’s building is just meeting new demand and not necessarily booting dirty energy off the grid.

The other hurdle preventing Texas from cleaning up its grid faster is the entrenchment of the fossil fuel industry in its local politics. Last year, the state passed a law creating a taxpayer-funded program to give energy developers billions of dollars in low-interest loans to build several gigawatts’ worth of new fossil-gas power plants.

In other words, the Lone Star state’s fossil fuel buildout isn’t ending even as its clean energy sector takes off. For Texas to be considered a true leader on decarbonizing the power sector — and not just a state that builds lots of everything — that will need to change.

11 notes

·

View notes

Note

How many hrt's are in this Wikipedia page?

https://en.m.wikipedia.org/wiki/Plug-in_electric_vehicle

Thanks for the ask, but lovingly I aint doing.... all that...

This is an 8500 word article of very big words and I am a human being, not a machine. That being said, I'm not outright denying this ask, but I'm not going to do 8500 words of tedious, painstaking work. This is a fun blog and my commitment to the bit is not worth weeks of work. Thanks for understanding <3

The first section, or summary of the article, has 60 counts of HRT

Plug-in electric vehicle

A plug-in electric vehicle (PEV) is any road vehicle that can utilize an external source of electricity (such as a wall socket that connects to the power grid) to store electrical energy within its onboard rechargeable battery packs, to power an electric motor and help propelling the wheels. PEV is a subset of electric vehicles, and includes all-electric/battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).[5][6][7] Sales of the first series production plug-in electric vehicles began in December 2008 with the introduction of the plug-in hybrid BYD F3DM, and then with the all-electric Mitsubishi i-MiEV in July 2009, but global retail sales only gained traction after the introduction of the mass production all-electric Nissan Leaf and the plug-in hybrid Chevrolet Volt in December 2010.

HRT 11

Plug-in electric cars have several benefits compared to conventional internal combustion engine vehicles. All-electric vehicles have lower operating and maintenance costs, and produce little or no air pollution when under all-electric mode, thus (depending on the electricity source) reducing societal dependence on fossil fuels and significantly decreasing greenhouse gas emissions, but recharging takes longer time than refueling and is heavily reliant on sufficient charging infrastructures to remain operationally practical. Plug-in hybrid vehicles are a good in-between option that provides most of electric cars' benefits when they are operating in electric mode, though typically having shorter all-electric ranges, but have the auxiliary option of driving as a conventional hybrid vehicle when the battery is low, using its internal combustion engine (usually a gasoline engine) to alleviate the range anxiety that accompanies current electric cars.

HRT 16

Cumulative global sales of highway-legal plug-in electric passenger cars and light utility vehicles achieved the 1 million unit mark in September 2015,[8] 5 million in December 2018.[9] and the 10 million unit milestone in 2020.[10] Despite the rapid growth experienced, however, the stock of plug-in electric cars represented just 1% of all passengers vehicles on the world's roads by the end of 2020, of which pure electrics constituted two thirds.[11]

HRT 7

As of December 2023, the Tesla Model Y ranked as the world's top selling highway-capable plug-in electric car in history.[1] The Tesla Model 3 was the first electric car to achieve global sales of more than 1,000,000 units.[12][13] The BYD Song DM SUV series is the world's all-time best selling plug-in hybrid, with global sales over 1,050,000 units through December 2023.[14][15][16][17][18][19]

HRT 11

As of December 2021, China had the world's largest stock of highway legal plug-in electric passenger cars with 7.84 million units, representing 46% of the world's stock of plug-in cars.[20] Europe ranked next with about 5.6 million light-duty plug-in cars and vans at the end of 2021, accounting for around 32% of the global stock.[21][22][23] The U.S. cumulative sales totaled about 2.32 million plug-in cars through December 2021.[24] As of July 2021, Germany is the leading European country with cumulative sales of 1 million plug-in vehicles on the road,[25] and also has led the continent plug-in sales since 2019.[22][26] Norway has the highest market penetration per capita in the world,[27] and also achieved in 2021 the world's largest annual plug-in market share ever registered, 86.2% of new car sales.[28]

HRT 15

#I feel as though my life flashed before my eyes while I just *kept. scrolling.*#probably could have done more but I couldn't find as good of a cutoff#hrt counter#here here for trans cars ig

9 notes

·

View notes

Text

Big Oil backtracks on renewables amid fading climate agenda

Europe’s biggest energy companies are doubling down on oil and gas in 2024 to focus on short-term profits instead of climate commitments, according to Reuters.

The cuts by oil companies came after governments around the world had slowed the implementation of clean energy policies and delayed targets. This followed the outbreak of the war in Ukraine in 2022.

Major European energy companies that heavily invested in the transition to clean energy found their shares lagging behind US rivals Exxon and Chevron, which maintained their focus on oil and gas. Against that backdrop, companies, such as BP and Shell, sharply slowed their plans to spend billions on wind and solar power projects this year. They shifted spending to more lucrative oil and gas projects instead.

Shell, which once promised to become the world’s largest power company, stopped investing in new offshore wind projects. The company eventually withdrew from electricity markets in Europe and China, weakening its carbon reduction targets.

Norwegian state-owned Equinor also slowed spending on renewable energy. BP, Shell and Equinor cut low-carbon spending by 8 per cent in 2024, according to Rohan Bowater, analyst at Accela Research.

Reducing climate targets

The decline of oil companies provides bad news for efforts to mitigate climate change. Global emissions of heat-trapping carbon are predicted to reach a new high in 2024, which will be the warmest year on record.

2025 promises to be another tumultuous year for the $3 trillion energy sector as climate sceptic Donald Trump returns to the White House. China, the world’s largest importer of crude oil, is also trying to revitalise its staggered economy, potentially boosting oil demand.

Demand growth in China, which has driven global prices for two decades, is slowing, with signs that the country’s petrol and diesel consumption is stabilising. Meanwhile, OPEC and leading oil-producing allies have repeatedly postponed plans to end supply cuts as other countries ramp up oil production.

A climate summit in Baku, Azerbaijan, in November led to global climate funding but disappointed climate advocates who hoped governments would unite around phasing out oil, gas and coal.

Read more HERE

#world news#news#world politics#energy#energy update#electricity#big oil#bp#chevron#china#china news#chinese politics#climate#climate change#climate crisis#climate action#climate catastrophe#climate justice#pollution#environment#global warming#equinor#exxon#shell#usa#usa politics#usa news#usa 2024#united states#united states of america

3 notes

·

View notes

Text

Ilana Berger at MMFA:

In a new analysis of electric vehicle-related content on Facebook, Media Matters found that negative stories made up the vast majority of content, particularly on right-leaning and politically nonaligned U.S. news and political pages, a trend which does not align with the optimistic outlook of EV adoption and technological advancements. Since 2021, the Biden administration has allocated billions of dollars toward meeting the ambitious goal of making half of all new cars sold electric or hybrid over the next few years. Provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act have provided tax credits and other incentives to jump start electric vehicle sales and infrastructure such as charging stations, domestic battery manufacturing, critical mineral acquisition, in addition to preparing the automotive industry workforce for the transition.

In March, an Environmental Protection Agency rule setting strict limits on pollution from new gas-powered cars primed automakers for success in meeting these goals. Biden’s EV push will continue to play an important role in the upcoming presidential election. Former president and current GOP candidate Donald Trump has insisted that Biden’s policies benefit China, which makes up the largest share of the global EV market. In March, while talking about the current state of the auto industry, Trump declared, “If I don’t get elected, it’s going to be a bloodbath for the whole — that’s going to be the least of it. It’s going to be a bloodbath for the country.” Economists disagree.

The comment tracks with years of outrage and opposition from Republican politicians, right-wing media, and fossil fuel industry surrogates, who have often disparaged the new technology and related policy and misleadingly framed the EV push as a threat to American jobs and national security. Constant attacks on EVs from the right have helped fuel a politically divided market, where people who identify as Democrats are now much more likely to buy them or consider buying them, while nearly 70% of Republican respondents to a recent poll said they “would not buy” an EV. So far in 2024, headline after headline announced EV sales slumps and proclaimed that “EV euphoria is dead,'' despite reports of “robust” growth. In February, CNN changed a headline about EV sales on its website from a success story to a failure. Despite the positive long term outlook for EVs based on indicators like sales and government investments, the discourse around electric vehicles is often pessimistic.

[...] Right-wing media have been driving anti-EV sentiment (with help from fossil fuel industry allies) since the start of Biden’s term. This trend was clearly reflected in Media Matters’ analysis. Out of the top 100 posts related to EVs on right-leaning pages, 95% were negative, earning over a million interactions in 2024 so far. But on Facebook, politically nonaligned pages fed into this trend as well. Nearly three quarters (74%) of EV related top posts on nonaligned pages had a negative framing. These posts generated 83% of all interactions on EV-related top posts from nonaligned pages.

On non-aligned and right-wing Facebook pages, anti-electric vehicle content-- likely fueled by a mix of climate crisis denial and culture war resentments-- draws lots of reliable engagement, in contrast to the reality of increased EV adoption in recent years.

#Electric Vehicles#Culture Wars#Automobiles#Climate Change#Facebook#CHIPS Act#Inflation Reduction Act#Infrastructure Investment and Jobs Act#Biden Administration#Joe Biden#EV Charging Stations

9 notes

·

View notes

Text

Fun fact to share with anyone who tells you about how they vote Trump because of prices or the economy, the "gas and eggs" lie that even leftists seem to believe...

Eggs have gone up in price around $0.70 since 1980 as has gas when adjusted for inflation.

So no it wasn't a choice between wallets and human rights -- because those prices haven't changed much.

It's taking more of your money to pay for essentials because of an artificial housing crisis (of Republican support), an out of date utility system (of Republican support), and wage suppression (of Republican support.)

You can check here

for prices on goods like gas and eggs and milk, adjusted for inflation every year.

The idea that Republicans are better on the economy is a lie. It's simply not supported by actual data. If we were in 1925, then we could debate the value of liberal and conservative economic policies -- they were both largely untried, simply theoretical math.

But it's been almost a century and every time conservative economics have been put in play, a market crash and recession inevitably follow. When liberal policies have been put into place, we rebounded from the biggest economic disaster in history to the longest period of sustained growth, created the middle class, funded not only our own part in WWII but a goodly portion of the UK's as well, paid to reconstruct Europe, increased education, created a safety net for our elderly (FDR post Hoover depression), had an economic and technological boom, a soaring stock market, ran a budget surplus, (Clinton post Reagan/Bush recession) restored industries, improved healthcare, came back with 72 months of sustained job growth (Obama post Bush 2 recession).

Now I will not blame Trump for the economic problems in his last year in office -- pandemics can happen to anyone and while better economic policies could have helped, that's theoretical which is up for debate, and I'm here to address FACTS. Hard data from unpartisan sources that is publicly available FACTS.

And Biden's "terrible" economy? Yeah we had the lowest inflation in the western world (EU inflation in 2023 was 6.59% versus US inflation in 2023 was 4.1% -- as of October 2024, inflation was at 2.6% versus Trump's 2.3% inflation rate in 2019) at a time when inflation is INEVITABLE (literally every pandemic has an inflation period after it, since forever -- look at the Black Death sometime), the highest GDP (21.43T for 2019 versus 27.36T for 2023) and GNP (21.73T in 2019 versus 29.03T for 2023) in history, jobs growth every quarter (unemployment rate of 3.7% in 2019 to 3.6% in 2023, which means we not only got back everything we lost from COVID, but then some), and an increase in the median wage from $35k per person per year to $59k.

For those of you who have some weird devotion to tax rates in 2019, the federal income tax rates were 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In 2023 they were... exactly the same. Your tax rates remained unchanged by Democrats at all. Also the largest budget deficit in history occurred under Trump's first administration. Personally I find these less than irrelevant (FDR put on a top tax of 94% and spent more than anyone knew you could spent and it paid off spectacularly.) But if you want to claim to be a fiscal conservative (tell me you don't understand history or economics without telling me...) then you should care.

The stock market is the worst indicator of economic health as its based on perception rather than value and has relatively little effect on daily life for most people. So how did it do under Trump (pre Covid number) versus Biden?

The S&P 500 value as of January 2020 was 3289.29. As of October 2024, 5705.45.

Again, those are all publicly available numbers.

STOP LETTING THEM GET BY WITH THE IDEA THAT THEY ARE GOOD FOR THE ECONOMY BECAUSE NO THEY ARE NOT. THEY HAVE LITERALLY NO DATA TO SUPPORT THAT.

Economics is a hard science. Data matters.

We can debate the role of religion or parental control or the fundamental nature of man. But basic arithmetic? No, sorry that question has been answered.

And anyone who tries to use it as a justification for supporting Nazis is wrong, lying, or both.

3 notes

·

View notes

Text

Unleashing American Energy

Issued January 20, 2025.

By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered:

Section 1. Background. America is blessed with an abundance of energy and natural resources that have historically powered our Nation's economic prosperity. In recent years, burdensome and ideologically motivated regulations have impeded the development of these resources, limited the generation of reliable and affordable electricity, reduced job creation, and inflicted high energy costs upon our citizens. These high energy costs devastate American consumers by driving up the cost of transportation, heating, utilities, farming, and manufacturing, while weakening our national security.

It is thus in the national interest to unleash America's affordable and reliable energy and natural resources. This will restore American prosperity -- including for those men and women who have been forgotten by our economy in recent years. It will also rebuild our Nation's economic and military security, which will deliver peace through strength.

Sec. 2. Policy. It is the policy of the United States:

(a) to encourage energy exploration and production on Federal lands and waters, including on the Outer Continental Shelf, in order to meet the needs of our citizens and solidify the United States as a global energy leader long into the future;

(b) to establish our position as the leading producer and processor of non-fuel minerals, including rare earth minerals, which will create jobs and prosperity at home, strengthen supply chains for the United States and its allies, and reduce the global influence of malign and adversarial States;

(c) to protect the United States's economic and national security and military preparedness by ensuring that an abundant supply of reliable energy is readily accessible in every State and territory of the Nation;

(d) to ensure that all regulatory requirements related to energy are grounded in clearly applicable law;

(e) to eliminate the "electric vehicle (EV) mandate" and promote true consumer choice, which is essential for economic growth and innovation, by removing regulatory barriers to motor vehicle access; by ensuring a level regulatory playing field for consumer choice in vehicles; by terminating, where appropriate, state emissions waivers that function to limit sales of gasoline-powered automobiles; and by considering the elimination of unfair subsidies and other ill-conceived government-imposed market distortions that favor EVs over other technologies and effectively mandate their purchase by individuals, private businesses, and government entities alike by rendering other types of vehicles unaffordable.

(f) to safeguard the American people's freedom to choose from a variety of goods and appliances, including but not limited to lightbulbs, dishwashers, washing machines, gas stoves, water heaters, toilets, and shower heads, and to promote market competition and innovation within the manufacturing and appliance industries;

(g) to ensure that the global effects of a rule, regulation, or action shall, whenever evaluated, be reported separately from its domestic costs and benefits, in order to promote sound regulatory decision making and prioritize the interests of the American people;

(h) to guarantee that all executive departments and agencies (agencies) provide opportunity for public comment and rigorous, peer-reviewed scientific analysis; and

(i) to ensure that no Federal funding be employed in a manner contrary to the principles outlined in this section, unless required by law.

Sec. 3. Immediate Review of All Agency Actions that Potentially Burden the Development of Domestic Energy Resources. (a) The heads of all agencies shall review all existing regulations, orders, guidance documents, policies, settlements, consent orders, and any other agency actions (collectively, agency actions) to identify those agency actions that impose an undue burden on the identification, development, or use of domestic energy resources -- with particular attention to oil, natural gas, coal, hydropower, biofuels, critical mineral, and nuclear energy resources -- or that are otherwise inconsistent with the policy set forth in section 2 of this order, including restrictions on consumer choice of vehicles and appliances.

(b) Within 30 days of the date of this order, the head of each agency shall, in consultation with the director of the Office of Management and Budget (OMB) and the National Economic Council (NEC), develop and begin implementing action plans to suspend, revise, or rescind all agency actions identified as unduly burdensome under subsection (a) of this section, as expeditiously as possible and consistent with applicable law. The head of any agency who determines that such agency does not have agency actions described in subsection (a) of this section shall submit to the Director of OMB a written statement to that effect and, absent a determination by the Director of OMB that such agency does have agency actions described in this subsection, shall have no further responsibilities under this section.

(c) Agencies shall promptly notify the Attorney General of any steps taken pursuant to subsection (a) of this section so that the Attorney General may, as appropriate:

(i) provide notice of this Executive Order and any such actions to any court with jurisdiction over pending litigation in which such actions may be relevant; and

(ii) request that such court stay or otherwise delay further litigation, or seek other appropriate relief consistent with this order, pending the completion of the administrative sections described in this order.

(d) Pursuant to the policy outlined in section 2 of this order, the Attorney General shall consider whether pending litigation against illegal, dangerous, or harmful policies should be resolved through stays or other relief.

Sec. 4. Revocation of and Revisions to Certain Presidential and Regulatory Actions. (a) The following are revoked and any offices established therein are abolished:

(i) Executive Order 13990 of January 20, 2021 (Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis);

(ii) Executive Order 13992 of January 20, 2021 (Revocation of Certain Executive Orders Concerning Federal Regulation);

(iii) Executive Order 14008 of January 27, 2021 (Tackling the Climate Crisis at Home and Abroad);

(iv) Executive Order 14007 of January 27, 2021 (President's Council of Advisors on Science and Technology);

(v) Executive Order 14013 of February 4, 2021 (Rebuilding and Enhancing Programs to Resettle Refugees and Planning for the Impact of Climate Change on Migration);

(vi) Executive Order 14027 of May 7, 2021 (Establishment of the Climate Change Support Office);

(vii) Executive Order 14030 of May 20, 2021 (Climate-Related Financial Risk);

(viii) Executive Order 14037 of August 5, 2021 (Strengthening American Leadership in Clean Cars and Trucks);

(ix) Executive Order 14057 of December 8, 2021 (Catalyzing Clean Energy Industries and Jobs Through Federal Sustainability);

(x) Executive Order 14072 of April 22, 2022 (Strengthening the Nation's Forests, Communities, and Local Economies);

(xi) Executive Order 14082 of September 12, 2022 (Implementation of the Energy and Infrastructure Provisions of the Inflation Reduction Act of 2022); and

(XII) Executive Order 14096 of April 21, 2023 (Revitalizing Our Nation's Commitment to Environmental Justice for All).

(b) All activities, programs, and operations associated with the American Climate Corps, including actions taken by any agency shall be terminated immediately. Within one day of the date of this order, the Secretary of the Interior shall submit a letter to all parties to the "American Climate Corps Memorandum of Understanding" dated December 2023 to terminate the memorandum, and the head of each party to the memorandum shall agree to the termination in writing.

(c) Any assets, funds, or resources allocated to an entity or program abolished by subsection (a) of this section shall be redirected or disposed of in accordance with applicable law.

(d) The head of any agency that has taken action respecting offices and programs in subsection (a) shall take all necessary steps to ensure that all such actions are terminated or, if necessary, appropriate, or required by law, that such activities are transitioned to other agencies or entities.

(e) Any contract or agreement between the United States and any third party on behalf of the entities or programs abolished in subsection (a) of this section, or in furtherance of them, shall be terminated for convenience, or otherwise, as quickly as permissible under the law.

Sec. 5. Unleashing Energy Dominance through Efficient Permitting. (a) Executive Order 11991 of May 24, 1977 (Relating to protection and enhancement of environmental quality) is hereby revoked.

(b) To expedite and simplify the permitting process, within 30 days of the date of this order, the Chairman of the Council on Environmental Quality (CEQ) shall provide guidance on implementing the National Environmental Policy Act (NEPA), 42 U.S.C. 4321 et seq., and propose rescinding CEQ's NEPA regulations found at 40 CFR 1500 et seq.

(c) Following the provision of the guidance, the Chairman of CEQ shall convene a working group to coordinate the revision of agency-level implementing regulations for consistency. The guidance in subsection (b) and any resulting implementing regulations must expedite permitting approvals and meet deadlines established in the Fiscal Responsibility Act of 2023 (Public Law 118-5). Consistent with applicable law, all agencies must prioritize efficiency and certainty over any other objectives, including those of activist groups, that do not align with the policy goals set forth in section 2 of this order or that could otherwise add delays and ambiguity to the permitting process.

(d) The Secretaries of Defense, Interior, Agriculture, Commerce, Housing and Urban Development, Transportation, Energy, Homeland Security, the Administrator of the Environmental Protection Agency (EPA), the Chairman of CEQ, and the heads of any other relevant agencies shall undertake all available efforts to eliminate all delays within their respective permitting processes, including through, but not limited to, the use of general permitting and permit by rule. For any project an agency head deems essential for the Nation's economy or national security, some agencies shall use all possible authorities, including emergency authorities, to expedite the adjudication of Federal permits. Agencies shall work closely with project sponsors to realize the ultimate construction or development of permitted projects.

(e) The Director of the NEC and the Director of the Office of Legislative Affairs shall jointly prepare recommendations to Congress, which shall:

(i) facilitate the permitting and construction of interstate energy transportation and other critical energy infrastructure, including, but not limited to, pipelines, particularly in regions of the Nation that have lacked such development in recent years; and

(ii) provide greater certainty in the Federal permitting process, including, but not limited to, streamlining the judicial review of the application of NEPA.

Sec. 6. Prioritizing Accuracy in Environmental Analyses. (a) In all Federal permitting adjudications or regulatory processes, all agencies shall adhere to only the relevant legislated requirements for environmental considerations and any considerations beyond these requirements are eliminated. In fulfilling all such requirements, agencies shall strictly use the most robust methodologies of assessment at their disposal and shall not use methodologies that are arbitrary or ideologically motivated.

(b) The Interagency Working Group on the Social Cost of Greenhouse Gases (IWG), which was established pursuant to Executive Order 13990, is hereby disbanded, and any guidance, instruction, recommendation, or document issued by the IWG is withdrawn as no longer representative of governmental policy including:

(i) the Presidential Memorandum of January 27, 2021 (Restoring Trust in Government Through Scientific Integrity and Evidence-Based Policymaking);

(ii) the Report of the Greenhouse Gas Monitoring and Measurement Interagency Working Group of November 2023 (National Strategy to Advance an Integrated U.S. Greenhouse Gas Measurement, Monitoring, and Information System);

(iii) the Technical Support Document of February 2021 (Social Cost of Carbon, Methane, and Nitrous Oxide Interim Estimates under Executive Order 13990); and

(iv) estimates of the social cost of greenhouse gases, including the estimates for the social cost of carbon, the social cost of methane, or the social cost of nitrous oxide based, in whole or part, on the IWG's work or guidance.

(c) The calculation of the "social cost of carbon" is marked by logical deficiencies, a poor basis in empirical science, politicization, and the absence of a foundation in legislation. Its abuse arbitrarily slows regulatory decisions and, by rendering the United States economy internationally uncompetitive, encourages a greater human impact on the environment by affording less efficient foreign energy producers a greater share of the global energy and natural resources market. Consequently, within 60 days of the date of this order, the Administrator of the EPA shall issue guidance to address these harmful and detrimental inadequacies, including consideration of eliminating the "social cost of carbon" calculation from any Federal permitting or regulatory decision.

(d) Prior to the guidance issued pursuant to subsection (c) of this section, agencies shall ensure estimates to assess the value of changes in greenhouse gas emissions resulting from agency actions, including with respect to the consideration of domestic versus international effects and evaluating appropriate discount rates, are, to the extent permitted by law, consistent with the guidance contained in OMB Circular A-4 of September 17, 2003 (Regulatory Analysis).

(e) Furthermore, the head of each agency shall, as appropriate and consistent with applicable law, initiate a process to make such changes to any rule, regulation, policy or action as may be necessary to ensure consistency within the Regulatory Analysis.

(f) Within 30 days of the date of this order, the Administrator of the EPA, in collaboration with the heads of any other relevant agencies, shall submit joint recommendations to the Director of OMB on the legality and continuing applicability of the Administrator's findings, "Endangerment and Cause or Contribute Findings for Greenhouse Gases Under Section 202(a) of the Clean Air Act," Final Rule, 74 FR 66496 (December 15, 2009).

Sec. 7. Terminating the Green New Deal. (a) All agencies shall immediately pause the disbursement of funds appropriated through the Inflation Reduction Act of 2022 (Public Law 117-169) or the Infrastructure Investment and Jobs Act (Public Law 117-58), including but not limited to funds for electric vehicle charging stations made available through the National Electric Vehicle Infrastructure Formula Program and the Charging and Fueling Infrastructure Discretionary Grant Program, and shall review their processes, policies, and programs for issuing grants, loans, contracts, or any other financial disbursements of such appropriated funds for consistency with the law and the policy outlined in section 2 of this order. Within 90 days of the date of this order, all agency heads shall submit a report to the Director of the NEC and Director of OMB that details the findings of this review, including recommendations to enhance their alignment with the policy set forth in section 2. No funds identified in this subsection (a) shall be disbursed by a given agency until the Director of OMB and Assistant to the President for Economic Policy have determined that such disbursements are consistent with any review recommendations they have chosen to adopt.

(b) When procuring goods and services, making decisions about leases, and making other arrangements that result in disbursements of Federal funds, agencies shall prioritize cost-effectiveness, American workers and businesses, and the sensible use of taxpayer money, to the greatest extent. The Director of OMB shall finalize and circulate guidelines to further implement this subsection.

(c) All agencies shall assess whether enforcement discretion of authorities and regulations can be utilized to advance the policy outlined in section 2 of this order. Within 30 days of the date of this order, each agency shall submit a report to the Director of OMB identifying any such instances.

Sec. 8. Protecting America's National Security. (a) The Secretary of Energy is directed restart reviews of applications for approvals of liquefied natural gas export projects as expeditiously as possible, consistent with applicable law. In assessing the "Public Interest" to be advanced by any particular application, the Secretary of Energy shall consider the economic and employment impacts to the United States and the impact to the security of allies and partners that would result from granting the application.

(b) With respect to any proposed deepwater port for the export of liquefied natural gas (project) for which a favorable record of decision (ROD) has previously been issued pursuant to the Deepwater Port Act of 1974 (DWPA), 33 U.S.C. 1501 et seq., the Administrator of the Maritime Administration (MARAD) shall, within 30 days of the date of this order and consistent with applicable law, determine whether any refinements to the project proposed subsequent to the ROD are likely to result in adverse environmental consequences that substantially differ from those associated with the originally-evaluated project so as to present a seriously different picture of the foreseeable adverse environmental consequences (seriously different consequences). In making this determination, MARAD shall qualitatively assess any difference in adverse environmental consequences between the project with and without the proposed refinements, including any potential consequences not addressed in the final Environmental Impact Statement (EIS), which shall be considered adequate under NEPA notwithstanding any revisions to NEPA that may have been enacted following the final EIS. MARAD shall submit this determination, together with a detailed justification, to the Secretary of Transportation and to the President.

(c) Pursuant to subsection (b) of this section, if MARAD determines that such refinements are not likely to result in seriously different consequences, it shall include in that determination a description of the refinements to supplement and update the ROD, if necessary and then no later than 30 additional days, he shall issue a DWPA license.

(d) If MARAD determines, with concurrence from the Secretary of Transportation, that such proposed refinements are likely to result in seriously different consequences, it shall, within 60 days after submitting such determination, issue an Environmental Assessment (EA) examining such consequences and, with respect to all other environmental consequences not changed due to project refinements, shall reaffirm the conclusions of the final EIS. Within 30 days after issuing the EA, MARAD shall issue an addendum to the ROD, if necessary, and shall, within 30 additional days, issue a DWPA license consistent with the ROD.

Sec. 9. Restoring America's Mineral Dominance. (a) The Secretary of the Interior, Secretary of Agriculture, Administrator of the EPA, Chairman of CEQ, and the heads of any other relevant agencies, as appropriate, shall identify all agency actions that impose undue burdens on the domestic mining and processing of non-fuel minerals and undertake steps to revise or rescind such actions.

(b) The Secretaries of the Interior and Agriculture shall reassess any public lands withdrawals for potential revision.

(c) The Secretary of the Interior shall instruct the Director of the U.S. Geological Survey to consider updating the Survey's list of critical minerals, including for the potential of including uranium.

(d) The Secretary of the Interior shall prioritize efforts to accelerate the ongoing, detailed geologic mapping of the United States, with a focus on locating previously unknown deposits of critical minerals.

(e) The Secretary of Energy shall ensure that critical mineral projects, including the processing of critical minerals, receive consideration for Federal support, contingent on the availability of appropriated funds.

(f) The United States Trade Representative shall assess whether exploitative practices and state-assisted mineral projects abroad are unlawful or unduly burden or restrict United States commerce.

(g) The Secretary of Commerce shall assess the national security implications of the Nation's mineral reliance and the potential for trade action.

(h) The Secretary of Homeland Security shall assess the quantity and inflow of minerals that are likely the product of forced labor into the United States and whether such inflows pose a threat to national security and, within 90 days of the date of this order, shall provide this assessment to the Director of the NEC.

(i) The Secretary of Defense shall consider the needs of the United States in supplying and maintaining the National Defense Stockpile, review the legal authorities and obligations in managing the National Defense Stockpile, and take all appropriate steps to ensure that the National Defense Stockpile will provide a robust supply of critical minerals in event of future shortfall.

(j) Within 60 days of the date of this order, the Secretary of State, Secretary of Commerce, Secretary of Labor, the United States Trade Representative, and the heads of any other relevant agencies, shall submit a report to the Assistant to the President for Economic Policy that includes policy recommendations to enhance the competitiveness of American mining and refining companies in other mineral-wealthy nations.

(k) The Secretary of State shall consider opportunities to advance the mining and processing of minerals within the United States through the Quadrilateral Security Dialogue.

Sec. 10. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

#us politics#us government#executive orders#climate change#energy#electric vehicles#EVs#deepwater port act

2 notes

·

View notes

Text

Distributed Acoustic Sensing Market to Experience Significant Growth

Distributed Acoustic Sensing Market to Experience Significant Growth

Straits Research has published a comprehensive report on the global Distributed Acoustic Sensing Market, projecting a significant growth rate of 11.58% from 2024 to 2032. The market size is expected to reach USD 1,617.72 million by 2032, up from USD 673.32 million in 2024.

Market Definition

Distributed Acoustic Sensing (DAS) is a cutting-edge technology that enables real-time monitoring of acoustic signals along the entire length of a fiber optic cable. This innovative solution has far-reaching applications across various industries, including oil and gas, power and utility, transportation, security and surveillance, and environmental and infrastructure monitoring.

Request Sapmle Link:https://straitsresearch.com/report/distributed-acoustic-sensing-market/request-sample

Latest Trends

The Distributed Acoustic Sensing Market is driven by several key trends, including:

Increasing demand for real-time monitoring: The need for real-time monitoring and data analysis is on the rise, driven by the growing importance of predictive maintenance, asset optimization, and operational efficiency.

Advancements in fiber optic technology: Advances in fiber optic technology have enabled the development of more sensitive and accurate DAS systems, expanding their range of applications.

Growing adoption in the oil and gas industry: The oil and gas industry is increasingly adopting DAS technology for monitoring and optimizing well operations, reducing costs, and improving safety.

Emerging applications in smart cities and infrastructure monitoring: DAS technology is being explored for various smart city applications, including traffic management, public safety, and infrastructure monitoring.

Key Opportunities

The Distributed Acoustic Sensing Market presents several key opportunities for growth and innovation, including:

Integration with other sensing technologies: The integration of DAS with other sensing technologies, such as seismic and electromagnetic sensing, can enhance its capabilities and expand its range of applications.

Development of advanced data analytics and AI algorithms: The development of advanced data analytics and AI algorithms can help unlock the full potential of DAS technology, enabling more accurate and actionable insights.

Expansion into new markets and industries: The Distributed Acoustic Sensing Market has significant potential for growth in new markets and industries, including renewable energy, transportation, and smart cities.

Key Players

The Distributed Acoustic Sensing Market is characterized by the presence of several key players, including:

Halliburton Co.

Hifi Engineering Inc.

Silixa Ltd.

Schlumberger Limited

Banweaver

Omnisens SA

Future Fibre Technologies Ltd.

Baker Hughes Inc.

Qintiq Group PLC

Fotech Solutions Ltd.

Buy Now:https://straitsresearch.com/buy-now/distributed-acoustic-sensing-market

Market Segmentation

The Distributed Acoustic Sensing Market can be segmented into two main categories:

By Fiber Type: The market can be segmented into single-mode fiber and multimode fiber.

By Vertical: The market can be segmented into oil and gas, power and utility, transportation, security and surveillance, and environmental and infrastructure monitoring.

About Straits Research

Straits Research is a leading provider of business intelligence, specializing in research, analytics, and advisory services. Our team of experts provides in-depth insights and comprehensive reports to help businesses make informed decisions.

#Distributed Acoustic Sensing Market#Distributed Acoustic Sensing Market Share#Distributed Acoustic Sensing Market Size#Distributed Acoustic Sensing Market Research#Distributed Acoustic Sensing Industry

3 notes

·

View notes

Text

Members of the NZBA committed to a set of anti-human principles that included transitioning to “net-zero” emmisons, or rolling back human progress for the sake of the climate hoax narrative. The initiative was launched with the goal of aligning the banking sector's lending, investment, and capital markets activities with the objective of achieving “net-zero” greenhouse gas emissions by 2050 or sooner. They set to achieve “targets” by claiming, based on the opinions of carefully selected “climate scientists,” (think: those on the payroll of the cartel) that humanity had the ability and the resources to dial back the temperature a few degrees Fahrenheit above pre-industrial levels. Of course, what they never reveal is that such maneuvers will harm the entire world’s population for the sake of the climate narrative mafia.

The NZBA amounted to a massively powerful banking cartel that pushed a poisonous set of incentives to harm human flourishing. Not only was it insanely destructive to human progress, it represented a series of initiatives that sought to undermine economic freedom and national sovereignty. This “global governance” aspect of the agenda put American banks at odds with the interests of their American customers and partners. Extreme ideological U.N. environmental policy was essentially dictating domestic banking practices.

It served as an ideological imposition on the financial sector. The NZBA sought to distort the free market, by committing banks to following specific ideological goals, forcing financial institutions to prioritize political objectives over economic reality. Capital was consistently being misallocated towards destructive but "greener" projects, and we will see the remnants of this junk for decades to come. Instead of lending based on the viability and profitability of projects, they were forcing clients and partners to meet arbitrary “environmental” (political) benchmarks. Of course, this had disastrous impolications, it stifled innovation, and destroyed growth in traditional sectors (oil, gas, etc) and companies run by non-aligned boards that were deemed not ESG friendly.

6 notes

·

View notes