#Post Office Time Deposit scheme

Explore tagged Tumblr posts

Text

Post office schemes in Marathi : पोस्ट ऑफिसची सुपरहिट योजना देणार सुपर रिटर्न - 5 वर्षात देणार 7 लाख 24 हजार 149 रुपये. जाणून घ्या पूर्ण माहिती.

Post office schemes in Marathi : पोस्ट ऑफिस गुंतवणूक योजना त्यांच्या सुरक्षित गुंतवणुकीसाठी गुंतवणुकीचे लोकप्रिय माध्यम आहे. तुम्हाला पोस्ट ऑफिसमध्ये गुंतवणुकीची अनेक साधने मिळतात, जी तुम्हाला बँकेत गुंतवणुकीसाठी मिळतात. पण सरकारी युनिट असल्याने तुम्हाला इथे सुरक्षाही इथे मिळते. पोस्ट ऑफिसने गेल्या महिन्यात आपल्या अनेक योजनांवरील व्याजदरात वाढ केली होती, ज्यामुळे गुंतवणूकदारांना आणखी जास्त परतावा…

View On WordPress

#Government Scheme#investment#Investment Plan#post office#post office scheme#Post Office Scheme 2023#Post office schemes in Marathi#Post Office Time Deposit scheme

0 notes

Text

Pension Through PPF Account: हर महीने आपको मिल सकता है ₹60,000 का पेंशन, कोई भी टैक्स नहीं देना पड़ेगा

Pension Through PPF Account : हम आज आपको रिटायरमेंट के बाद हर महीने पेंशन कैसे प्राप्त कर सकते हैं बताएंगे। जी हां, अगर आप आज से निवेश करना शुरू कर देते हैं, तो रिटायरमेंट के बाद आपको हर महीने ₹60,989 पेंशन मिलेगी। इस तरह की पेंशन पाने के लिए आपको पीपीएफ खाते में निवेश करना होगा। इसकी विशिष्टता यह है कि सरकार ने इस स्कीम को टैक्स से छूट दी है। जिससे आपको बहुत अधिक लाभ मिलता है। तो चलिए इसके बारे…

#benefits of ppf account#benefits of ppf account in post office#can a person have epf and ppf account#can i invest in both ppf and nps#epf gpf and ppf#epfo online pension transfer#pension fund vs provident fund#pension in epf account#pension through ppf account#pf account pension withdrawal#pf and ppf comes under 80c#pf or ppf which is better#pf pension eligible service#pf pension start process online#pf vs ppf vs nps#ppf account 1000 per month#ppf account 2000 per month#ppf account benefits 1000#ppf account benefits 5000#ppf account benefits calculator#ppf account for senior citizens#ppf account lump sum#ppf account maturity time#ppf account monthly deposit or yearly#ppf account pros and cons#ppf bank#ppf pension#ppf pension latest news#ppf pension plan#ppf pension scheme

0 notes

Text

Hey hey, if you like my work and also want to help out with our moving fund, don't forget I have a Ko-fi!

We'd appreciate anything rn, but do not worry if you can't help financially (times are tough for all of us rn, I know), you can help by reblogging this post if you want to!

I post updates about our situation on my main, but the tldr of it is we've received another section 21 eviction notice and thus have 2 to 3 months to find a place. The landlord is serious this time.

I've got £100 in savings rn, and while I'm aiming to put another 100 in next month, it just won't be enough (need at least 400 to 500 for a council house) by the time we have to leave.

BUT once we get in touch with a housing officer again, I'm gonna ask if they also pay deposit and first months rent on council houses too, as I'm unsure whether it's just private rented houses that they allow for that scheme.

Anyway, I'll be working on more art, and hopefully have something to show soon in terms of writing.

Thank you for taking the time to read this, hope everyone has a lovely day!!!

#me talking#i am deeply sorry that i have to keep doing this...i know its annoying#but i dont have any other choice#ive exhausted all other financial help

15 notes

·

View notes

Text

Smart Investing for Youth in India: A Comprehensive Guide

Introduction

Investing is a crucial skill that can secure your financial future. This guide is designed to help Indian youth, from teenagers to mature adults, understand the importance of investing, the available options, and how to make informed decisions. Starting early allows you to harness the power of compound interest, which can turn small savings into substantial wealth over time. In this introduction, we'll explore why investing matters, how to set financial goals, and the importance of balancing risk and reward.

Chapter 1: Basics of Financial Literacy

Understanding Money: Income, Expenses, and Savings

Learn the difference between earning, spending, and saving.

Track your expenses to identify unnecessary spending.

Importance of Budgeting

The 50/30/20 rule: Allocate 50% for needs, 30% for wants, and 20% for savings.

Use budgeting tools and apps to stay organized.

Building an Emergency Fund

Set aside 3-6 months' worth of expenses for emergencies.

Keep this fund in a high-liquidity instrument like a savings account.

The Concept of Inflation

Understand how inflation erodes purchasing power.

Invest in instruments that offer returns higher than inflation.

Chapter 2: Understanding Investments

What is Investment?

Investment involves allocating money to generate income or profit.

Types of Investments: Active vs. Passive

Active investments require constant monitoring (e.g., stocks).

Passive investments are less hands-on (e.g., index funds).

Short-Term vs. Long-Term Investments

Short-term: Instruments like fixed deposits or liquid funds.

Long-term: Equity, real estate, or retirement funds.

Factors Influencing Investment Decisions

Risk tolerance

Financial goals

Time horizon

Market conditions

Chapter 3: Investment Options in India

For Beginners (Age 13–21)

Savings Account and Fixed Deposits

Earn stable interest with minimal risk.

Ideal for first-time savers.

Recurring Deposits

Commit to saving a fixed amount monthly.

Earn better returns than a savings account.

Digital Wallets and UPI Savings

Save small amounts and earn cashback.

Suitable for tech-savvy youth.

Mutual Funds for Beginners

Start with SIPs to invest systematically.

Explore debt or balanced funds for low-risk entry.

Government Schemes for Students

Sukanya Samriddhi Yojana for girl child savings.

Scholarship-linked investments for education goals.

For Young Professionals (Age 22–40)

Equity Investments

Invest in shares of companies for long-term growth.

Use Demat accounts to trade easily.

Mutual Funds

Diversify your portfolio with equity, debt, or hybrid funds.

SIPs offer a disciplined investment approach.

Employee Provident Fund (EPF)

A tax-saving retirement scheme for salaried employees.

National Pension System (NPS)

Low-cost, government-backed retirement investment.

Gold Investments

Choose between physical gold, ETFs, or sovereign gold bonds.

Real Estate

Invest in property for long-term capital appreciation.

Cryptocurrency and Digital Assets

High-risk, high-reward option.

Research thoroughly before investing.

Insurance as an Investment Tool

Term plans offer pure protection.

ULIPs combine insurance with investment.

For Mature Investors (Age 41–60)

Portfolio Diversification

Balance risk with safe options like bonds and fixed deposits.

Fixed-Income Securities

Invest in government and corporate bonds for steady returns.

Senior Citizen Savings Scheme (SCSS)

A government-backed scheme with assured returns.

Post Office Savings Schemes

Reliable options for conservative investors.

Annuity Plans

Ensure regular income during retirement.

Chapter 4: Building an Investment Portfolio

Importance of Diversification: Spread your investments across different asset classes to minimize risk.

Allocating Assets by Age Group: Adjust your portfolio based on life stage and risk appetite.

Monitoring and Rebalancing Your Portfolio: Regularly review your portfolio to align with your goals.

Tools and Apps for Portfolio Management in India: Explore platforms like Groww, Zerodha, and Paytm Money.

Chapter 5: Tax-Saving Investment Options

Section 80C Investments

Public Provident Fund (PPF): Long-term, tax-free returns.

Tax-Saving Fixed Deposits: Lock-in period of 5 years.

ELSS Mutual Funds: High returns with tax benefits.

National Savings Certificate (NSC)

A safe, government-backed option with moderate returns.

Health Insurance Deductions (Section 80D)

Tax benefits on premiums paid for health insurance.

Home Loan Tax Benefits

Deductions on interest and principal repayment.

Chapter 6: Financial Habits for Successful Investing

Setting SMART Goals: Specific, Measurable, Achievable, Relevant, Time-bound.

Regularly Reviewing Financial Health: Track and analyze your spending and saving habits.

Avoiding Emotional Investment Decisions: Stay rational and avoid impulsive actions.

Learning from Mistakes: Treat setbacks as opportunities for growth.

Chapter 7: Common Investment Mistakes to Avoid

Following Trends Blindly: Base decisions on research, not hearsay.

Lack of Research: Understand the instruments you invest in.

Ignoring Inflation and Taxes: Account for their impact on returns.

Not Planning for Liquidity Needs: Always keep liquid assets.

Over-Diversification: Avoid diluting potential returns.

Chapter 8: Resources for Continuous Learning

Books and Online Courses: Recommendations for self-education.

Blogs and Financial News Platforms: Stay updated with economic trends.

Investment Apps in India: Learn and invest on platforms like Zerodha, Upstox.

Networking with Financial Experts: Gain insights from seasoned investors.

Conclusion

Investing is a lifelong journey that requires discipline, patience, and continuous learning. Start small, stay consistent, and let your money work for you. By following the strategies outlined in this guide, you can build wealth and achieve financial independence.

Appendices

Glossary of Investment Terms: Definitions of key terms like CAGR, NAV, ROI, etc.

Sample Investment Plans for Different Age Groups: Practical examples for teenagers, young professionals, and mature investors.

Useful Websites and Helplines for Investors in India: Resources for further guidance and support.

0 notes

Text

Post Office Scheme: If You Deposit Rs 5,000! You Will Get Rs 3,56,830 https://sbpspgcollege.org/post-office-scheme-new/

0 notes

Text

Mutual Fund SIP Vs PPF: A Complete Guide for Smart Investors

When it comes to growing your wealth, there are numerous investment options to consider. Two popular choices in India are Mutual Fund SIP (Systematic Investment Plan) and the Public Provident Fund (PPF). Both of these options offer different benefits, making it essential to understand their differences and evaluate which one aligns better with your financial goals.

Understanding Mutual Fund SIP and PPF

What is a Mutual Fund SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where you invest a fixed amount at regular intervals, typically monthly. SIPs are an effective way to invest in equity or debt mutual funds, helping to spread investment over time and reduce market risk.

What is Public Provident Fund (PPF)?

The Public Provident Fund (PPF) is a government-backed savings scheme that provides a guaranteed return on investment. It’s a long-term savings option primarily for conservative investors who seek a safe and tax-saving instrument with assured returns.

The Basics: How SIP and PPF Work

How a SIP Works in Mutual Funds

In a Mutual Fund SIP, investors deposit a fixed amount monthly, which is then used to purchase fund units. This way, investors benefit from rupee cost averaging and have the potential to accumulate wealth over time through compounding.

How the PPF Scheme Works

In PPF, individuals open an account with a bank or post office, deposit funds annually (with a minimum and maximum limit), and earn a government-fixed interest rate. The PPF has a lock-in period of 15 years, though partial withdrawals are allowed after the sixth year.

Key Differences Between Mutual Fund SIP and PPF

Investment Objective

SIP: Ideal for wealth creation and capital appreciation over the long term.

PPF: Primarily for safe savings with guaranteed returns and tax benefits.

Risk Factor

SIP: Market-linked, meaning the returns can vary based on market performance.

PPF: Government-backed and risk-free, offering guaranteed returns.

Returns on Investment

SIP: Potentially high returns due to equity market exposure, although there are risks.

PPF: Fixed interest rate, typically lower but secure.

Investment Horizon Comparison

SIP Investment Duration

There is no fixed duration for SIP investments. Investors can choose to invest for any time frame, though long-term SIPs (5-10 years or more) usually yield better returns due to compounding.

PPF Maturity Period

PPF has a fixed maturity period of 15 years, which can be extended in blocks of 5 years upon request.

Tax Benefits of SIP and PPF

Tax Deductions for SIP

Equity-linked SIPs that invest in Equity-Linked Savings Scheme (ELSS) funds qualify for tax deductions under Section 80C, up to INR 1.5 lakh annually.

Tax Benefits of PPF

PPF investments qualify for tax deductions under Section 80C, and the interest earned is tax-free, making it an EEE (Exempt-Exempt-Exempt) instrument.

Liquidity and Withdrawal Flexibility

SIP Withdrawal Options

SIP investors can usually withdraw their funds anytime, though exiting too soon may result in exit load charges or short-term capital gains tax.

PPF Withdrawal Rules

PPF has restricted liquidity, allowing partial withdrawals only from the seventh year of investment, with specific conditions.

Interest Rates and Returns

Expected Returns from SIP

Returns from SIPs in equity mutual funds vary with market performance and have historically offered 10-15% annually for long-term investments.

Guaranteed Returns from PPF

PPF provides a fixed rate of interest, currently around 7-8%, reviewed quarterly by the government.

Who Should Consider Investing in SIP?

Individuals looking for higher growth potential with a tolerance for risk may find SIPs appealing. They suit investors aiming for long-term financial goals like buying a home, funding children’s education, or retirement.

Who Should Consider Investing in PPF?

PPF is ideal for risk-averse individuals seeking a safe, guaranteed return and tax savings. It suits long-term savings goals, such as retirement, without exposure to market volatility.

Impact of Inflation on SIP and PPF

SIP: Potentially combats inflation due to higher returns from equity markets.

PPF: Provides fixed returns, which may not always keep pace with inflation.

SIP vs PPF: Wealth Creation Potential

SIPs, especially in equity mutual funds, offer a better wealth creation potential over the long term than PPF. However, they come with market risks, whereas PPF is a safer but lower-yield option.

SIP vs PPF: Which One is Better for Retirement?

For retirement planning, combining both SIP and PPF can create a balanced portfolio, with SIP offering growth potential and PPF providing stability and tax-free benefits.

How to Start Investing in SIP and PPF

Steps to Start a SIP

Select a reliable fund house or broker.

Choose the type of mutual fund (equity, debt, hybrid).

Set the SIP amount and duration.

Complete KYC and link your bank account.

Start investing and monitor regularly.

Steps to Open a PPF Account

Visit a bank or post office.

Fill out the PPF account opening form.

Submit KYC documents.

Deposit the minimum required amount.

Start depositing regularly.

Conclusion

Both Mutual Fund SIP and PPF have their own set of advantages and suit different types of investors. SIPs are ideal for investors looking for higher returns and can tolerate market risks, while PPF is perfect for those who prioritize security and guaranteed returns. Choosing between SIP and PPF depends on your financial goals, risk appetite, and investment horizon. A combination of both can also help achieve a balanced portfolio with growth and stability.

FAQs

Can I invest in both SIP and PPF?

Yes, investing in both can offer a balanced mix of growth and security.

Which one is better for tax savings: SIP or PPF?

Both SIP (in ELSS funds) and PPF offer tax deductions under Section 80C, but PPF offers tax-free returns.

Is SIP riskier than PPF?

Yes, SIPs are market-linked and can be volatile, while PPF offers guaranteed, risk-free returns.

What is the ideal duration for SIP investments?

A 5-10 year horizon is recommended for SIPs to maximize growth potential through compounding.

Can I withdraw money from my PPF before maturity?

Partial withdrawals are allowed after the sixth year, with certain restrictions.

0 notes

Text

Best Investment Plans for Small Investors: Growing Wealth with Limited Capital

For small investors, building wealth on a limited budget can seem challenging, but it is possible with the right strategies and investment plans. Selecting the best investment plan for a modest budget involves balancing low-risk options that still offer growth potential and smartly allocating funds to meet financial goals. Here’s a look at some of the best investment plans tailored for small investors that help grow wealth, even with limited capital.

1. Systematic Investment Plans (SIPs)

A systematic investment plan, or SIP, is one of the most popular and accessible investment options for small investors. SIPs allow you to invest small amounts of money regularly—monthly or quarterly—in mutual funds, which compounds over time to generate substantial returns. SIPs are flexible, as they allow investors to start with as little as INR 500 per month, which is ideal for individuals with limited capital.

One of the key advantages of SIPs is rupee cost averaging, which helps mitigate market volatility by spreading out investments over time. Additionally, SIPs leverage the power of compounding, where the returns earned are reinvested, leading to exponential growth. For small investors, SIPs are among the best investment plans to benefit from market-linked returns without requiring a large upfront commitment.

2. Recurring Deposits (RDs)

Recurring deposits (RDs) are a low-risk investment option that allows small investors to contribute a fixed amount monthly for a pre-determined period. With RDs, investors can earn a steady interest rate, typically higher than a standard savings account, and build a sizable corpus by the end of the tenure. The flexibility of monthly contributions and the low-risk nature of RDs make them an excellent option for those with limited capital seeking a predictable return.

Many banks and post offices offer RDs with terms ranging from 6 months to 10 years, allowing investors to choose a tenure that best aligns with their financial goals. For small investors looking for safety and guaranteed returns, recurring deposits provide a disciplined approach to building wealth gradually.

3. Public Provident Fund (PPF)

The Public Provident Fund (PPF) is one of the best investment plans for small investors looking for a long-term, tax-saving option. PPF offers a government-backed, tax-free interest rate and allows contributions as low as INR 500 per year, making it suitable for investors with limited capital. PPF accounts have a 15-year lock-in period, which encourages disciplined, long-term savings.

PPF accounts also benefit from compounding interest, which can significantly grow wealth over time. As a tax-saving tool under Section 80C, PPF investments are tax-exempt, providing an additional advantage to investors. For small investors who prefer security and guaranteed returns, PPF stands out as a reliable, low-risk option to build long-term wealth.

4. National Savings Certificate (NSC)

The National Savings Certificate (NSC) is another government-backed scheme aimed at small investors seeking safe, fixed returns. Available at post offices, NSC requires a minimum investment of INR 100, making it accessible for those with limited capital. NSC has a tenure of five years, offering a fixed interest rate and tax benefits under Section 80C.

NSC offers small investors the security of government-backed returns and an option to reinvest the interest at maturity, enhancing overall returns. For individuals looking for a secure investment plan with tax-saving benefits, NSC is an excellent choice.

5. Exchange-Traded Funds (ETFs)

For small investors with a higher risk tolerance looking to gain market exposure, exchange-traded funds (ETFs) are a viable option. ETFs are traded on stock exchanges and offer the benefit of diversification across different stocks or sectors. They have relatively low expense ratios, making them more affordable than traditional mutual funds, and can be purchased in small amounts, allowing investors to scale their investments gradually.

ETFs also provide liquidity, as they can be traded like stocks, making it easier for investors to manage their portfolios actively. Small investors interested in capitalizing on market performance may find ETFs among the best investment plans for cost-effective diversification.

6. Gold Savings Schemes

Gold remains a traditional favorite for Indian investors, and for those with limited capital, gold savings schemes or digital gold offer a way to invest in gold without needing to buy physical assets. Many banks and digital platforms provide gold accumulation plans where investors can contribute small amounts each month to build a gold portfolio.

Gold savings schemes offer flexibility, and their returns tend to hold steady in times of economic uncertainty, making them a good hedge against inflation. Additionally, investing in digital gold eliminates the need for storage and security, making it convenient for small investors to grow wealth over time.

Conclusion

For small investors, finding the best investment plan involves balancing low-risk options with the potential for steady growth. Systematic Investment Plans, Recurring Deposits, Public Provident Funds, National Savings Certificates, ETFs, and Gold Savings Schemes offer diverse choices tailored to different risk appetites and financial goals. Each of these plans provides a unique advantage, from the safety of government-backed returns in PPF and NSC to the market-linked growth potential of SIPs and ETFs.

With consistent contributions and a disciplined approach, even small investors can build a robust portfolio that grows wealth over time. The key is to start early, invest regularly, and focus on options that align with personal financial goals. By leveraging these best investment plans, small investors can achieve steady growth and financial stability, proving that wealth creation is possible even with limited capital.

0 notes

Text

Senior Citizen Savings Scheme (SCSS): Why You Should Invest In It .

As individuals approach retirement, the importance of sound financial planning becomes paramount. Ensuring a steady source of income during the golden years is essential to maintain a comfortable lifestyle without financial stress. One of the most reliable and government-backed options available for senior citizens in India is the Senior Citizen Savings Scheme (SCSS).

The SCSS is designed exclusively for citizens aged 60 and above, providing them with a safe investment avenue that offers a combination of attractive interest rates and tax benefits. Whether you’re planning for your retirement or have recently retired, understanding the nuances of this scheme and how it can benefit you will help you make a more informed decision.

What is the Senior Citizen Savings Scheme (SCSS)?

The Senior Citizen Savings Scheme is a government-backed savings instrument introduced in 2004. It primarily aims to offer retirees a safe, stable, and regular source of income, which is crucial after the cessation of a regular salary. This scheme is available at post offices and designated nationalized banks across India.

Key Features of SCSS

1. Eligibility

Individuals aged 60 years or above can open an SCSS account.

Early retirees between 55-60 years, who have opted for voluntary retirement or superannuation, can also invest, provided they open the account within one month of receiving retirement benefits.

2. Investment Amount

The minimum investment required is ₹1,000.

The maximum permissible investment is ₹30 lakhs (from April 2023). Previously, the limit was ₹15 lakhs. This increased limit allows senior citizens to park a more significant portion of their retirement corpus in this safe instrument.

3. Tenure of the Scheme

The SCSS has a tenure of 5 years, which can be further extended by an additional 3 years upon maturity.

During the extension, you continue to earn interest at the prevailing rate at the time of extension.

4. Interest Rates

SCSS offers an attractive interest rate, which is reviewed and decided by the government quarterly. As of 2023, the interest rate stands at 8.2% per annum, which is higher than most fixed deposits or savings accounts.

The interest is compounded quarterly and paid out every quarter, providing a regular source of income for senior citizens.

5. Premature Withdrawal

Premature withdrawals are allowed but come with penalties. If you withdraw after one year but before two years, a 1.5% penalty is levied. After two years, the penalty reduces to 1%.

6. Nomination Facility

SCSS allows you to nominate a beneficiary at the time of opening the account or afterward. This ensures that in case of the unfortunate demise of the account holder, the investment is passed on smoothly to the nominee.

7. Tax Benefits

The investment in SCSS is eligible for a tax deduction of up to ₹1.5 lakh under Section 80C of the Income Tax Act.

However, the interest earned is taxable, and TDS (Tax Deducted at Source) is applicable if the interest exceeds ₹50,000 in a financial year.

Why Should You Invest in SCSS?

1. Safety and Reliability

One of the primary concerns for any retiree is the safety of their investment. The SCSS is a government-backed scheme, which makes it one of the safest investment options available for senior citizens. Unlike market-linked instruments, SCSS offers guaranteed returns, insulating investors from market volatility. For risk-averse retirees, this feature is particularly attractive.

2. Regular Income

Post-retirement, most individuals lose the steady monthly income that their salary provided. SCSS is designed to address this issue by offering quarterly interest payouts. These payouts can act as a regular source of income to cover daily expenses, medical bills, or leisure activities.

3. Attractive Interest Rates

With an interest rate of 8.2% per annum (as of 2023), SCSS offers a far superior return compared to regular savings accounts or even many fixed deposits. While bank interest rates fluctuate, SCSS offers a more consistent and attractive return, making it an ideal choice for those looking for secure yet rewarding investment options.

4. Tax Benefits

Investing in SCSS allows you to claim deductions under Section 80C up to ₹1.5 lakh. For senior citizens looking to optimize their tax outgo while securing their future, this dual benefit of safety and tax saving is hard to ignore.

5. Flexibility of Withdrawal

Life after retirement can sometimes bring unexpected expenses, be it medical emergencies or personal needs. The SCSS allows for premature withdrawals with nominal penalties, offering flexibility if you need funds before the completion of the scheme’s tenure.

6. Option to Extend

While the initial tenure of the SCSS is five years, the scheme can be extended for an additional three years. This flexibility ensures that if you do not require the funds immediately, you can continue earning interest on your investment for a longer period without any hassles.

7. Higher Investment Cap

With the government increasing the maximum investment limit to ₹30 lakhs, senior citizens now have the opportunity to invest a larger portion of their savings into this secure instrument. This is particularly beneficial for those with substantial retirement funds who are looking for a safe place to invest.

SCSS vs. Other Investment Options

When compared to other investment avenues such as fixed deposits (FDs), mutual funds, and bonds, the SCSS stands out for its balance between safety, returns, and tax benefits.

Fixed Deposits: While FDs are relatively safe, they generally offer lower interest rates compared to SCSS. Additionally, FD interest is taxable, and the regular payouts are often not as frequent.

Mutual Funds: These are market-linked instruments, making them more volatile. While they offer potentially higher returns, they also come with higher risks, which may not be suitable for senior citizens seeking stable and predictable income.

Bonds: Government bonds are safe but often have lower yields compared to SCSS. Also, bonds usually don’t offer regular payouts like SCSS, which can be a disadvantage for those who rely on periodic income.

How to Open an SCSS Account?

Opening an SCSS account is a simple and straightforward process. Here’s how you can do it:

Visit a Post Office or Designated Bank: You can open the SCSS account at any post office or a designated bank like the State Bank of India (SBI), ICICI Bank, HDFC Bank, etc.

Fill in the Application Form: You will need to fill out the SCSS application form available at the bank or post office.

Submit Required Documents:

Age proof (Aadhaar Card, Passport, Voter ID, etc.)

Proof of retirement (if applicable)

PAN card

Photographs

Deposit the Investment: Deposit the amount you wish to invest (minimum ₹1,000 and up to ₹30 lakhs). The deposit can be made through cash or cheque.

Nomination: Provide the details of the nominee at the time of account opening.

Once your account is opened, you will start earning interest from the date of the deposit, and the first interest payout will occur after the end of the first quarter.

Conclusion

The Senior Citizen Savings Scheme (SCSS) is an excellent investment option for retirees looking for a safe, stable, and profitable way to grow their savings. With its government backing, attractive interest rates, and regular payouts, SCSS provides financial security during the post-retirement phase. Coupled with tax benefits under Section 80C, SCSS stands as one of the most efficient savings instruments for senior citizens.

For individuals nearing or already in their retirement, investing in SCSS is a smart choice that balances safety, income generation, and tax savings. With the ever-rising cost of living and healthcare expenses, securing a stable source of income becomes essential, and SCSS can be a cornerstone in that financial strategy.

#SeniorCitizenSavingsScheme#SCSS#RetirementPlanning#SafeInvestments#FinancialSecurity#RetirementFunds#SeniorCitizenFinance#InvestInYourFuture#FinancialPlanning#SecureInvestments

0 notes

Text

Savings Plans - Buy Best Saving Plan Online in India 2024

Savings Plan

A savings plan helps you get guaranteed returns against fixed monthly or yearly premiums. Further, these plans also offer a life cover that helps safeguard your family’s financial future.

What are Savings Plan?

An insurance savings plan is a financial tool that combines the benefits of a robust savings strategy with the security of insurance and guaranteed returns. Understanding how an insurance savings plan works can help you build a strong foundation for financial security. The best insurance savings plan offers a systematic approach to consistently setting aside a portion of your income, allowing you to accumulate funds over time. It provides a disciplined framework for allocating resources wisely, managing expenses effectively, and prioritizing your financial goals. By opting for an insurance savings plan, you can also adopt healthy financial habits and be better prepared to handle unexpected challenges and expenses.

Types of Savings Plan Saving money is ideal for financial planning, ensuring a user has a safety net for emergencies, future expenses, andlong-term plans. Savings plans are tailored to meet different needs and preferences. From traditional options like fixed deposits tomoderninvestment avenues like mutual funds, understand the diverse savings plans available in India.

Fixed Deposits Fixed deposits are India's most popular andcommonsavings instruments. Banks and financial institutions offer them as a way to allow individuals to deposit an amount for a fixed period at a predecided interest rate. Fixed deposits also provide capital protection and a guaranteed return, making them a secure option for conservative investors.

Recurring Deposits Recurring Deposits (RDs)are one of the commonfamiliar savings option for people who wish to deposit a fixed amount regularly, often monthly, for a pre-decided period. RDs offer flexibility regarding investment amount and duration, and they are agood optionfor individuals who build savings through disciplined and regularintervals..

Public Provident Fund (PPF) Public Provident Fund is astableand long-term plan the Government of India offers. PPF accounts have a lock-in period of 15 years, offergoodinterest rates, and offer tax benefits under Section 80C of the Income Tax Act. They also suit people looking for tax-efficient long-term savings with guaranteed returns.

National Savings Certificate National Savings Certificate is an instrument with a fixed maturity period and interest rates offered by the Government of India. NSC offers tax benefits under Section 80C and can be bought from post offices across India. It also provides a safe and reliable avenue for people looking to accumulate savings over a fixed period.

Sukanya Samriddhi Yojana SSY (Sukanya Samriddhi Yojana) is a savings plan for girls to promote their education and contribute towards their marriage expenses. It offers impressive interest rates, tax benefits under Section 80C, and partial withdrawal options after the girl child is of a certain age. SSY is a great savings option for parents looking to secure their daughter's tomorrow.

Employee Provident Fund Employee Provident Fund is an unavoidable savings scheme after retirement for employees in India. Both the employer and the employee contribute towards the fund, and the amount collated can be withdrawn at retirement or in case of emergency. It also offers tax benefits and is an essential retirement savings tool.

Mutual Funds MFs are schemes that collect funds from multiple investors to put money into a wide-ranging portfolio. They also offer a range of options catering todifferentrisk management profiles and investment plans. Italso offersprofessional management, liquidity, and a great chance for higher returns over the long-term goals.

Unit-Linked Insurance Plans ULIPs combine insurance coverage and investment options, allowing policyholders to invest in various fund options basis on the risk appetite and financial goals. Unit-linked Insurance Plans also offer flexibility, and potential for wealth creation, making it a great choice for long-term financial planning.

0 notes

Text

TDS under GST: Everything You Need to Know

In terms of indirect taxation, the advent of Goods and Services Tax (GST) in India has substantially modified the earlier tax machine Tax deduction at supply (TDS) gadget which has provisions of Under GST plays an essential position in tax compliance and greater transparency Understanding the filing of TDS returns and the method is important to live compliant and keep away from penalties. This article delves into the complexities of TDS below GST, together with who has to claim TDS, truthful price, and most importantly, the way to report a TDS return

What is TDS under GST? Under GST, tax deduction at supply (TDS) is a method of deducting a positive percent of tax from payments made to providers of taxable items or offerings The principal goal of this scheme in and to make sure timely collection of profits taxes and increase the tax base by means of tracking big groups and authorities entities Who should deduct TDS under GST? The following companies are mandatory to deduct TDS under GST: government departments or offices. Local Government. Creation of public offices. Institutions notified by the Government. These companies are required to deduct TDS when the total value of the goods supplied exceeds Rs. 2.5 lakh (inclusive of GST). Valid prices for TDS under GST The rate of TDS under GST is 2%, which is broken down as follows. 1% CGST (Central Goods and Services Tax) . In case of intra-State transactions, 1% SGST (State Goods and Services Tax) or 1% UTGST (Under Territory Goods and Services Tax). 2% IGST (Integrated Goods and Services Tax) on inter-State transactions. Steps for TDS Return Filing Under GST, filing of TDS return is a mandatory action to be taken through the deductor. Here is the step by step guide on a way to record TDS go back:

Registration: Ensure that the withdrawer is registered below GST and has a legitimate GSTIN. Form GSTR-7: Those who've deducted TDS need to document their returns thru Form GSTR-7. Deduction Details: Provide information of providers (deductees) from whom TDS has been deducted. TDS Certificate: Submit Form GSTR-7A for TDS certificates for deductions. Due date: Submit your TDS go back by the 10th of the subsequent month. Comprehensive process for filing TDS return Step 1: Go to GST Portal Apply your credentials to the GST portal (www.Gst.Gov.In). Go to the ‘Services’ tab, then visit ‘Returns’ and pick ‘Returns Dashboard’. Step 2: Select the ideal monetary 12 months and time Select the proper financial 12 months and go back length (month) from the drop-down menus. Step 3: Fill GSTR-7 form Click on ‘Prepare Online’ under the GSTR-7 tile. Enter the required details like GSTIN deduction, deduction payment, amount of TDS deduction. Be sure to be consistent to avoid contradictions. Step 4: Check before you can submit Fill in all of the info and test the shape before making sure all the information are correct. Click the ‘Submit’ button to post the shape. Step five: Payment of TDS Use the to be had fee strategies (Net Banking, NEFT, RTGS) to pay the TDS quantity. Once the charge is made, the GSTR-7 fame may be updated. Step 6: To publish TDS certificates Generate TDS certificates (Form GSTR-7A) from GST portal. For deductees, these certificates ought to be submitted as evidence of TDS deduction. Consequences of noncompliance Failure to conform with the TDS regime beneath GST may additionally bring about consequences and interest. Here are the principle results:

Late Fee: Late fee is Rs. 200 per day (Rs. A hundred for CGST and SGST) may be charged for overdue submitting, as much as a most of Rs. 5,000 rectangular feet. Benefits: Interest is charged on late TDS at 18% consistent with annum. Credit disallowance: If the drawee fails to deposit TDS on time, the deductees might also face disallowance of Investment Tax Credit (ITC). Key points to consider TDS applies to supplies of goods or services for which the contract price exceeds Rs. 2.Five lakhs is available. The TDS ought to be submitted to the authorities through the tenth of the following month. The deductors have to difficulty TDS certificates to the deductees inside five days of depositing the TDS. Deductibles should document GSTR-7 every month, and deductibles can declare TDS income in their electronic earnings library. Benefits of TDS beneath GST Ensures compliance: Helps manage high-price transactions and ensures compliance with tax laws. Reduces Tax Evasion: Reduces tax evasion by using keeping records of transactions. Improves transparency: Improves transparency in transactions and decreases the chances of disputes. The demanding situations they confronted Despite the advantages, corporations generally tend to stand numerous demanding situations associated with TDS under GST:

Complexity: Understanding the provisions and efficiently implementing TDS may be hard for corporations. Compliance burden: The burden of clearing TDS, issuing returns and certificate will increase the compliance burden. Technical Issues: Navigating the GST portal and troubleshooting technical challenges may be tough. Conclusion Under GST, TDS is one of the most crucial measures geared toward increasing tax compliance and transparency. Understanding the provisions, prices and manner for submitting TDS returns is vital for agencies to avoid penalties and make certain easy operations. By following the noted steps and staying abreast of the cutting-edge information, corporations can manage their TDS legal responsibility below GST efficaciously. Remember, timely and accurate filing of TDS returns no longer best guarantees compliance however also creates a subculture of transparency and responsibility in the business environment also.

0 notes

Text

Comparative Analysis: Estimating Returns from Post Office RD vs. EPF Investments

When it comes to secure investment options in India, both Post Office Recurring Deposits (RD) and the Employee Provident Fund (EPF) stand out as popular choices. Each investment avenue offers distinct advantages and suitability depending on the investor's profile and goals. By employing tools like the post office RD calculator, investors can easily forecast the returns on their monthly contributions to a Post Office RD, which is known for its stability and government backing.

On the other hand, the EPF, primarily designed for the salaried workforce, offers a retirement savings plan that not only helps in building a substantial retirement corpus but also provides tax benefits. To estimate the growth of their EPF contributions, investors can use an EPF calculator. This calculator takes into account variables such as the current EPF balance, employer’s contribution, employee’s contribution, and the current interest rate, which is revised annually by the government.

The key difference between these two investment options lies in their nature and the returns they offer. Post Office RDs allow for a fixed monthly deposit into an account, which earns interest at a rate determined by the prevailing government guidelines. The simplicity of the RD scheme makes it an attractive option for individuals with consistent but limited investing capacity. On the other hand, the EPF is not only a savings tool but also a vital component of India’s social security system, offering interest rates generally higher than those of RDs, which makes it highly beneficial for long-term growth.

Moreover, while the returns on RDs are taxed according to the individual's income tax slab, the interest earned and the maturity amount of the EPF are tax-free under certain conditions, making EPF a more tax-efficient investment in the long run. This distinction is crucial for investors when planning their tax liabilities.

For potential investors, understanding these nuances is vital. Using a post office Recurring Deposits calculator helps in setting realistic expectations on the returns from RDs, providing a clear picture of what the maturity amount will be at the end of the investment period. Similarly, the Employee Provident Fund calculator aids in comprehending how one's money grows over time with the added interest, especially with the compound interest feature that EPF offers.

When comparing both, it’s important to consider factors like investment tenure, risk appetite, liquidity needs, and tax implications. Post Office RDs are typically preferred by those who seek less risky avenues and may need to withdraw their investment relatively sooner. In contrast, EPF is ideal for individuals with a longer investment horizon, primarily due to its focus on retirement savings.

While both Post Office RD and EPF are solid investments, they serve different purposes and offer different benefits. The post office Recurring Deposits calculator and Employee Provident Fund calculator help investors make informed investment decisions that match their financial goals and retirement plans. By carefully analysing and comparing these options, investors can optimise their portfolios for long-term financial goals.

0 notes

Text

Understanding How Time Frames Affect Passive Income: Three Examples

Passive income is often touted as the ideal way to earn money with minimal effort. However, the time frame over which one invests can significantly impact the potential returns. Here are three examples of how different time frames can affect passive income streams:

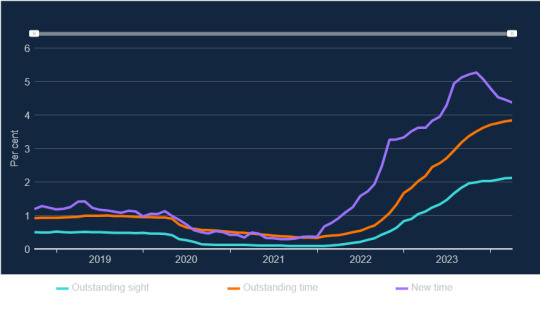

High-Interest Savings Accounts: In the short term, high-interest savings accounts can provide a reliable source of passive income. With interest rates having risen sharply since December 2021, savers can now enjoy more substantial returns on their deposits. For instance, moving your money to a high-interest account like the Post Office, which offers a 5.06% rate, can yield a decent income stream without much effort. However, it's crucial to monitor these rates regularly, as they can fluctuate.

Effective interest rates on individual deposits: source—Bank of England

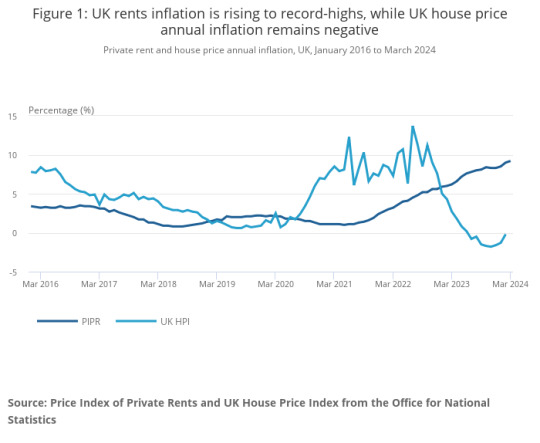

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

In conclusion, the impact of time frames on passive income can vary greatly depending on the type of investment and the effort involved. Short-term methods may require more frequent attention to rates and terms, while long-term strategies could yield higher returns with less ongoing effort. It's essential to consider your financial goals and the level of engagement you're willing to commit to when choosing the right passive income strategy for you.

0 notes

Text

In a concerning development, a Denver resident became the latest victim of an elaborate cryptocurrency scam, losing a whopping $14,000. Denver Police are urging the public to be vigilant after the individual was tricked into sending money through a cryptocurrency ATM under false pretenses. This incident highlights the growing trend of sophisticated scams targeting digital currency users. Authorities are now investigating the case, warning others to exercise caution and verify all transactions thoroughly to avoid falling prey to similar fraudulent schemes. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] In recent developments coming out of Denver, a warning has been issued by the local police department highlighting a worrying scam trend involving cryptocurrency ATMs. This new scam strategy has already led to a person losing a staggering $14,000. The manner in which these scammers operate isn't entirely new, but their method of collecting money has taken a digital turn, using the allure of cryptocurrency as their tool. Traditionally, scams have taken many forms, but this particular scam involves a caller impersonating a Denver Police Department officer. The victim is falsely informed of a missed court appearance resulting in an outstanding warrant. To make matters more convincing, the scammer directs the victim to deposit what they claim is "bail" money through a cryptocurrency option available at a kiosk in a local laundromat. Unsuspecting individuals are coerced into transferring an initial sum of money under the pretense of avoiding jail time. However, the demands don't stop there; more requests for money follow. In one devastating instance, a victim ended up transferring a total of $14,000 before realizing it was all a scam. The Denver Police Department has emphasized that they would never initiate contact with individuals to inform them about an outstanding warrant or demand money over the phone. They are strongly advising the public to be vigilant and disconnect any such calls immediately. Victims or individuals who encounter such incidents are encouraged to report these scams to the local law enforcement at 720-913-2000 and press 2 or take a step further by filing a complaint with the Colorado Attorney General’s Office online. This alarming trend underscores the evolving landscape of scams and the importance of staying informed about the tactics used by scammers. The use of cryptocurrency in scams adds a layer of complexity and anonymity, making it crucial for individuals to exercise caution and skepticism when approached with such demands. The Denver Police Department's warning serves as a timely reminder to remain alert and protect oneself from becoming a victim of such deceitful schemes. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. **What happened in the cryptocurrency ATM scheme in Denver?** A victim lost $14,000 in a scheme involving a cryptocurrency ATM, as reported by the Denver police. 2. **How did the victim lose money in this scheme?** The victim was tricked into sending money through a cryptocurrency ATM, leading to a loss of $14,000.

3. **Are the police investigating the cryptocurrency ATM scheme?** Yes, the Denver police are actively investigating the case to find the perpetrators behind the scheme. 4. **What can people do to avoid falling victim to such schemes?** It's important to be cautious and skeptical about unsolicited requests for money transfers, even if they appear legitimate, and to consult with trusted financial advisors or the police before making such transactions. 5. **Will the victim get their money back?** Recovering money from cryptocurrency scams can be challenging, but the authorities are working on the case. The victim's ability to get their money back will depend on the investigation's outcome and the possibility of tracing the stolen funds. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

पोस्ट ऑफिस की इस स्कीम में सिर्फ ब्याज में ही मिलेगा 2 लाख रुपए का फायदा, आज ही करें निवेश : Post Office Time Deposit Scheme

News Desk | Post Office Time Deposit Scheme : पोस्ट ऑफिस की स्कीम में निवेश करना एक काफी अच्छा और सुरक्षित ऑप��शन होता है क्युकी इसमे निवेश किए गए पैसों के रिटर्न की निश्चित गारंटी होती है जिससे मैच्योरिटी के समय पर निवेश किए गए पैसो का ब्याज के साथ रिटर्न का लाभ मिल पाता है, पोस्ट ऑफिस की निवेश स्कीम में टाइम डिपॉजिट स्कीम भी शामिल है जिसमे निवेश किए गए पैसों में 2 लाख रुपए के ब्याज का लाभ मिलता है । टाइम डिपॉजिट स्कीम में मिलता है इतने ब्याज का लाभ पोस्ट ऑफिस की इस स्कीम का नाम टाइम डिपॉजिट स्कीम है जिसमे निवेशक 1 साल, 2 साल, 3 साल और 5 साल के लिए निवेश कर सकते है इस स्कीम में निवेशक अपनी जरूरत के अनुसार निवेश कर सकते है साथ ही इस स्कीम में 5 साल के लिए निवेश करने पर 7.50% ब्याज का लाभ, 2 या 3 साल के लिए निवेश करने पर 7% ब्याज का लाभ और 1 साल के लिए निवेश करने पर 6.90% ब्याज का लाभ दिया जाता है । 2023 के बाद की गई ब्याज में बढ़ोतरी पोस्ट ऑफिस की इस स्कीम में पहले 5 साल के निवेश पर केवल 7 फीसदी ब्याज का लाभ दिया जाता था लेकिन साल 2023 के बाद से इस स्कीम में अगर कोई व्यक्ति 5 साल के लिए निवेश करता है तो उसे 7.50 फीसदी ब्याज का लाभ दिया जाता है जिससे की निवेश राशि पर काफी अच्छा ब्याज का लाभ मिल पाता है । ऐसे मिलेगा 2 लाख के ब्याज का लाभ अगर कोई व्यक्ति 2 लाख रुपए के ब्याज का लाभ पाना चाहता है तो उसे 5 लाख रुपए की राशि निवेश करनी होगी जिसमे निवेश का समय 5 साल का होगा जिससे की मैच्योरिटी के समय पर निवेशक को 7.50 फीसदी ब्याज का लाभ जोड़कर दिया जाएगा जिससे की 2 लाख 24 हजार 9 सौ 74 रुपए का अतिरिक्त लाभ मिलेगा जिससे की निवेशक को मैच्योरिटी के समय पर 7,24,974 रुपए मिलेंगे । टैक्स छुट के लाभ के साथ जॉइन्ट अकाउंट भी खुलवाया जा सकता है पोस्ट ऑफिस की इस स्कीम में इनकम टैक्स के ऐक्ट 1961 के सेक्शन 80C के तहत टैक्स छूट का भी लाभ प्रदान किया जाता है इसके साथ ही इस स्कीम में 1000 रुपए के निवेश से भी खाता खुलवाया जा सकता है साथ ही सिंगल और जॉइन्ट अकाउंट में भी खाता खुलवाकर निवेश किया जा सकता है, जिसके लिए आप नजदीकी पोस्ट ऑफिस में जाकर खाता खुलवा सकते है और निवेश करना शुरू कर सकते है । Read the full article

#InvestmentScheme#PostOfficeScheme#PostOfficeTDScheme#PostOfficeTimeDepositScheme#TDScheme#TimeDepositScheme

0 notes

Text

Why Should You Invest In Commercial Property In 2024?

We're going to talk about one of the greatest and most sustainable investment possibilities for 2024 today—the one that has no risk and offers profits that are guaranteed. The most profitable and environmentally friendly investment choice is commercial property, which is also one of India's fastest-growing industries and one that offers investors substantial, guaranteed returns.

You may be asking yourself why I should limit my investments to real estate. We can invest in a variety of other sectors that yield higher returns. Some examples of these sectors include shares, mutual funds, bonds, fixed deposits, Public Provident Funds, NPS, Post Office Savings Schemes, unit-linked insurance plans, debt funds, and SCSS. However, how secure are these investment options? Are they able to last? Even with those that will take a while to mature, there is no guarantee of returns, and even when you do, the returns are meagre.

You must choose whether you are investing for profit or loss while making your choice. It's similar to saving money for retirement because these programs only pay off if you invest for 20 or 30 years. After that, what happens? "It's time to come," declares God. These scams simply serve to enrich those running them and further impoverish you. Just consider market pricing and inflation. Your money will increase in value over the next twenty or thirty years, but because inflation will increase throughout that time, its worth may decrease or remain unchanged. It is therefore not inflation-proof.

Real estate is divided into a number of divisions, including residential, commercial property, retail, studio flats, etc. However, since we are discussing money cultivation, we will limit our discussion to commercial property.

Why Invest in Commercial Property in 2024?

It then becomes reasonable to ask: Why should you invest in commercial property? The future of real estate looks promising in 2024. The predicted increase in the economy, government initiatives, and infrastructure development are expected to sustain the strong growth momentum of the real estate sector.

The demand for office space and retail stores in particular has increased significantly over the last few months, and this trend is expected to continue as an increasing number of industries drive up demand for commercial property in India.

India's real estate sector grew significantly in 2023 because of the confidence of buyers and investors. The retail space market was particularly successful, with leasing rising by 46% in the top 8 cities over the prior year. The robustness of the industry, investor confidence, brand expansion, new market entrants, and rising consumer spending are some of the factors driving this growth.

According to a collaborative analysis from Knight Frank and the National Real Estate Development Council (NAREDCO), India's real estate market would be worth a significant USD 5.8 trillion by 2047. It is anticipated that this growth will propel the Indian economy forward by meeting the changing demands of different asset classes, such as commercial property, industrial, and residential projects. As a result, the most searched-for real estate topic on Google is "commercial property for sale."

A bright future for 2024 is made possible by the convergence of the residential and commercial property sectors and the growth of Tier 2 cities. It is anticipated that the industry will continue to grow and innovate, opening the door to a vibrant and successful future.

Top Reasons to Invest in Commercial property in 2024

India's commercial property market is expanding quickly for a number of reasons. Following the epidemic, office practices changed, and most companies now encourage their staff to work from home or return in a hybrid arrangement. India is a great destination for commercial property investment since, interestingly, a 2023 analysis by CBRE revealed that rentals in leading Indian cities are roughly 50% cheaper than those in rival Asian markets and 60% less than those in European markets. Source link : https://boardwalkindia.com/why-should-you-invest-in-commercial-property-in-2024/

0 notes

Text

Beyond 80C and 80D: Tax Saving for Long-term Saving

Tax planning and saving is a critical element of financial planning. It helps you maximise your savings, reduce your annual tax liability and utilise the money for other important financial goals you may have in life. Under the Indian Income Tax Act of 1969, you can use different sections to save your taxes.

Section 80 C and Section 80 D are the most popular sections under which people avail tax benefits. But the tax deduction you can avail under sections are capped to a certain limit. For example, the tax benefit available under Section 80C is limited to Rs. 1.5 lakhs in a financial year.

As a smart investor, you would know the importance of tax planning, and therefore, you must look to explore the different tax-saving opportunities. The good news is that there are different sections other than Section 80C and 80D. In this blog, we look at these sections:

Section 80 TTA

Under Section 80 TTA of the Indian Income Tax Act, you can claim a deduction of up to Rs. 10,000 on the interest earned from the savings account you maintain with any bank, post office or cooperative society.

Section 80GG

If you are a salaried individual and do not receive HRA (Housing Rent Allowance) from your employer, you can claim a deduction on the house rent under this section under certain conditions. The maximum tax benefit you can get under this section can be lesser of the following:

Rent minus 10% of the adjusted gross total income

A fixed amount of Rs. 5000 per month

25% of the adjusted total income

Section 80 EE

As a first-time homeowner, you can save your taxes on the home loan interest payment under Section 80EE. You can claim a maximum deduction of Rs. 50,000 in a financial year. This deduction you get is over and above the tax benefit under Section 80C on repaying the principal amount of the home loan.

Section 80CCG

If you are an Indian resident, and your total annual income is less than Rs. 12 Lakh, you can claim a deduction on 50% of the investment in the shares of Rajiv Gandhi Equity Savings Scheme (RGESS) or a fixed amount of Rs. 25,000 for three successive assessment years under this section. However, to claim the tax benefit, you must meet the following conditions:

You are a retail investor as per the notified scheme requirements.

The investment is listed as per the notified scheme requirements.

You must invest in the scheme with a minimum lock-in period of three years as per the notified scheme.

Section 80U

Section 80U of the Indian Income Tax Act is related to the physical disabilities. It allows you to claim a tax benefit of up to Rs. 75,000 and if you have a severe disability, you can claim a deduction of up to Rs. 1.25 Lakh. Please note that this deduction is available only for resident Indian citizens.

Section 80G

Under this section, you can enjoy tax benefits on the donations you make to different social causes. You can get a deduction of up to 50% or even up to 100% based on the list of the charitable institutions you are donating to.

Some of the popular non-profit organisations that are eligible for tax deductions, include: Prime Minister’s National Relief Fund, National Children’s Fund, Jawaharlal Nehru Memorial Fund, Swachh Bharat Kosh, etc.

Section 80TTB

This section of the Indian Income Tax Act is specifically meant for senior citizens only. If you are a senior citizen, you can claim a deduction of up to Rs. 50,000 on the interest earned from the deposits.

Section 80GGC

As an individual, you may support certain political ideologies or parties. If you truly believe in the party’s cause, you can make a financial contribution to the political party or electoral trust through any mode other than cash payments. You can claim tax benefits on the contributions you make under this section.

Conclusion

Now that you know the different tax benefits available to you under different sections of the Income Tax Act, the tax advantage of these benefits available to you. This will help you reduce your overall tax liability and maximise your savings.

0 notes