#pf pension eligible service

Explore tagged Tumblr posts

Text

Pension Through PPF Account: हर महीने आपको मिल सकता है ₹60,000 का पेंशन, कोई भी टैक्स नहीं देना पड़ेगा

Pension Through PPF Account : हम आज आपको रिटायरमेंट के बाद हर महीने पेंशन कैसे प्राप्त कर सकते हैं बताएंगे। जी हां, अगर आप आज से निवेश करना शुरू कर देते हैं, तो रिटायरमेंट के बाद आपको हर महीने ₹60,989 पेंशन मिलेगी। इस तरह की पेंशन पाने के लिए आपको पीपीएफ खाते में निवेश करना होगा। इसकी विशिष्टता यह है कि सरकार ने इस स्कीम को टैक्स से छूट दी है। जिससे आपको बहुत अधिक लाभ मिलता है। तो चलिए इसके बारे…

#benefits of ppf account#benefits of ppf account in post office#can a person have epf and ppf account#can i invest in both ppf and nps#epf gpf and ppf#epfo online pension transfer#pension fund vs provident fund#pension in epf account#pension through ppf account#pf account pension withdrawal#pf and ppf comes under 80c#pf or ppf which is better#pf pension eligible service#pf pension start process online#pf vs ppf vs nps#ppf account 1000 per month#ppf account 2000 per month#ppf account benefits 1000#ppf account benefits 5000#ppf account benefits calculator#ppf account for senior citizens#ppf account lump sum#ppf account maturity time#ppf account monthly deposit or yearly#ppf account pros and cons#ppf bank#ppf pension#ppf pension latest news#ppf pension plan#ppf pension scheme

0 notes

Text

[ad_1] A large number of Visakhapatnam Steel Plant (RINL) higher pension aspirants have met Gazuwaka MLA and TDP State President, Palla Srinivasa Rao today, at his party office in Gazuwaka, and submitted a memorandum seeking his intervention to speak to Union Minister of Civil Aviation K. Ram Mohan Naidu for taking up this issue of importance with the Union Labour Minister about their grievance. The higher Pensions matter has been pending for the last 14 months with the EPFO, the Steel Pensioners say. It may be recalled that during November 2022, the Hon’ble Supreme Court had given a verdict entitling the employees to higher pension on actual salary as against ceiling wage. Even after remittance of about ₹410 Crores to the Regional PF Office at Visakhapatnam by the eligible pensioners of RINL, Visakhapatnam steel plant in October 2023, the issue has been pending ever since with Employee’s Provident fund organisation (EPFO) raising the issue of eligibility in the last minute on the ground that PF(Provident fund) Trust rules of the respective establishments do not provide for such benefit. It has thus become a national issue for pensioners of all establishments including Visakhapatnam steel plant. It is learnt that EPFO has sent a proposal a week ago to the Ministry of Labour and Employment seeking to issue new guidelines for the exempted establishments, the pensioners allege. Against this background, those in service (eligible pensioners) and also retirees of Visakhapatnam Steel Plant (RINL) have sought intervention of Union Minister Ram Mohan Naidu to pursue their case and cause with his cabinet colleague Dr. Mansukh Mandaviya, Union Minister of Labour and Employment through the Gajuwaka MLA & AP State President, Telugu Desam Party Palla Srinivasa Rao. Touched by the genuine grievances of the RINL Pensioners, The AP State TDP Supremo Palla Srinivasa Rao immediately spoke to the Civil Aviation Minister Ram Mohan Naidu over phone and requested his intervention to impress upon Dr. Mansukh Mandaviya, Union Minister of Labour and Employment the need to sanction higher pensions (Pension on Higher wages). Union Civil Aviation Minister Ram Mohan Naidu has given an assurance that he would personally pursue the Higher pension issue with Dr. Mansukh Mandaviya, Union Minister of Labour and Employment. Vizag Steel Plant Pensioners’ collective has profusely thanked the Gazuwaka MLA and the Union Civil Aviation Minister, for responding to their grievance spontaneously. Retired employees of RINL, VS Murthy, JA Swamy, Pitta Rammohan Rao and Pitta Kuncha Rao and others met Gazuwaka MLA and TDP State President, Palla Srinivasa Rao on behalf of Visakhapatnam Steel Plant Pensioners. Press Release issued on behalf of Visakhapatnam Steel Plant Pensioners By VS Murthy, Retired Executive, Visakhapatnam Steel Plant (RINL) [ad_2] Source link

0 notes

Text

[ad_1] A large number of Visakhapatnam Steel Plant (RINL) higher pension aspirants have met Gazuwaka MLA and TDP State President, Palla Srinivasa Rao today, at his party office in Gazuwaka, and submitted a memorandum seeking his intervention to speak to Union Minister of Civil Aviation K. Ram Mohan Naidu for taking up this issue of importance with the Union Labour Minister about their grievance. The higher Pensions matter has been pending for the last 14 months with the EPFO, the Steel Pensioners say. It may be recalled that during November 2022, the Hon’ble Supreme Court had given a verdict entitling the employees to higher pension on actual salary as against ceiling wage. Even after remittance of about ₹410 Crores to the Regional PF Office at Visakhapatnam by the eligible pensioners of RINL, Visakhapatnam steel plant in October 2023, the issue has been pending ever since with Employee’s Provident fund organisation (EPFO) raising the issue of eligibility in the last minute on the ground that PF(Provident fund) Trust rules of the respective establishments do not provide for such benefit. It has thus become a national issue for pensioners of all establishments including Visakhapatnam steel plant. It is learnt that EPFO has sent a proposal a week ago to the Ministry of Labour and Employment seeking to issue new guidelines for the exempted establishments, the pensioners allege. Against this background, those in service (eligible pensioners) and also retirees of Visakhapatnam Steel Plant (RINL) have sought intervention of Union Minister Ram Mohan Naidu to pursue their case and cause with his cabinet colleague Dr. Mansukh Mandaviya, Union Minister of Labour and Employment through the Gajuwaka MLA & AP State President, Telugu Desam Party Palla Srinivasa Rao. Touched by the genuine grievances of the RINL Pensioners, The AP State TDP Supremo Palla Srinivasa Rao immediately spoke to the Civil Aviation Minister Ram Mohan Naidu over phone and requested his intervention to impress upon Dr. Mansukh Mandaviya, Union Minister of Labour and Employment the need to sanction higher pensions (Pension on Higher wages). Union Civil Aviation Minister Ram Mohan Naidu has given an assurance that he would personally pursue the Higher pension issue with Dr. Mansukh Mandaviya, Union Minister of Labour and Employment. Vizag Steel Plant Pensioners’ collective has profusely thanked the Gazuwaka MLA and the Union Civil Aviation Minister, for responding to their grievance spontaneously. Retired employees of RINL, VS Murthy, JA Swamy, Pitta Rammohan Rao and Pitta Kuncha Rao and others met Gazuwaka MLA and TDP State President, Palla Srinivasa Rao on behalf of Visakhapatnam Steel Plant Pensioners. Press Release issued on behalf of Visakhapatnam Steel Plant Pensioners By VS Murthy, Retired Executive, Visakhapatnam Steel Plant (RINL) [ad_2] Source link

0 notes

Text

Best Monthly Pension Scheme for Senior Citizen

Given the ageing population and low-interest rates, the government has implemented several efforts to protect the interests of older citizens. The government has created different schemes for senior citizens under which citizens over 60 can earn a regular income through a pension by investing in such programs.

National Pension System (NPS)

The NPS system in India is an optional defined contribution pension system.

Eligibility for National Pension System

Model for All Citizens

A resident or non-resident Indian citizen is entitled to the following criteria:

The applicant must be between the age 18 and 60 at the time of application to the POP/ POP-SP.

The applicant must acknowledge and follow the Know Your Customer (KYC) guidelines outlined in the Subscriber Registration Form. All documentation needed for KYC compliance must be provided in its entirety.

The Atal Pension Yojana

The Atal Pension Yojana (APY), a pension system for Indian residents, focuses on unorganised sector workers. The APY provides a minimum guaranteed pension of Rs. 1,000/-, Rs. 2,000/-, Rs. 3,000/-, Rs. 4,000/-, or Rs. 5,000/- per month at the age of 60, depending on the subscribers' contributions. Any Indian citizen can participate in the APY scheme.

Below mentioned are the eligibility requirements:

The subscriber needs to be between the age 18 and 40.

They must have a savings account or a post office savings account.

The Employee Provident Fund

Every company registered with the EPFO will grant employees a Provident Fund (PF) account number. The PF number is a numerical code. It denotes the state, regional office, location, and PF member code. The PF trust manages the PF number. When an employee switches jobs, their PF number changes. A Universal Account Number (UAN) is a one-of-a-kind number assigned to PF members. When an employee switches jobs, their PF account number changes. The UAN number, however, remains the same.

New Pension System

The New Pension System in India was implemented in 2004 and has since covered new entrants to the civil service of the central government. An exception is military forces employees, which is not in the purview of the New Pension System. Public service employees who have worked in government departments since 2004 have stayed in the old system.

Employers and employees each contribute 12% of their salaries, which are stored in separate accounts. The new system's minimum retirement age is 60 years, and taxes are based on the EET concept, with a statutory annuitization of 40% of accumulated capital. While the scheme is intended for central government personnel, 26 of the 29 state governments have stated their intention to participate.

Defence Pension

This is a pension fund for the three branches of the armed forces and civilian employees working in Defence installations. The Government of India contributes on their behalf to assist Defence personnel with retirement planning.

Open your account for the National pension system in HDFC; it is available to any Indian citizen and your old days. Our skilled team will undoubtedly aid you in any way possible to make you live your old age independently.

0 notes

Text

JIPMER Recruitment 2021 – Biotech / Biochem / Life Science Embryologist

New Post has been published on https://biotechtimes.org/2020/12/20/jipmer-recruitment-2021-biotech-biochem-life-science-embryologist/

JIPMER Recruitment 2021 – Biotech / Biochem / Life Science Embryologist

JIPMER Recruitment 2021

JIPMER Recruitment 2021 – Biotech / Biochem / Life Science Embryologist. Jawaharlal Institute of Postgraduate Medical Education and Research is looking for an Embryologist. Candidates having MSc Life Sciences / Zoology / Microbiology / Genetics / Biotechnology / Biochemistry can apply for this job.

JAWAHARLAL INSTITUTE OF POSTGRADUATE MEDICAL EDUCATION & RESEARCH (An Institution of National Importance under Ministry of Health & Family Welfare, Govt. of India) Dhanvantari Nagar, Puducherry 605 006

Advt No.JIP/Admn.I/AP(Contract)/01/2018/PF

Applications are invited by the Director, JIPMER, for JIPMER Recruitment 2021 from eligible candidates to fill the Embryologist post on a contract basis

Position Name: Embryologist

Consolidated pay: INR 60,000/- per month

No. of Positions: 1 – UR (One)

Essential Qualification: MBBS degree from a recognized University

OR

M.Sc. in Life Sciences / Zoology / Microbiology / Genetics / Physiology / Biotechnology / Biochemistry / Anatomy / Endocrinology from a recognized University.

OR

B.V.Sc. Degree from a recognized University

Experience: 1-year experience in In-vitro Fertilization lab/clinic of a recognized Centre with knowledge in all respects of IVF Techniques including ICSI/IMSI.

Desirable: MD/Ph.D./M.V.Sc

Age Limit: Not exceeding 45 years as on closing date

The experience will be considered only after obtaining essential qualification.

The closing date for receipt of the application will be considered as the cutoff date for computing the upper age limit and experience

NOTE: Application Fee (INR 500/- for UR & OBC and INR 250/- for SC & ST) must be paid through SBI Collect. No fee for PWD candidates.

How to Apply

One set of filled in application (Annexure-I) along with self-attested certificates/testimonials, Registration & Additional Registration certificate issued by MCI, Experience certificate, NOC (if applicable), other related documents/publications, and e-Receipt for Fee Payment through SBI COLLECT must be sent to the following address on or before 18.01.2021 (Monday) by 4:30 P.M.

The Deputy Director (Admn.), Administrative Block, JIPMER, Puducherry 605 006

The envelope containing the application should be super-scribed as: “Application for the Post of ……………… on Contract Basis at JIPMER, Puducherry”

In addition to the above, the softcopy of the application along with all the above said self-attested enclosures must also be sent to [email protected]

Terms & Conditions

1. The appointment is purely on CONTRACT BASIS and will be initially for a period of 11 months with effect from the date of joining and extension will be granted for further period, if it is required by the administration. If the contract is not extended further, the same will lapse automatically.

2. The appointment can be terminated at any time before the expiry of the period of 11 months referred to above, with one month’s notice without assigning any reason or if the person’s work is considered unsatisfactory by the Competent Authority.

3. If the appointee wishes to resign his/her job, he/she has to serve one month’s notice or remit one month’s salary or pay thereof, as the case may be proportionate to the shortfall in the notice period.

4. The appointee shall perform the duties as assigned to him/her. The Competent Authority reserves the right to assign any duty as and when required. No extra/additional allowances will be admissible in case of such assignment.

5. The appointee shall not be entitled to any benefit like Provident Fund, Pension, Gratuity, Medical Attendance Treatment, Seniority, Promotion, Allowances etc. or any other benefits available to the regular employees of this Institute.

6. The appointee shall not be granted any claim or right for regular appointment to any post of JIPMER Puducherry/JIPMER Karaikal.

7. The appointee shall be on a whole time appointment at JIPMER, Puducherry and shall not accept any other assignment, paid or otherwise and shall not engage himself/herself in a private practice of any kind during the period of contract.

8. The appointment to the said post will be subject to medical fitness from the competent medical board for which he/she will be sent to the designated Medical Authority.

9. On appointment, the appointee will be required to take an oath of allegiance to the Constitution of India or make a solemn affirmation to that effect in the prescribed proforma.

10. The appointee will not be entitled to any T.A. for attending the interview and joining the appointment.

11. Other conditions of service will be governed by relevant rules and orders issued from time to time.

12. If any declaration given or information furnished by him/her proves false or if he/she is found to have willfully suppressed any material, information, he/she will be liable for removal from the service and also such other action as the Government may deem it necessary.

13. The Competent Authority reserves the rights to increase or decrease the number of vacancies.

14. The Income Tax or any other tax liable to be deducted, as per the prevailing rules will be deducted at source before effecting the payment, for which the Department will issue TDS Certificate/s.

15. The contract appointment is purely temporary and will remain valid up to the contractual period for which the engagement is approved on each occasion.

16. The contract appointee will not be eligible to get official accommodation/quarters allotment within the campus as applicable to the other regular employees of this Institute.

17. The contract appointee shall in no case represent or give opinion or advice to others in any matter which is adverse to the interest of the Institute.

18. Canvassing of any kind will lead to disqualification.

19. The Contractually engaged person(s) should not have been convicted by any court of law

Last Date: 18.01.2021 (Monday)

Download Notification

#Biochemistry#Biotechnology#Jobs#Life Sciences#Microbiology Jobs#MSc Biotechnology Jobs#MTech Biotechnology#PhD Jobs

0 notes

Text

[ad_1] A group of pensioners of Rashtriya Ispat Nigam Limited (RINL) – Vizag Steel Plant met Pawan Kumar Jasti, Regional Provident Fund Commissioner-II, today in his office and submitted a memorandum requesting to immediately release higher pension orders which have been pending for the last 14 months. It may be recalled that the Supreme Court had delivered a judgement in favour of EPS pensioners entitling them to pension on actual salary drawn by them at the time of retirement on payment of the arrear contributions for the eligible period of their service. The local PF office has issued demand notices in September 2023 to about 2500 eligible aspirants of Vizag Steel asking them to remit such arrear contributions for processing the higher Pensions. On this account, more than ₹400 crores was remitted to the local PF office about 14 months ago. Although pension is to be granted within two-three months of receipt of contributions, there has been no progress ever since. Meanwhile, in the Central Board of Trust meeting held on 30th November 2024, the Union Labour Minister had directed to resolve the issue immediately particularly in the case of those who had remitted the contributions. The delay and indecision on the part of the PF authorities is assailed across the country by the pensioner’s fraternity. The National Confederation of Retirees is also organising a protest at Jantar Mantar in New Delhi on 18th December, 2024 in this regard. Recently, a meeting of Vizag Steel pensioners has taken place which resolved to take up the issue on a large scale by submitting memoranda, holding protests, and in case no action takes place, seeking legal address. Against this background, the above meeting of Vizag Steel pensioners with RPFC has assumed significance. [ad_2] Source link

0 notes

Text

[ad_1] A group of pensioners of Rashtriya Ispat Nigam Limited (RINL) – Vizag Steel Plant met Pawan Kumar Jasti, Regional Provident Fund Commissioner-II, today in his office and submitted a memorandum requesting to immediately release higher pension orders which have been pending for the last 14 months. It may be recalled that the Supreme Court had delivered a judgement in favour of EPS pensioners entitling them to pension on actual salary drawn by them at the time of retirement on payment of the arrear contributions for the eligible period of their service. The local PF office has issued demand notices in September 2023 to about 2500 eligible aspirants of Vizag Steel asking them to remit such arrear contributions for processing the higher Pensions. On this account, more than ₹400 crores was remitted to the local PF office about 14 months ago. Although pension is to be granted within two-three months of receipt of contributions, there has been no progress ever since. Meanwhile, in the Central Board of Trust meeting held on 30th November 2024, the Union Labour Minister had directed to resolve the issue immediately particularly in the case of those who had remitted the contributions. The delay and indecision on the part of the PF authorities is assailed across the country by the pensioner’s fraternity. The National Confederation of Retirees is also organising a protest at Jantar Mantar in New Delhi on 18th December, 2024 in this regard. Recently, a meeting of Vizag Steel pensioners has taken place which resolved to take up the issue on a large scale by submitting memoranda, holding protests, and in case no action takes place, seeking legal address. Against this background, the above meeting of Vizag Steel pensioners with RPFC has assumed significance. [ad_2] Source link

0 notes

Link

What is EPF?

The EPF is an avenue for saving and was introduced under the Employees’ Provident Fund and Miscellaneous Act, 1952. The EPF is managed by a Central Board of Trustees which consists of a representative from the Government, the employers, and the employees. This board of trustees is helped in its work by the Employees Provident Fund Organization (EPFO) which works under the jurisdiction of the Ministry of Labor and Employment. The main objective of the EPF or the Employee Provident Fund is to create a corpus that will be helpful after the retirement of your employees.

EPF is known to enjoy EEE status. EEE status is commonly referred to as exempt-exempt-exempt status of EPF. The contributions made by employees are tax-deductible under Section 80C, the interest that they earn via EPF is also interest-free. And lastly, the maturity benefits of EPF is also tax free. EPF is responsible for promoting savings among salaried individuals. The funds deposited into EPF are contributed by both the employer and the employees regularly. These funds can be used in case of the employees being unable to work or after their retirement.

The Employee Provident Fund (EPF) schemes are administered by mainly three Acts i.e.

Employees’ Provident Fund Scheme, 1952

Employees’ Pension Scheme, 1995

Employees’ Deposit Linked Insurance Scheme, 1976

The Employee Provident Fund is an ideal savings tool by which employees can save a considerable amount from their salary every month. This amount would be of great help to the employees in the future either after retirement or due to being unable to work.

Benefits of Employee Provident Fund

Some of the major benefits and advantages of the Employee Provident fund can be mentioned below.

Under Section 80C of the Income Tax Act, 1961 the contributors to the EPF can avail of the benefits of tax deductions.

According to Section 10(11) and Section 10(12) of the Income Tax Act, 1961 the contribution which has been made by the employer is also eligible for tax exemption.

There is no tax levied on the maturity amount.

The interest which is earned on the savings of EPF is also exempted from Income Tax. EPF also helps its contributors with loans whenever the necessity arises.

EPF Eligibility Criteria

The basic eligibility criteria to become a member of an EPF are mentioned below.

In general, the employees of an organization are directly eligible for obtaining the benefits of Provident Fund, Insurance, and Pension schemes as soon as they join the organization.

As an employer, you must open an EPF account for employees if their basic salary and dearness allowance amounts to less than Rs. 15,000.

For employees who receive a basic salary plus the dearness allowance more than Rs. 15,000, they can also become a member of the EPF. They can do so by getting consent from you and the Assistant Commissioner of PF.

Those organizations which have employee strength of 20 or more than 20 employees are mandated for registration under the EPF scheme. However, those organizations which have employees less than 20 can voluntarily register under the EPF.

The EPF scheme is not applicable for people who are residing in Jammu and Kashmir.

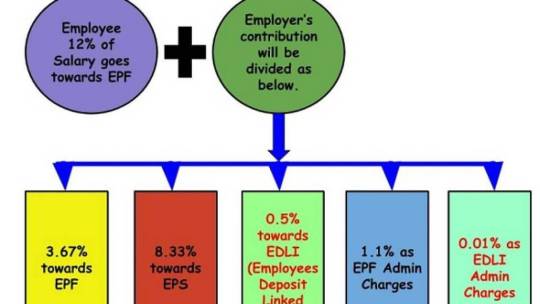

Contributions of employees and employers towards EPF

An employer and employee both make EPF contributions in the form of a particular part of the salary. This contribution is done every month and the contribution rate depends on the basic salary and the dearness allowance of an employee.

We can state the rate of EPF contribution by both employers and employees in the below-mentioned table.

Must know features about EPF Contributions

1. Rate of Contribution:

a) Generally, the rate of contribution by employees is fixed at 12% but for some exceptional cases, the rate of contribution is 10% like: i. Those organizations which have employee strength of a maximum of 19 persons have a contribution rate of 10% ii. Those organizations which have an annual loss which is much more as compared to that of the net value of the organization has a contribution rate of 10% iii. Industries such as coir, guar, beedi, brick, gum, jute, etc. have been allowed for an employee contribution of 10% towards the EPF iv. Some industries which have been declared as sick industries by the BIFR have their rate of employee contribution towards EPF as 10% v. Certain organizations operate under a wage limit of Rs. 6500 and the employees of these organizations can contribute 10% of their salary towards EPF.

b) As said earlier, employers will contribute 12% of the salary into EPF i.e. 12% of Rs. 15,000 which is Rs. 1800. So, both employers and employees will contribute Rs. 1800 in a month towards EPF.

2. Contribution distributiona) For the Employee

The total percentage of salary which is contributed by the employee goes completely into the employee’s provident fund.

b) For the Employer

The 12% contribution which is being made by the employer includes a contribution of 3.67% towards EPF (Employee Provident Fund) and 8.33% towards the EPS (Employee Pension Scheme).

3. Total Employer Contribution

Some contributions are made towards the administration cost to the EDLI and the EPF at the rate of 1.1% and 0.01%. These contributions are also made by the employer. So, the employer contributes to a total of 13.61% of the salary towards the EPF scheme.

We can illustrate the entire procedure of EPF contribution by both employer and employee by an example.

For example, the monthly salary of Mr. Kumar is Rs. 40,000 in a month. Then, the contributions which are made into the EPF can be summarized as below.

1.Contribution by employee=12% of Rs. 40,000=Rs. 4,800 2.Contribution made by employer towards EPF=3.67% of Rs. 40,000=Rs. 1,468 3.Contribution made by employer towards EPS=8.33% of Rs. 40,000=Rs. 3,332 4.Total contribution=Rs. 9600

Hence, a contribution of Rs. 9600 is made from the salary of Mr. Kumar towards EPF.

EPF Applicability

As an employer, you would have to contribute to EPF on the Basic salary along with the DA component. An organization much match the contribution of an employee and an extra 1% contribution towards EDLI (0.5%) and EPF plus EDLI administrative charges (0.5%). Your contribution towards EPF changes slightly depending on the number of employees that you have.

More than 20 employees The employee’s share in such conditions is 12% and as an employer, you must contribute 3.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

Less than 20 employees

The employee’s share in such cases is 10% and as an employer, you must contribute 1.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

How to disburse EPF online?

The procedure involved in the disbursal of the Employee Provident Fund payment by online means consists of the below-mentioned steps.

Employees can file for a pay EPF online claim by visiting the EPFO portal. For a pay EPF online claim, employee’s UAN (Universal Account Number) must be activated. Also, their bank details and the KYC details must be present in the EPFO portal.

It is your responsibility to provide employees with UAN and mention the same in the salary slip. If employees have not received their UAN, they can obtain it from the EPFO portal itself. They can select the tab Know your UAN status. Then they will have to fill in their details and a PIN obtained by employees on their phone number. With this, they can easily obtain their UAN. Even after they have received their UAN, the UAN needs to be activated.

For making their UAN active, employees must visit the ‘For Employees’ in the EPFO portal. Next, they will have to select the option ‘Our Services’ and under ‘Our Services’ and they will have the option of ‘Member UAN/Online Services’. Then, they will be directed towards the UAN portal where they will have to select ‘Activate your UAN’ option. Employees will obtain a PIN on their mobile number and they can use that PIN for the final step. With this, their UAN would be activated and they can apply for the disbursal of EPF online.

The steps that are involved in filing an online claim for the withdrawal of the EPF online are listed below.

First, your employees would have to log in to the EPFO portal with the help of their activated UAN and password.

In the next step, they will have to select the ‘Manage’ tab and verify the KYC details.

Now, they can visit the tab titled ‘Our Services’ and then select the option ‘Claim’.

Then, they will be directed to a section which is titled as ‘I want to apply for’ and choose their required type of approval i.e. full or partial or pension withdrawal.

After the selection of the type of withdrawal, your PF disbursal request will be forwarded to you for approval.

After your approval, employees will obtain their money within 10 days of raising the claim.

EPF withdrawal rules

Your employees can choose to withdraw their EPF contributions under certain conditions while adhering to some rules. Here are some of them.

1. Home Loan

Employees can choose to withdraw up to 90% of their contributions to pay off home loans. They must complete at least three years of service to avail the same.

2. Unemployment

If an employee remains unemployed for more than a month, they can withdraw up to 75% of their EPF.

3. Wedding

Employees can withdraw up to 50% of their EPF funds for their marriage, provided they have completed 7 years of service.

The current rules allow employees to withdraw their EPF if they do not have a job after two months of the completion of the previous job. And to avail of this benefit, the subscriber must have worked for at least 10 years.

A recent modification of the rules offers more flexibility for employees. Employees can now withdraw up to 75% of their EPF fund value if they do not have a job for more than a month. This change was introduced to help employees take care of their financial needs at such times.

You may also read: Employee loans – The complete guide

Interest rates on EPF

The interest rate on EPF for the financial year 2018-19 is 8.65%. It has been raised from 8.55% which was the interest rate in the year 2017-18. The fund which is accumulated in the Provident Fund Account is capable of attracting some interest which is completely exempted from tax.

The entire interest which is earned is transferred to EPF Account of employees and this is calculated based on the rate of interest that has been determined by the Government of India along with the Central Board of Trustees.

Let us understand some important aspects related to the interest rate on EPF.

The rate of interest i.e. 8.65 is valid for those EPF deposits which are being made in the financial year of April 2018 to March 2019.

The interest is transferred to the employee’s EPF account once in a year i.e. on 31st March of the current financial year.

For further calculation of interest, the interest which has been transferred to the employee’s EPF Account is summed up with the next month’s balance i.e. the balance of April.

For the inoperative accounts of non-retired employees, interest is offered.

For the inoperative accounts of retired employees, interest is not being offered.

The inoperative accounts earn interest and this interest is taxable under the current income tax slab.

When you contribute to the Employee Pension Scheme (EPS), employees will not be obtaining any interest. But they are eligible to obtain a pension of that specified amount after the age of 58 years.

For EPF, the interest is calculated monthly whereas the interest rate is announced every year. The interest rate can be calculated by division of the interest rate in a year by 12. By this, the interest amount which has to be given to you in a month is derived.

Understand with an example:

Let us consider an example to illustrate the entire concept of interest rates on the Employee Provident Fund. For example, an employee has started making their contribution to EPF by November 2018. Now, let us note down some of the important points related to the interest on EPF.

The interest rate which applies to the EPF is 8.65%

Now, the monthly rate of interest can be calculated as 8.65/12=0.7208%

Every month, they are transferring 12% of Rs. 15000= Rs. 1800 towards the Employee Provident Fund Account.

This amount of Rs. 1800 will be transferred into their Employee Provident Fund Account at the end of every month.

#Financial Wellness Platform#Employees Financial Wellness#Financial Stress#Employee Retention Guide#Financial Planning Guide#Financial Wellness Guide

0 notes

Link

What is EPF?

The EPF is an avenue for saving and was introduced under the Employees’ Provident Fund and Miscellaneous Act, 1952. The EPF is managed by a Central Board of Trustees which consists of a representative from the Government, the employers, and the employees. This board of trustees is helped in its work by the Employees Provident Fund Organization (EPFO) which works under the jurisdiction of the Ministry of Labor and Employment. The main objective of the EPF or the Employee Provident Fund is to create a corpus that will be helpful after the retirement of your employees.

EPF is known to enjoy EEE status. EEE status is commonly referred to as exempt-exempt-exempt status of EPF. The contributions made by employees are tax-deductible under Section 80C, the interest that they earn via EPF is also interest-free. And lastly, the maturity benefits of EPF is also tax free. EPF is responsible for promoting savings among salaried individuals. The funds deposited into EPF are contributed by both the employer and the employees regularly. These funds can be used in case of the employees being unable to work or after their retirement.

The Employee Provident Fund (EPF) schemes are administered by mainly three Acts i.e.

Employees’ Provident Fund Scheme, 1952

Employees’ Pension Scheme, 1995

Employees’ Deposit Linked Insurance Scheme, 1976

The Employee Provident Fund is an ideal savings tool by which employees can save a considerable amount from their salary every month. This amount would be of great help to the employees in the future either after retirement or due to being unable to work.

Benefits of Employee Provident Fund

Some of the major benefits and advantages of the Employee Provident fund can be mentioned below.

Under Section 80C of the Income Tax Act, 1961 the contributors to the EPF can avail of the benefits of tax deductions.

According to Section 10(11) and Section 10(12) of the Income Tax Act, 1961 the contribution which has been made by the employer is also eligible for tax exemption.

There is no tax levied on the maturity amount.

The interest which is earned on the savings of EPF is also exempted from Income Tax. EPF also helps its contributors with loans whenever the necessity arises.

EPF Eligibility Criteria

The basic eligibility criteria to become a member of an EPF are mentioned below.

In general, the employees of an organization are directly eligible for obtaining the benefits of Provident Fund, Insurance, and Pension schemes as soon as they join the organization.

As an employer, you must open an EPF account for employees if their basic salary and dearness allowance amounts to less than Rs. 15,000.

For employees who receive a basic salary plus the dearness allowance more than Rs. 15,000, they can also become a member of the EPF. They can do so by getting consent from you and the Assistant Commissioner of PF.

Those organizations which have employee strength of 20 or more than 20 employees are mandated for registration under the EPF scheme. However, those organizations which have employees less than 20 can voluntarily register under the EPF.

The EPF scheme is not applicable for people who are residing in Jammu and Kashmir.

Contributions of employees and employers towards EPF

An employer and employee both make EPF contributions in the form of a particular part of the salary. This contribution is done every month and the contribution rate depends on the basic salary and the dearness allowance of an employee.

We can state the rate of EPF contribution by both employers and employees in the below-mentioned table.

Must know features about EPF Contributions

1. Rate of Contribution:

a) Generally, the rate of contribution by employees is fixed at 12% but for some exceptional cases, the rate of contribution is 10% like: i. Those organizations which have employee strength of a maximum of 19 persons have a contribution rate of 10% ii. Those organizations which have an annual loss which is much more as compared to that of the net value of the organization has a contribution rate of 10% iii. Industries such as coir, guar, beedi, brick, gum, jute, etc. have been allowed for an employee contribution of 10% towards the EPF iv. Some industries which have been declared as sick industries by the BIFR have their rate of employee contribution towards EPF as 10% v. Certain organizations operate under a wage limit of Rs. 6500 and the employees of these organizations can contribute 10% of their salary towards EPF.

b) As said earlier, employers will contribute 12% of the salary into EPF i.e. 12% of Rs. 15,000 which is Rs. 1800. So, both employers and employees will contribute Rs. 1800 in a month towards EPF.

2. Contribution distributiona) For the Employee

The total percentage of salary which is contributed by the employee goes completely into the employee’s provident fund.

b) For the Employer

The 12% contribution which is being made by the employer includes a contribution of 3.67% towards EPF (Employee Provident Fund) and 8.33% towards the EPS (Employee Pension Scheme).

3. Total Employer Contribution

Some contributions are made towards the administration cost to the EDLI and the EPF at the rate of 1.1% and 0.01%. These contributions are also made by the employer. So, the employer contributes to a total of 13.61% of the salary towards the EPF scheme.

We can illustrate the entire procedure of EPF contribution by both employer and employee by an example.

For example, the monthly salary of Mr. Kumar is Rs. 40,000 in a month. Then, the contributions which are made into the EPF can be summarized as below.

1.Contribution by employee=12% of Rs. 40,000=Rs. 4,800 2.Contribution made by employer towards EPF=3.67% of Rs. 40,000=Rs. 1,468 3.Contribution made by employer towards EPS=8.33% of Rs. 40,000=Rs. 3,332 4.Total contribution=Rs. 9600

Hence, a contribution of Rs. 9600 is made from the salary of Mr. Kumar towards EPF.

EPF Applicability

As an employer, you would have to contribute to EPF on the Basic salary along with the DA component. An organization much match the contribution of an employee and an extra 1% contribution towards EDLI (0.5%) and EPF plus EDLI administrative charges (0.5%). Your contribution towards EPF changes slightly depending on the number of employees that you have.

More than 20 employees The employee’s share in such conditions is 12% and as an employer, you must contribute 3.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

Less than 20 employees

The employee’s share in such cases is 10% and as an employer, you must contribute 1.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

How to disburse EPF online?

The procedure involved in the disbursal of the Employee Provident Fund payment by online means consists of the below-mentioned steps.

Employees can file for a pay EPF online claim by visiting the EPFO portal. For a pay EPF online claim, employee’s UAN (Universal Account Number) must be activated. Also, their bank details and the KYC details must be present in the EPFO portal.

It is your responsibility to provide employees with UAN and mention the same in the salary slip. If employees have not received their UAN, they can obtain it from the EPFO portal itself. They can select the tab Know your UAN status. Then they will have to fill in their details and a PIN obtained by employees on their phone number. With this, they can easily obtain their UAN. Even after they have received their UAN, the UAN needs to be activated.

For making their UAN active, employees must visit the ‘For Employees’ in the EPFO portal. Next, they will have to select the option ‘Our Services’ and under ‘Our Services’ and they will have the option of ‘Member UAN/Online Services’. Then, they will be directed towards the UAN portal where they will have to select ‘Activate your UAN’ option. Employees will obtain a PIN on their mobile number and they can use that PIN for the final step. With this, their UAN would be activated and they can apply for the disbursal of EPF online.

The steps that are involved in filing an online claim for the withdrawal of the EPF online are listed below.

First, your employees would have to log in to the EPFO portal with the help of their activated UAN and password.

In the next step, they will have to select the ‘Manage’ tab and verify the KYC details.

Now, they can visit the tab titled ‘Our Services’ and then select the option ‘Claim’.

Then, they will be directed to a section which is titled as ‘I want to apply for’ and choose their required type of approval i.e. full or partial or pension withdrawal.

After the selection of the type of withdrawal, your PF disbursal request will be forwarded to you for approval.

After your approval, employees will obtain their money within 10 days of raising the claim.

#Financial Wellness Platform#Employees Financial Wellness#Financial Stress#Employee Retention Guide#Financial Planning Guide#Financial Wellness Guide

0 notes

Text

Employee Provident Fund

The Employees' Provident Fund came into existence with the promulgation of the Employees' Provident Funds Ordinance on the 15th November, 1951. It was replaced by the Employees' Provident Funds Act, 1952. The Employees' Provident Funds Bill was introduced in the Parliament as Bill Number 15 of the year 1952 as a Bill to provide for the institution of provident funds for employees in factories and other establishments. The Act is now referred as the Employees' Provident Funds & Miscellaneous Provisions Act, 1952 which extends to the whole of India. The Act and Schemes framed there under are administered by a tri-partite Board known as the Central Board of Trustees, Employees' Provident Fund,consisting of representatives of Government (Both Central and State), Employers, and Employees. The Central Board of Trustees administers a contributory provident fund, pension scheme and an insurance scheme for the workforce engaged in the organized sector in India. The Board is assisted by the Employees’ PF Organization (EPFO), consisting of offices at 135 locations across the country. The Organization has a well equipped training set up where officers and employees of the Organization as well as Representatives of the Employers and Employees attend sessions for trainings and seminars.The EPFO is under the administrative control of Ministry of Labour and Employment, Government of India (click here) EPFO Organisation Structure (Annual Report 2015-16) The Board operates three schemes - EPF Scheme 1952, Pension Scheme 1995 (EPS) and Insurance Scheme 1976 (EDLI). APPLICABILITY OF EPF REGISTRATION under EPF is compulsory: For every factory engaged in industry employing 20 or more employeesFor every other establishment having 20 or more employees during previous year.For every employee who is getting less than INR 15000/- per month. CONTRIBUTION Every employee who joins any establishment which is covered under EPF scheme has to mandatorily contribute certain percentage of his salary. These contributions have to be made regularly. The Contribution made by an employee is pooled up in the form of saving or investment which is given to the employee at the time of his retirement or he switches his job. Rate of Contribution for establishment hiring employees 20 or above Employer’s rate of contribution: Employer has to share his contribution at the rate of 12% of Employee’s basic salary plus dearness allowance. Employee’s rate of contribution: Employer has to share his contribution at the rate of 12% of Employee’s basic salary plus dearness allowance. Out of total employer’s contribution, it is further bifurcated into 8.33% which is converted to Employees’ Pension Scheme, and remaining 3.67% is converted into EDLI account. UAN UAN stand for Universal Account Number which is allotted to employees at the time of registering an employee under EPFO portal. This number is allotted by completing the details such as name, father’s name, aadhar number, Date of birth as per aadhar etc. This UAN can be used by an employee throughout whether he changes his service or establishment. EPS Pension Facts Full Pension age 58 yearsEarly Pension age stars from 50 years. There will be 4% reduction for each year before 58 years.Member can apply for pension after retirement or after attaining 58 years, whichever is earlier.If member attains 58 years and don’t have 10 year service, will not be eligible for member pension. He can withdraw pension amount.If member retires before 50 year and have > 10 year service, can apply for Scheme Certificate. This can submit after attaining 50 year and will get pension.Out of 3 Schemes of EPFO (EPS, EPF & EDLI), only EPS has retirement age, 58 years.If Member continues working after 58 years, please stop 8.33% pension payment towards EPS (A/c No. 10) and remit the same under EPF (A/c No.1 Employer’s share - ie. 3.67+8.33 = 12%).(EPF & EDLI must be paid till permanent retirement) Read the full article

0 notes

Link

EPF is otherwise known as the Employee’s Provident Fund and is a retirement plan available for salaried individuals. This retirement scheme will help your employees to save a portion of their salary every month.

What is EPF?

Benefits of EPF

EPF eligibility criteria

Contributions of employees and employers towards EPF

Must Know features about EPF Contributions

EPF Applicability

How to disburse EPF online?

EPF Withdrawal Rules

Interest rates on EPF

How to claim EPF? Which EPF claim forms to use?

UMANG App

Limitations of EPF

Employee Provident Fund Organization (EPFO) Contact Details

What is EPF?

The EPF is an avenue for saving and was introduced under the Employees’ Provident Fund and Miscellaneous Act, 1952. The EPF is managed by a Central Board of Trustees which consists of a representative from the Government, the employers, and the employees. This board of trustees is helped in its work by the Employees Provident Fund Organization (EPFO) which works under the jurisdiction of the Ministry of Labor and Employment. The main objective of the EPF or the Employee Provident Fund is to create a corpus that will be helpful after the retirement of your employees.

EPF is known to enjoy EEE status. EEE status is commonly referred to as exempt-exempt-exempt status of EPF. The contributions made by employees are tax-deductible under Section 80C, the interest that they earn via EPF is also interest-free. And lastly, the maturity benefits of EPF is also tax free. EPF is responsible for promoting savings among salaried individuals. The funds deposited into EPF are contributed by both the employer and the employees regularly. These funds can be used in case of the employees being unable to work or after their retirement.

The Employee Provident Fund (EPF) schemes are administered by mainly three Acts i.e.

Employees’ Provident Fund Scheme, 1952

Employees’ Pension Scheme, 1995

Employees’ Deposit Linked Insurance Scheme, 1976

The Employee Provident Fund is an ideal savings tool by which employees can save a considerable amount from their salary every month. This amount would be of great help to the employees in the future either after retirement or due to being unable to work.

Benefits of Employee Provident Fund

Some of the major benefits and advantages of the Employee Provident fund can be mentioned below.

Under Section 80C of the Income Tax Act, 1961 the contributors to the EPF can avail of the benefits of tax deductions.

According to Section 10(11) and Section 10(12) of the Income Tax Act, 1961 the contribution which has been made by the employer is also eligible for tax exemption.

There is no tax levied on the maturity amount.

The interest which is earned on the savings of EPF is also exempted from Income Tax. EPF also helps its contributors with loans whenever the necessity arises.

EPF Eligibility Criteria

The basic eligibility criteria to become a member of an EPF are mentioned below.

In general, the employees of an organization are directly eligible for obtaining the benefits of Provident Fund, Insurance, and Pension schemes as soon as they join the organization.

As an employer, you must open an EPF account for employees if their basic salary and dearness allowance amounts to less than Rs. 15,000.

For employees who receive a basic salary plus the dearness allowance more than Rs. 15,000, they can also become a member of the EPF. They can do so by getting consent from you and the Assistant Commissioner of PF.

Those organizations which have employee strength of 20 or more than 20 employees are mandated for registration under the EPF scheme. However, those organizations which have employees less than 20 can voluntarily register under the EPF.

The EPF scheme is not applicable for people who are residing in Jammu and Kashmir.

Contributions of employees and employers towards EPF

An employer and employee both make EPF contributions in the form of a particular part of the salary. This contribution is done every month and the contribution rate depends on the basic salary and the dearness allowance of an employee.

We can state the rate of EPF contribution by both employers and employees in the below-mentioned table.

Must know features about EPF Contributions

1. Rate of Contribution:

a) Generally, the rate of contribution by employees is fixed at 12% but for some exceptional cases, the rate of contribution is 10% like: i. Those organizations which have employee strength of a maximum of 19 persons have a contribution rate of 10% ii. Those organizations which have an annual loss which is much more as compared to that of the net value of the organization has a contribution rate of 10% iii. Industries such as coir, guar, beedi, brick, gum, jute, etc. have been allowed for an employee contribution of 10% towards the EPF iv. Some industries which have been declared as sick industries by the BIFR have their rate of employee contribution towards EPF as 10% v. Certain organizations operate under a wage limit of Rs. 6500 and the employees of these organizations can contribute 10% of their salary towards EPF.

b) As said earlier, employers will contribute 12% of the salary into EPF i.e. 12% of Rs. 15,000 which is Rs. 1800. So, both employers and employees will contribute Rs. 1800 in a month towards EPF.

2. Contribution distributiona) For the Employee

The total percentage of salary which is contributed by the employee goes completely into the employee’s provident fund.

b) For the Employer

The 12% contribution which is being made by the employer includes a contribution of 3.67% towards EPF (Employee Provident Fund) and 8.33% towards the EPS (Employee Pension Scheme).

3. Total Employer Contribution

Some contributions are made towards the administration cost to the EDLI and the EPF at the rate of 1.1% and 0.01%. These contributions are also made by the employer. So, the employer contributes to a total of 13.61% of the salary towards the EPF scheme.

We can illustrate the entire procedure of EPF contribution by both employer and employee by an example.

For example, the monthly salary of Mr. Kumar is Rs. 40,000 in a month. Then, the contributions which are made into the EPF can be summarized as below.

1.Contribution by employee=12% of Rs. 40,000=Rs. 4,800 2.Contribution made by employer towards EPF=3.67% of Rs. 40,000=Rs. 1,468 3.Contribution made by employer towards EPS=8.33% of Rs. 40,000=Rs. 3,332 4.Total contribution=Rs. 9600

Hence, a contribution of Rs. 9600 is made from the salary of Mr. Kumar towards EPF.

EPF Applicability

As an employer, you would have to contribute to EPF on the Basic salary along with the DA component. An organization much match the contribution of an employee and an extra 1% contribution towards EDLI (0.5%) and EPF plus EDLI administrative charges (0.5%). Your contribution towards EPF changes slightly depending on the number of employees that you have.

More than 20 employees The employee’s share in such conditions is 12% and as an employer, you must contribute 3.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

Less than 20 employees

The employee’s share in such cases is 10% and as an employer, you must contribute 1.67% as EPF, 8.33% as EPS, 0.5% as EDLI and 0.5% as EPF+EDLI administrative charges.

How to disburse EPF online?

The procedure involved in the disbursal of the Employee Provident Fund payment by online means consists of the below-mentioned steps.

Employees can file for a pay EPF online claim by visiting the EPFO portal. For a pay EPF online claim, employee’s UAN (Universal Account Number) must be activated. Also, their bank details and the KYC details must be present in the EPFO portal.

It is your responsibility to provide employees with UAN and mention the same in the salary slip. If employees have not received their UAN, they can obtain it from the EPFO portal itself. They can select the tab Know your UAN status. Then they will have to fill in their details and a PIN obtained by employees on their phone number. With this, they can easily obtain their UAN. Even after they have received their UAN, the UAN needs to be activated.

For making their UAN active, employees must visit the ‘For Employees’ in the EPFO portal. Next, they will have to select the option ‘Our Services’ and under ‘Our Services’ and they will have the option of ‘Member UAN/Online Services’. Then, they will be directed towards the UAN portal where they will have to select ‘Activate your UAN’ option. Employees will obtain a PIN on their mobile number and they can use that PIN for the final step. With this, their UAN would be activated and they can apply for the disbursal of EPF online.

The steps that are involved in filing an online claim for the withdrawal of the EPF online are listed below.

First, your employees would have to log in to the EPFO portal with the help of their activated UAN and password.

In the next step, they will have to select the ‘Manage’ tab and verify the KYC details.

Now, they can visit the tab titled ‘Our Services’ and then select the option ‘Claim’.

Then, they will be directed to a section which is titled as ‘I want to apply for’ and choose their required type of approval i.e. full or partial or pension withdrawal.

After the selection of the type of withdrawal, your PF disbursal request will be forwarded to you for approval.

After your approval, employees will obtain their money within 10 days of raising the claim.

EPF withdrawal rules

Your employees can choose to withdraw their EPF contributions under certain conditions while adhering to some rules. Here are some of them.

1. Home Loan

Employees can choose to withdraw up to 90% of their contributions to pay off home loans. They must complete at least three years of service to avail the same.

2. Unemployment

If an employee remains unemployed for more than a month, they can withdraw up to 75% of their EPF.

3. Wedding

Employees can withdraw up to 50% of their EPF funds for their marriage, provided they have completed 7 years of service.

The current rules allow employees to withdraw their EPF if they do not have a job after two months of the completion of the previous job. And to avail of this benefit, the subscriber must have worked for at least 10 years.

A recent modification of the rules offers more flexibility for employees. Employees can now withdraw up to 75% of their EPF fund value if they do not have a job for more than a month. This change was introduced to help employees take care of their financial needs at such times.

You may also read: Employee loans – The complete guide

Interest rates on EPF

The interest rate on EPF for the financial year 2018-19 is 8.65%. It has been raised from 8.55% which was the interest rate in the year 2017-18. The fund which is accumulated in the Provident Fund Account is capable of attracting some interest which is completely exempted from tax.

The entire interest which is earned is transferred to EPF Account of employees and this is calculated based on the rate of interest that has been determined by the Government of India along with the Central Board of Trustees.

Let us understand some important aspects related to the interest rate on EPF.

The rate of interest i.e. 8.65 is valid for those EPF deposits which are being made in the financial year of April 2018 to March 2019.

The interest is transferred to the employee’s EPF account once in a year i.e. on 31st March of the current financial year.

For further calculation of interest, the interest which has been transferred to the employee’s EPF Account is summed up with the next month’s balance i.e. the balance of April.

For the inoperative accounts of non-retired employees, interest is offered.

For the inoperative accounts of retired employees, interest is not being offered.

The inoperative accounts earn interest and this interest is taxable under the current income tax slab.

When you contribute to the Employee Pension Scheme (EPS), employees will not be obtaining any interest. But they are eligible to obtain a pension of that specified amount after the age of 58 years.

For EPF, the interest is calculated monthly whereas the interest rate is announced every year. The interest rate can be calculated by division of the interest rate in a year by 12. By this, the interest amount which has to be given to you in a month is derived.

Understand with an example:

Let us consider an example to illustrate the entire concept of interest rates on the Employee Provident Fund. For example, an employee has started making their contribution to EPF by November 2018. Now, let us note down some of the important points related to the interest on EPF.

The interest rate which applies to the EPF is 8.65%

Now, the monthly rate of interest can be calculated as 8.65/12=0.7208%

Every month, they are transferring 12% of Rs. 15000= Rs. 1800 towards the Employee Provident Fund Account.

This amount of Rs. 1800 will be transferred into their Employee Provident Fund Account at the end of every month.

Calculation

Now, the contribution made by you is also Rs. 1800 which is divided into

3.67% is contributed towards the employee’s EPF Account

8.33% is contributed towards the employee’s EPS Account

The total contribution made towards EPF Account is Rs. 1800 +3.67% of Rs. 1800=Rs. 1800 + Rs. 50=Rs. 2350

So, now the balance which has been carried forward from November 2018= Rs. 2350 The interest which is earned for December 2018=0.7208% of Rs. 2350= Rs. 16.938 Balance at the end of the month December 2018= Rs. 2350 + Rs. 2350=Rs. 4700

How to claim EPF ? Which EPF claim forms to use?

An EPF Form is necessary for performing any activity on the EPF Account. These activities can consist of

Registration for opening an EPF Account

Withdrawal from the EPF Account

Availing a loan against the EPF Account

Transfer of the Employee Provident Fund

There are several EPF Claim forms available and some of them can be listed below.

UMANG App

The government of India has introduced the UMANG app as a unified platform to access various government-based services. The app offers several e-governance services that you can access and avail of. You can use the app to file income taxes, apply for Aadhar, clarify your queries related to provident fund and avail several central governments, state government or local bodies services.

Limitations of EPF

There is no doubt that EPF is a great tool for saving for the future for your employees. However, it has its limitations as well. For example, irrespective of the contributions one cannot reach the magical number of INR 1 crore. Since it allows employees to withdraw funds, a lot of them choose to do so while changing their jobs. Thus, getting back to square one. Also, if you withdraw your EPF before the completion of five years, you must pay taxes on them as well.

Employee Provident Fund Organization (EPFO) Contact Details

In case of any details needed or doubts you can easily contact the Customer Support Cell of EPFO. The Helpdesk number which can be contacted for queries is 1800118005. Visit the EPFO website for more details.

Moreover, the official address of EPFO for contact is: Bhavishya Nidhi Bhawan, 14, Bhikalji Cama Place, New Delhi-110066

0 notes

Text

What is Aadhar – UID?

A billion people possess an Aadhar card. The majority of them still do not know everything about it or have misconceptions. This article covers everything you need to know about the Aadhar card.

So what is an Aadhar card?

UIDAI or Aadhar Card is a principal identification number issued by the Unique Identification Authority of India (UIDAI) on behalf of the Indian Government. The main objective of Aadhar is to establish a unique identity of every citizen. It acts as a proof of identity and address, and not of citizenship.

The card has 12-digit unique number issued to people on verification. Any individual, who is a resident of India, may voluntarily enroll to acquire an Aadhar card.

According to the official UIDAI website, “The Aadhaar identity platform is one of the key pillars of the ‘Digital India’, wherein every resident of the country is provided with a unique identity.”

Why was the Aadhaar card introduced in India?`

In several countries such as Argentina, Belgium, Colombia, Germany, Italy, Peru, and Spain etc., national identification systems have been implemented. While these schemes differ by country, generally people are assigned an ID number, which is used for a wide range of identification purposes. Storing data in a centralized database. These databases are helpful in increasing the efficiency of administration.

The electoral identity card, income-tax PAN card, passport, ration card, driving license, etc., verify identity in India. They can’t handle India’s large population. The aadhar card was introduced in 2010 by the then PM Dr Manmohan Singh.

The card is used as a nationally acceptable identity card and can be linked with bank accounts, insurance, and pension.

What are the benefits of Aadhar Card?

According to the former UIDAI chairman, Nandan Nilekani, Aadhaar Card has helped save Indian government about USD 9 billion. Implementation of Unique Aadhar Number has resulted in reduced frauds. Eliminated fake duplicate beneficiaries from the employee list.

The use of bio metrics gives a unique identity to every individual in India.

The Aadhar card reduces the number of documents required as opposed to previous method of multiple document requirement.

Aadhar is used as the main document to open a bank account in Prime Minister’s ‘Jhan Dhan Yojana,’ scheme.

Aadhar card allows the holder to avail all the government subsidies that they are eligible for.

It ordinarily takes several weeks for a person to complete all processes and avail a passport. An Aadhar Card fastens the process of acquiring passport. People can apply online and attach the soft copy of their Aadhar Card which serves as both, the residence and identity proof.

The ‘Jeevan Pramaan for Pensioners’ scheme aims to eliminate the need for pensioners to be physically present to receive a pension. People can receive pension directly to their bank accounts. The agency can digitally access their details through Aadhar Card number.

People who link their Aadhar card with their Pension Account can have their provident fund disbursed directly to their accounts via their PF organization.

Individuals can also link the Aadhaar number to their LPG ID and avail the LPG subsidy directly in their respective bank accounts.

What was the supreme court ruling in 2018 about Aadhaar card?

In September 2018, the supreme court revoked several provisions of the Aadhaar card which could violate the privacy of Indian citizens.

The Supreme Court ruled that Aadhaar Act does not violate your right to privacy when you agree to share biometric data.

Private companies can’t use Aadhar card for KYC authentication purposes.

Most commercial banks, payments bank and e-wallet companies like Paytm, previously used to request customers to get their KYC (Know Your Customer) done using Aadhar Card. Any delay or failure to comply would result in blocking of services. After the ruling, they cannot seek Aadhar data. Customers have to comply with other KYC Criteria. Authentication of Aadhaar is not required for Account settings.

To buy a new SIM card, you no longer need to provide your Aadhaar details to the telecom service provider. You can easily provide other KYC documents like Voter ID card, driving license, etc to acquire a new SIM card.

Students of CBSE, NEET, UGC also do not need Aadhaar card to appear in examinations. Even schools cannot demand the Aadhar card for admissions.

Aadhar card is mandatory to avail facilities of welfare schemes and subsidies but the Supreme Court has made an exemption for children, stating that no minor can be denied benefits of any scheme if they do not have Aadhaar card.

Where do you need Aadhaar compulsorily?

As mentioned above, the supreme court ruled that private companies cannot demand Aadhaar card details. But the judgement also states some areas where the Aadhaar card is mandatory.

PAN card: Under the section 139AA of the Income Tax Act, the linking of Aadhaar card with PAN card is mandatory. Tax evaders generally used to create multiple PAN cards to avoid income tax. By linking Aadhaar with PAN, multiple PAN cards become invalid.

Filing income tax returns (ITR): As Aadhaar-PAN linking is necessary, you will require the same for filing income tax returns.

Welfare schemes: Aadhaar is mandatory to avail benefits under various government-run social welfare schemes and subsidies.

Why you should register your mobile with Aadhaar?

There are various reasons for registering your mobile number with the Aadhar card. Use OTP through registered mobile number to avail facilities. This OTP gives the Aadhaar card an added layer of security. Register your mobile number with Aadhaar in simple and easy ways. Enjoy its facilities and benefits.

You can also download the mAadhaar app and carry your Aadhaar card on your phone once you have your mobile number registered with your Aadhaar.

Fee for Registering Your Mobile Number in Aadhaar

People have to pay a fee of 25 INR to take advantage of the service when they visit the Aadhaar Enrollment Center for either registering or updating their mobile number.

They will have to pay an additional 25 INR every time they update their mobile number. No fees for updating other details.

Documents Required to Register Your Mobile Number in Aadhaar.

Candidates do not have to submit any document for updating or registering their mobile number in Aadhaar. Only the Aadhaar update Form, that contains their current mobile number, has to be submitted along with the fee.

What is the password for e-aadhaar?

Aadhar Card is a unique ID. Used in financial and non-financial activities across India. e aadhar is advisable to download PDF format E-Aadhar from the UIDAI official website along with a . If you update your details on the Aadhaar card and do not receive the updated card, download the PDF of the Aadhar card after you receive an SMS notifying you about the completion of the update.

Process of getting E Aadhar:

Go to https://eaadhaar.uidai.gov.in/ and then enter your Aadhaar number.

Receive an OTP on the number mentioned on your card.

Get access to download your Aadhar card on entering OTP.

Click and download it on your device. Since it is a PDF file, you can open it using your PDF reader, for example, Adobe Reader. You can also download the pdf version of the Aadhar card from your mobile phone using the UIDAI official Aadhaar app.

To open the PDF, you will require a password without which you cannot access the file. The password ensures that your Aadhaar details are secure so that your E-aadhar card cannot be used by an unknown individual.

The password is an 8 letter which is a combination of the first four letters of your name and your year of birth. For e.g. Suppose your name is RAMESH SINGH and your year of birth is 1976, then your password is RAME1979.

0 notes

Link