#SeniorCitizenSavingsScheme

Explore tagged Tumblr posts

Text

Senior Citizen Savings Scheme (SCSS): Why You Should Invest In It .

As individuals approach retirement, the importance of sound financial planning becomes paramount. Ensuring a steady source of income during the golden years is essential to maintain a comfortable lifestyle without financial stress. One of the most reliable and government-backed options available for senior citizens in India is the Senior Citizen Savings Scheme (SCSS).

The SCSS is designed exclusively for citizens aged 60 and above, providing them with a safe investment avenue that offers a combination of attractive interest rates and tax benefits. Whether you’re planning for your retirement or have recently retired, understanding the nuances of this scheme and how it can benefit you will help you make a more informed decision.

What is the Senior Citizen Savings Scheme (SCSS)?

The Senior Citizen Savings Scheme is a government-backed savings instrument introduced in 2004. It primarily aims to offer retirees a safe, stable, and regular source of income, which is crucial after the cessation of a regular salary. This scheme is available at post offices and designated nationalized banks across India.

Key Features of SCSS

1. Eligibility

Individuals aged 60 years or above can open an SCSS account.

Early retirees between 55-60 years, who have opted for voluntary retirement or superannuation, can also invest, provided they open the account within one month of receiving retirement benefits.

2. Investment Amount

The minimum investment required is ₹1,000.

The maximum permissible investment is ₹30 lakhs (from April 2023). Previously, the limit was ���15 lakhs. This increased limit allows senior citizens to park a more significant portion of their retirement corpus in this safe instrument.

3. Tenure of the Scheme

The SCSS has a tenure of 5 years, which can be further extended by an additional 3 years upon maturity.

During the extension, you continue to earn interest at the prevailing rate at the time of extension.

4. Interest Rates

SCSS offers an attractive interest rate, which is reviewed and decided by the government quarterly. As of 2023, the interest rate stands at 8.2% per annum, which is higher than most fixed deposits or savings accounts.

The interest is compounded quarterly and paid out every quarter, providing a regular source of income for senior citizens.

5. Premature Withdrawal

Premature withdrawals are allowed but come with penalties. If you withdraw after one year but before two years, a 1.5% penalty is levied. After two years, the penalty reduces to 1%.

6. Nomination Facility

SCSS allows you to nominate a beneficiary at the time of opening the account or afterward. This ensures that in case of the unfortunate demise of the account holder, the investment is passed on smoothly to the nominee.

7. Tax Benefits

The investment in SCSS is eligible for a tax deduction of up to ₹1.5 lakh under Section 80C of the Income Tax Act.

However, the interest earned is taxable, and TDS (Tax Deducted at Source) is applicable if the interest exceeds ₹50,000 in a financial year.

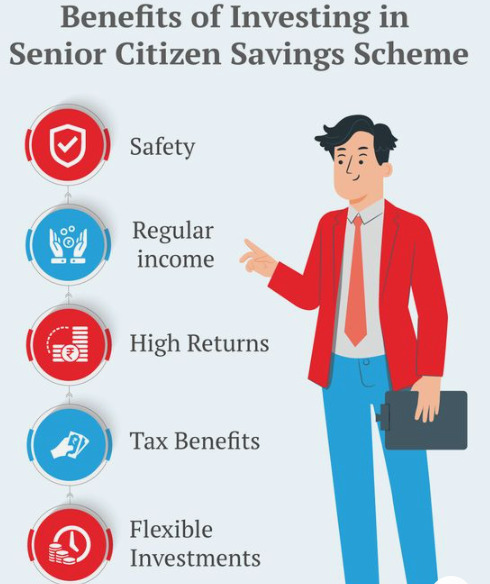

Why Should You Invest in SCSS?

1. Safety and Reliability

One of the primary concerns for any retiree is the safety of their investment. The SCSS is a government-backed scheme, which makes it one of the safest investment options available for senior citizens. Unlike market-linked instruments, SCSS offers guaranteed returns, insulating investors from market volatility. For risk-averse retirees, this feature is particularly attractive.

2. Regular Income

Post-retirement, most individuals lose the steady monthly income that their salary provided. SCSS is designed to address this issue by offering quarterly interest payouts. These payouts can act as a regular source of income to cover daily expenses, medical bills, or leisure activities.

3. Attractive Interest Rates

With an interest rate of 8.2% per annum (as of 2023), SCSS offers a far superior return compared to regular savings accounts or even many fixed deposits. While bank interest rates fluctuate, SCSS offers a more consistent and attractive return, making it an ideal choice for those looking for secure yet rewarding investment options.

4. Tax Benefits

Investing in SCSS allows you to claim deductions under Section 80C up to ₹1.5 lakh. For senior citizens looking to optimize their tax outgo while securing their future, this dual benefit of safety and tax saving is hard to ignore.

5. Flexibility of Withdrawal

Life after retirement can sometimes bring unexpected expenses, be it medical emergencies or personal needs. The SCSS allows for premature withdrawals with nominal penalties, offering flexibility if you need funds before the completion of the scheme’s tenure.

6. Option to Extend

While the initial tenure of the SCSS is five years, the scheme can be extended for an additional three years. This flexibility ensures that if you do not require the funds immediately, you can continue earning interest on your investment for a longer period without any hassles.

7. Higher Investment Cap

With the government increasing the maximum investment limit to ₹30 lakhs, senior citizens now have the opportunity to invest a larger portion of their savings into this secure instrument. This is particularly beneficial for those with substantial retirement funds who are looking for a safe place to invest.

SCSS vs. Other Investment Options

When compared to other investment avenues such as fixed deposits (FDs), mutual funds, and bonds, the SCSS stands out for its balance between safety, returns, and tax benefits.

Fixed Deposits: While FDs are relatively safe, they generally offer lower interest rates compared to SCSS. Additionally, FD interest is taxable, and the regular payouts are often not as frequent.

Mutual Funds: These are market-linked instruments, making them more volatile. While they offer potentially higher returns, they also come with higher risks, which may not be suitable for senior citizens seeking stable and predictable income.

Bonds: Government bonds are safe but often have lower yields compared to SCSS. Also, bonds usually don’t offer regular payouts like SCSS, which can be a disadvantage for those who rely on periodic income.

How to Open an SCSS Account?

Opening an SCSS account is a simple and straightforward process. Here’s how you can do it:

Visit a Post Office or Designated Bank: You can open the SCSS account at any post office or a designated bank like the State Bank of India (SBI), ICICI Bank, HDFC Bank, etc.

Fill in the Application Form: You will need to fill out the SCSS application form available at the bank or post office.

Submit Required Documents:

Age proof (Aadhaar Card, Passport, Voter ID, etc.)

Proof of retirement (if applicable)

PAN card

Photographs

Deposit the Investment: Deposit the amount you wish to invest (minimum ₹1,000 and up to ₹30 lakhs). The deposit can be made through cash or cheque.

Nomination: Provide the details of the nominee at the time of account opening.

Once your account is opened, you will start earning interest from the date of the deposit, and the first interest payout will occur after the end of the first quarter.

Conclusion

The Senior Citizen Savings Scheme (SCSS) is an excellent investment option for retirees looking for a safe, stable, and profitable way to grow their savings. With its government backing, attractive interest rates, and regular payouts, SCSS provides financial security during the post-retirement phase. Coupled with tax benefits under Section 80C, SCSS stands as one of the most efficient savings instruments for senior citizens.

For individuals nearing or already in their retirement, investing in SCSS is a smart choice that balances safety, income generation, and tax savings. With the ever-rising cost of living and healthcare expenses, securing a stable source of income becomes essential, and SCSS can be a cornerstone in that financial strategy.

#SeniorCitizenSavingsScheme#SCSS#RetirementPlanning#SafeInvestments#FinancialSecurity#RetirementFunds#SeniorCitizenFinance#InvestInYourFuture#FinancialPlanning#SecureInvestments

0 notes

Link

0 notes

Link

Portfolio Management Services (PMS), is a customised portfolio service consisting a basket of securities such as stocks, bonds, fixed income, cash & structured products or other individual securities. These portfolios are created and managed by an expert who hand-picks securities that are suitable for meeting respective investor’s financial goals. Unlike mutual funds, here, the investor invests in individual securities and not in the pool of funds. This investment avenue is most suitable for investors who are looking for customised investment portfolio management and personalised professional service/assistance. Those who are willing to spread their capital and risk across different asset classes can also invest in PMS. There are several advantages of getting the portfolio managed by a professional as the fund manager works on mitigating the portfolio risk and generating wealth in the long term at the same time. He regularly monitors the entire portfolio and makes changes in the portfolio to optimise returns.

Address: 28/A 3rd, Main Road, AECS Layout, RMS Colony, Sanjaynagar, Bangalore-560094

Call Us: 080-47096394

E-mail: [email protected]

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes