#InterestIncome

Explore tagged Tumblr posts

Text

Understanding Seller Financing: Benefits and Risks for Home Sellers

The Pros and Cons of Financing the Buyer When Selling Your Home When you decide to sell your home, the typical route is for buyers to secure financing through a mortgage lender. But what happens if a buyer struggles to get that loan? That’s where seller financing—also known as owner financing—comes into play. This arrangement can be beneficial for both the seller and the buyer. Yet, it does come…

#FinanceTips#HomeBuyingOptions#HomeSaleStrategies#HomeSelling#InterestIncome#MortgageAlternatives#OwnerFinancing#PropertyMarket#PropertySales#RealEstateAdvice#RealEstateInvesting#RealEstateLaw#RealEstateTips#RealEstateTransactions#SellerFinancing

0 notes

Text

#Form1099G#Form1099INT#TaxFAQs#TaxForms#TaxRefunds#UnemploymentTaxes#InterestIncome#IRSForms#TaxSeason#TaxHelp

0 notes

Text

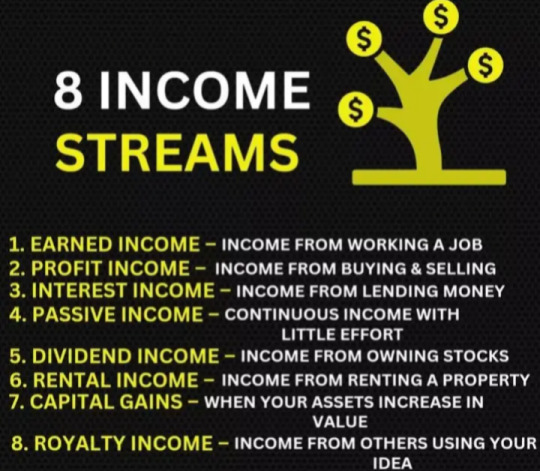

#newdaynewopportunities#successmindset#money#incomestreams#capitalgains#dividends#interestincome#profitincome#earnedincome#rentalincome#royaltyincome#businessowner#letsgo#getitdone#growth#potd#Tumblr

0 notes

Text

Nepal's microfinance landscape witnessed... #businessadaptation #Businesschallenges #Businessgrowth #Businessoperations #Businessstrategy #decline #due #economicanalysis #economicdownturn #economicindicators #feeandcommission #financialfoundation #financiallandscape #Financialoutlook #FinancialPerformance #Financialplanning #financialreport #Financialresilience #financialsetback #FinancialStability #Financialsustainability #financialtrends #fiscalmanagement #Fiscalreport #fiscalyear #income #Incurs #interest #interestincome #Laghubitta #loandisbursement #loanextension #loanmanagement #loanportfolio #loss #marketchallenges #marketchanges #marketconditions #marketdynamics #marketfluctuations #Microfinancesector #Nepalmicrofinance #nepalimarket #nepalimicrofinancecompany #netloss #netprofit #NMB #NMBLaghubitta #operatingincome #operatingloss #reservefund #Revenuegeneration

0 notes

Photo

......................................................... For more such content Follow 👉@millionaireworld._ 👉@millionaireworld._ 👉@millionaireworld._ ......................................................... #invest #bitcoins #assets #liability #investtobuildwealth #bankaccount #laugh #dreamitanddoit #millionairequotes #changinglivestogether #successquotes #businesstips #businessmotivation #entrepreneurmotivation #believe2success #earnedincome #profitincome #interestincome #royaltyincome #dividendincome #rentalincome #capitalgains #residualincome #rich #famousperson (at Las Vegas, Nevada) https://www.instagram.com/p/CQOqvKxjObl/?utm_medium=tumblr

#invest#bitcoins#assets#liability#investtobuildwealth#bankaccount#laugh#dreamitanddoit#millionairequotes#changinglivestogether#successquotes#businesstips#businessmotivation#entrepreneurmotivation#believe2success#earnedincome#profitincome#interestincome#royaltyincome#dividendincome#rentalincome#capitalgains#residualincome#rich#famousperson

1 note

·

View note

Photo

Get Monthly Income 💸 plus Capital Growth💰by investing in Hybrid Equity📊 Fund along with *“SWP”* - Systematic Withdrawal Plan 🗳 You can start SWP at any point of time, after 1 yr or when needed or at the time of Retirement 🏖 (Chk above 🎯 comparison 🔎between FDs, Rent & SWP) #swplan #swp #withdrawals #cashflow #monthlyincome #monthlyincomeplan #interestincome #fd #interestrates #rent #fixeddeposit #bank #bankdeposit https://www.instagram.com/p/Ccpg7V0sVPS/?igshid=NGJjMDIxMWI=

#swplan#swp#withdrawals#cashflow#monthlyincome#monthlyincomeplan#interestincome#fd#interestrates#rent#fixeddeposit#bank#bankdeposit

0 notes

Photo

What are some advantages of Municipal Bonds?

You pay zero federal tax on municipal bond investment income. This makes municipal bonds more attractive than many comparable taxable investments.

A municipal bond paying 6 percent to an investor in the 24 percent tax bracket is actually a better investment than a taxable bond paying interest at 7.9 percent, due to the federal income tax break.

Call us today to learn more about how this affects your year end goals at (619) 213-1303.

www.tanishamillscpa.com

#Bonds#MunicipalBonds#TaxBreak#TaxFree#TaxSavings#CPA#Accountant#Accounting#InterestIncome#Interest#BondFunds#Investing#TaxBreakInvestments#NeedToKnow#Securities#SanDiegoCPA#SanDiego

0 notes

Link

0 notes

Link

0 notes

Photo

LIFE INSURANCE PROCEEDS: Life insurance proceeds paid upon the death of an insured are not taxable unless the policy was turned over for a price. This is true even if the proceeds were paid under an accident or health insurance policy or an endowment contract. However, interest income received as a result of life insurance proceeds may be taxable. If death benefits are paid in a lump sum or other than at regular intervals, include in income only the amount of benefits that are more than the amount payable at the time of the insured person’s death. If the benefit payable at the death is not specifically, include in income the benefit payment that are more than the present value of the payments at the time of death. Note: if insurance proceeds are paid because of the death of a spouse before October 23, 1986, and those payments are received in installments, exclude up to $1,000 a year of the interest included in the installments, even if the taxpayer remarries. When the other advisors stop. We start. Free consultation: 800-558-6821 #stephensbrostaxservice #lumpsumpayment #lifeinsurance @hollywoodplay #riphollywoodplay #installmentpayment #insurance #brooklyn #brookynbridge #hollywood #contract #taxable #nontaxable #interestincome #health #policy (at Tavern Lounge) https://www.instagram.com/p/BpsJswrnn_e/?utm_source=ig_tumblr_share&igshid=1cqmva2jqc50u

#stephensbrostaxservice#lumpsumpayment#lifeinsurance#riphollywoodplay#installmentpayment#insurance#brooklyn#brookynbridge#hollywood#contract#taxable#nontaxable#interestincome#health#policy

0 notes

Photo

#hustlesoldseparately #Repost @chefjefflive ・・・ #fact ・・・ #vibewise: #IWILLNOTBEDENIED #THEAMERICANDREAM! I'll sacrifice late nights and early mornings, to get #closertomydreams. I need #earnedincome, #profitincome, #residualincome, #interestincome, and everything in between. I'm talking #capitalgains and #multipleincomestreams. Peace to the credo of #DOFORSELF... YOU CAN'T LEARN HUSTLE But you can practice #groupeconomics and germinate #BLACKWEALTH. When the Black Man spends his bands with Black Man, My bands touch his hands, Then touch his hands, That's how we teach unity and keep the money in the Black Community. #mypoemsarenotpoems, I'm tryna rebuild a nation But the congregation keep preaching integration; Meanwhile everyone's profiting off the Black Community except the Black Community. -Stevie #blackdollarsmatter #poem https://www.instagram.com/p/BnDrCD7DuWI/?utm_source=ig_tumblr_share&igshid=fbu2z50msnmk

#hustlesoldseparately#repost#fact#vibewise#iwillnotbedenied#theamericandream#closertomydreams#earnedincome#profitincome#residualincome#interestincome#capitalgains#multipleincomestreams#doforself#groupeconomics#blackwealth#mypoemsarenotpoems#blackdollarsmatter#poem

0 notes

Text

Beware! The Government Is Eyeing Your Interest Income

People investing in fixed deposits——-including a vast majority of senior citizens——are worried aboutearning a lower interest on their deposits, and also because the incidence of tax has been eroding their interest earnings severely. So what’s the remedy? They simply don’t report or underreport their interest income, which isn’t the right solution though. It’s a reflection of their belief in some myths that can prove dangerous for them. Are you under the wrong impression too? Myth 1: I am a small fish for the tax department, and my interest income will not catch the taxman’s attention; so I can afford to conceal it and miss the tax thereon. Fact: At the time of making a fixed deposit, you have to submit your PAN details. As the PAN is mapped against all your deposits; you cannot get away by concealing any income activity. Income-Tax (I-T) Departmentwill call your bluff, and you will have nothing going in your favour. Myth 2: I don’t have to pay tax on my interest income as it’s been already deducted in the form of TDS (Tax Deducted at Source). Fact: Banks, Non-Banking Financial Company (NBFCs), or other entities accepting deposits deduct tax only at 10% of the interest due to you. If you fall in the higher tax slab, you have to pay the balance tax from your pocket. Myth 3: I can submit the form 15G/15H with the bank and other institutions where I have fixed deposits, as I am paying tax at the end of the Financial Year. TDS is a freebie awarded to the Government. Why should I do such charity? Fact: You have to satisfy certain conditions before you can claim relaxation from the TDS provisions. Please note, whenever your interest income from fixed or recurring deposits exceeds Rs 10,000 in a financial year, provisions of TDS are applicable. However, the tax laws have offered some concessions. You should submit Form 15G if

Your net taxable income doesn’t exceed the basic exemption limit of Rs 2.5 lakh.

Your total interest income including the interest income exempt from tax, e.g. interest on PPF and tax-free bonds, doesn’t exceed Rs 2.5 lakh.

And Form 15H if You are a senior citizen, and your net taxable income doesn’t exceed Rs 3 lakh, you can submit Form 15H. The limit is further extended to Rs 5 lakh in case of very senior citizens—those above 80. But submitting 15G and 15H, when you don’t fulfil the set criteria, can land you in trouble. When you submit 15G or 15H to a bank or anyone paying you interest; you won’t be questioned by that entity/person. However, as per the reporting mechanism, they will intimate the I-T Department about your submission of the 15G/15H form. You will face real trouble when the information about your interest income from all sources will be clubbed under Form 26AS.

What’s 26AS?

Besides offering details of advanced tax you have paid, Form 26AS gives you a consolidated account of your income and TDS in a given Financial Year. It also contains details about tax paid to the Government by a person/entity deducting your tax. It offers information on tax refunds as well. It can be obtained from the website of the I-T Department and is updated on quarterly basis.

Myth 4: You can give a monetary gift to your spouse and to the minor children. Since this doesn’t attract any gift tax, income earned or accrued on gifted money won’t be counted as the receiver’s income. Fact Although gifting money to your dependent spouse or minor children isn’t taxable; provisions of clubbing the income still apply on the interest earned or accrued on deposits made on the money. In the case of children, there’s an exemption of income of upto Rs 1,500 per children, upto two children. Nonetheless, provisions of clubbing income won’t apply if a son/daughter gifts money to his/her parents and they earn interest on it. At a time when your PAN is linked to your Aadhaar and Aadhaar is becoming mandatory for almost everything, you will not get away with any attempts to evade taxes. To keep in the clear, pay all your tax dues and file your tax return before the deadline without compromising on any legal requirements.

This post on " Beware! The Government Is Eyeing Your Interest Income " appeared first on "PersonalFN"

0 notes

Photo

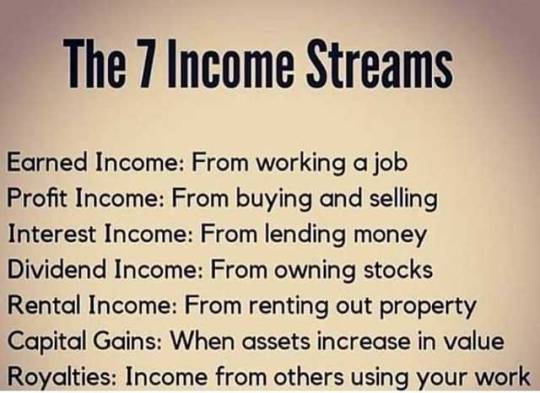

#income #money #rich #wealthy #financialfreedom #sevenincomestreams #earnedincome #profitincome #interestincome #dividendincome #rentalincome #capitalgains #royalties

#profitincome#rentalincome#capitalgains#wealthy#income#royalties#rich#sevenincomestreams#dividendincome#earnedincome#money#interestincome#financialfreedom

0 notes

Photo

#EarnedIncome – This is your day job, and most people’s primary source of income. this one’s easy to understand and most people’s primary source of income. You trade your time for money. #BusinessIncome – You own a business. You either make and sell something, or you provide a service. #InterestIncome – This is income you make from lending your money out. This might mean a CD, P2P lending, real estate crowdfunding, funding fix-and-flip debt deals, or simply money in a savings account. #DividendIncome – This is money that’s distributed as a result of owning shares of a company. #RentalIncome – You own something and you rent it out. Probably the most common is owning a rental property, such as a multifamily apartment building (renting apartments in exchange for monthly payments). #CapitalGains – This is money earned when you sell an investment, like stocks. #Royalties / #Licensing – You create a product, idea, or process, and you let someone use it. They pay you a small fee every time they do.

#licensing#businessincome#dividendincome#interestincome#earnedincome#royalties#rentalincome#capitalgains

0 notes

Text

Nepal Infrastructure Bank (NIFRA) has re... #bankingindustry #bankingsector #banks #declines #depositcollection #depositgrowth #Economicdevelopment #EPS #feeandcommissionincome #financialexpansion #FinancialGrowth #FinancialPerformance #FinancialStability #fiscalgrowth #fiscalmanagement #fiscalyear #infrastructure #interestincome #loanextensions #loanportfolio #Nepal #Nepaleconomy #NepalInfrastructureBank #netinterestincome #netprofit #NIFRA #NIFRAquarterlyreport #operatingprofit #PEratio #reservefund #thirdquarterreport

0 notes

Photo

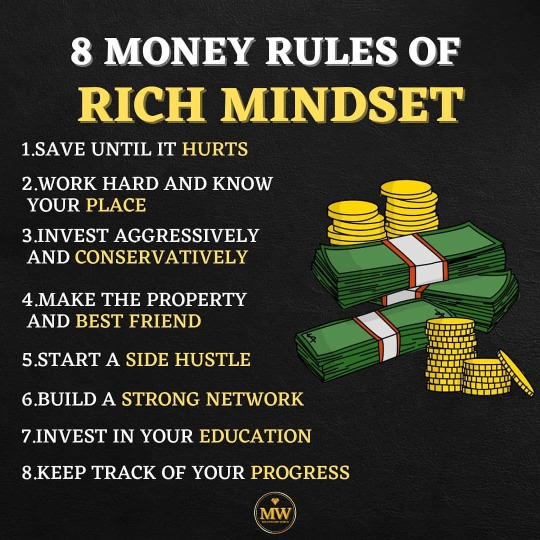

The only thing you can bet on is YOURSELF 🔥 _______ For more such content Follow 👉@millionairessaga 👉@millionairessaga 👉@millionairessaga _______ #invest #bitcoins #assets #liability #investtobuildwealth #bankaccount #laugh #dreamitanddoit #millionairequotes #changinglivestogether #successquotes #businesstips #businessmotivation #entrepreneurmotivation #believe2success #earnedincome #profitincome #interestincome #royaltyincome #dividendincome #rentalincome #capitalgains #residualincome #beyonće #beyoncéknowles #millionairessaga (at Houston, Texas) https://www.instagram.com/p/CQtlroYp-7E/?utm_medium=tumblr

#invest#bitcoins#assets#liability#investtobuildwealth#bankaccount#laugh#dreamitanddoit#millionairequotes#changinglivestogether#successquotes#businesstips#businessmotivation#entrepreneurmotivation#believe2success#earnedincome#profitincome#interestincome#royaltyincome#dividendincome#rentalincome#capitalgains#residualincome#beyonće#beyoncéknowles#millionairessaga

0 notes