#Pay Monthly Electric Bike

Explore tagged Tumblr posts

Text

Electric Bike On Finance | Hybrid Electric Bike!

Our program offers you the flexibility to spread the cost of your purchase over a set period of time, making it easier and more affordable for you to own an electric bike.

Shop Now: https://www.ginebikes.com/finance

#E-bike Collection#Electric Bike On Finance#Fastest Electric Bike UK#Electric Bikes Pay Monthly#Fast Electric Bike UK#Pay Monthly Electric Bike#Cycle To Work Scheme Calculator

0 notes

Text

The Real Cost of Living Comfortably in Melbourne: A Guide for New Residents

If you're considering relocating to Melbourne, one of the most vibrant and livable cities in the world, you might find yourself asking, "how much does it cost to live comfortably in Melbourne?"

Melbourne, celebrated for its rich cultural tapestry, thriving coffee scene, and remarkable architecture, comes with its own distinct financial challenges.

Whether you're moving for work, study, or simply seeking a change of scenery, understanding Melbourne's cost of living is essential to ensure a smooth transition.

Housing: The Largest Expense

Housing is likely to be your biggest financial commitment when moving to Melbourne. The cost varies significantly depending on the suburb you choose and whether you opt for a house, apartment, or shared accommodation. According to recent data:

Rent: A one-bedroom apartment in the city center costs approximately AUD 2,000 to AUD 2,500 per month, while the same apartment outside the city center ranges from AUD 1,500 to AUD 2,000.

Utilities: Expect to spend around AUD 150 to AUD 250 per month for electricity, gas, and water.

Internet: High-speed internet costs roughly AUD 70 to AUD 100 per month.

For those looking to purchase property, the median house price in Melbourne is around AUD 900,000, while units cost approximately AUD 600,000. Suburbs like Carlton, Fitzroy, and South Yarra are popular but come with premium price tags.

Transportation Costs

Melbourne boasts an extensive public transport network, including trains, trams, and buses. Here's what you need to know:

Public Transport: The myki card, used for all public transport, costs AUD 10 for the card itself. A monthly unlimited travel pass within Zones 1 and 2 is approximately AUD 165.

Owning a Car: If you plan to drive, factor in fuel costs averaging AUD 1.90 per liter, annual registration fees of about AUD 850, and car insurance ranging from AUD 800 to AUD 1,200 annually.

Cycling: Melbourne is bike-friendly, with dedicated lanes and trails. A quality bicycle can be purchased for AUD 300 to AUD 1,000.

Groceries and Dining Out

Groceries in Melbourne are relatively affordable compared to other global cities. On average, a single person spends about AUD 300 to AUD 400 per month on groceries. Popular supermarket chains include Coles, Woolworths, and Aldi. Here are some typical prices:

Milk (1 liter): AUD 1.50

Bread (loaf): AUD 3

Eggs (dozen): AUD 5

Chicken breast (1kg): AUD 10 to AUD 12

Dining out can vary widely depending on your preferences. A meal at an inexpensive restaurant costs around AUD 20, while a three-course meal for two at a mid-range restaurant is approximately AUD 100. Melbourne's renowned coffee culture means you’ll likely spend AUD 4 to AUD 5 per cup at local cafes.

Healthcare Costs

Australia has a robust healthcare system, with both public (Medicare) and private options. If you’re a permanent resident or citizen, Medicare covers most medical services at no direct cost. For others, health insurance is essential:

Private Health Insurance: Premiums range from AUD 100 to AUD 300 per month, depending on coverage.

Out-of-Pocket Costs: A standard GP visit costs around AUD 50 to AUD 100 without Medicare, though many clinics offer bulk billing.

Education Costs

For families moving to Melbourne, education expenses are a significant consideration. Public schools are free for Australian citizens and permanent residents, though there may be minimal costs for uniforms and extracurricular activities. International students can expect to pay:

Public Schools: AUD 5,000 to AUD 10,000 per year

Private Schools: AUD 15,000 to AUD 35,000 per year

Higher Education: Tuition fees for international students at universities like the University of Melbourne range from AUD 30,000 to AUD 45,000 annually.

Entertainment and Lifestyle

Melbourne offers a wide array of entertainment options, from world-class theaters and museums to sports and outdoor activities. Budgeting for leisure is crucial:

Movies: AUD 20 per ticket

Gym Memberships: AUD 60 to AUD 100 per month

Concerts and Events: AUD 50 to AUD 200 per ticket, depending on the event

Sports Matches: AFL games cost AUD 25 to AUD 60 per ticket

Free activities like exploring the Royal Botanic Gardens, St Kilda Beach, or the vibrant laneways of the CBD can also enrich your experience without impacting your budget.

Miscellaneous Expenses

Other costs to consider include:

Clothing: Prices are comparable to other developed countries, with a pair of jeans costing around AUD 80 and a mid-range dress about AUD 100.

Mobile Plans: Expect to pay AUD 30 to AUD 60 per month for a standard mobile plan with data.

Childcare: For families with young children, daycare can cost AUD 90 to AUD 150 per day.

Budgeting Tips for New Residents

Choose Suburbs Wisely: Research suburbs that offer a good balance of affordability and proximity to work or school. Suburbs like Brunswick, Footscray, and Coburg are popular for their affordability and vibrant communities.

Utilize Public Transport: Save on transportation by relying on Melbourne's efficient public transit system.

Shop Smart: Take advantage of weekly specials at supermarkets and local farmers’ markets.

Monitor Energy Use: Reduce utility costs by being energy-efficient, such as using LED lights and minimizing heater/AC usage.

Final Thoughts

So, how much does it cost to live comfortably in Melbourne? While it depends on your lifestyle and choices, a single person should budget at least AUD 3,000 to AUD 4,000 per month, including rent, utilities, groceries, and transportation. For families, this figure can rise to AUD 6,000 or more.

By understanding these costs and planning accordingly, you can make the most of your new life in Melbourne, enjoying all the incredible opportunities this city has to offer.

#house moving#housemovers#housemovingcompany#removalistsmelbourne#melbourne#australia#melbournemovers#moversmelbourne

1 note

·

View note

Text

The Mobility as a Service (MaaS) market represents a transformative shift in the way transportation services are delivered and consumed. MaaS integrates various forms of transport services such as public transit, car-sharing, bike-sharing, and ride-hailing into a single, accessible digital platform. Users can plan, book, and pay for multimodal trips seamlessly, often through subscription-based models or pay-as-you-go options.

Trends Shaping the MaaS Market

Subscription-based Models: Users prefer monthly plans for unlimited or capped trips, promoting predictable revenue streams.

Integration of EVs: Electric vehicles are being prioritized in MaaS platforms to support eco-friendly transportation.

Collaborative Partnerships: Public and private entities are working together to establish robust MaaS ecosystems.

AI-Powered Solutions: Enhanced machine learning algorithms provide better route recommendations and dynamic pricing models.

Global Expansion: Developed markets are seeing increasing investment, while emerging economies are adopting scalable solutions.

#Mobility as a Service Market#Mobility as a Service Market Size#Mobility as a Service Market Share#Mobility as a Service Market Growth

0 notes

Text

Is it expensive to live in Manchester as a student?

Manchester is one of the friendliest cities for students; therefore, such an experience can be quite exciting. The city is a busy community that is a place of student life. Still, the energy and vibrant culture of the city are combined with the historical and cultural background of the second-largest city in the United Kingdom. The question of whether living in Manchester as a student is expensive or not comes to the lips of every student. Let us give the topic the due and adequate attention it deserves by discussing the cost of living and the aspect that pertains to the participation of the students, i.e. budget management, in the activities this beautiful city has to offer.

Cost of Accommodation in Manchester

The biggest portion of any student's budget usually goes to accommodation. In Manchester, there are various student housings to choose from, including on-campus accommodations and off-campus ones. You should expect to pay about £400 per month for a room in a shared flat or student apartment that is away from the campus. The price, of course, is determined by various factors among them the location and the type of property i.e. on-campus or private. The type of amenities provided is also a factor. On-campus accommodation would probably be dearer but many of these usually have a package that includes everything such as utilities, Wi-Fi, and other expenses.

If you're the one looking for a more independent lifestyle, then the private rented apartments or shared houses, which have lower prices will fit your needs. Nonetheless, bear in mind that you're likely to have to account for extra bills such as gas, electricity, and council tax (the amount of which is $50-$100 per month), depending on the property size.

Food and Groceries

In terms of food, Manchester gives affordable choices to all types of residents. If you're going to cook at home, your regular weekly grocery shop can cost around £25-£35 depending on where you go and what you shop. Engaging the services of supermarkets like Aldi, Lidl, and Tesco, which are very familiar to students, can help in the quest to keep costs down. Eating out is also decently priced and plenty of cafes and eateries supplying meals between £5 to £10 are used by students. Whether you're buying a coffee at a restaurant on campus or planning a full-course meal to cook at home, your budget might still be adequate for food with some configurations on your part.

Transportation Costs

Travelling in Manchester is quite cheap, particularly for students, which is one of the main reasons that most of them live in this city. The cost of a student's monthly bus pass, which gives the right to unlimited rides across the city, is about £40. If cycling is the way you like the most, you will be glad to know that the city is bike-friendly, plus rental rates, starting from only £2 per day or £30 per month, are also very reasonable. Manchester's tram system is vast with a single trip normally costing £2, but discounts are available for students.

Students can also take advantage of the Metrolink tram service, which has reduced student fares, thereby lowering travel expenses. If your housing location is close to the university or the city centre, you will find walking as one untreated option to save your money entirely.

Entertainment and Social Life

Manchester, on the contrary, is regarded as one of the most bustling and vibrant cities in the country, being the hub concerning not only the entertainment and nightlife scene but the vibrant culture and arts scene as well, with tons of free or low-cost events across the whole year. You could enjoy a variety of things such as visits to museums and art galleries concerts in the open air and festivals. The wonderful museums of Manchester like the Manchester Museum or the Whitworth Art Gallery, where you have free entry, serve as quiet spots to chill out without worrying about any expenditure.

Another area that the nightlife of Manchester does very well is a variety of student-friendly pubs, bars, and clubs from which they can choose. You can go to the club and pay anywhere between £10-£30, or you can have a few drinks at the nearby pub. If the cinema is more of your thing there are quite a lot of places that sell student tickets for £6 to £8. Be sure to always have up-to-date information about cinemas, attractions, and other such activities to find all the discount cards and special offers you are looking for.

Healthcare and Miscellaneous Costs

As a student in Manchester, you will have access to free medical care via the National Health Service, which is one of the reasons why you will be able to live quite cheaply there. This is a major plus compared to many other countries where they may need to purchase medical insurance.

Other minor expenses are phone bills, toiletries, and other personal things. On average, they might be an extra £50-£70 every month, but there is nothing difficult about it if you restrain yourself from going overboard with your spending and always spend prudently.

Managing Your Budget

If you are living in Manchester on a student budget, it will be no longer than necessary if you do some forward-thinking and planning. Economical apartments, home-cooked meals when possible, and reductions that are available to students are the things that will make the money go further. The secret is to be thoughtful about your shopping habits and look for bargains wherever you go.

As far as housing is concerned, many companies provide students with cheap apartments. Student Tenant is a brilliant organization, where students may find a variety of student accommodations in Manchester or elsewhere in the country that is safe and affordable. If you're interested in shared accommodation, you may wish to visit Student Tenant, which, besides student accommodation, also has affordable apartments of various types that suit different budgets and tastes in the centre of Manchester. In short, Manchester is not only a thrilling city for studying purposes but could also be cheap if you make the proper plans. The city offers affordable housing options, food, and transportation that are not quite expensive, thus enabling a person to fully enjoy the features of this amusing city and spend low.

0 notes

Text

Blinkit Franchise Opportunities: Costs, Benefits, and How to Get Started

The rapid rise of quick-commerce has redefined consumer expectations, and Blinkit has emerged as a key player in this dynamic industry. With its ultra-fast delivery model, Blinkit caters to modern customers seeking convenience and immediacy for their grocery and daily needs, making the Blinkit franchise cost an attractive investment for those looking to tap into this growing market.

For aspiring entrepreneurs, a Blinkit franchise presents an excellent opportunity to tap into this booming market. By leveraging Blinkit’s established brand reputation, technological infrastructure, and customer base, franchise owners can position themselves for success in a high-demand industry.

This article offers a comprehensive look at Blinkit franchise opportunities, including the costs involved, the benefits of ownership, and a step-by-step guide to getting started.

Understanding the Costs Involved

Owning a Blinkit franchise requires careful financial planning. Below is a detailed breakdown of the investment and operational costs:

1. Franchise Fee

To become a Blinkit franchisee, you’ll need to pay an initial franchise fee, typically ranging from₹3 to₹5 lakhs. This fee grants you the rights to operate under Blinkit’s established brand and access their resources and support network.

2. Infrastructure and Setup Costs

Fulfillment Hub: Setting up the fulfillment center, including shelving, refrigeration, and workspace facilities, can cost ₹10 to ₹15 lakhs, depending on the location and scale of operations.

Delivery Logistics: A fleet of vehicles (bikes or vans) and necessary delivery equipment adds another ₹1 to ₹3 lakhs.

Technology Integration: Blinkit provides proprietary software for order management and delivery tracking with an initial setup fee of 1 to 2 lakhs.

3. Ongoing Operational Expenses

Staffing: Salaries for inventory managers, delivery personnel, and support staff range between₹50,000 and₹2 lakhs per month.

Inventory Management: Maintaining adequate stock levels requires monthly investment, typically ₹5 to ₹10 lakhs, depending on demand.

Utilities and Maintenance: Costs for electricity, internet, and equipment upkeep amount to approximately ₹20,000 to ₹50,000 per month.

Marketing Contributions: Franchisees may need to allocate ₹10,000 to ₹50,000 monthly for local promotions and campaigns.

Key Benefits of Owning a Blinkit Franchise

Partnering with Blinkit offers several compelling advantages:

1. Brand Recognition

Blinkit is a well-known name in the quick-commerce sector, giving franchisees a competitive edge with an established and trusted brand.

2. Growing Market Demand

The quick-delivery model is rapidly expanding, with customers increasingly relying on services like Blinkit for their everyday needs. Franchise owners can capitalize on this rising demand.

3. Operational Support

Blinkit provides franchisees with extensive training, logistical support, and access to proprietary technology, ensuring smooth operations from day one.

4. Diversified Revenue Streams

Franchisees earn through delivery fees, product margins, and promotional partnerships, offering multiple income opportunities.

How to Get Started: A Step-by-Step Guide

1: Research Market Demand

Conduct a thorough analysis of your target location. Assess the population density, local competition, and demand for quick delivery services to determine the viability of opening a Blinkit franchise, or even a tea time franchise, in the area.

2: Application Process

Visit Blinkit’s official website to apply for franchise ownership.

Submit required documentation, such as financial credentials, business experience, and location details.

Await approval after Blinkit evaluates your application and the market potential of your chosen area.

3: Setting Up the Infrastructure

Secure a suitable location for your fulfillment center.

Invest in necessary equipment, inventory, and delivery infrastructure.

Hire and train staff with Blinkit’s support to ensure efficient operations.

4: Launching the Franchise

Leverage Blinkit’s marketing and operational guidance to kickstart your franchise. Utilize localized promotions and ensure high service standards to attract and retain customers.

Tips for Success

Optimize Delivery EfficiencyStreamline routes, maintain sufficient stock levels, and ensure timely deliveries to enhance customer satisfaction.

Focus on Customer ExperienceProvide accurate and reliable service to build customer loyalty, which is critical for sustained growth.

Monitor Financial PerformanceTrack expenses and revenues regularly to identify areas for cost optimization and profit maximization.

Engage in Local MarketingParticipate in community events, offer exclusive deals, and actively promote your franchise to boost visibility.

Conclusion: Is Blinkit the Right Fit for You?

Starting a Blinkit franchise offers a promising business opportunity in the thriving quick-commerce market. While the initial investment and operational demands are significant, the benefits of brand support, growing customer demand, and diverse revenue streams make it an appealing venture for motivated entrepreneurs.

Before committing, assess your financial readiness, business acumen, and market potential. If you’re prepared to embrace the challenges and opportunities, owning a Blinkit franchise could be your gateway to entrepreneurial success in one of the most dynamic sectors of the modern economy.

With the right planning and dedication, your Blinkit franchise journey could not only be profitable but also highly rewarding in the long term.

0 notes

Text

Living in Cardiff: A Practical Guide

Cardiff, known for its historic sites, passionate sports culture, and cozy urban vibe, offers a high quality of life at a fraction of the cost you’d expect in other UK cities. Whether you’re planning a move or just curious about what it’s like, here’s a comprehensive breakdown of the cost of living in Cardiff.

1. Housing: Affordable Living with Welsh Charm

One of Cardiff’s biggest draws is its affordable housing. With a range of options, from modern city-center flats to quiet suburban homes, you’ll find something that suits your style and budget.

City Centre and Popular Neighborhoods: Renting a one-bedroom apartment in Cardiff’s city center, such as Cardiff Bay or Pontcanna, costs around £700-£900 per month. These areas are bustling with cafes, green spaces, and amenities.

More Affordable Options: For those looking to save, neighborhoods like Roath, Splott, and Llandaff offer lower rent, typically around £500-£700 per month for a one-bedroom flat. Roath, in particular, is popular among students and young professionals, known for its vibrant vibe and budget-friendly options.

Whether you want to live right in the center or in quieter areas with a community feel, Cardiff’s housing market offers flexibility without the London-sized price tags.

2. Groceries and Dining: Quality Food Without the Big-City Costs

Cardiff has a rich food scene, from independent cafes and international eateries to affordable supermarkets and markets.

Groceries: Grocery bills tend to average between £150 and £200 per month for one person. Local supermarkets like Tesco, Morrisons, and Lidl keep costs manageable, while smaller local shops often carry Welsh specialties and fresh produce.

Dining Out: Cardiff is known for its vibrant dining scene, and eating out doesn’t have to be a splurge. A meal at a mid-range restaurant costs around £10-£20. Casual dining options and street food spots in areas like the Cardiff Market or the Riverside Market offer wallet-friendly, tasty meals.

With its mix of affordable eateries and cafes, Cardiff lets you enjoy good food on nearly any budget.

3. Transportation: Affordable and Accessible

Getting around Cardiff is easy and affordable, whether you prefer public transport or biking around the city.

Buses and Trains: Cardiff’s bus network, run by Cardiff Bus, connects most areas of the city. A monthly bus pass costs around £55, while single trips are £1.90. For those commuting to nearby cities, train travel is well-priced, with frequent routes to places like Swansea and Newport.

Cycling and Walking: Cardiff is a compact and pedestrian-friendly city. Many residents choose to walk or bike around, and the Taff Trail offers scenic routes perfect for cyclists.

For those with a car, parking is relatively affordable, though Cardiff city center can get crowded during peak times.

4. Utilities and Internet: Keeping Warm and Connected

Cardiff’s utility costs are generally on par with other UK cities, though factors like apartment size and season affect monthly expenses.

Gas, Electricity, and Water: Expect to pay around £100-£150 per month for utilities, including gas and electricity, with higher costs during the winter months.

Internet: Standard broadband plans in Cardiff range from £20-£30 per month with popular providers like BT, Sky, and Virgin Media. For those working from home, high-speed options are widely available.

In general, utilities and internet are affordable, allowing Cardiff residents to stay warm and well-connected.

5. Entertainment and Leisure: Plenty to Do on a Budget

Cardiff is a city with a lively arts and sports culture, and you don’t need to spend a fortune to have a good time.

Cultural Activities: Cardiff has numerous free attractions, including the National Museum Cardiff and Bute Park. Cardiff Castle, a popular landmark, charges an entry fee, but many locals enjoy discounted or free entry during special events.

Sports and Nightlife: Cardiff is passionate about sports, especially rugby, and catching a game at the Principality Stadium is a must for fans (ticket prices vary depending on the match). The city’s pub culture is vibrant, and a pint of beer usually costs about £3-£4, making nights out affordable and enjoyable.

Theatre and Cinema: Cardiff’s theatres, such as the New Theatre and the Wales Millennium Centre, offer a mix of affordable and premium shows. For film lovers, movie tickets are about £8-£12, with discounts on weekdays.

With so much free and budget-friendly entertainment, Cardiff ensures there’s something for everyone.

6. Healthcare and Education: Quality Services Without Extra Costs

Healthcare is provided by the NHS, so Cardiff residents have access to free GP visits and emergency care, with prescription charges around £9. If you’re studying, Cardiff University, Cardiff Metropolitan University, and the University of South Wales are all respected institutions, and Welsh residents benefit from tuition subsidies.

7. Summing It Up: Cardiff’s Cost of Living in Perspective

While Cardiff is growing in popularity, it remains affordable compared to larger UK cities. Housing, transport, and everyday expenses are budget-friendly, and the city’s wealth of parks, cultural sites, and events mean there’s never a dull moment. From affordable flats to food markets and free attractions, Cardiff’s balance of affordability and quality of life is hard to beat.

Curious about making Cardiff your home? With its welcoming atmosphere, affordable lifestyle, and endless things to see and do, the Welsh capital is a fantastic place to live, study, or explore.

0 notes

Text

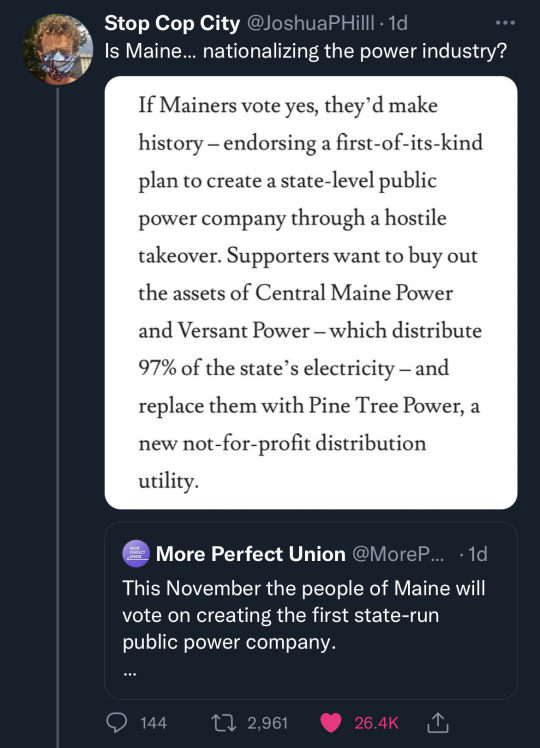

United Statesian here, & this is something I care a lot about so I'm gonna ramble about it & how fucked it is/how fucked we all are.

Pretty much everything is private.

“Public” green spaces usually cost money to enter (daily/every entry costs, &/or monthly / yearly “passes” to go in) &/or to park (& usually not accessible via public transit, & difficult to access via walking or biking). Electricity, waste processing/collecting (trash, recycling, etc.), hospitals & urgent care facilities ((I just got turned away from 5 different urgent care facilities because I'm on state Medicaid because I can't afford private insurance & they care more about profit than my life)), property management, car insurance (which is legally required but still run privately for profit), health insurance (again, legally required but still run privately for profit)....even all the “good” schools/education systems are privatised, because public schools are underfunded as heck.

Universities & colleges are often for profit too - all the ones near me cost $10,000 to $150,000 per year, & they somehow expect you to dig yourself out of that much debt (there are scholarships but there are fewer and fewer as the years go by & they rarely cover all costs, you basically have to get really lucky to get a full ride) if you don't just have that lying around (or can't rely on your parents’ money). And even when you do finally get a degree, all the jobs available (a) pay less than minimum wage (my girlfriend got stuck in a job that pays $11/hr for 40hrs a week on a Bachelor's with tons of impressive extracurriculars on her résumé; of course she's seeking other employment but that brings us to point b), (b) are super competitive & high demand because a lot of people went to college/university just to get a degree so they can maybe get a livable wage, which means it takes hundreds of job applications to get one call back ((it took her a month to get even one interview, & longer to get a job offer, & that's with her working since before she turned 18 & having super impressive stuff on her résumé)), (c) pay a “living stipend” instead of a wage (which has to be payment specifically “in exchange for labor”, & apparently living stipends don't count) which means you can't get unemployment because you “weren't employed”, which is really dangerous if they decide to suddenly fire you, &/or (d) leave job listings up that aren't actually available so they can guilt trip their existing employees that they're “trying” not to be understaffed & to make the existing employees work harder. So having a degree isn't enough to survive either.

Our middle/working classes are shrinking, & our impoverished & homeless populations are growing alarmingly fast, because corporations would rather you work full time from a tent or car or on the streets somewhere than pay you a livable way and lose a tiny margin of profit.

The USA is a scary place to live if you're not ridiculously weathy.

Maine?? Hello?

47K notes

·

View notes

Text

Top 5 Benefits of Taking a Loan for Your 2-Wheeler Electric Vehicle

With the rise of electric vehicles (EVs) in the global market, many people are shifting towards eco-friendly and cost-effective transportation solutions. Among these, 2-wheeler electric vehicles (EVs), such as electric scooters and bikes, are gaining popularity for their efficiency and convenience. However, the upfront cost of an electric vehicle can sometimes be a hurdle for prospective buyers. One of the best ways to overcome this challenge is by opting for a 2-wheeler electric vehicle loan. Financing your electric vehicle purchase comes with a range of benefits, making the dream of owning an eco-friendly ride easier and more affordable.

In this article, we will explore the top 5 benefits of taking a loan for your 2-wheeler electric vehicle.

1. Lower Upfront Costs

One of the primary advantages of taking a 2-wheeler electric vehicle loan is the ability to reduce your upfront financial burden. While electric scooters and bikes generally offer long-term savings on fuel and maintenance, their initial purchase price may be higher than traditional petrol-based two-wheelers.

With a loan, you can spread the cost of the vehicle over a manageable period, typically ranging from 12 to 60 months, depending on the lender. This means that instead of paying the entire amount at once, you make monthly payments that fit within your budget. This structure allows you to invest in an environmentally friendly vehicle without straining your immediate finances.

2. Easy Accessibility and Approval

Many banks and financial institutions now offer tailored loan products specifically for electric vehicles, including 2-wheelers. As governments around the world encourage the adoption of green technologies, more lenders are making it easier to access funds for electric vehicle purchases.

A 2-wheeler electric vehicle loan often comes with relaxed eligibility criteria, making it accessible to a wide range of consumers. Whether you are a salaried employee, self-employed, or even a student, many financial institutions offer loan options with simple documentation requirements and fast approval processes.

Additionally, lenders may provide flexible repayment terms, making it easier to choose a loan tenure that suits your financial situation. This flexibility makes financing an electric 2-wheeler an attractive option for individuals looking to make an environmentally conscious purchase without the hassle.

3. Competitive Interest Rates

As the demand for electric vehicles increases, so does the competition among lenders to offer the best financial products. Many banks and non-banking financial companies (NBFCs) now provide competitive interest rates for 2-wheeler electric vehicle loans. The lower the interest rate, the more affordable the loan becomes in the long run.

These favorable rates make it more attractive for consumers to finance their purchase through a loan rather than paying the full amount upfront. By opting for a loan with a low interest rate, you can reduce the overall cost of borrowing and save money in the long term while enjoying the benefits of an electric vehicle.

4. Tax Benefits

In several countries, governments are offering incentives and tax benefits to encourage the adoption of electric vehicles. If you're considering taking a 2-wheeler electric vehicle loan, you may be eligible for tax deductions on the interest paid for the loan.

For example, in India, under Section 80EEB of the Income Tax Act, individuals who take out a loan to purchase an electric vehicle can claim a deduction of up to ₹1.5 lakh on the interest paid. These types of tax benefits can significantly reduce the overall cost of owning an electric vehicle and make financing an even more attractive option.

It's important to check the specific incentives available in your region, as governments continue to introduce new policies to promote the use of electric vehicles.

5. Positive Environmental Impact with Financial Support

Electric 2-wheelers are an environmentally friendly alternative to traditional petrol-powered vehicles. By choosing an electric vehicle, you're contributing to reduced air pollution, lower carbon emissions, and less dependency on fossil fuels. Taking a 2-wheeler electric vehicle loan enables you to make a positive environmental impact while ensuring financial support.

This not only aligns with global efforts to combat climate change but also helps you reduce your carbon footprint on a personal level. By financing your purchase, you can contribute to a cleaner planet without waiting to save up for the full cost of the vehicle.

Conclusion

Financing your electric vehicle through a 2-wheeler electric vehicle loan comes with a variety of advantages, from reducing upfront costs to offering tax benefits and competitive interest rates. With the increasing availability of tailored loan products and government incentives, owning an electric vehicle has become more affordable and accessible than ever before. By taking a loan, you can enjoy the long-term savings and environmental benefits of an electric 2-wheeler while managing your finances responsibly.

As more people shift toward eco-friendly modes of transportation, now is the perfect time to explore the options available for financing your next electric 2-wheeler. Whether you're looking for lower monthly payments or the opportunity to contribute to a greener future, a 2-wheeler electric vehicle loan is an excellent choice for making your purchase more manageable and impactful.

0 notes

Text

Rapido financial outlook according to Aravind Sanka

Bengaluru-based mobility startup Rapido has recently made headlines with a significant $200 million funding round, elevating its valuation to $1.1 billion and earning it a spot in the unicorn club. Co-founder and CEO Aravind Sanka has revealed that the company is on the brink of achieving cash-flow positivity, with expectations to become profitable within the next few months.

Rapido's impressive growth is underscored by its vast network of 1.7 million active monthly driver-partners, who collectively manage nearly 0.5 million orders daily across bikes, auto-rickshaws, and four-wheeler cabs. Sanka highlighted Rapido's dominance in the market, claiming a market share exceeding 40% in the two-wheeler and three-wheeler segments, positioning it ahead of competitors like Ola and Uber.

The company reported a substantial increase in revenue for FY23, reaching Rs 497.5 crore compared to Rs 157.9 crore in FY22. Despite this growth, losses also widened, from Rs 439 crore to Rs 674.6 crore, largely due to heavy investments in expansion and development. Notably, Rapido's zero-commission model for drivers continues to be a key differentiator. Drivers pay a fixed monthly fee of Rs 500 for every Rs 10,000 earned on the platform, with Sanka affirming the company's commitment to maintaining this model.

Rapido is now turning its attention to the burgeoning quick commerce sector, aiming to capitalize on the growing demand for rapid delivery services. The company currently supports last-mile food delivery for Swiggy, a major investor in its recent Series D funding round, and collaborates with ONDC. Discussions are underway with quick commerce players like Zepto and Zomato’s Blinkit to explore 10-30-minute delivery options.

The company is also leveraging its extensive fleet to support small direct-to-consumer (D2C) businesses, with plans to partner with logistics firms and work directly with various companies. On the sustainability front, Rapido is making significant strides with electric vehicles. In the NCR region, over 25% of orders are now delivered by electric vehicles, and the company aims to transition all deliveries in Delhi to electric within the next six months. Partnerships with fleet operators to develop exclusive electric vehicle fleets for two-wheelers, three-wheelers, and four-wheelers are also in progress.

Looking ahead, Rapido may consider an initial public offering (IPO) within the next two to three years as a potential step in its growth trajectory. The company's recent fundraising efforts have seen it secure close to $500 million, with WestBridge Capital leading the latest $200 million Series E round, joined by Think Investments, Invus Opportunities, and longstanding partner Nexus Venture Partners.

Ownership of Rapido's parent company, Roppen Transportation Services, as of FY23 includes WestBridge Capital with a 25.6% stake, Swiggy with 15.1%, Nexus Venture Partners with 9.7%, and Integrated Capital with 4.9%. The combined shareholding of co-founders Pavan Guntupalli, Rishikesh SR, and Aravind Sanka stands at 7.5%.

Read More

#news#entrepreneur#business#ceo#Rapido#Profitability#Aravind Sanka#CEO#Near Profitability#Company Growth#Financial Performance#Startup Profitability#Rapido CEO#Business News

0 notes

Text

Navigating Student Apartment Rentals: A Comprehensive Guide

Finding the perfect student apartment can be a daunting task, especially with the myriad of options and considerations involved. Whether you're a freshman looking to move off-campus for the first time or a seasoned student seeking a new place, this guide will help you navigate the complexities of student apartment rent.

Location, Location, Location

One of the most critical factors in choosing a student apartment is its location. Proximity to campus can save you significant time and money on transportation. Look for apartments within walking or biking distance to reduce reliance on public transport or a car. Additionally, consider the safety of the neighborhood. Research crime rates and speak to current residents if possible.

Budget Wisely

Budgeting is crucial when searching apartments for students. Besides the monthly rent, factor in utilities, internet, groceries, and any additional fees such as parking or maintenance. Establish a budget beforehand and stick to it to avoid financial strain. Many students opt to share apartments to split the cost, making it more affordable. Be clear about how expenses will be divided among roommates to prevent conflicts later.

Amenities and Utilities

Evaluate what amenities and utilities are included in the rent. Some apartments offer perks such as gyms, study rooms, laundry facilities, and furnished units. These can enhance your living experience but might come at a higher price. Essential utilities to consider include water, electricity, heating, and internet. Ensure you understand which are included in the rent and which you'll need to pay separately.

Lease Terms and Conditions

Carefully review the lease terms before signing. Standard lease durations for student apartments are typically one academic year, but some may offer six-month or month-to-month leases. Understand the conditions for terminating the lease early, subletting, and any penalties for breaking the lease. Check if the lease aligns with your academic calendar to avoid paying rent during summer break if you plan to move out.

Inspect Before You Commit

Before committing to a lease, inspect the apartment thoroughly. Look for signs of damage, pests, or poor maintenance. Check the condition of appliances, plumbing, and electrical systems. If possible, visit the apartment at different times of day to assess noise levels and the overall environment. Take photos and document any pre-existing issues to avoid disputes over your security deposit later.

Roommates and Compatibility

If you plan to have roommates, ensure compatibility to foster a harmonious living environment. Discuss habits, schedules, and preferences regarding noise, cleanliness, and visitors. It's essential to have clear communication and set boundaries from the start to prevent misunderstandings. Some apartments offer roommate matching services, which can be helpful if you don't already have someone in mind.

Plan Ahead

Start your apartment search early, ideally several months before your move-in date. The best apartments often get rented quickly, and starting early gives you more options and leverage in negotiations. Make a list of potential apartments and schedule viewings to compare them.

Legal and Financial Documentation

Prepare the necessary documentation to expedite the rental process. This typically includes identification, proof of income or financial support, a guarantor if required, and references from previous landlords. Having these documents ready can make the application process smoother and quicker.

In conclusion, renting a student apartment requires careful planning and consideration. By focusing on location, budgeting wisely, understanding lease terms, inspecting properties, ensuring roommate compatibility, starting early, and preparing documentation, you can find an apartment that meets your needs and enhances your college experience. Happy apartment hunting!

0 notes

Text

What is the price of the Stealth Electric Bikes B-52?

Fast Electric Bike has a top speed of 50 mph and a range of 45-60 miles per battery charge. It comes with a sturdy steel body and costs around £10,000.

The Stealth Electric Bikes B-52 is a popular high-performance electric bike in the UK. Here are some key features and specifications that make it a fast and desirable electric bike:

Motor and Battery: The B-52 is powered by a 5.2 kW brushless DC motor and a battery pack that offers a range of up to 50 miles on a single charge, depending upon the riding conditions and rider input.

Speed: The B-52 is touted for its speed and power, capable of reaching speeds up to 50 mph.

Design and Suspension: This model features enduro-inspired suspension, making it robust and suitable for different terrains. It comes with a 9-speed sequential gearbox.

Braking System: The B-52 is equipped with either six or eight-pot hydraulic disc brakes, providing excellent stopping power.

Electric Bike Delivery merges the line between an electric bicycle and a motorbike, providing a thrilling high-speed experience. However, due to its specs, users must follow local laws and regulations about where and how this type of e-bike can be used, as it may fall into different legal categories in certain areas due to its speed capabilities.

Please note the availability and price of this model can vary, so check the Stealth Electric Bikes website or authorised retailers in the UK for the most accurate and up-to-date information.

Buy Now: https://www.ginebikes.com/

#E Bikes Pay Monthly#Electric Bikes Pay Monthly#E Bike Pay Monthly#Pay Monthly Electric Bike#Stealth Electric Bikes B-52#Ebike For Delivery#Delivery Electric Bike#Electric Bike Delivery#E Bike For Delivery#Cycle To Work Scheme Electric Bike

0 notes

Text

Ride Into Savings: How an Electric Bike Can Revolutionize Your Lifestyle

Tired of spending a fortune on gas and feeling guilty about your carbon footprint? It’s time to shake things up with an electric bike (ebike)! Not only will it inject some fun into your daily routine, but it'll also help you save money and reduce your impact on the planet.

Here are ten ways an ebike can transform your life while keeping your wallet happy.

1. Grocery Runs Made Easy

Ditch the car and hop on your ebike for quick trips to the store. With a sturdy rack and panniers, you can easily carry all your essentials while enjoying the fresh air and avoiding the hassle of parking.

2. Drive Less, Pay Less Insurance

Switch to a pay-by-mile insurance plan and watch your premiums drop as you clock fewer miles in your car. Riding your ebike more often means big savings on insurance costs.

3. Gym? Who Needs It!

Trade in your gym membership for some outdoor exercise on your ebike. It’s a fun and effective way to stay fit while saving money on monthly fees.

4. Say Goodbye to High EV Charging Bills

Use your ebike for short trips instead of your electric vehicle and watch your charging costs plummet. Ebikes are incredibly energy-efficient, making them a wallet-friendly choice for daily commutes.

5. Bye-bye, Car Maintenance Costs

With fewer miles on your car, you'll spend less on maintenance. Plus, ebike repairs are a fraction of the cost of car repairs, saving you even more in the long run.

6. Cruise to Dinner

Heading out for dinner or a friend’s house? Take your ebike for a spin and enjoy the savings on gas and parking fees. It’s the perfect way to start a night out on the town.

7. Mix It Up with Multimodal Transport

Combine your ebike with public transit for longer journeys. Ebikes are easy to take on buses or trains, giving you more flexibility and saving you from the stress of rush-hour traffic.

8. Share the Ride, Share the Savings

Keep your car for occasional trips and rent it out when you’re not using it. It’s a great way to offset the costs of car ownership while you enjoy the freedom of your ebike.

9. School Runs Made Simple

Forget the school car line—ride your ebike instead! It’s faster, more fun, and a great way to start the day with some outdoor activity.

10. Commute in Style

Ebikes are the ultimate commuter vehicle. They’re fast, efficient, and will get you to work without breaking a sweat. Plus, you’ll save money on gas and parking fees along the way.

Ready to revolutionize your lifestyle and save some serious cash? It’s time to embrace the ebike revolution! With these ten tips, you’ll be well on your way to a greener, healthier, and more affordable way of life.

So hop on your ebike with https://www.pogocycles.com and ride into savings today!

0 notes

Text

Electric Scooter Finance UK: Affordable Financing Options for Electric Scooters

With ecological issues becoming a hot topic and a mixture of transportation modes becoming popular, electric bikes are an avenue through which people can meet their driving goals and move around from one place to another.

The UK is currently faced with extra demand for automobiles that boast amazing fuel efficiency and look stunning. Similar to how people now own this electric car, they do so for a variety of reasons, including the ease with which they can obtain fast electric scooter on finance services.

Electric Scooter Finance UK

In the UK, financing an electric scooter is the easiest and most affordable way to get one. It's made for people who want to join the electric change without going bankrupt. As a result of the availability of financing options that enable you to pay the cost of your electric scooter finance UK in installments, it is now possible to commute without releasing any emissions that are not wanted.

As a consequence of this, the disbursement of the total cost of an electric scooter over a period of time that is convenient for the user became a tool that enabled anyone who advocates for activities that are beneficial to the environment.

The Benefits of Financing Your Electric Scooter

Affordable Monthly Payments

Flexible Terms Finance

Access to the Latest Models

Explore Fast Electric Scooter on Finance Options

For people who are more into velocity and thrill, high-speed e-scooters are available on finance options, so that you may use the latest electric mobility technology without the hassle of financial saving to buy it profitably.

Best New Motorcycle Deals UK

Despite the ascent of electric scooters, the old-fashioned motorcycle is still a favorite way of travel for a lot of transporters. When considering weighing up your options for a new motorcycle,it is crucial to explore the Best new motorcycle deals UK so that you can own the bike of your dreams at the best rate on offer.

Trike Motorcycle UK: A Unique Option

The trike's motorcycles have them try something out of the ordinary and create something really interesting and innovative for the general advantages compared with the standard as directed. These trike motorcycle UK ensure better stability and a unique style; therefore, lovers of a stylish view and functionality enjoyably present themselves on the roads.

Embrace the Future of Mobility

A particular innovative approach that is readily accessible in the UK is to make use of the many electric scooter finance UK for electric scooters, which will enable you to hit the road independently and begin to experience the green way of mobility. We have several relevant reasons that will make you look at these two answers as if they were written with a magic wand: in the case of electric bikes, it represents an opportunity to go green, and in the case of motorbikes powered by ICE, the thrill of cornering at full power.

You will be able to enjoy the simplicity and flexibility of owning your own vehicle to the fullest extent possible by taking advantage of our reasonable plans, flexible terms, and the availability of new models. In addition, you will be able to experience the elegance and pleasure of traveling by car.

For more information visit us - https://bikerloans.co.uk/

#electric scooter finance uk#UK#fast electric scooter on finance#Best new motorcycle deals UK#trike motorcycle uk

0 notes

Text

Caroles Sweepstakes Newsletter

Caroles’ Monthly Sweeps Tips Newsletter

Hello everyone!! Good morning, afternoon, evening, where ever you are

today, I hope you are having a good day. As promised, I am starting my monthly

sweepstakes newsletter. I will include three tips, and perhaps 3 of my favorite

sweepstakes.

First a little about me. I am married, this June 2024 will be our 30th wedding

anniversary. I met my husband Chuck 1.5 weeks after I graduated nursing

school. Needless to say, I have been a registered nurse for 33 yrs. I have 2

wonderful 20 something daughters. I do have some hobbies, and will soon

be trying a new one, crocheting!! We have pets, boy do we have pets.

Currently, we have 4 cats. Our beagle of 12 yrs. crossed his rainbow bridge

a few months back.

I have been a sweeper pretty consistently within last 2 yrs. I started 25 yrs

and had won a trip to a dude ranch. Unfortunately, we couldn’t go, as I was

pregnant with Abigail, and the trip required horseback riding.

Two years ago, I started a facebook group called caroles’ sweepstakes finds, and

It was a lot of fun, and pretty successful, but later I got my facebook hacked, and it is

Now pretty much taken over by someone I don’t know, and very quiet.

Yes, you can win sweepstakes! I’ve won beauty products, Hydration IV (similar to Gatorade)

A vineyard trip to Oregon, a whitesox game to which I got to put the ball on the mound, and got my

picture taken, an electric bike, shirts, sweatshirts, concerts including John Legend and Leeanne

Rhimes, a solo stove, an electric bike. My biggest wins were the oprah Winfrey sweeps and electric

thus far. Not bragging, just sharing. I know my friends have won larger, more often and much more,

it can be done!

TIPS

1. Join an aggregated sweep group either free or pay for it. Some examples are Sweepstakes fanatics, this is a free one. Iwincontests.com this will cost you a nominal yearly fee. Infinite sweeps. This is free, and I’ve used all these many times. Infinite sweeps has a lot of the same ones every sweepstake site has, including iwincontest.com. I do check it because there is sometimes a sweepstake I haven’t seen. Iwincontests.com and infinte sweeps allows you to keep track of your daily weekly sweeps, and gives you expiration dates and rules.

2. NETWORK! If you have had a small business or did anything on your own, you have heard this word before. Even if you haven’t had your own small business. What do I mean about network? Make sweeper friends! You’re half way there, you have a common interest.. You both want to win. SO…make friends! That’s the best part! The sweeper friends you make now will/can last a lifetime. Share your favorite or all of your sweepstakes with your sweeper friends and community. Help each

other out. Sometimes it’s rewarding to see your sweeper friend win that trip of a lifetime, and you’ve lended a hand!

3.�� Take a time out and breathe! Entering sweepstakes can be hard work. Some of my sweeper friends can enter up to

300-500 a day, or more. Take a break, stretch your leg, ignore the bickering, fighting and name calling. It does no one any

Good, and who needs the drama. Most importantly, don’t get discouraged because it’s a numbers game. That’s right,

55 million people do sweepstakes, and the community is getting larger! You can win, be consistent, and don’t give up!!!

MY 3 FAVORITE SWEEPS FOR MARCH

https://www.titosgameday.com/ Titos’ water cooler, ends 3/31

https://www.recipelion.com/sweeps/BergHOFF-Ouro-Gold-3pc-Steamer-Set-Giveaway ends 4/7

6/30 https://www.kahlua.com/en-us/espressosweeps/

THESE ARE ALL DAILY AND FREE TO ENTER. BECAUSE I AM GETTING THIS OUT LATE I WILL INCLUDE

2 MORE, SO YOU ALL HAVE A CHANCE TO ENTER!

https://gleam.io/mSXVn/dragonblogger-100-gift-card-giveaway?gsr=mSXVn-aal45R5o90 21 DAYS LEFT

https://swee.ps/dLkMDN_wdVGQn 4/28

Until next time

~~~~~~~~~~~~~~Until next time

Carole Harris

1 note

·

View note

Text

266. Religion

In our world which is so rational,

Logical and enlightened —

Where Atheists fight over Biblical land;

The God of the Bible has given them.

“This isn’t the 1960’s, hippies,

Get off your ass and work.”

Communists write Marxist Disney Movies,

For Capitalist audiences to enjoy,

With tickets and subscriptions

that cost 1/3 of their weekly, or monthly, income.

While the actors go home and spend

their paychecks, which is more than their

Audiences will ever make in their lifetimes.

And Socialist celebrities preach green energy and technology;

From their air-conditioned mansions, planes, and private jets —

Begging their fans and followers to

Invest in NFTs and Crypto instead of coal or energy,

Which has to be mined, by super-computers, that run on a city’s worth of coal-powered electricity.

My point isn’t that everyone’s a hypocrite;

Everyone knows they’re a hypocrite already,

(Don’t they?)

My point isn’t to bus or bike it to work, if you can afford to take a taxi —

My point is why do we have so much idolatry

So much love for other hypocrites?

Even the Jesus of the Bible, was a racist asshole,

And he’s no better (or worse) than Benny Gantz or Benjamin Netanyahu —

Why do we put them on pedestals, when their list of sins is so much longer than ours…?

Why do we let the bourgeois teach equality?

And let the elites teach virtue..?

(When most celebrities are high-school dropouts.)

Why do we let people living in mansions, tell us what to do with the land that belongs to us?

Not because God gave it to us, but because without it we would be broke and homeless –

Like most the people living in the Northwest.

Why do we even care about their opinions, what do they have to say, that matters in the slightest?

Every man needs a leader, and every woman needs an idol —

To display the latest fashions, and model the latest hairstyle.

This isn’t to suggest that we’re any better than they are,

We’re all hypocrites in our own times, places, and ages;

It makes no difference which Authority you cling to;

Judeo-Christian philosophy, Atheism, Satanism, Communism, Capitalism; Socialism, Science, Scientology, Naturalism;

Or any other useless religion —

It doesn’t matter what you believe in,

If it all adds up to nonsense;

It doesn’t matter if you have a nose-ring and dye your hair blue, if you do all the same things that other people do.

Our “Open-Minded, Liberal Society” brought us the closest we’ve ever been to Nuclear War.

And in the end, it won’t matter, whether Science or Religion wins —

Whether we turn to dust or pay for our sins,

And it won’t matter if Science, Atheism, Judaism;

Jesus, Moses, or Oppenheimer

Christianity or Satanism,

Rationality or Emotionality,

Logic, Reason, or Religion…

Gave us the bomb.

— A.M. McGee

[Notes & Commentary: This poem is about how anything can become a religion, from a fan-club to a political ideology, and is a bit of a response to Liberals who often say, “Religion is the source of all war,” when that couldn’t be further from the truth. Our liberal, rational, and open-minded scientific society has brought us closer to Nuclear War than we’ve ever been, and while Religion or religious people may have a hand in that, so do Atheists and non-religious people. I can understand that the line about Jesus being racist seems a bit provocative, but that isn’t to suggest that that makes him a bad person, since most people are that way; especially the people who try hardest to appear not to be. This poem is also about the Obama/Biden administrations in which many “AntiWar Liberals” became brainwashed into supporting Bush-Era foreign policy.]

0 notes

Video

Xidaa X9: Cutting-edge Technology with Eco-friendly design

"Introducing the Xidaa X9 electric motorcycle - the ultimate solution for saving money and embracing eco-friendly commuting. With its sleek design and efficient performance, the Xidaa X9 is not just a bike; it's a smart investment in your financial and environmental future. Picture yourself zooming along at a comfortable top speed of 75 km/h, That's the incredible efficiency of the Xidaa X9's electric motor, which allows you to cover up to 125 kilometers on a single full charge. With such impressive range and cost-effective operation, you'll wave goodbye to expensive fuel bills for good. But here's where it gets even better: thanks to its low maintenance requirements, your Xidaa X9 practically pays for itself over time. With a monthly maintenance cost of just 100 rupees, you'll find that your savings add up quickly. In fact, with careful financial planning, your Xidaa X9 could become entirely cost-free in as little as 2.5 years. With the Xidaa X9, you're not just investing in a mode of transportation; you're investing in a brighter, more sustainable future for yourself and the planet. Experience the joy of saving money while reducing your carbon footprint with the Xidaa X9 electric motorcycle. #XidaaX9 #ElectricVehicle #SaveMoney #FutureEBike"

0 notes