#Open Savings Account

Explore tagged Tumblr posts

Text

Steps to open a Zero-Balance Savings Account online

If you want to open a Savings Account instantly and without hassle, you can choose a Zero-Balance Savings Account. It is a convenient and straightforward account that you can use daily. Following simple steps, you can open a Savings Account anywhere. Follow these steps to open a Zero-Balance Savings Account:

Select a trusted bank

Start by finding a bank that offers online services for a Zero-Balance Account opening. Do not open the account with the first bank you see. Research and find differences in interest rates and other facilities available. This ensures you make the right decision based on your financial capabilities.

Visit the bank website

Once you have decided on a bank, go to its official website to initiate the account opening process. Look for options like Open Savings Account on the homepage or banking services section. Always check that you do not have any third-party links open before entering your details.

Click on 'Open an Account'

Find and click on the 'Open an Account' button or link. You will be directed to a page to select the account you wish to open. Choose the Zero-Balance Savings Account from the available options, and you will be navigated to the online form.

Upload required documents

Once you enter the required details, upload scanned documents requested by the bank. Ensure the documents are precise and updated to avoid any delays in the verification process.

Read policies

Also, review the terms and conditions associated with the Zero-Balance Savings Account. Then, calculate any fees, interest rates, and other essential related details. Ensure that you completely agree with the terms before proceeding.

Submit your application

Once you complete all the steps and review the terms, submit your application for processing. You will either receive an email confirmation stating that your application has been submitted and providing further instructions.

Verify your identity

After submission, the bank verifies your identity and the documents provided. You will receive a personal call, or the bank personnel will visit your residence to confirm your address. This step varies depending on the bank.

Account details

Upon successful verification, you will receive the confidential account details via email or SMS. These details are sent with utmost security and cannot be accessed without a password. You can then start using your Zero-Balance Savings Account to manage your finances and begin saving.

Conclusion

Opening a Zero-Balance Savings Account online is a straightforward and convenient way to start saving money. You can quickly set up your Zero-Balance Savings Account.

0 notes

Text

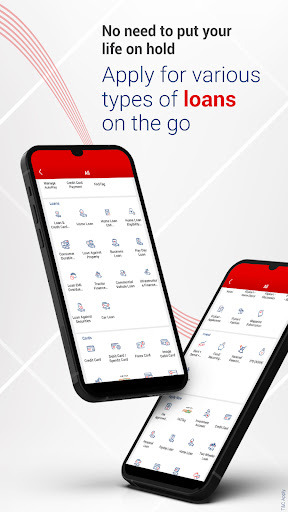

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account#digital banking app#bank account online#premium banking

0 notes

Text

Top banking mistakes you cannot afford to make

Although banking offers numerous benefits, most people need help with the procedure. Every time you conduct a banking transaction, you and your bank communicate. Such as cashing out from an ATM or depositing a check, among many other things. It is normal to make mistakes, but doing so while conducting financial transactions with your bank could cost you more. So, while doing banking activities, you should be more cautious because a single mistake can lead to big losses.

Source : https://luxurystnd.com/top-banking-mistakes-you-cannot-afford-to-make/

#zero balance account open#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note

Text

Reasons to switch to online banking

Recent years have seen significant changes in the banking industry, and many people now find banking simpler due to technological advancements. Those days of waiting in a queue at the bank or spending hours on the phone to resolve transactions are long gone. With a free online bank account, you may accomplish all of your daily tasks from the convenience and privacy of your home. Indeed, this has become a very popular banking approach in the last several years. Here mentioned are the reasons to switch to online banking:

No monthly fees:

Your checking and savings accounts are maintained by most traditional banks every month for a cost. These needless fees deplete your hard-earned money. For certain accounts, if you keep a specific balance or get a certain amount of direct deposits each month, the monthly maintenance charge is waived. However, you shouldn't have to worry about whether you can meet those obligations every month.

Convenience:

Money management is easy with online banking. You can check your bank statements, make bill payments, and transfer money whenever you can access the Internet. Bank-to-bank transfers, bill payments, mobile cheque deposits, and paperless statements are popular aspects of Internet banking. Certain online banks have tools and apps on their websites that are intended to help you save more money.

Stay in control:

You should consider free online bank accounts because they make it easier to maintain financial control. You have quick and simple access to watch what comes in and goes out of your account, keep an eye on your spending, schedule payments, and carry out financial activities. You gain complete comfort and convenience in handling your finances and bank accounts, making it much easier to maintain control over your finances.

No balance requirement:

For savings and checking accounts, large banks may have multiple balance requirements. Additionally, they might ask you to keep a minimum daily balance. Not everyone can accomplish this. Less stringent balance requirements apply to online banks. Many have no requirements at all for a starting deposit. Usually, the ones that do are a few. Most also don't demand you to keep a specific monthly balance.

Save time:

Giving online banking a try is also encouraged because many individuals are surprised by how much time and hassle they may save using its services. It used to take a lot of time for customers to call bank employees or to visit offices and wait in long lines. You can easily handle everything online from the comfort of your home when you have internet banking, so this is no longer a problem. You can handle your finances much more quickly and easily as a result.

Bottom line:

These are just a few reasons to make opening an online bank account wise. An online new account open has made simpler nowadays. Due to benefits like reasonable rates, no fees, and digital capabilities that can make managing your accounts and increasing your savings easier, online banks frequently provide substantial advantages over traditional banks.

#open online bank account#bank online account open#online opening account#bank account online opening#zero balance account online#online banking app#open new account online#online open bank account app#open savings account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#open savings account#apply online bank account#apply for bank account online#mobile banking app#mobile banking apps#online new account open#online banking#saving account opening

0 notes

Text

How Does Online Savings Account Work?

In this digital age, everyone is aware of and switched to online bank accounts. You may begin saving money after making an initial contribution to your online savings account. You may manage your funds with an online savings account anytime, anywhere. While many banks and credit unions frequently offer unique benefits on online account management capabilities, completely online savings accounts. It is also important to note to open savings bank account online, so you do not have to worry about entering a branch and depositing or withdrawing your money. In this post, you will learn about how does online savings account works:

What is an online savings account?

An online savings bank account, commonly called a digital account, including the process of open savings bank account online conducted entirely digitally. Financial technology frequently provides these online accounts in collaboration with large, well-known banks or small finance banks. As you are familiar with conventional banks, they are governed by the Reserve Bank of India. They must follow all the laws and guidelines established by the regulatory authorities.

How to open an online savings account?

Opening an online savings account is much easier than opening in the bank. First, you need to research and choose your desired banking sector. Before choosing it, check that your chosen bank has all the online banking features like mobile applications and high-interest rates paid to customers. Your account opening methods can change from bank to bank.

Once and for all, when you finalize your desired bank, you may need to download their mobile application or online account opening form on their website. Your bank will require basic information like your name, age, address, phone number, mail ID, etc. In addition, for identity proof, they may ask for your Aadhaar card.

After verification, they ask you to complete the KYC form like Know Your Customer. With e-KYC and video KYC development, proving your identity by sharing a brief video or your Aadhaar-OTP can be done quickly with biometrics.

Benefits of online savings account

Easy to use: You can manage your funds whenever and wherever you want without adding another stop to your schedule or waiting for the bank to open because all of your interactions with your account occur digitally.

User-friendly apps: Online banks frequently invest a lot of effort to make sure their websites and mobile banking apps are optimized and simple to use. This enables you to shift your money without any problems with just a few clicks on your bank's website.

Security: Online savings accounts intensely focus on encrypting user data and ongoing monitoring to protect your accounts. With the help of two-factor authentications like passwords and biometrics, your online accounts are safeguarded efficiently.

Customer support: Many online savings accounts offers a 24-hour in-app service and toll-free calling feature because their main goal is to give a hassle-free banking experience.

Final Thoughts

By opening a savings account in online you can easily and flexibly able to manage your money. It is crucial that you should compare bank accounts in order to determine which one best suits your banking requirements.

#bank khata kholna#best banking app#savings bank account#online saving account opening#digital savings account#open savings account#new savings account#saving account opening#saving account#online savings account

0 notes

Text

HI TUMBLR IM NOT DEAD

Take the boys for nowwww

#art#artwork#art account#fanart#tmnt fanart#2012 tmnt#tmnt 2012#2012 donnie#2012 casey jones#caseytello#jonatello#gays#small sketch#commisions open#save rottmnt#tmnt

1K notes

·

View notes

Text

WOAH I FINALLY POSTED TMNT ART?!?! ONLY HAS BEEN SEVERAL FREAKING MONTHS

This art is in honor of @t1atam3ra as I promised 🫡 hope you don’t mind the tag! And I hope you enjoy it :)

Is this art perfect? No, it was pretty quick but. This idea was floating around in my head for a little while n’ wanted to share so I hope y’all’s like it!

Oh Raph my son my child my poor traumatized guy can the fandom start like focusing on him more please please please please? I’m so desperate actually I love him so much

Anywho. See you all in like. A long time later!!

I’d draw more tmnt stuff but I have no ideas 💔 I WILL take suggestions I’m dying

#art for friend <3#hope you like it :D#send recs please#my creativity is suffering rn#I can only think of Batman characters 💔#plus my motivation? in the trash#requests force me to draw. but like in a good way#force me to draw please#burnout is a bitch#krang raph#rise of the teenage mutant ninja turtles#rottmnt#art#finally stopped ghosting this freaking account damn#digital art#rottmnt fanart#save rise of the tmnt#rottmnt raph#rise raph#raphael#rottmnt raphael#raphael hamato#reqs open#unpause rottmnt#krangified#artists on tumblr#save rottmnt#teenage mutant ninja turtles

63 notes

·

View notes

Text

The year that was 2024:

But first...

Standing at the threshold of 2025 I look back far past 2024 to that day in June 2022 and the grief, disbelief... the shock and trauma those of us experienced while watching the Festa Dinner video. That dinner had been pre-recorded a few weeks prior and they released it on June 14. The members had to be scared of what our reactions would be when we watched it.

At that time we still had no idea how military enlistment would unfold, that news was still months away for us after the October concert in Busan. All we knew was BTS was going to pause but we did not really know what that meant. And it wasn't just the fans who went into a tailspin, Hybe stock took a dip, the secretary of Ministry of Culture Sports and Tourism begged BTS to come back. The news of a BTS hiatus began to hit international news media across the globe. The emotional devastation was real.

That day and following days, it seemed like 2025 was forever in the future. What would we be like in 2025? What would the members of BTS be like? What would the music industry landscape be like? What would the world be like? It was two and a half years away from that day. Back in June 2022, 2025 seemed like a lifetime away in the future, a bleak, dark unknown.

We attempted to pull ourselves together and look for the positives... "we'll save so much money!” and "we'll have time to learn Korean!" HAH! The real winner: “I can catch up on content!” LMAO!

Here we are now, two and a half years later. My god the shit that's transpired since. A lot of it was not on anyone's radar.

2024, the year of fighting...

Throughout the year and as the year wore on, we fought boycotters, haters, mantis and solos. We fought the media, each other, other fandoms... it was a constant battle to clear the mess. Our main weapon? Our love for BTS and the members and our commitment and determination.

We should be better at recognizing bad actors, at recognizing organized hate. I hope you all are blocking it, muting it because it is an energy drain to dwell on it and it exists. Some people are compelled to lash back at it. I'm not one of those. I prefer blocking/muting. Do what is right for you.

So here's a recap of 2024...the first quarter of the year started out calmly.

January: We were basking in the BTS documentary series Beyond the Star and waiting for a sign of our men completing their basic training. We were hoping to find out where they would be stationed for the rest of their military service.

February was relatively quiet. Except for this.

Tae's song "Fri(end)s", released mid-March.

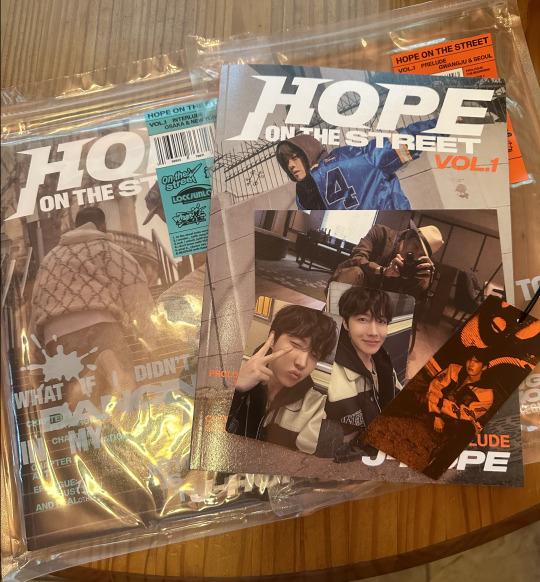

Hope on the Street Vol. 1 released end of March with the six episode docu-series running through April.

We were hitting our stride, understanding that they'd prepared so much for us while they were away. Even k-media reported on the unusual amount of content produced by BTS to span their enlistment time. It was reassuring and we were spoiled. Looking back, it was the quiet before the storm...

This "quiet before the storm" has never quieted before the storm like this quiet before the storm quieted the first quarter of 2024.

In April we witnessed a real eclipse in the sky and then while we were having the best time unraveling the mystery of the Monochrome merch popups, the shit hit the fan with the Min Hee Jin revelations. And that circus was just beginning. Maybe I'm just naive or too much of a positive person but I never fathomed that there were people out there this demented, this twisted, this delusional, controlling and narcissistic that they thought they could single-handedly bring down a huge company like Hybe via public opinion. And as time went on and continues to go on we learned she was not alone. That woman is sick and evil.

I recalled back in 2021 seeing people be paranoid about the young company, Hybe, hiring ex-SM employees. I wanted to believe these former SM employees they hired saw the opportunity to escape a toxic workplace and therefore defected to Hybe. Now we know the paranoia was justified.

The end of April and into May I watched Begins ≠ Youth, the drama series based on the BTS Universe. It took years for that series to finally see the light of day. It was very intriguing. There was a lot of controversy about Xclusive, the platform it was delivered on. My theory is it was an experiment to see how fans would react to a blockchain/NFT product. I have a huge post in my drafts about it but we moved on from it quickly, so I did too. The series was great though.

The rest of May was a month where we were trying to remain calm, trying to remain positive. We as a fandom felt very beat up. Anticipation was through the roof for Jin's military discharge and Festa.

But first, Namjoon released Right Place, Wrong Person, the studio album and subsequently, the accompanying documentary, Right People, Wrong Place. Both the album and documentary are critically acclaimed, winning awards and landing on "best of" lists across the globe.

Finally, it's June. Jin's discharge was so emotional for everyone. We were able to see everyone except Yoongi greet him outside the gates. But it was amazing seeing all 7 together in still photos afterward. It was a collective sigh of relief that we truly are beginning the downhill side of their military enlistment. Jin has been working his ass off since that day, his album Happy and its title song Running Wild doing well.

I know we've got our opinions about the South Korean government but that day, for me, seeing Jimin and Jungkook in their uniforms, as soldiers, just hit a spot in me that I can't describe. I felt proud of them. And I hope after their discharge they can tuck away that sense of accomplishment in a safe space and flip the bird at the bureaucrats running their country.

Jimin dropped his second album, Muse, in July, the mystery solved of what all those other producers were doing with Jimin the second half of 2022. The title song Who continues to chart. His songs are wonderful. I'm so proud of how far he's come during this solo era. I miss him.

And then Are You Sure?! happened. Even though we KNEW it was coming, I can't believe we got that show. I can't believe they did all of that. Naked Jimin except for a small pair of black shorts... naked Jungkook. Just so much naked after years of Victorian era artist protection CG over every square inch of bare skin. Watching that show, so much of what I knew in my mind of how they are together was mostly confirmed.

I said this months ago: After Jungkook’s 2023 Weverse lives, the Are You Sure?! series, their companion military enlistment and his documentary I Am Still the theatrical release and the Disney+ docu-series, it is clear that Jimin is Jungkook’s touchstone, a significant presence through at least this part of his life. We can’t know what the future holds, I would never dare to assume what their own personal desires or goals are for themselves, but I do know that Jimin will play a big part in it and I hope we still get to see some of that play out when it happens.

I'm still processing. I digressed. It happens when it comes to me, Jimin and Jungkook. Moving on.

August... my god. My dear Yoongi. We are still waiting to see him again, to see with our own eyes that he is actually ok and to figuratively take his hand in ours, to reassure each other and keep moving forward to leave this year far behind. I know he knows we are here. I can't stand the wall though, of not being able to see him. Does that make sense? I mostly keep my thoughts to myself about him because it really hurts my heart to think about him having to suffer through all that. August and into September were hard, hard… so hard.

Fast forward to October when Hobi stepped out of those doors on the day of his discharge, it seemed like time had flown by as if we just watched him leaving for training camp, even though it was sooooooo long ago.

And now he's lived in LA for almost a month, been in Japan and seen with more people... A possible fashion collab? Songs/album in February? We don't know anything for sure yet but info has leaked. A tour in spring? I'll be there if I can snag tickets.

We've seen glimpses of Tae and his buff self. His collab with Bing Crosby was ground breaking and hopefully will become a holiday classic just like the original. Also, happy birthday, Tae!

[Photo shared by Taehyung on his Instagram stories.]

December began shockingly with South Korea's President Yoon attempting to impose martial law. My heart dropped. Our guys were on red alert, scrambling. It lasted a few hours before being overturned by their national assembly.

Mid-December, while on a vacation leave, Jungkook surprised us with a 2 and a half hour live just like he used to do. He looked so good. He sounded good. From what I saw, he's still the same Jungkook.

Do you realize, if martial law had remained in effect, we would not have seen Jungkook? There would be no celebrating. We would all be in limbo. Who knows what that crazy shithead (now impeached-president Yoon) would have done if martial law was still in place. The slow reveal of information about the planning of it is chilling and should be a reminder to us all to not take things for granted. Their National Assembly are still trying to get everything under control, the turmoil is not over yet.

Somehow, the Universe is working overtime to get BTS through their service and I hope it continues to do so because we still have just under six months left. At this point, I believe anything could happen.

Counting down the hours to 2025

We are about to enter the holy Borayear of our Lord Min Yoongi 2025. Bestie and I talked a lot about what the possibilities might be for 2025.

Of course, like everyone else, we know nothing for sure, only what we've gleaned from the member's themselves, official announcements, news releases and hints here and there. What we DO know for sure is there will not be a void. We have two Tannies back with us. Music will be released, content produced:

January 4 is Jin's OST.

Not directly BTS related but we as a fandom would like some closure and satisfaction surrounding the MHJ drama because trials will begin in January.

Hobi has something coming. Certainly Hobi will have another EP, perhaps HOTS Vol. 2? which would be supported with a tour. There's been a leak of info. We are on high alert.

For the others, perhaps a few one-off singles before June. Between us, we don't think Tae has another album's worth of music. Jungkook either.

A Yoongi collab perhaps?

Namjoon, probably nothing. Poor baby is so ready to be discharged.

The Jimin x Benny Blanco music, whatever that may be.

Maybe that rumored JK x Tae subunit song. Or maybe it's not a song?

Jin mentioned another album but the timing is tight to squeeze it in before June.

Then the HYYH 10th Anniversary in April, whatever that may entail. A retrospective perhaps?

Attempting to predict how their discharge days will play out is difficult. Jin and Hobi splitting up to meet Namjoon and Tae at their respective bases? And then all four of them head to Jimin and Jungkook the next day to greet them as they exit their base? We wait with anticipation.

After the Boraholy month of June 2025, we expect group activities to ramp up. What those will be is anyone's guess. Weverse lives for sure. Also, dance practice videos. We expect new music. We also expect performances. Perhaps a one-off "we're baaAAAaack!" type concert? Or not. But performances of some sort. They've been looking forward so much to performing I can't see them waiting any longer than they have to for at least one performance somewhere, somehow.

And toward the end of 2025, a comeback album and the world tour announcement. May the odds be ever in your favor. Just kidding. I'm getting those tickets.

Our speculation continues... could new music consist of more subunits?

I could be wrong but I do not think they will revisit a Bon Voyage or In The Soop format. They might pick up Run BTS but it won’t be like it was before. I can’t even see them doing what Jin’s doing in many Run Jin episodes. Not as a group.

I think (I hope) that Yoongi picks up Suchwita again. I hope he does not change one iota of the format. He can address his incident again if he chooses, reiterate he apologized, paid his fine and now we’re moving on to live our big life. That’s it. I hope if this happens his first guest is BTS as a group.

Maybe that last thing is really wishful thinking on my part but even considering Yoongi might ditch Suchwita or change it just doesn’t align with who he is. He is a “fuck you” type of guy.

Anyway. 2025 has a promise of hope and happiness and relief and closure. But now, I think we all know to be wary, that anything can happen.

Bottomline to all of this, to wrap up the year and look forward to the new year is that BTS is COMING BACK. SEVEN MEMBERS STRONG.

The reality is, it will be three years from that day back in 2022, when we finally see them as a group again. The members are slowly becoming more active. We have less than six months to wait and we know how fast that can go. 163 days left for Jimin and Jungkook, 162 for Namjoon and Tae, 173 left for Yoongi.

We must enjoy every moment we can until June 2025 and hope for the best! FIGHTING.

#2024 was hard and my sense of humor took a hit#we are all dead serious now to get to June 2025#i am so behind on content#jin out did everyone#i can't keep up with him#i hope to catch up#so much for saving money and becoming more proficient at Korean#2025 i am hoping the best is yet to come#my suggestions to you for new year's resolutions:#stop watching rumor-mongering edited videos from toxic youtube channels#stop engaging with or promoting hate on the timeline - ignore/block do not screen shot do not repost#stop engaging with trolls on tumblr - it is so much more enjoyable when you can block them out of existence#open a bluesky account it really is so peaceful over there#apobangpo#jimin#jungkook#yoongi#namjoon#hobi#jin#taehyung#bangtan sonyeondan#i hope i didnt miss anything but damn 2024 was a blur

109 notes

·

View notes

Text

Man obviously there’s a bunch of really unfortunate consequences to Elon’s mishandling of twitter but the thing that really got to me after a while was how lonely it feels to use the platform now. I only follow my friends and a couple of artists yet my whole dash is filled with total strangers and blue checkmarks trying to farm engagement. There’s an unblockable ad every three tweets (two if you’re counting the bots trying sell me something). There’s no lingering on interesting videos cause they all autoscroll tiktok style (with ads every 3 vids). Following someone means zilch so if I wanna see what the friends I use the platform for have been up to I have to manually go to their accounts & half the time the first tweet I see is an announcement that they’re leaving. It’s such a dead mining town of a website, but instead of dying because the mines just naturally dried out and people left for greener pastures, it’s dying because the newly appointed nepobaby Sheriff got really into building a 7-story mall in the middle of the desert without ever stopping to think what it’d do to the local economy and wildlife, or even if anyone needed an apple store and three taco bells in the middle of the outback.

#like twitter used to be my little place where i made my little jokes and saved bits and poems and thoughts in my concepts#i used it like a public diary more than anything. it was nice. it was relaxing.#i love tumblr but I have 4000+ ppl following me on here & even if many of those accounts arent active anymore it still FEELS too public#too public for my amateur poetry and dream diary at least#twitter was a little more intimate. i was screaming abt all my little hyperfixations on there.#multiple of my friends told me they opened my acc up like the morning newspaper every once in a while. just for fun.#and I know its not a big deal. because its not. but its sad. if things were different id be posting mouthwashing thoughts on there right no#and that’s sad to me. i know we have bluesky and i love her but i still have to leave the mining town id settled in for years.#fuck you sheriff. hawk tuah on your shitfuck cowboy boots.#rose ramblings

43 notes

·

View notes

Text

Things to learn regarding zero balance account opening with debit card access:

Zero balance accounts have become popular in today's banking environment as easily accessible options that provide financial inclusion to a larger group of people. These accounts have no minimum balance requirements, which makes them appealing choices for people who want banking services without having to keep a certain amount on hand. Debit cards further improve the usefulness of these accounts by facilitating simple access to money and a host of banking functions. This is a thorough post that will walk you through opening a debit card-accessible account with zero balance savings account online:

Look into your banking options:

Find out which banks offer debit card access and zero balance accounts. Compare the fees they charge for services, the features available for online banking, the availability of physical branches and ATMs, and any other benefits or rewards they may provide. Keep things like savings interest rates, transaction costs, and account management simplicity in mind. To guarantee a smooth financial experience with your debit card and zero balance account, look for companies recognized for their dependable customer support and user-friendly online banking systems.

Have the required documents:

Required documents include gathering valid identity, address evidence, and income-related documentation. Bring official identification, such as a passport, PAN card, or Aadhar card, to prove your identity. You should also have supporting documentation attesting to your address, including utility bills or rental agreements. Get income tax returns (ITR) or salary slips to document your income.

Choose The Account Type:

Once you have these documents together, evaluate each bank's account kinds. Consider straightforward savings accounts or more specialized choices based on your needs, including salary or student accounts. Consider account features that correspond with your financial objectives, such as interest rates, overdraft capabilities, and other benefits. Knowing the many account kinds makes it easier to choose the one that best meets your banking needs and provides the features and perks you want for your financial goals.

Application for Debit Cards

Apply for a debit card connected to the account after opening the zero balance account online. Fill out the bank's debit card application form, including all relevant documentation and personal information. Apply in person at the bank branch or online via the bank's mobile application or website. Following processing, the debit card will be issued by the bank. You may then activate it and use it for various purchases and transactions, taking advantage of the convenient cashless transactions and simple money access that comes with using a debit card.

Turn on and Utilize the Debit Card

Once you receive the debit card, activate it by following the steps provided by the bank, which usually require activating the card via an ATM or phone call. Establish a security PIN (personal identification number). Once activated, use the card for POS, contactless payments, internet purchases, and ATM withdrawals. Learn about the rules of overseas usage, spending caps, and security features. Look for any strange behavior with the card, and immediately notify the bank.

Wrapping It Up:

The above points give you crystal clear insights regarding zero balance account opening online with debit card. People can obtain necessary financial services and efficiently manage their finances by knowing the process and taking advantage of the available features.

#open bank account online free#open indian bank account online#open new bank account#open savings account#opening bank account#opening savings account

0 notes

Text

(empty look of death)

#in case you're wondering how i'm doing uhh#ya boy is considering opening commissions at some point#on account of his life rapidly going to shit#given the whole 'i either spend all my savings fixing my car or i spend all my savings getting a new car'#'and i don't have many other options because it's either i go to work or the company physically implodes and i don't have a job anymore'#benefits of being the one load-bearing employee <333#because your main terrible boss never managed to pick up anyone else as all the other employees left one by one <333#anyway. sorry. i've been. crying on and off all day#it's not like there haven't been good times these past six months (i've been grabbing little mouthfuls of life) but#i'm feeling it on my psyche. i'm feeling the fact that i've been holding my brain to the grindstone since 2023 and it's <333 bad <3333#the fact that twice today i've had brief Ideations tells you all you need to know </333#anyway. i will be okay. ultimately.#life has to get easier sooner or later but. unironically i may need to look into supplementing my job income#or else i'm not going to survive the upcoming gap season

35 notes

·

View notes

Text

Tiresias, getting shivers up their spine every time a part of the prophecy is completed:

#GIF from Emperor’s New Grove by Disney#Why is this what I post? Eh I’m feelin’ a little silly#And bored — sooooo bored#Please send asks to either of my accounts 🥹 save me 😭 /silly#Anyway- uhhh ODY IM MAKING TIR LORE 🥳✨#Welp that’s it; thanks for coming to my TedTalk /silly /gen#epic rp#tiresias rp#epic the musical rp#epic rp blog#epic ask blog#asks open#ooc#epic the musical#epic underworld saga#THE PROPHECY *blasting rock guitar sounds* /ref /silly#epic musical

31 notes

·

View notes

Text

//laughs in "I know what this is and I got it for $20"

#it's a late victorian vase c 1880s#a similar one is going for £872 for example#I couldnt let this slip by so I did go into my savings but I get paid Friday and im talking to my financial guy on Thursday#also if you open a retirement account with my guy he gets paid .1% of the GAINS from the account

17 notes

·

View notes