#OPEC+Cuts

Explore tagged Tumblr posts

Text

Energia: Simplify Energy Investing - Access Private Market Assets

Energy is a critical component of a sound portfolio The energy sector offers the potential for substantial returns but also provides a hedge against economic uncertainties, ensuring stability and resilience in your overall investment strategy. Why Energia Current options to hold direct oil and gas exposure are complex and expensive, and traditional private equity opportunities have high entry and exit costs. Energia users can gain direct access to energy assets in a simple and transparent manner with low fees.

#EagleFordBasin#EnergyHistory#OilandGasExploration#TexasEnergy#USOilProduction#NaturalGasResources#EnergyIndustry#HydrocarbonProduction#Fracking#EnergyIndependence#EnergyInvestment#EnergyInvestor#EnergyNews#OPEC+Cuts#CrudeOilPrices#EnergyOutlook#EnergyResources#EnergiaAnalytics#DCMBSecurities

0 notes

Text

Saudi Arabia cutting from 13 million barrels a day to 8 million barrels a day. Why? So they can jack up the price up of oil.

This is Saudi Arabia and OPEC attempt to help Trump in this election.

#gop#democrats#vote blue#republicans#vote biden#democracy#fuck trump#maga 🧠 = 🐶 💩#opec#CUTTING OIL PRODUCTION#trying to influence the election 🗳️

3 notes

·

View notes

Text

🏭 OPEC ANNOUNCES FURTHER OIL PRODUCTION CUTS OF 2.2 MILLION BARRELS PER DAY

The OPEC Secretariat, on Thursday November 30th, noted the announcement of several OPEC countries of additional voluntary cuts amounting to a total of 2.2 million barrels a day, aimed at "supporting the stability and balance of oil markets."

Production cuts were calculated from the 2024 required production level as set on June 4th, 2023, and are in addition to the voluntary cuts announced in April and extended through the end of 2024.

Production cuts are being announced by the following countries:

🇸🇦 Saudi Arabia: 1'000 thousand barrels per day

🇮🇶 Iraq: 223 thousand barrels per day

🇦🇪 United Arab Emirates: 163 thousand barrels per day

🇰🇼 Kuwait: 135 thousand barrels per day

🇰🇿 Kazakhstan: 82 thousand barrels per day

🇩🇿 Algeria: 51 thousand barrels per day

🇴🇲 Oman: 42 thousand barrels per day

Starting January 1st until the end of March 2024. Afterwards, these voluntary cuts will be returned gradually, subject to market conditions.

The above amounts will be in addition to those announced by the Russian Federation of 500 thousand barrels per day for the same period, which will be made from the average export levels of the months May and June of 2023, and will consist of 300 thousand barrels per day of crude oil and 200 thousand barrels per day of refined products.

#source

@WorkerSolidarityNews

#opec#oil production#opec cuts#politics#geopolitics#russia#saudi arabia#saudi news#united arab emirates#kuwait#oman#algeria#iraq#kazakhstan#news#world news#global news#international news#international affairs#international politics#global economy#global oil production#global production#breaking news#current events#middle east#europe#business news#economy#economics

4 notes

·

View notes

Text

OPEC+: Riyadh to reduce oil output, others to extend previous cuts

The Saudi cut, set to start in July,July, comes as the other OPEC+ producers agreed in a meeting in Vienna to extend earlier production cuts through next year. Calling the reduction a “lollipop,” Saudi Energy Minister Abdulaziz bin Salman said at a news conference that “We wanted to ice the cake.” He said the cut could be extended and that the group “will do whatever is necessary to bring…

View On WordPress

0 notes

Text

Images and text from this Reuters article.

"OPEC cut its forecast for global oil demand growth this year and next on Tuesday, highlighting weakness in China, India and other regions, marking the producer group's fourth consecutive downward revision in the 2024 outlook."

#oil#natural gas#fossil fuels#global warming#climate change#good news#economics#economy#fossil fuel industry#hope#climate anxiety#climate grief#environment#clean energy#sustainability#sustainable energy

179 notes

·

View notes

Text

The KSA and the UAE are as much to blame as US and UK

To forget to boycott and talk about Saudi Arabia and Emirates part of this genocide on Gaza and attack on Yemen

As an Arab, I know that Arabs and Muslims bare unforgettable shame right now as we're unable to help Palestinians, Sudanese, and Yemenis.

And by 'We' I mean the people. The leaders are something else that I hope will burn in hell.

Arabic countries are among some of the worst dictatorships. We can scream and shout all we want, but no one will listen, and yet, I do feel unbearable guilt every day. But the guilt should not be distributed equally

Egypt has the border with Palestine and barely opens it. But Egypt is already on the verge of economic collapse and is billions of dollars in debt. The government can not move without the approval of the US. Not to say that they're right for not opening the borders, not at all. Yemen is even poorer than Egypt, and they had more courage than the entire world to stop Israeli ships! But I am saying that while Egypt is to blame, it's already in deep shit and more economic punishment will affect its people decades before it affects its dictators.

But Saudi Arabia and Emirates are two of the richest countries in the world! With enough oil that they have the US throat in their hands, and they're giving it a soothing massage.

And what did they do? Nothing. No, worse than nothing. The rockets that attacked Yemen flew over Emirates by their permission.

And with evidence from history we know they can single handedly stop this genocide.

In 1973, in the war between Egypt and Israel, USA tried to back Israel - like today - and King Faisal, the king of Saudi Arabia, basically told the USA,"Take one step towards Egypt and you will not see a drop of oil"

And he kept his promise.

Arab members of the Organization of Petroleum Exporting Countries (Opec), led by King Faisal, announced an embargo on oil sales to America, Britain, Canada, Japan and the Netherlands in retaliation for their support of Israel.These cuts nearly quadrupled the price of oil from $2.90 a barrel before the embargo to $11.65 a barrel in January 1974.

And the US backed off. In a full-blown war. Not just one-sided genocide.

The UAE products are boycotted in Egypt under the knowledge that "Emirates are as much Zionists as The US"

And again and again, Arabs are not their leaders! Saudi and Emirati citizens are not their leaders, just like not all Americans are Biden or Trump.

But two insanely rich countries that can stop this genocide and don't? Their products should be boycotted, and their names should be dragged through the mud, just like the US and UK

#palestine#free palestine#gaza#palestinian lives matter#free gaza#social justice#genocide in gaza#jerusalem#save palestine#yemen#icj hearing#south africa#us colonialism#usa#uk#saudi arabia#Emirates#end israels genocide

315 notes

·

View notes

Text

39 notes

·

View notes

Text

We thank you, Joe

Tonight is for you

Robert Reich

Aug 19, 2024

Friends,

Tonight’s opening of the Democratic National Convention in Chicago will be an opportunity for the Democratic Party and the nation to take stock of Joe Biden’s term of office and thank him for his service.

He still has five months to go as president, of course, but the baton has been passed.

Biden’s singular achievement has been to change the economic paradigm that reigned since Reagan and return to one that dominated public life between 1933 and 1980 — and is far superior to the one that has prevailed since.

Biden’s democratic capitalism is neither socialism nor “big government.” It is, rather, a return to an era when government organized the market for the greater good.

The Great Crash of 1929 followed by the Great Depression taught the nation a crucial lesson that we forgot after Reagan’s presidency: markets are human creations. The economy that collapsed in 1929 was the consequence of allowing nearly unlimited borrowing, encouraging people to gamble on Wall Street, and permitting the Street to take huge risks with other people’s money.

Franklin D. Roosevelt and his administration reversed this. They stopped the looting of America. They also gave Americans a modicum of economic security. During World War II, they put almost every American to work.

Subsequent Democratic and Republican administrations enlarged and extended democratic capitalism. Wall Street was regulated, as were television networks, airlines, railroads, and other common carriers. CEO pay was modest. Taxes on the highest earners financed public investments in infrastructure (such as the national highway system) and higher education.

America’s postwar industrial policy spurred innovation. The Department of Defense and its Defense Advanced Research Projects Administration developed satellite communications, container ships, and the internet. The National Institutes of Health did trailblazing basic research in biochemistry, DNA, and infectious diseases.

Public spending rose during economic downturns to encourage hiring. Antitrust enforcers broke up AT&T and other monopolies. Small businesses were protected from giant chain stores. Labor unions thrived. By the 1960s, a third of all private-sector workers were unionized. Large corporations sought to be responsive to all their stakeholders.

But then America took a giant U-turn. The OPEC oil embargo of the 1970s brought double-digit inflation followed by Fed Chair Paul Volcker’s effort to “break the back” of it by raising interest rates so high that the economy fell into deep recession.

All of which prepared the ground for Reagan’s war on democratic capitalism. From 1981 onward, a new bipartisan orthodoxy emerged that markets functioned well only if the government got out of the way.

The goal of economic policy thereby shifted from the common good to economic growth, even though Americans already well-off gained most from that growth. And the means shifted from public oversight of the market to deregulation, free trade, privatization, “trickle-down” tax cuts, and deficit reduction — all of which helped the monied interests make even more money.

The economy grew for the next 40 years, but median wages stagnated, and inequalities of income and wealth surged. In sum, after Reagan’s presidency, democratic capitalism — organized to serve public purposes — all but disappeared. It was replaced by corporate capitalism, organized to serve the monied interests.

**

Joe Biden revived democratic capitalism. He learned from the Obama administration’s mistake of spending too little to pull the economy out of the Great Recession that the pandemic required substantially greater spending, which would also give working families a cushion against adversity. So he pushed for and got the giant $1.9 trillion American Rescue Plan.

This was followed by a $550 billion initiative to rebuild the nation’s bridges, roads, public transit, broadband, water, and energy systems. He championed the biggest investment in clean energy sources in American history — expanding wind and solar power, electric vehicles, carbon capture and sequestration, and hydrogen and small nuclear reactors. He then led the largest public investment ever made in semiconductors, the building blocks of the next economy. Notably, these initiatives were targeted to companies that employ American workers.

Biden also embarked on altering the balance of power between capital and labor, as had FDR. Biden put trustbusters at the head of the Federal Trade Commission and the Antitrust Division of the Justice Department. And he remade the National Labor Relations Board into a strong advocate for labor unions.

Unlike his Democratic predecessors Bill Clinton and Barack Obama, Biden did not reduce all trade barriers. He targeted them to industries that were crucial to America’s future — semiconductors, electric batteries, electric vehicles. Unlike Trump, Biden did not give a huge tax cut to corporations and the wealthy.

It’s also worth noting that, in contrast with every president since Reagan, Biden did not fill his White House with former Wall Street executives. Not one of his economic advisers — not even his treasury secretary — is from the Street.

The one large blot on Biden’s record is Benjamin Netanyahu. Biden should have been tougher on him — refusing to provide him offensive weapons unless Netanyahu stopped his massacre in Gaza. Yes, I know: Hamas began the bloodbath. But that is no excuse for Netanyahu’s disproportionate response, which has made Israel a pariah and endangered its future. Nor an excuse for our complicity.

***

One more thing needs to be said in praise of Joe Biden. He did something Donald Trump could never do: He put his country over ego, ambition, and pride. He bowed out with grace and dignity. He gave us Kamala Harris.

Presidents don’t want to bow out. Both Richard Nixon and Lyndon Johnson had to be shoved out of office. Biden was not forced out. He did nothing wrong. His problem is that he was old and losing some of the capacities that dwindle with old age.

Even among people who are not president, old age inevitably triggers denial. How many elderly people do you know who accept that they can’t do the things they used to do or think they should be able to do? How many willingly give up the keys to their car? It’s not surprising he resisted.

Yet Biden cares about America and was aware of the damage a second Trump administration could do to this nation, and to the world. Biden’s patriotism won out over any denial or wounded pride or false sense of infallibility or paranoia.

For this and much else, we thank you, Joe.

20 notes

·

View notes

Note

I want the Billionaires to pay more in taxes. The money they hoard does not go back into the economy. Trickle Down Economics never worked. If Hunter Biden can get called on the carpet for his taxes then Trump should too. The President doesn't have control over the price of oil. OPEC does. Supply and demand dictate prices here and if OPEC chooses to cut production, that's where the blame lies. I want a meaningful Border Bill. Republicans voted against a Bill and Trump told them not to vote yes on that Bill saying that he will fix it when he gets into office. I don't want wars either but Trump says he'll let Putin do what he wants if he wants to invade a country. The Hunter Biden trial proved that the Justice System isn't rigged.

There is a lot to unpack here.

I want the Billionaires to pay more in taxes. The money they hoard does not go back into the economy. - Then change the tax code.

Trickle Down Economics never worked. - So what

If Hunter Biden can get called on the carpet for his taxes then Trump should too. - I don't even know what this f*cking means.

The President doesn't have control over the price of oil. OPEC does. - Under the last president we were energy independent and on Jan 20, 2020 the price of gas in my neck of the woods was $1.97. It is not that now.

I want a meaningful Border Bill. Republicans voted against a Bill and Trump told them not to vote yes on that Bill saying that he will fix it when he gets into office. - Republicans want illegals here, too. Just for different reasons. And republicans suck almost as much as democrats.

I don't want wars either but Trump says he'll let Putin do what he wants if he wants to invade a country. - Why is it our business what Vladimir does anywhere? I frankly don't care if Macron wants to invade Estonia. Not my concern. And, by the way, under the last president, there were no major wars.

The Hunter Biden trial proved that the Justice System isn't rigged. - This is how to say, "I'm a fucking retard" without using the words, 'I'm,' 'retard,' 'a,' or 'fucking.' If you can say that with a straight face you truly are a fucking retard and I pray you don't breed.

24 notes

·

View notes

Text

TEHRAN, Iran (AP) — Iran’s capital and outlying provinces have faced rolling power blackouts for weeks in October and November, with electricity cuts disrupting people’s lives and businesses. And while several factors are likely involved, some suspect cryptocurrency mining has played a role in the outages.

Iran economy has been hobbled for years by international sanctions over its advancing nuclear program. The country’s fuel reserves have plummeted, with the government selling off more to cover budget shortfalls as wars rage in the Middle East and Tehran grapples with mismanagement.

The demand on the grid has not let up, however — even as Iranians stopped using air conditioners as the weather cooled in the fall and before winter months set in, when people fire up their gas heaters.

Meanwhile, bitcoin’s value has rocketed to all-time highs after the U.S. election was clinched by Donald Trump. It hit the $100,000 mark for the first time last week, just hours after the president-elect said he intends to nominate cryptocurrency advocate Paul Atkins to be the next chair of the Securities and Exchange Commission.

The surge has led some to suspect that organized cryptocurrency mining — sucking away huge amounts of power — has played a part in the outages in Iran.

“Unfortunately, some opportunistic and exploitative individuals use subsidized electricity, public networks and other resources for cryptocurrency mining without authorization,” Mostafa Rajabi, the CEO of Iran’s government-owned power company, said back in August.

Iran’s state energy company did not respond to a request for comment.

Power outages have come and gone in the past in Iran, which struggles with aging equipment at many of its plants. Over the summer, sustained blackouts struck industrial parks near Tehran and other cities. Then in October and November, rolling power cuts across Tehran’s neighborhoods became the norm in daylight hours.

Climate change has been blamed in part, with persisting droughts and less water running through Iranian hydroelectric dams.

Iran’s reformist President Masoud Pezeshkian ordered several power plants to stop burning mazut, a high-polluting heavy fuel common in the former Soviet Union countries. Tehran has used it in the past to make up the difference in electricity generation.

Fuel reserves, both in diesel and natural gas, also remain low even though Iran is an OPEC member and home to one of the world’s second-largest reserves of natural gas, behind only Russia. There’s been no explanation for the decision to keep those reserves low, though critics have suggested Iran likely sold the fuel to cover budget shortfalls.

For his part, Pezeshkian has said that he must “honestly tell the public about the energy situation.”

“We have no choice but to consume energy economically, especially gas, in the current conditions and the cold weather,” he said in mid-November. “I myself use warm clothes at home; others can do the same.”

Still, winter heating isn’t in full swing quite yet on Tehran — raising questions where the power is going.

In many poor and densely populated neighborhoods across the country, people have access to free, unmetered electricity. Mosques, schools, hospitals and other sites also receive free power.

And with electricity in general sold at subsidized rates, bitcoin processing centers have boomed. They require immense amounts of electricity to power specialized computers and to keep them cool.

Determining how much power is used up by mining is difficult, particularly as miners now use virtual private networks that mask their location, said Masih Alavi, the CEO of an Iranian-government-licensed mining company called Viraminer.

Also, miners have been renting apartments to hide their rigs inside of empty homes. “They distribute their machines across several apartments to avoid being detected,” Alavi said.

In 2021, one estimate suggested Iran processed as much as $1 billion in bitcoin transactions. That value likely has spiked, given bitcoin’s rise. Meanwhile, Iran’s blackouts began in earnest as bitcoin spiked from around $67,000 to over $100,000 in its historic rally.

Rajabi, the state electricity company CEO, said his firm would offer rewards of $725 for people to report unlicensed bitcoin farms.

The farms have caused “an abnormal increase in consumption, disruptions, and problems in power networks,” Rajabi said.

The amount of power used by some 230,000 unlicensed devices is equivalent, he said, to the entire power needs of Iran’s Markazi province — one of the country’s chief manufacturing sites.

Iranian officials and media have not linked bitcoin’s surge and the ongoing blackouts but the public has, with social media users resharing a video showing a massive bitcoin farm earlier this year uncovered in Iran. A voice off camera asks how it was possible the electrical company did not discover the farm sooner.

The U.S. Treasury and Israel have targeted bitcoin wallets that they’ve alleged are affiliated with operations run by Iran’s paramilitary Revolutionary Guard to finance allied militant groups in Mideast war zones.

That suggests the Guard itself — one of the most-powerful forces within Iran — may be involved in the mining.

In contrast, Iranian media nearly every day report on individual mining operations being raided by police.

Iran may see bitcoin as a hedge against increased pressure from the incoming Trump administration and as regional allies are engulfed in turmoil, said Richard Nephew, an adjunct fellow at the Washington Institute for Near East Policy.

“The question for the economists inside Iran is do we trust this enough to fund the government,” said Nephew, who has long worked on Iran issues and sanction strategies in the U.S. government.

However, he cautioned against thinking of bitcoin as a magic bullet for Iran, particularly as bitcoin wallets can be targeted in sanctions.

“A pattern of behavior screams out to intelligence services,” Nephew said. “It screams out to bank compliance departments.”

5 notes

·

View notes

Text

A Historical Overview of the Eagle Ford Basin

The historical significance of the Eagle Ford Basin extends beyond its resource potential. It has played a vital role in Texas's enduring legacy in the energy sector and contributes approximately 12% of the nation's daily oil production. From the pioneering well drilled by Petrohawk Energy to the ongoing operations of industry giants like EOG, ConocoPhillips, and Marathon, the Eagle Ford Basin has shaped the American energy landscape.

#EagleFordBasin#EnergyHistory#OilandGasExploration#TexasEnergy#USOilProduction#NaturalGasResources#EnergyIndustry#HydrocarbonProduction#Fracking#EnergyIndependence#EnergyInvestment#EnergyInvestor#EnergyNews#OPEC+Cuts#CrudeOilPrices#EnergyOutlook#EnergyResources#EnergiaAnalytics#DCMBSecurities

0 notes

Text

We have been seeing numerous stories in the media about how people support Donald Trump because he did such a great job with the economy. Obviously, people can believe whatever they want about the world, but it is worth reminding people what the world actually looked like when Trump left office (kicking and screaming) and Biden stepped into the White House.

Trump’s Legacy: Mass Unemployment

The economy had largely shut down in the spring of 2020 because of the pandemic. It was still very far from fully reopening at the point of the transition.

In January of 2021, the unemployment rate was 6.4 percent, up from 3.5 percent before the pandemic hit at the start of the year. A more striking figure than the unemployment rate was the employment rate, the percentage of the population that was working. This had fallen from 61.1 percent to 57.4 percent, a level that was lower than the low point of the Great Recession.

The number of people employed in January of 2021 was nearly 8 million people below what it had been before the pandemic. We see the same story if we look at the measure of jobs in the Bureau of Labor Statistics establishment survey. The number of jobs was down by more than 9.4 million from the pre-pandemic level.

We were also not on a clear path toward regaining these jobs rapidly. The economy actually lost 268,000 jobs in December of 2020. The average rate of job creation in the last three months of the Trump administration was just 163,000.

What the World Looked Like When Donald Trump Left Office

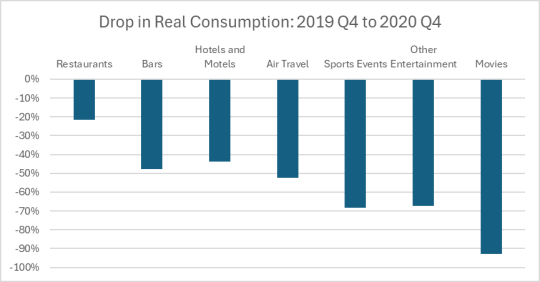

In the fourth quarter of 2020 the economy was still being shaped in a very big way by the pandemic. Most of the closures mandated at the start of the pandemic had been lifted, but most people were not conducting their lives as if the pandemic had gone away. We can see this very clearly in the consumption data.

Source: Bureau of Economic Analysis and author’s calculations.

The figure above shows the falloff in consumption between the fourth quarter of 2019 and the fourth quarter of 2020 in some of the areas hardest hit by the pandemic. While overall consumption was down just 0.8 percent, there has been an enormous shift from services to goods.

Inflation-adjusted spending at restaurants was down by 21.5 percent, and much of this spending went for picking up food rather than sit-down meals. Spending at bars was down 47.7 percent. Spending at hotels and motels was down by 43.8 percent as people had hugely cut back travel. Air travel was down 52.4 percent.

Spending on football games, baseball games, and sports events was down by 68.3 percent. Spending on live concerts and other entertainment was down a bit less, at 67.4 percent. And movie going was down 92.7 percent.

The Story of Cheap Gas

Donald Trump and his supporters have often boasted about the cheap gas we had when he was in office. This is true. Gas prices did fall below $2.00 a gallon in the spring of 2020 when the economy was largely shut down, although they had risen above $2.30 a gallon by the time Trump left office. The cause of low prices was hardly a secret, demand in the U.S. and around the world had collapsed. In the fourth quarter of 2020 gas consumption was still 12.5 percent below where it had been before the pandemic.

In fact, gas prices likely would have been even lower in this period if not for Trump’s actions, which he boasted about at the time. Trump claimed to have worked a deal with Russia and OPEC to slash production and keep gas prices from falling further. The sharp cutbacks in production were a major factor in the high prices when the economy began to normalize after President Biden came into office since oil production cannot be instantly restarted.

The End of the Trump Economy Was a Sad Story

Donald Trump handed President Biden an incredibly damaged economy at the start of 2021. People can rightfully say that the problems were due to the pandemic, not Trump’s mismanagement, but the impact of the pandemic did not end on January 21. The problems associated with the pandemic were the main reason the United States, like every other wealthy country, suffered a major bout of inflation in 2021 and 2022.

It is often said that people don’t care about causes, they just care about results. This is entirely plausible, but the results in the last year of the Trump administration were truly horrible by almost any measure.

It may be the case that people are more willing to forgive Trump for the damage the pandemic did to the economy than Biden, but that is not an explanation based on the reality in people’s lives, or “lived experience” to use the fashionable term.

That would mean that for some reason people recognize and forgive Trump for the difficult circumstances he faced as a result of the pandemic, but they don’t with Biden. It would be worth asking why that could be the case.

27 notes

·

View notes

Text

Podcasting "Ideas Lying Around"

This week on my podcast, I read my recent Medium column, “Ideas Lying Around: Milton Friedman was a monster, but he wasn’t wrong about this,” which I describe a theory of change for unrigging markets, addressing the climate emergency, building worker power and fixing the imbalance between news publishers and Big Tech:

https://doctorow.medium.com/ideas-lying-around-33a28901a7ae

What is this amazing theory of change, that can do so much to right the world’s wrongs? Fittingly, it’s the same theory of change that got us into this mess. It’s Milton Friedman’s theory of change.

Friedman was the archduke of neoliberal economics, the man who led the counter-reformation that destroyed the gains of the New Deal and the Great Society, restored corporate monopolies to primacy over democratically accountable government, gutted labor power, and put the world in the hands of mediocre, narcissistic billionaires who are determined to set it on fire.

We live in Friedman’s world, but it wasn’t always thus. When Friedman set out to restore America’s deposed oligarchs to their Gilded Age thrones, his ideas were incredibly unpopular. The post-war reforms — trustbusting, unions, environmental and labor protections, Social Security, etc — were wildly popular. Year after year, these reforms grew, and the groups who had been excluded from them — women, racialized people, queer people, colonized people — launched liberation movements demanding (and winning) inclusion in this broad prosperity.

Friedman’s financiers and acolytes — plutocrats and the temporarily embarrassed millionaires who aspired to join them in despotic rule — loved Friedman’s vision, but they were naturally skeptical that he could make it into reality. They had been painfully disabused of the notion that their social inferiors were comforted by a life of forelock-tugging servitude:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

How would Friedman convince these sharp-elbowed proles to go back belowstairs and stay there? Friedman had an answer:

Only a crisis — actual or perceived — produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes the politically inevitable.

Even the best-run society is subject to exogenous shocks — pandemic, invasion, natural disaster, meteor strike — and in the reeling dislocation of the crisis, people will turn to the loudest, most persistent critics of the failed status quo, desperate for alternatives.

Friedman got his crisis. In 1973, OPEC cut off the global supply of oil, and plunged the world into recession. The source of the recession was obvious: OPEC didn’t keep it a secret. But Friedman and his pals were able to convince the people shivering in the dark that their pain was caused by women’s lib, labor unions, civil rights and the EPA. In the crisis, his ideas moved from the periphery to the center.

Jimmy Carter got the ball rolling, adopting Friedman’s proposals for coddling monopolies and forcing workers out of guaranteed pensions and into the market’s rigged casino, where they would bet their 401(k)s against shrewd stock brokers for the chance of a dignified retirement:

Next came Ronald Reagan, who incinerated whole libraries’ worth of regulations that protected the American people from corporate predators, gutted unions and ripped out society’s steering wheel and brakes and set it rolling towards extinction’s cliff, whose brink we can see growing closer daily:

https://locusmag.com/2022/07/cory-doctorow-the-swerve/

Friedman’s been in hell since 2006, but we live in Friedman’s world. His ideas are firmly rooted in the center, and the ideas that delivered environmental regulation, decent jobs, and progress on gender and racial equality have been banished to the periphery.

But there will be crises. As Stein’s Law goes, “anything that can’t go on forever will eventually stop.” In every domain of human endeavor, we lurch from crisis to crisis: labor, climate, discrimination, corruption. Each of these crises is terrible, and each one is an opportunity for ideas lying around to rush into the center currently occupied by Friedman’s intellectual descendants.

80 years on, Woody Guthrie’s 1943 New Year’s Resolutions are a hell of a read, and not a day goes by that I don’t think of number 19: “Keep hoping machine running.”

https://www.townandcountrymag.com/society/news/a9130/woody-guthrie-resolutions/

My hoping machine runs on the creation and spreading of ideas lying around. Last year, Rebecca Giblin and I published Chokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We’ll Win Them Back:

https://chokepointcapitalism.com/

The first half of the book consists of detailed explanations of the scams that the highly concentrated tech and entertainment sectors use to reduce the income of creative workers, even as their own profits rise to never-seen heights. Readers tell us that by the time they’re reached the book’s midpoint, they hear the dangerous, high-pitched keening that signals an incipient rage aneurysm.

But the second half of the book consists entirely of detailed, shovel-ready, systemic reforms that would make immediate, significant shifts in the pay creative workers get for their labor. None of these are individual solutions: we don’t tell you how to shop better or other consumerist theater. You’re not going to shop your way out of monopoly capitalism — no more than you’re going to recycle your way out of the climate emergency.

These are meant to be ideas lying around — ideas that are more than “let’s just make copyright last longer or cover more works,” which is all we’ve done for 40 years, to disastrous effect. After all, giving an artist more copyright to bargain with five publishers, four studios, three labels, two ad-tech companies or the one ebook/audiobook company is like giving your bullied kid extra lunch money. There isn’t an amount of lunch money that will get that kid lunch. You’ve gotta do something about the bullies. Hence the back half of Chokepoint Capitalism — ideas lying around for unrigging labor markets, to be deployed in a crisis.

On those lines: for the past month, EFF and I have been publishing a series called “Saving the News From Big Tech”:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

This series lays out four “ideas lying around” for fixing the real problem with Big Tech’s relationship to the news: stealing money by rigging ads, payments and social media, so that 51% of every ad dollar and 30% of every app-based subscription goes to a tech giant, and news companies have to spend whatever they have left to “boost” their social media posts to reach the subscribers who asked to see their stuff.

News is in (perpetual) crisis, and, as with creative labor markets, the “solution” of first resort is to force tech companies to share their profits with news companies. This makes the news and tech into partners, just at the moment where we’re relying on news to investigate tech and expose its rot. It also favors the largest news companies, which are overwhelmingly either billionaires’ playthings or skeleton-crewed ghost ships owned by private equity looters.

The ideas (lying around) I develop with EFF are designed to prevent tech from reaping its illegitimate profits, making it weaker and making the press stronger, including indie news outlets, from nonprofits to spunky outlets run by laid-off reporters who are determined to bring their readers real news.

Fiction is also a great way to create ideas lying around. My next novel, The Lost Cause, is a science fiction thriller set in a world where the Green New Deal is underway and people are confronting, rather than denying, the scale and urgency of the climate emergency. It’s a novel full of joy, an emotional flythrough of what it would feel like to formulate and execute a plan to save ourselves, rather than hoping that the threat just goes away on its own:

https://us.macmillan.com/books/9781250865939/the-lost-cause

Kim Stanley Robinson describes The Lost Cause thus:

This book looks like our future and feels like our present — it’s an unforgettable vision of what could be. Even a partly good future will require wicked political battles and steadfast solidarity among those fighting for a better world, and here I lived it along with Brooks, Ana Lucía, Phuong, and their comrades in the struggle. Along with the rush of adrenaline I felt a solid surge of hope. May it go like this.

I am a firm believer in the power of ideas lying around, and I admit to feeling a guilty pleasure every time I cite Friedman’s own words. I like to think that whenever he hears his words in my mouth, he looks up from the spit he’s turning on in Hell, and amuses the demons turning the crank by gargling a curse around the red-hot bar protruding from his jaws.

Here’s the podcast episode:

https://craphound.com/news/2023/06/11/ideas-lying-around/

And here’s a direct link to the MP3 (hosting courtesy of the Internet Archive, they’ll host your stuff for free, forever):

https://ia802608.us.archive.org/28/items/Cory_Doctorow_Podcast_445/Cory_Doctorow_Podcast_445_-_Ideas_Lying_Around.mp3

And here’s a link to subscribe to my podcast’s RSS feed:

https://feeds.feedburner.com/doctorow_podcast

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/12/only-a-crisis/#lets-gooooo

[Image ID: A workbench with a pegboard behind it. from the pegboard hang an array of hand-tools.]

Image: btwashburn (modified) https://commons.wikimedia.org/wiki/File:Garage_Workbench_-_%281%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#ideas lying around#podcasts#mp3s#audio#saving the news from big tech#theories of change#milton friedman#shock doctrine#chokepoint capitalism#the lost cause

43 notes

·

View notes

Text

30 notes

·

View notes

Text

Saudi Arabia's Oil Gambit: A Potential Blow to Putin's War Chest

The global oil market faces potential upheaval as Saudi Arabia contemplates a strategic shift that could significantly impact the Russian war economy. Experts suggest that Riyadh's frustration with uncoordinated production cuts among oil-producing nations may lead to a dramatic increase in Saudi crude output. This move aims to secure market share and profits, even at the cost of lower oil prices. The ramifications of such a decision could prove detrimental to Moscow's financial stability. For the past decade, oil and gas revenues have been the primary source of income for the Russian state, accounting for up to half of its budget. The Russian war economy heavily relies on these funds to sustain its military operations in Ukraine. Energy analyst Mikhail Krutikhin warns of the "enormous risk" this poses to Russia's state budget. He emphasizes the unpredictability of various factors, including the upcoming U.S. presidential election, that could further complicate the situation for Moscow.

Oil market experts have little doubt that Saudi Arabia has the enormous production and export capacity to change tactics and gun for market domination through volume instead. | Fayez Nureldine/AFP via Getty Images Economist Alexandra Prokopenko projects that a $20 drop in oil prices could result in a substantial loss of revenue for Russia, equivalent to approximately 1% of its GDP. This financial squeeze would force the Kremlin to make difficult choices between reducing expenditures – an unlikely option during wartime – or accepting inflationary pressures and high interest rates. The potential Saudi strategy shift comes in response to persistent quota violations by some OPEC+ members, including Russia. Despite agreeing to production limits, Moscow has consistently exceeded its allocated quota, currently set at 8.98 million barrels per day. This overproduction has contributed to keeping oil prices well below the $100 per barrel target sought by Saudi Arabia and other producers. Ajay Parmar, an oil markets expert at ICIS, explains that Saudi Arabia's move could serve as a warning to other producers. By prioritizing market share over high prices, Riyadh aims to compel compliance with agreed-upon production limits. Despite Western sanctions imposed due to the Ukraine conflict, Russia's fossil fuel profits have increased by 41% in the first half of this year. The country has employed various tactics to circumvent restrictions, including the use of a "shadow fleet" of aging vessels to transport crude oil and exploiting loopholes that allow for the sale of refined products. While a drop in oil prices would undoubtedly strain Russia's finances, experts like Heli Simola from the Bank of Finland caution that it may not immediately halt the country's military operations. The Russian war economy has demonstrated resilience, and the Kremlin appears determined to continue its campaign in Ukraine despite growing economic challenges. As the situation unfolds, the global community watches closely to see how Saudi Arabia's potential oil strategy shift will reshape the energy market and impact Russia's ability to finance its ongoing military activities. Read the full article

2 notes

·

View notes

Text

Almost two and half years into Russia’s full-scale invasion of Ukraine, Moscow’s war machine still runs on energy revenues—despite unprecedented Western sanctions that took a bite out of, but hardly battered, the Kremlin’s cash cow.

Russian exports of oil, natural gas, and coal continue apace with their biggest markets in Asia, especially China and India. Even Europe, which has largely sworn off Russian gas since the invasion, is stealthily buying a lot more of the stuff off tankers to meet its own energy needs, indirectly helping finance the invader that it spends so much time, energy, and money trying to combat.

Russian energy export revenues before the war were about 1 billion euros ($1.1 billion) a day, and the whole gamut of sanctions had brought that down to about 660 million euros ($720 million) by this June—but those levels have stayed remarkably steady for the past 18 months. Russia recorded a rare current accounts surplus just last month, a sign of that export health. The sanctions battle, like the war itself, seems to have stalemated.

“The glass is neither half full, nor half empty. The sanctions are working, but not as well as we expected,” said Petras Katinas, an energy analyst at the Centre for Research on Energy and Clean Air (CREA).

Some aspects of Russia’s energy exports have fallen off a cliff, such as its exports of natural gas via pipelines, which have all but disappeared from the lucrative European market. But the country’s exports of oil and refined oil products, which make up the biggest chunk of its sales, have stayed essentially the same after an initial hit in the first months after the introduction of Western sanctions, and state earnings even crept a little higher thanks to a rise in global oil prices.

The main Western effort to curb Russian energy earnings was a balancing act meant to keep the global market supplied while limiting the Kremlin’s take by capping Russian oil sales at $60 a barrel. Some countries wanted an even lower price cap of about $30 a barrel to really cut Moscow’s earnings, but that idea—as demonstrated when Ukraine floated it again this spring—was politically and diplomatically a lot tougher.

Still, the original price cap worked great at first, until Russia—with a little help from its friends in OPEC—goosed the global price of oil higher, which dragged the price of discounted Russian oil above the cap as well. That’s pretty much where it has been for the past year.

More importantly, Russia has found a reliable way to sidestep that formal limit on its crude oil exports by using a fleet of so-called shadow tankers that don’t have to follow Western restrictions on insurance, safety, and the like. About 4 out of every 5 barrels of seaborne crude that Russia sells are now carried on shadow tankers, Katinas said, meaning that they are entirely outside the reach of Western measures. (Those shadow tankers aren’t beyond the reach of the Iran-backed Houthi insurgents in Yemen, though: One got blown up trying to take Russian oil to China this week.)

“The strategy was good, but the tactics were poor—there was little enforcement,” Katinas said.

The United States cracked down on part of that trade a couple of times—late last year on shadow tankers and earlier this year on Russian state-owned vessels—by sanctioning individual tankers; CREA estimates that tougher enforcement probably cost Russia about 5 percentof its oil export revenues since October 2023. But there is still a long way to go to ensure thorough enforcement of the existing limits on Russian oil trade: Full enforcement would have kept almost 20 billion euros ($21.8 billion) out of Russian President Vladimir Putin’s coffers, CREA estimates.

The Biden administration has toyed with additional efforts to tighten the screws on the shadow fleet, but it worries that stricter measures might send oil (and gasoline) prices higher just in time for a pivotal U.S. presidential election in November.

But there is a way to get there without causing much pain, if any, for global energy consumers, argue global economy experts Robin Brooks and Ben Harris of the Brookings Institution. There remain some 100-odd unsanctioned ships in the Sovcomflot state-owned fleet that are doing heavy lifting for Russian oil exports. Targeted sanctions on just 15 of the busiest of those tankers would cut into a good-sized chunk of Russia’s oil export earnings with little market impact. “With such a process in place, we anticipate little to no impact on global oil prices but suspect the action will meaningfully lower Russia’s revenue from the oil trade,” they wrote.

But it’s not just oil. Russian natural gas exports are not dead yet, either, despite lots of pain for state-owned energy company Gazprom and plenty of crowing in Europe about largely weaning itself off of what used to be its biggest energy supplier. Some European countries, including Hungary, Austria, and Slovakia, are still heavily reliant on the remnants of Russian gas that arrive via Ukraine or Turkey, for reasons that range from the geographic to the political.

What’s amazing about the sharp decline in exports of Russian natural gas to what was formerly the nation’s biggest market is that Russian natural gas is not sanctioned in Europe at all, yet it has suffered the most of all of Moscow’s energy streams.

“Gas is not sanctioned; it was the stupidity of Putin” that drove the Europeans off of it, Katinas said.

But this year, Russian gas is sneaking back into Europe in liquefied form, supercooled and shipped on tankers rather than compressed and routed through pipelines. European Union imports of Russian liquefied natural gas, or LNG, are up 24 percent over past year, especially to big Western European countries such as France, Spain, and Belgium; the bloc buys half of all Russian LNG exports.

There are plenty of reasons why—Spain’s main suppliers in North Africa have their own geopolitical squabbles that have disrupted exports, long-term contracts with Russia essentially lock in some European buyers for years, and Russian gas is nearby and fairly cheap compared to alternatives—but the biggest reason is simply concern over the security of supplies.

“There was lots of talk even last year about banning LNG imports, but then what prevailed were the fears about the implications for the security of supply,” said Anne-Sophie Corbeau, a gas expert at Columbia University’s Center on Global Energy Policy. The trickle of Russian gas that still comes in through Ukraine will end later this year; Turkey, despite offers to do more, can hardly export significantly more gas to southern Europe since it isn’t a gas producer itself. And Europeans remember the shock and pain of the war’s first winter, when energy prices skyrocketed due to the upheavals in the gas market.

Last month, the European Union finally took its first step to deal with Russian LNG—not by banning the import of the fuel, but by making sure that European ports would not be waystations for Russian exports to Asia. That measure won’t even start until early next year. And there certainly won’t be any further EU efforts to target Russian gas this year, with Hungary at the helm of the rotating presidency of the EU council.

“We are not actually banning imports, but preventing other countries from getting Russian LNG,” Corbeau said. “It makes life more difficult for Russia’s Asia exports, but does nothing to keep LNG out of Europe.”

The good news, such as it is, is that LNG isn’t quite the cash cow for the Russian government that other energy sources are. Oil is sold in huge volumes and is taxed; pipeline gas, too, helps prop up the federal budget. But LNG has all sorts of tax breaks that mean much less of that Western money goes straight to the Ukrainian battlefront. In terms of how to target Russian energy earnings, Corbeau said, “first oil, then piped gas, then finally LNG.”

The bad news is that despite years of unprecedented sanctions on one of the world’s biggest energy providers, Russia’s cash machine is still working enough to continue underwriting the war. The relatively limited success in the battle against the country’s energy sector is mirrored by similar failings in cracking down on Russian trade in all sorts of other things, from Western machinery routed through Central Asia to the high-tech Chinese-made components needed for the war.

“We are not doing enough. We need to strengthen sanctions—we need to start enforcing sanctions, and start punishing companies that are violating them,” said Katinas. “There are just too many loopholes.”

3 notes

·

View notes