#NASDAQ 100 INDEX

Explore tagged Tumblr posts

Text

It may be a good time for investors to look at less risky ways to stay in the stock market

As President Trump’s “not going to bend at all” approach to tariffs raises recession risk and helped to send the market into a correction last week, investors may want to consider strategies that focus more on the downside — ways to stay invested but stay protected during major stock downswings. Alternative exchange-traded funds are an option, and they have been growing in popularity in recent…

#Breaking News: Markets#business news#CBOE Volatility Index#Exchange-traded funds#Goldman Sachs Group Inc#Goldman Sachs Nasdaq-100 Core Premium Income ETF#Goldman Sachs S&P 500 Core Premium Income ETF#Goldman Sachs U.S. Large Cap Buffer 3 ETF#Investment strategy#Investors#JPMorgan Chase & Co#JPMorgan Equity Premium Income ETF#Markets#Personal finance#Personal investing#Portfolio management#Retail Investors#S&P 500 Index#Stock markets

0 notes

Text

Why are equity markets seeing so many new highs in 2024?

One of the economic surprises of 2024 so far has been the performance of equity markets. In terms of economic theory there was a case for them rallying in response to the expected interest-rate cuts. Yet instead of a couple of cuts from the Federal Reserve with more to come we have not only drawn a blank on that front but also are much less sure about future ones. Indeed I looked earlier this…

View On WordPress

#business#Dr Isabel Schnabel#Economics#economy#Finance#FTSE 100#GDP#Interest Rates#Investing#NASDAQ#Nikkei 225 equity index#Nvidia#QE#S&P 500#Stock Market#stocks

1 note

·

View note

Text

Stock market today: Live updates

Traders on the floor of the NYSE June 29, 2023. Source: NYSE Stock futures were near flat Thursday night after the Dow Jones Industrial Average wrapped up a ninth day of wins. Futures tied to the Dow added 16 points, trading close to the flat line. S&P 500 futures were little changed, and Nasdaq 100 futures ticked down 0.1%. Transportation stocks CSX and Knight-Swift fell 4% and 3%,…

View On WordPress

#Breaking News: Markets#business news#CSX Corp#Dow Jones Fut (Mar&x27;23)#Dow Jones Industrial Average#Johnson & Johnson#Markets#NASDAQ 100 Fut (Mar&x27;23)#NASDAQ Composite#Netflix Inc#S&P 500 Fut (Mar&x27;23)#S&P 500 Index#Scholastic Corp#Stock markets#Swift Transportation Co#Tesla Inc#Travelers Companies Inc#United States

0 notes

Text

Fuck it, I feel like bragging about a (relative) win.

I don't talk about it much on here, but I'm an active swing/momentum trader so I keep track of the stock market and individual sectors on a daily basis. I exited out of a long position that acted as my anchor for a long time (I was 80% $SPLG at one point) in February when the S&P index dropped below its 100-day EMA (Exponential Moving Average). There have been a few relief rallies and fake-outs that I didn't believe in, so I stayed out of US stocks; the past six or seven weeks have felt like a slow-mo version of the 2020 COVID crash to me. So I've mostly rotated into international large cap value/dividend plays, a US Bond market index, and, god help me, physical hold shares, because that's how bleak it's been looking out there.

Anyway, after some not so great ~news~ yesterday, the market shit the bed today. Looks like the Dow ended 3.98% in the red, SPY is down 4.93%, NASDAQ dropped 5.3%. Meanwhile I eked out a gain of 0.01%. Basically feeling like this guy right now:

22 notes

·

View notes

Text

Global markets reacted sharply and swiftly after President Donald Trump revealed his much-anticipated tariff plans Wednesday, with investors fleeing U.S. stock indexes and stocks of companies that rely on global supply chains plummeting. S&P 500 futures, which indicate where it is likely to open Thursday, plunged 3%. Nasdaq 100 futures sold off by more than 4%, and Dow futures slid about 1,000 points, or 2%. Those indexes just endured their worst quarter in years in large part because of growing concern about the economic impacts of Trump's expected tariff plan. Global markets also posted significant losses just minutes into their trading days. Japan's Nikkei 225 index plunged more than 4.1%, and South Korea's Kospi stock average fell more than 2.5%. Australia's ASX 200 dipped about 2%. ETFs (exchange-traded funds) that track specific countries, such as India, tumbled about 3%, while one that tracks Europe slid 2%, and the China ETF fell 3.8%.

8 notes

·

View notes

Text

Russell 2000 Historically Best Ahead of Christmas

Click here to view table full size…

For decades we have been tracking the market’s performance around holidays in the annual Stock Trader’s Almanac. In the 58th edition for 2025, data for DJIA, S&P 500, NASDAQ and Russell 2000 can be found on page 100. Of the eight holidays tracked, Christmas has been one of the most consistently bullish with respectable average gains occurring from 3 days before to the day before. Since 1988, the second day before Christmas, December 23 this year, has been most bullish over the past 36 years with greatest average gains and the highest frequency of advances.

Small caps measured by Russell 2000 have enjoyed the most consistent strength on all three days. Volatility also tends to be subdued ahead of Christmas with significant declines occurring only in 2018, 2008, 2001 and 2000. 2018 was the only year to see declines on all three days by all four indexes.

11 notes

·

View notes

Text

What to expect from the stock market this week

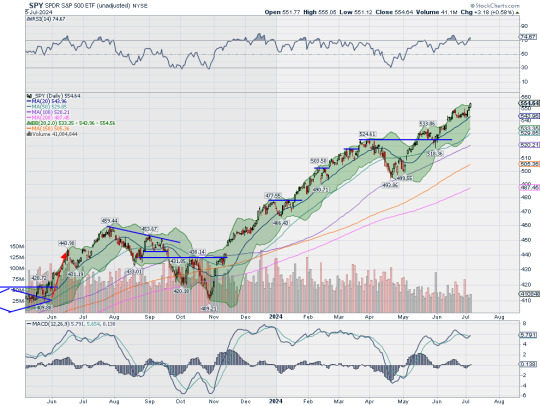

Last week, the review of the macro market indicators saw with the 2nd Quarter of 2024 in the books and heading into the holiday shortened week, equity markets showed resilience with a rebound from a pullback and large caps and tech names holding at the highs. Elsewhere looked for Gold ($GLD) to continue in consolidation after the record move higher while Crude Oil ($USO) consolidated in a broad range. The US Dollar Index ($DXY) continued the short term move to the upside while US Treasuries ($TLT) continued in their secular downtrend. The Shanghai Composite ($ASHR) looked to continue the downtrend while Emerging Markets ($EEM) consolidated under long term resistance.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY were showing signs of a possible reset on momentum measures as both were extended. The $IWM continued to lag in a long term channel.

The week played out with Gold pushing up out of the descending triangle while Crude Oil moved up out of consolidation. The US Dollar met resistance and pulled back while Treasuries found short term trend support and bounced. The Shanghai Composite had a weak bounce and fell back while Emerging Markets moved up towards the May high.

Volatility held near the lows of the year. This created a positive environment for equities and by Tuesday they started rising. This resulted in the SPY and QQQ printing 3 more all-time high closes to end the week. The IWM continued to move to its own drumbeat though and fell back Friday, all within the long consolidation range. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week in a digestive consolidation after making the top in mid-June. It continued Monday getting tighter to the 20 day SMA on the daily chart. Tuesday it moved higher, printing a new all-time high, and followed that up with new highs Wednesday and Friday. The Bollinger Bands® are opening higher now with the RSI strong and bullish and the MACD crossing back higher and positive.

The weekly chart shows the break higher from the short consolidation. The RSI is strong and bullish with the MACD positive and rising. The target from the Cup and Handle at 560 is above with the 161.8% extension of the retracement of the 2022 drop at 562 and the 200% extension at 613 above that. Support lower sits at 549.50 and 545.75 then 542 and 537 before 533 and 530. Uptrend.

SPY Weekly, $SPY

With the first week of July in the books, equity markets showed strength from the large cap and tech focused S&P 500 and Nasdaq 100, but continued churn from the small caps. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a tightening range. The US Dollar Index continues to drift to the downside in consolidation while US Treasuries move lower in their downtrend. The Shanghai Composite looks to continue the short term move lower while Emerging Markets remain in broad consolidation.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY have reset momentum measures and both are also looking strong upon reversing. The IWM continues to be dead money, going on 30 months now. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview July 5, 2024

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above.

8 notes

·

View notes

Text

Stock Market Crashes by 5-6%

· · ────────── · ·

Friday, April 5th, China retaliated on the increase in tariffs against foreign countries. The increase had sent prices on a steady on the tariffs and sent prices way upwards and sent the Stock Market in a steady climb. All three of the USA’s major stock indexes have lowered drastically since the raise. The DJIA and Nasdaq Composite have gone down by around 5%, however the S&P 500 has shot down by 6%. This is the biggest drop in the Stock Marker since Covid, in 2020.

In the UK, the FTSE 100 has gone down by almost 5%, which its steepest fall in five years. Various Asian markets have dropped, as well as exchanges in Germany and France faced with similar lowers. The global stock market has lost trillions of dollars in value, because of Trump’s new 10% import taxes on goods from every country, with products from dozens of countries, including key trading partners such as China, the European Union and Vietnam.

Analysts say that this may amount to the biggest tax increase in the US since 1968.

China’s increase on American import is 34%, which bridles the export of minerals. They’ve also added various American business firms to their blacklists, because Trump’s actions have classified as “bullying” and are against the international trade rules.

The trade commissioner from the EU had originally intended to retaliate the day of, but had a brief meeting with US officials, resulting in a social media post that the trade relationship simply needs a fresh approach.

Trump says big business won’t worry over the increase because they’re focused on the “big deal” that’ll “supercharge the economy”.

· · ────────── · ·

Signing off, Wren

(Links always below cut)

· · ────────── · ·

BBC

ROLLING STONG MAGS

CNBC

· · ────────── · ·

#donald trump#us politics#stock market crash#stock crash#market crash#stock market#tariffs#this is an english speaking blog#however translations are welcome and encouraged#wren signing off#A Little Birdie Told Me — Newsletter

2 notes

·

View notes

Text

The Year of Bitcoin: Why 2025 Could Be a Turning Point

The start of 2025 has set the stage for what may be Bitcoin’s most transformative year yet. The events of 2024, from significant corporate acquisitions to milestones in adoption, have positioned Bitcoin as a central player in the evolving financial landscape. With growing economic instability, technological advancements, and shifting narratives, Bitcoin is poised to reach new heights in both relevance and adoption.

Setting the Stage

In 2024, Bitcoin witnessed several pivotal moments. Institutional interest soared, adoption among individuals continued to grow, and countries started exploring Bitcoin as a hedge against economic uncertainty. As we enter 2025, the momentum is unmistakable. Bitcoin is no longer merely a speculative asset��it is becoming a cornerstone of financial innovation and security.

The Macro Environment

The global economy is in a state of flux. Rising inflation and growing distrust in fiat currencies have left governments and central banks scrambling for solutions. In this environment, Bitcoin’s fixed supply and decentralized nature offer a stark contrast to the instability of traditional systems. As more people recognize its value as a store of wealth, Bitcoin’s role in the global financial system is expanding.

Adoption Trends: A Billion-Dollar Vote of Confidence

December 2024 was a monumental month for corporate Bitcoin adoption. In just the first 10 days, U.S. companies invested a staggering $3.26 billion into Bitcoin.

MicroStrategy, the largest corporate holder of Bitcoin, acquired 21,550 BTC worth $2.1 billion, bringing its total holdings to 423,650 BTC valued at $25.6 billion.

Marathon Digital, a leading Bitcoin mining firm, added 11,774 BTC for around $1.1 billion, boosting its total to 40,435 BTC worth $3.9 billion.

Riot Platforms, a Bitcoin infrastructure company, acquired 705 BTC worth $68.45 million.

These investments underscore the confidence U.S. companies have in Bitcoin as a long-term store of value. They also signal a broader shift in institutional attitudes toward Bitcoin as an essential financial asset.

A Historic Milestone: Bitcoin Enters the Nasdaq-100

In another major development, MicroStrategy joined the Nasdaq-100 Index on December 23, 2024, standing alongside titans like Apple, Microsoft, and Tesla. This milestone not only highlights MicroStrategy’s success but also validates Bitcoin’s integration into traditional financial systems.

Founded over 30 years ago as an enterprise software company, MicroStrategy transitioned into a Bitcoin powerhouse under the leadership of Executive Chairman Michael Saylor. Since 2020, the company has amassed over 423,000 BTC worth $42 billion, becoming the largest corporate holder of the scarce digital asset. Its inclusion in the Nasdaq-100 symbolizes Bitcoin’s growing credibility and mainstream acceptance.

The Strategic Bitcoin Reserve

In a groundbreaking move, the incoming Trump administration has announced plans to create a strategic Bitcoin reserve. This initiative aims to position the United States as a leader in the digital asset space while safeguarding its financial future. By holding Bitcoin as a reserve asset, the government signals its confidence in Bitcoin’s long-term value and utility. Such a policy could set a precedent for other nations, accelerating global adoption and further solidifying Bitcoin’s status as a global store of value.

Technological Advancements

Bitcoin’s infrastructure continues to evolve. The Lightning Network, which facilitates instant and low-cost Bitcoin transactions, is gaining widespread adoption, enabling new use cases like micropayments and decentralized financial services. Upgrades like Taproot and innovations in Ordinals have also enhanced Bitcoin’s privacy, scalability, and functionality. These advancements are transforming Bitcoin from a simple store of value to a versatile tool for global commerce.

The Narrative Shift

Bitcoin’s narrative is evolving. Once seen primarily as a speculative investment, it is now recognized as a tool for financial sovereignty and inclusion. Younger generations, who grew up in an era of financial crises and technological disruption, are driving this shift. For them, Bitcoin represents not just an asset but a movement—a way to opt out of traditional systems and build a fairer, more transparent financial future.

Challenges to Watch

Despite its progress, Bitcoin faces significant challenges. Regulatory uncertainty remains a critical hurdle, with governments worldwide grappling with how to classify and regulate Bitcoin. Competing narratives, such as the rise of central bank digital currencies (CBDCs), also pose a threat. Additionally, the debate over Bitcoin’s energy consumption continues, though proponents argue that it’s driving innovation in renewable energy.

Why 2025 Could Be the Year of Bitcoin

As we look ahead, it’s clear that 2025 holds immense potential for Bitcoin. With institutional adoption accelerating, technological innovations reshaping its utility, and the macroeconomic landscape driving demand, Bitcoin is on the brink of a new era.

For individuals and institutions alike, the message is clear: stay informed, get involved, and embrace Bitcoin as a cornerstone of the future financial system. The revolution is underway, and 2025 could be the year Bitcoin proves it is here to stay.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#Blockchain#FinancialRevolution#DigitalAssets#CryptoAdoption#Bitcoin2025#MacroEconomics#BitcoinMining#CryptoNews#Nasdaq100#BitcoinReserve#DigitalGold#Decentralization#CryptoInnovation#BitcoinMilestones#CryptoFuture#MoneyRevolution#HODL#LightningNetwork#financial empowerment#globaleconomy#finance#financial experts#digitalcurrency#financial education#unplugged financial

2 notes

·

View notes

Text

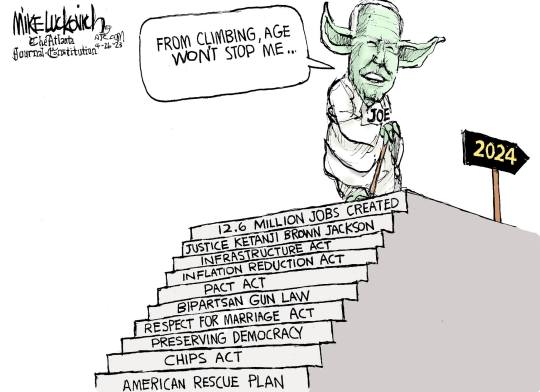

LETTERS FROM AN AMERICAN

December 30, 2023

HEATHER COX RICHARDSON

DEC 31, 2023

One day short of his first 100 days in the White House, on April 28, 2021, President Joe Biden spoke to a joint session of Congress, where he outlined an ambitious vision for the nation. In a time of rising autocrats who believed democracy was failing, he asked, could the United States demonstrate that democracy is still vital?

“Can our democracy deliver on its promise that all of us, created equal in the image of God, have a chance to lead lives of dignity, respect, and possibility? Can our democracy deliver…to the most pressing needs of our people? Can our democracy overcome the lies, anger, hate, and fears that have pulled us apart?”

America’s adversaries were betting that the U.S. was so full of anger and division that it could not. “But they are wrong,” Biden said. “You know it; I know it. But we have to prove them wrong.”

“We have to prove democracy still works—that our government still works and we can deliver for our people.”

In that speech, Biden outlined a plan to begin investing in the nation again as well as to rebuild the country’s neglected infrastructure. “Throughout our history,” he noted, “public investment and infrastructure has literally transformed America—our attitudes, as well as our opportunities.”

In the first two years of his administration, when Democrats controlled both chambers of Congress, lawmakers set out to do what Biden asked. They passed the $1.9 trillion American Rescue Plan to help restart the nation’s economy after the pandemic-induced crash; the $1.2 trillion Infrastructure Investment and Jobs Act (better known as the Bipartisan Infrastructure Law) to repair roads, bridges, and waterlines, extend broadband, and build infrastructure for electric vehicles; the roughly $280 billion CHIPS and Science Act to promote scientific research and manufacturing of semiconductors; and the Inflation Reduction Act, which sought to curb inflation by lowering prescription drug prices, promoting domestic renewable energy production, and investing in measures to combat climate change.

This was a dramatic shift from the previous 40 years of U.S. policy, when lawmakers maintained that slashing the government would stimulate economic growth, and pundits widely predicted that the Democrats’ policies would create a recession.

But in 2023, with the results of the investment in the United States falling into place, it is clear that those policies justified Biden’s faith in them. The U.S. economy is stronger than that of any other country in the Group of Seven (G7)—a political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, along with the European Union—with higher growth and faster drops in inflation than any other G7 country over the past three years.

Heather Long of the Washington Post said yesterday there was only one word for the U.S. economy in 2023, and that word is “miracle.”

Rather than cooling over the course of the year, growth accelerated to an astonishing 4.9% annualized rate in the third quarter of the year while inflation cooled from 6.4% to 3.1% and the economy added more than 2.5 million jobs. The S&P 500, which is a stock market index of 500 of the largest companies listed on U.S. stock exchanges, ended this year up 24%. The Nasdaq composite index, which focuses on technology stocks, gained more than 40%. Noah Berlatsky, writing for Public Notice yesterday, pointed out that new businesses are starting up at a near-record pace, and that holiday sales this year were up 3.1%.

Unemployment has remained below 4% for 22 months in a row for the first time since the late 1960s. That low unemployment has enabled labor to make significant gains, with unionized workers in the automobile industry, UPS, Hollywood, railroads, and service industries winning higher wages and other benefits. Real wages have risen faster than inflation, especially for those at the bottom of the economy, whose wages have risen by 4.5% after inflation between 2020 and 2023.

Meanwhile, perhaps as a reflection of better economic conditions in the wake of the pandemic, the nation has had a record drop in homicides and other categories of violent crime. The only crime that has risen in 2023 is vehicle theft.

While Biden has focused on making the economy deliver for ordinary Americans, Vice President Kamala Harris has emphasized protecting the right of all Americans to be treated equally before the law.

In April 2023, when the Republican-dominated Tennessee legislature expelled two young Black legislators, Justin Jones and Justin J. Pearson, for participating in a call for gun safety legislation after a mass shooting at a school in Nashville, Harris traveled to Nashville’s historically Black Fisk University to support them and their cause.

In the wake of the 2022 Dobbs v. Jackson Women’s Health Supreme Court decision overturning the 1973 Roe v. Wade decision that recognized the constitutional right to abortion, Harris became the administration’s most vocal advocate for abortion rights. “How dare they?” she demanded. “How dare they tell a woman what she can and cannot do with her own body?... How dare they try to stop her from determining her own future? How dare they try to deny women their rights and their freedoms?” She brought together civil rights leaders and reproductive rights advocates to work together to defend Americans’ civil and human rights.

In fall 2023, Harris traveled around the nation’s colleges to urge students to unite behind issues that disproportionately affect younger Americans: “reproductive freedom, common sense gun safety laws, climate action, voting rights, LGBTQ+ equality, and teaching America’s full history.”

“Opening doors of opportunity, guaranteeing some more fairness and justice—that’s the essence of America,” Biden said when he spoke to Congress in April 2021. “That’s democracy in action.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#Biden Administration#Biden's accomplishments#Election 2024#Mike Luckovich

10 notes

·

View notes

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Text

Stocks Pressured by Mixed Trade News and Corporate Earnings Results

The S&P 500 Index ($SPX) (SPY) today is down -0.30%, the Dow Jones Industrials Index ($DOWI) (DIA) is down -0.55%, and the Nasdaq 100 Index ($IUXX) (QQQ) is down -0.26%. June E-mini S&P futures (ESM25) are down -0.25%, and June E-mini Nasdaq futures (NQM25) are down -0.21%. Stock indexes today are under pressure from mixed signals from China and mixed corporate earnings results. Bloomberg…

0 notes

Text

Stock market today: Live updates

Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, July 19, 2023. Brendan McDermid | Reuters Nasdaq 100 futures slipped Wednesday evening after Netflix posted its latest quarterly results. Nasdaq 100 futures dipped 0.41%. S&P 500 futures slipped 0.14%, while Dow futures hovered near the flat line. Shares of Netflix dropped 8% in after-hours action after the…

View On WordPress

#American Airlines Group Inc#Blackstone Inc#Breaking News: Markets#business news#Dow Jones Fut (Mar&x27;23)#Dow Jones Industrial Average#Economic events#Johnson & Johnson#Markets#NASDAQ 100 Fut (Mar&x27;23)#NASDAQ Composite#Netflix Inc#S&P 500 Fut (Mar&x27;23)#S&P 500 Index#Tesla Inc#Travelers Companies Inc

0 notes

Text

Wall Street Pushes Higher, Nasdaq 100 Breaks Out

US stocks ended stronger again on Thursday, extending their recent rally into a third session having easily recouped all and more of Monday’s sharp falls amid the potential for an easing in the US-China trade tensions and hints of future interest rate cuts from Federal Reserve officials.

Donald Trump said the US met China on Thursday morning, though the president stopped short of elaborating either on the topics of discussion or the personnel involved.

The update added further confusion to the status of China-US trade relations after Beijing denied any suggestion that it was in active talks with the Trump administration over tariffs.

Sentiment was also supported by Trump dialling back his rhetoric against the Fed, clarifying that he did not intend to fire chair Jerome Powell. Trump had embarked on a social media tirade against Powell in the past week, calling on him to lower interest rates or risk a recession.

Although Jerome Powell has insisted on a wait-and-see approach to additional interest rate cuts amid the tariff wars, a couple of other Fed heads on Thursday discussed a willingness for potential cuts.

Federal Reserve Bank of Cleveland President Beth Hammack said in a CNBC interview that a cut as soon as June could be possible. Meanwhile, Federal Reserve Governor Christopher Waller said in a Bloomberg interview that he would support rate cuts if tariffs started weighing on the job market.

Data on Thursday showed seasonally adjusted US jobless claims climb to 222,000 in the week ended on April 19, up from 216,000 in the prior week.

At the stock market close in New York on Monday, the blue-chip Dow Jones Industrials Average was up 1.2% to 40,093, while the broader S&P 500 index gained 2.0% to 5,484, and the tech-laden Nasdaq Composite added 2.7% to 17,166.

US30Roll H1

Among the tech leaders, Amazon, up 3.3%, and NVIDIA, ahead 3.6%, found support after both companies highlighted strong demand for AI data centres.

The other main corporate focus was on a mixed batch of quarterly earnings, including after-hours from another of the market’s ‘Magnificent Seven’.

Google owner Alphabet, which was up 2.8% during the session, gained another 3.1% in after-hours trading after it posted above-forecast first-quarter results, underpinned by cloud business growth and ongoing strength in its search business.

However, negative after-hours news came from chip giant Intel, which had gained 4.4% during Thursday’s session but dropped 6.8% in after-hours trading after it forecast second-quarter revenue below Wall Street estimates having posted better-than-expected but flat first quarter revenue.

NAS100Roll H1

At the start of the session, another chip manufacturer Texas Instruments had reported first quarter earnings that exceeded expectations and gave an optimistic outlook for the second quarter, sending its stock up 6.6%.

But tech bellwether International Business Machines, which posted its first quarter earnings after the close on Wednesday, dropped 6.6% after it only maintained its full-year guidance despite posting better-than-anticipated earnings and revenue.

Away from tech, PepsiCo fell 4.9% after the soft drinks giant cut its annual core profit forecast as it battles issues with its supply chain. And consumer products giant Proctor & Gamble was down 3.7% after cutting annual profit forecasts.

But Hasbro jumped 14.6% after the toymaker reported first-quarter revenue that beat expectations, helped by strength in its digital gaming segment.

Among commodities, oil prices edged higher having dropped in the previous session on reports of increased supply, with several nations in the OPEC+ producer group reportedly pushing to accelerate output hikes in June, extending May’s surprise boost.

US WTI crude gained 0.8% to $62.75 a barrel, and UK Brent crude added 0.5% to $66.48 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Hong Kong stocks fell and then rose after the long holiday. The Hang Seng Index opened 91 points lower at 21,303 points, and fell 204 points to 21,191 points in the early trading session. It then gradually recovered its losses and rose 197 points to 21,592 points in the afternoon. It rose 167 points or 0.78% for the day to 21,562 points. The Technology Index rose 11 points or 0.24% to 4,899 points. The main board traded HK$251.3 billion .

The Sino-US trade war has not yet shown any signs of serious deterioration, so the Hong Kong stock market rebounded after the resumption of trading. Technically speaking, the gap in the Hong Kong stock market has not been filled. It is expected that if the Hang Seng Index does not fall below the 100-DMA (21,281), there is still room for upward movement. However, under the shadow of the trade war, the Hang Seng Index will face resistance in testing the 20-DMA (22,126) in the short term.

European stock markets fluctuated and stabilized after the holiday, with UK, French and German stocks rising 0.64%, 0.56% and 0.41% respectively.

As investors digested concerns about the possible removal of Federal Reserve Chairman Powell, U.S. stocks rebounded significantly on Tuesday. The Dow Jones Industrial Average opened 345 points higher, and the mid-session gain expanded to 1,101 points, reaching a high of 39,272 points, recovering all losses on Monday. The S&P 500 rose as much as 2.94%, and the Nasdaq rebounded 3.4%.

At the close of the U.S. market, the Dow Jones Industrial Average was at 39,186, up 1,016 points, or 2.66%; the S&P 500 rose 129 points, or 2.51%, to 5,287; and the Nasdaq rose 429 points, or 2.71%, to 16,300.

The U.S. dollar index rebounded by 0.72% to 98.99; the euro fell 0.8% in the late trading to $1.1422; the yen rose above 140 against the dollar for the first time since September last year, and rose as much as 0.69% to 139.89. Bitcoin re-entered $90,000, rising 5.4% to $91,706 at one point.

0 notes

Text

Küresel Endeksler ve Yatırımcılar İçin Önemi

Küresel endeksler, finansal piyasaların genel performansını ölçen ve yatırımcılar için kritik referans noktaları sunan araçlardır. Bu endeksler, belirli bir ülkenin borsasını, sektörü veya varlık sınıfını temsil ederek, ekonomik trendleri ve piyasa dinamiklerini anlamada yol gösterici olurlar. Ekofin.net ile Global Endekslere artık erişim daha kolay, detaylı analiz ve daha fazlası için Ekofin.net’e göz atmayı unutmayın.

Küresel Endekslerin Türleri

Hisse Senedi Endeksleri:

Örnekler: S&P 500, NASDAQ, BIST 100, FTSE 100

Şirketlerin piyasa değeri, likiditesi ve sektörel ağırlıklara göre oluşturulur.

Özellikle S&P 500, ABD ekonomisinin sağlığını değerlendirmede yaygın kullanılır.

Sabit Getirili Endeksler:

Örnekler: Bloomberg Barclays Global Aggregate Bond Index

Devlet ve kurumsal tahvillerin performansını izler.

Emtia Endeksleri:

Örnekler: S&P GSCI, Bloomberg Commodity Index

Petrol, altın, tarım ürünleri gibi emtiaların fiyat hareketlerini yansıtır.

Endeksler Neden Önemli?

Piyasa Analizi: Endeksler, ekonomik büyüme veya durgunluk sinyalleri verir.

Portföy Çeşitlendirme: Yatırımcılar, endeks fonları (ETF’ler) aracılığıyla risk dağıtımı yapabilir.

Kıyaslama (Benchmarking): Fon yöneticileri, performanslarını bir endekse göre ölçer.

Türkiye’deki Endekslerin Rolü

BIST 100, Türkiye’nin önde gelen şirketlerini kapsar ve yabancı yatırımcılar için önemli bir göstergedir. Son dönemde enerji ve finans sektörlerindeki hareketlilik, endeksin dalgalanmasına neden olmuştur.

Küresel endeksler, yatırım kararlarını şekillendiren temel araçlardır. Doğru okunduğunda, ekonomik döngüleri öngörme ve strateji geliştirme konusunda avantaj sağlarlar. Ekofin.net ile Global Endeksler bölümünden detaylı analiz yapabilir aynı zamanda Ekofin.net ile bir çok analiz gerçekleştirebilirsiniz.

0 notes