#Mobile Payment Devices

Explore tagged Tumblr posts

Text

Mobile Payment Devices: Smart Mobile Payment Terminals and POS Mobile Payment Solutions for Your Business

In today’s fast-paced, tech-driven world, businesses must adopt modern payment solutions to keep up with consumer demand and improve operational efficiency. Mobile payment devices, including smart mobile payment terminal systems and POS mobile payment systems, are revolutionizing how businesses accept payments. These solutions offer speed, flexibility, and enhanced security, making them essential tools for businesses of all sizes.

Whether you run a brick-and-mortar store, a food truck, or an e-commerce platform, mobile payment devices can simplify transactions and improve the overall customer experience. In this blog, we will explore how mobile payment devices, smart mobile payment terminals, and POS mobile payment systems can benefit your business, streamline your operations, and boost your customer satisfaction.

What Are Mobile Payment Devices?

A mobile payment device is any tool or technology that allows businesses to accept payments through smartphones, tablets, or dedicated point-of-sale (POS) systems. These devices are designed to handle electronic payments, including credit and debit card transactions, mobile wallet payments, and even contactless payments. They enable businesses to process transactions quickly and securely, providing customers with a smooth and convenient shopping experience.

With the increasing adoption of mobile wallets like Apple Pay, Google Wallet, and Samsung Pay, mobile payment devices have become indispensable for businesses looking to stay competitive. These devices allow businesses to accept payments not only via traditional methods like credit and debit cards but also through newer forms of payment such as contactless NFC-enabled devices.

Benefits of Mobile Payment Devices

Convenience: Customers can make payments using their smartphones or contactless cards, providing flexibility at the point of sale.

Security: Many mobile payment devices come equipped with advanced encryption technology and comply with PCI-DSS standards, ensuring the safety of customer data.

Portability: Mobile payment devices are compact and easy to transport, allowing businesses to accept payments on the go, whether at a remote location, pop-up shop, or trade show.

Speed: Mobile payments are processed quickly, reducing wait times and enhancing the customer experience.

The Power of Smart Mobile Payment Terminals

A smart mobile payment terminal is an advanced version of a traditional payment terminal that integrates additional functionalities such as inventory management, customer relationship management (CRM), and detailed analytics. These terminals are equipped with features like touchscreen interfaces, barcode scanners, and receipt printing, providing an all-in-one solution for businesses that need to manage payments and more.

Why Choose Smart Mobile Payment Terminals?

All-in-One Solution Smart mobile payment terminals are designed to handle not only payments but also other key aspects of business management. They can track inventory, generate reports, and manage customer data, making them a valuable tool for businesses looking to streamline operations.

Enhanced Security Smart mobile payment terminals use the latest encryption and tokenization technologies to ensure the security of customer transactions. These terminals comply with industry standards like PCI-DSS to protect sensitive customer information and reduce the risk of fraud.

Real-Time Data and Analytics One of the biggest advantages of smart mobile payment terminals is the ability to access real-time data and analytics. Business owners can track sales, monitor inventory levels, and gain insights into customer behavior, helping them make informed decisions and improve business performance.

Easy Integration These terminals integrate seamlessly with other business systems, including accounting software, inventory management tools, and CRM platforms. This ensures that data flows smoothly between different business functions, reducing the risk of errors and improving operational efficiency.

How Smart Mobile Payment Terminals Benefit Your Business

By integrating smart mobile payment terminals into your operations, you can improve transaction efficiency, enhance customer satisfaction, and streamline your internal processes. These devices are especially beneficial for small to medium-sized businesses that want to consolidate multiple functions into one system while keeping costs low.

POS Mobile Payment Solutions: The Future of Payment Systems

POS mobile payment solutions combine traditional point-of-sale systems with the convenience and flexibility of mobile technology. These solutions allow businesses to accept payments via smartphones, tablets, or dedicated POS hardware. With POS mobile payment systems, businesses can process a variety of payment methods, including contactless cards, NFC-enabled devices, and mobile wallets.

Why Opt for POS Mobile Payment Solutions?

Flexibility and Compatibility POS mobile payment solutions are highly versatile, allowing businesses to accept various types of payments, including credit and debit cards, mobile wallets, and even cryptocurrency in some cases. This flexibility ensures that businesses can accommodate the diverse preferences of their customers.

Cloud-Based Integration Many POS mobile payment solutions are cloud-based, meaning that businesses can access their payment and sales data remotely from any location. This is particularly beneficial for businesses with multiple branches or those that need to monitor transactions and inventory in real time.

Cost-Effective Compared to traditional POS systems, POS mobile payment solutions are often more affordable, requiring fewer hardware components. Many solutions are available as Software-as-a-Service (SaaS), which means businesses pay a subscription fee rather than making a large upfront investment.

Ease of Use POS mobile payment systems are typically user-friendly, with intuitive interfaces that make them easy for employees to learn and use. This reduces the time needed for training and ensures a smoother experience for both staff and customers.

Mobility and Portability POS mobile payment systems allow businesses to accept payments anywhere, making them ideal for mobile businesses like food trucks, delivery services, or pop-up shops. As long as there is internet access, businesses can process transactions from virtually any location.

How Mobile Payment Devices, Smart Mobile Payment Terminals, and POS Mobile Payment Solutions Improve Business Efficiency

Improved Customer Experience

One of the main reasons businesses are switching to mobile payment devices, smart mobile payment terminals, and POS mobile payment solutions is to enhance the customer experience. Faster, more efficient transactions lead to shorter wait times and improved satisfaction. Customers appreciate the ability to pay quickly, whether using a credit card, mobile wallet, or contactless payment method.

Increased Security

With data breaches and fraud becoming increasingly common, businesses need to ensure that customer data is secure. Mobile payment devices and smart terminals utilize encryption and tokenization technologies to keep sensitive information safe. This added layer of security helps build customer trust and loyalty.

Operational Efficiency

By integrating mobile payment systems with inventory management, sales tracking, and CRM tools, businesses can automate various aspects of their operations. This reduces human error, streamlines workflows, and ensures that businesses are making data-driven decisions.

Cost Savings

Although there is an initial investment in mobile payment devices, smart mobile payment terminals, and POS mobile payment systems, the long-term benefits far outweigh the costs. These devices reduce the need for expensive hardware, minimize transaction errors, and enable businesses to scale more easily.

Conclusion: Make the Switch Today

Incorporating mobile payment devices, smart mobile payment terminals, and POS mobile payment systems into your business is more than just a trend—it’s a smart investment that can enhance transaction speed, increase customer satisfaction, and improve overall operational efficiency. Whether you run a small retail store or a large enterprise, adopting these payment solutions will future-proof your business and help you stay competitive in an increasingly digital marketplace.

If you're ready to make the switch to a more efficient and secure payment system, explore our range of mobile payment devices, smart mobile payment terminals, and POS mobile payment solutions. Visit SmartMobilePOS today to learn more and get started on transforming your business’s payment experience.

0 notes

Text

Mobile Card Readers: How Portable Payment Processing is Revolutionizing Commerce

Emergence of Mobile Card Readers Mobile card first emerged about a decade ago as simple magnetic stripe readers that connected to a mobile device via the audio jack. These early solutions allowed basic in-person credit card processing but lacked robust security and functionality. In recent years, advancements in technology have enabled the development of sophisticated mobile card readers that connect via Bluetooth and support chip cards, contactless payments, and value-added features. These next-gen devices are fueling massive growth and transforming how businesses accept payments on the go. Evolution of Connectivity and Compatibility Early mobile card used the audio jack connection, which provided a simple plug-and-play experience but came with security risks. As Bluetooth became mainstream, readers migrated to this wireless standard, allowing for a more seamless pairing with iOS and Android devices without compromising data. Now the latest mobile readers even support wireless payment formats like NFC/contactless that don't require direct tapping. In terms of compatibility, the first readers only worked with certain mobile models, but now universal readers are available that are compatible with virtually any smartphone or tablet. This wide compatibility combined with simple Bluetooth pairing has significantly lowered the barrier to entry for mobile payments acceptance. Expanded Acceptance of Payment Types Initially mobile card were limited to magnetic stripe cards only, which posed problems for newer chip-based cards. However, as EMV compliance grew in importance, card reader manufacturers added chip card slots and contactless payments to their products. Now a single mobile card reader can accept all major payment types, from magnetic stripe and EMV chips to NFC/contactless technologies. Mobile Card Reader unified acceptance allows merchants to receive all forms of customer tenders regardless of the cards' underlying technologies. The emergence of mobile wallets like Apple Pay and Google Pay has further expanded the opportunities for mobile merchants to accept new types of touchless payments. Advanced Functionalities and Integration Options Early card readers were basic platforms for swiping or inserting cards. However, modern readers integrate robust point-of-sale features into intuitive mobile apps. These apps turn a smartphone or tablet into a fully-functional mobile POS by enabling inventory management, integrated invoices/receipts, customer profiles, loyalty programs, analytics, and more. Leading providers also deliver payment APIs to seamlessly connect readers to leading shopping carts and platforms. Merchants gain access to robust back-end tools while retaining control over their brand experience. Additionally, many readers now feature integrated card-not-present payment options, allowing remote or mail/phone order merchants to accept payments seamlessly. Rise of New Mobile Commerce Models The combination of powerful yet affordable mobile card readers and extensive payment acceptance has spurred innovative new mobile business models. Food trucks, pop-up shops, delivery services, traveling consultants and more can now easily start and run commerce operations from a smartphone or tablet. Door-to-door and direct-to-consumer merchants no longer need to rely on costly POS terminals or delay accepting payments. Events and trade shows have also benefited as exhibitors gain the ability to quickly and securely accept payments at their booth. This proliferation of mobile commerce opportunities allows entrepreneurs to pursue flexible, entrepreneurial ventures that were not previously financially viable without robust payment acceptance solutions. Get more insights on Mobile Card Reader

Also read related article on Synthetic Aperture Radar Market

Unlock More Insights—Explore the Report in the Language You Prefer

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

#Mobile Card Reader#Portable Card Reader#Mobile Payment#Credit Card Reader#Mobile POS#Contactless Payment#Mobile Payment Device

0 notes

Text

An Epic antitrust loss for Google

A jury just found Google guilty on all counts of antitrust violations stemming from its dispute with Epic, maker of Fortnite, which brought a variety of claims related to how Google runs its app marketplace. This is huge:

https://www.nytimes.com/2023/12/11/technology/epic-games-google-antitrust-ruling.html

The mobile app store world is a duopoly run by Google and Apple. Both use a variety of tactics to prevent their customers from installing third party app stores, which funnels all app makers into their own app stores. Those app stores cream an eye-popping 30% off every purchase made in an app.

This is a shocking amount to charge for payment processing. The payments sector is incredibly monopolized and notorious for its price-gouging – and its standard (wildly inflated) rate is 2-5%:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

Now, in theory, Epic doesn't have to sell in Google Play, the official Android app store. Unlike Apple's iOS, Android permit both sideloading (installing an app directly without using an app store) and configuring your device to use a different app store. In practice, Google uses a variety of anticompetitive tricks to prevent these app stores from springing up and to dissuade Android users from sideloading. Proving that Google's actions – like paying Activision $360m as part of "Project Hug" (no, really!) – were intended to prevent new app storesfrom springing up was a big lift for Epic. But they managed it, in large part thanks to Google's own internal communications, wherein executives admitted that this was exactly why Project Hug existed. This is part of a pattern with Big Tech antitrust: many of the charges are theoretically very hard to make stick, but because the companies put their evil plans in writing (think of the fraudulent crypto exchange FTX, whose top execs all conferred in a groupchat called "Wirefraud"), Big Tech keeps losing in court:

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Now, I do like to dunk on Big Tech for this kind of thing, because it's objectively funny and because the companies make so many unforced errors. But in an important sense, this kind of written record is impossible to avoid. Any large institution can only make and enact policy through administrative systems, and those systems leave behind a paper-trail: memos, meeting minutes, etc. Yes, we all know that quote from The Wire: "Is you taking notes on a fucking criminal conspiracy?" But inevitably, any ambitious conspiracy can only exist if someone is taking notes.

What's more, any large conspiracy involving lots of parties will inevitably produce leaks. Think of this as the corollary to the idea that the moon landing can't be a hoax, because there's no way 400,000 co-conspirators could keep the secret. Big Tech's conspiracies required hundreds or even thousands of collaborators to keep their mouths shut, and eventually someone blabs:

https://www.science.org/content/article/fake-moon-landing-you-d-need-400000-conspirators

This is part of a wave of antitrust cases being brought against the tech giants. As Matt Stoller writes, the guilty-on-all-counts jury verdict will leak into current and future actions. Remember, Google spent much of this year in court fighting the DoJ, who argued that the company bribed Apple not to make a competing search engine, paying tens of billions every year to keep a competitor from emerging. Now that a jury has convinced Google of doing that to prevent alternative app stores from emerging, claims that it used these pay-for-delay tactics in other sectros get a lot more credible:

https://www.thebignewsletter.com/p/boom-google-loses-antitrust-case

On that note: what about Apple? Epic brought a very similar case against Apple and lost. Both Apple and Epic are appealing that case to the Supreme Court, and now that Google has been convicted in a similar case, it might prompt the Supremes to weigh in and resolve the seeming inconsistencies in the interpretation of federal law.

This is a key moment in the long project to wrest antitrust away from the pro-monopoly side, who spent decades "training" judges to produce verdicts that run counter to the plain language of America's antitrust law:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

There's 40 years' worth of bad precedent to overturn. The good news is that we've got the law on our side. Literally, the wording of the laws and the records of the Congressional debate leading to their passage, all militate towards the (incredibly obvious) conclusion that the purpose of anti-monopoly law is to fight monopoly, not defend it:

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

It's amazing to realize that we got into this monopoly quagmire because judges just literally refused to enforce the law. That's what makes one part of the jury verdict against Google so exciting: the jury found that Google's insistence that Play Store sellers use its payment processor was an act of illegal tying. Today, "tying" is an obscure legal theory, but few doctrines would be more useful in disenshittifying the internet. A company is guilty of illegal tying when it forces you to use unrelated products or services as a condition of using the product you actually want. The abandonment of tying led to a host of horribles, from printer companies forcing you to buy ink at $10,000/gallon to Livenation forcing venues to sell tickets through its Ticketmaster subsidiary.

The next phase of this comes when the judge decides on the penalty. Epic doesn't want cash damages – it wants the judge to order Google to fulfill its promise of "an open, competitive Android ecosystem for all users and industry participants." They've asked the judge to order Google to facilitate third-party app stores, and to separate app stores from payment processors. As Stoller puts it, they want to "crush Google’s control over Android":

https://www.epicgames.com/site/en-US/news/epic-v-google-trial-verdict-a-win-for-all-developers

Google has sworn to appeal, surprising no one. The Times's expert says that they will have a tough time winning, given how clear the verdict was. Whatever this means for Google and Android, it means a lot for a future free from monopolies.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/12/im-feeling-lucky/#hugger-mugger

#pluralistic#conspiracies#big tech#discovery#ai#copyright#copyfight#app stores#circuit splits#apple#apple v epic#law#trustbusting#competition#monopolies#google#epic#google v epic#fortnite#antitrust#tying#payment processing#scotus#project hug#pay for delay#games#gaming

1K notes

·

View notes

Text

So I don't know how people on this app feel about the shit-house that is TikTok but in the US right now the ban they're trying to implement on it is a complete red herring and it needs to be stopped.

They are quite literally trying to implement Patriot Act 2.0 with the RESTRICT Act and using TikTok and China to scare the American public into buying into it wholesale when this shit will change the face of the internet. Here are some excerpts from what the bill would cover on the Infrastructure side:

SEC. 5. Considerations.

(a) Priority information and communications technology areas.—In carrying out sections 3 and 4, the Secretary shall prioritize evaluation of— (1) information and communications technology products or services used by a party to a covered transaction in a sector designated as critical infrastructure in Policy Directive 21 (February 12, 2013; relating to critical infrastructure security and resilience);

(2) software, hardware, or any other product or service integral to telecommunications products and services, including— (A) wireless local area networks;

(B) mobile networks;

(C) satellite payloads;

(D) satellite operations and control;

(E) cable access points;

(F) wireline access points;

(G) core networking systems;

(H) long-, short-, and back-haul networks; or

(I) edge computer platforms;

(3) any software, hardware, or any other product or service integral to data hosting or computing service that uses, processes, or retains, or is expected to use, process, or retain, sensitive personal data with respect to greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including— (A) internet hosting services;

(B) cloud-based or distributed computing and data storage;

(C) machine learning, predictive analytics, and data science products and services, including those involving the provision of services to assist a party utilize, manage, or maintain open-source software;

(D) managed services; and

(E) content delivery services;

(4) internet- or network-enabled sensors, webcams, end-point surveillance or monitoring devices, modems and home networking devices if greater than 1,000,000 units have been sold to persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction;

(5) unmanned vehicles, including drones and other aerials systems, autonomous or semi-autonomous vehicles, or any other product or service integral to the provision, maintenance, or management of such products or services;

(6) software designed or used primarily for connecting with and communicating via the internet that is in use by greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including— (A) desktop applications;

(B) mobile applications;

(C) gaming applications;

(D) payment applications; or

(E) web-based applications; or

(7) information and communications technology products and services integral to— (A) artificial intelligence and machine learning;

(B) quantum key distribution;

(C) quantum communications;

(D) quantum computing;

(E) post-quantum cryptography;

(F) autonomous systems;

(G) advanced robotics;

(H) biotechnology;

(I) synthetic biology;

(J) computational biology; and

(K) e-commerce technology and services, including any electronic techniques for accomplishing business transactions, online retail, internet-enabled logistics, internet-enabled payment technology, and online marketplaces.

(b) Considerations relating to undue and unacceptable risks.—In determining whether a covered transaction poses an undue or unacceptable risk under section 3(a) or 4(a), the Secretary— (1) shall, as the Secretary determines appropriate and in consultation with appropriate agency heads, consider, where available— (A) any removal or exclusion order issued by the Secretary of Homeland Security, the Secretary of Defense, or the Director of National Intelligence pursuant to recommendations of the Federal Acquisition Security Council pursuant to section 1323 of title 41, United States Code;

(B) any order or license revocation issued by the Federal Communications Commission with respect to a transacting party, or any consent decree imposed by the Federal Trade Commission with respect to a transacting party;

(C) any relevant provision of the Defense Federal Acquisition Regulation and the Federal Acquisition Regulation, and the respective supplements to those regulations;

(D) any actual or potential threats to the execution of a national critical function identified by the Director of the Cybersecurity and Infrastructure Security Agency;

(E) the nature, degree, and likelihood of consequence to the public and private sectors of the United States that would occur if vulnerabilities of the information and communications technologies services supply chain were to be exploited; and

(F) any other source of information that the Secretary determines appropriate; and

(2) may consider, where available, any relevant threat assessment or report prepared by the Director of National Intelligence completed or conducted at the request of the Secretary.

Look at that, does that look like it just covers the one app? NO! This would cover EVERYTHING that so much as LOOKS at the internet from the point this bill goes live.

It gets worse though, you wanna see what the penalties are?

(b) Civil penalties.—The Secretary may impose the following civil penalties on a person for each violation by that person of this Act or any regulation, order, direction, mitigation measure, prohibition, or other authorization issued under this Act: (1) A fine of not more than $250,000 or an amount that is twice the value of the transaction that is the basis of the violation with respect to which the penalty is imposed, whichever is greater. (2) Revocation of any mitigation measure or authorization issued under this Act to the person. (c) Criminal penalties.— (1) IN GENERAL.—A person who willfully commits, willfully attempts to commit, or willfully conspires to commit, or aids or abets in the commission of an unlawful act described in subsection (a) shall, upon conviction, be fined not more than $1,000,000, or if a natural person, may be imprisoned for not more than 20 years, or both. (2) CIVIL FORFEITURE.— (A) FORFEITURE.— (i) IN GENERAL.—Any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States. (ii) PROCEEDS.—Any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States. (B) PROCEDURE.—Seizures and forfeitures under this subsection shall be governed by the provisions of chapter 46 of title 18, United States Code, relating to civil forfeitures, except that such duties as are imposed on the Secretary of Treasury under the customs laws described in section 981(d) of title 18, United States Code, shall be performed by such officers, agents, and other persons as may be designated for that purpose by the Secretary of Homeland Security or the Attorney General. (3) CRIMINAL FORFEITURE.— (A) FORFEITURE.—Any person who is convicted under paragraph (1) shall, in addition to any other penalty, forfeit to the United States— (i) any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate the violation or attempted violation of paragraph (1); and (ii) any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of the violation. (B) PROCEDURE.—The criminal forfeiture of property under this paragraph, including any seizure and disposition of the property, and any related judicial proceeding, shall be governed by the provisions of section 413 of the Controlled Substances Act (21 U.S.C. 853), except subsections (a) and (d) of that section.

You read that right, you could be fined up to A MILLION FUCKING DOLLARS for knowingly violating the restrict act, so all those people telling you to "just use a VPN" to keep using TikTok? Guess what? That falls under the criminal guidelines of this bill and they're giving you some horrible fucking advice.

Also, VPN's as a whole, if this bill passes, will take a goddamn nose dive in this country because they are another thing that will be covered in this bill.

They chose the perfect name for it, RESTRICT, because that's what it's going to do to our freedoms in this so called "land of the free".

Please, if you are a United States citizen of voting age reach out to your legislature and tell them you do not want this to pass and you will vote against them in the next primary if it does. This is a make or break moment for you if you're younger. Do not allow your generation to suffer a second Patriot Act like those of us that unfortunately allowed for the first one to happen.

And if you support this, I can only assume you're delusional or a paid shill, either way I hope you rot in whatever hell you believe in.

#politics#restrict bill#tiktok#tiktok ban#s.686#us politics#tiktok senate hearing#land of the free i guess#patriot act#patriot act 2.0

898 notes

·

View notes

Text

Sending him letters:

**Yes, he can receive international mails too! 💚**

- Mail must have his full name (Luigi Nicholas Mangione) and register number (52503-511).

- Mail will be opened and inspected by staff, so content must be kept appropriate or else it will be rejected. Do not talk about the incident. Talk to him like a friend.

These suggestions are collected from @renegadeforjustice (TikTok):

- Use plain paper.

- Use plain black/blue pen or pencil.

- Greeting cards can be included but they have to be as simple as possible (one piece of folded paper without any layer, embossing, glitter, or other extra material).

- Puzzles like crossword and sudoku can also be sent. Make sure to include the answers in a separate paper.

- Mail can include multiple pages.

- If you are not comfortable using your real name, you can use a pen name instead (just make sure it is a simple one with a first and last name).

Sending him packages:

From bop.gov:

“Inmates are not allowed to receive packages from home without prior written approval from the inmate's unit team or authorized staff member at the institution. The only packages an inmate may receive from home are those containing release clothing and authorized medical devices. However, inmates may receive magazines, hard and paperback books directly from the publisher.”

More information from Policy on Incoming Publications:

"At all Bureau institutions, an inmate may receive hardcover publications and newspapers only from the publisher, from a book club, or from a bookstore.”

“At medium security, high security, and administrative institutions, an inmate may receive softcover publications (for example, paperback books, newspaper clippings, magazines, and other similar items) only from the publisher, from a book club, or from a bookstore."

- Books, magazines, and newspapers can only be sent to him by the publisher/bookstore/book club themselves. You cannot mail it to him yourself. When ordering, put Luigi as the recipient.

- If you are going to use Amazon to send him books, there is a “send as a gift” button below the cart that you can click if you want to include a message to him as well.

Sending money to his commissary account:

To deposit money into his commissary account, you can choose from 3 options:

1.) MoneyGram

You'll need the following information:

Account Number: 52503511MANGIONE

Company Name: Federal Bureau of Prisons

City & State: Washington, DC

Receive Code is always: 7932

Beneficiary: Luigi Nicholas Mangione

a. At a MoneyGram location

Locate the nearest agent by calling 1-800-926-9400 or visiting: www.moneygram.com.

You'll need to complete a MoneyGram ExpressPayment Blue Form (see a sample form).

You can pay with cash.

b. Online

Please visit https://www.moneygram.com/mgo/us/en/paybills and enter the receive code 7932 or Federal Bureau of Prisons.

Enter the Receive Code (7932) and the amount you are sending (up to $300).

First time users will have to set up a profile and account.

A MasterCard or Visa credit card is required.

2.) Western Union

You'll need the following information:

Account Number: 52503511MANGIONE

Attention Line: Luigi Nicholas Mangione

Code City is always: FBOP, DC

a. Online

Please visit www.send2corrections.com

A credit/debit card will be required to complete a payment online.

You can also initiate a payment via mobile app and pay later with cash or payment card, at a Western Union agent location.

b. At a Western Union location

Locate the nearest agent by using our agent locator or by calling 1-800-325-6000.

You can pay with cash. Debit cards are accepted at select locations.

c. Over the phone

Call 1-800-634-3422 and choose option 2.

A credit/debit card will be required.

d. Via Send2Corrections mobile application

Search "Send2Corrections" in the Apple App Store (Apple iOS) or the Google Play Store (Android devices).

3.) Using mail

For detailed information, click on this link.

Information is extracted from bop.gov. Please visit the site if you need any confirmation.

💚F💚R💚E💚E💚💚💚💚L💚U💚I💚G💚I💚

42 notes

·

View notes

Text

Genshin Impact · Cloud US & Canada Open Beta on iOS, Android, and PC Now Available!

Dear Travelers,

Genshin Impact · Cloud US & Canada Open Beta on iOS, Android, and PC is now available!

Genshin Impact · Cloud currently supports US, Canada, Singapore, Malaysia, Indonesia, Thailand, Philippines, Laos, Cambodia, Bangladesh, Myanmar. Players in other regions, stay tuned!

★ Genshin Impact · Cloud is a cloud version of HoYoverse's Genshin Impact. Real-time cloud technology allows you to enjoy high graphics and high frame rates without having to download Genshin Impact's full game package.

After logging in to Genshin Impact · Cloud, Travelers will be able to experience Genshin Impact on mobile devices. Game progress is shared across other platforms.

>> Click here to download Genshin Impact · Cloud <<

〓Payment Guidelines〓

Billing will start immediately after Travelers launch the game within Genshin Impact · Cloud. The billing standard is at 10 Cloud Coins per minute. If their accounts still have remaining Free Trial time or an active Cloud Pass, then bills will be deducted in the order of Cloud Pass > Free Trial > Cloud Coins.

Travelers can obtain a certain amount of Free Trial. Upon Travelers' first login, you may obtain a 5-hour Free Trial. Also, you may claim a 15-minute Free Trial by logging in daily (refreshes at 12:00 UTC+8 daily). The upper limit of Free Trial is 600 minutes. You will be unable to accumulate any more Free Trial once this limit is reached.

Thanks to Travelers' love and support, Genshin Impact · Cloud is now officially launched for iOS, Android, and PC in the United States and Canada. We will continue to monitor Travelers' suggestions and feedback, and work to provide a better gaming experience for Travelers.

#genshin impact#genshin impact updates#genshin impact news#official#''yay maybe i can download this and have a decent experience on my phone for once!''#> shit costs money#:/

130 notes

·

View notes

Text

July is disability pride month! In honor of this, as a proud disabled person, the top 10 things I've heard/read about disability that just need to be addressed.

"Disability payments" = SSI.

Nope. There are a number of programs which are "disability payments." There are programs that look at your income in addition to disability status, such as SSI and VA pensions. There are programs that look at your disability status and work credits, like SSDI. There are also programs that look at disability and if it's service connected to your military status, like VA disability. There are people who have disability through their former employer. All of these provide a monthly payment to people who are disabled and cannot work. 2. Disabled people can't get married.

Okay, this one is complicated. There is to my knowledge no law on the books anywhere in the United States that prohibits a consenting disabled adult from marrying another consenting adult, disabled or not. If you are on disability with a program like SSDI they could care less if you get married or divorced.

The trick here is that if you are receiving disability under a program that considers income, like SSI, if you get married it's more than likely that you will go above the maximum income threshold and lose your benefits entirely. They somehow assume that you both can survive on your spouse's income alone. This also means the disabled person essentially loses all their financial independence. The maximum income threshold for SSI is to my knowledge far lower than almost any other program, so there's very little wiggle room here.

So a disabled person on SSI has to choose between getting married and losing all their income, or maintaining some financial independence with their own income - and that's really not a fair choice at all 3. I saw that wheelchair user stand up! Scammer.

Nope. A lot of people who use wheelchairs and other mobility devices are ambulatory. They may have pain or orthopedic issues, they may have a condition causing extreme fatigue or dizziness that makes them a fall risk, they may have a heart issue, they may be able to do some walking and standing but not a lot. Some people need mobility devices only when they are doing something particularly strenuous that would involve a lot of walking and standing - for example going through an airport or visiting a museum or theme park.

Bottom line, if you see someone using a wheelchair, a scooter, a walker, a cane, whatever, don't be an asshole to them, and don't ask them to explain their medical history to you. 4. That person has a placard and is using the parking space close to the building, but they can walk!! Scammer.

Nope. Again, you have no idea what that person's condition might be. They could have a cardiac or respiratory condition, they could have rheumatoid arthritis or an issue with their feet or knees, you have no bloody idea, so mind your business. 5. That person wouldn't be disabled if they'd meditate/take this supplement/pray/think positive! Why were they offended when I told them so?

Because their treatment is not your concern? Because although you did a lot of studying on Tik Tok University, maybe they're trusting the trained medical professionals who are treating them? Maybe because what you are saying has no actual basis in mainstream peer reviewed science? It's gross to try to give a disabled or chronically ill person unsolicited treatment or religious advice. 6. I asked that disabled person what was wrong with them and they got mad! Why?

Random strangers you meet are not required to give you detailed descriptions of their medical conditions. Also, asking anyone what is WRONG with them is so damned rude. 7. Ugh, the pandemic is over but that person is still wearing a mask! ROFL.

Yeah, there are a lot of people out there who are either immunocompromised or have another condition that makes them high risk for the numerous airborne viral illnesses still circulating, or they live with/care for someone who is, or they have another reason they're wearing a mask and they don't want to get sick. And? Mind your business. 8. Heh, that person said they were allergic to soy and I put soy milk in their coffee! They'll never know.

Congrats, you just might have killed someone or sent them to the hospital. If someone's telling you they have an allergy, please for God's sake take them seriously. If they consume or in some cases even smell or have contact with that allergen, it could absolutely kill or hospitalize them. There are also a lot of other medical reasons someone might tell you they can't have a particular food or drink - for example, some very common medications have a serious interaction with some very common fruits that could potentially cause them a tremendous amount of harm. Or they have a condition like celiac disease where eating certain things will result in pain and illness flares and serious complications for them. None of that is a joke. 9. Eyeroll this disabled person needs to get to the bathroom/another area that is only accessible by stairs and now they need me to unlock the elevator or door for them. Damned PITA.

Blame your employer or whoever owns the building for not making it accessible. Don't blame the disabled person who is asking for the same access to the facility as anyone else. Do you really think it's the highlight of anyone's day to find a locked elevator and have to search for whomever has the key, simply to go pee? 10. Eh, that person told me they can't walk up the stairs! But it's not that steep!

If a person tells you they can't walk up or down stairs, they can't walk up or down stairs. Period. Case closed. This isn't something negotiable.

78 notes

·

View notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

438 notes

·

View notes

Text

heyyy so my clip studio paint subscription expired today (trust me, if CSP let you do 1-time payments on mobile devices I'd do it in a heartbeat)

i can cover the cost on my own, but also i share a lot of my art on here for free and it seems to cheer a lot of people up so... if you enjoy my work and feel like throwing me a ko-fi so i can cover part of it that would be a very kind way to support the art i make :]

no pressure btw, just if you feel like it okay BYE

86 notes

·

View notes

Text

How Peter Duton has consistently Voted in parliament

Spoiler: He hates you Not everything is terrible, but holy shit it gets bad and a lot of it is bad (Source at the bottom)

Voted for:

A citizenship test

A plebiscite on the carbon pricing mechanism (Remove the tax on carbon)

A same-sex marriage plebiscite (plebiscite means to get rid of)

An Australian Building and Construction Commission (ABCC)

Carbon Farming Initiative Amendment Bill 2014

Charging postgraduate research students fees

Civil celebrants having the right to refuse to marry same-sex couples

Compensating victims of overseas terrorism since the September 11 attack

Decreasing availability of welfare payments

Deregulating undergraduate university fees (Removing any restrictions on the amount that universities can charge students for tuition)

Drug testing welfare recipients

Getting rid of Sunday and public holiday penalty rates

Greater control over items brought into immigration detention centres

Having a referendum on whether to create an Indigenous Voice to Parliament (To be fair he also did recently have a trantrum because he didn't want to stand infrount of the Aboriginal flag, so)

Increasing eligibility requirements for Australian citizenship

Government administered paid parental leave

Increasing indexation of HECS-HELP debts (HECS-HELP is basically student loans)

Increasing state and territory environmental approval powers

Increasing the cost of humanities degrees (Humanities include: History, Geography, Philosophy, Religion, Citizenship, Economics, Business, ect)

Increasing the price of subsidised medicine

Prioritising religious freedom

Privatising government-owned assets

Putting welfare payments onto cashless debit cards (or indue cards) on a temporary basis as a trial

Recognising local government in the Constitution

Reducing the corporate tax rate

Senate electoral reform

Stopping people who arrive by boat from ever coming to Australia

Temporary Exclusion Orders

Temporary protection visas

The territories being able to legalise euthanasia

Turning back asylum boats when possible

A combined Federal Circuit and Family Court of Australia

Banning mobiles and other devices in immigration detention

Increasing scrutiny of unions

Implementing refugee and protection conventions

Putting welfare payments onto cashless debit cards (or indue cards) on an ongoing basis

Privatising certain government services

Voluntary student union fees

Increasing funding for road infrastructure

Increasing the initial tax rate for working holiday makers to 19%

Increasing the Medicare Levy to pay for the National Disability Insurance Scheme

Making more water from Murray-Darling Basin available to use

The Coalition's new schools funding policy ("Gonski 2.0")

The Intervention in the Northern Territory

Voted against:

A carbon price

A minerals resource rent tax

A Royal Commission into Violence and Abuse against People with Disability

A transition plan for coal workers

Banning pay secrecy clauses

Capping gas prices

Carbon farming

Considering legislation to create a federal anti-corruption commission (procedural)

Considering motions on Gaza (2023-24) (procedural)

Criminalising wage theft

Decreasing the private health insurance rebate

Doctor-initiated medical transfers for asylum seekers

Ending illegal logging

Ending immigration detention on Manus Island

Extending government benefits to same-sex couples

Federal action on public housing

Federal government action on animal & plant extinctions

Increasing availability of abortion drugs

Increasing consumer protections

Increasing funding for university education

Increasing housing affordability

Increasing investment in renewable energy

Increasing legal protections for LGBTI people

Increasing marine conservation

Increasing penalties for breach of data

Increasing political transparency

Increasing protection of Australia's fresh water

Increasing restrictions on gambling

Increasing scrutiny of asylum seeker management

Increasing support for the Australian film and TV industry

Increasing support for the Australian shipping industry

Increasing the diversity of media ownership

Increasing trade unions' powers in the workplace

Increasing transparency of big business by making information public

Market-led approaches to protecting biodiversity

Net zero emissions by 2035

Re-approving/ re-registering agvet chemicals (Agvet chemicals protect crops and livestock)

Removing children from immigration detention

Reproductive bodily autonomy

Requiring every native title claimant to sign land use agreements

Restricting donations to political parties

Restricting foreign ownership

Same-sex marriage equality

Stem cell research

Stopping tax avoidance or aggressive tax minimisation

The Australian Renewable Energy Agency (ARENA)

The Carbon Pollution Reduction Scheme

The Paris Climate Agreement

Tobacco plain packaging

Transgender rights

Treating the COVID vaccine rollout as a matter of urgency

Mix

Reducing tax concessions for high socio-economic status

Increasing competition in bulk wheat export

Mostly Yes

Speeding things along in Parliament (procedural)

Unconventional gas mining

A character test for Australian visas

Increasing or removing the Government debt limit

Regional processing of asylum seekers

Mostly No

Increasing the age pension

Net zero emissions by 2050

Suspending the rules to allow a vote to happen (procedural)

Vehicle efficiency standards

Increasing support for rural and regional Australia

Letting all MPs or Senators speak in Parliament (procedural)

Source

https://theyvoteforyou.org.au/people/representatives/dickson/peter_dutton

#peter dutton#aus pol#australian politics#auspol#australian election#election#election 2025#politics#australia

5 notes

·

View notes

Text

5 Best Mobile Payment Devices [80% of Businesses Use These for Secure Transactions]

Mobile payment devices have become important tools for merchants who want to offer seamless, secure, and efficient payment options.

Why are 80% of businesses choosing mobile payment devices?

The answer lies in the combination of convenience, security, and speed these devices offer, all while keeping transaction costs low.

In this blog, we’ll explore the 5 best mobile payment devices that 80% of businesses are already using for secure transactions.

1.Square Reader

Best for: Small businesses, retail, and mobile businesses

Why 80% of businesses love it: Square Reader is one of the most popular mobile payment devices due to its simplicity and affordability. It allows businesses to accept chip, magstripe, and contactless payments via mobile devices.

Features:

Compact & portable: Fits in your pocket and connects to smartphones via Bluetooth.

Easy setup: No monthly fees, just pay a small percentage per transaction.

Supports various payment methods: Accepts all major credit and debit cards, Apple Pay, Google Pay, and more.

Benefits: Square offers a free card reader and transparent pricing, making it a go-to for small businesses and startups looking for an easy-to-use, secure solution.

2.PayPal Here

Best for: Retail, online sales, and freelancers

Why 80% of businesses love it: As one of the most recognized names in online payments, PayPal Here offers an easy way to accept payments anywhere, anytime. It’s known for its low transaction fees and reliable service.

Features:

Wide compatibility: Works with both iOS and Android devices.

No monthly fee: You only pay per transaction.

Built-in reporting tools: Track sales, inventory, and customer information.

Benefits: PayPal Here combines seamlessly with your PayPal account, making it perfect for businesses that already use PayPal for online sales.

3.Clover Go

Best for: Small to mid-sized businesses, restaurants, and service providers

Why 80% of businesses love it: Clover Go is a mobile payment device that works seamlessly with the Clover Point of Sale (POS) system. As one of the top mobile payment devices on the market, it’s designed to make payment processing easy for businesses on the move. Whether you're a small business owner, in retail, or a service provider, Clover Go allows you to accept payments securely and efficiently, all from the palm of your hand.

Features:

Versatile payment acceptance: Accepts swipe, chip, and tap payments.

Integrated POS: Syncs directly with Clover POS for inventory and reporting.

User-friendly app: Manage your business operations from anywhere.

Benefits: With Clover Go, you get all the features of a traditional POS system, but in a mobile-friendly, compact device. Great for businesses on the go!

4.SumUp Air

Best for: Freelancers, small businesses, and pop-up stores

Why 80% of businesses love it: SumUp Air is an affordable, mobile card reader that’s perfect for small businesses and solo entrepreneurs. It’s simple to use, and transactions are processed quickly.

Features:

Accepts all major cards: Visa, Mastercard, and American Express.

Bluetooth connection: Works with smartphones and tablets.

Free app: Provides transaction history and reporting.

Benefits: SumUp has no monthly fees, so you only pay a small percentage per transaction, making it a cost-effective solution for startups and freelancers.

5.Shopify POS

Best for: E-commerce businesses and retail shops

Why 80% of businesses love it: Shopify POS is part of the popular Shopify ecosystem, which makes it a perfect fit for online businesses that want to expand to physical stores. It's easy to set up and combines perfectly with your Shopify online store.

Features:

Seamless integration with Shopify: Syncs your online and offline sales, inventory, and customer data.

Supports multiple payment methods: Accepts credit cards, gift cards, and mobile wallets.

Advanced reporting tools: Track sales, inventory, and customer insights.

Benefits: Shopify POS is great for businesses that want to manage both online and in-store sales from one platform.

Conclusion

Choosing the right mobile payment device can have a significant impact on your business’s efficiency and customer satisfaction.

Whether you’re running a small retail store, restaurant, or offering on-the-go services, these 5 best mobile payment devices are the tools that 80% of businesses trust for secure transactions.

Ready to take your business to the next level?

Choose the perfect mobile payment device for your needs and start processing payments seamlessly!

0 notes

Note

Hello Sarah,

I'm so sorry for the multiple posts, but I have some good news!

The first one is that I might have found a way around SKIYAKI's region issue with the sms verification, which (guess what) was also a problem for me. 😅

You need a good VPN that works on mobile devices through an app (nord VPN, express VPN, etc.) I connected to Tokyo and attempted the SMS verification through the SKIYAKI app and it worked!

The 2nd is I managed to become a member of Keiko's FC! After all these countless attempts and failures, perseverance finally paid off!

Some tips for those who want to become a member and may run through similar issues:

At step 2.2 -2.3 where I got stuck and couldn't receive the email to proceed. I tackled it by using a VPN and incognito tab on an android mobile device (on pc this didn't work) in order to get around the possible region lock.

For the name, I just followed your advice for the closest instance of it in Katakana. After I receive the membership ID, I will follow the tip of the fellow fan hkrwa to edit my name.

Be careful as the Lawson ticket registration is extremely case sensitive. A single space after the name can cause an error.

Then, it was the address issue. At that point, I thought of asking tenso support if I had made a mistake at the address step since I couldn't make their tutorial work.

After a couple back and forth e-mails with them (they thought I was trying to get a ticket 😑), they sent me an email with what to place at the address fields and... IT WORKED!!! 🥳🎉

This is what they sent:

City [足立区千住曙町]

Street address [42-4]

Apartment name and room number [TS1330825 転送コム]

Maybe the width I used was wrong 🤔

For payment for both FCs I used my Revolut, which worked fine.

Anyway, my apologies for the long post and spamming your ask corner with posts all these days! I hope the above can be of help to fellow fans!

YAY!!! So happy it all worked out eventually. Thanks for the tip regarding the SKIYAKI SMS verification. I will try this method to register my new smartphone so I don't always have to bring my old one with me to Wakana's concerts. It was slowly becoming a hassle because the old phone required constant charging. I think it should be fine with my Surfshark VPN. *fingers crossed*

It's been so long since I registered my Keiko FC membership but maybe I struggled with similar issues. I don't remember T_T By now, I am almost used to constant errors when I first try to register on a Japanese site. It's always a lot of trial and error so I've learned to be patient and to try many different options. But it's honestly a case by case matter so there are no universal tips that I can give.

Thank you for providing all this info about your personal experience. I am sure it can be useful to people who want to join Keiko's fan club.

8 notes

·

View notes

Text

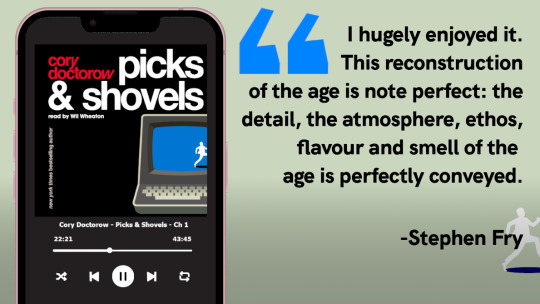

Canada shouldn’t retaliate with its US tariffs

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

Five years ago, Trump touted his "big, beautiful" replacement for NAFTA, the "free trade agreement" between the US, Mexico and Canada. Trump's NAFTA-2 was called the USMCA (US-Mexico-Canada Agreement) and it was pretty similar to NAFTA, to be honest.

That tells you a couple things: first, NAFTA was, broadly speaking a good thing for Trump and the ultra-wealthy donors who backed him (and got far richer as a result). That's why he kept it intact. NAFTA and USMCA are, at root, a way to make rich people richer by making poorer people poorer. Trump's base hated NAFTA because they (correctly) believed that it was being used to erode wages by chasing cheaper labor and more lax environmental controls in other countries. Neither NAFTA nor USMCA have any stipulations requiring exported goods to be manufactured by unionized workers, or in factories with robust environmental and workplace safety rules.

The point of NAFTA/USMCA is to goose profits by despoiling the environment, maiming workers, stealing their wages, paying them less, all while poisoning the Earth. Trump's "new" NAFTA was just the old NAFTA with some largely cosmetic changes so that Trump's base could be (temporarily) fooled into thinking Trump was righting the historic wrong of NAFTA.

However, there was one part of USMCA that marked a huge departure from NAFTA: the "IP" chapter. USCMA bound Canada and Mexico to implementing brutal new IP laws. For example, Mexico was forced to pass an anti-circumvention law that makes it a crime to tamper with "digital locks." This means that Mexican mechanics can't bypass the locks US car companies use to lock-out third party repair. Mexican farmers can't fix their own tractors. And, of course, Mexican software developers can't make alternative app stores for games consoles and mobile devices – they must sell their software through US Big Tech companies that take 30% of every sale:

https://pluralistic.net/2020/09/09/free-sample/#que-viva

Shamefully, Canada had already capitulated to most of these demands. Two Canadian Conservative Party politicians, Tony Clement and James Moore, had sold the country out in 2012, throwing away 6,138 negative responses to a consultation on a new DRM law (on the grounds that they were "babyish" views of "radical extremists"), siding instead with the 54 cranks and industry shills who supported their proposal:

https://pluralistic.net/2024/11/15/radical-extremists/#sex-pest

When Canadian politicians are pressed on why these anti-interoperability policies are good for Canada, they'll say that it's a condition of free trade, and the benefits of being able to export Canadian goods to the US without tariffs outweigh the costs of having to pay rents to American companies for consumables (like car parts or printer ink), repair, and software sales.

Sure, when Canadian software authors sell iPhone apps to Canadian customers, the payments take a round trip through Cupertino, California and return 30% short. But Canadian consumers get to buy iPhones without paying tariffs on them, and the oil, timber, and minerals we rip out of the ground can be sent to America without tariffs, either (oh, also, a few things that are still manufactured in Canada can do this, too).

Enter Trump, carrying a 25% tariff on all Canadian goods, which he has vowed to impose on his first day in office. Obviously, this demands a policy response. What should Canada do when Trump tears up his "big, beautiful" trade deal and whacks Canadian exporters? One obvious response is to impose a 25% retaliatory tariff on American exporters:

https://mishtalk.com/economics/canada-says-it-will-match-us-tariffs-if-trump-launches-trade-war/

After all, Canada and the US are one another's mutual largest trading partners. American businesses rely on selling things to Canadians, so a massive tariff on US goods will certainly make some of Trump's business-lobby backers feel pain, and maybe they'll talk some sense into him.

I think this would be a huge mistake. The most potent political lesson of the past four years is that politicians who preside over rising prices – regardless of their role in causing them – will swiftly feel the wrath of their voters. The public is furious about inflation, whether it comes from transient covid supply chain shocks, Russia's invasion of Ukraine, or cartels using "inflation" as cover for illegal, collusive price-gouging.

Canadians are very reliant on American imports of finished goods. That's another legacy of NAFTA: it crashed Canada's manufacturing sector. Canadian manufacturing companies treated the US as a "nearshore" source of non-union labor and weak environmental and safety rules, and shipped Canadian union jobs to American scabs. Canada's economy is supposedly now all about "services" but what we really export is stuff we tear out of the Earth.

Countries that are organized around resource extraction don't need fancy social safety nets or an educational system capable of producing a high-tech workforce. All you need to extract resources is a hole in the ground surrounded by guns, which explains a lot about shifts to the Canadian political climate since the Mulroney years.

Since Canada is now substantially reorganized as an open-pit mine for American manufacturers, cutting off American imports would drive the prices of everyday good sky-high, and would be political suicide.

But there's another way.

Because, of course, Canada – like any other country – has the capacity to make all kinds of things, including high-tech things. Sure, it's unlikely that Canada will launch another Research in Motion with a Blackberry smart-phone that will put the iPhone and Android in the shade. The mobile duopoly has the market sewn up, and can use predatory pricing, refusal to deal, and other anticompetitive tactics to strangle any competitor in its cradle.

But you know what Canada could make? A Canadian App Store. That's a store that Canadian software authors could use to sell Canadian apps to Canadian customers, charging, say, the standard payment processing fee of 5% rather than Apple's 30%. Canada could make app stores for the Android, Playstation and Xbox, too.

There's no reason that a Canadian app store would have to confine itself to Canadian software authors, either. Canadian app stores could offer 5% commissions on sales to US and global software authors, and provide jailbreaking kits that allows device owners all around the world to install the Canadian app stores where software authors don't get ripped off by American Big Tech companies.

Canadian companies like Honeybee already make "front-ends" for John Deere tractors – these are the components that turn a tractor into a plow, or a thresher, or another piece of heavy agricultural equipment. Honeybee struggles constantly to get its products to interface with Deere tractors, because Deere uses digital locks to block its products:

https://honeybee.ca/

Canada could produce jailbreaking kits for John Deere tractors, too – not just for Honeybee. Every ag-tech company in the world would benefit from commercially available, professionally supported John Deere jailbreaking kits. So would farmers, because these kits would restore farmers' Right to Repair their own tractors:

https://pluralistic.net/2022/05/08/about-those-kill-switched-ukrainian-tractors/

Speaking of repair: Canadian companies could jailbreak every make and model of every US automobile, and make independent, constantly updated diagnostic tools that every mechanic in the world could buy for hundreds of dollars, rather than paying the five-figure ransom that car makers charge for their own underpowered, junk versions of these tools.

Jailbreaking cars doesn't stop with repair, either. Cars like the Tesla are basically giant rent-extraction machines. If you want to use all the "features" your Tesla ships with – like access to the full charge on your battery – you have to pay tens of thousands of dollars in subscription fees over the life of the car, and when you sell your car, all that "downloadable content" is clawed back. No one will pay extra to buy your used Tesla just because you spent thousands on manufacturer upgrades, because they're all downgraded when you sign over the pink slip.

But Canadian companies could make jailbreaking kits for Teslas that unlock all the features in the car for a single low price – and again, they could sell these to every Tesla owner in the world.

Elon Musk doesn't invent anything, he just takes credit for other people's ideas, and that's as true of bad ideas as it is for good ones. Musk didn't invent the extractive Tesla rip-off: he stole it from inkjet printer companies like HP, who have used the fact that jailbreaking is illegal to turn printer ink into the most expensive fluid in the world, selling for more than $10,000/gallon.

Canadian companies could sell jailbreaking kits for inkjet printers that disconnect them from "subscription" services and disable the anti-features that check for and reject third party ink. People all over the world would buy these.

What's standing in the way of a Canadian industrial policy that focuses on raiding the sky-high margins of American monopolists with third-party add-ons, mods and jailbreaks?

Only the IP laws that Canada has agreed to in order to get tariff-free access to American markets. You know, the access that Trump has promised to end in less than a week's time?

Canada should tear up these laws – and not impose tariffs on American goods. That way, Canadians can still buy cheap American goods, and then they can save billions of dollars every year on the consumables, parts, software, and service for those goods.

This is hurting American big business where it hurts – in the ongoing rents it extracts from Canadians through IP laws like Bill C-11 (the law that bans jailbreaking). Canada could become a global high-tech export powerhouse, selling "complementary" goods that disenshittify all the worst practices of US tech monopolists, from car parts to insulin pumps.

It's the only kind of trade war that Canadian politicians can win against Americans: the kind where prices for Canadians don't go up because of tariffs; where the price of apps, repair, parts, and upgrades goes way down; and where a new, high-tech manufacturing sector pulls in vast sums from customers all over the world.

Canada can win this kind of war, even against a country as big and powerful as the USA. After all, we did it once before:

https://www.youtube.com/watch?v=5CK3EDncjGI

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/15/beauty-eh/#its-the-only-war-the-yankees-lost-except-for-vietnam-and-also-the-alamo-and-the-bay-of-ham

#pluralistic#nafta#tariffs#trump tariffs#trade war#usmca#ip#copyfight#canada#cdnpoli#51st state#dmca#dmca 1201#anticircumvention#industrial policy#right to repair#r2r#uspoli

217 notes

·

View notes

Video

youtube

Here are the steps to register for the RideBoom app:Download the RideBoom AppVisit the RideBoom website or your device's app store and download the RideBoom mobile app.Create an AccountOpen the RideBoom app and select the "Sign Up" or "Create Account" option.Enter your basic personal information such as your name, email address, and phone number.Create a secure password for your RideBoom account.Verify Your IdentityRideBoom may require you to verify your identity by providing a government-issued ID, such as a driver's license or passport.Follow the in-app instructions to upload a photo or scan of your ID document.Add a Payment MethodConnect a debit or credit card to your RideBoom account to enable payment for rides and services.You can also link your mobile wallet or other preferred payment options.Complete Your ProfileFill out any additional profile information, such as your preferred riding preferences, payment settings, and contact details.You can also customize your account avatar and notification preferences.Accept the Terms of ServiceReview and accept RideBoom's terms of service and privacy policy to complete the registration process.Get VerifiedRideBoom may require additional verification steps, such as a background check or skills assessment, depending on the type of services you want to use (e.g., becoming a delivery driver).Start Exploring RideBoom's ServicesOnce your account is set up, you can begin booking scooter rentals, accepting delivery jobs, or exploring other mobility options available through the RideBoom app.How to make money without driving in RideBoom गाड़ी ना चले फिर भी पैसा बने

18 notes

·

View notes

Text

Fictober 4 - "No, we're not doing that"

"Do we need one of these?"