#Missing or inaccurate data management

Explore tagged Tumblr posts

Text

Timothy Noah at TNR:

Elon Musk may have “left Washington” last week, but the Department of Government Efficiency won’t miss a step. That’s because Musk was never running DOGE in the first place. I’m not suggesting that Amy Gleason was in charge. Gleason, you may recall, is the government official whom the White House last February named as a sort of papier-mâché acting DOGE administrator as part of its legal sleight of hand to shield Musk from litigation. Gleason is a data expert who worked for Musk, not the other way around. No, I’m talking about Office of Management and Budget Director Russell Vought.

The worst-kept secret in Washington is that Vought, from day one, was pulling Musk’s marionette strings at DOGE. That lends some irony to news reports that Vought will inherit Musk’s DOGE portfolio. In truth, that portfolio has been sitting atop Vought’s desk since January. “Elon Musk is the face of DOGE,” said Bloomberg Businessweek last month, “but Russell Vought is the brains.” Am I saying Musk brought nothing to the table? I am not. Assembling and deploying DOGE’s team of tech saboteurs—those hoodied 24-year-oldswho tapped into government computer systems that were theoretically off-limits to them—was Musk’s chief contribution. The wildly inaccurate DOGE scorecard of savings achieved looks like Musk’s handiwork too. And it goes without saying that Musk enlivened the project with hateful rhetoric. I won’t soon forget this tweet (which Musk took down after it caused an uproar): “Stalin, Mao, and Hitler didn’t murder millions of people. Their public sector employees did.”

But when Musk took on this project, he knew nothing about how the federal government works and therefore would have been incapable of choosing DOGE’s targets. Also, it’s doubtful Musk had the first clue how to get around the obstacles that civil servants threw in his path. Then there’s the matter of Musk’s pill-popping and severely disordered personal life while campaigning for candidate Donald Trump last fall, as documented last week by The New York Times. According to the Times’ Kirsten Grind and Meghan Twohey, Musk was “using drugs far more intensely than previously known.” These drugs included ecstasy, magic mushrooms, and so much ketamine that the richest man in the world struggled to maintain bladder control.

Per Grind and Twohey, it’s “unclear” whether Musk continued doing all this in the White House. But I wouldn’t call it very unclear. Grind and Twohey note that Musk’s behavior while in government was “erratic … insulting cabinet members, gesturing like a Nazi and garbling his answers in a staged interview.” (Grind and Twohey wrote that before Musk showed up Friday in the Oval Office with a shiner.) We know from a January 2024 Wall Street Journal report by Grind and Emily Glazer that executives and board members at Musk’s companies have for some time been worrying a great deal about Musk’s consumption of these same drugs (and also LSD).

Vought, on the other hand, is by all accounts extremely knowledgeable about how the government works, having previously worked as OMB director during Trump’s first term, assuming the role in 2019 after his predecessor, Mick Mulvaney, became acting chief of staff. Before that, Vought was (among other things) executive director of the Republican Study Committee and policy director of the House Republican Conference. “There’s a category of conservative activists who say, ‘This is what should be done,’” Tom Fitton, president of the conservative nonprofit Judicial Watch, told McKay Coppins of The Atlantic last month,“and there’s a much smaller group who actually know how to make it happen. Russ is one of them.” DOGE was carved out of an existing (and far more anodyne) White House office, the United States Digital Service, which is part of … you guessed it—OMB. According to The New York Times, Trump moved DOGE out of OMB to put it out of the reach of “open records laws that could give the public insight into its operations.” It would not surprise me to learn that this was Vought’s idea.

Vought is also Mister Project 2025. He wrote the chapter in this notorious Heritage Foundation book about White House powers over the executive branch, having previously served seven years as vice president of Heritage’s political advocacy arm, Heritage Action. According to David Graham’s new book The Project: How Project 2025 Is Reshaping America, Vought is “widely understood to be the driving intellectual force behind the project.” Trump disavowed Project 2025 during the 2024 campaign (“I don’t know anything about it, I don’t want to know anything about it”), but Vought’s involvement alone is sufficient to call Trump a liar: Trump installed Vought as policy director of the platform committee at the Republican National Convention. Since January, Project 2025 has been (to the extent anything is) the Trump White House’s blueprint for policymaking. A Project 2025 tracker maintained jointly by two nonprofits, the Center for Progressive Reform and Governing for Impact, checks off 31 recommendations just at OMB, which lies (per Graham) “at the heart of Project 2025’s plan to remake the government.” A somewhat more user-friendly Project 2025 tracker created by two tech nerds on Reddit follows 313 policy recommendations from the volume. Of these, it reports, 98 are done and 66 are “in progress.”

Turns out Russ Vought is the one pulling all the strings at DOGE.

#Elon Musk#Russ Vought#DOGE#United States Digital Service#Office of Management and Budget#OMB#Mick Mulvaney#Amy Gleason#Project 2025

6 notes

·

View notes

Note

Ah, sorry. I don’t think I was very clear. I wasn’t trying to suggest or imply that you didn’t know the specificities of what the term meant. I laid it out because I don’t remember if it was clearly defined at any point, even in the original reblog that started the conversation (and it entirely might have been, I was just being safe and I have a spotty memory). And because I thought it was better context for my question, but I think I missed the mark there.

I can tell that this has been a frustrating discussion to have, and even though I wasn’t sending anon hate I’m still sorry you’ve gotten it. I think you’ve been very diligent in trying to handle the conversation with compassion and an open mind in spite of it.

And, for the record, I don’t expect a hard answer on my question, it was really something more to consider for you or more likely, anyone else who was going to read it. Since non-extant species (and especially ones who have no fossil record, so things like dragons, spirits, etc) don’t have the luxury of hard categories, I felt that relying on ‘scientific accuracy’ as a reason to use the term was a bit of a grey area in that case. But maybe in asking the question I improperly categorized your stance or the stances of others, so sorry again if I managed to do so.

Anyways :) feel free to answer or not. I won’t take it personally if you’re just sick of the topic and don’t want to talk about it anymore lol. I just wanted to clear up what I meant especially since my previous ask came across like I was insulting your intelligence or knowledge on the subject.

That makes somewhat more sense, thank you for clarifying. It was not defined at any point in the discussion, you are correct, but only because I kind of assumed that anyone with enough stake in it to participate in the discussion would look it up on their own time if they weren't already familiar. It's a fair question in general, it just came off a little... condescending, I guess? in this context specifically and I wasn't honestly sure how else to interpret it, because taking it outside of the context of this discussion hadn't occurred to me ^^; I apologize for the misunderstanding and appreciate the clarification.

You have a fair point about non-extant and particularly mythical species being a little bit gray, but at that point, the problem is that to be "truly" accurate, each individual would have to come up with a whole taxonomy and suite of scientific language to discuss their own species, and that's... kind of a ridiculous ask, y'feel? Like, no, a unicorn isn't technically a mammal because a mammal is a family of species on Earth, but we talk about them as if they are because morphologically it's accurate and it'd be kind of insane to ask every unicorn to come up with a whole separate taxonomy to describe their particular species of unicorn.

In this case, yes, there's a chance that there's an inaccuracy in the term hermaphrodite that I don't know about because of the gaps of knowledge I have about my species - but it's equally possible that it is perfectly accurate, and from the knowledge I do have it appears to be (and nothing else appears to surpass it for accuracy), so the term applies until I learn something that indicates it's actually inaccurate. From the data I have, it's accurate. If I get new data in the future that contradicts that conclusion, I can update my terminology then.

(For the record, by the way, I raise a glass in admiration of your conflict management skills. I recognize the de-escalation skills you're using and have used them myself (and am admittedly laughing at the fact that they're still working on me despite me recognizing them for what they are). That's a difficult skill a lot of people struggle with and I appreciate and admire you sticking to it even when I'm not being as gracious as I probably should be on my end. Props.)

6 notes

·

View notes

Text

Why Large Language Models Skip Instructions and How to Address the Issue

New Post has been published on https://thedigitalinsider.com/why-large-language-models-skip-instructions-and-how-to-address-the-issue/

Why Large Language Models Skip Instructions and How to Address the Issue

Large Language Models (LLMs) have rapidly become indispensable Artificial Intelligence (AI) tools, powering applications from chatbots and content creation to coding assistance. Despite their impressive capabilities, a common challenge users face is that these models sometimes skip parts of the instructions they receive, especially when those instructions are lengthy or involve multiple steps. This skipping leads to incomplete or inaccurate outputs, which can cause confusion and erode trust in AI systems. Understanding why LLMs skip instructions and how to address this issue is essential for users who rely on these models for precise and reliable results.

Why Do LLMs Skip Instructions?

LLMs work by reading input text as a sequence of tokens. Tokens are the small pieces into which text is divided. The model processes these tokens one after another, from start to finish. This means that instructions at the beginning of the input tend to get more attention. Later instructions may receive less focus and can be ignored.

This happens because LLMs have a limited attention capacity. Attention is the mechanism models use to decide which input parts are essential when generating responses. When the input is short, attention works well. But attention becomes less as the input gets longer or instructions become complex. This weakens focus on later parts, causing skipping.

In addition, many instructions at once increase complexity. When instructions overlap or conflict, models may become confused. They might try to answer everything but produce vague or contradictory responses. This often results in missing some instructions.

LLMs also share some human-like limits. For example, humans can lose focus when reading long or repetitive texts. Similarly, LLMs can forget later instructions as they process more tokens. This loss of focus is part of the model’s design and limits.

Another reason is how LLMs are trained. They see many examples of simple instructions but fewer complex, multi-step ones. Because of this, models tend to prefer following simpler instructions that are more common in their training data. This bias makes them skip complex instructions. Also, token limits restrict the amount of input the model can process. When inputs exceed these limits, instructions beyond the limit are ignored.

Example: Suppose you give an LLM five instructions in a single prompt. The model may focus mainly on the first two instructions and partially or fully ignore the last three. This directly affects how the model processes tokens sequentially and its attention limitations.

How Well LLMs Manage Sequential Instructions Based on SIFo 2024 Findings

Recent studies have looked carefully at how well LLMs follow several instructions given one after another. One important study is the Sequential Instructions Following (SIFo) Benchmark 2024. This benchmark tests models on tasks that need step-by-step completion of instructions such as text modification, question answering, mathematics, and security rule-following. Each instruction in the sequence depends on the correct completion of the one before it. This approach helps check if the model has followed the whole sequence properly.

The results from SIFo show that even the best LLMs, like GPT-4 and Claude-3, often find it hard to finish all instructions correctly. This is especially true when the instructions are long or complicated. The research points out three main problems that LLMs face with following instructions:

Understanding: Fully grasping what each instruction means.

Reasoning: Linking several instructions together logically to keep the response clear.

Reliable Output: Producing complete and accurate answers, covering all instructions given.

Techniques such as prompt engineering and fine-tuning help improve how well models follow instructions. However, these methods do not completely help with the problem of skipping instructions. Using Reinforcement Learning with Human Feedback (RLHF) further improves the model’s ability to respond appropriately. Still, models have difficulty when instructions require many steps or are very complex.

The study also shows that LLMs work best when instructions are simple, clearly separated, and well-organized. When tasks need long reasoning chains or many steps, model accuracy drops. These findings help suggest better ways to use LLMs well and show the need for building stronger models that can truly follow instructions one after another.

Why LLMs Skip Instructions: Technical Challenges and Practical Considerations

LLMs may skip instructions due to several technical and practical factors rooted in how they process and encode input text.

Limited Attention Span and Information Dilution

LLMs rely on attention mechanisms to assign importance to different input parts. When prompts are concise, the model’s attention is focused and effective. However, as the prompt grows longer or more repetitive, attention becomes diluted, and later tokens or instructions receive less focus, increasing the likelihood that they will be overlooked. This phenomenon, known as information dilution, is especially problematic for instructions that appear late in a prompt. Additionally, models have fixed token limits (e.g., 2048 tokens); any text beyond this threshold is truncated and ignored, causing instructions at the end to be skipped entirely.

Output Complexity and Ambiguity

LLMs can struggle with outputting clear and complete responses when faced with multiple or conflicting instructions. The model may generate partial or vague answers to avoid contradictions or confusion, effectively omitting some instructions. Ambiguity in how instructions are phrased also poses challenges: unclear or imprecise prompts make it difficult for the model to determine the intended actions, raising the risk of skipping or misinterpreting parts of the input.

Prompt Design and Formatting Sensitivity

The structure and phrasing of prompts also play a critical role in instruction-following. Research shows that even small changes in how instructions are written or formatted can significantly impact whether the model adheres to them.

Poorly structured prompts, lacking clear separation, bullet points, or numbering, make it harder for the model to distinguish between steps, increasing the chance of merging or omitting instructions. The model’s internal representation of the prompt is highly sensitive to these variations, which explains why prompt engineering (rephrasing or restructuring prompts) can substantially improve instruction adherence, even if the underlying content remains the same.

How to Fix Instruction Skipping in LLMs

Improving the ability of LLMs to follow instructions accurately is essential for producing reliable and precise results. The following best practices should be considered to minimize instruction skipping and enhance the quality of AI-generated responses:

Tasks Should Be Broken Down into Smaller Parts

Long or multi-step prompts should be divided into smaller, more focused segments. Providing one or two instructions at a time allows the model to maintain better attention and reduces the likelihood of missing any steps.

Example

Instead of combining all instructions into a single prompt, such as, “Summarize the text, list the main points, suggest improvements, and translate it to French,” each instruction should be presented separately or in smaller groups.

Instructions Should Be Formatted Using Numbered Lists or Bullet Points

Organizing instructions with explicit formatting, such as numbered lists or bullet points, helps indicate that each item is an individual task. This clarity increases the chances that the response will address all instructions.

Example

Summarize the following text.

List the main points.

Suggest improvements.

Such formatting provides visual cues that assist the model in recognizing and separating distinct tasks within a prompt.

Instructions Should Be Explicit and Unambiguous

It is essential that instructions clearly state the requirement to complete every step. Ambiguous or vague language should be avoided. The prompt should explicitly indicate that no steps may be skipped.

Example

“Please complete all three tasks below. Skipping any steps is not acceptable.”

Direct statements like this reduce confusion and encourage the model to provide complete answers.

Separate Prompts Should Be Used for High-Stakes or Critical Tasks

Each instruction should be submitted as an individual prompt for tasks where accuracy and completeness are critical. Although this approach may increase interaction time, it significantly improves the likelihood of obtaining complete and precise outputs. This method ensures the model focuses entirely on one task at a time, reducing the risk of missed instructions.

Advanced Strategies to Balance Completeness and Efficiency

Waiting for a response after every single instruction can be time-consuming for users. To improve efficiency while maintaining clarity and reducing skipped instructions, the following advanced prompting techniques may be effective:

Batch Instructions with Clear Formatting and Explicit Labels

Multiple related instructions can be combined into a single prompt, but each should be separated using numbering or headings. The prompt should also instruct the model to respond to all instructions entirely and in order.

Example Prompt

Please complete all the following tasks carefully without skipping any:

Summarize the text below.

List the main points from your summary.

Suggest improvements based on the main points.

Translate the improved text into French.

Chain-of-Thought Style Prompts

Chain-of-thought prompting guides the model to reason through each task step before providing an answer. Encouraging the model to process instructions sequentially within a single response helps ensure that no steps are overlooked, reducing the chance of skipping instructions and improving completeness.

Example Prompt

Read the text below and do the following tasks in order. Show your work clearly:

Summarize the text.

Identify the main points from your summary.

Suggest improvements to the text.

Translate the improved text into French.

Please answer all tasks fully and separately in one reply.

Add Completion Instructions and Reminders

Explicitly remind the model to:

“Answer every task completely.”

“Do not skip any instruction.”

“Separate your answers clearly.”

Such reminders help the model focus on completeness when multiple instructions are combined.

Different Models and Parameter Settings Should Be Tested

Not all LLMs perform equally in following multiple instructions. It is advisable to evaluate various models to identify those that excel in multi-step tasks. Additionally, adjusting parameters such as temperature, maximum tokens, and system prompts may further improve the focus and completeness of responses. Testing these settings helps tailor the model behavior to the specific task requirements.

Fine-Tuning Models and Utilizing External Tools Should Be Considered

Models should be fine-tuned on datasets that include multi-step or sequential instructions to improve their adherence to complex prompts. Techniques such as RLHF can further enhance instruction following.

For advanced use cases, integration of external tools such as APIs, task-specific plugins, or Retrieval Augmented Generation (RAG) systems may provide additional context and control, thereby improving the reliability and accuracy of outputs.

The Bottom Line

LLMs are powerful tools but can skip instructions when prompts are long or complex. This happens because of how they read input and focus their attention. Instructions should be clear, simple, and well-organized for better and more reliable results. Breaking tasks into smaller parts, using lists, and giving direct instructions help models follow steps fully.

Separate prompts can improve accuracy for critical tasks, though they take more time. Moreover, advanced prompt methods like chain-of-thought and clear formatting help balance speed and precision. Furthermore, testing different models and fine-tuning can also improve results. These ideas will help users get consistent, complete answers and make AI tools more useful in real work.

#2024#ADD#ai#AI systems#ai tools#APIs#applications#approach#artificial#Artificial Intelligence#attention#Behavior#benchmark#Bias#Building#challenge#chatbots#claude#coding#complexity#Conflict#content#content creation#data#datasets#Design#efficiency#engineering#excel#focus

1 note

·

View note

Text

The Right Approach to S4HANA for Business Growth

In today’s fast-paced digital world, businesses are under increasing pressure to streamline their operations, enhance data quality, and embrace cutting-edge technologies to stay competitive. This is where the Approach to S4HANA and digital transformation in business come into play, providing companies with the tools and strategies they need to adapt and thrive in a constantly evolving landscape.

One of the most transformative solutions available today is SAP S4HANA, a next-generation enterprise resource planning (ERP) suite that helps organizations achieve greater agility, efficiency, and visibility into their operations. In this article, we’ll explore the role of S4HANA, chart of account harmonization, and SAP data quality in driving business intelligence digitalization and the digital transformation journey.

The Power of S4HANA in Digital Transformation

SAP S4HANA is a game-changer for businesses looking to enhance their ERP capabilities and accelerate their digital transformation in business. Built on the robust HANA in-memory database, S4HANA offers real-time insights, simplifies business processes, and enhances decision-making capabilities. This modern ERP solution allows organizations to move away from outdated legacy systems and embrace a more agile, data-driven approach to business management.

One of the key advantages of S4HANA is its ability to unify and streamline processes across finance, procurement, manufacturing, and other core business functions. This level of integration ensures that data is consistent, accurate, and accessible, helping companies make smarter, data-driven decisions.

Chart of Account Harmonisation for Better Financial Management

An essential aspect of digital transformation in business is ensuring that your financial data is organized, consistent, and easily accessible. Chart of account harmonisation is a crucial step in achieving this. This process involves aligning the chart of accounts across different regions, departments, or business units to create a unified and standardized structure for financial reporting.

By harmonizing the chart of accounts, businesses can eliminate inconsistencies and complexities in financial reporting, making it easier to track expenses, revenues, and assets across the entire organization. This not only improves transparency but also supports better decision-making by providing a clear and accurate picture of the company’s financial health.

In the context of S4HANA, the chart of account harmonization becomes even more critical. S4HANA’s integration capabilities allow businesses to harmonize their financial data effortlessly, ensuring that all departments and functions operate from a single, accurate source of truth. This reduces the risk of errors, enhances financial visibility, and accelerates financial close processes.

Ensuring SAP Data Quality for Reliable Business Insights

No matter how advanced your digital tools are, the value they provide is only as good as the quality of the data they use. SAP data quality is, therefore, a cornerstone of any successful digital transformation initiative. Inaccurate, incomplete, or inconsistent data can lead to poor decision-making, inefficiencies, and missed opportunities.

To ensure high-quality data, businesses must implement robust data governance practices, including data cleansing, validation, and standardization. Cbs Consulting, a leading provider of SAP solutions, helps companies establish best practices for data management to maintain SAP data quality throughout the organization.

With the proper data governance framework in place, businesses can ensure that their data is accurate, complete, and up to date, allowing them to leverage the full potential of SAP solutions like S4HANA for actionable business insights. High-quality data also enhances the effectiveness of business intelligence digitalization, enabling companies to unlock deeper insights and make more informed strategic decisions.

Business Intelligence Digitalization: Unlocking the Power of Data

As businesses continue to embrace digital transformation, the role of business intelligence digitalization becomes increasingly essential. By digitizing business intelligence, companies can leverage advanced analytics and reporting tools to uncover valuable insights from their data, driving more intelligent decision-making and improving overall business performance.

SAP S4HANA plays a pivotal role in this process by offering real-time analytics capabilities that allow businesses to gain deeper insights into their operations, market trends, and customer behavior. When combined with high-quality data and harmonized financial information, companies can use these insights to optimize their processes, identify new opportunities, and stay ahead of the competition.

Why CBS Consulting is Your Trusted Partner in SAP Solutions

At CBS Consulting, we understand the importance of digital transformation in business and the role of SAP solutions in driving growth and efficiency. Our team of experts is committed to helping companies like yours implement S4HANA, chart of account harmonization, and SAP data quality initiatives that unlock the full potential of your data and accelerate your journey toward business intelligence digitalization.

We work closely with each client to develop tailored strategies that address their unique challenges and objectives, ensuring a seamless and successful digital transformation. Whether you’re looking to enhance your financial management processes or gain deeper insights through business intelligence, Cbs Consulting is here to guide you every step of the way.

Conclusion

In conclusion, the approach to S4HANA, chart of account harmonization, and SAP data quality are integral components of a successful digital transformation in business. By leveraging the power of SAP’s innovative solutions and ensuring high-quality data, companies can unlock the full potential of business intelligence digitalization and stay ahead in the competitive digital landscape. Partner with Cbs Consulting to ensure your business is equipped with the tools, expertise, and strategies needed to succeed in today’s data-driven world.

1 note

·

View note

Text

How Can You Ensure Data Quality in Healthcare Analytics and Management?

Healthcare facilities are responsible for the patient’s recovery. Pharmaceutical companies and medical equipment manufacturers also work toward alleviating physical pain, stress levels, and uncomfortable body movement issues. Still, healthcare analytics must be accurate for precise diagnosis and effective clinical prescriptions. This post will discuss data quality management in the healthcare industry.

What is Data Quality in Healthcare?

Healthcare data quality management includes technologies and statistical solutions to verify the reliability of acquired clinical intelligence. A data quality manager protects databases from digital corruption, cyberattacks, and inappropriate handling. So, medical professionals can get more realistic insights using data analytics solutions.

Laboratories have started emailing the test results to help doctors, patients, and their family members make important decisions without wasting time. Also, assistive technologies merge the benefits of the Internet of Things (IoT) and artificial intelligence (AI) to enhance living standards.

However, poor data quality threatens the usefulness of healthcare data management solutions.

For example, pharmaceutical companies and authorities must apply solutions that remove mathematical outliers to perform high-precision data analytics for clinical drug trials. Otherwise, harmful medicines will reach the pharmacist’s shelf, endangering many people.

How to Ensure Data Quality in the Healthcare Industry?

Data quality frameworks utilize different strategies to prevent processing issues or losing sensitive intelligence. If you want to develop such frameworks to improve medical intelligence and reporting, the following 7 methods can aid you in this endeavor.

Method #1| Use Data Profiling

A data profiling method involves estimating the relationship between the different records in a database to find gaps and devise a cleansing strategy. Data cleansing in healthcare data management solutions has the following objectives.

Determine whether the lab reports and prescriptions match the correct patient identifiers.

If inconsistent profile matching has occurred, fix it by contacting doctors and patients.

Analyze the data structures and authorization levels to evaluate how each employee is accountable for specific patient recovery outcomes.

Create a data governance framework to enforce access and data modification rights strictly.

Identify recurring data cleaning and preparation challenges.

Brainstorm ideas to minimize data collection issues that increase your data cleaning efforts.

Ensure consistency in report formatting and recovery measurement techniques to improve data quality in healthcare.

Data cleaning and profiling allow you to eliminate unnecessary and inaccurate entries from patient databases. Therefore, healthcare research institutes and commercial life science businesses can reduce processing errors when using data analytics solutions.

Method #2| Replace Empty Values

What is a null value? Null values mean the database has no data corresponding to a field in a record. Moreover, these missing values can skew the results obtained by data management solutions used in the healthcare industry.

Consider that a patient left a form field empty. If all the care and life science businesses use online data collection surveys, they can warn the patients about the empty values. This approach relies on the “prevention is better than cure” principle.

Still, many institutions, ranging from multispecialty hospitals to clinical device producers, record data offline. Later, the data entry officers transform the filled papers using scanners and OCR (optical character recognition).

Empty fields also appear in the database management system (DBMS), so the healthcare facilities must contact the patients or reporting doctors to retrieve the missing information. They use newly acquired data to replace the null values, making the analytics solutions operate seamlessly.

Method #3| Refresh Old Records

Your physical and psychological attributes change with age, environment, lifestyle, and family circumstances. So, what was true for an individual a few years ago is less likely to be relevant today. While preserving historical patient databases is vital, hospitals and pharma businesses must periodically update obsolete medical reports.

Each healthcare business maintains a professional network of consulting physicians, laboratories, chemists, dietitians, and counselors. These connections enable the treatment providers to strategically conduct regular tests to check how patients’ bodily functions change throughout the recovery.

Therefore, updating old records in a patient’s medical history becomes possible. Other variables like switching jobs or traveling habits also impact an individual’s metabolism and susceptibility to illnesses. So, you must also ask the patients to share the latest data on their changed lifestyles. Freshly obtained records increase the relevance of healthcare data management solutions.

Method #4| Standardize Documentation

Standardization compels all professionals to collect, store, visualize, and communicate data or analytics activities using unified reporting solutions. Furthermore, standardized reports are integral to improving data governance compliance in the healthcare industry.

Consider the following principles when promoting a documentation protocol to make all reports more consistent and easily traceable.

A brand’s visual identities, like logos and colors, must not interfere with clinical data presentation.

Observed readings must go in the designated fields.

Both the offline and online document formats must be identical.

Stakeholders must permanently preserve an archived copy of patient databases with version control as they edit and delete values from the records.

All medical reports must arrange the data and insights to prevent ambiguity and misinterpretation.

Pharma companies, clinics, and FDA (food and drug administration) benefit from reporting standards. After all, corresponding protocols encourage responsible attitudes that help data analytics solutions avoid processing problems.

Method #5| Merge Duplicate Report Instances

A report instance is like a screenshot that helps you save the output of visualization tools related to a business query at a specified time interval. However, duplicate reporting instances are a significant quality assurance challenge in healthcare data management solutions.

For example, more than two nurses and one doctor will interact with the same patients. Besides, patients might consult different doctors and get two or more treatments for distinct illnesses. Such situations result in multiple versions of a patient’s clinical history.

Data analytics solutions can process the data collected by different healthcare facilities to solve the issue of duplicate report instances in the patients’ databases. They facilitate merging overlapping records and matching each patient with a universally valid clinical history profile.

Such a strategy also assists clinicians in monitoring how other healthcare professionals prescribe medicine to a patient. Therefore, they can prevent double dosage complications arising from a patient consuming similar medicines while undergoing more than one treatment regime.

Method #6| Audit the DBMS and Reporting Modules

Chemical laboratories revise their reporting practices when newly purchased testing equipment offers additional features. Likewise, DBMS solutions optimized for healthcare data management must receive regular updates.

Auditing the present status of reporting practices will give you insights into efficient and inefficient activities. Remember, there is always a better way to collect and record data. Monitor the trends in database technologies to ensure continuous enhancements in healthcare data quality.

Simultaneously, you want to assess the stability of the IT systems because unreliable infrastructure can adversely affect the decision-making associated with patient diagnosis. You can start by asking the following questions.

Questions to Ask When Assessing Data Quality in Healthcare Analytics Solutions

Can all doctors, nurses, agents, insurance representatives, patients, and each patient’s family members access the required data without problems?

How often do the servers and internet connectivity stop functioning correctly?

Are there sufficient backup tools to restore the system if something goes wrong?

Do hospitals, research facilities, and pharmaceutical companies employ end-to-end encryption (E2EE) across all electronic communications?

Are there new technologies facilitating accelerated report creation?

Will the patient databases be vulnerable to cyberattacks and manipulation?

Are the clinical history records sufficient for a robust diagnosis?

Can the patients collect the documents required to claim healthcare insurance benefits without encountering uncomfortable experiences?

Is the presently implemented authorization framework sufficient to ensure data governance in healthcare?

Has the FDA approved any of your prescribed medications?

Method #7| Conduct Skill Development Sessions for the Employees

Healthcare data management solutions rely on advanced technologies, and some employees need more guidance to use them effectively. Pharma companies are aware of this as well, because maintaining and modifying the chemical reactions involved in drug manufacturing will necessitate specialized knowledge.

Different training programs can assist the nursing staff and healthcare practitioners in developing the skills necessary to handle advanced data analytics solutions. Moreover, some consulting firms might offer simplified educational initiatives to help hospitals and nursing homes increase the skill levels of employees.

Cooperation between employees, leadership, and public authorities is indispensable to ensure data quality in the healthcare and life science industries. Otherwise, a lack of coordination hinders the modernization trends in the respective sectors.

Conclusion

Healthcare analytics depends on many techniques to improve data quality. For example, cleaning datasets to eliminate obsolete records, null values, or duplicate report instances remains essential, and multispecialty hospitals agree with this concept.

Therefore, medical professionals invest heavily in standardized documents and employee education to enhance data governance. Also, you want to prevent cyberattacks and data corruption. Consider consulting reputable firms to audit your data operations and make clinical trials more reliable.

SG Analytics is a leader in healthcare data management solutions, delivering scalable insight discovery capabilities for adverse event monitoring and medical intelligence. Contact us today if you want healthcare market research and patent tracking assistance.

3 notes

·

View notes

Text

Smart Gage Management: Revolutionizing Tool Calibration and Maintenance

In today’s rapidly evolving manufacturing landscape, precision and efficiency are paramount. This is where Gage Management Software steps in, offering a powerful solution to streamline and optimize your company’s tool management processes. Also known as Smart Gage Management, this software provides comprehensive control over your tools, from tracking their locations to automating calibration schedules, ensuring compliance, and ultimately maximizing productivity.

What is Gage Management Software?

Gage Management Software is designed to efficiently track, organize, and optimize a company’s tool management process. It offers a suite of features including an intuitive dashboard for a quick overview of gage information, customizable calibration intervals (daily, monthly, or measurement-based), and automated email alerts for upcoming due dates. Beyond scheduling, it facilitates measurement tracking, integrates with production planning, and generates essential reports and certifications. The core aim is to enhance accuracy, reduce costs, improve compliance, and provide centralized data with improved traceability, unlocking significant operational efficiencies.

Solving Common Challenges in Tool Calibration and Maintenance

The traditional methods of managing tool calibration and maintenance often come with a host of challenges, including missed deadlines, inaccurate records, and inefficient resource allocation. Smart Gage Management directly addresses these pain points by providing real-time insights into your tool inventory. It helps users stay on top of calibration schedules, effectively eliminating the risk of missing critical deadlines. By optimizing resource utilization and ensuring accurate and timely calibrations, the software significantly boosts productivity and minimizes downtime.

Why Smart Factory Solutions?

Smart Factory Solutions stands out by offering this robust software as part of their dedication to developing affordable, digitalized solutions for manufacturers to embrace Industry 4.0. Under the “Make in India” initiative, Smart Factory Solutions develops cost-effective digitalization solutions that empower companies on their journey towards smart manufacturing. Their expertise and commitment to advanced digital solutions make them a relevant and impactful partner for businesses looking to enhance their manufacturing capabilities.

Conclusion

Embracing Gage Management Software is a strategic move for any manufacturing company aiming for higher efficiency, improved quality, and reduced operational costs. By automating critical processes and providing actionable insights, it transforms tool management from a complex challenge into a streamlined, productive asset. Invest in Smart Gage Management today to elevate your manufacturing capabilities and secure a competitive edge.

0 notes

Text

The Role of Automation in Warranty Lifecycle Management

Warranty management often feels like juggling too many balls at once—paperwork, claims, follow-ups, and the endless cycle of verification and approvals. Every mistake costs time, money, and customer trust.

But there is good news! The future of warranty management is about making things simpler, faster, and more reliable. Automation is here to turn the tide; businesses already see the benefits.

If you want to streamline your warranty process and leave those manual headaches behind, this is the perfect time to dive into warranty lifecycle management with automation.

The Challenges of Traditional Warranty Management

In many businesses, warranty management solutions are still stuck in the past. Think about how long it takes to handle customer follow-ups, cross-reference information, and sort through paper claims. Human errors turn a seamless warranty process into a nightmare due to missing deadlines, inaccurate inputs, or misplaced paperwork.

This outdated system is both costly and inefficient. Employees spend hours processing claims manually instead of focusing on customer service or improving other business areas.

And while businesses try their best to handle warranty claims, the lack of automation only adds to the workload, leaving room for more mistakes. So, how can you break free from this exhausting cycle?

Why Automate the Warranty Lifecycle?

Let us address the actual query, which is: Why should you think about automating your warranty lifecycle? Imagine a world in which claims are handled promptly, effectively, and error-free. Automation improves accuracy, lowers the possibility of expensive errors, and eventually improves the customer experience in addition to speeding up the process.

Claims are automatically generated, validated, and monitored in real time using warranty lifecycle management automation. Instead of sifting through mountains of documents or manually entering data, your team can concentrate on finding solutions. Customers will be pleased, there will be fewer delays, and the warranty procedure will run more smoothly. What's the catch, then? There isn't any. Automation makes the job easier and more effective.

How Does Automation Work in Warranty Management?

So, what does automation in warranty management solutions look like in action? It is all about taking the repetitive, time-consuming tasks off your plate. Let us break it down:-

Automated Claim Creation:- When a customer files a claim, the system automatically gathers all the necessary data, processes it, and logs it into your system:- no more paperwork shuffling or manual data entry.

Faster Approvals:- The system can also instantly verify warranty details and customer eligibility, speeding up approvals. With automated notifications, you stay on top of every process stage.

Real-Time Tracking:- Automation ensures that the status of each claim is updated in real time. Customers can track their claims, and you can monitor progress without the endless phone calls or emails.

By taking care of these tasks automatically, you free up valuable time for your team to focus on more important things—like customer engagement or improving product offerings. And the result? A faster, more efficient warranty process that benefits both the business and the customer.

The Benefits of Automated Warranty Lifecycle Management

Imagine a world where your warranty process is smooth, efficient, and error-free. That is the promise of automation in warranty lifecycle management. Here is how it can benefit your business.

Reduced Errors and Increased Accuracy:- With automation, there is no room for human error. Your claims are processed precisely, ensuring nothing gets lost or overlooked.

Faster Claim Resolution:- Customers no longer have to wait weeks for their claims to be processed. Automated systems can handle claims in hours, not days, improving customer satisfaction and loyalty.

Cost Savings:- The more you automate, the less you rely on manual labour resulting in fewer mistakes and lower operational costs. This also means quicker resolutions, less follow-up time, and reduced labour costs.

By implementing automated warranty management, your business can save money and deliver faster service. This keeps customers happy and improves retention rates.

Future Trends in Warranty Management

The future of warranty lifecycle management is not just about automating what already exists—it is about making warranty management smarter and more predictive.

Automation is evolving with the help of technologies like artificial intelligence (AI) and machine learning (ML), which allow systems to learn from past claims and predict future needs.

Predictive Analytics:- Imagine a system that predicts which products are more likely to have warranty claims, allowing you to address issues before they escalate proactively.

Smart Warranty Monitoring:- Integration with IoT devices will allow businesses to monitor product performance in real time and automatically trigger warranty claims if necessary, even before the customer notices a problem.

These innovations transform the warranty management landscape, helping businesses stay one step ahead. Automation is not just about improving efficiency today but about preparing for tomorrow’s challenges.

Why is Digi Warr the Solution?

Now that you have seen how warranty lifecycle management automation works let us return it to Digi Warr. Our software is designed to address all the challenges we’ve discussed and more. With our warranty management solutions, businesses can:-

Automate claims processing

Cut down on errors and delays

Improve customer satisfaction

Make better, data-driven decisions

Stay ahead of emerging trends in warranty management

At Digi Warr, we understand the importance of a streamlined, efficient warranty process. That is why our platform combines automation, real-time Tracking, and predictive analytics to help you easily manage warranties.

Ready to Automate Your Warranty Process?

The days of sifting through piles of paperwork and dealing with delayed claims are over. Automation of warranty lifecycle management can improve customer satisfaction, streamline operations, and reduce costs.

With our cutting-edge software, Digi Warr is here to assist you in embracing the future of warranty administration.

Why wait, then? Get in touch with us right now to discuss how Digi Warr can help you succeed by streamlining your warranty procedures.

0 notes

Text

Small Business Bookkeeping Services in US

Running a small business is an exciting journey filled with opportunities, challenges, and learning curves. Entrepreneurs often wear multiple hats—managing operations, customer service, marketing, and more. However, one crucial area that should never be overlooked is bookkeeping. Accurate and timely bookkeeping is the backbone of financial health in any organization. For entrepreneurs in the United States, leveraging Small Business Bookkeeping Services in US can be a game-changer.

In this blog, we’ll explore why every small business—regardless of size or industry—needs a professional bookkeeping service. From staying compliant to making informed decisions, we’ll break down the critical benefits and highlight how Accounting Services for Small Business in US can drive sustainable growth.

What is Bookkeeping?

Bookkeeping is the process of recording and managing all financial transactions within a business. It involves tracking income, expenses, accounts payable and receivable, payroll, and more. This information is foundational for financial reporting, tax preparation, budgeting, and strategic planning.

The Real Cost of DIY Bookkeeping

Many small business owners initially attempt to handle bookkeeping on their own to save money. However, DIY bookkeeping often results in:

Errors and discrepancies

Missed tax deadlines

Cash flow issues

Compliance problems

Lost growth opportunities

Without a solid bookkeeping system, financial blind spots can occur. The cost of mistakes—both in terms of money and time—can outweigh any perceived savings. That’s why more entrepreneurs are turning to Small Business Bookkeeping Services in US for expert support.

The Top Reasons Every Small Business Needs Bookkeeping Services

1. Ensures Accurate Financial Records

Inaccurate books can be a recipe for disaster. Bookkeeping services help ensure that your financial records are updated, error-free, and organized. This level of accuracy is vital for:

Filing taxes

Applying for loans

Attracting investors

Managing payroll

Professional Accounting Services for Small Business in US offer advanced tools and trained personnel who can maintain your books with a level of precision that’s difficult to achieve independently.

2. Improves Cash Flow Management

Cash flow is the lifeblood of any small business. Without clear insight into where your money is going and coming from, you risk running into liquidity issues. Bookkeeping services provide real-time financial reporting and help business owners:

Monitor receivables and payables

Forecast cash flow needs

Schedule payments

Avoid overdrafts and penalties

Reliable Small Business Bookkeeping Services in US help streamline your finances so you can make proactive financial decisions.

3. Saves Time and Resources

Time is a limited resource, and as a business owner, your focus should be on growing your enterprise—not managing spreadsheets. By outsourcing your financial tasks to experts, you free up time for:

Sales and marketing

Customer relationships

Product development

Strategic planning

Accounting Services for Small Business in US are designed to take the load off your shoulders, allowing you to concentrate on what matters most.

4. Ensures Tax Compliance

Tax laws in the United States are complex and subject to frequent changes. Missing a deadline or making a reporting error can lead to penalties, audits, and reputation damage. A professional bookkeeping service ensures that:

All tax documents are prepared accurately

Quarterly and annual filings are submitted on time

Deductions are maximized

Audit trails are well-maintained

The best Small Business Bookkeeping Services in US are equipped with tax expertise and work closely with CPAs to ensure year-round compliance.

5. Enables Informed Decision-Making

Every business decision, from hiring to expansion, should be grounded in financial data. Bookkeeping services provide regular reports that help business owners evaluate performance and plan effectively. Common financial reports include:

Income statements

Balance sheets

Cash flow statements

Budget vs. actual analysis

By working with Accounting Services for Small Business in US, you gain access to actionable insights that support long-term success.

6. Supports Business Growth

Growth without financial planning can lead to chaos. Whether you’re opening a new location, launching a product, or expanding your team, you need reliable numbers to back your decisions. A good bookkeeping service can:

Help assess financial readiness

Analyze capital requirements

Set growth targets

Monitor KPIs (Key Performance Indicators)

With professional Small Business Bookkeeping Services in US, your business can grow with confidence, backed by robust financial systems.

7. Simplifies Payroll and Employee Management

Managing payroll involves more than just cutting checks. It includes:

Calculating hours and wages

Withholding taxes

Filing payroll taxes

Issuing year-end forms (W-2, 1099)

Mistakes in payroll can lead to unhappy employees and legal issues. Outsourcing payroll to a bookkeeping service ensures accuracy and timely processing. Most Accounting Services for Small Business in US offer integrated payroll management, removing one more headache from your plate.

8. Facilitates Better Budgeting

Budgeting is essential for resource allocation and future planning. Bookkeeping provides historical data that’s critical for creating realistic budgets. Services typically include:

Tracking spending patterns

Forecasting future expenses

Identifying areas to cut costs

Creating rolling budgets

Having access to reliable financial data through Small Business Bookkeeping Services in US makes the budgeting process more strategic and less speculative.

9. Prepares You for Audits

Whether it's an internal review, a tax audit, or applying for funding, your business should always be audit-ready. Bookkeeping services help you maintain clean records, documented receipts, and reconciled accounts—ensuring that you're ready for any scrutiny.

Partnering with professional Accounting Services for Small Business in US means your books will always be in audit-ready condition.

10. Adds Professionalism to Your Business

Using bookkeeping services elevates your brand’s professionalism. Investors, banks, and partners are more likely to trust a business with organized and transparent financials. This credibility can:

Boost investor confidence

Accelerate loan approvals

Attract strategic partnerships

Top-tier Small Business Bookkeeping Services in US often provide dashboards, graphs, and clean reports that you can share with stakeholders to build trust and credibility.

What to Look for in a Small Business Bookkeeping Service

Choosing the right service provider is crucial. Here are some qualities to look for:

Experience with small businesses

Knowledge of industry-specific regulations

Transparent pricing

Customizable service packages

Cloud-based accounting tools

Ongoing support and consultation

Many providers offering Accounting Services for Small Business in US also bundle in tax preparation, financial advising, and software integration, giving you comprehensive support.

DIY vs. Professional Services: A Quick Comparison

Feature DIY Bookkeeping Professional Bookkeeping

Accuracy Risk of errors High accuracy

Time Investment High Low

Tax Compliance Limited knowledge Expert support

Reporting Inconsistent Regular and customized

Cost Low short-term cost High long-term value

While DIY bookkeeping might seem budget-friendly initially, the long-term benefits of using Small Business Bookkeeping Services in US make it a smart investment.

Final Thoughts

Bookkeeping is more than just a financial chore—it’s a critical pillar of business success. Whether you’re just starting out or scaling your operations, having access to expert financial guidance can make all the difference. Outsourcing to professional Small Business Bookkeeping Services in US or trusted Accounting Services for Small Business in US ensures that your financial house is always in order.

The right bookkeeping service can help you avoid costly mistakes, unlock financial clarity, and set your business on a path toward sustainable growth. So if you’re a small business owner looking to streamline your operations, stay compliant, and make data-driven decisions, investing in a reliable bookkeeping partner is not just a smart choice—it’s a necessary one.

Need help finding the best bookkeeping solution? Whether you're seeking standalone Small Business Bookkeeping Services in US or comprehensive Accounting Services for Small Business in US, start exploring providers today to set your business up for long-term success.

0 notes

Text

How to Pick the Right Competitive Price Intelligence Software

Competitive price intelligence is one of the most important tools today for businesses that sell online or in retail. With prices changing quickly and customer expectations rising, knowing what your competitors charge — and reacting fast — can be the difference between leading the market or losing sales.

In this blog, you’ll learn how to choose the best software to track, compare, and respond to competitor pricing. This guide is made for business owners, ecommerce managers, and pricing teams who want smarter, faster tools to improve their pricing strategy.

What is Competitive Price Intelligence?

Competitive price intelligence is the process of gathering and analyzing your competitors’ pricing data so you can make better business decisions. It helps you:

Understand where you stand in the market

Avoid setting prices too high or too low

React fast to pricing changes

Boost profits while staying competitive

Without the right tools, tracking prices manually takes too much time and leads to outdated decisions.

Why You Need Competitive Price Intelligence Software

If you sell on your own site, on marketplaces like Amazon, or across multiple stores, using competitive price intelligence software can save time and improve your pricing.

Benefits:

Save time: Stop checking competitor websites manually

Avoid mistakes: Get accurate data for better pricing

React fast: Update your prices as the market shifts

Improve strategy: Use real data to build smarter plans

Businesses that guess their pricing often fall behind. Software helps you make decisions based on facts, not hope.

Key Features to Look For in Competitive Price Intelligence Software

1. Real-Time Price Monitoring:

Get updates as soon as competitor prices change so you never miss a beat.

2. Dynamic Pricing Rules:

Let your prices adjust automatically based on real-time data and your chosen rules.

3. Easy System Integration:

Pick tools that work with your current platforms like Shopify, Magento, or your ERP system.

4. Product Matching Tools:

Good software matches your products to competitor listings, even when names or SKUs don’t match exactly.

5. Alerts and Simple Reports:

You should get price change alerts and easy-to-understand reports you can act on quickly.

Who Can Benefit From Competitive Price Intelligence Software?

1) Ecommerce Stores:

Online stores on platforms like Shopify or WooCommerce can keep prices competitive across all products.

2) Marketplace Sellers:

Amazon, Walmart, and eBay sellers can use the tool to stay ahead of price changes and win the Buy Box.

3) Retail Chains:

Multi-location stores can stay aligned across all regions with real-time pricing control.

4) B2B Sellers:

Businesses selling to other companies can use pricing data to craft better quotes and proposals.

Common Problems to Avoid When Choosing a Software

1. Too Many Features:

Some tools have more than you need, making them hard to use and more expensive.

2. Poor Support:

A tool is useless if you can’t get help when something breaks or if training isn’t included.

3. Hidden Fees:

Watch out for pricing models that charge per SKU or competitor — it adds up fast.

4. Inaccurate Data:

If the data isn’t fresh or reliable, your pricing decisions won’t work.

Pick a tool that solves your real problems, not one that looks good but falls short.

How to Choose the Best Competitive Price Intelligence Software

Step 1: Set Clear Goals

Decide what matters most — lowering costs, increasing profit, or reacting fast to market changes.

Step 2: Identify Must-Have Features

Focus on what you truly need, like real-time monitoring or automated pricing rules.

Step 3: Compare Tools

Read reviews, explore features, and ask questions. Shortlist tools that meet your exact needs.

Step 4: Test It First

Always request a demo or trial to see how well the tool works with your current setup.

Step 5: Look for Support and Room to Grow

Choose a tool with strong customer support and the ability to scale as your business grows.

Best Competitive Price Intelligence Tools to Explore

Prisync — Easy to use and affordable for smaller businesses

Price2Spy — Offers flexible tracking and strong reporting

Intelligence Node — AI-powered and great for large catalogs

Minderest — Strong analytics and dynamic pricing tools for advanced users

Pick a software based on your specific size, platform, and pricing strategy.

Mistakes to Avoid When Using Competitive Price Intelligence

Choosing based on price alone

Ignoring data freshness

Overlooking system compatibility

Not training your team

Thinking software replaces your strategy

Remember: the software helps you, but your pricing plan still needs human thinking.

Conclusion:

Competitive price intelligence is no longer optional — it’s essential. The right software helps your business respond faster, price smarter, and avoid guesswork. Whether you’re a small online store or a growing retail chain, using the right tool gives you an edge.

To succeed, focus on real-time monitoring, easy integration, and actionable data. Don’t get distracted by extra features you won’t use. Choose a solution that supports your business goals and gives your team the insights they need to win.

If you’re ready to take control of your pricing, Iconic Data Scrap can help. Our tools are built to deliver accurate, real-time competitive price intelligence so you can make smarter decisions every day.

Contact us now for a personalized demo and see how we can help you stay ahead of the competition and boost your bottom line.

#iconicdatascrap#competitivepriceintelligence#pricingstrategy#ecommercepricing#retailintelligence#dynamicpricing#marketanalysis#priceoptimization#competitoranalysis#businessintelligence#pricingtools#ecommercegrowth#retailtech#dataanalytics#smartpricing#pricingsoftware#priceintelligence#priceintelligencesoftware

0 notes

Text

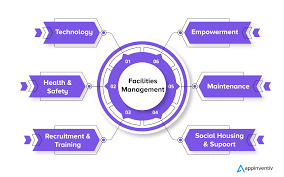

Why Building Information is the Foundation of Facility Resilience

The modern facility operates in an environment of constant change—new regulations, aging infrastructure, evolving technologies, and increasing occupant expectations. Amid all this, one thing remains constant: the need for fast, accurate, and accessible building information.

Facility teams rely on it every day to maintain systems, respond to emergencies, and ensure safety. Yet, despite advances in facility management software, many organizations still treat building documentation as an afterthought—stored in binders, file cabinets, or fragmented digital folders.

In doing so, they create barriers to efficiency, safety, and long-term facility resilience.

What Is Building Information and Why Is It So Valuable?

Building information refers to the technical documentation and data tied to a facility’s physical assets and systems. This includes:

Floor plans and architectural drawings

MEP (Mechanical, Electrical, Plumbing) schematics

Fire protection layouts and safety equipment locations

Shut-off valve maps and utility infrastructure

Equipment documentation, serial numbers, and O&M manuals

Inspection reports, permits, and compliance records

Together, these documents paint a complete picture of the facility’s history, infrastructure, and functionality. They’re essential to understanding how the building operates—and how to keep it running smoothly.

What Happens When Building Information is Inaccessible?

Without organized and accessible building documentation, even routine maintenance can become frustratingly inefficient. And during emergencies, the consequences can be far more serious.

Common issues include:

Delayed emergency response when teams can’t locate shut-offs or critical systems.

Wasted time as technicians search for old prints or diagrams that may be inaccurate.

Compliance failures due to missing inspection records or outdated permits.

Increased reliance on senior staff whose institutional knowledge isn’t documented.

Project planning delays when decisions are made without accurate as-built records.

The cost of inaccessible building information is measured not just in dollars, but in risk.

Facility Management Software: Powerful, But Not Complete

Most organizations now use some form of facility management software to handle asset tracking, preventive maintenance, and work order management. These tools have transformed how tasks are assigned, tracked, and analyzed.

But they often lack direct integration with the documents and drawings that field teams need to do their work efficiently.

A technician may be assigned to repair a pump or check a fire panel—but if they don’t know where it is, or how the system connects to others, the work is delayed. This is where building information fills the gap, providing the context behind the task.

Digitizing Building Information: From Paper to Performance

To truly empower facility teams, building documentation must be digitized, organized, and made mobile. Leading organizations are taking steps to:

Scan and digitize historical documents and plans

Tag files by location, system, or asset to allow fast search and retrieval

Integrate building information with FM software platforms

Provide mobile access so technicians can view plans in the field

Use QR codes or floor plans to visually map systems and equipment

This digital transformation turns static records into living resources that improve daily operations.

Benefits of Accessible, Organized Building Information

Facilities that invest in building information systems alongside their FM software enjoy wide-ranging benefits:

Faster maintenance execution, with less time spent searching or second-guessing

Improved emergency preparedness, as teams can act without hesitation

Reduced knowledge loss, thanks to better documentation and handoffs

Smoother audits and inspections, with records ready when needed

Better capital planning, informed by real system and space histories

Ultimately, building information improves every layer of facility management—from immediate task execution to strategic long-term planning.

Building Information as a Long-Term Asset

The value of building information increases over time. Every repair, upgrade, inspection, or renovation adds another layer of complexity. Capturing that data and connecting it with daily operations helps teams stay ahead, not just react.

It’s also an investment in the future—ensuring that new hires, emergency responders, and future project managers have the knowledge they need to work safely and effectively.

Conclusion

Efficient facility management requires more than just tracking tasks and assets. It requires access to the critical building information that brings those tasks to life. When paired with facility management software, this information becomes the key to faster workflows, safer operations, and more resilient facilities. ARC Facilities supports this integration by helping teams turn their building data into a reliable, field-ready resource for smarter decisions every day.

0 notes

Text

Why Your Salesforce CRM Needs a Lead-to-Account Matching Tool—Before It Costs You Revenue

In the U.S. B2B world, where account-based selling and RevOps alignment drive growth, the CRM is a central pillar. Salesforce, while powerful, has a critical limitation—it doesn’t automatically connect leads to existing accounts.

This missing link leads to misrouted leads, poor account visibility, and missed revenue opportunities. The fix? Implementing a Salesforce CRM lead-to-account matching tool that automates connections and powers smarter go-to-market execution.

The Core Challenge: Leads and Accounts Are Disconnected by Default

Salesforce stores leads as independent records until they’re manually converted. Without automation, someone from “Microsoft Azure” could submit a demo request and never be connected to the main “Microsoft” account already in your system.

That gap creates operational breakdowns:

High-value leads routed to the wrong rep

Disconnected buyer journeys

Ineffective ABM campaign targeting

Inaccurate pipeline attribution

Over time, these inefficiencies hurt both pipeline performance and rep productivity.

Why Lead-to-Account Matching Matters More Than Ever

For U.S. B2B companies using ABM and territory-based sales, matching leads to accounts is essential to sales execution and revenue efficiency.

✅ Prioritize Opportunities Reps gain full account context—open deals, recent touches, and firmographics—for more relevant, high-impact outreach.

✅ Improve ABM Targeting Effective ABM relies on identifying which leads belong to key accounts. Without L2A, personalization breaks down.

✅ Enhance Lead Routing Automatically assign leads to the correct owner based on territory, vertical, or named account strategy.

✅ Streamline Buyer Experience Avoid disjointed messaging and duplicate outreach by connecting all leads to the right account path early.

What to Look For in a Salesforce-Integrated L2A Tool

When choosing a lead-to-account matching tool for Salesforce, look for these must-haves:

Native Integration – Seamlessly works with Salesforce objects, flows, and rules.

Fuzzy Logic & Rules – Handles naming variations and allows business-specific configurations.

Real-Time Processing – Matches leads instantly upon entry—no batch delays.

Confidence Scoring – Automates high-certainty matches, flags low-confidence ones.

Auditing & Transparency – Provides match history and logs for optimization and oversight.

These features ensure accurate routing, data hygiene, and scalable sales execution.

Top Tools Trusted by U.S. GTM Teams

Here are some of the top-performing Salesforce-compatible lead-to-account matching tools on the market:

LeadAngel – A flexible Salesforce CRM lead to account matching tool offering rule-based logic, territory mapping, and fuzzy matching—well-suited for mid-market organizations.

LeanData – Highly scalable, ideal for large U.S. revenue teams with complex routing and ABM needs.

Openprise – Focuses on data orchestration and enrichment, great for RevOps-led CRM management.

RingLead (now part of ZoomInfo) – Combines matching with robust enrichment and data hygiene.

Each of these tools enables deeper CRM alignment, better lead routing, and a more intelligent GTM execution layer.

Good Data Powers Great Sales

Your CRM is only as strong as its data relationships. When leads aren’t tied to the right accounts, you lose visibility, context, and momentum. As U.S. B2B organizations continue to prioritize pipeline precision and GTM efficiency, lead-to-account matching in Salesforce is no longer a RevOps afterthought—it’s a core component of revenue strategy.

Invest in the right L2A tool, and your sales, marketing, and operations teams will finally speak the same language: context, clarity, and conversion.

1 note

·

View note

Text

The Power of Real-Time Data in Modern ERP & CRM Platforms

In an age where milliseconds matter, real-time data has become the lifeblood of modern business. It drives decisions, powers customer experiences, and delivers the agility businesses need to survive and scale in an unpredictable world.

While ERP and CRM platforms have long been essential tools in the enterprise tech stack, their evolution toward real-time intelligence is nothing short of revolutionary.

Gone are the days of batch updates, delayed reports, and blind decision-making. Today, real-time ERP and CRM platforms empower organizations to sense, respond, and act immediately across every department, touchpoint, and transaction.

In this guide, we’ll unpack how real-time data is transforming the way businesses operate and why modern ERP and CRM systems are leading this charge.

Why Real-Time Data Matters More Than Ever

In a hyper-competitive, hyper-connected world, decisions delayed are opportunities lost.

Real-time data allows businesses to:

Adjust pricing instantly based on demand

Personalize customer interactions mid-journey

Detect fraud or compliance issues as they occur

Reroute logistics in case of disruption

Predict resource bottlenecks before they happen

Speed is now a strategy, and real-time systems are its engine.

What Is Real-Time Data in ERP and CRM Systems?

Real-time data refers to information that is captured, processed, and made available instantly across systems, without delays or manual syncs.

In ERP and CRM, this means:

Sales teams seeing live inventory data

Finance tracking real-time cash flow

Operations adjusting production based on current demand

Marketing triggering journeys based on live customer behaviour

Support resolving issues with up-to-date account histories

In essence, everyone works off the same, always-fresh version of the truth.

The Shift from Reactive to Proactive Business Operations

Before real-time systems, most businesses operated in lag mode:

Monthly reports

Weekly stock updates

End-of-day reconciliations

Customer data updated after interactions

This lag led to missed signals, outdated insights, and reactive decisions.

Modern ERP and CRM platforms eliminate that lag. They allow companies to:

Spot trends as they emerge, not weeks later

Intervene before issues escalate

Optimize workflows on the fly

Predict customer needs in advance

Proactive > reactive. And only real-time data makes that possible.

Real-Time Data in ERP: Visibility, Control, Confidence

ERP systems govern the operational backbone of a business — procurement, inventory, manufacturing, HR, and finance.

With real-time data:

Inventory levels auto-update across locations

Purchase orders are triggered dynamically

Project timelines adjust based on live workforce data

CFOs track revenue, expenses, and profitability hour-by-hour

Supply chain managers reroute logistics based on traffic, weather, or vendor delays

Key Benefits:

Reduced waste

Improved resource allocation

Faster financial closing

Operational consistency across geographies

Real-Time CRM: Customer Intelligence on Tap

While ERP fuels your operations, CRM fuels your relationships. And nothing kills relationships faster than delayed, inaccurate, or generic communication.

With real-time CRM:

Sales reps see who opened emails, visited the website, or abandoned a cart live

Support agents access current service tickets, orders, and feedback in context

Marketers trigger campaigns based on real-time customer behaviour

Relationship managers get alerted to churn risk as it forms

This leads to:

Hyper-personalized customer journeys

Shorter response times

Stronger retention

Increased revenue per customer

The Power of Integration: A Single Source of Truth

Standalone systems create data silos. Even if they’re updated regularly, they can’t provide continuity across the customer lifecycle or operational flow.

When ERP and CRM are integrated:

Marketing can sync promotions with inventory availability

Sales sees exact product delivery dates