#Microeconomics

Explore tagged Tumblr posts

Text

Ko-fi prompt from IndigoMay:

What would be the economic impact if people could magically grow whatever food they liked? Including fodder for animals.

This is a very wide-ranging question, like... when was the magic introduced? What was the state of agriculture before that? Is this food generated from existing matter, delivered by gods, or something else?

I'm going to narrow this to:

What would happen if people could, starting tomorrow, grow any plant...

That is edible, by either humans or livestock, with appropriate treatment.

Without delay, meaning that the time sink is several minutes instead of weeks or months.

Without concerns for weather or other natural dangers like fungal infections or pests, or requirements for water or fertilizer.

Without depleting soil nutrients, so long as they have arable land to work with.

Without relying on fresh seeds or other 'raw ingredients' like leaf cuttings.

Well... let's start small.

Personal Basis - people who are not farmers

People who do not normally grow things would start angling to acquire some kind basic gardening implements. For some, like those who live in the suburbs, this would be as simple as going into the backyard. For those in cities, they'd need to get a window box or similar to use. If you have free, guaranteed fresh plant matter, that's already a good thing, but the time and care required to keep a garden alive is more than some people can manage due to work or children or housing. With immediate food that requires minimal effort, a lot of those hurdles are removed. You can grow the two tomatoes you need for dinner, and then put the pot of soil away for tomorrow.

The cost of

Personal Basis - small farmers

The obvious impacts for those who are small farmers is that people are less likely to buy their raw ingredients. Most of these small farmers would start looking into modifying their operations to do things that require processing.

Growing apples in your house for a snack is fine--if you have a pot big enough for a small tree, and a way to dispose of the wood if it's a one-time thing--but if you want applesauce or cider or pie, someone who knows how to cook or bake needs to do that part. You can grow wheat, but your chances of having the necessary tools to grind flour are slim. You can grow cashews, but fuck knows how you're going to process that without poisoning yourself! You can grow grapes on your trellis, but that doesn't mean you have the knowledge to make wine without accidentally going straight to vinegar. You can grow corn, but that doesn't mean you know the best way to dry it to make popcorn.

So small farms shift to those products that either need processing, or are part of an animal-based food. This includes things like flowers for bees. You can't really control bees, so just 'grow and go' might incite the bees to leave somehow. Maybe they can sense magic! Who knows!

Another option would be to focus on unique or heirloom things. If you go to a farmer's market, you might be going just to see all the fruits you've never encountered before. If there's an apple stand one year, and suddenly you can grow your own apples at home, then maybe what they start doing is growing unique or rare cultivars that you've never heard of, and that's their new niche. It's not that you can't grow the apples, but would you grow them if you've never heard of them? Plus, the apple stand is doing sauces and ciders now.

Mid-tier and large farms

These farms will start to focus in on large-scale crops that don't go straight to tables or cooking pots in homes. Scrap the eggplants, the cucumbers, the blueberries. Focus on:

Fruits and vegetables that are needed for popular secondary products, like tomatoes (ketchup, marinara), or oranges (juice), or corn (anything with fructose corn syrups, popcorn).

Plants that are popular but NEED processing to be edible, like coffee beans, cocoa beans, or wheat, that most people just don't have.

Plants that are needed in massive quantities for animal feed, such as alfalfa or chicken grains.

Now, I think these large farms would still be in production. We'd see a massive reduction in water usage, which is great (except for cranberries, I guess), but many of these products would still be needed in quantities that need industrial levels of processing. Someone needs to pick the oranges, to drive them to the juicing facility, the facility needs to juice and treat and preserve and bottle them, and then that needs to be driven to the store. The reduced time to grow, reduced water usage, reduced waste from natural predators or dangers, and general ability to plan things more efficiently would result in lower costs for many of these products in a truly free market... but would possibly also rise in cost as companies try to maintain a consistent flow of profit.

Sure you can make the juice at home, but what if you're already at work? There's still a demand for products; most of us can get water from a tap at home, but there are still convenience stores selling bottled water on every other corner in a big city.

I think the most interesting of these concerns would be grazing animals, like sheep, cattle, and goats. Being able to 'refresh' the grass of a single field without having to rotate the animals to new pastures once they've eaten away at one, and without damaging the nutrient profiles of the one they're staying at, means reduced deforestation or soil destabilization in agricultural areas. We'd see a fairly significant stalling of things like the decimation of Mongolia's grasslands if the goats didn't need as much grazing land.

Maintaining the meat industry would be one of the most constant sources of demand for large-scale agriculture, given that other products could go through cycles to more efficiently use land. You can grow and harvest oranges for Tropicana on Monday, grapes for Welch's on Tuesday, soy beans for Silk on Wednesday, tomatoes for Heinz on Thursday, and so on. They probably won't need more than they used to.

Meanwhile, the cows gotta eat. And eat. And eat.

Corporations

This one is fun! MONSANTO'S GONNA BE PISSED.

So, magically growing food, you don't need seeds, at least in this case. Or you can coax more product out of a seed you already have planted. You've gotten eight cycles corn out of this one stalk this season!

So Monsanto loses some of that insane seed monopoly situation.

You'd see a decrease in pesticides and anti-fungal products as agriculture speeds up a cycle by enough to prevent the spread of dangerous infestations. It's not going to kill your entire farm if you find fungus one day and have to burn it to prevent the spread. You lost one day's profit, not a full year's.

This impacts Monsanto too. Remember the Roundup debacle?

Now, to be clear, there are still plants that will rely on pesticides and anti-fungals. The premise only covers food, after all, so there are still important plants that will need longer, dedicated growing seasons.

Industry-wide shifts

Sooooooooooo a lot of the money starts to come from non-edible plants. This is your cottons, linens, hemps, latex/rubber trees, cork trees, lumber, and so on.

As the needed arable land necessary to feed humanity (and our livestock) decreases, more land is freed up for return to indigenous peoples, reclamation by nature, usage for alternate cultivation, housing, or... well, other capitalist ventures, like bitcoin mining or whatever.

On a geopolitical level, this causes some interesting shifts in places that draw their power from being 'breadbasket' nations. For instance, if you remember the start of the Russo-Ukrainian war, we saw some major pressures being placed by virtue of some countries (e.g. Lebanon, Pakistan) getting most of their wheat from Ukraine, and the war suddenly cutting off a massive portion of how they fed their people. Much of Ukraine's support, in those early days, derived from their importance as a breadbasket nation. If everyone can grown their own food, that moves the lines. Countries that are poor on space or water can stop relying on trade to survive in terms of water. Countries that rely on their agriculture to be able to trade for other things need to diversify their economies, and fast.

(Does mean that Saudi Arabia can stop using Arizona's water, though.)

The greatest shifts would come down to water usage and pollution, I think. Agriculture is currently one of the biggest contributors to the climate crisis, and the reduction of water use by farming would be a massive help. However, I'm less sure of how we'd see meat consumption change. The greater availability of fresh fruits and vegetables could result in a shift towards more plant-based diets worldwide, but just as easily we could see large agricultural corporations (and those that rely on them, like John Deere or the aforementioned Monsanto) market meat to consumers as a greater rate due to the profit margin.

Oh, also, I have a feeling that a lot of those corporations would try to get garden centers shut down, or buy out ceramic pot and planter factories. If you can't grow anything at home because you don't have a window planter, you have to buy from the store, right?

#ko fi#ko-fi#ko fi prompts#phoenix talks#magic#agriculture#microeconomics#macroeconomics#politics#environmentalism#water usage#pollution

113 notes

·

View notes

Text

We passed Econ!!!

#art#doodle#doodle sketch#obey me#lamb#obey me ibuki#obey me mc#obey me shall we date#obey me!#digital art#omomtrta#omswd#pink#microeconomics#economy#grades#83#heck yeah#banana bread at work situation

62 notes

·

View notes

Text

Don’t Be Evil

Tonight (November 22), I'll be joined by Vass Bednar at the Toronto Metro Reference Library for a talk about my new novel, The Lost Cause, a preapocalyptic tale of hope in the climate emergency.

My latest Locus Magazine column is "Don't Be Evil," a consideration of the forces that led to the Great Enshittening, the dizzying, rapid transformation of formerly useful services went from indispensable to unusable to actively harmful:

https://locusmag.com/2023/11/commentary-by-cory-doctorow-dont-be-evil/

While some services have fallen harder and/or faster, they're all falling. When a whole cohort of services all turn sour in the same way, at the same time, it's obvious that something is happening systemically.

After all, these companies are still being led by the same people. The leaders who presided over a period in which these companies made good and useful services are also presiding over these services' decay. What factors are leading to a pandemic of rapid-onset enshittification?

Recall that enshittification is a three-stage process: first surpluses are allocated to users until they are locked in. Then they are withdrawn and given to business-customers until they are locked in. Then all the value is harvested for the company's shareholders, leaving just enough residual value in the service to keep both end-users and business-customers glued to the platform.

We can think of each step in that enshittification process as the outcome of an argument. At some product planning meeting, one person will propose doing something to materially worsen the service to the company's advantage, and at the expense of end-users or business-customers.

Think of Youtube's decay. Over the past year, Google has:

Dramatically increased the cost of ad-free Youtube subscriptions;

Dramatically increased the number of ads shown to non-subscribers;

Dramatically decreased the amount of money paid to Youtube creators;

Added aggressive anti-adblock;

Then, this week, Google started adding a five-second blanking interval for non-Chrome users who have adblockers installed:

https://www.404media.co/youtube-says-new-5-second-video-load-delay-is-supposed-to-punish-ad-blockers-not-firefox-users/

These all smack of Jenga blocks that different product managers are removing in pursuit of their "key performance indicators" (KPIs):

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

We can think of each of these steps as the outcome of an argument. Someone proposes a Youtube subscription price-hike, and other internal stakeholders object. These objections fall into two categories:

We shouldn't do this because it will make the product worse; and/or

We shouldn't do this because it will reduce the company's earnings.

Lots of googlers sincerely care about product quality. People like doing a good job, and they take pride in making good things. Many have sacrificed something that mattered in the service of making the product better. It's bad enough to miss your kid's school play so you can meet a work deadline – but imagine making that sacrifice and then having the excellent work you put in deliberately degraded.

I have been around Google's orbit since its early days, going to the odd company Christmas party in the early 2000s and giving talks at Google offices in cities all over the world. I've known hundreds of skilled googlers who passionately cared about making the best products they could.

For most of Google's history, those googlers won the argument. But they didn't do so merely by appealing to their colleagues' professional pride in a job well-done. For most of Google's history, the winning argument was a combination of "doing this bad thing would make me sad," and "doing this bad thing will make Google poorer."

Companies are disciplined by three forces:

Competition (the fear of losing business to a rival);

Regulation (the fear of legal penalties that would exceed the expected profits from a given course of action);

Self-help (the fear that customers or users will change their behavior, say, by installing an ad-blocker).

The ability of googlers to win enshittification arguments by appealing to the company's bottom line was a function of one or more of these three disciplining factors. The weakening of each of these factors is the reason that every tech company is sliding into enshittification at once.

For example, when Google contemplates raising the price of a Youtube subscription, the dissent might say, "Well, this will reduce viewership and might shift viewers to rivals like Tiktok" (competition). But the price-hiking side can counter, "No, because we have a giant archive, we control 90% of searches, we are embedded in the workflow of vloggers and other creators who automatically stream and archive to Youtube, and Youtube comes pre-installed on every Android device." Even if the company leaks a few viewers to Tiktok, it will still make more money in aggregate. Prices go up.

When Google contemplates increasing the number of ads shown to nonsubscribers, the dissent might say, "This will incentivize more users to install ad-blockers, and then we'll see no ad-revenue from them." The pro-ad side can counter, "No, because most Youtube viewing is in-app, and reverse-engineering the Youtube app to add an ad-blocker is a felony under Section 1201 of the Digital Millennium Copyright Act. As to non-app viewers: we control the majority of browser installations and have Chrome progressively less hospitable to ad-blocking."

When Google contemplates adding anti-adblock to its web viewers, the dissent might say, "Processing users' data in order to ad-block them will violate Europe's GDPR." The anti-adblock side can counter, "But we maintain the fiction that our EU corporate headquarters is in the corporate crime-haven of Ireland, where the privacy regulator systematically underenforces the GDPR. We can expect a very long tenure of anti-adblock before we are investigated, and we might win the investigation. Even if we are punished, the expected fine is less than the additional ad-revenue we stand to make."

When Google contemplates stealing performers' wages through opaque reshufflings of its revenue-sharing system, the dissent might say, "Our best performers have options, they can go to Twitch or Tiktok." To which the pro-wage-theft side can counter, "But they have no way of taking their viewers with them. There's no way for them to offer their viewers on Youtube a tool that alerts them whenever they post a new video to a rival platform. Their archives are on Youtube, and if they move them to another platform, there's no way redirect users searching for those videos to their new homes. What's more, any attempt to unilaterally extract their users' contact info, or redirect searchers or create a multiplatform client, violates some mix of our terms of service, our rights under DMCA 1201, etc."

It's not just Google. For every giant platform, the threats of competition, regulation and self-help have been in steady decline for years, as acquisitions, underenforcement of privacy/labor/consumer law, and an increase in IP protection for incumbents have all mounted:

https://locusmag.com/2020/09/cory-doctorow-ip/

When internal factions at tech companies argue about whether to make their services worse, there's a heavy weight tilting the scales towards enshittification. The lack of competition, an increase in switching costs for users and business-customers, and broad powers to prevent users from modifying the service for themselves all mean that even when a product gets worse, profits can still go up.

This is the culprit: monopoly, and its handmaiden, regulatory capture. That's why today's antimonopoly movement – and the cases against all the tech giants – are so important. The old, good internet was built by flawed tech companies whose internal ranks included the same amoral enshittifiers who are gobbling up the platforms' seed corn today. The thing that stood in their way before wasn't merely the moral character of colleagues who shrank away from these cynical maneuvers: it was the economic penalties that befell those who enshittified too rashly.

Incentives matter. Money talks and bullshit walks. Enshittification isn't due to the moral failings of individuals in tech companies. It's possible to have a good internet run by flawed people. But to get that new, good internet, we have to support technologists of good will and character by terrorizing their venal and cynical colleagues by hitting them where they live: in their paychecks.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/22/who-wins-the-argument/#corporations-are-people-my-friend

#pluralistic#microeconomics#incentives matter#microincentives#enshittification#corporate discipline#big tech#competition#too big to fail#too big to jail#ip#dont be evil#google#institutions#locus magazine

195 notes

·

View notes

Text

21/100 days of productivity

Wednesday, 25 September, 2024

I missed my first lecture in calculus 1 this morning because i woke up sick today and cuz i slept close to two hours last night cuz i was anxious about the lecture. So i slept in.

But then my macroeconomics professor sent me the slides and homework so i had something to do today. (He didn't send the textbook pdf though :/). So i sat down to study at home and instead made a five and a half hour long playlist cuz i got hyperfixated on Pier 4 by Clairo and had to make a playlist based on that song.

Finally, i started actually studying and

🪐 organized all my notebooks for new classes this semester

🪐 solved 2 out of 7 problem exercises for microeconomics

Also, i managed to remember Duolingo lessons and did that too. It's not even eleven yet but I'm going to bed. I wanna actually sleep tonight.

I love you :-)

Arrivederci <3

#*timekeeper*#study blog#studyblr#adhd student#adhd studyblr#study aesthetic#study motivation#studyspo#economics major#economics student#uni studyblr#studyblr community#realistic studyblr#microeconomics#calculus#clairo#uni life#uni student#university#100 days of productivity#100 dop#study challenge#struggler academia#🪐

17 notes

·

View notes

Text

Quick PSA if your annual salary increase isn't at least keeping pace with inflation you're earning less than you did the previous year.

7 notes

·

View notes

Text

#studyblr#student life#ibdp#academic weapon#studying#economics#microeconomics#study blog#study motivation

2 notes

·

View notes

Text

I'm taking microeconomics and every 8 seconds they're like "now, this might SEEM cruel and classist and oppressive but that's only because you're on the receiving end of the damage and not the one benefiting from it! if you were on the other end of things you could see how this is actually good because it generates profit for smart businessmen."

#♥︎#microeconomics#economics#anyone else have this issue with econ or am i losing my mind. i feel crazy

10 notes

·

View notes

Text

just spent the past three hours redoing microeconomics notes because my dogs chewed the pages. these notes aren’t even for what we’re doing in class tomorrow so i have to either kill myself to get up early enough to do those notes and make both my appointments as well as my two classes i’ve got, or i have to hope and pray my crush that’s in that class with me will have his notes and share with me

6 notes

·

View notes

Text

Crafting Chaos

Not had enough time to draw, so here's some of the insanity brought down upon me by the relatively normal crafting system in Five Torches deep. My poor economics...

2 notes

·

View notes

Text

Theories of the Philosophy of Microeconomics

The philosophy of microeconomics encompasses various theories and approaches that seek to understand the principles, assumptions, and implications of individual decision-making within the context of markets and economic systems. Some key theories in the philosophy of microeconomics include:

Rational Choice Theory: Rational choice theory posits that individuals make decisions by maximizing utility or satisfaction given their preferences, constraints, and available information. It assumes that individuals act in their self-interest and make choices that maximize their well-being.

Marginalism: Marginalism examines how individuals make decisions at the margin, weighing the benefits and costs of small changes or incremental units of goods and services. It emphasizes the importance of marginal analysis in determining optimal decision-making and resource allocation.

Utility Theory: Utility theory explores the concept of utility as a measure of satisfaction or happiness derived from consuming goods and services. It investigates how individuals allocate their limited resources to maximize utility, subject to budget constraints and preferences.

Consumer Choice Theory: Consumer choice theory analyzes how consumers make decisions about what goods and services to purchase based on their preferences, budget constraints, and the prices of goods in the market. It explores consumer behavior, demand curves, and the determinants of consumer choice.

Production Theory: Production theory examines the behavior of firms and producers in allocating resources to produce goods and services. It analyzes the relationship between inputs (such as labor and capital) and outputs, the concept of production functions, and the factors influencing production decisions.

Market Equilibrium: Market equilibrium theory explores the interaction of supply and demand in determining prices and quantities exchanged in markets. It examines how markets reach equilibrium through the adjustment of prices and quantities to balance supply and demand.

Game Theory: Game theory studies strategic interactions between rational decision-makers, such as individuals, firms, or governments, in competitive or cooperative settings. It analyzes the outcomes of strategic interactions, including the Nash equilibrium, cooperation, and competition.

Information Economics: Information economics investigates the role of information and uncertainty in economic decision-making. It examines how individuals gather, process, and act on information in markets, the impact of asymmetric information on market outcomes, and the role of signaling and screening mechanisms.

Behavioral Economics: Behavioral economics integrates insights from psychology and economics to study how cognitive biases, heuristics, and social factors influence economic behavior. It challenges the assumptions of rationality and explores deviations from standard economic models.

Welfare Economics: Welfare economics evaluates the efficiency and equity of resource allocation in economic systems. It assesses the welfare implications of market outcomes, including market failures, externalities, income distribution, and the role of government intervention.

These theories and approaches in the philosophy of microeconomics provide frameworks for understanding individual decision-making, market dynamics, and the allocation of resources in economic systems.

#philosophy#epistemology#knowledge#learning#chatgpt#education#ethics#psychology#Rational choice theory#Marginalism#Utility theory#Consumer choice theory#Production theory#Market equilibrium#Game theory#Information economics#Behavioral economics#Welfare economics#economics#microeconomics#economic theory#theory

5 notes

·

View notes

Text

Ko-Fi Prompt from Eli:

do landlords have price wars? it seems like with the insane way rents are going it wouldn't be hard for them to undercut competition. but it also doesnt feel like thats happening.

Oh, this is a fun one. Let's talk about price elasticity!

Note: I will be including graphs in this post. While it's helpful as a visual aid, there is no way to describe it that actually helps explain the premise that isn't already in the post's body of text. As such, I will not be providing image descriptions beyond the short sentence before or after stating what it's meant to represent, since further information wouldn't be of any use to those with screen readers.

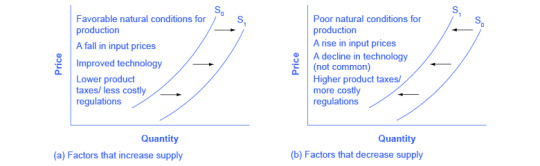

In the field of microeconomics, one of the basic models everyone learns is the supply and demand curve. Here's a visual example:

Image Source: Wikimedia Commons

Traditionally, a product with an elastic price is one where demand fluctuates directly in response to cost, isolated from other factors*. A basic example is affordable luxury goods, say, a nice steak. If the cost goes up by a dollar, a certain portion of the population will decide it's no longer worth the cost, and will switch to something cheaper, like a chicken breast, instead.

* Other factors include, but are not limited to, luxury appeal, subsidized costs, and the lipstick effect. This post is already pretty long, so I can't go into many details on those situations.

The Demand curve is specifically a visualization of how much of a product can be sold for, not necessarily how much the product can be sold in quantity. As a general rule, it's easier to think of Price as the independent factor for Demand (and quantity as the dependent), and quantity as the independent factor for Supply (and price as the dependent).

With a traditional S&D curve, the intersection of the Supply and Demand curves is the optimal price point from both ends. The X-axis is supply quantity, which a lot of people find unintuitive... but that's where it's been for years and that's where it's staying.

If there is a great quantity of a product, with healthy competition levels, then the supply line moves to the right. The intersection of the lines then drops, and prices go down, as businesses lower prices to gain more customers.

If there is a small quantity of a product, due to limited raw materials or unique patents or skills, then the supply line moves to the left, and they can charge more for the product.

Here is a visual of what I mean by the supply curve moving:

(Source: Wikimedia Commons)

The text is fairly small, so I'll describe here: The image states that factors that can increase supply (shift to the right) include favorable conditions for production, falling input prices, improved technology, and lower taxes or regulation costs. The second graph describes a decrease in supply, causing a shift to the left, the factors of which are the exact inverse of the first graph for increased supply.

A good example of a shift in supply resulting in a change in cost is gas: prices go up when supplies go down, whether due to higher taxes/regulations (e.g. the current refusal to trade with Russia), or disappearing raw materials (diminishing quantities of oil and natural gas, as finite, unrenewable resources). Comparatively, other forms of energy, like solar, have had their quantity lines shift to the right (cheaper) as the technology becomes more efficient and cheaper to produc.

Now, in areas that genuinely do not have enough housing, this is part of why prices go up: options are limited enough that they can get away with charging more. Due to zoning laws, construction costs, etc. they cannot add more housing, and so the supply curve is further to the left (pricier).

Here is a similar example image for the Demand curve, and how it shifts:

(Source: Wikimedia Commons)

The factors, here, are more intuitive. If demand goes up for reasons like trends, population, rise in general disposable income, changes in the costs of competitors or accessories, or expectations of investment viability, then the demand curve shifts to the right, and costs can increase without losing market share. For the reverse causes, the curve shifts to the right, and fewer people are willing to buy at that same cost.

Let's consider laptop computers: they have gotten more popular. A larger portion of the population has reason to buy them than twenty years ago. For that reason, the price can go up without necessarily losing market share (shifting to the right). However, income across the board has dropped, and there is a reasonably cheaper substitute (smartphones) for some uses, so the demand is lower (shifting to the left).

If you are in a city where there are suddenly a lot of people moving in for some shiny new company, then there is a greater population trying to buy, and so the demand curve shifts to the right, and prices can safely go up without losing market share.

...but that's with elastic pricing and competition.

Elastic pricing and costs are for most traditional goods. For specific foods, you can usually just... buy something else. If a plague wiped out half the crop of lettuce for the season, the costs will rise on the supply side (shift to the left), but there are unaffected substitutes, like broccoli and cabbage and tomato, for general use, so demand will also drop (also shift to the left). This means that prices go higher, but they are further to the left for both, meaning the quantity sold is lower.

Selling four million units at $3 vs. selling two million units at $6. The final amount of money changing hands is the same, but it's at a different cost and quantity.

Summary:

Supply moves to the left: less product, higher price from the seller to cover costs

Supply moves to the right: more product with healthy competition, lower price from the seller

Demand moves to the left: less interest in the product, customers need a lower price to buy the same amount

Demand moves to the right: more interest in the product, customers will tolerate a higher price to buy the same amount

But again, this is for elastic products.

What's an inelastic product?

Well... housing, actually, but let's start on the other side this time.

Products with inelastic demand are ones where customers cannot respond to changes in cost or supply. It doesn't matter if the cost goes sky high, and you know the profit is 96% because the cost of production is 4% of the price you paid; you can't afford to not buy it.

You know how insulin prices in the US spent decades being prohibitively expensive because diabetic individuals could not survive without buying it? That's inelastic demand.

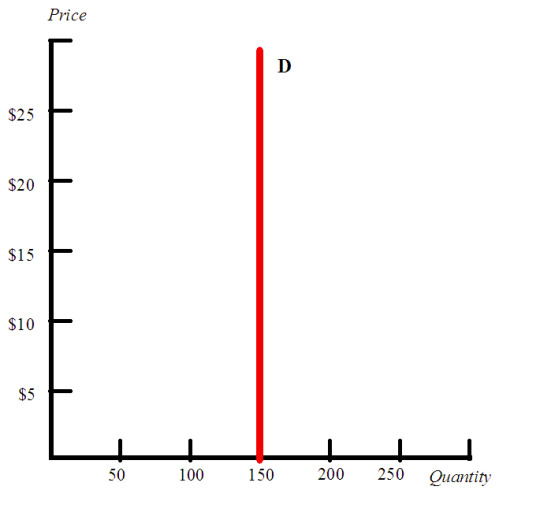

(Source: Wikimedia Commons)

If you look at the image above, you see a 'perfectly' inelastic demand curve. It is a straight, vertical line, where the quantity is immovably stuck at 150 no matter how high the cost goes.

In the real world, very, very few products are perfectly inelastic. Even insulin is... well, some people can move abroad. Not many, so it's pretty close to vertical, but some.

With housing, demand is fairly inelastic. The vast, vast majority of people do need housing. There are very few substitutes for this need, and while there is a range of prices and options, it does sort of... flatten out early.

If you demand that people spend $3000/month in order to live within 50 miles of their place of work, and everyone else is also demanding $3000/month, then there aren't any other options. The person either gets a new job elsewhere, spends a few hours a day on a commute, or pays those $3000.

Inelastic supply is the other side of that coin. The very limited quantity, and the high costs of expanding that supply, mean that the line shifts pretty far to the left, causing prices to rise. The line is also nearly vertical. With housing, there exists an argument that it is often cheaper to let the apartment sit empty than to rent it out too cheaply, due to maintenance costs and property taxes or what have you. Unless there's an exorbitant mortgage that needs to be contributed to by the tenants, though, those numbers don't quite work out.

So... if the Demand curve is nearly vertical, and the Supply curve is also nearly vertical, and there are no viable substitutes other than exiting the market entirely, you have a situation where the Supply side has nearly all the power and an excuse for why they're raising prices that doesn't actually reflect the reality.

Because there's plenty of housing being built, just, you know, not in the tax bracket that needs it. (Remember, a very large portion of Billionaire's row is currently unoccupied.)

You could argue that this is a form of price-fixing, which is an illegal act in which competitors in the same industry agree to collectively raise, lower, or stabilize pricing of a product. If 90% of microprocessor companies raise their prices simultaneously without cause, consumers will have to bite the bullet and buy the product at that new cost, as there aren't enough substitutes to find another option.

(If this sounds like a monopoly to you, good job! It's the same principle: control pricing for enough of the market that you can raise it higher than demand justifies. It's just done by making deals with the competitor instead of buying them out.)

However, due to the shape of the supply and demand curves in this housing market, and the very gradual way in which this situation has developed, it's not really a deliberate, organized price-fix, just something that came about as landlords realized that tenant's rights and alternate options (e.g. the council/public housing, affordable housing lotteries) weren't keeping up with their ability to continue to nudge prices upwards without losing out on money.

(Most of the time. Price-fixing does still happen, in pockets.)

Long story short: landlords don't have price wars because the demand curve is so inelastic that they can basically get away with anything.

(Prompt me on ko-fi!)

#economics#housing#housing industry#supply and demand#supply curves#demand curves#ko fi prompts#economics prompts#microeconomics#phoenix posts

205 notes

·

View notes

Text

Micro Outlook: Navigating daily life through a micro eco view

Microeconomics is a side character in our life which actually also is the main character, just usually unnoticed. Let me share a little slice of my day with you. This one day, a beautiful morning, it rained so beautifully and it was such a beautiful weather. The sound of rain, the earthen smell, and the cool breeze. Everything about the weather was pointed towards absolute perfection. I just wanted to go to the balcony and snuggle in my bed, do nothing and just observe the weather. But oh, to my realization, it was Tuesday. A regular working day. Which meant that I had classes. I halfheartedly had to get up to get ready and go to my classes. Guess what that was? You’re sweet to notice if you realized what this was, but you’re still sweet if you did not. Getting a good sleep was my opportunity cost here. Just for the record, I absolutely had a great time getting up and going to classes (sarcasm intended). So, moving on, when I was on my way to the university, we were struck in the traffic due to the rain. I love rain, but the traffic and roadblocks are the worst part about it. Well, I decided to plug in music to not pay attention to that. Just as I was about to, I heard a group of people talking. I wasn’t eavesdropping, they just talked loud enough for several people to hear. They were discussing about how the price of tomato would go lower by the end of September since its gotten very high and the government would interfere and put a price ceiling on the high prices soon. These were the adaptive expectations they set. Adaptive expectations are always set by people about a lot many other things too, this was just a part of what I witnessed.

After I got done with the classes, when I was on my way home my father stopped at the gas station to fill up the car. I had nothing much to do so I just sat and thought about how high the price of petrol was. INR 96 per liter, the inflation is insane! I couldn’t help but think about how many people would switch to public transport and how the car sales would have gone down as petrol and car are complement goods. I don’t even know how, that just came to my mind because like, I’m usually not that political about stuff. And since we are on the topic, I also realized that there are only a few companies in the oil industries in India so they all cooperate and act as oligopoly. After getting the car all filled up, I reached home, freshened myself up and had my lunch. I rested for a bit and then got up because- well I had an assignment due. I didn’t really want to put it off till the last minute because my luck could fail me anytime. And a little bit of overthinking here. Well, let’s look at it objectively. The assignment might just not upload, or worse, my internet could not work. Anything could happen. So after working on my assignment, I decided to surf on the internet a little bit. Just for fun, I looked up the concert tickets for a BTS concert, and the front row prices had me a little zoned out for a while. I was a little surprised. Let’s just say- the prices were very high for me to even dream about attending a concert at this age, in the front row and in a different country because the tour didn’t include our country yet. I wondered if it takes time for front row tickets to sell but then to my surprise I found out that even these high priced tickets were sold out within seconds of the ticket release. Yes, seconds of the ticket release. Even the tickets which were purchased and sold for even higher prices by people to earn profits were sold. And let me tell you, these prices set by people who black marketed the tickets were absurd. No matter how high the prices went, people were ready to buy the tickets. I mean, the band does make good music, so I guess the hype is reasonable. We can say that the tickets here would be considered as Giffen goods. Well, I consoled myself with the typical “I’ll go when I will start to earn myself” and shut down my laptop; no use to being delusional.

It was evening by the time I did all the work and finished my work. I decided to go out and take a walk. I called up my friends and we hung out together for the evening talking to each other for a while. I was really craving for dumplings and my friends wished to eat something as well so I suggested that we all go and eat something. When we reached the food outlet, there was the common dilemma of choosing what to eat apart from the dumplings as there was a lot of other choices. We took our time and finally decided upon three things- dumplings, chili potato and noodles. But we realized that we could have two things out of the three, given the limited amount of money we were carrying since it was a spontaneous plan. We had to make a choice. We chose dumplings and noodles. There was a trade-off between the three options and we sacrificed chili potato to get dumplings and noodles since we had limited resources (money) with us. Had we carried more money, we could have purchased all three of them of course. Then we finally ate. Initially, I enjoyed the dumplings a lot since I was craving for them. And so everyone ate and agreed on getting one more plate of the dumplings. But by the end of second plate of dumplings, I was really full, there was a huge difference between the satisfaction I got after the first bite and the last one. I didn’t derive as much satisfaction as I initially did. It was due to the Law of diminishing marginal utility here. We ate and then walked our way back till we parted our way homes. At the night, my mother was getting ready to go to the market to purchase groceries and asked me if I wanted to tag along. I had not gone out with her to the market in a while and I could also help her pick up the bags as they can get kind of heavy. So, I agreed and went with her. Vendors from all walks of life set up their stalls. There was a hustle and bustle all around and there were a lot of stalls. And on the stalls were people bargaining and purchasing. There was demand and supply of different commodities. We noticed that the stall of Apples had a lot of crowd. I soon got to know that it was because the prices of the Apples had recently gone down, so people wanted to purchase them. As price was less, it affected the demand and the quantity demanded for apples was high. As we went further, we saw the stall of tomatoes. The price for tomatoes was very high. I did hear that it had gone up, but I didn’t know that it had gone up THAT high. My mom tried to bargain but the tomato seller clearly refused. The price was the same everywhere and no vendor was ready to sell it below that price. Since the tomato sellers set up a competitive market, there wasn’t much impact if one buyer didn’t buy their product since there were numerous others who would buy at that price since tomato is essential in most of the food items. After a while, we were met with a friend of my mom’s in the market. They both started talking and discussed about various stuff. They also mentioned how the tomatoes have become absurdly costly to which her friend said that the tomatoes have become so costly that she doesn’t buy much tomatoes and uses the packed and readymade tomato puree available in the market. Tomato and the readymade tomato puree are substitute goods so as the prices of the tomatoes increased, people started using the readymade puree as a temporary substitute and demand for it increased. When I reached home, I was a little tired and so I had my dinner and then I head to my bed to sleep.

As we explore our daily lives, microeconomics concepts influence our choices and decisions quietly. From seemingly ordinary to the bigger scale, these concepts paint a vivid picture of the world we inhabit. From the moment we wake up to the time we lay our heads down on the bed at night, economic concepts are unnoticeably and quietly at work, influencing the choices we make and the outcomes we experience.

6 notes

·

View notes

Text

REGISTERED FOR MY CLASSES!!

#i'm taking uhhh#human genetics#microeconomics#business organization#and something else i can't remember rn#oh. statistics :)

6 notes

·

View notes

Text

20/100 days of productivity

Tuesday, September 24, 2024

🪐 went to a 9AM lecture

🪐 revised microeconomics

I Had my first lecture of this semester today. It was a 9 AM one so i didn't get much sleep but most of my lectures will be like that so i will need to sleep at a reasonable hour. The lecture was in Microeconomics 1 and I'm retaking it cuz i failed it last year. I like my professor for this class. He's organised. Now I'm in the library watching a YouTube video on the basics of Microeconomics cuz i took that course two years ago now and i want to refresh my memory. I'm gonna make an overview of it. Also I'm waiting for my professor to send us the homework, slides and the textbook pdf since our website isn't working yet.

Managed to review and take notes of the first half of that video. I was waiting for my professor to send over those files but he didn't (serves me right for calling him organized). So i didn't do any uni work today. I did enjoy revising those microeconomics materials though. And being in the library is always so lovely.

I have been neglecting my italian lessons on Duolingo these days but i just finished one so it's all good. On that note though, I've been getting back in the flow of russian. I've been rewatching Gravity Falls with a russian dub and i fucking love it. Feels like childhood again.

You're doing better than you think, dear.

Arrivederci <3

#*timekeeper*#study blog#studyblr#100 dop#adhd student#public libraries#100 days of productivity#adhd studyblr#gravity falls#study aesthetic#study motivation#studyspo#economics major#economics student#learning italian#learning russian#microeconomics#uni studyblr#studyblr community#realistic studyblr#uni life#university#struggler academia#🪐

9 notes

·

View notes

Text

so where are my ap micro econ bros at

0 notes

Text

right now is the perfect time to be taking an intro to microeconomics course actually

if anyone wants me to briefly explain how the mass deportations will affect the prices of foods in (relatively basic) economics terms let me know

1 note

·

View note