#Medical practice accountants

Explore tagged Tumblr posts

Text

Accountant for Physicians & Doctors Calgary | Medical Practice accountants

MMT’s Medical Practice accountants offer comprehensive services for physicians will allow you to shift your focus back to where it belongs, on your medical practice. While you keep your patients healthy, let us keep your bottom line healthy, too. MMT offers professional accountant services specifically for medical professionals [Accountant for Physicians & Doctors] to help with complex accounting and financial management and tax preparation.

0 notes

Text

Accountant for Physicians Calgary | Accountant for Doctors

Build a successful medical practice with our professional accounting & financial services. Rest assured of accurate record-keeping, cost-effective financial support.

0 notes

Text

Professional Financial & Accounting Services for Doctors & Physicians in Vancouver

At MMT, we know how demanding the life of a physician can be. That’s why we make accounting and financial management easy with accounting services tailored specifically to meet your needs. Our team of highly trained chartered professional accountants are ideally suited to support medical professionals with their time-consuming and complex accounting and financial records. We offer a range of physician-specific accounting and financial services, including tax planning and bookkeeping, so that you can free up more time to spend with your patients.

0 notes

Text

ER doctor lied in my medical records about me having a history of methamphetamine abuse bc he has a grudge against ppl who are prescribed adderall! lol

#i know it's a lie bc i told him abt my prescription and have a witness#i'm getting this man fucking fired i don't care he doesn't need to be practicing medicine if he can't accept adhd exists in adults lol#you know how fucking damaging it can be to have drug abuse in your medical records?#when you're a chronic pain patient???????#fucking hell#AND when i tried to complain no one answered i left a message and im gonna call again later#there's ways to correct it but i want him held accountable for lying about me in my medical records

2 notes

·

View notes

Text

mutuals who see my shockbee posts, I'm sorry

#also shoutout to my mutual who reads my wips i love u ty for reading my shockbee mess. it doesnt make sense half the time#ALSO JUST REALIZED I HAVENT UPLOADED ANYTHING IN MONTHS#ao3 account is basically dead#havent had enough inspo to finish my million wips on google docs lmao#know that i am working SLOWLY. sooo slowly#but working#the dubious medical practices shockbee fic will one day see the light of day i promise#txt

2 notes

·

View notes

Text

saw a post that got me thinking abt that whole 'yr brain doesn't fully mature until age 25 (at which point it abruptly congeals like an aspic)' pseudoscience fictoid again, and—

the other thing that gets me about it, besides my previously-registered complaint that the notion of a hard stop on plasticity at the quarter-century mark is depressing as fuck for those of us past that age who need to believe change is still possible, is that it's yet another instance of people looking to substitute a hard-and-fast rule for the active, careful exercise of their own judgment—life isn't a binary where pre-25 nothing goes and post-25 anything goes! you have to actively think about how to behave well and how to treat others well, whatever your age and whatever theirs!

#had originally expanded on this but i think actually let's just crop it here#but like. what if you didn't need the excuse of physiological immaturity in order to forgive yrself for the struggles of yr early twenties.#what if you were to practice extending a gentle compassion towards yr past self‚ and also yr present self while you're at it#bc you thought *everyone* deserved that‚ just inherently‚ and it didn't need to be earned via a medicalized excuse slip. what then.#anyway. as ever: i do not pretend to have perfected what i preach‚ lol#but just like. what is accountability without compassion. what is compassion without accountability. at any age we need both.#the idea of turning the world into a binary where there's no accountability before age 25‚ and no compassion afterwards‚ is. bad actually.#change is never necessarily likely but always possible.#(am i thinking eternally abt the end of SYWTBAW‚ and writing the possibility of change into the lone power's name? yeah. yeah i am.)#anyway. at this pt i'm just riffing really. but.

15 notes

·

View notes

Text

how's feeling more confident about adulting this year going, violet?

so glad you asked. I told myself at the beginning of january that this year I'd be prioritizing both mine and my cat's health (e.g. taking us to the vet/doctor bc it's been years for either of us) and promptly made her a vet appt. now that the vet appt is arriving uhhh next week I'm realizing I really need to also make myself that doctor's appointment I guess? uh?? fuck!

#doctors cw#medical cw#my previous gp retired last summer but I hadn't seen her in years before that anyway#I could see a nurse practitioner at that same practice#or I could go with one of the ppl my boss recommended#or one of the docs I found googling for fat-friendly providers near me#so now I have too many options and am overwhelmed#I know I need to go to the doctor#it's been multiple years + I am getting older + want to take better care of myself#specifically I would like to get (back) into (long distance) biking which I haven't been doing on account of My Joints#something Is Wrong with them and I need to get it checked out#but there's like a 95% chance that any doctor is going to start and end that conversation at 'you need to exercise more/lose weight'#never mind that I want to get the joints looked at so I *can* exercise because right now things hurt#anyway this isn't me looking for advice unless you have a specific GP rec for my area#e.g. only if you know where I live#I'm just venting bc it's so frustrating as a process#also lmao @ me for getting my cat's medical care sorted out before my own#classic! but also there's a vet literally walking distance from my apt. so that made the 'where to take her' choice easier#I've put in an appt rec for one doc. but now I'm second guessing that so back to the drawing board I suppose#sigh.

3 notes

·

View notes

Text

For Effective Medical Practice Accounting And Financial Health

To maintain financial health in a medical practice, implementing effective accounting strategies is vital. One essential strategy is to establish a Medical practice accounting budgeting process that reflects the practice's goals and anticipated expenses. This involves analyzing historical financial data to project future revenues and costs accurately. Another crucial aspect is optimizing billing practices to minimize errors and reduce the days in accounts receivable. This can be achieved through the use of advanced billing software that automates claims submissions and tracks payments efficiently. Additionally, healthcare providers should regularly review financial reports to identify trends and make informed decisions. These reports should include profit and loss statements, cash flow analyses, and balance sheets, which provide insights into the practice's financial health and areas for improvement. Moreover, investing in training for administrative staff can enhance their understanding of financial procedures, ensuring that billing and coding are performed accurately and efficiently. By adopting these strategies, medical practices can improve their financial management, leading to enhanced profitability and stability.

Medical Practice Accounting: Navigating Tax Regulations

Navigating tax regulations and compliance is a significant aspect of medical practice accounting that requires careful attention. Healthcare providers must adhere to various federal, state, and local tax laws, which can be complex and often subject to change. To ensure compliance, medical practices must maintain accurate records of all financial transactions, including income, expenses, and payroll. This meticulous record-keeping helps to substantiate claims and deductions during tax filings. Engaging with a tax professional who specializes in healthcare can also provide valuable guidance on tax-saving strategies and compliance requirements. Furthermore, practices should stay informed about changes in healthcare laws, such as the Affordable Care Act, which can impact tax obligations. Regular audits of financial records can help identify potential compliance issues before they become significant problems. By prioritizing tax compliance and regulatory adherence, medical practices can avoid costly penalties and ensure their financial operations align with legal requirements.

Challenges In Medical Practice Accounting And How To Overcome Them

Medical practice accounting is not without its challenges, and recognizing these hurdles is essential for effective financial management. One key challenge is the ever-increasing complexity of healthcare reimbursement models, which can lead to confusion regarding billing and collections. Practices often struggle with delayed payments from insurance companies, which can strain cash flow. To address this, it is essential to establish clear communication with payers and utilize electronic claims submission systems that expedite the reimbursement process. Additionally, the shortage of qualified accounting professionals in the healthcare sector can hinder effective financial management. To overcome this, practices may consider outsourcing accounting functions to specialized firms that understand the nuances of medical billing and coding. Furthermore, implementing robust financial management software can streamline accounting processes, reducing the risk of errors and improving efficiency. By proactively addressing these challenges, medical practices can create a solid foundation for financial stability and growth.

Through Strategic Medical Practice Accounting

Maximizing profitability in a medical practice requires a strategic approach to accounting that focuses on identifying and leveraging revenue opportunities. One effective strategy is to conduct regular financial analysis to assess the practice's performance against industry benchmarks. This analysis can reveal areas where costs can be reduced or revenues can be increased. Implementing a proactive revenue cycle management system is also critical; it ensures that billing processes are optimized and that claims are submitted promptly and accurately. Practices should also evaluate their service offerings and consider expanding into high-demand areas that align with their expertise, thereby increasing potential revenue streams. Additionally, engaging in patient satisfaction initiatives can lead to improved retention and referrals, ultimately enhancing profitability. By employing these strategic accounting practices, healthcare providers can position their practices for financial success while continuing to deliver high-quality care.

Accurate Medical Practice Accounting For Healthcare Providers

Accurate medical practice accounting is vital for healthcare providers, as it directly impacts their ability to operate efficiently and provide quality patient care. Inaccurate financial records can lead to cash flow problems, which may jeopardize the practice's ability to pay staff, purchase supplies, or invest in new technologies. Furthermore, precise accounting helps healthcare providers make informed decisions regarding budgeting and resource allocation, ensuring that funds are used effectively to support clinical operations. Accurate financial reporting also fosters transparency and accountability within the practice, which can enhance trust among staff and patients alike. In addition, maintaining accurate financial records is crucial for compliance with regulatory requirements, as inaccuracies can lead to audits and potential penalties. By prioritizing accuracy in accounting practices, healthcare providers can enhance their financial stability and focus on their primary mission: delivering exceptional patient care.

Operations With Effective Medical Practice Accounting Solutions

Streamlining operations is essential for medical practices aiming to improve efficiency and reduce costs. Implementing effective medical practice accounting solutions can significantly contribute to this goal. One approach is to utilize integrated practice management software that combines scheduling, billing, and financial reporting in one platform. This integration reduces the need for multiple systems, minimizes errors, and enhances data accuracy. Additionally, automating routine accounting tasks, such as invoicing and payment reminders, can free up valuable administrative time, allowing staff to focus on patient care and other critical activities. Regular training on accounting software for staff can also improve overall proficiency and reduce the likelihood of costly mistakes. Furthermore, practices should establish standardized procedures for financial management, ensuring consistency and clarity in operations. By adopting these solutions, medical practices can streamline their financial processes, leading to improved efficiency and enhanced overall performance.

Medical Practice Accounting: Best Practices For Improved Cash

Effective cash flow management is crucial for the financial health of any medical practice. Implementing best practices in medical practice accounting can help ensure that cash flow remains stable and predictable. One fundamental practice is to establish a detailed cash flow forecast that outlines expected income and expenses over a specific period. This forecast allows healthcare providers to anticipate cash shortages and take proactive measures to address them. Another key strategy is to optimize billing and collections processes, ensuring that claims are submitted promptly and follow-ups are conducted on outstanding balances. Offering flexible payment options to patients can also enhance cash flow, as it encourages timely payments. Additionally, maintaining a reserve fund for unexpected expenses can provide a safety net during challenging financial periods. By focusing on these best practices, medical practices can improve their cash flow management, ensuring they have the resources necessary to sustain operations and invest in growth opportunities.

The Benefits Of Outsourced Medical Practice Accounting Services

Outsourcing medical practice accounting services offers a range of benefits that can enhance financial management and operational efficiency. By partnering with specialized accounting firms, healthcare providers can access a team of professionals with expertise in medical billing, coding, and compliance. This expertise can lead to improved accuracy in financial reporting and reduced billing errors, ultimately enhancing revenue cycles. Additionally, outsourcing can free up internal resources, allowing practice staff to focus on patient care and other core functions. It can also provide access to advanced accounting technologies and software that may be cost-prohibitive for individual practices to implement. Moreover, outsourced services often offer scalable solutions, allowing practices to adjust their accounting needs as they grow. By embracing outsourced accounting services, medical practices can streamline their financial operations while benefiting from specialized knowledge and improved accuracy.

Conclusion

Medical practice accounting is a critical component of successful healthcare operations. By implementing effective strategies, navigating tax regulations, overcoming challenges, and maximizing profitability, healthcare providers can ensure their financial health. Accurate accounting practices not only support operational efficiency but also enhance the overall quality of care delivered to patients. As the healthcare landscape continues to evolve, embracing innovative accounting solutions and outsourcing services can further streamline operations and improve financial management. Ultimately, prioritizing medical practice accounting enables healthcare providers to focus on their mission of delivering exceptional patient care while maintaining robust financial health.

0 notes

Text

How to Choose the Right Medical Practice Accounting?

Selecting the right medical practice accounting software is a pivotal decision that can significantly impact the efficiency and accuracy of financial management within a healthcare practice. The process involves evaluating various software solutions to find one that aligns with the specific needs and goals of the practice. Key considerations include the software’s ability to handle complex billing scenarios, such as different types of insurance claims and patient payment plans, as well as its compatibility with existing practice management systems. Features to look for include robust reporting capabilities, user-friendly interfaces, integration options with electronic health records (EHR), and compliance with healthcare regulations such as HIPAA. The software should also offer scalability to accommodate the practice’s growth and changes in financial requirements. Additionally, evaluating customer support and training options provided by the software vendor is crucial, as these can significantly impact the ease of implementation and ongoing usability.

Top Common Mistakes in Medical Practice Accounting and How to Avoid Them

Medical practice accounting is fraught with potential pitfalls that can compromise financial accuracy and efficiency. Common mistakes include inadequate billing practices, failure to reconcile accounts regularly, and poor management of accounts receivable. For instance, inaccuracies in billing codes or missing charges can lead to revenue loss and compliance issues. Failure to regularly reconcile accounts can result in discrepancies that might go unnoticed, affecting financial reporting and decision-making. Additionally, neglecting to follow up on outstanding claims and patient balances can lead to cash flow problems. To avoid these mistakes, it is essential to implement rigorous accounting procedures, including regular audits and reconciliations, meticulous billing and coding practices, and proactive management of patient accounts.

Understanding the Role of Medical Practice Accounting in Reducing Operational Costs

Medical practice accounting plays a critical role in reducing operational costs by providing insights into financial management and identifying areas where cost savings can be achieved. Effective accounting practices enable medical practices to track and analyze various expense categories, such as staffing, equipment, and overhead costs. By implementing cost control measures and optimizing resource allocation, practices can significantly reduce unnecessary expenditures. Detailed financial reports and analyses help identify trends and areas of inefficiency, allowing practices to make informed decisions about budgeting and cost management. Additionally, accurate financial tracking supports better negotiation with vendors and insurance companies, potentially leading to cost reductions.

Innovative Trends in Medical Practice Accounting: What to Watch for in the Coming Years?

The field of medical practice accounting is evolving rapidly, with several innovative trends expected to shape its future. One significant trend is the increased use of artificial intelligence (AI) and machine learning to automate routine accounting tasks, such as billing and reconciliation, and to enhance financial analytics. AI-driven tools can improve accuracy, reduce manual errors, and provide predictive insights for better financial planning. Another trend is the integration of advanced data analytics and business intelligence tools that enable practices to gain deeper insights into financial performance and patient behavior. Additionally, the adoption of cloud-based accounting solutions offers greater flexibility and accessibility, allowing practice managers to access real-time financial data from anywhere.

How Medical Practice Accounting Can Improve Cash Flow and Financial Planning?

Effective medical practice accounting is essential for improving cash flow and financial planning. By implementing robust accounting practices, medical practices can gain a clearer understanding of their financial position and manage their cash flow more effectively. Key strategies include optimizing billing and collections processes to ensure timely payment from patients and insurance companies, as well as closely monitoring accounts receivable to minimize delays. Accurate financial forecasting and budgeting are also critical components of effective financial planning, helping practices anticipate future cash flow needs and make informed decisions about investments and expenditures.

Essential Benefits of Outsourcing Medical Practice Accounting for Your Practice

Outsourcing medical practice accounting offers several key benefits that can enhance the financial management of a healthcare practice. One major advantage is access to specialized expertise and experience, as accounting firms specializing in medical practices have a deep understanding of healthcare financial management and regulatory requirements. Outsourcing can also lead to cost savings by reducing the need for in-house accounting staff and associated overhead expenses. Additionally, outsourcing providers often use advanced technology and accounting software, which can improve efficiency and accuracy in financial reporting and management. Another benefit is the ability to focus on core clinical activities, as outsourcing allows practice owners and managers to concentrate on patient care rather than financial management tasks.

Comprehensive Guide to Financial Reporting in Medical Practice Accounting

Financial reporting is a crucial aspect of medical practice accounting, providing essential insights into the financial health and performance of a healthcare practice. A comprehensive guide to financial reporting involves understanding various types of financial reports, such as income statements, balance sheets, and cash flow statements. These reports offer a detailed overview of revenue, expenses, assets, liabilities, and cash flow, enabling practice managers to assess financial performance and make informed decisions. Effective financial reporting requires accurate data collection and analysis, as well as a thorough understanding of accounting principles and healthcare regulations. Key components of financial reporting include tracking revenue and expenses, monitoring accounts receivable and payable, and preparing regular financial statements for review.

Navigating Tax Compliance and Reporting with Medical Practice Accounting Expertise

Navigating tax compliance and reporting is a critical aspect of medical practice accounting, requiring a thorough understanding of tax regulations and healthcare-specific requirements. Medical practices must ensure accurate and timely filing of tax returns, including income tax, payroll tax, and sales tax while adhering to relevant tax laws and regulations. Expertise in medical practice accounting is essential for managing tax-related tasks, such as calculating deductions, credits, and other tax benefits specific to healthcare providers. Additionally, maintaining proper documentation and records is crucial for supporting tax filings and responding to potential audits. Implementing effective tax planning strategies can help practices minimize tax liabilities and optimize their financial position.

Conclusion

Medical practice accounting is a vital component of managing a successful healthcare practice, encompassing various financial management tasks that support operational efficiency and financial health. From selecting the right accounting software to avoiding common mistakes, understanding the role of accounting in reducing operational costs, and staying abreast of innovative trends, effective medical practice accounting provides the foundation for financial success. By improving cash flow and financial planning, outsourcing accounting services, and ensuring accurate financial reporting and tax compliance, medical practices can achieve better financial control and support their clinical objectives.

0 notes

Text

Accountants For Doctors

Reed Tinsley, CPA, specializes in accounting and consulting services exclusively for physicians and medical practices. As one of the leading accountants for doctors, he has extensive experience in managed care contracting, operational efficiency, financial management, and strategic planning. Tinsley offers tailored solutions to enhance practice performance and growth. His expertise is recognized through numerous publications, speaking engagements, and affiliations with professional organizations. Clients benefit from his personalized approach and deep industry knowledge, ensuring comprehensive support in managing and optimizing their medical practices.

#accounting for doctors office#medical accountants#healthcare accounting firms#medical office accounting#cpa for doctors near me#medical practice management company

0 notes

Text

Busy medical professional? Let’s check ‘filing your taxes’ off your list

Tax season is upon us, so before you file as a medical professional, read up on what you need to know to prepare your taxes in the most efficient way possible.

0 notes

Text

Slimming Success: My Positive Experience with

There are a lot of weight-loss supplements out there, and many promise the world but deliver little. I've been on my weight-loss journey for a while now, and I've tried a fair few products with mixed results. That's why I'm so excited to share my positive experience with .Feeling Fuller for Longe

One of the biggest struggles I had with weight loss was managing hunger pangs. I'd constantly feel like reaching for snacks, and it was hard to stick to a calorie deficit. Since incorporating [Product Name] into my routine, I've noticed a significant difference in my appetite. The supplement helps me feel fuller for longer, which means I'm less likely to overeat throughout the day.Increased Energy LevelsAnother fantastic benefit of [Product Name] is the boost it's given my energy levels. In the past, feeling sluggish and tired was a common obstacle during weight loss. However, [Product Name] seems to have helped improve my metabolism, leaving me feeling more energized throughout the day. This newfound energy has not only aided my workouts but also improved my overall well-being.Aiding My Weight Loss GoalsWhile [Product Name] isn't a magic bullet, it's definitely become a valuable tool in my weight-loss journey. Combined with a healthy diet and regular exercise, I've seen consistent progress on the scales. The feeling of my clothes fitting looser and having more energy is truly motivating.Overall, I'm incredibly happy with the positive impact [Product Name] has had on my weight-loss efforts. If you're looking for a supplement to support your weight-loss goals, I highly recommend giving it a try.Disclaimer: It's important to consult with your doctor before starting any new supplement, especially if you have any underlying health conditions.

#healthyfood#Etactics | Revenue Cycle Software#The Best Health Hashtags to Use on Each Platform (More Than 55!)#Maria Clark August 6#2020#HealthHashtag_820.jpg#If your medical practice is on social media#it’s most likely because you want to interact with more patients and audiences. These platforms make it so much easier to reach more people#especially if they’re looking for self-diagnosis answers.#But there are intentional ways to categorize your account’s content so that it’s associated with the healthcare space. A common tool for do#HealthHashtag_ExpandAudience_820.png#Hashtags are words and phrases preceded by the hash sign (#). They revolutionized the social media space and grew so popular that they changed the name of the pound sign#think about that.#They identify related content posts. That way#users can search for a particular hashtag in what they’re interested in and find all posts that used that tag. Alternatively#they can click on a hashtag within a post and it will take them to the page of posts.#This helps users find similar content to what they’re viewing. It makes it much easier to expand your audience so more people learn about y#leading to more traffic to your page.#So now that you understand what this tool is#what are the best ones to include in healthcare practice’s posts? You’ll definitely want to use them considering that posts that include at#You don’t need to look too hard#because we’ve done the work for you. Here are some of the most popular health hashtags on each platform to get you more traffic.#Table of Contents#Instagram#TikTok#LinkedIn#Twitter#Conclusion#Most Popular:

0 notes

Text

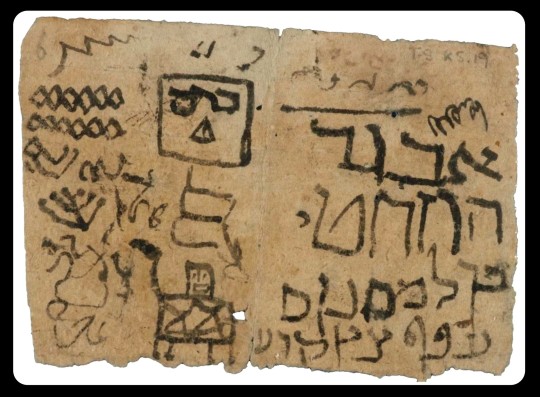

Child's Writing Exercises and Doodles, from Egypt, c. 1000-1200 CE: this was made by a child who was practicing Hebrew, creating doodles and scribbles on the page as they worked

This writing fragment is nearly 1,000 years old, and it was made by a child who lived in Egypt during the Middle Ages. Several letters of the Hebrew alphabet are written on the page, probably as part of a writing exercise, but the child apparently got a little bored/distracted, as they also left a drawing of a camel (or possibly a person), a doodle that resembles a menorah, and an assortment of other scribbles on the page.

This is the work of a Jewish child from Fustat (Old Cairo), and it was preserved in the collection known as the Cairo Genizah Manuscripts. As the University of Cambridge Library explains:

For a thousand years, the Jewish community of Fustat placed their worn-out books and other writings in a storeroom (genizah) of the Ben Ezra Synagogue ... According to rabbinic law, once a holy book can no longer be used (because it is too old, or because its text is no longer relevant) it cannot be destroyed or casually discarded: texts containing the name of God should be buried or, if burial is not possible, placed in a genizah.

At least from the early 11th century, the Jews of Fustat ... reverently placed their old texts in the Genizah. Remarkably, however, they placed not only the expected religious works, such as Bibles, prayer books and compendia of Jewish law, but also what we would regard as secular works and everyday documents: shopping lists, marriage contracts, divorce deeds, pages from Arabic fables, works of Sufi and Shi'ite philosophy, medical books, magical amulets, business letters and accounts, and hundreds of letters: examples of practically every kind of written text produced by the Jewish communities of the Near East can now be found in the Genizah Collection, and it presents an unparalleled insight into the medieval Jewish world.

Sources & More Info:

Cambridge Digital Library: Writing Exercises with Child's Drawings

Cambridge Digital Library: More About the Cairo Genizah Manuscripts

#archaeology#anthropology#history#artifact#middle ages#medieval#near east#egypt#cairo#children in archaeology#judaism#medieval jews#hebrew#writing exercise#doodle#art#cairo genizah#jewish history#reminds me of onfim#kids have always been kids

8K notes

·

View notes

Text

important edit!

UPDATE 9/4/2024: we will be closing down the old campaign because mohamed was having issues with the guy hosting it. i'm hosting a new campaign which i am linking below. THIS IS THE UPDATED LINK.

(this is a verified campaign and is 192 on the vetted fundraiser sheet)

mohammed @save-mohamed-family has been trying to raise money to save his family for a while on tumblr, and he raised a significant amount of money but the bank his beneficiary was using abruptly shut his account down and he lost all his progress. a lot of banks and money services have been arbitrarily freezing or shutting down the money palestinians are raising to survive this genocide, which is just an additional injustice for people already suffering so much. mohammed has since opened a new gofundme but its made very little progress.

please donate to this campaign– especially if youve donated in the past because gofundme will have refunded you

mohammed already lost his mother, father, and four sisters in the war who were killed in a bombing, and is now living in tents with his remaining family members. he was seriously injured in his foot and it may need to be amputated, but he told me that hes doesn't care if he loses his foot, he just doesn't want to lose his wife and children. his wife has uterine cancer but hasn't been able to get treatment because the genocidal israeli army has destroyed health centers. his children are suffering from infectious diseases spreading throughout gaza. there is practically no medical treatment or medicine available in gaza and the massacres continue everyday. food and water is scarce and priced exorbitantly. mohammed has made posts on his blog about their situation and i do encourage you to read his own words too.

please dont be desensitized to this just because it's been going on for so long. put yourself in his shoes and think about how you would feel– after nearly a year of the most destructive bombing campaign in history, living in hunger and pain every second with no home, no running water, no sanitation, not having a moment of security, subject to arbitrary decisions from an occupying force. no one should have to live like this.

the pain of losing so many family members, your home, your job, and everything you have is already unimaginable. please dont let him lose any more of his family. donate to this campaign and if you cant, share it with someone who can.

especially if you have a degree of disposable income i implore you to think about what you can reasonably give. it could be relatively small adjustment for you but make a significant difference for someone else.

5K notes

·

View notes

Text

Medical Practice Accountant

At Sterling Tax & Accounting, we specialize in accounting for medical practices. We know the medical industry and our CPA's are here to serve you.

0 notes

Text

Demystifying the Medical Billing Cycle: Everything You Need to Know

From patient registration to claim reimbursement, they got you covered with the most accurate and up-to-date information. Qiaben goal is to provide a resource that not only demystifies the medical billing cycle but also empowers you with valuable insights to manage medical billing efficiently.

1. Patient Registration

The medical billing cycle begins with patient registration, a crucial step that lays the foundation for the entire process. During this stage, healthcare providers gather essential patient information, including personal details, insurance coverage, and medical history. Accurate data entry is vital at this stage to prevent billing errors and claim denials in the future. Emphasising the importance of precise patient data collection and efficient record-keeping will ensure a seamless billing process.

2. Verification of Insurance Coverage

Once the patient registration is complete, the next step is to verify insurance coverage. This involves cross-referencing the patient's insurance details with the healthcare provider's network to determine the scope of coverage and any potential limitations. An in-depth understanding of various insurance plans and their terms is crucial to avoid coverage-related discrepancies and to maximize claim reimbursement.

3. Appropriate Medical Coding

Medical coding plays a pivotal role in the medical billing cycle. Trained professionals assign standardized codes to diagnoses, procedures, and treatments provided during the patient's visit. These codes must adhere to industry guidelines, such as the International Classification of Diseases (ICD) and Current Procedural Terminology (CPT). Accurate coding ensures that healthcare services are appropriately billed, leading to faster claim processing and minimizing claim rejections.

4. Claim Submission

Once the medical coding is complete, it's time to submit the insurance claim. This step involves sending all relevant information, including patient details, medical codes, and the healthcare provider's charges, to the insurance company. Timely submission of claims is crucial for expedited reimbursement. To optimize the claim submission process, streamlining administrative workflows and utilizing electronic claim submission platforms can significantly enhance efficiency.

5. Adjudication and Payment

After the insurance company receives the claim, it undergoes a process known as adjudication. During this stage, the insurance company reviews the claim for accuracy and verifies if the provided services are covered under the patient's insurance policy. The process may include pre-authorization checks, which can impact claim processing times.

Once the claim is adjudicated, the insurance company informs the healthcare provider of the payment details. Depending on the insurance policy and claim complexity, payment can be made in full, partially, or be denied altogether. To mitigate potential delays in payment, healthcare providers must ensure meticulous documentation of provided services and adherence to insurance guidelines.

6. Patient Responsibility

In cases where the insurance coverage falls short or certain services aren't covered, patients are responsible for the remaining balance, commonly known as co-pays, co-insurance, or deductibles. Transparent and proactive communication with patients regarding their financial responsibility is essential to avoid misunderstandings and improve patient satisfaction.

7. Denials and Appeals

Claim denials are an unfortunate reality in the medical billing cycle. When a claim is denied, it can significantly impact a healthcare provider's revenue stream. To address denials effectively, prompt identification of the reason for denial and diligent appeals are necessary. Utilizing data analytics to identify patterns of denials can aid in preventing similar issues in the future.

8. Accounts Receivable Management

Efficient accounts receivable (AR) management is crucial for maintaining a healthy revenue cycle. Timely follow-up on unpaid claims, resolving denials, and managing patient collections are vital aspects of effective AR management. Implementing robust AR tracking systems and automated reminders can lead to improved collections and reduced accounts receivable aging.

9. Compliance and Regulations

Throughout the medical billing cycle, adherence to regulatory guidelines and compliance standards is non-negotiable. Healthcare providers must stay up-to-date with changes in regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA). Failing to comply with these regulations can result in severe penalties and legal repercussions.

Conclusion

In conclusion, mastering the medical billing cycle is essential for healthcare providers to ensure streamlined operations, prompt claim reimbursement, and overall financial stability. By focusing on precise patient registration, accurate medical coding, efficient claim submission, and diligent accounts receivable management, healthcare providers can enhance their revenue cycle and improve patient satisfaction.

Remember, staying informed about ever-evolving insurance policies, regulatory changes, and industry best practices is key to success in medical billing. We hope this comprehensive guide has empowered you with the knowledge needed to navigate the medical billing cycle with confidence.

1 note

·

View note