#Long Term Loans No Credit Check

Explore tagged Tumblr posts

Text

I slept in and just woke up, so here's what I've been able to figure out while sipping coffee:

Twitter has officially rebranded to X just a day or two after the move was announced.

The official branding is that a tweet is now called "an X", for which there are too many jokes to make.

The official account is still @twitter because someone else owns @X and they didn't reclaim the username first.

The logo is 𝕏 which is the Unicode character Unicode U+1D54F so the logo cannot be copyrighted and it is highly likely that it cannot be protected as a trademark.

Outside the visual logo, the trademark for the use of the name "X" in social media is held by Meta/Facebook, while the trademark for "X" in finance/commerce is owned by Microsoft.

The rebranding has been stopped in Japan as the term "X Japan" is trademarked by the band X JAPAN.

Elon had workers taking down the "Twitter" name from the side of the building. He did not have any permits to do this. The building owner called the cops who stopped the crew midway through so the sign just says "er".

He still plans to call his streaming and media hosting branch of the company as "Xvideo". Nobody tell him.

This man wants you to give him control over all of your financial information.

Edit to add further developments:

Yes, this is all real. Check the notes and people have pictures. I understand the skepticism because it feels like a joke, but to the best of my knowledge, everything in the above is accurate.

Microsoft also owns the trademark on X for chatting and gaming because, y'know, X-box.

The logo came from a random podcaster who tweeted it at Musk.

The act of sending a tweet is now known as "Xeet". They even added a guide for how to Xeet.

The branding change is inconsistent. Some icons have changed, some have not, and the words "tweet" and "Twitter" are still all over the place on the site.

TweetDeck is currently unaffected and I hope it's because they forgot that it exists again. The complete negligence toward that tool and just leaving it the hell alone is the only thing that makes the site usable (and some of us are stuck on there for work).

This is likely because Musk was forced out of PayPal due to a failed credit line project and because he wanted to rename the site to "X-Paypal" and eventually just to "X".

This became a big deal behind the scenes as Musk paid over $1 million for the domain X.com and wanted to rebrand the company that already had the brand awareness people were using it as a verb to "pay online" (as in "I'll paypal you the money")

X.com is not currently owned by Musk. It is held by a domain registrar (I believe GoDaddy but I'm not entirely sure). Meaning as long as he's hung onto this idea of making X Corp a thing, he couldn't be arsed to pay the $15/year domain renewal.

Bloomberg estimates the rebranding wiped between $4 to $20 billion from the valuation of Twitter due to the loss of brand awareness.

The company was already worth less than half of the $44 billion Musk paid for it in the first place, meaning this may end up a worse deal than when Yahoo bought Tumblr.

One estimation (though this is with a grain of salt) said that Twitter is three months from defaulting on its loans taken out to buy the site. Those loans were secured with Tesla stock. Meaning the bank will seize that stock and, since it won't be enough to pay the debt (since it's worth around 50-75% of what it was at the time of the loan), they can start seizing personal assets of Elon Musk including the Twitter company itself and his interest in SpaceX.

Sesame Street's official accounts mocked the rebranding.

158K notes

·

View notes

Text

Zettai BL Ni Naru Sekai VS Zettai BL Ni Naritakunai Otoko 2024 - Episode 2 Eng Sub

VS SMELLS and VS AGE GAP RELATIONSHIPS

For downloading instructions and where to find the raw files please check our masterpost

Subs link

We ask that you not upload our subs to streaming sites.

Sharing with friends is fine. We’re also OK with folks sharing them in other ways as long as they aren’t public. Please use discretion when talking about the fansub outside of tumblr, but don’t hesitate to get the word out in other ways, and feel free to promote it here. Please credit ikeoji-subs whenever possible--we put a lot of time and effort into this.

Feel free to use the fansub for fandom purposes. Gif-making, meta-writing, and other fandom-related creative endeavors made using our fansub are not only welcome but encouraged.

translation notes:

about Fish Cake Man (7:28)

As we state in the subtitles, this guy’s monologue isn’t something we’re equipped to translate and if we did, it probably wouldn’t make much, if any, sense to English-speaking viewers. We learned from Snow’s Japanese friend that he's a comedian who is famous for doing this particular bit. After we had already finished most of the subtitles, I rewatched seasons 1 and 2 of the show and found that he was also in the other two seasons. In the first season, when Mob is explaining about how he's a side character and intends to keep it that way, he looks at a gardener on his university campus who is pulling weeds, illustrating that the world of BL needs to include some people who are unlikely to ever become main characters. That’s this dude. He appears again in season 2, when Mob is scouring the university for signs of Kikuchi after reading his goodbye letter. In every appearance, he's shown wearing the same sort of nondescript work clothes and cap and seems to work in some kind of maintenance or cleaning capacity at National BL University. –Towel

His name is Nou Misoo (脳みそ夫) which means brain tissue. I believe there's a pun here I'm missing but you can check our his sillyness on youtube, instagram or tiktok. –Snow

about “the gods decided to smite me” (10:24)

The first version of this line said that Mob “received divine punishment” for his Mob Move. That was already a great line! But I thought it had the potential to be a little more specific and evocative in an English-speaking context. At first, I was just trying to think of something a bit more specific to replace “received.” I thought of a few possibilities, including “I was smitten by divine punishment.” But since “smitten” is barely used anymore except to describe someone who's in love, it had the wrong connotation. Then I thought about how another tense of the same verb, “smite,” avoids those connotations and has a kind of King James Bible quality. But if I was going to say “smite,” I’d have to change the sentence from passive voice to active voice (which is generally best anyway) and give the sentence a subject who is doing the smiting.

I thought a unitary, capital-G God would make it sound a little too Biblical, possibly tipping it over into sounding overtly Christian. I knew that some religious traditions practiced in Japan, like Shintoism, included multiple gods. So I tried “the gods decided to smite me.” This seemed to balance out the Old Testament-ish aspect of “smite” a bit. The end result seemed more vivid than the earlier version, and it seemed like something Mob would say.–Towel

about “select shop” (11:30)

Observant English speakers might notice that when the guy who used the same shampoo as Mob talks about where he got it, he uses a term made up of English loan words. He says he bought it at a “serekuto shoppu" (in English, a "select shop"). While both parts of the word are borrowed from English, the term you get when you put them together isn’t commonly used in the US. I ended up replacing it with “boutique,” which gets across some of the meaning. But I’ll explain in more detail here.

It turns out that a “select shop” is a kind of smallish shop with carefully curated items that all fit a certain aesthetic. A business like this might be called a “lifestyle boutique” in America, but it’s slightly different from any business model used widely here. The big selling point of a shop like this is the fact that they’ve already vetted and coordinated these products. Their offerings are tailored for a particular niche, so that if you’re into the general idea a select shop is going for, you’re likely to be interested in a lot of what they’re selling. The items for sale will also have been hand-picked by a professional who’s able to find just the right thing in a way that a typical consumer wouldn’t be able to.

You can imagine what kind of college student would not only shop at this sort of place but declare it proudly. Even if Mob was going to fall in L with a B, this guy would be a bad fit.–Towel

about “a listless ne’er-do-well” (19:04)

The more literal translation of this part goes “a man like this, without ambitions or vitality.” It’s a nice turn of phrase, definitely, but I thought if I could localize it a bit it might evoke more of the right feeling. I thought it would be more typical in English to express this in terms of an adjective plus a noun describing the kind of person he’d appear to be, rather than saying he was without these qualities. From “without ambition” I got “ne’er-do-well” and from “without vitality” I got “listless.”–Towel

Tag list: @absolutebl @bengiyo @c1nto @come-back-serotonin @lurkingshan @my-rose-tinted-glasses @porridgefeast @sorry-bonebag @twig-tea @wen-kexing-apologist

#zettai bl#zettai bl 3#zettai bl season 3#zettai bl 2024#zettai bl ni naru sekai vs zettai bl ni naritakunai otoko#a man who defies the world of bl#translation notes

85 notes

·

View notes

Note

Would it make more sense to contribute money to my employers 401k to max out the match contribution or to instead just contribute a small amount and use the rest to pay off high interest debt or building an emergency savings (I have like 1.5 months worth of expenses saved and… $30k of credit card debt….). I was unemployed for a long time but now have a stable salaried job where I make enough to cover my expenses (credit card minimums, loans, groceries, rent, etc) and have a little left over that I divvy up between small treats (a movie ticket, a nice pastry, thrifted clothes), donation posts, and like an extra $50 credit card payment and I’m not fully sure the optimal way to use that small amount of money. I do need a small treat from time to time to not lose it (and socializing often costs money even if it’s a cheap activity) but maybe it’s better saving on getting a $10 movie ticket each month to potentially pay off my debt like a month faster a couple years from now? how do I create financial security without feeling like I’m putting my life on a depressing pause for a debt free future that won’t happen for a couple years (assuming I make the same money and don’t incur additional expenses)?

Yeah, you've hit on a really important piece here, which is motivation and long-term resolve. The Mr Money Mustaches of the world talk up the importance of stoicism and shit and preach reducing living expenses, but it's equally important to keep in mind what actively gives you enough hope, pleasure, and reinforcement to keep you going.

Cutting back on expensive nights out is one thing; removing all joy and socialization from your life and therefore nerfing your long-term ability to remain employed and earning is another matter entirely. Enjoy those movie nights out. Supplement with having friends over to stream something on your laptop and eat snacks, free museum days, you know, do lots of cheap shit in addition to the little treats, but dont deny yourself the treats. those arent extravagances, that's being ALIVE! and the only reason we aspire toward financial independence is so that we can live life as we wish to, rather than being owned by an employer.

Employer matches are pretty much a guaranteed double on your money, which is better than even paying off a loan in terms of earning potential. so I'd recommend socking away that 5% from your paycheck automatically, so that you never even have to think about it, and then budgeting any remaining expendable income on knocking out that credit card debt.

30k is enough to really hurt, especially with interest over time, but not so great that knocking it out is impossible. you can do this! make sure in particular to focus any unexpected income on paying down that debt. birthday money, tax returns, perhaps filling out some class action forms online, any little bit helps -- you may want to check out the Snowball Debt Repayment method, in particular, as a lot of people find it more motivating to have a few shorter-term goals. (Basically, if you have multiple credit card debts, focus on paying off the smallest one first, so you'll get the rush of having vanquished at least one beast).

Good luck!!

21 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

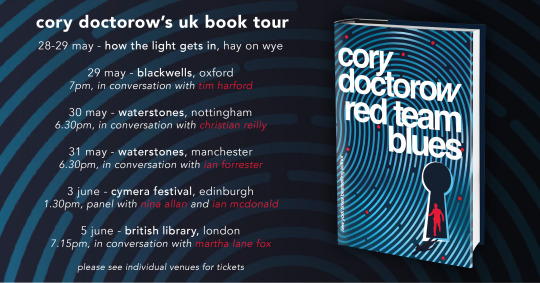

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Short Term Loans UK: Quick Cash Assistance Based on Your Needs

You are seeking immediate financial assistance to address unforeseen bills. Short term loans UK, which are designed to help customers with an any card, are the most profitable alternative. Because of this, they have no trouble getting financial aid in the modern era.

The most convenient aspect is that the borrower may easily obtain funds in the range of £100 to £2500 without providing the lender with any security. The payback time is also quite easy, as it is paid back in 2-4 weeks. It is explained that you can obtain the money without pledging the lender any kind of collateral.

You can use the short term loans UK direct lender for a variety of short-term needs, including utility bills, loan installments, rent, medical bills, auto repairs, outstanding bank overdrafts, and many more, as there are no restrictions on how you can use the funds.

There are very basic requirements that you must meet, such as being employed full-time for the past few months, being at least eighteen years old, earning at least £750 per month, and having an active bank account. You can then apply for short term loans UK without having to go through a credit check process and without needing an any card. As a result, you are eligible to get financial aid because of defaults, arrears, foreclosure, missing payments, CCJs, IVAs, or bankruptcy.

All Set to Apply For Short Term Cash That Is Easy To Receive and Quick to Obtain

Within a few minutes, we can assist you in resolving your financial dilemma. We recognize the urgency you have. Our goal is to expedite the process of obtaining short term loans UK direct lender. Instead of magic, it is a conglomeration of small, priceless actions. We disagree with needless procedure elaboration. Our procedures and the ones we would urge you to follow make this clear.

We work hard to identify our borrowers' common problems. Following that, we tailor an offer to fit their circumstances. In contrast to conventional lenders, we will never offer generic lending solutions to address every kind of financial issue. Without hesitation, you may rely on our services if you want to obtain short term loans UK direct lender from one of the most reputable lenders UK. We strive to provide our borrowers with the finest possible service every single day. The only goal we have is to design a loan product that fits our borrowers' budget. You may occasionally lose your peace of mind due to a minor financial necessity. In the UK, you can obtain a little quantity of short term cash loans to alleviate this kind of financial difficulty.

How is Short Term Cash Loan applications evaluated?

We consider the unique conditions when analyzing each application. We do a few tests to help us determine whether you are affordable. It will determine whether you are able to repay the short term loans UK direct lender amount.

Will it take too long for us to respond?

Not at all. We act quickly. It doesn't take long for us to process. We start by confirming a few crucial elements that don't take a lot of time. You should anticipate hearing back from us shortly.

https://classicquid.co.uk/

#short term cash loans#short term loans for bad credit#short term loans uk direct lender#short term cash#same day loans online#short term loans uk#fast payday loans online

4 notes

·

View notes

Text

I know it's pretty unhelpful to offer unsolicited advice to donation posts but for those in the US who are going through a hard time I do want to at least make sure people know some options they may have available to them that have helped me and friends out over the year.

Call everyone you pay bills to and ask about hardship plans or assistance options. Try and avoid any long term reduced payment plans but short term are generally fine. One or two month deferments are fine too. If it's a long term (1+ years) sudden situation then ask about settlement options. It's not the best for your credit but it's better than late payment reports ending up in a charge off.

Do not use a DSC unless you have a lot of stuff in collections/different accounts to pay and don't have the time or energy to deal with them yourself. Dsc's charge you to settle on accounts usually one by one as accounts fall more and more delinquent. You can do that yourself. If it's already charged off save it for later

Don't wait until savings are gone to ask for these assistance options. The minute you don't have income reduce your expenses as much as possible.

Unless it is an expense you are 95% you can pay off without issue do not take out a loan

Apply for unemployment the same day you lose a job and keep up with the paperwork. I've lost out on potential unemployment earnings 3 different times because of how confused I get from it so don't be afraid to call and ask for help or explanations.

Car auctions can be your friend for a vehicle . Police auctions are not great but see if there are any other auctions nearby and you can generally get a car for the same price as a down payment. If you have car knowledge great if not try and bring someone that does. Even if you don't check that it starts, pop the hood and make sure nothing's missing, and look up the car model for common issues.

Need a job fast and can't stand fast food? Call centers are always hiring. Like any job they do suck and some are worse than others but they tend to pay more than minimum wage and they're not physically demanding if that's an issue. Also try storage facilities as they tend to have benefits and may provide housing or at least a discount on a storage unit if your living situation demands one.

This isn't important financially but it's something that affected me for a long time. But if you're feeling lonely and looking for a community or even just someone to connect with then do participate in book clubs, low cost classes or social events, strike up conversation with others at the parades, bars/clubs, library, store wherever. Even if it's just a connection in passing it will enrich you. And if you don't put yourself out there those connections will be harder to come by.

Therapy isn't cheap and journaling isn't a replacement but it can cost less than 2 dollars and it at least helps to get the thoughts and feelings out somewhere.

Goodwill sucks. Look for smaller donation shops a lot of them do actual community outreach.

That's all I got and this is not a list of cure all solutions that will work for everyone or solve problems 100%. These are just things that have either helped me in the past or I wish I would've done differently. There's a lot of tips out there and it sucks to live in survival mode like that but always choose what's best for you.

6 notes

·

View notes

Text

Top Sales Strategies for Banking Professionals

In the highly competitive world of banking, sales professionals need to go beyond basic customer service. They must master the art of selling a variety of financial products—from loans and credit cards to investment opportunities and wealth management services. For banking professionals, having a well-rounded skill set and using proven sales strategies can be the key to boosting performance, meeting targets, and building lasting customer relationships.

Sales strategies for banking professionals differ from other industries because financial services are complex, often involve long-term commitments, and require a high level of trust. Therefore, a specialized approach is necessary to be successful in this field. In this blog, we’ll dive into the top sales strategies for banking professionals and how a well-structured sales training program for banking can elevate your performance and help you reach your sales goals.

1. Understand Your Customer's Financial Goals

One of the most important aspects of banking sales is understanding the financial goals and needs of your customers. Banking is a trust-based business, and clients expect their financial service providers to offer personalized solutions rather than a cookie-cutter approach. To succeed in selling financial products, you need to know what matters most to your customers.

Are they looking to invest in their future, save for a large purchase, or secure a loan for a business venture? The more information you gather about their financial goals, the better you can tailor your sales pitch to offer products that align with their needs.

How to Apply This Strategy:

Ask questions: During your initial interactions, ask open-ended questions that allow customers to share their financial aspirations. This will help you identify the most relevant products.

Active listening: Make sure you listen closely to their responses so you can offer products that truly fit their situation.

Personalization: Use the information you gather to tailor your recommendations to their unique financial situation. Personalization builds trust and makes your pitch more compelling.

2. Build Trust and Long-Term Relationships

Trust is the foundation of banking. Clients need to know they can rely on you for their financial well-being, and they often prefer to work with someone they have a strong relationship with. Building trust takes time, but it pays off in the long run, as clients who trust you are more likely to come back for repeat business and refer you to others.

Sales in banking are not transactional but relationship-based. This means that even if you don’t close the deal right away, building rapport and demonstrating your reliability can lead to sales in the future.

How to Apply This Strategy:

Transparency: Be open and honest about all the products, fees, and terms you’re offering. Clients value transparency and are more likely to trust you if they feel you’re being upfront.

Follow-up: Regularly check in with your clients, even when you’re not actively selling to them. This keeps the relationship warm and builds trust over time.

Deliver on promises: Always do what you say you will, whether it’s a follow-up call, more information, or simply checking in after they’ve purchased a product. Consistency builds credibility.

3. Leverage Cross-Selling and Upselling Opportunities

In the banking industry, many products are interrelated. For example, a customer who opens a checking account may also need a savings account or a credit card. Learning how to cross-sell (offering additional complementary products) and upsell (offering more premium products) can help you maximize the value of each client relationship.

Cross-selling and upselling should be done thoughtfully. It’s not about pushing more products—it’s about offering additional value to the customer. By genuinely identifying their needs, you can provide them with products that improve their financial situation.

How to Apply This Strategy:

Identify opportunities: During your conversations with clients, listen for cues that indicate they might need additional products or services. For example, if a client mentions saving for retirement, you might suggest a retirement savings plan or investment account.

Be strategic: Offer products that genuinely benefit the customer. Avoid overwhelming them with too many choices; instead, present the most relevant products based on their needs.

Educate your clients: Some clients may not be aware of all the products available to them. Educate them on the benefits of complementary products without pressuring them to make a decision on the spot.

4. Provide Exceptional Customer Service

Great customer service is essential in banking sales. Financial decisions are often complex, and customers want to feel supported throughout the process. Providing excellent customer service can differentiate you from your competitors and increase customer loyalty. A satisfied customer is more likely to recommend your services to friends and family, leading to additional sales opportunities.

Service doesn’t stop at the point of sale; it continues after the transaction is complete. Being proactive about following up and making sure customers are happy with their purchases can set you apart from others.

How to Apply This Strategy:

Be responsive: Answer inquiries promptly and provide thorough information when needed. Slow responses can cost you a sale.

Solve problems: When issues arise, be proactive about resolving them quickly and professionally. This shows that you care about your clients’ experience.

Stay connected: After completing a sale, follow up with clients to ensure they are satisfied and see if there are any other ways you can assist them.

5. Master Product Knowledge

As a banking professional, you need to have a deep understanding of the products and services you offer. Clients rely on you to guide them through complex financial decisions, and your expertise can make all the difference. Knowing your products inside and out allows you to confidently answer questions, provide recommendations, and present solutions that align with your clients’ financial goals.

When you have strong product knowledge, it also helps you feel more confident during sales conversations, which in turn makes your clients more comfortable and likely to trust your recommendations.

How to Apply This Strategy:

Stay updated: The financial industry is always evolving. Make it a priority to stay informed about new products, services, and regulations.

Know the competition: Understand how your bank’s products compare to competitors. This will help you highlight the unique benefits of what you’re offering.

Simplify explanations: Banking products can be complex. Break down the information in a way that’s easy for your clients to understand, using simple language and clear examples.

6. Utilize Digital Tools and Technology

The digital age has revolutionized how banking professionals can engage with clients and make sales. Using digital tools like CRM systems, email marketing, and even social media can help you manage client relationships more effectively and streamline your sales process. These tools can also provide valuable insights into client behavior and preferences, allowing you to personalize your sales approach even further.

Incorporating digital platforms into your sales strategy can also help you reach a wider audience and provide customers with convenient, online service options, making the sales process smoother and faster.

How to Apply This Strategy:

Use CRM tools: Customer Relationship Management (CRM) systems can help you keep track of client interactions, preferences, and important follow-up dates. This ensures that no lead or client slips through the cracks.

Embrace online banking services: Show clients how they can use digital banking services to manage their accounts, investments, or loans. This enhances their experience and keeps you relevant in the digital age.

Leverage data analytics: Use available data to gain insights into client behavior, helping you anticipate their needs and offer tailored solutions.

7. Enroll in a Sales Training Program for Banking Professionals

Finally, enrolling in a specialized sales training program for banking professionals can help you hone your skills, learn new strategies, and stay competitive in the ever-changing financial landscape. Sales training programs designed specifically for banking can provide valuable insights into client psychology, regulatory changes, and effective selling techniques for financial products.

A sales training program for banking can offer role-playing exercises, real-world case studies, and practical applications that help you improve your sales performance. Additionally, it can equip you with tools and knowledge that are directly applicable to the challenges you face as a banking professional.

How to Apply This Strategy:

Choose a specialized program: Look for a sales training program that focuses specifically on the financial services industry, as these programs will offer insights relevant to your field.

Stay committed to learning: Even if you’re already successful in sales, ongoing education is important. The financial world is constantly evolving, and continuing your training ensures you stay ahead of the curve.

Practice what you learn: After completing a training program, implement the new techniques you’ve learned in your day-to-day sales activities. Consistent practice will help you master these skills.

Conclusion

For banking professionals, having the right sales strategies in place is crucial to achieving success in a competitive industry. By understanding your customer’s needs, building trust, leveraging cross-selling opportunities, and continually improving your skills through sales training programs for banking you can enhance your sales performance and deliver exceptional results. Focus on personalizing your approach, mastering product knowledge, and using digital tools to stay ahead of the curve. By applying these top sales strategies, you’ll be well-equipped to navigate the dynamic world of banking sales.

2 notes

·

View notes

Text

Millennials Money Tips for Personal Finance

It is very difficult for millennials to manage their own finances today as the world of competition requiring one to workout harder has changed in a matter of months. From student loan debt to increasing living costs, this generation has faced financial struggles that are all its own. Nevertheless, there are strategies out there that can work for the millennial in search of sustainable financial security or even just a better bottom line. Below are a few of the basic personal finance tips for millennials.

1. Set Clear Financial Goals

The first step in any financial plan is establishing specific and attainable goals. Whether it's to buy a home, pay off your student loans, or save for retirement — knowing what you're working towards will keep you more engaged and inspired. Divide your goals into short-term (one to two years), medium-term (three to five years) and long-(five or more). This approach helps you to prioritize and use your resources accordingly.

2. Create and Stick to a Budget

The Facet of Financial Management: Budgeting Track your income and expenses: The very first step is to track how much you are earning, after that what things consume your bills? Budgeting tools; you may use an app to categorize what you spend on and where they can be reduced. If possible, adhere to the 50/30/20 rule — apportion half of your funds towards needs and twenty percent for saving or repaying debt.

3. Build an Emergency Fund

It is only a rainy day fund to act as an emergency safety net in case life decides not to follow your plan. The hopefully three to six months of absolute must-have sequestered in a separate, liquid account. It can help you with the cost of surprising expenses–whether they be medical bills or it lets you maintain your financial schedule, rather than having a huge hole in it due to car repairs.

4. Manage Debt Wisely

For many millennials, student loan debt can be a large financial weight. Start your payoff journey with high-interest debt — credit card balances are a solid place to begin. Refinance or consolidate student loans at a lower interest rate. Establish and Maintain a HISTORY of consistent on-time payments to improve your credit score, reducing overall debt.

5. Invest for the Future

If you want to create wealth then investment is the most important thing for it. If your employer offers a matching 401(k) plan, that is what you should start with. Demand more investment options like IRAs, Stocks and Mutual Funds. Simply Diversify A toasted way to diversification! The point is that, your money should earning with compounding.

6. Enhance Financial Literacy

One can be really good at making informed decision which is backed by financial literacy. Use online sources, books and courses to learn more about personal finance. Understanding concepts such as interest rates, inflation and investment options can help you make more informed financial decisions.

7. Plan for Retirement

Architecting retirement: It is never too early to plan for retirement. Save a minimum of 15% of your income toward retirement. Make use of Roth IRAs and traditional IRA tax-advantaged accounts. You may want to talk with a financial advisor who can help you put together your own retirement plan based on what you hope for in retirement and how much risk you are willing to take.

8. Protect Your Assets

But while it may not be the sexiest asset class around, insurance is integral to any complete financial plan. Make sure of health, auto and and home insurance coverage. Good idea: If you have dependents, consider life insurance. Disability insurance provides you income in the event of an illness or injury.

9. Check Your Credit Score

Great credit can unlock lower-interest rates and financial possibilities. Review your credit report on a regular basis for inaccuracies and work towards building up the score. By paying your bills on time, keeping credit card balances low and only opening new accounts when you need them (and therefore improved scores so long as other key factors don't weigh in ).

10. Seek Professional Advice

If you are unsure of where to begin or need help, then speak with a financial advisor. They can give you advice and even consult with you to build a financial plan as well. Also look for a good pedigree — Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

With these personal finance tips, a millennial can move forward in the financial journey feeling more secure for their future. Earning money is only part of the process… its mastering discipline, consistency and continuous learning that leads to long-term financial success.

#millionaire#millionarelifestyle#investing#investment#personal finance#startup#business#entrepreneur#economy#mindset#luxury#luxurious

3 notes

·

View notes

Text

I’m 10,000 dollars in debt so moving forward I’m going to be posting about my journey to becoming debt free with 850 credit score . Also , about having a Huge savings account.

Here are some essential skills to help me and you if you are going through this to achieve this goal:

1. Budgeting: Create a realistic budget that accounts for every dollar spent.

2. Debt Snowball: Prioritize debts by focusing on the smallest balance first.

3. Debt Avalanche: Prioritize debts by focusing on the highest interest rate first.

4. Expense Tracking: Monitor and record every expense to identify areas for reduction.

5. Savings: Build an emergency fund to avoid further debt.

6. Credit Report Analysis: Understand your credit report and dispute errors.

7. Credit Utilization: Keep credit card balances below 30% of the limit.

8. Payment Planning: Make consistent, on-time payments.

9. Interest Rate Negotiation: Contact creditors to negotiate lower rates.

10. Credit Score Monitoring: Regularly check your credit score to track progress.

11. Financial Discipline: Avoid new debt and impulsive purchases.

12. Income Increase: Explore ways to boost income, such as a side hustle or raise.

13. Debt Consolidation: Consider consolidating debt into a lower-interest loan.

14. Credit Card Management: Use credit cards responsibly and pay off balances.

15. Long-term Planning: Set financial goals and develop a plan to achieve them.

Additionally, consider the following strategies to raise your credit score:

1. Pay bills on time (35% of credit score)

2. Keep credit utilization low (30% of credit score)

3. Monitor credit report errors (10% of credit score)

4. Don't open too many new credit accounts (10% of credit score)

5. Build a credit history (15% of credit score)

Remember, paying off debt and improving your credit score takes time and effort. Focus on developing these skills and staying committed to your goals. Paying off $10,000 in debt and raising your credit score to 850 requires discipline, patience, and a solid understanding of personal finance. Stay tuned to see me accomplish this easy goal and save triple that amount in savings

#budget#money#finance#sucessful#rags to riches#850creditscoreclub#bible#god#self care#christianity#jesus#self help#self improvement#becoming that girl#black love#boyfriend#husband#black marriage#motherhood#mother

3 notes

·

View notes

Text

Ditch the Debt, Drive Your Dreams: No Credit Check Van Leasing

Building your business shouldn't be held hostage by credit scores. Enter the world of "no credit check van leasing", a game-changer for entrepreneurs who need a reliable workhorse without the financial hurdles. Forget the stress of loan applications and credit inquiries; this innovative option lets you get behind the wheel and start hustling, regardless of your credit history.

But how does it work? Unlike traditional leasing, which relies heavily on credit scores, these specialized providers take a more holistic approach. They consider your income, business stability, and even alternative credit data to assess your suitability. This means freelancers, startups, and those with limited credit history have a fair shot at securing the van they need.

Here are some key benefits of no credit check van leasing:

1- Faster approval process: Say goodbye to weeks of waiting. With streamlined assessments, you could be driving your new van within days. 2- No credit score impact: Forget the anxiety of credit checks. This option protects your credit history, leaving you free to build it organically. 3- Flexible terms: Choose a lease duration and mileage that suits your needs, from short-term contracts to long-term flexibility. 4- Reduced upfront costs: Skip the hefty down payments. Most no-credit-check leases require minimal upfront investments, freeing up your capital for business growth. 5- Predictable monthly payments: Enjoy fixed installments for the duration of your lease, making budgeting a breeze. 6- Focus on what matters: With a reliable van at your disposal, you can concentrate on what truly drives your business, whether it's client satisfaction or market expansion.

No credit check van leasing isn't a magic bullet, but it's a powerful tool for entrepreneurs who need a boost. Remember, it's crucial to research reputable providers, compare lease terms, and ensure you understand all the associated costs. With careful planning and responsible financial management, you can leverage this option to fuel your business growth without breaking the credit bank.

So, are you ready to ditch the debt and drive your dreams? Explore the world of no credit check van leasing and unlock the freedom to navigate your entrepreneurial journey with confidence.

2 notes

·

View notes

Text

Unlocking Opportunities: How Your Credit Bureau Report Shapes Your Financial Destiny

In the complicated world of personal finance, your credit bureau report is a powerful key to unlocking a plethora of opportunities. Your credit report is a comprehensive dossier that shapes your financial destiny in subtle and profound ways. In this article, we will look at the importance of your credit bureau report and how it affects the opportunities available to you on your financial journey.

Understanding the Blueprint of Financial Health

Your credit bureau report is essentially your financial health blueprint. It contains a comprehensive record of your credit history, payment habits, outstanding debts, and various financial transactions. Lenders, landlords, and even potential employers use this report to assess your financial responsibility and trustworthiness.

Paving the Way for Loans & Credit

Your credit bureau report influences your financial destiny in a variety of ways, including determining your eligibility for loans and lines of credit. A good credit history opens the door to lower interest rates and larger loan amounts. A poor report, on the other hand, may restrict your borrowing options or result in higher interest rates, potentially costing you thousands of dollars over the life of a loan.

Shaping Interest Rates

Your credit score, as determined by your credit bureau report, plays a significant role in determining the interest rates you will be offered. A higher credit score frequently translates into lower interest rates, which can save you money on mortgages, auto loans, and credit cards. This financial benefit can add up to significant savings over time, allowing you to put money towards other important aspects of your life.

Facilitating Housing Opportunities

When it comes to finding a place to live, your credit bureau report can play an important role. Landlords frequently use credit reports to assess the financial validity of potential tenants. A good credit history can mean the difference between getting your dream flat and encountering difficulties during the rental application process.

Influencing Employment Opportunities

Some industries may require credit checks as part of the hiring process. While not always the case, having a good credit history can help you make a good first impression. It reflects your dependability and responsibility, which can influence hiring decisions in competitive job markets.

Negotiating Power in Financial Transactions

Aside from the binary of approval or denial, your credit bureau report has negotiating power. A good credit history allows you to bargain with financiers or lenders. This use can result in better terms, allowing you to retain control over your financial agreements.

Charting a Course for Financial Success

Your credit bureau report is essentially a road map for navigating the complex world of personal finance. Monitoring your report regularly allows you to identify areas for improvement, dispute errors, and manage your credit profile strategically. This proactive approach is critical for charting a path to long-term financial success.

Conclusion

In the grand tapestry of personal finance, your credit bureau report emerges as a critical thread that weaves opportunities into the fabric of your financial destiny. Understanding the significance of this report allows you to reclaim control of your financial narrative, ensuring that doors of opportunity remain open on your path to long-term financial well-being. Regularly engaging with and optimising your credit bureau report is more than just a financial best practice; it is an early step towards unlocking the broad range of opportunities that await you in your financial future.

3 notes

·

View notes

Text

Should I Get Personal Loan During A Period With High Inflation Rate ?

Long-term inflation hikes can be concerning for an individual, and with good reason, even though price increases are partially a reflection of generally positive economic progress. Your personal finances are directly impacted by inflation, which sets spending and budgetary restrictions. However, in the event that you require additional funds, is it prudent to obtain a personal loan at a time of elevated inflation rates?

This blog provides all the information you need to take out a personal loan during a period of high inflation, including how much it will cost, if it makes sense, what the advantages are, and what to watch out for.

Do you need a personal loan?

You should think about whether a loan is the right choice for you and your circumstances before taking out a personal loan. When used wisely, personal loans may be a dependable and practical financial instrument. You should consider how you will repay the loan balance because missing loan payments can negatively impact your credit score and financial stability, making it more difficult for you to obtain financing in the future, should you want to do so.

Even if personal loans are fantastic, you should consider your options carefully before selecting the best course of action in light of rising inflation rates. This includes utilizing a credit card or personal lines of credit, checking your personal savings, and taking out secured loans.

What impact does inflation have on loan rates?

Fixed interest rates are affected by inflation indirectly, and the two are associated even though they don't directly affect each other. The main instrument that central banks use to control inflation is inflation, which explains why. Authorities may increase interest rates in order to discourage borrowing and promote saving if inflation is out of control. The government will, on the other hand, cut interest rates if the economy needs a boost, which will encourage people to borrow more money and increase their spending capacity.

What is the cost of inflation on personal loans?

The interest rate for personal loans is often fixed, meaning that it stays the same over the term of the loan. Your interest rates on personal loans that you took out prior to inflation will remain stable, so inflation won't affect them. But if you're a first-time borrower taking out a loan during inflation, you might have to pay more interest because lending rates are likely to rise.

How do inflation rates benefit borrowers?

Money loses value with time, and as they say, "now is better than later." This is a fundamental principle of inflation. Thus, as a borrower, you will be able to repay lenders with money that is worth less than what you borrowed in the first place if inflation increases.

Should you take out a personal loan during an inflation increase?

It all comes down to your requirements in the end. Food, goods, and other basics of life could cost more than you can afford when inflation strikes. A personal loan might assist you pay for any unforeseen costs that may develop in this situation and solve your cash flow issues. Although you should take into account how long it will take, it is likely that your finances will start to improve and you will be able to pay back the personal loan.

As lending is typically done at a fixed rate, the inflation rate is typically appropriately factored into the loan cost. Your credit score and ability to repay the loan are other elements that affect the cost of the personal loan. Banks will charge you a low interest rate if they believe you have a solid capacity for payback. On the other hand, a high interest rate will apply if your credit score is outstanding. Applications for personal loans may occasionally be denied to borrowers with extremely low credit scores and inadequate ability to repay the loans. That way, when you search for a personal loan, these factors are taken into consideration.

When taking out a personal loan, it's important to consider your needs, your ability to repay the loan, and your other choices.

2 notes

·

View notes

Note

saw you in the notes of some post saying you work in finance. like, no pressure, and i'm not expecting any depth from a tumblr ask, but... do you have any advice for people living paycheck to paycheck other than the classic "make a budget"? (i have already discovered that getting a credit card does not help.)

just wondering if there's anything you've learned from your profession that you wish was better known to the public

https://undebt.it/ is a big help to help pay off debt efficiently undebt it - google search if you don’t like hitting links - I don’t hitting links. I have a super hard time with budgets myself. And credit cards are rough - I get manic and then my budget friendly self can’t keep up with manic me.

Apologies in advance if some of this is like bro - I don’t live a place w these stores - just mentally replace store names with what’s around you.

If your debt has an interest rate under 7%, pay the minimums because a lot of investments will grow at 7% or better (common examples - car loans, most student loans, mortgages, etc.). Typically it’s better to focus on the higher interest loans/debt first. If it’s above 7%, prioritize that. A lot of minimum payments will also never pay off your debt - designed to keep you in it.

If you have a Roth option in your work retirement account, do that. It’s taxed now instead of in retirement - taxes only go up over time. However if you need to reduce your taxable income, then pretax dollars will do that. Only contribute up to the match if it’s not Roth. If it’s pretax, then you usually only want do up to the match. Maximize the free money you can get from your employer.

Always opt into long term disability insurance at work. When you can afford some extra coverage check out supplemental (most employers offer 60% in the US - if you only were paid 60% of your income it would be rough), life insurance is cheap - 200k is a small policy. The company you go with matters. A company like mass mutual or northwestern mutual (I’m at northwestern) gives higher dividends- basically a good chunk of profit goes back to policy holders instead of stockholders. Most companies can run company comparisons. Insurance pays for financial security. It’s not a scam - which is genuinely what I thought of it before I got into the field and understood it better.

Whole life insurance costs more - but it’s worth it. It’s like buying your insurance instead of renting. Again company matters - example: northwestern mutual cash value grows historically at 5% on average, give or take, usually give. It’s money you can use to collateralize a loan or take a loan out against your own policy and “be your own bank” - downside, if finances are unstable, it’s a policy with regular premiums. Unlike a Roth you can stop contributing to any time, you’re paying for coverage and it’s monthly or whatever interval without much for exceptions. Probably not a good fit for you right now with being paycheck to paycheck - but something to keep in mind for the future.

Some of my hacks for my own life and my tight budget - I get most of my stuff off of Facebook marketplace for free or cheap - if you search something for a week or two and save the cheap items eventually they’ll appear for free or less and less. You just gotta be quick to ask and pick up. I picked up a stand alone pantry cabinet yesterday for free so now I have more storage space for non-perishables. Also if you just always keep free and “curb alert” as a regular search item you’ll find good stuff. I’ve picked up some things that I know have value near me - like fish tanks with stands only to resell them later at market value which is higher because I’m in a city/suburban outskirts - I only deal in cash on Facebook because they wanna start tracking and people can’t rescind a $20 electronically.

There are food shelves that don’t require minimums. There’s also no shame in seeing if you can get assistance from the government. If you can boost yourself to live better, do it.

The dollar tree (and some other dollar stores) - while most food at the dollar tree isn’t a good deal - I’ve also found shelf stable tofu, pesto, mustard (1.25 vs $5 for pesto). I also have pets - my cats get their toys on a stick with the dangly strings from the dollar tree. I get all of my cleaning products at the dollar tree. You can also make your own - one super simple one is lemon juice (from bottle), white vinegar, and water.

I shop at specific places for specific items. I get carbon litter box filters at my hardware store because they’re a dollar there instead of $5-7 elsewhere.

I order my groceries online - it’s convenient but it also eliminates a lot of impulse shopping. I pay $10/month for it, but I save more than $10 in not impulse buying.

I mostly avoid target - target has done research on how to get you to buy more - it works. So I avoid it. Not that other stores don’t do similarly, but I know that I will fail myself at target - sort of a figure out your vices.

I shop at discount grocery stores. I got to Asian grocery stores for tea because I get way more tea for way less. I go to Aldi for most of my vegetarian foods and also their chicken. Most of their stuff is a fair bit cheaper and I’ve figured out which off brand or Aldi brand stuff I like.

I work in a super fancy office - think of a building with literal halls with marble tile. I get 99% of my clothes from thrift stores. I’m picky - I try to buy only things that I feel good in (not I feel okay, but I feel good) and I have a hard time pushing myself over $10 for almost anything. I dress with a classic style because then I don’t have to chase trends. I mostly just wear black pants and a shirt that looks business casual.

Garage sale - I spent a Saturday driving around the town I grew up in going to garage sales. Saturdays are usually the last day sales are open - they want stuff gone as the reality sets in that whatever isn’t sold is being donated. I filled a paper grocery bag full of clothing for my spouse and paid $1. I’ve hit sales where the person just wanted to be done and said just take everything you want, free. I haggle. I ask if they’d do a deal for a bunch of stuff if it’s a good sale. If there’s something I’m looking for or need - I know the value of the item before I go shopping and I know the value of it to me. I wanted a giant bean bag chair. I valued that at a maximum of $20. The going Facebook marketplace was $50-150. I held out and got one for $7 at a thrift store.

Sign up for VIP stuff at thrift stores and reward programs (assuming it’s free). Don’t buy most holiday decor new - thrift stores can barely sell a christmas tree.

Home Depot and many hardware stores offer free how-to classes - you want to learn how to lay tile? Sign up for a class. Learn to diy what you’re comfortable doing. Some labor and know how is worth paying for. Example: I will not lay tile because I can live with a crooked tile if someone else did it. I can’t if I did it. For my sanity, I would pay for that. Minding - I need that done currently and can’t afford it so it’s just not on the reality list.

Grow some of your own food if you can. Grow lights can be cheap and seeds are cheap. Sometimes you can split a pack with a friend. You can also get free pots and gardening materials online easily. Maybe not the seeds tho. If you hate gardening then don’t bother. What you want matters too.

When you buy stuff - make sure you love it when you can. Stuff you love, you will keep and use. Stuff you feel so-so about might end up being donated next year.

Utilize libraries! They have e-books also and there are so many free apps you can download to read them on. If I’m only gonna read a book once, then I shouldn’t own it. Reality is - I don’t reread that many books. Too many more books to read.

If you’re into cold brew coffee - dark roast Walmart makes just as good as a fancy brand that costs more. Try off brand stuff - it’s often way better or exactly the same. Walmart chips ahoy offbrand is better than chips ahoy. ALDIs version of coconut caramel Girl Scout chocolate cookies taste the same as Girl Scout ones but cost under $2.

Find hobbies that don’t cost you money or cost you very little money. Aquarium fish are not that hobby as I’ve learned the hard way. But I have a beautiful dr who tank so at least there’s that. I volunteered for a while with shelter cats - the ones that are in pet stores. I got kitty snuggles and got to put it on my resume. Can’t afford a pet but want one? Foster - the shelter pays for everything. One of my new hobbies is literally finding free things on Facebook marketplace. It’s great.

If you’re on meds and insurance isn’t covering everything - check out goodrx. Also - check different pharmacies and keep checking. CVS wanted $300 for 1 month of my depression meds. I walked away w/o meds. I went to Costco a week later (no membership needed for specifically their pharmacy) and got those same meds for maybe $10 without insurance.

YouTube can also teach you neat skills. Tumblr can too - I got really into tiny homes - still love them but I can’t ethically keep a Great Dane mix and all my cats in a tiny space - a big part of tiny homes is making sure you have what you need but you have it smart. I gleaned a lot from that obsession. How to have a full wardrobe w 30 pieces of clothing but still variety? It showed it. Most tiny home people are about financial freedom - a lot of them perhaps don’t have a financial background, but it’s about gathering info that works for you.

If you have kids - I do not - but I have a niece. So much free stuff from other people. I think I gave my sister in law about the first years worth of clothing for her kid and it mostly cost me some laundry soap and time with marketplace and stopping for bags of free kids clothes on the side of the road (that I then picked through, washed, and donated the iffy ones). I even got a bouncer thingy that I took apart and cleaned and gave her. Plus a stroller for my mother in law - one of those $300 ones that someone just wanted gone at no cost.

I’ve got home owner savings tricks too if you need them - but let’s be honest, few of us can afford homes. I have one in a super sketchy area that has shot spotter tech to help police respond faster to gunfire. But honestly just lucked out and fell into the job I have now.

Buy quality when you can - I got clearance Clark’s brand shoes for my job - I think they cost me $40? They’ve lasted years. I got thrift store shoes and they are falling apart in less than a year. Those same thrift store shoes during the 5 years that I’ve had my clearance Clark’s would have cost more to replace that 5x over.

Make sure you’re taking care of yourself - eat enough, sleep enough. Your health will affect how you work and live - you matter. I do premier protein shakes in the morning so I get enough protein and also account for my inability to wake up with enough time to make food. I try to bring my lunch to work. Peanut butter sandwiches are a big go-to for me. I’m rather sick of them, but for now, it helps me to save a bit and prioritize things that are more important to me.

I’m trying to think of other stuff. I mean maybe you’re already doing a big load of this or have even cut some of these expenses out. I’ve got more pet saving tricks - pets are something in life that bring me so much joy and happiness so I have them and I try to be responsible and smart with spending on them - but maybe you don’t have pets or don’t want them. I love video games so I have a few systems - mainly PC. I wait for sales for games. I still buy things that are discretionary. I buy “what I want” when I can but I try to make sure it really is something that I want. I wait for game reviews to come out.

I try to find easy recipes online with a focus on budget friendly and quick to make. Preferably with leftovers to avoid a peanut butter sandwich for a day or two. I’m in a Facebook group called “what broke vegans eat.” I go to a butcher to get ground beef because it costs the same but has less gristle and they can give me tips on making different things. Plus I can occasionally splurge on something simple - they have the best in house take home and bake lasagna which last me at least 4-5 days between my spouse and I.

What field are you job-wise? What field or kind of work would you want to be in if you could choose? What kind of hours would you prefer to work? Education level? Are you in the US? Might have some tips around that too. Is there an area you want advice on - like X costs so much, what tips do you have for cost savings with that, etc.

So happy to help. Sorry for the novel.

2 notes

·

View notes

Text

Quick Way to Get Hassle-Free Cash Assistance with Short Term Loans UK

Have you married in the event of an unplanned financial crisis? Would you like to swiftly get out of this mess? You can apply for short term loans UK and get financial relief from your bad financial problems. One of the best things about short term cash is that you can use the credit to help you get through some emergencies quickly. Taking everything into account, all compensation categorized people are eligible for these credits, including those without debit cards to present to the loan specialist.

You must fulfill all of the qualifying requirements given below in order to apply for a short term loan. It is recommended that you be at least 18 years old. To enable online cash transactions, you ought to have a current checking account. You should have worked for a reputable company for at least the previous six months. You ought to make at least £750 each month in a steady income. You ought to be a permanent resident of the United Kingdom.

You can apply for a sum that varies from £100 to £2500 in the provided short term loans UK. There is a roughly 14-day shift to a 30-day reimbursement residency. Due to the fact that these advances are issued in the moment, there is a slight increase in the loan cost. As such, you are required to return the amount received within the stipulated time frame. The money received through these advances can be used for a variety of financial obligations, such as covering the costs of a child's education, unanticipated medical expenses, market fees, electricity bills, phone bills, unexpected car repairs, small home repairs, Visa duty, buying an occasion package to open, and so on.

Short term loans UK direct lender offer financial benefits without requiring a credit check of your credit history over a considerable period of time. Despite your horrible credit history, which includes liquidation, abandonment, CCJs, defaults, unfulfilled obligations, missed payments, IVA, or even late installments, you can now receive credit.

Easy to acquire and obtain Short Term Loans UK Direct Lender available UK

The repayment terms for short term loans UK direct lender are self-explanatory and range from a few days to less than a year. In comparison to long-term loans, the loan amount is likewise less, but the interest rates are noticeably greater. Short term loans UK direct lender fall under the category of short term cash. These loans are simpler to apply for and acquire because they don't require as much time or effort.

You may now apply particularly for same day loans UK having to leave the comforts of your home or place of business, saving you precious time and effort. Additionally, you can avoid doing time-consuming tasks like faxing old documents, reading a lot of printed material, waiting around for a long time, and so on. Complete a simple online application form by filling out all the necessary fields (full name, address, bank account balance, email address, phone number, age, employment status, etc.). The bank must see the completed form for verification. When the moneylender deposits the amount directly into your bank account in a secure manner, your advance will be confirmed. Therefore, when you need credit most, getting it online is easy and quick.

https://paydayquid.co.uk/

#short term loans uk#same day loans online#short term cash loans#same day loans uk#same day loans#fast cash loans#same day payday loans#short term loans

4 notes

·

View notes

Text

A Complete Guide to Buying and Financing a Crane

New Post has been published on https://www.vikingequipmentfinance.com/a-complete-guide-to-buying-and-financing-a-crane/

A Complete Guide to Buying and Financing a Crane

Buying a crane can be a significant investment, so it’s important to understand the process and make an informed decision. Here is a complete guide to buying and financing a crane:

Determine Your Needs: Before buying a crane, you need to determine the type of crane you need for your current and future projects. There are many types of cranes available, including tower cranes, mobile cranes, crawler cranes, and overhead cranes. Each type of crane has its own advantages and disadvantages, so it’s important to choose the one that is best suited for your short and long term needs.

Choose a Crane Supplier: Once you have determined the type of crane you need, you should choose a reputable supplier. Look for a supplier that has experience in the industry and offers quality cranes. You can ask for referrals from other contractors or search online for reviews and ratings.

Check the Crane’s Condition: Before finalizing the purchase, it’s important to check the crane’s condition thoroughly. You should inspect the crane’s structural integrity, mechanical components, electrical system, and safety features. If possible, you should also test the crane’s performance to ensure it’s in good working condition.

Determine the Total Cost: In addition to the purchase price of the crane, you should also consider the cost of transportation, installation, maintenance, and insurance. These costs can add up quickly, so it’s important to factor them into your budget.

Choose a Financing Option: Once you have determined the total cost of the crane, you should consider your crane financing options. You can choose to pay for the crane in cash, obtain a loan from a bank or financial institution, or lease the crane.

Cash Payment: If you have sufficient cash reserves, you may choose to pay for the crane upfront. This option provides the advantage of avoiding interest payments and owning the crane outright.

Bank Loan: If you don’t have enough cash reserves, you may obtain a loan from a bank or financial institution. The loan amount and interest rate will depend on your credit score, business history, and collateral. You should compare the interest rates and terms of different lenders to choose the one that suits your needs.