#Instant zero balance account open online

Explore tagged Tumblr posts

Photo

Instant zero balance account: Open online with IndusInd Bank

Are you looking for the most convenient way to open an instant zero balance account? Open online within minutes with IndusInd Bank's Indus Delite in just 4 simple steps. Visit the official website to get started.

0 notes

Text

What is POS in debit card? Why it matters?

In recent days, convenience and security in transactions have never been more crucial. This is where POS systems come into play. Mobile banking apps also play a major part in digital transactions. You may swipe your debit card at a retail store or enter your PIN at a restaurant. POS systems are the backbone of modern transactions. But what exactly is POS in a debit card, and why is it so important? Let us explore the details and how they impact your banking experience.

What is POS?

POS stands for Point of Sale. It refers to the location or system where a transaction takes place. When you use your debit card at a checkout counter, the POS system is the technology that processes the payment. It involves a combination of hardware and software. This enables merchants to accept payments from customers easily. This includes card readers, terminals, and the accompanying software that communicates with your bank to authorize and complete the transaction.

How Does POS Work?

When you make a purchase with your debit card, the POS terminal captures your card details and sends them to your bank for authorization. The bank checks your account to ensure you have sufficient funds and whether the transaction is legitimate. If everything is in order, the bank returns an authorization code to the POS system. This will complete the transaction. The entire process usually happens in a matter of seconds. This provides a smooth and quick payment experience.

Why Does POS Matter?

POS systems modernize transactions, making it easy for you to pay for goods and services quickly. With just a swipe or tap, your payment is processed. It will save you time and effort.

Modern POS systems come equipped with advanced security features like encryption and tokenization. This means your card details are protected during the transaction.

Using your debit card with a POS system lets you track your spending. With mobile banking apps, you can check bank balance and review your transaction history.

Many POS systems now integrate with UPI payment apps. This integration allows for smooth transactions between various payment methods and simplifies payment.

POS systems provide a smoother checkout experience. It will improve customer satisfaction. Faster transactions and reliable processing help ensure a positive shopping experience.

The Future of POS Systems

As technologies advance, POS systems are evolving to offer more features. With the rise of mobile payments and digital wallets, the role of POS systems is expanding to include various payment options. Advancements in AI and machine learning are enhancing the security and efficiency of POS systems. These technologies can detect and prevent fraudulent activities. This makes transactions safer and more reliable.

To conclude

Point-of-sale systems are a vital component of the modern payment setting. With the integration of UPI payment apps and the ongoing evolution of technology, POS systems offer enhanced features and improved security. So, next time you swipe your debit card, you will know that the POS system is working diligently behind the scenes to ensure a smooth and secure transaction.

#zero balance bank account open#zero balance account opening#0 account opening bank#bank account opening#open a zero balance account#open zero balance account#banking upi mobile#saving account opening zero balance#0 balance account opening#open new savings account#instant account opening zero balance#zero balance open bank account#bank account with zero balance#online zero balance account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open instant zero balance account#open a zero balance account online#new account opening#instant zero balance account opening#zero account opening online#zero account open online#instant zero balance account opening online#online savings account opening#online zero balance bank account opening#account open 0 balance#instant account opening#open zero balance account online instantly

1 note

·

View note

Text

Effective Tips to Get the Most Out of Your Fixed Deposits

Everyone has dreams and long-term goals. They could be owning a car, taking that dream vacation abroad, or securing our children’s future education. While a savings account might seem like a step toward achieving these goals, it may not be the most effective way to grow your savings. Looking for an alternative option? If so, then a fixed deposit is the right solution. Fixed deposits offer a safe and reliable way to earn higher returns on your savings. But how can you maximize those returns? Let’s explore strategies to help you get the most out of your fixed deposits!

Choose the Right Tenure

Selecting the appropriate tenure for your FD is important to achieving your financial goals. The interest rate on fixed deposits can vary significantly depending on the term. For example, in India, the difference in interest rates between a 1-year FD and a 3-year FD can be as much as 1.5%. Therefore, it is important to align the FD tenure with your financial objectives. If you plan to buy property or land within the next two years, opting for a 5-year term might not be the best choice. Choosing the right tenure ensures that your investments are both accessible and optimized for maximum growth.

Explore Fixed Deposit Laddering

Another effective strategy to enhance your returns is known as fixed deposit laddering. This involves splitting your investment into multiple FDs with varying maturities. By doing so, you can manage your financial needs more flexibly and achieve different goals without having to break your FDs prematurely. For instance, you could divide a lump sum into three portions. Each FD can be aligned with a specific financial goal. This staggered approach allows you to benefit from potentially higher interest rates on longer-term deposits.

Capitalize on Compounding Interest

You can also benefit from compounding interest. Compounding means that the interest you earn is added to your principal, and you then earn interest on this new, larger sum in the subsequent period. To maximize this benefit, consider reinvesting the interest earned along with any additional funds you may have. Over time, the power of compounding can lead to substantial growth in your investment. It provides a significant boost to your returns. The longer you keep your money invested, the more you can take advantage of this compounding effect.

Stay Updated

Interest rates are a key factor in determining the returns on your FD investments. Therefore, staying informed about market conditions and economic trends that could impact these rates is essential. By keeping an eye on interest rate fluctuations, you can time your FD investments to coincide with periods of favorable rates. Additionally, check transaction history, which allows you to track your investment performance and make more informed decisions.

Final Thoughts By applying these strategies, you can optimize your fixed deposit investments and secure the best possible returns. Always check the balance of fixed deposits and stay informed about interest rate trends and economic conditions. You also need to consider your financial goals, risk tolerance, and liquidity requirements before making any investment decisions.

#zero balance bank account open#zero balance account opening#instant saving account#zero balance account open#0 balance account opening#instant account opening zero balance#zero balance open bank account#open online zero balance account#zero balance account saving account#khata kholne wala app#online 0 balance account opening#open a zero balance account online#new account opening#instant zero balance account opening#online zero balance bank account opening#open zero balance account online instantly#zero balance bank account opening online#zero balance bank account online#zero balance account online#zero balance account app#0 balance bank account open online#online savings bank account opening

0 notes

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

Instant Account Opening: A Hassle-Free Way to Manage Your Finances

In today's fast-paced world, managing finances efficiently has become a priority for individuals and businesses alike. The traditional banking process often involves long queues, paperwork, and a lot of hassle. However, with the advent of digital banking, opening a bank account has never been easier. Instant account opening is revolutionizing the way people access banking services, and Digi Khata is at the forefront of this transformation. In this blog, we will explore how instant account opening works, its benefits, and how you can leverage this service for seamless financial management.

The Rise of Instant Account Opening

Gone are the days when opening a bank account required visiting a branch and filling out lengthy forms. With instant account opening, you can now create an account from the comfort of your home or office in just a few minutes. This is made possible by digital platforms like Digi Khata, which streamline the entire process by offering an easy-to-use interface and secure verification methods.

Digi Khata’s instant account opening service allows users to open a bank account quickly, without any hassle. Whether you're an individual looking to manage your personal finances or a business seeking a convenient way to handle transactions, Digi Khata’s platform makes it simple and efficient.

Benefits of Free Digital Account Opening

One of the standout features of Digi Khata’s service is free digital account opening. Unlike traditional banks that may charge account maintenance fees, Digi Khata offers a completely free digital account opening service. Here are some key benefits:

Convenience: You can open an account anytime, anywhere, without the need to visit a physical bank branch.

Cost-Effective: With no hidden charges or fees, Digi Khata ensures that your digital banking experience is both affordable and transparent.

Time-Saving: The process is quick and easy, enabling users to open an account in just a few minutes.

Paperless Process: Everything is handled online, reducing the need for paperwork and manual submissions.

How Instant Account Opening Works

The instant account opening process with Digi Khata is designed to be user-friendly and accessible to everyone. Here’s a step-by-step guide on how you can open an account instantly:

Sign Up: Visit the Digi Khata website or download the app and sign up with your mobile number.

Verify Your Identity: Upload the required documents, such as your Aadhaar card and PAN card, for identity verification.

Account Activation: Once the verification process is complete, your account will be activated immediately, and you’ll have access to all the banking features.

This entire process takes just a few minutes, making it one of the quickest ways to set up a bank account.

Online Kiosk Banking: A New Frontier

For those who prefer an in-person experience, online kiosk banking is another innovative service provided by Digi Khata. Kiosk banking allows users to perform basic banking transactions, such as deposits and withdrawals, through local agents who are authorized by the platform. This service is especially beneficial for individuals in rural areas or those who may not have easy access to a traditional bank branch.

Digi Khata’s online kiosk banking service is designed to bring financial services to the doorstep of every individual, making banking more inclusive and accessible. Whether you're opening an account or conducting a transaction, kiosk banking offers a convenient and secure way to manage your finances.

Digital Vyapar: Simplifying Business Banking

For small businesses and entrepreneurs, Digi Khata’s digital vyapar platform is a game-changer. Digital Vyapar is an all-in-one solution that allows businesses to manage their transactions, invoicing, and payments through a single platform. With instant account opening, businesses can set up their accounts in minutes and start conducting transactions immediately.

Some of the key features of digital vyapar include:

Easy Invoicing: Generate and send invoices to customers with just a few clicks.

Transaction Tracking: Keep track of all your incoming and outgoing payments in real-time.

Seamless Payments: Accept payments through UPI, bank transfers, or other digital methods, ensuring that your business runs smoothly.

Digi Khata’s digital vyapar service simplifies the financial side of running a business, allowing entrepreneurs to focus on growth rather than paperwork.

Create UPI ID Online for Seamless Payments

One of the most convenient features of modern banking is the ability to create UPI ID online. With Digi Khata, you can easily generate your own UPI ID, which can be used for quick and secure transactions. UPI (Unified Payments Interface) is a real-time payment system that enables users to transfer money instantly between bank accounts using a mobile device.

By creating a UPI ID online, you can enjoy the following benefits:

Instant Transactions: Send or receive money within seconds, with no delays.

Secure Payments: UPI is encrypted and secure, ensuring that your transactions are protected.

No Additional Fees: UPI transactions are typically free, making it a cost-effective way to handle payments.

Whether you're making a personal payment or conducting business transactions, Digi Khata’s UPI feature offers a hassle-free solution for managing your finances.

Open Zero Balance Account with Digi Khata

One of the biggest barriers to opening a traditional bank account is the requirement for a minimum balance. However, with Digi Khata, you can open a zero balance account, meaning you are not required to maintain a specific balance to keep your account active.

Some benefits of opening a zero balance account include:

No Minimum Balance Requirement: Enjoy full access to banking services without the pressure of maintaining a minimum balance.

Free Services: Access all the features of your account without worrying about hidden fees.

Instant Account Opening: Get started with your account immediately and begin managing your finances efficiently.

Conclusion: The Future of Banking with Digi Khata

The future of banking lies in digital solutions, and Digi Khata is leading the way with its instant account opening services. Whether you're an individual looking to manage your personal finances or a business owner in need of efficient banking solutions, Digi Khata offers a hassle-free, paperless, and quick way to get started.

With additional services like free digital account opening, online kiosk banking, digital vyapar, the ability to create UPI ID online, and the option to open zero balance accounts, Digi Khata ensures that everyone has access to the financial services they need.

Embrace the future of finance with Digi Khata and experience the convenience of digital banking at your fingertips!

#Instant Account Opening#free digital account opening#online kiosk banking#digital vyapar#create UPI ID online#open zero balance account

0 notes

Text

open zero balance bank account

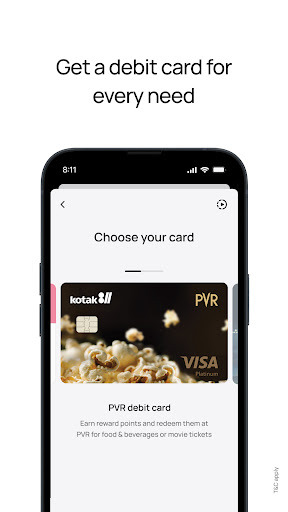

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes

Text

Features of a zero minimum balance account

A savings account with minimum restrictions is a dream for the majority of the working class. You can deposit your funds in a savings account, which is a deposit account service offered by the bank. Typically, banks will provide you with a savings account as long as you keep a certain minimum balance in the account. If not, you'll be required to pay a maintenance fee.

However, some people start Instant Online Bank Account Opening to create an account known as a zero-balance savings account which does not require a minimum amount. Simple in concept, there is no requirement to keep a minimum balance in a savings account in order to maintain this kind of account.

Read some of the features of a zero minimum balance account:

No minimum balance

As its name would suggest, this account requires no minimum balance to be present in it. As a result, you are not required to keep a minimum balance. Therefore, if there is a zero balance, there is no penalty. When people open this kind of account, this is what draws them in the most.

Restricted transactions

The number of transactions you can make each month on zero-balance accounts is restricted. Banks often limit withdrawals to four per month. The bank will turn your account into a standard Savings Account if you do make more withdrawals than are allowed. For these additional transactions, some banks might even impose a small fee.

What are the different types of zero-balance accounts?

Zero-balance savings accounts come in a variety of forms. The three primary forms of zero-balance accounts are digital savings zero-balance accounts, Basic Savings Bank Deposit Accounts, or BSBDA, and BSBDA Small Accounts.

The e-KYC procedure allows for the immediate opening of digital savings accounts online. To open the account, you must have a PAN card and an identification number. In this process, the OTP issued to the registered mobile number is used to verify the biometric information. These accounts initially have some limitations under central bank standards.

Economically challenged people without bank accounts who possess the required KYC documents can open a Basic Savings Bank Deposit Account or BSBDA. This requires zero balance.

Performing Instant Online Bank Account Opening for BSBDA Small accounts can be opened by those without the necessary KYC documentation with the aid of an introducer. Small savings account holders are limited to holding a certain amount. Additionally, consumers have a year to submit the necessary KYC documentation.

A limited number of savings accounts

According to new restrictions issued by central banks, there can only be one zero-balance account at one bank. Additionally, if you have a zero-balance savings account with one bank, you are not permitted to have any other savings accounts with that bank. You must provide a declaration to the bank saying that you do not already have a zero-balance savings account with another bank when you apply for one.

Final thoughts

While having its own benefits, a zero-balance savings account may have an impact on your financial situation. An Account Opening App is helpful if you encounter unanticipated financial situations that require numerous withdrawals. Having a minimum balance in your savings account may therefore be advantageous.

#kotak#kotak811#Instant Online Bank Account Opening#Payment Bank#Digital Account Opening App#Online Bank Accounts Opening#नेट बैंकिंग#नेट बैंकिंग एप्प#Banking App#Money Transfer#Bank Account Check#Online Digital Account Opening#Online Open Bank Account App#Bank Open Account Online#Online Bank Account Opening App Sbi#Digital Account App#Open Saving Account Online#Zero Balance Account Online#Instant Open Bank Account

1 note

·

View note

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below *Adhaar Address Update *Adhaar download *Adaar PVC card apply *Adhaar Update History *Adhaar Card Slot Booking *Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services * New Pan Card Apply *Pan card Corrections *Instant Pan card *Minor Pan Card *Duplicate Pan Card

4.Micro& Mini ATM Services *Cash withdrawal *Fund transfer *Cash Deposit *Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines: 1.Adhaar card photo 2.Pan Card photo 3.Phone number 4.Email Id 5.Live Location to be shared 6.2-4 Sec video Recording by holding adhaar /pan 7.Any other person reference contact number and ID proof 8.bank passbook photo 9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339 Note : Registration fees non Refundable

2 notes

·

View notes

Text

Zerodha Discount Broker Review 2020: Compare Broker Online

Zerodha with a one of a kind name and significance, Zero + rodha (Barrier in English) is developing as the single largest discount broker in India you will see in this zerodha discount broker review 2020. The reason Zerodha turning into the best trading platform in India is expected to giving “the best internet exchanging stage India”, “low brokerage and high presentation”, “free direct shared reserve venture stage” and “effective client assistance.”

In only a limited capacity to focus time (9+ years) Zerodha top the list to become the best stock broker in India as far as dynamic customers. Zerodha contributions & backing is developing step by step.

The principle contributing exercises offered by Zerodha are exchanging value, value F&O, ware, cash on NSE, BSE, MCX and MCX-SX and interest in Direct Mutual Funds through SIP and single amount, ETFs, Government protections, and securities.

Zerodha offers free exchanging value delivery and charges a low brokerage of Rs 20 or .03% whichever is lower for exchanging value Intraday, F&O, cash, and ware.

The Demat administrations provided are of being a DP of CDSL. Furthermore, there is NRI trading facility at Rs 200 or .1% per request whichever is lower for value conveyance and Rs 100 for each request for value F&O.

Zerodha Mutual Fund Investment

This is the first broker in quite a while to offer a Direct Mutual Fund investment facility to its clients for nothing.

In this, you can put resources into direct shared store plots that give you better returns contrasted with customary common reserve plans.

Fundamentally, there is no commission setting off to the brokerage house from your common store speculation.

Zerodha Account Opening Process and 3-in-1 Account

You would instant be able to open records with them. The advantages of 3-in-1 record are offered in tie-up with IDFC First bank in the structure of Zerodha-IDFC FIRST Bank 3-in-1 record.

The business as usual of the record – a solitary record comprehensive of exchanging, DEMAT and financial balance for consistent and bother free web based banking and contributing experience. It has now become the exchanging and self-clearing part to give customers the advantage of no clearing charges. In addition, Zerodha provides cover request and section request (CO/BO) with trailing stop misfortune include for value and F&O best among the top 10 discount brokers in India.

Zerodha Charge/Fee Structure:

Protections Transaction Tax (STT): This is charged distinctly on the sell side for intraday and F&O exchanges. It’s charged on two sides for Delivery exchanges Equity.

Stamp Duty: Charged according to the condition of the customer’s correspondence address.

Merchandise and Enterprises Tax (GST): This is charged at 18% of the complete expense of brokerage in addition to exchange charges.

Different Charges (Zerodha Hidden Fees):

Call and Trade highlight is accessible at an additional expense of ₹50 per call.

Source - https://medium.com/@deepakcomparebroker/zerodha-discount-broker-review-2020-compare-broker-online-2e0b057bef50

Related - https://comparebrokeronline.com/

#best trading platform in india#top stock broker#best stock broker in india#lowest brokerage charges#top share broker#zerodha review

2 notes

·

View notes

Text

Discover Mashreq Neo Bank Accounts in UAE with Soulwallet

Mashreq Neo, the digital-only bank by Mashreq, offers a seamless and modern banking experience for customers in the UAE. With Mashreq Neo bank accounts in UAE, you enjoy the convenience of opening an account within minutes, all through your smartphone. Soulwallet provides a comprehensive overview of Mashreq Neo’s unique features, including zero balance accounts, instant fund transfers, and a user-friendly app. Stay on top of your finances with innovative digital banking solutions tailored to your lifestyle. Discover how Mashreq Neo can simplify your banking experience while offering competitive rates and exclusive benefits, only with Soulwallet. https://soulwallet.com/bank-accounts-online-uae/mashreq-neo-bank-accounts

0 notes

Text

The Role of Credit Cards in Financial Planning and Management

Credit cards, when used wisely, can be a powerful tool in your financial planning and management arsenal. They offer convenience, security, and various benefits that can enhance your financial health. Here's a closer look at how credit cards can play a significant role in managing your finances effectively.

Building and Maintaining a Good Credit Score

One of the primary benefits of using a credit card is the ability to build and maintain a good credit score. Your credit score is a crucial factor that lenders consider when you apply for loans, mortgages, or even certain jobs. By making timely payments and keeping your credit utilization low, you can improve your credit score over time. This not only opens doors to better financial opportunities but also ensures you get favorable terms on future loans and credit products.

Tracking and Managing Expenses

Credit cards offer a convenient way to track your spending. Most credit card issuers provide detailed monthly statements that categorize your expenses. This can help you understand your spending habits, identify areas where you might be overspending, and make necessary adjustments to your budget. Many credit card companies also offer online tools and mobile apps to help you manage your finances more effectively.

Leveraging Rewards and Benefits

Credit cards come with various rewards and benefits that can add significant value to your financial management plan. These rewards can include cashback, travel points, discounts, and more. By using a credit card for your everyday purchases, you can earn rewards that you can redeem for future expenses. This can help you save money and make the most out of your spending.

Emergency Fund Access

Having a credit card provides you with immediate access to funds in case of an emergency. While it's not advisable to rely solely on credit cards for emergencies, they can be a useful backup when your emergency fund is insufficient. Ensure that you use this option sparingly and pay off the balance as quickly as possible to avoid high interest charges.

Managing Cash Flow

Credit cards can help you manage your cash flow more effectively. By using a credit card for your purchases, you can keep your cash in your bank account longer, earning interest or meeting other financial goals. Additionally, if you pay your credit card bill in full each month, you can benefit from the interest-free period provided by most cards, allowing you to manage your finances more flexibly.

Taking Advantage of Online Credit Card Features

Applying for and managing a credit card online has become increasingly convenient. Many banks offer features such as instant approval, easy access to statements, and the ability to track rewards through their online platforms. This can simplify the process of choosing and using a credit card that best fits your financial needs.

Understanding Credit Card Interest Rates

A crucial aspect of financial management with credit cards is understanding the credit card interest rate. Interest rates can significantly impact your finances if you carry a balance on your card. To avoid high interest charges, it's best to pay off your balance in full each month. If that's not possible, try to pay as much as you can to reduce the amount of interest you’ll accrue.

Utilizing Balance Transfer Options

If you're carrying a high-interest balance on one or more credit cards, consider using a balance transfer to consolidate your debt at a lower interest rate. Many credit cards offer promotional balance transfer rates that can help you save money on interest and pay off your debt faster. Be sure to read the terms and conditions carefully, including any fees associated with the transfer.

Planning for Large Purchases

Credit cards can be useful for planning and financing large purchases. Many cards offer zero-interest introductory periods on new purchases, allowing you to pay off big-ticket items over time without incurring additional costs. This can be an effective way to manage your finances and avoid dipping into your savings for large expenses.

Conclusion Incorporating credit cards into your financial planning and management strategy can offer numerous benefits, from building a strong credit score to providing emergency funds and rewards. By understanding the features of your credit card, such as the credit card interest rate, and using online credit card management tools, you can make informed decisions that enhance your financial health. Always remember to use credit cards responsibly to maximize their benefits while avoiding potential pitfalls.

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online 0 balance account opening#online savings account opening#new bank account open#open new bank account online#open saving account#online open saving bank account#open a bank account online free#online saving bank account#0 bank account opening#instant bank account#zero balance account app#opening a bank account#bank account opening process#online savings bank account#bank account opening procedure#bank online account open#zero balance account open online

0 notes

Text

Top Benefits of Creating UPI ID Online for Secure and Fast Transactions

Did you know that UPI transactions in India surpassed 78 billion in 2023? This staggering figure highlights the growing preference for digital payment methods. If you Create UPI ID online that not only simplifies transactions but also enhances security, making it a popular choice for millions.

In this article, we will explore the top benefits of creating a UPI ID online for secure and fast transactions.

Understanding UPI

Unified Payments Interface (UPI) is a revolutionary payment system in India that allows users to link multiple bank accounts to a single mobile application. This platform facilitates instant money transfers, enabling users to send and receive money seamlessly. By using a unique UPI ID, individuals can conduct transactions without needing to remember lengthy bank details, making payments quick and efficient.

Key Benefits of UPI

Instant Transactions: Transfer money in seconds with an instant UPI account, available 24/7 for all your needs.

User-Friendly: Create a UPI ID online and link multiple bank accounts to easily manage your finances from one place.

Enhanced Security: UPI uses two-factor authentication, making it one of the most secure payment methods available.

No Fees: Most UPI transactions come with zero charges, making it a cost-effective way to send or receive payments.

Quick Bill Payments: Automate your bill payments directly through UPI, ensuring you never miss due dates again.

QR Code Convenience: Scan a QR code to pay, making UPI ideal for both businesses and customers.

Digital Vyapar: UPI simplifies business transactions, supporting digital vyapaar with fast, seamless payments for small and large enterprises.

24/7 Accessibility: UPI operates round-the-clock, allowing you to make secure payments anytime, anywhere.

Why Choose Digi Khata for UPI Payments

Digi Khata offers a user-friendly platform for managing UPI transactions, making it an ideal choice for those looking to create UPI ID online. With Digi Khata, users can open instant UPI account with ease, ensuring a seamless payment experience.

Benefits of Using Digi Khata

Free Digital Account Opening: Users can open free digital account online, making it accessible for everyone.

Instant Account Opening: Instant account opening process is quick and efficient, allowing you to start transacting immediately.

Kiosk Banking Service Online: Digi Khata provides a convenient kiosk banking service online, enhancing user experience.

Support for Various Users: Whether you're a student, housewife, or professional, Digi Khata caters to all with tailored digital account solutions.

By choosing Digi Khata, you can effortlessly open an instant UPI account and enjoy the benefits of digital transactions.

How to Create UPI Account with Digi Khata

Download the Digi Khata App: Install the Digi Khata app from the Google Play Store or Apple App Store.

Register with Your Mobile Number: Use the mobile number linked to your bank account to register on the app.

Verify OTP: Enter the One-Time Password (OTP) sent to your mobile number to verify your account.

Link Your Bank Account: Select your bank from the list and link your account with Digi Khata.

Set UPI PIN: Create a secure UPI PIN by entering your debit card details and verifying it with an OTP.

Create Your UPI ID: Customize your UPI ID as per your preference (e.g., yourname@bank).

Start Transacting: Once your UPI account is created, you’re ready to make secure and instant payments!

Conclusion

In today’s fast-paced world, managing finances should be effortless and secure. When you create a UPI ID online with Digi Khata, you’re not just opting for speed and security but also unlocking a world of possibilities—from instant account opening to kiosk banking services online. With tailored solutions like a zero balance account for students and digital accounts for homemakers, Digi Khata ensures that everyone has easy access to fast and reliable transactions. Start now and take control of your finances with UPI!

#Free Digital Account opening#Open Free Digital Account Online#Instant account opening#online kiosk banking#Kiosk Banking Service Online#digi kiosk self service#digital vyapar#instant upi account#Create UPI ID Online#Open Instant UPI Account#Open zero balance Account#Zero Balance Account for Student#Open Digital Account for Housewives

0 notes

Text

Navigating International Business with Azlo Alternatives: Going Global

In the ever-evolving landscape of international commerce, small businesses seek easy financial solutions to navigate complexities efficiently. With the closing of Azlo Bank, businesses both inside and outside the US are exploring alternatives to facilitate their global ventures.

The Ultimate Fintech Platform

Fintech redefines online banking for businesses with its innovative cloud-based technology. The platform offers free setup, no minimum balance requirements, and zero account costs or monthly fees. Businesses can conduct instant money transfers and initiate ACH and wire transfers at minimal service charges, ensuring cost-effective financial transactions.

Unmatched Affordability and Transparency

Fintech stands out for its affordability and transparency. With no hidden fees, businesses can manage their finances without worrying about unexpected charges. It’s commitment to transparent pricing makes it a trusted choice for businesses seeking clarity in their banking transactions.

Comprehensive Business Solutions

Fintech serves as a one-stop solution for businesses, offering a suite of features to simplify operations. From employee cost management to instant visa cards and finance management, the platform caters to diverse business needs efficiently. It enables companies to concentrate on growth without the burden of complex financial management thanks to easy integration and user-friendly interfaces.

Secure and Transparent Virtual Cards

Fintech prioritizes security and transparency, evident in its virtual card system. Businesses can generate cards without disclosing sensitive bank account information, ensuring enhanced security during transactions. With no upfront costs or concealed fees, the virtual card system provides a reliable and straightforward payment solution for businesses.

Conclusion

Businesses are turning to fintech as the premier Azlo alternative for international banking needs. Businesses may effortlessly negotiate the challenges of international trade thanks to its cost, transparency, and extensive set of features. Embrace the banking of the future today to open up a world of possibilities for your company.

0 notes