#Online Open Bank Account App

Explore tagged Tumblr posts

Text

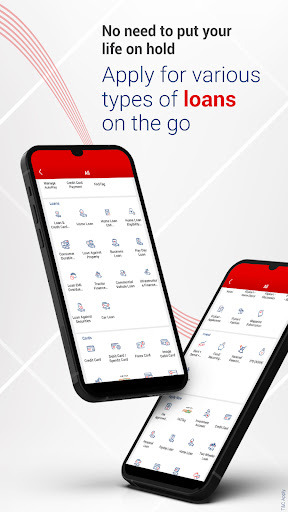

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account#digital banking app#bank account online#premium banking

0 notes

Text

Top banking mistakes you cannot afford to make

Although banking offers numerous benefits, most people need help with the procedure. Every time you conduct a banking transaction, you and your bank communicate. Such as cashing out from an ATM or depositing a check, among many other things. It is normal to make mistakes, but doing so while conducting financial transactions with your bank could cost you more. So, while doing banking activities, you should be more cautious because a single mistake can lead to big losses.

Source : https://luxurystnd.com/top-banking-mistakes-you-cannot-afford-to-make/

#zero balance account open#online open bank account app#bank account open online#savings account#open savings account#open online account#bank account opening online#opening bank account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note

Text

Reasons to switch to online banking

Recent years have seen significant changes in the banking industry, and many people now find banking simpler due to technological advancements. Those days of waiting in a queue at the bank or spending hours on the phone to resolve transactions are long gone. With a free online bank account, you may accomplish all of your daily tasks from the convenience and privacy of your home. Indeed, this has become a very popular banking approach in the last several years. Here mentioned are the reasons to switch to online banking:

No monthly fees:

Your checking and savings accounts are maintained by most traditional banks every month for a cost. These needless fees deplete your hard-earned money. For certain accounts, if you keep a specific balance or get a certain amount of direct deposits each month, the monthly maintenance charge is waived. However, you shouldn't have to worry about whether you can meet those obligations every month.

Convenience:

Money management is easy with online banking. You can check your bank statements, make bill payments, and transfer money whenever you can access the Internet. Bank-to-bank transfers, bill payments, mobile cheque deposits, and paperless statements are popular aspects of Internet banking. Certain online banks have tools and apps on their websites that are intended to help you save more money.

Stay in control:

You should consider free online bank accounts because they make it easier to maintain financial control. You have quick and simple access to watch what comes in and goes out of your account, keep an eye on your spending, schedule payments, and carry out financial activities. You gain complete comfort and convenience in handling your finances and bank accounts, making it much easier to maintain control over your finances.

No balance requirement:

For savings and checking accounts, large banks may have multiple balance requirements. Additionally, they might ask you to keep a minimum daily balance. Not everyone can accomplish this. Less stringent balance requirements apply to online banks. Many have no requirements at all for a starting deposit. Usually, the ones that do are a few. Most also don't demand you to keep a specific monthly balance.

Save time:

Giving online banking a try is also encouraged because many individuals are surprised by how much time and hassle they may save using its services. It used to take a lot of time for customers to call bank employees or to visit offices and wait in long lines. You can easily handle everything online from the comfort of your home when you have internet banking, so this is no longer a problem. You can handle your finances much more quickly and easily as a result.

Bottom line:

These are just a few reasons to make opening an online bank account wise. An online new account open has made simpler nowadays. Due to benefits like reasonable rates, no fees, and digital capabilities that can make managing your accounts and increasing your savings easier, online banks frequently provide substantial advantages over traditional banks.

#open online bank account#bank online account open#online opening account#bank account online opening#zero balance account online#online banking app#open new account online#online open bank account app#open savings account

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

Kotak 811 offers a paperless, zero balance digital savings account that you can open instantly from your mobile. Enjoy seamless banking anytime, anywhere. Download App Now!

#digital savings account#instant saving account#zero balance account#account opening online#mobile banking app

0 notes

Text

Open Instant Digital Savings Account Online

Kotak 811 offers a paperless, zero balance digital savings account that you can open instantly from your mobile. Enjoy seamless banking anytime, anywhere. Download App Now :

#digital savings account#instant saving account#zero balance account#account opening online#mobile banking app

0 notes

Text

Account Online Open Apps in 2025: Fastest Way to Get Started

In 2025, opening a bank account is easier than ever—all thanks to fast, secure account online open apps. No paperwork, no branch visits—just your smartphone and a few minutes of your time. Whether you’re a student, working professional, or small business owner, these apps simplify the entire bank account opening process.

This blog covers the fastest ways to open a bank account online, step-by-step procedures, and what to expect from modern-day bank account opening applications.

Why Choose Account Online Open Apps in 2025?

Opening a bank account through an app saves time and effort. Here’s why people now prefer bank account opening online:

100% paperless

Instant verification via Aadhaar & PAN

Zero branch visits

Bank account online open in just minutes

Most apps now support zero balance account opening

Bank Account Opening Process via App

Here’s a simplified view of the bank account opening process using a mobile app:

1. Download the App

Choose a trusted bank's official app from the Play Store or App Store that supports bank account opening online zero balance.

2. Start the Application

Click on “Open New Account” or similar. This begins your bank account opening application digitally.

3. Enter Personal Details

You’ll need to fill out:

Full Name

Mobile Number

Email ID

Aadhaar & PAN numbers

This forms the digital application for bank account opening.

4. Complete eKYC or Video KYC

Most apps offer two types of KYC:

OTP-based Aadhaar eKYC

Video KYC with a live call agent

Both are fast and secure, with verification completed within minutes.

5. Get Instant Account Activation

Once verified, your account is ready to use. You’ll get:

Account number & IFSC

Virtual debit card

UPI ID for instant transactions

Some banks even let you start transactions before physical KYC is done.

Benefits of Opening Bank Account Online in 2025

✅ Zero Balance Option

Most apps offer bank account opening online zero balance, allowing you to start with ₹0.

✅ No Paperwork, No Queues

Everything is digital, making the bank account opening procedure hassle-free.

✅ Instant Access

After approval, you can use UPI, make transfers, and receive payments immediately.

✅ Secure & RBI-Compliant

eKYC and video KYC are regulated by RBI, ensuring your data stays protected.

Top Features to Expect from 2025 Bank Account Opening Apps

Real-time account status updates

In-app account balance checks

Free UPI setup and virtual debit card

24/7 support and help center access

Easy upgrade to full KYC account if needed

Final Thoughts

In 2025, the fastest way to get started with banking is through account online open apps. They simplify the bank account opening process, provide instant access, and even support zero balance accounts for more flexibility.

So, if you're planning to start your financial journey or open a second savings account, don’t wait. Pick a trusted app and open your bank account online—paper-free, queue-free, and stress-free.

#account opening#account opening app#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check app#bank account kholna#bank account online open#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process

0 notes

Text

Kotak Bank : 811 Mobile App

Experience Seamless Banking with the Kotak811 Mobile Banking App. Apply for a 0 balance account online and enjoy hassle-free banking from your smartphone. With the Kotak811 app, you can apply for a bank account, manage your zero balance bank account, make seamless UPI payments, apply for credit cards, and much more.

#zero balance account saving account#zero balance account app#bank account online#new bank account online#open savings bank account online#open a bank account online free#online savings bank account opening#new bank account#online bank account opening#digital account app

1 note

·

View note

Text

Kotak811 Mobile Banking App: Apply for a Zero Balance Savings Account Instantly. Unlock seamless banking with Kotak811 Mobile Banking, one of the ultimate banking app that helps you to apply for a bank account online in just a few minutes. Whether you're looking to apply for a zero balance account, manage your savings, or explore investment opportunities, our mobile banking app has you covered.

#account opening app#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check app#bank account kholna#bank account online open#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates

0 notes

Text

Kotak811 Mobile Banking App: Apply for a Zero Balance Savings Account Instantly

Unlock seamless banking with Kotak811 Mobile Banking, one of the ultimate banking app that helps you to apply for a bank account online in just a few minutes. Whether you're looking to apply for a zero balance account, manage your savings, or explore investment opportunities, our mobile banking app has you covered.

#best fd account interest rate#best fd interest rates#best fd rates#best fd rates in bank#best fixed deposit rates#best interest rate for fixed deposit#best mobile banking app#best online account opening#best rates on fd#bank fd interest rates#bank fd rates#bank fixed deposit rates

0 notes

Text

Online Application for Opening a Bank Account – Step-by-Step Guide

In today’s digital era, opening a bank account is no longer a tedious, paperwork-heavy process. With online platforms and mobile apps, you can now submit your application for account opening in bank within minutes. Whether you're a student, professional, or homemaker, the process to apply for bank account online is quick, secure, and efficient.

Benefits of Applying for a Bank Account Online

Filing an application for opening bank account online comes with several advantages:

Convenience: No need to visit a physical branch.

Quick Processing: Most accounts are opened within a few hours.

Paperless Process: Documents can be uploaded digitally.

Instant Access: Once approved, your account supports account UPI payments, mobile banking, and more.

Documents Required for Online Bank Account Opening

Before you start your account opening process, keep the following documents ready:

Aadhaar Card (linked with mobile number)

PAN Card

Recent passport-sized photo

Email ID and mobile number

These are essential to verify your identity and complete the e-KYC process.

Step-by-Step Guide to Fill the Application for Account Opening in Bank

Step 1 – Choose a Digital Platform

To begin, visit the official website or download a reliable account opening app. Choose the type of account you want to open – savings, salary, or digital-only.

Ensure the bank offers account open 0 balance if you’re looking to start without a minimum deposit.

Step 2 – Start the Online Application

Look for the option labeled “application for account opening in bank” or “apply for savings account online”. Select your preferred account type.

Step 3 – Fill in Your Personal Details

Enter your name, date of birth, contact details, and address as per your Aadhaar card.

Step 4 – Upload KYC Documents

Upload scanned copies or pictures of your Aadhaar and PAN card. Some platforms also require a selfie for face verification.

Step 5 – Complete e-KYC or Video KYC

You will be prompted to complete e-KYC using an OTP sent to your Aadhaar-linked number. Some banks may offer video KYC for further verification.

Step 6 – Set Up Account Access

Once your account is verified and active, you can:

Check balances through mobile banking

Enable account UPI payments

Set up internet banking and mobile alerts

Who Should Use Online Bank Account Opening?

The digital process to apply for savings account or open a new one is perfect for:

Students needing a quick setup

Remote workers or freelancers

First-time account holders

Individuals looking to account online open without visiting a branch

Things to Consider Before Applying

Before you submit your application for opening bank account, keep the following in mind:

Check if the bank offers account open 0 balance

Review maintenance charges and services

Confirm the mobile app’s security and features

Understand transaction limits and UPI access

Conclusion

Opening a bank account no longer requires standing in long queues or handling heaps of paperwork. With a few taps, your application for account opening in bank can be submitted and approved from the comfort of your home. Whether you want to apply for bank account online, manage your finances digitally, or enable account UPI payments, the process has never been simpler.

Ready to apply for savings account or open your account online? Make sure you have your documents ready and choose a trusted digital banking platform to get started.

#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online

1 note

·

View note

Text

How to Apply for a Bank Account Online Using UPI: Step-by-Step Guide with Best Apps

In the age of digital transformation, traditional banking methods have evolved dramatically. You no longer need to visit a bank branch or fill out paper forms to open a savings account. With the help of modern account opening apps, you can now apply for a bank account online in minutes and start using UPI payments immediately. Whether you’re opening your first account or switching to a more convenient digital option, this guide explains how to submit an application for opening a bank account with ease.

What is Online Account Opening?

Account opening online refers to the process of creating a new bank account using a mobile app or website, without visiting a physical bank. It’s fast, paperless, and accessible 24/7. The process typically includes digital KYC (using Aadhaar and PAN), mobile verification, and instant access to your account through an app.

Benefits of Applying for a Bank Account Online

📝 No paperwork required

📲 Instant mobile banking access

💳 UPI and debit card support from day one

💼 Ideal for professionals, students, freelancers

🕒 Submit application anytime — no working hours needed

How to Apply for Bank Account Online: Step-by-Step

Here’s how you can apply using any account opening app:

Step 1: Choose a Bank or Fintech Platform

Popular banks offering online account opening:

Kotak Mahindra (Kotak 811)

ICICI (iMobile Pay)

Axis Bank (ASAP)

SBI (YONO App)

Fintechs: Paytm, Airtel Payments Bank, Jupiter

Step 2: Download the Account Opening App

Head to Google Play Store or App Store and install the chosen bank or fintech app.

Step 3: Start the Application for Account Opening in Bank

Click on “Open New Account” or “Start Application.” You’ll be asked for:

Name

Date of Birth

Email ID

Mobile number (linked to Aadhaar)

Step 4: Complete eKYC Process

Most apps will require:

PAN card number

Aadhaar number verification via OTP

Some may conduct video KYC

Step 5: Set Up UPI and Mobile Banking

After successful verification:

Get your account number, IFSC, and virtual debit card

Choose your UPI ID (e.g., yourname@upi)

Set your UPI PIN

You can now make instant account UPI payments for bills, transfers, and online shopping.

Top Account Opening Apps in India (2025)

App/Platform

Type

Key Features

Kotak 811

Bank App

Zero balance, full mobile banking, UPI

Bank App

Government bank, Aadhaar-based eKYC

Instant account number, digital onboarding

Advantages of UPI-Linked Accounts

🔄 Send and receive money instantly

🏪 Pay at stores using QR codes

📥 Get salary or business payments directly

🔐 Secure PIN-based authentication

📲 Manage all banking from your phone

Once submitted, the app generates your account credentials and enables UPI payments instantly.

Conclusion

Submitting an application for opening a bank account has never been easier. With powerful account opening apps and instant UPI payment integration, anyone can apply for a bank account online and go fully digital in just minutes. Whether you're opening your first account or looking for a smarter way to bank, choose a trusted platform and enjoy the future of finance today.

#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry

0 notes

Text

Unlock the Power of Mobile Banking Apps: Top Features You Should Know

In the digital age, mobile banking apps have become an essential tool for managing personal finances. Whether you’re checking your balance, making an instant UPI payment, or setting up a fixed deposit, mobile banking apps provide the convenience and security you need to handle all your banking tasks from your smartphone.

In this article, we’ll dive into the most valuable features of mobile banking apps and why you should make them a part of your financial routine.

What Makes Mobile Banking Apps So Popular?

Mobile banking apps have changed the way we think about banking. Gone are the days when you had to visit a branch for basic transactions. Now, everything can be done with just a few taps on your smartphone.

The popularity of mobile banking apps lies in their ability to offer secure, convenient, and real-time banking services. These apps are designed to simplify tasks like transferring money, paying bills, opening savings accounts, and more—right at your fingertips.

Key Features of Mobile Banking Apps

Feature

Benefit

Instant UPI Payments

Send money instantly using UPI apps to anyone, anytime, with no charges.

Account Management

Easily view your balance, recent transactions, and statements at any time.

Bill Payments

Pay utility bills, recharge your phone, and even pay for online purchases.

Fixed Deposit Setup

Open an instant FD account with a few taps and start earning interest.

Loan Application

Apply for personal loans or overdraft facilities directly through the app.

How to Make Payments with Mobile Banking Apps

One of the standout features of mobile banking apps is the ability to make UPI payments. Unified Payments Interface (UPI) allows you to transfer money directly between bank accounts without any delay, whether it's for a personal transaction or a business payment.

Here’s how to make a payment:

Open the Mobile Banking App: Launch your mobile banking app and log in securely using your credentials.

Go to the UPI Section: Find the UPI payments section, where you’ll be prompted to enter the recipient’s phone number or UPI ID.

Enter Payment Details: Specify the amount you want to send and the reason for payment (if necessary).

Confirm and Send: Once you’ve reviewed the details, confirm the transaction with your secure PIN or biometrics. Your payment will be processed instantly.

Benefits of Using Mobile Banking Apps

1. 24/7 Access to Your Account

One of the most significant benefits of mobile banking apps is the ability to access your account anytime, anywhere. You don’t need to wait for banking hours or visit a branch to check your balance or perform any other transactions. Whether you're traveling or at home, your bank is always just a tap away.

2. Instant Payments

Gone are the days of waiting for payments to clear. With UPI payments, you can send and receive money in real-time, ensuring that your financial transactions are processed instantly.

3. Secure Transactions

Banks employ high-level encryption and other security measures to ensure that all your transactions via the mobile app are secure. Most apps also offer features like two-factor authentication (2FA) and biometric login to protect your account.

4. Convenient Savings and Investment

Whether you want to set up an instant FD, open a zero balance account, or simply track your savings, mobile banking apps make it easy to manage your finances and invest securely from anywhere.

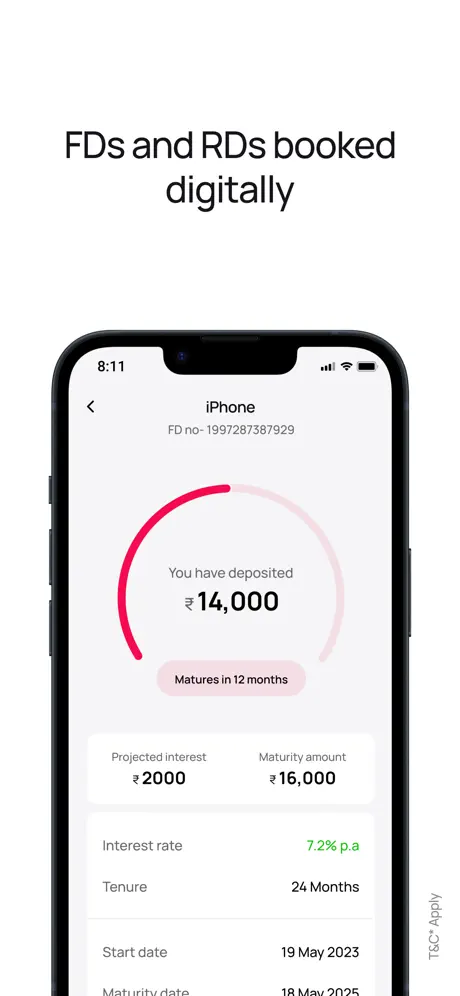

How to Set Up an Instant Fixed Deposit via Mobile Banking App

Setting up a fixed deposit using your mobile banking app is quick and hassle-free. Here’s how you can do it:

Open the Mobile Banking App: Login to your bank’s app.

Navigate to the FD Section: Find the section for Fixed Deposits under the investment options.

Choose Your FD Type and Tenure: Select the type of fixed deposit (tax-saving or regular) and the tenure (from a few months to years).

Enter the Investment Amount: Specify the amount you want to invest.

Confirm and Complete the Process: Review the details and confirm. Your FD account will be set up instantly, and you'll start earning interest right away.

How Secure is Mobile Banking?

Security is one of the biggest concerns when it comes to digital banking. Banks ensure that their mobile banking apps are safe by using cutting-edge technology:

Encryption: All your personal and financial data is encrypted to prevent unauthorized access.

Two-Factor Authentication: Many apps require an extra layer of security with OTPs or biometric verification (fingerprint/face recognition) to ensure only you can access your account.

Real-Time Alerts: Stay informed with real-time alerts for every transaction, so you can quickly spot any unauthorized activity.

Fraud Detection: Banks employ advanced fraud detection systems that analyze your transactions and flag anything suspicious.

Conclusion

Mobile banking apps have become a staple for managing personal finances due to their convenience, security, and range of features. From UPI payments and bill payments to instant FD setup, these apps provide a seamless banking experience that’s accessible anytime, anywhere.

By embracing mobile banking, you can save time, enjoy secure transactions, and gain real-time access to your finances. Start using a mobile banking app today and experience the future of banking at your fingertips.

#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit rates#bank khata#bank online account open#bank online application#best banking app#best fd account interest rate#best fd credit card#best fd interest rates#best fd rates#best fd rates in bank#best fixed deposit rates#best interest rate for fixed deposit#best mobile banking app#best online account opening#best rates on fd#check balance#check bank account balance

0 notes

Text

The Future of Banking: How to Open a Zero Balance Account Online

Imagine being able to open a zero balance account from the comfort of your home, without worrying about keeping a minimum balance. Sounds like a dream? It’s now a reality! Thanks to digital banking, you can open a 0 balance bank account online in just a few minutes—no physical paperwork, no hidden charges.

Let’s dive into how easy it is to open a zero balance account online and why it’s the best option for many people today.

What is a Zero Balance Account?

A zero balance account is a type of savings account that doesn’t require you to maintain a minimum balance. Whether you are just starting your banking journey or looking for an account with fewer restrictions, this is the perfect option.

Thanks to online 0 balance account opening, this account is now more accessible than ever. Opening an account is straightforward, and you can start using it right away.

Benefits of a Zero Balance Account

Feature

Benefit

No Minimum Balance

Say goodbye to monthly maintenance fees

Digital Onboarding

Skip the paperwork with online setup

Instant Access

Begin banking with just your mobile phone

Free Services

Access UPI, debit card, and more without fees

User-Friendly

Manage your account easily through the mobile banking app

Steps to Open a Zero Balance Account Online

Opening a zero balance account online is a breeze. Here’s how:

Download the Bank’s Mobile App or Visit Their Website: Start by downloading the app or going to the bank’s website.

Select the “Zero Balance Account” Option: Choose the option to open a zero balance account.

Provide Basic Details: Enter your personal details like name, phone number, and address.

Verify Your Identity: Complete eKYC via video verification or OTP-based authentication.

Set Up Your Account: After verification, your account will be created instantly, and you’ll receive your account number and IFSC details.

Who Should Open a Zero Balance Account?

This account type is perfect for:

Students: Manage your pocket money, receive scholarships, or transfer funds easily.

Freelancers and Gig Workers: For those who don’t have a fixed monthly income, this account offers flexibility.

Small Business Owners: Keep your business finances separate without the pressure of minimum balance requirements.

First-Time Bankers: If you’re new to banking, a zero balance account is the easiest way to start.

The Convenience of Mobile Banking

Once your zero balance account is opened, you gain full access to the bank’s mobile banking app, which offers:

UPI Integration: Send and receive money instantly using UPI.

Instant Transfers: Transfer funds to any account or open a bank account for someone else.

Bill Payments: Pay utility bills, school fees, or subscriptions from the app.

Instant FD Account Setup: Park extra money into a fixed deposit directly from your account.

Safety and Security Features

Opening a zero balance account online doesn’t mean compromising on security. Here’s how digital banking ensures your account stays safe:

Encrypted Transactions: All online transactions are encrypted for maximum security.

Biometric and PIN Access: Use facial recognition, fingerprint scanning, or PIN to access your account.

Real-Time Alerts: Get notifications for every transaction, ensuring you can track all activity.

Final Thoughts

A zero balance account is an excellent choice for those who want a hassle-free banking experience. Whether you’re opening an account to manage your savings, receive payments, or set up an instant FD account, this option offers maximum convenience and flexibility.

With the added benefits of mobile banking, you can manage your finances on the go, making it the perfect solution for modern-day banking. Open your zero balance account online today, and start your journey towards smarter financial management.

#net banking money transfer#new account opening#new bank account#new bank account open#new bank account open online#new bank account upi limit#new upi payment app#online 0 balance account opening#online account open#online account opening bank#online application for bank account#online bank#online bank account kaise khole#online bank account opening#online bank account opening 0 balance#online digital account opening

0 notes

Text

Mobile Banking on the Rise: How to Choose the Best App for Everyday Banking

Managing your money on the go has never been easier. Thanks to the rise of mobile banking apps, people can now send payments, check balances, open accounts, and even invest—right from their smartphones. But with so many apps available, how do you know which one is right for you?

Let’s break down how to choose the best mobile banking app and what features really matter.

Why Mobile Banking is Now Essential

The pandemic accelerated a shift toward digital banking, and now mobile banking is not just a luxury—it’s a necessity. Whether you're paying for groceries via UPI payment, setting up an FD, or checking your account balance, the convenience of having your bank in your pocket is unmatched.

Must-Have Features in a Mobile Banking App

Not all apps are created equal. Here’s what to look for when choosing the best mobile banking app:

Feature

Why It Matters

UPI Integration

Enables instant money transfers via your UPI app bank

Online Account Opening

Helps you open zero balance account or savings account in minutes

Instant FD Setup

Allows quick instant FD account setup

24/7 Customer Support

Ensures assistance whenever you need it

Security

Two-factor authentication, biometrics, and encrypted data

How to Evaluate Your Banking Needs

Before you pick a mobile app, assess your own usage:

Do you need to send daily UPI payments?

Are you planning to open a bank account digitally?

Do you prefer Hindi or other languages? Choose apps that support मोबाइल बैंकिंग in your language.

Want to build savings? Look for built-in FD setup tools.

Top Reasons to Go Mobile with Banking

Convenience: Do everything from the comfort of home

Speed: Instant transactions and services like online 0 balance account opening

Control: Real-time alerts and spending analytics

Accessibility: Services are just a few taps away

With a powerful UPI mobile banking app, your phone becomes your personal bank branch.

Safety First: Tips for Secure Mobile Banking

Always use apps from verified sources (Google Play or App Store)

Enable biometric login or strong passwords

Avoid logging in from public Wi-Fi

Keep your app updated to the latest version

These practices keep your bank saving account and FD investments secure.

Real-Life Scenario: A Day with the Right Mobile App

Morning: Check balance and pending UPI payments

Afternoon: Use UPI app bank to pay a vendor

Evening: Start a quick instant FD account setup to lock away savings

Anytime: Track all activity with notifications and analytics

Your mobile app can help you build a financial routine effortlessly.

Final Thoughts

The future of personal banking lies in your hands—literally. A good mobile banking app does more than just show your balance; it empowers you with smart tools to save, invest, and manage money on the fly. Whether you're looking to set up an FD, make UPI payments, or open a bank account online free, make sure you’re using the app that gives you control, flexibility, and peace of mind.

#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank balance app download#bank balance check karne wala app#bank balance enquiry#bank balance enquiry app#bank best fixed deposit rates#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit rates#bank khata#bank online account open

0 notes