#Hypothec

Explore tagged Tumblr posts

Text

Ghostbusters (1984, Ivan Reitman)

10/04/2024

#ghostbusters#film#Commedia fantascientifica#united states#1984#ivan reitman#john belushi#saturday night live#cult film#comedy film#action film#horror film#comedy#AFI'S 100 Years 100 Laughs#American Film Institute#national film registry#library of congress#Compagnia Edizioni Internazionali Artistiche Distribuzione#new york city#peter venkman#ray stantz#egon spengler#parapsychology#paranormal#new york public library#ectoplasm#sample#Hypothec#proton pack#Energia psicocinetica

98 notes

·

View notes

Text

What If: Project Sekai and Jewelpet Collab

Since Project Sekai released Sanrio collab cards a few months ago, I thought it'd be fun pair up all the characters with Jewelpets for this hypothetical collab! I'll be basing these mostly on personalities and Jewelpets' special abilities!!

1. Ichika and Nix

Since Leo/Need started with the girls reconciling and fixing their friendship, I thought it'd be fitting if Ichika, the unit representative, had the Jewelpet of Reconciliation. Also, Nix's Jewel Charm has a star motif so that also fits!

2. Saki and Rosa

A big part of Saki's character is how she wants to make the most of her youth because she's spent so much time in the hospital and how wants to appreciate her teen years. In other words, she is passionate about even the small things in life, which fits with Rosa's power which is Passion. Also, I just think their colours look nice together.

3. Honami and Milky

A big part of Honami's character is how much she cares about others and how she wants to help her bandmates and friends, which goes really well with the Jewelpet of Sympathy. Also, Honami works as a housekeeper which is seen as a very traditional job, and one of Milky's human magic partners was a woman with a more "traditional" demeanor and was also a housekeeper.

4. Shiho and Kris

Kris represents Relationships, which is is the basis of all units, but I feel like it's the especially strong in Leo/Need. This one could tehnically apply to all four members, but I think it fits Shiho the most because in her part of the main story she remembers how impornant her friends are to her and that she doesn't have to be alone.

5. Minori and Peridot

Ever since the beggining of her story, Minori is set on becoming an idol no matter how many times she fails and never loses the sight of that wish. Peridot's powers are Positiveness and Dream Fulfillment, which goes hand in hand with Minori's optimistic attitude about her goal and the sheer persistance she shows for that goal.

6. Haruka and Diana

I wasn't very sure which Jewelpet to give Haruka, so this is based on the fact that Haruka apparently has an overwhelmingly strong idol aura/presence and that Diana is the Jewelpet of Charisma.

7. Airi and Alex

Just like Peridot, Alex represents Dream Fulfillment, but in Airi's story it is presented differently than in Minori's. A big part of Airi's backstory is that she dreamed of becoming an idol, but instead got marketed as a variety show personality and had to abandon her dreams of being the idol she wanted to be. Of course, she got her dream back after she joined MMJ, which is why I feel like she would go well with Alex.

8. Shizuku and Flora

This one is more based on vibes and personality than on their stories, but both of them are very gentle and cloud-headed. There was also a main event in which Shizuku took it upon herself to help Haruka relax, which fits with Flora's power of Stress Removal.

9. Kohane and Opal

The first arc of Kohane's story revolves around her finding her voice, and in the end finding out that her abilities are far stronger than she ever imagined, resulting in getting recognition from the famous musician Taiga. This all goes hand in hand with Opal's power, which is Hidden Talent.

10. An and Amelie

Amelie is the Jewelpet of Bonds, which I feel fits with An because an important and quite large part of her backstory and motivation is her connection with the people on Vivid Street, especially Nagi and the rest of the VBS.

11. Akito and Nephrite

I'll be honest: I'm not completely caught up with Akito's story, but I know that some of his events center around him learning to rely more on his teammates and then getting to know other singers which'll be performing alongside VBS. So yeah, there's an emphasis on teamwork in his stories (well, in all VBS stories, but I have a feeling that it's more in his) so I chose the Jewelpet of Teamwork!

12. Toya and Charotte

I wasn't sure which Jewelpet to give Toya either, Charotte is in fact the only one I had a feeling would fit. Her power is Challenging Spirit, which I feel fits with Toya's backstory since the reason he first got into street music is because he wanted to oppose his father and challenge the way his father viewed him.

13. Tsukasa and Topaz

Topaz represents Radiance and Confidence, which fits with Tsukasa's wish to become a star. ...Uh, yeah, that's kinda all I have to say for them, I can't really think of anything else atm, sorry!

14. Emu and Tour

Emu is very much open to new experiences and is not afraid of hard challenges, best seen in the beggining of the main story when she is set on restoring the Wonder Stage even before getting Tsukasa's help. She also deeply cares about her friends and understands when something is wrong even when others around her don't (best seen with Mayufu, but there have been other circumstances I can't remember atm). I think those are a good reason to pair her with Tour, the Jewelpet of Adventure and Friendship Bonds!

15. Nene and Ruby

Nene's first arc revolves around her finding courage to sing in front of an audience without hiding behind Robo-Nene, and finds it with the help of her teammates and her love for singing. Uhh, I don't really know what else to say; it just fits cuz Ruby represents Courage!

16. Rui and Brownie

This one is simply based on the fact that Rui is an inventor who makes all sorts of funky contraptions and is also the one who writes the plays for WxS, and Brownie is the Jewelpet of Inspiration and Imagination.

17. Kanade and Granite

Granite is the Jewelpet of Security, and Kanade is the first one who started making music for N25, or in other words made a space which provided her and the other three members with mutually-provided sense of security (sorry if this is weirdly worded, idk how to phrase it any other way), and she provides shelter for Mafuyu after she runs away from home. Also, their colour palettes match!

18. Mafuyu and Kaiya

Kaiya represents Independence, which goes really well with Mafuyu's arc of reclaiming her future and becoming the person she wants to be, not the person her mother wants her to be.

19. Ena

I'm really sorry, I racked my brain but couldn't decide on a fitting Jewelpet for her. If you have any ideas, please tell me, I'd love to hear them!

20. Mizuki and Luna

Luna has the power of Charm Improvement which basically means she has the ability to make people look like their ideal selves, which I feel goes nicely with the implications about Mizuki's secret and the way they view themselves. They're both also associated with fashion and their motifs are ribbons!

#project sekai#prosekai#proseka#colourful stage#colorful stage#hatsune miku colorful stage#hatsune miku colourful stage#jewelpet#if you have any ideas for other hypothecical collabs feel free to tell me#I might write up something for that too if I get the inspiration

2 notes

·

View notes

Text

Hypothecation removal | Hypothecation termination

Discover seamless solutions for Hypothecation removal and termination services. Our experts guide you through the hassle-free process of releasing hypothecation, ensuring a smooth transition for your vehicle or asset. Explore trusted and efficient services tailored to meet your needs. Unlock the freedom from hypothecation with our dedicated assistance.

1 note

·

View note

Text

Streamline vehicle hypothecation cancellation online. Know RTO process, charges for hypothecation removal at Motolic India. Simplify ownership transfer.

0 notes

Text

RoR Incorrect quotes#187 Hypothec

Y/n: I think we should get a divorce

Leonidas: what are you doing?

Y/n: just practicing

Leonidas:: why are you already planning your hypothetical divorce?

Y/n: I don't know. I'm getting old, I think I'm having a mid-life crisis

Leonidas: you don't even have a S.O

Y/n: hypothetically divorce me

Leonidas: okay, then I'm hypothetically taking half your assets

Y/n: well, you didn't sign the hypothetical prenup

Y/n, to Geirölul: it's called a prenup, right?

Geirölul: yeah, it's a prenup, and you DID hypothetically sign one

Leonidas: What the fuck Geirölul?

Geirölul: I'm their hypothetical lawyer in this divorce case

Leonidas: well, then, I'm taking the hypothetical kids

Leonidas, to Nikola: right? we can get those, right?

Nikola: yes, we can definitely get the hypothetical kids, don't worry about it

Y/n: who the fuck is this hypothetical fucking idiot? a hella fucking nerd idiot

Nikola: wow, that is a lot of hypothetical insults. I need to keep these on for continuity because I look like the other lawyer

Leonidas: this is MY hypothetical lawyer, and we have been hypothetically sleeping with each other

Y/n: how could you hypothetically do this to me?!

Leonidas: because you hypothetically are an alcoholic!

Y/n: GASP AM NOT THAT'S YOU HENCE THE DIVORCE!?!

Leonidas: I BEEN FRAMING YOU AS THE ALCOHOLIC FOR MONTHS-

#record of ragnarok#record of ragnarok x reader#shuumatsu no valkyrie#shuumatsu no valkyrie x reader#ror#snv#ror leonidas#snv leonidas#ror nikola tesla#snv nikola tesla#ror leonidas x reader#snv leonidas x reader#ror incorrect quotes#snv incorrect quotes#incorrect quotes

362 notes

·

View notes

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

bridge

* “Thus far and no more…” at least not as currently constituted;

perhaps we may not be allowed, perhaps we were never meant to breach that which is beyond our current reach;

for we see from here to there, dimly through eyes uniquely owned; and our envisioning is but a hypothesis to the totality of the conclusory reality understood at experiment’s end. *

As hypothecated, raw materials always drive and fuel a process to conclusion, just as anothers’ eyes may just glean a more precious light in a spectrum far beyond our visible one;

in spanning a bridge too far for the likes of us - they say, we must by necessity fall short. * As a poet once said, “the wall-eyed wally of the airwaves…” and so we are - makers of and staring at the bricks in the wall we built to perdition;

we’re secretaries of the interior of the singularity of sensations we commonly share; both bound to and bounded by present conventions and their attendant wisdom; constrained by the very apparatus which allows us to append our vision in the first place, and to project that which we cannot attain at present. *

But as another great thinker once said, “the map is not the territory…” and so it is not;

projections, however intentioned do not constitute, nor do they create causality beyond their inherent dimensional span;

and though amusing and oft’ enchanting (in a hypothetical ‘thought-experiment’ kind of way) they serve no great, tangible purpose outside of the classroom, so to speak - though they be taught and lectured upon ad nauseum in successive semesters, ad infinitum. *

Our ascension and attainment just may occasion a symbiotic relationship with matter or beings presently beyond our perceptual and physical horizons, thereby bridging the material-temporal gap our present embodiment cannot alone achieve. * Thus far and no more…” as presently postulated - is both a bracing java-jolt to the jugular of our grandiosity, and a daunting double-dare to the determination of our species, if the infancy of our relative history is to be any guide;

a dare which certain of you readers will examine, embrace, absorb, exhaust, let expire in anguish at its unattainment, encrust, entomb uneasily… * only to later exhume, unfold & interpret, inform & exhort to future generations, to be extrapolated to the nth of the nth of the nth degree of that which can possibly be cast seeking to span and conquer the bridge - some said was too far…

’cause that’s how we roll. * 7/14 - 8/24 - lebuc - bridge

#poetry#poets on tumblr#spilled ink#free verse#writerscreed#creative writing#poetryriot#lit#poem#lebuc#smittenbypoetry#themonkeyreview#bridge#TWC

21 notes

·

View notes

Note

I don't remember if this was Millie but i'm still gonna ask.

Since in the RF au Millie doesn't have lips how does she kiss?

If hypothecally she does kiss someone.

Millie does still have lips haha! 😂

Just just parts of her lips that were removed because of her scarring! But she still has enough to give you a kiss! As long as you don’t mind feeling some teeth and gums/muscle!

Ofc she wouldn’t be the best kisser in the world and will absolutely feel awkward after but I think that’s just a part of her charm ☺️

So she would just kiss you normally!

(RF Millie design still isn’t offical but pretty close!)

#welcome home#welcome home puppet show#welcome home puppet arg#welcome home oc#digital illustration#rainbow factory au

135 notes

·

View notes

Text

Alice Through the Looking Glass (2016, James Bobin)

24/07/2024

#alice through the looking glass#2016#james bobin#sequel#alice in wonderland#2010#Through the looking glass#lewis carroll#mia wasikowska#johnny depp#anne hathaway#helena bonham carter#alan rickman#alice#china#Hypothec#caterpillar#white queen#white rabbit#cheshire cat#Hatter#father time#time travel#psychiatric hospital#diagnosis#Hysteria#2012#linda woolverton#2013#2014

15 notes

·

View notes

Text

On September 28th 1864 Charles Murray,, a poet who wrote in the Doric dialect of Scots, was born at Alford, Aberdeenshire.

Though easily the best known and most popular Scots poet of the period from 1910 till the 1960s, Charles Murray’s literary output was modest. Though there was nothing amateur in his approach to his poetry, Murray was not a professional literary man and had to compose in the time he could spare from a busy working life first as prospector and mine manager, then as a senior colonial civil servant, in the newly created Union of South Africa.

In 1969, twenty-eight years after Murray’s death, poems which had not appeared in book form during his lifetime were published as The Last Poems, with Preface and Notes by Alexander Keith.

Finally in 1979, Murray’s friend, the novelist Nan Shepherd, edited Hamewith: the complete poems of Charles Murray. These publications were supported by the Charles Murray Memorial Fund.

Gin I Was God

Gin I was God, sittin' up there abeen,

Weariet nae doot noo a' my darg was deen,

Deaved wi' the harps an' hymns oonendin' ringin',

To some clood-edge I'd daunder furth an', feth,

Look ower an' watch hoo things were gaun aneth.

Syne, gin I saw hoo men I'd made mysel'

Had startit in to pooshan, sheet an' fell,

To reive an' rape, an' fairly mak' a hell

O' my braw birlin' Earth, - a hale week's wark -

I'd cast my coat again, rowe up my sark,

An', or they'd time to lench a second ark.

Tak' back my word an' sen' anither spate,

Droon oot the hale hypothec, dicht the sklate,

Own my mistak', an', aince I'd cleared the brod,

Start a'thing ower again, gin I was God.

Meaning of unusual words:

gin=if

darg was deen=day's work was done

deaved=deafened

oonendin'=unending

feth=faith

syne=soon

pooshan, sheet an' fell=poison, shoot and kill

reive=thieve

birlin'=spinning

rowe up my sark=pull up my shirt

lench=launch

dicht the sklate=wipe the slate clean

brod=brood

10 notes

·

View notes

Note

what if... I hypothecally "disband" scythe's cult?

¯\(°_o)/¯

"....hmmm...How could you do that exactly?"

#(ooc: IM ACTUALLY VERY CURIOUS!)#venomshank phighting#blog rp#vemonshank parody account#venomshank parody account#phighting roblox#rp blog#phighting!#roblox#phighting#vemonshank

24 notes

·

View notes

Note

hi icedagger how do I hypothecally survive being hunted by both subspace AND illumina

You don’t! Hope this helps :]

10 notes

·

View notes

Text

I will forever be mad that there is not and likely never will be a TV series adaption of Children of the Red King, because IMAGINE THE FANDOM WE COULD HAVE!

- people who'd make fan theories and try to figure out what happened to Lyell

- people simping for Paton Yewbeam and shipping him and Julia so FRICKING much

- people hypothecizing what endowment they'd have and making UQuizzes

- video essays analyzing characters like Manfred and Asa and Dagbert and decyphering if they truly are "bad guys"

- people making edits of literally ALL the characters

- THE COSPLAYS

- THE FANFICS

- book readers trying not to spoil, but constantly looking for easter eggs in the show

- people who start reading the books after season 1 and are like "wow we're in for a wild ride!"

WE WERE FUCKING ROBBED!!!

#children of the red king books#children of the red king#charlie bone books#charlie bone#charlie bone series#jenny nimmo

77 notes

·

View notes

Text

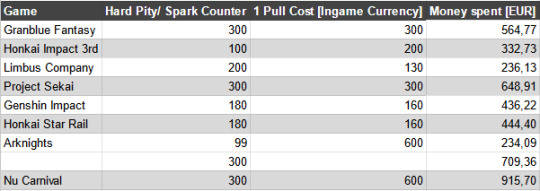

Gacha Game Price Comparison

Every so often, I stumple upon someone who've spent money on various gacha games, saying, "Man, X is so expensive compared to Y". As a freeloader who enjoys playing but never spends money on any of those games, it got me thinking: Is there really a significant difference in the cost between these games?

At first glance, it is impossible to determine how much you would spend on them because you don't really make direct purchases. You start by buying virtual currencies, then you convert them into ingame premium currency and THEN you can pull on a banner.

Wait a sec... if I break it down like that, it does't sound all that bad. Okay, let's try going through an example together.

Picture a banner which gives us the featured character when we pull 100 times and with each pull costing 160 scented candles. As we look through the shop to make our purchase, we stumble upon various beeswax offers that can be converted to scented candles.

Here are the offers:

50 beeswax = 0.99

100 beeswax = 1.99

200 beeswax = 3.99

600 beeswax = 10.99

1200 beeswax = 20.99

Now, it is important to note that the conversion rate from beeswax to scented candle isn't a straightforward 1:1. In fact, 50 beeswax translates to 150 scented candles.

To reach the 16000 scented candles needed, we need appx. 5333~ beeswax. Lastly, we have to determine which offer is best suited. In this case, we could either choose to buy 5 sets of 1200 beeswax out of convience or, if we want to be cost efficent, buy 4 sets of 1200 and 1 set of 600 beeswax.

In the end, it would cost us either 104.95 or 94.95.

I hope this example gives you the gist how confusing it can be and requires you to do some mental gymnastics to pin down the exact price.

Due to the lack of price transparency, I always assumed that every gacha has somewhat the same price tag.

News Flash: I was wrong.

In a Google Excel sheet, I've crunched the numbers to calculate the cost of the Hard Pity/Spark system in the games I personally play.

It is to say that those results do not reflect the actual cost of purchasing packages. They represent more of a hypothecical cost if you were to use the exact premium ingame currency to reach a Hard Pity/ Spark. Not only that but it is also only an estimate due to rounding and currency conversion.

Please be aware that the costs emcompass the Hard Pity/ Spark without factoring in elements such as premium currency income (e.g. dailies, limited events, ...), monthly battle passes, etc.

#gacha games#genshin impact#honkai star rail#granblue fantasy#limbus company#prsk#arknights#nu carnival#price comparison

23 notes

·

View notes

Text

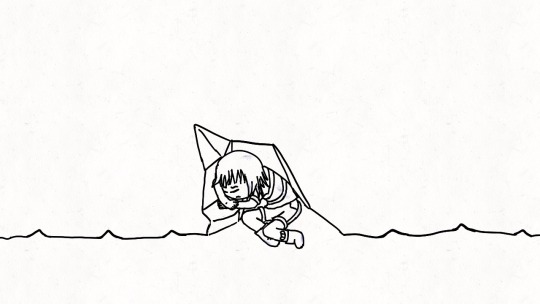

An art! for the fanfic Heart on the Table! again!, this one is like specifically the first chapter

And hey! what a coincidence! according to our dear The Author @floofanflurr (say that like it's a title, I mean it is but like in a fantasy way or something) today! (20/09 I think, well it's 21 now in my timezone but like it's still 20 in America until like another 8 hours or so so-) is the anniversary of the fic! or well the fic is published at March today is first draft anniversary.

First draft! of the first chapter! I am drawing that this can be anniversary art that's cool!

So yea have this picture of Frisk suffering like an hour before the comfort part of the hurt/comfort in this story! well the first part of suffering I am sure they will get to suffer more, not like I want them to or anything but like there're plenty more chapter

that sounds kinda suspicious

ANYWAY yea happy anniversary! what do people say in this occasion again? is it like some character's birthday? well happy birthday a hypothecal character I don't know exist! or I do but don't know which one is it!

...oh yea I know how to end this, picture without the grasses and stuffs under the cut!

I don't really know what to put on the wall, I could put up some gems I guess but like, it isn't going to be seen anyway, also yea the grass, is like that tall, but like there're more closer to the camera so it looks bigger

as you can see I have no idea how waterfall wall works like is it a rock or dirt or... well at least in this case it's probably rock since there're creek, anyway what even is those wavey line? rock jutting out? and the above part of it is like flat anyway? and the thing, at the bottom, in not lining up with the lines, well it looks great so it works I guess

hmm, oh yea I put the black pencil thing for dirty particle or whatever on the wrong layer so I guess it's just with the lineart now and not like color... it's specifically the one on their cloths and hair too, huh

...well, I should make a seperate layer for that anyway but like, I didn't really want to at the moment so

anyyway welcome back to the end where I didn't know what to say next

I guess this is a long post now?

well, uh yea

oh hey another one, this one is the version I sent in voice chat as like a WIP because that's yesterday and I want to sent something before I sleep, it looks kinda nice actually, also tis one got the full grass lineart, and Frisk without the dust thing... well that sounds like they did murder it's, not monster dust, okay?

hell yea ending 3, electric... boogalee

I guess I'll just end here

beep

#Frisk#Undertale#undertale fanart#Heart on the Table#utdr#my art#not reblogs#notreblogs#for your information#that I don't know if you want to know or not#I was suffering from the silence of writing texts under the picture and don't know what to say next for like#a while

24 notes

·

View notes

Note

can you, think of some hypothecal side quest in Chara's game? like what sort of thing a lil kid would do while gardening

(also what would the story be about? Frisk?)

Hah I love y'all's want to know more about this.

Simple Story Message - Found Family Mixed with Educational Learning :)

And then a hypothetical side quest could be asking neighbors if Chara could help with tasks and/or gardening, Buying seeds at a market, planting plants in a pattern, etc. Simple cute stuff.

And Frisk.. haha oh boy. They are there, thats for sure :)

#If it were a real game the Media would be ALL OVER IT. praising it for the bold departure from traditional children's media.#I would be a billionaire basically /j#ask stuff#ct q&a

32 notes

·

View notes