#How to avoid loan default?

Explore tagged Tumblr posts

Text

Can a Bank Take Legal Action for Non-Payment of Personal Loans?

Taking a personal loan can help you manage financial needs such as medical expenses, home renovation, education, or debt consolidation. However, repaying the loan on time is crucial. If you default on your loan payments, the bank has the legal right to take action against you. Non-payment of personal loans can lead to severe financial and legal consequences, including penalties, credit score damage, and legal proceedings.

In this article, we will explore what happens if you fail to repay a personal loan, the legal actions banks can take, and how you can prevent such situations.

What Happens If You Don’t Pay a Personal Loan?

When you take a personal loan, you agree to repay it in fixed monthly installments, including the principal and interest. If you miss multiple payments, the bank may classify your loan as a "Non-Performing Asset (NPA)", and the consequences begin to unfold.

Here’s a timeline of what typically happens after non-payment:

First Missed Payment: You may receive reminders from the bank via SMS, calls, or emails asking you to make the payment.

30 Days Overdue: The lender may apply a late payment fee and report your missed payment to credit bureaus, affecting your credit score.

60-90 Days Overdue: If the payments remain unpaid, the bank will increase collection efforts, and your loan status may be marked as "delinquent."

90-180 Days Overdue: Your loan is classified as a Non-Performing Asset (NPA). The bank may escalate the issue to legal recovery teams.

Beyond 180 Days: The bank may initiate legal action, arbitration, or file a case under the Negotiable Instruments Act (if post-dated cheques were issued) or the SARFAESI Act (for secured loans).

Legal Actions Banks Can Take for Non-Payment of Personal Loans

If you default on a personal loan, the bank has the right to initiate legal action. The specific course of action depends on the loan agreement, the amount due, and the lender’s policies. Here are some possible legal consequences:

1. Credit Score Damage & Loan Blacklisting

The first and most immediate consequence of loan default is a negative impact on your credit score. The bank reports missed payments to credit bureaus like CIBIL, Experian, and Equifax. This can:

Lower your credit score significantly.

Make it difficult to get future loans or credit cards.

Affect your chances of securing financial products such as home loans or business loans.

2. Legal Notice & Demand Letter

If payments remain unpaid, the lender may send a legal notice demanding repayment. The notice outlines the outstanding amount, applicable penalties, and a deadline to make the payment. Ignoring this notice may lead to further legal proceedings.

3. Civil Lawsuit for Loan Recovery

Banks and NBFCs can file a civil lawsuit against defaulters under the Civil Procedure Code, 1908. They can:

Demand full repayment through the Debt Recovery Tribunal (DRT) if the loan amount exceeds ₹20 lakh.

Approach a civil court for lower loan amounts.

Request the court to issue a recovery certificate, allowing legal enforcement of the debt.

4. Legal Action Under the Negotiable Instruments Act, 1881

If you issued post-dated cheques for loan repayment and they bounce due to insufficient funds, the bank can file a case under Section 138 of the Negotiable Instruments Act. This can lead to:

A penalty or fine.

A possible jail term of up to two years in extreme cases.

5. SARFAESI Act for Secured Loans

Though personal loans are unsecured, if you have taken a secured loan with collateral, such as a home or fixed deposit-backed loan, the bank can:

Take possession of the pledged asset.

Auction it under the SARFAESI Act, 2002 to recover the outstanding dues.

6. Arbitration or Lok Adalat Proceedings

Many lenders prefer arbitration before filing a court case. The bank may:

Take the case to Lok Adalat or an Arbitration Tribunal for settlement.

Offer loan restructuring to recover dues without lengthy litigation.

7. Bankruptcy Proceedings

In extreme cases, if a borrower is unable to repay the loan, they may be forced to declare bankruptcy. This can:

Lead to legal proceedings under the Insolvency and Bankruptcy Code (IBC), 2016.

Affect all financial dealings and creditworthiness for years.

What Should You Do If You Can’t Repay a Personal Loan?

If you are facing financial hardship and can’t repay your personal loan, do not ignore the problem. Instead, take proactive steps:

1. Contact Your Lender Immediately

Banks often provide options such as:

Loan restructuring: Extending the loan tenure to reduce EMI burden.

Moratorium periods: Temporary suspension of payments during financial hardship.

Settlement options: In some cases, banks may offer a lump sum one-time settlement (OTS) at a reduced interest rate.

2. Request EMI Reduction or Loan Refinancing

Consider negotiating for lower EMIs if you’re struggling with payments.

Refinancing your loan with another lender at a lower interest rate can also help manage repayments better.

3. Avoid Borrowing More to Repay Existing Debt

Taking another loan or using a credit card to pay off a personal loan can lead to a debt trap. Instead, explore:

Side income opportunities.

Selling unused assets.

Asking family or friends for temporary financial support.

4. Seek Legal and Financial Advice

If you’re unable to negotiate with the bank, consult a financial advisor or lawyer for guidance on your rights and possible legal remedies.

5. Opt for a Loan Settlement Only as a Last Resort

Loan settlement involves paying a reduced amount to close the loan. While this may seem like a good option, it severely affects your CIBIL score and can make future borrowing difficult.

How to Avoid Legal Issues Related to Loan Default?

To prevent facing legal action from banks, consider these financial practices:

✅ Borrow only what you can repay. ✅ Keep an emergency fund to handle unexpected financial hardships. ✅ Set reminders for EMI payments to avoid missing due dates. ✅ Avoid multiple loans that can strain your finances. ✅ Monitor your credit score regularly and take steps to improve it.

Conclusion

Yes, banks can take legal action for non-payment of personal loans, but this happens only after multiple missed payments and repeated reminders. The consequences of defaulting include a damaged credit score, legal notices, court cases, and even bankruptcy proceedings.

To avoid such situations, always communicate with your lender if you’re facing financial difficulties. Banks may offer solutions like loan restructuring or settlement to help you manage repayments without facing legal trouble.

For more information on personal loans, repayment strategies, and trusted lenders, visit FinCrif Personal Loan.

#Personal loan default#Non-payment of personal loan#Legal action for loan default#Bank legal notice for loan#Debt recovery process#Loan repayment rules#Missed EMI consequences#Personal loan consequences#Loan default penalties#Loan repayment issues#What happens if you don’t pay a personal loan?#Can a bank take legal action for loan non-payment?#Legal process for loan recovery#Credit score impact of loan default#Personal loan recovery process#Debt collection laws in India#Personal loan settlement process#Bank actions against defaulters#Debt Recovery Tribunal India#How to avoid loan default?#personal loan online#nbfc personal loan#fincrif#personal loans#personal loan#loan apps#loan services#finance#bank#personal laon

0 notes

Text

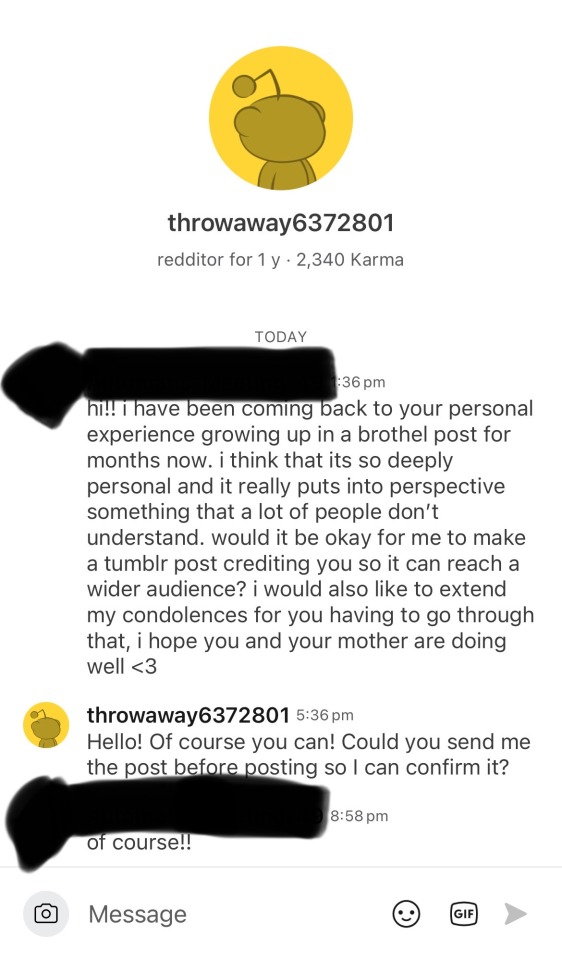

this post is a repost of an amazing reddit post by u/throwaway6372801 on the r/MoDaoZuShi subreddit.

https://www.reddit.com/r/MoDaoZuShi/s/GeHsDKCFON

Growing up in a Chinese brothel and how it may relate to Jin Guangyao/Meng Yao as a character

Just to start off I would like to preface that I’m not excusing his crimes, only putting in perspective parts of his character that I personally resonate with based on similarities. I will start off discussing how brothels and debts tend to work, especially involving children.

I will not be releasing where I grew up nor my name due to privacy reasons as I have somewhat personal information about myself on this account, despite its name.

But in short, I grew up in a brothel in China with my mother. She worked as a prostitute out of desperation and debt, which I ended up also helping with.

Debt was accumulated through food, housing, water, electricity, makeup, clothes, anything that we were unable to pay for ourselves and had to ‘take out a loan’ for. Things necessary for my mother to work, such as makeup, also fell into this category. This is not to mention baby items which were even more expensive and often times couldn’t be stretched out to last as long as other items.

Your co-workers are not your friends. You may both be in this situation, you may both have children, but if you cannot afford it, kindness is not an option. You have to be callous to survive.

On the same subject, politeness is a sought after commodity. If you can have a convincing smile, laugh, anything of the sort. Lying as well, if you can’t convince the man about to rape your child that they can’t because you would be ‘jealous’, you and your child are cooked.

Selling a child isn’t uncommon either. If someone has a particularly low-paying client who happens to be ugly or undesirable, they may offer the nearest person to them, not uncommonly a child that’s either their or one of their co-workers’.

Being a woman in a brothel is not a ‘women supporting women’ place. It is survival. And yes, some people are just evil, and will try and sell the child of a better paid co-worker than work themselves.

It doesn’t matter how pitiful you look, though it can help, you cannot stop it.

Onto Meng Yao. I will be calling him that since at this point in his life, he was indeed called Meng Yao.

We see when Wei Wuxian performs Empathy, that he goes into the body of Anxin. We as the readers get a glimpse into Meng Yao’s childhood at the brothel. It’s brief, and mostly focuses on the event of his mother, Meng Shi, being dragged naked into the streets, with himself after (fully dressed). Sisi comes to their defence.

But what I think that most people forget is that earlier, Anxin tries to sell Meng Yao to a customer. Not an uncommon thing to see in a brothel sadly.

We as the readers also are aware of Meng Yao’s signature ‘customer service smile’. This is pretty common with people in the customer service industry. Where you have to keep people happy to keep them from screaming at you. I have no doubt that this is likely a learned behaviour from his childhood at the brothel. All my fellow brothel brats, as well as myself, default to it as well.

Another response is possibly immediate lying/not taking fault in a situation where you are obviously at fault or have been caught red-handed. Think the scene of Meng Yao stabbing the Jin Captain and being caught be Nie Mingjue. Reading this scene, it always felt more like when a child drops a plate and immediately points to the dog to avoid punishment. While the child was clearly at fault, they took the blame off of themselves in an act of self-preservation. I’m not claiming that he was right here, just that his response makes sense to me. I have found myself and many others with a similar background doing it as well.

Well, that was definitely long. I don’t want to come off like I’m ridding Meng Yao of all his faults. I’m only trying to shed light on how some of his responses to things make sense given his upbringing, as well as maybe give people an insight as to how horrible brothels can be, especially to children.

If your mother is the only kind person to you, she is your whole world.

In addition, prostitution is often called ‘the first profession’ or ‘the oldest job’. I think this rings very true. Much of the practices mentioned have been practiced for centuries and likely will continue to be practiced for centuries to come.

If anyone decided to sit through and read everything, thank you. I would also like to apologise in advance for any grammatical or spelling mistakes, English is not my first language. I’m pretty all over the place here so apologies for that as well.

Edit: I forgot to mention the disgust and prejudice that people hold to this day. Meng Yao serving tea and it being seen as ‘tainted’ is a sentiment still somewhat held to this day. Same with him not being allowed to hold Jin Ling due to his perceived ‘dirtiness’. It’s something that is sad but true, and follows people for their entire lives. You will never be clean, due only to the circumstances of your birth and childhood, as well as a desperate attempt to survive. Prostitution is not something people aspire to achieve generally. If they do, they likely don’t understand the long term effects and social stigma that isn’t just limited to you.

Edit 2: Safety is another huge thing, especially for formal brothel brats. Safety comes with power. I’m not excusing Meng Yao’s use of getting power, he definitely used certain means that I don’t agree with. But especially growing up in that setting safety = power. I was given the advice many times growing up to cling to a powerful man in hopes that I become his wife, as that would grant me safety and stability. Many of the children I grew up with ended up working alongside their mothers or turning to drug dealing and criminal activity, which in turn gave them power. I think that what we learn growing up has a huge impact on people as adults. It can be very difficult to unlearn these associations.

Last edit, more of an update: I would like to thank everyone and extend that thanks on behalf of my mother. We are both doing well now. We have both come to America and I have started my own family in the past few months. She has a new job and recently moved. She’s very happy and has many friends here. Thank you all for your kindness and well wishes. Have a lovely day!

screenshots of the original post as well as my messages. cut off, but she did approve this post.

85 notes

·

View notes

Note

Does Yuuya have a more active role in the light novel compared to Yuu in the game? If so, how?

Also thank you for providing us some contents with twst light novel. I've been curious about it myself and glad I came upon your blog.

I guess that depends on what you mean by more "active"? Personally, I would say Yuuya is more involved just because of the structure of the light novel. We're able to hear more of his thoughts and emotions compared to Yuu, so by default Yuuya will feel more "active" anyway. We just understand him more than Yuu, who is designed to be a blank slate that's easily projected onto or self-inserted into. Yuuya basically goes through all the same general motions as in-game Yuu does. However, due to his cowardly and meek personality, he tends to react disparagingly/with little confidence and avoids conflict rather than throw himself into the thick of things. Additionally, because there are logical gaps that need to be filled in for light novels, we do see more detail on Yuuya's actions or little extra details in some parts. For example, it's never explicitly stated that Crowley gave Yuu a uniform in the game. In the light novel, Yuuya is said to have been loaned a uniform. As another example, Yuuya expresses fear when encountering Malleus and Leona for the first time, whereas in-game Yuu tends to demonstrate curiosity or just general shock instead. Yuuya also frequently flashbacks to the life he had in his original world, which is considerably more backstory than we ever get for Yuu. I unfortunately don't have the time or the space to run through every single variation or notable change between the light novel Yuuya and the game Yuu 💦 but I hope that this at least helped to give you an idea of what kinds of differences there are between the two mediums!

#twst#twisted wonderland#Malleus Draconia#Leona Kingscholar#Dire Crowley#twst light novel#twisted wonderland light novel#Yuu#Yuuya Kuroki#Kuroki Yuuya#disney twisted wonderland#notes from the writing raven#question

117 notes

·

View notes

Text

not me and portrayal of twinship

Be forewarned, this is long as hell.

Normally when I think about writing about media depictions of twins (as a highly opinionated twin), two things stop me. One, nobody cares. Seriously, most people actively want to avoid understanding twins' point of view. It's my overwhelming experience. Two, it's just too much to delve into and I have thoughts about every little thing. I would digress until I became overwhelmed. But I think it might actually work to discuss this one facet. It might connect with a few people because fandom types are often actually interested in novel points of view and the emotional landscapes of others. And if I only talk about this one show that narrows things for me in a helpful way. So here goes.

As soon as Not Me starts with episode 1, there is an item on the balance sheet. We begin with the idea that twins can feel each others' feelings and feel when the other is seriously injured. We see this in Black & White's childhood and then again when White returns to Thailand after many years away. So, psychic twin connections. I'm both highly militant and oddly patient when it comes to twin depiction stuff. I don't love the psychic thing, but that's the variety of twinship media nonsense I'm willing to take on board *if* it's done well and it's worthwhile. When you begin a story about twins with a psychic connection and make it a central feature of your plot, you've essentially borrowed goodwill from me. If you squander it, then your balance will come due and you'll be left owing. If you use it well, I'll forgive the loan. So we start not on a bad note, but with higher stakes.

Pretending-to-be-one's-twin plots work okay for me. Why? Because as much as they might rely on twin resemblance, they can't work without the twins being different, whole people. That shouldn't be considered a positive because all characters should begin as whole people, but we know that doesn't always happen in general and it certainly doesn't always happen with twins.

We begin a whole big chunk of the story where the crux may be that White is sort of undercover as his own brother, but twinship isn't actually at issue much at all. It's about deception and risk, not twin connection or twinship. We do get constant reminders that White and Black are very different, and we get a lot of White trying and only kind of succeeding at pretending.

One thing that rings true to me is that he doesn't actually have to do all that great a job of pretending. If you don't know somebody has a twin, and to some extent even if you do, as a human being you'll default very hard to this-is-the-same-person. It's just necessary in every moment of our lives that we're not dealing with identical twins, so it's necessary to lean that way. Also, as a twin I know very well that the majority of people are highly unobservant about a great many things. And it's not like these guys have any reason to think this is some other guy, though it would have been a note of realism if at some point at least one of them had gone wait, is Black reporting on us to the cops or something because he's acting sketchy. They do point out that he's being weird, so that base is partially covered.

I did some Tumblr poking around before I was done watching, so I saw a few spoilery things. Thanks partly to that, I couldn't help but hope that Sean figured out comparatively early that White was not Black. That would have been kind of thrilling to see, honestly, as a twin. But I certainly understand how that might not happen, and I also see the efficacy (to the plot) of having him not figure it out too quickly. It's more interesting if he doesn't know right away.

Clearly Tumblr world loves memeing about how Black woke up from his coma when, possibly because, White hooked up with Sean (I'll be more coy in my wording than some). Twin-rep-wise, that's a wash to me, neither better or worse than the psychic connection trope. I'm already tolerating the psychic stuff, and I can't say it's not an interesting plot point. If you need Black to wake up, when else would it be? It probably borrows a little more goodwill, but again that's stakes rather than a deficit.

As someone who remains skeptical of the psychic twin connection trope, I will say this. The particular way Black wakes up kind of shows the absurdity of the whole conceit. I'm cool with it because this is melodrama and it *should* be bonkers, but it goes to show what you're playing with when you invoke that trope.

This is when stuff gets interesting, to me but I assume to everybody. White and Black are both running around in the world of the show, and crucially they're also interacting with each other. And some of what happens is honestly pretty great twin-rep-wise. I really have to hand it to writer/director Nuchy Anucha Boonyawatana—she must be a pretty empathetic, intuitive person. (Along with her cowriters.) She seems to have made an effort to put herself in both Black and White's shoes in a real human way. Like, well beyond what the story would require.

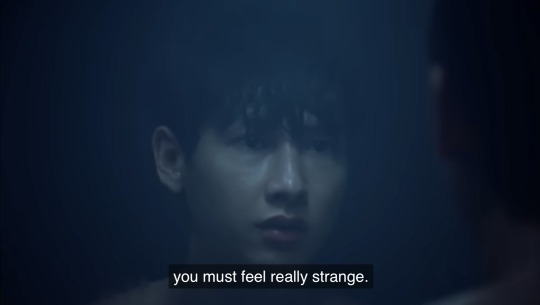

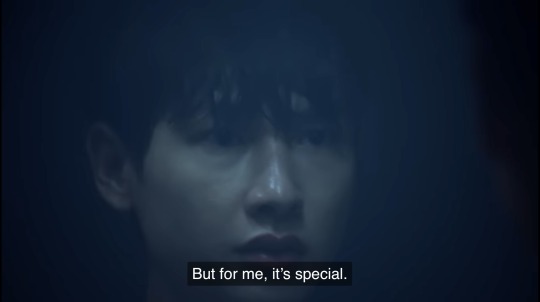

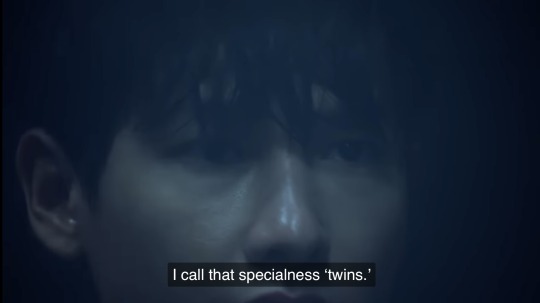

I wanted to avoid digressing too much, but I want to go back to the very first moment in the entire show. In that brief scene, White looks in a dark, foggy mirror and says these words in voiceover: “When you see somebody who looks precisely like you, every part of his body resembles yours, you must feel really strange. But for me, it’s special. I call that specialness ��twins.’”

When I saw this scene, I won’t say I knew this would be a thoughtful treatment of twins. But I did find it promising. Part of what annoys me about being a twin is how non-twins, aka singletons, think that being a twin is great because on some level they think of their hypothetical twin as an extension of themselves. Your twin is not you, and your twin is not part of you. Your twin is a human being, and like any other human being in the world there are some moments and some ways when they can seem utterly unknowable, foreign, unfathomable.

Back to the point in the story where I left off.

There’s a big twin moment near the end of episode 9: White is confronted in Black's apartment by an unknown figure, only to find that it's his brother. White’s voiceover tells us what he's thinking, and he calls back to that brief beginning scene. Now that I’ve gone back to look at both moments, I can say that they’re very similar in length and rhythm. So I suspect our writer/director was not only deliberate about the echo but also exacting in how both moments play out.

White’s voiceover says: “I’d always imagined the day I’d see my brother again. It’s supposed to be a heartwarming moment. But now it’s happening. It’s surprisingly frightening. It’s as though I’m meeting my doppelgänger.” Of course this is a translation, but it’s worth noting that you can hear actor Gun Atthaphan saying “doppelgänger,” so you know there isn’t a ton of poetic license on the part of the translator here.

White and Black exchange some awkward pleasantries, and then Black echoes White, saying "You look so much like me, it’s creepy.”

If I hadn’t seen my twin in ten years (especially at that age), it would have been very surreal even if that person weren’t as menacing as Black seems to be. It’s just that there are dimensions to twinship that fade in your mind when you’re not actively engaged with them. I assume that regular degular siblings can experience this in partial ways or in flashes, but I don’t have any of those so I can only guess. Seeing your twin after a long time apart isn’t somehow magical in a good or a bad way. But your twin carries all the powerful associations of any close family member along with a similarly large number of associations to your own identity.

I chase catharsis in media, but I don’t usually experience it strongly. But there can be a catharsis in recognition of self, and that’s what I get from these moments. To be clear, I don’t feel some profound otherness when I interact with my sister. She’s a sweetheart and I feel very close to her. But the twin experience, for me at least, connects strongly and meaningfully to some very basic aspects of my human existence. The fact that one is a little bit alone even in the closest togetherness. The fact that other people are never fully knowable. The fact of my own identity and how its boundaries aren’t quite as firm and distinct as I might pretend they are. How much I need connection. The way so much about my perceptions and actions can be strongly influenced by others in ways I’m totally unconscious of. Some of this may sound hokey! But it’s difficult to express it any other way.

Moving on. White goes to meet their mother as Black, and just as their conversation is ending she makes it clear she knows who he really is. You might think that bit is meaningful to me, but it doesn’t strike a stong chord. Parents can tell their twin children apart, yes. Would it be harder after ten years? Assumably. What is it supposed to mean about her that she can? I don’t know; I’m not a huge fan of hers.

Black encounters Sean and is incredibly cruel to him, beats him, and it sucks. It annoys me to heap praise on actors for playing twins—actors play different roles all the time and that’s just doing two of them in the same project—but I have to admit that Gun Atthaphan not only does a great job playing dual roles, but a good job playing twins specifically. In a way it’s hard to understand now, having seen what we have as the audience, how Sean could fail to see that this isn’t “his” Black. But he doesn’t, because there’s no way anything else is possible according to what he knows about his world.

Sean sees White-as-Black again as White saves him from sketchy mercenary types, and then tries repeatedly to confront him. White doesn’t really explain and Sean doesn’t come to an obvious epiphany. But when Sean sees Black again, something has clicked. He attempts the trust fall White showed him and Black just stares on contemptuously. Black is smoking “again.” And we get to another big twin moment. This is episode 12.

Sean gets it. He says “You’re not the Black that I love.” He handcuffs himself to Black. They have an oddly realistic fight that involves various uncomfortable wrestling positions. And he says “You have a twin brother?” Black denies it, Sean insists repeatedly. And you see Black’s face change from contempt to anger as he says “Don’t you get close to my little brother again.”

This is a fun, climactic moment. It is, of course, adorable that Sean insists he won’t stay away from White, and honestly pretty adorable in an extremely grumpy way that Black is being protective. (Here again Gun is very convincing. For such a small, baby-faced guy he is genuinely menacing as Black.)

The moment is also true to my experience, though the only direct connections I can make aren’t exactly similar in circumstances. If your social world intersects heavily with that of your twin, there really are particular moments in many romantic relationships and even in many close friendships where the other person will sort of take a twin inventory with you. They don’t go on a spiel about how you’re cooler than your twin (unless maybe they suck as a person), they probably don’t even compare you exactly. But each person has to come to their own realization because (often at least) while they knew you and your twin are different people, they had to learn it all over again on another level. And they want you to know they perceive it.

There are smaller iterations of this phenomenon where people will emphatically tell you that while they have been able to tell you apart in the past, *now* they don’t even think of you as looking the same, now they can’t imagine how anybody *ever* confuses you. It’s not like this happens every single time I get to know every single person, but it’s so common in its broad strokes that I feel confident saying that the people around me and my sister share some common experiences in how they perceive us. And a change comes at a certain point that’s compelling enough that people are motivated to talk about it, try to make you understand.

Anyway, while this is a phenomenon that happens around me rather than to me, Sean’s insistence strikes a chord.

Sean finds White. White does a totally accidental trust fall, and it’s pretty cute.

White... decides to halfway drown himself to “remind [Black] of [their] connection”? Which makes some intuitive sense in the moment even if it sounds a bit silly. And is a little. Black finds him, they talk, Black concludes that he can’t stop White from staying with the group, going on their mission, and being with Sean. White stops Sean from going to the drug warehouse alone, at which point he says something that rings true for me as well. He explains why he hesitated to stay part of things, and says “I thought it wasn’t my place.”

When Black returned and demanded his phone, demanded White go away and not see the gang anymore, White went along with that because in a real way that was valid. White had genuine reasons for essentially stealing Black’s life, but that is what he did. White is an empathetic sweetheart so while he did get used to Black’s world he does feel guilty and out of place suddenly. But now he sees that things have changed, and he can’t go back to before all this happened. And of course he’s in loooove, so there’s that as well.

Then White tells the other dudes who he is (except for Gumpa, who knew the whole time) and it takes them a while to believe him. But when they do, they immediately do the twin inventory with him, saying how did I not see this earlier, etc.

They do their attempted heist, loads of shit goes wrong, they fall from various frying pans into various fires for a good while. They get away, things settle down. Sean does the twin inventory with White again and insists he’s completely able to tell White and Black apart now.

Then we have my final twin moment. White says he knows Black won’t be returning to the group. “Nobody wants to live in someone else’s shadow,” he says. “My brother sacrificed this role for me.”

This rings true for me. As a twin, you never want to think of yourself as interchangeable with your sibling. But at the same time many relationships and groups don’t have room for each of a pair of twins to feel comfortable. It’s not like you have to come up with some legalistic scheme for who “owns” a social group or anything like that. But at least in my sort of twin relationship, you’re never going to have a symmetrical relationship with a third person or a social circle. Even if you each have the same degree of connection to the same person, it’s different. And I can’t say it’s ever really been the same. One has always been closer, or more comfortable, or something.

Well, if you can believe it that’s not everything I could have said. But it’s a lot, and if you made it to the end I thank you. In case it doesn’t go without saying, I did find it worthwhile to indulge the psychic twin trope. What I got out of Not Me was worth the latitude.

#not me#not me the series#gun atthaphan#off jumpol#avoiding twin tags like the plague until i figure out which are not sketchy

70 notes

·

View notes

Note

💭

💭 for a memory from jet’s past.

“ fuckfuckFUCK. ” panic with a backing track of a blaring security alarm, the rapid thud of sneakers on pavement, and the sharp jingling of hands and feet scrambling up and back down a chainlink fence. the teenager, no older than sixteen, fleeing from the impound lot keeps running as fast as he can while he considers his options-- how long could it take police to respond to the tripped alarm ? was there any cameras ? did they catch his face ? ezekiel (long before he is ever called jet) finds himself ducking onto a side street to avoid crossing paths with the inevitably incoming law enforcement. the time this affords him, while brief, is long enough for an outburst.

he screams. jagged frustration tearing itself out of his lungs, through his throat, and into the world to be heard by whatever poor fucks live on this shitty residential street.

he had just wanted his fucking car back. it’d been repossessed when his dad defaulted on some loan. the stupid thing had still in his dad’s name for insurance or whatever, but goddammit, it was his. his car. his chance to leave one day, his one shot at getting away from whatever horrible thing was coming next for his family. his one chance at living a different life was stuck in a fucking impound lot until his dad scrounged up enough money to get it back. fuck.

3 notes

·

View notes

Text

What is being ignored by the mainstream media are the dangers facing the global economy

Dec 03, 2024

On the economic front, it is more of the same, but just a different day.

The U.S. equities keep riding high following the re-election of Donald Trump.

While there are fears that his tariff policies will have negative effects on the economy, at this point, it is a guessing game.

The same with his plans to cut taxes. Will the richest Americans reap the biggest rewards like his last cuts in 2017, or will We the People of Slavelandia get a cut?

What is being ignored by the mainstream media are the dangers facing the global economy.

Economies were artificially propped up with trillions of dollars in fake money backed by nothing and printed on nothing, plus negative and zero interest rate policies, are now suffering from the draconian COVID lockdown policies imposed by politicians that destroyed the lives and livelihoods of billions of people across the planet.

We continue to report on the looming Office Building Bust that will cause Banks to Go Bust.

Need more proof?

The recent four-week office occupancy rate of the largest 10 cities in the U.S. was, according to Kastle Systems, down to 40.6 percent. Much of the decline was a result of the Thanksgiving holiday, but overall, for the year, the average is around 50 percent, while the vacancy rate, meaning empty office buildings, is at around 20 percent.

As of last week, the delinquency rates on commercial mortgage-backed securities (CMBS) was at 10.4 percent, up one percent in November, hitting its fastest spike in two years... the depth of the COVID War lockdowns.

According to Trepp data, the current CMBS delinquency rate is just .3 percent below the 10.7 percent spike during the Panic of ’08 Great Recession.

Illustrating the danger ahead, but again banned by the mainstream media, was the 31 October 2024 article in Wall Street on Parade, New York Fed Report: 27 Percent of Bank Capital Is “Extend and Pretend” Commercial Real Estate Loans... which in part states the dire office building crisis as a result of the vacancy rates and how it is being covered up.

They quote a paper written by Matteo Crosignani, financial research advisor at the New York Fed, and Saketh Prazad, a former research analyst at the New York Fed who is now a doctoral student in the Business Economics program at the Harvard Business School who wrote:

“In this paper, using detailed supervisory data, we document that banks have ‘extended-and-pretended’ their distressed CRE mortgages in the post-pandemic period to delay the recognition of losses. Banks with weaker marked-to-market capital—largely due to losses in their securities portfolio since 2022:Q1—have extended the maturity of their impaired CRE mortgages coming due and pretended that such credit provision was not as distressed to avoid further depleting their capital. The resulting limited number of loan defaults hindered the reallocation of capital, crowding out the origination of both CRE mortgages and loans to firms. The maturity extensions granted by banks also fueled the volume of CRE mortgages set to mature in the near term—a ‘maturity wall’ with the associated risk of large losses materializing in a short period of time.”

One of the scariest potential outcomes referenced by the authors is their so-called “maturity wall” when the debt bombs come due and losses pile up suddenly. The authors write this:

“…we document that banks’ extend-and-pretend has led to an ever-expanding ‘maturity wall’, namely a rapidly increasing volume of CRE loans set to mature in the near term. As of 2023:Q4, CRE mortgages coming due within three years represent 27% of bank marked-to-market capital, up 11 percentage points from 2020:Q4—and CRE mortgages coming due within five years represent 40% of bank marked-to-market capital. We show (i) that weakly capitalized banks drive this expansion, consistent with their extend-and-pretend behavior, and (ii) that the maturity wall represents a sizable 16% of the aggregate CRE debt held by the banking sector as of 2023:Q4.

“Taken together, our results highlight the costs of banks’ extend-and-pretend behavior. In the short term, the resulting credit misallocation might slow down the capital reallocation needed to sustain the transition of real estate markets to the post-pandemic equilibrium—for example supporting the conversion of office space into residential units and recreational spaces in large urban areas. In the medium term, the delayed recognition of losses exposes banks (and all other holders of CRE debt) to sudden large losses which can be exacerbated by fire sales dynamics and bankruptcy courts congestion.”

Further illustrating the reality of the looming CMBS debt bomb, today Wall Street on Parade noted that:

“Life insurers continued to allocate a substantial percentage of assets to risky and less liquid instruments, such as leveraged loans, collateralized loan obligations (CLOs), high-yield corporate bonds, privately placed corporate bonds, and alternative investments. Moreover, life insurance companies have material direct exposures to commercial mortgages and are large holders of commercial mortgage-backed securities (CMBS). This exposure to illiquid and risky assets makes life insurers vulnerable to an array of adverse shocks, including that of an economic downturn or of a significant further deterioration of the CRE [commercial real estate] market.”

TREND FORECAST: Yes, the significant further deterioration of the CRE [commercial real estate] market,” that so few are talking about... a mega trend we warned about when we had forecast the Office Building Bust and its socioeconomic implications.

2 notes

·

View notes

Text

see here's the difference:

YA/NA: 19 year old princess Cindy has two hot suitors vying for her hand while on the run from her father's murderer. how will she choose between these two utter hotties and still save her kingdom?

older audience: 30-40 year old Sarah works in the government as a high ranking official brokering peace between her country and a neighboring country, when suddenly someone wants her dead and frames her for murder. She's on the run from assassins while trying to stay alive, clear her name, and get that damn peace treaty brokered so she can avoid unnecessary war and bloodshed. Harvest time is coming and if the crops are destroyed then her people will starve. She has to worry about supply lines, finances, politics, and whether her country would default on international loans if it got engulfed with war. she doesn't know who to trust at this point except the warrior who happened to save her one night, but even he doesn't really understand the complexities of what's at stake, and the only one that does seems to be the assassin that's chasing her, and seems to be her counterpart from the other country. Perhaps they could put aside their differences and find out who benefits from war, and who really orchestrated events. the clock is ticking and there's so much at stake. She doesn't have time for love while staying alive and trying to solve everything, but sometimes you have no choice when love finds you. She hopes and prays that they stay alive long enough to find out what their future holds.

5 notes

·

View notes

Text

Take Advantage of the Assistance to Meet Your Urgent Needs Same Day Payday Loans

Same day payday loans could help you get your emergency finances under control if you're experienced in using a same day payday lending business to handle unforeseen expenses. Many lenders offer an easy-to-use service that enables hard-working Americans to obtain fast cash and repay it over time with a manageable payback schedule that works for them.

When you have no choice than to seek your employment, family, or friends for a same day funding loans, lenders may offer an alternative loan in cash because some people would rather not to divulge their current financial situation. The qualifications are as follows: you need to be a citizen of the United States, be at least eighteen years old, have an open checking account linked to your Social Security number, and perform a permanent job that pays a minimum of $1000 in a steady income.

It is also acceptable for people to gain as much as possible from same day payday loans without any reservations if they are dealing with bad credit elements such as defaults, arrears, foreclosure, late payments, and country court judgments (CCJs), IVAs, or insolvency, among others. With the flexibility of a two- to four-week repayment schedule, these loans allow you to get amounts ranging from $100 to $1000. You can use this loan to pay for a variety of expenditures, including those related to healthcare, power, groceries, unpaid bank overdrafts, and other expenses.

How Can I Obtain An Instant Fast Cash Loans Online?

It's simple to obtain fast cash loans online. Simply fill out the online application by providing your bank, job, and personal details. Within minutes, you will know if you are authorized. If you accept the terms of repayment, the funds will be transferred into your bank account by the following day. The money is then yours to do with as you like. Just remember to return the loan on schedule to avoid penalties.

You can be authorized in a matter of minutes if you submit an online application. One of our representatives will then give you a call to go over the procedure and confirm the information you provided. From that point on, you have the option of receiving your fast cash loans online via electronic check the following business day or on your debit card, enabling same-day funding.

Can I increase my Payday Loans amount after I accept the loan agreement terms?

Your maximum loan amount is based on your income. If you have taken out a loan for less than your maximum or you have paid down some of your principal through payments, then you can refinance and receive more money.

We offered with immediate approval for qualified applicants are known as payday loans online same day. You can obtain $100 to $1,000 sent to your bank account as soon as the same day with Nueva Cash. In contrast to certain typical payday loans, you don't have to wait days or weeks to be accepted. All you need is a phone number, a checking account, and three months of consistent work experience or more, as well as a minimum monthly salary of $1,000. You can even improve your credit by making on-time payments on the loan, which you will repay in manageable installments.

https://nuevacash.com/

3 notes

·

View notes

Text

How to Reduce EMI Burden on Your Personal Loan

A personal loan provides quick financial assistance for various needs, including medical emergencies, weddings, home renovations, and education expenses. However, high Equated Monthly Installments (EMIs) can become a financial burden, affecting your monthly budget and savings. Fortunately, there are several strategies to reduce your EMI burden and make loan repayment more manageable.

In this article, we will explore practical ways to lower your personal loan EMIs, factors affecting EMI amounts, and the best lenders offering flexible repayment options.

1. Understanding Personal Loan EMIs

An EMI (Equated Monthly Installment) is the fixed amount you pay every month towards your loan repayment. It consists of: ✅ Principal – The original amount borrowed. ✅ Interest – The cost of borrowing, calculated based on the loan amount, tenure, and interest rate.

The EMI amount depends on three key factors:

Loan Amount – Higher loans result in higher EMIs.

Interest Rate – A lower interest rate means a lower EMI.

Loan Tenure – A longer tenure reduces the EMI but increases the total interest paid.

Now, let's explore different ways to reduce your personal loan EMI burden.

2. Effective Ways to Reduce Your EMI Burden

2.1 Opt for a Longer Loan Tenure

Choosing a longer loan tenure spreads your repayment over more months, reducing your EMI amount. However, this also means you will pay more total interest over the loan tenure.

Example:

A ₹5,00,000 loan at 12% interest for 3 years = EMI of ₹16,607

A ₹5,00,000 loan at 12% interest for 5 years = EMI of ₹11,122

Best For: Borrowers looking for short-term relief in monthly expenses.

💡 Apply for a flexible tenure loan here: 👉 IDFC FIRST Bank Personal Loan

2.2 Make a Higher Down Payment or Part-Prepayment

If possible, make a lump sum payment towards your loan principal to reduce the EMI burden. This method helps you pay off the principal faster, lowering future EMIs.

How to do this?

Use bonuses, incentives, or tax refunds to prepay a portion of your loan.

Some lenders allow part-prepayment without extra charges.

💡 Best lenders offering part-prepayment options: 👉 Bajaj Finserv Personal Loan

2.3 Transfer Your Loan to a Lower Interest Rate Lender

If your current lender is charging high interest, consider a loan balance transfer to another bank or NBFC offering lower rates. This can significantly reduce your EMI.

Example: If your current loan interest rate is 14% p.a. and another bank offers 10.5% p.a., transferring your loan could save you a substantial amount in EMI payments.

💡 Best lenders for balance transfer: 👉 Tata Capital Personal Loan

2.4 Negotiate for a Lower Interest Rate

If you have a high credit score (750+), stable income, and good repayment history, you can negotiate with your lender for a lower interest rate, which directly reduces your EMI.

How to do this?

Request your lender for a reduced interest rate based on your financial profile.

If you’re a loyal customer, use that as leverage to negotiate better loan terms.

💡 Apply for low-interest loans here: 👉 Axis Finance Personal Loan

2.5 Opt for Step-Up EMI Plans

Some lenders offer step-up EMI plans, where your EMI starts at a lower amount and gradually increases as your income grows. This helps in managing the EMI burden in the early years.

Best for: Young professionals expecting salary hikes in the future.

💡 Lenders offering step-up EMI plans: 👉 Axis Bank Personal Loan

2.6 Choose a Fixed or Floating Interest Rate Wisely

Fixed interest rate loans have stable EMIs throughout the tenure.

Floating interest rate loans may change over time but can be lower when interest rates decrease.

If the market rates are expected to drop, consider a floating-rate loan to reduce EMI payments in the future.

💡 Best lenders for flexible interest rate options: 👉 InCred Personal Loan

2.7 Consolidate Multiple Loans into One

If you have multiple loans (personal loan, credit card debt, etc.), consider a debt consolidation loan. This helps in combining all loans into one, often with a lower interest rate and manageable EMI.

Benefits: ✅ Simplifies repayment with a single EMI. ✅ Reduces overall interest burden. ✅ Avoids multiple due dates and penalties.

💡 Apply for debt consolidation loans here: 👉 IDFC FIRST Bank Personal Loan

3. How to Avoid EMI Defaults & Late Payment Penalties

Even after reducing your EMI, ensure that you never miss a payment. Here’s how:

✔ Set Up Auto-Debit for EMIs – Link your loan EMI to auto-debit from your bank account to avoid missing payments. ✔ Keep an Emergency Fund – Save at least 3-6 months’ worth of EMI payments as a backup for emergencies. ✔ Monitor Your EMI Payments – Regularly check bank statements and loan accounts to track EMI deductions. ✔ Avoid Taking Multiple Loans – Too many loans can increase your financial stress. Borrow only what you need.

💡 For seamless EMI payments, set up auto-debit here: 👉 Personal Loan Auto-Debit Guide

Smart EMI Management for Financial Stability

Managing and reducing your EMI burden is key to maintaining financial stability while repaying your personal loan. The best strategies include:

✅ Opting for a longer tenure to reduce EMI size. ✅ Making part-prepayments to lower the outstanding principal. ✅ Transferring your loan to a lower interest rate lender. ✅ Negotiating with your lender for a better rate. ✅ Consolidating multiple loans into one for simplified repayment.

By applying these smart repayment techniques, you can ease your financial burden and repay your loan comfortably.

For the best personal loan options, check out: 👉 Apply for a Personal Loan

By planning your loan repayment wisely, you can enjoy lower EMIs, improved financial health, and stress-free loan management! 🚀

#Reduce EMI burden#Lower personal loan EMI#How to reduce EMI on loan#Personal loan EMI management#Ways to reduce loan EMI#Lower personal loan interest rate#EMI reduction strategies#Loan repayment tips#How to lower loan installment#Best ways to manage loan EMI#Personal loan balance transfer#Loan tenure and EMI impact#Debt consolidation loan#How to negotiate lower interest rates#Personal loan prepayment benefits#Fixed vs floating interest rates#Loan refinancing benefits#Personal loan repayment strategies#How to avoid EMI default#Best banks for low-interest personal loans#finance#personal loan online#personal loans#personal loan#bank#nbfc personal loan#fincrif#loan services#loan apps#personal laon

0 notes

Text

Short Term Loans UK Direct Lender: Find a Quick Fix for Your Money Issues

The loan market is flourishing these days thanks to sophisticated services for borrowers who require last-minute support or extra cash. These people can now receive significant financial aid using a debit card, but they must first apply for short term loans UK direct lender. There are no debit cards available in the finance sector seven days a week, twenty-four hours a day. They can obtain the required amount in a day by following the easy procedure.

This implies that all holders of non-debit cards are eligible to receive the prompt assistance of the aforementioned loans. However, in order for these candidates to be able to repay the loan balance, they must have a steady source of income. Then, and only then, may they complete the loan application form with the necessary information for short term loans UK direct lender in order to expedite the loan approval process. It is also acceptable for everyone who has bad credit history, such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy, to take advantage of these credits without any restrictions.

These loans are excellent short-term financial options for those in need of money right away. You can therefore take out a small loan of between £100 and £1000, which you must return within a month. The money received can assist people in resolving financial issues that surfaced in the middle of the month. Short term loans UK does not come with a little higher interest rate because the criterion holders are exempt from the additional procedures. It doesn't take long for candidates to settle their accounts after they can exhale comfortably after realizing they have paid off all of their debt.

What is meant by the term "Short Term Loans UK"?

It's obvious that it's referring to a loan that you could obtain fast rather than having to wait several days or more to hear back about your loan approval.

That is reasonable, but how quickly is fast?

How and where you apply for the short term loans direct lenders will determine a number of things. Nevertheless, let's start by talking about how long it takes to get approved and receive your money. This can take a few minutes, a day, or longer. For instance, after being approved, a payday loan could be sent to you in a matter of minutes. It's one loan type to consider while looking at payday quid. On the other hand, there are other short term loans direct lenders that could take a day or two longer; these are commonly referred to as personal loans or unsecured loans.

For whatever reason, you may need urgent cash, but you should think about how long a direct lender can take to process your payment. Usually, you can find out before applying for a same day loans UK. In this manner, unpleasant surprises and lengthier waits than anticipated are avoided. You must be familiar with the concept of quick loans. However, you may be wondering if they're just a myth. Our purpose is to respond to your inquiry. Can you obtain a loan quickly? Are they real? Is it possible that we will occasionally search for but never find a same day loan? In any case, how long might it take to find a loan?

https://paydayquid.co.uk/

4 notes

·

View notes

Text

Navigating the World of Loans: Expert Advice from My Mudra CEO, Vaibhav Kulshrestha

Introduction

In today's dynamic financial landscape, understanding the intricacies of loans is essential for individuals and businesses alike. To shed light on this topic, we turn to Vaibhav Kulshrestha, esteemed CEO of My Mudra Company, who shares his expert advice and insights on navigating the world of loans. With his vast experience and deep understanding of the financial industry, Vaibhav offers valuable guidance for making informed decisions when it comes to borrowing money.

Assessing Your Needs

According to Vaibhav Kulshrestha, the first step in obtaining a loan is to assess your needs thoroughly. Whether you're a business owner looking to expand operations or an individual seeking financial support for personal endeavors, it's crucial to identify the specific purpose of the loan. By clearly defining your goals and requirements, you can select the most suitable loan type that aligns with your objectives.

Research and Compare Options

In the current market, numerous lenders and loan products are available. Vaibhav emphasizes the significance of thorough research and comparison before making a decision. It's crucial to evaluate factors such as interest rates, repayment terms, associated fees, and customer reviews. By exploring different lenders and loan options, you can find the best fit for your financial situation while minimizing costs and maximizing benefits.

Understand the Fine Print

Before entering into a loan agreement, it's essential to read and understand the fine print. Vaibhav advises borrowers to carefully review all terms and conditions, including interest rates, repayment schedules, penalties for late payments, and any additional charges. Seeking professional advice, such as consulting a financial advisor or legal expert, can provide clarity and ensure that you are fully aware of the implications of the loan agreement.

Evaluate Your Repayment Capacity

One of the most critical aspects of borrowing money is assessing your repayment capacity. Vaibhav advises borrowers to realistically evaluate their financial capabilities and consider how the loan payments will fit into their budget. It's essential to calculate the monthly installment amounts, taking into account existing obligations and potential fluctuations in income. Maintaining a sustainable repayment plan is vital to avoid financial strain and potential default.

Build a Strong Credit Profile

A robust credit profile is crucial when applying for loans, as it significantly impacts the approval process and the interest rates offered. Vaibhav stresses the importance of maintaining a good credit history by making timely payments, minimizing debt, and managing credit responsibly. A strong credit profile enhances your chances of securing favorable loan terms and conditions, ultimately saving you money in the long run.

Seek Professional Advice

For complex loan scenarios or if you are unsure about the best course of action, Vaibhav Kulshrestha recommends seeking professional advice. Financial advisors, loan officers, and experts in the field can provide personalized guidance based on your unique circumstances. Their expertise can help you navigate through the loan application process, understand complex financial jargon, and make informed decisions that align with your financial goals.

Conclusion

When it comes to loans, CEO Vaibhav Kulshrestha's expert advice serves as a valuable compass for borrowers. By assessing needs, researching options, understanding loan terms, evaluating repayment capacity, and building a strong credit profile, individuals and businesses. Remember, taking a loan is a financial commitment, and responsible borrowing is essential. Only borrow what you genuinely need, understand the terms and conditions, and make sure you have a solid plan for repayment to avoid unnecessary financial stress.

3 notes

·

View notes

Text

After twelve grinding months, China appears no more capable of influencing the outcome of Russia’s war in Ukraine than it was at the conflict’s inception. Largely reduced to spectator status, Beijing’s primary role has been to provide Moscow with a financial lifeline by ramping up purchases of heavily discounted Russian crude oil and coal, while reaping an unexpected windfall from surging exports to Russia. But these and other Chinese half-measures appear aimed, for now, at ensuring Russia has what it needs to sustain its wartime economy—not actually win the war.

In a similar twist, China’s 12-point peace plan for Ukraine is not geared toward restoring peace in Europe. Indeed, China’s dead-on-arrival missive has little to do with ending the war in Ukraine and everything to do with setting the conditions to win a future war over Taiwan. Put differently, China recognizes the causes of Russia’s failure in Ukraine are the same that threaten its eventual reunification plans.

Read correctly, China’s phony peace proposal could also serve as the basis for a Western-led roadmap to prevent an Indo-Pacific war from breaking out in the first place.

Clearly, Beijing’s position paper, titled “The Political Settlement of the Ukraine Crisis,” reflects China’s concerns about current battlefield conditions in Europe. To date, transatlantic resolve to support Ukraine remains more or less resolute, even as Western democracies grapple with absorbing the costs associated with being cut off from Russian energy and other raw materials. Even though more Russian soldiers have perished in Ukraine than during all Russian wars combined since World War II, Russian President Vladimir Putin remains entirely too confident he can still defeat Ukraine and altogether too stubborn to change course. Meanwhile, China continues to vacillate in providing lethal assistance to Russia, a decision made more complicated now that Washington has leaked details on Beijing’s internal deliberations.

No doubt, Chinese leader Xi Jinping appears powerless to pull Putin back from the brink—not that Xi has demonstrated any inclination to do so. At the same time, China’s refusal to condemn Russia’s invasion has ravaged its credibility across Europe, including in countries such as Austria, Poland, and Croatia, where Beijing has historically enjoyed positive relations. And China’s sunk costs are not purely reputational but increasingly economic. With the war weighing on global growth, debt defaults in the developing world loom, with Beijing holding many of those loans. Economic uncertainty also threatens to depress worldwide demand for Chinese exports just as Beijing’s attempts to stimulate domestic consumer spending—the key to re-igniting China’s recovery and revamping the country’s broken growth model—have fallen flat.

Cue Beijing’s peace plan, both a masterstroke at misdirection as well as a not-so-subtle admission that Western unity, sanctions, supply chain instability, and potential grain disruption could derail China’s Indo-Pacific revisionism.

Sure, China’s diplomatic gambit was immediately disavowed as a viable path to peace in Ukraine in Washington, Brussels, Kyiv, and elsewhere. But read more carefully, Beijing’s proposal lays bare the rhetorical and legal scaffolding it intends to erect if and when Xi decides to forcefully retake Taiwan. If last August’s marathon of military maneuvers around the island revealed the attack vectors China likely intends to prosecute during an all-out amphibious assault on Taiwan, the laundry list of conditions embodied in the peace plan reveals how China intends to complicate Western attempts to replicate the Ukraine playbook during a future contingency.

Central to China’s peace plan are demands that Western countries abandon their “Cold War mentality” and avoid “bloc confrontation”—phrases that are code for NATO’s alliance system and Beijing’s belief that Kyiv should not receive any additional Western military assistance. China’s crack at military de-escalation masks its real motive: It would like Russia to prevail over Ukraine in the absence of continued U.S. and European support. That same preferred balance of power applies in a Taiwan contingency, too. In a head-to-head match-up between China and Taiwan, China wins handily. If Taiwan, like Ukraine, can draw on extended external military equipment, training, and real-time intelligence support, all bets are off. And so, Beijing remains focused on degrading the ability of international actors to inject strategic risk into Chinese decision-making, as well as on exploiting cleavages among U.S. allies.

Just as glaring is the plan’s outright rejection of unilateral sanctions, which China views as violating international law. Instead, China prefers measures be debated multilaterally by the U.N. Security Council, where Beijing and Moscow wield vetoes. Undoubtedly, the U.S. and European Union-led sanctions regime on Russia has exacerbated Beijing’s dread that it, too, could someday be economically hobbled. But whereas Russia turned to economically more powerful China for support, Beijing would largely be on its own if the situation were reversed. That stark realization undergirds China’s intensifying self-sufficiency push, which is aimed at sanctions-proofing its economy. Those measures include establishing a yuan-based commodities trading scheme and developing the Cross-Border Interbank Payments System, augmented by the digital yuan, to enable sanctioned entities to dodge SWIFT, the Western-controlled global payments network.

That same fear of sanctions factors into the plan’s push to “keep industrial and supply chains stable.” The timidity of Chinese firms—large and small, state-backed and ostensibly private—to cross the sanctions threshold suggests China’s campaign to inoculate itself from Western export controls remains a work very much in progress. Case in point: China’s meek response to U.S. semiconductor restrictions. Inflicting proportionate pain on the United States, Beijing worries, could be self-defeating given China’s dependence on Western markets and technology. Russia clearly fell victim to a similar vulnerability gap. In binding itself to global value chains in ways that Russia never could, Beijing hopes to exercise leverage over Western deliberations regarding Taiwan, rather than the other way around.

The plan has two final priorities: “ceasing hostilities” and “respecting the sovereignty of all countries.” The former reflects Beijing’s understanding that Russian casualty counts are unsustainable and that Moscow must regroup its forces. As for the latter, China has struggled to rationalize how Russia’s breach of Ukraine’s borders does not infringe upon Kyiv’s sovereignty. But that is largely irrelevant to Beijing’s situation, since China believes Taiwan enjoys neither borders nor sovereignty. And, at least as far as international law is concerned, China’s supposition stands strong. Taiwan’s arbitrary exclusion from the U.N. system, Western adherence to the “one-China” myth, and Taipei’s dwindling recognition network ensure that, unlike Ukraine, Taiwan’s international legal recourse could be limited following an invasion.

All told, Beijing rightly understands that any plan to retake Taiwan—or at least any plan that carries the least risk—is predicated upon manifesting and subsequently sustaining the 12 conditions found in its Ukraine peace plan. In recent years, Washington has made tremendous strides strengthening its alliance network in the Indo-Pacific, as well as better aligning and boosting regional partner capability. Efforts are also underway to undercut China’s supply chain dominance in certain sectors, as well as to dent Beijing’s ability to leverage its grip on critical minerals to advance its foreign policy objectives.

But to undermine China’s other strategic pillars, much work remains. The top priority is for Western countries, led by the United States, to accelerate the difficult task of defining and telegraphing plans to institute a robust sanctions regime with automatic triggers should China mobilize its forces for an invasion or proceed with one. Democracies must also selectively deepen their trade and industrial ties to Taiwan, in effect reducing Taiwan’s economic reliance on China, while also wielding their influence to bolster Taiwan’s legal participation in international organizations. Last, and most controversially, Western nations must consider weaponizing China’s core vulnerability—and one of its other peace plan principles—by threatening to target its heavy reliance on foreign countries for food, arguably the commodity most tied to China’s political stability and most likely to seed doubt into Xi’s invasion calculus.

As Putin learned the hard way, waging a war on faulty assumptions can mean the difference between victory and stalemate. Undermining Xi’s assumptions regarding a potential showdown over Taiwan may just be the best way to avoid one altogether.

4 notes

·

View notes

Text

How to Handle Midland Funding LLC – E-Book Guide Only $29.95

How to Handle a Collection Agency: A Comprehensive Guide to Settling Debt with Midland Funding LLC

Dealing with debt collection can be incredibly stressful, especially when you’re faced with persistent communications from a collection agency like Midland Funding LLC. If you’re in this situation, you are not alone. Midland Funding is one of the largest debt buyers in the United States, purchasing old debt accounts at a discount and then attempting to collect the full amount. This blog will guide you through the steps to settle your debt with Midland Funding LLC and offer insights from my e-book, “How to Handle a Collection Agency.” As the founder of MyDebtRep.com and a former debt collector, I bring you this comprehensive guide to help you navigate these challenging waters.

Understanding Midland Funding LLC

Midland Funding LLC is owned by Encore Capital Group, a major player in the debt-buying industry. Encore Capital Group, along with Midland Funding, Midland Credit Management, and Asset Acceptance Capital Corp, has been involved in significant legal actions with the Consumer Financial Protection Bureau (CFPB). This means they are a well-known entity in the realm of debt collection, often pursuing consumers for various debts including credit cards, personal loans, and medical bills.

BBB Customer Complaints Summary

910 total complaints in the last 3 years.

663 complaints closed in the last 12 months.

Why Settle Your Debt with Midland Funding LLC?

Receiving a debt collection notice from Midland Funding LLC can be intimidating. The debt amount they seek to collect often includes accumulated interest and late fees, making it seem much larger than you might expect. Ignoring these communications can lead to serious consequences, such as lawsuits, wage garnishments, or bank account seizures. Instead, proactive communication can lead to a settlement, helping you focus on rebuilding your credit.

Steps to Settle Your Debt with Midland Funding LLC

1. Respond to Communication

The first and most crucial step is to respond to any communication from Midland Funding LLC. Ignoring their letters and calls will only escalate the situation. Start by sending a Debt Validation Letter. This formal request compels the agency to verify the debt, giving you time to assess your finances and plan your next steps.

2. Evaluate Your Finances

Once you receive validation of the debt, take a close look at your financial situation. Determine how much you can reasonably save to make a settlement offer. Cutting unnecessary expenses can help you build up a lump sum payment faster.

3. Prepare for Negotiation

Midland Funding LLC may prefer to settle debts out of court to avoid the costs and time associated with litigation. Even if a lawsuit has been filed, you can still negotiate a settlement before a court decision is made.

Craft a debt settlement letter to Midland Funding LLC, proposing a reasonable offer. Ensure that all communications are in writing to maintain a clear record. Start with a sensible but not necessarily the highest offer you can afford, leaving room for negotiation.

Making an Effective Settlement Offer

Initial Offer: Start with a lower offer to provide room for negotiation. Ensure it is reasonable enough for the agency to consider seriously.

Explain Your Situation: In your letter, explain why you cannot pay the full amount and express your willingness to settle. This can evoke empathy and increase your chances of reaching an agreement.

Negotiate Upward: If your first offer is rejected, be prepared to negotiate. Only promise what you can realistically pay to avoid defaulting on the settlement.

4. Get the Agreement in Writing

Once you and Midland Funding LLC reach an agreement, ensure it is documented in a written Debt Settlement Agreement. This protects both parties and provides a clear record of the terms.

5. Make Timely Payments

Adhere strictly to the payment schedule outlined in your settlement agreement. Missing a payment could nullify the agreement, reverting you to the original debt amount.

Essential Forms for Handling Debt Collection for Purchase

To aid in your debt settlement journey, MyDebtRep.com offers a comprehensive set of forms designed to streamline the process:

Cease and Desist-Verification of Debt Form

Verification of Credit Card Debt Form

Verification of Debt Form

Payment Plan Form

Debt Settlement Offer Form

Debt Settlement Payment Plan Offer Form

Verification of Medical Debt Form

Cease and Desist-Dispute Debt Form

These forms can help you handle various aspects of debt collection, from verifying the debt to negotiating and finalizing a settlement.

COMMON QUESTIONS

WHAT IS A UNFAIR COLLECTION ACT?

CAN MIDLAND FUNDING LLC USE PROFANITY OR OBSCENE LANGUAGE?

Answer: No. A Debt Collector cannot use obscene vulgar language at any time. The Federal Fair Debt Collection Act Prohibits Profane and Threatening Language to get you to pay the debt. They cannot abuse the hearer as to call you a “Deadbeat” or “Flake” . This is also illegal.

CAN MIDLAND FUNDING LLC CONTACT YOU REPEATEDLY BY TELEPHONE?

Answer: No. The Law does not limit the number of calls a Debt Collector can make. However , repeated or continuous calls over a short period of time , in an effort to harass or annoy you are prohibited.

CAN MIDLAND FUNDING LLC LEAVE MESSAGES WITH NEIGHBORS OR FRIENDS AND DISCUSS THE DEBT WITH THEM?

Answer: No. If a Debt Collector is talking to a person not Directly involved with the account. They cannot give or discuss any information other than their name and number. Only if asked , where they are calling from. The Debt cannot be discussed. While the content of the message is limited they cannot confuse the nature of the call by using terms “emergency” or “Urgent” this is an Unfair collection practice act.

CAN A MIDLAND FUNDING LLC THREATEN LEGAL ACTION IF THEY DON’T INTEND TO SUE YOU?

If legal action is threatened, they must intend to sue you if payment is note made. Normally Junk debt Buyers or Collection Agencies want to sue under a certain amount not worth their time. However they can sue you at any time, it’s a debt, and also if the client Authorizes the Law Suit.

CAN A DEBT COLLECTOR MISREPRESENT THEMSELVES?

Answer: No. A Debt Collector cannot pass themself off as being anyone other than a Debt Collector including any of the following:

An Attorney

A Law Enforcement Official

Being affiliated with a federal, state, or local government agency.

Being an employer of credit reporting agency unless the agency provides credit reports

CAN MIDLAND FUNDING LLC BUYER THREATEN TO REPORT TO THE CREDIT BUREAUS AND NOT DO SO?

Answer: No. A debt collector cannot threaten to provide information that is false to the credit bureaus. They also cannot threaten they are going to report it if there is no intent to report the information. A Junk Debt Buyer or Collection Agency can report to the Credit Bureaus if that is a standard practice of their business. If this information is provided to the 3 credit bureaus they have to update the status of any changes.

CAN A DEBT COLLECTOR THREATEN YOU WITH ARREST, IMPRISONMENT, BODILY HARM OR SEIZURE , GARNISHMENT, ATTACHMENT, OR SALE OF PERSONAL PROPERTY OR MY WAGES?

Answer: No. A debt collector cannot arrest you for non payment of a debt.They cannot threaten bodily harm to you or damage to your property or reputation. Seizure, garnishment, attachment and sale. Are the legal means available to them to enforce payment. Only after you have been served with a summons, and after a court of law has awarded them a judgement.

CAN A NOTICE THEY SEND ME CONTAIN FALSE MISLEADING STATEMENTS OR SIMULATE LEGAL OR GOVERNMENT DOCUMENTS?

Answer: No. Notices cannot threaten any action that the Junk debt Buyer or Collection Agency doesn’t intend to take. The notice cannot look like Government or Legal documents to intimidate you. Examples of statements which are false and misleading. “Notice to Appear” or “Office of Cashier” on the envelope.

WHAT EXTRA CHARGES CAN BE ADDED TO MY ACCOUNT?

Answer: Junk Debt Buyers and Collection Agencies usually charge between 7% and 10% interest per year on your unpaid balance. The original contract you signed could call for a larger amount. Court costs and attorney fees may be added on a judgement if awarded against you in a court of law.

CAN A DEBT COLLECTOR DEMAND POST DATED CHECK OR DEBIT CARD ON FILE FOR PAYMENT?

Answer” Yes. There is no Law preventing a debt collector asking you for post dated checks or a debit card on file if a payment arrangement is offered to you. Most of the time this is the only way a payment arrangement is made with a debt collector a requirement by them. They Must send you a notice 3 to 10 days prior to the date of your payment.

CAN I MAKE DEBT COLLECTORS STOP CALLING OR WRITING ME?

Answer: Yes. If you want them to stop contacting you. Write them a letter and tell them so. This is easier said than done. Once they receive your letter, they have one final time to advise you of what action they plan to take. After that , communications must cease. Should the Balance be a Large amount, with no payment agreement in effect. Once they are told not to contact you again, a large balance account legal action can result.

Conclusion

Dealing with Midland Funding LLC can be daunting, but with the right approach, you can navigate this process effectively. By responding promptly, evaluating your finances, preparing for negotiation, and making timely payments, you can settle your debt and move forward with your financial life.

For a more detailed guide and access to essential forms, purchase our e-book “How to Handle a Collection Agency” at MyDebtRep.com. With insights from a former debt collector, this resource will empower you to take control of your financial situation and handle debt collection with confidence.

Remember, proactive communication and a well-planned strategy are your best tools in dealing with any collection agency, including Midland Funding LLC. Start your journey to financial freedom today

Purchase the E-book here: https://tinyurl.com/bdsadm5t

#medicaldebt#creditcarddebt#creditrepair#unitedstates#fdcpa#knowyourrights#CreditRepair#Credit#CreditScore#CreditRestoration#FinancialFreedom#Business#CreditCard#BadCredit#DebtRelief#DebtCollectors#StopCollectionCalls#DebtHelp#MoneyManagement#TakeControl#EndDebtStress#DebtSolutions#FixYourCredit#debtcollector#debtfreecommunity#collectionagency#yourrights#debtfreejourney#stopdebtcollectors#debt settlement

0 notes

Text

Get Fast Cash with Direct Lender's Short-Term Loans UK for Debit Cards

Short term loans UK direct lender make it simple and timely to acquire financial aid. All you have to do is provide the lender with your debit card. You can receive financial aid with this loan and avoid the burden of additional papers. Unexpected costs can blow your budget, but with these debit card loans, you can acquire immediate cash and take care of your demands right now. Key characteristics of loans without debit cards with the help of this financial plan, loans between £100 and £2,500 can be obtained for duration of 14 to 30 days. Debit card loans are the sole prerequisite for these 12-month payday loans; no other requirements apply.

It is not necessary for you to give the lender any of your pricey assets or real estate. Furthermore, those with a poor credit history—default, late payments, insolvency, CCJs, etc.—can also apply for short term loans UK direct lender financial aid. Since there is no credit check involved, poor credit history is not a problem. Who is eligible to benefit from this scheme? The following requirements must be met by the borrowers in order to receive financial assistance from these loans: