#Global recession incoming

Explore tagged Tumblr posts

Text

Donald Trump has proven that he has zero diplomatic ability.

He can’t talk to anybody, his way of dealing with things is to just tariff everybody until he gets his way.

Looks like we need to buckle in for the Great Depression 2.0.

#politics#election 2024#us politics#democrats#american politics#2024 presidential election#us elections#donald trump#trump tariffs#diplomacy#Global recession incoming

30 notes

·

View notes

Text

it's so wild to me how many people (here in the us) have this attitude about the debt ceiling negotiations like "who cares? this will only affect rich stockbrokers anyway" because like. do y'all not realize that defaulting on our debt could trigger a MASSIVE recession that will come down the hardest on people who are already struggling, including major impacts for people who rely on things like SSI, Medicaid, and other forms of payment/assistance from the govt. as well as the usual steep rise in interest rates across the board affecting things like mortgages, credit cards and car loans

#literally my partner this morning said who actually cares abt this and i was like?? me lmfao? do you want inflation to increase??#also this could trigger global economic crises like it probably will not just have negative effects on us economy and citizens#if this happens because the conservatives have decided to hold this country hostage to push their unpopular agendas#im going to [redacted] kevin mccarthy. if youre a govt agent looking at this that could mean anything you never know#anyway it's great if youre lucky enough to not rely on income or assistance from the us government#and youre secure financially enough that the devaluing of the us dollar wouldnt damage you too much#but that is not the case for a lot of people. i was homeless as a result of the 2008 recession#and id rather not repeat that tbh

8 notes

·

View notes

Text

Bernie Would Have Won

By Krystal Ball

There are a million surface-level reasons for Kamala Harris’s loss and systematic underperformance in pretty much every county and among nearly every demographic group. She is part of a deeply unpopular administration. Voters believe the economy is bad and that the country is on the wrong track. She is a woman and we still have some work to do as a nation to overcome long-held biases.

But the real problems for the Democrats go much deeper and require a dramatic course correction of a sort that, I suspect, Democrats are unlikely to embark upon. The bottom line is this: Democrats are still trying to run a neoliberal campaign in a post-neoliberal era. In other words, 2016 Bernie was right.

Let’s think a little bit about how we got here. The combination of the Iraq War and the housing collapse exposed the failures and rot that were the inevitable result of letting the needs of capital predominate over the needs of human beings. The neoliberal ideology which was haltingly introduced by Jimmy Carter, embraced fully by Ronald Reagan, and solidified across both parties with Bill Clinton embraced a laissez-faire market logic that would supplant market will for national will or human rights, but also raise incomes enough overall and create enough dynamism that the other problems were in theory, worth the trade off. Clinton after all ran with Reagan era tax cutting, social safety net slashing and free trade radicalism with NAFTA being the most prominent example.

Ultimately, of course, this strategy fueled extreme wealth inequality. But for a while this logic seemed to be working out. The Soviet Union collapsed and the Cold War ended. Incomes did indeed rise and the internet fueled tech advances contributing to a sense of cosmopolitan dynamism. America had a swaggering confidence that these events really did represent a sort of end of history. We believed that our brand of privatization, capitalism, and liberal democracy would take over the world. We confidently wielded institutions like the World Bank, IMF, and WTO to realize this global vision. We gave China most-favored nation trade status.

Underneath the surface, the unchecked market forces we had unleashed were devastating communities in the industrial Midwest and across the country. By the neoliberal definition NAFTA was a roaring success contributing to GDP growth. But if your job was shipped overseas and your town was shoved into economic oblivion, the tradeoff didn’t seem like such a great deal.

The underlying forces of destruction came to a head with two major catastrophes, the Iraq War and the housing collapse/Great Recession. The lie that fueled the Iraq war destroyed confidence in the institutions that were the bedrock of this neoliberal order and in the idea that the U.S. could or should remake the world in our image. Even more devastating, the financial crisis left home owners destitute while banks were bailed out, revealing that there was something deeply unjust in a system that placed capital over people. How could it be that the greedy villains who triggered a global economic calamity were made whole while regular people were left to wither on the vine?

These events sparked social movements on both the right and the left. The Tea Party churned out populist-sounding politicians like Sarah Palin and birtherist conspiracies about Barack Obama, paving the way for the rise of Donald Trump. The Tea Party and Trumpism are not identical, of course, but they share a cast of villains: The corrupt bureaucrats or deep state. The immigrants supposedly changing your community. The cultural elites telling you your beliefs are toxic. Trump’s version of this program is also explicitly authoritarian. This authoritarianism is a feature not a bug for some portion of the Trump coalition which has been persuaded that democracy left to its own devices could pose an existential threat to their way of life.

On the left, the organic response to the financial crisis was Occupy Wall Street, which directly fueled the Bernie Sanders movement. Here, too, the villains were clear. In the language of Occupy it was the 1% or as Bernie put it the millionaires and billionaires. It was the economic elite and unfettered capitalism that had made it so hard to get by. Turning homes into assets of financial speculation. Wildly profiteering off of every element of our healthcare system. Busting unions so that working people had no collective power. This movement was, in contrast to the right, was explicitly pro-democracy, with a foundational view that in a contest between the 99% and the 1%, the 99% would prevail. And that a win would lead to universal programs like Medicare for All, free college, workplace democracy, and a significant hike in the minimum wage.

These two movements traveled on separate tracks within their respective party alliances and met wildly different fates. On the Republican side, Donald Trump emerged as a political juggernaut at a time when the party was devastated and rudderless, having lost to Obama twice in a row. This weakened state—and the fact that the Trump alternatives were uncharismatic drips like Jeb Bush—created a path for Trump to successfully execute a hostile takeover of the party.

Plus, right-wing populism embraces capital, and so it posed no real threat to the monied interests that are so influential within the party structures. The uber-rich are not among the villains of the populist right (see: Elon Musk, Bill Ackman, and so on), except in so much as they overlap with cultural leftism. The Republican donor class was not thrilled with Trump’s chaos and lack of decorum but they did not view him as an existential threat to their class interests. This comfort with him was affirmed after he cut their taxes and prioritized union busting and deregulation in his first term in office.

Meanwhile, the Democratic Party put its thumb on the scales and marshaled every bit of power they could, legitimate and illegitimate, to block Bernie Sanders from a similar party takeover. The difference was that Bernie’s party takeover did pose an existential threat—both to party elites who he openly antagonized and to the party’s big money backers. The bottom line of the Wall Street financiers and corporate titans was explicitly threatened. His rise would simply not be allowed. Not in 2016 and not in 2020.

What’s more, Hillary Clinton and her allies launched a propaganda campaign to posture as if they were actually to the left of Bernie by labeling him and his supporters sexist and racist for centering class politics over identity politics. This in turn spawned a hell cycle of woke word-policing and demographic slicing and dicing and antagonism towards working class whites that only made the Democratic party more repugnant to basically everyone.

This identity politics sword has also been wielded within the Democratic Party to crush any possibility of a Bernie-inspired class focused movement in Congress attempted by the Justice Democrats and the Squad in 2018. My colleague Ryan Grim has written an entire book on this subject so I won’t belabor the point here. But suffice it to say, the threat of the Squad to the Democratic Party’s ideology and order has been thoroughly neutralized. The Squad members themselves, perhaps out of ideology and perhaps out of fear of being smeared as racist, leaned into identitarian politics which rendered them non-threatening in terms of national popular appeal. They were also relentlessly attacked from within the party, predominately by pro-Israel groups that an unprecedented tens of millions of dollars in House primaries, which has led to the defeat of several members and has served as a warning and threat to the rest.

That brings us to today where the Democratic Party stands in the ashes of a Republican landslide which will sweep Donald Trumpback into the White House. The path not taken in 2016 looms larger than ever. Bernie’s coalition was filled with the exact type of voters who are now flocking to Donald Trump: Working class voters of all races, young people, and, critically, the much-derided bros. The top contributors to Bernie’s campaign often held jobs at places like Amazon and Walmart. The unions loved him. And—never forget—he earned the coveted Joe Rogan endorsement that Trump also received the day before the election this year. It turns out, the Bernie-to-Trump pipeline is real! While that has always been used as an epithet to smear Bernie and his movement, with the implication that social democracy is just a cover for or gateway drug to right wing authoritarianism, the truth is that this pipeline speaks to the power and appeal of Bernie’s vision as an effective antidote to Trumpism. When these voters had a choice between Trump and Bernie, they chose Bernie. For many of them now that the choice is between Trump and the dried out husk of neoliberalism, they’re going Trump.

I have always believed that Bernie would have defeated Trump in 2016, though of course there is no way to know for sure. What we can say for sure is that the brand of class-first social democracy Bernie ran on in 2016 has proven successful in other countries because of course the crisis of neoliberalism is a global phenomenon. Most notably, Bernie’s basic political ideology was wildly successful electorally with Andrés Manuel López Obrador and now his successor Claudia Sheinbaum in Mexico, Lula Da Silva in Brazil, and Evo Morales in Bolivia. AMLO, in fact, was one of the most popular leaders in the entire world and dramatically improved the livelihoods of a majority of his countrymen. Bernie’s basic ideology was also successful in our own history.

In the end, I got this election dead wrong. I thought between January 6th and the roll back of human rights for women, it would be enough. I thought that the overtly fascist tendencies of Donald Trump and the spectacle of the world’s richest man bankrolling him would be enough strikes against him to overcome the problems of the Democratic Party which I have spoken out about for years now–problems Kamala Harris decided to lean into rather than confront. Elevating Liz Cheney as a top surrogate was not just a slap in the face to all the victims of American imperialism—past and ongoing; it was a broad signal to voters that Democrats were the party of elites, playing directly into right-wing populist tropes. While the media talked about it as a “tack to the center,” author and organizer Jonathan Smucker more aptly described it as “a tack to the top.” And as I write this now, I have zero hope or expectation that Democrats will look at the Bernie bro coalition and realize why they screwed up. Cable news pundits are already blaming the left once again for the failures of a party that has little to do with the actual left and certainly not the populist left.

Instead, Trump’s victory represents a defeat of social democratic class-first politics in America—not quite final, but not temporary either. The Democrats have successfully smothered the movement, blocked the entranceways, salted the earth. Instead they will, as Bill Clinton did in the ‘90s, embrace the fundamental tenets of the Trumpist worldview.

They already are, in fact. Democrats have dropped their resistance to Trump’s mass deportation policies and immigrant scapegoating. The most ambitious politician in the Democratic coalition, Gavin Newsom, is making a big show of being tough-on-crime and dehumanizing the homeless. Democrat-leaning billionaires like Jeff Bezos who not only owns Amazon but the Washington Post have already abandoned their resistance.

Maybe I will be just as wrong as I was about the election but it is my sense that with this Trump victory, authoritarian right politics have won the ideological battle for what will replace the neoliberal order in America. And yes, I think it will be ugly, mean, and harmful—because it already is.

#krystal ball#bernie sanders#election 2024#USA#politics#democratic party#critique#kamala harris#joe biden#donald trump

93 notes

·

View notes

Note

wrt the AI thing, the doom is in what is just good enough to no longer pay people for it. Machine translation isn't good! The sentences are nice and often grammatically correct, but the information hasn't been accurately transferred a lot of the time (genre doesn't matter, but DeepL is pretty good for news articles, less good for other stuff). AI text is sentences that are made of words likely to go together it doesn't understand any of it. Especially if you want to write something a bit experimental, if you want to use specific words to evoke specific things etc etc... true art will not die, no matter how much some people try.

I mean, yeah, but that’s also just a progression of what’s already been happening for years. Publishing houses and companies have been outsourcing to the cheapest bidder for decades now due to lack of labor regulation and the death of unions. That’s what the major Harper Collins strike was about. Even while publishing houses are making record profits, they’re not paying their editors a living wage.

When I worked for a medium sized mainstream publisher back in the late 2000’s to 2010s, they used to remind us daily that if we didn’t hit our editing quota there were people on Freelancer and Fiver who would do it for a lot cheaper— and I was already earning below minimum hourly wage, that you could “make up” by taking on extra work.

(The salaried editors were the only ones with guaranteed income, the rest of us were told we were just lucky to be there.)

And multiple times a month they’d eliminate someone to ‘cut costs’ and the work would land on your desk and you’d be told to get it done because they knew we had no other options. It was this or unemployment at the start of what would be the second global recession of my life.

Eventually we did all get laid off and they opted for the cheaper, subpar labor. And while it sucked to be unemployed at that time, the relief I felt was real. I was no longer self-medicating with caffeine and alcohol to cope with the work environment. I was no longer churning out 100-200k a week in edits and rewrites to keep a job that treated me like shit. I missed it, because I loved working with my authors and editing and writing was something I loved. But I did not miss the rat race they had us locked into for the sake of profit over quality.

The fact that Harper Collins staff, one of the biggest publishers in the world who contribute to the monopoly that creates that environment, were also not making enough to live, tells me things have only gotten worse inside the industry. Unless, of course, you’re near the top of the corporate ladder. In which case you probably can’t understand why all the peasants are so unhappy.

The machines will not fully replace us—at least probably not in my lifetime. But that doesn’t mean what’s already happening isn’t bad.

AI is just the next wrung on this sordid descent into exploitation and elimination. We need better labor laws. We need better protections. We need fucking respect.

894 notes

·

View notes

Text

The next German election will be held on February 23, and if recent polls are of any indication, Chancellor Olaf Scholz may be out of work. The Social Democrats (SPD) are part of a global trend of political parties that have pushed their nations so far to the left that the people are voting to the right.

Bild newspaper believed SPD’s favorability declined one point to 15.5% since December. The Christian Democratic Union (CDU) and sister party the Christian Social Union (CDU) are leading the polls at 31%. The Alternative for Germany (AfD) Party rose in popularity by one percentage point to 21.5%.

The Greens did see a 1.5 percentage point rise but they are only standing at 13.5% favorability, which marks their highest support level since 2023. All other parties are beneath the 5% level as people are completely done with the direction of the left.

Open borders, climate change, the woke agenda, and endless wars have pushed citizens worldwide to a breaking point. Progressive policies have failed. We saw the celebrated shift in Italy when Giorgia Meloni and the Brothers of Italy Party took office in 2022. Marine Le Pen of France won a majority of seats with the National Rally. The Netherlands saw Geert Wilders’ Party of Freedom win a large portion of seats in the House of Representative. The tide is shifting across Europe.

The German government basically collapsed under Scholz’s watch. He left a massive hole in their budget and sacrificed economic sovereignty for Brussels. The left also lost America’s protection of Germany now that Biden is leaving office. The left is simply losing internationally as the people can no longer tolerate the failing Marxist agenda.

We had a directional change in 2024 and should see a recession sharply into 2026 into 2028. Marxism should end in Europe by 2037 but it will be a long road to get there. In the short term, all incoming governments will be forced to undo the mistakes of prior regimes while accepting that some of the damage cannot be undone.

6 notes

·

View notes

Text

"We live in a time of crisis. Consider three interwoven ones.

First, climate change. Every year brings more forest fires and less breathable air, the result of an economic system predicated on burning fossil fuels and working long hours to fuel energy-intensive consumption.

Second, overwhelmed families. Even though people in the Global North live in the richest societies the world has ever known, the majority still find themselves overworked and overwhelmed. Practically every family, especially with young kids, is stressed and strained, struggling to balance the unbalanceable demands of care with no support and work with no flexibility.

Third, millions of poor and working-class people are profoundly unfree in that they have no time for anything but the constant scramble to stay ahead of the bills. In Europe, the average woman in a couple with children works a massive seventy-one hours per week when you include her unpaid care labor. In New York, a single mother on minimum wage would need to labor for an astounding (and impossible) 117 hours every week to meet her basic needs. We live in an epidemic of time poverty, where compulsory overwork defers dreams and crushes aspirations under the relentlessness of Sisyphean toil.

Imagine, for a moment, a different kind of society where the standard job was part-time, but also a good job, offering decent pay and benefits as well as flexibility and career advancement. Public provision of essential services would provide a background of economic security: from health care to childcare, pensions to transit (and, ideally, a basic income as well). With their basic needs met, individuals wouldn’t have to rely on their jobs nearly as much to get by — and working substantially less than forty hours would be something to be desired rather than feared.

The Research on Part-Time Work

Recent scholarly evidence shows that slashing work hours is key to confronting climate change. For example, Jonas Nässén and Jörgen Larsson find that “a decrease in working time by 1% may reduce energy use and greenhouse gas emissions by about 0.7% and 0.8%, respectively.” David Rosnick and Mark Weisbrot find that if the United States were to slash its working hours to Western European levels, energy consumption would drop by 20 percent. The most rigorous study to date is probably that of Jared Fitzgerald and colleagues, who performed a longitudinal study on fifty-two countries. They confirmed the results of other studies that more working time leads to more energy consumption, and that this relationship is intensifying over time for both rich and poor countries.

We know that under regular conditions, capitalist economies grow and grow, but so far only by producing more and more emissions. Global emissions have only fallen four times over the last sixty years — 1981, 1992, 2009, and 2020 — precisely when the world was in the throes of economic recession. This is the cold reality of neoliberal capitalism: it forces us to choose between environmental destruction or the social misery of mass unemployment.

Good part-time work offers us a structural escape hatch — a new model to immediately reduce emissions without putting people out of work.

Of course, part-time work isn’t enough by itself. A pro-worker climate agenda must also include national and global agreements on carbon caps, a Green New Deal that unleashes massive state investment fueling decarbonization (for instance, shifting toward clean energy and building new public transit infrastructure), and so on. But good part-time work is a necessary, if insufficient condition, for preventing ecological disaster.

In terms of work-life balance, the evidence is even stronger. The academic literature finds again and again that bringing down work hours alleviates family stress and strain. To cite one of many examples, Rosemary Crompton and Clare Lyonette report in a 2006 paper that in every one of the five countries they studied, “working hours were the most significant predictor of work-life conflict.”

We also know that free time is foundational for individual freedom. To live the life one wants, free time is essential to devise and accomplish any of one’s life goals. One cannot be deeply engaged with family, friends, art, activism, sport, music, education, or any of the variegated projects that animate people’s aspirations if one is always on the clock.

The US vs. Western Europe

For hundreds of years, a vibrant strand of socialism has aspired to build a world with substantial freedom from toil — a world where machines do much of the work so humans don’t have to, freeing us to pursue our aims, develop our capabilities, and flourish in whatever directions we see fit. This is a world where artificial intelligence and robots actually make human life better and easier, rather than ushering in unemployment, fear, and inequality.

But is good part-time work really possible?

For those of us living in North America, part-time employment usually means poorly paid and precarious, with few benefits and even less autonomy. However, there’s nothing inevitable about this. Western European examples show that it’s completely possible to transform crappy part-time jobs into good, secure jobs.

In Denmark, for example, part-time work is usually good work. Whereas the hourly wage gap between full-time and part-time women is more than 20 percent in Italy, Spain, and the United Kingdom, in Denmark, it is about zero. Danish part-timers also enjoy robust benefits and pensions; a person who works part-time at 75 percent for ten years then full-time for the rest of their career, will end up with a pension worth 98 percent as much as someone who worked full-time their whole career.

A single mother working at the lowest wage (there is no official minimum wage in Denmark, since wages are set through collective bargaining) for thirty hours per week earns €27,600, while the living wage is roughly €15,000. Danish part-timers appear to be very happy with their situation. The percentage of part-time women who say they are “dissatisfied” with their job is only 4 percent, and the percentage of part-time workers who are dissatisfied with their life as a whole is just 0.4 percent.

The Netherlands is another illuminating example. It is the world’s first so-called “part-time economy,” with the highest proportion of part-time jobs in the world. Amazingly, close to 50 percent of the entire labor force works part-time (compared to only 18 percent in the EU27).

Since implementing the Equal Treatment (Working Hours) Act in 1996, it has been illegal for Dutch employers to discriminate between full- and part-time workers in the provision of pay, benefits, holidays, and employment opportunities. Part-time jobs are mostly open-ended contracts, not a precarious form of nonstandard employment — part-timers are not significantly more likely to work unsocial hours like evenings, nights, or weekends — and the country boasts the highest proportion of firms in Europe with part-time positions at high levels of qualification (47 percent). The result is that the gap between hourly part-time and full-time wages is only about 5 percent, with very little part-time work being involuntary (only 5 percent of female and 10 percent of male part-timers would prefer to be full-time).

Crucially, the cluster of policies boosting part-time work exists against a background of relatively robust economic security. The country’s National Old Age Pension guarantees every citizen a flat-rate pension by sixty-five, regardless of previous employment or earnings. A living wage for a single mother in the Netherlands is today about €15,000, whereas her income from working thirty hours per week on minimum wage is roughly €19,000. A family with two adults, both working thirty-hour weeks, earns a median income of roughly €60,000 — easily surpassing the living wage floor for the whole family (two adults, two kids) of €43,000. Part-time work, in other words, is perfectly feasible for everyone.

Things could hardly be more different in the United States.

In California, a living wage for a four-person family is roughly $110,000. If both adults worked part-time (thirty hours per week) the family would take in a median income of just $70,000. If part-time work is unattractive for the bottom half of the population, the situation is far worse for the poorest. A single mother in Los Angeles working thirty hours per week at a minimum wage job will bring in only $24,180 — pitifully short of a living wage, which for such a family is more than three-times greater, at over $80,000.

The reason the living wage in the United States is so much higher than in Europe is because social democratic welfare states provide their citizens with free or subsidized health care, childcare, transport, housing, etc. The amount of private money that anyone needs to acquire their basic needs (the “living wage”) is therefore much less. A good life based on part-time work is completely feasible in many parts of Europe.

Germany is another example. Although the country has many fewer part-time jobs than the Netherlands, they have done an excellent job of shrinking the number of hours worked in standard full-time jobs. Germany currently has the shortest working hours in the world — an average of 1,341 a year — which is, remarkably, 26 percent, or the equivalent of eleven full working weeks, shorter than in the United States. In Berlin, a living wage today is about €15,000 — within reach of anyone on a part-time income, since even a minimum-wage part-time worker makes €18,720.

A Transformative Demand

The bottom line is that constructing an economic system where part-time jobs are both good and widely available is possible. Doing so requires the standard social democratic tools of unions, high taxes, and progressive governments willing to regulate the market on behalf of workers. None of this is easy to achieve, particularly in countries with as weak a labor movement and as powerful a business class as the United States. But political will, not technical feasibility, is what is standing in the way of a good life for the majority.

In these times of crisis, it is easy to feel dispirited and hopeless. And when hope departs, cynicism grows. The vision of a freer society built around good part-time work is one antidote to such cynicism. It is a bold, feasible demand — at once radical and realistic in the medium term. The elements that are required already exist in various places around the world.

The result would not be a utopia. It would not solve all our problems. But it could transform our lives."

- Tom Malleson, from "We Should All Be Working Part Time for Full-Time Pay." Jacobin, 22 November 2023.

#tom malleson#quote#quotations#work life balance#leisure#economics#democratic socialism#overwork#adulting#climate change#climate crisis#capitalism#jobs#neoliberalism

47 notes

·

View notes

Text

So many ordinary objects and experiences have become technologized—made dependent on computers, sensors, and other apparatuses meant to improve them—that they have also ceased to work in their usual manner. It’s common to think of such defects as matters of bad design. That’s true, in part. But technology is also more precarious than it once was. Unstable, and unpredictable. At least from the perspective of human users. From the vantage point of technology, if it can be said to have a vantage point, it's evolving separately from human use. “Precarity” has become a popular way to refer to economic and labor conditions that force people—and particularly low-income service workers—into uncertainty. Temporary labor and flexwork offer examples. That includes hourly service work in which schedules are adjusted ad-hoc and just-in-time, so that workers don’t know when or how often they might be working. For low-wage food service and retail workers, for instance, that uncertainty makes budgeting and time-management difficult. Arranging for transit and childcare is difficult, and even more costly, for people who don’t know when—or if—they’ll be working. Such conditions are not new. As union-supported blue-collar labor declined in the 20th century, the service economy took over its mantle absent its benefits. But the information economy further accelerated precarity. For one part, it consolidated existing businesses and made efficiency its primary concern. For another, economic downturns like the 2008 global recession facilitated austerity measures both deliberate and accidental. Immaterial labor also rose—everything from the unpaid, unseen work of women in and out of the workplace, to creative work done on-spec or for exposure, to the invisible work everyone does to construct the data infrastructure that technology companies like Google and Facebook sell to advertisers. But as it has expanded, economic precarity has birthed other forms of instability and unpredictability—among them the dubious utility of ordinary objects and equipment.

***

The more technology multiplies, the more it amplifies instability. Things already don’t quite do what they claim. The fixes just make things worse. And so, ordinary devices aren’t likely to feel more workable and functional as technology marches forward. If anything, they are likely to become even less so. Technology’s role has begun to shift, from serving human users to pushing them out of the way so that the technologized world can service its own ends. And so, with increasing frequency, technology will exist not to serve human goals, but to facilitate its own expansion. This might seem like a crazy thing to say. What other purpose do toilets serve than to speed away human waste? No matter its ostensible function, precarious technology separates human actors from the accomplishment of their actions. They acclimate people to the idea that devices are not really there for them, but as means to accomplish those devices own, secret goals. This truth has been obvious for some time. Facebook and Google, so the saying goes, make their users into their products—the real customer is the advertiser or data speculator preying on the information generated by the companies’ free services. But things are bound to get even weirder than that.

3 notes

·

View notes

Text

Dubai Real Estate Investing: Fractional vs. Traditional Ownership

When you are looking at how to invest in Dubai real estate properties, the options are a bit overwhelming. Should you take the traditional route of buying an entire property or opt for the new fashion of fractional ownership? Each has its advantages, disadvantages, and opportunities. This blog delves into the differentiators between traditional and fractional real estate investment, helping you choose which method is best for your financial objectives and lifestyle.

The Evolution of Real Estate Investment

The real estate market has undergone a major transformation in the past couple of years. Traditional investments in property, which were once reserved for individuals or companies with substantial capital, are now more accessible because of technological advances. Digital platforms today offer many options for investing which makes real estate investing more transparent, efficient, and accessible.

This has led to the introduction of options such as Real estate crowdfunding (crowd investment) and fractional ownership which have lowered the bar to investors who are not affluent. Through the use of technology, the real estate market is drawing a wider audience which is increasing its popularity and growth.

Traditional Real Estate Investment

What It Involves Traditional real estate investing involves buying a house outright either by yourself or in a partnership. Although it gives full control and autonomy, however, it requires a substantial amount of capital upfront, as well as long-term management responsibility.

Key Challenges

High Entry Costs: Buying properties in the most desirable areas typically requires a significant amount of capital such as closing costs, down payment, and regular maintenance.

Investment Managers who are Active: are accountable for the relationship with tenants maintenance of the property, legal compliance, as well as other administrative tasks.

Market volatility: Economic recessions or vacant properties could cause financial stress.

Limited Diversification: Owning a single property ties up a significant portion of an investor’s portfolio in one asset, increasing risk exposure.

Despite these difficulties, traditional investments provide the long-term benefit of the appreciation of property and rental income which makes them a solid option for investors with experience.

Fractional Ownership Investing

What It Is Fractional ownership permits multiple investors to jointly own the highest-value property. Each investor has a stake proportional to their investment and receives benefits like rent income and property appreciation.

How It Works Platforms such as Avarten Invest permit fractional ownership by automatizing the process. Investors can purchase fractions of high-end off-plan properties, usually beginning with a small amount of capital while professionals manage the property administration.

The Rising Popularity of Fractional Ownership

Global growth: The part of fractional ownership was worth $5.39 billion by 2020, and is predicted to grow to $8.92 billion in 2025. This is due to an increase in demand for affordable investments and the rapid adoption of technology.

Dubai's Real Housing Trends: Dubai the concept of fractional ownership is a major driver of the growth of the market. According to Hamptons International, it plays an important role in attracting foreign investors to the area.

Comparing Fractional & Traditional Ownership

Benefits of Fractional Ownership

Affordable Access to Premium Properties Fractional ownership allows investors to purchase shares in luxurious properties without having to invest millions. Platforms such as Avarten Invest make investments more accessible and allow investors to invest in as little as Euro 10000.

Diversification Across Markets Investors are able to spread their money across several properties in various locations, decreasing risk and increasing the stability of portfolios.

Ease of ManagementManagement of property, legal compliance along with tenant and landlord relations, are managed by experts, providing an easy experience for the investors.

Enhanced Liquidity In contrast to traditional real estate, where selling a house could take months, however, fractional ownership platforms typically let investors sell their shares quickly.

Eligibility for Residency Programs In the UAE fractional ownership is a way to be a qualifying factor for investors to investors to be eligible for the Golden Visa program, granting the benefit of a residency for 10 years.

The Role of Technology in Real Estate Investment

Technology has changed the game within the residential real estate industry as blockchain technology and AI driving the way.

Blockchain for Security and Transparency Blockchain technology provides safe, tamper-proof transactions. This does not just build confidence among investors, it helps streamline processes like sharing trading and property registration.

AI-Driven Insights Artificial Intelligence enhances market analysis aiding investors in making informed choices. Predictive analytics, for instance, can predict property value trends, rental demand, and market risk.

Digital Platforms Platforms such as Avarten Invest simplify the process of investing from property selection to trading shares, making real estate more accessible to a wider public.

Case Study: Avarten Invest’s Fractional Ownership Model

Avarten Invest is an eminent marketplace in the UAE that shows the way fractional ownership is changing real estate investing. It gives investors access to Dubai's most desirable properties without requiring large capital.

Key Benefits

Avarten Invest guarantees constant returns, as it manages properties with efficiency.

The limited amount helps to invest and everyone to co-own a big property

Easy to Use The platform offers a user-friendly interface to facilitate smooth investment management.

Investments are open to people outside of the UAE, even if they never visited the UAE they can also invest in the most promising economy.

Challenges and Considerations

Although fractional ownership can have numerous advantages, it's important to be aware of the possible drawbacks

Reliability of Platform: Success is dependent on the reliability and credibility of the platform that manages the investment.

Market Risks: Just like other investments they are subject to market fluctuations as well as economic conditions.

The Future of Real Estate Investment

The real estate investment market is changing rapidly, fueled by the emergence of new ideas and a greater acceptance of diversity. New technologies such as smart contracts IoT-enabled property management and AI-driven decision-making are poised to revolutionize how investors engage and interact with markets.

Trends to Watch

Global acceptance of Fractional Ownership: As the awareness is growing, more investors across the globe are expected to adopt this form of ownership.

Integration of Sustainable Practices Properties that adhere to green standards can gain an investor preference.

The Enhanced Investor Protection frameworks are being designed to protect fractional investors.

Final Thoughts

The debate over traditional as well as fractional property investment will ultimately come down to personal preferences, financial goals, and tolerance to risk. Traditional ownership provides security and control While fractional ownership gives flexibility, diversification, as well as technology-based convenience.

As platforms such as Avarten Invest continue to develop the way they operate, fractional ownership is now more attractive, particularly for investors who are young or those with a limited amount of capital. With these innovative investing models, the real estate market is opening up to a larger audience and ensuring that everyone has the chance to earn wealth through real estate.

Start the first step on your real estate investment deal, whether conventional or fractional. Then, discover the possibilities that are most compatible with your goals.

#invest#investment#investors#real estate#real estate dubai#dubai#dubailife#europe#economy#luxury#developers#residential#popular#crowdfunding

3 notes

·

View notes

Text

Internal Debate Over Tariff Policies Emerges Within Trump’s Team

Source: aljazeera.com

President-elect Donald Trump continues to advocate for universal tariff policies on imports, as his trade advisers work to shape policies based on his campaign promises. Discussions within his team focus on implementing a 10% tariff on all imports and a steeper 60% levy on goods from China, while also considering adjustments to address political and economic factors.

Internal Deliberations on Tariff Implementation

Advisers are considering a strategy that could involve imposing tariffs on a selection of critical industries as a preliminary measure or alongside broader tariffs. This approach aims to emphasize trade imbalances and boost U.S. manufacturing. The policy framework remains under discussion, with no final decisions made.

Reports of a selective approach to tariffs have sparked responses from Trump himself. He publicly denied claims that his team was scaling back the initial tariff policy, emphasizing that the commitment to his proposed tariffs remains unchanged.

Economic Advisers’ Diverging Views

Trump’s economic team is divided over how to implement the tariffs without causing major disruptions to the stock market and consumer prices. Some advisers support a comprehensive tariff plan, while others favor a more calculated approach to avoid economic strain.

Scott Bessent, Trump’s pick for Treasury Secretary and a hedge fund investor, has reportedly expressed skepticism about universal tariff policies on all goods. Howard Lutnick, the nominee for Commerce Secretary, views tariffs as a potential negotiation tool rather than a blanket policy. Meanwhile, Larry Kudlow, a longtime Trump ally and former economic adviser, has suggested that tariffs could help balance the costs of proposed tax cuts.

Peter Navarro, known for his strong protectionist stance, remains one of the most vocal supporters of implementing tariffs, emphasizing their importance in trade policy.

Kushner Emphasizes Fair Trade Principles

Jared Kushner, Trump’s son-in-law who worked on international economic policy during the first term, has indicated that the tariff strategy may still require refinement. He suggested that Trump’s ultimate goal is a level playing field for American businesses rather than punitive measures alone. Kushner expressed confidence in American industry, stating that as long as all countries compete under the same standards, U.S. businesses could outperform global competitors.

Uncertain Path Forward

The debate mirrors ideological divisions from Trump’s first term, when officials like Steven Mnuchin and Gary Cohn opposed aggressive tariffs, fearing economic retaliation and recession. Trump’s current team faces similar challenges in balancing campaign promises with economic stability.

While Trump’s push for universal tariff policies remains central to his trade policy, the final structure and scope of the policy are still evolving. His team continues to weigh the economic risks and potential benefits as they finalize strategies for his incoming administration.

#china#trade#tradewar#markets#investing#news#usa#investment#investors#investor#invest#trump#donaldtrump#economy#tariffman#usbusiness#werindia#usbased#us#xijinping#forex#stockmarkets#stockmarket#prepaid#revenue

2 notes

·

View notes

Text

Societal comment.......

The media is all "abuzz" over the phrase of FRUGAL LIVING!

The cost of living is so high!

Mortgages are out of reach. People can't afford to buy a house OR a new car!

College tuition is approaching and hitting SIX figures per year!

40 PERCENT OR MORE HAVE NOTHING SAVED FOR RETIREMENT!

All of a sudden, "we" need to live life according to our means.

NEWS FLASH!

Life has ALWAYS been like that.

The cost of living has ALWAYS been more than average income could provide.

There have ALWAYS been wars, a global depression, recessions tragedies, personal and country wide, global health crises, etc., etc.

Generations before us knew how to live then.

Frugality was the style for most of us.

Yeah, there were rich people. You only read about them in the papers (if you could afford one).

Today, keeping up with the Jonses, big house or two, new, expensive cars, best colleges, government forgiveness of student loans, AND no personal responsibility for behavior.

Financial education was save every penny you could because most people knew retirement or illness was eventually coming for you.

Pay off your mortgage at a mortgage burning party and live "frugally" for the rest of your life.

Yeah, that's how you got through life.

Maybe, in todays society, living for today and letting the government take care of you later is the new normal.

Only time will tell........

#capitalism#democrats#republicans#democracy#us politics#donald trump#government#immigration#politics#reading

6 notes

·

View notes

Text

Todos somos cómplices

Los republicanos, Richard Nixon con la apertura a China en los años 1970 y Ronald Reagan con la deslocalización a México en los años 1980, pusieron en el mercado cantidades de productos a precios inferiores a los de antes. Esto se presentó como un regalo al poder adquisitivo. Esto significaba que la gente disponía de más dinero. Los propietarios aumentaron entonces los alquileres y los precios de los inmuebles. En 1980, el alquiler medio ajustado a la inflación de un hogar estadounidense era de 243 dólares. En 1985, era de 432 dólares. En 2022, había subido a 1.388 dólares.

How Much the Middle Class Paid for Rent in the 1980s Compared to Now – Go Banking Rates: https://www.gobankingrates.com/money/economy/how-much-middle-class-paid-for-rent-in-1980s-vs-now/

New Data Show Just How Much Mortgage, Rent Payments Have Outpaced Income Growth; Some Cities Remain Affordable – CU today: https://www.cutoday.info/Fresh-Today/New-Data-Show-Just-How-Much-Mortgage-Rent-Payments-Have-Outpaced-Income-Growth-Some-Cities-Remain-Affordable

Las mejoras del poder adquisitivo fueron absorbidas por el coste de la vivienda. Ya no había vuelta atrás, y ya no era posible subir el precio de los bienes de consumo.

Tras el 11 de septiembre de 2001, los partidos de derechas de G.W. Busch explotaron el miedo a la identidad para restringir la inmigración legal a Estados Unidos. Presentaron a los extranjeros como una amenaza, como terroristas. Al mismo tiempo, redujeron considerablemente los recursos de sus inspectores de trabajo. Esto ha provocado una explosión de mano de obra inmigrante ilegal mal pagada, especialmente en las granjas. Ha provocado una caída del precio de la comida de la población. Una vez más, ha provocado un rápido aumento del coste de la vivienda, así como de los gastos de educación y enfermedad.

Size of U.S. Unauthorized Immigrant Workforce Stable After the Great Recession – Pew Research center: https://www.pewresearch.org/race-and-ethnicity/2016/11/03/size-of-u-s-unauthorized-immigrant-workforce-stable-after-the-great-recession/

La política de precios bajos ha convertido a gran parte de la población en cómplice de la explotación de inmigrantes ilegales o trabajadores baratos en el extranjero. Las personas ya no pueden permitirse comprar alimentos o bienes producidos al precio justo porque ya no pueden pagar su vivienda, educación y sanidad. Las pequeñas empresas ya no pueden prescindir de la mano de obra ilegal. No pueden contratar a personas legales al precio adecuado, así que los inmigrantes les quitan el trabajo. Si hoy se aplicara la ley, todas estas pequeñas empresas quebrarían. Esto convierte a toda la población en cómplice de la explotación humana.

Un candidato que va a luchar contra la inmigración legal y a reducir los controles está poniendo más trabajadores ilegales en el mercado. Cuanto más dura sea la política de inmigración, más barato será el trabajo ilegal.

Para cambiar esta situación, la vivienda, la enfermedad y la educación no pueden seguir dejándose a las simples leyes del mercado. Hay que controlar los precios para que el poder adquisitivo de los ciudadanos les permita comprar bienes de consumo al precio justo, bienes que respeten a los trabajadores, el medio ambiente y el bienestar de los animales. Ahora mismo, la gente no puede pagar el precio justo.

The global challenges of labour inspection – ILO: https://www.ilo.org/media/318756/download

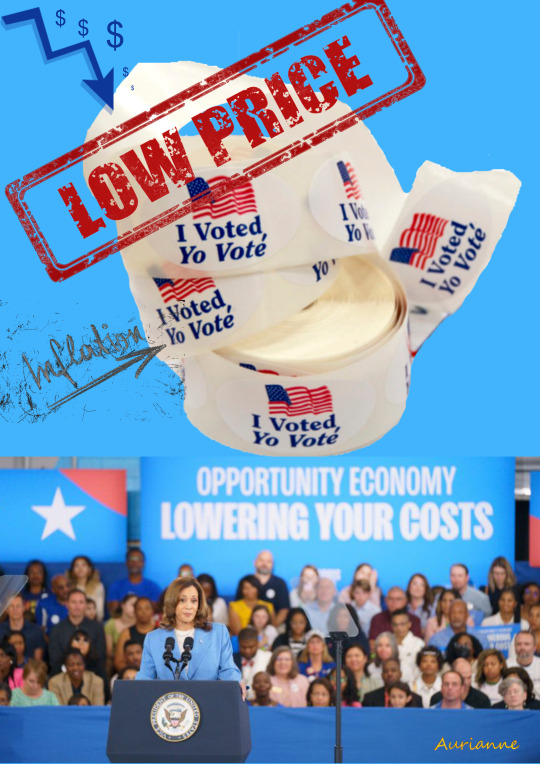

Kamala Harris propone controlar estos precios.

New homes and end to price-gouging: Harris sets economic goals – BBC: https://www.bbc.com/news/articles/cy8xqy0jv24o

Kamala Harris unveils economic agenda cracking down on ‘price gouging’: https://youtu.be/DMrNAMWYTjU?si=PYbBhSjubxIxYVu4

youtube

Traducido con DeepL.com (versión gratuita)

------------------------------------------------------------------------

Tous complices: https://www.aurianneor.org/tous-complices/

We’re all in it together: https://www.aurianneor.org/were-all-in-it-together/

Arizona, Nevada y California Dream: https://www.aurianneor.org/arizona-nevada-y-california-dream/

¿Quién apoya a los militares estadounidenses?: https://www.aurianneor.org/quien-apoya-a-los-militares-estadounidenses/

El Rust belt: https://www.aurianneor.org/el-rust-belt/

Una porción del pastel: https://www.aurianneor.org/una-porcion-del-pastel/

Precios de techo y suelo: https://www.aurianneor.org/precios-de-techo-y-suelo/

La vivienda: https://www.aurianneor.org/la-vivienda/

Una vida digna: https://www.aurianneor.org/una-vida-digna/

Tener la mayoría del poder sin la mayoría de los votos: https://www.aurianneor.org/tener-la-mayoria-del-poder-sin-la-mayoria-de-los-votos/

Sólo dos candidatos, ¿cuál elegir?: https://www.aurianneor.org/solo-dos-candidatos-cual-elegir/

Will you get what you expect from Trump? Chaos is unpredictable: https://www.aurianneor.org/will-you-get-what-you-expect-from-trump-chaos-is-unpredictable/

The army’s duty is to stop this fascist: https://www.aurianneor.org/the-armys-duty-is-to-stop-this-fascist/

Immigration: https://www.aurianneor.org/immigration-2/

Les intermédiaires: https://www.aurianneor.org/les-intermediaires/

Dans l’ombre de Trump: https://www.aurianneor.org/dans-lombre-de-trump-elections-the-electoral/

Rob the poor to feed the rich: https://www.aurianneor.org/rob-the-poor-to-feed-the-rich/

#america#aurianneor#barato#complice#democracia#economía#elecciones#extranjeros#inflación#inmigración#Kamala Harris#ley#medio ambiente#poder adquisitivo#precio#propietarios#republicanos#salud#trabajadores#vivienda#Youtube

5 notes

·

View notes

Text

You’ve no doubt seen the Democrats and their apologists in the media exclaim that the issue is really messaging and that the economic challenges people feel are just “perception” or made up.

Here’s the lone non-radical on The View trying to make the case that economic issues matter, but the ladies are STILL convinced it’s just racism and misogyny.

Below is a litany of retail and consumer industry stats and reports which show everything is not hunky dory and there are LEGITIMATE and SERIOUS economic headwinds for businesses and consumers.

Declining Sales and Revenue:

Macy's: Downgraded sales forecast, expecting a year-over-year decline. Comparable store sales also projected to be negative. CEO cites "softness," "carefulness," and "macroeconomic uncertainty."

Kroger: Reporting declining sales, with consumers shifting to lower-priced items and essentials. CEO acknowledges consumers are pressured by reduced savings, inflation, and interest rates. Same-store sales shrinking.

McDonald's: First negative same-store sales comparison since 2020. US same-store sales down 0.7%. CEO admits prices are perceived as too high by lower-income consumers. Declining traffic in major markets globally.

Home Depot: Experiencing declining sales, particularly in discretionary categories like home improvement and renovations.

Wayfair: Reporting sales declines comparable to the 2008-2010 recession period. CFO expresses concern about the magnitude of the correction.

LVMH (Luxury Goods): First decline in revenues since 2020, pointing to weakness even among high-income consumers. Misleading statements attempting to downplay the downturn. Blames "uncertain economic and geopolitical environment."

Walmart: While experiencing increased foot traffic (likely due to promotions), overall sales are declining. Increased traffic to grocery suggests consumers prioritizing essentials and seeking value. Affluent customers shifting to Walmart indicates broader consumer distress.

Wendy's: Similar to McDonald's and Walmart, with increased traffic but declining sales.

Dollar Stores: Also seeing increased traffic but declining sales, a classic sign of consumers trading down to lower-priced options.

4 notes

·

View notes

Text

White-Collar Recession: It's Hard to Find a High-Salary Job

Over the past year or so, pretty much everyone who's looked for a job has told me the same thing: The job market is brutal right now. They've applied to dozens if not hundreds of openings, only to get one or two callbacks. No one's hiring, they tell me. I've never seen it this bad.

Listening to them, you'd think we were in the middle of a recession. But the confusing thing is we're nowhere close to one. Unemployment is near a five-decade low. The economy is adding hundreds of thousands of jobs each month. Wages are growing faster than inflation. By all the standard measures, the job market is doing just fine. So why am I hearing such a different story from people on the ground?

The dissonance finally started to make sense to me when Vanguard, the investment-management company, released its latest report on hiring. By looking at the enrollment and contribution rates of its 401(k) retirement plans, Vanguard is able to calculate a national hiring rate broken down by income level. And what the numbers show is a two-tier job market — one divided between a blue-collar boom and a white-collar recession.

Among Vanguard's lowest earners — those who make less than $55,000 — the hiring rate has held up well. At 1.5%, it's still above pre-pandemic levels. But among those who make more than $96,000? It's pretty depressing. Hiring has slowed to a dismal 0.5%, less than half the peak it reached in mid-2022. Excluding the dip in the early months of the pandemic, that's the worst it's been since 2014. If you make a six-figure salary, it really is a bad time to be looking for a job.

The question here is why. Why are companies hiring so few white-collar workers right now? Several possible explanations come to mind. It might be that fewer people in corporate jobs are quitting right now, which would mean companies have fewer openings they need to fill. It might be that the industries that are struggling the most — tech and finance — are the ones that employ a lot of high-earning professionals. Or it might be that CEOs are making good on their threats to cut back on what they see as corporate bloat — what Mark Zuckerberg has called "managers managing managers, managing managers, managing managers, managing the people who are doing the work."

But there could be a bigger, more worrisome explanation for the downturn in white-collar hiring. Maybe companies are anticipating tough times ahead and trimming their budgets accordingly. "If you need to pull back on costs," says Fiona Greig, the global head of investor research and policy at Vanguard, "pulling back on expensive workers will reduce costs to a greater extent than pulling back on your lower-income workers." Translation: The more you earn when budgets are tight, the less an employer wants to hire you.

Now, you could argue that a slowdown in white-collar hiring doesn't really matter in the current economy, even for white-collar workers. Sure, Vanguard's data show that things are tough for professionals who are looking for a job. But there aren't that many people who actually need a new job right now: The unemployment rate for people with a college degree is 2.1%, and the national layoff rate is below what it was pre-pandemic. When the vast majority of professionals already have a job — and are able to keep their jobs — maybe it's OK that companies aren't hiring.

But that argument doesn't take into account one important factor: What if the job you have is one you hate? I have several friends who are unhappy in their current jobs, but they can't quit because no one is hiring. Some observers have called this combination of lower hiring and less quitting "the Big Stay," suggesting a kind of equilibrium after the chaos of the Great Resignation. But my colleague Emily Stewart has a better name for it: the "trapped in place" economy. I think professionals feel this trapped-in-placeness particularly acutely. After all, it wasn't that long ago that they were enjoying a "take this job and shove it" swagger, which was fun to watch. During the Great Resignation, they knew it'd be easy to find a new job, which meant it'd be easy to walk away from their current one. Even if they weren't planning to leave, the job market gave them a sense of freedom — the feeling that they no longer had to put up with a bad boss, or a brutal workload, or an arbitrary return-to-office mandate.

This, I think, is what explains what people are calling the "vibecession": the weird state of feeling like we're in a recession even though all the standard metrics show we're not. What we're experiencing is actually a slowdown in white-collar hiring — and white-collar professionals (me and my angsty friends) are the people who shape the public discourse about the economy. "People feel that things are moving in the wrong direction," says Guy Berger, the director of economic research at the Burning Glass Institute, which analyzes the labor market.

And for the most elite professionals, things could get worse before they get better. Berger tells me he doesn't expect a full-on recession anytime soon. But he's keeping an eye on the unemployment rate for people with advanced degrees. Pretty much everyone else is doing OK, job-wise — but there's been a slight uptick for all the smarty-pants with master's degrees and doctorates. They aren't exactly struggling right now. "We're still talking about the people that have the highest pay in the job market and the lowest unemployment rate," Berger says. But for them, hiring is headed in the wrong direction. And as AI tools increasingly encroach on professionals' tasks — writing, coding, coordination, analysis — we'll likely see a lot more weakness at the higher end of the income scale than at the lower end.

This isn't the story we're used to hearing about employment. For decades the economy has been leaving workers with lower incomes and less education behind while professionals have reaped all the gains. But now those roles are reversed, and it's the high earners who are taking the hit. No wonder everyone is confused about how the economy is doing. "We're having some trouble collectively digesting that," Berger says. And the longer the white-collar hiring lull continues, he warns, the more the resentment will build.

"Even if there's no big surge in layoffs, people are just going to get grumpier and more dissatisfied," Berger says. "If it continues for three or four more years, it's going to cause a lot of discontent and low morale in corporate America."

SO?

4 notes

·

View notes

Text

Failure to raise the debt limit would be an entirely different kind of crisis.

Unable to continue borrowing, the federal government would have to rely only on incoming revenue to pay its bills — and there isn’t nearly enough money on most days. That means Social Security payments most likely would get delayed, a day or two at first and then longer if the standoff drags on.

The problem would be repeated with other government payments, sending a cascade of delays rippling across the economy.

“You’re dealing with the potential for an order of magnitude of greater economic consequences that are felt throughout the country,” Shai Akabas, director of economic policy at the centrist Bipartisan Policy Center think tank, said of the difference between a debt limit crisis and a shutdown.

Unlike with a government shutdown, the damage from a first-ever debt limit breach — which could happen as soon as June 1 — could be more severe and long lasting, experts said.

Just getting dangerously close to one in 2011 led Standard & Poor’s to downgrade the US government’s top-level AAA credit rating for the first time, causing higher government borrowing costs. Coming close again, or even failing outright to pay some government bills, could lead to downgrades from the other two credit ratings companies, Fitch Ratings and Moody’s Investor Services, that could sharply raise US government borrowing costs for years.

“A shutdown is an economic problem, but it’s not an existential problem,” said Mark Zandi, chief economist at Moody’s Analytics, an economics research and consulting firm that is separate from the credit rating company. “A debt limit breach is existential.”

There have been 20 government shutdowns since 1977 in which some or all Congressional appropriations expired. Most shutdowns have lasted just a few days and caused little economic damage. But longer ones, such as the 35-day partial shutdown from late 2018 to early 2019, had more serious consequences.

The Congressional Budget Office estimated the 2018-19 partial shutdown (some appropriation bills had already been approved) led to 300,000 government workers being furloughed and reduced the nation’s economic output by about $11 billion. Much of that output was made up after the government reopened, but about $3 billion of it was permanently lost, the CBO said.

Still, that wasn’t nearly enough to push the economy into a recession.

A debt limit breach that lasts for even just a few days would be much different because it would shake business and consumer confidence and rattle financial markets, Zandi said.

“We’re right on the precipice of a recession anyway,” he said. “This is going to throw us over the ledge.”

Moody’s Analytics estimated in March that a standoff that lasts a few weeks would cause economic damage similar to what occurred during the 2008 global financial crisis, including the loss of more than 7 million jobs, a nearly 20 percent decline in stock prices and mortgage rates and other borrowing costs spiking.

A report released Wednesday by the White House Council of Economic Advisors was similarly bleak, warning that “a protracted default would likely lead to severe damage to the economy, with job growth swinging from its current pace of robust gains to losses numbering in the millions.”

House Republicans say they want to avoid that economic damage and the solution is legislation they approved on April 26. The bill, which Senate Democratic leaders declared dead on arrival, would increase the nation’s $31.4 trillion debt limit by $1.5 trillion or suspend it until March 31 (whichever comes first) in exchange for reducing the deficit by about $4.8 trillion over the next decade.

President Biden and most Democrats argue those cuts are too severe and they shouldn’t be paired with an increase in the debt limit, which is required to pay for funding Congress already has authorized. Biden has invited congressional leaders of both partiesto the White House Tuesday, but the sides are nowhere close to a deal.

The nation technically hit the debt ceiling in January, but the Treasury Department has been conducting what it calls “extraordinary measures” that allow the government to stay within the limit while still paying all the nation’s bills on time. Treasury Secretary Janet Yellen warned congressional leaders last week that the latest estimate based on incoming revenue after April’s annual tax filings show the federal government might not be able to pay all its bills as soon as June 1.

Republicans have argued the Treasury could use incoming money to prioritize payments to government bondholders to avoid defaulting on US debt. And some lawmakers have proposed requiring Treasury also prioritize Social Security and Medicare payments, as well as military pay and veterans programs.

Treasury officials have rejected prioritizing payments, as well as other, less conventional ideas to avoid a default, such as minting a $1 trillion coin. Yellen told lawmakers that Treasury’s system — which made more than 1.4 billion payments in 2022 — is designed to pay all bills on time and that failure to pay any of them still would constitute a default.

A Treasury Inspector General’s report after the 2011 debt limit standoff said officials determined “the least harmful option” in the case of a breach was to suspend payments for a given day until there was enough money to pay them all. In such a scenario, delays “would have quickly worsened each day the debt limit remained at its limit,” the report said.

Treasury and Federal Reserve officials also developed a plan in 2011 to prioritize payment of principal and interest on US debt, according to Fed meeting transcripts released five years later. That is possible because debt payments are made using a separate Fed system. But it’s unclear if that prioritization plan would have worked, said William English, a professor at the Yale School of Management who was a Fed staffer at the time.

“The amount of manual intervention into various very complicated payment systems to make that happen is huge,” said English, who attended the 2011 Fed meeting where the plan was discussed. “And so you can decide to do that and still not successfully do that.”

And even if such a plan were feasible, it might not be enough to avoid a downgrade of the US credit rating.

“Prioritising debt payments to avoid an immediate default, if this were possible, might not be consistent with a ‘AAA’ rating,” London-based Fitch Ratings warned in a statement last month.

All this highlights the tremendous stakes, and unpredictability, of a debt limit breach.

“It’s really hard to foresee a world where the United States is not paying all of its bills because the whole economic system is based on the fact that we do,” said Akbas, an expert on the debt limit. “And once the card at the bottom of that tower is taken out, we don’t know where everything lands.”

#14th amendment#debt ceiling raise#us congress#us budget#budget default#gop#ratings#A debt limit breach could be like a government shutdown — but much worse

7 notes

·

View notes

Text

Divested Black women are falling into a trap. While society wants you to focus on debating about going 50/50 with males or getting into twitter debates about interracial dating, you as a black woman have more important things to worry about. It’s great to see black girls previously robbed of their girlhood reclaiming their natural femininity, however there is more to be concerned about. Divestment is not about males or how cute you can be, but self preservation as a priority. Look past the hyper-sexualizing and demoralizing attempted propaganda. Look past your childhood brainwashing and abuse to internalize the Jezebel and Mammy stereotypes. Stop defending and protecting everyone except for yourself. Stop worshiping males in attempts to gain romantic responses and respect. Pay attention to what really matters. Black Americans will soon have a net worth of $0 as the global economic depression and food shortage gets closer. Our “communities” are the primary target for all things struggle so migrants will be housed where you live, crime will sky rocket, and income/economic opportunities will deplete. Suburban black women are not exempt from this. The vast majority of black girls are not entering recession proof career fields. It’s important that black women are multi tasking everyday life while preparing for the future because 99% are not informed or prepared. It doesn’t have to be alone when there are likeminded black girls and women out there :)

Black women prepping, homesteading, self defense, gardening TikTok compilation. https://youtu.be/KkguBqtXdto?si=daiMQX6kgI6ROt_V

youtube

#pay attention#if you are more concerned with isreal or what dusties are doing than yourself then we have a problem that needs a solution#black women#black femicide#burnthecape#divest#black girls#Youtube#black women in luxury#black femininity#divestment

5 notes

·

View notes

Text

A strange thing happened in the eurozone economy at the end of last year. Despite widespread forecasts that the common currency area would plunge into recession and register negative growth in the last quarter of 2022, it managed to eke out a small gain of 0.1 percent. What is remarkable is not that Europe beat expectations, but that it was one small country—Ireland—whose surging economy single-handedly prevented the eurozone from slipping into the red.

Almost unbelievably, little Ireland, with a population of only 5 million, now has the economic scale to shift the growth statistics of the entire eurozone and its 343 million inhabitants. In 2022, Irish GDP growth of 12.2 percent compared to 3.5 percent in the eurozone as a whole. In absolute numbers, only Germany, France, and Italy contributed more than Ireland to eurozone GDP growth in 2021 and 2022. Ireland’s economic boom has enabled the country’s government to post a budget surplus of 1.6 percent of GDP, even as eurozone countries struggled with an average deficit of more than 3 percent.

Honestly, who wouldn’t want this luck of the Irish?

Look closely, however, and Ireland’s so-called economic miracle looks more than a little odd. The country’s growth is simultaneously both real and artificial. Much of it is driven by a handful of U.S. multinationals, which continue to route global sales and profits through their Irish operations to take advantage of Dublin’s lower business taxes. Although difficult and complex to calculate, Apple’s shifting of intellectual property assets to Ireland is estimated to have contributed half of Ireland’s miraculous 26 percent GDP growth in 2016. That bizarre fact inspired New York Times columnist Paul Krugman to ridicule Ireland’s “leprechaun economics”—and the Irish statistics office to move away from using GDP as a measure of economic growth.

Yet the surge of U.S. investment in Ireland is also real. In particular, Ireland’s role as a pharmaceuticals manufacturing hub dramatically increased during the COVID-19 pandemic. Nine out of the world’s top 10 drug companies have significant production facilities in Ireland. The U.S. State Department thinks the corporate build-out in Ireland will continue, given Ireland’s status as the only remaining English-speaking European Union country following Britain’s departure. That makes it easy for international companies to operate and enjoy barrier-free access to the EU’s single market.

It’s hard to exaggerate Ireland’s dependence on U.S. tech and pharma companies for investment and taxes. Corporate tax receipts are now the second-largest source of tax revenue (after income tax) for the Irish state: 27 percent of all tax income in 2022. The average was just 9 percent in the 38 member countries of the Organisation for Economic Co-operation and Development (OECD) in 2020, the last year for which data is available. This, in turn, is fueling an unprecedented torrent of tax income for the Irish government. Corporate tax revenues were up nearly 50 percent in 2022 alone.

Just 10 multinationals—all of them U.S.-based tech and pharmaceutical companies—now pay nearly 60 percent of Ireland’s corporate tax. Directly and indirectly, U.S. multinationals employ more than 375,000 people in Ireland, approximately 15 percent of the country’s labor force. Driven by investment from the United States, foreign multinationals now account for 53 percent of all payroll taxes paid by corporate employers.

Driven by the windfall in corporate tax receipts, the Irish government’s budget surplus is expected to swell further, to 10 billion euros in 2023 and 16 billion euros in 2024. Relative to the size of the economy, this would be equivalent to a U.S. budget surplus of more than 1 trillion dollars in 2024.

The problem for Ireland is that this singular dependence exposes the country to growing risks. Take the tech sector: As multinationals like Google, Microsoft, Meta, and Amazon see their profits shrink and slash jobs worldwide, it will not only hurt the Irish economy, but deprive Dublin of tax income as well.

What’s more, the threat to Ireland’s stability from its overdependence on U.S. companies is about to be multiplied. In 2021, nearly 140 tax jurisdictions, including Ireland, agreed to a major reform of how multinationals companies will be taxed in the future. Pillar 2 of these reforms—a minimum corporate tax rate of 15 percent for large companies—is already coming into effect. In 2024, Ireland’s corporate tax rate is due to increase to 15 percent from its current level of 12.5 percent, reducing its attractiveness as a tax haven compared to other countries. The United States also approved the minimum tax plan in August 2022, despite significant private sector and political opposition.

However, it is Pillar 1 of the OECD’s reforms that will dramatically erode Ireland’s future income from corporate taxes. This reform will reallocate a share of company profits to where sales (or users) are actually located. Previously, tax liability was calculated on where the company or its subsidiary was legally based, no matter how many profits it rerouted from other parts of the world for tax-avoiding purposes. For Ireland, the consequences are obvious: U.S. multinationals operating in the EU will be forced to divide some of their sales by member state, thus significantly reducing the amount of sales and profits that can be “booked” through Ireland. This reform is due to come into force in 2024. The end of Ireland’s windfall is therefore only a matter of time.

The Irish Department of Finance estimated in January that around half of Ireland’s corporate tax receipts—$10 billion—are “transitionary” and will be lost as the new tax rules are implemented. That translates to more than 10 percent of total government spending in 2022—more than the entire Irish education budget. This is putting the Irish government on the precipice of another financial disaster, little more than a decade after it had to be bailed out of impending bankruptcy by the European Commission, European Central Bank, and the International Monetary Fund. That disaster left Ireland with one of the highest per capita public debt levels in the world.

Regardless of the impending financial train wreck, however, Dublin is unlikely to wake up from its American dream anytime soon. Diversifying its economy and revenue sources away from U.S. multinationals would require Ireland to shift its economic and geopolitical orientation, downgrade (in Dublin’s eyes) its deep relationship with the United States, and seek greater integration into the EU economy and its myriad rules.

That’s because Ireland’s dependence on U.S. multinationals is just another expression of the country’s affinity with the United States—the “shared heritage” referenced by U.S. presidents from John F. Kennedy to Ronald Reagan to Joe Biden. These ties to the United States long precede Dublin’s embrace of European integration and make it unlikely that Ireland will ever have the same intensity of economic, cultural, and other ties to France, Germany, or the rest of the EU.

The approaching economic and fiscal train wreck resulting from the new tax rules requires a fundamental change of mindset from Irish policymakers. Squaring the circle—holding on to its deep U.S. ties while integrating more closely with the EU to diversify its economy—means Dublin must give a little (and lose a little) to both sides. Yet Ireland’s ability to navigate this conundrum is doubtful. Even though the coming changes have been plain for all to see, Dublin’s current Trade and Investment Strategy does not contain any concrete policies to mitigate the overdependence on U.S. investment flows. Although the document acknowledges that EU market opportunities are underutilized, it again recognizes the importance “markets such as the UK and the US, which offer familiarity with language and culture.”