#Fund Accounting

Text

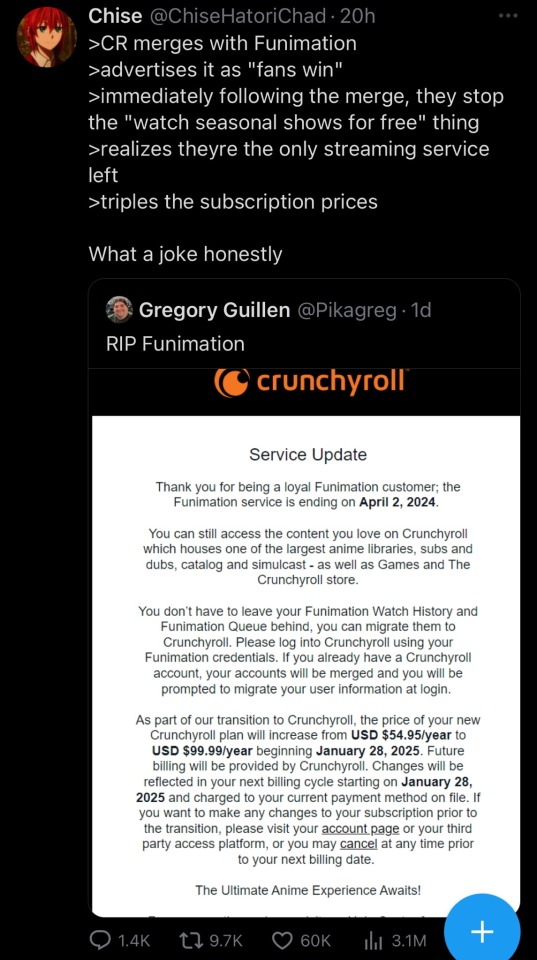

Oh…. Well, it’s over for Crunchyroll I guess

#Crunchyroll#piracy#funimation#money hungry ass streaming service#rambling#I’ve never paid for a streaming service in my life thank god#I appreciated using others accounts but I personally cannot see myself paying this much for a service if I had the funds 😭!#get back to pirating kings!!!#anime has always been one of the easiest forms of media to pirate anyway so y’all got this#CR is definitely not worth paying for though#CR is certainly not worth paying this much for even if it’s a yearly one time fee#capitalism#the fact that CR has always had pretty bad quality as a streaming service anyway#it buffers every time you pause or rewind anything

83K notes

·

View notes

Text

Accounting for Nonprofit Organizations

Introduction

Accounting plays a crucial role in the operations of nonprofit organizations, ensuring transparency, accountability, and effective stewardship of resources. Unlike for-profit entities, nonprofits have unique financial reporting requirements and considerations. This blog post delves into the intricacies of accounting for nonprofit organizations, shedding light on key principles,…

View On WordPress

#accounting#community#Compliance Requirements#donor restrictions#donors#Financial Management#Financial Reporting#financial sustainability#fund accounting#fundraising#marketing#nonprofit#Nonprofit Organizations#Regulatory Compliance

0 notes

Text

The Role of Fund Accounting in Financial Advisory Services

Fund accounting plays an important role in the field of financial advising, where precision and clarity are critical. It goes beyond standard bookkeeping and assists in the management of money for both ordinary individuals and large institutions.

Fund accounting is a method that maintains track of all financial transactions in investments. This involves recording transactions, determining the value of assets, and compiling financial statements. Fund accounting is critical for financial advisers since it maintains all documents correct and up to date. This assists them in making sound judgments. Financial advisers must provide tailored advice to their customers. Fund accounting assists them in accomplishing this by providing a clear, real-time image of what is in a client's investment portfolio. This isn't just about

Fund accounting is even more crucial for large investors, known as qualified institutional investors. These astute investors demand that everything be precise and adhere to the regulations. Fund accounting ensures that QIIs receive reports on schedule and that they are proper. This enables individuals to make sound financial decisions and cope confidently with complex financial problems. The collaboration between fund accounting and financial advisory services is excellent. Financial advisers that employ precise and straightforward fund accounting may provide incredible benefit to their customers. This collaboration not only ensures that things operate smoothly, but it also improves the entire customer experience.

Finally, the role of fund accounting in financial advice services is critical. It's more than simply a powerful tool for managing money; it's the foundation that allows advisers to provide top-tier services to customers, whether they're individual investors or large institutional players. Embracing the precision and openness of fund accounting is a smart decision as the financial industry continues to grow and expand. It guarantees that financial advising services are not only relevant, but also extremely successful in helping customers through the complexity of an ever-changing financial world. The confluence of accurate fund accounting and intelligent financial advising services builds a strong foundation, allowing advisers to handle problems, capture opportunities, and ultimately contribute to their clients' long-term financial success.

0 notes

Text

Fund Accounting 101: Basics & Unique Approach for Nonprofits

You receive donations or grants designated for a specific purpose that you have to spend within a calendar year. For instance, if you receive a donation explicitly for cancer suffering children, you can’t use that fund for HIV or any other life-threatening diseases.

As you are not free to use funds however you please, it is called restricted funds or donor-designated funds. The complexities of restricted funds present unique nonprofit bookkeeping and accounting challenges, which is not the case in regular accountings.

Read More on Demystifying Fund Accounting Basics for Nonprofits: A Unique Approach

#accounting challenges#fund accounting#Fund Accounting 101#Nonprofit accountants#nonprofit bookkeeping#nonprofit bookkeeping and accounting

0 notes

Text

#accounting#bookkeeping#crypto business#finance#fund administration#Hedge Fund Administration#Fund Accounting#Investor Services#Net Asset Value (NAV) Calculation#Trade Settlement#Performance Reporting#Compliance Management#Regulatory Reporting#Asset Valuation#Securities Lending#Middle Office Operations#Reconciliation#Custody Services#Hedge Fund Operations#Investor Onboarding#Risk Management#Fund Compliance#Alternative Investments#Financial Reporting#Hedge Fund Technology#User#ChatGPT#Certainly#Real Estate Fund Administration#Property Accounting

0 notes

Text

Formidium Achieves New Milestone With Release of the Tax Allocations and Returns Module for SeamlessTM Fund Accounting Software

Formidium Announces Tax Allocations and Returns Module for SeamlessTM

Formidium, a global leader in fund technology and back-office solutions, has introduced its Tax Allocations and Returns Module for SeamlessTM, their fund accounting software. This module streamlines tax allocation processes and tax return preparation for various investment funds, including SPVs, hedge funds, venture funds, private equity funds, and crypto/digital asset funds. The system is designed to empower tax professionals with more time for in-depth analysis and managing complex tax matters.

In an accounting system for pooled investment funds, the tax allocations module efficiently calculates investor-level tax allocations and tracks book vs. tax adjustments. It ensures precise processing of tax returns, K-1s, 1099s, and other essential tax schedules required by US tax regulations for investment funds. The system also promises prompt delivery of tax returns and distribution of K-1s & 1099s to investors, saving fund managers time and money.

Nilesh Sudrania, Founder & CEO of Formidium, expressed excitement about the new technology, emphasizing its capacity to provide clients with faster, higher-quality tax returns and K1s. SeamlessTM is now available to hedge funds, CFO services, CPA firms, and other service providers on flexible single or multi-year licensing terms.

0 notes

Text

Fund accounting

Fund accounting is one of the most typical services the custodians alongside the safekeeping function.

This type of accounting is used by the financial funds on money entrusted to them by donors, grantors, or other external sources. In fund accounting, the organization’s financial resources are classified into separate funds based on the purpose for which they have been donated, and the…

View On WordPress

0 notes

Text

Ultimus LeverPoint Welcomes Senior Sales Executive Jeffrey

Ultimus LeverPoint Welcomes Senior Sales Executive Jeffrey

CLIFTON PARK, N.Y., Nov. 01, 2022 (GLOBE NEWSWIRE) — Ultimus LeverPoint Private Fund Solutions®, a leading tech-driven private fund administrator, is pleased to announce Jeffrey Rosen recently joined the firm as Managing Director; an advantageous move as the firm continues to secure top industry talent in the competitive realm of the private equity business market. Rosen has over 20+ years of…

View On WordPress

#Asset Managers#Client Service#Fund Accounting#Fund Admin#Jeff Rosen#Middle Market#Private Equity#Private Fund Administration#ULP#Ultimus LeverPoint

0 notes

Text

What are the roles of the fund accountant that might benefit your company?

What is Fund Accountant?

Fund accountants analyse several financial variables on a daily basis to assist businesses in determining the price or value of their funds. Additionally, they compute and submit revenue, expense, and item-specific accrual statements, as well as worksheets for dividend or interest income and other schedules like a T-bill.

Fund accountants provide accounting services and performance analysis to Hedge Fund Services, Private Equity Fund Services, Real Estate Fund Services, Digital Asset Fund Services, and other areas.

Roles and responsibilities of Fund Accountant:

They produce accurate and timely fund accounting output, such as net asset values, yields, distributions for future review, and accounting for investment portfolios that include stocks, real estate, or commodities.

They provide regular weekly and monthly financial statements as well as income expense accruals, and they report net asset values per unit.

Fund accountants are largely in charge of the day-to-day accounting functions for the institutional or mutual funds they are assigned.

Fund accountants analyze several financial variables on a daily basis to assist businesses in determining the price or value of their funds.

They keep track of and document all financial events, such as trades, interest payments, maturity dates, and corporate actions.

They compute and submit income, expense, and item-specific accrual statements, along with other schedules like a T-bill and worksheets for dividend or interest income.

They ensure that their findings comply with regulations, protocol, and compliance before swiftly reporting their findings to clients.

Hedge funds and mutual funds can use the accounting services provided by fund accountants. These individuals are in charge of financial statement preparation, general ledger upkeep, net asset valuation, and other accounting and recordkeeping duties.

The fund accountant keeps the accounts and records for the investment portfolio, handles capital calls and investor payouts, and reports to management on how the fund assets are being used and performing.

Real Estate Fund uses Fund Accountant's fund-level accounting, reporting, and administration solutions to improve their operational models and concentrate on the investing strategies that produce higher results.

On a distributed ledger, Fund Accountant keeps track of digital records that were created using cryptography for security and verification (referred to as a blockchain). A blockchain network's distributed ledger maintains a record of each transaction.

Benefits of Fund Accounting:

It distinguishes between funds with specific and general purposes.

Budgeting and forecasting are both aided by segregating the finances.

The entity can keep track of how much money it has received and how much it has spent over time with the use of the receipt and payment account.

If you are looking for fund accountant, please visit on below link

https://www.fundtec.in/fund-services

0 notes

Text

#megaman#mega man#dr light#the protomen#the proto men#thomas light#putting my school funded adobe account to good use

296 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

154 notes

·

View notes

Text

genuine question but why is this even merch

Like who even asked for this

#‘helps fund the show’ YOU MEAN YOUR PERSONAL BANK ACCOUNT VIVZEPOP#anti helluva boss#helluva boss critical#vivzepop critical#anti vivziepop

120 notes

·

View notes

Text

I know a sorta made a small post along these lines the other day, but something a lil more official of!!

im kinda broke rn, between the recent stuff with losing my car and having to get a new one and work literally scheduling me 13 hrs a week. Im slowly losing money and it got really bad this month after paying my bills and everything and realizing I had just 300 bucks in my bank account.

My current job hasn't been working with me to give me the hours i need to make a living wage and iv been trying to get a new job for months with no success and it's looking like i could really use a lil extra support via online commission work rn until I can land a more solid paying job. I really hate to sound like a desperate wet cardboard box beast but I still need to insure my new car and cant afford it as i stand right now.

I wont ask for donations, I think im going to be fine, but a lil money to help keep my head above the water would be great so im just gonna promo my commission work. To anyone who can commission me in some way or another would be awesome! I appreciate any support I can get rn even just a reblog

My Commission Info

My Kofi

My Etsy

My Toyhouse

#again sorry for sounding like im crying wolf with 200 in my account but i havent bought groceries this month#or my car insurance#im waiting for my next paycheck#so i kinda know its about to get sucked down the drain#i still havent bought christmas gifts for my brother and the cousins which i would really like to be able to if i could#again im not gonna die#so im not asking for donations#i will be fine#im just a lil money stressed and if i could branch out to try and get some commission work rn that would be a huge help#again im not asking for donations#there defiantly ppl who need it more than me#but if you were everythinkin to commission me and have the funds rn#i wouldnt mind if you reached out#i know its the holidays and everyone is probably low on funds#i see the situation as it is rn#but if i could just make an extra hundred or two i think it put my mind at ease a lil more for when its time to pay all my bills again

158 notes

·

View notes

Text

Trends and Innovations in Investment Portfolio Management

Investing has come a long way, and the methods of managing investment portfolios are evolving at a rapid pace. The world of finance, including investment management companies, is embracing trends and innovations that are reshaping how we grow and safeguard our wealth. In this article, we'll delve into some of the latest developments in investment portfolio management, and fund accounting, and how it's all being facilitated by forward-thinking investment management companies.

Diving into Data-Driven Decisions

One of the significant trends is the increased reliance on data-driven decision-making. An investment management company now harnesses the power of big data and advanced analytics to make informed choices. They scrutinize vast amounts of financial data to identify trends, assess risk, and optimize portfolio performance. For instance, by examining historical data and real-time market indicators, investment managers can spot opportunities and make timely adjustments to investment portfolios.

AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning have also found a home in the world of investment portfolio management. These technologies allow investment management companies to create intelligent algorithms that can learn from historical data and adapt to changing market conditions. For example, AI-driven systems can assess a portfolio's risk exposure and automatically rebalance assets to align with the investor's goals.

Incorporating Sustainable Investing

Another major shift is the emphasis on sustainable investing, often referred to as Environmental, Social, and Governance (ESG) investing. Investors are increasingly conscious of the environmental and social impact of their investments. Investment management companies are responding by offering ESG-focused portfolios, allowing investors to align their financial goals with their ethical values.

Personalized Investment Solutions

Investment portfolio management is moving away from the one-size-fits-all approach. Today, it's all about personalization. Investment management companies recognize that every investor is unique, with specific financial goals and risk tolerances. By leveraging technology, they can create personalized investment solutions that cater to individual needs, ensuring clients get the most from their investments.

The Role of Fund Accounting

Fund accounting, the financial backbone of investment management, is also evolving. It's no longer a mere bookkeeping function. Modern fund accounting systems provide real-time insights into the financial health of investment portfolios. They facilitate accurate reporting and help investment managers make informed decisions about asset allocation.

Keeping It Secure

Innovations in security are crucial to protect investments. An investment management company employs advanced cybersecurity measures to safeguard sensitive financial data. They continuously monitor for potential threats, ensuring that your investments are kept safe from cyberattacks and fraud.

Global Investment Opportunities

Technology has made it easier for investors to explore global markets. Investment management companies now offer diversified investment portfolios that include international assets. This diversification helps spread risk and seize opportunities in different regions.

So, as you embark on your investment journey, consider the exciting opportunities and advancements that lie ahead in investment portfolio management.

0 notes

Text

Postin my kid oc from FNV, Tumbleweed :) Basically that kid thats only comeback is how he did your mom. Also im a Benny Gecko likes dad jokes truther

#my art#my ocs#benny gecko#fnv benny#fallout new vegas#fnv#tumbleweed#deep down hes a good kid and kind of a wiwi#tumbleweed wishes he had an xbox live account but he doesnt :(#The punchline of the joke is none btw#they're too short staffed to fund it

146 notes

·

View notes

Text

I don’t think we know for sure how Jacobi lost $13,000 in an internet scam, but I’m pretty sure Kepler was the one who scammed him.

I think he did it as test during the recruitment process. I also think he used the money to buy those expensive drinks at that bar when he first met Jacobi. He would totally do this.

#To this day he still hasn’t told Jacobi the truth#Kepler has it in a bank account labeled “Whiskey Funds from Jacobi” which he affectionately thinks of as a gift from his dear friend Jacobi#Never mind that Jacobi doesn’t know about it and was unemployed at the time he lost all that money#And that was part of what motivated him to work at Goddard in the first place#daniel jacobi#warren kepler#wolf 359#bods wolf359 reactions#w359#wolf359

117 notes

·

View notes