#Foreclosure fraud

Explore tagged Tumblr posts

Text

My Loan Modification Application Keeps Getting Rejected

Why Does My Lender Keep Rejecting My Loan Modification Application. What Am I Doing Wrong? Applying for a loan modification requires you to think like a chess player. Homeowners call us on a regular basis befuddled and confused. They claim their lender keeps rejecting their loan modification application. They believe they qualify for a loan modification. Yet, the lender keeps rejecting their…

View On WordPress

#banking#bankruptcy#banks#Chapter 13 Bankruptcy#Chapter 7 bankruptcy#Connecticut Loan Modifications#CRA#economic meltdown#financial crisis#Florida loan modifications#foreclosure#foreclosure crisis#foreclosure defense#foreclosure fraud#foreclosure help#foreclosure help new york#foreclosure rescue#foreclosures#illegal foreclosures#illegal foreclosures in New York#illegal new york foreclosures#loan modification#Loan Modifications#Loan Mods#loan workouts#mfi-miami#Mortgage Crisis#mortgage fraud#mortgage help#mortgage loan modifications

0 notes

Link

0 notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Text

Try to imagine Trump going to campaign HQ to reassure those working to get him elected with a speech like this after one of his unwelcome surprises.

Of course, that's impossible. This classy speech is all about "we" — the team, and the American people — although of course it's got a few "I's" in there to contrast herself with Trump and sketch out goals.

youtube

First five minutes: Squaring the circle of saluting Biden graciously, thanking and reassuring his election team, and moving forward

05:40 - rundown of major accomplishments of President Biden's administration

8:45 Harris lays out how she sees this election and I'm actually gonna transcribe it despite my arthritis because YES YES YES. (It's not very long.)

"It is my great honor to go out and EARN this nomination, and to win.

"So in the days and weeks ahead, I together with you will do everything in my power to unite the Democratic party, to unite our nation, and to win this election.

"You know, as many of you know, before I was elected as Vice President, before I was elected as United States Senator, I was the elected Attorney General of California, and before that I was a courtroom prosecutor. In those roles, I took on perpetrators of all kinds. [chuckles start around the room, she smiles.] Predators who abused women. Fraudsters who ripped off consumers. Cheaters who broke the rules for their own gain. So hear me when I say: I know Donald Trump's type.

"And in this campaign I will proudly — I will proudly put my record against his. As a young prosecutor, when I was in the Alameda County District Attorney's Office, I specialized in cases involving sexual abuse. Donald Trump was found liable by a jury for committing sexual abuse. As Attorney General of California I took on one of our country's largest for-profit colleges and put it out of business. Donald Trump ran a for-profit college, Trump University, that was forced to pay $25 million to the students it scammed. As District Attorney, to go after polluters, I created one of the first environmental justice units in our nation. Donald Trump stood in Mar-o-lago and told Big Oil lobbyists he would do their bidding for a $1 billion campaign contribution. During the foreclosure crisis, I took on the big Wall Street banks and won $20 billion for California families, holding those banks accountable for fraud. Donald Trump was just found guilty of 34 counts of fraud.

"But make no mistake — all that being said, this campaign is not just about us versus Donald Trump. There is more to this campaign than that. Our campaign has always been about two different versions of what we see as the future of our country, two different visions for the future of our country. One focused on the future, the other focused on the past.

"Donald Trump wants to take our country backward, to a time before many of our fellow Americans had full freedoms and rights.

"But we believe in a brighter future that makes room for all Americans. We believe in a future where every person has the opportunity not just to get by, but to get ahead. [Calls of "That's right!"] We believe in a future where no child has to grow up in poverty, where every person can buy a home, start a family and build wealth, and where every person has access to paid family leave and affordable child care. That's the future we see! [Applause.] Together we fight to build a nation where every person has affordable healthcare, where every worker is paid fairly, and where every senior can retire with dignity.

"All of this is to say that building up the middle class will be a defining goal of my presidency. Because we here know that when our middle class is strong, America is strong. And we know that's not the future Donald Trump is fighting for. He and his extreme Project 2025 will weaken the middle class and bring us backward — please do note that — back to the failed trickle-down policies that gave huge tax breaks to billionaires and big corporations and made working families pay the cost, back to policies that put Medicare and Social Security on the chopping block, back to policies that treat healthcare as only a privilege for the wealthy, instead of what we all know it should be, which is a right for every American.

"America has tried these economic policies before. They do not lead to prosperity. They lead to inequity and economic injustice. And we are NOT GOING BACK. We are not going back. (You're not taking us back.)

"Our fight for the future is also a fight for freedom. Generations of Americans before us have led the fight for freedom from our founders to our framers, to the abolitionists and the suffragettes, to the Freedom Riders and farm workers. And now I say, team, the baton is in our hands. We, who believe in the sacred freedom to vote. We, who are committed to pass the John Lewis Voting Rights Advancement Act and the Freedom to Vote Act. We, who believe in the freedom to live safe from gun violence, and that's why we will work to pass universal background checks, red flag laws, and an assault weapons ban. We, who will fight for reproductive freedom, knowing if Trump gets the chance, he will sign a national abortion ban to outlaw abortion in every. single. state—but we are not going to let that happen.

"It is this team here that is going to help in this November to elect a majority of members of the United States Congress who agreethe government should not be telling a woman what to do with her body. And when Congress passes a law to restore reproductive freedoms, as President of the United States I will sign it into law! [cheers, someone shouts "we the people!"] "Indeed, we the people.

"So ultimately, to all the friends here I say: in this election we know we each face a question. What kind of country do we want to live in? A country of freedom, compassion and rule of law, ["Yes!"] or a country of chaos, fear, and hate? [Boos] You all are here because you as leaders know we each — including our neighbors and our friends and our family — we each as Americans have the power to answer that question. That's the beauty of it, the power of the people. We each have the ability to answer that question.

"So in the next 106 days—" looks around the room smiling at various people, "We have work to do. We have doors to knock on, we have people to talk to, we have phone calls to make, and we have an election to win. …" [a few final crowd -whipping-up platitudes like "Do we believe in freedom"]

------

Note: Yes, I know, she spoke about rights for all Americans without getting into any specifics besides reproductive and voting rights, because those two are core values of the Democratic party and the ones most Americans agree with. Unifying a party and coalition building starts by finding common ground. The approach Harris is taking will pull away some old-school moderate Republicans who are reluctant to leave their party even as it changes beyond recognition, but who really don't like Trump. Many of them have been poisoned more or less by Fox News, so they need to see she's not a crazy crazy liberal.

108 notes

·

View notes

Text

The foreclosure notice for Graceland is a scam. Gregory and Kurt Naussany and Naussany Investments do not exist. They have no presence online at all. No office and only PO Boxes and a post office address. I hope whoever is behind this is revealed and charged with fraud.

14 notes

·

View notes

Text

youtube

Democratic party civil war, you say?

Matt Stoller on Kamala Harris:

There's a fair critique here of Kamala Harris skeptics. What basis do we have for skepticism? I'll lay out my views, which are largely policy-centered. I realize no one cares about what kind of leader Harris will be as President, but if there's one lesson we should take away from this moment, it's that we as a party should try to think more than five minutes ahead instead of panicking ourselves into a rushed decision. I started paying attention to Harris when she became California AG in 2010, because some friends worked to get her elected. It was in the middle of the financial crisis, Bush's and Obama's handling of which eventually led to the emergence of Trump. While AG, she had her most important test as an executive presiding over a big political economy decision - what to do about foreclosure crisis in California. Her position was unusual, because California is a big state, so the AG office is, staffed with many lawyers who can do complex finance analysis. Most states don't. There are only a few places - Texas, NY, Illinois, California - who have the capacity to truly wage independent litigation against powerful institutions like big banks. Harris pledged to do so. [Harris] pledged take on the banks and get something genuinely meaningful for homeowners for a mass legal violation called foreclosure fraud that put them on the hook for trillions. The details aren't important but if you want to know them read Dave Dayen's Chain of Title. It's something I was involved in. After two years where it became obvious Obama was on the wrong side, it was exciting to see a Democrat finally stand up.

Only, she didn't. Harris signed a sham settlement with a big fake fine number, that mostly let the banks do whatever they want, and I believe even get a tax deduction for the fines they did pay. As a result, a lot of people lost their homes who shouldn't have. That was a tragedy. But then when she was running for President in 2020, she *bragged* about what she did. It was rancid, similar to the worst of Obama. https://theintercept.com/2019/03/13/kamala-harris-mortage-crisis… Later it came out that her staff had given her memos on how she should have prosecuted (later) Trump Treasury Secretary Steve Mnuchin's bank OneWest, but just chose not to. It's not hard to see that, had Obama (and Harris) actually put the bad guys away, a whole slew of Trump officials would have been in jail rather than in the cabinet. https://politico.com/news/2019/10/22/kamala-harris-attorney-general-california-housing-053716…

I didn't pay as much attention to her big tech work or her time in the Senate, but she's quite close to a whole slew of people in the industry, top execs at Google and Facebook like Sheryl Sandberg. While AG, which was when these companies cemented their dominance in America, Harris's office saw Facebook as "a good actor." She took no actions against big firms as AG, opposed important legislation, and even started a privacy-related "monthly working group that included representatives from Facebook, Google, Instagram, and Kleiner Perkins. In internal documents, Harris' office referred to the companies as "partners."' Again, standard operating Obamacrat stuff. https://businessinsider.com/kamala-harris-silicon-valley-big-tech-facebook-attorney-general-2021-11…… Harris's circle of friends and family are biglaw Obamacrats. Her brother-in-law Tony West was a high-level Obama official, and now GC of Uber. Her niece worked at Uber, Slack, and FB, and her husband was a biglaw partner at Venable and DLA Piper. His clients included Walmart, Merck, and an arms dealer, and there were ethics questions since DLA Piper had a long list of foreign clients. https://nytimes.com/2020/08/17/us/elections/doug-emhoff-kamala-harriss-husband-takes-a-leave-of-absence-from-his-law-firm.html…

How does this differ from Biden's track record? As a Senator, you could read him like Harris. Biden did whatever the credit card companies wanted, was in on bad trade deals, and was VP when Obama mishandled the financial crisis. But Biden always had a tinge of populism. In the 1990s, he went after Stephen Breyer in his hearing for the Supreme Court, calling him an elitist for instance. He was a foreign policy guy, and never liked the Silicon Valley and Wall Street execs, he always thought they looked down on him. As President, he delegated and ignored most domestic policy, and so some of it went to populists and union people while most of it went to neoliberals like Janet Yellen and Neera Tanden. The net result of Biden's choices is a mix - good policy in a few areas, and rank incompetence across a host of them, as well as fantastically incompetent messaging. What was Harris's role? As VP, she's largely been absent from most policy areas I follow, so I don't know how to think about her views on Biden's economic agenda. She's certainly never talked about or been involved in anything competition or regulatory minded that I can see. She does not seem to be a player in any of the big money areas. That said, Harris has proven incapable of managing important tasks like addressing or even explaining the obviously dysfunctional asylum process at the border, so it's hard to know how much she *can* actually do in terms of competence. There's also a lot of inertia here, it's not like she can change everything on a dime. She will inherit Biden's legacy and officeholders, and she hasn't done much as VP to thwart economic policy, for good or ill.

So how will she be as President? I don't want to overstate my read, it's just a guess. But since we're all just guessing, what I suspect is she'll lead to a total wipeout of Dems in 2026 and 2028 as the party turns wholly against working people, and a more complete Trump-y style realignment. And that's if she wins. So that's the optimistic scenario.

Dem Civil War commencing...

#my gif#2024: Year of the Wood Dragon#USA#politics#democratic party#joe biden#nancy pelosi#alexandria ocasio cortez#glenn greenwald#twitter#matt stoller#kamala harris#critique#Youtube#election 2024

9 notes

·

View notes

Text

The abandoned Warner & Swasey Observatory, constructed by Worchester Warner and Ambrose Swasey as a gift for Case School of Applied Science.

Worchester Warner and Ambrose Swasey founded the Warner & Swasey Company in 1880 and manufactured telescopes and other precision tools. Warner and Swasey became trustees of the Case School of Applied Science and constructed an observatory for the school as a gift.

Designed by the architectural firm Walker & Weeks, the observatory was built between 1918 and 1920 at the cost of $87,000. The original wing on the south end consisted of a copper dome atop a cylindrical brick tower for a 9½-inch refractor, which was relocated from the backyard of Warner and Swasey’s mansions. The new facility also included two four-inch transits, a zenith telescope, and two Riefler clocks.

The new observatory was dedicated at 2:30 p.m. on October 12, 1920. Dr. W.W. Campbell, one of the most noted astronomers of the world and director of the Lick Observatory, gave the opening address.

In October 1940, a new wing to the observatory was completed, which was outfitted with a library, lecture hall, and a new 24-inch Burrell Schmidt telescope from Warner & Swasey that was installed in the spring of 1941 at the cost of $127,000.

Light pollution began to impact the dark skies that initially attracted Warner and Swasey A new $200,000 observatory, Nassau Astronomical Station, was completed 30 miles to the east in Geauga County on September 7, 1957. The Burrell Schmidt telescope was relocated to the new facility. To compensate for the relocation, a 36-inch telescope was installed.

An enlargement of the library and office space were completed in 1963.

In 1978, the Astronomy Department at Case Western Reserve University made a deal with the Association of Universities for Research in Astronomy to build a new observatory at Kitt Peak National Observatory in Arizona. The Burrell Schmidt telescope was moved from the Geauga County observatory was relocated in May 1979, and the 36-inch reflector from the facility was moved to Nassau in 1980.

Public night lectures, which were open to the public, were relocated to the Museum of Natural History’s Murch Auditorium in 1979.

After the reflector was removed from the facility, the building was used for offices for Case Western. In 1982, the five remaining faculty members who were stationed in the building were moved to the main campus of Case Western. The structure was sold in 1983 to a partnership controlled by Alfred Quarles for the television outfit, TBA, Inc. for $130,000.

The abandoned observatory was sold at a foreclosure auction on September 6, 2005, to Nayyir Al Mahdi and his girlfriend, Stacey Stoutemire, for $115,000. The couple had planned on restoring the building into a residence. The plans were scrapped after the owner was convicted of mortgage fraud and sent to prison in 2007.

School Of Science Still Stands Today In 2024

You can Follow For More on

Instagram - Mantis Lyblaca

TikTok - Mantis Lyblaca

Facebook - Mantis Lyblaca

#photography#my photos#photooftheday#aesthetic#horror#photographer#abandoned#urbex#explore#exploring#Ohio#abandoned Ohio

5 notes

·

View notes

Text

For 2024, my new years wish is for millennials & older gen z to stop parroting the phrase “I hope the housing market crashes so I can afford a home” because oh my god did yall not experience the same 2007-2008 as the rest of us?

I worked as a government loan analyst for fraudulent/mismanaged home loans from the early to late 2000s housing bubble/crisis, and I hate to break it to yall (even myself) but housing issues will skyrocket further than they’re already at.

So much of the US economy is tied into home ownership, more than I thought when I first started working in the housing industry, and while we may not have the same causes (fraud) of the Great Recession, we will have similar outcomes. I.e. high unemployment, depletion of savings/investments for everyday people, houselessness, rampant credit card debt, inflation, and more. My personal prediction is investment home buying will get worse (remember house flipping in the late 00s and early 2010s?). people became predatory on those facing foreclosure, which at one point was averaged at 10% of all homes (!!!!!)

Tldr if the housing market crashes, you will lose the buying power to even be able to afford a home that lost half its value bc the economy will fucking tank like a lead anchor

3 notes

·

View notes

Text

Watch the first two minutes of this video. This is Kamala Harris talking to her own staff. Auto generated transcript under the cut. This feels like a very different campaign than even a week ago. I do not think a Harris victory is a guarantee, but it feels possible now. Transcript:

0:01 you know as many of you know before I

0:02 was elected as vice president before I

0:05 was elected as United States Senator I

0:07 was the elected attorney general as I've

0:09 mentioned in California before that I

0:11 was a courtroom

0:12 prosecutor in those roles I took on

0:14 perpetrators of all kinds

0:21 [Applause]

0:30 Predators who Abused

0:32 women frers who ripped off

0:36 consumers cheaters who broke the rules

0:39 for their own

0:40 gain so hear me when I

0:43 say I know Donald Trump's type

0:58 [Applause]

1:03 and in this campaign I will

1:05 proudly I will proudly put my record

1:09 against

1:10 [Applause]

1:14 his as a young prosecutor when I was in

1:16 the Alama County District Attorney's

1:18 Office in California I specialized in

1:21 cases involving sexual

1:23 abuse Donald Trump was found liable by a

1:26 jury for committing sexual

1:28 abuse as a Attorney General of

1:30 California I took on one of our

1:32 country's largest for-profit colleges

1:35 and put it out of

1:37 business Donald Trump ran a for-profit

1:41 college Trump

1:43 University that was forced to pay $25

1:46 million to the students it

1:50 scammed as district attorney to go after

1:53 polluters I created one of the first

1:55 environmental justice units in our

1:57 nation

2:01 Donald Trump stood in maralago and told

2:05 Big Oil lobbyists he would do their

2:08 bidding for a$1 billion campaign

2:13 [Music]

2:15 contribution

2:17 during during the Foreclosure crisis I

2:21 took on the Big Wall Street Banks and

2:23 won $20 billion for California

2:26 [Applause]

2:28 families holding those Banks accountable

2:31 for

2:32 fraud Donald Trump was just found guilty

2:36 of 34 counts of

2:38 fraud

I just want everyone to remember that Donald Trump has spent the last several weeks mocking and berating everybody who suggested Biden step aside because the republicans really did not want to run against someone other than Joe Biden. They have no plan, no playbook, no protocol, for running against someone other than Joe.

If you're feeling defeatist right now, please just understand that the Trump Campaign Strategy People are having the worst, most stressful day of the campaign as they scramble to figure out how to beat somebody who isn't Biden in November. Their ace in the hole was a hunk of Kryptonite up their sleeve and now they find out they won't be fighting Superman. THAT is the mood of today.

33K notes

·

View notes

Text

Lender Processing: Streamlining Mortgage Services for Efficiency and Compliance

Lender processing refers to the essential steps and services involved in handling mortgage loans from origination to closing. It encompasses a range of tasks that ensure mortgage lenders meet regulatory requirements, provide efficient service to borrowers, and facilitate a seamless loan process. In today’s competitive mortgage industry, lender processing has become increasingly automated, leveraging advanced technology and data analytics to enhance efficiency and accuracy.

What is Lender Processing?

Lender processing is a comprehensive term that includes all the necessary actions performed by a mortgage lender or service provider throughout the lifecycle of a mortgage loan. This includes receiving the loan application, evaluating the borrower's financial situation, processing documentation, verifying information, and managing compliance. Lender processing can occur at different stages, starting from the application process through underwriting, approval, and closing, as well as managing post-closing services like servicing the loan or handling defaults.

The goal of lender processing is to ensure smooth operations while maintaining compliance with industry regulations. This involves reducing errors, improving turn times, and mitigating risks that may arise from non-compliance or poor documentation handling.

Key Aspects of Lender Processing

Loan Origination: The first step in lender processing is the loan origination process, where a borrower submits a loan application. During this stage, the lender collects personal and financial information, including income, assets, employment history, credit score, and the purpose of the loan (e.g., purchase, refinance). Lender processing systems help streamline data collection and integration into underwriting systems to make loan approval smoother.

Document Verification and Compliance: Once the loan application is received, the lender must verify the provided information to assess the borrower’s creditworthiness. Lender processing services ensure all documents are accurate, legitimate, and compliant with legal requirements. This includes validating employment information, assessing credit scores, and verifying property details through third-party services like title checks and appraisals. Adherence to laws such as the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA) is crucial.

Underwriting: Underwriting is a critical part of lender processing where the lender evaluates the risk involved in approving the loan. The underwriter examines all submitted documentation and assesses the borrower’s ability to repay the loan. Lender processing systems play a key role in assisting underwriters by automating risk assessment models and calculating debt-to-income ratios, ensuring accuracy, and speeding up the decision-making process.

Loan Approval and Closing: After underwriting, the loan moves to the approval stage where the lender confirms whether the borrower is eligible. Lender processing ensures that the necessary disclosures, terms, and conditions are presented to the borrower. Once the loan is approved, closing is the final step in the mortgage process, where the borrower signs the loan documents, and the lender disburses the funds. Lender processing systems make closing more efficient by organizing the required documents and ensuring that all regulatory requirements are met.

Post-Closing Services: After the loan is closed, the lender may require ongoing servicing such as managing payments, maintaining escrow accounts, and handling borrower inquiries. Lender processing services continue in this phase by automating payment processing, handling loan modifications, and managing the mortgage payment schedule. Some lenders also outsource foreclosure and default management services to processing companies in cases of payment delinquencies.

The Importance of Efficient Lender Processing

Efficient lender processing is vital to the success of both lenders and borrowers. Lenders rely on streamlined processing systems to reduce operating costs, improve turnaround times, and minimize the chances of errors that could lead to legal or financial complications. Furthermore, effective processing ensures compliance with federal, state, and local regulations, protecting lenders from costly penalties or legal disputes.

For borrowers, efficient lender processing translates to faster loan approvals, clearer communication, and better customer experience. In today’s fast-paced mortgage market, delays or mistakes in processing can lead to frustration and loss of trust. By enhancing efficiency, lender processing services create a smoother path to homeownership or refinancing.

Benefits of Lender Processing Services

Improved Operational Efficiency: By automating several steps in the loan process, lenders can significantly reduce manual labor, freeing up resources to focus on higher-priority tasks such as customer acquisition or strategic growth.

Compliance Assurance: Lender processing services ensure that all aspects of the mortgage loan comply with applicable laws, such as RESPA and TILA. Compliance is critical for lenders to avoid regulatory violations that can lead to penalties.

Cost Reduction: By automating key functions and outsourcing administrative tasks, lenders can lower operational costs. Streamlined processes also reduce errors, minimizing the need for costly corrections or reprocessing.

Risk Mitigation: Lender processing services help reduce risks by conducting thorough due diligence, verifying documents, and ensuring the loan meets underwriting guidelines. Accurate data processing minimizes the chances of approving high-risk loans.

Better Customer Experience: Fast, efficient, and transparent processing is crucial for maintaining borrower satisfaction. Customers appreciate quick loan approvals and timely updates, which improve their overall experience and can enhance customer loyalty.

Conclusion

Lender processing is an essential part of the mortgage industry, providing lenders with the tools to manage and streamline loan origination, underwriting, closing, and post-closing activities. The efficiency of lender processing systems impacts both the bottom line of lenders and the experience of borrowers.

0 notes

Text

Homestar Financial Throws In The Towel

And Another One Bites The Dust! Homestar Financial Shuts Down Amidst Mortgage Volatility Georgia based Homestar Financial announced this week that it is shutting down. The company blames rising mortgage rates and massive volume decrease. Additionally, they are also blaming the market compression for the closure. A Homestar Financial LO posted on Facebook: Read More On LenderMeltdown.com

View On WordPress

#banking#banks#debt#foreclosures#Homestar CEO Wes Hunt#Homestar Financial#Homestar Financial Closing#mortgage fraud#mortgage industry#mortgage industry implosions#mortgage industry meltdown#mortgages#real estate#Wes Hunt

0 notes

Link

#CancelYourMortgage#CAPSecurity#debttermination#FederalTerritorialGovernment#FRNDollars#historicalfacts#NegotiableSecurityInstruments#RegisteredStateLicensedProcessedCreditAgreement#TerritorialFederalGovernment#UnitedStatesCorporation#USADollarcurrency

0 notes

Text

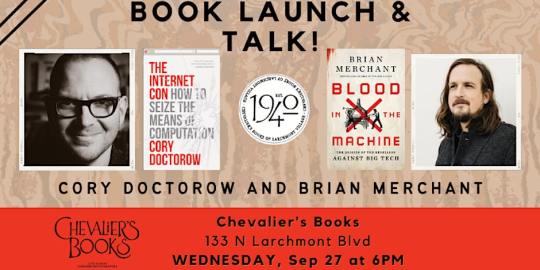

Intuit: “Our fraud fights racism”

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

Mortgage Fraud Audit: Protecting Borrowers and Lenders from Fraudulent Practices

A mortgage fraud audit is an essential tool in the fight against fraudulent practices in the mortgage industry. Mortgage fraud involves intentionally misleading information or deceptive practices used to secure a mortgage loan, resulting in financial harm to borrowers, lenders, and investors. These fraudulent actions can range from misrepresenting income, assets, and employment status to inflating property values or falsifying documents to secure a loan. Mortgage fraud audits play a critical role in uncovering these fraudulent activities, ensuring that both borrowers and lenders are protected from financial and legal risks.

What is a Mortgage Fraud Audit?

A mortgage fraud audit is a detailed examination of mortgage loan documents and the mortgage transaction process to identify potential fraudulent activities or misrepresentations. This audit involves reviewing a variety of documents, including loan applications, credit reports, property appraisals, closing documents, and payment histories. The goal of the audit is to identify any discrepancies, misstatements, or signs of fraud that may have affected the integrity of the loan.

Mortgage fraud auditors are trained professionals who are familiar with the legal standards and regulations governing the mortgage industry. They use their expertise to investigate whether the loan was originated and serviced according to industry best practices and whether any fraudulent actions were involved. Audits are particularly crucial for identifying fraud in loans that may have been improperly secured, including in the context of foreclosures or disputes.

Types of Mortgage Fraud

Mortgage fraud can take several forms, and auditors are trained to identify each one. Some of the most common types of mortgage fraud include:

Income and Employment Misrepresentation Fraudsters may exaggerate or fabricate their income, employment status, or financial situation in order to qualify for a mortgage they would not otherwise be able to afford. This type of fraud can lead to loan defaults and financial instability for both borrowers and lenders.

Property Valuation Fraud In property valuation fraud, appraisers may inflate the value of a property to ensure that a loan is approved for a higher amount. This could involve colluding with lenders or borrowers to artificially boost the price of the property, creating a risk for both the lender and the investor.

Straw Buyer Fraud In this scenario, a "straw buyer" is used to apply for a mortgage loan, often in cases where the actual borrower is unable to qualify. The straw buyer typically has no intention of paying the loan, and the property is either flipped or sold quickly, leaving the lender with a worthless asset.

Foreclosure Rescue Scams Fraudsters may approach distressed homeowners facing foreclosure, offering to "rescue" them by taking over the property or arranging a loan modification. In reality, these scams often involve fraudulent documentation or fees, leaving the homeowner with even greater financial hardship.

Why is a Mortgage Fraud Audit Important?

Protecting Borrowers A mortgage fraud audit helps protect borrowers from being victimized by fraudulent lenders or agents who may use deceptive practices to secure a loan. It can also identify issues related to predatory lending, such as inflated interest rates or hidden fees, ensuring that borrowers are not taken advantage of in the mortgage process.

Protecting Lenders and Investors For lenders and investors, a mortgage fraud audit is a critical tool for identifying loans that may have been improperly secured. These fraudulent loans carry significant risk, especially if the property value was artificially inflated or if the borrower misrepresented their financial standing. Detecting fraud early on can help lenders avoid potential losses and take appropriate action, such as pursuing legal remedies or canceling the loan.

Preventing Financial Loss Fraudulent loans can result in significant financial losses for both borrowers and lenders. For borrowers, it can lead to unaffordable loan terms, foreclosure, or loss of equity in their homes. For lenders, it can lead to defaulted loans, non-performing assets, and reputational damage. Mortgage fraud audits help detect these issues before they escalate into larger financial problems.

Legal Protection Mortgage fraud audits also provide legal protection for both borrowers and lenders. If fraudulent activity is uncovered, the audit provides evidence that can be used in court or regulatory proceedings. This can lead to the cancellation of fraudulent loans, legal action against fraudulent parties, and potential restitution for affected parties.

The Mortgage Fraud Audit Process

The process of a mortgage fraud audit involves several key steps:

Document Collection The first step in a mortgage fraud audit is collecting all relevant loan documents. These include the loan application, credit reports, property appraisals, closing documents, payment histories, and any correspondence between the borrower and lender.

Detailed Review Once the documents are gathered, the auditor reviews them carefully for any inconsistencies, discrepancies, or potential red flags. This could involve comparing the borrower’s stated income and assets with the documentation provided or examining property appraisals for signs of inflated values.

Identifying Fraud Indicators The auditor uses their expertise to identify specific indicators of fraud, such as mismatched signatures, altered documents, or suspicious patterns of behavior. This step is crucial for uncovering hidden fraudulent activity that may not be immediately apparent.

Reporting Findings After completing the audit, the auditor prepares a detailed report outlining their findings. The report highlights any evidence of fraud, misrepresentation, or discrepancies in the loan process, and provides recommendations for next steps.

Conclusion

A mortgage fraud audit is an invaluable tool for detecting fraudulent activities in the mortgage industry. Whether you're a borrower, lender, or investor, conducting an audit can help uncover potential risks, prevent financial losses, and protect against legal liabilities. Mortgage fraud audits ensure that both borrowers and lenders are held accountable and that the integrity of the mortgage process is maintained. By identifying fraudulent actions early, a mortgage fraud audit provides an opportunity to take corrective measures and prevent the escalation of fraudulent activities.

0 notes

Text

The Importance of a Mortgage Fraud Audit

A Mortgage Fraud Audit is a critical tool for uncovering discrepancies, errors, and fraudulent activities within the mortgage lending process. Whether you are a homeowner facing unexplained charges or an attorney building a legal case, a comprehensive mortgage fraud audit can provide the evidence and insights needed to address potential wrongdoing.

What is a Mortgage Fraud Audit?

A mortgage fraud audit involves a meticulous review of all loan-related documents, including the mortgage agreement, payment history, disclosures, and closing paperwork. The goal is to identify fraudulent practices, regulatory violations, or errors that could harm borrowers or compromise the integrity of the loan.

Common Issues Uncovered in a Mortgage Fraud Audit

Predatory Lending Practices These audits often reveal cases where lenders manipulated loan terms, misrepresented information, or imposed excessive fees to exploit borrowers.

Fraudulent Documentation Audits can uncover instances where loan documents were altered, income was overstated, or property values were inflated during the loan approval process.

Violation of Federal Laws A mortgage fraud audit can highlight breaches of laws like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which protect borrowers from deceptive practices.

Unauthorized Charges Hidden fees or charges that were not disclosed at the time of signing may be identified through an audit, providing grounds for legal action or dispute resolution.

Why a Mortgage Fraud Audit is Important

Protecting Borrowers Homeowners often face significant financial challenges due to errors or fraudulent practices in their mortgage agreements. An audit can reveal these issues, empowering borrowers to seek justice or negotiate better terms.

Preventing Foreclosure In cases of foreclosure, audit findings can delay or halt proceedings by uncovering errors or illegal actions by the lender.

Supporting Legal Cases For attorneys, a detailed mortgage fraud audit provides critical evidence to build strong cases against lenders or servicers engaging in fraudulent practices.

How a Mortgage Fraud Audit Works

Document Collection: Loan files, payment records, and communications are gathered for review.

Detailed Analysis: Experts analyze the documents to detect discrepancies, compliance issues, or fraud.

Comprehensive Report: A detailed report outlines findings, identifies potential violations, and recommends next steps.

Final Thoughts

A mortgage fraud audit is a powerful tool for ensuring transparency and accountability in the mortgage process. Whether you’re a borrower seeking answers, an attorney pursuing justice, or a lender aiming to maintain compliance, a fraud audit provides the clarity needed to address issues and protect your financial future.

0 notes