#illegal foreclosures

Explore tagged Tumblr posts

Text

My Loan Modification Application Keeps Getting Rejected

Why Does My Lender Keep Rejecting My Loan Modification Application. What Am I Doing Wrong? Applying for a loan modification requires you to think like a chess player. Homeowners call us on a regular basis befuddled and confused. They claim their lender keeps rejecting their loan modification application. They believe they qualify for a loan modification. Yet, the lender keeps rejecting their…

View On WordPress

#banking#bankruptcy#banks#Chapter 13 Bankruptcy#Chapter 7 bankruptcy#Connecticut Loan Modifications#CRA#economic meltdown#financial crisis#Florida loan modifications#foreclosure#foreclosure crisis#foreclosure defense#foreclosure fraud#foreclosure help#foreclosure help new york#foreclosure rescue#foreclosures#illegal foreclosures#illegal foreclosures in New York#illegal new york foreclosures#loan modification#Loan Modifications#Loan Mods#loan workouts#mfi-miami#Mortgage Crisis#mortgage fraud#mortgage help#mortgage loan modifications

0 notes

Text

Big Telco’s fury over FCC plan to infuse telecoms policy with facts

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Reality has a distinct anti-conservative bias, but conservatives have an answer: when the facts don't support your policies, just get different facts. Who needs evidence-based policy when you can have policy-based evidence?

Take gun violence. Conservatives tell us that "an armed society is a polite society," which means that the more guns you have, the less gun violence you'll experience. To prevent reality from unfairly staining this pristine ideological mind-palace with facts, conservatives passed the Dickey Amendment, which had the effect of banning the CDC from gathering stats on American gun-violence. No stats, no violence!

https://en.wikipedia.org/wiki/Dickey_Amendment

Policy-based evidence is at the core of so many cherished conservative beliefs, like the idea that queer people (and not youth pastors) are responsible for the sexual abuse of children, or the idea that minimum wages (and not monopolies) decrease jobs, or the idea that socialized medicine (and not private equity) leads to death panels:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

The Biden administration features a sizable cohort of effective regulators, whose job is to gather evidence and then make policy from it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

Fortunately for conservatives, not every Biden agency is led by competent, honest brokers – the finance wing of the Dems got to foist some of their most ghoulish members upon the American people, including a no-fooling cheerleader for mass foreclosure:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

And these same DINOs reached across the aisle to work with Republicans to keep some of the most competent, principled agency leaders from being seated, like the remarkable Gigi Sohn, targeted by a homophobic smear campaign funded by the telco industry, who feared her presence on the FCC:

https://pluralistic.net/2023/03/19/culture-war-bullshit-stole-your-broadband/

The telcos are old hands at this stuff. Long before the gun control debates, Ma Bell had figured out that a monopoly over Americans' telecoms was a license to print money, and they set to corrupting agencies from the FCC to the DoJ:

https://pluralistic.net/2021/11/14/jam-to-day/

Reality has a vicious anti-telco bias. Think of Net Neutrality, the idea that if you pay an ISP for internet service, they should make a best effort to deliver the data you request, rather than deliberately slowing down your connection in the hopes that you'll seek out data from the company's preferred partners, who've paid a bribe for "premium delivery."

This shouldn't even be up for debate. The idea that your ISP should prioritize its preferred data over your preferred data is as absurd as the idea that a taxi-driver should slow down your rides to any pizzeria except Domino's, which has paid it for "premium service." If your cabbie circled the block twice every time you asked for a ride to Massimo's Pizza, you'd be rightly pissed – and the cab company would be fined.

Back when Ajit Pai was Trump's FCC chairman, he made killing Net Neutrality his top priority. But regulators aren't allowed to act without evidence, so Pai had to seek out as much policy-based evidence as he could. To that end, Pai allowed millions of obviously fake comments to be entered into the docket (comments from dead people, one million comments from @pornhub.com address, comments from sitting Senators who disavowed them, etc). Then Pai actively – and illegally – obstructed the NY Attorney General's investigation into the fraud:

https://pluralistic.net/2021/05/06/boogeration/#pais-lies

The pursuit of policy-based evidence is greatly aided by the absence of real evidence. If you're gonna fill the docket with made-up nonsense, it helps if there's no truthful stuff in there to get in the way. To that end, the FCC has systematically avoided collecting data on American broadband delivery, collecting as little objective data as possible:

https://pluralistic.net/2020/05/26/pandemic-profiteers/#flying-blind

This willful ignorance was a huge boon to the telcos, who demanded billions in fed subsidies for "underserved areas" and then just blew it on anything they felt like – like the $45 billion of public money they wasted on obsolete copper wiring for rural "broadband" expansion under Trump:

https://pluralistic.net/2022/02/27/all-broadband-politics-are-local/

Like other cherished conservative delusions, the unsupportable fantasy that private industry is better at rolling out broadband is hugely consequential. Before the pandemic, this meant that America – the birthplace of the internet – had the slowest, most expensive internet service of any G8 country. During the lockdown, broadband deserts meant that millions of poor and rural Americans were cut off from employment, education, health care and family:

https://pluralistic.net/2021/02/12/ajit-pai/#pai

Pai's response was to commit another $8 billion in public funds to broadband expansion, but without any idea of where the broadband deserts were – just handing more money over to monopoly telcos to spend as they see fit, with zero accountability:

https://pluralistic.net/2020/05/26/pandemic-profiteers/#flying-blind

All that changed after the 2020 election. Pai was removed from office (and immediately blocked me on Twitter) (oh, diddums), and his successor, Biden FCC chair Jessic Rosenworcel, started gathering evidence, soliciting your broadband complaints:

https://pluralistic.net/2021/03/23/parliament-of-landlords/#fcc

And even better, your broadband speed measurements:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#fly-my-pretties

All that evidence spurred Congress to act. In 2021, Congress ordered the FCC to investigate and punish discrimination in internet service provision, "based on income level, race, ethnicity, color, religion, or national origin":

https://www.congress.gov/117/plaws/publ58/PLAW-117publ58.pdf

In other words, Congress ordered the FCC to crack down on "digital redlining." That's when historic patterns of underinvestment in majority Black neighborhoods and other underserved communities create broadband deserts, where internet service is slower and more expensive than service literally across the street:

https://pluralistic.net/2021/06/10/flicc/#digital-divide

FCC Chair Rosenworcel has published the agency's plan for fulfilling this obligation. It's pretty straightforward: they're going to collect data on pricing, speed and other key service factors, and punish companies that practice discrimination:

https://www.fcc.gov/document/preventing-digital-discrimination-broadband-internet-access

This has provoked howls of protests from the ISP cartel, their lobbying org, and their Republican pals on the FCC. Writing for Ars Technica, Jon Brodkin rounds up a selection of these objections:

https://arstechnica.com/tech-policy/2023/11/internet-providers-say-the-fcc-should-not-investigate-broadband-prices/

There's GOP FCC Commissioner Brendan Carr, with a Steve Bannon-seque condemnation of "the administrative state [taking] effective control of all Internet services and infrastructure in the US. He's especially pissed that the FCC is going to regulate big landlords who force all their tenants to get slow, expensive from ISPs who offer kickbacks to landlords:

https://www.fcc.gov/document/carr-opposes-bidens-internet-plan

The response from telco lobbyists NCTA is particularly, nakedly absurd: they demand that the FCC exempt price from consideration of whether an ISP is practicing discrimination, calling prices a "non-technical aspect of broadband service":

https://www.fcc.gov/ecfs/document/110897268295/1

I mean, sure – it's easy to prove that an ISP doesn't discriminate against customers if you don't ask how much they charge! "Sure, you live in a historically underserved neighborhood, but technically we'll give you a 100mb fiber connection, provided you give us $20m to install it."

This is a profoundly stupid demand, but that didn't stop the wireless lobbying org CTIA from chiming in with the same talking points, demanding that the FCC drop plans to collect data on "pricing, deposits, discounts, and data caps," evaluation of price is unnecessary in the competitive wireless marketplace":

https://www.fcc.gov/ecfs/document/1107735021925/1

Individual cartel members weighed in as well, with AT&T and Verizon threatening to sue over the rules, joined by yet another lobbying group, USTelecom:

https://www.fcc.gov/ecfs/document/1103655327582/1

The next step in this playbook is whipping up the low-information base by calling this "socialism" and mobilizing some of the worst-served, most-gouged people in America to shoot themselves in the face (again), to own the libs:

https://pluralistic.net/2022/12/15/useful-idiotsuseful-idiots/#unrequited-love

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/10/digital-redlining/#stop-confusing-the-issue-with-relevant-facts

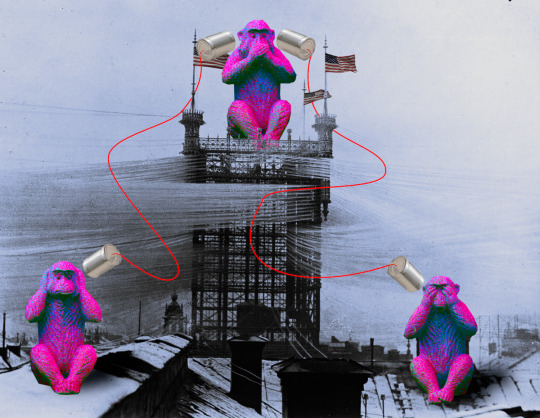

Image: Japanexperterna.se (modified) https://www.flickr.com/photos/japanexperterna/15251188384/

CC BY-SA 2.0: https://creativecommons.org/licenses/by-sa/2.0/

--

Mike Mozart (modified) https://www.flickr.com/photos/jeepersmedia/14325839070/

https://www.flickr.com/photos/jeepersmedia/14325905568/

https://www.flickr.com/photos/jeepersmedia/14489390566/

www.ccPixs.com https://www.flickr.com/photos/86530412@N02/8210762750/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#reality-based community#willful ignorance#digital redlining#telecoms#isps#cable company fuckery#net neutrality#network neutrality#fcc#monopolies#market failures#musketfuckers#ammosexuals#guns#race#reality has an anti-conservative bias#dickey amendment#policy based evidence#facts don't care about your feelings

137 notes

·

View notes

Text

The politicization of the transgender subject’s present pain rather than future liberation forecloses the question: What does transgender exist in reference to? This foreclosure easily leads to liberal concepts of justice and equality. As Brown (1993) argues, claims to inclusion, which have originated from far more liberatory intentions, are “tethered to a formulation of justice, which, ironically, reinscribes a bourgeois idea as its measure”; (394) the transgender woman seeks an “equal chance” at being included in the stable category of “woman,” and transgender politics becomes deeply tied to a proliferation of precisely defined signifiers—as if we can somehow signify our way toward liberation. The tragic result of this contradiction, in combination with the renaturalization of capitalism within identity politics, is that the transgender subject must form a wounded attachment to the very terms of gender that oppress her in the first place. It is this fear of illegibility, the need to exist in spaces where one’s relationship to gender is legible, even as one grapples with the intangibility of gender—the fiction of gender essentialism that trans people are forced to take on—that makes our need for intangible things such as “safety” and “security” so easily co-optable. The incitement to vulnerability (“what are you?”) serves to remind us of that.

Papantonopoulou, Saffo (2014). “‘Even a Freak Like You Would Be Safe in Tel Aviv’: Transgender Subjects, Wounded Attachments, and the Zionist Economy of Gratitude.”

6 notes

·

View notes

Text

Another term for Dementia Joe? President Kamala Harris? If either should happen, we are well and truly screwed. More Debt. More Crime. More illegal immigrants. More failing schools. More drug overdoses. More inflation. More foreclosures. More despair.

#joe biden is a failure#joe Biden is a joke#leadership#government#democracy#extremism#kamala harris#kamala is a fool#save our nation#save america

26 notes

·

View notes

Text

A life hauls itself uphill through hoar-mist steaming the sun's tongue licking leaf upon leaf into stricken liquid When? When? cry the soothseekers but time is a bloodshot eye seeing its last of beauty its own foreclosure a bloodshot mind finding itself unspeakable What is the last thought? Now I will let you know? or, Now I know? (porridge of skull-splinters, brain tissue mouth and throat membrane, cranial fluid)

Shattered head on the breast of a wooded hill Laid down there endlessly so tendrils soaked into matted compost become a root torqued over the faint springhead groin whence illegible matter leaches: worm-borings, spurts of silt volumes of sporic changes hair long blown into far follicles blasted into a chosen place

Revenge on the head (genitals, breast, untouched) revenge on the mouth packed with its inarticulate confessions revenge on the eyes green-gray and restless revenge on the big and searching lips the tender tongue revenge on the sensual, on the nose the carrier of history revenge on the life devoured in another incineration

You can walk by such a place, the earth is made of them where the stretched tissue of a field or woods is humid with beloved matter the soothseekers have withdrawn you feel no ghost, only a sporic chorus when that place utters its worn sigh let us have peace

And the shattered head answers back I believed I was loved, I believed I loved who did this to us?

Shattered Head by Adrienne Rich

2 notes

·

View notes

Text

The Most Common Indicators of Illegal Property Flipping

Illegal property flipping is a term used to describe a fraudulent real estate practice in which an individual or group of individuals buy properties to quickly resell them at a much higher price. This practice often involves inflating the value of the property through various means, such as submitting false or misleading appraisals or using straw buyers. The goal of illegal property flipping is to make a quick profit without making any improvements or adding any value to the property. However, this practice can have severe negative consequences for both the housing market and the unsuspecting buyers.

What are The Common Indicators of Illegal Flipping?

The practice of property flipping may involve fraudulent schemes and unethical activities. But you should be aware of the indications. Here is a thorough explanation of the most common indicators of illegal property flipping:

Misleading Documents

Predatory Lending

False Evaluation

Concealment of Defects

Flips With no Repairs or Improvements

Negative Consequences of Illegal Flipping on Buyers

Flipping, when done the right way, can have severe consequences on a buyer. These may include the following:

Financial Losses

Legal Issues

Negative Impact on Community

Foreclosure Risk

Property flipping is legal, given that no misleading statements are made or signed. Whenever you decide to invest in a property, read all the paperwork and contracts. The contract you provide to the lender is a statement of facts. But, it should be devoid of any false assertions.

If there is honesty and integrity, the process is legal. If not, identify the signs of illegal property flipping and take appropriate action. To get a consultation on property flipping and want to know more about the process of property flipping, visit our website or the link mentioned below.

Source: illegal property flipping

6 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure. — Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

7 notes

·

View notes

Link

#CancelYourMortgage#CAPSecurity#debttermination#FederalTerritorialGovernment#FRNDollars#historicalfacts#NegotiableSecurityInstruments#RegisteredStateLicensedProcessedCreditAgreement#TerritorialFederalGovernment#UnitedStatesCorporation#USADollarcurrency

0 notes

Text

The Importance of a Mortgage Fraud Audit

A Mortgage Fraud Audit is a critical tool for uncovering discrepancies, errors, and fraudulent activities within the mortgage lending process. Whether you are a homeowner facing unexplained charges or an attorney building a legal case, a comprehensive mortgage fraud audit can provide the evidence and insights needed to address potential wrongdoing.

What is a Mortgage Fraud Audit?

A mortgage fraud audit involves a meticulous review of all loan-related documents, including the mortgage agreement, payment history, disclosures, and closing paperwork. The goal is to identify fraudulent practices, regulatory violations, or errors that could harm borrowers or compromise the integrity of the loan.

Common Issues Uncovered in a Mortgage Fraud Audit

Predatory Lending Practices These audits often reveal cases where lenders manipulated loan terms, misrepresented information, or imposed excessive fees to exploit borrowers.

Fraudulent Documentation Audits can uncover instances where loan documents were altered, income was overstated, or property values were inflated during the loan approval process.

Violation of Federal Laws A mortgage fraud audit can highlight breaches of laws like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which protect borrowers from deceptive practices.

Unauthorized Charges Hidden fees or charges that were not disclosed at the time of signing may be identified through an audit, providing grounds for legal action or dispute resolution.

Why a Mortgage Fraud Audit is Important

Protecting Borrowers Homeowners often face significant financial challenges due to errors or fraudulent practices in their mortgage agreements. An audit can reveal these issues, empowering borrowers to seek justice or negotiate better terms.

Preventing Foreclosure In cases of foreclosure, audit findings can delay or halt proceedings by uncovering errors or illegal actions by the lender.

Supporting Legal Cases For attorneys, a detailed mortgage fraud audit provides critical evidence to build strong cases against lenders or servicers engaging in fraudulent practices.

How a Mortgage Fraud Audit Works

Document Collection: Loan files, payment records, and communications are gathered for review.

Detailed Analysis: Experts analyze the documents to detect discrepancies, compliance issues, or fraud.

Comprehensive Report: A detailed report outlines findings, identifies potential violations, and recommends next steps.

Final Thoughts

A mortgage fraud audit is a powerful tool for ensuring transparency and accountability in the mortgage process. Whether you’re a borrower seeking answers, an attorney pursuing justice, or a lender aiming to maintain compliance, a fraud audit provides the clarity needed to address issues and protect your financial future.

0 notes

Text

The Importance of a Mortgage Fraud Audit

A Mortgage Fraud Audit is a critical tool for uncovering discrepancies, errors, and fraudulent activities within the mortgage lending process. Whether you are a homeowner facing unexplained charges or an attorney building a legal case, a comprehensive mortgage fraud audit can provide the evidence and insights needed to address potential wrongdoing.

What is a Mortgage Fraud Audit?

A mortgage fraud audit involves a meticulous review of all loan-related documents, including the mortgage agreement, payment history, disclosures, and closing paperwork. The goal is to identify fraudulent practices, regulatory violations, or errors that could harm borrowers or compromise the integrity of the loan.

Common Issues Uncovered in a Mortgage Fraud Audit

Predatory Lending Practices These audits often reveal cases where lenders manipulated loan terms, misrepresented information, or imposed excessive fees to exploit borrowers.

Fraudulent Documentation Audits can uncover instances where loan documents were altered, income was overstated, or property values were inflated during the loan approval process.

Violation of Federal Laws A mortgage fraud audit can highlight breaches of laws like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which protect borrowers from deceptive practices.

Unauthorized Charges Hidden fees or charges that were not disclosed at the time of signing may be identified through an audit, providing grounds for legal action or dispute resolution.

Why a Mortgage Fraud Audit is Important

Protecting Borrowers Homeowners often face significant financial challenges due to errors or fraudulent practices in their mortgage agreements. An audit can reveal these issues, empowering borrowers to seek justice or negotiate better terms.

Preventing Foreclosure In cases of foreclosure, audit findings can delay or halt proceedings by uncovering errors or illegal actions by the lender.

Supporting Legal Cases For attorneys, a detailed mortgage fraud audit provides critical evidence to build strong cases against lenders or servicers engaging in fraudulent practices.

How a Mortgage Fraud Audit Works

Document Collection: Loan files, payment records, and communications are gathered for review.

Detailed Analysis: Experts analyze the documents to detect discrepancies, compliance issues, or fraud.

Comprehensive Report: A detailed report outlines findings, identifies potential violations, and recommends next steps.

Final Thoughts

A mortgage fraud audit is a powerful tool for ensuring transparency and accountability in the mortgage process. Whether you’re a borrower seeking answers, an attorney pursuing justice, or a lender aiming to maintain compliance, a fraud audit provides the clarity needed to address issues and protect your financial future.

0 notes

Text

I Beat My Foreclosure. How Do I Get My Lender To Pay Up?

I Beat My Foreclosure In Florida. How Do I Get My Greedy SOB Lender To Pay My Legal Bill? Can I get my lender to pay legal fees if I prevail in a foreclosure case? So now you have bragging rights. You are one of the few homeowners in Florida who can hold their head up high and proclaim, “I beat my foreclosure!” So, now you’re feeling euphoric. Your head is spinning with million different…

View On WordPress

#banking#banks#beat my foreclosure#Central Florida Foreclosure Defense#Florida foreclosure attorneys#florida foreclosure cases#florida foreclosure defense#Florida foreclosure defense attorneys#florida foreclosure defense lawyers#Florida Foreclosure Law#florida foreclosures#foreclosure#foreclosure defense#foreclosure legal fees#foreclosures#i beat my foreclosure#illegal florida foreclosures#mortgage fraud#mortgages#real estate#Stop Florida Foreclosure

0 notes

Text

This day in history

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then SAN FRANCISCO (Mar 13), Anaheim, and more!

#15yrsago Middle schooler wins C-SPAN prize for doc about NSA spying https://www.eff.org/deeplinks/2014/03/middle-schoolers-win-c-span-prizes-nsa-documentaries

#10yrsago Chocolate cookie milk shots: milk tumblers made from chocolate chip cookies https://www.eater.com/2014/3/5/6269103/dominique-ansel-to-debut-milk-cookie-shots-at-sxsw

#10yrsago Make taser-proof clothing with carbon-fiber linings https://hackaday.io/project/196-homamade-carbon-tape-taser-proof-clothing

#10yrsago Why does Hollywood like dystopian LAs and utopian SFs? https://boomcalifornia.org/2014/02/27/postcards-from-the-future/

#10yrsago Why DRM’ed coffee-pods may be just the awful stupidity we need https://memex.craphound.com/2014/03/06/why-drmed-coffee-pods-may-be-just-the-awful-stupidity-we-need/

#10yrsago Complaint: WIPO director illegally collected staff DNA in order to out whistleblower https://unwatch.org/un-whistleblower-head-world-intellectual-property-agency-stole-employees-dna-samples/

#10yrsago US Embassy and Godaddy conspire to censor dissenting Mexican political site https://www.eff.org/deeplinks/2014/03/mexican-protest-site-censored-godaddy-us-embassys-help

#10yrsago Harry Reid on the Koch Brothers’ agenda https://www.youtube.com/watch?v=y2-cIpXIoY4

#10yrsago Rob Ford’s pitiable moment on Jimmy Kimmel https://www.joeydevilla.com/2014/03/04/rob-fords-red-faced-interview-on-jimmy-kimmel-live/

#10yrsago Video explainer: why open spectrum matters, and why you’re about to lose it https://www.youtube.com/watch?v=MhVx-kH7RAQ

#10yrsago Feds drop link-related charges against Barrett Brownhttps://www.techdirt.com/2014/03/05/barrett-brown-tells-court-that-sharing-link-is-not-crime/ https://www.techdirt.com/2014/03/05/barrett-brown-tells-court-that-sharing-link-is-not-crime/

#5yrsago Ruminations on decades spent writing stories that run more than 1,000,000 words https://www.antipope.org/charlie/blog-static/2019/03/lessons-learned-writing-really.html

#5yrsago A thorough defense of Modern Monetary Theory https://www.forbes.com/sites/johntharvey/2019/03/05/mmt-sense-or-nonsense/

#5yrsago A brilliant, simple exercise to teach privacy fundamentals https://twitter.com/Klonick/status/1102970732890316801

#5yrsago GOP lawmaker driven mad by bill that would decriminalize children who take naked photos of themselves, delivers a frenzied rant about anal sex on legislature’s floor https://www.thestranger.com/news/2019/03/05/39511377/a-bill-decriminalizing-teen-sexting-passes-the-house-causing-republican-to-scream-about-anal-sex-on-the-floor

#5yrsago Bounty hunters and stalkers are able to track you in realtime by lying to your phone company and pretending to be cops https://www.vice.com/en/article/panvkz/stalkers-debt-collectors-bounty-hunters-impersonate-cops-phone-location-data

#5yrsago From prisons to factories to offices: the spread of workplace surveillance and monitoring tech https://datasociety.net/wp-content/uploads/2019/09/DandS_WorkplaceMonitoringandSurveillance-.pdf

#5yrsago NH GOP lawmakers mocked gun violence survivors by wearing clutchable pearl necklaces to gun control hearing https://www.washingtonpost.com/politics/2019/03/06/gop-lawmakers-wore-pearls-while-gun-violence-victims-testified-activists-were-outraged/

#5yrsago Omniverse CEO rejects piracy accusations, claims that he has a legit, “mind-blowing” 100-year license to stream TV on the internet https://www.lightreading.com/video-broadcast/omniverse-ceo-i-m-doing-everything-literally-by-the-book-

#1yrago Biden set to appoint mass foreclosure cheerleader to the Fed https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

Name your price for 18 of my DRM-free ebooks and support the Electronic Frontier Foundation with the Humble Cory Doctorow Bundle.

4 notes

·

View notes

Text

Foreclosure Videos

Foreclosure defense lawsuit center Georgia- Check out my lawsuit center if you face a legal dispute. We have the lawsuit packages to help you take control of illegal foreclosure, property tax attacks, and more. If you face an eviction court hearing in Texas, California, Florida, learn how to stop the foreclosure process auction without an attorney.

Foreclosure Videos

Click here for more info :- https://www.youtube.com/watch?v=UaGFa9qhB4o

0 notes

Text

pfftttt... “ define.. nobody. “ it’s the dead of night & the building @mercred & i stood in—front of, was in foreclosure for surrrrre. had the chained link fence, nailed up blanks, signs, overgrown lawn & beat down, ‘abandoned vibe’ to prove that awful fact but.. the lights reflecting under the window-pane tell a different story. i’d go as far as hopin’ it’s just an unhoused person, making the best with what they’ve got. i’ve been there.. college, livin’ in my car for a couple months without much to my name besides ramen in bulk & an ungodly amount of parking tickets ( now paid off & fully housed, don’t worry … ). but the point is: i get the need to use a vessel no one else is usin’ — it only makes sense. & my gut tells me something more sinister is behind those boards. fingers reach down & pull back metal suffrage, the groan of material giving way was enough to switch focus over to wade. there was no going back now, it was all.. semi-illegal from here. [ well, it didn't have to be. if given a few minutes, i could get a warrant, actually.. judge henry's on speed-dial but would he be awake (?) hmmm.... ] i cut my own thought off with slight humor, “ you think they’re friendly .. (?) “ rhetorical question / kinda. not many were friendly after dark, especially when disturbed.. we’d find that out soon enough, huh. or.. maybe i should hope not. yeah. hope not.

⚠️ㅤ … nobody's supposed to be here.

1 note

·

View note

Text

Civil Rights Lawsuit Package

The 42 USC 1983 foreclosure lawsuit package will help you sue the state players for the illegal court process that violated your due process rights. Civil Rights Lawsuit Package.

Civil Rights Lawsuit Package

Click Here For More Info:-

https://winincourtnow.com/product/42-usc-1983-foreclosure-lawsuit/

0 notes

Text

At 9 a.m. on September 11, 2001, we had 9-11 and the destruction of the Twin Towers and Tower 7. And humanity has discovered that the Deep State is extremely serious about maintaining control over humanity, even to the point of killing or destroying anyone and anything that gets in their way.

At 10 a.m., Alan Greenspan was to publicly announce NESARA, the new law that was the cure for the illegal activities of the banking industry in cahoots with the government. This public announcement would have fulfilled the conditions required to integrate NESARA into positive law, which was to introduce GESARA, on a global level.

Banks and the government illegally seized Midwestern family farms that belonged to the Farmers Union by giving land patents to farms. A land patent provides legal protection against illegal land grabbers. It is illegal to seize any property owned by an allodial title.allodial.

The corporation USA Inc. thought they owned the land when they seized the land from the Federal Republic of the United States. They did not honor property rights.

A land farm with this type of title can only be transferred by the owner voluntarily; which means it cannot be removed by any other means. The properties in question were pledged to banks by the innocent and unknowing owner as security for a loan. They had no choice, to pawn the land or not take a loan. Forfeiture of the property was written into the loan if it was not repaid on time. This was against the law; the banks knew it and the county clerks of county government knew it too.

Clerks recorded the transfer of ownership to the banks without the voluntary signature of the legal owner. This was pure fraud perpetrated and justified by America’s illegal foreclosure of USA, Inc. NESARA aims to reclaim all of this land and pay the illegal lawsuits and legal fees to these people, as well as return lots of Native American lands and not limit them to reservation lands and sick casinos.

0 notes