#Financial Trading

Explore tagged Tumblr posts

Link

Watch this video to learn about the basics of the financial market with Inveslo's expert market analyst. This introductory video teaches the definition, different types, and classification of financial trading. Get to know the fundamentals of financial markets, what makes people trade, and how different assets are categorized in the financial market. See what you can expect from a financial market overview as well as in-depth examples of derivatives, stocks, commodities, bonds, forex, and crypto-assets market.

Follow us on our other channels:

Instagram –https://www.instagram.com/inveslo_off...

Facebook – https://www.facebook.com/official.inv...

Twitter –https://twitter.com/InvesloOfficial

LinkedIn - https://www.linkedin.com/company/offi...

To get the best trading experience, register at https://www.inveslo.com/register

0 notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

143 notes

·

View notes

Text

The average Mario Kart character owns 35 shitty businesses

#mario kart#mario#super mario#super mario bros#nintendo#Donkey Kong's Bargin Ballcream#Toad Funeral Services#Rosalina and Bitches Lumber Company#Pink Gold Peach Paracetomol with Ibuprofen#Tanooki Mario Investments#Funky Private Investigations#Fawful's Meet and Fuck#Self Help Seminars with Punio#MicroParaGoomba and Chargin Chuck Barristers at law#Wario's fucking shop#LORD BOWSER'S PIPE CLEANER SUBSCRIPTION BOX#LUIGI'S CRYPTO MINE#THE OLD PSYCHIC LADY WITH THE EVIL EYE WHO READS FORTUNES AND KNOWS EVERYTHING BEFORE IT HAPPENS FOUNDATION: Financially supporting the-#families of chronically sick children since 1998#Dooplis: LIVE AND CANCELLED#THE I AM A TEACHER MARIO SWEATER ACADEMY OF TRADES AND CRAFTS#SHYGUY'S SLURPED UP MILKSHAKE FUCKIN STAND#STARLOW LIVE IN CONCERT#ANTASMA A FRAGRANCE BY ANTASMA#THE BELDAM REPORT#CONFESSIONS OF THE ORIGAMI CRAFTSMAN#7 KIDS IN THE KOOP ON TOADFLIX NOW#DIDDY KONG MEMORIAL PARK#THE SUPER BOWL: AXEM RANGERS V KOOPA BROS#CANDY KONG LIVE AT THE APOLLO

72 notes

·

View notes

Text

Craig Harrington at MMFA:

The economic policy provisions outlined by Project 2025 — the extreme right-wing agenda for the next Republican administration — are overwhelmingly catered toward benefiting wealthier Americans and corporate interests at the expense of average workers and taxpayers. Project 2025 prioritizes redoubling Republican efforts to expand “trickle-down” tax cuts for the wealthy and deregulation across the economy. The authors of the effort’s policy book, Mandate for Leadership: A Conservative Promise, recommend putting key government agencies responsible for oversight of large sectors of the economy under direct right-wing political control and empowering those agencies to prioritize right-wing agendas in dealing with everything from consumer protections to organized labor activity. [...]

Project 2025 would chill labor unions' abilities to engage in political activity. Project 2025 suggests that the National Labor Relations Board change its enforcement priorities regarding what it describes as unions using “members' resources on left-wing culture-war issues.” The authors encourage allowing employees to accuse union leadership of violating their “duty of fair representation” by having “political conflicts of interest” if the union engages in political activity that the employee disagrees with. [Project 2025, Mandate for Leadership, 2023; National Labor Relations Board, accessed 7/8/24]

Project 2025 would make it easier for employers to classify workers as “independent contractors.” The authors recommended reinstating policies governing the classification of independent contractors that the NLRB implemented during the Trump administration. Those Trump-era NLRB regulations were amended in 2023, expanding workplace and labor organizing protections to previously exempt American workers. [Project 2025, Mandate for Leadership, 2023; The National Law Review, 6/19/23; National Labor Relations Board, 6/13/23]

Project 2025 would reduce base overtime pay for workers. The authors recommend changing overtime protections to remove nonwage compensatory and other workplace benefits from calculations of their “regular” pay rate, which forms the basis for overtime formulations. If that change is enacted, every worker currently given overtime protections could be subject to a slight reduction in the value of their overtime pay, which the authors claim will encourage employers to provide nonwage benefits but would effectively just amount to a pay cut. The authors also propose other changes to the way overtime is calculated and enforced, which could result in reduced compensation for workers. Overtime protections have long been a focus of right-wing media campaigns to reduce protections afforded to American workers. [Project 2025, Mandate for Leadership, 2023, Media Matters, 7/9/24]

Project 2025 proposes capping and phasing out visa programs for migrant workers. Project 2025’s authors propose capping and eventually eliminating the H-2A and H-2B temporary work visa programs, which are available for seasonal agricultural and nonagricultural workers, respectively. Even the Project 2025 authors admit that these proposals could threaten many businesses that rely on migrant workers and could result in higher prices for consumers. [Project 2025, Mandate for Leadership, 2023]

Project 2025 recommends institutionalizing the “Judeo-Christian tradition” of the Sabbath. Under the guise of creating a “communal day of rest,” Project 2025 includes a policy proposal amending the Fair Labor Standards Act to require paying workers who currently receive overtime protections “time and a half for hours worked on the Sabbath,” which it said “would default to Sunday.” Ostensibly a policy that increases wages, the proposal is specifically meant to disincentivize employers from providing services on Sundays as an explicitly religious overture. [Project 2025, Mandate for Leadership, 2023]

[...]

International Trade

Project 2025 contains a lengthy debate between diametrically opposed perspectives on international trade and commerce.Over the course of 31 pages, disgraced former Trump adviser and current federal inmate Peter Navarro outlines various proposals to fundamentally transform American international commercial and domestic industrial policy in opposition to China, primarily by using tariffs. He dedicates well over a dozen pages to obsessing over America’s trade deficit with China, even though Trump’s trade war with China was a failure and as he focused on China, the overall U.S. trade deficit exploded. Much of the rest of Navarro’s section is economic saber-rattling against “Communist China’s economic aggression and quest for world domination.”In response, Kent Lassman of the conservative Competitive Enterprise Institute promotes a return to free trade orthodoxy that was previously pursued by the Republican Party but has fallen out of favor during the Trump era.

The Heritage Foundation’s Project 2025 agenda would be a boon for the wealthy and a disaster for the working class folk.

See Also:

MMFA: Project 2025’s dystopian approach to taxes

#Economy#Project 2025#The Heritage Foundation#Donald Trump#Income Inequality#Mandate For Leadership#Federal Reserve#IRS#Student Loan Debt#Unions#Labor#Overtime Pay#Independent Contractors#H2A Visa#H2B Visa#Sabbath#Workplace Safety#Gender Pay Gap#Trade#Consumer Financial Protection Bureau

63 notes

·

View notes

Text

i also realise there's people who are gonna be like "you expect me to believe that tony tinystepsforward is 29, disabled, a sex worker of nearly a decade, worked at automattic for six years, and someone who does as much organising with local trans and prison abolitionist and sex worker spaces as they seem to imply" and frankly you can believe i'm lying if you want, that's your right, just block me or w/e you don't have to be here. but yes i do in fact both work to eat and work for a better world. i just happen to be the kind of person who really struggles with inertia and is always doing a million things. kiasu, as my singaporean friends still call me, though i don't think i fit the classic archetype there at all — it's not a fomo thing as much as a having poor judgement about the feasibility of the ways i want to be generous with my time and energy and skills. i'm working on it. i would like to learn how to rest.

#i first traded sex for material goods at fifteen so if i wanted to count those years i'd have been doing it way longer than that#but like. i moved in foss spaces enough that i got doxxed at sixteen. the local nazis know who i am.#terfs made fun of me publicly for needing financial support when i was unable to swork bc i had a genital precancer that needed surgery#i've been accused of planning murder in irl queer spaces by racists#you genuinely cannot kill me in a way that matters#and in that sense i am very grateful to be surrounded by as many tough and gracious and dedicated organisers as i am#resilience is not built in a vacuum it is cultivated through concerted effort that takes root in community#tony muses

21 notes

·

View notes

Text

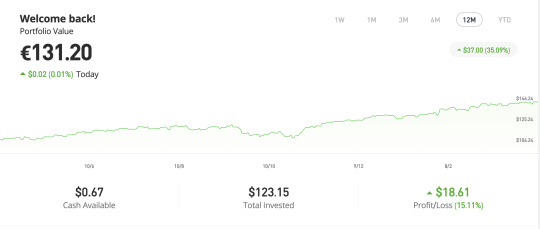

the beginner's guide to making money by investing in stocks (hot girl version)

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

51 notes

·

View notes

Text

This season, on Hermitcraft: ZombieCleo commits every financial crime she can think of

#first what was essentially tax evasion and now money laundering#insider trading seems the next logical step but financial terrorism would make a lot of sense for cleo#zombiecleo#hc9#I FORGOT TO LIST RACKETEERING#what with the running of an illegal shop through the mail lmao

21 notes

·

View notes

Text

You know what I find funny? That people across the world expect Palestinian people to just sit there and be bombed like good little victims and never retaliate against Israel because ‘thAt mAKes YOu JuST aS bAD as THem’ while not truly believing that Israel is actually doing anything bad because it’s so much better to be tragic pure victims with no ‘shameful and violent’ incidents behind them because that makes western media less likely to paint you as a tragic hero decades after Palestine is finely free and everyone can agree without being accused os anti semitism (despite the fact that Zionism =/= Judaism) that what Israel is doing is very bad actually. Which is genuinely hilarious because most of the people who are supporting Israel and condemning Palestinian for violent revolution are countries and states that gained freedom through violent revolution themselves.

Like, the USA, France, India, all of them had violent revolution to be where they are at today. And I know most of the anti-Palestinian movement is motivated by Islamophobia (not surprising considering the mentioned countries have some of the highest number of Islamophobic citizens) which also completely ignores the high Jewish and Christian Palestinians population might I add, but the genuine mental disassociation required to believe that violent revolution is not most often the only resolution left at the hands of the oppressed, especially after using violent revolution yourself to gain your freedom is not just hypocrisy but just downright evil.

Anyway, if you want to help Palestinians out and not be a genocide supporter, then please donate to relief funds and gofundmes so that the Palestinian people may one day again thrive in their ancestral land. Since I am not personally supporting any family from Palestine, I’m just going to link @/el-shab-hussein and @/nabulsi vetted gaza fundraiser spreadsheet, please donate if you can and share if you cant.

#palestine#gaza#fundraisers#islamophobia#anti zionism#anti imperialism#and#anti capitalism#<- look me in the eye and tell me imperialism and capitalism don't play a part in the unrelenting support that israel has gained#not when the israeli people have literally said that they plan to raze gazan ground and build fucking luxury hotels over them for profit#which would then obviosly influence many of these states that support israel financially with import-export trade agreements#etc etc

7 notes

·

View notes

Text

Navigating Market Trends with the Vortex Indicator: A Comprehensive Guide

In the dynamic world of trading and technical analysis, the Vortex Indicator (VI) stands out as a powerful tool designed to identify the start of new trends and spot continuations within the financial markets. Developed by Etienne Botes and Douglas Siepman, the indicator draws inspiration from the natural flow and vortices in water. This unique approach to understanding market movements provides…

View On WordPress

#Advanced Trading Strategies Using Vortex Indicator#Enhancing Technical Analysis with Vortex Indicator#Financial Markets#Financial Trading#How to Use Vortex Indicator in Trading#Identifying Market Trends with Vortex Indicator#Integrating Vortex Indicator with Moving Averages#Investment Analysis#Market Trends#Overcoming Limitations of the Vortex Indicator#Risk Management Strategies for Vortex Indicator Trading#technical analysis#Technical Indicators#Trading Strategies#trading tools#Trend Identification#Understanding Vortex Indicator Signals#Vortex Indicator#Vortex Indicator Calculation and Interpretation#Vortex Indicator for Trend Confirmation

0 notes

Photo

P9B

#ny#manhattan#new york#subway#black and white#world trade center#financial district#nyc#world trade center station#november#my work#photography

11 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

11 notes

·

View notes

Text

One World Trade Center - Lower Manhattan, New York City by Andreas Komodromos

#one world trade center#skyline#skyscrapers#street#financial district#manhattan#city#nyc#cityscape#new york#urban#travel#new york city#nyandreas#architecture#tumblr pics#nyc street photography#nyc photography

10 notes

·

View notes

Text

#forex robot#forex#forextrading#forex market#investing#finance#algo trading#forex expert advisor#invest#financial

11 notes

·

View notes

Text

hiiii i'm dagger!

🆒 30, asian, gmt-6 🆓 she/her/prince 🆕 ♈♌♊ 🔢 literally an accountant! art is my hobby for when i am sick of jobby which is. always 👍🏼

thanks 4 stopping by + feel free 2 reach out!

#beautiful local woman crosses ''make a pinned post'' off her list after only 365 days 🏆#babble#hi i work in financial reporting for a publicly-traded company so if u can't find me i'm prob [ checks notes ] at work#i do have discord but have been spurning it for a year and should rly go back soon....... dm for main blog ig...........#that's all mwah!!!!!!

7 notes

·

View notes

Text

Week 47 - Landscape

Living across the river from one of the greatest cities in the world does have some advantages. I will never tire of this view.

#photo of the day#capture52#capture52week47#landscape#cityscape#nikon photography#nikon d5600#tamron#Hudson River#nyc skyline#fog#financial district#freedom tower#one world trade#nj has some great views#fall 2023

25 notes

·

View notes

Note

Hi it's been so fun seeing your Driptober art! Sorry to read you're getting burnt out, it's truly incredible how much cat you've already drawn this month. I hope the last few prompts go well!

hi thank u i appreciate that!! since my last attempt at a challenge in 2020 failed this was rly just to prove to myself that i've gotten out of the slump that i was in. i am in a better place in life :)

#recovery is real! it gets better! even if you have shitty parents or are in a shitty financial situation#go to trade school btw. fuck academia and fuck art school#ask

25 notes

·

View notes