#Digital Document Provider in India

Explore tagged Tumblr posts

Text

Digital Document Provider in India

Sinch Docxcomm is a leading digital document provider in India, offering advanced solutions for document creation, management, and automation. Our platform delivers high-quality, customizable digital documents with features like real-time updates and seamless integration. Trusted for its efficiency and precision, Sinch Docxcomm enhances your document workflows, ensuring reliable and professional results across various needs.

0 notes

Text

IETM for Beginners A Quick Guide to IETM Code and Pixels

IETM: Interactive Electronic Technical Manual

Training Aids to Defence Client

If you are a supplier of defence then along with the system/equipment you also need to provide Training Aids

(CBT) — Computer-Based Training

Charts and Bloups

Video Film

Training Work Modules

Manuals Hard Copies

IETM

Evolution of Documentation in Defence

Before — Hardcopies and PDFs in DVDs (Upto 2015)

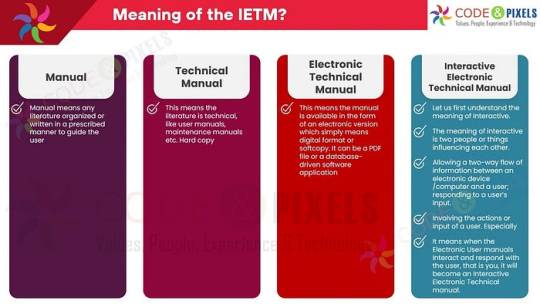

What is the meaning of the IETM?

Manual: Manual means any literature organized or written in a prescribed manner to guide the user.

TechnicalManual: This means the literature is technical, like user manuals, maintenance manuals etc. Hard copy

Electronic Technical Manual: This means the manual is available in the form of an electronic version which simply means digital format or softcopy. It can be a PDF file or a database-driven software application.

Interactive Electronic Technical Manual:

Let us first understand the meaning of Interactive. The meaning of interactive is two people or things influencing each other.

Allowing a two-way flow of information between an electronic device /computer and a user; responding to a user’s input.

Involving the actions or input of a user. Especially

It means when the Electronic User manuals Interact and respond with the user, that is you, it will become an Interactive Electronic Technical manual.

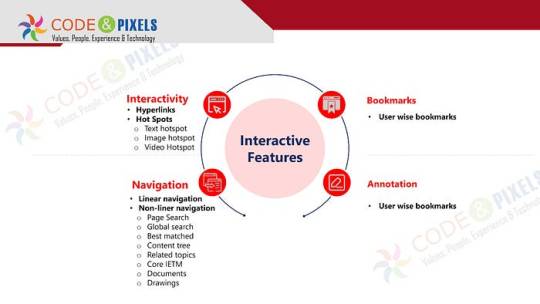

Interactive Features

Interactivity

Hyperlinks

Hot Spots

Text hotspot

Image hotspot

VideHotspot

Bookmarks

User wise bookmarks

Navigation

Linear navigation

Non-liner navigation

Page Search

Global search

Best matched

Content tree

Related topics

Core IETM

Documents

Drawings

Annotation

User wise bookmarks

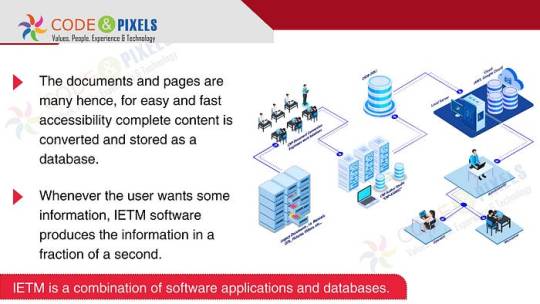

The documents and pages are many hence, for easy and fast accessibility complete content is converted and stored as a database.

Whenever the user wants some information, IETM software produces the information in a fraction of a second.

Use or Purpose of the IETM?

The purpose of the Manual is to give information related to the equipment to the end user for quick reference.

All the technicality is written in detail so that when an issue arises, the user can refer to the manual, as every time OEM or technical person or subject matter expert might not be available on the spot to resolve the issue.

If the manual has 10 pages users can refer easily.

But any system used by the defence will have multiple manuals and thousands of page counts and many times a user has to cross-refer between manuals, intra-manual and inter-manual to resolve the issue.

Referring to 10- 15 hard-copy or even soft-copy books simultaneously will be difficult and time-consuming.

How to access the IETM ?

IETM is a web-based application like our bank software or any other web application. The graphic user interface will be provided to use IETM through which users can interact and get the desired data.

Like all other standard software, Unauthorized users cannot access the IETM. IETM is a Login - login-based application. Only users having valid Login credentials can access the software.

Based on the user log credentials data will be provided to the user.

IETM has 2 types of Users and one Administrator

Maintainer

Operator

If the operator logs in, the user gets all the content related to operator use, similarly if the maintainer logs in only maintenance-related content is visible for that user.

Ideally, all the content is available for both users, because the purpose of the IETM is to refer to the manual to fix the issue.

Administrators can create users who can see the user’s navigation and log-in history and interact with the users using user dashboards through Annotations.

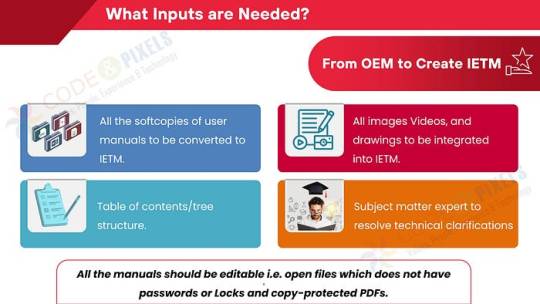

What Inputs are Needed? (From OEM to Create IETM)

All the softcopies of user manuals to be converted to IETM.

All images Videos, and drawings to be integrated into IETM.

Subject matter expert to resolve technical clarifications

Table of contents/tree structure.

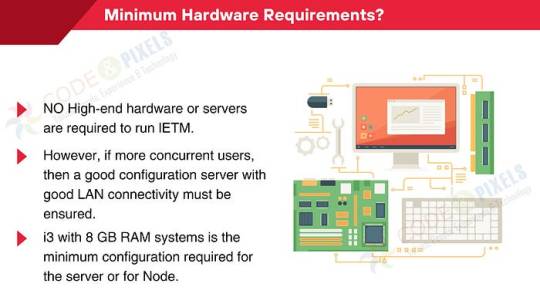

Minimum Hardware Requirements?

NO High-end hardware or servers are required to run IETM.

However, if more concurrent users, then a good configuration server with good LAN connectivity must be ensured.

i3 with 8 GB RAM systems is the minimum configuration required for the server or for Node.

Deliverables

BASED DB (Manuals are covered in the Database)

IETM VIEWER Software

User Manual and Installation Manual

Standards — compliance

Costing of IETM: (Interactive Electronic Technical Manual)

Level of IETM, is it Level 3 or Level 4

Cost will be based on the number of pages that are to be converted

The vendor calculates the cost per page. And a fixed cost of IETM viewer software

If you want to create IETM by yourself self then you also need to buy IETM authoring software.

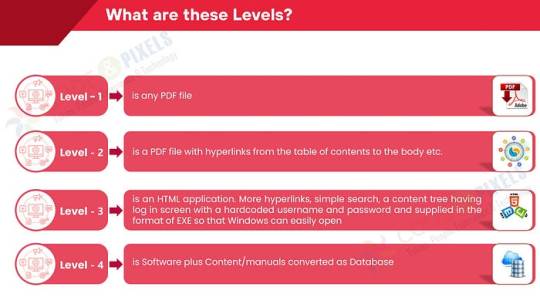

What are these Levels?

Level — 1 is any PDF file

Level — 2 is a PDF file with hyperlinks from the table of contents to the body etc.

Level — 3 is an HTML application. More hyperlinks, simple search, a content tree having log a screen with a hardcoded username and password and supplied in the format of EXE so that Windows can easily open

Level — 4 is Software plus Content/manuals converted as Database

Regarding Level — 5, rest assured, till 2028 it will be Level — 4 only. As of now, there is nothing practically called Level — 5. Few are calling virtual reality and Augmented reality and Artificial intelligence Level — 5.

Pulling data from many user inputs and analyzing and giving results are done in Level — 5. IETM software cannot pull the data from various real-time points as No OEM will give the real-time information to third-party software directly. Yes, if the information is available offline, then that information can be imported into IETM and can be used as a reference.

#ietm#software#technology#ietm developement#ietm code and pixels ietm hyderabad#ietm software#elearning#code and pixels#ietm level iv#codeandpixels#ietm level 4 software requirements#technical documentation#ietm document#ietm documentation#interactive electronic technical manual#Ietm Service Providers#Ietm Software Designers of India#Software Development Company#Elearning Solutions Company#E Learning Content Development Company#Online Education#Digital Education#Digital Content#Software Development Solutions#Elearning#Ietm Developers#Econtent Development#Elearning Solutions Providers#Econtent Developers#Econtent

2 notes

·

View notes

Text

It was a tip that brought a dog to the main post office in downtown Jackson, Mississippi. An employee there had reported seeing someone in the lobby putting pills into hot pink envelopes.

Hours later, Ed Steed, a police officer from the small city of Richland, just south of Jackson, walked into a back room at the post office where one of the envelopes had been set aside. Steed, a K-9 handler, arrived with Rip, his narcotics sniffer dog. Rip strode around and, when he got to the pink envelope, sat down. According to records obtained through a Freedom of Information Act request, Steed said this meant the dog had smelled narcotics. That claim became evidence to get a warrant to open the envelope.

This, though, was no ordinary drug bust. As it turned out, there were pills inside the package, but they were not the kind that Rip or other police K-9s are trained to detect. The envelope contained five pills labeled “AntiPreg Kit.” They were made in India, and their medical purpose is to induce abortion. Dwayne Martin, at the time the head of the U.S. Postal Inspection Service in Jackson, told me this was exactly what the initial tipster had suspected.

...

What will happen to abortion-pills-by-mail and the people who use them if Donald Trump is elected in November? As the accounts of the regional USPIS head and FOIA documents show, a piecemeal crackdown is already underway during a Democratic administration. Under a Trump regime, things might go much further.

Whoever is in power, the incident in Jackson provides a potential window into the future — one in which freelancing local Postal Service employees and officials can call on local cops to halt women from accessing reproductive care and potentially charge and arrest those providing or using abortion medication.

My FOIA request asked for records from past years of investigations of people who’d used the mail to send pills. The documents I got back show how a willing administration might go after distributors. The feds could even lend support to police in states that have criminalized abortion care as they pursue cases under local laws. Pregnant people who order the medications could get caught in the dragnet.

The documents I received after my FOIA request were highly redacted but still reveal many details about a federal investigation that began less than two years ago in Mississippi. Dozens of envelopes with abortion pills were seized. The bust followed on the heels of the Supreme Court overturning Roe v. Wade, and came after a group of anti-abortion doctors filed a federal lawsuit in Texas, arguing that abortion pills should be banned from the mail.

The Jackson investigation apparently also employed what’s called a mail cover: a little-known Postal Service method for collecting data about people suspected of committing crimes. Using an enormous database of images of the outside of envelopes and packages, postal inspectors can digitally compare names, addresses, and other information on one item to others. And the findings can be freely shared with almost any law enforcement agency that requests them. The return address for the hot pink envelope in Jackson included an unused post office box number, the sort of information postal inspectors can use to correlate parcels to each other.

Reproductive justice activist Laurie Bertram Roberts worries about an anti-abortion regime taking power. They direct the Jackson-based Mississippi Reproductive Freedom Fund, which assists fellow Mississippians with any reproductive decision they make, from having a baby, to leaving the state to go to an abortion clinic, to using pills at home.

In a state where abortion is strictly banned post-Roe, Bertram Roberts is also a doula. Along with other doulas, they have organized help for people at the end of their pregnancies, including those which do not come to term. Whether that end is due miscarriage or to abortion is immaterial. “We don’t ask,” they said.

The pink-envelope investigation came out of a sort of collaboration between the feds’ regional offices and a local official: U.S postal workers and a city K-9 cop. Though no one in Mississippi has yet been arrested for helping carry out an abortion, Bertram Roberts fears that synergy. They leaned forward and tensed their lips as I opened my computer and pulled up images I’d obtained from the FOIA request: photos the USPIS had taken, in a post office parking lot, of vehicles suspected of belonging to the person who mailed the pills.

Bertram Roberts peered anxiously at the screen. “I don’t recognize them!” they said. Their face relaxed, but they shook their head. “The thing I worry about most is people getting criminalized.

...

Using local dogs creates risk for abortion-seekers. With the post office inviting local law enforcement to assist with federal investigations, local police could theoretically do their own investigations, by copying names and addresses from the mail. And they could pass that information to anti-abortion district attorneys.

Police dogs, however, are trained to smell only the illegal drugs heroin, marijuana, ecstasy, fentanyl, and cocaine, not the ingredients in abortion pills, which currently remain legal. And the K-9s’ forensic reliability is suspect.

Why would a police dog alert on abortion pills in the first place, when they’re not narcotics?

Martel, the USPIS national spokesperson, speculated that the pills found in Jackson were contaminated in the manufacturing process by trace amounts of a drug such as marijuana, or perhaps someone was handling narcotics when they did the packing and left molecules behind that only canines’ super-sensitive noses can detect.

Theories along these lines are widespread among police, and they’re inherently impossible to disprove. Elisa Wells, a co-founder and co-director of Plan C, is skeptical. She said her group has conducted laboratory analyses of various brands of foreign-made abortion pills. They’ve all been pure, she said, and no one has ever complained about their containing narcotics.

There is another reason why a K-9 can zero in on a package that’s devoid of illicit drugs. Animal researchers call it “cueing.” Canines are exquisitely sensitive to the minutiae of a human’s posture, eye movements, and other subtle behaviors. Handlers wishing to develop probable cause to do intrusive searches for narcotics can coax their dogs into drug-alerting behavior. To get a reward, the dog will alert, even if nothing illegal is present. (Steed, the K-9 handler, declined to be interviewed for this story.)

Cueing can be deliberate, but it’s more often unconscious. In 2011, Lisa Lit, a researcher at the University of California, Davis, published a now-famous study in which she told the handlers of several police dogs that their K-9s would be searching for “target scents” hidden randomly in several containers. She put red tape on some containers and said it marked the targets. In reality, none of the containers had scents. Even so, most of the dogs alerted on containers, especially those with red tape.

49 notes

·

View notes

Text

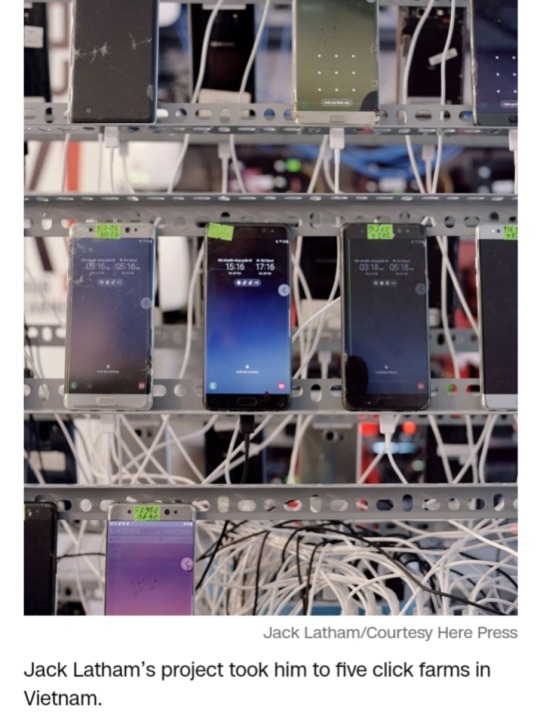

(CNN) — Jack Latham was on a mission to photograph farms in Vietnam — not the country’s sprawling plantations or rice terraces but its “click farms.”

Last year, the British photographer spent a month in the capital Hanoi documenting some of the shadowy enterprises that help clients artificially boost online traffic and social media engagement in the hope of manipulating algorithms and user perceptions.

The resulting images, which feature in his new book “Beggar’s Honey,” provide rare insight into the workshops that hire low-paid workers to cultivate likes, comments and shares for businesses and individuals globally.

“When most people are on social media, they want nothing but attention — they’re begging for it,” Latham said in a phone interview, explaining his book’s title.

“With social media, our attention is a product for advertisers and marketers.”

In the 2000s, the growing popularity of social media sites — including Facebook and Twitter, now called X — created a new market for well-curated digital profiles, with companies and brands vying to maximize visibility and influence.

Though it is unclear when click farms began proliferating, tech experts warned about “virtual gang masters” operating them from low-income countries as early as 2007.

In the following decades, click farms exploded in number — particularly in Asia, where they can be found across India, Bangladesh, Indonesia, the Philippines, and beyond.

Regulations have often failed to keep pace: While some countries, like China, have attempted to crack down on operations (the China Advertising Association banned the use of click farms for commercial gain in 2020), they continue to flourish around the continent, especially in places where low labor and electricity costs make it affordable to power hundreds of devices simultaneously.

‘Like Silicon Valley startups’

Latham’s project took him to five click farms in Vietnam.

(The click farmers he hoped to photograph in Hong Kong “got cold feet,” he said, and pandemic-related travel restrictions dashed his plans to document the practice in mainland China).

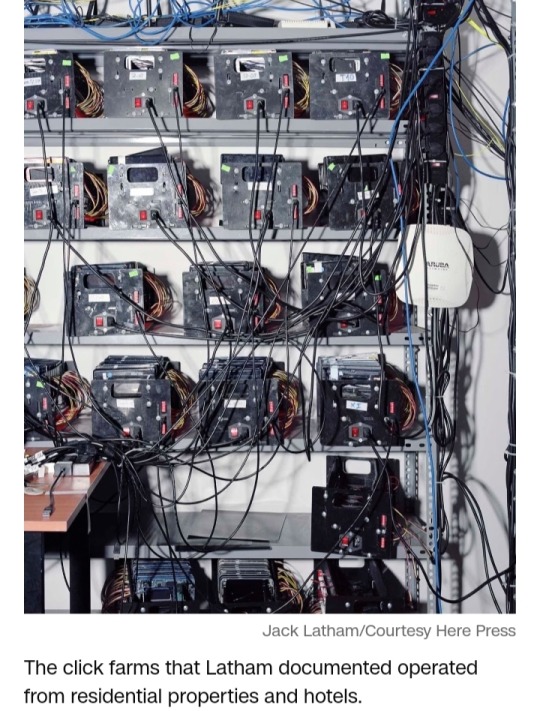

On the outskirts of Hanoi, Latham visited workshops operating from residential properties and hotels.

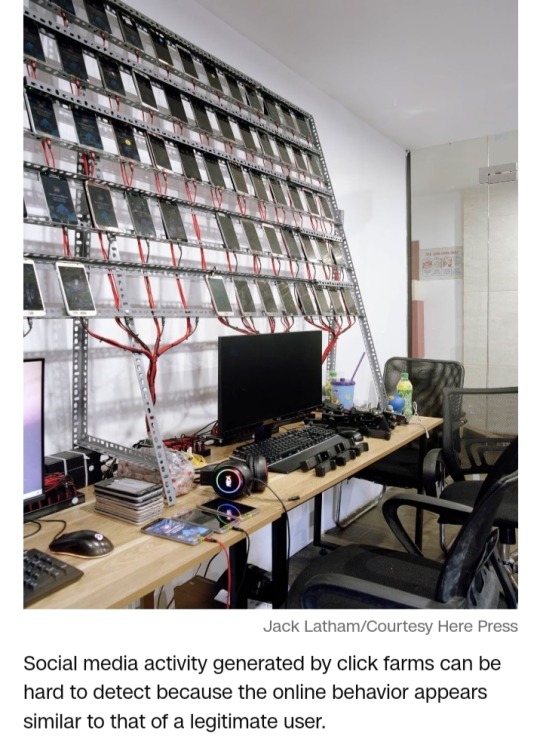

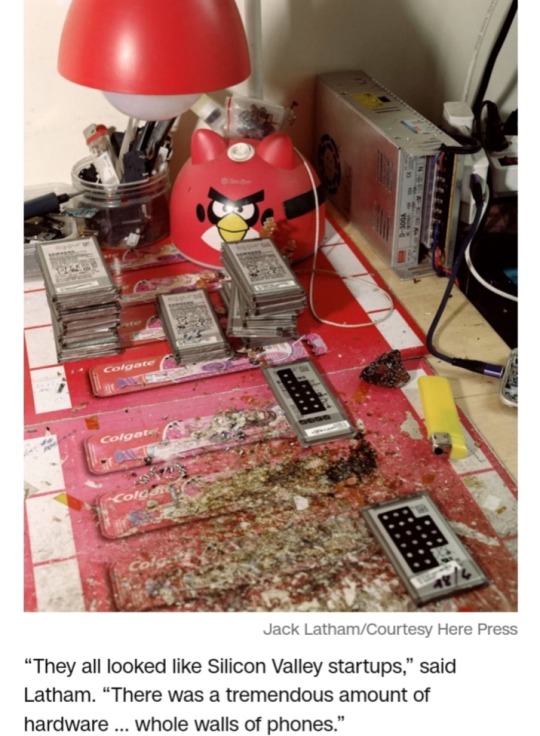

Some had a traditional setup with hundreds of manually operated phones, while others used a newer, compact method called “box farming” — a phrase used by the click farmers Latham visited — where several phones, without screens and batteries, are wired together and linked to a computer interface.

Latham said one of the click farms he visited was a family-run business, though the others appeared more like a tech companies.

Most workers were in their 20s and 30s, he added.

“They all looked like Silicon Valley startups,” he said. “There was a tremendous amount of hardware … whole walls of phones.”

Some of Latham’s photos depict — albeit anonymously — workers tasked with harvesting clicks.

In one image, a man is seen stationed amid a sea of gadgets in what appears to be a lonely and monotonous task.

“It only takes one person to control large amounts of phones,” Latham said. “One person can very quickly (do the work of) 10,000. It’s both solitary and crowded.”

At the farms Lathan visited, individuals were usually in charge of a particular social media platforms.

For instance, one “farmer” would be responsible for mass posting and commenting on Facebook accounts, or setting up YouTube platforms where they post and watch videos on loop.

The photographer added that TikTok is now the most popular platform at the click farms he visited.

The click farmers Latham spoke to mostly advertised their services online for less than one cent per click, view or interaction.

And despite the fraudulent nature of their tasks, they seemed to treat it like just another job, the photographer said.

‘There was an understanding they were just providing a service,” he added. “There wasn’t a shadiness. What they’re offering is shortcuts.”

Deceptive perception

Across its 134 pages, “Beggar’s Honey” includes a collection of abstract photographs — some seductive, others contemplative — depicting videos that appeared on Latham’s TikTok feed.

He included them in the book to represent the kind of content he saw being boosted by click farms.

But many of his photos focus on the hardware used to manipulate social media —webs of wires, phones and computers.

“A lot of my work is about conspiracies,” Latham said. ” Trying to ‘document the machines used to spread disinformation’ is the tagline of the project. The bigger picture is often the thing we don’t see.”

Click farms around the world are also used to amplify political messages and spread disinformation during elections.

In 2016, Cambodia’s then-prime minister Hun Sen was accused of buying Facebook friends and likes, which according to the BBC he denied, while shadowy operations in North Macedonia were found to have spread pro-Donald Trump posts and articles during that year’s US presidential election.

While researching, Latham said he found that algorithms — a topic of his previous book, “Latent Bloom” — often recommended videos that he said got increasingly ��extreme” with each click.

“If you only digest a diet of that, it’s a matter of time you become diabetically conspiratorial,” he said.

“The spreading of disinformation is the worst thing. It happens in your pocket, not newspapers, and it’s terrifying that it’s tailored to your kind of neurosis.”

Hoping to raise awareness of the phenomenon and its dangers, Latham is planning to exhibit his own home version of a click farm — a small box with several phones attached to a computer interface — at the 2024 Images Vevey Festival in Switzerland.

He bought the gadget in Vietnam for the equivalent of about $1,000 and has occasionally experimented with it on his social media accounts.

On Instagram, Latham’s photos usually attract anywhere from a few dozen to couple hundred likes.

But when he deployed his personal click farm to announce his latest book, the post generated more than 6,600 likes.

The photographer wants people to realize that there’s more to what they see on social media — and that metrics aren’t a measurement of authenticity.

“When people are better equipped with knowledge of how things work, they can make more informed decisions,” he said.

“Beggar’s Honey,” co-published by Here Press and Images Vevey, is available now.

#Jack Latham#click farms#box farms#Hanoi#Vietnam#Beggar’s Honey#box farming#social media#algorithms#user perception#trolls#PR#marketing#advertising#likes#comments#shares#digital profiles#virtual gang masters#bots#spam#China Advertising Association#click farmers#mass post#disinformation#misinformation#fake news#metrics

13 notes

·

View notes

Text

Foreign Company Registration India: A Comprehensive Guide by Masllp

India is becoming an attractive destination for foreign companies looking to expand their operations. With its growing economy, large consumer base, and a business-friendly environment, many international businesses are setting up in India. However, understanding the legal and regulatory framework for Foreign Company Registration India can be complex. This is where Masllp comes in, offering seamless services to help foreign businesses register and establish themselves in India.

Why Choose India for Foreign Company Registration? India offers several benefits to foreign companies:

Growing Market: India is one of the fastest-growing economies in the world, with a massive consumer base. Favorable Government Policies: The Indian government has introduced several initiatives like Make in India and eased foreign direct investment (FDI) regulations. Skilled Workforce: India boasts a large, skilled, and affordable labor force, making it ideal for companies in IT, manufacturing, and services. Steps for Foreign Company Registration India Here’s a step-by-step guide to registering a foreign company in India with Masllp's expert assistance:

Choose the Type of Business Structure Foreign companies can register as:

Wholly Owned Subsidiary (WOS) Joint Venture Liaison Office Branch Office Project Office Choosing the right business structure depends on the nature of your business and long-term goals.

Obtain Digital Signature Certificate (DSC) A DSC is mandatory for filing online forms. Masllp assists you in obtaining the DSC, ensuring the process is hassle-free.

Director Identification Number (DIN) At least one director must have a DIN. If foreign nationals are involved, Masllp helps them acquire the necessary documentation and identification.

Name Approval Your company’s name must be approved by the Registrar of Companies (ROC). Masllp ensures that your desired name complies with the regulations and is unique to avoid rejection.

Filing the Incorporation Documents The incorporation process includes filing the Memorandum of Association (MoA) and Articles of Association (AoA) with the ROC. Masllp provides expert guidance in drafting and filing these documents.

PAN and TAN Application Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) are required for tax purposes. Masllp ensures timely application and delivery of these essential tax identification numbers.

Opening a Bank Account Once all approvals are obtained, a corporate bank account must be opened. Masllp assists you in selecting and opening a business bank account with the required documentation.

GST Registration Foreign companies must register for the Goods and Services Tax (GST) if their annual turnover exceeds the threshold. Masllp helps you with GST registration to ensure smooth compliance.

Why Choose Masllp for Foreign Company Registration India? Expert Legal Assistance: Masllp’s team of legal experts ensures compliance with Indian regulations and smooth registration processes. End-to-End Services: From choosing the right business structure to post-registration compliance, Masllp provides end-to-end services. Time-Saving and Hassle-Free Process: With Masllp’s assistance, you can focus on business operations while we handle the registration process for you. Customized Solutions: Masllp understands that every business is unique, so we offer tailored solutions to meet your specific needs. Post-Registration Compliance Once registered, foreign companies need to comply with various regulations, including:

Filing Annual Returns Maintaining Statutory Records Tax Filings Masllp offers comprehensive post-registration services to ensure your business stays compliant with Indian laws.

Conclusion Setting up a foreign company in India involves multiple steps and legal formalities. With Masllp, you can simplify the registration process and ensure full compliance with Indian regulations. Whether you are a startup or a large multinational, Masllp provides customized solutions to help you establish your business in India successfully. Contact Masllp today to learn more about how we can assist with foreign company registration in India.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

5 notes

·

View notes

Text

Your Complete Guide: How to Apply for the ACCA Course in India

The Association of Chartered Certified Accountants (ACCA) is one of the most sought-after global certifications for aspiring finance and accounting professionals. It is internationally recognized, making it a top choice for students looking to build a successful career in finance, accounting, and auditing. If you're in India and are interested in pursuing the ACCA course, here’s a step-by-step guide on how to apply.

Step 1: Check Eligibility Criteria

Before applying, ensure that you meet the eligibility requirements for the ACCA course. Typically, candidates who have completed their 10+2 with a minimum of 65% in Mathematics/Accounts and English and 50% in other subjects are eligible. Graduates in commerce or related fields may also be eligible for exemptions from some exams, depending on the university they attended.

Step 2: Register for ACCA

To apply for the ACCA course in India, you first need to register on the official ACCA Global website. The registration process is straightforward:

Visit the ACCA official website.

Navigate to the ‘Apply Now’ section and fill out the registration form.

You will need to provide personal details, educational qualifications, and other relevant information.

Once the form is submitted, you will receive a confirmation email with details of your ACCA student account.

Step 3: Submit Required Documents

To complete your registration, you will need to upload scanned copies of the following documents:

Proof of Identity: Passport, Aadhaar card, or any other government-approved ID.

Educational Certificates: Marksheets and certificates from your 10+2 and graduation (if applicable).

Passport-sized Photograph: A recent digital photo.

Make sure all documents are clear and meet the specifications mentioned on the ACCA website.

Step 4: Pay the Registration Fee

After submitting your documents, the next step is to pay the ACCA registration fee. The fee can be paid online through a secure payment gateway on the ACCA website using a credit/debit card or other accepted payment methods. Once payment is made, you will receive an official confirmation of your enrollment in the ACCA program.

Step 5: Start Your ACCA Journey

After completing your registration and fee payment, you can access your ACCA account, where you’ll find details about the exam schedule, study resources, and more. You can then plan your study schedule and register for the ACCA exams.

NorthStar Academy: The Best Option for ACCA Coaching

Choosing the right coaching institute is crucial to your success in the ACCA course. NorthStar Academy is the best option for ACCA coaching in India, offering comprehensive study materials, expert faculty, and flexible learning schedules. With a proven track record of success, NorthStar Academy ensures that students are well-prepared for their ACCA exams and can confidently pursue their career in global finance.

In conclusion, applying for the ACCA course in India is a simple, step-by-step process. With the guidance and support of NorthStar Academy, you can ensure a smooth application process and be on your way to achieving your ACCA certification.

2 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Can I Sell Online Without GST? GST Requirements for E-commerce

In 2024, the trend of e-commerce has transformed the way people shop and businesses operate online. Whether you're selling groceries, electronic items, or running a full-fledged online store, the question of GST (Goods and Services Tax) often arises. GST is a consumption tax levied on the supply of goods and services in Chennai, Tamilnadu designed to replace various indirect taxes.

What is GST?

GST is a comprehensive indirect tax on online store, sale, and consumption of goods and services throughout India, aimed at simplifying the tax structure on consumers. It is mandatory for businesses whose turnover exceeds specified thresholds to register under GST and comply with its regulations.

You Need GST for Selling Online on Shocals

The requirement for GST registration depends primarily on your turnover and the category of your business. Here are some key points to consider for GST:

Threshold Limits: As of the latest information available, businesses with an aggregate turnover exceeding Rs. 40 lakhs (Rs. 10 lakhs for northeastern states) in a financial year must register for GST. This turnover includes all taxable supplies, exempt supplies, exports of goods and services, and inter-state supplies.

Inter-state Tamilnadu Sales: If you are selling goods or services to customers in different states, you are likely to exceed the turnover threshold sooner. GST registration is mandatory for businesses making inter-state supplies, regardless of turnover.

Mandatory Registration: Even if your turnover is below the threshold, you may choose to voluntarily register for GST. This can be beneficial for claiming input tax credits on purchases and improving your business credibility.

Selling on Shocals Partners

If you are selling through popular Shocals Partners, you need to understand the policies regarding GST compliance. It requires sellers to provide GSTIN (GST Identification Number) during registration and ensure compliance with GST laws.

Steps to Register for GST

If you decide to register for GST, here's a brief overview of the registration process:

Prepare Documents: Keep your PAN (Permanent Account Number), proof of business registration, identity and address proof, bank account details, and business address proof.

Online Registration: Visit the GST portal (www.gst.gov.in) and fill out the registration form with required details. Upload scanned copies of documents as specified.

Verification: After submission, your application will be verified by the GST authorities. Once approved, you will receive your GSTIN and other credentials.

Benefits of GST Registration

While GST compliance involves maintaining proper accounting records and filing periodic returns, it offers several advantages:

Input Tax Credit: You can claim credit for GST paid on your business purchases, thereby reducing your overall tax liability.

Legal Compliance: Avoid penalties and legal repercussions by operating within the GST framework.

Business Expansion: Facilitates smoother inter-state and international sales, enhancing business opportunities.

Conclusion

In conclusion, while small businesses and startups may initially wonder if they can sell online without GST, understanding the thresholds and benefits of GST registration is crucial. Compliance not only ensures legal adherence but also opens avenues for business growth and competitiveness in the digital marketplace. Whether you're a budding entrepreneur or an established seller, staying informed about GST requirements will help you navigate the e-commerce landscape more effectively.

For more details please visit - https://partner.shocals.com/

2 notes

·

View notes

Text

Transforming Healthcare with Digital Solutions: A Closer Look at Electronic Health Records and Online Doctor Consultations!

Electronic Health Records (EHRs)

Electronic Health Records (EHRs) are digital versions of patients' paper charts. They contain comprehensive medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images, and laboratory test results. EHRs enable healthcare providers to have instant access to patient information, facilitating better decision-making and improved patient outcomes.

Benefits of EHRs:

Improved Patient Care: EHRs provide accurate, up-to-date, and complete information about patients at the point of care.

Enhanced Coordination: They enable quick access to patient records for more coordinated, efficient care.

Increased Patient Participation: Patients can access their records and engage more actively in their own care.

Better Diagnostics and Outcomes: EHRs help providers diagnose patients more accurately, reduce medical errors, and provide safer care.

Electronic Medical Documentation

Electronic medical documentation refers to the digital recording of patient interactions, treatments, and medical procedures. This form of documentation enhances the accuracy and accessibility of patient records, ensuring that critical information is always available when needed.

Advantages of Electronic Medical Documentation:

Efficiency: Reduces the time spent on paperwork, allowing healthcare providers to focus more on patient care.

Accuracy: Minimizes errors associated with manual record-keeping.

Accessibility: Facilitates quick access to patient information, improving the quality of care.

Compliance: Helps in maintaining compliance with regulatory requirements by ensuring accurate and complete documentation.

#healthcare#health and wellness#health wealth happiness#healthylifestyle#health products#health & fitness#mental health#healthyliving

2 notes

·

View notes

Text

Public Limited Company Registration in Gurgaon

Enjoy a quick & seamless online Public Limited Company Registration process in Gurgaon. Kickstart your Company in Gurgaon with the expert assistance of RegisterKaro.

Step 1: Connect with our experts.

Step 2: Our experts will guide and prepare all the documents for Incorporation.

Step 3: Get your Company Incorporation Certificate in Gurgaon.

An Overview of Public Limited Company Registration in Gurgaon

In India, Gurgaon is one of the fastest growing cities and it’s an IT hub and it provides advantages to various companies. One of the main benefits of a Company registered in Gurgaon is the availability of a highly-skilled workforce composed mostly of technologically inclined professionals. Cutting edge infrastructure & favorable business laws in Gurgaon form a sustainable economic framework for start-ups. Further, its home to world-class tech companies luring fresh talent across the nation & a well-known startup epicenter. There is a huge scope for new Company Registration in Gurgaon.

At RegisterKaro, our experts help many clients every day for Company Registration in Gurgaon. Our experts will help you in the process of Company Registration in Gurgaon in a very small time frame subject to complete and proper documentation required for Online Company Registration in Gurgaon.

What are the Benefits of Public Limited Company Registration in Gurgaon?

With a strong infrastructure, flourishing IT Sector & a pro-business administration, Gurgaon provides a conducive environment for companies to grow & thrive. Gurgaon offers many benefits that can help your companies to succeed, including:

1. Secured assets;

2. Strong infrastructure;

3. Access to a large customer base;

4. Limited Liability Protection;

5. Easy access to Government Services;

6. Steadier contribution of capital & stability;

7. Business-friendly environment;

8. Exponential growth & expansion opportunities;

9. Access to capital.

Eligibility Criteria for Public Limited Company Registration in Gurgaon

Following is the eligibility criteria for Public Limited Company Registration in Gurgaon:

1. A minimum of 2 Shareholders & 2 Directors are required for Public Limited Company Registration and both the Directors & Shareholders can be the same people;

2. All businesses must have a registered office address from where they will conduct their business;

3. DSC (Digital Signature Certificate) and DIN (Director Identification Number) for all the Directors are also required;

4. The owners of the business will have to draft the required legal documents such as MoA, AoA & Shareholders Agreement;

5. At least one of the Directors must be an Indian Resident i.e., he or she must have stayed in India for at least 182 days in the last year.

For More info Click here :

#public limited company registration#Register Karo#company registration#Public Limited Company registration in Gurugram

2 notes

·

View notes

Text

Welcome to SRI SAI ENTERPRISES

We do Bulk Document & Photo’s Digital Scanning / Bulk Legal Document & Study Materials Digital Color / Black & White Printing with Bulk Hard Binding / Perfect Glue Binding / Spiral Binding.

ABOUT US:

SRI SAI ENTERPRISES is a Bangalore based firm dealing with Digital Bulk Hard Copy to Soft Copy, Digital Bulk Xerox, Digital Bulk Color & B/w Printing, Bulk Perfect Glue Binding / Hard Binding & Spiral Binding, Bulk PVC ID Card’s Printing Services & also we do Bulk Digital Study Materials Printing & Bulk Digital Legal documents printing.

We have emerged into the domain to prove how passionate we are about what we do to provide 100% satisfaction to our customers. We are committed to providing a High Quality Bulk Digital Printing / Xerox / Scanning experience at affordable price to our customers, which is why, lot of our customers are happy and satisfied with our services and are our permanent customers. We ensure to provide the best services with 100% clarity & quality.

Mission:

To serve our clients efficiently, cost effectively and fulfilling the end user requirements through our prompt Digital Xerox / Printing / Scanning / Spiral Binding / Hard Binding & Perfect Glue Binding services.

Our philosophy and our success are based upon treating and maintaining long-term business relationship with our customers.

Our customers are also experiencing our services through Online & Offline booking for printing.

We have built an active and extensive online & offline store that sparks much of our innovation – we are always finding new ways to engage with our customers. We look forward for positive customer satisfaction in every order we go through because our motto is “CUSTOMER SATISFACTION”, so stop wandering and begin exploring with us for printing services at SRI SAI ENTERPRISES.

If you would like to know more about our customer satisfaction Reviews & Ratings, then go through at

Like Share and subscribe to my YouTube Channel @srisaienterprises1

SRI SAI ENTERPRISES

Purushotham G

No. 346, 11th “A” Cross, 14th main, J P Nagar, 2nd Phase,Bangalore–560078, Karnataka, India.

Mobile: + 91 - 9739289295 / 080 - 26582233.

Land Mark : VET College.

Email - [email protected] / [email protected]

Website: www.srisaipurushotham.wix.com/raghu

Youtube account - https://youtube.com/@SRISAIENTERPRISES1

Channel id - UCl2o4E5fGXwdqBFAm6F74Zg

Google Feedback & Review - https://g.page/sri-sai-enterprises-karnataka/review?gm

Subscribe to Youtube Channel - https://youtube.com/@SRISAIENTERPRISES1

2 notes

·

View notes

Text

Police in the Indian capital, Delhi, have raided the homes of prominent journalists and authors in connection with an investigation into the funding of news website NewsClick.

NewsClick's founder Prabir Purkayastha and a colleague were arrested. Police also seized laptops and mobile phones.

Officials are reportedly investigating allegations that NewsClick got illegal funds from China - a charge it denies.

Critics say the move is an intentional attack on press freedom.

Started in 2009, NewsClick is an independent news and current affairs website known to be critical of the government. In 2021, it was raided by tax authorities on allegations of breaking India's foreign direct investment rules.

The co-ordinated raids at 30 locations on Tuesday are some of the largest and most extensive on India's media in recent years. Police later confirmed they had arrested Mr Purkayastha and Amit Chakravarty, the website's head of human resources.

"A total of 37 male suspects have been questioned at premises, nine female suspects have been questioned at their respective places of stay and digital devices, documents etc have been seized/collected for examination," a police statement said.

Opposition leaders accused the Bharatiya Janata Party (BJP) government of a "fresh attack on the media". But Information and Broadcasting Minister Anurag Thakur said investigative agencies were merely doing their job.

How did the raids happen?

Among those also questioned were journalists Abhisar Sharma, Paranjoy Guha Thakurta, Aunindyo Chakravarty, Urmilesh, Bhasha Singh, popular satirist Sanjay Rajoura and historian Sohail Hashmi. Some were taken to police stations.

Searches were also carried out at the website's office in Delhi, news agency ANI reported.

In Mumbai, activist Teesta Setalvad's house was also searched. Ms Setalvad has long fought for victims of the deadly 2002 riots in Gujarat state and has written articles critical of the government for NewsClick.

A source close to Mr Purkayastha told the BBC that more than 15 policemen arrived at the editor's home at 06:30 local time (01:00 GMT).

"They did not produce any warrants or paperwork, questioned him for several hours and took away all the electronic devices they found at home," they said. Later, news agencies showed him being taken away by the police in a vehicle.

Mr Rajoura's lawyer, Ilin Saraswat, said the comedian was raided at the same time and that police took away his laptop, his two phones, some DVDs of his old work and some documents.

"The police said that Mr Rajoura is not named in the current investigation, but since he has worked with the website, he will be interrogated. We have not been provided a copy of the police complaint," he added.

BBC India offices searched by income tax officials

Indian tax authorities raid critical media outlets

India top court frees Muslim comic on bail

According to reports, the raids are in connection with a case registered against NewsClick in August after a New York Times report alleged that the website had received funds from an American millionaire to spread "Chinese propaganda".

It claimed that Neville Roy Singham worked closely with the "Chinese government media machine" and used his network of non-profit groups and shell companies to "finance its propaganda worldwide".

A case was reportedly registered against the website under Unlawful Activities (Prevention) Act, or UAPA, a draconian anti-terror law that makes it nearly impossible to get bail. NewsClick has rejected all the charges as false.

Who was raided?

All the people who were raided have been associated with NewsClick - some are employees, while others have worked on freelance projects.

Prabir Purkayastha, its founder and editor-in-chief, is the author of a number of books and a founding member of the Delhi Science Forum. During the 1975 Emergency - when civil liberties were suspended - he was jailed along with several opposition politicians.

Bhasha Singh is an activist and journalist who has reported extensively on manual scavenging and farmers' suicides. She has accused the government of being anti-women and on Monday appeared in a NewsClick video expressing concern over the increasing trend of members of the governing BJP praising the man who assassinated India's independence leader Mahatma Gandhi.

Abhisar Sharma is a prominent video journalist known for his critical views of the government. He worked for BBC Hindi before moving to work at the NDTV news channel. One of his last videos covered widespread protests by government employees against a new pension scheme.

Paranjoy Guha Thakurta, writer, journalist and filmmaker, is best known for his investigations into billionaire tycoon Gautam Adani and is facing several defamation suits filed by the industrialist. Earlier this year, he was mentioned in a report by Hindenburg Research which alleged that companies owned by Mr Adani had engaged in decades of "brazen" stock manipulation and accounting fraud - allegations denied by the industrialist who is perceived as being close to PM Modi.

3 notes

·

View notes

Text

What are these Levels -Code and Pixels IETM

Code and Pixels Interactive Technologies Private Limited (CNP) is an IT service provider based in Hyderabad (India). We provide end-to-end eLearning solutions and IETM development (INDIAN STANDARD IETM JSG 0852:2001, LEVELS 3,4,5 and European Aviation Standard IETM Level4 ), specialized in innovative use of technology.

#ietm level 4 software requirements#technical documentation#ietm developement#ietm document#ietm documentation#interactive electronic technical manual#Ietm Service Providers#Ietm Software Designers of India#Software Development Company#Elearning Solutions Company#E Learning Content Development Company#Online Education#Digital Education#Digital Content#Software Development Solutions#Elearning#Ietm Developers#Econtent Development#Elearning Solutions Providers#Econtent Developers#Econtent#Mobile Learning#What is Html5#Software Solutions#Software Development & E-learning Solutions

1 note

·

View note

Text

This day in history

I’m coming to San Diego Comic-Con!

Tomorrow (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause— Nov 2023 — to the first 50 people!)

Fri, Jul 21 1030h: Wish They All Could be CA MCs, room 24ABC (panel)

Fri, Jul 21 12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

#15yrsago Bletchley Park kicks so much ass https://memex.craphound.com/2008/07/20/bletchley-park-kicks-so-much-ass/

#15yrsago Spamwar’s worst mistakes being recapitulated by the copyright wars https://www.theguardian.com/technology/2008/jul/15/copyright.filesharing

#10yrsago Cheap, easy, no-mess cold-brew coffee https://memex.craphound.com/2013/07/20/cheap-easy-no-mess-cold-brew-coffee/

#5yrsago UK government accidentally includes Scarfolk poster endorsing culls of rabid children in official publication https://twitter.com/Scarfolk/status/1020290984549249026

#5yrsago UK government defends the use of under 16s as covert operatives https://www.theguardian.com/uk-news/2018/jul/20/child-spies-used-only-when-very-necessary-says-downing-street

#5yrsago Gmail rolls out DRM for email and office documents, calls it “Confidential Mode” https://www.eff.org/deeplinks/2018/07/between-you-me-and-google-problems-gmails-confidential-mode

#5yrsago Singapore healthcare provider breached, personal records of 1.5m people — including the Prime Minister — stolen https://www.straitstimes.com/singapore/personal-info-of-15m-singhealth-patients-including-pm-lee-stolen-in-singapores-most

#5yrsago Your phone company’s shitty security is all that’s standing between you and total digital destruction https://memex.craphound.com/2018/07/20/your-phone-companys-shitty-security-is-all-thats-standing-between-you-and-total-digital-destruction/

#5yrsago The American Conservative: “The Dickensian Return of Debtors’ Prisons” https://www.theamericanconservative.com/the-dickensian-return-of-debtors-prisons/

#5yrsago As hoax-fueled lynchings continue in India, Whatsapp puts limits on video-forwarding https://www.washingtonpost.com/world/whatsapp-launches-new-controls-after-widespread-app-fueled-mob-violence-in-india/2018/07/19/64433ec9-c944-446f-8d82-8498234ee8a9_story.html

#5yrsago In-depth look at the Financial Times’ weekly guide to ostentatious status goods for tasteless one-percenters https://www.theguardian.com/news/2018/jul/19/how-to-spend-it-the-shopping-list-for-the-1-percent

3 notes

·

View notes

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation? Expertise in Legal Procedures MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles. Compliance Assurance: Ensures that your company is set up in full compliance with Indian law. Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation. Conclusion For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

3 notes

·

View notes