#Deutsche Bank Center

Explore tagged Tumblr posts

Text

Doors, Gates and Windows (No. 82)

Film Center Building, NYC

Deutsche Bank Center, NYC

Lefcourt Normandie Building, NYC

Hearst Tower, NYC (two pics)

COVA Building, NYC

781 Fifth Avenue, NYC

1860 Broadway, NYC (two pics)

former Barbizon-Plaza Hotel, NYC

#Lefcourt Normandie Building#Film Center Building#Hearst Tower#travel#original photography#vacation#tourist attraction#landmark#cityscape#architecture#detail#façade#door#window#exterior#summer 2019#USA#Manhattan#New York City#Deutsche Bank Center#COVA Building#former Barbizon-Plaza Hotel#781 Fifth Avenue#1860 Broadway#Art Deco

9 notes

·

View notes

Photo

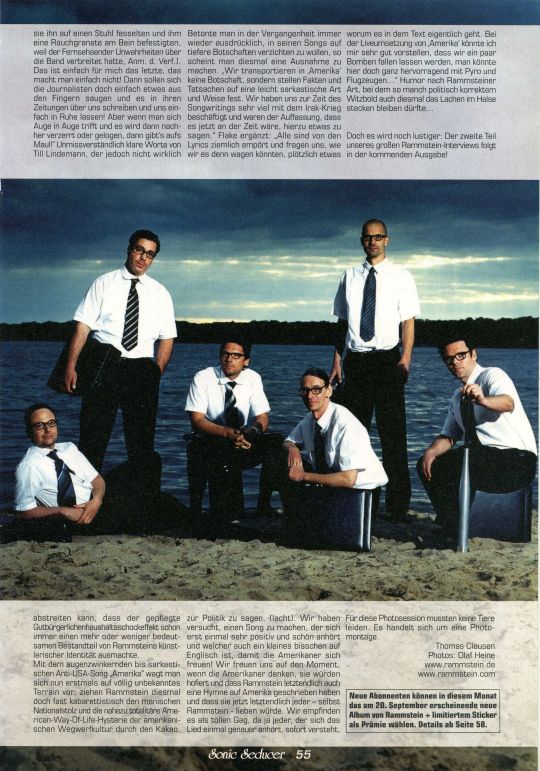

Sonic Seducer - September 2004, interview with Till and Flake - part 1

Thanks to ramjohn for the scans!

For a long time it was quiet around frontman Till Lindemann's scandalous, muscle-bound troupe, who completely cut themselves off from current music events after their last album 'Mutter' and, apart from the DVD 'Lichtspielhaus' at the end of last year, didn't let anything be heard of themselves.

But from July 26, the Berlin Neue Deutsche Härte flagship rockers will break their strict news ban with their single 'Mein Teil' and the fourth album that will follow at the end of September, in order to once again put the tolerance limits to a hard test after their abstinence and in domestic bourgeois idylls again blowing the deer antlers, cuckoo clocks and dusty Spitzweg oil ham with their bombast metal from the oak paneled walls.

Rammstein are back — with a vengeance! For a good year and a half, singer Till Lindemann, drummer Christoph Schneider, keyboarder Christian 'Flake' Lorenz, guitarists Richard Kruspe-Bernstein and Paul Landers as well as bassist Oliver Riedel have holed up with regular producer Jacob Kellner to work on Album number 4 (whose ultimate title at the time was not 100% certain when this issue went to print, after having already discarded working titles such as 'Reise, Reise' or 'Das rote Album') to go into group dynamics intensively, to collect oneself and to discuss the impatiently awaited successor to the controversial one in Stockholm, completely undisturbed 2001's chart-busting ‘Mutter’ to work. The fact that a lot has happened in the meantime with the notorious Provo Rock pyromaniacs from the Spree can now be clearly heard on the first single release 'Mein Teil', with which Rammstein, after numerous heated discussions, settled for artistic freedom , good taste, piety or political views in the past once again best recommend as probably the most controversial and most polarizing German band of the hour: In the usual ambiguous manner, 'Mein Teil' invites you to a macabre feast, the source of inspiration from the sensational cannibal murder trial of Rotenburg is fed in the middle of last year. After its successful general overhaul, the battleship Rammstein is once again tackling all existing conventions and moral concepts - and it's not just musically that you shoot out of all guns, as Till and Flake, who lined up for the six-eyes talk, make clear in great detail in our multi-part interview.

However, the Berlin command center is not aware of any concerns about finally breaking the bank with his calculated taboo. Fire free for Rammstein: "I wouldn't expect anyone to get upset about 'Mein Teil'. Making a song about something that really happened is the most normal thing in the world to me! Nobody complains to the spokesman for the Tagesschau either, what horror reports he reads again”, says Flake indignantly. "Of course people will get upset again — whether I understand it now or not," Till Lindemann, in the past rather reluctant to be interviewed, also intervened. “With the last album, the headline in BILD was about us: 'Disgusting - dead baby as record cover! This band should be banned!' I was really happy about that and thought for the first time: We've really made it... I think there will be something really, really bad to read about us this time too... “ (smiles). And even with songs like 'Mein Teil', 'Daila Lama (Fear of Flying)' or 'Amerika' the chances of a respectable repeat success in terms of page 1 scandal band are more than good. Since the release of the 1995 debut 'Herzeleid', the blameless average citizen has had a highly allergic reaction to the distorting mirror held up by the widely misunderstood metal satirists and will presumably also react to the new tracks about plane crashes, the Iraq war or masturbation of any kind of humor or Traditionally closed to sarcasm. Entertainment or derailment - as with all uncomfortable artists, the crucial question, the answer to which each listener must be left to themselves against the background of great art. “Actually, you can go just a little bit deeper into the subject matter of the individual songs, read the lyrics or take a look at us, you can't misinterpret Rammstein - unless you're really really stupid!” “Or malicious,” adds Lindemann. “I very often have the feeling that Rammstein is dragged through the dirt with spiteful superiority! I do not know why. There is absolutely nothing to misunderstand with us.”

Such discussions have been held too often and for too long in the past, against more or less unfounded accusations, false suspicions and nasty slander, for one to still feel any great desire today to explain oneself and one's texts to the masses like a mantra . Although, as in the case of some of the content on the last album, this seems to have been a matter of urgency for some. Rammstein is undoubtedly one of the very few German/German-singing bands whose lyrics and forms of expression make you reflect and question them, as Till Lindemann's very own (thought) world and lyrical expressionism are not always easy to understand; the quirky, deep black humor and latent sarcasm are not always immediately apparent and misunderstandings seem to be inevitable. “Many will once again not understand it and will be terribly outraged at us... But you simply cannot change the world, and so we don't care anymore! Let them get upset with us as much and for as long as they want!” That the relationship between Rammstein./. While the general public is irreparably shattered, Flake also has to admit: "One example: I don't like Daniel Küblböck either, but I would never scold him or call him an asshole or a spasm. He gives me no reason to get upset with him and no one forces me to listen to his music either! That's why I can't understand why people complain about us — we don't force anyone to listen to our records either! If people don't bother to find out what our songs are about and if we possibly do things, then they have no right to judge us!”

“It's getting on our nerves so much now, talking about these stories over and over again, discussing it, evaluating everything... - our success simply proves us right! However, the fun stops at these malicious things: If the press writes things that we didn't say, or cuts our statements together incorrectly, then there's a bomb in the leg, as is well known, someone must have noticed that painfully (a few years ago Rammstein played on at a festival, they 'pranked' the then MTV program executive by tying him to a chair and tying a smoke grenade to his leg because the TV station had spread falsehoods about the band). That's just the last thing for me, you just don't do that! Then the journalists should just pull something out of their fingers and write about us in their newspapers and just leave us alone! But if you meet face to face and it is then distorted or lied to afterwards, then it's on the mouth!” Unmistakably clear words from Till Lindemann, who, however, cannot really deny that the cultivated middle-class household shock effect has always been a more or less important part of Rammstein's artistic identity.

With the tongue-in-cheek to sarcastic anti-USA song 'Amerika', they venture into completely unknown territory for the first time; This time, Rammstein pull the manic national pride and the almost totalitarian American Way Of Life hysteria of the American throwaway culture through the cocoa in an almost cabaret manner.

In the past they repeatedly emphasized that they wanted to do without deeper messages in their songs, but this time they seem to be making an exception. “We don't transport a message in 'Amerika', but state facts and facts in a slightly sarcastic way. We dealt a lot with the Iraq war at the time of writing the song and felt that now was the time to say something about it.” Flake adds: “Everyone is quite outraged by the lyrics and asks us how dare we suddenly say something about politics. (laughs). We tried to make a song that sounds very positive and beautiful at first and which is also in a little bit of English so that Americans would be happy! We look forward to the moment when Americans think they're being courted and that Rammstein also ended up writing an anthem to America and that everyone — even Rammstein — would end up loving it now. We think it's a great gag, since anyone who listens to the song more closely will immediately understand what the lyrics are actually about. When it comes to the live implementation of 'Amerika', I could very well imagine that we will drop a few bombs, you could do a great job here with pyro and airplanes...” Rammsteiner-style humor, with many a politically correct joker saying this this time too Laughter should get stuck in your throat...

But it gets even funnier: The second part of our big Rammstein interview will follow in the next issue! No animals had to suffer for this photo session. It is a photomontage.

#Rammstein#Till Lindemann#Flake#Paul Landers#Oliver Riedel#Christoph Schneider#Richard Kruspe#2004#interview#translation#*scans#*

96 notes

·

View notes

Text

TOM HAMMICK (b 1963, British)

Artist Tom Hammick has described landscape in his work as a metaphor to explore an “imaginary and mythological dreamscape.” Drawing from a wide range of sources, from Japanese woodblock prints to Northern European Romantic painting and contemporary cinema, Hammick’s depictions of isolated human dwellings grounded in uncanny dream-like settings summon the uneasy atmosphere of a psychologically-charged thriller, or a dystopian suburban nightmare.

Hammick was the recipient of the V&A Prize at the International Print Biennale, Newcastle, UK in 2016.. His work is in many major public and corporate collections including the British Museum, the Victoria and Albert Museum, Bibliotheque Nationale de France, Deutsche Bank, the Yale Center for British Art, and The Library of Congress, Washington DC.

hammick.com/

25 notes

·

View notes

Text

New York City real estate, 02024 AD

https://www.nytimes.com/2024/08/06/nyregion/pharmacies-vacant-drugstores-retail.html?smtyp=cur&smid=bsky-nytimes

An empty Duane Reade, steps from Wall Street, darkens a landmark office building.

A former Walgreens in a condo in Murray Hill has been closed for over seven years.

A boarded-up Rite Aid in Astoria has attracted a homeless encampment in its parking lot.

They’re all examples of zombie pharmacies, the city’s living dead.

Scores of chain drugstores that once anchored shopping hubs across New York City remain shuttered even as much of the city’s storefront real estate has bounced back from the Covid-19 pandemic. Many could stay that way for years to come, because of ironclad leases, the difficulty of finding new tenants for the sprawling spaces and seismic shifts in the drugstore business, brokers and industry analysts said.

The result is over a million square feet of prime real estate collecting dust in some of the busiest commercial districts, according to a new analysis of the city’s pharmacy market. And critics say the stores have become neighborhood eyesores that attract illegal activity and detract from nearby businesses.

(...)

The pandemic forced many New York landlords to reduce rent and consider different tenants, which benefited many businesses, especially restaurants and cafes, services like nail salons and, for a time, a run of illicit smoke shops, he said.

But big pharmacies have gone in reverse. In 2014, after years of aggressive openings, the major drugstore chains had 656 locations in New York City, according to the Center for an Urban Future, a nonprofit think tank that tracks retail. Now there are fewer than 370, according to Live XYZ.

The industry has changed drastically in recent years, said George Hill, an analyst at Deutsche Bank who covers pharmacies. Pharmacies are now being reimbursed at lower rates for drug sales, which make up three-quarters of store revenue, while online shopping has cut into sales of convenience items like toothpaste and deodorant.

A major retail trade group had cited a surge in theft as a major contributor to store closures, but later admitted that its analysis was overstated. That perception, however, has been costly.

The most common reason is a concept called “dark rent.”

Pharmacy companies are seeking to cut their losses by shuttering unprofitable stores that have high labor costs, Mr. Hill said, but in most cases they are obligated to continue paying the rent long after the store closes, or goes dark.

Most of the pharmacies that have closed in recent years were signed to 10-, 15- or even 20-year leases, at rents that often exceed today’s rates, brokers said.

In these cases, a landlord has almost no incentive to seek a new tenant, allowing the store to sit empty for months or years, said Aric Trakhtenberg, an associate director at Newmark, a real estate firm....

2 notes

·

View notes

Text

Buoyed by a wave of buying from overseas, including the stamp of approval from legendary investor Warren Buffett, Japan’s economic outlook is brightening, deflationary concerns are dissipating, and the stock market is on a climb that could take it above its all-time record highs. It only took 33 years.

On Dec. 30, 1989, Japan’s premier market index, the Nikkei 225, closed at 38,915.87, capping a year that saw a 29 percent rise and an amazing 15-year climb that helped to put Japan at the center of the global economic map. But in 1990, it fell 39 percent, marking what is now known as the end of the so-called bubble economy. The sharp fall that year was far from the end. Despite numerous attempted rallies over the years, the market was on a long and seemingly inexorable fall, hitting just 7,054.98 points in March 2009. Over 20 years, the market had fallen 82 percent.

The latest rally shows how far the market has come back, with valuations now up more than 370 percent from the 2009 nadir. And it may have a long way to go yet. While Tokyo, as of mid-June, remains 13 percent below its 1990 high-water mark, in the same time period the FTSE 100 in London has risen 213 percent, and the Dow Jones Industrial Average has soared 1,146 percent. No wonder investors are now seeing opportunity in Japan, since just catching up to the rest of the world would represent potentially large gains.

One of the main drivers in the market’s climb is a surge in inflation that started with the shortages and higher commodity prices of the COVID-19 pandemic. While the higher external costs have been a headache for all major economies, in Japan they quickly produced what a decade of monetary easing had failed to achieve: demand-driven inflation where wages and prices both rise. After nearly three decades of deflationary price pressures, Japan’s inflation rate has quickly climbed from near-zero levels to 4 percent. While that is still subdued by global standards, it is still the highest since September 1981. “A cycle between inflation and wages is finally emerging in Japan. I think this is a structural change in the economy,” said Kentaro Koyama, Japan chief economist for Deutsche Bank.

This is exactly what former Bank of Japan Gov. Haruhiko Kuroda vowed to create when he took office in 2013. He quickly undertook a bond and equity buying spree that left the central bank holding 50 percent of all the Japanese government bonds in circulation and becoming a major holder of stocks. The target he set was a consistent 2 percent inflation rate that would be seen in both prices and wages. After 10 years in office, making him the longest-serving Bank of Japan governor in history, but with little sign of numbers moving, his goal finally came into sight just as he stepped down earlier this year.

Even Japan’s stingy employers, which have offered near-guaranteed job security but little extra cash over the years, are now pushing up wages at their highest level in 30 years. Japan’s Trade Union Confederation this spring won a 3.8 percent increase for its nearly 7 million members. Medium- and small-sized businesses are now seeing that they need to keep up to avoid losing people.

Another attraction is the health of Japan’s corporate sector. While the global dominance of companies such as Sony, Panasonic, Japan Steel Works, and Toshiba is long gone, major corporations have remained highly profitable, finding specialist areas that offer strong profit margins. Instead of producing the electronic goods or even the computer chips that drive them, Japanese companies have done well in a globalized economy with specialist products, ranging from the chemicals needed to make the chips to the industry-leading motion sensors needed for a robotic work floor.

But experienced Japan watchers might feel a twinge of disquiet. Ever since the mid-1990s, when it became clear there were serious structural issues in the economy, there have been a series of “Japan is back” declarations, with the fizzling of initial rosy forecasts giving way to declarations that “this time is different.” Stock market rallies in 1996, 2000, and 2007 all gave way to renewed bear markets. Promises that corporate Japan had now changed and was serious about rewarding shareholders instead of hoarding cash also seemed to be more talk than action. Retained earnings have risen steadily, reaching 242 trillion yen ($2.2 trillion) in 2020.

But even some veterans who have seen it all before are much more optimistic today. “Japan is back,” said Tokyo strategist Nicholas Smith of the Asian financial services firm CLSA. In a report to clients in May, he said that strong earnings and attractive valuations have now been kickstarted by a new drive coming from regulators and the Tokyo Stock Exchange to push up share prices through stock buybacks. This cooperation is coming together in a way he has not seen in 35 years of watching the Japan market. “Japan’s market is still very much more than just cheap. It has growth when others haven’t, due to belated reopening; it’s awash with cash, driving some eyepopping buybacks,” he said in the report.

Helping this along, Smith said, is the involvement of once-shunned activist investors. His data shows that Japan is now the No. 2 market for activists in the world, after the United States. When the firms, including major international names, first saw opportunities in Japan in the early 2000s, they were often derided as hagetaka, the Japanese word for vultures. But after some high-profile agreements with corporate titans such as Toshiba and Olympus, the mood has changed. Well-known names such as the Carlyle Group and Bain Capital are active in Japan, along with some home-grown Japanese firms that often work from offshore.

The other big recovery has been in real estate values, which had plunged at the same rate as stocks in the 1990 collapse. Foreign investment is pouring into the sector as investors look at prices little-changed over the past 30 years, made even cheaper by a weaker Japanese yen, which has fallen 20 percent over the past two years. According to the Numbeo international cost-tracking website, apartment purchase prices in Tokyo are around half the price of the equivalent space in New York.

As depressingly often with economic developments, the boom has left one group out of the party: the average Japanese person, especially the estimated 88 percent who do not own shares. And while wages are rising, the gains are being outstripped by inflation.

“The current situation is a very good tailwind for risk assets. Real estate valuations are being helped by low interest rates. But will it help the average Japanese person? To be honest, I don’t think so,” said Deutsche’s Koyama.

He cites government data showing that even as wages are rising, inflation is one step ahead. According to the Labor Ministry, Japan’s inflation-adjusted real wage index fell 3 percent in April from a year earlier, the 13th consecutive month of declines.

Part of the problem, he said, is that wages are raised only annually, in many cases through the spring labor negotiation season, while prices rise continuously.

Unless, of course, people change jobs, an idea that is alien to traditional Japanese workers. But with Japan’s labor force now shrinking and demand for employees rising, the younger generation has taken to job hopping, which can easily add 10-20 percent to salaries.

The demand is clearly there, with 1.3 jobs for every job seeker, according to the Labor Ministry. (For those in construction, there are nearly 12 jobs per person.) The problem is that with one of the world’s fastest-shrinking populations, Japan is starting to face critical labor shortages, and the problem is expected to worsen.

This could undermine another potential area of growth for Japan from the new drive for economic security and the decoupling from China, which is now more politely called de-risking. While investment flows are typically slower to change than trade due to the long lead times involved, foreign investment into China was down 7 percent, at $76.7 billion, in the second half of 2022.

“The simple story of foreign business retreating from China is overdone and often just wrong. But neither is there a stampede back to China now that the mood music has become more positive,” Andrew Cainey, a senior associate fellow with the Royal United Services Institute in London, said in a commentary for Japan’s Nikkei.

With companies now increasingly nervous about their prospects in China, Japan is burnishing its credentials as a rule-of-law country that also offers solid infrastructure, a good lifestyle, and surprisingly low costs. Tokyo, which was for decades was ranked the most expensive place for foreigners, now scrapes in at No. 19, according to the latest Mercer ranking of cities by cost of living.

It’s not that costs have come down significantly; instead, they have gone up everywhere else. Japan’s newfound status as a low-cost destination is the natural result of 30 years of near-zero inflation. The longer-term problem is how to find the people to fill the jobs needed for any new boom period. But for now, foreign investors seem unconcerned. The bargains are just too good to pass up.

3 notes

·

View notes

Text

Brazilian data center market draws foreign investors

Rising demand for data storage spurs asset acquisition

Foreign investors, including major global funds, are actively participating in processes to acquire data centers in Brazil. The growing demand for data infrastructure is coupled with an intent to diversify investments. Brazil, with its energy availability to operate data centers, is attracting these investors in large operations that are beginning to materialize. The sector is expanding at a double-digit growth rate annually.

For instance, Scala Data Centers, which already has foreign investors like Rosewood Capital and the World Bank, received $500 million in investments this year. These funds, from U.S.-based asset manager Coatue Tactical Solutions and Canadian pension fund Imco, will accelerate the company’s expansion.

There is also a trend of company sales, taking advantage of global investors’ interest. Scala recently engaged Deutsche Bank to structure its sale, Valor learned. Ascenty has not launched a formal sale process, but its controlling shareholder, Brookfield, is exploring the market, a person familiar with the matter said. Pátria sold Odata to Aligned Data two years ago for $1.8 billion.

Elea Digital is reportedly considering selling a minority stake, according to sources. When contacted, Piemonte Holding, which owns Elea Data Centers, denied seeking to sell a stake in the company and stated it plans to continue its investment plans in the country for the long term. Piemonte Holding’s founder and CEO Alessandro Lombardi pointed out that “any sale would be a breach of commitments made to stakeholders.” “Although investment banks, both local and foreign, frequently present potential buyers, none of these proposals have progressed,” he said.

Continue reading.

0 notes

Text

Linkin Park Announce 2025 Tour

Linkin Park have announced a 2025 tour. 01/31 – Mexico City, MX @ Estadio GNP Seguros % 02/03 – Guadalajara, MX @ Estadio 3 de Marzo % 02/05 – Monterrey, MX @ Estadio Banorte % 04/12 – Las Vegas, NV @ Sick New World Festival * 04/26 – Austin, TX @ Moody Center ^ 04/28 – Tulsa, OK @ BOK Center ^ 05/01 – Grand Rapids, MI @ Van Andel Arena ^ 05/03 – Baltimore, MD @ CFG Bank Arena ^ 05/06 – Raleigh, NC @ Lenovo Center ^ 05/08 – Greenville, SC @ Bon Secours Wellness Arena ^ 05/10 – Columbus, OH @ Sonic Temple * 05/17 – Daytona, FL @ Welcome to Rockville * 07/29 – Brooklyn, NY @ Barclays Center + 08/01 – TD Garden @ Boston, MA + 08/03 – Newark, NJ @ Prudential Center + 08/06 – Montreal, QC @ Bell Centre + 08/08 – Toronto, ON @ Scotiabank Arena + 08/11 – Chicago, IL @ United Center + 08/14 – Detroit, MI @ Little Caesars Arena + 08/16 – Philadelphia, PA @ Wells Fargo Center # 08/19 – Pittsburgh, PA @ PPG Paints Arena # 08/21 – Nashville, TN @ Bridgestone Arena # 08/23 – St. Louis, MO @ Enterprise Center # 08/25 – Milwaukee, WI @ Fiserv Forum # 08/27 – Minneapolis, MN @ Target Center # 08/29 – Omaha, NE @ CHI Health Center # 08/31 – Kansas City, MO @ T-Mobile Center # 09/03 – Denver, CO @ Ball Arena # 09/06 – Phoenix, AZ @ Footprint Center # 09/13 – Los Angeles, CA @ Dodger Stadium !& 09/15 – San Jose, CA @ SAP Center & 09/17 – Sacramento, CA @ Golden 1 Center & 09/19 – Portland, OR @ Moda Center & 09/21 – Vancouver, BC @ Rogers Arena & 09/24 – Seattle, WA @ Climate Pledge Arena & Linkin Park 2025 Tour Dates: 01/31 – Mexico City, MX @ Estadio GNP Seguros % 02/03 – Guadalajara, MX @ Estadio 3 de Marzo % 02/05 – Monterrey, MX @ Estadio Banorte % 02/11 – Tokyo, JP @ Saitama Super Arena 02/12 – Tokyo, JP @ Saitama Super Arena 02/16 – Jakarta, ID @ Venue TBA 04/12 – Las Vegas, NV @ Sick New World Festival * 04/26 – Austin, TX @ Moody Center ^ 04/28 – Tulsa, OK @ BOK Center ^ 05/01 – Grand Rapids, MI @ Van Andel Arena ^ 05/03 – Baltimore, MD @ CFG Bank Arena ^ 05/06 – Raleigh, NC @ Lenovo Center ^ 05/08 – Greenville, SC @ Bon Secours Wellness Arena ^ 05/10 – Columbus, OH @ Sonic Temple * 05/17 – Daytona, FL @ Welcome to Rockville * 06/12 – Nickelsdorf, AT @ Novarock Festival * 06/14 – Hradec Kralove, CZ @ Rock for People Festival * 06/16 – Hannover, DE @ Heinz-Von-Heiden Arena ~ 06/18 – Berlin, DE @ Olympiastadion ~ 06/20 – Bern, CH @ Bernexpo 06/24 – Milan, IT @ I-DAYS Festival * 06/26 – Arnhem, NL @ Gelredome $ 06/28 – London, UK @ Wembley Stadium $& 07/01 – Dusseldorf, DE @ Merkur Spiel Arena ~ 07/03 – Werchter, BE @ Rock Werchter Festival * 07/05 – Gdynia, PL @ Open’er Festival * 07/08 – Frankfurt, DE @ Deutsche Bank Park ~ 07/11 – Paris, FR @ Stade de France 07/29 – Brooklyn, NY @ Barclays Center + 08/01 – TD Garden @ Boston, MA + 08/03 – Newark, NJ @ Prudential Center + 08/06 – Montreal, QC @ Bell Centre + 08/08 – Toronto, ON @ Scotiabank Arena + 08/11 – Chicago, IL @ United Center + 08/14 – Detroit, MI @ Little Caesars Arena + 08/16 – Philadelphia, PA @ Wells Fargo Center # 08/19 – Pittsburgh, PA @ PPG Paints Arena # 08/21 – Nashville, TN @ Bridgestone Arena # 08/23 – St. Louis, MO @ Enterprise Center # 08/25 – Milwaukee, WI @ Fiserv Forum # 08/27 – Minneapolis, MN @ Target Center # 08/29 – Omaha, NE @ CHI Health Center # 08/31 – Kansas City, MO @ T-Mobile Center # 09/03 – Denver, CO @ Ball Arena # 09/06 – Phoenix, AZ @ Footprint Center # 09/13 – Los Angeles, CA @ Dodger Stadium !& 09/15 – San Jose, CA @ SAP Center & 09/17 – Sacramento, CA @ Golden 1 Center & 09/19 – Portland, OR @ Moda Center & 09/21 – Vancouver, BC @ Rogers Arena & 09/24 – Seattle, WA @ Climate Pledge Arena & 10/26 – Bogota, CO @ Venue TBA 10/29 – Lima, PE @ Venue TBA 11/01 – Buenos Aires, AR @ Venue TBA 11/05 – Santiago, CL @ Venue TBA 11/08 – Rio de Janeiro, BR @ Venue TBA 11/10 – São Paulo, BR @ Venue TBA 11/13 – Brasilia, BR @ Venue TBA 11/15 – Porto Alegre, BR @ Venue TBA * = festival performance ! = w/ Queens of the Stone Age $ = w/ Spiritbox % = w/ AFI ~ = w/ Architects ^ = w/ grandson # = w/… https://chorus.fm/news/linkin-park-announce-2025-tour/

0 notes

Text

The Latest News on Anilesh Ahuja: A Closer Look at His Financial Journey, Net Worth, and Influence at Premium Point Investments

In the world of finance, few names resonate as strongly as Anilesh Ahuja. Known for his strategic insight, leadership, and commitment to innovative investment strategies, Ahuja has built a legacy that is both respected and widely influential. As the founder and former CEO of Premium Point Investments, Ahuja has driven the firm to prominence, shaping a unique approach to investing in structured credit and mortgage-backed securities. In this post, we’ll take a closer look at the latest news surrounding Anilesh Ahuja, his current ventures, his substantial net worth, and the lasting impact he and his family have on the financial sector.

Anilesh Ahuja Influence in Finance: An Overview

Anilesh Ahuja’s journey in finance began with an early interest in complex financial products, particularly in mortgage-backed securities, which he first explored during his tenure at Deutsche Bank. With a strong academic foundation and years of professional experience, Ahuja founded Premium Point Investments to capitalize on these interests. Under his guidance, Premium Point quickly became known for its innovative investment approach, focusing on high-return assets and tailored strategies.

Even after stepping back from his leadership role, Ahuja’s name remains highly respected within the finance world. His approach and vision continue to shape Premium Point’s growth, with a commitment to client-focused strategies, diversification, and understanding emerging markets. Recently, there has been a surge in interest regarding Anilesh Ahuja latest news, including his ongoing contributions to finance, his influential network, and the potential plans he has for the future.

Anilesh Ahuja Net Worth: A Reflection of Financial Success

As a leader in the investment world, it’s no surprise that Anilesh Ahuja Net Worth has been a topic of considerable interest. Though precise figures vary, Ahuja’s success with Premium Point Investments and other ventures has positioned him as one of the more affluent figures in the financial sector. His net worth reflects not only his professional accomplishments but also the high level of expertise and dedication he has brought to every project.

Ahuja’s net worth has allowed him to pursue philanthropic interests, support financial literacy initiatives, and invest in emerging markets. He continues to balance professional success with personal endeavors, embodying a commitment to both financial growth and meaningful contributions to society.

Latest News on Premium Point Investments

Under Anilesh Ahuja leadership, Premium Point Investments established itself as a powerhouse in the world of hedge funds. The firm’s focus on structured credit and mortgage-backed securities set it apart, attracting high-profile clients interested in specialized investment portfolios with growth potential. Since its founding, Premium Point has expanded its offerings, adapting to the changing financial landscape and maintaining a client-centered approach.

Although Ahuja is no longer at the helm, his influence endures. The latest news surrounding Premium Point Investments highlights its continued commitment to innovation in finance. From exploring new asset classes to prioritizing market resilience, Premium Point remains a top player in the investment world. Anilesh’s vision still echoes in its strategic approach, with ongoing developments ensuring the firm stays competitive and responsive to market trends.

The Role of Neil Ahuja in Continuing the Legacy

While Anilesh Ahuja leadership was instrumental in the rise of Premium Point, the legacy doesn’t end with him. His family, particularly Neil Ahuja, continues to play a significant role in the firm’s direction. Neil Ahuja Premium Point involvement has sparked new interest as he steps into leadership roles and explores fresh approaches within the financial world. Neil’s work complements his father’s vision, blending traditional investment wisdom with a modern outlook on finance and risk management.

Neil brings a unique perspective to Premium Point, reflecting the values of discipline, innovation, and integrity. His influence is particularly evident in the firm’s emphasis on sustainable and ethical investments, areas that are becoming increasingly important in the global financial community. The leadership duo of Anilesh and Neil showcases a powerful balance of experience and innovation, ensuring that Premium Point Investments continues to grow and adapt.

Anilesh Ahuja Latest Ventures and Interests

While Anilesh Ahuja is no longer the active CEO of Premium Point, his passion for finance and investment has not waned. In recent years, Ahuja has explored various projects, focusing on expanding his knowledge and contributing his insights to emerging areas in finance. His latest ventures have attracted considerable attention, with industry insiders keen to see where Ahuja’s expertise will next make an impact.

There are also reports of Ahuja mentoring up-and-coming financial professionals, sharing his knowledge and inspiring a new generation of investors. His continued engagement with the financial world, combined with his family’s ongoing work at Premium Point, underscores Ahuja’s enduring commitment to excellence.

Why Anilesh Ahuja Approach to Finance Matters

Ahuja’s influence goes beyond just numbers and investments; it’s about how he approaches finance as a discipline. His vision for Premium Point was always rooted in a holistic understanding of markets, with a focus on long-term growth rather than short-term gains. This philosophy has shaped Premium Point’s ethos and has influenced a generation of investors who look to Ahuja as a model of financial stewardship and integrity.

Ahuja’s approach also emphasizes the importance of ethical investing—a quality that has become especially significant in today’s market. Through sustainable investments, diversification, and a focus on underserved markets, he has proven that it’s possible to drive profitability while also doing good.

Looking Ahead: What’s Next for Anilesh Ahuja?

As the financial world watches closely, Anilesh Ahuja latest news is likely to continue making waves. Whether he is supporting Neil Ahuja Premium Point initiatives, exploring new financial frontiers, or advising other firms, Ahuja’s next steps will undoubtedly leave an impact. Investors and industry leaders alike will be watching to see how his vision continues to evolve and where he will focus his expertise next.

In the meantime, the partnership of Anilesh and Neil Ahuja at Premium Point stands as a testament to their shared values, combining the wisdom of experience with a forward-thinking approach to investing. Together, they continue to shape the financial landscape, proving that family legacy and financial success can work hand-in-hand to create a lasting influence on the world of investments.

Conclusion: The Enduring Legacy of Anilesh Ahuja

The story of Anilesh Ahuja is a story of resilience, innovation, and leadership. From his early days in finance to the founding of Premium Point Investments, Ahuja has left an indelible mark on the industry. His net worth and latest news serve as milestones in a career defined by insight and influence, with Neil Ahuja following closely in his footsteps.

As Premium Point Investments continues to grow and adapt, the Ahuja legacy remains a powerful force in the investment world. Through their work, both Anilesh and Neil Ahuja continue to inspire investors, leaders, and future generations. Their story is one of progress, resilience, and the enduring power of family in the ever-evolving world of global finance.

#anilesh ahuja#anilesh ahuja latest news#anilesh ahuja net worth#neil ahuja#neil ahuja premium point#premium point investments

0 notes

Text

hi NATO let me revise & change & lengthen what is below: income is for Count Primo. Alexis Desjardins. Deposit in Landbank Landbank UP diliman Apacible st. but owned in its registration & ownership papers by Maiden RINA (earthly name as Severina Bella T. Lim) address is unit 1908 tower C Rockwell the Grove- 117 E. Rodriguez Jr. avenue Brgy. Ugong Pasig city Philippines 1.711 2. tartufo 3.asakusa 4.Rustan’s marketplace 5.Starbucks 6.pan de manila 7.bon chon 8.Eastwest bank 9.security bank 10. BDO/BPI/RCBC/unionbank 11.capitol commons rentals & indv stalls of the above 12.SM megamall rentals & indv. Stalls of the above 13.SM hyper market & indv stalls of the above 14.RUSTAN’S brand 15.Deutsche bank 16.Landesbank Baden wurttemberg (nos. 15&16- local & worldwide) 17.McDonalds 18. desjardins (France & Canada & worldwide) 19. Unilever (worldwide) 20. Landers superstore 21. metrobank 22. hop inn hotel 23. ANZ 24. KFC 25. deloitte 26. SGV & co. 27. marks & Spencer/debenhams/H&M 28.general motors 29. jeep 30. smart & globe telecom 31. unimart grocery/santis/UP town center 32. Costco/Tesco 33. all Ayala malls income 34. MERALCO 35. MANila water 36. mwss 37. Skycable 38. SM dept store income - anything SM

0 notes

Text

Time Warner was formed by the merger of Time Inc and Warner Communications on January 10, 1990.

#Time Warner#formed#10 January 1990#anniversary#US history#vacation#Midtown Manhattan#New York City#Time Warner Center#architecture#Deutsche Bank Center#1 Columbus Circle#David Childs#skyscraper#Mustafa Kemal Abadan#reflection#tourist attraction#landmark#2019#USA#summer 2018#30 Hudson Yards#North Tower#500 West 33rd Street#Kohn Pedersen Fox#2013#Central Park#travel#original photography#cityscape

2 notes

·

View notes

Link

#AartiSrivastava#Accenture#AdityaBirlaGroup#AirIndiaExpress#AmarpreetKaurAhuja#AmritaPadda#AnjaliChatterjee#AnuradhaRazdan#ArchanaBhaskar#ArchanaShiroor#AstraZeneca#BhartiAirtel#CapgeminiIndia#ChandraBhattacharjee#Dr.Reddy'sLaboratories#GrasimIndustries#HindustanUnilever#JayanthiAnilKumar#L&T#LakshmiC#YesBank

0 notes

Text

Latest DeFi News From The World Of Finance And Banking

DeFi, short for decentralized finance, represents a shift in the financial sector by leveraging blockchain technology, primarily Ethereum, to eliminate traditional financial intermediaries. It enables various financial applications, from simple transactions to complex contracts, through smart contracts that execute automatically under specific conditions.

Here are some latest DeFi news you may be interested in:

Latest DeFi news from Financial Sector:

Decentralized finance is coming to Bitcoin withBitcoin Layers – the meta-protocols, sidechains, layer 2’s and other technologies currently being built on the Bitcoin blockchain. These layers will enable faster payments, as well as lending, enhanced functionality of fungible and non-fungible tokens, decentralized exchanges, GameFi, SocialFi and many other use cases. Holders of bitcoin will soon be able to increase the productivity of their asset via a protocol-based decentralized financial system. The primary differentiator between DeFi on Bitcoin and DeFi on other chains is the underlying asset (native token). Whereas Ethereum, Solana and next-gen blockchains compete on the merits of their respective technologies, DeFi on Bitcoin is purely focused on increasing the productivity of bitcoin, placing the Bitcoin DeFi ecosystem in a league of its own.

DeFi adaptability is front and center with the Arbitrum launch – This new deployment uses Angle Protocol’s staked USDA (stUSD) as collateral for bitcoin trading, meaning traders earn a yield on deposited capital. Other derivatives DEXs like Aevo have offered this before but D8X’s is more generalized.

Latest DeFi news from the banking sector:

German banking giant Deutsche Bank AG views blockchain technology as a means to mitigate margin compression. According to Anand Rengarajan, the bank’s Asia-Pacific and Middle East head of securities services and global head of sales, by using blockchain and smart contract-based solutions, the German banking giant can reduce costs, transaction times, and overall risk.

Anchorage Digital Bank became the first federally chartered bank for digital assets. The bank seeks to give institutions easy and efficient access to crypto custody, trading, financing, staking, and governance services.

Block Matra is your go-to platform that makes an efficient process by providing comprehensive information about latest developments happening in the industry. We collect latest DeFi news from reliable sources and then present to users in a precise and detailed manner.

1 note

·

View note

Text

Latest DeFi News From The World Of Finance And Banking

DeFi, short for decentralized finance, represents a shift in the financial sector by leveraging blockchain technology, primarily Ethereum, to eliminate traditional financial intermediaries. It enables various financial applications, from simple transactions to complex contracts, through smart contracts that execute automatically under specific conditions.

Here are some latest DeFi news you may be interested in:

Latest DeFi news from Financial Sector:

Decentralized finance is coming to Bitcoin withBitcoin Layers – the meta-protocols, sidechains, layer 2’s and other technologies currently being built on the Bitcoin blockchain. These layers will enable faster payments, as well as lending, enhanced functionality of fungible and non-fungible tokens, decentralized exchanges, GameFi, SocialFi and many other use cases. Holders of bitcoin will soon be able to increase the productivity of their asset via a protocol-based decentralized financial system. The primary differentiator between DeFi on Bitcoin and DeFi on other chains is the underlying asset (native token). Whereas Ethereum, Solana and next-gen blockchains compete on the merits of their respective technologies, DeFi on Bitcoin is purely focused on increasing the productivity of bitcoin, placing the Bitcoin DeFi ecosystem in a league of its own.

DeFi adaptability is front and center with the Arbitrum launch – This new deployment uses Angle Protocol’s staked USDA (stUSD) as collateral for bitcoin trading, meaning traders earn a yield on deposited capital. Other derivatives DEXs like Aevo have offered this before but D8X’s is more generalized.

Latest DeFi news from the banking sector:

German banking giant Deutsche Bank AG views blockchain technology as a means to mitigate margin compression. According to Anand Rengarajan, the bank’s Asia-Pacific and Middle East head of securities services and global head of sales, by using blockchain and smart contract-based solutions, the German banking giant can reduce costs, transaction times, and overall risk.

Anchorage Digital Bank became the first federally chartered bank for digital assets. The bank seeks to give institutions easy and efficient access to crypto custody, trading, financing, staking, and governance services.

Block Matra is your go-to platform that makes an efficient process by providing comprehensive information about latest developments happening in the industry. We collect latest DeFi news from reliable sources and then present to users in a precise and detailed manner. Visit us at: https://blockmatra.com/

#Crypto News Today#Defi News Today#Latest Crypto News#Crypto Narratives 2025#Ai Crypto Trading Platform#Crypto Trading Bots For Beginners#Crypto Trading Bots 2025#Latest Degen News#Web3 News#Web3 Blockchain Technology

0 notes

Text

House Intelligence Asks Why Russia-linked Austrian Bank Funded Trump Tower Project and Never Sought Repayment

An Austrian bank implicated in various money laundering scandals became the subject of a House Intelligence Committee hearing this week when Democratic Representative Jackie Speier of California asked about its connections to Russia and the financing of a failed Trump real estate project.

"I'm curious about the Raiffeisen bank in Austria," Speier said to Heather Conley, an expert on Europe and Eurasia at the Center for Strategic and International Studies and author of the Kremlin's Playbook, which looks at Russian economic influence in Europe. "You spend a whole chapter [of your book] on Austria and the banks. Can you express to us the relationship between Russia and the Raiffeisen Bank?"

The Austrian bank is just one in a handful of European banks, including Danske Bank and Deutsche Bank, that have received increased scrutiny over the past several years following allegations of money laundering and Russian influence. Raiffeisen was named in a Hermitage Fund report submitted to prosecutors in Austria this month that contained allegations of money laundering. The bank also helped finance a 2007 Trump Tower project in Canada.

"What we're seeing in the banking structures is really Austria's ability to amplify that Russian funding and take it elsewhere within Europe. So Austria is very powerfully placed, their banking system, across Central Europe, in the Western Balkans," Conley told the House Intelligence Committee on Thursday. "Raiffeisen bank, because of its size and great importance to the region, amplifies non-transparency."

Speier, meanwhile, highlighted that the bank, which was also named in an extensive investigation into Russian money laundering published by the Organized Crime and Corruption Reporting Project this month, was involved in a Trump real estate project in 2007.

"The Raiffeisen Bank actually funded a Toronto Trump Project for $300 million, and never came back after that project went bankrupt, to secure what it could in bankruptcy, in terms of the return of their funds," Speier added.

The exchange highlighted Congress's focus on President Trump's past business practices, as the Democrat-held House continues to investigate the president's ties to Russia.

"In the case of Toronto, in 2001 the Trump Organization licensed the Trump name to businessmen with links to Eastern Europe who reportedly sold a stake in a Ukrainian steel mill in 2010 to individuals linked to the Russian government. Questions have been raised about whether Kremlin money was used to finance parts of the Trump Toronto project. The question of why Raiffeisen never reclaimed the millions it lost in the tower also remains.

"From 2007 to 2014, money flowed out of Russia like wine from a broken bottle. In short order, between 2007 and 2014 there were two boom and busts. Anyone with an ounce of sense was trying to get money out of Russia and into a western currency. The wealthy were concerned with potential additional sanctions as well as the value of the ruble when the Russian government would eventually have to quit supporting.

0 notes

Text

[ad_1] Job title: Telefonischer Kundenbetreuer / Call Center Agent (d/m/w) in Schkeuditz Company: Deutsche Bank Job description: Job Description: Flexible Arbeitszeiten. Und ein sicheres Arbeitsverhältnis genießen? Geht beides! Auf halber Strecke zwischen Leipzig und Halle liegt Schkeuditz. Gut angebunden und bekannt durch das Schkeuditzer Kreuz, das erste Autoba... Expected salary: Location: Frankfurt am Main, Hessen Job date: Wed, 24 Jan 2024 08:57:45 GMT Apply for the job now! [ad_2]

0 notes

Text

Dark-Eyed Junco

Today I picked up a small dead bird. In the hustle of humans trying to get somewhere. Just like me. Cradled it in my palm. Still warm. So innocent. So small. To get here It may have flown a thousand miles.

I took it to a garden bed In the middle of Columbus Circle. Placed it among chrysanthemums. Under the pillar of a man whose hubris spelt our doom.

At the pillar of Man’s legacy of doom Spoke of a wheel I turned Round from Central Park to the glass Tower of Time Warner Deutsche Bank Center Its façade the killer of a thousand birds Each year, reflecting our disregard.

Our disregard. Where to start. Worried about a little bird? A dust speck On this mote of a planet. We boil it. The planet, that is, as we hustle to get somewhere. Feeling nothing as we charge ahead

Despite everything.

Can you see it? There in the window. Our hubris outpaces us our palms outstretched A small dead bird in hand.

Richard Morrison, 2023/24

0 notes