#Daniel Mendelsohn opere

Explore tagged Tumblr posts

Text

Recensione completa: Gli scomparsi di Daniel Mendelsohn. A cura di Alessandria today

Pubblicato in Italia da Einaudi, Gli scomparsi di Daniel Mendelsohn è un'opera monumentale, intensa e profondamente personale.

Introduzione all’opera:Pubblicato in Italia da Einaudi, Gli scomparsi di Daniel Mendelsohn è un’opera monumentale, intensa e profondamente personale. Questo libro, a metà strada tra memoir, reportage e romanzo storico, esplora le radici familiari dell’autore attraverso un’indagine sulla sorte di sei membri della sua famiglia, vittime dell’Olocausto. Mendelsohn intreccia una narrazione che è al…

#Alessandria today#cultura e memoria#Daniel Mendelsohn#Daniel Mendelsohn opere#genealogia#Gli scomparsi#Google News#introspezione e memoria#italianewsmedia.com#Letture consigliate#letture emozionanti#libri da leggere#libri Einaudi#libri indimenticabili#libri sulla seconda guerra mondiale#libri sull’Olocausto#memoir familiari#memoria collettiva#narrativa di non-fiction#narrativa documentaristica#narrativa ebraica#narrativa moderna#Narrativa storica#narrazione storica#Pier Carlo Lava#ricerca storica#Ricostruzione storica#riflessioni sulla memoria.#romanzi storici#Romanzi sull’identità

0 notes

Text

Movies to Look Forward to in March!

March is going to be a good month for movies. Not only is the first female-led feature film from Marvel finally here, but March offers laughs, scares, and edge-of-your-seat action. Here are the movies I’m looking forward to this month.

The Hole in the Ground

Sarah and young son Chris move to the fringes of a backwood rural town, but a terrifying encounter with a neighbor uncovers disturbing changes in her little boy. Is this connected to an ominous sinkhole buried deep in the forest that borders their home?

Release Date: March 1st

Genre: Horror

Starring: Seána Kerslake, James Quinn Markey, Simone Kirby

Director: Lee Cronin

Apollo 11

A look at the Apollo 11 mission to land on the moon led by commander Neil Armstrong and pilot Buzz Aldrin.

Release Date: March 1st

Genre: Documentary

Stars: Buzz Aldrin, Neil Armstrong, Michael Collins

Director: Todd Douglas Miller

Greta

A young woman befriends a lonely widow who's harboring a dark and deadly agenda towards her.

Release Date: March 1st

Genre: Drama/Horror

Stars: Isabelle Huppert, Chloë Grace Moretz, Maika Monroe

Director: Neil Jordan

The Wedding Guest

A story centered on a mysterious British Muslim man on his journey across Pakistan and India to kidnap a guest from a wedding.

Release Date: March 1st

Genre: Thriller

Stars: Dev Patel, Radhika Apte, Jim Sarbh

Director: Michael Winterbottom

Climax

French dancers gather in a remote, empty school building to rehearse on a wintry night. The all-night celebration morphs into a hallucinatory nightmare when they learn their sangria is laced with LSD.

Release Date: March 1st

Genre: Thriller

Stars: Sofia Boutella, Romain Guillermic, Souheila Yacoub

Director: Gaspar Noé

Captain Marvel

Carol Danvers becomes one of the universe's most powerful heroes when Earth is caught in the middle of a galactic war between two alien races.

Release Date: March 8th

Genre: Action/Adventure

Stars: Brie Larson, Gemma Chan, Ben Mendelsohn

Director: Anna Boden, Ryan Fleck

Gloria Bell

A free-spirited woman in her 50s seeks out love at L.A. dance clubs.

Release Date: March 8th

Genre: Drama/Romance

Stars: Julianne Moore, Sean Astin, Michael Cera

Director: Sebastián Lelio

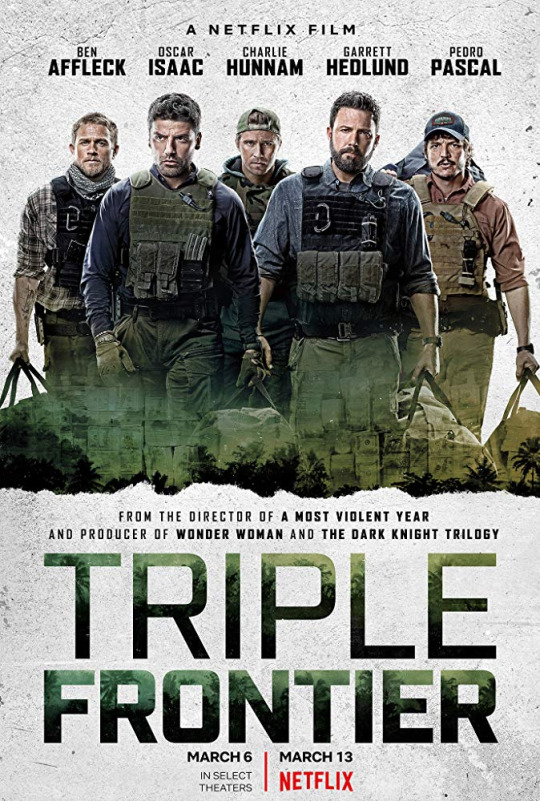

Triple Frontier

Five former Special Forces operatives reunite to plan a heist in a sparsely populated multi-border zone of South America.

Release Date: March 13th

Genre: Action/Adventure

Stars: Ben Affleck, Charlie Hunnam, Adria Arjona

Director: J.C. Chandor

Captive State

Set in a Chicago neighborhood nearly a decade after an occupation by an extra-terrestrial force, Captive State explores the lives on both sides of the conflict - the collaborators and dissidents.

Release Date: March 15th

Genre: Sci-Fi/Thriller

Stars: Machine Gun Kelly, Vera Farmiga, John Goodman

Director: Rupert Wyatt

Five Feet Apart

A pair of teenagers with life-threatening illnesses meet in a hospital and fall in love.

Release Date: March 15th

Genre: Drama/Romance

Stars: Haley Lu Richardson, Cole Sprouse, Claire Forlani

Director: Justin Baldoni

Wonder Park

Wonder Park tells the story of a magnificent amusement park where the imagination of a wildly creative girl named June comes alive.

Release Date: March 15th

Genre: Family/Animation

Stars: Brianna Denski, Jennifer Garner, Ken Hudson Campbell

Director: David Feiss

The Aftermath

Post World War II, a British colonel and his wife are assigned to live in Hamburg during the post-war reconstruction, but tensions arise with the German who previously owned the house.

Release Date: March 15th

Genre: Drama/War

Stars: Alexander Skarsgård, Keira Knightley, Jason Clarke

Director: James Kent

Superpower Dogs

Join an immersive IMAX adventure to experience the life-saving superpowers and extraordinary bravery of some of the world's most amazing dogs. (Narrated by my- not mine, I don’t own him- man, Chris Evans.)

Release Date: March 15th

Genre: Documentary

Stars: Chris Evans, Dayna Hilton, Matt Abrams

Director: Daniel Ferguson

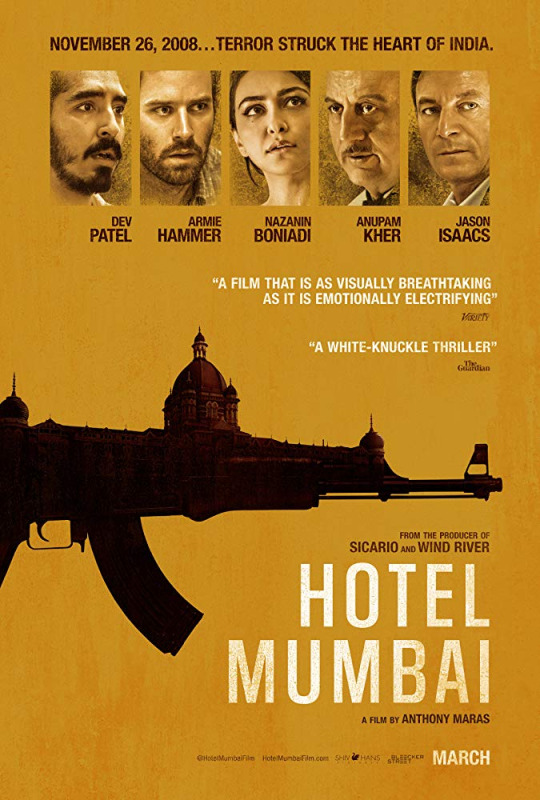

Hotel Mumbai

The true story of the Taj Hotel terrorist attack in Mumbai. Hotel staff risk their lives to keep everyone safe as people make unthinkable sacrifices to protect themselves and their families.

Release Date: March 22nd

Genre: Drama/Historical

Stars: Dev Patel, Armie Hammer, Nazanin Boniadi

Director: Anthony Moras

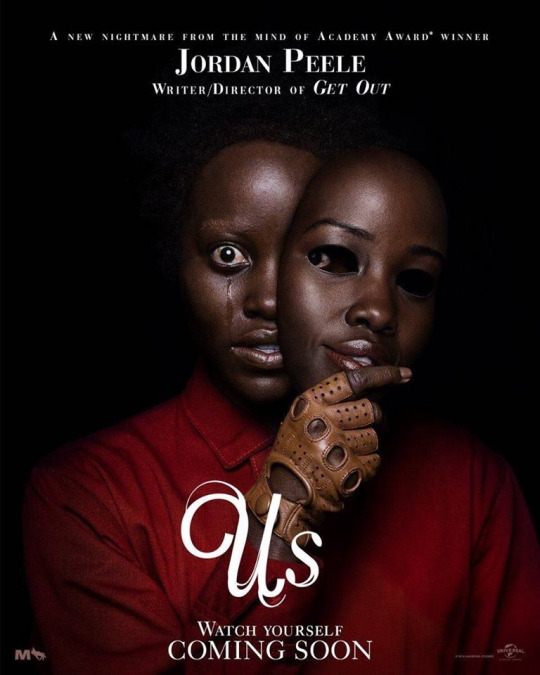

Us

A family's serenity turns to chaos when a group of doppelgängers begin to terrorize them.

Release Date: March 22nd

Genre: Horror

Stars: Elisabeth Moss, Lupita Nyong'o, Anna Diop

Director: Jordan Peele

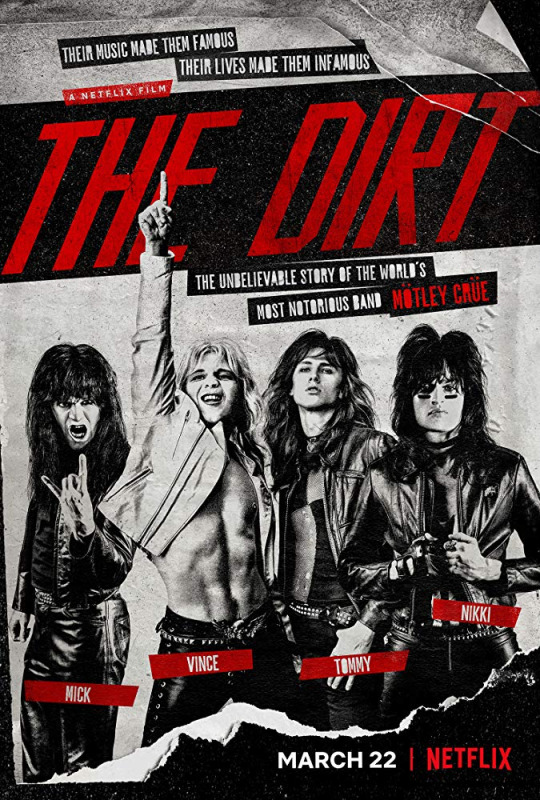

The Dirt

The story of how Mötley Cr��e came to be one of the most notorious rock 'n roll groups in history.

Release Date: March 22nd

Genre: Biopic

Stars: Machine Gun Kelly, Iwan Rheon, Douglas Booth

Director: Jeff Tremaine

Maze

Inspired by the true events of the infamous 1983 prison breakout of 38 IRA prisoners from HMP, which was to become the biggest prison escape in Europe since World War II.

Release Date: March 22nd

Genre: Drama/Historical

Stars: Tom Vaughan-Lawlor, Barry Ward, Martin McCann

Director: Stephen Burke

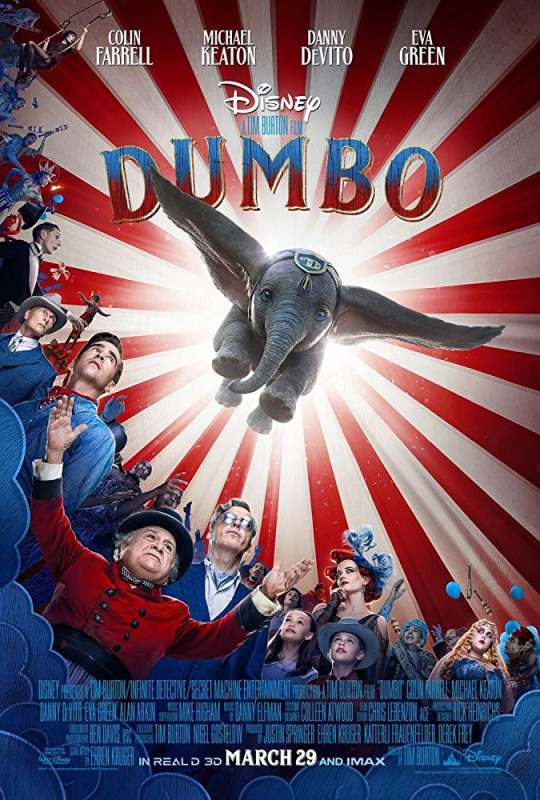

Dumbo

A young elephant, whose oversized ears enable him to fly, helps save a struggling circus, but when the circus plans a new venture, Dumbo and his friends discover dark secrets beneath its shiny veneer.

Release Date: March 29th

Genre: Family/Musical

Stars: Eva Green, Colin Farrell, Michael Keaton

Director: Tim Burton

Unplanned

One of the youngest Planned Parenthood clinic directors, Abby Johnson used her passion to help women to become a spokesperson for PP, until the day she saw something that changed everything.

Released Date: March 29th

Genre: Drama

Stars: Ashley Bratcher, Brooks Ryan, Robia Scott

Director: Chuck Konzelman, Cary Solomon

The Highwaymen

A pair of police officers come out of retirement to catch the infamous outlaws Bonnie & Clyde.

Release Date: March 29th

Genre: Drama/Historical

Stars: Kevin Costner, Woody Harrelson, Kim Dickens

Director: John Lee Hancock

A Vigilante

A vigilante helps victims escape their domestic abusers.

Release Date: March 29th

Genre: Drama/Crime

Stars: Olivia Wilde, Morgan Spector, Betsy Aidem

Director: Sarah Daggar-Nickson

These are just the ones that caught my eye. March has a near endless offering of movie to pick one. There is something for everyone on this list so take some time and enjoy a flick!

Lost in dictation,

Jess

#march movies#movie lists#march 2019#drama#comedy#family#historical#action#thriller#movie#film#theatres#theaters#list#jess pende#captain marvel#us#greta#captive state#dumbo

12 notes

·

View notes

Text

Sia onore, ora, a Bibi Andersson: con lei è morto definitivamente il cinema di Ingmar Bergman (un tempo, l’abbecedario del buon europeo)

Un segno di immancabile nitidezza. Dieci anni fa un ictus le toglie la voce. Nella mia mente romanzesca è Ingmar Bergman, morto nel 2007, che le ruba i verbi, le parole, l’ugola. In sua assenza, lei, Bibi, non può parlare.

*

Dire che è morta Bibi Andersson significa ribadire che Ingmar Bergman, nato un secolo fa, è definitivamente morto. Chi li vede i suoi film, ora, un tempo l’abbecedario per l’educazione alla tenebra di ogni buon europeo?

*

In un articolo recente sulla New York Review of Books Daniel Mendelsohn ragiona intorno a Ingmar Bergman, Novelist. Nel mondo anglofono l’editore Arcade pubblica i libri di Bergman, Con le migliori intenzioni, Conversazioni private, Nati di domenica. Insieme a pochi altri – Herzog, ad esempio – Bergman è un regista che sa scrivere. Decritta i destini, li compone e li scinde a suo piacere. Così ha fatto con Bibi.

*

La vita cinematografica di Bibi Andersson è consustanziale alla filmografia di Ingmar Bergman. Da Il settimo sigillo a Il posto delle fragole, da Scene da un matrimonio a Persona, il capolavoro. Un volto di indecorosa bellezza, quello di Bibi, certo, ma sono gli occhi che ti spossessano, che ti riempiono il corpo di cani.

*

Desiderarla è un’algebra, raggiungerla, mai – perché è irraggiungibile e immortale, Bibi, da cui qualcuno ha munto tutte le parole, dieci anni fa, e ora setaccia il corpo per ricalcarlo nell’aldilà. Una bellezza dedicata all’opera di un genio, Bergman, un cruccio in marmo per lui, che feriva tutto.

*

Quando scrissi Ingmar per il teatro, apparve anche lei, tra le donne vampirizzate da Bergman, sessomane dell’arte. Ricalco alcune parti, perché dal pozzo giunge infine la gioia. Ciao, Bibi. (d.b.)

***

Ingmar Bergman e la moglie, Ingrid von Rosen, sono seduti ciascuno su una sedia. Le loro sedie sono una contro l’altra, si fronteggiano di schiena. Può darsi che nel corso dell’azione Ingmar sia quello che si alza e si muove, esagitato, esagerato; mentre Ingrid resta sulla sedia, compiendo atti lenti e miracolosi, incide un legno, ad esempio, disegna.

Ingmar: Il matrimonio è una lotta pattuita. Prima si uccide silenziosamente, attraverso la tattica dei sorrisi e dei baci sulla fronte. Poi si ingurgita, si digerisce, si caga. Matrimonio, amore: tutto cagato via, un cibo delizioso dà come compimento la merda. L’altra volta, l’ho detto, a Ingrid, “sai qual è l’unico atto erotico che ci cinge? Tagliare l’insalata. Ti vedo fremere perché speri che mi mozzi il dito. Il sangue riuscirà a farmelo tornare duro. E tu, tu saprai elevare le tue voglie che ora come ora sembrano sponsorizzate dal catechismo della Chiesa cattolica”. L’unico godimento nello sposarsi è trasformare il sussiego in sottomissione, obbligare la sposa all’osceno, provocare il disgusto. E quando lei mi avrà finalmente odiato con tutta se stessa, riconquistarla. Lasciarsi alla lascivia della dolcezza. Lisciarla. Farsi domestico struzzo, seppellire i rancori nella sabbia, lasciarsi frollare. Concedergli di credere che sia lei ad avere dominio, ora. Leccarla. Come un cane. Viziare le sue voglie, camminando per la stanza a quattro zampe. E quando lei riconoscerà di non amare altra carne che la mia… Corromperla, distruggerla, sottometterla. Si ama soltanto nella lotta – soltanto torturati dalla colpa.

Ingrid: Una, cinque, dieci, cento donne Ingmar ha portato a Faro, pronunciando, come solo lui sa fare, dolcissime parole di eternità. A me ha detto le stesse parole che ha detto a Liv e a Gun, a Else e a Ingrid, a Liv e a Bibi, senza badare al contenuto di quelle parole, ma soltanto alla risposta, alla reazione che ho avuto, che abbiamo avuto. E valutando, giudicando queste diverse reazioni, come un dio vendicativo ma sorridente valuta le pene da distribuire a seconda della voracità con cui gli si obbedisce. Faro è bellissima, violenta. Ingmar ha bisogno di un’isola, della clausura, di rapporti esclusivi. Ingmar avvolge come una coperta sul viso. Soffoca, uccide. Ma alla fine è lui il primo a fuggire. Non ha bisogno degli uomini perché pensa, maliziosamente, di saper creare tutti i possibili sentimenti e pensieri dell’umanità. Ingmar pretende gli applausi anche quando sbaglia, anche quando è orribile. Come si può non compatire un uomo che per girare un film ha bisogno di dominare, psicologicamente e fisicamente, tutte le attrici? In modo che loro, in scena, come prostitute, come amanti perdute, debbano convincere il regista di essere le più belle, le più desiderabili, le più brave – anche a letto? “Il set di Ingmar è un harem”, ha detto Bibi Andersson. “Mi ha fatto sentire una donna immortale – e una troia”, ha aggiunto. La differenza tra me e loro, le troie, è che io so tutto, amo la mostruosità di Ingmar. Lui crede di usarmi – io lo accontento. Ingmar crede di spiarmi, ma sono io a compiere una spietata indagine del suo cuore.

Ingmar: L’opera d’arte accade solo da un nucleo radioso di rabbia. Bibi e Liv sono state eccelse per un’unica ragione: le ho scopate entrambe. Stavo con una dopo essere stato con l’altra. La rivalità ha fatto emergere la loro arte: non recitavano, lottavano. Per avermi. Per possedere il mio compiacimento, il mio sorriso. “Voglio avervi entrambi”, dissi. Le avevo chiuse in una sala. Buia. Vuota. I nostri guaiti ingigantiti dalle pareti sembravano una corsa di lupi. Due donne nude, un uomo, una stanza cieca, buia: non è questa la Genesi, l’inizio, il principio del mondo? Loro si mordevano. Ricordo che Bibi azzannò Liv al collo; Liv mozzò un pezzo di labbro a Bibi. Le scopai insanguinate. Il giorno dopo le feci portare all’ospedale, con la scusa di un “incidente di lavorazione”. La luce le trasformò, tornarono angeliche. Di una bellezza diafana, violentata. Se non fosse per il loro antagonismo, per la mia cattiveria, non esisterebbe Persona, un capolavoro.

Ingrid: Morirò. Qualcosa mi distrugge dalla pancia, dallo stomaco. Pare che lo stomaco si sbriciolerà come un ghiacciaio – io svanirò, scivolerò per la stanza, come acqua. Ingmar accompagnerà i rivoli del mio corpo con una scopa, sparirò nel rubinetto di una doccia. Per una volta, anch’io, sarò indecifrabile. “Mi danno il voltastomaco”, così, una volta, brutalmente, ho detto a Ingmar. I tuoi film, le tue opere immortali, mi danno il voltastomaco. Ora l’opera di Ingmar si è rivoltata contro di me – mi scassa da dentro – mi uccide. Quando ancora stavo con Jan, ma la mia bellezza diventò una sfida per Ingmar, gli scrissi. “Ho un bisogno estremo che la mia vita sia eccezionale – ti prego aiutami a non concentrarmi sempre sul male”, gli scrissi. Lo imploravo a convertirsi. Probabilmente, sperai che per me Ingmar abbandonasse il cinema, che io fossi tutto, una vita sufficiente. Ho ritrovato qualche giorno fa quel biglietto. Insieme ad alcuni vecchi biglietti del treno, Ingmar lo teneva in un libro che non ha finito di leggere. È l’unico biglietto che ho osato scrivere a Ingmar – la tenerezza, se non si volta in erotismo, lo irrita. Ora, morirò. Dicono che questa è una prova – ma chi mi mette alla prova, a che pro, perché?

Ingmar: Morirà. E con lei spero che muoiano i miei figli. Insieme a lei. I figli sono sigilli di carne che non ho desiderato. Li ho donati. Come fa un re, un dio. Ti dono il mio sperma perché la tua stirpe sia numerosa come le stelle del cielo. E perché tu non mi rompa più le palle. Un gorgo di carne, un ragù, una pappa carnale che precipita nello scolo del tempo: Ingrid, Maria, Bibi, Liv, Else, Ellen, Gun… Non le sopportò più – le conosco così bene – è così banale l’uomo. Altro che abisso, vertigine insondabile e vergine, innominato mistero: l’uomo non è un rebus, ma un repertorio di ovvietà, sappiamo che toccando un muscolo, esso scoccherà in quella direzione, che una parola determinerà quel particolare gesto. C’è più intelligenza in un gatto, in un albero che in un uomo. Non mi eccitano più le loro reazioni alle mie meccaniche cattiverie: so già tutto, potrei recitare la vita di ognuno di loro, uno per uno. Eppure, continuo a stimolarli – per abitudine, penso. La vita è questi sentimenti fossili, insopportabili. Vorrei che morissero tutti. Nell’isola di Skull, in Irlanda, ho conosciuto un frate. Non aveva paura della povertà e aveva le dita scorticate. Anche le labbra. Nere. Gonfie. Ustionate da una parola di troppo, forse. “Da quando Dio si è incarnato diventando Gesù, la carne è il mezzo e il metro della nostra salvezza, ne è il misterioso tramite. Anche il male implicito nella carne, perciò, è tramite di gloria”. Mi ha detto questo. Poi andò, a quattro zampe, nella cella che si era fabbricato tra le rocce. Se la carne è sacra voglio scopare tutto il giorno. Ma non mi viene più duro. Voglio che Ingrid muoia come vorrei morire io, voglio che sparisca dalla mia vista, voglio liberarmi di me stesso.

(silenzio)

Innocenti. Vuol dire che siamo innocenti da duemila anni e non lo sappiamo? Che Gesù è passato come un fuoco, sradicandoci dal male. Siamo innocenti anche quando lo crocefiggono. Innocenti anche quando uccidiamo. Innocenti e irresponsabili.

L'articolo Sia onore, ora, a Bibi Andersson: con lei è morto definitivamente il cinema di Ingmar Bergman (un tempo, l’abbecedario del buon europeo) proviene da Pangea.

from pangea.news http://bit.ly/2VOtQcw

0 notes

Text

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

New Post has been published on http://foursprout.com/wealth/the-wall-street-bankers-who-feast-during-recessions-say-theres-a-smell-in-the-air-and-its-starting-to-feel-like-2007-mc-hli-ghl/

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

The global economy is growing and corporate defaults are low and projected to drop even further.

Yet the Wall Street investment bankers who feast during recessions are optimistic about their business, and some say it’s starting to feel like it did just before the financial crisis.

Top restructuring firms have been filling out their rosters of talent to be prepared in case of an economic recession.

Restructuring bankers told Business Insider that a massive amount high-yield debt issued in recent years could produce defaults and keep them busy even without a recession.

Another source of optimism: The restructuring business has changed since the last financial crisis, with firms finding year-round work across the globe by providing solutions to companies before they get to bankruptcy court.

At an earnings call in April, an analyst pressed bank CEO Ken Moelis on his rosy outlook for his firm’s restructuring business — the corner of Wall Street known for advising companies with messy books veering toward bankruptcy.

For a healthy chunk of his opening commentary, the namesake founder and CEO of independent investment bank Moelis & Co. touted his firm’s “market-leading restructuring business” for supplying meaningful activity.

“Your comments were surprisingly positive,” said Ken Worthington, a senior equity analyst with JPMorgan Chase. “Is this sort of steady state for you in a lousy environment? Can things only get better from here?”

On the surface, market conditions are showing few signs of distress. The economies in the US and throughout the developed world are growing, the stock market has been upbeat despite fits of volatility, and corporate default rates remain low and are projected to fall further in 2018 and beyond.

So why was Moelis so optimistic about his restructuring team?

“Look, it could get worse. I guess nobody could default,” Moelis said. (Keep in mind that ��worse” from the perspective of a restructuring banker, who feasts during recessions, means “better” for most of the rest of the world). “But I think between 1% and 0% defaults and 1% and 5% defaults, I would bet we hit 5% before we hit 0%.”

The billionaire dealmaker isn’t alone in his sentiment. Many on Wall Street are scrutinizing cracks in the economy’s glossy veneer.

JPMorgan copresident and investmen banking head Daniel Pinto told Business Insider in March that a 40% correction, triggered by inflation and rising interest rates, could be looming on the horizon.

The market’s biggest money managers are already positioning as if a major economic downturn is near, according to research this month from Bank of America Merrill Lynch.

And while they’re quick to note that no one can predict the next collapse, Wall Street’s top restructuring bankers are also joining in the chorus cautioning that the economic boom may be on its last legs.

“I do think we’re all feeling like where we were back in 2007,” Bill Derrough, the cohead of recapitalization and restructuring at Moelis & Co., told Business Insider. “There was sort of a smell in the air; there were some crazy deals getting done. You just knew it was a matter of time.”

Business Insider spoke with several top restructuring bankers who were all buoyant on the outlook for their industry, in part because of disconcerting trends facing debt-burdened companies but also because of how the business has changed since the last financial crisis.

Massive debt, rising interest rates, flimsy covenants

The global default rate for weak companies is indeed very low; it climbed in March to 3.9% on the struggles of a handful of retail and oil and gas firms, but it ticked back down to 3% in April and is expected to dip to 1.2% a year from now, according to Moody’s.

But as Moelis alluded to in his investor call, the amount of high-yield corporate debt — bonds and loans issued to riskier companies — doled out in the US in recent years is at levels far exceeding precrisis highs.

Historically, large volumes of high-yield issuance “has led, after a period of time, to an increased level of restructuring,” according to Steve Zelin, head of the restructuring in the Americas at PJT Partners.

Four of the past five years have seen both high-yield bond and leveraged loan issuance that exceeded 2007’s precrisis levels. Further, 2017 was the highest year on record for US leveraged lending, with volume of $1.4 trillion nearly 25% more than the previous high point, in 2013, according to Thomson Reuters data.

“Even if there is not a recession or credit correction, with the sheer volume of issuance there are going to be defaults that take place,” said Neil Augustine, cohead of the restructuring practice at Greenhill & Co.

Granted, the glut of debt is in no small part attributable to the super-low-interest-rate environment imposed by the Federal Reserve following the crisis. Many companies took advantage and refinanced their debt before 2015 when a large swath was set to mature, kicking the can several years down the road.

But going forward “there’s going to be refinancing at significantly higher rates,” Zelin said, given the Fed in March hiked interest rates to the highest level since 2008 and is expected to unleash at least two more hikes in 2018.

Refinancing at higher rates will further shrink the margin of error for troubled companies, as they’ll have to dedicate additional cash flow to cover more expensive interest payments.

“When you have highly leveraged companies and even a modest rise in interest rates, that can result in an increase in restructuring activity,” Irwin Gold, executive chairman at Houlihan Lokey and cofounder of the firm’s restructuring group, said.

And as some bankers said, with investors stretching for yield amid low interest rates, covenant packages on debt deals have grown increasingly flimsy.

But another reason for optimism has to do with how restructuring has changed since the financial crisis. For top firms, it’s become all-weather business in which bankers can earn fees by solving problems and cleaning up balance sheets before a company is teetering upon financial ruin.

“The way restructuring used to work, it was more of an episodic business associated primarily with a spike in default rates,” Gold said. “When you get an environment like 2009, 2010, you’re obviously swimming in opportunities, but we’re quite busy right now and we have been for the last couple of years. We’re always prepared. We’re going after opportunities all the time.”

Part of Moelis & Co.’s strategy involves working with clients before they ever end up in bankruptcy court — arranging debt buybacks and using exchange offers to lessen the debt load and capture discounts. About 50% of its restructuring mandates are completed out of court, according to the firm.

‘There will be a massive amount of work to do’

Still, some firms have been filling out their rosters with talent to be prepared should the economy take a turn for the worse.

“The restructuring business is a good business during normal times and an excellent business during a recessionary environment,” Augustine said. “Ultimately, when a recession or credit correction does happen, there will be a massive amount of work to do on the restructuring side”

Greenhill hired Augustine from Rothschild in March to cohead its restructuring practice. The firm also hired George Mack from Barclays last summer to cohead restructuring. The duo, along with Greenhill vet and fellow cohead Eric Mendelsohn, are building out the firm’s team from a six-person operation to 25 bankers.

Evercore Partners in May hired Gregory Berube, formerly the head of Americas restructuring at Goldman Sachs, as a senior managing director. The firm also poached Roopesh Shah, formerly the chief of Goldman Sachs’ restructuring business, to join its restructuring business in early 2017.

“It feels awfully toppy, so people are looking around and saying, ‘If I need to build a business, we need to go out and hire some talent,'” one headhunter with restructuring expertise told Business Insider.

It’s not exactly a war for talent at this point, though. Firms are primarily adding for junior and mid-level positions, according to the recruiter, who’s noticed job advertisements online and in trade publications for restructuring positions from several large firms.

“Places that don’t traditionally need to advertise in trade rags are popping up,” the recruiter said. Evercore, for instance, has job postings online for restructuring analysts, associates, and vice presidents.

“In our world, people are just anticipating that it’s coming. People are trying to position their teams to be ready for it,” Derrough said. “That was the lesson from last cycle: Better to invest early and have a cohesive team that can do the work right away and maybe be a little bit overstaffed early, so that you can execute for your clients when the music ultimately stops.”

It’s anybody’s guess when that day will come, as nobody has a crystal ball, aside from Ken Moelis, who is said to keep one on a stand in his office that he picked up at a flea market in Paris.

Join the conversation about this story »

NOW WATCH: Millennials are driving a shift in investing — here’s how to meet your financial and social impact goals

1 note

·

View note

Text

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

New Post has been published on http://foursprout.com/wealth/the-wall-street-bankers-who-feast-during-recessions-say-theres-a-smell-in-the-air-and-its-starting-to-feel-like-2007-mc-hli-ghl/

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

The global economy is growing and corporate defaults are low and projected to drop even further.

Yet the Wall Street investment bankers who feast during recessions are optimistic about their business, and some say it’s starting to feel like it did just before the financial crisis.

Top restructuring firms have been filling out their rosters of talent to be prepared in case of an economic recession.

Restructuring bankers told Business Insider that a massive amount high-yield debt issued in recent years could produce defaults and keep them busy even without a recession.

Another source of optimism: The restructuring business has changed since the last financial crisis, with firms finding year-round work across the globe by providing solutions to companies before they get to bankruptcy court.

At an earnings call in April, an analyst pressed bank CEO Ken Moelis on his rosy outlook for his firm’s restructuring business — the corner of Wall Street known for advising companies with messy books veering toward bankruptcy.

For a healthy chunk of his opening commentary, the namesake founder and CEO of independent investment bank Moelis & Co. touted his firm’s “market-leading restructuring business” for supplying meaningful activity.

“Your comments were surprisingly positive,” said Ken Worthington, a senior equity analyst with JPMorgan Chase. “Is this sort of steady state for you in a lousy environment? Can things only get better from here?”

On the surface, market conditions are showing few signs of distress. The economies in the US and throughout the developed world are growing, the stock market has been upbeat despite fits of volatility, and corporate default rates remain low and are projected to fall further in 2018 and beyond.

So why was Moelis so optimistic about his restructuring team?

“Look, it could get worse. I guess nobody could default,” Moelis said. (Keep in mind that “worse” from the perspective of a restructuring banker, who feasts during recessions, means “better” for most of the rest of the world). “But I think between 1% and 0% defaults and 1% and 5% defaults, I would bet we hit 5% before we hit 0%.”

The billionaire dealmaker isn’t alone in his sentiment. Many on Wall Street are scrutinizing cracks in the economy’s glossy veneer.

JPMorgan copresident and investmen banking head Daniel Pinto told Business Insider in March that a 40% correction, triggered by inflation and rising interest rates, could be looming on the horizon.

The market’s biggest money managers are already positioning as if a major economic downturn is near, according to research this month from Bank of America Merrill Lynch.

And while they’re quick to note that no one can predict the next collapse, Wall Street’s top restructuring bankers are also joining in the chorus cautioning that the economic boom may be on its last legs.

“I do think we’re all feeling like where we were back in 2007,” Bill Derrough, the cohead of recapitalization and restructuring at Moelis & Co., told Business Insider. “There was sort of a smell in the air; there were some crazy deals getting done. You just knew it was a matter of time.”

Business Insider spoke with several top restructuring bankers who were all buoyant on the outlook for their industry, in part because of disconcerting trends facing debt-burdened companies but also because of how the business has changed since the last financial crisis.

Massive debt, rising interest rates, flimsy covenants

The global default rate for weak companies is indeed very low; it climbed in March to 3.9% on the struggles of a handful of retail and oil and gas firms, but it ticked back down to 3% in April and is expected to dip to 1.2% a year from now, according to Moody’s.

But as Moelis alluded to in his investor call, the amount of high-yield corporate debt — bonds and loans issued to riskier companies — doled out in the US in recent years is at levels far exceeding precrisis highs.

Historically, large volumes of high-yield issuance “has led, after a period of time, to an increased level of restructuring,” according to Steve Zelin, head of the restructuring in the Americas at PJT Partners.

Four of the past five years have seen both high-yield bond and leveraged loan issuance that exceeded 2007’s precrisis levels. Further, 2017 was the highest year on record for US leveraged lending, with volume of $1.4 trillion nearly 25% more than the previous high point, in 2013, according to Thomson Reuters data.

“Even if there is not a recession or credit correction, with the sheer volume of issuance there are going to be defaults that take place,” said Neil Augustine, cohead of the restructuring practice at Greenhill & Co.

Granted, the glut of debt is in no small part attributable to the super-low-interest-rate environment imposed by the Federal Reserve following the crisis. Many companies took advantage and refinanced their debt before 2015 when a large swath was set to mature, kicking the can several years down the road.

But going forward “there’s going to be refinancing at significantly higher rates,” Zelin said, given the Fed in March hiked interest rates to the highest level since 2008 and is expected to unleash at least two more hikes in 2018.

Refinancing at higher rates will further shrink the margin of error for troubled companies, as they’ll have to dedicate additional cash flow to cover more expensive interest payments.

“When you have highly leveraged companies and even a modest rise in interest rates, that can result in an increase in restructuring activity,” Irwin Gold, executive chairman at Houlihan Lokey and cofounder of the firm’s restructuring group, said.

And as some bankers said, with investors stretching for yield amid low interest rates, covenant packages on debt deals have grown increasingly flimsy.

But another reason for optimism has to do with how restructuring has changed since the financial crisis. For top firms, it’s become all-weather business in which bankers can earn fees by solving problems and cleaning up balance sheets before a company is teetering upon financial ruin.

“The way restructuring used to work, it was more of an episodic business associated primarily with a spike in default rates,” Gold said. “When you get an environment like 2009, 2010, you’re obviously swimming in opportunities, but we’re quite busy right now and we have been for the last couple of years. We’re always prepared. We’re going after opportunities all the time.”

Part of Moelis & Co.’s strategy involves working with clients before they ever end up in bankruptcy court — arranging debt buybacks and using exchange offers to lessen the debt load and capture discounts. About 50% of its restructuring mandates are completed out of court, according to the firm.

‘There will be a massive amount of work to do’

Still, some firms have been filling out their rosters with talent to be prepared should the economy take a turn for the worse.

“The restructuring business is a good business during normal times and an excellent business during a recessionary environment,” Augustine said. “Ultimately, when a recession or credit correction does happen, there will be a massive amount of work to do on the restructuring side”

Greenhill hired Augustine from Rothschild in March to cohead its restructuring practice. The firm also hired George Mack from Barclays last summer to cohead restructuring. The duo, along with Greenhill vet and fellow cohead Eric Mendelsohn, are building out the firm’s team from a six-person operation to 25 bankers.

Evercore Partners in May hired Gregory Berube, formerly the head of Americas restructuring at Goldman Sachs, as a senior managing director. The firm also poached Roopesh Shah, formerly the chief of Goldman Sachs’ restructuring business, to join its restructuring business in early 2017.

“It feels awfully toppy, so people are looking around and saying, ‘If I need to build a business, we need to go out and hire some talent,'” one headhunter with restructuring expertise told Business Insider.

It’s not exactly a war for talent at this point, though. Firms are primarily adding for junior and mid-level positions, according to the recruiter, who’s noticed job advertisements online and in trade publications for restructuring positions from several large firms.

“Places that don’t traditionally need to advertise in trade rags are popping up,” the recruiter said. Evercore, for instance, has job postings online for restructuring analysts, associates, and vice presidents.

“In our world, people are just anticipating that it’s coming. People are trying to position their teams to be ready for it,” Derrough said. “That was the lesson from last cycle: Better to invest early and have a cohesive team that can do the work right away and maybe be a little bit overstaffed early, so that you can execute for your clients when the music ultimately stops.”

It’s anybody’s guess when that day will come, as nobody has a crystal ball, aside from Ken Moelis, who is said to keep one on a stand in his office that he picked up at a flea market in Paris.

Join the conversation about this story »

NOW WATCH: Millennials are driving a shift in investing — here’s how to meet your financial and social impact goals

1 note

·

View note

Text

32 Ecommerce Experts Give Their #1 Piece of Advice on International Ecommerce

To wrap up our book on cross-border commerce and launching your brand international, I knew it was necessary to make sure everything we said wasn’t a “strategy in a bubble.”

In other words, I wanted to ensure that industry experts and brands who have done this before offered the same advice as this book does.

So, per usual, I asked them:

What’s your #1 tip for brands looking to launch internationally?

In total, I got 32 responses, all below, which turned into 8 categories of advice.

Dive on in. Learn from the experts and those who have done it before.

The International Expansion Playbook

What if you are ready to invest in international expansion and localization to own a brand new market long before you competitors?

That’s what this guide will teach you to do.

Get it now.

Just Do It!

David Tendrich, CEO & Co-Founder, Reliable PSD

Give it a shot. It’s so easy to test traffic from other countries with PPC advertising that why wouldn’t you try it?

The keyword research will also give you insight into how people in those other countries are searching for your products.

You might discover that they call it a “satchel” instead of a “bag”, “bespoke” instead of “custom,” etc.

Sammy Gibson, Director, Neon Poodle

Just do it! We sat down to discuss starting a branch in Europe last September, four months later we moved to start it, now we also have a branch in USA.

If you have every faith in your product and believe you can expand, don’t take the time to think about it or dwell on it. You need to move and move fast. Guarantee your competitor will be thinking about it, so beat them!

William Harris, Ecommerce Consultant, Elumynt

Do it. One of the biggest reason people don’t do it is because they’re afraid of the unknown – so bring on an expert and eliminate that excuse.

Sure, customs, shipping, language, etc – those barriers add up, but you aren’t the first person to do it.

Find someone that’s done it in a different niche, reach out to experts that have experience launching brands in other markets and do it. It will cost you less than if you never get around to doing it.

Find the Low Hanging Fruit

Max DB, Founder, HeyMaxDB – Content Strategy

Find the low hanging fruit.

Start looking at your traffic, add an email capture on your “We only ship to the U.S.” page. Look at the countries that stand out.

That’s where you should go. Always go where you have guaranteed customers.

Emil Kristensen, co-founder & CMO, Sleeknote

Paid advertising is a good way to explore international opportunities because you can see how different groups respond to your efforts and better determine which countries to proceed with.

It’s always a good idea to exploit low hanging fruits.

An example is if your website is in English expand to other English speaking countries. You should always consider language barriers and if your paid advertising shows good results in countries with a different language than your own, consider translating it.

Eric Carlson, Co-Founder, 10X Factory

International expansion is one of the easiest ways to grow revenue. When you open up foreign markets, you can access cheaper ad inventory & rapidly expand your market.

I often see EU & APAC countries generate cheaper conversions especially in beauty & fashion than the US.

John Lott, CFO/COO, SpearmintLOVE

Facebook has been a great tool for growing our international business. You can target by country, language and device to reach the right customers.

Jordan Brannon, President and COO, Coalition Technologies

Brands looking for international growth in 2018 need to look for the low hanging fruit / opportunities first, before pursuing major new markets with decidedly different audiences.

India and China are always tempting, but the cost to enter and the margins available aren’t sustainable for most US companies.

Low hanging fruit are countries with favorable exchange rates and tax for US goods, and that may not require significant, unique content, customer support, or operational shifts.

Localization is Key

Bill Widmer, eCommerce SEO & Content Marketing Consultant

Create international versions of your site, like www.yoursite.com.au for Australia for example. This will help massively with SEO in your target country –– plus, search is often less competitive outside the US.

For added benefit, translate that version of your site to match the local language. This will further improve your search results, conversions, and trust.

Daniel Wallock, Marketing Strategist, Wallock Media

If your looking to expand internationally then you need to start changing your marketing and social media content to appeal to an international audience as well.

You don’t need to make any major chances per-say, but I would spent a lot of time trying to understand exactly where your customers in those new markets are hanging out and what makes them different and what makes them the same as your current customers.

Edin Sabanovic, senior CRO consultant, Objeqt

Make an effort to localize the content and take into account cultural differences, nuances of language (preferably use a native speaker).

Provide customer support and every other piece of content in local language.

Timi Garai, Marketing Manager, Antavo Loyalty Management Software

Know your target market, and do localization right. Beyond translating your brand’s messages and all the available texts on your site, make sure that you find your product market fit.

For example, if you are selling books, you need to do a market research to see, what kind of genre or writers are liked the most in your target country.

For example, spiritual books can sell the best in Spain, while in Sweden thriller stories what people like the most. So you need to localize your product offerings, too.

And don’t forget to offer preferred payment options.

While in the UK people like to use their credit card during online shopping, in the Benelux people like to transfer their money directly from their bank account. All in all, try to find the best tone and technical solutions which your target audience is used to.

Jason Ehmke, Senior Client Data Analyst, AddShoppers.com

Regionalize your content. Some styles or colors won’t be as popular in one country as they are in another.

Some colors have a very different meaning in another country. Do your research and make sure what you’re presenting is applicable to the audience in the country you’re expanding to.

Work Out the Economics

James Brown, Client Engagement Manager, RANDEM

Before you pull the trigger, ensure you have worked out all the economics of selling your products in the new territory; and that these economics – along with currency exchange rate risk – are sufficiently favourable that you will remain profitable and successful.

Many businesses who have had much success on their home turf have gone on to replicate their success with customers abroad resulting in great sales figures, but have nonetheless gone broke as the cost of serving these customers turned out too heavy for even their local sales to support.

Bill Bailey CEO, Nodal Ninja

Watch your analytics and know which countries are driving the most traffic. Work to overcome language barriers through translation helpers and use currency conversions.

Look for potential distributors in your target countries.

Customers prefer to buy locally as is much more convenient. Value Added Tax (VAT) and shipping can be very high in some countries.

Consider offering added discounts or promotions to help offset these added costs without sacrificing to much loss in profit. A little profit is better than no profit. Soon one person will tell another and so on.

Understand Regional Customer Expectations

Ross Simmonds, Founder, Foundation Marketing

Finding success on an international scale isn’t an easy task. It’s easy to simply put up a Facebook post and change your currency settings to announce your launch but it needs to be more intentional than that.

Spend time understanding the customs of the new places in which you’re looking to target.

Take time to understand what networks they’re using on a more regular basis.

Establish a launch strategy that ensures that when you do make that first initial push into a new country – the audience you’re looking to target within it have no choice but to listen.

One simple tactic that can be a game changer for international expansion is partnering up with brands, writers, media outlets or influencers who have a following in that particular space. Collaborate with them to create a launch story that they know their audience will love and find authentic.

Josh Mendelsohn, VP Marketing, Privy

Do your homework first! Make sure you know exactly how you will fulfill international orders and what that does to your margin before you start selling. And if you’re creating multi-lingual product pages, use a professional translator who will make sure you avoid any unintended mistakes.

Kaleigh Moore, Freelance Writer

Make sure UX remains positive for international customers.

That might mean doing focus group work or having an extended beta test to be sure you get things right. You only have once chance to wow a new customer, so you have to get this right.

Jamie Turner: Author, Speaker, and CEO, 60SecondMarketer.com

If you’re a brand that plans to expand internationally, there are two important things you should keep in mind.

The first is that we’re all the same. And the second is that we’re all different.

What do I mean by that? I mean that

We’re all human beings and human beings behave similarly across all borders

Your brand has to act like a local no matter what country you’re doing business in.

In other words, we all behave the same (when it comes to buying products) and we’ll buy more of your products if you act like a local.

David Feng, Co-Founder and Head of Product, Reamaze

Understand local markets by researching purchasing trends and advertising trends.

Identify cultural and sub-cultural phenomenons so you can take advantage of them while relating effectively to local social crazes.

Understand international shipping and payment policies and how they will affect your (and your customers’) costs.

Plan your localization if applicable and put a structured plan in place to adapt your product, team, and workflows. Stick to all of the above.

Erik Christiansen, CEO, Justuno

Focus on personalization. Deliver personalized messages by understanding WHO your visitors are. One method to achieve this is by leveraging geo-targeting to deliver messages in a different language or show specific offers to visitors from different locations.

Sweta Patel, Director of Demand Generation, Cognoa

I would say test an area before you establish the product globally. You want to know which areas will dominate when it comes to selling your product.

For example, one startup which entailed a provider and a consumer side started with their providers in certain areas first.

Once they had their providers set in the specific areas, they started creating demand in those areas. Make sure you validate your market before you deploy globally.

The Timing Must Be Right

Christopher Cowden, Director of Operations, Grace and Lace

Make sure your timing is right.

If you have solid momentum with your core region, then looking internationally may make sense to you. Same advice as before, get counsel. Find experts who have already paid the price of making the mistakes you need to make to be successful.

Doug Root, CEO & Website Guy, Atlanta Light Bulbs

Test the waters in Canada, Mexico and places nearby. International customers have their challenges. We do a lot of International business and we use a quote system and make direct contact before closing the deal.

Unfortunately there is a lot of fraud out there so make sure you have the checks in place on accepting credit cards.

We offer Canada & Mexico the ability to purchase with credit cards but outside of that it is wire transfer only.

Greg Johnston, Managing Director, Be A Part Of

I would just say, make sure to have your home country perfected and solid before expanding.

Expansion brings many twists and turns, border fees etc… unless you are expanding to the U.S., as a U.S. business you are in the biggest market possible.

Make it work there first….perfectly.

Use Marketplaces + Local Partners

James Thomson, President, PROSPER Show

Think Tmall in China — biggest consumer channel in China, and the marketplace helps brands to protect their content.

Donald Pettit, Sales & Partners Manager, SalesWarp

Do your homework, and find a local partner. Identify cultural trends, recognize buyer expectations, and gain an understanding of the customer buying journey.

A partner can provide these crucial insights and help you to avoid any cultural misinterpretations.

There’s nothing more cringe-inducing than to find a piece of content that wasn’t sensitive to the nuances of their intended audience. A local partner can help avoid these embarrassments.

Jason Boyce, Co-founder & CEO, Dazadi

Expanding internationally using an online marketplace’s infrastructure, like Amazon FBA, is a great way to learn what customers in other countries like to buy from your catalog.

It’s a low cost intelligence gathering source that will save you a lot of heartache, because different cultures like different things.

Lastly, if you are selling other people’s brands, make sure to speak to those brands about whether you have the rights to sell in foreign lands. It will be painful if you land a bunch of inventory only to find that someone else has the exclusive selling rights in your new territory.

Remember: Global Shipping is Hard

Aaron Houghton, Co-Founder and CEO, BoostSuite

Shipping consistency and speed will be your number biggest hurdle as you figure out how to acquire customers in new countries.

Test shipping a few of your trickiest products to friends or family in a few countries before opening up sales to those countries through your online store.

Harrison Dromgoole, Content Creator, Ordoro

One of the most significant hurdles to selling globally is shipping. It’s complicated enough domestically, even more so internationally.

To ease up on the process and cut down on your shipping workflow, look for shipping software that can autofill customs forms or route orders to international 3PLs (third-party logistics providers) if you’re tapping them for fulfillment.

Ed Lasher, Marketing Guy, Bob Johnson’s Computer Stuff, Inc.

Be careful.

Plan ahead for increased shipping rates and make sure to check for any country-specific regulations or restrictions that might prevent your product from being delivered, even if you sell something you think is innocuous.

Did you know you can’t ship calendars to Malaysia, shoes to Nigeria or yarn to Italy?.

Rupert Cross, Digital Director, 5874

It’s important not to jump too far ahead and be too ambitious – not everything will sell in all countries.

Don’t overprice shipping as this is a quick way to lose customers – localised site needs localised shipping.

It’s also important you get your translations right, customer service via Google Translate isn’t great, so it’s best to hire a freelancer. It’s not as expensive as you might think and will improve your visits and sales dramatically.

We recommend using a PIMS system to save time and effort with product listings and sync stock.

The International Expansion Playbook

What if you are ready to invest in international expansion and localization to own a brand new market long before you competitors?

That’s what this guide will teach you to do.

Get it now.

Want more insights like this?

We’re on a mission to provide businesses like yours marketing and sales tips, tricks and industry leading knowledge to build the next house-hold name brand. Don’t miss a post. Sign up for our weekly newsletter.

Email*

jQuery(document).bind('gform_post_render', function(event, formId, currentPage){if(formId == 1) {if(typeof Placeholders != 'undefined'){ Placeholders.enable(); }} } );jQuery(document).bind('gform_post_conditional_logic', function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger('gform_post_render', [1, 1]) } );

32 Ecommerce Experts Give Their #1 Piece of Advice on International Ecommerce published first on http://ift.tt/2wGG0YJ

0 notes