#Creole Heritage Month

Explore tagged Tumblr posts

Text

October is Creole Heritage Month in Louisiana!

‘Eve’s Bayou’ — I missed so many other scenes with Kouri-Vini dialogue first time around, here’s an updated version. The last clip is from this video.

#Kouri-Vini#Kouri Vini#Louisiana Creole#Eve’s Bayou#Black American culture#Black American language#Louisiana Creole Heritage Month#Creole Heritage Month#Black American#Louisiana#Black American Creoles#Creoles#Creole#Louisiana Creoles#Kreyol

25 notes

·

View notes

Text

#creole heritage month#creole#caribbean#cuban spanish#dominican spanish#puerto rican spanish#papiamento#indian words#indigenous words#caribbean language#broken european language#lmsu

7 notes

·

View notes

Text

on the topic of paime actually happy creole heritage month and belated jounen kwéyòl here is a good recipe for paime. you can use vegan margarine instead of butter (there is a good chance when she says butter she is talking about margarine anyway), you can use grated pumpkin instead of coconut and you can use pretty much any milk instead of coconut milk. the banana leaves are non negotiable though*

youtube

*kidding. you can replace those with foil.

27 notes

·

View notes

Text

#caribbean creole#haiti#st lucia#guadeloupe#dominica#martinique#san miguel#panama#antillean creole#french based patois#kreyol#trindad & tobago#creole languages#creole heritage month

11 notes

·

View notes

Text

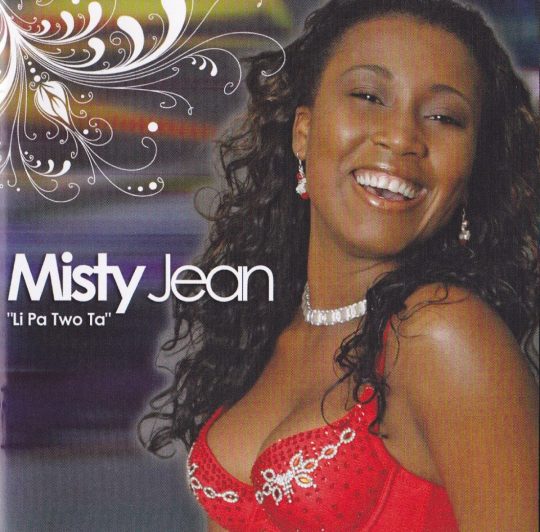

OLDIES SUNDAY: @MistyJeanMusic - Kijan Lari A Ye (2008)

The month of May is recognized as “Haitian Heritage Month“, and we’re sending love to Haiti, and those of Haitian descent on “Oldies Sunday“. Today, we go back in time a lil to check out Recording Artist Misty Jean’s “Kijan Lari A Ye“. Produced by Jeff Wainwright and released through Melodie Makers, Inc. in 2008, “Kijan Lari A Ye” is a Compas single by Misty Jean that started a party in the…

View On WordPress

#13thstreetpromo#13thstreetpromotions#2008#blog#Compas#Haiti#Haitian#Haitian Creole#Haitian Heritage Month#Jeff Wainwright#Kijan Lari A Ye#Li Pa Two Ta#Melodie Makers Inc.#Misty Jean#music#music video#Old School#Oldies#Oldies Sunday#riddim#video#youtube

0 notes

Text

Our second edition of the Black History Month Author Spotlight series features beloved author, C.C. Hill (@when-life-gives-you-lemons-if)!

(CC is an absolute institution. What better way to celebrate Valentine’s than by doing a feature of the slice-of-life romance queen herself? CC is one the most inspiring, supportive IF writers out there, and it was a great honor to pick her brain! Read on for pandemic-setting feel good stories and Creole-based spells!)

Author: C.C. Hill

I'm from Haiti, born and raised. I love red wine, ice cream, and I'm obsessed with true crime podcasts.

Games: When Life Gives You Lemons (Slice-of-Life)

Synopsis: You play as an MC starting a new life in a small town called Lemon. It’s a story about self-discovery, love, and parenthood—a comfort story where the love interests want to sweep you off your feet.

Games: The Midnight Saga (Horror)

Synopsis: After finding yourself trapped in another dimension, you and your friends must fight for survival and defeat the monsters that lurk in the shadows. Make sure to grab a weapon as your quiet Halloween night turns into an out-of-this-world adventure!

Quote from the interview:

What mostly inspired Lemon in particular was the need for a feel-good story—a story where the character just needs a break. No magic, no monsters, just going through life and having the romance options fall in love with them no matter what. It was just the need for comfort, for feel-good moments, for romance, and a little bit of drama.

Read on for the full interview!

Tell me more about yourself! What are some things new readers or long-time readers might not know about you?

I'm from Haiti, born and raised. I love red wine, ice cream, and I'm obsessed with true crime podcasts.

Can you tell me a bit about what you’re working on right now and your journey into interactive fiction? What inspired the game/story you’re currently writing?

I'm working on so many things it should be illegal for my brain to operate this way. But mainly, When Life Gives You Lemons. My plan is to focus on the final part in March, do some beta testing, and submit it to Hosted Games in April for my birthday month.

I'm also under contract with Heart’s Choice, writing Spices of the Heart, with hopes of completing it this year. On top of that, I’m working on publishing my first visual novel, The Wedding. It’s close to completion, and I have the third quarter of 2025 planned for publication.

I only started writing interactive fiction in 2020. When the pandemic hit, I needed something to keep my brain occupied, and five years later, I’ve published three games and still have a ton of projects in progress.What mostly inspired Lemon in particular was the need for a feel-good story—a story where the character just needs a break. No magic, no monsters, just going through life and having the romance options fall in love with them no matter what. It was just the need for comfort, for feel-good moments, for romance, and a little bit of drama.

How has your identity, heritage/background, upbringing, or personal experiences influenced your storytelling or writing process? OR How does your work feature aspects of your identity / experience?

My first game, The Midnight Saga, was heavily inspired by my background and where I'm from. The story itself is based on an old Haitian folklore about not staying outside after midnight—if you do, the Keeper of Midnight will eat you. I took that idea and built the characters around it.

I even managed to include some spells written in Haitian Creole. It was a lot of fun to write, and even though Book 2 is currently on hiatus, this story has a special place in my heart because it was my first game. The characters are a representation of my people and the struggles they’ve gone through. I’m really happy that it was my debut story.

What are some of the most rewarding or challenging aspects of writing Interactive Fiction for you?

For me, it’s branching and being able to write an MC and other characters in a way that readers can truly connect with. Lately, I’ve been writing a lot of feel-good romance and slice-of-life stories, and I’m starting to feel like this is my comfort zone—and I want to stay here forever.

I never want to create a romance option that is inherently bad or purposely deceitful. My biggest challenge is writing characters who are flawed and complex—where readers can love them or hate them—but making sure they aren’t just villains for the sake of it. They’re simply existing in the world they were created in.

What does your writing process look like? Any rituals or habits? Any tips, tricks, philosophies or approaches that have worked very well for you?

My writing process is a mess. My brain gets pulled in so many directions. When I get an idea, I have to code it, shape it, and give it life—otherwise, it’s going to bug me forever. That’s why I end up with so many WIPs. I need to see them through, at least to a short demo, to see if they make sense.

My desk is also full of notes, and I basically write on anything—pieces of napkins, tissue boxes, whatever is nearby. One weird habit I have is that some of the best changes I’ve made to my games, those "spark" moments, happen when I’m in the shower. It’s weird and strange, but it works.

What’re you excited to tackle/implement/work on next? Or anything you’re looking forward to in the year ahead?

Keep writing romance and feel-good slice-of-life stories. Get When Life Gives You Lemons published this year. Focus on doing this full-time. Publish my visual novel.

Overall, just stay busy and be productive.

If you were to say one thing to your readers, other authors, and/or the interactive fiction community: what would it be?

To the readers—us authors don’t have all the answers. Sometimes, we start writing a story and end up forgetting certain plots or characters, which is easy to do when writing interactive fiction. So yes, we often write ourselves into a corner and just put a period there so the story can progress.

To the authors—write stories you love, something you would want to read. It makes it easier to keep going because if it’s a story you love, you’ll want to see how it ends, and that will push you to persevere.

This-or-that segment: (red = CC's pick)

Coffee or tea?

Early mornings or late nights?

Angsty or Cozy romances?

Steady progress or frenzied binge-writing followed by periods of calm?

Introvert or extrovert?

Plotter or pantser?

#interactive fiction#author feature#black history month#game developer#interview#cc hill#wlgyl if#midnight saga if

165 notes

·

View notes

Text

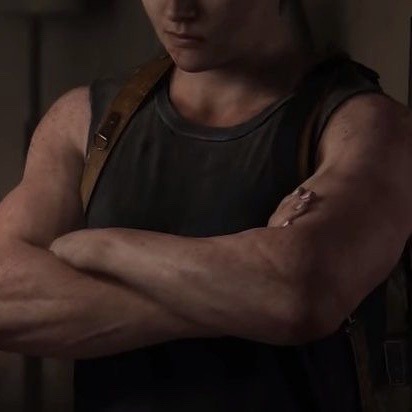

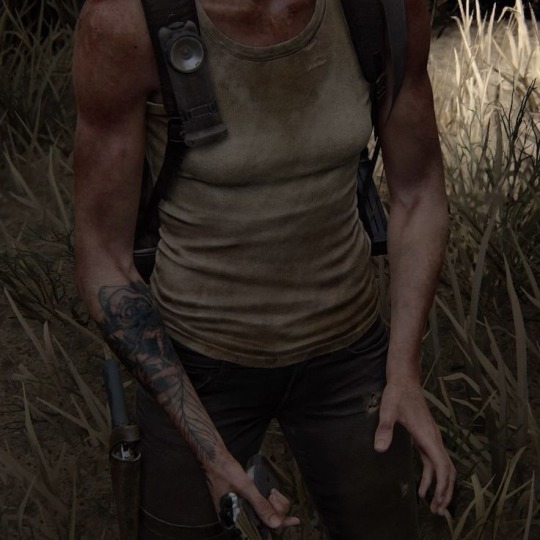

ellie & abby w/ a latina partner

warnings: fluff! , fem!reader + r is latina ;)

a/n: in honor of hispanic heritage month!!!! we blowin’ this bitch up. with my headcanons, that is. mostly mexican headcanons (for the reader), because that’s really the only dialect/tradition & cultural that i know ┐( ˘ 、 ˘ )┌

also, SUPPORT HISPANIC/LATINO WRITERS, ARTISTS, AND BUSINESSES!!!! or else... >:(

abby WOULD DEFINITELY try learning spanish. she’d pick it up here and there because of manny, but the farther you guys develop into the relationship, the more she wants to immerse herself within your culture and your language.

and dare i say it, but she’s pretty darn good at speaking spanish.

the first time she speaks spanish to you, it catches you off guard.

you’d come home from your day out with your friends and she’d just peek out from around the corner like, “mi amor, que pasa?”

“Q-QUE?! WHAT?”

“WHAT?! did i say something wrong, babe?” she asks, a frown forming on her face.

“oh no, mi corazon, you just caught me off guard!” you smile, reaching up to caress her rosy cheeks, “have you finally been pickin’ up what i’ve been puttin’ down, abs?”

she scoffs playfully, “supongo, reinita.”

"okay white girlllll~"

abby would love helping you in the kitchen, cooking up your favorite traditional meals.

but sometimes she’d make a mistake, putting the wrong seasoning in the rice, overcooking the beans, or burning the tortillas. (😭) and you’d temporarily ban her form the kitchen, meaning she’d only be able to watch you.

but every once in a while, she’d remind you about the mole or the broth for the caldo de res.

you’re grateful she reminds you and she’s just happy to be of service.

if you’re not mexican specifically, she’d most likely start arguments between you and manny about the differences in the dialects and slang since she’s not too familiar with the other latin slang out there. but she does her best

if you happen to be brazilian, she’ll do her best to research and become more familiar with the portuguese language and the brazilian culture.

if you’re haitian, she’ll love learning creole and/or french for you since she’s more familiar with french. (i have a feeling she’s had french lessons in the past/someone she knew was french so she learned it from them!)

ellie BUTCHERS the FUCK outta some words in spanish. like she genuinely CANNOT pronounce “cuatro.” like…

but it’s okay because you know what she’s trying to say…. most of the time.

“quieres comer, mamashita?" with heavy pronunciation on the “shi” sound.

you stare at her for a moment, trying to figure out if she’s be funny or not. “what?”

“what?” she replies

“baby thats not-“

ellie is banned from the kitchen. permanently. she is not allowed anywhere NEAR that bigass pot on the stove.

when you find her sneaking into the kitchen when she’s trying to steal a tamale, you can’t help but giggle as you try and drag her away from the stove.

“ellie i already told you twice!- you can't be in here!!”

“YOU CANT MAKE ME!”

*insert that meme of the kid running away w/ the knife*

ellie LOVES dancing with you. whether its cumbia, salsa, bachata, or samba, ellie is IN IT!

i think cumbias her fave (bc it’s my fav). and she’s the best at it.

whenever she’s invited to the carne asada, she’s the only one that all your cousins, your tias, and your abuela want to dance with.

by the 9th-10th song, she’s already complaining about how she’s ready to go to sleep (and she does in your old room at your family’s house) and how she underestimated your grandma’s stamina.

mi amor, que pasa? = my love, what’s going on/how are you?

mi corazon = my heart

supongo, mi reinita = i guess, my little queen

quieres comer? = do you want to eat?

constructive criticism is appreciated !!!

#basically a self insert fic#hispanic heritage month#tlou#tlou2#tlou x reader#tlou ellie#tlou abby#ellie tlou#abby tlou#ellie williams#ellie williams x reader#ellie williams x you#abby anderson#abby anderson x you#abby anderson x reader#abby anderson x y/n#ellie williams x y/n#latina!reader#ellie the last of us#abby the last of us#𝐛𝐞𝐚𝐫𝐢𝐞𝐢𝐨 ୧ *.˚₊

541 notes

·

View notes

Text

bon jounen kwéyòl èk riot of rot. here is the plaguebringer en kwéyòl.

october is creole heritage month and here in st lucia the last sunday of the month is creole day (joune kwéyòl) so these two things often overlap. so.

56 notes

·

View notes

Text

nov 9 - nov 13 readings

hi! this is reaux (she/they)! as many of you know, BFP is slowly waking up and will be undergoing a full makeover in the coming months. in the mean time, to help get back into the pattern of posting and to continue to share resources, i want to start posting what i read each week!

without further ado, here is everything i've been learning from and engaging with so far just between last saturday night [nov 9, 2024] and right now [wednesday afternoon, nov 13, 2024]! i tried to post this on tiktok @/edgeofeden.17 (go check me out for cool political talks and reading recs!) with my reactions as well, but they said it violated community guidelines :(

journal article: The House on Bayou Road: Atlantic Creole Networks in the Eighteenth and Nineteenth Centuries

wikipedia: Plaçage

wikipedia: Signare

paperback book: Africans In Colonial Louisiana: The Development of Afro-Creole Culture in the Eighteenth-Century

article: Why Is Gen Z So Sex-Negative?: A prehistory of the Puriteen.

article: Policy-makers must not look to the “Nordic model” for sex trade legislation

article: Sex workers face unique challenges when trying to unionize: Anti-sex work stigma and labor status create roadblocks in sex workers’ fight against the industry status quo

wikipedia: Decriminalization of sex work

short youtube video: "Decriminalization of sex work does not mean the decriminalization of human trafficking."

short youtube video: What About Legalization? Decriminalization is the only solution

short youtube video: Dis/Ability and Sex Work Decriminalization

short youtube video: "Helping people through police is inherently coercive." - Gilda Merlot

wikipedia: Page Act of 1875

essay: Uses of the Erotic: The Erotic as Power by Audre Lorde

wikipedia: Erotic Capital

long youtube video: KATHERINE MCKITTRICK: Curiosities, Wonder, and Black Methodologies // 09.14.20

journal article: Black life is Not Ungeographic! Applying a Black Geographic Lens to Rural Education Research in the Black Belt

journal article: Black matters are spatial matters: Black geographies for the twenty-first century

journal article: Unspoken Grammar of Place: Anti-Blackness as a Spatial Imaginary in Education

short video: Chicago Works | Andrea Carlson: Shimmer on Horizons

zine: Evaluating What Skills You Can Bring to Radical Organizing

diagram + workbook?: The Social Change Ecosystem Map (2020)

essay: How to Build Language Justice

guide: Anti-Oppressive Facilitation for Democratic Process: Making Meetings Awesome for Everyone

radical resource library: Center for Liberatory Practice & Poetry

short essay: The Short Instructional Manifesto for Relationship Anarchy

essay/blog post: Access Intimacy: The Missing Link

i think that's everything? whew. let's see how i finish off the week! if you need PDFs for anything i didn't directly link, lmk and i'll find a way to get it to you. might upload it to my google drive or something!

--

topics: Louisiana Creole history + heritage, women of color + erotic capital, sex work decriminalization, Black geography, revolutionary organizing, language, relationship anarchy, disability, intimacy

#reaux speaks#resources#louisiana creole#creole#women of color#audre lorde#decriminalization#geography#landscape painting#organizing#community organizing#language#disability#accessibility#intimacy#relationship anarchy#anarchism#marriage#academia#political education#zine#skills

36 notes

·

View notes

Text

its haitian heritage month so now i HAVE to drop haitian shepard hcs every day especially the first day so bere we go🙄🙄

•ok so tanbou is the national instrument for haiti and i wholeheartedly feel like the shepards just,,,have one,,,chillin in their living room

•sometimes they fuck around w it, and by they i mean curly, just to fuck around w it he likes banging on things

•they absolutely love chiritos like omg they just have a big bin of them

•angela typically wears her headwrap at home, she wants her hair to breath but she also doesnt want it in the way, its something that followed her from her move from haiti🙏🏽🙏🏽

•literally the ONLY thing curly is ever allowed to touch while someone is cooking is the pilon (this thing used to crush up spices)

•angela gets too tired too fast trying to use it and tim is always busy trynna do somethin else, curly got that strength and rage to keep crushin those spices✊🏽✊🏽

•they literally love diri ak kalalou, mostly for the rice and sauce bc they arent PUSSIES who only eat the MEAT

•actually maybe they r pussies, angela and curly hate beans and so many haitian foods have beans in them so they take like 5 mins picking the beans out

•theyre all rum and raisin ice cream luvrs i wont apologize for this its so good man

•if there’s one thing spoiled haitian girls are always gonna be called, it’s fonfon, angela’s nickname right behind angel is fonfon (u pronouns it fah-fon, the on is said like the word on)

•keeping up this ‘them living in haiti’ hcs but listen to me,,,they’d live in one of those creole style houses in cap-haïtien or at least generally in one of those old houses in cap-haïtien bc those houses have my heart actually

•theres this thing called peinture à l’eau (in french) or peinti kò/peinti in kreyòl and its basically where u paint ur body for kanaval or rlly any celebriation, and thats what its always used for BUT sometimes ppl use it as just casual self expression and i think angela would do that and just, force curly and tim to do the same

•when sylvia comes over they just paint each other and dally comes up cause its time to go hes just like “what???happened here???” and sylvias like “dw bout it”

•sylvia loves cola lacaye and pat n to ice cream, the shepards have a few tubs of it and she just steals it like they wont fucking notice🤨🤨

•dally loves it too so he just lets her lol

•theres this game in haiti where everyone is in a circle with someone in the middle and theres this song playing, and the person in the middle has to look around for someone to dance w (presumably their crush) and sance gouyad (this dance) with them, so just hear me out,,, purly playing the game, WOAH

•angela and sylvia playing childhood haitian games>>>>

•like they WERE gossiping but holy fuck SOMETIMES they just wanna jump around and play and giggle and who r we to hate on em

18 notes

·

View notes

Text

4 notes

·

View notes

Text

on the topic of creole heritage month i need to ask my mom if shes planning on getting any smoked herring bc i canNOT end this month without any.

7 notes

·

View notes

Text

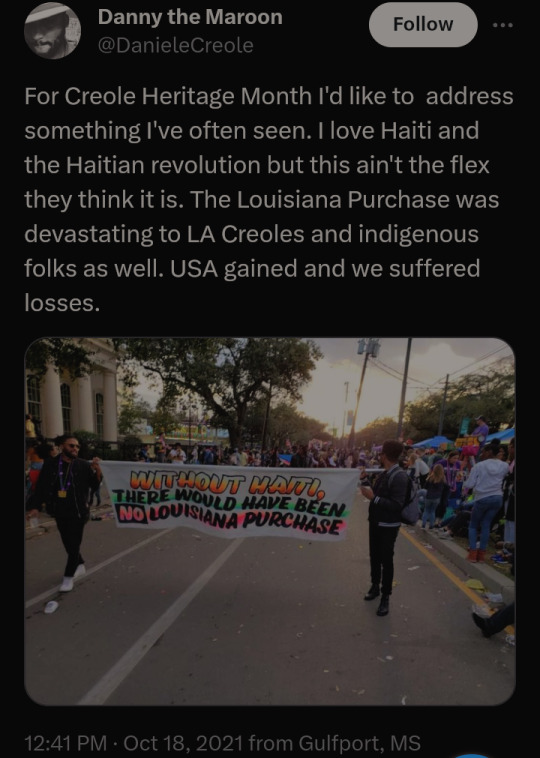

#creole heritage month#louisiana creoles#louisiana#haiti#haitian revolution#diaspora#black people#african diaspora

9 notes

·

View notes

Text

Happy Creole Heritage Month to us! 🌱⚜️

18 notes

·

View notes

Text

Selipha only considers Dominica a sibling out of the Caribbean, partially because of their closeness geographically and shared Creole heritage. It might not even be a mutual thing, but if anyone asked about siblings, she’d say she had the one. Physically, they’re probably a similar age, but Sel jokes that she’s the younger one because she got independence a few months after Dominica did.

#❝Watch the sunset at your shores.❞ — HEADCANON#I remember reading an essay that said#'On no other Antillean island that passed from French to British tutelage has the French legacy persisted so tenaciously...'#'with the notable exception of Dominica' and that kind of just sealed it for me#they're also a part of La Francophonie along with Haiti

2 notes

·

View notes