#Compliance automation

Explore tagged Tumblr posts

Text

Streamlining Business Processes with PDQ Docs: The Future of Document Automation Software

In today’s fast-paced business world, companies are constantly looking for ways to improve efficiency, reduce errors, and save valuable time. One of the most significant advancements in business technology is the use of document automation software. PDQ Docs is a leading solution in this field, designed to automate and streamline document creation and management processes, enabling businesses to operate more efficiently. Whether you are a small business or a large corporation, PDQ Docs can revolutionize the way you handle documents.

What is Document Automation Software?

Document automation software refers to tools that enable businesses to create, edit, and manage documents automatically using pre-set templates and data input. Instead of manually generating each document from scratch, automation software allows you to streamline the process by populating templates with necessary information. This reduces the likelihood of human error, saves time, and increases consistency across documents. PDQ Docs is a prime example of how automation software can transform document management into a seamless process.

Why PDQ Docs is the Ideal Choice for Businesses

PDQ Docs is designed to handle a wide range of document types, from contracts and invoices to reports and proposals. What sets PDQ Docs apart is its ease of use and flexibility. The platform enables businesses to automate both simple and complex document generation tasks, adapting to the unique needs of any organization. Whether you need to create personalized documents for clients, generate internal reports, or maintain compliance, PDQ Docs provides a solution that fits.

Increase Efficiency and Productivity

The use of document automation software like PDQ Docs significantly improves operational efficiency. By automating repetitive and time-consuming tasks, employees can focus on higher-value work that requires their expertise. Instead of spending hours formatting and customizing documents, employees can rely on PDQ Docs to handle the routine aspects, speeding up document creation and reducing bottlenecks.

PDQ Docs also ensures that the correct documents are produced each time, following company standards and compliance requirements. This is particularly crucial for businesses that must adhere to strict regulations. With document automation, you can ensure that all documents meet legal and regulatory standards without the need for constant oversight.

The Future of Document Management with PDQ Docs

As businesses continue to evolve in the digital age, document automation will only become more essential. PDQ Docs provides a glimpse into the future of business document management, where automation, efficiency, and accuracy are prioritized. By adopting PDQ Docs, companies can save time, reduce costs, and improve the accuracy of their documents, ultimately enhancing their overall business operations.

In conclusion, document automation software like PDQ Docs is no longer just a luxury for businesses but a necessity. It simplifies document creation, reduces errors, and increases overall productivity. With its user-friendly interface, customizable templates, and seamless integration with other business systems, PDQ Docs is the perfect tool for businesses looking to streamline their document management processes. Whether you are in legal, finance, healthcare, or any other industry, PDQ Docs can help take your document workflows to the next level.

#document automation software#document management#workflow automation#automated document generation#document assembly#digital document solutions#contract management#legal document automation#template automation#document collaboration#document drafting tools#compliance automation#smart document creation#efficient document generation#centralized document management

0 notes

Text

AI's Transformative Role in Regulatory Compliance Consulting

Discover how AI is transforming regulatory compliance consulting with real-time monitoring, adaptive frameworks, and enhanced efficiency for businesses worldwide. Click on https://postr.yruz.one/ai-regulatory-compliance-consulting-solutions

#regulatory compliance services#compliance jobs#AI in compliance#Compliance automation#AI compliance solutions#Regulatory technology#legal#law

0 notes

Text

Key Trends Shaping the Future of Corporate Compliance

Corporate compliance functions are entering a new era of rapid transformation, driven by technological advances, regulatory shifts and stakeholder pressures surrounding sustainability. By understanding critical developments in compliance operating models, risk management approaches and oversight frameworks, leaders can proactively position their organizations for long-term success.

Digitization to Enable “Compliance by Design”

Automation through robotic process automation (RPA), artificial intelligence and advanced analytics is empowering next-generation compliance. Machine learning facilitates real-time audits, gathering intelligence across transactions, communications and ecosystem signals to identify regulatory exposure. Self-updating compliance manuals tuned to latest ordinance shifts are on the horizon. The end vision is embedding compliance through system design across operations.

Focus Expanding Beyond Narrow Regulations

With intensifying scrutiny by investors, employees and society on ethical conduct, compliance roles are ballooning beyond narrowly meeting legal obligations alone to championing holistic integrity. Leading organizations are tying codes of conduct to societal value frameworks addressing diversity, sustainability and equitable impacts surrounding products and services. Data transparency, anti-corruption and human rights commitments are rising in priority.

Centralized Governance with Localized Operations

Global companies are moving towards centralized compliance governance under chief ethics/compliance officers and committees to align policies while localizing procedures. Geographic and divisional compliance heads are being empowered to tailor training programs using cultural nuances and localized languages to make integrity standards intuitively resonate across borders rather than appear disconnected edicts from headquarters.

Ultimately corporate compliance is maturing into a value creation function contributing towards trust and transparency with stakeholders rather than merely a check-the-box necessity. As guardians of integrity underpinning quality, fairness and reliability commitments made across supply chains and communities, compliance is becoming an ethical backbone driving capitalism’s next chapter.

#Corporate compliance trends#Compliance technology#Compliance automation#Compliance digitization#Compliance artificial intelligence#Compliance machine learning#Compliance analytics#Regulatory technology (RegTech)#Compliance audits#Compliance by design#Compliance scope expansion#Compliance ethics#Corporate social responsibility#ESG compliance#Sustainability compliance#Diversity and inclusion compliance#Human rights compliance#Anti-corruption compliance#Compliance governance#Chief Compliance Officer

1 note

·

View note

Text

Elevate Your Compliance Journey with Zigram: Unleashing the Power

In the fast-paced world of business, compliance is not just a requirement – it's a strategic imperative. Introducing Zigram, your trusted ally in compliance automation. Elevate your business operations with our cutting-edge solutions designed to simplify, streamline, and enhance your compliance processes.

Key Features:

Effortless Compliance Management: Zigram's Compliance Automation solution takes the complexity out of compliance. Manage regulatory requirements effortlessly, allowing your team to focus on strategic initiatives.

Real-Time Updates: Stay ahead of regulatory changes with Zigram. Our solution provides real-time updates on compliance requirements, ensuring that your business is always in sync with the latest regulations.

0 notes

Text

Efficiency Redefined: Zigram's Compliance Technology for Seamless Regulatory Adherence

Experience a paradigm shift in compliance efficiency with Zigram's state-of-the-art compliance technology. Zigram understands the challenges businesses face in adhering to ever-changing regulations. Their technology solutions are designed to empower organizations, automating compliance workflows, and providing real-time insights. From risk mitigation to data security, Zigram's compliance technology ensures that businesses not only meet but exceed regulatory expectations. Embrace a future where compliance is seamlessly woven into the fabric of your operations with Zigram's groundbreaking technology.

1 note

·

View note

Text

Compliance Automation

Experience the power of Compliance Automation! Explore how Compliance Automation turns challenges into assets, streamlining processes, minimizing errors, and effortlessly ensuring regulatory adherence. Delve into optimized operations and risk reduction today.

0 notes

Text

HIVE CITY FESTIVAL EXTRAVAGANZA – WHERE DIGNITY GETS BURIED IN A SHALLOW GRAVE 🍖⚙️

"Bring your Thrones, your questionable morals, and your complete lack of regard for human safety! Because if you don’t, we’ll have one of our rusty servitors throw your ass into an oven with a carrot shoved straight up your rectum."

🍖 1. CORPSE-STARCH COOK-OFF – WHERE EVERY BITE TASTES LIKE A LABOR VIOLATION 🍽️☠️

💀 Tagline: "If you can still chew, you’re either lucky or heavily augmented."

🔹 What’s on the "menu" (read: crimes against digestion)?

Reprocessed Nutrient Ration Blocks – Freshly extruded from the Administratum’s most aggressive recycling program!

Fried "Grox" Nuggets – A legally distinct meat product! (Warning: DNA testing not recommended.)

Arbites Surprise Stew – It’s called "Surprise" because you won’t know if it’s food or a missing person’s case!

💡 Festival Highlights:

"Guess The Meat" Challenge – If you guess it right, you get a free extra ration. If you guess it wrong, you get a citation for heresy and a punch to the gut!

Deep-Fried Horror Show – If it fits in the fryer, it gets served. Bring your enemies! Bring your servitors! Bring your own damn foot!

Hive Chef Deathmatch – Can YOU create a meal so rancid it physically incapacitates a rival chef? First one to pass out loses!

📢 ATTENDEE WARNING: All meals are legally classified as "edible" but not "safe." If your esophagus melts, that’s a YOU problem.

🤖 2. SERVITOR REFURBISHMENT EXPO – WHERE BROKEN MEATBAGS BECOME "PRODUCTIVE CITIZENS" 🛠️☠️

💀 Tagline: "Still got a heartbeat? Fixable. Screaming in agony? Also fixable."

🔹 Services Offered (Totally Not War Crimes):

"Barely Legal" Cogitator Rewiring – Does your servitor "accidentally" remember its past life? We’ll fix that—by lobotomizing it so hard its last thought is static.

Cybernetic Bargain Bin – We’ve got prosthetics, augmetics, and the occasional random limb. No, we don’t care if it matches your skin tone. It works, shut the fuck up.

"Last-Chance Reboot" Station – If your servitor is making weird noises, we’ll “fix” it by welding its mouth shut. Boom. Problem solved.

💡 Festival Highlights:

Rust Bucket Swap Meet – Trade your half-dead servitor for one that’s only slightly haunted!

Best-Looking Monstrosity Contest – Winner gets a lifetime supply of oil rations and a half-functional chainsword!

Live Servo-Skull Auction – Some whisper tactical secrets, some just scream. Either way, you’re getting a deal!

📢 WARNING: All servitors are sold "as is." If your new model starts leaking coolant or reciting Imperial poetry at 3 AM, we don’t wanna hear about it.

🦠 3. NURGLE’S BACK-ALLEY BUFFET – FOOD THAT’S TECHNICALLY ALIVE 🤢🧫

💀 Tagline: "You don’t eat this food. This food eats you."

🔹 What’s on the menu (besides impending diarrhea and an Inquisitorial investigation)?

Spore-Fermented Grox Sausage – Now with 80% less spontaneous combustion!

Nurgle’s "Secret Sauce" Casserole – Chunky. Lumpy. Makes your insides rot faster than a hive factory worker’s lungs.

Warp-Fried Maggot Delight – Every bite is an "experience!" (Translation: You’re gonna see some shit. Literally.)

💡 Festival Highlights:

"What’s That Smell?" Game – Hint: It’s either an unwashed servitor or something that used to be human.

Plague Roulette – Eat a dish. If you live, you win. If you don’t, well… welcome to the Grandfather’s loving embrace!

Stomach Purge Olympics – Who can hold down their meal the longest? Place your bets!

📢 LEGAL NOTICE: All food items contain at least three unidentifiable ingredients. If it gives you an extra limb, you get to keep it.

⚙️ 4. IMPERIAL REJECTS AUCTION – BUY USED WAR GEAR AND HOPE FOR THE BEST 🔧🔫

💀 Tagline: "Weapons so janky, even the Guard said ‘nah’ to using them."

🔹 What’s up for grabs?

Battle-Damaged Bolt Pistols – You ever seen a gun backfire so hard it turns into a grenade? No? You will.

Half-Repaired Chain Swords – Still got bits of the last guy stuck in the teeth. Authentic!

Mystery Servo-Skulls – Might scream, might recite the Emperor’s Litany, might tell you where the bodies are buried!

💡 Festival Highlights:

Best Jury-Rigged Weapon Contest – If it fires without killing the user, you win!

Arbites Raid Speedrun – Can you make a sale before the cuffs snap shut?

Mystery Crate Raffle – Could be relics. Could be junk. Could be a pissed-off servitor who just remembered how to kill. Good luck!

📢 WARNING: If your purchase malfunctions and vaporizes your own skull, that’s on YOU.

🩸 5. THE RED MARKET – "GENUINELY ACQUIRED" ORGANS & AUGMENTS 🚑🦴

💀 Tagline: "If it still bleeds, it’s still fresh!"

🔹 What’s for sale?

Lightly-Used Kidneys – Perfect for replacing your own, or for starting a collection!

Discount Augmetics – Once belonged to a noble—before he had a "falling accident."

Imperial Guard "Donations" – They didn’t "quit" the battlefield, but they’re definitely not using these anymore!

💡 Festival Highlights:

Lung Capacity Showdown – Who can survive the longest with only one lung?

Surprise DNA Testing – Is your new organ human? Roll a D6 to find out!

"Genuine" Clone Flash Sale – Buy it, raise it, and hope it doesn’t eat you in your sleep!

📢 NOTICE: No, we will NOT be issuing refunds if your new liver starts whispering in High Gothic at night.

WHICH HIVE CITY FESTIVAL ARE YOU ATTENDING?

🔥 REBLOG if you’d risk your life for a good deal! 💬 COMMENT with which cursed meal or reject servitor you’d buy! 🚀 FOLLOW for more grimdark horrors, disgusting markets, and Warhammer meme depravity!

#Grimdark Future Dystopia#Servitor Horror Stories#Warhammer 40K Dark Humor#Dystopian Workplace Reality#AI Gone Wrong#Humanity Is Optional#Corporate Nightmare Fuel#Cyberpunk Horror Aesthetic#Machines Over Meat#Mandatory Compliance Or Death#Dark SciFi Comedy#Mechanized Oppression#The Flesh Is Weak#You Are Replaceable#Factory Floor Body Count#Work Until You Drop#Technology With No Mercy#When Automation Goes Wrong#Scary But Funny#Nobody Cares About You

3 notes

·

View notes

Text

How DeepSeek AI Revolutionizes Data Analysis

1. Introduction: The Data Analysis Crisis and AI’s Role2. What Is DeepSeek AI?3. Key Features of DeepSeek AI for Data Analysis4. How DeepSeek AI Outperforms Traditional Tools5. Real-World Applications Across Industries6. Step-by-Step: Implementing DeepSeek AI in Your Workflow7. FAQs About DeepSeek AI8. Conclusion 1. Introduction: The Data Analysis Crisis and AI’s Role Businesses today generate…

#AI automation trends#AI data analysis#AI for finance#AI in healthcare#AI-driven business intelligence#big data solutions#business intelligence trends#data-driven decisions#DeepSeek AI#ethical AI#ethical AI compliance#Future of AI#generative AI tools#machine learning applications#predictive modeling 2024#real-time analytics#retail AI optimization

3 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

per my last email

#get your shit together#why am i even dealing with this#update your fucking shit and stop sending me automated garbage telling me i'm not in compliance

2 notes

·

View notes

Text

Businesses seeking to leverage this power can achieve transformative results by prioritizing quality assurance (QA) practices. Integrating real-time analytics allows for continuous improvement, while a strong focus on call center compliance ensures every interaction meets the highest standards. Click Here To Read More: https://rb.gy/p4nen1

#VoIP phone systems#VoIP for business#Omnichannel contact center solution#Automated call distribution#Bulk SMS marketing#Interactive voice response (IVR) system#Call center compliance#VoIP call center#Global reach#Real-time analytics#singapore#call center#internet#telecom#voip

2 notes

·

View notes

Text

Revolutionizing Healthcare with HIPAA Compliant Workflow Automation in India

The healthcare industry in India is rapidly evolving, with digital transformation reshaping how medical data is managed and secured. With increasing concerns over patient privacy, regulatory compliance, and operational efficiency, healthcare providers must adopt HIPAA compliant workflow automation in India to streamline their processes while ensuring data security and regulatory adherence.

The Need for HIPAA Compliant Workflow Automation in India

Healthcare organizations deal with vast amounts of sensitive patient data, making security and compliance crucial. Manual processes not only slow down operations but also pose risks such as data breaches, unauthorized access, and compliance violations. By implementing HIPAA compliant workflow automation in India, hospitals, clinics, and medical service providers can enhance efficiency, reduce errors, and maintain compliance with global standards.

Key benefits of workflow automation include:

Improved Data Security: Automating healthcare workflows minimizes human intervention, reducing the chances of data mishandling.

Regulatory Compliance: Automated systems ensure that healthcare organizations meet regulatory standards effortlessly.

Operational Efficiency: Faster data processing, seamless coordination, and reduced paperwork enhance overall patient care.

Ensuring Data Protection with Healthcare Data Security Solutions in India

Data security remains one of the biggest challenges in the healthcare sector. With cyber threats on the rise, implementing robust healthcare data security solutions in India is non-negotiable. These solutions help in protecting electronic health records (EHRs), preventing unauthorized access, and ensuring that sensitive patient data remains confidential.

Leading healthcare data security solutions in India include:

End-to-End Encryption: Protects patient data during storage and transmission.

Access Control Mechanisms: Ensures only authorized personnel can access sensitive information.

Regular Security Audits: Helps identify vulnerabilities and maintain compliance with regulations.

Streamlining Compliance with Healthcare Regulatory Compliance Software in India

Navigating the complex regulatory landscape in India’s healthcare sector requires specialized tools. Healthcare regulatory compliance software in India helps organizations adhere to industry guidelines such as HIPAA, NABH, and GDPR by automating compliance processes, reducing human error, and ensuring regular reporting.

Features of compliance software include:

Automated Compliance Checks: Reduces risks of violations and penalties.

Audit-Ready Reports: Simplifies regulatory inspections and documentation.

Real-Time Monitoring: Ensures continuous adherence to evolving regulations.

The Future of Healthcare Automation and Compliance in India

As India’s healthcare sector embraces digitalization, the demand for HIPAA compliant workflow automation in India, healthcare data security solutions in India, and healthcare regulatory compliance software in India will continue to grow. By leveraging these technologies, healthcare organizations can enhance efficiency, improve security, and ensure seamless regulatory compliance, ultimately leading to better patient care and trust.

If you’re looking to implement top-tier healthcare automation and security solutions, now is the time to invest in cutting-edge technologies that protect your organization and your patients.

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india

0 notes

Text

Dr. Ashish Agarwal, Co-Founder & CTO of WRMS – Interview Series

New Post has been published on https://thedigitalinsider.com/dr-ashish-agarwal-co-founder-cto-of-wrms-interview-series/

Dr. Ashish Agarwal, Co-Founder & CTO of WRMS – Interview Series

Ashish Agarwal is an accomplished Chief Technology Officer with extensive experience in the industrial automation industry. He has a robust skill set encompassing software development, start-ups, mobile payments, embedded systems, and mobile devices. Ashish co-founded Weather Risk Management Services Pvt. Ltd. (WRMS) and has been serving as the Chief Technology Officer since January 2016. In this role, he has been pivotal in developing innovative solutions to mitigate weather-related risks, significantly enhancing the company’s service offerings.

WRMS is a global company specializing in agricultural and climate risk management, with over two decades of experience. The organization develops solutions that incorporate advanced technology to assist businesses and communities in adapting to climate-related challenges.

With a multidisciplinary team of experts and consultants, WRMS focuses on identifying emerging climate risks, assessing potential impacts, and formulating risk management strategies aimed at improving climate resilience.

What inspired you to found Weather Risk Management Services (WRMS) in 2004? Were there specific challenges or gaps in the market you aimed to address?

Founded in 2004, WRMS emerged as a great response to the overwhelming demand for farmers and businesses to shield themselves from the uncertainties exploited by climate risks. Back then, agricultural communities and enterprises used to suffer from erratic weather patterns. Their losses were only compounded by scant access to reliable risk mitigation tools.

And in realizing that gap, we set out to create innovative technology-driven solutions for proactive climate risk management. We needed to treat data, analytics, and insurance-backed models as forms of empowerment to offer timely insights on climate risk and financial means to the stakeholders.

Over the years, WRMS has moved beyond agriculture, offering AI-led climate resilience solutions to various sectors that assist companies in managing climate-related disruptions. We are still leveraging IoT, AI, and predictive analytics to respond to climate change that threatens organizations and their sustainability, allowing them to make informed decisions in protecting their operations.

How has your vision for WRMS evolved over the past two decades, especially with the growing awareness of climate change and its impact?

Over the past two decades, WRMS has evolved from a farmer-centric approach to a comprehensive climate risk management organization. Initially, our focus was on providing innovative solutions to help farmers mitigate climate risks. As climate change accelerated, we expanded our expertise, integrating advanced technology, data analytics, and risk management frameworks to build resilient solutions for diverse industries.

Today, WRMS is at the forefront of climate risk solutions, extending beyond agriculture to sectors like travel, renewable energy, and insurance. Our vision is not just to protect livelihoods but to empower businesses and communities with adaptive strategies that ensure sustainability in an unpredictable climate. This journey has strengthened our commitment to delivering impact-driven solutions that help vulnerable populations navigate climate challenges with confidence.

How does WRMS differentiate itself from competitors in providing data-driven climate risk management solutions?

WRMS stands out with its data-driven and technology-centric approach to climate risk management. Unlike conventional models, we leverage cutting-edge analytics, artificial intelligence (AI), and predictive modeling to provide accurate, real-time risk assessments. This enables organizations to make proactive, informed decisions in navigating climate risks.

Our customized climate resilience solutions go beyond assessment, offering governments and businesses tailored strategies to identify and mitigate physical climate risks. By integrating sector-specific insights, we help stakeholders build sustainable, long-term adaptation frameworks to combat climate volatility.

What truly differentiates WRMS is its multidisciplinary team of experts specializing in climate risk identification, impact analysis, and risk mitigation. We don’t just analyze climate threats—we design comprehensive risk management plans that enhance resilience, minimize losses, and create lasting impact for industries ranging from agriculture and renewable energy to infrastructure and finance.

Can you dive deeper into how SecuSense uses AI-driven analytics and granular weather data to help businesses make smarter decisions?

SecuSense is WRMS’s AI-powered climate intelligence platform that provides organizations with real-time, hyper-local weather insights and advanced analytics. By leveraging machine learning, predictive modeling, and satellite-linked weather stations, SecuSense delivers high-precision forecasts, empowering businesses to make well-informed, timely decisions in the face of climate uncertainty.

Organizations that integrate SecuSense gain a strategic advantage by identifying risks before they escalate. Its ability to overlay location-specific weather data with operational parameters helps businesses assess climate threats such as storms, heat waves, and floods. This level of customization ensures targeted risk mitigation, optimized resource deployment, and enhanced business continuity.

What truly sets SecuSense apart is its seamless risk intelligence framework, which spans early warnings, impact evaluation, and response planning. By providing short- to medium-term forecasts with actionable insights, it enables businesses to anticipate disruptions, protect assets, and reinforce climate resilience. With SecuSense, businesses don’t just react to climate risks—they proactively adapt, ensuring sustainability and long-term growth.

AI-powered tools play a pivotal role in WRMS’s offerings. How do these tools enhance climate resilience and risk management for your clients?

AI-driven solutions are at the core of WRMS’s approach, enabling precise risk assessments and proactive climate adaptation strategies. By processing vast amounts of climate data, these tools identify trends, predict potential disruptions, and provide actionable insights to minimize risks before they escalate.

For our clients, this translates into stronger preparedness and adaptive decision-making. AI-powered models analyze historical weather patterns, real-time climate variables, and geospatial data, allowing businesses to optimize resource allocation, fortify supply chains, and mitigate financial exposure. This level of predictive intelligence helps them build long-term resilience against evolving climate threats.

How does WRMS ensure the accuracy and reliability of its predictive models, especially in sectors where real-time data is critical?

WRMS operates within a framework built by standards according to IMD and WMO for the validation and reliability of predictive models. We aspire to the continually scalable IoT network through a wide array of AWS-based and AWS-based facilities across diverse geographies that render complete coverage and full and thorough data services.

Advanced data infrastructure with the ability to collect, validate, and store real-time data on temperature, humidity, rainfall, wind speed, wind direction, and solar radiation forms the backbone of our enterprise that makes sure our predictive models are based on precise and dependable data very much important to those sectors in which real-time information has a preeminent significance.

With climate risks evolving rapidly, how does WRMS use AI and data analytics to stay ahead of these changes?

WRMS applies AI and data analytics to monitor weather patterns and other climate variables continuously to remain one step ahead of the challenges posed by rapidly changing climatic conditions.

Our AI-based tools can recognize emerging trends and potential risks allowing us to fine-tune our predictive models and risk management strategies in an advanced way. This proactive approach ensures that our clients receive timely and relevant insights, allowing them to adapt to changing climate conditions and mitigate potential impacts effectively.

How do you see the role of technology, especially AI, evolving in the future of climate risk management?

Technology, particularly AI, is set to assume an even more vital role in future climate management. Considering climate risks have become more complicated and unpredictable, their provisions for vast data processing and analyses will be needed in the formulation of accurate forecasting models and sound risk management practices.

We expect advancements in AI to allow for better forecasting, optimal resource allocation, and greater resilience against climate threats. From our side at WRMS, we will continue to stay at the forefront of these scientific advances to ensure our clients receive the best solutions available.

What new opportunities do you foresee for businesses in leveraging data-driven climate resilience strategies?

Organizations that integrate data-backed resilience strategies can unlock significant advantages, from risk-proofing operations to enhancing regulatory compliance. Predictive analytics and scenario modeling enable businesses to anticipate disruptions, improve decision-making, and ensure long-term financial stability in an increasingly volatile climate landscape.

Additionally, investing in supply chain resilience and sustainable infrastructure strengthens business continuity while boosting corporate reputation and investor confidence. By proactively addressing climate risks, companies can not only safeguard their assets but also position themselves as industry leaders in sustainability and responsible governance.

Are there any emerging trends or technologies you’re particularly excited about that could revolutionize the way we manage climate risks?

I am quite optimistic about some of the key trends and upstream technologies poised to disrupt climate risk management. AI and ML are changing the game with endless predictions and responses to climate risks by crunching through massive datasets to anticipate such events as droughts and floods. IoT-enabled devices are playing an increasingly prominent role in offering real-time environmental data to enable quality decision-making. Earth Observation offered by drones and satellites creates high-resolution images that can be used for assessing climate effects and planning for future risks.

Simple advanced computing and data analytics offer sophisticated approaches to climate risk assessment while climate-resilient infrastructural assets fall back as a means to lessen the impacts of extreme weather events. New insurance products for climate risk are coming along to support businesses and communities in climate-related events’ recovery. These waves of innovations are only upgrading our ability to manage climate risk and nurture a culture of resilience and sustainability.

We at WRMS Global are dedicated to leveraging these technologies toward building a safer and more sustainable world.

Thank you for the great interview, readers who wish to learn more should visit WRMS.

#agriculture#ai#AI-powered#analyses#Analysis#Analytics#approach#artificial#Artificial Intelligence#assessment#assets#automation#awareness#AWS#Building#Business#business continuity#change#climate#Climate Challenges#climate change#climate threats#Companies#compliance#comprehensive#computing#CTO#cutting#data#data analytics

0 notes

Text

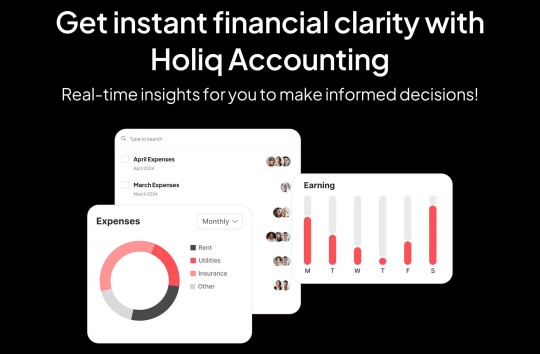

Elevate Your Liquor Store Finances with Professional Accounting Solutions

Running a liquor store involves more than just stocking shelves with premium wines and spirits. Financial management is the backbone of a successful business, ensuring profitability, compliance, and long-term growth. However, keeping up with bookkeeping, tax regulations, and cash flow management can be overwhelming. That’s where Holiq’s Accounting Services comes in—providing liquor store owners with professional financial solutions that simplify operations and boost profitability.

Why Your Liquor Store Needs Professional Accounting

Managing the financial side of your liquor business can be complex, with fluctuating inventory costs, seasonal sales trends, and regulatory requirements. Without a streamlined accounting system, errors in bookkeeping can lead to financial losses, compliance issues, and missed growth opportunities. A professional accounting solution like Holiq helps you:

Ensure Accurate Bookkeeping – Keep track of every sale, expense, and tax obligation with automated accounting tools.

Optimize Cash Flow – Monitor revenue and expenses in real-time to prevent financial bottlenecks.

Stay Tax Compliant – Avoid penalties by accurately calculating sales tax and meeting state regulations.

Gain Financial Insights – Use in-depth reports to identify profitable products, reduce unnecessary costs, and drive smarter business decisions.

How Holiq’s Accounting Services Transform Liquor Store Finances

Holiq isn’t just a liquor store management solution—it’s your financial partner. With integrated accounting features, Holiq streamlines your entire financial workflow so you can focus on growing your business.

1. Automated Bookkeeping & Expense Tracking

Say goodbye to spreadsheets and manual data entry. Holiq automatically records every transaction, categorizing revenue and expenses for easy tracking. You’ll always have an up-to-date financial snapshot of your business.

2. Seamless Tax Calculation & Compliance

Liquor sales come with unique tax obligations that vary by state. Holiq’s accounting tools calculate taxes accurately and ensure compliance with local regulations, reducing the risk of costly fines.

3. Real-Time Financial Reporting

Holiq provides detailed financial reports, including profit and loss statements, sales trends, and expense breakdowns. These insights help liquor store owners make data-driven decisions to increase profitability.

4. Integrated Payment & Invoice Management

Whether you need to track supplier invoices or manage customer transactions, Holiq consolidates all financial activities in one place, making it easier to manage cash flow and payments.

5. Multi-Location Financial Management

Own multiple liquor store locations? Holiq allows you to oversee and manage the finances of all stores from a single dashboard, ensuring seamless financial oversight across your entire business.

Maximize Your Liquor Store’s Profitability with Holiq

Professional accounting is essential for liquor store success, and Holiq makes it effortless. With automated bookkeeping, real-time insights, and tax compliance tools, you can optimize your financial operations and focus on growing your business.

Ready to take control of your liquor store’s finances? Schedule a demo today and see how Holiq can simplify your accounting and boost your profitability!

#accounting services#accounting and bookkeeping#financial insights#automated bookkeeping#track inventory#tax compliance#tax savings#tax regulations#budgeting and forecasting

0 notes

Text

Achieve Effortless Compliance with Zigram's Automation Solutions

In the complex landscape of regulatory compliance, simplification and automation are key. Zigram, a leading brand in automation solutions, presents a revolutionary approach to Compliance Automation, making it easier than ever to meet regulatory requirements and maintain your organization's integrity.

Why Choose Zigram for Compliance Automation?

Innovative Technology: Zigram offers cutting-edge automation tools that streamline the compliance process.

Efficiency: Our automation solutions simplify and accelerate compliance tasks, reducing the time and effort required.

1 note

·

View note