#Chairman Federal Bank

Explore tagged Tumblr posts

Text

C Balagopal’s book ‘Below The Radar’ debunks notions about Kerala being an investor-unfriendly State

Which is the biggest dental lab in India? The biggest in-vitro diagnostic company in India? Which company in India makes steel castings for Mitsubishi Heavy Engineering, Man Turbo Switzerland, British Petroleum and so on? Which is one of the largest manufacturers of blood bags in the world? The fact that all those industries are situated in small towns in Kerala enthused Chandrasekhar…

View On WordPress

#Agappe#C Achutha Menon#Chairman Federal Bank#Chandrasekhar Balagopal#DentCare#Keltron#Kerala Industries#Peekay Steel Castings#Terumo Penpol#trade unions in Kerala

0 notes

Text

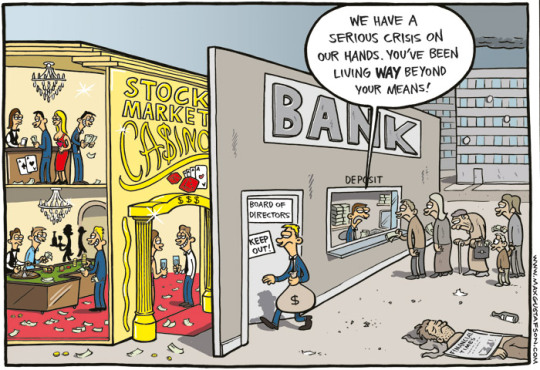

Credit Event Coming??? Michael Douville

Global liquidity and money are in short supply. Liquidity is the fuel of the economy. Bank deposits are decreasing. Things are getting more difficult to get a loan.

Proverbs 27:12 The prudent sees danger and hides himself, but the simple go on and suffer for it. Proverbs 4:13 Hold on to instruction; do not let go. Guard it, for it is your life. Are we entering another Credit Event? I remember Lehman Brothers and Bear Stears. These events start slow and gather speed until things start to cascade. Germany’s Deutsche Bank is in the news. Credit Default Swaps…

View On WordPress

#banks#bonds#cash#Chairman Jerome Powell#credit default swaps#credit event#Danielle DiMartino Booth#Deutsche Bank#Europe#Federal Reserve#interest rates#liquidity#money supply

3 notes

·

View notes

Text

"This event ends the moment you write us a check, and it better not bounce, or you're a dead motherfucker" -- Big Bill Hell

There was a time when you'd see little old ladies paying for the groceries with a hand-written personal check, holding up the line, causing an immediately-forgiven slight sense of annoyance with those behind her. Buddy. Those days are over. They've been over. What, did you think you were going to just pop a couple extra zeroes on the end of your paycheck there? Maybe scan your paycheck, open it in photoshop, make a template, print em out all nice? You think you're the first to think of that, dipshit?

It takes the law a long time to catch up with the state of the art. You're reading this on the internet, which means you never use checks. The law has caught up. Your ass will be going to prison immediately and you will see zero return.

You can't even kite checks anymore, and hell, nobody under 40 will even know what that means, due to the blazing fast, two day settlement on all ACH transactions. Let me paint you a picture.

You get paid on Friday, but it is Monday, and bills are due on Tuesday. And you're broke: $0 in the bank. Goose egg. Pop open your checkbook, go to a store, "buy" some things, write a check for the amount. The cashier takes it!

Now take those things you "bought", across town, to another store location, and return them for cold hard cash. Sweet. Bills paid. Friday rolls around, and you just make it to the bank to deposit your paycheck before it closes. After the weekend, the checks you wrote finally post, and they don't bounce! You've kited a check. You've surreptitiously taken a zero-interest loan. And we know your broke ass. The interest rate on that short-term payday loan should have been straight up usurious. We're talking 29%. That makes predatory fuckers like us horny for sex. We're so mad. Now you are going to Federal Prison. For a good minute. Fuckface.

COST: $0.10 (With banks offering free checking accounts + Bic pen)

"Neither snow nor rain nor heat nor sleet, if you fuck with the mail, we'll rip your nuts off" -- Ronald Mail (Inventor of Mail)

Many people have this misnomer that the most powerful people in politics are democratically elected. The president, of the United States, of America, is a stupid cartoon hotdog. All of them, I don't care. Way less clout than you'd think. Brilliantly, it is the people that the hotdog president appoints who are actually doing anything significant. The director of the CIA. The fucking chairman of the Federal Reserve. Probably the, like, most senior, uh, general of the military, and shit too. I don't know, we don't "do" army here at Bloomberg. You probably don't even know their names! I don't! These are the ones you should be seeing in your sleep.

There's another position like that. Appointed directly by the hotdog. The Postmaster General. That's a real title. He's the CEO of the mail, and buddy, what he may lack in political power relative to the director of the CEO, he makes up in raw sexual energy. Total Tom Selleck energy. Like an airline pilot. We're talking Donald Sutherland in Invasion of the Body Snatchers. I'm tentpoling in my black business slacks just writing this, and all my Bloomberg newsroom bros are peering over my shoulder and also tent-poling. We're not gay though, and especially me, I'm probably the least gay, but sometimes I just lay awake for hours at night what that mustache would feel like pressed against my lips, the unbelievable and utter, total sense of security I'd feel burying my head into his hard chest.

You get it. He's your dad. And if you fuck with the mail, you've fucked with the tools in your dad's garage. And dad's been drinking. You're in for it, bucko, you are in trouble. Do you think the United States Postal Service actually makes any money? Hell no. It costs like five bucks to mail a box basically anywhere I can think of and they give you the boxes for free. You can just walk in the post office and take them. I do that, and then just throw them away, I don't know why, some kind of compulsion. Being able to move shit around like this, quickly, cheaply -- Jesus H, I've got a huge amount of money in my bank account, probably tens of trillions of dollars (due to financial knowledge gained from reading Bloomberg articles) and I could probably mail every single person ever something and still come out in the black.

No way pal. They've thought of that already. The Postmaster General is going to know every time, and he's going to grab you by the shirt collar, wearing his cool as fuck hat, and you're going to get your pants pulled down, and your bare ass spanke...I need to go use the restroom real quick.

We rely on the mail system to get important shit done. It's not something to be taken lightly, and it isn't. Trust me. This is why, like almost every other person who receives mail in this year 2023, I just fucking put a wastebasket under my mail slot. I don't even shred that shit anymore. I just burn it. Takes less time.

COST: $0.63 (Postal stamp)

"Can call all you want, but there's no one home // And you're not gonna reach my telephone // Out in the club, and I'm sipping that bubb // And you're not gonna reach my telephone" -- Lady Gaga

I read something wild that the children of today do not know what a dial tone is, because of how fucked up and stupid they are. Isn't that super fucked up?

While it's not really our style, allow me to fill you in on some ancient, arcane knowledge about the telephone. You can turn it on, and then you can punch in numbers. Any numbers. Random ones, or maybe not random ones. If the ten numbers you punch in are the same as the numbers in someone else's telephone number, their phone will ring, and then you are talking to them. This is called "Phreaking".

Here's the kicker: You can tell that jackass anything you want. "Oh, Hi, Yes, I am Reginald Sumpter calling from Avalon Consulting LLC, we are just following up on the invoice we sent you. Please remit to ###### routing ###### account."

BOOM! Your name isn't Reginald whatever and that company doesn't exist, but you just received a deposit. It's fucking beautiful. What have you done wrong? It isn't your responsibility to handle who your business' clients/etc are, it's their's. If they want to just pay you money for no real reason, well, that's kind of on them, isn't it? I haven't stuck a pistol in your face and demanded everything in the register.

Well, it's too clever. It's too slick. This is the United States of America. It's one thing to commit a felony like armed robbery, it's another thing to piss off someone in charge of the accounting division who uses a special bathroom you need a key to get into.

You can do it on the computer too, I use a PC Computer at work and send email, so you can see how it'd work there. You can make a document that is indifferentiable from a real invoice and, straight up, 1/3 of the time they will pay that shit. Lmfao.

It's called wire fraud because, uhh, duhhhh, there's wires. What do you think that thing is strung between the telephone receiver and the dialer? And computers? Give me a break. There's so many wires with those.

COST: $0.25 (Coin for payphone)

"People calculate too much and think too little." -- Charlie Munger

It is insane how dumb the common man can be when it comes to our world of expertise. I hear this same sentiment, like, ALL THE TIME:

"Durr hurr I will buy an insurance policy for my car or house or whatever so that in case something happens to it I will get money". And then that same person proceeds to drive safely or not burn their house down. Dumbest crap imaginable.

Let me break it down for you. Insurance is a two player competitive game. There is a winner and there is a loser. Go take out an expensive insurance policy on your American sports car. Buy a neck brace, a football helmet, and pack that bitch with throw pillows. Then get in the left lane of a major highway at like noonish, let it rip and then SLAM on your brakes. Hit from behind! Your fault! Congratulations. You have won insurance. How this gets past people is beyond me.

You can only do this once or twice before the insurance companies catch on. Then they don't want to fuck with you. It is also..I don't know man...something feels off about taking a car or a house, which like, some guy had to build and just destroying it, but that is only a weird emotional thing, since you're making money, more than whatever the destroyed thing is worth, so in reality you've built that house plus some extra. You've contributed.

COST: $106.00 (Average monthly car insurance payment)

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

SUBSCRIBE TO MY WHATEVER FOR PART TWO, COMING SOON. i'll post it later today probably. whatever time frame will juice the numbers. have a sneaky peaky

disclaimer | private policy | unsubscribe

1K notes

·

View notes

Text

Hey what the fuck is this news story?

“ But the world’s largest economies are already there: The total fertility rate among the OECD’s 38 member countries dropped to just 1.5 children per woman in 2022 from 3.3 children in 1960. That’s well below the “replacement level” of 2.1 children per woman needed to keep populations constant.

That means the supply of workers in many countries is quickly diminishing.

In the 1960s, there were six people of working age for every retired person, according to the World Economic Forum. Today, the ratio is closer to three-to-one. By 2035, it’s expected to be two-to-one.

Top executives at publicly traded US companies mentioned labor shortages nearly 7,000 times in earnings calls over the last decade, according to an analysis by the Federal Reserve Bank of St. Louis last week.

“A reduction in the share of workers can lead to labor shortages, which may raise the bargaining power of employees and lift wages — all of which is ultimately inflationary,” Simona Paravani-Mellinghoff, managing director at BlackRock, wrote in an analysis last year. “

Is this seriously how normal people think? Improving the bargaining power of workers and increased wages are bad?

“ And while net immigration has helped offset demographic problems facing rich countries in the past, the shrinking population is now a global phenomenon. “This is critical because it implies advanced economies may start to struggle to ‘import’ labour from such places either via migration or sourcing goods,” wrote Paravani-Mellinghoff.

By 2100, only six countries are expected to be having enough children to keep their populations stable: Africa’s Chad, Niger and Somalia, the Pacific islands of Samoa and Tonga, and Tajikistan, according to research published by the Lancet, a medical journal.

BlackRock’s expert advises her clients to invest in inflation-linked bonds, as well as inflation-hedging commodities like energy, industrial metals and agriculture and livestock.

Import labor via migration or sourcing goods? My brother in Christ they are modern day slaves!! I feel like I’m in backwards town reading this what the fuck?!

“ Elon Musk, father of 12 children, has remarked that falling birthrates will lead to “a civilization that ends not with a bang but a whimper, in adult diapers.”

While his words are incendiary, they’re not entirely wrong

P&G and Kimberly-Clark, which together make up more than half of the US diaper market, have seen baby diaper sales decline over the past few years. But adult diapers sales, they say, are a bright spot in their portfolios. “

Oh now the guy with a breeding kink is going to lecture us. Great. /s

“ The AI solution: Some business leaders and technologists see the boom in productivity through artificial intelligence as a potential solution.

“Here are the facts. We are not having enough children, and we have not been having enough children for long enough that there is a demographic crisis, former Google CEO and executive chairman Eric Schmidt said at the Wall Street Journal’s CEO Council Summit in London last year.

“In aggregate, all the demographics say there’s going to be shortage of humans for jobs. Literally too many jobs and not enough people for at least the next 30 years,” Schmidt said.

Oh god not the AI tech bros coming into this shit too. Wasn’t the purpose of improving tech to give people more free time? So they can relax and spend time with family more and actually enjoy life? Isn’t our economy already bloated with useless pencil-pushing number-crunching desk jobs that ultimately don’t serve a purpose?

I’m not going to post the entire article but give it a read. It’s… certainly something. Anyway degrowth is the way of the future.

53 notes

·

View notes

Text

So, you know all those bad laws I tell y'all to call your senators to kill? Well here's a good one for you to promote!

Basically, you know how payment processors freak the fuck out if even the slightest whiff of adult content shows up on a website, which has lead to the widespread sanitization of the internet?

Well, this bill, S.293; aims to prevent that crap!

And, it's currently in the Committee of Banking, Housing, and Urban Affairs, so if your Senator is one of the following, call them and tell them to vote yes on it:

Sherrod Brown, Ohio, Chairman

Jack Reed, Rhode Island

Bob Menendez, New Jersey

Jon Tester, Montana

Mark Warner, Virginia

Elizabeth Warren, Massachusetts (Tell her it would be a start on apologizing for voting yes on FOSTA/SESTA)

Chris Van Hollen, Maryland

Catherine Cortez Masto, Nevada

Tina Smith, Minnesota

Kyrsten Sinema, Arizona (ugh)

Raphael Warnock, Georgia

John Fetterman, Pennsylvania

Tim Scott, South Carolina, Ranking Member

Mike Crapo, Idaho

Mike Rounds, South Dakota

Thom Tillis, North Carolina (Probably not reaching this asshole)

John Kennedy, Louisiana

Bill Hagerty, Tennessee

Cynthia Lummis, Wyoming

J.D. Vance, Ohio (Ugh)

Katie Britt, Alabama

Kevin Cramer, North Dakota

Steve Daines, Montana

If they're one of those right-wing dipshits, tell them it would help them prevent "cancel culture" via socially-conscious payment processors. Because subterfugue towards conservatives is always cool and good! Always!

Also mention that, in a happy irony, this would actually make kids safer by allowing platforms to acknowlege that, yes, people make a living selling well-endowed monoecious horsegirl drawings on their platform, and actually put properly finetuned safeguards in place.

As opposed to now, where they have to dance around it and put it in a grey-area hell so that Peter "Dracula" Thiel doesn't get his seastead in a shoal and ban them, which nobody likes!

So, call 'em if you can, boost even if you can't!

535 notes

·

View notes

Text

Andrew Perez and Adam Rawnsley at Rolling Stone:

THE CONSULTING FIRM led by Leonard Leo, the architect of the Supreme Court’s conservative supermajority, has worked for billionaire Charles Koch’s political advocacy network and a dark-money group that is currently arguing a Supreme Court case designed to preempt a wealth tax, according to documents obtained by Rolling Stone. The firm even worked to promote a book by Donald Trump cronies Corey Lewandowski and David Bossie. Leo has played a central role in shifting the high court and its decisions far to the right. As former President Donald Trump’s judicial adviser, Leo helped select three of the Supreme Court’s six conservative justices. He also leads a dark-money network that boosted their confirmations and helps determine what cases the justices hear and shape their rulings. The Supreme Court connection has paid off for Leo — big time. In 2021, he was gifted control of a $1.6 billion political advocacy slush fund. Over the past decade, Leo’s dark money network has plowed more than $100 million into his for-profit consulting firm, CRC Advisors.

Leo co-chairs the Federalist Society, the conservative lawyers network. He is also the chairman of CRC. Like many consulting firms, CRC does not publicly disclose its clients. However, several of the firm’s clients were named in resumes that applicants submitted to an online jobs bank hosted by the Conservative Partnership Institute, which accidentally left the files exposed online. One CRC employee’s 2024 resume says his clients include the Competitive Enterprise Institute, a dark-money group arguing a case before the Supreme Court this term that is designed to slam the door shut on a federal wealth tax. Experts say the case could upend the nation’s tax code. “In the last Congress, legislation to establish a wealth tax was introduced in both the House and the Senate,” CEI wrote in its petition to the Supreme Court, adding that justices should act now to “head off a major constitutional clash down the line.” During oral arguments in December, Justice Samuel Alito presented a hypothetical where “somebody graduates from school and starts up a little business in his garage, and 20 years later, 30 years later, the person is a billionaire,” and asked whether the government “can Congress tax all of that.” According to the CRC employee’s 2024 resume, Leo’s firm has also worked for the Koch network’s political advocacy arm, Americans for Prosperity. AFP’s super PAC spent more than $40 million supporting former South Carolina Gov. Nikki Haley’s failed Republican primary campaign against Trump this election cycle. AFP’s charitable arm has supported a case at the Supreme Court this term pushing justices to block the government from influencing content moderation by social media platforms.

Rolling Stone exposes radical right-wing SCOTUS puppetmaster Leonard Leo's consulting firm CRC Advisors, whose clients were leaked online.

#Eli Lilly#Koch Brothers#Leonard Leo#Competitive Enterprise Institute#Wealth Tax#CRC Advisors#Corey Lewandowski#David Bossie#Moore v. United States#Americans For Prosperity#Rumble#Federalist Society#Conservative Partnership Institute

46 notes

·

View notes

Text

Salivating & Waiting...

They want people living in fear with a scarcity mindset full of self-doubt blaming themselves for an unsuccessful job search.

Who is "they"?

The Fed. The government. World leaders & politicians. Industry titans & leviathans.

The elite rulers of this world.

You know. Them.

All of the screaming headlines about half of a point of an interest rate cut boil down to that.

The Fed is controlled by a Board of Governors selected by the President then confirmed by the Senate — who serve a term of FOURTEEN YEARS.

All old white men like Chairman Powell.

They CAUSE recessions ON PURPOSE by PURPOSELY RAISING INTEREST RATES to make things LESS AFFORDABLE, to allow LESS BORROWING, LESS HOMES BEING PURCHASED, LESS JOBS, TIGHTER ECONOMY.

So, then it goes back to being an employer market and they have the control & leverage again, jobs are tight and scarce, the economy sucks and the job market is challenging.

Just how they want it.

People are less likely to take a chance, pursue off beat opportunities, take risks — which are all of the things that lead to learning & growth often times especially when you fail — its not based on whether its a "successful" outcome — its based on, did you learn anything from your various challenges, trials & tribulations.

Did you learn anything as a person? Were you challenged? Did you grow? Did you learn life lessons? Did you gain resilience? Did you gain confidence in who you were as a person?

Its not really about — did you make money? Was it profitable? Was it a financial success?

Its — did you learn more about your SELF — your actual self as a person — your dreams, your inspirations, your moxie, your fire, your spirit, your verve, your juju, your juice, your essence, your uniqueness, what makes you you.

Did you challenge yourself? Did you grow as a person?

Did you change, evolve, transform?

Did you alchemize your experiences?

Did you elevate? Did you change your state of mind & state of being?

Sometimes those lessons can actually only come from conventional "failure".

They want people operating in a low 3D mindset that just has them endlessly chasing clout, titles, prestige & companys brand names. Influence, Wealth. Money. Material things. Possessions. The flex. Vacations. Homes. Cars. Clothes. Shoes. Bags. Makeup. Luxury.

Chasing. The energy of want, lack, need. Scarcity mindset. Fear. Feelings of worthlessness & inadequacy. Envy & jealousy. Bitterness. Self doubt. Mental exhaustion & fatigue. Desperation.

The vibes of, "I'll take anything I can get. I hope they want me. So many other people have been laid off."

Fear of additional layoffs.

Chasing stability & security as the goal instead of change, discomfort, transformation & alchemization.

Surface, no substance.

Gloss & shine, no substance.

So, the Fed repeatedly causes recessions at scripted, planned, timed intervals. Then they will cut the interest rates & the economy will predictably grow.

If you question the Federal Reserve — why cant it be abolished? Why cant we go back to the gold standard? Why cant we go back to a time where there was no central banking authority?

You will invariably be told the following:

Shut the fuck up, you're not an economist.

Something something Panic of 1907.

Something something without the Fed there would be constant recessions every 3 to 5 years.

Something something the US is the worlds default currency so the Fed is necessary.

Something something inflation would be out of control.

Notice that none of the trite responses above actually even addresses anything that I typed prior — that the recessions are on PURPOSE.

The Feds website clearly & plainly states this — they seek to ensure "maximum employment" while "avoiding inflation" — why do you think they seek "maximum employment"?

They want people to be insecure, unsure of themselves, stressed, pressed, depressed & obsessed.

They dont want people trying new things, taking chances, taking risks, failing in order to learn, failing in order to grow, failing in order to transform.

They dont want people alchemizing.

They dont want people questioning THEIR current system.

If you look at LinkedIn's screaming headlines about the Fed's interest rate cuts — dont they seem a bit scripted to you? A bit contrived & forced? A bit transparent & obvious?

Almost to the point of parody?

Do you actually think anyone in power's actual goal is for people to be employed, satisfied, content, financially solvent, not drowning in debt, not panicking, not struggling to pay bills, not struggling to afford groceries, struggling to pay rent, to keep a roof over their heads, working multiple jobs, part time & full time, living in fear of yet another layoff, another reduction in force, becoming "redundant"?

Living in fear of endless online applications, auto rejections, ghosting, being unemployed for months after unemployment runs out, being evicted, losing your house, living out of your car, having your car repossessed, furniture repossessed, couch surfing, being homeless?

Being overly grateful & sucking off whichever employer deigns to give them an actual job, falling in line, vowing to never move around again, never leave again, never quit without a job lined up again, as the job search process — BY DESIGN — is too arduous, too debilitating, too soul crushing, too confidence killing, too draining, too depressing, too fatiguing, too exhausting, too humiliating, too crushing to your humanity, too inhumane?

And then you bust your ass, stay put & get laid off anyway.

And youre too drained, too tired, too depressed, too exhausted, too fatigued to even think about starting your own business, to even think about freelancing, to even think about creating social media content with the hopes of monetizing it, to even think about being a delivery driver for Doordash, to even think about delivering groceries for Instacart, to even think about being a rideshare driver for Lyft, to even think about using your expertise to start a knowledge as a service (KAAS) coaching or consulting business, to even think about becoming an author, to even think about becoming a public speaker...

To even think.

Just the way they want it.

They want you obsessively chasing money your entire career. Along with basing your entire identity & self-worth on a job title and name brand company that can be taken away from you at any time and at any moment.

They want you breathlessly monitoring every movement that Powell & the Fed makes, reading every prediction, waiting for every interest rate cut, every half point.

Salivating & waiting.

Hanging on their every word, every speech, every update.

Like a conditioned Pavlovian dog.

They want you believing the lie that the economy is doing well right now??????????

With the US presidential election literally next month?

Anyone who is currently job searching like I am right now knows that the US economy is absolute dog shit right now.

Every remote posting has hundreds of applications within literally a few hours.

While on-site positions obviously have way less applicants, the economy is challenging as fuck right now, despite the lies of the Fed to the contrary who keep insisting that we are absolutely not in a recession right now when literally anyone who is currently job searching right now can see that the economy sucks dick with their own eyes.

Never believe what your lying eyes are telling you.

But you should believe the Fed...right?

Because Chairman Powell & the board of governors of the Federal Reserve are NOT appointed by the US President and they DONT serve a term of FOURTEEN years...right?

It's all a script. It's all a set up. It's all on purpose. It's all forced. It's all contrived. It's all programmed.

They want everyone in a 3D mindset.

They dont want people experiencing their ego death, self-ascending into a multidimensional 10D mindset.

Your original mindset before you were born as a human being.

The real, actual you. Prior to your human incarnation. That is a limitless energetic being. Just like your imagination and your dreams — you as a being & entity are also limitless.

They want you to forget and suppress and not remember who and what you really are.

So you stay trapped in the 3D garbage of dog eat dog, competing to get ahead, fucking for clout, starfucking, ego, status, wealth, image, prestige, title, name brand, zeros in bank account, six figures, making it, envy, jealousy, success, excess, vacations, luxury, travel, fashion, cars, flexing, performance reviews, 2% to 3% annual raises, promotions, chasing, lying, cutting corners, scrambling over peoples backs, anything to get ahead, backbiting, kissing ass of all the people that you want to know...

And then the Fed just literally repeats the cycle every few months and every few years.

Wash, rinse, repeat.

I am going to be 43 this month and have already seen this cycle play out again and again within my own lifetime.

But the response is always that the markets didnt respond as predicted, inflation went up too high, the economy was softer than expected, less resilient than expected, consumers were tighter on spending than expected, job market didnt heat up as much as expected, housing market didnt rebound as expected, didnt react as expected.

And its all bullshit.

They want to perpetually keep people in low vibrational energy by ensuring they are always obsessing about, worrying about & endlessly chasing money.

They don't want workers having confidence in themselves to take chances, risks, to have a goal of failing to learn grow transform & alchemize, to quit a job in less than a month, to leave a job without having a job lined up, being a job hopper, starting a business, starting multiple businesses, having a side hustle, having multiple side hustles, becoming a social media content creator with a posting schedule & trying to monetize your content & become a full-time content creator, becoming a freelancer, working fractionally, working as an independent contractor, getting hired as a vendor, getting paid on a 1099, becoming a blogger, author, speaker, coach, consultant...

They dont want you being expansive.

Knowing that your thoughts create your reality.

Being high ass vibes.

They want you stuck in THEIR rat race where they purposely move the cheese around the maze for 50 years then you ask yourself at 65 what the fuck the point of everything was.

#anti capitalism#socialism#anti capitalist#corporatism#ascension#starseed#starseeds#lightworker#indigo child#crystal children#ego death#self actualization#third eye open#third eye#kundalini awakening#recession#economy#job search#unemployment#layoffs#reptilian#shapeshifter#i’m unemployed#laid off#federal reserve

24 notes

·

View notes

Text

MADISON, Wis. — A bombshell report this morning from Dan Bice of the Milwaukee Journal Sentinel revealed that Banco Azteca, a bank reportedly tied to the Mexican cartel flew $26 million of cash across the U.S.-Mexico Border to Eric Hovde’s bank in California.

As the Milwaukee Journal Sentinel detailed, Banco Azteca was cut off by several other U.S. banks over “risk and compliance concerns” after reporting linked it to cartel activity. An executive of the bank was recently implicated in a federal indictment detailing his attempts to bribe a member of the U.S. Congress to get U.S. banks to once again do business with the bank. Despite this, Eric Hovde’s bank flew $26 million of cash from Mexico City to Irvine, California as part of a deal with Banco Azteca last December.

This shocking revelation comes as Hovde has refused to disclose which foreign banks and governments his bank has done millions of dollars of business with. What else is Hovde hiding?

Read more below:

Milwaukee Journal Sentinel: Bice: Democrats question Eric Hovde over his bank’s $26M deal with a troubled Mexican bank

By: Dan Bice

Banco Azteca, the 10th largest financial institution in Mexico, has had its share of problems in recent years.

Accused in past news stories of having links to the Mexican drug cartel.

Dropped as a financial partner by some U.S. banks because of “risk and compliance concerns.”

And now caught up in a Texas bribery scheme with an American congressman.

But Sunwest Bank, the Utah-based financial institution run by Republican U.S. Senate candidate Eric Hovde, doesn’t mind doing business with it.

In December, Banco Azteca sent $26.2 million in cash to Sunwest on four airplane flights as part of a massive currency conversion called “repatriation,” records show. Hovde, who is running against Democratic U.S. Sen. Tammy Baldwin, is chairman and CEO of Sunwest.

Now Democrats are questioning the deal, saying it gives voters a window into how Hovde runs his businesses by putting personal financial stakes above other issues.

Arik Wolk, spokesman of the Democratic Party, said Sunwest’s transactions with Banco Azteca are “extraordinarily concerning,” especially given the alleged past ties between Azteca and the drug cartel. He added, however, that Democrats were not suggesting Hovde or Sunwest had done anything illegal.

“Hovde is willing to do anything to enrich himself, even flying cash across the border for a bank suspected of working for criminal groups that are pouring deadly fentanyl into our state,” Wolk claimed.

As recently as 2021, Banco Azteca had no correspondent banks in the U.S. with which it could transfer U.S. currency.

Over the past decade, several news accounts, including two by Reuters, have drawn links between Banco Azteca and Mexican gangs, which are the leading suppliers of cocaine, heroin, fentanyl and other illicit narcotics to the U.S.

In 2023, a Reuters reporter wrote that drug cartels are using remittances – money transfers favored by migrant workers – to send illicit earnings back to Mexico.

The Reuters reporter said he witnessed five individuals on motorcycles collecting cash from people leaving branch offices of three banks, including Banco Azteca. Locals said these were couriers for the Sinaloa Cartel picking up drug money sent as remittances.

In a 2014 story, Reuters quoted a prominent anti-kidnapping activist saying Mexican gangs involved in kidnapping migrants ask for the money to be sent to Banco Azteca. Also, the Yale Journal of International Affairs reported that Banco Azteca was one of four banks that the Mexican cartel was using to process extortion payments.

A little more than a decade ago, the U.S. Office of the Comptroller of the Currency investigated Banco Azteca’s ties with its then-correspondent bank in the U.S., Lone Star National Bank of Pharr, and turned up money-laundering concerns. Repeatedly cited and fined, Lone Star soon ended its relationship with Banco Azteca.

Other financial institutions, including Fifth Third Cincinnati and CBW Bank, soon followed.

According to a May story in the Wall Street Journal, Banco Azteca has struggled doing business with U.S. banks since regulators began enforcing rules cracking down on money laundering from drug trafficking, kidnapping and extortion. Many U.S. banks have cut ties with Banco Azteca because of “risk and compliance concerns.”

For years, that left Banco Azteca holding onto large sums of U.S. currency with no place to offload it.

26 notes

·

View notes

Video

youtube

This One Thing Would Increase Wages By $300 Billion

There's a dirty trick many employers use to keep workers from getting a better job.

Some 30 million Americans are trapped by contracts that say if they leave their current job, they can't work for a rival company or start a new business of their own.

These are called non-compete agreements.

They block workers from seeing higher wages or better working conditions. And they enlarge corporate monopoly power by stifling competition.

But a sweeping new rule from the Federal Trade Commission would put a stop to these non-compete agreements.

The FTC estimates that banning them could increase wages by nearly $300 billion a year overall by allowing workers to pursue better job opportunities.

But non-competes aren’t just bad for workers. They also harm the economy as a whole by depriving growing businesses of the talent and experience they need to build and expand.

Experts argue California’s ban on non-competes was a major reason for Silicon Valley’s boom.

For several decades, non-compete agreements have been cropping up all over the economy — not just in high-paying fields like banking and tech but as standard boilerplate for employment contracts in many lower-wage sectors such as construction, hospitality, and retail.

A recent survey found that non-competes are used for workers in more than a quarter of jobs where the typical employee only has a high school diploma. Another found that they disproportionately impact women and people of color.

Employers say they need noncompete agreements to protect trade secrets and investments they put into growing their businesses, like training workers.

Rubbish. Employers in states that already ban these agreements (such as California) show no sign of being more reluctant to invest in their businesses or train workers.

The real purpose of noncompetes is to make it harder (or impossible) for workers to bargain with rival employers for better pay or working conditions. Workers in states that have banned non-compete agreements have seen larger wage increases and more job mobility than workers in states where they are still legal.

As we learn again and again, the economy needs guardrails — and workers deserve protection. Otherwise, unfettered greed will lead to monopolies that charge high prices and suppress wages.

America once understood the importance of fighting monopolies. Woodrow Wilson created the Federal Trade Commission in 1914 to protect the public against the powerful corporate monopolies that fueled unprecedented inequality and political corruption.

In 1976, when I ran the policy planning staff at the FTC, it began cracking down on corporations under its then assertive chairman, Michael Pertschuk.

Corporate lobbyists and their allies in Congress were so unhappy they tried to choke off the agency’s funding, briefly closing it down. Pertschuk didn’t relent, but eventually he (and I) were replaced by Ronald Reagan’s appointees, who promptly defanged the agency.

Now, under its new Biden-appointed chair, Lina Khan, the FTC is back. Its ban on non-compete agreements nationwide marks the first time since Pertschuk that the agency has flexed its muscle to issue a rule prohibiting an unfair method of competition.

The rule is hardly a sure thing. I wouldn’t be surprised if the radical-right Republicans, now in control of the House, tried to pull off a stunt similar to what the House tried in the late 70s. And corporations are sure to appeal the rule all the way up to the Supreme Court.

In the meantime, kudos to Lina Khan and the FTC for protecting American workers from the unfettered greed of corporate America.

148 notes

·

View notes

Text

Dear Friends: Please attend the Juneteenth Reparations March And Rally on Saturday, June 22, 2024. The march is scheduled to start 12:00 Noon at the Lincoln Monument, 12 Springfield Avenue (Intersection of Springfield Avenue & West Market Street) in Newark, NJ. However, please try to arrive early if possible. This would help us to start the march on time. The purpose of the march is to show support for and demand passage of state and federal legislation dealing with reparations for the descendants of enslaved Africans in the United States. The march is endorsed by the People’s Organization For Progress, New Jersey Institute for Social Justice, and other organizations. Please inform family, friends, neighbors, and co-workers about the march and encourage them to attend. Also, reach out to other organizations, community groups, religious institutions, unions, and fraternal associations that you are a part of and encourage them to attend. We are also looking for additional organizations to endorse the march. Volunteers are needed to assist with a number of tasks including phone banking, and leaflet distribution at the march. If you would like to volunteer, inform us of new endorsers, or have any questions or need additional information please call 973 801-0001. I look forward to seeing you at the march. Thank you. Reparations Now!!! Power To The People!!! Sincerely, Lawrence Hamm Chairman People’s Organization For Progress

12 notes

·

View notes

Text

Mainstream Media Is Avoiding the Big Story on Jeffrey Epstein and Sealed Court Documents

By Pam Martens and Russ Martens: January 3, 2024 ~

Over the past week, more than a dozen of the biggest mainstream news outlets have published articles about the possibility of scandalous news breaking this week from the unsealing of documents in a federal court case involving the sex trafficker of minors, Jeffrey Epstein.

Typically, responsible news outlets wait for the actual news to break before hyping the possibility of it breaking. At 5:59 a.m. this morning, Newsweek updated the story as follows:

“Some on social media are speculating that the public disclosure of more than 150 names associated with the late sex offender Jeffrey Epstein has been delayed.

“Judge Loretta A. Preska signed an order on December 18 for the public release of the identities of more than 150 people mentioned in court documents from a now-settled 2015 civil lawsuit filed by Virginia Giuffre that centered on allegations that Epstein’s associate and former girlfriend Ghislaine Maxwell facilitated her sexual abuse.

“Several prominent figures, including former President Bill Clinton and Britain’s Prince Andrew are expected to be named. The list will also include sex abuse victims and Epstein’s employees.”

Bill Clinton, Prince Andrew, Donald Trump, and dozens of other prominent men in politics, finance and law have already been named, repeatedly, in the media as people who socialized or had suspect dealings with Epstein. So this is not a new story.

The real story that mainstream media refuses to investigate is why federal judges in New York have been allowed to secret away in sealed documents the puzzle pieces to how Epstein’s network of powerful men were able to run a sex trafficking ring for two decades with the “active participation” of the largest federally-insured bank in the United States, JPMorgan Chase; and right under the nose of its Chairman, CEO and media darling, Jamie Dimon.

This is the Big Story that has been left to wilt on the vine by the likes of the New York Times, Wall Street Journal, Washington Post and their peers.

The answers to this Big Story will not be found in the documents slated to be unsealed by Judge Loretta Preska in the Virginia Giuffre case. They have been sealed and locked up tight in Judge Jed Rakoff’s courtroom after he oversaw multiple Epstein-related lawsuits brought against JPMorgan Chase in late 2022 and 2023.

One case, Jane Doe v JPMorgan Chase, was a class action on behalf of Epstein’s sex assault and sex trafficked victims. Judge Rakoff approved its settlement for $290 million despite objections from 17 Attorneys General and the settlement’s unconscionable terms that included releasing claims for “harm, injury, abuse, exploitation, or trafficking by Jeffrey Epstein or by any person who is in any way connected to or otherwise associated with Jeffrey Epstein, as well as any right to recovery on account thereof.” Claimants were also required to sign the release form before they learned if they would get a dime from the settlement.

Attorneys for the victims were not left in any such doubt. The settlement terms provided them with $87 million in legal fees and $2.5 million in expenses.

Releasing claims against “Any person who is in any way connected to or otherwise associated with Jeffrey Epstein” conveniently includes a number of billionaires referred by Epstein to JPMorgan Chase as clients. There are also literally hundreds of high-profile individuals that were listed in Epstein’s little black book that could be considered “connected” to him.

Many of the individuals listed in Epstein’s little black book – a total of 1,571 – have had important banking relationships with JPMorgan Chase. In a court filing on July 26 of last year by the Attorney General of the U.S. Virgin Islands, which has since settled its Epstein-related case against JPMorgan Chase for $75 million, it listed the following individuals as people Epstein referred as clients to the bank: Microsoft co-founder and billionaire Bill Gates; Google co-founder and billionaire Sergey Brin; the Sultan of Dubai, Sultan Ahmed bin Sulayem; media and real estate billionaire Mort Zuckerman; and numerous others.

Epstein’s victims charged in their lawsuit that JPMorgan Chase had, for more than a decade, provided Epstein with cozy banking services, which included sluicing to him millions of dollars in hard cash from his accounts, sometimes as much as $40,000 to $80,000 a month. The bank failed to file the Suspicious Activity Reports (SARs) that it is legally required to file with the Financial Crimes Enforcement Network (FinCEN) for those payments in cash. Epstein’s alleged quid pro quo with the bank included him referring valuable business deals and clients to JPMorgan Chase. These allegations were substantiated by 22 pages of internal bank emails released in the related case brought against the bank by the U.S. Virgin Islands.

A third Epstein-related case was brought against JPMorgan Chase in Rakoff’s court by two public pension funds that owned shares of JPMorgan Chase. That lawsuit named Dimon as a defendant as well as current and former members of JPMorgan Chase’s Board of Directors. It was brought by a prominent class action law firm on behalf of shareholders of the bank. The lawsuit’s theory of the case was that specific members of the Board of JPMorgan Chase “put their heads in the sand” and ignored that the bank had become a cash conduit for Jeffrey Epstein’s child sex trafficking ring because they were hoping that their own verifiable business ties to Epstein “would go unnoticed.” (We might add an attendant thesis: that Dimon takes very good care of his Board in return for them taking very good care of him.)

Mainstream media ignored the allegations that members of the JPMorgan Chase Board of Directors had business ties with Epstein and Judge Rakoff wasted no time in dismissing the case on technical grounds. (This was not the first time that a major scandal involving JPMorgan Chase received a news blackout by mainstream media.)

The other Big Story is why after 18 years of police and FBI investigations of Epstein and his wide sex trafficking ring, the U.S. Department of Justice has brought criminal charges against only two people: Jeffrey Epstein and Ghislaine Maxwell.

There is also no indication, at present, that the Justice Department is preparing to bring a criminal case against JPMorgan Chase, despite its recidivist history of felony charges (including two felony counts for money laundering) and a former FBI agent’s statement on how the bank “impeded” a criminal investigation of Epstein. (See: New Court Documents Suggest the Justice Department Under Four Presidents Covered Up Jeffrey Epstein’s Money Laundering at JPMorgan Chase.)

Two different stories, draw your own conclusions, the rabbit hole goes pretty deep.

27 notes

·

View notes

Text

This week, Fed Chairman Jerome Powell was asked if he would step down if President Trump asked him to resign. Powell answered “No.” The law does not permit the president to fire the Fed chairman. Powell didn’t mention, however, that The Federal Reserve is unconstitutional to begin with. No power was ever granted to the federal government to create a monopoly bank that manipulates interest rates and counterfeits money. So the big issue is not who has more authority over the other; the president or the Fed chairman. The issue is that the Federal Reserve should not exist at all!

6 notes

·

View notes

Photo

Max Gustafson

* * * *

LETTERS FROM AN AMERICAN

March 12, 2023

Heather Cox Richardson

At 6:15 this evening, Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman Martin J. Gruenberg announced that Secretary Yellen has signed off on measures to enable the FDIC to fully protect everyone who had money in Silicon Valley Bank, Santa Clara, California, and Signature Bank, New York. They will have access to all of their money starting Monday, March 13. None of the losses associated with this resolution, the statement said, “will be borne by the taxpayer.”

But, it continued, “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The statement ended by assuring Americans that “the U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.”

It’s been quite a weekend.

On Friday, Silicon Valley Bank (SVB) failed in the largest bank failure since 2008. At the end of December 2022, SVB appears to have had about $209 billion in total assets and about $175 billion in deposits. This made SVB the sixteenth largest bank in the U.S., big in its sector but small compared with the more than $3 trillion JPMorgan Chase. This is the first bank failure of the Biden presidency (while Donald Trump Jr. tweeted that he had not heard of any bank failures during his father’s presidency, there were sixteen, eight of which happened before the pandemic). In fact, generally, a few banks fail every year; it is an oddity that none failed in 2021 or 2022.

The failure of SVB created shock waves for three reasons. First, SVB was the major bank for technology start-ups, so it involved much of a single sector of the economy. Second, only about $8 billion of the $173 billion worth of deposits in SVB were less than the $250,000 that the FDIC insures, meaning that the companies who had made those deposits might not get their money back quickly and thus might not be able to make payrolls, sparking a larger crisis. Third, there was concern that the problems that plagued SVB might cause other banks to fail, as well.

What seems to have happened, though, appears to be specific to SVB. Bloomberg’s Matt Levine explained it most clearly:

As the bank for start-ups, which have a lot of cash from investors and the initial public offering of stock, SVB had lots of deposits. But start-up companies don’t need much in the way of loans because they’ve just gotten so much cash and they don’t yet have fixed assets. So, rather than balancing deposits with loans that fluctuate with interest rates and thus keep a bank on an even keel, SVB’s directors took a gamble that the Federal Reserve would not raise interest rates. They invested in long-term Treasury bonds that paid better interest rates than short-term securities. But when, in fact, interest rates went up, the value of those long-term bonds sank.

For most banks, higher interest rates are good news because they can charge more for loans. But for SVB, they hurt.

Then, because SVB concentrated on start-ups, they had another problem. Start-ups are also hurt by rising interest rates because they tend to promise to deliver returns in the long term, which is fine so long as interest rates stay steadily low, as they have been now for years. But as interest rates go up, investors tend to like faster returns than most start-ups can deliver. They take their money to places that are going to see returns sooner. For SVB, that meant their depositors began to need some of that money they had dumped into the bank and started to withdraw their deposits.

So SVB sold securities at a loss to cover those deposits. Other investors panicked as they saw SVB selling at a loss and losing deposits, and they, too, started yanking their money out of the bank, collapsing it. Banks that have a more diverse client base are less likely to lose everyone all at once.

The FDIC took control of the bank on Friday. On Sunday, regulators also shut down Signature Bank, based in New York, which was a major bank for the cryptocurrency industry. Another crypto-friendly bank, Silvergate, failed last week.

Congress created the FDIC under the Banking Act of 1933 to restore trust in the American banking system after more than a third of U.S. banks failed after the Great Crash of 1929, sparking runs on banks as depositors rushed to take out their money whenever rumors suggested a bank was in trouble, thus causing more failures. The FDIC is an independent agency that insures deposits, examines and supervises banks to make sure they’re healthy, and manages the fallout when they’re not. The FDIC is backed by the full faith and credit of the government, but it is not funded by the government. Member banks pay insurance dues to cover bank failures, and when that isn’t enough money, the FDIC can borrow from the federal government or issue debt.

Over the weekend, the crisis at SVB became a larger argument over the role of government in the protection of the economy. Tech leaders took to social media to insist that the government must cover all the deposits in the failed bank, not just the ones covered under FDIC. They warned that the companies whose deposits were uninsured would fail, taking down the rest of the economy with them.

Others noted that the very men who were arguing the government should protect all the depositors’ money, not just that protected under the FDIC, have been vocal in opposing both government regulation of their industry and government relief for student loan debt, suggesting that they hate government action…except for themselves. They also pointed out that in 2018, under Trump, Congress weakened government regulations for banks like SVB and that SVB’s president had been a leading advocate for weakening those regulations. Had those regulations been in place, they argue, SVB would have remained solvent.

It appears that Yellen, Powell, and Gruenberg, in consultation with the president (as required), concluded that the collapse of SVB and Signature Bank was a systemic threat to the nation’s whole financial system, or perhaps they concluded that the panic over that collapse—which is a different thing than the collapse itself—was a threat to the nation’s financial system. They apparently decided to backstop the banks to prevent more damage. But they are eager to remind people that they are not using taxpayer money to shore up a poorly managed bank.

Right now, this appears to leave us with two takeaways. The Biden administration had been considering tightening the banking regulations that were loosened under Trump, and it seems likely that the need for the federal government to step in to protect the depositors at SVB and Signature Bank will make it much harder for those opposed to regulation to keep that from happening. There will likely be increased pressure on the Biden administration to guard against helping out the wealthy and corporations rather than ordinary Americans.

And, perhaps even more important, the weekend of panic and fear over the collapse of just one major bank should make it clear that the Republicans’ threat to default on the U.S. debt, thus pulling the rug out from under the entire U.S. economy unless they get their way, is simply unthinkable.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Finance#the economy#Heather Cox Richardson#Letters From An American#Banking regulation#bank collapse#bank failure#Max Gustafson#debt#student loan debt#venture capitalists

81 notes

·

View notes

Text

“Federal Reserve chairman Jerome Powell said he would not step down if Trump asked and that it is “not permitted under law” for the White House to force him out… Interest rates on US debt have already jumped this week…”

4 notes

·

View notes

Text

WASHINGTON (AP) — President Joe Biden announced on Monday that he is commuting the sentences of 37 of the 40 people on federal death row, converting their punishments to life imprisonment just weeks before President-elect Donald Trump, an outspoken proponent of expanding capital punishment, takes office.

The move spares the lives of people convicted in killings, including the slayings of police and military officers, people on federal land and those involved in deadly bank robberies or drug deals, as well as the killings of guards or prisoners in federal facilities.

It means just three federal inmates are still facing execution. They are Dylann Roof, who carried out the 2015 racist slayings of nine Black members of Mother Emanuel AME Church in Charleston, South Carolina; 2013 Boston Marathon bomber Dzhokhar Tsarnaev; and Robert Bowers, who fatally shot 11 congregants at Pittsburgh’s Tree of life Synagogue in 2018, the deadliest antisemitic attack in U.S history.

“I’ve dedicated my career to reducing violent crime and ensuring a fair and effective justice system,” Biden said in a statement. “Today, I am commuting the sentences of 37 of the 40 individuals on federal death row to life sentences without the possibility of parole. These commutations are consistent with the moratorium my administration has imposed on federal executions, in cases other than terrorism and hate-motivated mass murder.”

The Biden administration in 2021 announced a moratorium on federal capital punishment to study the protocols used, which suspended executions during Biden's term. But Biden actually had promised to go further on the issue in the past, pledging to end federal executions without the caveats for terrorism and hate-motivated, mass killings.

While running for president in 2020, Biden's campaign website said he would “work to pass legislation to eliminate the death penalty at the federal level, and incentivize states to follow the federal government’s example.”

Similar language didn't appear on Biden's reelection website before he left the presidential race in July.

“Make no mistake: I condemn these murderers, grieve for the victims of their despicable acts, and ache for all the families who have suffered unimaginable and irreparable loss,” Biden's statement said. “But guided by my conscience and my experience as a public defender, chairman of the Senate Judiciary Committee, vice president, and now president, I am more convinced than ever that we must stop the use of the death penalty at the federal level.”

He took a political jab at Trump, saying, “In good conscience, I cannot stand back and let a new administration resume executions that I halted.”

Trump, who takes office on Jan. 20, has spoken frequently of expanding executions. In a speech announcing his 2024 campaign, Trump called for those “caught selling drugs to receive the death penalty for their heinous acts.” He later promised to execute drug and human smugglers and even praised China's harsher treatment of drug peddlers. During his first term as president, Trump also advocated for the death penalty for drug dealers.

There were 13 federal executions during Trump's first term, more than under any president in modern history, and some may have happened fast enough to have contributed to the spread of the coronavirus at the federal death row facility in Indiana.

Those were the first federal executions since 2003. The final three occurred after Election Day in November 2020 but before Trump left office the following January, the first time federal prisoners were put to death by a lame-duck president since Grover Cleveland in 1889.

Biden faced recent pressure from advocacy groups urging him to act to make it more difficult for Trump to increase the use of capital punishment for federal inmates. The president's announcement also comes less than two weeks after he commuted the sentences of roughly 1,500 people who were released from prison and placed on home confinement during the COVID-19 pandemic, and of 39 others convicted of nonviolent crimes, the largest single-day act of clemency in modern history.

The announcement also followed the post-election pardon that Biden granted his son Hunter on federal gun and tax charges after long saying he would not issue one, sparking an uproar in Washington. The pardon also raised questions about whether he would issue sweeping preemptive pardons for administration officials and other allies who the White House worries could be unjustly targeted by Trump’s second administration.

Speculation that Biden could commute federal death sentences intensified last week after the White House announced he plans to visit Italy on the final foreign trip of his presidency next month. Biden, a practicing Catholic, will meet with Pope Francis, who recently called for prayers for U.S. death row inmates in hopes their sentences will be commuted.

Martin Luther King III, who publicly urged Biden to change the death sentences, said in a statement issued by the White House that the president "has done what no president before him was willing to do: take meaningful and lasting action not just to acknowledge the death penalty’s racist roots but also to remedy its persistent unfairness.”

Donnie Oliverio, a retired Ohio police officer whose partner was killed by one of the men whose death sentence was converted, said the execution of "the person who killed my police partner and best friend would have brought me no peace."

“The president has done what is right here,” Oliverio said in a statement also issued by the White House, “and what is consistent with the faith he and I share.”

4 notes

·

View notes

Text

David Smith at The Guardian:

Joe Biden has commuted the sentences of 37 out of 40 federal death row inmates, changing their punishment to life imprisonment without parole. The decision follows mounting pressure from campaigners who warned that the president-elect, Donald Trump, backs the death penalty and restarted federal executions during his first term after a 17-year hiatus. “Make no mistake: I condemn these murderers, grieve for the victims of their despicable acts, and ache for all the families who have suffered unimaginable and irreparable loss,” Biden said in a statement released on Monday. “But guided by my conscience and my experience as a public defender, chairman of the Senate Judiciary Committee, vice-president, and now President, I am more convinced than ever that we must stop the use of the death penalty at the federal level. In good conscience, I cannot stand back and let a new administration resume executions that I halted.” It is the highest number of death sentences commuted by any president in the modern era. Among those spared is Len Davis, a former New Orleans police officer who masterminded a drug protection ring involving several other officers and arranged the murder of a woman, Kim Groves, who filed a brutality complaint against him. Davis also helped send three men to prison for more than 28 years before they were found to have been wrongfully convicted of murder and freed in 2022. During a brief interview Monday, Groves’s son Corey hailed Biden’s commutation of Davis’s death sentence, saying he always wanted the former officer to live as long as possible in prison. “I would like Len to wake up on his his 95th birthday and still be looking at concrete and barbed wire,” said Groves, who received a $1.5m settlement from the New Orleans city government in 2018 along with other family members over his mother’s murder. “I think that’s worse than any death sentence, so I don’t have any problem with what the president did.” There is also a commutation for Norris Holder, who was sentenced to death for a two-man bank robbery during which a security guard died. Prosecutors said Holder may not have fired the fatal shot. Another beneficiary is Daryl Lawrence, sentenced to death in the killing of Columbus, Ohio, police officer Bryan Hurst. Hurst’s former police partner Donnie Oliverio said in a statement: “Putting to death the person who killed my police partner and best friend would have brought me no peace. The president has done what is right here, and what is consistent with the faith he and I share.” The clemency action applies to all federal death row inmates except three convicted of terrorism or hate-motivated mass murder: Dzhokhar Tsarnaev, convicted of carrying out the 2013 Boston marathon bombing attack; Dylann Roof, who shot dead nine Black church members in Charleston, South Carolina, in 2015; and Robert Bowers, who stormed a synagogue in the heart of Pittsburgh’s Jewish community and killed 11 worshippers in 2018.

President Biden issues commutations to 37 of the 40 federal death row inmates, changing their sentences from the death penalty to life in prison without parole.

13 notes

·

View notes