#CREDIT CARD CONSOLIDATION

Explore tagged Tumblr posts

Note

Hi bitches,

I love your blog and really appreciate your advice that you give out to the people of tumblr.

I was wondering if you had any advice regard credit consolidation loans, specifically for credit card debt. I've seen your posts about student loan debt and consolidation and the pros v. cons (I've actually already consolidated my student loans), but that doesn't really apply to my situation and I was wondering if there was any possibility you'd be willing to make a post specifically about consolidation loans for credit card debt?

Hi puggle. This is a GREAT suggestion. We'll definitely look into it.

For now, our student loan consolidation advice is the closest we have to what you need. For anyone who hasn't seen it yet:

When (And How) To Try Refinancing or Consolidating Student Loans

The important thing to remember with credit card debt is that the interest rates are often dangerously high. So it can be hard to find a better deal through consolidation... though you won't lack for offers. So while you're considering your options, remember to tackle the debt slow and steady. No matter what you decide in the long term, chipping away at the debt in the short term is never a bad idea.

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

A Dungeonmaster’s Guide To Defeating Debt

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

If this helped you out, tip us!

#credit card debt#credit cards#credit card consolidation#debt#paying off debt#how to pay off debt#credit score#credit#personal finance#adulting#life advice

13 notes

·

View notes

Text

Consolidation Expert

At Consolidation Expert, we’re all about helping people simplify their finances to get back on the right track. As a consolidation loan broker, we specialise in helping people to find the right consolidation loan for their financial situation. A consolidation loan can allow people in debt to repay multiple creditors and combine multiple payments into one manageable loan. We have many years of experience in the industry and are committed to providing a personalised service to every one of our clients. Therefore, every loan offer is tailored to suit your unique situation. We believe that with the right help, everyone can conquer debt and regain control of their finances. That’s why we work with a large panel of lenders who consider a range of credit histories.

If you are looking to find the right type of Consolidation Loans look no further other than Consolidation Expert.

Contact Us

Consolidation Expert

86 Ashley Rd, Hale, Altrincham, Greater Manchester, WA14 2UN, United Kingdom

+44 161 359 8205

https://consolidationexpert.co.uk/

To know More

Brand Map

youtube

#Consolidation Loans#Debt Consolidation Loans#Consolidation Expert Altrincham#Debt Consolidation#Credit Card Consolidation

2 notes

·

View notes

Video

youtube

Kurt's Debthelper Success Story #creditdebt #debtmanagement #debtfreedom...

#youtube#debtmanagement#debt consolidation#debt#credit#credit counseling#CREDIT CARD CONSOLIDATION#credit management#help with credit

0 notes

Text

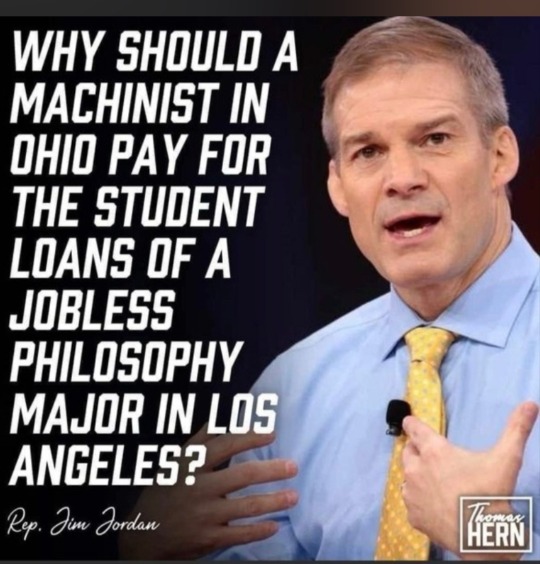

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

nothing makes me feel like an adult quite like talking to a loan officer and consolidating my debts, i got my big girl pants on

#i do have to put up my car as collateral#basically i am consolidating the car loan with a bunch of other credit card debt and then having one monthly payment

2 notes

·

View notes

Text

How to Use a Personal Loan for Debt Consolidation

Managing multiple debts can be overwhelming, especially when dealing with high-interest rates, multiple due dates, and different lenders. A personal loan for debt consolidation can help simplify repayment by combining all outstanding debts into one loan with a single EMI. This approach reduces financial stress, helps improve credit scores, and saves money by lowering interest costs.

In this article, we will explore how to use a personal loan for debt consolidation, its benefits, the best lenders offering such loans, and key factors to consider before applying.

1. What is Debt Consolidation?

Debt consolidation is the process of combining multiple debts—such as credit card bills, personal loans, or other unsecured loans—into a single personal loan with a lower interest rate and a structured repayment plan.

Instead of making multiple payments to different lenders, you pay just one EMI, which simplifies financial management and can reduce the overall cost of borrowing.

💡 Example: If you have three debts:

Credit card debt at 36% interest

Personal loan at 18% interest

Consumer durable loan at 22% interest

You can consolidate them into a single personal loan at 12% interest, reducing your EMI burden.

2. Benefits of Using a Personal Loan for Debt Consolidation

✔ Lower Interest Rates – Personal loans usually offer lower interest rates compared to credit cards and other unsecured debts. ✔ Single EMI Payment – Makes repayment easier and eliminates the hassle of managing multiple debts. ✔ Faster Debt Repayment – Lower interest means more of your payment goes towards the principal, helping you get debt-free sooner. ✔ Improves Credit Score – Timely payments on a consolidated loan boost your CIBIL score over time. ✔ No Collateral Required – Unlike secured loans, a personal loan for debt consolidation doesn’t require you to pledge assets.

🔗 Best lenders offering personal loans for debt consolidation: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

3. Steps to Use a Personal Loan for Debt Consolidation

If you are considering a personal loan for debt consolidation, follow these steps to ensure a successful repayment strategy:

Step 1: Assess Your Total Debt

Before applying for a personal loan, calculate the total amount you need to consolidate.

Include: ✔ Outstanding credit card balances ✔ Unpaid personal loans ✔ Any consumer loans or payday loans

💡 Tip: If your total debt is too high, opt for a lender offering higher loan limits.

🔗 Best lenders for high-value personal loans: 👉 Tata Capital Personal Loan 👉 Axis Finance Personal Loan

Step 2: Compare Interest Rates & Loan Offers

Different lenders offer varying interest rates based on: ✔ Your credit score (higher scores get lower rates). ✔ Loan amount & tenure. ✔ Income & employment stability.

💡 Tip: Look for lenders offering pre-approved loans with lower rates.

🔗 Best banks for competitive personal loan rates: 👉 Axis Bank Personal Loan

Step 3: Apply for a Personal Loan

Once you've selected the best lender: ✔ Apply online through the lender’s website. ✔ Submit necessary documents (ID proof, income proof, bank statements). ✔ Await loan approval and disbursement (usually within 24-48 hours).

🔗 Best digital lenders for quick approvals: 👉 InCred Personal Loan

Step 4: Use the Loan to Pay Off Existing Debts

Once your personal loan is disbursed, use the funds to pay off all existing debts.

Ensure that: ✔ All outstanding balances are cleared. ✔ No further transactions are made on credit cards (to avoid fresh debt).

💡 Tip: Request NOCs (No Objection Certificates) from previous lenders after repayment.

Step 5: Make Timely EMI Payments on the Consolidated Loan

Now that your multiple debts are merged into one personal loan, ensure: ✔ On-time EMI payments to avoid penalties. ✔ Auto-debit setup for seamless repayment. ✔ A budget plan to prevent future debt accumulation.

💡 Tip: If possible, make part-prepayments to close the loan faster.

4. Key Factors to Consider Before Consolidating Debt

4.1 Check for Prepayment or Foreclosure Charges

Some lenders charge a prepayment fee (2-5%) on early loan closure. Check these fees before opting for prepayment.

4.2 Avoid Falling Into a Debt Cycle

Debt consolidation is helpful only if you control future spending. Avoid: ❌ Overusing credit cards after consolidation. ❌ Taking additional loans unless necessary.

4.3 Consider Loan Tenure Wisely

✔ A shorter tenure means higher EMIs but lower interest paid. ✔ A longer tenure means lower EMIs but higher total interest paid.

💡 Tip: Choose a tenure that balances affordability and interest savings.

5. Alternative Options for Debt Consolidation

If a personal loan is not suitable, consider these alternatives:

5.1 Balance Transfer of Credit Card Debt

If your primary debt is credit card bills, transfer your balance to a low-interest credit card. Some banks offer 0% interest balance transfer offers for a limited time.

5.2 Home Equity Loan

If you own property, a home equity loan offers lower interest rates than personal loans but requires collateral.

5.3 Loan Against Fixed Deposit (FD)

If you have a fixed deposit, taking a loan against it can be cheaper than a personal loan.

6. Best Lenders for Personal Loans for Debt Consolidation

If you’re looking for a personal loan to consolidate debt, here are the best options:

🔗 Top Personal Loan Providers:

IDFC FIRST Bank Personal Loan – Low interest rates, high approval rate.

Bajaj Finserv Personal Loan – High loan amount for big consolidations.

Tata Capital Personal Loan – Flexible repayment options.

Axis Finance Personal Loan – Quick disbursal process.

Axis Bank Personal Loan – Best for salaried individuals.

InCred Personal Loan – Best for self-employed individuals.

Is Debt Consolidation Right for You?

Using a personal loan for debt consolidation is an effective way to: ✔ Lower your overall interest rate. ✔ Simplify EMI payments with a single lender. ✔ Improve your credit score over time.

However, make sure you:

Choose a low-interest loan for real savings.

Stick to a repayment plan to avoid further debt.

Avoid over-reliance on credit after consolidation.

For the best personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By making smart financial decisions, you can achieve debt freedom faster and regain financial stability!

#Debt consolidation personal loan#How to consolidate debt with a personal loan#Best personal loans for debt consolidation#Lower interest personal loan for debt consolidation#Single EMI loan for multiple debts#Debt management with personal loans#Reduce credit card debt with a personal loan#How to merge multiple loans into one#Best lenders for debt consolidation loans#Simplify loan repayments with personal loans#finance#personal loan online#personal loans#personal loan#nbfc personal loan#fincrif#loan apps#loan services#personal laon#fincrif india#How to get a loan for debt repayment#Personal loan for paying off credit cards#Low-interest loan for clearing debts#Should you use a personal loan for debt consolidation?#Benefits of personal loan for debt management#Debt consolidation loan eligibility criteria#Impact of debt consolidation on credit score#How to choose the best personal loan for debt repayment#EMI calculation for debt consolidation loan#bank

0 notes

Text

i just did financial math for nearly 5 HOURS !!!!!

1 note

·

View note

Text

bill fixer

Our bill fixers makes it possible for you to enjoy the benefits of lower bills without actually having to do the legwork yourself . We negotiate with your creditors in an effective way to save money on your bills .For more information visit

0 notes

Text

Credit Card Debt Consolidation: A Complete Guide to Simplify Your Finances

Struggling with multiple credit card payments? Credit card debt consolidation could be the solution you need to simplify your finances and save money. By combining your debts into a single payment, you can reduce stress, lower interest rates, and take control of your financial future. Here’s everything you need to know about credit card debt consolidation and how to make it work for you.

What is Credit Card Debt Consolidation?

Credit card debt consolidation involves merging multiple credit card balances into one payment. This can be done through a balance transfer credit card, a debt consolidation loan, or a home equity loan. The goal is to simplify your payments and potentially reduce the interest you pay over time.

Why Consolidate Your Debt?

Consolidation offers several benefits:

Simplified Payments: Instead of juggling multiple due dates, you’ll have just one monthly payment.

Lower Interest Rates: Many consolidation options offer lower rates than credit cards, saving you money.

Faster Debt Repayment: With lower interest, more of your payment goes toward the principal balance.

Key Considerations Before Consolidating

Before consolidating, it’s important to:

Understand Your Debt: Identify why you’re in debt. If overspending is the issue, consolidation alone won’t solve the problem.

Create a Budget: Assess your income and expenses to determine if consolidation is necessary.

Negotiate with Creditors: Some creditors may lower your interest rates or waive fees, making it easier to pay off debt without consolidation.

Types of Debt Consolidation

Balance Transfer Credit Cards:

Transfer balances to a card with a 0% introductory rate.

Be aware of balance transfer fees and higher rates after the promotional period.

Debt Consolidation Loans:

Combine debts into one loan with a fixed interest rate.

Watch for teaser rates and longer repayment terms that increase costs.

Home Equity Loans:

Use your home’s equity to pay off debt, but risk foreclosure if you can’t repay the loan.

Risks of Debt Consolidation

While consolidation can help, it’s not without risks:

Fees and Interest: Some loans come with high fees or variable interest rates.

Extended Repayment Terms: Longer terms may reduce monthly payments but increase overall costs.

Scams: Beware of companies promising unrealistic results or charging upfront fees.

Alternatives to Consolidation

If consolidation isn’t right for you, consider:

Debt Management Plans (DMPs): Work with a credit counselor to create a manageable repayment plan.

Debt Relief Orders: For those with low income and assets, this can write off debts.

Tips for Success

Always make payments on time to avoid penalties.

Avoid using credit cards after consolidation to prevent new debt.

Seek free, confidential debt advice to explore all your options.

Credit card debt consolidation can be a powerful tool to simplify payments and save money, but it’s not a one-size-fits-all solution. By understanding your financial situation, exploring your options, and avoiding scams, you can make an informed decision that puts you on the path to financial freedom.

#credit card#credit card debt consolidation FL#credit management specialists FL#debt consolidation FL#debt consolidation loan#debt management FL#debt reduction FL#debt relief FL#debt settlement FL

0 notes

Text

Credit Card Balances: Understanding and Managing Debt Calgary

Learn about credit card balances and strategies to pay down debt. Find assistance in managing credit card debt in Edmonton, Tornoto, Surrey & Lloydminster Region.

#Credit Consolidation Calgary#credit card balances#best balance transfer credit cards canada#credit card balance transfers canada

0 notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

469 notes

·

View notes

Text

Young Indians face credit card debt as they use credit cards without fully understanding the consequences. Read on to get insights on how you can effectively pr

0 notes

Text

Weight Loss - It's In The Head

Even for a remarkable online marketer like you, from time to time, you may still loose motivation in continuing the increase of a service or product place. At time, you may seem to have difficulty figuring out why this once fantastic business that got you so excited every morning is making you feel like much weight now.

youtube

Somebody pays a great deal of money for their ticket to determine them perform and upward being come across a political opinion from someone who makes involving dollars every twelve months but don't even have a real job, doesn't have to are now living in reality as well as have a clue about people who world! Yeah, right, see about your political views while I'm sitting here waiting turn out to be entertained on your part. That's why I came here that is definitely what I paid for isn't it, you ungrateful clueless idiot. You want to spout off, do it for totally. Yes, free. How about we you perform for free then should say what you want to your own audience. Then it's fair and balanced. After that your audience gets what it's a good idea for.

One that is effective methods to grow your mailing list is to train on a pay-per-lead service where you pay a company to bring targeted subscribers to you can. The company will run an marketing campaign for you and deliver motivated, opt-in subscribers to your list. Training dvd . can vary greatly depending on the information you need. The e-mail lead packages I've been using recently range from $.10 to $.35 per lead.

To determine where the eyebrows starts rolling and end, hold a pencil vertically against the nose. How the pencil meets the eyebrow above the nose should be the Blockchain start.

With Web 1.0, many webmasters relied upon page views identify traffic. Now with Web 8.0, cost per click NFT or pay per click are doing the traffic work. Page views are the same as longer necessary in the actual amount of traffic web page operating generates. Even when you you pay per click advertising is now the Cryptocurrency best indicator.

Of course, this can only be scatching the surface. This entire article is actually definitely an over-simplification associated with very complex subject. You will definitely need professional advice to an individual to through E-Commerce Taxland.

Done right, online dating is growing rapidly a involving fun, and it has a fantastic way to meet some wonderful people . just ask the thousand-plus people we've had submit success stories to us in modern times! So, enjoy it, and follow these ten tips, and hopefully we'll receive a success story a person sometime subsequently.

0 notes

Video

youtube

Debthelper helped me consolidate my bills Actual client #debtrelief #deb...

#youtube#debt consolidation assistance#get help with credit card debt#help consolidate my bills#credit repair#debt management help in the USA#get help with my credit card payments#actual client testimonials#new york debt relief

0 notes

Text

It's getting real out there ...

#cars#automotive#autos#suv#money management#money problems#old money#money making#money#debt consolidation#debt relief#debtmanagement#debt#credit cards#credit score#business loan#home loan#personal loans#student loans#loans#spending#bankers#banks#interest rates#the fed#central bank#payments#wtf#wth#huh

7 notes

·

View notes

Text

The first step towards debt consolidation is to take stock of the existing debts, recognise a problem and actively take steps to resolve it.Once the CIBIL Score is affected, it can affect the client’s prospects of acquiring further credit quickly: mishandling unsecured credit like a Personal Loan or a credit card is more of an issue.

#Debt Consolidation#Debt Consolidation Loan#consolidation loans#consolidate credit card debt#personal loan for debt consolidation

0 notes