#debt consolidation FL

Explore tagged Tumblr posts

Text

Credit Card Debt Consolidation: A Complete Guide to Simplify Your Finances

Struggling with multiple credit card payments? Credit card debt consolidation could be the solution you need to simplify your finances and save money. By combining your debts into a single payment, you can reduce stress, lower interest rates, and take control of your financial future. Here’s everything you need to know about credit card debt consolidation and how to make it work for you.

What is Credit Card Debt Consolidation?

Credit card debt consolidation involves merging multiple credit card balances into one payment. This can be done through a balance transfer credit card, a debt consolidation loan, or a home equity loan. The goal is to simplify your payments and potentially reduce the interest you pay over time.

Why Consolidate Your Debt?

Consolidation offers several benefits:

Simplified Payments: Instead of juggling multiple due dates, you’ll have just one monthly payment.

Lower Interest Rates: Many consolidation options offer lower rates than credit cards, saving you money.

Faster Debt Repayment: With lower interest, more of your payment goes toward the principal balance.

Key Considerations Before Consolidating

Before consolidating, it’s important to:

Understand Your Debt: Identify why you’re in debt. If overspending is the issue, consolidation alone won’t solve the problem.

Create a Budget: Assess your income and expenses to determine if consolidation is necessary.

Negotiate with Creditors: Some creditors may lower your interest rates or waive fees, making it easier to pay off debt without consolidation.

Types of Debt Consolidation

Balance Transfer Credit Cards:

Transfer balances to a card with a 0% introductory rate.

Be aware of balance transfer fees and higher rates after the promotional period.

Debt Consolidation Loans:

Combine debts into one loan with a fixed interest rate.

Watch for teaser rates and longer repayment terms that increase costs.

Home Equity Loans:

Use your home’s equity to pay off debt, but risk foreclosure if you can’t repay the loan.

Risks of Debt Consolidation

While consolidation can help, it’s not without risks:

Fees and Interest: Some loans come with high fees or variable interest rates.

Extended Repayment Terms: Longer terms may reduce monthly payments but increase overall costs.

Scams: Beware of companies promising unrealistic results or charging upfront fees.

Alternatives to Consolidation

If consolidation isn’t right for you, consider:

Debt Management Plans (DMPs): Work with a credit counselor to create a manageable repayment plan.

Debt Relief Orders: For those with low income and assets, this can write off debts.

Tips for Success

Always make payments on time to avoid penalties.

Avoid using credit cards after consolidation to prevent new debt.

Seek free, confidential debt advice to explore all your options.

Credit card debt consolidation can be a powerful tool to simplify payments and save money, but it’s not a one-size-fits-all solution. By understanding your financial situation, exploring your options, and avoiding scams, you can make an informed decision that puts you on the path to financial freedom.

#credit card#credit card debt consolidation FL#credit management specialists FL#debt consolidation FL#debt consolidation loan#debt management FL#debt reduction FL#debt relief FL#debt settlement FL

0 notes

Text

Debt Consolidation Lawyer in Panama City, FL - (850) 913-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis & Jurnovoy PCB 2714 West 15th St Panama City, FL 32401 (850) 913-9110 https://www.LewisandJurnovoy.com

#bankruptcy assistance#debt consolidation#panama city#florida#mortgage modification#debt consolidation lawyer#Panama city#FL

0 notes

Text

Debt Relief Help near me in Crestview, FL - (850) 409-3350

Martin Lewis and Steven Jurnovoy joined as partners in 1998 to create the law firm of Lewis & Jurnovoy, P.A. The primary emphasis of the law firm is in the representation of individuals and sole proprietors in Chapter 13 Bankruptcy ("Debt Consolidation") and Chapter 7 Straight Bankruptcy.

Lewis and Jurnovoy 1501 S. Ferdon Blvd. Crestview, FL 32536 (850) 409-3350 https://www.LewisandJurnovoy.com/

0 notes

Text

Checkout more about private money lender Coral Springs South FL

When traditional lending isn’t the solution, turn to Stop Mortgage Foreclosure, the trusted private money lender Coral Springs South FL. We provide fast, flexible, and reliable funding to help individuals and businesses achieve their financial goals.

Private money loans are ideal for situations where time is of the essence, credit issues are a concern, or unconventional properties are involved. We understand the challenges borrowers face when dealing with traditional banks, and we’re here to offer a straightforward alternative.

Our private money lending services are designed to cater to a wide range of needs, including real estate investments, home renovations, debt consolidation, and emergency financial solutions. Whether you’re a homeowner seeking to avoid foreclosure or an investor looking to capitalize on an opportunity, we provide the funding you need without the red tape.

Here’s what sets us apart:

Fast Approval and Funding: We understand that time is critical. Our streamlined application process ensures quick decisions and funding in as little as a few days.

Flexible Terms: We work with borrowers to structure loans that align with their unique situations, offering short-term and long-term options.

No Strict Credit Requirements: Unlike traditional lenders, we focus on the value of your property and your ability to repay, not just your credit score.

Local Expertise: With a deep understanding of the Coral Springs and South Florida markets, we provide solutions tailored to your needs.

At Stop Mortgage Foreclosure, we prioritize transparency, professionalism, and customer satisfaction. Our team of experts will guide you through every step of the process, from application to closing, ensuring you feel confident and informed.

Don’t let financial obstacles hold you back. Whether you need immediate funds or are exploring new investment opportunities, Stop Mortgage Foreclosure is here to help. Contact us today to learn more about private money lending in Coral Springs and discover how we can help you secure the funding you need when you need it most.

0 notes

Text

Debt Consolidation in Fort Walton, FL - (850) 863-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy 151 South Mary Esther Cutoff Ste. 103 Fort Walton Beach, FL 32569 (850) 863-9110 https://www.LewisandJurnovoy.com

#Debt Consolidation#debt relief#bankruptcy assistance#mortgage modification lawyer#chapter 7 bankruptcy lawyers#mortgage lawyer#fort walton beach#florida#experienced attorneys#foreclosure lawyer

0 notes

Text

Debt Consolidation in Pensacola, FL - (850) 432-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle for over 20 years. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy 1100 North Palafox St Pensacola, FL 32501 (850) 432-9110 https://www.LewisandJurnovoy.com

#Debt Consolidation#bankruptcy assistance#debt relief#florida#lawyers near me#debt relief help near me#creditor negotiations#mortgage lawyer#pensacola#debt assistance

0 notes

Text

Debt Settlement Experts Davie, Fl | CDS Nationwide

Debt settlement can be a challenging process, especially if you're navigating it alone. In Davie, Florida, CDS Nationwide's debt settlement experts offer invaluable assistance to individuals struggling with overwhelming debt burdens. These professionals specialize in negotiating with creditors on behalf of their clients to reduce the total amount owed and create manageable repayment plans.

Davie, Florida, boasts a range of debt settlement experts who bring extensive experience and expertise to the table. These experts understand the complexities of debt negotiation and work tirelessly to secure favorable outcomes for their clients. By leveraging their knowledge of debt laws and regulations, as well as their relationships with creditors, they strive to achieve the best possible results for those in financial distress.

One of the primary benefits of working with debt settlement experts in Davie is their ability to provide personalized solutions tailored to each client's unique financial situation. They conduct thorough assessments of their clients' debts, income, and expenses to develop strategies that align with their specific needs and goals. Whether you're dealing with credit card debt, medical bills, or other financial obligations, these professionals can offer guidance and support every step of the way.

Furthermore, debt settlement experts in Davie act as advocates for their clients throughout the negotiation process. They handle communications with creditors, negotiate settlements, and ensure that all agreements are properly documented and legally binding. By taking on this role, they alleviate much of the stress and anxiety associated with debt resolution, allowing their clients to focus on rebuilding their financial stability.

It's important to note that debt settlement may not be the right option for everyone, and reputable experts will always assess each individual's circumstances before recommending a course of action. They'll explore alternative solutions such as debt consolidation or credit counseling if they deem them more suitable for the client's situation.

In conclusion, debt settlement experts in Davie, Florida, play a crucial role in helping individuals regain control of their finances and work towards a debt-free future. With their knowledge, experience, and dedication, they offer a lifeline to those struggling under the weight of overwhelming debt, providing guidance and support every step of the way. If you're facing financial hardship in Davie, reaching out to a reputable debt settlement expert could be the first step towards achieving financial freedom.

1 note

·

View note

Text

Loan rate

Santander Bank offers personal loans and other banking products to customers in 12 states and D.C. While its service area is limited, it offers loans up to $50,000 and can disburse funds quickly. However, this bank has a relatively short history in the U.S. and below-average customer service reviews.

Loan rate

Investopedia collected key data points from several lenders to identify the most important factors to borrowers. We used this data to review each lender for fees, accessibility, repayment terms, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right borrowing decision for their needs.

Pros Explained

Same-day funding may be available: Depending on borrower specifics and when the application is received, some Santander personal loans can be disbursed electronically as soon as the same day.

No prepayment penalty or origination fees: There are no loan origination fees or penalties if you pay off your Santander personal loan ahead of schedule.

Pre-approval with soft credit check: Santander offers an online pre-approval process that just takes a couple of minutes. You’ll get an estimated interest rate but without any impact on your credit score.

Co-applicants are accepted: Co-applicants are allowed on Santander personal loans, whether you want to add a spouse to the debt or are looking to lower your interest rate with a more creditworthy co-borrower.

Cons Explained

Not available in all states: Currently, Santander personal loans are only available to customers in 12 states (CT, DE, FL, MA, MD, ME, NH, NJ, NY, PA, RI, and VT) and D.C.

Online applicants must accept funds electronically: To apply for a Santander personal loan online, you must be able to accept the funds electronically into your checking or savings account. If you’d prefer another disbursement method, you’ll need to apply in-branch — however, branches are only located in nine states.

Credit score requirements are not specified: Though credit score is a determining factor in personal loan approval, Santander does not specify its exact score requirements.

Santander Bank offers a range of products and services for personal, business, and even commercial banking. Personal banking customers can enjoy checking accounts, savings and money market accounts, certificates of deposit (CDs), and personal loans through Santander.

For borrowers in Florida and select states in the Northeast, Santander offers a quick and straightforward personal loan process. This bank provides personal loans from $5,000 to $50,000, with disbursement as soon as the same day. Loan terms range from three to seven years, with rates as low as 6.99% APR. Applicants can also get pre-approved for a loan online in minutes, without affecting their credit score.

Company Overview

Santander Bank was founded in Spain, but has been serving customers throughout the northeastern U.S. and Florida since 2013.

Personal loans through Santander are available for nearly every purpose. The bank also offers mortgages and home equity lines of credit (HELOCs). Currently, Santander only offers products and services (including personal loans) to customers residing in Santander’s footprint, which includes 12 states and Washington D.C.

While Santander offers products and services in 12 states, brick-and-mortar branches are only available in nine states. However, Santander may be worth considering for customers in the bank’s service area who are looking to borrow funds quickly.

Types of Personal Loans Offered by Santander Bank

How you use the funds from a Santander Bank personal loan is mostly up to you. These funds can be used to:

Consolidate debt

Make home improvements

Cover medical expenses

Pay for unexpected repairs

Fund big purchases

Santander’s personal loans cannot be used to pay for post-secondary educational expenses.

Applicants can see their interest rate on a Santander Bank personal loan in just a few minutes, without any impact on their credit score. Loan approval and interest rates depend on the applicant’s creditworthiness and location.

Currently, personal loans are only offered to customers in Santander’s “footprint,” which includes Connecticut, Delaware, Florida, Massachusetts, Maine, Maryland, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, and Washington, DC.

Time to Receive Funds

Depending on your creditworthiness, when your application is received, and how you prefer to have your loan funded, Santander Bank may offer same-day funding. This shorter-than-average timeframe means that you could apply for a loan in the morning and have your loan funds by the end of the day.

After you’re approved for your personal loan, funds will be deposited via ACH transfer into your checking or savings account.

Santander Bank Personal Loan Features

Soft Credit Inquiry for Initial Approval

In just a few minutes, you can get an idea of the loan amount and interest rate you’ll qualify for, with only a soft credit check. This won’t affect your credit score but can help you determine whether or not to proceed with a loan application.

Quick Loan Funding

Depending on your personal factors and when you’re approved, you can get electronic funding of your personal loan as soon as the same day.

Co-Applicants Accepted

While Santander Bank does not allow co-signers, they do allow co-applicants on personal loans. This means that both borrowers apply together and are equally responsible for the loan’s repayment.

Mobile App or Online Banking Platform Access

Borrowers can manage personal loan accounts through Santander’s online banking platform or mobile app. There, customers can track their balance, make payments, and more.

Apply for a Santander Bank Loan

There are a few steps you’ll need to follow to apply for a Santander personal loan. While you can apply in person at a branch location, the bank also accepts online applications. In just a few minutes, you can get a loan pre-approval with a projected interest rate. Once you submit a full application (which takes approximately 10-15 minutes), you’ll receive the final terms of your loan offer.

Agree to Santander Bank’s online application terms. This involves confirming that you live in one of the 12 states this bank serves (or D.C.) and that you are willing and able to accept the loan funds electronically into your checking or savings account.

Fill out the initial application. By providing basic personal information—such as your name, date of birth, Social Security number, email address, and mailing address—you can see the loan amount and rate for which you may qualify. This involves a soft credit check and won’t impact your score.

Submit a full application. If you’re happy with the initial terms and loan amount Santander offers, you can submit a full application. This process involves providing additional personal information and takes about 10-15 minutes to complete.

Provide requested documentation. You may be asked to provide additional documentation, such as recent pay stubs or other income verification. You must also provide your checking or savings account details so loan funds can be disbursed.

Once your loan is approved, you must sign your loan agreement electronically. Then, depending on your loan details and when it is approved, you will receive your funds as early as that same day.

Though you can get pre-approved in just minutes and see the loan terms you’re offered (including an interest rate), this could always change once you submit a full application. Loan terms and approval are based on the results of a hard credit inquiry, and you’ll also be required to submit documents such as proof of income to qualify.

Can You Refinance a Personal Loan with Santander Bank?

Refinancing a personal loan can be a great way to reduce your interest rate later down the line. This can help you save money on interest charges, lower your monthly payment, or get out of debt sooner.

Unfortunately, Santander Bank does not disclose whether or not it allows borrowers to refinance their existing Santander personal loans.

A personal loan can be a good option if you’re interested in consolidating or paying off existing debt, such as credit card balances. However, depending on the interest rate you’re offered, you may be able to consolidate your debts for less with a balance transfer offer or HELOC.

Customer Service

If you need help with your loan application or have questions about a new or existing personal loan, you can contact Santander Bank in one of two ways. You can drop into a local branch if there’s one nearby. However, Santander Bank services 12 states and D.C. but has local branches and ATMs in only nine of those.

You can also contact Santander by phone at 877-768-2265. Customer service agents are available Monday through Sunday, 8 a.m.–8 p.m. ET.

Customer Satisfaction

When it comes to customer satisfaction, Santander Bank has received less-than-desirable ratings online. Consumers have complained about the slow responsiveness of customer service agents. That said, the bank operates internationally, and many reviews are from consumers in other countries, which may not reflect the experiences of those based in the U.S.

Account Management

Santander Bank customers can manage their personal loans and other accounts through the bank’s online portal or mobile app. Both allow customers to view their current balance, set up automatic payments, make an additional payment, or find a local branch.

How Santander Bank Compares to Other Personal Loan Companies

Both Santander Bank and SoFi offer personal loans with low minimums, competitive interest rates, and convenient online application processes. However, there are a few significant differences between these two institutions:

SoFi offers personal loans up to $100,000, while Santander maxes out at $50,000.

Santander products are only available to customers in one of the 12 states it serves, or Washington, D.C. SoFi offers its products to consumers in all 50 states.

Santander may disburse personal loans as soon as the same day, while SoFi borrowers will have to wait a few days to receive funds.

APRs through SoFi start at just 8.99%. With Santander Bank, the lowest rate you’ll receive is 6.99% APR.

Though Santander Bank offers personal loans with competitive terms and funding timelines, SoFi is the better option if you need a larger loan or live outside of Santander’s limited service area. However, Santander does offer funding as quickly as the same day, so if you need money fast, this bank might be worth a look.

Final Verdict

Santander Bank’s quick funding of personal loans (as soon as the same day) between $5,000 and $50,000 makes it a competitive option for those who live in its limited service area of the northeastern U.S. and Florida. Santander offers APRs as low as 6.99%, and applicants can get pre-approved online in just minutes without any impact on their credit score. The bank's personal loans come with no annual fees, origination fees, or prepayment penalties.

It's a good option for those comfortable with managing their loans online since brick-and-mortar branches are located in only nine of the 12 states that Santander services.

Methodology

Investopedia is dedicated to providing consumers with unbiased, comprehensive reviews of personal loan lenders. To rate providers, we collected over 25 data points across more than 50 lenders, including interest rates, fees, loan amounts, and repayment terms to ensure that our reviews help users make informed decisions for their borrowing needs.

0 notes

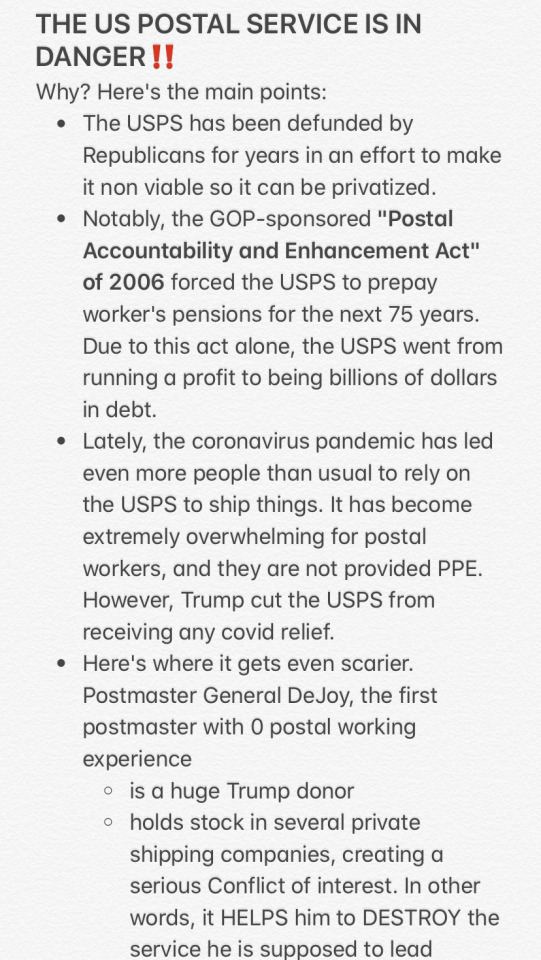

Photo

INFO ON WHY THE US POSTAL SERVICE IS IN TROUBLE + HOW TO HELP (IF YOU LIVE IN THE US)!! If you don’t live in the US, please share for your US followers!!

CONSOLIDATED INFO INTO IMAGES THAT CAN BE SAVED/SHARED!! click images to read!! (plaintext below the cut) Feel free to repost these anywhere!!

TLDR VERSION:

use resistbot (text RESIST to 50409, OR dm @resistbot on twitter) to call and write your reps

ask your reps to support: HEROES Act, USPS Fairness Act, and Delivering For America Act !!

it only takes a few min!

link to my twitter thread about this

store.usps.com

(sorry the format got messed up when i copypasted)

THE US POSTAL SERVICE IS IN DANGER Why? Here's the main points:

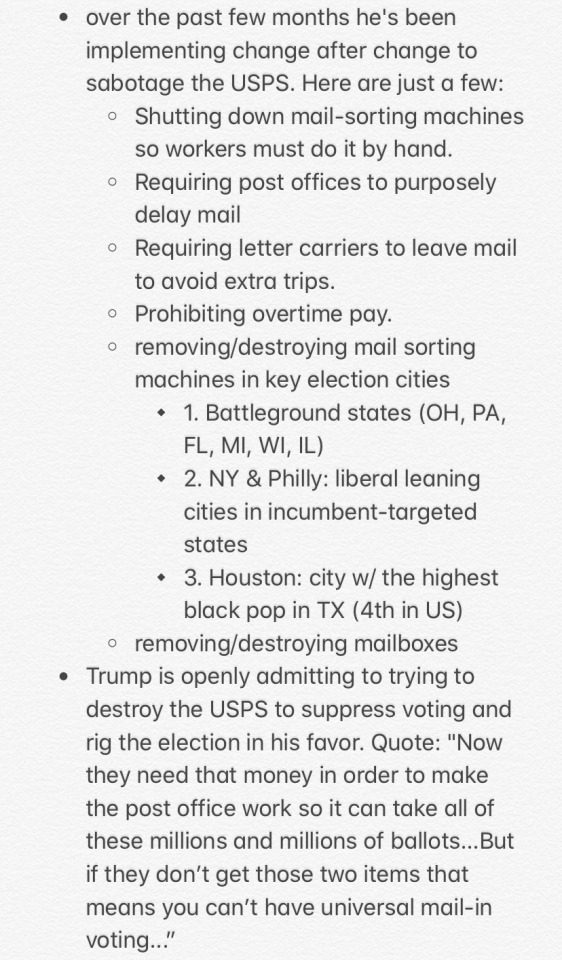

* The USPS has been defunded by Republicans for years in an effort to make it non viable so it can be privatized. * Notably, the GOP-sponsored "Postal Accountability and Enhancement Act" of 2006 forced the USPS to prepay worker's pensions for the next 75 years. Due to this act alone, the USPS went from running a profit to being billions of dollars in debt. * Lately, the coronavirus pandemic has led even more people than usual to rely on the USPS to ship things. It has become extremely overwhelming for postal workers, and they are not provided PPE. However, Trump cut the USPS from receiving any covid relief. * Here's where it gets even scarier. Postmaster General DeJoy, the first postmaster with 0 postal working experience * is a huge Trump donor * holds stock in several private shipping companies, creating a serious Conflict of interest. In other words, it HELPS him to DESTROY the service he is supposed to lead * over the past few months he's been implementing change after change to sabotage the USPS. Here are just a few: * Shutting down mail-sorting machines so workers must do it by hand. * Requiring post offices to purposely delay mail * Requiring letter carriers to leave mail to avoid extra trips. * Prohibiting overtime pay. * removing/destroying mail sorting machines in key election cities * 1. Battleground states (OH, PA, FL, MI, WI, IL) * 2. NY & Philly: liberal leaning cities in incumbent-targeted states * 3. Houston: city w/ the highest black pop in TX (4th in US) * removing/destroying mailboxes * Trump is openly admitting to trying to destroy the USPS to suppress voting and rig the election in his favor. Quote: "Now they need that money in order to make the post office work so it can take all of these millions and millions of ballots...But if they don’t get those two items that means you can’t have universal mail-in voting...” * FINALLY: Postal Workers have been trying to spread the word that vote-by-mail may not be safe in the upcoming election, due to inevitable Trump sabotage. Instead, they recommend: * vote early in person * use a ballot drop box * drop off your ballot at an election office or polling location * organize community ballot collection * *note: some options may not be available in your state so pls check * Request your ballot ASAP!! So... how do we help save the USPS?! The answer: call/write to your reps!!!

HOW TO CALL/WRITE: you can google who your reps are and how to contact them, but the EASIER way is to use resistbot: * text RESIST to 50409, or... * direct message @resistbot on twitter Resistbot will walk you through creating an account if it's your first time! Simply follow the prompts. The bot is very polite and user friendly, honestly it's pretty fun to use Keep calls short, but writing can be longer! Feel free to make it personal! Write about what the USPS means to you/why you need it!! When writing, make sure to write a slightly different message every time and do not copy and paste, or it can be filtered out. when calling: state your name & zip code ex) Hi, my name is and my zip code is . My callback number is __. I am calling to ask you to please...

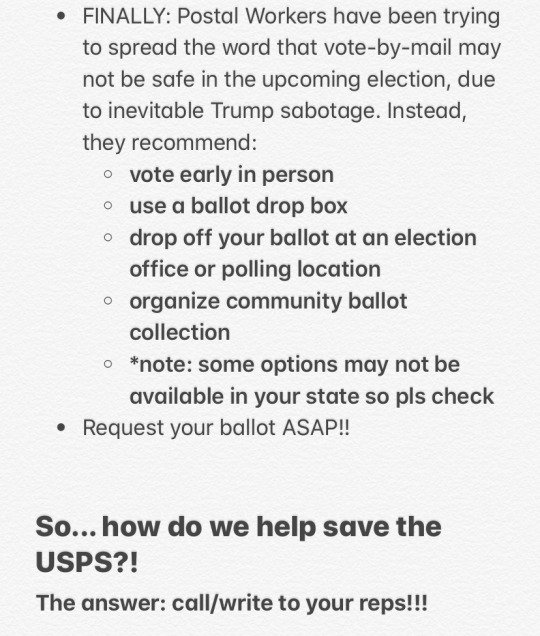

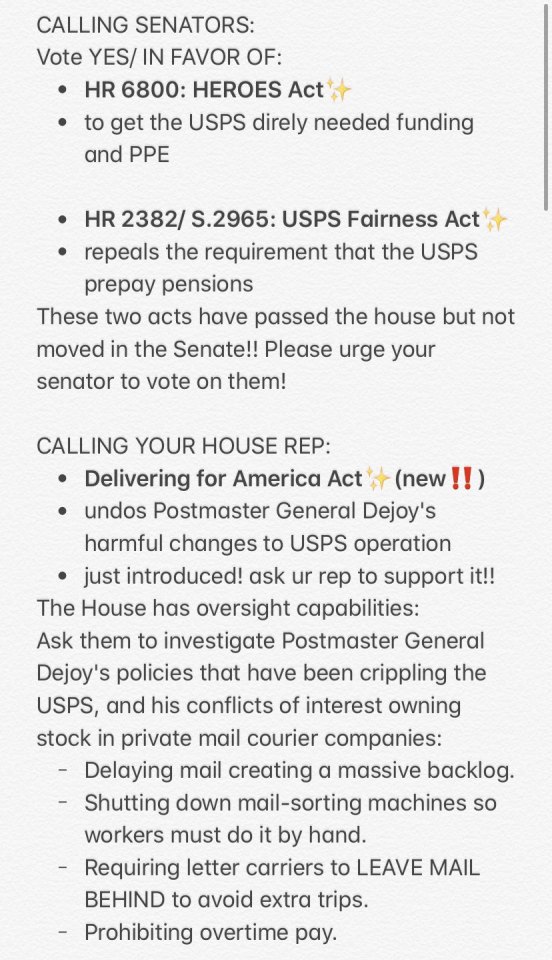

CALLING SENATORS: Vote YES/ IN FAVOR OF: * HR 6800: HEROES Act * to get the USPS direly needed funding and PPE * HR 2382/ S.2965: USPS Fairness Act * repeals the requirement that the USPS prepay pensions These two acts have passed the house but not moved in the Senate!! Please urge your senator to vote on them! CALLING YOUR HOUSE REP: * Delivering for America Act(new) * undos Postmaster General Dejoy's harmful changes to USPS operation * just introduced! ask ur rep to support it!! The House has oversight capabilities: Ask them to investigate Postmaster General Dejoy's policies that have been crippling the USPS, and his conflicts of interest owning stock in private mail courier companies: - Delaying mail creating a massive backlog. - Shutting down mail-sorting machines so workers must do it by hand. - Requiring letter carriers to LEAVE MAIL BEHIND to avoid extra trips. - Prohibiting overtime pay.

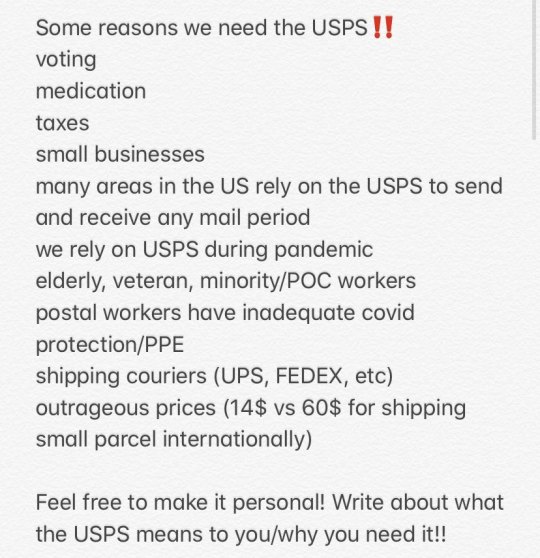

make saving the post office a NATIONAL PRIORITY! Some reasons we need the USPS voting medication taxes small businesses many areas in the US rely on the USPS to send and receive any mail period we rely on USPS during pandemic elderly, veteran, minority/POC workers postal workers have inadequate covid protection/PPE shipping couriers (UPS, FEDEX, etc) outrageous prices (14$ vs 60$ for shipping small parcel internationally) Feel free to make it personal! Write about what the USPS means to you/why you need it!!

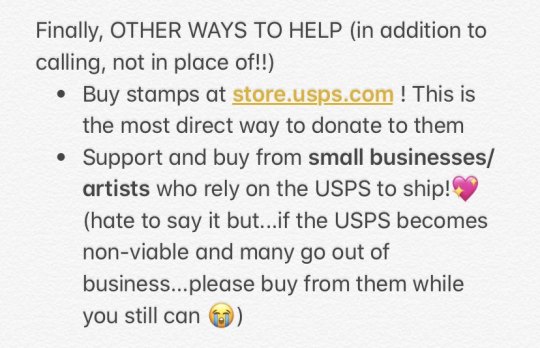

Finally, OTHER WAYS TO HELP (in addition to calling, not in place of!!) * Buy stamps at store.usps.com ! This is the most direct way to donate to them * Support and buy from small businesses/artists who rely on the USPS to ship! (hate to say it but...if the USPS becomes non-viable and many go out of business...please buy from them while you still can )

#USPS#save the usps#save the us postal service#us postal service#sorry if this post is not easy to read im just trying to spread the word here too

228 notes

·

View notes

Text

Bankruptcy Law Firm in Panama City, FL - (850) 913-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis & Jurnovoy PCB 2714 West 15th St Panama City, FL 32401 (850) 913-9110 https://www.LewisandJurnovoy.com

#bankruptcy assistance#bankruptcy law firm#Panama city#FL#debt consolidation#florida#bankruptcy#chapter 13 bankruptcy

0 notes

Text

Debt Consolidation in Crestview, FL - (850) 409-3350

Martin Lewis and Steven Jurnovoy joined as partners in 1998 to create the law firm of Lewis & Jurnovoy, P.A. The primary emphasis of the law firm is in the representation of individuals and sole proprietors in Chapter 13 Bankruptcy ("Debt Consolidation") and Chapter 7 Straight Bankruptcy.

Lewis and Jurnovoy 1501 S. Ferdon Blvd. Crestview, FL 32536 (850) 409-3350 https://www.LewisandJurnovoy.com/

#Debt Consolidation#Lewis & Jurnovoy#Chapter 7 Bankruptcy#Chapter 13 bankruptcy#Crestview#FL#Law Firm

0 notes

Text

Find expert assistance for foreclosure mortgage loans in Palm Beach Island, FL

Stop Mortgage Foreclosure offers specialized foreclosure mortgage loans in Palm Beach Island, FL, providing essential support to those facing the threat of foreclosure. With a focus on helping residents preserve their homes, these loans are designed to provide immediate relief and a path to financial stability during challenging times.

Foreclosure mortgage loans are tailored to meet the specific needs of homeowners on Palm Beach Island, offering solutions to prevent foreclosure and address financial hardships. These loans can be used to pay overdue mortgage payments, cover late fees, and consolidate debt, allowing homeowners to regain control of their finances and bring their mortgage accounts back into good standing. The flexibility of these loans can make a significant difference for those at risk of losing their property, especially when time is of the essence.

Our team understands the unique pressures faced by homeowners in high-value areas like Palm Beach Island. Our expertise in foreclosure prevention allows them to provide personalized solutions that address the immediate need to stop foreclosure proceedings and the long-term goal of financial recovery. Each loan application is carefully evaluated, focusing on securing manageable terms for the homeowner and can lead to sustainable financial health.

In addition to offering foreclosure loans, we provide guidance on alternative solutions and refinancing options, helping clients explore every possible avenue to protect their homes. Our team of specialists works closely with each client to assess their situation, discuss available options, and create a plan that minimizes the impact of financial stress on their lives.

We prioritize speed and efficiency, aiming to provide funds quickly to meet pressing deadlines and keep the foreclosure process from advancing. With a streamlined application process and accessible terms, they strive to make foreclosure mortgage loans a viable solution for Palm Beach Island homeowners facing financial challenges. We are committed to assisting Palm Beach Island residents to safeguard their homes with tailored foreclosure mortgage loans. Providing immediate financial relief and long-term support empowers homeowners to overcome foreclosure threats and regain financial stability in a trusted, supportive environment. Learn more!

0 notes

Text

Debt Consolidation in Fort Walton, FL - (850) 863-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy 151 South Mary Esther Cutoff Ste. 103 Fort Walton Beach, FL 32569 (850) 863-9110 https://www.LewisandJurnovoy.com

#Debt Consolidation#bankruptcy assistance#debt relief#mortgage modification lawyer#chapter 7 bankruptcy lawyers#florida#mortgage lawyer#fort walton beach#experienced attorneys#foreclosure lawyer

0 notes

Text

Debt Consolidation in Pensacola, FL - (850) 432-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle for over 20 years. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy 1100 North Palafox St Pensacola, FL 32501 (850) 432-9110 https://www.LewisandJurnovoy.com

#debt relief#debt consolidation#pensacola#bankruptcy assistance#mortgage lawyer#florida#creditor negotiations#debt relief help near me#lawyers near me#debt assistance

0 notes

Text

Little Known Facts About How to Invest in Real Estate.

tend to be the profits you make on a sale. Fundamentally, if you acquire a bit of property and bought it for revenue, you’ve manufactured

Drop by Chase home loan providers to handle your account. Produce a home finance loan payment, get facts in your escrow, submit insurance policies declare, ask for a payoff quote or check-in towards your account. Drop by Chase home equity solutions to handle your house equity account.

Make use of your funds to finish or strengthen rooms and turn them into Areas short-phrase renters will choose to spend income for. You can list your space on Airbnb and related web pages to generate passive profits.

Superior investment returns according to a unique differentiated money stack method unmatched inside the sector

Offering an investment property must be claimed, and should lead to cash gains, which could have tax implications for investors.

It is far more within your means housing, lessen the cost of living, obtainable workforce, and secure local climate forecast a growing economic climate and more powerful housing expansion.

Orlando, FL is a tourism and amusement favorite, due to this, it remains a robust real estate investment location. Investors Use the option of concentrating on the long-term household or vacation marketplaces with their properties. Both equally provide solid returns. Whilst improving the Orlando real estate marketplace and flourishing tourism are two of the most important motives behind Orlando’s financial steadiness, these two industries Have got a great deal to get into the prosperous economy.

An array of investment chances to order, promptly and common updates on new Attributes since they become available. No longer, will you have to invest hours, trawling Rightmove, or pay for a property source?

Forward-searching statements are according to MIM’s assumptions and current expectations, which can be inaccurate, and on The existing financial setting which may alter. These statements aren't guarantees of future general performance. They contain a variety of pitfalls and uncertainties which can be tough to predict. Outcomes could differ materially from Those people expressed or implied from the ahead-seeking statements.

That has a Chase home equity line of credit history (HELOC), You need to use your own home's equity for house advancements, personal debt consolidation, or other expenses. Before you apply for a HELOC, see our house equity costs, Examine your eligibility and use our HELOC calculator moreover other HELOC resources.

Investors from time to time perform studies to determine the very best, and most worthwhile, utilization of a property. This is frequently often called the property's highest and very best use.

investors acquire their specific returns. This motivates our group to extract value at each phase of growth — so we get paid too, but only When you!

That has created a lot of residences unaffordable for his or read more her opportunity buyers. All these elements are influencing A growing number of folks to elect to lease a house as an alternative to acquiring one particular or to remain inside their rental extended than that they had at first hoped.

For so long as You will find not enough houses available for sale, the harmony of would-be entrepreneurs not able to uncover economical entry-amount housing will probably be predisposed to transition into solitary-relatives rentals. Meaning rental demand will carry on to improve in 2021.

1 note

·

View note